• The U . S . automobile SAAR figure for January 2017 came in at 17 . 48 M vehicles, up from 17 . 40 M vehicles in January 2016 . • TMS January 2017 sales totaled 143 , 048 vehicles, a decrease of 11 . 3 % from January 2016 volume, a decrease of 11 . 3 % on a daily selling rate (DSR) basis . • Lexus reported January 2017 sales of 15 , 572 vehicles, down 25 . 6 % from January 2016 on a volume basis and DSR basis . • North American production for January 2017 totaled 101 , 872 vehicles, a volume decrease of 13 . 1 % from January 2016 . Source: Toyota, Bloomberg, Ward’s Automotive Group. TMS monthly results include fleet sales volume. ‡ “Other” consists of Central and South America, Oceania, Africa and the Middle East Source : TMC company filings . TOYOTA MOTOR SALES (TMS), U.S.A. INC . MONTHLY RESULTS TOYOTA MOTOR CORPORATION (TMC) FINANCIAL RESULTS Toyota Business Highlights 3 QFY2017 TMC consolidated financial performance Q3 FY2016 Q3 FY2017 Net Revenues ¥7,339,882 ¥7,084,187 Operating Income (Loss) 722,266 438,586 Net Income attributable to TMC (Loss) 627,965 486,531 TMC Consolidated Balance Sheet Current Assets ¥18,179,547 ¥17,038,147 Noncurrent finance receivables, net 9,160,158 9,135,122 Total Investments and other assets 11,734,030 11,741,049 Property, plant and equipment, net 9,849,256 10,197,167 Total Assets ¥48,922,991 ¥48,111,485 Liabilities ¥30,297,149 ¥29,722,406 Mezzanine equity 477,977 483,428 Shareholders' equity 18,147,865 17,905,651 Total Liabilities and Shareholders' Equity ¥48,922,991 ¥48,111,485 Operating Income (Loss) by geographic region Japan ¥392,748 ¥209,325 North America 150,750 70,678 Europe 20,515 18,148 Asia 134,834 124,664 Other‡ 25,028 24,158 Inter-segment elimination and/or unallocated amount -1,609 -8,387 Yen in millions Production (units) Q3 FY2016 Q3 FY2017 Japan 1,010,196 1,012,874 North America 464,441 493,531 Europe 151,774 175,515 Asia 413,349 433,419 Other‡ 105,680 123,991 Sales (units) Q3 FY2016 Q3 FY2017 Japan 492,258 533,919 North America 727,591 744,647 Europe 210,332 232,997 Asia 362,669 428,061 Other‡ 421,927 340,225 0 50 100 150 200 250 300 6 8 10 12 14 16 18 20 Jan-12 Apr-12 Jul-12 Oct-12 Jan-13 Apr-13 Jul-13 Oct-13 Jan-14 Apr-14 Jul-14 Oct-14 Jan-15 Apr-15 Jul-15 Oct-15 Jan-16 Apr-16 Jul-16 Oct-16 Jan-17 Toyota U.S. light vehicle sales (units in thousands) Seasonally adjusted annual rate (units in millions) U.S. Light Vehicle Seasonally Adjusted Annual Rate (SAAR) and Toyota Motor Sales (TMS), U.S.A. Inc. Sales January 2012 - January 2017 Jan-16 Jan-17 Jan-16 Jan-17 COROLLA 23,612 21,567 CAMRY 26,848 20,313 RAV4 21,554 22,155 HIGHLANDER 11,258 12,656 TACOMA 12,717 12,509 Toyota U.S. January 2017 vehicle sales - Toyota Division Top 5 makes Jan-16 Jan-17 Jan-16 Jan-17 RX 6,956 5,520 NX 3,133 2,964 ES 3,400 2,171 IS 2,178 1,423 GX 1,608 1,418 Toyota U.S. January 2017 vehicle sales - Lexus Division Top 5 makes 127,476 15,572 Toyota Motor Sales (TMS), U.S.A. Inc. Jan 2017 vehicle sales Toyota Division Lexus Division Exhibit 99.2

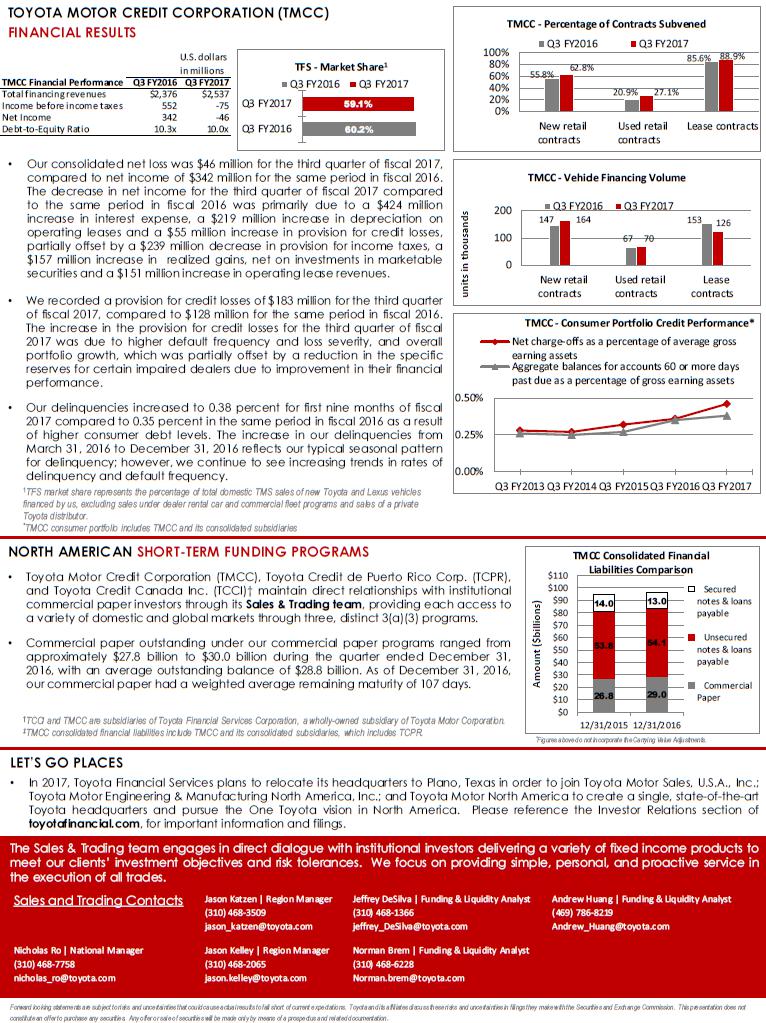

TOYOTA MOTOR CREDIT CORPORATION (TMCC) FINANCIAL RESULTS • Our consolidated net l oss was $ 46 million for the third quarter of fiscal 2017 , compared to net income of $ 342 million for the same period in fiscal 2016 . The decrease in net income for the third quarter of fiscal 2017 compared to the same period in fiscal 2016 was primarily due to a $ 424 million increase in interest expense, a $ 219 million increase in depreciation on operating leases and a $ 55 million increase in provision for credit losses, partially offset by a $ 239 million decrease in provision for income taxes, a $ 157 million increase in realized gains, net on investments in marketable securities and a $ 151 million increase in operating lease revenues . • We recorded a provision for credit losses of $ 183 million for the third quarter of fiscal 2017 , compared to $ 128 million for the same period in fiscal 2016 . The increase in the provision for credit losses for the third quarter of fiscal 2017 was due to higher default frequency and loss severity, and overall portfolio growth, which was partially offset by a reduction in the specific reserves for certain impaired dealers due to improvement in their financial performance . • Our delinquencies increased to 0 . 38 percent for first nine months of fiscal 2017 compared to 0 . 35 percent in the same period in fiscal 2016 as a result of higher consumer debt levels . The increase in our delinquencies from March 31 , 2016 to December 31 , 2016 reflects our typical seasonal pattern for delinquency ; however, we continue to see increasing trends in rates of delinquency and default frequency . 1 TFS market share represents the percentage of total domestic TMS sales of new Toyota and Lexus vehicles financed by us, excluding sales under dealer rental car and commercial fleet programs and sales of a private Toyota distributor. * TMCC consumer portfolio includes TMCC and its consolidated subsidiaries NORTH AMERICAN SHORT - TERM FUNDING PROGRAMS • Toyota Motor Credit Corporation (TMCC), Toyota Credit de Puerto Rico Corp . (TCPR), and Toyota Credit Canada Inc . (TCCI)† maintain direct relationships with institutional commercial paper investors through its Sales & Trading team , providing each access to a variety of domestic and global markets through three, distinct 3 (a)( 3 ) programs . • Commercial paper outstanding under our commercial paper programs ranged from approximately $ 27 . 8 billion to $ 30 . 0 billion during the quarter ended December 31 , 2016 , with an average outstanding balance of $ 28 . 8 billion . As of December 31 , 2016 , our commercial paper had a weighted average remaining maturity of 107 days . † TCCI and TMCC are subsidiaries of Toyota Financial Services Corporation, a wholly - owned subsidiary of Toyota Motor Corporation. ‡ TMCC consolidated financial liabilities include TMCC and its consolidated subsidiaries, which includes TCPR. LET’S GO PLACES • In 2017 , Toyota Financial Services plans to relocate its headquarters to Plano, Texas in order to join Toyota Motor Sales, U . S . A . , Inc .; Toyota Motor Engineering & Manufacturing North America, Inc .; and Toyota Motor North America to create a single, state - of - the - art Toyota headquarters and pursue the One Toyota vision in North America . Please reference the Investor Relations section of toyotafinancial . com , for important information and filings . Forward looking statements are subject to risks and uncertainties that could cause actual results to fall short of current ex pec tations. Toyota and its affiliates discuss these risks and uncertainties in filings they make with the Securities and Exchan ge Commission. This presentation does not constitute an offer to purchase any securities. Any offer or sale of securities will be made only by means of a prospectus a nd related documentation . The Sales & Trading team engages in direct dialogue with institutional investors delivering a variety of fixed income products to meet our clients’ investment objectives and risk tolerances . We focus on providing simple, personal, and proactive service in the execution of all trades . * Figures above do not incorporate the Carrying Value Adjustments. Sales and Trading Contacts Jason Katzen | Region Manager (310) 468 - 3509 jason_katzen@toyota.com Jeffrey DeSilva | Funding & Liquidity Analyst (310) 468 - 1366 jeffrey_DeSilva@toyota.com Andrew Huang | Funding & Liquidity Analyst (469) 786 - 8219 Andrew_Huang@toyota.com Nicholas Ro | National Manager (310) 468 - 7758 nicholas_ro@toyota.com Jason Kelley | Region Manager (310) 468 - 2065 jason.kelley@toyota.com Norman Brem | Funding & Liquidity Analyst (310) 468 - 6228 Norman.brem@toyota.com U.S. dollars in millions TMCC Financial Performance Q3 FY2016 Q3 FY2017 Total financing revenues $2,376 $2,537 Income before income taxes 552 -75 Net Income 342 -46 Debt-to-Equity Ratio 10.3x 10.0x 60.2% 59.1% Q3 FY2016 Q3 FY2017 TFS - Market Share 1 Q3 FY2016 Q3 FY2017 55.8% 20.9% 85.6% 62.8% 27.1% 88.9% 0% 20% 40% 60% 80% 100% New retail contracts Used retail contracts Lease contracts TMCC - Percentage of Contracts Subvened Q3 FY2016 Q3 FY2017 147 67 153 164 70 126 0 100 200 New retail contracts Used retail contracts Lease contracts units in thousands TMCC - Vehicle Financing Volume Q3 FY2016 Q3 FY2017 0.00% 0.25% 0.50% Q3 FY2013 Q3 FY2014 Q3 FY2015 Q3 FY2016 Q3 FY2017 TMCC - Consumer Portfolio Credit Performance* Net charge-offs as a percentage of average gross earning assets Aggregate balances for accounts 60 or more days past due as a percentage of gross earning assets 26.8 29.0 53.8 54.1 14.0 13.0 $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 $110 12/31/2015 12/31/2016 Amount ($billions) TMCC Consolidated Financial Liabilities Comparison Secured notes & loans payable Unsecured notes & loans payable Commercial Paper