Filed by Tyco International plc

pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Johnson Controls, Inc.

SEC File No.: 001-05097

Date: March 30, 2016

Explanatory Note: The following screen shots are derived from a website made available to employees of Tyco International plc.

Featured Story

Additional Leaders Announced for Integration Team

Integration Management Office introduces leaders for Value Capture Teams

The Johnson Controls/Tyco merger Integration Management Office has selected additional integration team members — executive sponsors and leaders from both companies for key function and process Value Capture Teams, known as “towers”.

Read more

Frequently Asked Questions

Watch this space for questions and responses about the planned merger that are relevant to employees globally. Questions that are specific or local in nature will be handled by business/regional units. As decisions are made and information becomes available, new responses will be posted. Updated on March 29, 2016.

SUBMIT A QUESTION

Announcements Merger Integration Leaders Named NEW 3/14/2016

Tyco-Johnson Controls Merger Fair Competition Guidelines Announcement NEW 1/27/2016

George Oliver-Tyco-Johnson Controls Merger Announcement 1/25/2016

News Release-Johnson Controls and Tyco to Merge 1/25/2016

Videos

Johnson Controls and Tyco

Creating a Global Industrial Leader

Johnson Controls

tyco

15 Feb CEO Merger Update Webcast Replay

Materials

Tyco Johnson Controls Merger Fair Competition Guidelines NEW 1/27/2016

Important Information

IMPORTANT INFORMATION FOR INVESTORS AND SHAREHOLDERS

This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

In connection with the proposed transaction between Johnson Controls, Inc. (“Johnson Controls”) and Tyco International plc (“Tyco”), Tyco will file with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 that will include a joint proxy statement of Johnson Controls and Tyco that also constitutes a prospectus of Tyco (the “Joint Proxy Statement/Prospectus”). Johnson Controls and Tyco plan to mail to their respective shareholders the definitive Joint Proxy Statement/Prospectus in connection with the transaction. INVESTORS AND SECURITY HOLDERS OF JOHNSON CONTROLS AND TYCO ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT JOHNSON CONTROLS, TYCO. THE TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain free copies of the Joint Proxy Statement/Prospectus (when available) and other documents filed with the INVESTORS AND SECURITY HOLDERS OF JOHNSON CONTROLS AND TYCO ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT JOHNSON CONTROLS. TYCO, THE TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain freecopies of the Joint Proxy Statement/Prospectus (when available) and other documents filed with the SEC by Johnson Controls and Tyco through the website maintained by the SEC at www.sec.gov. In addition, investors and security holders will be able to obtain free copies of the documents filed with the SEC by Johnson Controls by contacting Johnson Controls Shareholder Services at Shareholder Services@jci.com or by calling (800) 524-6220 and will be able

to obtain free copies of the documents filed with the SEC by Tyco by contacting Tyco Investor Relations at lnvestorrelations@Tyco.com or by calling (609) 720-4333. PARTICIPANTS IN THE SOLICITATION

Johnson Controls, Tyco and certain of their respective directors, executive officers and employees may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of the respective shareholders of Johnson Controls and Tyco in connection with the proposed transactions, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the Joint Proxy Statement/Prospectus when it is filed with the SEC. Information regarding Johnson Controls’ directors and executive officers is contained in Johnson Controls’ proxy statement for its 2016 annual Johnson Controls, Tyco and certain of their respective directors, executive officers and employees may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of the respective shareholders of Johnson Controls and Tyco in connection with the proposed transactions, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the Joint Proxy Statement/Prospectus when it is filed with the SEC. Information regarding Johnson Controls’ directors and executive officers is contained in Johnson Controls’ proxy statement for its 2016 annual Johnson Controls, Tyco and certain of their respective directors, executive officers and employees may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of the respective shareholders of Johnson Controls and Tyco in connection with the proposed transactions, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the Joint Proxy Statement/Prospectus when it is filed with the SEC. Information regarding Johnson Controls’ directors and executive officers is contained in Johnson Controls’ proxy statement for its 2016 annual meeting of shareholders, which was filed with the SEC on December 14, 2015. Information regarding Tyco’s directors and executive officers is contained in Tyco’s proxy statement for its 2016 annual meeting of shareholders, which was filed with the SEC on January 15, 2016.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not limited to, Tyco’s expectations or predictions of future financial or business performance or conditions.

Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “plan,” “predict,” “project,” “forecast,” “guidance,” “goal,” “objective,” “prospects,” “possible” or “potential,” by future conditional verbs such as “assume,” “will,” “would,” “should,” “could” or “may”, or by variations of such words or by similar expressions. These forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made and we assume no duty to update forward-looking statements. Actual results may differ materially from current projections.

Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed transaction. Many factors could cause actual results to differ materially from these forward-looking statements, including, in addition to factors previously disclosed in Tyco’s reports filed with the SEC, which are available at www.sec.gov and www.Tyco.com under the “Investor Relations” tab, and those identified elsewhere in this communication, risks relating to the completion of the proposed transaction on anticipated terms and timing, including obtaining shareholder and regulatory approvals, anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the new combined company’s operations, the ability of Tyco and JCI to integrate their businesses successfully and to achieve anticipated synergies, changes in tax laws or interpretations, access to available financing, potential litigation relating to the proposed transaction, and the risk that disruptions from the proposed transaction will harm Tyco’s business. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results.

STATEMENT REQUIRED BY THE IRISH TAKEOVER RULES

The directors of Tyco International plc accept responsibility for the information contained in this communication. To the best of their knowledge and belief (having taken all reasonable care to ensure such is the case), the information contained in this communication is in accordance with the facts and does not omit anything likely to affect the import of such information.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION. This communication is not intended to be and is not a prospectus for the purposes of Part 23 of the Companies Act 2014 of Ireland (the “2014 Act”), Prospectus (Directive 2003/71/EC) Regulations 2005 (S.I. No. 324 of 2005) of Ireland (as amended from time to time) or the Prospectus Rules issued by the Central Bank of Ireland pursuant to section 1363 of the 2014 Act, and the Central Bank of Ireland (“CBI”) has not approved this communication.

Please contact Tyco Communications at tycocommunications@tyco.com for more information.

tyco Tyco-JCI Merger Information Center

Johnson Controls

Featured Story

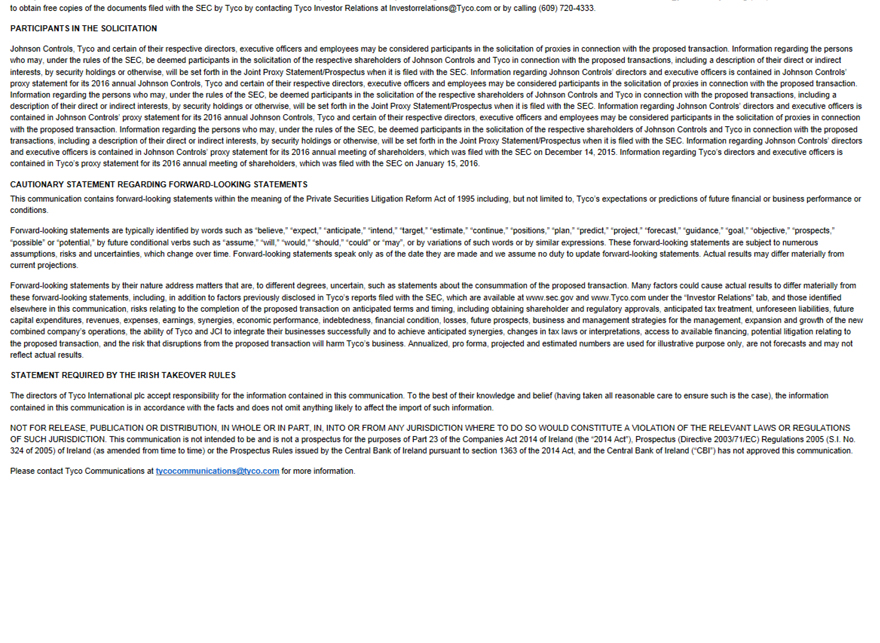

Additional Leaders Announced for Integration Team

Integration Management Office introduces leaders for Value Capture Teams

The Johnson Controls/Tyco merger Integration Management Office has selected additional integration team members — executive sponsors and leaders from both companies for key function and process Value Capture Teams, known as “towers”.

These teams will focus on planning how to deliver value from the merger by optimizing their functions and/or processes and improving overall efficiency. With the oversight of executive sponsors, team leaders will develop tailored processes and work plans,

coordinate integration activities, and support the integration leaders and steering committee on driving key decisions.

Central Function Value Capture Teams

Value Capture Teams

Corporate Finance Treasury Tax HR IT Procurement Brian Stief Brian Stief Brian Stief Simon Davis Jeff Augustin Terry Nadeau Robert Olson Robert Olson Robert Olson Larry Costello John Repko Andrea Greco Sue Vincent Frank Voltolina Skip McConeghy Jill Glandt Mary Dugan Sajid Kunnummal Mark Armstrong Mark Armstrong Madeleine Barber Noreen Farrell Rusty Patel John O’Sullivan Legal Brian Cadwallader Judy Reinsdorf Andrew Thorson Matthew Heiman

Communications Kim Metcaf-Kupres Judy Reinsdorf Kathie Campbell Steve Wasdick

Sales and Marketing Kim Metcaf-Kupres Brian Young Mark Katz Maureen Lally

JCI OS/Tyco BS Jeff Williams John Repko Bob Garlinghouse Ian Howard

Public Affairs/Diversity Grady Crosby Judy Reinsdorf Larry Costello Reggie Layton Art Jones Jean Larkin

Manufacturing/Distribution Product, Technology, Brands Jeff Williams MikeFleming Kim Metcaf-Kupres Bill Jackson Andrea Greco Daryll Fogal Brian Young Miguel Alvarez Laura Farnham Jim Gross Don Folite Rob Waters Kerry Eby Dave LeBlanc Joe Buccino Svenja Schulz IT Systems Jeff Augustin Rusty Patel Mary Dugan Jason Davis

Procurement Spend Terry Nadeau Andrea Greco Sajid Kunnummal Jim Delahanty

Additional teams, sub-teams and leaders may be added as integration planning progresses.

Show less

tyco

Tyco/Johnson Controls Merger Update

14 March 2016

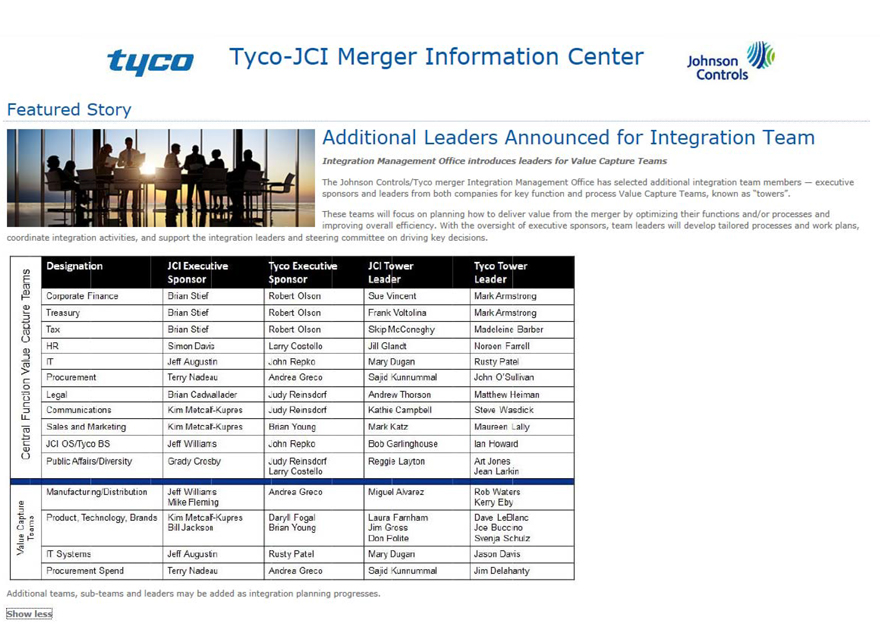

Merger Integration Leaders Named

Integration Management Office formed as merger planning for the combined company picks up speed

In January, Johnson Controls and Tyco entered into a definitive merger agreement to create a global leader in building products and technology, energy storage and integrated solutions.

As the first strategic step in preparation for the merger, a joint Integration Management Office (IMO) has been established. This leadership group is responsible for determining how the new Johnson Controls will operate post-merger.

The collective integration team will be responsible for:

Designing the new Johnson Controls – selecting the best of both companies

Ensuring Day One readiness

Delivering revenue and expense synergies across the organizations after the merger

Aligning on an operating model that will position the new company for growth and an improved customer experience

Mike Bartschat, vice president and chief procurement officer for Johnson Controls, will co-lead the Integration Management Office with Tyco’s Bob Roche, senior vice president, Business Finance.

The IMO leaders for key work streams have also been identified as shown below:

Steering Committee

Alex Molinaroli and George Oliver

Integration Leaders Mike Bartschat and Bob Roche

Integration Management Office

Master Planning Tyco: Joe Kenney JCI: TBD

Org, Talent, Cultural & Change Management Tyco: Jean Larkin JCI: Jill Glandt

Tax Strategy Tyco: Madeleine Barber JCI: Skip McConeghy

Business Processes & Systems Tyco: John Repko JCI: Rehan Ashraf

Finance Planning & Capture Tyco: Michael Sang JCI: Mark Payne

Communications Tyco: Steve Wasdick JCI: Melissa Farrington

Real Estate/Footprint Tyco: Jeff Furman JCI: Ward Komorowski

Safer. Smarter. Tyco. TM

//Company Confidential

In addition, a Go-to-Market Team has also been established to define requirements for organization-facing field operations in the buildings space after the merger. This crucial work group will be co-led by Johnson Controls Building Efficiency President Bill Jackson and Tyco’s Girish Rishi, executive vice president, North America Installation and Services and Tyco Retail Solutions. Trent Nevill from Johnson Controls will also contribute to this project as he works through his transition from vice president, Systems and Service, North America to president, Asia Pacific.

This team will take several weeks to complete work to inform the future organizational design based on customer buying behaviors and marketplace dynamics. The insight resulting from this group will drive many of the integration team’s subsequent steps.

In addition, leaders from both companies are being identified to staff a number of Value Capture Teams that will focus on developing plans for securing the operational synergies of the merger. These assignments will be communicated in the coming weeks as teams begin mobilizing.

Safer. Smarter. Tyco.

// Company Confidential

Page 2

NO OFFER OR SOLICITATION

This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the proposed transaction between Johnson Controls, Inc. (“JCI”) and Tyco International plc (“Tyco”), Tyco will file with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 that will include a joint proxy statement of JCI and Tyco that also constitutes a prospectus of Tyco (the “Joint Proxy Statement/Prospectus”). JCI and Tyco plan to mail to their respective shareholders the definitive Joint Proxy Statement/Prospectus in connection with the transaction. INVESTORS AND SECURITY HOLDERS OF JCI AND TYCO ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT JCI, TYCO, THE TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain free copies of the Joint Proxy Statement/Prospectus (when available) and other documents filed with the SEC by JCI and Tyco through the website maintained by the SEC at www.sec.gov. In addition, investors and security holders will be able to obtain free copies of the documents filed with the SEC by JCI by contacting JCI Shareholder Services at Shareholder.Services@jci.com or by calling (800) 524-6220 and will be able to obtain free copies of the documents filed with the SEC by Tyco by contacting Tyco Investor Relations at Investorrelations@tyco.com or by calling (609) 720-4333.

PARTICIPANTS IN THE SOLICITATION

JCI, Tyco and certain of their respective directors, executive officers and employees may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of the respective shareholders of JCI and Tyco in connection with the proposed transactions, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the Joint Proxy Statement/Prospectus when it is filed with the SEC. Information regarding JCI’s directors and executive officers is contained in JCI’s proxy statement for its 2016 annual meeting of shareholders, which was filed with the SEC on December 14, 2015. Information regarding Tyco’s directors and executive officers is contained in Tyco’s proxy statement for its 2016 annual meeting of shareholders, which was filed with the SEC on January 15, 2016.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not limited to, Tyco’s expectations or

predictions of future financial or business performance or conditions. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “plan,” “predict,” “project,” “forecast,” “guidance,” “goal,” “objective,” “prospects,” “possible” or “potential,” by future conditional verbs such as “assume,” “will,” “would,” “should,” “could” or “may”, or by variations of such words or by similar expressions. These forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made and we assume no duty to update forward-looking statements. Actual results may differ materially from current projections.

Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed transaction. Many factors could cause actual results to differ materially from these forward-looking statements, including, in addition to factors previously disclosed in Tyco’s reports filed with the SEC, which are available at www.sec.gov and www.Tyco.com under the “Investor Relations” tab, and those identified elsewhere in this communication, risks relating to the completion of the proposed transaction on anticipated terms and timing, including obtaining shareholder and regulatory approvals, anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the new combined company’s operations, the ability of Tyco and JCI to integrate their businesses successfully and to achieve anticipated synergies, changes in tax laws or interpretations, access to available financing, potential litigation relating to the proposed transaction, and the risk that disruptions from the proposed transaction will harm Tyco’s business.

Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results.

STATEMENT REQUIRED BY THE IRISH TAKEOVER RULES

The directors of Tyco accept responsibility for the information contained in this communication. To the best of their knowledge and belief (having taken all reasonable care to ensure such is the case), the information contained in this communication is in accordance with the facts and does not omit anything likely to affect the import of such information.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION.

This communication is not intended to be and is not a prospectus for the purposes of Part 23 of the Companies Act 2014 of Ireland (the “2014 Act”), Prospectus (Directive 2003/71/EC) Regulations 2005 (S.I. No. 324 of 2005) of Ireland (as amended from time to time) or the Prospectus Rules issued by the Central Bank of Ireland pursuant to section 1363 of the 2014 Act, and the Central Bank of Ireland (“CBI”) has not approved this communication.

2