Filed by Tyco International plc

pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Johnson Controls, Inc.

SEC File No.: 001-05097

Date: April 27, 2016

Explanatory Note: The following screen shots are derived from the website of Tyco International plc.

ACCEPT TERMS AND CONTINUE ABOUT THIS WEBSITE This website is intended to provide information about the proposed transaction between Johnson Controls, Inc. (“Johnson Controls”) and Tyco International plc (“Tyco”). Until the closing of the transaction, Johnson Controls and Tyco are separate, independent companies and nothing contained on this website should be construed to the contrary. NO OFFER OR SOLICITATION This website is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. ADDITIONAL INFORMATION AND WHERE TO FIND IT In connection with the proposed transaction between Johnson Controls, Inc. (“Johnson Controls”) and Tyco International plc (“Tyco”), Tyco has filed with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 that includes a preliminary joint proxy statement of Johnson Controls and Tyco that also constitutes a preliminary prospectus of Tyco (the “Joint Proxy Statement/Prospectus”). These materials are not yet final and will be amended. Johnson Controls and Tyco plan to mail to their respective shareholders the definitive Joint Proxy Statement/Prospectus in connection with the transaction after the registration statement has become effective. INVESTORS AND SECURITY HOLDERS OF JOHNSON CONTROLS AND TYCO ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT JOHNSON CONTROLS, TYCO, THE TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the Joint Proxy Statement/Prospectus (when available) and other documents filed with the SEC by Johnson Controls and Tyco through the website maintained by the SEC at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents filed with the SEC by Johnson Controls by contacting Johnson Controls Shareholder Services at Shareholder.Services@jci.com or by calling (800) 524-6220 and will be able to obtain free copies of the documents filed with the SEC by Tyco by contacting Tyco Investor Relations at Investorrelations@Tyco.com or by calling (609) 720-4333. PARTICIPANTS IN THE SOLICITATION Johnson Controls, Tyco and certain of their respective directors, executive officers and employees may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of the respective shareholders of Johnson Controls and Tyco in connection with the proposed transactions, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the Joint Proxy Statement/Prospectus. Information regarding Johnson Controls’ directors and executive officers is contained in Johnson Controls’ proxy statement for its 2016 annual meeting of shareholders, which was filed with the SEC on December 14, 2015. Information regarding Tyco’s directors and executive officers is contained in Tyco’s proxy statement for its 2016 annual meeting of shareholders, which was filed with the SEC on January 15, 2016. Johnson Controls Cautionary Statement Regarding Forward-Looking Statements There may be statements in this website that are, or could be, “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and, therefore, subject to risks and uncertainties, including, but not limited to, statements regarding Johnson Controls’ or the combined company’s future financial position, sales, costs, earnings, cash flows, other measures of results of operations, capital expenditures or debt levels are forward-looking statements. Words such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “should,” “forecast,” “project” or “plan” or terms of similar meaning are also generally intended to identify forward-looking statements. Johnson Controls cautions that these statements are subject to numerous important risks, uncertainties, assumptions and other factors, some of which are beyond Johnson Controls’ control, that could cause Johnson Controls’ or the combined company’s actual results to differ materially from those expressed or implied by such forward-looking statements, including, among others, risks related to: Johnson Controls’ and/or Tyco’s ability to obtain necessary regulatory approvals and shareholder approvals or to satisfy any of the other conditions to the transaction on a timely basis or at all, any delay or inability of the combined company to realize the expected benefits and synergies of the transaction, changes in tax laws, regulations, rates, policies or interpretations, the loss of key senior management, anticipated tax treatment of the combined company, the value of the Tyco shares to be issued in the transaction, significant transaction costs and/or unknown liabilities, potential litigation relating to the proposed transaction, the risk that disruptions from the proposed transaction will harm Johnson Controls’ business, competitive responses to the proposed transaction and general economic and business conditions that affect the combined company following the transaction. A detailed discussion of risks related to Johnson Controls’ business is included in the section entitled “Risk Factors” in Johnson Controls’ Annual Report on Form 10-K for the fiscal year ended September 30, 2015 filed with the SEC on November 18, 2015 and available at www.sec.gov and www.johnsoncontrols.com under the “Investors” tab. Any forward-looking statements in this website are only made as of the date of this website, unless otherwise specified, and, except as required by law, Johnson Controls assumes no obligation, and disclaims any obligation, to update such statements to reflect events or circumstances occurring after the date of this website. Tyco Cautionary Statement Regarding Forward-Looking Statements This website contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not limited to, Tyco’s expectations or predictions of future financial or business performance or conditions. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “plan,” “predict,” “project,” “forecast,” “guidance,” “goal,” “objective,” “prospects,” “possible” or “potential,” by future conditional verbs such as “assume,” “will,” “would,” “should,” “could” or “may”, or by variations of such words or by similar expressions. These for-ward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made and we assume no duty to update forward-looking statements. Actual results may differ materially from current projections. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed transaction. Many factors could cause actual results to differ materially from these forward-looking statements, including, in addition to factors previously disclosed in Tyco’s reports filed with the SEC, which are available at www.sec.gov and www.Tyco.com under the “Investor Relations” tab, and those identified elsewhere in this website risks relating to the completion of the proposed transaction on anticipated terms and timing, including obtaining shareholder and regulatory approvals, anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the new combined company’s operations, the ability of Tyco and Johnson Controls to integrate their businesses successfully and to achieve anticipated synergies, changes in tax laws or interpretations, access to available financing, potential litigation relating to the proposed transaction, and the risk that disruptions from the proposed transaction. Statement Required by the Irish Takeover Rules The directors of Johnson Controls accept responsibility for the information contained on this website other than that relating to Tyco and the Tyco group of companies and the directors of Tyco and members of their immediate families, related trusts and persons connected with them. To the best of the knowledge and belief of the directors of Johnson Controls (who have taken all reasonable care to ensure that such is the case), the information contained on this website for which they accept responsibility is in accordance with the facts and does not omit anything likely to affect the import of such information. The directors of Tyco accept responsibility for the information contained on this website relating to Tyco and the directors of Tyco and members of their immediate families, related trusts and persons connected with them. To the best of the knowledge and

belief of the directors of Tyco (who have taken all reasonable care to ensure such is the case), the information contained on this website for which they accept responsibility is in accordance with the facts and does not omit anything likely to affect the import of such information. Centerview Partners LLC is a broker dealer registered with the United States Securities and Exchange Commission and is acting as financial advisor to Johnson Controls and no one else in connection with the proposed transaction. In connection with the proposed transaction, Centerview Partners LLC, its affiliates and related entities and its and their respective partners, directors, officers, employees and agents will not regard any other person as their client, nor will they be responsible to anyone other than Johnson Controls for providing the protections afforded to their clients or for giving advice in connection with the proposed transaction or any other matter referred to in this announcement. Barclays Capital Inc. is a broker dealer registered with the United States Securities and Exchange Commission and is acting as financial advisor to Johnson Controls and no one else in connection with the proposed transaction. In connection with the proposed transaction, Barclays Capital Inc., its affiliates and related entities and its and their respective partners, directors, officers, employees and agents will not regard any other person as their client, nor will they be responsible to anyone other than Johnson Controls for providing the protections afforded to their clients or for giving advice in connection with the proposed transaction or any other matter referred to in this announcement. Lazard Freres & Co. LLC, which is a registered broker dealer with the SEC, is acting for Tyco and no one else in connection with the proposed transaction and will not be responsible to anyone other than Tyco for providing the protections afforded to clients of Lazard Freres & Co. LLC, or for giving advice in connection with the proposed transaction or any matter referred to herein. NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION. This website is not intended to be and is not a prospectus for the purposes of Part 23 of the Companies Act 2014 of Ireland (the “2014 Act”), Prospectus (Directive 2003/71/EC) Regulations 2005 (S.I. No. 324 of 2005) of Ireland (as amended from time to time) or the Prospectus Rules issued by the Central Bank of Ireland pursuant to section 1363 of the 2014 Act, and the Central Bank of Ireland (“CBI”) has not approved this website. ACCEPT TERMS AND CONTINUE

Tyco /Solution /Markets / About /Newsroom /Investor Relations / Contact / Careers Search Tyco Johnson Controls and Tyco to Merge A global industrial leader for safety, security and sustainability about the merger VALUE OF THE MERGER About the Merger Johnson Controls, a global multi-industrial company, will combine with Tyco, a global fire and security provider, to create Johnson Controls plc, a global leader in building products and technology, integrated solutions and energy storage. This merger brings together best-in-class product, technology and service capabilities across controls, fire, security, HVAC, power solutions and energy storage, to serve various end markets including large institutions, commercial buildings, retail, industrial, small business and residential. The merger is expected to close on or around the end of the Johnson Controls fiscal year, which is September 30, 2016. Under the terms of the agreement, Johnson Controls shareholders are expected to own about 56 percent of business equity, and Tyco shareholders will own about 44 percent. The company will have annual revenue of $32 billion, and will maintain Tyco’s global headquarters in Cork, Ireland; its North America operations will be headquartered in Milwaukee, Wisconsin. Creating a Multi-industrial Global Leader Johnson Controls and Tyco have highly complementary businesses, which will enable the combined company to offer comprehensive and innovative building technology solutions to even more customers globally across various end markets. The transaction will combine innovation pipelines for devices, controls, sensors, data analytics and advanced solutions to better capture the enormous market opportunity around “smart” buildings, campuses and cities. In addition, the new company will offer one of the largest energy storage platforms with capabilities including traditional lead acid as well as advanced lithium ion battery technology serving the global energy storage market. Johnson Controls and Tyco will link complementary branch networks and independent channels for global growth, which will enhance the revenue and earnings growth profile of established businesses. Download the full investor deck Johnson Controls Uniting Global leaders uniquely positioned in buildings and energy markets Download the complete fact sheet

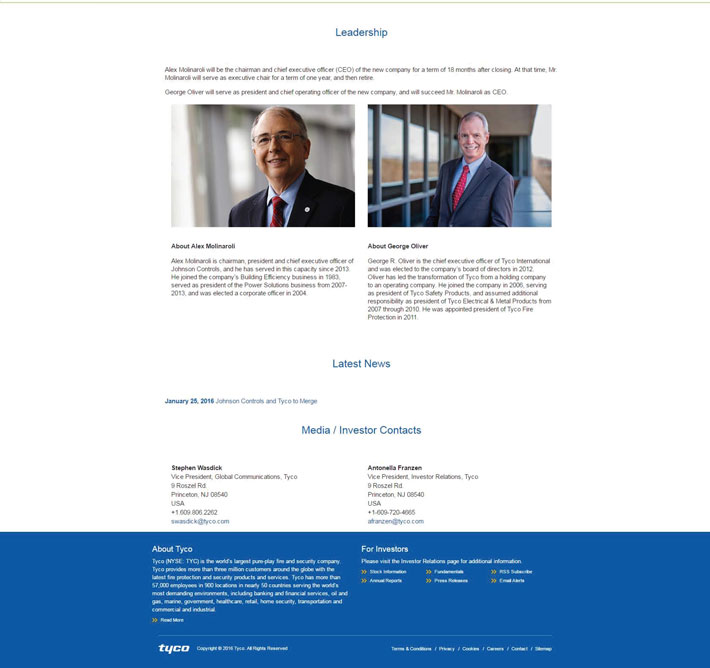

Leadership Alex Molinaroli will be the chairman and chief executive officer (CEO) of the new company for a term of 18 months after closing. At that time, Mr. Molinaroli will serve as executive chair for a term of one year, and then retire. George Oliver will serve as president and chief operating officer of the new company, and will succeed Mr. Molinaroli as CEO. About Alex Molinaroli Alex Molinaroli is chairman, president and chief executive officer of Johnson Controls, and he has served in this capacity since 2013. He joined the company’s Building Efficiency business in 1983, served as president of the Power Solutions business from 2007-2013, and was elected a corporate officer in 2004. About George Oliver George R. Oliver is the chief executive officer of Tyco International and was elected to the company’s board of directors in 2012. Oliver has led the transformation of Tyco from a holding company to an operating company. He joined the company in 2006, serving as president of Tyco Safety Products, and assumed additional responsibility as president of Tyco Electrical & Metal Products from 2007 through 2010. He was appointed president of Tyco Fire Protection in 2011. Latest News January 25, 2016 Johnson Controls and Tyco to Merge Media / Investor Contacts Stephen Wasdick Vice President, Global Communications, Tyco 9 Roszel Rd. Princeton, NJ 08540 USA +1.609.806.2262 swasdick@tyco.com Antonella Franzen Vice President, Investor Relations, Tyco 9 Roszel Rd. Princeton, NJ 08540 USA +1-609-720-4665 afranzen@tyco.com About Tyco Tyco (NYSE: TYC) is the world’s largest pure-play fire and security company. Tyco provides more than three million customers around the globe with the latest fire protection and security products and services. Tyco has more than 57,000 employees in 900 locations in nearly 50 countries serving the world’s most demanding environments, including banking and financial services, oil and gas, marine, government, healthcare, retail, home security, transportation and commercial and industrial. Read More For Investors Please visit the Investor Relations page for additional information. Stock Information Fundamentals RSS Subscribe Annual Reports Press Releases Email Alerts Terms & Conditions Privacy Cookies Careers Contact Sitemap Copyright © 2016 Tyco. All Rights Reserved

Johnson Controls and Tyco to Merge Most comprehensive portfolio of building and energy platforms Tyco /Solution /Markets / About /Newsroom /Investor Relations / Contact / Careers Search Tyco Johnson Controls and Tyco to Merge A global industrial leader for safety, security and sustainability $32 BILLION IN REVENUE WITH STRONG GROWTH POTENTIAL The combined company will pair leading businesses with best-in-class product, technology and service capabilities to deliver greater value to customers, shareholders and employees. The company will continue its commitment to innovation and growth in the United States and globally. 48,000 U.S. Emplyees 128,000 global employees About the Merger Value of the Merger Value of the Merger Financial Highlights This transaction creates compelling value for shareholders, with at least $650 million in identified annual synergies, and substantial opportunities for enhanced revenue and global growth. The merger increases revenue with accelerated top-line growth in product and service portfolio opportunities, in addition to geographic growth opportunities. Download the full investor deck Value to Tyco Shareholders Anticipated benefits to Tyco shareholders: A premium of 14% to the 30-day volume weighted average share price as of January 19, 2016 ~44% equity ownership in value creation potential of the combined company including capitalized value of $650 million of synergies plus substantial opportunities for enhanced revenues More diversified, larger portfolio with greater exposure to global growth and expanded opportunities in “smart” buildings of the future Ownership of Adient, Automotive Experience planned spin-off, as pure-play company post spin-off Enhanced scale and cash flow to continue to pursue value-creating growth Value to Johnson Controls Shareholders Anticipated benefits to Johnson Controls shareholders: An enhanced multi-industrial portfolio, and a strategic addition to Johnson Controls’ buildings platform ~56% equity ownership in value creation potential of the combined company including capitalized value of $650 million of synergies plus substantial opportunities for enhanced revenues and profitability ~$3.9 billion aggregate cash consideration in merger in addition to equity ownership Strong pro forma balance sheet including enhanced financial flexibility Strong financial metrics (growth and profit) to drive multiple expansion over time Benefits Delivering on an Integrated Vision for Buildings of the Future The combined company plans to leverage “Internet of Things” technologies and domain expertise to drive “smarter” customer solutions. These include building technologies in HVAC, Fire & Safety, and Lighting and Power; energy storage from distributed power, to renewables support and new battery technologies; enterprise asset management like asset tagging and tracking; as well as the ability to analyze data, optimize energy efficiency and enhance asset utilization. Convergence Creates Unique Opportunities The Internet of Things is expanding existing markets and defining new markets and ecosystems. The combined company will be well-positioned to make buildings, campuses and cities “smarter,” and bring new solutions to the operations of retailers, hospitals, stadiums and other built environments. Two Complementary, World-class Operating Systems The merger will integrate two already strong business systems, bringing together world-class operating models and capabilities to drive synergies, speed, quality and growth throughout the company. Total synergies will exceed $650 million annually. In addition, the highly complementary product, service and geographic profiles will offer unique opportunities for growth through cross-selling of products and services.

About the companies About Johnson Controls Johnson Controls (NYSE: JCI) is a global diversified technology and industrial leader serving customers in more than 150 countries, providing quality products, services and solutions to optimize energy and operational efficiencies of buildings; and lead-acid automotive batteries and advanced batteries for hybrid and electric vehicles. For additional information, please visit www.johnsoncontrols.com. About Tyco Tyco (NYSE: TYC) is the world’s largest pure-play fire protection and security company. Tyco provides more than three million customers around the globe with the latest fire protection and security products and services. For more information, visit www.tyco.com. Media / Investor Contacts Stephen Wasdick

Vice President, Global Communications, Tyco

9 Roszel Rd.

Princeton, NJ 08540

USA

+1.609.806.2262

swasdick@tyco.com Antonella Franzen

Vice President, Investor Relations, Tyco

9 Roszel Rd.

Princeton, NJ 08540

USA

+1-609-720-4665

afranzen@tyco.com Cautionary Statement Regarding Forward-Looking Statements This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not limited to, Tyco’s expectations or predictions of future financial or business performance or conditions. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “plan,” “predict,” “project,” “forecast,” “guidance,” “goal,” “objective,” “prospects,” “possible” or “potential,” by future conditional verbs such as “assume,” “will,” “would,” “should,” “could” or “may”, or by variations of such words or by similar expressions. These forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made and we assume no duty to update forward-looking statements. Actual results may differ materially from current projections. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed transaction. Many factors could cause actual results to differ materially from these forward-looking statements, including, in addition to factors previously disclosed in Tyco’s reports filed with the SEC, which are available at www.sec.gov and www.Tyco.com under the “Investor Relations” tab, and those identified elsewhere in this communication, risks relating to the completion of the proposed transaction on anticipated terms and timing, including obtaining shareholder and regulatory approvals, anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the new combined company’s operations, the ability of Tyco and JCI to integrate their businesses successfully and to achieve anticipated synergies, changes in tax laws or interpretations, access to available financing, potential litigation relating to the proposed transaction, and the risk that disruptions from the proposed transaction will harm Tyco’s business. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. About Tyco Tyco (NYSE: TYC) is the world’s largest pure-play fire and security company. Tyco provides more than three million customers around the globe with the latest fire protection and security products and services. Tyco has more than 57,000 employees in 900 locations in nearly 50 countries serving the world’s most demanding environments, including banking and financial services, oil and gas, marine, government, healthcare, retail, home security, transportation and commercial and industrial. Read More For Investors Please visit the Investor Relations page for additional information. Stock Information Fundamentals RSS Subscribe Annual Reports Press Releases Email Alerts Terms & Conditions Privacy Cookies Careers Contact Sitemap Copyright © 2016 Tyco. All Rights Reserved