UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05547

Laudus Trust

(Exact name of registrant as specified in charter)

211 Main Street, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Omar Aguilar

Laudus Trust

211 Main Street, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 636-7000

Date of fiscal year end: March 31

Date of reporting period: March 31, 2024

Item 1: Report(s) to Shareholders.

No Action Required – Notice Regarding Shareholder Report Delivery |

Beginning on July 24, 2024, fund shareholder reports will be streamlined to highlight key information deemed important for investors to assess and monitor their fund investments. Other information, including financial statements, will not appear in the streamlined shareholder reports but will available online and delivered free of charge upon request. |

• If you already receive the full shareholder reports, you will receive the streamlined shareholder reports in the same way that you currently receive the full shareholder reports (either in paper or electronically). |

• If you currently receive a notification when a shareholder report is available on a fund’s website, beginning July 24, 2024, you will begin to receive the streamlined shareholder report (in paper). |

Total Return for the 12 Months Ended March 31, 2024 | |

Schwab Select Large Cap Growth Fund (Ticker Symbol: LGILX) | 43.44% 1 |

Russell 1000® Growth Index | 39.00% |

Fund Category: Morningstar Large Growth2 | 36.45% |

Performance Details | pages 5-7 |

Fund and Inception Date | 1 Year | 5 Years | 10 Years |

Schwab Select Large Cap Growth Fund (10/14/97)* | 43.44% 2 | 14.46% | 14.07% |

Russell 1000® Growth Index | 39.00% | 18.52% | 15.98% |

Fund Category: Morningstar Large Growth3 | 36.45% | 14.89% | 13.24% |

Fund Expense Ratio4: 0.75% | |||

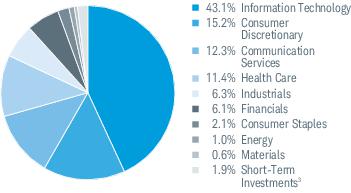

Investment Managers | Investment Style | % of Net Assets |

American Century Investment Management, Inc. | U.S. Large-Cap Growth | 59.3% |

J.P. Morgan Investment Management Inc. | U.S. Large-Cap Growth | 40.1% |

Cash and other assets6 | 0.6% |

Number of Holdings | 112 |

Weighted Average Market Cap (millions) | $1,098,026 |

Price/Earnings Ratio (P/E) | 39.89 |

Price/Book Ratio (P/B) | 10.15 |

Portfolio Turnover Rate | 63% |

EXPENSE RATIO (ANNUALIZED) 1 | BEGINNING ACCOUNT VALUE AT 10/1/23 | ENDING ACCOUNT VALUE (NET OF EXPENSES) AT 3/31/24 | EXPENSES PAID DURING PERIOD 10/1/23-3/31/24 2 | |

Schwab Select Large Cap Growth Fund | ||||

Actual Return | 0.74% | $1,000.00 | $1,297.90 | $4.25 |

Hypothetical 5% Return | 0.74% | $1,000.00 | $1,021.30 | $3.74 |

1 | Based on the most recent six-month expense ratio. |

2 | Expenses for the fund are equal to its annualized expense ratio, multiplied by the average account value over the period, multiplied by 183 days in the period, and divided by 366 days in the fiscal year. |

4/1/23– 3/31/24 | 4/1/22– 3/31/23 | 4/1/21– 3/31/22 | 4/1/20– 3/31/21 | 4/1/19– 3/31/20 | ||

Per-Share Data | ||||||

Net asset value at beginning of period | $19.87 | $26.64 | $29.23 | $19.61 | $21.31 | |

Income (loss) from investment operations: | ||||||

Net investment income (loss)1 | (0.02 ) | 0.01 | (0.09 ) | (0.07 ) | (0.04 ) | |

Net realized and unrealized gains (losses) | 8.07 | (4.48 ) | 1.69 | 11.21 | 0.23 | |

Total from investment operations | 8.05 | (4.47 ) | 1.60 | 11.14 | 0.19 | |

Less distributions: | ||||||

Distributions from net investment income | — | — | — | — | (0.02 ) | |

Distributions from net realized gains | (3.85 ) | (2.30 ) | (4.19 ) | (1.52 ) | (1.87 ) | |

Total distributions | (3.85 ) | (2.30 ) | (4.19 ) | (1.52 ) | (1.89 ) | |

Net asset value at end of period | $24.07 | $19.87 | $26.64 | $29.23 | $19.61 | |

Total return | 43.44 % | (15.94 %) | 3.88 % | 56.98 % | (0.06 %) | |

Ratios/Supplemental Data | ||||||

Ratios to average net assets: | ||||||

Net operating expenses | 0.74 % | 0.75 %2 | 0.71 % | 0.72 % | 0.74 % | |

Gross operating expenses | 0.74 % | 0.75 %2 | 0.71 % | 0.72 % | 0.74 % | |

Net investment income (loss) | (0.09 %) | 0.03 % | (0.28 %) | (0.25 %) | (0.18 %) | |

Portfolio turnover rate | 63 % | 49 % | 50 % | 37 % | 40 % | |

Net assets, end of period (x 1,000,000) | $2,196 | $1,876 | $2,926 | $2,943 | $1,981 | |

1 | Calculated based on the average shares outstanding during the period. |

2 | Ratio includes less than 0.005% of non-routine proxy expenses. |

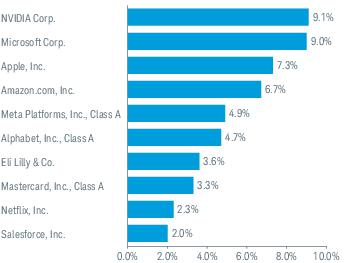

SECURITY | NUMBER OF SHARES | VALUE ($) |

COMMON STOCKS 97.9% OF NET ASSETS | ||

Automobiles & Components 1.6% | ||

Tesla, Inc. * | 198,523 | 34,898,358 |

Capital Goods 4.5% | ||

Acuity Brands, Inc. | 29,422 | 7,906,574 |

Advanced Drainage Systems, Inc. | 55,492 | 9,557,942 |

Deere & Co. | 5,011 | 2,058,218 |

Donaldson Co., Inc. | 44,599 | 3,330,653 |

Eaton Corp. PLC | 50,779 | 15,877,578 |

Fortive Corp. | 102,386 | 8,807,244 |

Johnson Controls International PLC | 47,873 | 3,127,064 |

Nordson Corp. | 24,433 | 6,707,836 |

Quanta Services, Inc. | 19,290 | 5,011,542 |

Trane Technologies PLC | 31,701 | 9,516,640 |

TransDigm Group, Inc. | 10,012 | 12,330,779 |

Westinghouse Air Brake Technologies Corp. | 38,128 | 5,554,487 |

WW Grainger, Inc. | 6,114 | 6,219,772 |

Yaskawa Electric Corp. | 45,702 | 1,945,748 |

97,952,077 | ||

Commercial & Professional Services 0.7% | ||

Cintas Corp. | 5,147 | 3,536,143 |

Copart, Inc. * | 127,569 | 7,388,797 |

Paycom Software, Inc. | 17,415 | 3,465,759 |

14,390,699 | ||

Consumer Discretionary Distribution & Retail 7.8% | ||

Amazon.com, Inc. * | 812,169 | 146,499,044 |

AutoZone, Inc. * | 2,289 | 7,214,127 |

Lowe's Cos., Inc. | 21,380 | 5,446,127 |

MercadoLibre, Inc. * | 6,679 | 10,098,381 |

Pool Corp. | 6,735 | 2,717,573 |

171,975,252 | ||

Consumer Durables & Apparel 1.7% | ||

DR Horton, Inc. | 72,445 | 11,920,825 |

Lululemon Athletica, Inc. * | 57,058 | 22,289,707 |

NIKE, Inc., Class B | 31,514 | 2,961,686 |

37,172,218 | ||

Consumer Services 4.1% | ||

Airbnb, Inc., Class A * | 19,390 | 3,198,574 |

Booking Holdings, Inc. | 1,658 | 6,015,025 |

Chipotle Mexican Grill, Inc. * | 14,977 | 43,534,694 |

DoorDash, Inc., Class A * | 50,413 | 6,942,878 |

Marriott International, Inc., Class A | 43,318 | 10,929,565 |

Starbucks Corp. | 38,964 | 3,560,920 |

SECURITY | NUMBER OF SHARES | VALUE ($) |

Wingstop, Inc. | 42,902 | 15,719,293 |

89,900,949 | ||

Consumer Staples Distribution & Retail 1.2% | ||

Costco Wholesale Corp. | 36,368 | 26,644,288 |

Energy 1.0% | ||

Cheniere Energy, Inc. | 8,188 | 1,320,561 |

ConocoPhillips | 36,321 | 4,622,937 |

EOG Resources, Inc. | 73,329 | 9,374,379 |

Schlumberger NV | 128,965 | 7,068,572 |

22,386,449 | ||

Financial Services 6.1% | ||

Blackstone, Inc. | 44,572 | 5,855,424 |

Block, Inc. * | 82,097 | 6,943,764 |

KKR & Co., Inc. | 44,596 | 4,485,466 |

Mastercard, Inc., Class A | 152,339 | 73,361,892 |

MSCI, Inc. | 24,525 | 13,745,036 |

Tradeweb Markets, Inc., Class A | 31,226 | 3,252,813 |

Visa, Inc., Class A | 92,889 | 25,923,462 |

133,567,857 | ||

Food, Beverage & Tobacco 0.9% | ||

Celsius Holdings, Inc. * | 108,137 | 8,966,720 |

Constellation Brands, Inc., Class A | 34,776 | 9,450,726 |

Monster Beverage Corp. * | 28,883 | 1,712,184 |

20,129,630 | ||

Health Care Equipment & Services 4.9% | ||

Align Technology, Inc. * | 6,932 | 2,273,142 |

Dexcom, Inc. * | 120,730 | 16,745,251 |

Edwards Lifesciences Corp. * | 106,729 | 10,199,023 |

HCA Healthcare, Inc. | 1,861 | 620,699 |

IDEXX Laboratories, Inc. * | 8,847 | 4,776,761 |

Insulet Corp. * | 17,628 | 3,021,439 |

Intuitive Surgical, Inc. * | 78,231 | 31,221,210 |

McKesson Corp. | 19,302 | 10,362,279 |

UnitedHealth Group, Inc. | 57,203 | 28,298,324 |

107,518,128 | ||

Materials 0.6% | ||

Ecolab, Inc. | 47,309 | 10,923,648 |

Freeport-McMoRan, Inc. | 40,162 | 1,888,417 |

12,812,065 | ||

Media & Entertainment 12.3% | ||

Alphabet, Inc., Class A * | 688,412 | 103,902,023 |

Meta Platforms, Inc., Class A | 220,072 | 106,862,562 |

Netflix, Inc. * | 82,673 | 50,209,793 |

Spotify Technology SA * | 19,103 | 5,041,282 |

SECURITY | NUMBER OF SHARES | VALUE ($) |

Trade Desk, Inc., Class A * | 36,234 | 3,167,576 |

269,183,236 | ||

Pharmaceuticals, Biotechnology & Life Sciences 6.4% | ||

Alnylam Pharmaceuticals, Inc. * | 26,470 | 3,955,941 |

Biogen, Inc. * | 17,936 | 3,867,540 |

Eli Lilly & Co. | 101,760 | 79,165,210 |

Exact Sciences Corp. * | 43,626 | 3,012,811 |

Genmab AS * | 14,493 | 4,345,415 |

Gilead Sciences, Inc. | 39,084 | 2,862,903 |

Regeneron Pharmaceuticals, Inc. * | 40,649 | 39,124,256 |

Thermo Fisher Scientific, Inc. | 712 | 413,821 |

Waters Corp. * | 12,278 | 4,226,456 |

140,974,353 | ||

Semiconductors & Semiconductor Equipment 15.6% | ||

Advanced Micro Devices, Inc. * | 156,588 | 28,262,568 |

Analog Devices, Inc. | 72,317 | 14,303,580 |

Applied Materials, Inc. | 140,037 | 28,879,831 |

ASML Holding NV | 15,604 | 15,127,469 |

ASML Holding NV NY Registry Shares | 3,426 | 3,324,830 |

Broadcom, Inc. | 19,033 | 25,226,529 |

Lam Research Corp. | 10,626 | 10,323,903 |

Lattice Semiconductor Corp. * | 128,722 | 10,069,922 |

NVIDIA Corp. | 221,106 | 199,782,537 |

Taiwan Semiconductor Manufacturing Co. Ltd., ADR | 55,566 | 7,559,754 |

342,860,923 | ||

Software & Services 18.7% | ||

Adobe, Inc. * | 13,567 | 6,845,908 |

Cognizant Technology Solutions Corp., Class A | 31,080 | 2,277,853 |

Datadog, Inc., Class A * | 85,364 | 10,550,990 |

DocuSign, Inc. * | 140,482 | 8,365,703 |

Dynatrace, Inc. * | 196,934 | 9,145,615 |

Fair Isaac Corp. * | 13,483 | 16,848,492 |

Gartner, Inc. * | 12,429 | 5,924,532 |

HubSpot, Inc. * | 8,219 | 5,149,697 |

Intuit, Inc. | 14,002 | 9,101,300 |

Microsoft Corp. | 467,481 | 196,678,606 |

MongoDB, Inc. * | 7,332 | 2,629,549 |

Okta, Inc. * | 147,887 | 15,471,938 |

Oracle Corp. | 127,323 | 15,993,042 |

Palo Alto Networks, Inc. * | 15,010 | 4,264,791 |

Salesforce, Inc. | 146,219 | 44,038,238 |

SECURITY | NUMBER OF SHARES | VALUE ($) |

ServiceNow, Inc. * | 13,126 | 10,007,262 |

Shopify, Inc., Class A * | 144,716 | 11,167,734 |

Synopsys, Inc. * | 30,178 | 17,246,727 |

Workday, Inc., Class A * | 19,200 | 5,236,800 |

Zscaler, Inc. * | 76,047 | 14,648,934 |

411,593,711 | ||

Technology Hardware & Equipment 8.7% | ||

Amphenol Corp., Class A | 65,561 | 7,562,461 |

Apple, Inc. | 938,267 | 160,894,025 |

Arista Networks, Inc. * | 24,980 | 7,243,700 |

Cognex Corp. | 50,216 | 2,130,163 |

Jabil, Inc. | 32,894 | 4,406,151 |

Keyence Corp. | 18,850 | 8,751,317 |

190,987,817 | ||

Transportation 1.1% | ||

JB Hunt Transport Services, Inc. | 28,070 | 5,592,947 |

Uber Technologies, Inc. * | 250,948 | 19,320,487 |

24,913,434 | ||

Total Common Stocks (Cost $1,199,975,780) | 2,149,861,444 | |

SHORT-TERM INVESTMENTS 1.9% OF NET ASSETS | ||

Money Market Funds 1.9% | ||

State Street Institutional U.S. Government Money Market Fund, Premier Class 5.26% (a) | 42,068,859 | 42,068,859 |

Total Short-Term Investments (Cost $42,068,859) | 42,068,859 | |

Total Investments in Securities (Cost $1,242,044,639) | 2,191,930,303 | |

NUMBER OF CONTRACTS | NOTIONAL AMOUNT ($) | CURRENT VALUE/ UNREALIZED APPRECIATION ($) | |

FUTURES CONTRACTS | |||

Long | |||

Russell 1000 Growth Index, e-mini, expires 06/21/24 | 87 | 14,946,600 | 63,019 |

SETTLEMENT DATE | COUNTERPARTY | CURRENCY TO BE RECEIVED | AMOUNT OF CURRENCY TO BE RECEIVED | CURRENCY TO BE DELIVERED | AMOUNT OF CURRENCY TO BE DELIVERED | UNREALIZED APPRECIATION ($) |

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS | ||||||

06/28/24 | UBS AG | USD | 3,880,625 | JPY | 579,429,736 | 1,961 |

* | Non-income producing security. |

(a) | The rate shown is the annualized 7-day yield. |

ADR — | American Depositary Receipt |

JPY — | Japanese Yen |

USD — | U.S. Dollar |

DESCRIPTION | QUOTED PRICES IN ACTIVE MARKETS FOR IDENTICAL ASSETS (LEVEL 1) | OTHER SIGNIFICANT OBSERVABLE INPUTS (LEVEL 2) | SIGNIFICANT UNOBSERVABLE INPUTS (LEVEL 3) | TOTAL |

Assets | ||||

Common Stocks1 | $1,377,086,274 | $— | $— | $1,377,086,274 |

Capital Goods | 96,006,329 | 1,945,748 | — | 97,952,077 |

Pharmaceuticals, Biotechnology & Life Sciences | 136,628,938 | 4,345,415 | — | 140,974,353 |

Semiconductors & Semiconductor Equipment | 327,733,454 | 15,127,469 | — | 342,860,923 |

Technology Hardware & Equipment | 182,236,500 | 8,751,317 | — | 190,987,817 |

Short-Term Investments1 | 42,068,859 | — | — | 42,068,859 |

Futures Contracts2 | 63,019 | — | — | 63,019 |

Forward Foreign Currency Exchange Contracts2 | — | 1,961 | — | 1,961 |

Total | $2,161,823,373 | $30,171,910 | $— | $2,191,995,283 |

1 | As categorized in the Portfolio Holdings. |

2 | Futures contracts and forward foreign currency exchange contracts are reported at cumulative unrealized appreciation or depreciation. |

Assets | ||

Investments in securities, at value - unaffiliated issuers (cost $1,242,044,639) | $2,191,930,303 | |

Cash | 394,843 | |

Deposit with broker for futures contracts | 2,416,000 | |

Receivables: | ||

Investments sold | 3,856,580 | |

Dividends | 571,192 | |

Fund shares sold | 390,909 | |

Foreign tax reclaims | 27,237 | |

Unrealized appreciation on forward foreign currency exchange contracts | 1,961 | |

Prepaid expenses | + | 17,832 |

Total assets | 2,199,606,857 | |

Liabilities | ||

Payables: | ||

Fund shares redeemed | 2,206,380 | |

Investment adviser fees | 1,163,372 | |

Sub-accounting and sub-transfer agent fees | 174,395 | |

Investments bought | 169,795 | |

Variation margin on futures contracts | 9,537 | |

Accrued expenses | + | 151,854 |

Total liabilities | 3,875,333 | |

Net assets | $2,195,731,524 | |

Net Assets by Source | ||

Capital received from investors | $1,164,674,384 | |

Total distributable earnings | + | 1,031,057,140 |

Net assets | $2,195,731,524 | |

Net Asset Value (NAV) | ||||

Net Assets | ÷ | Shares Outstanding | = | NAV |

$2,195,731,524 | 91,222,128 | $24.07 | ||

For the period April 1, 2023 through March 31, 2024 | ||

Investment Income | ||

Dividends received from securities - unaffiliated issuers (net of foreign withholding tax of $239,910) | $13,156,693 | |

Interest received from securities - unaffiliated issuers | + | 47,237 |

Total investment income | 13,203,930 | |

Expenses | ||

Investment adviser fees | 12,606,244 | |

Sub-accounting and sub-transfer agent fees | 1,862,238 | |

Shareholder reports | 120,303 | |

Accounting and administration fees | 77,353 | |

Professional fees | 74,836 | |

Independent trustees’ fees | 71,199 | |

Registration fees | 46,926 | |

Transfer agent fees | 19,809 | |

Custodian fees | 17,157 | |

Other expenses | + | 28,974 |

Total expenses | – | 14,925,039 |

Net investment loss | (1,721,109 ) | |

REALIZED AND UNREALIZED GAINS (LOSSES) | ||

Net realized gains on sales of securities - unaffiliated issuers | 404,546,699 | |

Net realized gains on futures contracts | 5,914,996 | |

Net realized gains on forward foreign currency exchange contracts | 165,746 | |

Net realized losses on foreign currency transactions | + | (57,388 ) |

Net realized gains | 410,570,053 | |

Net change in unrealized appreciation (depreciation) on securities - unaffiliated issuers | 323,136,807 | |

Net change in unrealized appreciation (depreciation) on futures contracts | 63,019 | |

Net change in unrealized appreciation (depreciation) on forward foreign currency exchange contracts | 1,961 | |

Net change in unrealized appreciation (depreciation) on foreign currency translations | + | (268 ) |

Net change in unrealized appreciation (depreciation) | + | 323,201,519 |

Net realized and unrealized gains | 733,771,572 | |

Increase in net assets resulting from operations | $732,050,463 | |

OPERATIONS | |||

4/1/23-3/31/24 | 4/1/22-3/31/23 | ||

Net investment income (loss) | ($1,721,109 ) | $678,849 | |

Net realized gains | 410,570,053 | 321,598 | |

Net change in unrealized appreciation (depreciation) | + | 323,201,519 | (502,671,436 ) |

Increase (decrease) in net assets resulting from operations | $732,050,463 | ($501,670,989 ) | |

DISTRIBUTIONS TO SHAREHOLDERS | |||

Total distributions | ($321,256,855 ) | ($219,998,276 ) | |

TRANSACTIONS IN FUND SHARES | |||||

4/1/23-3/31/24 | 4/1/22-3/31/23 | ||||

SHARES | VALUE | SHARES | VALUE | ||

Shares sold | 9,029,000 | $199,920,434 | 11,457,148 | $234,521,827 | |

Shares reinvested | 12,788,232 | 267,146,185 | 10,018,932 | 181,843,602 | |

Shares redeemed | + | (25,041,141 ) | (558,314,598 ) | (36,885,487 ) | (744,859,725 ) |

Net transactions in fund shares | (3,223,909 ) | ($91,247,979 ) | (15,409,407 ) | ($328,494,296 ) | |

SHARES OUTSTANDING AND NET ASSETS | |||||

4/1/23-3/31/24 | 4/1/22-3/31/23 | ||||

SHARES | NET ASSETS | SHARES | NET ASSETS | ||

Beginning of period | 94,446,037 | $1,876,185,895 | 109,855,444 | $2,926,349,456 | |

Total increase (decrease) | + | (3,223,909 ) | 319,545,629 | (15,409,407 ) | (1,050,163,561 ) |

End of period | 91,222,128 | $2,195,731,524 | 94,446,037 | $1,876,185,895 | |

2. Significant Accounting Policies:

3. Risk Factors:

4. Affiliates and Affiliated Transactions:

% OF AVERAGE DAILY NET ASSETS | |

First $500 million | 0.700 % |

$500 million to $1 billion | 0.650 % |

$1 billion to $1.5 billion | 0.600 % |

$1.5 billion to $2 billion | 0.575 % |

Over $2 billion | 0.550 % |

Schwab Balanced Fund | 4.7 % |

Schwab Target 2010 Fund | 0.0 %* |

Schwab Target 2015 Fund | 0.1 % |

Schwab Target 2020 Fund | 0.4 % |

Schwab Target 2025 Fund | 0.6 % |

Schwab Target 2030 Fund | 1.7 % |

Schwab Target 2035 Fund | 1.2 % |

Schwab Target 2040 Fund | 2.8 % |

Schwab Target 2045 Fund | 0.9 % |

Schwab Target 2050 Fund | 1.2 % |

Schwab Target 2055 Fund | 0.9 % |

Schwab Target 2060 Fund | 0.3 % |

Schwab Target 2065 Fund | 0.1 % |

* | Less than 0.05% |

5. Board of Trustees:

6. Borrowing from Banks:

7. Derivatives:

EQUITY CONTRACTS | FOREIGN EXCHANGE CONTRACTS | TOTAL | |

Asset Derivatives | |||

Futures Contracts1 | $63,019 | $— | $63,019 |

Forward Foreign Currency Exchange Contracts2 | — | 1,961 | 1,961 |

1 | Includes cumulative unrealized appreciation of futures contracts as reported in the fund’s Portfolio Holdings. Only current day’s variation margin on futures contracts is reported within the Statement of Assets and Liabilities. |

2 | Statement of Assets and Liabilities location: Unrealized appreciation on forward foreign currency exchange contracts. |

EQUITY CONTRACTS | FOREIGN EXCHANGE CONTRACTS | TOTAL | |

Net Realized Gains (Losses) | |||

Futures Contracts1 | $5,914,996 | $— | $5,914,996 |

Forward Foreign Currency Exchange Contracts1 | — | 165,746 | 165,746 |

Net Change in Unrealized Appreciation (Depreciation) | |||

Futures Contracts2 | $63,019 | $— | $63,019 |

Forward Foreign Currency Exchange Contracts2 | — | 1,961 | 1,961 |

1 | Statement of Operations location: Net realized gains on futures contracts and net realized gains on forward foreign currency exchange contracts. |

2 | Statement of Operations location: Net change in unrealized appreciation (depreciation) on futures contracts and net change in unrealized appreciation (depreciation) on forward foreign currency exchange contracts. |

NOTIONAL AMOUNT | NUMBER OF CONTRACTS |

$11,108,315 | 75 |

NOTIONAL AMOUNT | UNREALIZED APPRECIATION (DEPRECIATION) |

$1,749,574 | $33,216 |

COUNTERPARTY | GROSS AMOUNTS OF ASSETS PRESENTED IN THE STATEMENT OF ASSETS AND LIABILITIES | FINANCIAL INSTRUMENTS AVAILABLE FOR OFFSET | CASH COLLATERAL PLEDGED | NET AMOUNT(a) |

UBS AG | $1,961 | $— | $— | $1,961 |

Total | $1,961 | $— | $— | $1,961 |

(a) | Represents the net amount due from the counterparty in the event of default. |

8. Purchases and Sales of Investment Securities:

PURCHASES OF SECURITIES | SALES OF SECURITIES |

$1,238,743,825 | $1,696,015,320 |

9. Federal Income Taxes:

TAX COST | GROSS UNREALIZED APPRECIATION | GROSS UNREALIZED DEPRECIATION | NET UNREALIZED APPRECIATION (DEPRECIATION) | |

$1,244,468,931 | $975,292,791 | ($27,766,439 ) | $947,526,352 | |

UNDISTRIBUTED ORDINARY INCOME | UNDISTRIBUTED LONG-TERM CAPITAL GAINS | NET UNREALIZED APPRECIATION (DEPRECIATION) ON INVESTMENTS | NET OTHER UNREALIZED APPRECIATION (DEPRECIATION) | TOTAL |

$18,898,785 | $64,632,271 | $947,526,352 | ($268 ) | $1,031,057,140 |

CURRENT FISCAL YEAR END DISTRIBUTIONS | PRIOR FISCAL YEAR END DISTRIBUTIONS | |||

ORDINARY INCOME | LONG-TERM CAPITAL GAINS | ORDINARY INCOME | LONG-TERM CAPITAL GAINS | |

$35,291,477 | $285,965,378 | $— | $219,998,276 | |

10. Subsequent Events:

Denver, Colorado

May 17, 2024

Independent Trustees | |||

Name, Year of Birth, and Position(s) with the trust (Terms of office, and length of Time Served1) | Principal Occupations During the Past Five Years | Number of Portfolios in Fund Complex Overseen by the Trustee | Other Directorships |

Michael J. Beer 1961 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2022) | Retired. Director, President and Chief Executive Officer (Dec. 2016 – Sept. 2019), Principal Funds (investment management). | 106 | Director (2016 – 2019), Principal Funds, Inc. |

Robert W. Burns 1959 Trustee (Trustee of Schwab Strategic Trust since 2009; The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios and Laudus Trust since 2016) | Retired/Private Investor. | 106 | None |

Nancy F. Heller 1956 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2018) | Retired. | 106 | None |

David L. Mahoney 1954 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios and Laudus Trust since 2011; Schwab Strategic Trust since 2016) | Private Investor. | 106 | Director (2004 – present), Corcept Therapeutics Incorporated Director (2009 – 2021), Adamas Pharmaceuticals, Inc. Director (2003 – 2019), Symantec Corporation |

Jane P. Moncreiff 1961 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2019) | Consultant (2018 – present), Fulham Advisers LLC (management consulting); Chief Investment Officer (2009 – 2017), CareGroup Healthcare System, Inc. (healthcare). | 106 | None |

Independent Trustees (continued) | |||

Name, Year of Birth, and Position(s) with the trust (Terms of office, and length of Time Served1) | Principal Occupations During the Past Five Years | Number of Portfolios in Fund Complex Overseen by the Trustee | Other Directorships |

Kimberly S. Patmore 1956 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2016) | Consultant (2008 – present), Patmore Management Consulting (management consulting). | 106 | None |

J. Derek Penn 1957 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2021) | Head of Equity Sales and Trading (2006 – 2018), BNY Mellon (financial services). | 106 | None |

Interested Trustees | |||

Name, Year of Birth, and Position(s) with the trust (Terms of office, and length of Time Served1) | Principal Occupations During the Past Five Years | Number of Portfolios in Fund Complex Overseen by the Trustee | Other Directorships |

Walter W. Bettinger II2 1960 Chairman and Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust and Schwab Annuity Portfolios since 2008; Schwab Strategic Trust since 2009; Laudus Trust since 2010) | Co-Chairman of the Board (July 2022 – present), Director and Chief Executive Officer (Oct. 2008 – present) and President (Feb. 2007 – Oct. 2021), The Charles Schwab Corporation; President and Chief Executive Officer (Oct. 2008 – Oct. 2021) and Director (May 2008 – Oct. 2021), Charles Schwab & Co., Inc.; Co-Chairman of the Board (July 2022 – present) and Director (Apr. 2006 – present), Charles Schwab Bank, SSB; Co-Chairman of the Board (July 2022 – present) and Director (Nov. 2017 – present), Charles Schwab Premier Bank, SSB; Co-Chairman of the Board (July 2022 – present) and Director (July 2019 – present), Charles Schwab Trust Bank; Director (May 2008 – present), Chief Executive Officer (Aug. 2017 – present) and President (Aug. 2017 – Nov. 2021), Schwab Holdings, Inc.; Manager (Sept. 2023 – present), TD Ameritrade Holding LLC; Director (Oct. 2020 – Aug. 2023), TD Ameritrade Holding Corporation; Director (July 2016 – Oct. 2021), Charles Schwab Investment Management, Inc. | 106 | Director (2008 – present), The Charles Schwab Corporation |

Richard A. Wurster2 1973 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2022) | President (Oct. 2021 – present) and Executive Vice President – Schwab Asset Management Solutions (Apr. 2019 – Oct. 2021), The Charles Schwab Corporation; President, Director (Oct. 2021 – present), Executive Vice President – Schwab Asset Management Solutions (July 2019 – Oct. 2021) and Senior Vice President – Advisory (May 2016 – July 2019), Charles Schwab & Co., Inc.; President (Nov. 2021 – present), Schwab Holdings, Inc.; Director (Oct. 2021 – present) and Chief Executive Officer (Nov. 2019 – Jan. 2022), Charles Schwab Investment Management, Inc.; Director, Chief Executive Officer and President (Mar. 2018 – Oct. 2022), Charles Schwab Investment Advisory, Inc.; Chief Executive Officer (July 2016 – Apr. 2018) and President (Mar. 2017 – Apr. 2018), ThomasPartners, Inc.; Chief Executive Officer (July 2016 – Apr. 2018), Windhaven Investment Management, Inc. | 106 | None |

Officers of the Trust | |

Name, Year of Birth, and Position(s) with the trust (Terms of office, and length of Time Served3) | Principal Occupations During the Past Five Years |

Omar Aguilar 1970 Chief Executive Officer, President and Chief Investment Officer (Officer of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2011) | Chief Executive Officer (Jan. 2022 – present), President (Oct. 2023 – present), (Chief Investment Officer (Apr. 2011 – present) and Senior Vice President (Apr. 2011 – Jan. 2022), Charles Schwab Investment Management, Inc.; Director, Chief Executive Officer and President (Oct. 2022 – present), Charles Schwab Investment Advisory, Inc.; Chief Executive Officer (Sept. 2023 – present), President (Oct. 2023 – present), Chief Investment Officer (June 2011 – present) and Vice President (June 2011 – Sept. 2023), Schwab Funds, Laudus Trust and Schwab ETFs. |

Mark Fischer 1970 Chief Operating Officer (Officer of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2013) | Chief Operating Officer (Dec. 2020 – present) and Treasurer and Chief Financial Officer (Jan. 2016 – Dec. 2022), Schwab Funds, Laudus Trust and Schwab ETFs; Chief Financial Officer (Mar. 2020 – present), Chief Operating Officer (Oct. 2023 – present), Managing Director (Mar. 2023 – present) and Vice President (Oct. 2013 – Mar. 2023), Charles Schwab Investment Management, Inc. |

Dana Smith 1965 Treasurer and Chief Financial Officer (Officer of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2023) | Treasurer and Chief Financial Officer (Jan. 2023 – present) and Assistant Treasurer (Dec. 2015 – Dec. 2022), Schwab Funds, Laudus Trust and Schwab ETFs; Managing Director (Mar. 2023 – present), Vice President (Mar. 2022 – Mar. 2023) and Director (Oct. 2015 – Mar. 2022), Charles Schwab Investment Management, Inc.; Managing Director (May 2022 – present) and Vice President (Apr. 2022 – May 2022), Charles Schwab & Co., Inc. |

Patrick Cassidy 1964 Vice President and Chief Investment Officer (Officer of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2018) | Chief Investment Officer (Oct. 2023 – present) and Vice President (Feb. 2018 – present), Schwab Funds, Laudus Trust and Schwab ETFs; Managing Director (Mar. 2023 – present), Chief Investment Officer (Oct. 2023 – present), and Senior Vice President (Oct. 2012 – Mar. 2023), Charles Schwab Investment Management, Inc. |

William P. McMahon, Jr. 1972 Vice President and Chief Investment Officer (Officer of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2021) | Managing Director (Mar. 2023 – present), Senior Vice President (Jan. 2020 – Mar. 2023) and Chief Investment Officer (Jan. 2020 – present) Charles Schwab Investment Management, Inc.; Vice President and Chief Investment Officer (June 2021 – present), Schwab Funds, Laudus Trust and Schwab ETFs; Senior Vice President and Chief Investment Officer – ThomasPartners Strategies (Apr. 2018 – Dec. 2019), Charles Schwab Investment Advisory, Inc.; Senior Vice President and Chief Investment Officer (May 2001 – Apr. 2018), ThomasPartners, Inc. |

Catherine MacGregor 1964 Chief Legal Officer and Secretary, Schwab Funds and Schwab ETFs Chief Legal Officer, Vice President and Clerk, Laudus Trust (Officer of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios and Laudus Trust since 2005; Schwab Strategic Trust since 2009) | Chief Legal Officer (Mar. 2022 – present), Managing Director (Mar. 2023 – present) and Vice President (Sept. 2005 – Mar. 2023), Charles Schwab Investment Management, Inc.; Managing Director (May 2022 – present) and Vice President (Aug. 2005 – May 2022), Charles Schwab & Co., Inc.; Vice President (Dec. 2005 – present) and Chief Legal Officer and Clerk (Mar. 2007 – present), Laudus Trust; Chief Legal Officer and Secretary (Oct. 2021 – present), Vice President (Nov. 2005 – Oct. 2021) and Assistant Secretary (June 2007 – Oct. 2021), Schwab Funds; Chief Legal Officer and Secretary (Oct. 2021 – present), Vice President and Assistant Secretary (Oct. 2009 – Oct. 2021), Schwab ETFs. |

Member SIPC®

Printed on recycled paper.

Item 2: Code of Ethics.

| (a) | Registrant has adopted a code of ethics that applies to its principal executive officer, principal financial officer, and any other persons who perform a similar function, regardless of whether these individuals are employed by Registrant or a third party. |

| (c) | During the period covered by the report, no amendments were made to the provisions of this code of ethics. |

| (d) | During the period covered by the report, Registrant did not grant any waivers, including implicit waivers, from the provisions of this code of ethics. |

(f)(1) Registrant has filed this code of ethics as an exhibit pursuant to Item 19(a)(1) of Form N-CSR.

Item 3: Audit Committee Financial Expert.

Registrant’s Board of Trustees has determined that Kimberly S. Patmore, Michael J. Beer and J. Derek Penn, each currently serving on its audit, compliance and valuation committee, are each an “audit committee financial expert,” as such term is defined in Item 3 of Form N-CSR. Each member of Registrant’s audit, compliance and valuation committee is “independent” under the standards set forth in Item 3 of Form N-CSR.

The designation of each of Ms. Patmore, Mr. Beer and Mr. Penn as an “audit committee financial expert” pursuant to Item 3 of Form N-CSR does not (i) impose upon such individual any duties, obligations, or liability that are greater than the duties, obligations and liability imposed upon such individual as a member of Registrant’s audit, compliance and valuation committee or Board of Trustees in the absence of such designation; and (ii) affect the duties, obligations or liability of any other member of Registrant’s audit, compliance and valuation committee or Board of Trustees.

Item 4: Principal Accountant Fees and Services.

Registrant is composed of one series which has a fiscal year-end of March 31, whose annual financial statements are reported in Item 1. Principal accountant fees disclosed in Items 4(a)-(d) and 4(g) include fees billed for services rendered to the operational series during 2024 and 2023 fiscal years, as applicable.

The following table presents fees billed by the principal accountant in each of the last two fiscal years for the services rendered to the Funds:

| (a)Audit Fees1 | (b)Audit-Related Fees | (c) Tax Fees2 | (d) All Other Fees | |||||||||||||||||||||||||||

| Fiscal Year 2024 | Fiscal Year 2023 | Fiscal Year 2024 | Fiscal Year 2023 | Fiscal Year 2024 | Fiscal Year 2023 | Fiscal Year 2024 | Fiscal Year 2023 | |||||||||||||||||||||||

| $ | 32,945 | $ | 31,080 | $ | 0 | $ | 0 | $ | 3,285 | $ | 3,100 | $ | 0 | $ | 0 | |||||||||||||||

| 1 | The nature of the services includes audit of the registrant’s annual financial statements and normally provided services in connection with regulatory filings for those fiscal years. |

| 2 | The nature of the services includes tax compliance, tax advice and tax planning. |

| (e)(1) | Registrant’s audit, compliance and valuation committee does not have pre-approval policies and procedures as described in paragraph (c)(7) of Rule 2-01 of Regulation S-X. |

(2) There were no services described in each of paragraphs (b) through (d) above that were approved by Registrant’s audit, compliance and valuation committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Not applicable.

(g) Below are the aggregate non-audit fees billed in each of the last two fiscal years by Registrant’s principal accountant for services rendered to Registrant, to Registrant’s investment adviser, and to any entity controlling, controlled by, or under common control with Registrant’s investment adviser that provides ongoing services to Registrant.

| 2024: $4,034,714 | 2023: $3,136,515 |

(h) During the past fiscal year, all non-audit services provided by Registrant’s principal accountant to either Registrant’s investment adviser or to any entity controlling, controlled by, or under common control with Registrant’s investment adviser that provides ongoing services to Registrant were pre-approved. Included in the audit, compliance and valuation committee’s pre-approval was the review and consideration as to whether the provision of these non-audit services is compatible with maintaining the principal accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5: Audit Committee of Listed Registrants.

Not applicable.

Item 6: Schedule of Investments.

The schedules of investments are included as part of the report to shareholders filed under Item 1 of this Form.

Item 7: Financial Statements and Financial Highlights for Open-End Management Investment Companies.

The financial statements and financial highlights are included as part of the report to shareholders filed under Item 1 of this Form.

Item 8: Changes in and Disagreements with Accountants for Open-End Management Investment Companies.

Not applicable.

Item 9: Proxy Disclosures for Open-End Management Investment Companies.

Not applicable.

Item 10: Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies.

The remuneration paid to directors, officers and others are included as part of the report to shareholders filed under Item 1 of this Form.

Item 11: Statement Regarding Basis for Approval of Investment Advisory Contract.

Not applicable.

Item 12: Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 13: Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 14: Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 15: Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 16: Controls and Procedures.

(a) Based on their evaluation of Registrant’s disclosure controls and procedures, as of a date within 90 days of the filing date, Registrant’s Principal Executive Officer, Omar Aguilar and Registrant’s Principal Financial Officer, Dana Smith, have concluded that Registrant’s disclosure controls and procedures are: (i) reasonably designed to ensure that information required to be disclosed in this report is appropriately communicated to Registrant’s officers to allow timely decisions regarding disclosures required in this report; (ii) reasonably designed to ensure that information required to be disclosed in this report is recorded, processed, summarized and reported in a timely manner; and (iii) are effective in achieving the goals described in (i) and (ii) above.

(b) During the period covered by this report, there have been no changes in Registrant’s internal control over financial reporting that the above officers believe to have materially affected, or to be reasonably likely to materially affect, Registrant’s internal control over financial reporting.

Item 17: Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable.

Item 18: Recovery of Erroneously Awarded Compensation.

(a) Not applicable.

(b) Not applicable.

Item 19: Exhibits.

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) Laudus Trust

| By: | /s/ Omar Aguilar | |

Omar Aguilar Principal Executive Officer | ||

| Date: | May 17, 2024 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: | /s/ Omar Aguilar | |

Omar Aguilar Principal Executive Officer | ||

| Date: | May 17, 2024 | |

| By: | /s/ Dana Smith | |

Dana Smith Principal Financial Officer | ||

| Date: | May 17, 2024 | |