SECURITIES AND EXCHANGE COMMISSION

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05547

(Exact name of registrant as specified in charter)

211 Main Street, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

211 Main Street, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 636-7000

Date of fiscal year end: March 31

Date of reporting period: September 30, 2024

Item 1: Report(s) to Shareholders.

Schwab Select Large Cap Growth Fund

This

semiannual shareholder report

contains important information about the fund for the period of April 1, 2024, to September 30,

2024.

You can find additional information about the fund at

www.schwabassetmanagement.com/prospectus

.

You can also request

this information by calling

or by sending an email request to

orders@mysummaryprospectus.com

.

If you purchase

or hold fund shares through a financial intermediary, the fund’s prospectus, Statement of Additional Information (SAI), reports to

shareholders and other information about the fund are available from your financial intermediary.

FUND COSTS FOR THE LAST six months ENDED September 30, 2024

(BASED ON A HYPOTHETICAL $10,000 INVESTMENT)

| | |

Schwab Select Large Cap Growth Fund | | |

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns

may be lower or higher.

The performance information does not reflect the deduction of taxes that a shareholder would pay on fund

distributions or the redemption of fund shares.

The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost.

To obtain performance information current to the

most recent month end, visit

www.schwabassetmanagement.com/prospectus

Average Annual Total Returns

| | | | |

Schwab Select Large Cap Growth Fund (10/10/1997)* | | | | |

| | | | |

Russell 1000 ® Growth Index | | | | |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower

performan

ce.

Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see www.schwabassetmanagement.com/glossary.

Inception date is that of the fund’s predecessor fund, the Class Y Shares of the UBS U.S. Large Cap Growth Fund.

Fund expenses may have been partially absorbed by the investment adviser. Without these reductions, the fund’s returns would have been lower.

These returns do not

reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Prior to September 15, 2023, the fund had a different subadviser. The performance history of the fund prior to that date is attributable to the previous subadviser.

Due to new regulatory requirements, the fund’s regulatory index has changed from the Russell 1000

®

Growth Index to the S&P 500

®

Index. The S&P 500

®

Index provides a

broad measure of market performance. The Russell 1000

®

Growth Index is the fund’s additional index and is more representative of the fund’s investment universe than t

he

regulatory index.

Schwab

Select Large Cap Growth Fund | Semiannual Report

| |

| |

| |

Weighted Average Market Cap (millions) | |

Price/Earnings Ratio (P/E) | |

| |

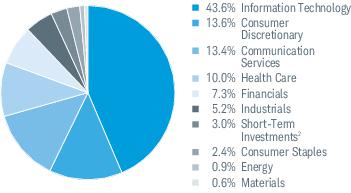

Sector Weightings % of Investments

Top Equity Holdings % of Net Assets

Portfolio holdings may h

ave c

hanged since the report date.

The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc.

(MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc.

Includes the fund’s position(s) in money market mutual funds registered under the Investment Company Act of 1940, as amended.

Schwab Select Large Cap Growth Fund | Semiannual Report

AVAILABILITY OF ADDITIONAL INFORMATION

You can find the fund’s prospectus, Statement of Additional Information (SAI), reports to shareholders, financial information,

holdings, certain tax information, proxy voting information, and other information about the fund online at

www.schwabassetmanagement.com/prospectus

.

Proxy Voting Policies, Procedures and Results

A description of the proxy voting policies and procedures used to determine how to vote proxies on behalf of the funds is available

without charge, upon request, by visiting the Schwab Funds’ website at

www.schwabassetmanagement.com/prospectus

, the

SEC’s website at

, or by contacting Schwab Funds at 1-877-824-5615.

Information regarding how a fund voted proxies relating to portfolio securities during the most recent twelve-month period ended

June 30 is available, without charge, by visiting the fund’s website at

www.schwabassetmanagement.com/prospectus

or the

SEC’s website at

, by calling

, or by sending an email request to

orders@mysummaryprospectus.com

.

Schwab Select Large Cap Growth Fund | Semiannual Report

Item 2: Code of Ethics.

Not applicable to this semi-annual report.

Item 3: Audit Committee Financial Expert.

Not applicable to this semi-annual report.

Item 4: Principal Accountant Fees and Services.

Not applicable to this semi-annual report.

Item 5: Audit Committee of Listed Registrants.

Not applicable.

Item 6: Schedule of Investments.

The schedules of investments are included as part of the report to shareholders filed under Item 7 of this Form.

Item 7: Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Semiannual Holdings and Financial Statements | September 30, 2024

Schwab Select Large Cap Growth Fund

Fund investment adviser: Charles Schwab Investment Management, Inc., dba Schwab Asset Management®

Distributor: Charles Schwab & Co., Inc. (Schwab)

The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc. (MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Schwab. The Industry classifications used in the Portfolio Holdings are sub-categories of Sector classifications.

Schwab Select Large Cap Growth Fund | Semiannual Holdings and Financial Statements

1

Schwab Select Large Cap Growth Fund

Financial Statements

| | | | | | |

|

Net asset value at beginning of period | | | | | | |

Income (loss) from investment operations: | | | | | | |

Net investment income (loss)1 | | | | | | |

Net realized and unrealized gains (losses) | | | | | | |

Total from investment operations | | | | | | |

| | | | | | |

Distributions from net investment income | | | | | | |

Distributions from net realized gains | | | | | | |

| | | | | | |

Net asset value at end of period | | | | | | |

| | | | | | |

|

Ratios to average net assets: | | | | | | |

| | | | | | |

Net investment income (loss) | | | | | | |

| | | | | | |

Net assets, end of period (x 1,000,000) | | | | | | |

| |

| Calculated based on the average shares outstanding during the period. |

| |

| |

| Ratio includes less than 0.005% of non-routine proxy expenses. |

2

Schwab Select Large Cap Growth Fund | Semiannual Holdings and Financial Statements

Schwab Select Large Cap Growth Fund

Portfolio Holdings as of September 30, 2024 (Unaudited)

| | |

COMMON STOCKS 97.0% OF NET ASSETS |

|

Automobiles & Components 2.3% |

| | |

|

|

| | |

| | |

Advanced Drainage Systems, Inc. | | |

| | |

| | |

| | |

Johnson Controls International PLC | | |

| | |

| | |

| | |

| | |

Vertiv Holdings Co., Class A | | |

Westinghouse Air Brake Technologies Corp. | | |

| | |

| | |

| | |

|

Commercial & Professional Services 0.4% |

| | |

| | |

| | |

|

Consumer Discretionary Distribution & Retail 6.9% |

| | |

| | |

| | |

| | |

| | |

|

Consumer Durables & Apparel 1.2% |

| | |

Lululemon Athletica, Inc. * | | |

| | |

|

|

| | |

| | |

Chipotle Mexican Grill, Inc. * | | |

DoorDash, Inc., Class A * | | |

| | |

| | |

| | |

| | |

|

Consumer Staples Distribution & Retail 1.3% |

| | |

|

|

| | |

| | |

| | |

| | |

| | |

| | |

|

|

Berkshire Hathaway, Inc., Class B * | | |

| | |

| | |

Goldman Sachs Group, Inc. | | |

| | |

Mastercard, Inc., Class A | | |

| | |

| | |

Tradeweb Markets, Inc., Class A | | |

| | |

| | |

|

Food, Beverage & Tobacco 1.1% |

| | |

| | |

Constellation Brands, Inc., Class A | | |

| | |

| | |

|

Health Care Equipment & Services 3.9% |

| | |

| | |

Edwards Lifesciences Corp. * | | |

IDEXX Laboratories, Inc. * | | |

| | |

Intuitive Surgical, Inc. * | | |

| | |

| | |

| | |

|

|

| | |

| | |

| | |

|

Media & Entertainment 13.4% |

| | |

Meta Platforms, Inc., Class A | | |

| | |

| | |

Trade Desk, Inc., Class A * | | |

| | |

|

Pharmaceuticals, Biotechnology & Life Sciences 6.1% |

Alnylam Pharmaceuticals, Inc. * | | |

| | |

| | |

Regeneron Pharmaceuticals, Inc. * | | |

Thermo Fisher Scientific, Inc. | | |

| | |

| | |

|

Semiconductors & Semiconductor Equipment 16.0% |

Advanced Micro Devices, Inc. * | | |

| | |

| | |

| | |

Schwab Select Large Cap Growth Fund | Semiannual Holdings and Financial Statements

3

Schwab Select Large Cap Growth Fund

Portfolio Holdings as of September 30, 2024 (Unaudited) (continued)

| | |

ASML Holding NV NY Registry Shares | | |

| | |

| | |

Lattice Semiconductor Corp. * | | |

| | |

Taiwan Semiconductor Manufacturing Co. Ltd., ADR | | |

| | |

|

Software & Services 17.2% |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

International Business Machines Corp. | | |

| | |

| | |

| | |

| | |

| | |

Palo Alto Networks, Inc. * | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

Technology Hardware & Equipment 10.4% |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

|

Uber Technologies, Inc. * | | |

Total Common Stocks

(Cost $1,095,301,519) | |

| | |

SHORT-TERM INVESTMENTS 3.0% OF NET ASSETS |

|

|

State Street Institutional U.S. Government Money Market Fund, Premier Class 4.94% (a) | | |

Total Short-Term Investments

(Cost $68,192,994) | |

Total Investments in Securities

(Cost $1,163,494,513) | |

| | | CURRENT VALUE/

UNREALIZED

APPRECIATION

($) |

|

| | | |

Russell 1000 Growth Index, e-mini, expires 12/20/24 | | | |

| | | AMOUNT OF CURRENCY TO BE RECEIVED | | AMOUNT OF CURRENCY TO BE DELIVERED | UNREALIZED

APPRECIATION

($) |

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS |

| | | | | | |

| | | | | | |

Net Unrealized Appreciation on Forward Foreign Currency Exchange Contracts | |

| Non-income producing security. |

| The rate shown is the annualized 7-day yield. |

| American Depositary Receipt |

| |

| |

4

Schwab Select Large Cap Growth Fund | Semiannual Holdings and Financial Statements

Schwab Select Large Cap Growth Fund

Portfolio Holdings as of September 30, 2024 (Unaudited) (continued)

The following is a summary of the inputs used to value the fund’s investments as of September 30, 2024 (see financial note 2(a) for additional information):

| QUOTED PRICES IN

ACTIVE MARKETS FOR

IDENTICAL ASSETS

(LEVEL 1) | OTHER SIGNIFICANT

OBSERVABLE INPUTS

(LEVEL 2) | SIGNIFICANT

UNOBSERVABLE INPUTS

(LEVEL 3) | |

| | | | |

| | | | |

| | | | |

Pharmaceuticals, Biotechnology & Life Sciences | | | | |

Semiconductors & Semiconductor Equipment | | | | |

Technology Hardware & Equipment | | | | |

| | | | |

| | | | |

Forward Foreign Currency Exchange Contracts2 | | | | |

| | | | |

| As categorized in the Portfolio Holdings. |

| Futures contracts and forward foreign currency exchange contracts are reported at cumulative unrealized appreciation or depreciation. |

Schwab Select Large Cap Growth Fund | Semiannual Holdings and Financial Statements

5

Schwab Select Large Cap Growth Fund

Statement of Assets and Liabilities

As of September 30, 2024; unaudited

|

Investments in securities, at value - unaffiliated issuers (cost $1,163,494,513) | | |

| | |

Deposit with broker for futures contracts | | |

| | |

| | |

| | |

| | |

Variation margin on future contracts | | |

| | |

Unrealized appreciation on forward foreign currency exchange contracts | | |

| | |

| | |

|

|

| | |

| | |

| | |

Sub-accounting and sub-transfer agent fees | | |

| | |

| | |

| | |

|

|

Capital received from investors | | |

Total distributable earnings | | |

| | |

6

Schwab Select Large Cap Growth Fund | Semiannual Holdings and Financial Statements

Schwab Select Large Cap Growth Fund

Statement of Operations

For the period April 1, 2024 through September 30, 2024; unaudited |

|

Dividends received from securities - unaffiliated issuers (net of foreign withholding tax of $27,076) | | |

| | |

| | |

|

|

| | |

Sub-accounting and sub-transfer agent fees | | |

| | |

| | |

Independent trustees’ fees | | |

Accounting and administration fees | | |

| | |

| | |

| | |

| | |

| | |

| | |

|

REALIZED AND UNREALIZED GAINS (LOSSES) |

Net realized gains on sales of securities - unaffiliated issuers | | |

Net realized gains on futures contracts | | |

Net realized losses on forward foreign currency exchange contracts | | |

Net realized losses on foreign currency transactions | | |

| | |

Net change in unrealized appreciation (depreciation) on securities - unaffiliated issuers | | |

Net change in unrealized appreciation (depreciation) on futures contracts | | |

Net change in unrealized appreciation (depreciation) on forward foreign currency exchange contracts | | |

Net change in unrealized appreciation (depreciation) on foreign currency translations | | |

Net change in unrealized appreciation (depreciation) | | |

Net realized and unrealized gains | | |

Increase in net assets resulting from operations | | |

Schwab Select Large Cap Growth Fund | Semiannual Holdings and Financial Statements

7

Schwab Select Large Cap Growth Fund

Statement of Changes in Net Assets

For the current and prior report periods

Figures for the current period are unaudited

|

| | |

| | | |

| | | |

Net change in unrealized appreciation (depreciation) | | | |

Increase in net assets resulting from operations | | | |

|

DISTRIBUTIONS TO SHAREHOLDERS |

| | | |

TRANSACTIONS IN FUND SHARES |

| | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Net transactions in fund shares | | | | | |

|

SHARES OUTSTANDING AND NET ASSETS |

| | |

| | | | | |

| | | | | |

Total increase (decrease) | | | | | |

| | | | | |

8

Schwab Select Large Cap Growth Fund | Semiannual Holdings and Financial Statements

Schwab Select Large Cap Growth Fund

Financial Notes, unaudited

1. Business Structure of the Fund:

Schwab Select Large Cap Growth Fund is the only series of Laudus Trust (the trust), a no-load, open-end management investment company. The trust is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended (the 1940 Act).

The Schwab Select Large Cap Growth Fund offers one share class. Shares are bought and sold at closing net asset value per share (NAV), which is the price for all outstanding shares of the fund. Each share has no par value and the fund’s Board of Trustees (the Board) may authorize the issuance of as many shares as necessary.

The fund maintains its own account for purposes of holding assets and accounting, and is considered a separate entity for tax purposes. Within its account, the fund may also keep certain assets in segregated accounts, as required by securities law. The "Fund Complex" includes The Charles Schwab Family of Funds, Schwab Capital Trust, Schwab Investments, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust.

The Schwab Select Large Cap Growth Fund’s goal is to seek long-term capital appreciation. Under normal circumstances, the fund invests at least 80% of its net assets (including, for this purpose, any borrowings for investment purposes) in equity securities of U.S. large capitalization companies.

2. Significant Accounting Policies:The following is a summary of the significant accounting policies the fund uses in its preparation of financial statements. The fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification Topic 946 Financial Services — Investment Companies. The accounting policies are in conformity with accounting principles generally accepted in the United States of America (GAAP).

The fund may invest in mutual funds, which are referred to as "underlying funds". For more information about the underlying funds’ operations and policies, please refer to those funds’ semiannual and annual reports and holdings and financial statements, which are filed in Form N-CSR with the U.S. Securities and Exchange Commission (SEC) and are available on the SEC’s website at www.sec.gov.

Pursuant to Rule 2a-5 under the 1940 Act, the Board has designated authority to a Valuation Designee, the fund’s investment adviser, to make fair valuation determinations under adopted procedures, subject to Board oversight. The investment adviser has formed a Pricing Committee to administer the pricing and valuation of portfolio securities and other assets and liabilities as well as to ensure that prices used for internal purposes or provided by third parties reasonably reflect fair value. The Valuation Designee may utilize independent pricing services, quotations from securities and financial instrument dealers and other market sources to determine fair value.

Securities held in the fund’s portfolio are valued every business day. The following valuation policies and procedures are used by the Valuation Designee to value various types of securities:

● Securities traded on an exchange or over-the-counter: Traded securities are valued at the closing value for the day, or, on days when no closing value has been reported, at the mean of the most recent bid and ask quotes. Securities that are primarily traded on foreign exchanges are valued at the official closing price or the last sales price on the exchange where the securities are principally traded with these values then translated into U.S. dollars at the current exchange rate, unless these securities are fair valued as discussed below.

● Foreign equity security fair valuation: The Valuation Designee has adopted procedures to fair value foreign equity securities that are traded in markets that close prior to the valuation of the fund’s holdings. By fair valuing securities whose prices may have been affected by events occurring after the close of trading, the Valuation Designee seeks to establish prices that investors might expect to realize upon the current sales of these securities. This methodology is designed to deter “arbitrage” market timers, who seek to exploit delays between the change in the value of the fund’s portfolio holdings and the NAV of the fund’s shares and seeks to help ensure that the prices at which the fund’s shares are purchased and redeemed are fair and do not result in dilution of shareholder interest or other harm to shareholders. When fair value pricing is used at the open or close of a reporting period, it may cause a temporary divergence between the return of the fund and that of its comparative index or benchmark.

Schwab Select Large Cap Growth Fund | Semiannual Holdings and Financial Statements

9

Schwab Select Large Cap Growth Fund

Financial Notes, unaudited (continued)

2. Significant Accounting Policies (continued):

● Futures contracts and forward foreign currency exchange contracts (forwards): Futures contracts are valued at their settlement prices as of the close of their exchanges. Forwards are valued based on that day’s forward exchange rates or by using an interpolated forward exchange rate for contracts with interim settlement dates.

● Mutual funds: Mutual funds are valued at their respective NAVs.

● Securities for which no quoted value is available: The Valuation Designee has adopted procedures to fair value the fund’s securities when market prices are not “readily available” or are unreliable. For example, a security may be fair valued when it’s de-listed or its trading is halted or suspended; when a security’s primary pricing source is unable or unwilling to provide a price; or when a security’s primary trading market is closed during regular market hours. Fair value determinations are made in good faith in accordance with adopted valuation procedures. The Valuation Designee considers a number of factors, including unobservable market inputs, when arriving at fair value. The Valuation Designee may employ methods such as the review of related or comparable assets or liabilities, related market activities, recent transactions, market multiples, book values, transactional back-testing, disposition analysis and other relevant information. Due to the subjective and variable nature of fair value pricing, there can be no assurance that the fund could obtain the fair value assigned to the security upon the sale of such security.

In accordance with the authoritative guidance on fair value measurements and disclosures under GAAP, the fund discloses the fair value of its investments in a hierarchy that prioritizes the significant inputs to valuation methods used to measure the fair value. The hierarchy gives the highest priority to valuations based upon unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to valuations based upon unobservable inputs that are significant to the valuation (Level 3 measurements). If inputs used to measure the financial instruments fall within different levels of the hierarchy, the categorization is based on the lowest level input that is significant to the valuation. If it is determined that either the volume and/or level of activity for an asset or liability has significantly decreased (from normal conditions for that asset or liability) or price quotations or observable inputs are not associated with orderly transactions, increased analysis and the Valuation Designee’s judgment will be required to estimate fair value.

The three levels of the fair value hierarchy are as follows:

● Level 1 — quoted prices in active markets for identical investments — Investments whose values are based on quoted market prices in active markets. These generally include active listed equities, mutual funds, exchange-traded funds (ETFs) and futures contracts. Mutual funds and ETFs are classified as Level 1 prices, without consideration to the classification level of the underlying securities held which could be Level 1, Level 2 or Level 3 in the fair value hierarchy.

● Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) — Investments that trade in markets that are not considered to be active, but whose values are based on quoted market prices, dealer quotations or valuations provided by alternative pricing sources supported by observable inputs are classified as Level 2 prices. These generally include forward foreign currency exchange contracts, U.S. government and sovereign obligations, most government agency securities, investment-grade corporate bonds, certain mortgage products, less liquid listed equities, and state, municipal and provincial obligations. In addition, international securities whose markets close hours before the valuation of the fund’s holdings may require fair valuations due to significant movement in the U.S. markets occurring after the daily close of the foreign markets. The Valuation Designee has approved a vendor that calculates fair valuations of international equity securities based on a number of factors that appear to correlate to the movements in the U.S. markets.

● Level 3 — significant unobservable inputs (including the Valuation Designee’s assumptions in determining the fair value of investments) — Investments whose values are classified as Level 3 prices have significant unobservable inputs, as they may trade infrequently or not at all. When observable prices are not readily available for these securities, one or more valuation methods are used for which sufficient and reliable data is available. The inputs used in estimating the value of Level 3 prices may include the original transaction price, quoted prices for similar securities or assets in active markets, completed or pending third-party transactions in the underlying investment or comparable issuers, and changes in financial ratios or cash flows. Level 3 prices may also be adjusted to reflect illiquidity and/or non-transferability, with the amount of such discount estimated in the absence of market information. Assumptions used due to the lack of observable inputs may significantly impact the resulting fair value and therefore a fund’s results of operations.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The levels associated with valuing the fund’s investments as of September 30, 2024, are disclosed in the fund’s Portfolio Holdings.

10

Schwab Select Large Cap Growth Fund | Semiannual Holdings and Financial Statements

Schwab Select Large Cap Growth Fund

Financial Notes, unaudited (continued)

2. Significant Accounting Policies (continued):

(b) Accounting Policies for certain Portfolio Investments (if held):

Futures Contracts: Futures contracts are instruments that represent an agreement between two parties that obligates one party to buy, and the other party to sell, specific instruments at an agreed upon price on a stipulated future date. The fund must give the broker a deposit of cash and/or securities (initial margin) whenever it enters into a futures contract. The amount of the deposit may vary from one contract to another. Subsequent payments (variation margin) are made or received by the fund depending on the daily fluctuations in the value of the futures contract and are accounted for as unrealized appreciation or depreciation until the contract is closed, at which time the gains or losses are realized. Futures contracts are traded publicly on exchanges, and their value may change daily.

Forward Foreign Currency Exchange Contracts (forwards): Forwards are contracts to buy and sell a currency at a set price on a future date. The value of the forwards is accounted for as unrealized appreciation or depreciation until the contracts settle, at which time the gains or losses are realized.

Passive Foreign Investment Companies: The fund may own shares in certain foreign corporations that meet the Internal Revenue Code definition of a Passive Foreign Investment Company (PFIC). The fund may elect for tax purposes to mark-to-market annually the shares of each PFIC lot held and would be required to distribute as ordinary income to shareholders any such marked-to- market gains (as well as any gains realized on sale).

Central Securities Depositories Regulation: The Central Securities Depositories Regulation (CSDR) introduced measures for the authorization and supervision of European Union Central Security Depositories and created a common set of prudential, organizational, and conduct of business standards at a European level. CSDR is designed to support securities settlement and operational aspects of securities settlement, including the provision of shorter settlement periods; mandatory buy-ins; and cash penalties, to prevent and address settlement fails. CSDR measures are aimed to prevent settlement fails by ensuring that all transaction details are provided to facilitate settlement, as well as further incentivizing timely settlement by imposing cash penalty fines and buy-ins. The fund may be subject to pay cash penalties and may also receive cash penalties with certain counterparties in instances where there are settlement fails. These cash penalties are included in net realized gains (losses) on sales of securities in the fund’s Statement of Operations, if any.

(c) Security Transactions:

Security transactions are recorded as of the date the order to buy or sell the security is executed. Realized gains and losses from security transactions are based on the identified costs of the securities involved.

Assets and liabilities denominated in foreign currencies are reported in U.S. dollars. For assets and liabilities held on a given date, the dollar value is based on market exchange rates in effect on that date. Transactions involving foreign currencies, including purchases, sales, income receipts and expense payments, are calculated using exchange rates in effect on the transaction date. Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the differences between the recorded amounts of dividends, interest, and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange appreciation or depreciation arises from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period. These realized and unrealized foreign exchange gains or losses are reported in foreign currency transactions or translations in the fund’s Statement of Operations. The fund does not isolate the portion of the fluctuations on investments resulting from changes in foreign currency exchange rates from the fluctuations in market prices of investments held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Gains realized by the fund on the sale of securities in certain foreign countries may be subject to non-U.S. taxes. In those instances, the fund records a liability based on unrealized appreciation to provide for potential non-U.S. taxes payable upon the sale of these securities.

When the fund closes out a futures contract position, it calculates the difference between the value of the position at the beginning and at the end of the contract, and records a realized gain or loss accordingly.

Interest income is recorded as it accrues. Dividends and distributions from portfolio securities and underlying funds are recorded on the date they are effective (the ex-dividend date), although the fund records certain foreign security dividends on the date the ex-dividend date is confirmed. Any distributions from underlying funds are recorded in accordance with the character of the distributions as designated by the underlying funds.

Schwab Select Large Cap Growth Fund | Semiannual Holdings and Financial Statements

11

Schwab Select Large Cap Growth Fund

Financial Notes, unaudited (continued)

2. Significant Accounting Policies (continued):

Income received from foreign sources may result in withholding tax. Withholding taxes are accrued at the same time as the related income if the tax rate is fixed and known, unless a tax withheld is reclaimable from the local tax authorities in which case it is recorded as receivable. If the tax rate is not known or estimable, such expense or reclaim receivable is recorded when the net proceeds are received.

Expenses that are specific to the fund are charged directly to the fund. Expenses that are common to more than one fund in the Fund Complex generally are allocated among those funds in proportion to their average daily net assets.

(f) Distributions to Shareholders:

The fund makes distributions from net investment income and net realized capital gains, if any, once a year. To receive a distribution, you must be a registered shareholder on the record date. Distributions are paid to shareholders on the payable date.

(g) Accounting Estimates:

The accounting policies described in this report conform to GAAP. Notwithstanding this, shareholders should understand that in order to follow these principles, fund management has to make estimates and assumptions that affect the information reported in the financial statements. It’s possible that once the results are known, they may turn out to be different from these estimates and these differences may be material.

(h) Federal Income Taxes:

The fund intends to meet federal income and excise tax requirements for regulated investment companies under subchapter M of the Internal Revenue Code, as amended. Accordingly, the fund distributes substantially all of its net investment income and net realized capital gains, if any, to its respective shareholders each year. As long as the fund meets the tax requirements, it is not required to pay federal income tax.

The fund may be subject to foreign taxes (a portion of which may be reclaimable) on income, corporate events, foreign currency exchanges and capital gains on investments. All foreign taxes are recorded in accordance with the applicable foreign tax regulations and rates that exist in foreign markets in which the fund invests. These foreign taxes, if any, are paid by the fund and are disclosed in the fund’s Statement of Operations. Foreign taxes accrued as of September 30, 2024, are reflected in the fund’s Statement of Assets and Liabilities.

Under the fund’s organizational documents, the officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business the fund enters into contracts with its vendors and others that provide general indemnifications. The fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the fund. However, based on experience, the fund expects the risk of loss attributable to these arrangements to be remote.

Investing in the fund may involve certain risks, as discussed in the fund’s prospectus, including, but not limited to, those described below. Any of these risks could cause an investor to lose money.

Market Risk. Financial markets rise and fall in response to a variety of factors, sometimes rapidly and unpredictably. Markets may be impacted by economic, political, regulatory and other conditions, including economic sanctions and other government actions. In addition, the occurrence of global events, such as war, terrorism, environmental disasters, natural disasters and epidemics, may also negatively affect the financial markets. As with any investment whose performance is tied to these markets, the value of an investment in the fund will fluctuate, which means that an investor could lose money over short or long periods.

Multi-Manager Risk. Each subadviser makes investment decisions independently, and it is possible that the investment styles of subadvisers may not complement one another. As a result, the fund’s exposure to a given stock, industry or investment style could unintentionally be smaller or larger than if the fund had a single subadviser.

12

Schwab Select Large Cap Growth Fund | Semiannual Holdings and Financial Statements

Schwab Select Large Cap Growth Fund

Financial Notes, unaudited (continued)

3. Risk Factors (continued):

Management Risk. As with all actively managed funds, the fund is subject to the risk that the subadvisers will select investments or allocate assets in a manner that could cause the fund to underperform or otherwise not meet its investment objective. The fund’s subadvisers apply their own investment techniques and risk analyses in making investment decisions for the fund, but there can be no guarantee that they will produce the desired results.

Equity Risk. The prices of equity securities rise and fall daily. These price movements may result from factors affecting individual companies, industries or the securities market as a whole. In addition, equity markets tend to move in cycles, which may cause stock prices to fall over short or extended periods of time.

Market Capitalization Risk. Securities issued by companies of different market capitalizations tend to go in and out of favor based on market and economic conditions. During a period when securities of a particular market capitalization fall behind other types of investments, the fund’s performance could be impacted.

Large-Cap Company Risk. Large-cap companies are generally more mature and the securities issued by these companies may not be able to reach the same levels of growth as the securities issued by small- or mid-cap companies.

Growth Investing Risk. Growth stocks can be volatile. Growth companies usually invest a high portion of earnings in their businesses and may lack the dividends of value stocks that can cushion stock prices in a falling market. The prices of growth stocks are based largely on projections of the issuer’s future earnings and revenues. If a company’s earnings or revenues fall short of expectations, its stock price may fall dramatically. Growth stocks may also be more expensive relative to their earnings or assets compared to value or other stocks.

Foreign Investment Risk. The fund’s investments in securities of foreign issuers involve certain risks that may be greater than those associated with investments in securities of U.S. issuers. These include risks of adverse changes in foreign economic, political, regulatory and other conditions; changes in currency exchange rates or exchange control regulations (including limitations on currency movements and exchanges); the imposition of economic sanctions or other government restrictions; differing accounting, auditing, financial reporting and legal standards and practices; differing securities market structures; and higher transaction costs. These risks may negatively impact the value or liquidity of the fund’s investments, and could impair the fund’s ability to meet its investment objective or invest in accordance with its investment strategy. There is a risk that investments in securities denominated in, and/or receiving revenues in, foreign currencies will decline in value relative to the U.S. dollar or, in the case of hedging positions, that the U.S. dollar will decline in value relative to the currency hedged, resulting in the dollar value of the fund’s investment being adversely affected. Foreign securities also include American Depositary Receipts (ADRs), Global Depositary Receipts (GDRs) and European Depositary Receipts (EDRs) which may be less liquid than the underlying shares in their primary trading market and GDRs, many of which are issued by companies in emerging markets, may be more volatile. These risks may be heightened in connection with investments in emerging markets or securities of issuers that conduct their business in emerging markets.

Derivatives Risk. The fund may, but is not required to, use derivatives to earn income and enhance returns, to manage or adjust the risk profile of the fund, to replace more traditional direct investments, or to obtain exposure to certain markets. A future is an agreement to buy or sell a financial instrument at a specific price on a specific day. An option is the right, but not the obligation, to buy or sell an instrument at a specific price on or before a specific date. A forward currency agreement involves an obligation to purchase or sell a specific currency at a future date, which may be any fixed number of days from the date of the contract agreed upon by the parties, at a price set at the time of the contract. The fund’s use of derivatives involves risks different from or possibly greater than the risks associated with investing directly in securities and other traditional investments. Certain of these risks, such as liquidity risk, leverage risk, market risk and operational risk, are discussed elsewhere in this section. The fund’s use of derivatives is also subject to counterparty risk, lack of availability risk, valuation risk, correlation risk and tax risk. Counterparty risk is the risk that the counterparty to a derivative may not fulfill its contractual obligations. Lack of availability risk is the risk that suitable derivative transactions may not be available in all circumstances for risk management or other purposes. Valuation risk is the risk that a particular derivative may be valued incorrectly. Correlation risk is the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index. Tax risk is the risk that the use of derivatives may cause the fund to realize higher amounts of short-term capital gains. The fund’s use of derivatives could reduce the fund’s performance, increase the fund’s volatility, and could cause the fund to lose more than the initial amount invested. However, these risks are less severe when the fund uses derivatives for hedging rather than to enhance the fund’s returns or as a substitute for a position or security. The use of derivatives that are subject to regulation by the Commodity Futures Trading Commission (CFTC) could cause the fund to become a commodity pool, which would require the fund to comply with certain CFTC rules.

Leverage Risk. Certain fund transactions, such as derivatives transactions, may give rise to a form of leverage and may expose the fund to greater risk. Leverage tends to magnify the effect of any increase or decrease in the value of the fund’s portfolio securities, which means even a small amount of leverage can have a disproportionately large impact on the fund.

Schwab Select Large Cap Growth Fund | Semiannual Holdings and Financial Statements

13

Schwab Select Large Cap Growth Fund

Financial Notes, unaudited (continued)

3. Risk Factors (continued):

Liquidity Risk. The fund may be unable to sell certain securities, such as illiquid securities, readily at a favorable time or price, or the fund may have to sell them at a loss.

Please refer to the fund’s prospectus for a more complete description of the principal risks of investing in the fund.

4. Affiliates and Affiliated Transactions:Charles Schwab Investment Management, Inc., dba Schwab Asset Management, a wholly owned subsidiary of The Charles Schwab Corporation, serves as the fund’s investment adviser pursuant to the Management Contract (Advisory Agreement) between the investment adviser and the trust. American Century Investment Management Inc. (ACIM) and J.P. Morgan Investment Management Inc. (JP Morgan), the fund’s subadvisers, provide day-to-day portfolio management services to the fund, subject to the supervision of the investment adviser.

For its advisory services to the fund, the investment adviser is entitled to receive an annual fee, payable monthly, based on a percentage of the fund’s average daily net assets described as follows:

% OF AVERAGE DAILY NET ASSETS | |

| |

$500 million to $1 billion | |

$1 billion to $1.5 billion | |

$1.5 billion to $2 billion | |

| |

For the period ended September 30, 2024, the aggregate net advisory fee paid to the investment adviser was 0.62% (annualized) for the fund, as a percentage of the fund’s average daily net assets.

The investment adviser (not the fund) pays a portion of the advisory fees it receives to ACIM and JP Morgan in return for their portfolio management services.

The trustees have authorized the fund to reimburse, out of the assets of the fund, financial intermediaries, including Charles Schwab & Co., Inc. (a broker-dealer affiliate of the investment adviser, Schwab) (together, “service providers”) that provide sub-accounting and sub-transfer agency services in connection with the fund’s shares in an amount of up to 0.10% of the average daily net assets of the fund on an annual basis. The sub-accounting and sub-transfer agency fee paid to a particular service provider is made pursuant to its written agreement with Schwab, as distributor of the fund (or, in the case of payments made to Schwab acting as a service provider, pursuant to Schwab’s written agreement with the fund), and the fund will pay no more than 0.10% of the average annual daily net asset value of the fund shares owned by shareholders holding shares through such service provider. Payments are made as described above without regard to whether the fee is more or less than the service provider’s actual cost of providing the services, and if more, such excess may be retained as profit by the service provider.

The investment adviser has contractually agreed, until at least July 30, 2026, to limit the total annual fund operating expenses (excluding acquired fund fees and expenses, interest, taxes and certain non-routine expenses) of the fund to 0.77%. Acquired fund fees and expenses are indirect expenses incurred by a fund through its investments in underlying funds.

14

Schwab Select Large Cap Growth Fund | Semiannual Holdings and Financial Statements

Schwab Select Large Cap Growth Fund

Financial Notes, unaudited (continued)

4. Affiliates and Affiliated Transactions (continued):

Investments from Affiliates

Funds in the Fund Complex may own shares of other funds in the Fund Complex. The table below reflects the percentage of shares of the fund that are owned by other funds in the Fund Complex as of September 30, 2024, as applicable:

The fund’s investment adviser or subadvisers may engage in direct transactions with other funds they manage in accordance with procedures adopted by the Board pursuant to Rule 17a-7 under the 1940 Act. When a fund is seeking to sell a security that another fund is seeking to buy, an interfund transaction can allow both funds to benefit by reducing transaction costs while allowing each fund to execute the transaction at the current market price. This practice is limited to funds that share the same investment adviser, subadvisers, trustees and/or officers. The net realized gains or losses on sales of interfund transactions are recorded within Net realized gains (losses) on sales of securities — unaffiliated issuers in the Statement of Operations. For the period ended September 30, 2024, the fund did not have any purchases and sales of securities with other funds managed by the investment adviser or subadvisers.

Interfund Borrowing and Lending

Pursuant to an exemptive order issued by the SEC, the fund may enter into interfund borrowing and lending transactions with other funds in the Fund Complex. All loans are for temporary or emergency purposes and the interest rate to be charged will be the average of the overnight repurchase agreement rate and the short-term bank loan rate. All loans are subject to numerous conditions designed to ensure fair and equitable treatment of all participating funds. The interfund lending facility is subject to the oversight and periodic review by the Board. The fund had no interfund borrowing or lending activity during the period.

The Board may include people who are officers and/or directors of the investment adviser or its affiliates. Federal securities law limits the percentage of such “interested persons” who may serve on a trust’s board, and the trust was in compliance with these limitations throughout the report period. The fund did not pay any of these interested persons for their services as trustees, but did pay non-interested persons (independent trustees), as noted in the fund’s Statement of Operations.

During the period, the fund was a participant with other funds in the Fund Complex in a joint, syndicated, committed $1 billion line of credit (the Syndicated Credit Facility), which matured on September 26, 2024. On September 26, 2024, the Syndicated Credit Facility was amended to run for a new 364 day period with the line of credit amount increasing to $1.2 billion, maturing on September 25, 2025. Under the terms of the Syndicated Credit Facility, in addition to the interest charged on any borrowings by the fund, the fund paid a commitment fee of 0.15% per annum on the fund’s proportionate share of the unused portion of the Syndicated Credit Facility.

Schwab Select Large Cap Growth Fund | Semiannual Holdings and Financial Statements

15

Schwab Select Large Cap Growth Fund

Financial Notes, unaudited (continued)

6. Borrowing from Banks (continued):

During the period, the fund was a participant with other funds in the Fund Complex in a joint, unsecured, uncommitted $400 million line of credit (the Uncommitted Credit Facility), with State Street Bank and Trust Company, which matured on September 26, 2024. On September 26, 2024, the Uncommitted Credit Facility was amended to run for a new 364 day period with the line of credit amount remaining unchanged, maturing on September 25, 2025. Under the terms of the Uncommitted Credit Facility, the fund pays interest on the amount the fund borrows. There were no borrowings by the fund from either line of credit during the period.

The fund also has access to custodian overdraft facilities. The fund may have utilized the overdraft facility and incurred an interest expense, which is disclosed in the fund’s Statement of Operations, if any. The interest expense is determined based on a negotiated rate above the current Federal Funds Rate.

The fund entered into futures contracts during the report period to equitize available cash. The fund also invested in forwards in connection with the purchase and sale of portfolio securities to minimize the uncertainty of changes in future foreign currency exchange rates and to hedge exposure to certain currencies. Refer to financial note 2(b) for the fund’s accounting policies with respect to futures contracts and financial note 3 for disclosures concerning the risks of investing in futures contracts.

As of September 30, 2024, the Statement of Assets and Liabilities included the following financial derivative instrument fair values held at period end:

| | | |

| | | |

| | | |

Forward Foreign Currency Exchange Contracts2 | | | |

| |

| Includes cumulative unrealized appreciation of futures contracts as reported in the fund’s Portfolio Holdings. Only current day’s variation margin on futures contracts is reported within the Statement of Assets and Liabilities. |

| Statement of Assets and Liabilities location: Unrealized appreciation on forward foreign currency exchange contracts and Unrealized depreciation on forward foreign currency exchange contracts. |

The effects of the derivative contracts in the Statement of Operations for the period ended September 30, 2024, were:

| | | |

Net Realized Gains (Losses) | | | |

| | | |

Forward Foreign Currency Exchange Contracts1 | | | |

Net Change in Unrealized Appreciation (Depreciation) | | | |

| | | |

Forward Foreign Currency Exchange Contracts2 | | | |

| |

| Statement of Operations location: Net realized gains (losses) on futures contracts and net realized gains (losses) on forward foreign currency exchange contracts. |

| Statement of Operations location: Net change in unrealized appreciation (depreciation) on futures contracts and net change in unrealized appreciation (depreciation) on forward foreign currency exchange contracts. |

During the period ended September 30, 2024, the month-end average notional amounts of futures contracts held by the fund and the month-end average number of contracts held were as follows:

16

Schwab Select Large Cap Growth Fund | Semiannual Holdings and Financial Statements

Schwab Select Large Cap Growth Fund

Financial Notes, unaudited (continued)

7. Derivatives (continued):

During the period ended September 30, 2024, the month-end average notional amounts of forwards held by the fund and the month-end average unrealized appreciation (depreciation) were as follows:

| UNREALIZED APPRECIATION (DEPRECIATION) |

| |

| |

The fund’s forwards are entered into pursuant to International Swaps and Derivatives Association, Inc. (ISDA) agreements which govern certain terms of derivative transactions. ISDA agreements typically contain, among other things, master netting provisions in the event of a default or other termination event. Master netting provisions allow the fund and the counterparty, in the event of a default or other termination event, to offset payable and receivable amounts for each party related to derivative contracts to one net amount payable by either the fund or the counterparty. The fund’s forwards, which are reported gross in the Statement of Assets and Liabilities, are presented in the table below. The following table presents the fund’s forwards, net of amounts available for offset under a master netting agreement and net of any related collateral received by the fund for assets and pledged by the fund for liabilities as of September 30, 2024.

| GROSS AMOUNTS OF ASSETS PRESENTED IN THE STATEMENT OF ASSETS AND LIABILITIES | FINANCIAL INSTRUMENTS AVAILABLE FOR OFFSET | | |

| | | | |

| | | | |

| Represents the net amount due from the counterparty in the event of default. |

8. Purchases and Sales of Investment Securities:For the period ended September 30, 2024, purchases and sales of securities (excluding short-term obligations) were as follows:

As of September 30, 2024, the tax basis cost of the fund’s investments and gross unrealized appreciation and depreciation were as follows:

| | GROSS UNREALIZED

APPRECIATION | GROSS UNREALIZED

DEPRECIATION | NET UNREALIZED

APPRECIATION

(DEPRECIATION) |

| | | | |

| | | | |

| | | | |

The primary difference between book basis and tax basis unrealized appreciation or unrealized depreciation of investments is the tax deferral of losses on wash sales. The tax cost of the fund’s investments, disclosed above, have been adjusted from its book amounts to reflect these unrealized appreciation or depreciation differences, as applicable.

The tax basis components of distributions and components of distributable earnings on a tax basis are finalized at fiscal year-end; accordingly, tax basis balances have not been determined as of September 30, 2024. The tax basis components of distributions paid during the fiscal year ended March 31, 2024, were as follows:

| PRIOR FISCAL YEAR END DISTRIBUTIONS |

| | |

| | |

Schwab Select Large Cap Growth Fund | Semiannual Holdings and Financial Statements

17

Schwab Select Large Cap Growth Fund

Financial Notes, unaudited (continued)

9. Federal Income Taxes (continued):

Distributions paid to shareholders are based on net investment income and net realized gains determined on a tax basis, which may differ from net investment income and net realized gains for financial reporting purposes. These differences reflect the differing character of certain income items and net realized gains and losses for financial statement and tax purposes, and may result in reclassification among certain capital accounts in the financial statements. The fund may also designate a portion of the amount paid to redeeming shareholders as a distribution for tax purposes.

As of March 31, 2024, management has reviewed the tax positions for open periods (for federal purposes, three years from the date of filing and for state purposes, four years from the date of filing) as applicable to the fund, and has determined that no provision for income tax is required in the fund’s financial statements. The fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the fund’s Statement of Operations. During the fiscal year ended March 31, 2024, the fund did not incur any interest or penalties.

Management has determined there are no subsequent events or transactions through the date the financial statements were issued that would have materially impacted the financial statements as presented.

18

Schwab Select Large Cap Growth Fund | Semiannual Holdings and Financial Statements

Schwab Select Large Cap Growth Fund

Investment Advisory and Sub-Advisory Agreement Approval

The Investment Company Act of 1940, as amended (the 1940 Act), requires that the continuation of a fund’s investment advisory agreement must be specifically approved (1) by the vote of the trustees or by a vote of the shareholders of the fund, and (2) by the vote of a majority of the trustees who are not parties to the investment advisory agreement or “interested persons” of any party thereto (the Independent Trustees), cast in person at a meeting called for the purpose of voting on such approval. In connection with such approvals, the fund’s trustees must request and evaluate, and the investment adviser is required to furnish, such information as may be reasonably necessary to evaluate the terms of the investment advisory agreement.

Approval of Renewal of Investment Advisory Agreement and Sub-Advisory Agreements

The Board of Trustees (the Board or the Trustees, as appropriate) calls and holds one or more meetings each year that are dedicated, in whole or in part, to considering whether to renew the investment advisory agreement between Laudus Trust (the Trust) and Charles Schwab Investment Management, Inc. (dba Schwab Asset Management) (the investment adviser), and the sub-advisory agreement between the investment adviser and each of J.P. Morgan Investment Management Inc. (J.P. Morgan) and American Century Investment Management, Inc. (American Century) (such investment advisory and each sub-advisory agreement, together, the Agreements), each with respect to Schwab Select Large Cap Growth Fund (the Fund) and to review certain other agreements pursuant to which the investment adviser provides investment advisory services to certain other registered investment companies. In preparation for the meeting(s), the Board requests and reviews a wide variety of materials provided by the investment adviser and each of J.P. Morgan and American Century, including information about their affiliates, personnel, business goals and priorities, profitability, third-party oversight, corporate structure and operations. The Board also receives data provided by an independent provider of investment company data. This information is in addition to the detailed information about the Fund that the Board reviews during the course of each year, including information that relates to the Fund’s operations and performance, legal and compliance matters, risk management, portfolio turnover, and sales and marketing activity. In considering the renewal, the Independent Trustees receive advice from Independent Trustees’ legal counsel, including a memorandum regarding the responsibilities of trustees for the approval of investment advisory agreements. In addition, the Independent Trustees participate in question and answer sessions with representatives of the investment adviser and meet in executive session outside the presence of Fund management.

As part of the renewal process and ongoing oversight of the investment advisory and sub-advisory relationships, the Independent Trustees’ legal counsel, on behalf of the Independent Trustees, sends an information request letter to

the investment adviser and the investment adviser sends an information request letter to each of J.P. Morgan and American Century seeking certain relevant information. The responses by the investment adviser and each of J.P. Morgan and American Century are provided to the Trustees in the Board materials for their review prior to their meeting, and the Trustees are provided with the opportunity to request any additional materials.

The Board, including a majority of the Independent Trustees, considered information specifically relating to the continuance of the Agreements with respect to the Fund at meetings held on May 2, 2024 and June 6, 2024, and approved the renewal of the Agreements with respect to the Fund each for an additional one-year term at the meeting on June 6, 2024 called for the purpose of voting on such approval.

The Board’s approval of the continuance of the Agreements was based on consideration and evaluation of a variety of specific factors discussed at these meetings and at prior meetings, including:

1.

the nature, extent and quality of the services provided to the Fund under the Agreements, including the resources of the investment adviser and its affiliates, J.P. Morgan and American Century, dedicated to the Fund;

2.

the Fund’s investment performance and how it compared to that of certain other comparable mutual funds and benchmark data;

3.

the Fund’s expenses and how those expenses compared to those of certain other similar mutual funds;

4.

the profitability of the investment adviser and its affiliates, including Charles Schwab & Co., Inc. (Schwab), with respect to the Fund, including both direct and indirect benefits accruing to the investment adviser and its affiliates, as well as the profitability of J.P. Morgan and American Century; and

5.

the extent to which economies of scale would be realized as the Fund grows and whether fee levels in the Agreements reflect those economies of scale for the benefit of Fund investors.

Nature, Extent and Quality of Services. The Board considered the nature, extent and quality of the services provided by the investment adviser to the Fund and the resources of the investment adviser and its affiliates , as well as J.P. Morgan and American Century dedicated to the Fund. In this regard, the Trustees evaluated, among other things, the investment adviser’s, J.P. Morgan’s and American Century’s experience, track record, compliance program, resources dedicated to hiring and retaining skilled personnel and specialized talent, and information security resources. The Trustees also considered information provided by the investment adviser, J.P. Morgan and American Century relating to services and support provided with respect to the Fund’s portfolio management

Schwab Select Large Cap Growth Fund | Semiannual Holdings and Financial Statements

19

Schwab Select Large Cap Growth Fund

team, portfolio strategy, and internal investment guidelines, as well as trading infrastructure, liquidity management, product design and analysis, shareholder communications, securities valuation, and vendor and risk oversight. The Trustees also considered the investment adviser’s continued investment in its infrastructure, including the investment adviser’s technology and use of data, business continuity, cybersecurity, due diligence, risk management processes, and information security programs. The Trustees considered Schwab’s overall financial condition and its reputation as a full service brokerage firm, as well as the wide range of products, services and account features that benefit Fund shareholders who are brokerage clients of Schwab. Following such evaluation, the Board concluded, within the context of its full deliberations, that the nature, extent and quality of services provided by the investment adviser, J.P. Morgan and American Century to the Fund and the resources of the investment adviser, J.P. Morgan and American Century and their respective affiliates supported renewal of the Agreements with respect to the Fund.

Fund Performance. The Board considered the Fund’s performance in determining whether to renew the Agreements with respect to the Fund. Specifically, the Trustees considered the Fund’s performance relative to a peer category of other mutual funds and an applicable index/benchmark, in light of total return and the market environment, as well as in consideration of the Fund’s investment style and strategy. As part of this review, the Trustees considered the composition of the peer category, selection criteria and the reputation of the independent provider of investment company data who prepared the peer category analysis. In evaluating the performance of the Fund, the Trustees considered the risk profile for the Fund and the appropriateness of the benchmark used to compare the performance of the Fund. The Trustees further considered the level of Fund performance in the context of their review of Fund expenses and adviser profitability discussed below and also noted that the Board and a designated committee of the Board review performance throughout the year. Although the Fund had performance that ranked in the fourth quartile of a relevant peer group for more than one performance period considered, the Board noted the Fund’s 2023 changes in sub-advisers and concluded that other factors relevant to performance supported renewal of the Agreement with respect to the Fund including that the underperformance was attributable, to a significant extent, to investment decisions made by the investment adviser and sub-advisers that were reasonable and consistent with the Fund’s investment objective and policies. Following such evaluation, the Board concluded, within the context of its full deliberations, that the performance of the Fund supported renewal of the Agreements with respect to the Fund.

Fund Expenses. With respect to the Fund’s expenses, the Trustees considered the rate of compensation called for by the Agreements and the Fund’s operating expense ratio, in each case, in comparison to those of other similar mutual funds, such peer category and comparison having been selected and calculated by an independent provider of investment company data. The investment adviser reported to the Board, and the Board took into account, the risk assumed by the investment

adviser in the development of the Fund and provision of services, as well as the competitive marketplace for financial products. The Trustees considered the effects of the investment adviser’s contractual waivers of management and other fees to prevent total Fund expenses from exceeding a specified cap. The Trustees also considered fees charged by the investment adviser, J.P. Morgan and American Century to other mutual funds and to other types of accounts, but, with respect to such other types of accounts, accorded less weight to such comparisons due to the different legal, regulatory, compliance and operating features of mutual funds as compared to these other types of accounts and any differences in the nature and scope of the services the investment adviser provides to these other accounts and any differences in the market for these types of accounts. The Trustees also noted that, at the June 6, 2024 meeting, they approved an amendment to the sub-advisory agreement with American Century that retroactively reduced American Century’s fees payable by the investment adviser effective March 1, 2024 and discussed the expected savings for the investment adviser resulting from the amendment. Following such evaluation, the Board concluded, within the context of its full deliberations, that the expenses of the Fund are reasonable and supported renewal of the Agreements with respect to the Fund.

Profitability. With regard to profitability, the Trustees considered the compensation flowing to the investment adviser and its affiliates, directly or indirectly and the compensation flowing to J.P. Morgan and American Century, directly or indirectly. The Trustees also reviewed the profitability of the investment adviser relating to the Schwab fund complex as a whole, noting the benefits to Fund shareholders of being part of the Schwab fund complex, including the allocations of certain costs across the Fund and other funds in the complex. The Trustees also considered any other benefits derived by the investment adviser, J.P. Morgan and American Century from their relationships with the Fund, such as whether, by virtue of their management of the Fund, the investment adviser, J.P. Morgan and American Century obtains investment information or other research resources that aid it in providing advisory services to other clients. With respect to the investment adviser, J.P. Morgan and American Century, and their respective affiliates, the Trustees considered whether the varied levels of compensation and profitability with respect to the Fund under the Agreements and other service agreements were reasonable in light of the quality of all services rendered to the Fund by the investment adviser, J.P. Morgan and American Century and their respective affiliates. The Trustees noted that the investment adviser continues to invest substantial sums in its business in order to provide enhanced services and systems to benefit the Fund. With respect to the profitability of J.P. Morgan and American Century, the Board also considered that J.P. Morgan and American Century are compensated by the investment adviser and not by the Fund directly, and such compensation reflects an arms-length negotiation between the investment adviser, J.P. Morgan and American Century. Based on this evaluation, the Board concluded, within the context of its full deliberations, that the profitability of the investment adviser,

20

Schwab Select Large Cap Growth Fund | Semiannual Holdings and Financial Statements

Schwab Select Large Cap Growth Fund

J.P. Morgan and American Century is reasonable and supported renewal of the Agreements with respect to the Fund.

Economies of Scale. Although the Trustees recognized the difficulty of determining economies of scale with precision, the Trustees considered the potential existence of any economies of scale and whether those are passed along to the Fund’s shareholders through (i) the enhancement of services provided to the Fund in return for fees paid, including through investments by the investment adviser in its infrastructure, including modernizing the investment adviser’s technology and use of data, increasing expertise and capabilities in key areas (including portfolio and trade operations), and improving business continuity, cybersecurity, due diligence and information security programs, which are designed to provide enhanced services to the Fund and its shareholders; and (ii) pricing the Fund to scale and keeping overall expenses down as the Fund grows. The Trustees acknowledged that the investment adviser has invested in its infrastructure, as discussed above, over time and noted the impact of regulatory and other developments on the investment adviser’s internal costs of providing investment management, technology, administrative, legal and compliance services to the Fund. The Trustees also considered the existing contractual investment advisory fee schedule for the Fund that includes lower fees at higher graduated asset levels. Based on this evaluation, the Board concluded, within the context of its full deliberations, that the Fund obtains reasonable benefits from economies of scale.

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

In the course of their deliberations, the Trustees may have accorded different weights to various factors and did not identify any particular information or factor that was all important or controlling. Based on the Trustees’ deliberation and their evaluation of the information described above, the

Board, including all of the Independent Trustees, approved the continuation of the Agreements with respect to the Fund and concluded that the compensation under the Agreements with respect to the Fund is fair and reasonable in light of the services provided and the related expenses borne by the investment adviser and its affiliates and such other matters as the Trustees considered to be relevant in the exercise of their reasonable judgment.

Approval of Amendment to Sub-Advisory Agreement with American Century

At a meeting held on June 6, 2024, the Board, including a majority of the Independent Trustees, considered information specifically relating to its consideration of the approval of an amendment to the sub-advisory agreement with American Century relating to the Fund to reflect a reduction to the rate paid by CSIM to American Century as compensation for American Century’s services rendered to the Fund. The Board reviewed materials provided at their June 6, 2024 meeting and also took into account the detailed information that the Board reviewed at the May 2, 2024 meeting during the course of its consideration and approval of the renewal of the sub-advisory agreement between CSIM and American Century with respect to the Fund.

Based on the Trustees’ deliberation and their evaluation of the information described above, the Board, including a majority of the Independent Trustees, approved an amendment to the sub-advisory agreement with American Century relating to the Fund to reflect a reduction to the rate paid by CSIM to American Century as compensation for American Century’s services rendered to the Fund and concluded that the change to the rate paid by CSIM to American Century would not result in any reduction in the nature or quality of services provided by American Century under the sub-advisory agreement between CSIM and American Century.

Schwab Select Large Cap Growth Fund | Semiannual Holdings and Financial Statements

21

Item 8: Changes in and Disagreements with Accountants for Open-End Management Investment Companies.

Not applicable.

Item 9: Proxy Disclosures for Open-End Management Investment Companies.

Not applicable.

Item 10: Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies.

The remuneration paid to directors, officers and others are included as part of the report to shareholders filed under Item 7 of this Form.

Item 11: Statement Regarding Basis for Approval of Investment Advisory Contract.

The statement regarding basis for approval of investment advisory contract is included as part of the report to shareholders filed under Item 7 of this Form.

Item 12: Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 13: Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

| Item 14: | Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers. |

Not applicable.

Item 15: Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 16: Controls and Procedures.

| (a) | Based on their evaluation of Registrant’s disclosure controls and procedures, as of a date within 90 days of the filing date, Registrant’s Chief Executive Officer, Omar Aguilar and Registrant’s Chief Financial Officer, Dana Smith, have concluded that Registrant’s disclosure controls and procedures are: (i) reasonably designed to ensure that information required to be disclosed in this report is appropriately communicated to Registrant’s officers to allow timely decisions regarding disclosures required in this report; (ii) reasonably designed to ensure that information required to be disclosed in this report is recorded, processed, summarized and reported in a timely manner; and (iii) are effective in achieving the goals described in (i) and (ii) above. |

| (b) | During the period covered by this report, there have been no changes in Registrant’s internal control over financial reporting that the above officers believe to have materially affected, or to be reasonably likely to materially affect, Registrant’s internal control over financial reporting. |

Item 17: Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable.

Item 18: Recovery of Erroneously Awarded Compensation.

(a) Not applicable.

(b) Not applicable

Item 19: Exhibits.

(a) (1) Code of ethics – not applicable to this semi-annual report.

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) Laudus Trust

| | |

| By: | | /s/ Omar Aguilar |

| | Omar Aguilar Principal Executive Officer (Chief Executive Officer) |

| |

| Date: | | November 15, 2024 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | |

| By: | | /s/ Omar Aguilar |