Presentation Materials for Investors February 2017 Exhibit 99.1

2 Disclaimer • This presentation includes certain “forward - looking statements” within the meaning of The U.S. Private Securities Litigation Reform Act of 1995. • These statements are based on current expectations and currently available information. • Actual results may differ materially from these expectations due to certain risks, uncertainties and other important factors, including the risk factors set forth in the most recent annual and periodic reports of Toyota Motor Corporation and Toyota Motor Credit Corporation. • We do not undertake to update the forward - looking statements to reflect actual results or changes in the factors affecting the forward - looking statements. • This presentation does not constitute an offer to sell or a solicitation of an offer to purchase any securities. Any offer or sale of securities will be made only by means of a prospectus and related documentation. • Investors and others should note that we announce material financial information using the investor relations section of our corporate website ( http://www.toyotafinancial.com ) and SEC filings. We use these channels, press releases, as well as social media to communicate with our investors, customers and the general public about our company, our services and other issues. While not all of the information that we post on social media is of a material nature, some information could be material. Therefore, we encourage investors, the media, and others interested in our company to review the information we post on the Toyota Motor Credit Corporation Twitter Feed ( http://www.twitter.com/toyotafinancial ). We may update our social media channels from time to time on the investor relations section of our corporate website. 2

3 Disclaimer • This presentation includes certain “forward - looking statements” within the meaning of The U.S. Private Securities Litigation Ref orm Act of 1995. • These statements are based on current expectations and currently available information. • Actual results may differ materially from these expectations due to certain risks, uncertainties and other important factors, in cluding the risk factors set forth in the most recent annual and periodic reports of Toyota Motor Corporation and Toyota Motor Credit Corporation (“TMCC”) . • We do not undertake to update the forward - looking statements to reflect actual results or changes in the factors affecting the f orward - looking statements. • This presentation does not constitute or form part of and should not be construed as, an offer to sell or issue or the solici tat ion of an offer to purchase or subscribe for securities of TMCC in any jurisdiction or an inducement to enter into investment activity in any jurisdiction. Nei ther this presentation nor any part thereof, nor the fact of its distribution, shall form the basis of, or be relied on in connection with, any contract or commitment or investment decision whatsoever. Any offer or sale of securities by TMCC will be made only by means of a prospectus and related document ati on. • Investors and prospective investors in securities of TMCC are required to make their own independent investigation and apprai sal of the business and financial condition of TMCC and the nature of its securities. This presentation does not constitute a recommendation regardin g s ecurities of TMCC. Any prospective purchaser of securities in TMCC is recommended to seek its own independent financial advice. • This presentation is made to and directed only at ( i ) persons outside the United Kingdom, or (ii) qualified investors or investment professionals falling within Article 19(5) and Article 49(2)(a) to (d) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2 005 (the “Order”), or (iii) high net worth individuals, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order, and (iv) persons who are “qualified investors” within the meaning of Article 2(1)(e) of the Prospectus Directive (Directive 2003/71/EC ) a s amended (such persons collectively being referred to as “Relevant Persons”). This presentation must not be acted or relied on by persons wh o a re not Relevant Persons. Any investment or investment activity to which this presentation relates is available only to Relevant Persons and w ill be engaged in only with Relevant Persons. • This presentation is an advertisement and not a prospectus and investors should not subscribe for or purchase any securities of TMCC referred to in this presentation or otherwise except on the basis of information in the base prospectus of Toyota Motor Finance (Netherlands ) B .V., Toyota Credit Canada Inc., Toyota Finance Australia Limited and Toyota Motor Credit Corporation dated 9 September 2016 as supplemented from time to time together with the applicable final terms which are or will be, as applicable, available on the website of the London Stock Ex cha nge plc at www.londonstockexchange.com/exchange/news/market - news/market - news - home.html. • Investors and others should note that we announce material financial information using the investor relations section of our cor porate website ( http://www.toyotafinancial.com ) and SEC filings. We use these channels, press releases, as well as social media to communicate with our investors, customers and the general public about our company, our services and other issues. While not all of the information that we p ost on social media is of a material nature, some information could be material. Therefore, we encourage investors, the media, and others interested in o ur company to review the information we post on the Toyota Motor Credit Corporation Twitter Feed ( http://www.twitter.com/toyotafinancial ). We may update our social media channels from time to time on the investor relations section of our corporate website .

Toyota ’ s Global Businesses Markets vehicles in over 160 countries/regions. 53 manufacturing companies in 29 countries/regions . OTHER BUSINESSES AUTOMOTIVE Design, Manufacturing, Distribution Consumer Financing Dealer Support & Financing Banking Ancillary Products & Services Housing Marine Information Services & Telematics Biotechnology & Afforestation 4

Nine Months Ended December 31, (JPY billions) 2015 2016 2016 Net Revenues 27,234.5 28,403.1 20,154.7 Operating Income 2,750.6 2,854.0 1,555.4 Net Income 2,173.3 2,312.7 1,432.7 Fiscal Year Ended March 31, 5 TMC Consolidated Financial Results Source : TMC FY2015 , FY2016, & FY2017 Q3 Financial Summary

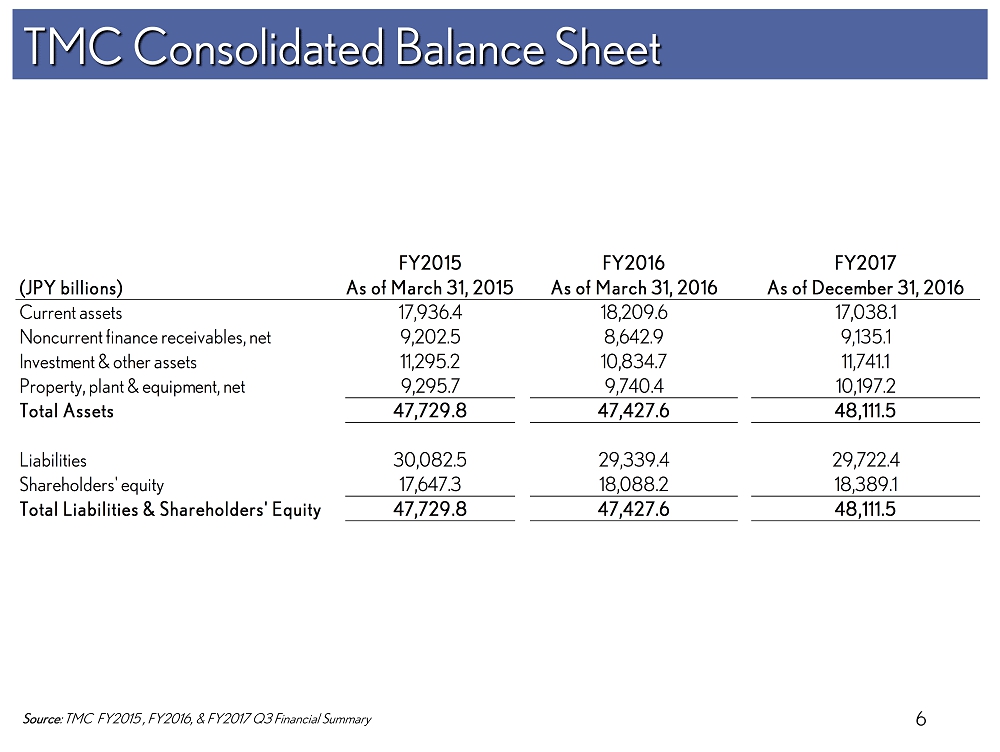

6 TMC Consolidated Balance Sheet Source : TMC FY2015 , FY2016, & FY2017 Q3 Financial Summary FY2015 FY2016 FY2017 (JPY billions) As of March 31, 2015 As of March 31, 2016 As of December 31, 2016 Current assets 17,936.4 18,209.6 17,038.1 Noncurrent finance receivables, net 9,202.5 8,642.9 9,135.1 Investment & other assets 11,295.2 10,834.7 11,741.1 Property, plant & equipment, net 9,295.7 9,740.4 10,197.2 Total Assets 47,729.8 47,427.6 48,111.5 Liabilities 30,082.5 29,339.4 29,722.4 Shareholders' equity 17,647.3 18,088.2 18,389.1 Total Liabilities & Shareholders' Equity 47,729.8 47,427.6 48,111.5

Toyota Across the United States 7

Toyota Across the United States 8

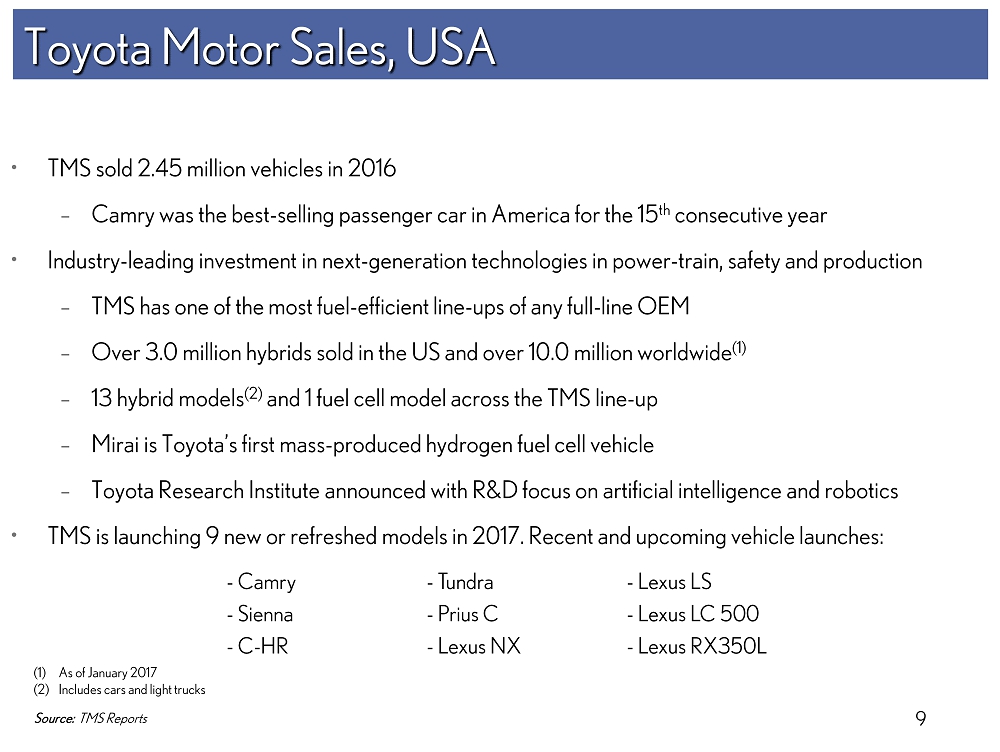

9 • TMS sold 2.45 million vehicles in 2016 – Camry was the best - selling passenger car in America for the 15 th consecutive year • Industry - leading investment in next - generation technologies in power - train, safety and production – TMS has one of the most fuel - efficient line - ups of any full - line OEM – Over 3.0 million hybrids sold in the US and over 10.0 million worldwide (1) – 13 hybrid models (2) and 1 fuel cell model across the TMS line - up – Mirai is Toyota’s first mass - produced hydrogen fuel cell vehicle – Toyota Research Institute announced with R&D focus on artificial intelligence and robotics • TMS is launching 9 new or refreshed models in 2017. Recent and upcoming vehicle launches: Toyota Motor Sales, USA Source: TMS Reports - Camry - Tundra - Lexus LS - Sienna - Prius C - Lexus LC 500 - C - HR - Lexus NX - Lexus RX350L (1) As of January 2017 (2) Includes cars and light trucks

10 Toyota Motor Sales, USA (2) • Qu ality, dependability , safety and product appeal remain high as reflected by numerous 3 rd party accolades 2017 IIHS Top Safety Pick+ Awards 9 Toyota & Lexus models took the highest award, the most of any manufacturer 2017 Kelley Blue Book Best Electric/Hybrid Buy of 2017 2017 Toyota Prius Prime 2017 Kelley Blue Book Best Resale Value Toyota No. 1 Brand Winner (3 out of top 5 Best Resale Values for 2017) 2016 Forbes Toyota ranked No. 1 most valuable automotive brand 2016 Kelley Blue Book Best Resale Value for Luxury Brand Lexus (5 th year running) 2016 J.D. Power and Associates Vehicle Dependability Survey Lexus ranked No. 1 overall 2016 J.D. Power IQS 6 Toyota/Lexus/Scion models Rank highest in their segments 2016 NHTSA 5 - Star Overall Safety 10 Toyota/Lexus/Scion models 2016 Consumer Reports Lexus & Toyota No. 1 brands 2016 NY International Auto Show Mirai received the World Green Car Award 2016 U.S. News Best Cars for the Money Camry, Prius, RAV4 Hybrid & Lexus NX 2015 Fast Company Toyota ranked among World’s 50 Most Innovative Companies

11 Toyota Motor Sales, USA (3) Lexus LC 500 Highlander Prius Prime Tacoma C - HR Lexus LS 460 F

12 Toyota Financial Services

13 TFS Group Global Presence

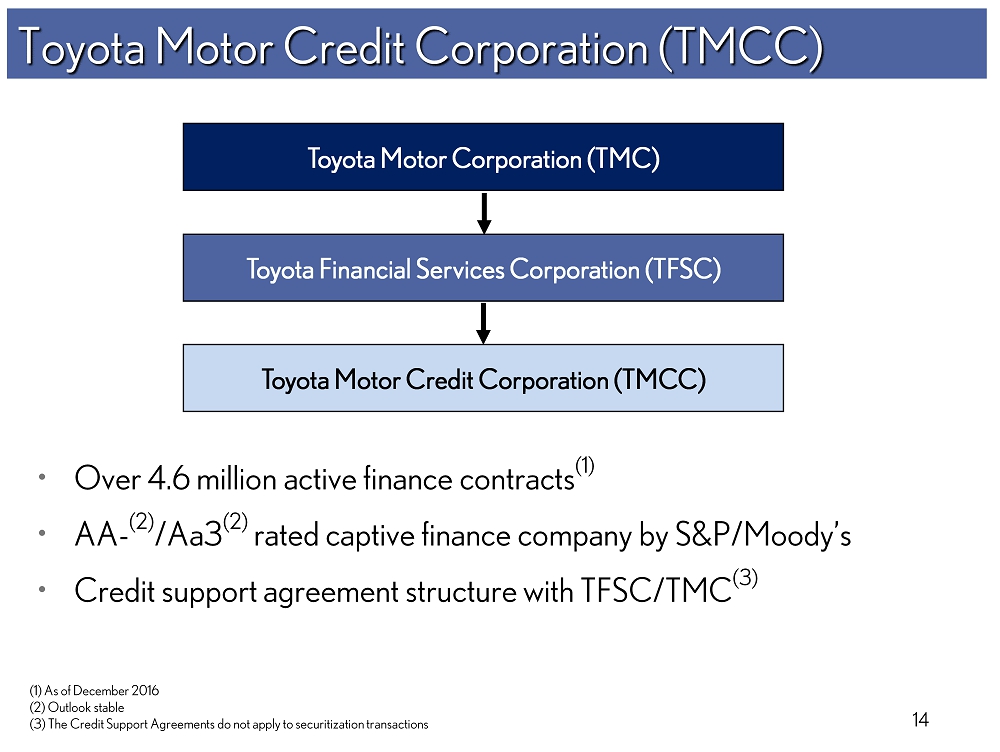

14 • Over 4.6 million active finance contracts (1) • AA - (2) /Aa3 (2) rated captive finance company by S&P/Moody’s • Credit support agreement structure with TFSC/TMC (3) Toyota Financial Services Corporation (TFSC) Toyota Motor Credit Corporation (TMCC) Toyota Motor Credit Corporation (TMCC) Toyota Motor Corporation (TMC) (1) As of December 2016 (2) Outlook stable (3) The Credit Support Agreements do not apply to securitization transactions

15 Credit Support Agreements • Securities* issued by TMCC (and various other TFSC subsidiaries) have the benefit of a credit support agreement with TFSC – TFSC will own 100% of TMCC – TFSC will cause TMCC to maintain a tangible net worth of at least $100,000 as long as covered securities are outstanding – If TMCC determines it will be unable to meet its payment obligations on any securities, TFSC will make sufficient funds available to TMCC to ensure that all such payment obligations are paid as due – Agreement cannot be terminated until (1) repayment of all outstanding securities or (2) each rating agency requested by Toyota to provide a rating has confirmed no change in rating of all such securities • TFSC in turn has the benefit of a credit support agreement with TMC – Same key features as TFSC/TMCC credit support agreement – TMC will cause TFSC to maintain a tangible net worth of at least JPY10mm as long as covered securities are outstanding • TFSC’s and/or TMC's credit support obligations will rank pari passu with all other senior unsecured debt obligations * “Securities” defined as outstanding bonds, debentures, notes and other investment securities and commercial paper, but does not include as set - backed securities issued by TMCC’s securitization trusts.

16 TMCC Products and Services Consumer Finance • Retail • Lease Dealer Finance • Wholesale • Real Estate • Working Capital • Revolving Credit Lines Insurance • Service Agreements • Prepaid Maintenance • Guaranteed Auto Protection • Excess Wear & Use • Tire & Wheel

17 Extensive Field Organization • Decentralized dealer and field support • Centralized servicing and collections (circled)

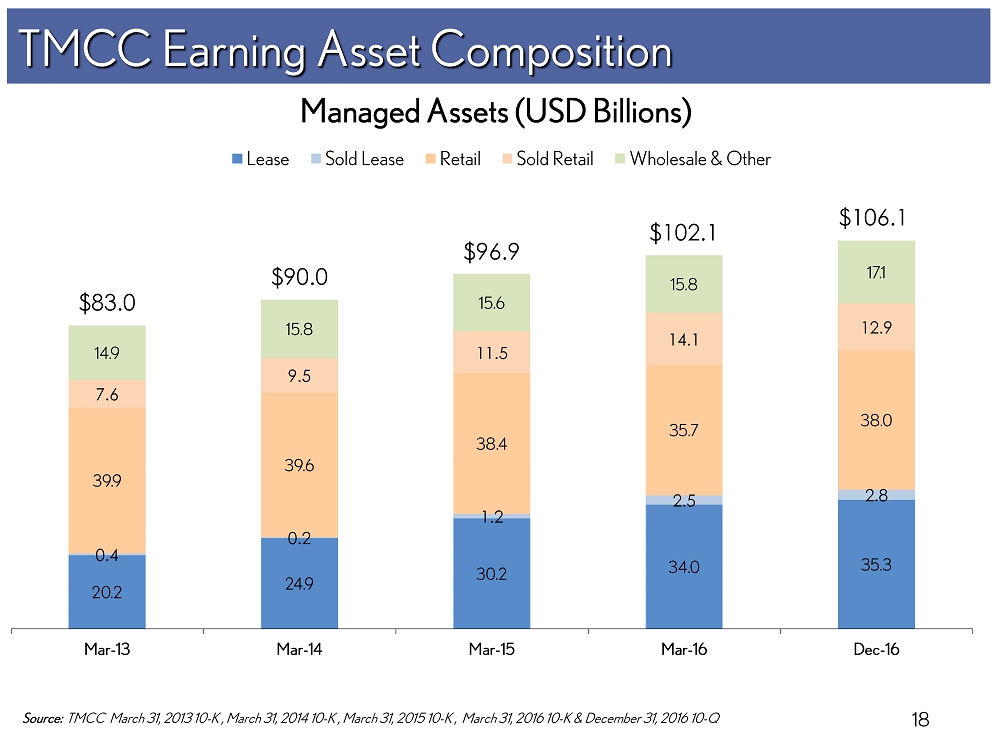

18 TMCC Earning Asset Composition Source: TMCC March 31, 2013 10 - K , March 31, 2014 10 - K , March 31, 2015 10 - K , March 31, 2016 10 - K & December 31, 2016 10 - Q Managed Assets (USD Billions) 20.2 24.9 30.2 34.0 35.3 0.4 0.2 1.2 2.5 2.8 39.9 39.6 38.4 35.7 38.0 7.6 9.5 11.5 14.1 12.9 14.9 15.8 15.6 15.8 17.1 $83.0 $90.0 $96.9 $102.1 $106.1 Mar-13 Mar-14 Mar-15 Mar-16 Dec-16 Lease Sold Lease Retail Sold Retail Wholesale & Other

19 TMCC Financial Performance - Select Data Source: T MCC March 31, 2015 10 - K , March 31, 2016 10 - K & December 31, 2016 10 - Q Nine Months Ended December 31, (USD millions) 2013 2014 2015 2016 2016 Total Financing Revenues 7,244 7,397 8,310 9,403 7,491 add: Other Income 744 702 832 1,080 967 less: Interest Expense 4,508 5,352 5,593 7,051 6,299 and Depreciation Net Financing Revenues 3,480 2,747 3,549 3,432 2,159 and Other Revenues Net Income 1,331 857 1,197 932 358 Fiscal Year Ended March 31,

20 TMCC Financial Performance - Select Data (1) Percentage of gross earning assets (2) The quotient of allowance for credit losses divided by the sum of gross finance receivables (net finance receivables less all owa nce for credit losses) plus gross investments in operating leases (net investments in operating leases less allowance for credit losses ) Note: All percentage figures calculated were based on a 120 - day charge - off policy Source: TMCC March 31, 2015 10 - K , March 31, 2016 10 - K & December 31, 2016 10 - Q Nine Months Ended December 31, 2013 2014 2015 2016 2016 Over 60 Days Delinquent (1) 0.19% 0.18% 0.21% 0.26% 0.38% Allowance for Credit Losses (1) (2) 0.63% 0.50% 0.50% 0.52% 0.53% Net Credit Losses (1) 0.27% 0.28% 0.29% 0.38% 0.46% Fiscal Year Ended March 31,

21 TMCC Funding Programs

22 • A - 1+/P - 1 rated direct commercial paper program • $20.4 billion committed credit facilities (1) • $7.9 billion short - term liquidity investment portfolio (2) • Over $60 billion in readily salable consumer retail loan & lease assets • Access to various domestic and international capital markets • Billions of additional capacity in global benchmark markets • Extensive inter - company lending infrastructure • Credit support agreements: TMCC TFSC TMC Exceptional Liquidity (1) As of December 31, 2016 (2) Average balance for fiscal year to date December 31, 2016 Source : TMCC December 31, 2016 10 - Q

23 • TMCC is committed to: – Maintaining funding diversity and exceptional liquidity – Issuing into strong demand with attractive deals – Identifying & developing new markets and investor relationships – Responding quickly to opportunities with best - in - class execution – Managing our business and stakeholder relationships with a long - term view TMCC Funding Program Objectives

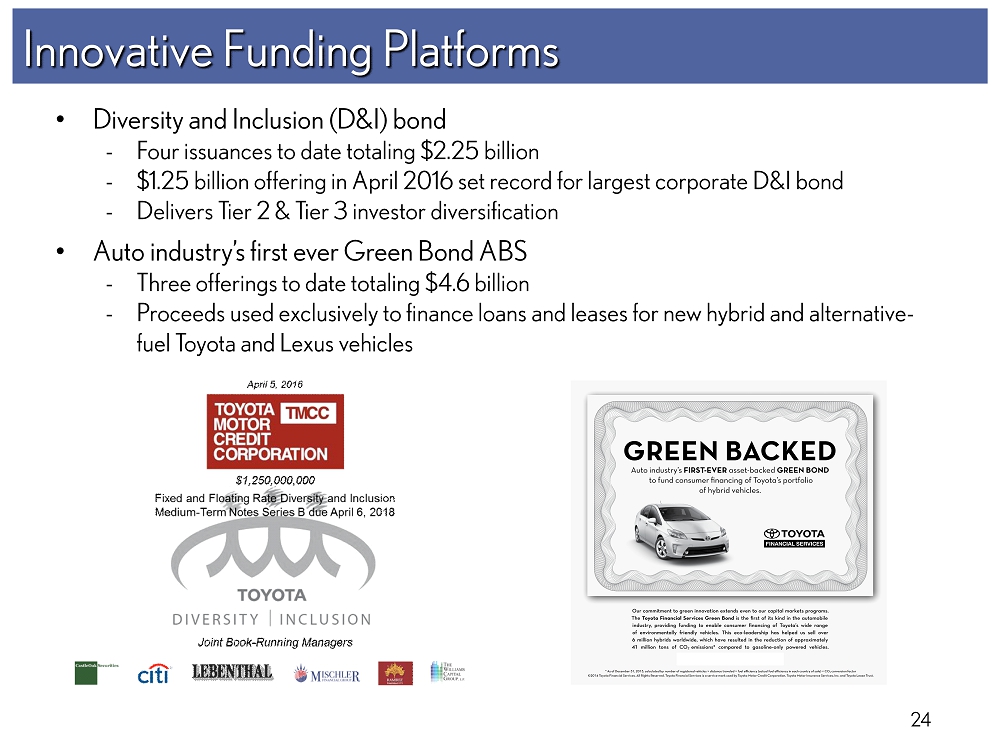

Innovative Funding Platforms 24 • Diversity and Inclusion (D&I) bond - Four issuances to date totaling $2.25 billion - $1.25 billion offering in April 2016 set record for largest corporate D&I bond - Delivers Tier 2 & Tier 3 investor diversification • Auto industry’s first ever Green Bond ABS - Three offerings to date totaling $4.6 billion - Proceeds used exclusively to finance loans and leases for new hybrid and alternative - fuel Toyota and Lexus vehicles

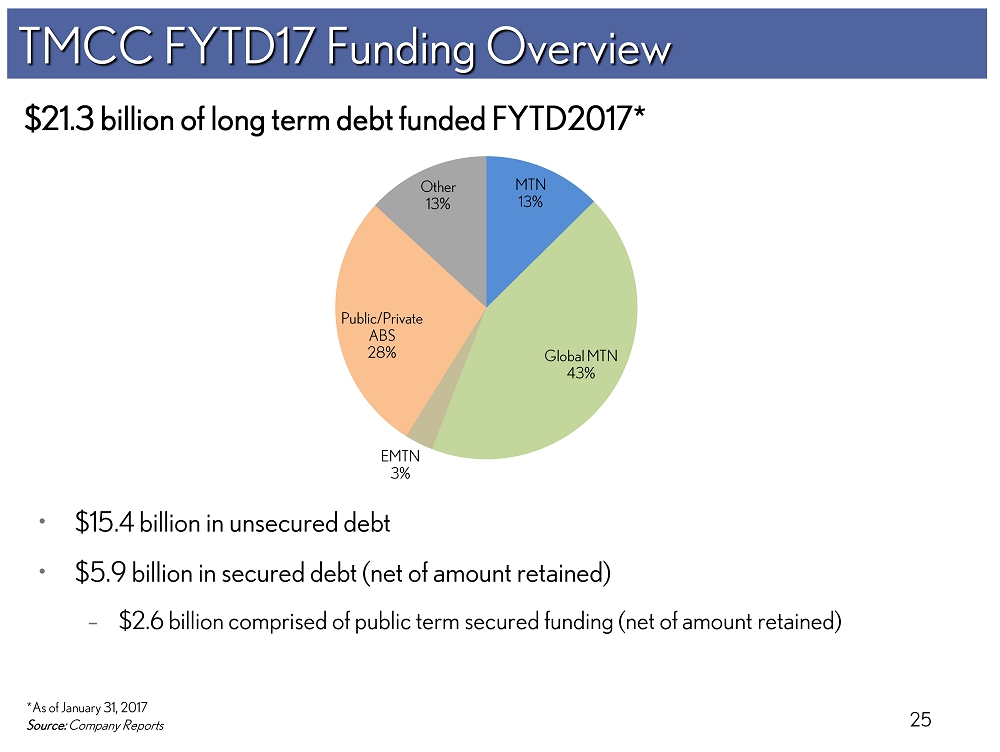

25 • $15.4 billion in unsecured debt • $5.9 billion in secured debt (net of amount retained) – $2.6 billion comprised of public term secured funding (net of amount retained ) TMCC FYTD17 Funding Overview Source : Company Reports $21.3 billion of long term debt funded FYTD2017* *As of January 31, 2017 MTN 13% Global MTN 43% EMTN 3% Public/Private ABS 28% Other 13%

26 TMCC Long Term Debt Outstanding (USD millions ) * Diversification in Debt Offerings *As of January 31, 2017 Source: Company Reports By Deal Type By Currency Global MTN $29,200 MTN $6,682 Public/Private ABS $13,166 Other $10,313 EMTN $12,027 USD 55,820 EUR 8,740 AUD 3,345 JPY 1,408 GBP 1,530 Other 546

27 Funding Flexibility And Responsiveness Source: Company Reports Diversification Across USD Curve (1 ) (1) Unsecured U.S. MTN issuance, excluding Structured Notes and Retail Notes Percentages may not add to 100% due to rounding *As of January 31, 2017 37% 39% 45% 27% 53% 21% 4% 3% 2% 5% 7% 12% 11% 9% 21% 19% 12% 14% 28% 37% 23% 20% 27% 26% 21% 23% 13% 5% 4% 16% 6% 8% 0% 20% 40% 60% 80% 100% FY12 FY13 FY14 FY15 FY16 FYTD17* 1yr 18mth 2yr 3yr 5yr 7yr 10yr

28 Key Investment Highlights • Financial strength supported by strong credit ratings • Transparent business model with exceptional liquidity • Rational funding programs with long - term perspective – Diversification in bond offerings – Focus on proactively meeting needs of market – Strong emphasis placed on flexibility and responsiveness • Industry - leading in: – Liquidity management framework – Balance sheet strength – Business model resiliency

29 TMCC Retail Loan Collateral & ABS Transactions

30 • Consistent and conservative underwriting standards have produced low levels of delinquencies and credit losses – Focus on prime origination – Ongoing focus on Toyota and Lexus business • Optimization of collections strategy and staff supports loss mitigation while enabling portfolio growth – Emphasis on early intervention – Reinforcement of strong compliance management system Credit Decisioning & Collections 30 (1) Delinquency is 60+ day delinquencies as a percentage of retail receivable contracts outstanding (2) Credit loss is annual net credit loss as a percentage of retail receivable principal balance outstanding (3) As of December 31, 2016 0.0% 1.0% 2.0% FY2009 FY2010 FY2011 FY2012 FY2013 FY2014 FY2015 FY2016 FYTD2017 Delinquency (1) Credit loss (2) (3)

Source: Company Reports 31 31 Cumulative Net Losses: Annual Origination Vintages 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 0 4 8 12 16 20 24 28 32 36 40 44 48 52 56 60 64 68 72 Months 2008 2009 2010 2011 2012 2013 2014 2015

2016 2015 2016 2015 2014 2013 2012 Outstanding Contracts (2) 3,190,526 3,204,795 3,163,189 3,209,872 3,220,641 3,156,247 3,119,781 Number of Accounts Past Due in the following categories 30 - 59 days 52,127 46,257 35,795 31,130 32,920 35,672 35,162 60 - 89 days 12,525 10,945 7,822 6,569 6,660 7,182 6,786 Over 89 days 9,186 10,278 6,776 5,616 5,799 6,362 5,870 Delinquencies as a Percentage of Contracts Outstanding (3) 30 - 59 days 1.63% 1.44% 1.13% 0.97% 1.02% 1.13% 1.13% 60 - 89 days 0.39% 0.34% 0.25% 0.20% 0.21% 0.23% 0.22% Over 89 days 0.29% 0.32% 0.21% 0.17% 0.18% 0.20% 0.19% At December 31, At March 31, 32 TMCC Retail Loan Delinquency Experience (1) (1) The historical delinquency data reported in this table includes all retail vehicle installment sales contracts purchased by TMCC, excluding those purchased by a subsidiary of TMCC operating in Puerto Rico. Includes contracts that have been sold but are still being serviced by TMCC. (2) Number of contracts outstanding at end of period. (3) The period of delinquency is based on the number of days payments are contractually past due. A payment is deemed to be pas t due if less than 90% of such payment is made. Managed Portfolio Performance Source: Company Reports

2016 2015 2016 2015 2014 2013 2012 Principal Balance Outstanding (2) $50,941,646 $50,570,615 $49,716,914 $49,645,354 $48,761,164 $46,932,720 $44,648,020 Average Principal Balance Outstanding (3) $50,329,280 $50,107,985 $49,681,134 $49,203,259 $47,846,942 $45,790,370 $44,850,661 Number of Contracts Outstanding 3,190,526 3,204,795 3,163,189 3,209,872 3,220,641 3,156,247 3,119,781 Average Number of Contracts Outstanding (3) 3,176,858 3,207,334 3,186,531 3,215,257 3,188,444 3,138,014 3,154,686 Number of Repossessions (4) 35,296 26,259 37,741 34,780 34,923 34,353 42,937 Number of Repossessions as a Percent of the Number of Contracts Outstanding 1.48% (7) 1.09% (7) 1.19% 1.08% 1.08% 1.09% 1.38% Number of Repossessions as a Percent of the Average Number of Contracts Outstanding 1.48% (7) 1.09% (7) 1.18% 1.08% 1.10% 1.09% 1.36% Gross Charge-Offs (5) $291,112 $232,390 $322,814 $267,835 $257,586 $244,432 $240,736 Recoveries (6) $37,898 $36,296 $47,966 $59,931 $62,714 $69,088 $78,593 Net Losses $253,214 $196,094 $274,848 $207,904 $194,872 $175,344 $162,143 Net Losses as a Percentage of Principal Balance Outstanding 0.66% (7) 0.52% (7) 0.55% 0.42% 0.40% 0.37% 0.36% Net Losses as a Percentage of Average Principal Balance Outstanding 0.67% (7) 0.52% (7) 0.55% 0.42% 0.41% 0.38% 0.36% December 31, For the Month Ended March 31, For the Fiscal Years Ended Performance – Retail Loan TMCC Managed Portfolio Net Loss and Repossession Experience (dollars in thousands) (1) 33 Source : Company Reports (1) The net loss and repossession data reported in this table includes all retail installment sales contracts purchased by T MCC , excluding those purchased by a subsidiary of TMCC operating in Puerto Rico. Includes contracts that have been sold but are still being serviced by TMCC. (2) Principal Balance Outstanding includes payoff amount for simple interest contracts and net principal amount for actuaria l c ontracts. Actuarial contracts do not comprise any of the Receivables. (3) Average of the principal balance or number of contracts outstanding as of the beginning and end of the indicated periods . (4) Includes bankruptcy - related repossessions but excludes bankruptcies. (5) Amount charged - off is the net remaining principal balance, including earned but not yet received finance charges, repossess ion expenses and unpaid extension fees, less any proceeds from the liquidation of the related vehicle. Also includes dealer reserve charge - offs. (6) Includes all recoveries from post - disposition monies received on previously charged - off contracts including any proceeds from the liquidation of the related vehicle after the related charge - off. Also includes recoveries for dealer reserve charge - offs and chargebacks. (7) Annualized

34 TMCC Retail Auto Loan Originations ( 1 ) Percentages may not add to 100.0% due to rounding Origination Profile 34 Source: Company Reports Original Summary Characteristics by Vintage Origination Year: 2012 2013 2014 2015 2016 Number of Pool Assets 973,979 1,008,958 951,133 925,631 757,369 Original Pool Balance $24,029,119,369 $25,332,328,542 $24,516,581,298 $24,222,949,274 $20,661,504,403 Average Initial Loan Balance $24,671 $25,107 $25,776 $26,169 $27,281 Weighted Average Interest Rate 3.15% 2.94% 3.07% 3.35% 3.29% Weighted Average Original Term 63 Months 63 Months 64 Months 65 Months 66 Months Weighted Average FICO 731 727 726 720 726 Minimum FICO 371 388 381 383 380 Maximum FICO 886 886 887 886 900 Geographic Distribution of Receivables representing the 5 states with the greatest aggregate original principal balance: State 1 CA - 19.3% CA - 21.4% CA - 21.0% CA - 21.3% CA - 21.3% State 2 TX - 14.1% TX - 13.3% TX - 14.0% TX - 15.7% TX - 15.2% State 3 NY - 5.1% NY - 4.6% NY - 4.7% NY - 4.9% NY - 4.8% State 4 NJ - 4.5% NJ - 4.4% NJ - 4.0% NJ - 3.8% NJ - 4.0% State 5 VA - 4.2% IL - 3.9% IL - 4.2% IL - 3.8% IL - 3.9% Distribution of Receivables by Contract Rate: (1) Less than 2.0% 44.1% 51.2% 50.8% 46.2% 47.5% 2.0% - 3.99% 27.8% 20.2% 19.4% 19.9% 23.6% 4.0% - 5.99% 15.1% 14.0% 13.5% 14.0% 13.2% 6.0% - 7.99% 6.6% 6.7% 7.7% 8.7% 7.1% 8.0% - 9.99% 2.7% 3.2% 3.6% 4.9% 4.0% 10.0% - 11.99% 1.4% 1.5% 1.7% 2.7% 2.1% 12.0% - 13.99% 0.5% 0.6% 0.7% 1.4% 1.1% 14.0% - 15.99% 0.5% 0.6% 0.6% 0.9% 0.7% 16.0% and greater 1.4% 2.0% 1.9% 1.2% 0.6% Total 100.00% 100.00% 100.00% 100.00% 100.00% Share of Original Assets: Percentage of Non-Toyota/Non-Lexus 3.3% 3.3% 3.8% 4.0% 3.1% Percentage of 72+ Month Term 10.0% 10.6% 11.1% 13.2% 13.2% Percentage of Used Vehicles 24.4% 24.5% 23.7% 24.6% 25.0%

Origination Characteristics APR Distribution 35 35 Weighted Average FICO Weighted Average Original Term New vs. Used 44% 51% 51% 46% 47% 28% 20% 19% 20% 24% 28% 29% 30% 34% 29% CY2012 2013 2014 2015 2016 <2.0% 2.0%-3.99% >= 4.0% 731 727 726 720 726 CY2012 2013 2014 2015 2016 63 63 64 65 66 CY2012 2013 2014 2015 2016 76% 76% 76% 75% 75% 24% 25% 24% 25% 25% CY2012 2013 2014 2015 2016 New Used Source: Company Reports

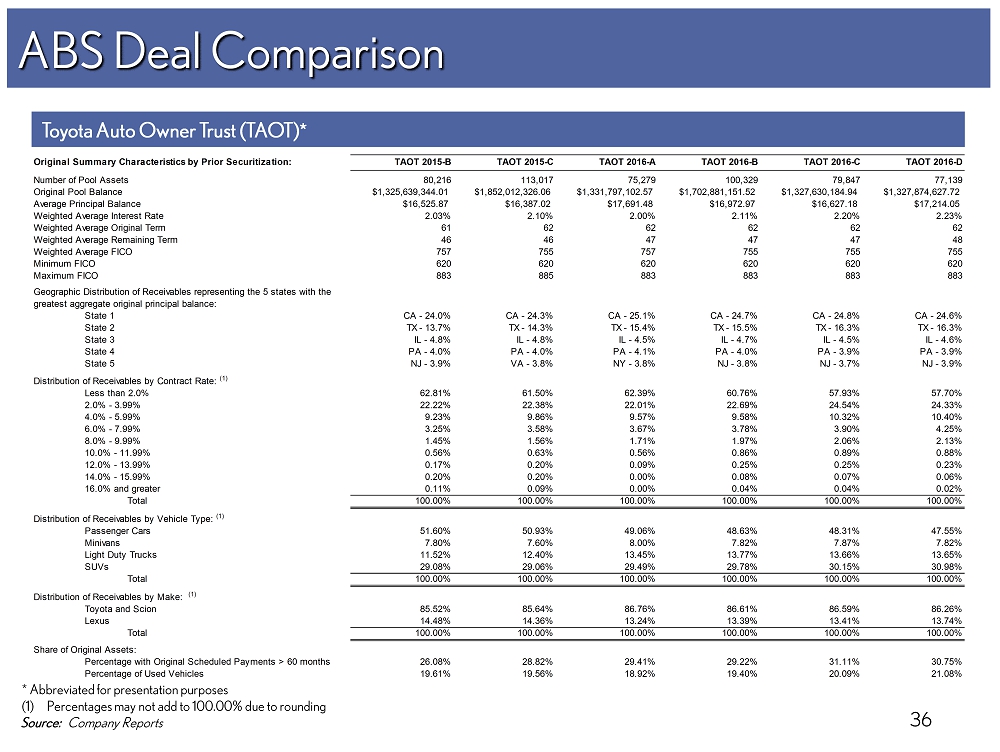

ABS Deal Comparison Toyota Auto Owner Trust (TAOT ) * * Abbreviated for presentation purposes (1) Percentages may not add to 100.00% due to rounding 36 Source: Company Reports Original Summary Characteristics by Prior Securitization: TAOT 2015-B TAOT 2015-C TAOT 2016-A TAOT 2016-B TAOT 2016-C TAOT 2016-D Number of Pool Assets 80,216 113,017 75,279 100,329 79,847 77,139 Original Pool Balance $1,325,639,344.01 $1,852,012,326.06 $1,331,797,102.57 $1,702,881,151.52 $1,327,630,184.94 $1,327,874,627.72 Average Principal Balance $16,525.87 $16,387.02 $17,691.48 $16,972.97 $16,627.18 $17,214.05 Weighted Average Interest Rate 2.03% 2.10% 2.00% 2.11% 2.20% 2.23% Weighted Average Original Term 61 62 62 62 62 62 Weighted Average Remaining Term 46 46 47 47 47 48 Weighted Average FICO 757 755 757 755 755 755 Minimum FICO 620 620 620 620 620 620 Maximum FICO 883 885 883 883 883 883 Geographic Distribution of Receivables representing the 5 states with the greatest aggregate original principal balance: State 1 CA - 24.0% CA - 24.3% CA - 25.1% CA - 24.7% CA - 24.8% CA - 24.6% State 2 TX - 13.7% TX - 14.3% TX - 15.4% TX - 15.5% TX - 16.3% TX - 16.3% State 3 IL - 4.8% IL - 4.8% IL - 4.5% IL - 4.7% IL - 4.5% IL - 4.6% State 4 PA - 4.0% PA - 4.0% PA - 4.1% PA - 4.0% PA - 3.9% PA - 3.9% State 5 NJ - 3.9% VA - 3.8% NY - 3.8% NJ - 3.8% NJ - 3.7% NJ - 3.9% Distribution of Receivables by Contract Rate: (1) Less than 2.0% 62.81% 61.50% 62.39% 60.76% 57.93% 57.70% 2.0% - 3.99% 22.22% 22.38% 22.01% 22.69% 24.54% 24.33% 4.0% - 5.99% 9.23% 9.86% 9.57% 9.58% 10.32% 10.40% 6.0% - 7.99% 3.25% 3.58% 3.67% 3.78% 3.90% 4.25% 8.0% - 9.99% 1.45% 1.56% 1.71% 1.97% 2.06% 2.13% 10.0% - 11.99% 0.56% 0.63% 0.56% 0.86% 0.89% 0.88% 12.0% - 13.99% 0.17% 0.20% 0.09% 0.25% 0.25% 0.23% 14.0% - 15.99% 0.20% 0.20% 0.00% 0.08% 0.07% 0.06% 16.0% and greater 0.11% 0.09% 0.00% 0.04% 0.04% 0.02% Total 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% Distribution of Receivables by Vehicle Type: (1) Passenger Cars 51.60% 50.93% 49.06% 48.63% 48.31% 47.55% Minivans 7.80% 7.60% 8.00% 7.82% 7.87% 7.82% Light Duty Trucks 11.52% 12.40% 13.45% 13.77% 13.66% 13.65% SUVs 29.08% 29.06% 29.49% 29.78% 30.15% 30.98% Total 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% Distribution of Receivables by Make: (1) Toyota and Scion 85.52% 85.64% 86.76% 86.61% 86.59% 86.26% Lexus 14.48% 14.36% 13.24% 13.39% 13.41% 13.74% Total 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% Share of Original Assets: Percentage with Original Scheduled Payments > 60 months 26.08% 28.82% 29.41% 29.22% 31.11% 30.75% Percentage of Used Vehicles 19.61% 19.56% 18.92% 19.40% 20.09% 21.08%

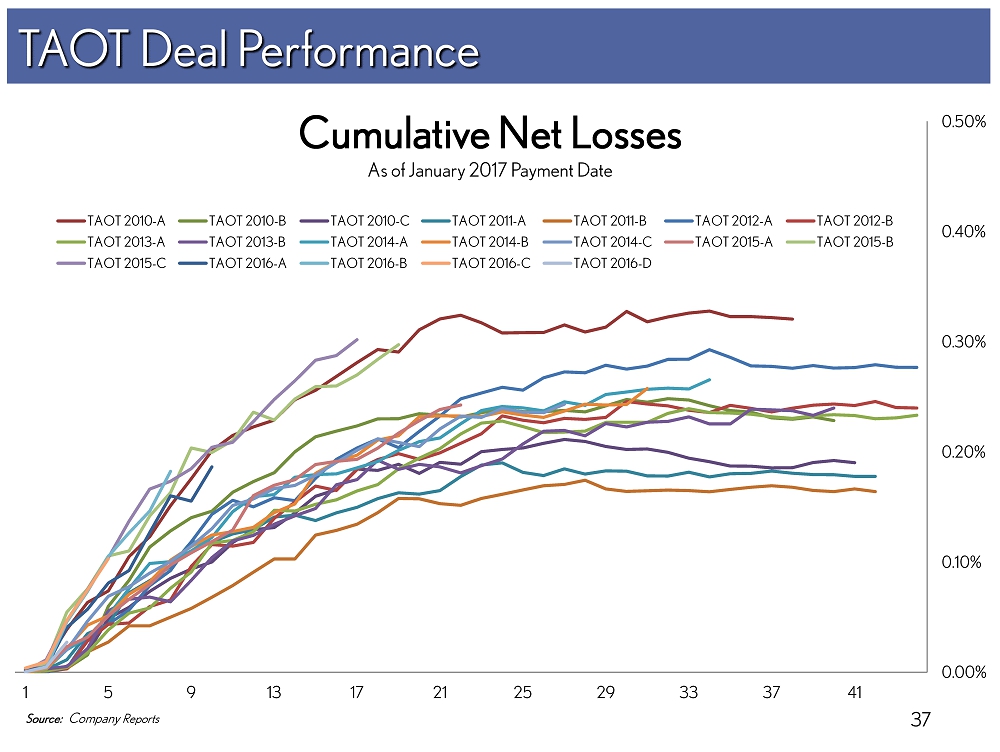

TAOT Deal Performance 37 37 Source: Company Reports Cumulative Net Losses As of January 2017 Payment Date 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 1 5 9 13 17 21 25 29 33 37 41 TAOT 2010-A TAOT 2010-B TAOT 2010-C TAOT 2011-A TAOT 2011-B TAOT 2012-A TAOT 2012-B TAOT 2013-A TAOT 2013-B TAOT 2014-A TAOT 2014-B TAOT 2014-C TAOT 2015-A TAOT 2015-B TAOT 2015-C TAOT 2016-A TAOT 2016-B TAOT 2016-C TAOT 2016-D

38 Sales & Trading Update

Commercial Paper Programs Highlights • A - 1+/P - 1 Direct Commercial Paper Programs – 3 distinct USD commercial paper programs (TMCC, TCPR, TCCI) – $15.0 billion multi - party committed credit facilities – $5.4 billion bilateral committed credit facilities – $28.8 billion USCP combined average outstanding for TMCC and TCPR – Over 700 diverse institutional investors • State and local municipalities • Large corporations • Pension and retirement funds • Financial institutions • Money managers and mutual fund companies – Rates are posted daily on Bloomberg DOCP screen Source : TMCC December 31, 2016 10 - Q 39