UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-5577 |

|

The Glenmede Fund, Inc. |

(Exact name of registrant as specified in charter) |

|

200 Clarendon Street

Boston, Massachusetts | | 02116 |

(Address of principal executive offices) | | (Zip code) |

|

Michael P. Malloy, Esq.

Secretary

Drinker Biddle & Reath LLP

One Logan Square

18th & Cherry Streets

Philadelphia, PA 19103-6996 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-800-442-8299 | |

|

Date of fiscal year end: | October 31, 2005 | |

|

Date of reporting period: | October 31, 2005 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

GLENMEDE

THE GLENMEDE FUND, INC.

THE GLENMEDE PORTFOLIOS

ANNUAL REPORT

OCTOBER 31, 2005

The performance for each of the portfolios shown on pages 6 to 18 represents past performance and is not a guarantee of future results. A portfolio's share price and investment return will vary with market conditions, and the principal value of shares, when redeemed, may be more or less than their original cost. An investment in a portfolio is neither insured nor guaranteed by the US Government, the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other governmental agency or bank. The yields of money market funds will fluctuate as market conditions change. Although the money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in these funds. Unlike actual fund performance, performance of an index does not reflect any expenses or transaction costs. A direct investment in an unmanaged index is not possible.

The reports concerning the portfolios included in this shareholder report may contain certain forward-looking statements about the factors that may affect the performance of the portfolios in the future. These statements are based on the adviser's or sub-adviser's predictions and expectations concerning certain future events and their expected impact on the portfolios, such as performance of the economy as a whole and of specific industry sectors, changes in the levels of interest rates, the impact of developing world events and other factors that may influence the future performance of the portfolios. The adviser or sub-adviser, as applicable, believes these forward-looking statements to be reasonable, although they are inherently uncertain and difficult to predict. Actual events may cause adjustments in portfolio management strategies from those currently expected to be employed.

THE GLENMEDE FUND, INC. AND THE GLENMEDE PORTFOLIOS

PRESIDENT'S LETTER

Dear Shareholder:

We are pleased to present the investment results of The Glenmede family of funds for the fiscal year ended October 31, 2005. In February of 2005, the name of the Small Capitalization Growth Portfolio was changed to the U.S. Emerging Growth Portfolio and management of the portfolio was taken over by Vladimir ("Val") de Vassal of Glenmede Advisers, Inc. We hope you find the description of the management team and investment process for this portfolio which follows interesting. We have also included a description of the Strategic Equity Portfolio which has been managed by Peter Zuleba, Gordon Fowler and their team since August of 2004.

At the fiscal year end on October 31, 2005, The Glenmede Fund, Inc. and The Glenmede Portfolios (collectively the "Glenmede Funds") consisted of thirteen portfolios with total net assets of $3.3 billion. These included two EAFE International portfolios, International and Philadelphia International (formerly Institutional International), which are sub-advised and advised respectively by Philadelphia International Advisors LP ("PIA"). The Glenmede Trust Company formed the PIA partnership with members of their International Equity team on January 1, 2002 to allow them to focus entirely on the International Equity products. These portfolios account for 44% of the fund family's net assets as of October 31, 2005.

All of the Glenmede Funds, other than the money market funds, are managed to seek long-term total returns consistent with reasonable risk to principal for their asset category.1 Efforts are made to keep expenses at competitive levels. All of the portfolios use a quantitative style of investing.

This fiscal year ended October 31, 2005 showed positive returns across all asset classes. The S&P 500 Index2 returned 8.71% and the Lehman Brothers U.S. Aggregate Index3 returned 1.13% for the fiscal year ended October 31, 2005. All of the Glenmede domestic funds outperformed (before taxes) their primary benchmarks for the fiscal year. These returns are shown in the Portfolio Highlights section of the report. The MSCI EAFE Index4 performed better than domestic stocks for the fiscal year returning 18.09%5. The bulk of the equity returns occurred during the last two months of 2004.

The Federal Reserve continued to raise interest rates as a result of steady economic growth. There were eight increases in the Fed Funds Target rate, from 1.75% to 3.75% during the fiscal year ended October 31, 2005. Long rates remained low as inflation appeared to be under control. The yield curve flattened dramatically during the period with three-month treasury bills rising 198 basis points in yield and the 30-year treasury bond dropping 4 basis points. Correlating with higher short term rates, mortgage-backed securities were the best performing sector resulting in the Lehman Brothers MBS Fixed Rate Index6 returning 1.75% versus the return on the Lehman Brothers US Credit Index7 of 0.65% and the return on the Lehman Brothers US Government Bond Index8 of 0.94%.

1

We welcome any questions about the Glenmede Funds and thank our clients for their continued support.

Sincerely,

Mary Ann B. Wirts

President

November 21, 2005

1 Mutual fund investing involves risks. Principal loss is possible. The Portfolios may invest in foreign securities which will involve greater volatility and political, economic and currency risks and differences in accounting methods. The Small Cap Equity and U.S. Emerging Growth Portfolios invest in smaller companies, which will involve additional risks such as limited liquidity and greater volatility.

2 The S&P 500 Stock Index is a market capitalization weighted index comprised of 500 widely held common stocks.

3 The Lehman Brothers U.S. Aggregate Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. These major sectors are subdivided into more specific indices that are calculated and reported on a regular basis.

4 The Morgan Stanley EAFE Index is an unmanaged capitalization weighted composite portfolio consisting of equity total returns of countries in Australia, New Zealand, Europe and the Far East.

5 Please refer to Portfolio Highlights of the Annual Report for fund performance information.

6 The Lehman Brothers MBS Fixed Rate Index, an unmanaged index measuring the performance of mortgage-backed pass-through securities of Ginnie Mae (GNMA), Fannie Mae (FNMA) and Freddie Mac (FHLMC). This index is formed by grouping the universe of over 600,000 individual fixed rate MBS pools into approximately 3,500 generic aggregates.

7 The Lehman Brothers U.S. Credit Index measures the performance of a large group of high quality corporate bonds with maturities greater than one year.

8 The Lehman Brothers U.S. Government Bond Index is an unmanaged total return index comprised of all public obligations of the U.S. Treasury, U.S. government agencies, quasi-federal agencies, and corporate debt guaranteed by the U.S. government.

Past performance is no guarantee of future results.

This material must be preceded or accompanied by a current prospectus.

The Glenmede Fund, Inc. and the Glenmede Portfolios are distributed by Quasar Distributors, LLC. 12/05.

2

THE GLENMEDE FUND, INC.

Inside the

STRATEGIC EQUITY PORTFOLIO

The portfolio is led by Gordon B. Fowler, Jr., who joined Glenmede as Chief Investment Officer in 2003 and Peter J. Zuleba, III, CFA, who joined Glenmede as Director of Fundamental Research in 2004.

The investment process we employ to the Glenmede Strategic Equity Portfolio is the marriage of our quantitative and fundamental analysis which we believe should create a portfolio of stocks that are statistically attractive and whose growth should outpace the broader market. Our quantitative analysis team, led by Val deVassal, has developed a proprietary stock ranking model by industry group. Rankings range from 1 (most attractive) to 100 (least attractive). Stocks that rank 30 or less are potential candidates for inclusion in the portfolio, if they meet a minimum prospective growth score. A prospective growth score on each company that quantitatively ranks is developed by our fundamental analysts and is our assessment of a company's ability to outgrow its industry over the next 3-5 years. Our team of four fundamental analysts is as follows: John Kichula, CFA, Cindy Axelrod, CFA, Brad Hoopman and Robert Niemeyer. Each analyst is an industry specialist and, together, have an average of 15 years experience.

Glenmede believes that a portfolio of large cap stocks, constructed with a disciplined blend of proprietary, multifactor models and fundamental analysis, will achieve superior long-term performance1. The portfolio is managed based on the following investment process:

PETER J. ZULEBA, III AND

GORDON B. FOWLER, JR.

3

THE GLENMEDE FUND, INC.

• Multifactor Models. The first stage in the investment process is the creation of multi-factor models to rank the relative attractiveness of stocks within the large cap universe. The team performs historical backtests for each market sector to find which combination of factors and weightings the team believes produces equity portfolios with relatively consistent outperformance versus the average stock.

• Prospective Growth Scores. The second stage of the investment process is the development of forward looking assessments of a company's business model and revenue, earnings and cash-flow growth rates by our fundamental research analysts.

• Opportunity Lists. For the portfolio, the multifactor models and downside risk screens are applied to a large cap universe of Russell 1000 stocks, other domestic large cap stocks and ADRs to determine an opportunity list of stocks for buying consideration.

• Portfolio Optimization – Based on the multifactor models, prospective growth score ranks and the opportunity lists, the goal is to optimize the Portfolio to provide relatively broad diversification across sectors, industries, and individual companies, while controlling turnover and limiting tax consequences.

We believe the proprietary multifactor models combined with our internal fundamental analysis and disciplined investment processes will provide a successful portfolio for the long-term. The goal of the portfolio is to create relatively strong return performance with relatively broad diversification and relatively limited risk.

1 Please refer to Portfolio Highlights on page 9 for detailed performance figures.

4

THE GLENMEDE FUND, INC.

Inside the

U.S. EMERGING GROWTH PORTFOLIO

In February 2005, Glenmede's Small Capitalization Growth Portfolio was renamed the U.S. Emerging Growth Portfolio with portfolio management responsibilities assigned to Val de Vassal, CFA. Val and his quantitative research team are also responsible for the Large Cap 100 and Large Cap Growth Portfolios. Val joined Glenmede in 1998 as Director of Quantitative Research. Val has over 20 years of asset management experience and has been managing equity portfolios for Glenmede since March 2002. Val is supported in portfolio management by Paul Sullivan, CFA, who has been with Glenmede for over 10 years. In addition, the team gets active support from six fundamental analysts, three experienced equity traders, as well as senior high net worth and institutional portfolio managers.

Glenmede believes that portfolios of stocks, constructed with a disciplined blend of proprietary, multifactor models and downside risk screens, will achieve superior long-term performance1. The benchmark for the U.S. Emerging Growth Portfolio is the Russell 2000 Growth Index. The portfolio attempts to hold the stocks in this universe that Glenmede believes are most attractive using the following investment process:

• Multifactor Models. The first stage in the investment process is the creation of multi-factor models to rank the relative attractiveness of stocks within the Russell 2000 universe. The team performs historical backtests for each market sector to find which combination of factors and weightings the team believes produces equity portfolios with relatively consistent outperformance versus the average stock. Based on these multi-factor models, stock ranking screens are run on a monthly basis to identify attractive and unattractive stocks.

• Downside Risk Screens. To help reduce downside risk, the quantitative team uses several screens to identify stocks that the team believes may have a greater risk for a price decline. These screens include multi-factor sell models, proprietary earnings surprise signals and liquidity.

• Opportunity Lists. For the U.S. Emerging Growth Portfolio, the multifactor models and downside risk screens are applied to the universe of stocks in the Russell 2000 Growth universe to determine an opportunity list of stocks for buying consideration.

• Portfolio Optimization. Based on the multifactor stock ranking models, proprietary leading industry group indicators and the opportunity list, the team attempts to optimize the Portfolio to provide relatively broad diversification across sectors and individual companies, while controlling turnover and limiting tax consequences.

We believe the proprietary multifactor and leading industry group models, along with the disciplined investment process will provide a successful portfolio for the long-term. The goal of this small cap growth portfolio is to create relatively strong return performance with relatively broad diversification and relatively limited risk.

1 Please refer to Portfolio Highlights on page 14 for detailed performance figures.

VLADIMIR ("VAL") DE VASSAL

5

THE GLENMEDE FUND, INC.

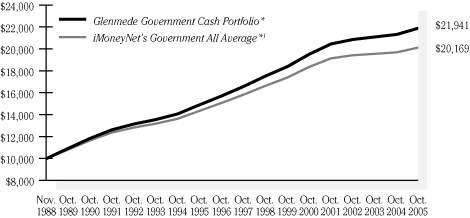

Government Cash Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2005

Average Annual Total Return

| Government Cash Portfolio | | | | iMoneyNet's

Government

All AverageTM1 | |

| Year ended 10/31/05 | | | 2.74 | % | | | 2.28 | % | |

| Five Years ended 10/31/05 | | | 2.34 | % | | | 1.88 | % | |

| Ten Years ended 10/31/05 | | | 3.93 | % | | | 3.46 | % | |

| Inception (11/7/88) through 10/31/05 | | | 4.74 | % | | | 4.23 | % | |

| Government Cash Portfolio | | 7-Day2

Current Yield | | 7-Day2

Effective Yield | |

| As of 10/31/05 | | | 3.66 | % | | | 3.73 | % | |

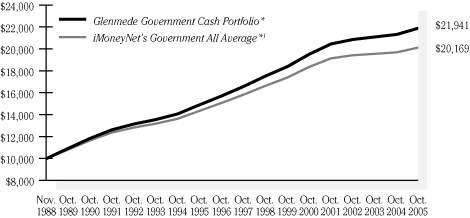

During the past fiscal year, the Government Cash Portfolio outperformed the iMoneyNet's Government All AverageTM1 due to its use of overnight and term mortgage-backed securities repurchase agreements. This strategy plus the low expense ratio enhanced the yield while maintaining a high quality diversified portfolio of money market instruments.

Hypothetical Illustration of $10,000 Invested in

Government Cash Portfolio vs.

iMoneyNet's Government All Average(TM)1

11/7/88 through 10/31/05

* Assumes the reinvestment of all dividends.

Performance data quoted represents past performance; past performance does not guarantee future results. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Although the Portfolio seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Portfolio. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

1 iMoneyNet's Government All AverageTM is comprised of money market funds investing in U.S. treasury securities and government agency obligations. It is not possible to invest directly in an index.

Benchmark return is for the period beginning November 30, 1988.

2 "Current Yield" also referred to as the "SEC Yield," refers to the income generated by an investment in the Fund over a 7-day period. This income is then "annualized." The "effective yield" is calculated similarly but, when annualized, the income earned by an investment in the Fund is assumed to be reinvested. The "effective yield" will be slightly higher than the "current yield" because of the compounding effect of this assumed reinvestment. The yield quotation more closely reflects the current earnings of the Fund than the total return quotation.

6

THE GLENMEDE FUND, INC.

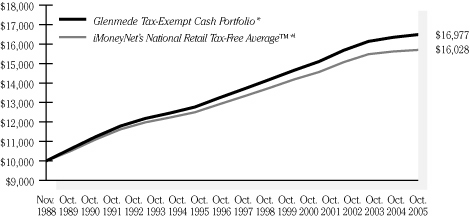

Tax-Exempt Cash Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2005

Average Annual Total Return

| Tax-Exempt Cash Portfolio | | | | iMoneyNet's

National Retail

Tax-Free AverageTM1 | |

| Year ended 10/31/05 | | | 1.94 | % | | | 1.52 | % | |

| Five Years ended 10/31/05 | | | 1.58 | % | | | 1.20 | % | |

| Ten Years ended 10/31/05 | | | 2.50 | % | | | 2.09 | % | |

| Inception (11/10/88) through 10/31/05 | | | 3.17 | % | | | 2.75 | % | |

| Tax-Exempt Cash Portfolio | | 7-Day

Current Yield2 | | 7-Day

Effective Yield2 | |

| As of 10/31/05 | | | 2.42 | % | | | 2.45 | % | |

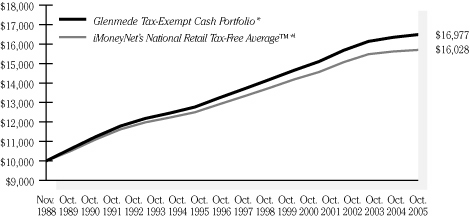

The Tax-Exempt Cash Portfolio has outperformed iMoneyNet's National Retail Tax-Free AverageTM1 in all of the periods shown above. During the past fiscal year, the strategy of maintaining a shorter average maturity, which increases yield when rates rise or when there is a greater supply of short-term securities, combined with a low expense ratio has resulted in good relative performance.

Hypothetical Illustration of $10,000 Invested in

Tax-Exempt Cash Portfolio vs.

iMoneyNet's National Retail Tax-Free Average(TM)1

11/10/88 through 10/31/05

* Assumes the reinvestment of all dividends and distributions.

Performance data quoted represents past performance; past performance does not guarantee future results. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Although the Portfolio seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Portfolio.

1 iMoneyNet's National Retail Tax-Free AverageTM is comprised of money market funds investing in fixed-income securities issued by state and local governments. Generally, interest payments on securities qualify for exemption from Federal income taxes. Funds may also own municipal securities subject to the alternative minimum tax. It is not possible to invest directly in an index.

Benchmark return is for the period beginning November 30, 1988.

2 "Current Yield" also referred to as the "SEC Yield," refers to the income generated by an investment in the Fund over a 7-day period. This income is then "annualized." The "effective yield" is calculated similarly but, when annualized, the income earned by an investment in the Fund is assumed to be reinvested. The "effective yield" will be slightly higher than the "current yield" because of the compounding effect of this assumed reinvestment. The yield quotation more closely reflects the current earnings of the Fund than the total return quotation.

7

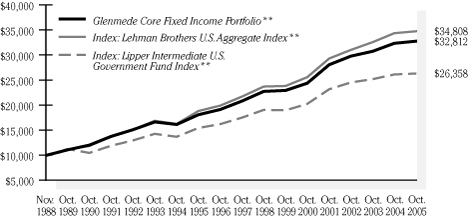

THE GLENMEDE FUND, INC.

Core Fixed Income Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2005

Average Annual Total Return

| Core Fixed Income Portfolio | | | | Lehman Brothers

U.S. Aggregate

Index1 | | Lipper

Intermediate

U.S. Government

Fund Index*1 | |

| Year ended 10/31/05 | | | 1.32 | % | | | 1.13 | % | | | 0.69 | % | |

| Five Years ended 10/31/05 | | | 6.08 | % | | | 6.31 | % | | | 5.35 | % | |

| Ten Years ended 10/31/05 | | | 6.11 | % | | | 6.32 | % | | | 5.46 | % | |

| Inception (11/17/88) through 10/31/05 | | | 7.26 | % | | | 7.64 | % | | | 5.88 | % | |

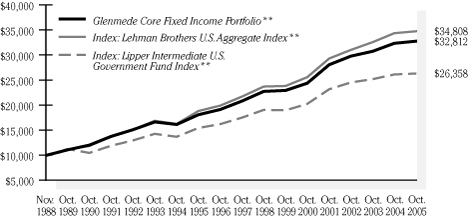

The Core Fixed Income Portfolio outperformed its benchmarks returning 1.32% for the year ended October 31, 2005. The Portfolio outperformed both the Lehman Brothers U.S. Aggregate Index and the Lipper Intermediate U.S. Government Fund Index. The Portfolio's outperformance versus the Lehman Brothers U.S. Aggregate Index can be attributed to accurately selected yield curve exposure and sector rotation strategies. The Portfolio also outperformed its peer group by monitoring and matching its equivalent benchmark duration target and interest rate exposure.

Diversification, liquidity, and low risk themes dominate the Portfolio's investment discipline. The Portfolio seeks to add value monitoring yield curve exposure while utilizing sector and security selection. The Portfolio seeks to maintain market neutral interest rate risk.

Hypothetical Illustration of $10,000 Invested in

Core Fixed Income Portfolio vs.

Lehman Brothers U.S. Aggregate Index and

Lipper Intermediate U.S. Government Fund Index*

11/17/88 through 10/31/05

* Index commenced 12/31/89. The Index starts at $11,284, which is the value of the Portfolio in the graph on this date.

** Assumes the reinvestment of all dividends and distributions.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

1 The Lehman Brothers U.S. Aggregate Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. These major sectors are subdivided into more specific indices that are calculated and reported on a regular basis. The Lipper Intermediate U.S. Government Fund Index is comprised of the 30 largest funds in the Lipper Intermediate U.S. Government Fund classification. This classification consists of funds that invest at least 65% of their assets in securities issued or guaranteed by the U.S. government, its agencies or instrumentalities with dollar-weighted average matur ities of 5 to 10 years. Total return consists of price appreciation/depreciation and income as a percentage of the original investment. Indexes are rebalanced by market capitalization each month. It is not possible to invest directly in an index.

Benchmark returns are for the periods beginning November 30, 1988 for Lehman Brothers U.S. Aggregate Index and December 31, 1989 for Lipper Intermediate U.S. Government Fund Index.

8

THE GLENMEDE FUND, INC.

Strategic Equity Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2005

Average Annual Total Return

| Strategic Equity Portfolio | | | | After-tax

Pre

Redemption | | After-tax

Post

Redemption | | Dow Jones Ind.

Monthly

Reinvested1 | | S&P 500

Stock

Index1 | | Lipper Large Cap

Core Fund

Index1 | |

| Year ended 10/31/05 | | | 9.98 | % | | | 9.50 | % | | | 7.11 | % | | | 6.44 | % | | | 8.71 | % | | | 8.67 | % | |

Five Years ended

10/31/05 | | | (2.83 | )% | | | (3.20 | )% | | | (2.53 | )% | | | 1.09 | % | | | (1.73 | )% | | | (2.75 | )% | |

Ten Years ended

10/31/05 | | | 8.13 | % | | | 6.51 | % | | | 6.47 | % | | | 10.31 | % | | | 9.33 | % | | | 8.00 | % | |

Inception (07/20/89)

through 10/31/05 | | | 9.21 | % | | | 7.62 | % | | | 7.44 | % | | | 11.60 | % | | | 10.50 | % | | | 9.19 | % | |

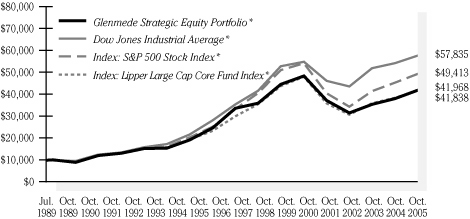

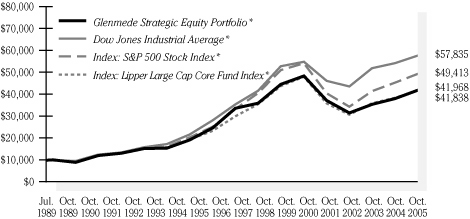

The Portfolio invests in companies that we believe are high quality with good growth prospects and attractively valued. In order to identify stocks that meet these criteria, the Portfolio combines our proprietary quantitative model with the insight of our fundamental research analysts. For the fiscal year ended October 31, 2005, the Portfolio outperformed the S&P 500 Stock Index and Lipper Large Cap Core index by 1.27% and 1.31%, respectively. The Portfolio's focus on valuation, catalyst identification and potential for positive earnings revision drove stock selection and the bulk of the Portfolio's excess.

Hypothetical Illustration of $10,000 Invested in

Strategic Equity Portfolio vs. S&P 500 Stock Index,

Dow Jones Industrial Average and Lipper Large Cap Core Fund Index

7/20/89 through 10/31/05

* Assumes the reinvestment of all dividends and distributions.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns, other than after-tax returns, do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares. After-tax returns are calculated using the historical highest individual federal marginal income tax rates, do not reflect the impact of state and local taxes and are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or IRAs. Actual after-tax returns depend on the investor's tax situation and may differ from those shown.

1 The S&P 500 Stock Index is a market capitalization weighted index comprised of 500 widely held common stocks. The Dow Jones Industrial Average is a price-weighted average of 30 blue-chip stocks. The average is computed by adding the prices of the 30 stocks and dividing by a denominator, which has been adjusted over the years for stock splits, stock dividends, and substitutions of stock. The Lipper Large Cap Core Fund Index is comprised of the 30 largest mutual funds in the Lipper Large Cap Core Funds classification. This classification consists of funds that invest at least 75% of their equity assets in companies with market capitalizations greater than 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the S&P SuperComposite 150 0 Index. It is not possible to invest directly in an index.

Benchmark returns are for the period beginning July 31, 1989.

9

THE GLENMEDE FUND, INC.

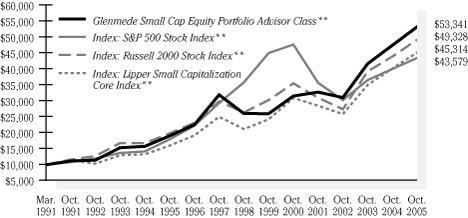

Small Cap Equity Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2005

Average Annual Total Return

Small Cap Equity Portfolio -

Advisor Class | | | | Russell 2000

Stock Index1 | | S&P 500

Stock Index1 | | Lipper Small

Capitalization

Core Index*1 | |

| Year ended 10/31/05 | | | 12.22 | % | | | 12.08 | % | | | 8.71 | % | | | 12.43 | % | |

| Five Years ended 10/31/05 | | | 11.02 | % | | | 6.75 | % | | | (1.73 | )% | | | 7.89 | % | |

| Ten Years ended 10/31/05 | | | 10.82 | % | | | 9.53 | % | | | 9.33 | % | | | 10.97 | % | |

| Inception (03/01/91) through 10/31/05 | | | 12.09 | % | | | 11.49 | % | | | 10.56 | % | | | N/A | | |

Small Cap Equity Portfolio -

Institutional Class2 | | | | | | | | | |

| Year ended 10/31/05 | | | 12.43 | % | | | 12.08 | % | | | 8.71 | % | | | 12.43 | % | |

| Five Years ended 10/31/05 | | | 11.26 | % | | | 6.75 | % | | | (1.73 | )% | | | 7.89 | % | |

| Inception (01/02/98) through 10/31/05 | | | 12.21 | % | | | 11.49 | % | | | 10.56 | % | | | N/A | | |

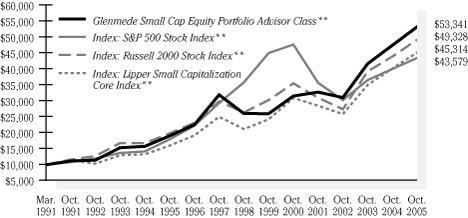

The Small Cap Equity Portfolio performed well over the past twelve months slightly outperforming the Russell 2000. The Portfolio was primarily led by strong stock selection and a strategic overweight in the energy sector. More specifically, stock selection within the technology sector offered the largest contribution to our relative outperformance with the real estate and consumer sectors following closely behind.

Hypothetical Illustration of $10,000 Invested in

Small Cap Equity Portfolio Advisor Class vs. S&P 500 Stock Index,

Russell 2000 Stock Index and Lipper Small Capitalization Core Index*

3/1/91 through 10/31/05

* Index commenced 12/31/91. The Index starts at $11,371, which is the value of the Portfolio in the graph on this date. Thus Portfolio inception comparisons are not provided.

** Assumes the reinvestment of all dividends and distributions.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares. Performance of the Institutional Class will vary from the Advisor Class due to differences in fees.

1 The S&P 500 Stock Index is a market capitalization weighted index comprised of 500 widely held common stocks. The Russell 2000 Stock Index is an unmanaged market capitalization weighted total return index which measures the performance of the 2,000 smallest companies in the Russell 3000 Index. The Lipper Small Capitalization Core Index is comprised of the 30 largest funds in the Lipper Small Capitalization Core funds classification. This classification consists of funds that invest at least 75% of their equity assets in companies with market capitalizations less than 250% of the dollar weighted median of the smallest 500 of the middle 1,000 securities of the S&P SuperComposite 1500 Index. It is not possible to invest directly in an index.

2 Average annual total return for the Institutional Class includes the period from 03/01/91 through 10/31/03. Prior to the inception of the Institutional Class on 01/02/98, performance for the Institutional Class is based on the average annual total return of the Advisor Class.

Benchmark returns for the Russell 2000 Stock Index and the S&P 500 Stock Index are for the period beginning February 28, 1991.

10

THE GLENMEDE FUND, INC.

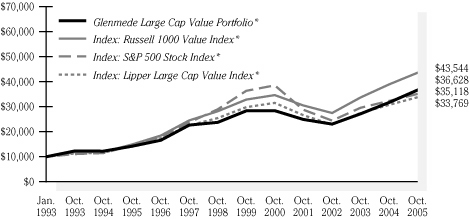

Large Cap Value Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2005

Average Annual Total Return

| Large Cap Value Portfolio | | | | Russell 1000

Value Index1 | | S&P 500

Stock Index1 | | Lipper

Large Cap

Value Index1 | |

| Year ended 10/31/05 | | | 15.66 | % | | | 11.86 | % | | | 8.71 | % | | | 9.96 | % | |

| Five Years ended 10/31/05 | | | 5.20 | % | | | 4.71 | % | | | (1.73 | )% | | | 1.37 | % | |

| Ten Years ended 10/31/05 | | | 9.98 | % | | | 11.34 | % | | | 9.33 | % | | | 9.00 | % | |

| Inception (01/04/93) through 10/31/05 | | | 10.65 | % | | | 12.16 | % | | | 10.29 | % | | | 9.96 | % | |

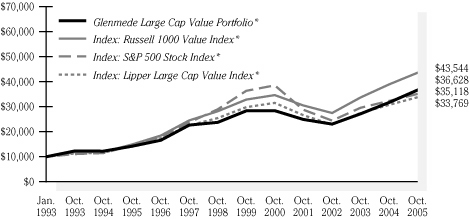

The Large Cap Value Portfolio turned in another very good year of performance, outpacing the Russell 1000 Value Index and the S&P 500 Index by a wide margin. The value style has now turned in three straight years of double digit returns despite the fact that p/e ratios have declined.

The Portfolio took advantage of the continued strength in the energy and utility sectors where we were overweight until later in the year. Relative to the Russell index, the energy (integrated oils, refineries and exploration companies) and health care (service providers) overweights contributed over 0.75% of outperformance, but stock selection was responsible for most of the gains. The Portfolio owned strong companies in the sectors mentioned above, yet our best relative gains came from top-picks in our two largest underweighted sectors, financials and consumer discretionary.

Hypothetical Illustration of $10,000 Invested in

Large Cap Value Portfolio vs. S&P 500 Stock Index,

Russell 1000 Value Index and Lipper Large Cap Value Index

1/4/93 through 10/31/05

* Assumes the reinvestment of all dividends and distributions.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

1 The S&P 500 Stock Index is a market capitalization weighted index comprised of 500 widely held common stocks. The Russell 1000 Value Index is an unmanaged capitalization weighted total return index which is comprised of those securities in the Russell 1000 Index with a less than average growth orientation. The Lipper Large Cap Value Index is comprised of the 30 largest mutual funds within the Lipper Large Cap Value funds classification. This classification consists of funds that normally invest between 25% to 75% of their assets in companies with market capitalizations above 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the S&P Super Composite 1500 Index. It is not possible to invest directly in an index.

Benchmark returns are for the period beginning December 31, 1992.

11

THE GLENMEDE FUND, INC.

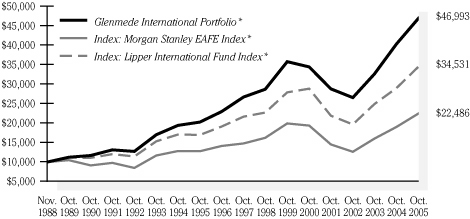

International Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2005

Average Annual Total Return

| International Portfolio | | | | Morgan Stanley

EAFE

Index1 | | Lipper

International

Fund Index1 | |

| Year ended 10/31/05 | | | 16.34 | % | | | 18.09 | % | | | 18.91 | % | |

| Five Years ended 10/31/05 | | | 6.39 | % | | | 3.04 | % | | | 3.62 | % | |

| Ten Years ended 10/31/05 | | | 8.78 | % | | | 5.81 | % | | | 7.35 | % | |

| Inception (11/17/88) through 10/31/05 | | | 9.56 | % | | | 4.90 | % | | | 7.66 | % | |

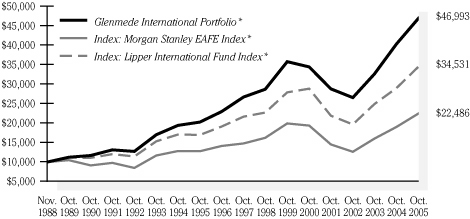

The International Portfolio underperformed the Morgan Stanley EAFE index over the past twelve months. Security selection, on a country and sector basis, was the primary driver of the shortfall. In particular, the Portfolio's holdings in Australia, Japan, Switzerland, and the UK underperformed their respective country indices. On a sector basis, the Portfolio's overweight in the Materials sector, which posted solid returns over the year, was not enough to overcome poor stock selection in Consumer Discretionary and Staples. Over longer periods, favorable security selection has been a primary driver for the enhanced comparative results versus the Index.

Hypothetical Illustration of $10,000 Invested in

International Portfolio vs. Morgan Stanley EAFE Index

and Lipper International Fund Index

11/17/88 through 10/31/05

* Assumes the reinvestment of all dividends and distributions excluding withholding taxes.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

1 The Morgan Stanley EAFE Index is an unmanaged capitalization weighted composite portfolio consisting of equity total returns of countries in Australia, New Zealand, Europe and the Far East. The Lipper International Fund Index is comprised of the 30 largest funds in the Lipper International Fund classification. This classification consists of funds that invest in securities whose primary trading markets are outside the United States. It is not possible to invest directly in an index.

Benchmark returns are for the period beginning November 30, 1988.

12

THE GLENMEDE FUND, INC.

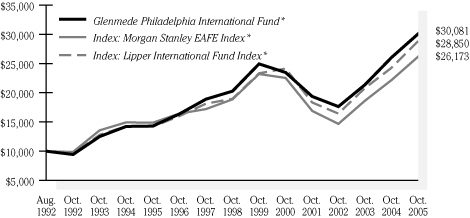

Philadelphia International Fund

PORTFOLIO HIGHLIGHTS

October 31, 2005

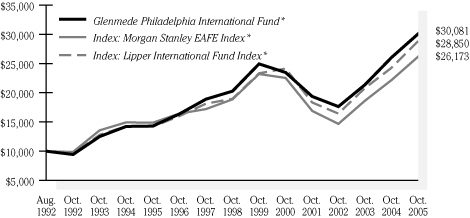

Average Annual Total Return

| Philadelphia International Fund | | | | Morgan Stanley

EAFE

Index1 | | Lipper

International

Fund Index1 | |

| Year ended 10/31/05 | | | 15.50 | % | | | 18.09 | % | | | 18.91 | % | |

| Five Years ended 10/31/05 | | | 5.09 | % | | | 3.04 | % | | | 3.62 | % | |

| Ten Years ended 10/31/05 | | | 7.72 | % | | | 5.81 | % | | | 7.35 | % | |

| Inception (08/01/92) through 10/31/05 | | | 8.67 | % | | | 7.53 | % | | | 8.33 | % | |

During the past fiscal year, international equity markets posted solid absolute returns. The Philadelphia International Fund participated in the rally but fell short of the Morgan Stanley EAFE index return. This shortfall is primarily attributed to poor stock selection in the Consumer Discretionary and Staples sectors and also within the Japanese, Swiss, UK, and Australian markets. The Portfolio's overweight in the Materials sector, which posted solid returns over the year, was not enough to overcome the stock selection shortfall. Favorable security selection has been a primary driver for the enhanced comparative results of the longer time periods.

Hypothetical Illustration of $10,000 Invested in

Philadelphia International Fund vs. Morgan Stanley EAFE Index and

Lipper International Fund Index

8/1/92 through 10/31/05

* Assumes the reinvestment of all dividends and distributions excluding withholding taxes.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

1 The Morgan Stanley EAFE Index is an unmanaged capitalization weighted composite portfolio consisting of equity total returns of countries in Australia, New Zealand, Europe and the Far East. The Lipper International Fund Index is comprised of the 30 largest funds in the Lipper International Fund classification. This classification consists of funds that invest in securities whose primary trading markets are outside the United States. It is not possible to invest directly in an index.

Benchmark returns are for the period beginning July 31, 1992.

13

THE GLENMEDE FUND, INC.

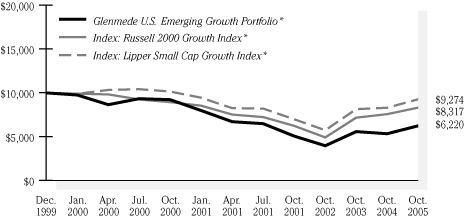

U.S. Emerging Growth Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2005

Average Annual Total Return

| U.S. Emerging Growth Portfolio | | | | After-tax

Pre

Redemption | | After-tax

Post

Redemption | | Russell 2000

Growth Index1 | | Lipper Small Cap

Growth Index1 | |

Year ended

10/31/05 | | | 16.92 | % | | | 16.92 | % | | | 11.00 | % | | | 10.91 | % | | | 11.79 | % | |

Five Years ended

10/31/05 | | | (7.57 | )% | | | (7.57 | )% | | | (6.27 | )% | | | (1.62 | )% | | | (1.08 | )% | |

Inception (12/29/99)

through 10/31/05 | | | (7.80 | )% | | | (7.80 | )% | | | (6.24 | )% | | | (2.98 | )% | | | (0.71 | )% | |

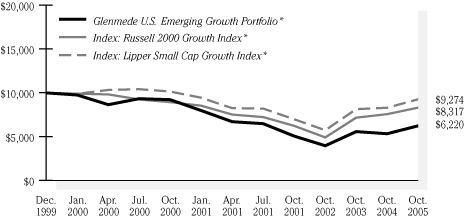

As of February 27, 2005, the management of the US Emerging Growth (formerly Small Capitalization Growth) Portfolio was changed from two outside managers to an in-house team headed by Val de Vassal. The Portfolio invests in small cap growth companies based on proprietary multi-factor models that include valuation, fundamental, earnings, and technical characteristics. Since its inception on December 29, 1999, the Portfolio has underperformed the Russell 2000 Growth Index and the Lipper Small Cap Growth Index by -4.82% and -7.09%, respectively. However, for the fiscal year ended October 31, 2005, the Portfolio has outperformed the Russell 2000 Growth benchmark and Lipper Small Cap Growth indexes by 6.01% and 5.13%, respectively. The strong recent performance of the Portfolio has come from its quantitative discipline with a bias towards small cap growth companies with cheaper valuations and improving earnings.

Hypothetical Illustration of $10,000 Invested in

U.S. Emerging Growth Portfolio vs. Russell 2000 Growth Index

and Lipper Small Cap Growth Index

12/29/99 through 10/31/05

* Assumes the reinvestment of all dividends and distributions.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns, other than after-tax returns, do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares. After-tax returns are calculated using the historical highest individual federal marginal income tax rates, do not reflect the impact of state and local taxes and are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or IRAs. Actual after-tax returns depend on the investor's tax situation and may differ from those shown.

1 The Russell 2000 Growth Index is an unmanaged capitalization weighted total return index which is comprised of securities in the Russell 2000 Index with greater than average growth orientation. The Lipper Small Cap Growth Index is comprised of the 30 largest funds in the Lipper Small Cap Growth funds classification. This classification consists of funds that invest at least 75% of their equity assets in companies with market capitalizations less than 250% of the dollar weighted median of the smallest 500 of the middle 1,000 securities of the S&P SuperComposite 1500 Index. It is not possible to invest directly in an index.

Benchmark returns are for the period beginning December 31, 1999.

14

THE GLENMEDE FUND, INC.

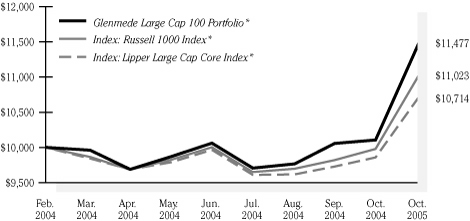

Large Cap 100 Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2005

Average Annual Total Return

| Large Cap 100 Portfolio | | | | After-tax

Pre

Redemption | | After-tax

Post

Redemption | | Russell 1000

Index1 | | Lipper

Large Cap

Core Index1 | |

Year ended

10/31/05 | | | 13.58 | % | | | 13.31 | % | | | 9.17 | % | | | 10.47 | % | | | 8.67 | % | |

Inception (2/27/04)

through 10/31/05 | | | 8.55 | % | | | 8.39 | % | | | 7.29 | % | | | 6.00 | % | | | 4.21 | % | |

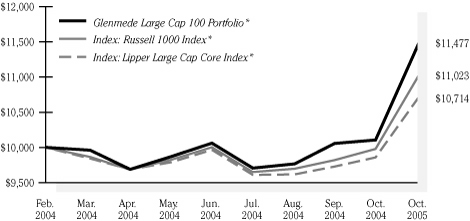

The Large Cap 100 Portfolio invests in large cap companies based on proprietary multi-factor models that include valuation, fundamental, earnings, and technical characteristics. Since its inception on February 27, 2004, the portfolio has outperformed the Russell 1000 Index and Lipper Large Cap Core index by +2.55% and +4.34%, respectively. For the fiscal year ended October 31, 2005, the Portfolio outperformed the Russell 1000 benchmark index by 3.11%. The strong performance of the Portfolio came from its bias towards various factors, including companies with cheaper valuations, greater profitablity and positvie technicals. In addition, the Portfolio benefited from its relatively higher weighting in mid-cap companies.

Hypothetical Illustration of $10,000 Invested in

Large Cap 100 Portfolio vs. Russell 1000 Index and

Lipper Large Cap Core Index

2/27/04 through 10/31/05

* Assumes the reinvestment of all dividends and distributions.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns, other than after-tax returns, do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares. After-tax returns are calculated using the historical highest individual federal marginal income tax rates, do not reflect the impact of state and local taxes and are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or IRAs. Actual after-tax returns depend on the investor's tax situation and may differ from those shown.

1 The Russell 1000 Index is an unmanaged market capitalization weighted total return index which is comprised of the 1,000 largest companies in the Russell 3000 Index. The Lipper Large Cap Core Index is comprised of the 30 largest mutual funds in the Lipper Large Cap Core Funds classification. This classification consists of funds that invest at least 75% of their equity assets in companies with market capitalizations greater than 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the S&P SuperComposite 1500 Index. It is not possible to invest directly in an index.

Benchmark returns are for the period beginning February 28, 2004.

15

THE GLENMEDE FUND, INC.

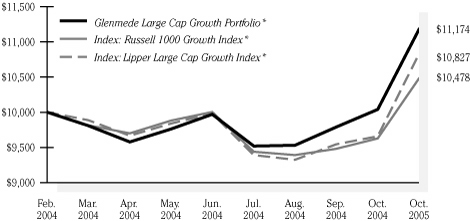

Large Cap Growth Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2005

Average Annual Total Return

| Large Cap Growth Portfolio | | | | After-tax

Pre

Redemption | | After-tax

Post

Redemption | | Russell 1000

Growth Index1 | | Lipper Large

Cap Growth

Index1 | |

| Year ended 10/31/05 | | | 11.29 | % | | | 11.28 | % | | | 7.34 | % | | | 8.81 | % | | | 12.09 | % | |

Inception (2/27/04)

through 10/31/05 | | | 6.83 | % | | | 6.82 | % | | | 5.82 | % | | | 2.83 | % | | | 4.87 | % | |

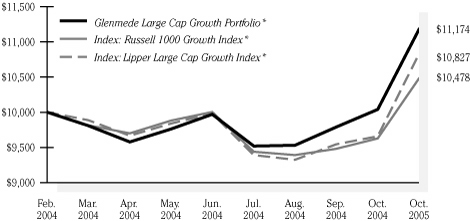

The Large Cap Growth Portfolio invests in large cap growth companies based on proprietary multi-factor models that include valuation, fundamental, earnings, and technical characteristics. Since its inception on February 27, 2004, the Portfolio has outperformed the Russell 1000 Growth Index and the Lipper Large Cap Growth Index by +4.00% and +1.96%, respectively. For the fiscal year ended October 31, 2005, the Portfolio outperformed the Russell 1000 Growth benchmark index by 2.48%. The strong performance of the Portfolio came from its bias towards large cap growth companies with cheaper valuations and improving earnings. In addition, the Portfolio benefited from its relatively higher weighting in mid-cap companies.

Hypothetical Illustration of $10,000 Invested in

Large Cap Growth Portfolio vs. Russell 1000 Growth Index

and Lipper Large Cap Growth Index

2/27/04 through 10/31/05

* Assumes the reinvestment of all dividends and distributions.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns, other than after-tax returns, do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares. After-tax returns are calculated using the historical highest individual federal marginal income tax rates, do not reflect the impact of state and local taxes and are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or IRAs. Actual after-tax returns depend on the investor's tax situation and may differ from those shown.

1 The Russell 1000 Growth Index is an unmanaged capitalization weighted total return index which is comprised of securities in the Russell 1000 Index with greater than average growth orientation. The Lipper Large Cap Growth Index is the average of the 30 largest funds in the Lipper Large-Cap Growth Funds Category. These funds invest at least 75% of equity assets in companies with market capitalizations (on three-year weighted basis) greater than 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the S&P SuperComposite 1500 Index. These funds typically have an above average price-to-earnings ration, price-to-book ratio, and three-year sales-per-share.

Benchmark returns are for the period beginning February 28, 2004.

16

THE GLENMEDE PORTFOLIOS

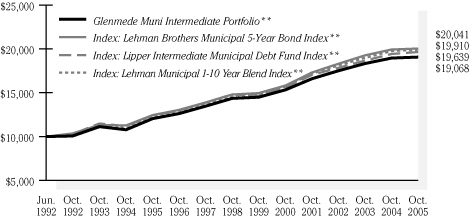

Muni Intermediate Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2005

Average Annual Total Return

| Muni Intermediate Portfolio | | | | Lehman Brothers

Municipal 5-Year

Bond Index1 | | Lipper Intermediate

Municipal

Debt Fund Index1 | | Lehman

Municipal 1-10

Year Blend Index*1 | |

| Year ended 10/31/05 | | | 0.55 | % | | | 0.54 | % | | | 1.08 | % | | | 0.78 | % | |

| Five Years ended 10/31/05 | | | 4.47 | % | | | 4.87 | % | | | 4.74 | % | | | 4.85 | % | |

| Ten Years ended 10/31/05 | | | 4.69 | % | | | 4.85 | % | | | 4.69 | % | | | 4.98 | % | |

Inception (06/05/92)

through 10/31/05 | | | 4.93 | % | | | 5.32 | % | | | 5.16 | % | | | N/A | | |

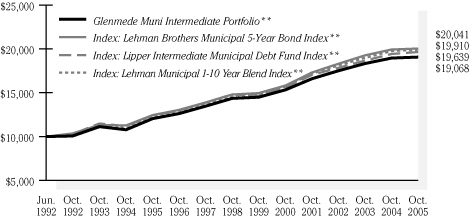

Muni Intermediate performed in line with the Lehman 5 Year index in 2005. However, the Portfolio underperformed versus the Lehman 1-10 and the Lipper Intermediate Index due to the defensive nature of the fund and the shorter duration. The Portfolio is defensively positioned to provide high current interest and protection to the value of the bonds in the Portfolio if rates begin to rise.

Hypothetical Illustration of $10,000 Invested in

Muni Intermediate Portfolio vs. Lehman Brothers

Municipal 5-Year Bond Index, Lipper Intermediate

Municipal Debt Fund Index and Lehman Municipal 1-10 Year Blend Index

6/5/92 through 10/31/05

* Index commenced 6/30/93. The Index starts at $10,811, which is the value of the Portfolio in the graph on this date. Thus comparison to the Portfolio's inception is not provided.

** Assumes the reinvestment of all dividends and distributions.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns.

1 The Lehman Brothers Municipal 5-Year Bond Index is an unmanaged total return performance benchmark for the short-intermediate, investment-grade tax-exempt bond market. The Lipper Intermediate Municipal Debt Fund Index is comprised of the 30 largest funds in the Lipper Intermediate Municipal Debt Fund Average. The Average consists of funds that invest in municipal debt issues with dollar-weighted average maturities of 5 to 10 years. The Lehman Municipal 1-10 Year Blend Index is a composite index made up of several different broad sub-indices: the Lehman Municipal 1-Year Index; Lehman Municipal 3-Year Index; Lehman Municipal 5-Year Index; Lehman Municipal 7-Year Index and the Lehman Municipal 10-Year Index. The total of all these indices represents all maturities between 1-10 Years. It is not possible to invest directly in an index.

Benchmark returns for the Lehman Brothers Municipal 5-Year Bond Index and the Lipper

Intermediate Municipal Debt Fund Index are for the period beginning May 31, 1992.

17

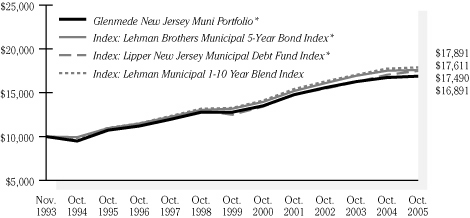

THE GLENMEDE PORTFOLIOS

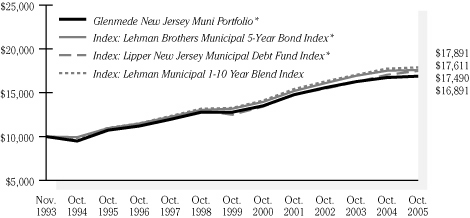

New Jersey Muni Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2005

Average Annual Total Return

| New Jersey Muni Portfolio | | | | Lehman Brothers

Municipal 5-Year

Bond Index1 | | Lipper

New Jersey

Municipal Debt

Fund Index1 | | Lehman

Municipal 1-10

Year Blend Index1 | |

| Year ended 10/31/05 | | | 0.94 | % | | | 0.54 | % | | | 2.62 | % | | | 0.78 | % | |

| Five Years ended 10/31/05 | | | 4.55 | % | | | 4.87 | % | | | 5.41 | % | | | 4.85 | % | |

| Ten Years Ended 10/31/05 | | | 4.63 | % | | | 4.85 | % | | | 5.02 | % | | | 4.98 | % | |

Inception (11/01/93)

through 10/31/05 | | | 4.47 | % | | | 4.83 | % | | | 4.79 | % | | | 5.19 | % | |

New Jersey Muni outperformed versus the Lehman 5 year and the Lehman 1-10 over the last 12 months. As opportunities to sell shorter dated maturities and extend on the yield curve presented themselves, bonds were swapped to take advantage of those opportunities. The overall credit quality of the Portfolio is high and this has helped the outperformance of the Portfolio in volatile markets.

Hypothetical Illustration of $10,000 Invested in

New Jersey Muni Portfolio vs. Lehman Brothers

Municipal 5-Year Bond Index, Lipper New Jersey

Municipal Debt Fund Index and Lehman Municipal 1-10 Year Blend Index

11/1/93 through 10/31/05

* Assumes the reinvestment of all dividends and distributions.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns.

1 The Lehman Brothers Municipal 5-Year Bond Index is an unmanaged total return performance benchmark for the short-intermediate, investment-grade tax-exempt bond market. The Lipper New Jersey Municipal Debt Fund Index is comprised of the 10 largest funds in the Lipper New Jersey Municipal Debt Fund Average. The Average consists of funds that invest only in securities that are exempt from taxation in New Jersey or cities in New Jersey. The Lehman Municipal 1-10 Year Blend Index is a composite index made up of several different broad sub-indices: the Lehman Municipal 1-Year Index; Lehman Municipal 3-Year Index; Lehman Municipal 5-Year Index; Lehman Municipal 7-Year Index and the Lehman Municipal 10-Year Index. The total of all these indices represents all maturities between 1-10 Years. It is not possible to invest directly in an index.

Benchmark returns are for the period beginning October 31, 1993.

18

THE GLENMEDE FUND, INC.

Shareholder Expenses (Unaudited)

As a shareholder of a Glenmede Portfolio, you incur ongoing costs, including management fees and other portfolio expenses. The following example is intended to help you understand your ongoing costs (in dollars and cents) of investing in a Glenmede Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from May 1, 2005 to October 31, 2005.

Actual Expenses

The first line under each Portfolio in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for your Portfolio under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line under each Portfolio in the table below provides information about hypothetical account values and hypothetical expenses based on each Portfolio's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. As a shareholder of a Glenmede Portfolio, you do not incur any transaction costs, such as sales charges (loads), redemption fees or exchange fees, but shareholders of other funds may incur such costs. Therefore, the second line under each Portfolio in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds whose shareholders may incur transaction costs.

| | | Beginning

Account

Value

(May 1,

2005) | | Ending

Account

Value

(October 31,

2005) | | Annualized

Expense

Ratio* | | Expenses

Paid During

Period**

(May 1, to

October 31,

2005) | |

| Government Cash Portfolio | |

| Actual | | $ | 1,000.00 | | | $ | 1,016.10 | | | | 0.19 | % | | $ | 0.97 | | |

| Hypothetical (5% return less expenses) | | | 1,000.00 | | | | 1,024.25 | | | | 0.19 | | | | 0.97 | | |

| Tax-Exempt Cash Portfolio | |

| Actual | | | 1,000.00 | | | | 1,011.30 | | | | 0.19 | | | | 0.97 | | |

| Hypothetical (5% return less expenses) | | | 1,000.00 | | | | 1,024.25 | | | | 0.19 | | | | 0.97 | | |

19

THE GLENMEDE FUND, INC.

Shareholder Expenses (Unaudited) — (Continued)

| | | Beginning

Account

Value

(May 1,

2005) | | Ending

Account

Value

(October 31,

2005) | | Annualized

Expense

Ratio* | | Expenses

Paid During

Period**

(May 1, to

October 31,

2005) | |

| Core Fixed Income Portfolio*** | |

| Actual | | $ | 1,000.00 | | | $ | 1,001.30 | | | | 0.38 | % | | $ | 1.92 | | |

| Hypothetical (5% return less expenses) | | | 1,000.00 | | | | 1,023.29 | | | | 0.38 | | | | 1.94 | | |

| Strategic Equity Portfolio*** | |

| Actual | | | 1,000.00 | | | | 1,042.40 | | | | 0.57 | | | | 2.93 | | |

| Hypothetical (5% return less expenses) | | | 1,000.00 | | | | 1,022.33 | | | | 0.57 | | | | 2.91 | | |

| Small Cap Equity Portfolio - Advisor | |

| Actual | | | 1,000.00 | | | | 1,098.50 | | | | 0.92 | | | | 4.87 | | |

| Hypothetical (5% return less expenses) | | | 1,000.00 | | | | 1,020.57 | | | | 0.92 | | | | 4.69 | | |

| Small Cap Equity Portfolio - Institutional | |

| Actual | | | 1,000.00 | | | | 1,099.60 | | | | 0.72 | | | | 3.81 | | |

| Hypothetical (5% return less expenses) | | | 1,000.00 | | | | 1,021.58 | | | | 0.72 | | | | 3.67 | | |

| Large Cap Value Portfolio*** | |

| Actual | | | 1,000.00 | | | | 1,065.50 | | | | 0.62 | | | | 3.23 | | |

| Hypothetical (5% return less expenses) | | | 1,000.00 | | | | 1,022.08 | | | | 0.62 | | | | 3.16 | | |

| International Portfolio*** | |

| Actual | | | 1,000.00 | | | | 1,079.80 | | | | 0.23 | | | | 1.21 | | |

| Hypothetical (5% return less expenses) | | | 1,000.00 | | | | 1,024.05 | | | | 0.23 | | | | 1.17 | | |

| Philadelphia International Fund | |

| Actual | | | 1,000.00 | | | | 1,076.70 | | | | 0.86 | | | | 4.50 | | |

| Hypothetical (5% return less expenses) | | | 1,000.00 | | | | 1,020.87 | | | | 0.86 | | | | 4.38 | | |

| U.S. Emerging Growth Portfolio*** | |

| Actual | | | 1,000.00 | | | | 1,167.00 | | | | 0.95 | | | | 5.19 | | |

| Hypothetical (5% return less expenses) | | | 1,000.00 | | | | 1,020.42 | | | | 0.95 | | | | 4.84 | | |

| Large Cap 100 Portfolio | |

| Actual | | | 1,000.00 | | | | 1,074.80 | | | | 0.87 | | | | 4.55 | | |

| Hypothetical (5% return less expenses) | | | 1,000.00 | | | | 1,020.82 | | | | 0.87 | | | | 4.43 | | |

| Large Cap Growth Portfolio | |

| Actual | | | 1,000.00 | | | | 1,085.80 | | | | 0.93 | | | | 4.89 | | |

| Hypothetical (5% return less expenses) | | | 1,000.00 | | | | 1,020.52 | | | | 0.93 | | | | 4.74 | | |

* Expense ratios for the period may differ from expense ratios based on one-year data in the Financial Highlights.

** Expenses are calculated using each Portfolio's annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (184 days), and divided by the number of days in the calendar year (365 days).

*** Since August 1, 2005, the Core Fixed Income, Strategic Equity and Large Cap Value Portfolios have paid investment advisory fees at the annual rate of 0.35%, 0.55% and 0.55%, respectively. Upon the expiration of the Advisor's voluntary fee waiver on January 1, 2006, the International Portfolio will pay investment advisory fees at the annual rate of 0.75%. In addition, the shareholder servicing fee for the International

20

THE GLENMEDE FUND, INC.

Shareholder Expenses (Unaudited) — (Concluded)

Portfolio increased effective August 1, 2005 from 0.05% to 0.25% of the Portfolio's average daily net assets. Effective August 1, 2005, the investment advisory fee paid by the U.S. Emerging Growth Portfolio increased from 0.25% to 0.55%. Had these fee changes been in effect throughout the period from May 1, 2005 to October 31, 2005, the expense information for these Portfolios would have been as follows:

| | | Beginning

Account

Value

(May 1,

2005) | | Ending

Account

Value

(October 31,

2005) | | Annualized

Expense

Ratio* | | Expenses

Paid During

Period**

(May 1, to

October 31,

2005) | |

| Core Fixed Income Portfolio | |

| Actual | | $ | 1,000.00 | | | $ | 999.50 | | | | 0.56 | % | | $ | 2.82 | | |

| Hypothetical (5% return less expenses) | | | 1,000.00 | | | | 1,022.38 | | | | 0.56 | | | | 2.85 | | |

| Strategic Equity Portfolio | |

| Actual | | | 1,000.00 | | | | 1,039.60 | | | | 0.85 | | | | 4.37 | | |

| Hypothetical (5% return less expenses) | | | 1,000.00 | | | | 1,020.92 | | | | 0.85 | | | | 4.33 | | |

| Large Cap Value Portfolio | |

| Actual | | | 1,000.00 | | | | 1,062.70 | | | | 0.95 | | | | 4.94 | | |

| Hypothetical (5% return less expenses) | | | 1,000.00 | | | | 1,020.42 | | | | 0.95 | | | | 4.84 | | |

| International Portfolio | |

| Actual | | | 1,000.00 | | | | 1,071.80 | | | | 1.09 | | | | 5.69 | | |

| Hypothetical (5% return less expenses) | | | 1,000.00 | | | | 1,019.71 | | | | 1.09 | | | | 5.55 | | |

| U.S. Emerging Growth Portfolio | |

| Actual | | | 1,000.00 | | | | 1,165.50 | | | | 1.10 | | | | 6.00 | | |

| Hypothetical (5% return less expenses) | | | 1,000.00 | | | | 1,019.66 | | | | 1.10 | | | | 5.60 | | |

* Expense ratios for the period may differ from expense ratios based on one-year data in the Financial Highlights.

** Expenses are calculated using each Portfolio's annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (184 days), and divided by the number of days in the calendar year (365 days).

21

THE GLENMEDE PORTFOLIOS

Shareholder Expenses (Unaudited)

As a shareholder of a Glenmede Portfolio, you incur ongoing costs, including management fees and other portfolio expenses. The following example is intended to help you understand your ongoing costs (in dollars and cents) of investing in a Glenmede Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from May 1, 2005 to October 31, 2005.

Actual Expenses

The first line under each Portfolio in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for your Portfolio under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line under each Portfolio in the table below provides information about hypothetical account values and hypothetical expenses based on each Portfolio's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs. As a shareholder of a Glenmede Portfolio, you do not incur any transaction costs, such as sales charges (loads), redemption fees or exchange fees, but shareholders of other funds may incur such costs. Therefore, the second line under each Portfolio in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds whose shareholders may incur transaction costs.

| | | Beginning

Account

Value

(May 1,

2005) | | Ending

Account

Value

(October 31,

2005) | | Annualized

Expense

Ratio* | | Expenses

Paid During

Period**

(May 1, to

October 31,

2005) | |

| Muni Intermediate Portfolio | |

| Actual | | $ | 1,000.00 | | | $ | 1,004.80 | | | | 0.29 | % | | $ | 1.47 | | |

| Hypothetical (5% return less expenses) | | | 1,000.00 | | | | 1,023.77 | | | | 0.29 | | | | 1.48 | | |

22

THE GLENMEDE PORTFOLIOS

Shareholder Expenses (Unaudited) — (Concluded)

| | | Beginning

Account

Value

(May 1,

2005) | | Ending

Account

Value

(October 31,

2005) | | Annualized

Expense

Ratio* | | Expenses

Paid During

Period**

(May 1, to

October 31,

2005) | |

| New Jersey Muni Portfolio | |

| Actual | | $ | 1,000.00 | | | $ | 1,005.40 | | | | 0.32 | % | | $ | 1.62 | | |

| Hypothetical (5% return less expenses) | | | 1,000.00 | | | | 1,023.59 | | | | 0.32 | | | | 1.63 | | |

* Expense ratios for the period may differ from expense ratios based on one-year data in the Financial Highlights.

** Expenses are calculated using each Portfolio's annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (184 days), and divided by the number of days in the calendar year (365 days).

23

THE GLENMEDE FUND, INC.

STATEMENTS OF ASSETS AND LIABILITIES

October 31, 2005

| | | Government

Cash

Portfolio | | Tax-

Exempt

Cash

Portfolio | | Core

Fixed

Income

Portfolio | |

| Assets: | |

| Investments1: | |

| Investments at value2 | | $ | 327,821,907 | | | $ | 551,481,523 | | | $ | 212,180,459 | | |

| Repurchase agreements at value | | | 320,315,084 | | | | — | | | | 34,680,470 | | |

| Total investments | | | 648,136,991 | | | | 551,481,523 | | | | 246,860,929 | | |

| Cash | | | — | | | | 6,755 | | | | — | | |

| Receivable for securities sold | | | — | | | | — | | | | 297 | | |

| Interest receivable | | | 2,101,414 | | | | 1,518,447 | | | | 1,736,490 | | |

| Prepaid expenses | | | 20,071 | | | | 18,642 | | | | 6,575 | | |

| Total assets | | | 650,258,476 | | | | 553,025,367 | | | | 248,604,291 | | |

| Liabilities: | |

| Dividends payable | | | 1,900,575 | | | | 1,105,651 | | | | — | | |

| Payable for fund shares redeemed | | | 8,774 | | | | — | | | | 57,199 | | |

| Payable for securities purchased | | | 11,752,427 | | | | — | | | | — | | |

Obligation to return securities lending

collateral | | | — | | | | — | | | | 23,973,850 | | |

| Payable for when-issued securities | | | — | | | | — | | | | 29,465,930 | | |

| Payable for Directors' fees | | | 1,947 | | | | — | | | | 198 | | |

| Accrued expenses | | | 169,324 | | | | 155,874 | | | | 111,611 | | |

| Total liabilities | | | 13,833,047 | | | | 1,261,525 | | | | 53,608,788 | | |

| Net Assets | | $ | 636,425,429 | | | $ | 551,763,842 | | | $ | 194,995,503 | | |

| Net Assets consist of: | |

| Par value ($0.001 of shares outstanding) | | | 636,357 | | | | 551,974 | | | | 18,326 | | |

| Paid-in capital in excess of par value | | | 635,720,151 | | | | 551,347,683 | | | | 196,699,251 | | |

| Undistributed net investment income | | | 73,094 | | | | (265 | ) | | | 701,518 | | |

Accumulated net realized gain (loss) from

investment transactions | | | (4,173 | ) | | | (135,550 | ) | | | (2,650,905 | ) | |

Net unrealized appreciation (depreciation)

on investments | | | — | | | | — | | | | 227,313 | | |

| Total Net Assets | | | 636,425,429 | | | | 551,763,842 | | | | 194,995,503 | | |

| Shares Outstanding3 | | | 636,356,507 | | | | 551,974,146 | | | | 18,326,329 | | |

| Net Asset Value Per Share | | $ | 1.00 | | | $ | 1.00 | | | $ | 10.64 | | |

| 1 Investments at cost | | $ | 648,136,991 | | | $ | 551,481,523 | | | $ | 246,633,616 | | |

| 2 Market value of securities on loan | | | — | | | | — | | | $ | 23,391,478 | | |

| 3 Authorized shares | | | 700,000,000 | | | | 740,000,000 | | | | 135,000,000 | | |

See Notes to Financial Statements.

24

THE GLENMEDE FUND, INC.

STATEMENTS OF ASSETS AND LIABILITIES — (Continued)

October 31, 2005

| | | Strategic

Equity

Portfolio | | Small Cap

Equity

Portfolio | | Large Cap

Value

Portfolio | |

| Assets: | |

| Investments1: | |

| Investments at value2 | | $ | 88,458,759 | | | $ | 304,843,755 | | | $ | 25,478,396 | | |

| Repurchase agreements at value | | | 254,119 | | | | 2,113,897 | | | | 1,182,302 | | |

| Total investments | | | 88,712,878 | | | | 306,957,652 | | | | 26,660,698 | | |

| Receivable for fund shares sold | | | — | | | | 58,151 | | | | 150,000 | | |

| Dividends receivable | | | 96,625 | | | | 127,554 | | | | 35,088 | | |

| Interest receivable | | | 1,522 | | | | 15,035 | | | | 201 | | |

| Prepaid expenses | | | 2,641 | | | | 8,804 | | | | 20,939 | | |

| Total assets | | | 88,813,666 | | | | 307,167,196 | | | | 26,866,926 | | |

| Liabilities: | |

| Payable for fund shares redeemed | | | 43,042 | | | | 618,411 | | | | 133,225 | | |

Obligation to return securities lending

collateral | | | 8,806,394 | | | | 64,356,600 | | | | 204,610 | | |

| Payable for Directors' fees | | | 399 | | | | 352 | | | | 152 | | |

| Accrued expenses | | | 58,568 | | | | 221,187 | | | | 22,272 | | |

| Total liabilities | | | 8,908,403 | | | | 65,196,550 | | | | 360,259 | | |

| Net Assets | | $ | 79,905,263 | | | $ | 241,970,646 | | | $ | 26,506,667 | | |

| Net Assets consist of: | |

| Par value ($0.001 of shares outstanding) | | | 4,714 | | | | 14,480 | | | | 2,579 | | |

| Paid-in capital in excess of par value | | | 68,983,023 | | | | 187,251,826 | | | | 22,976,179 | | |

| Undistributed net investment income | | | 18,543 | | | | 43,437 | | | | 10,499 | | |

Accumulated net realized gain (loss) from

investment transactions | | | (39,938 | ) | | | (166,598 | ) | | | (37,549 | ) | |

Net unrealized appreciation (depreciation)

on investments | | | 10,938,921 | | | | 54,827,501 | | | | 3,554,959 | | |

| Total Net Assets | | | 79,905,263 | | | | 241,970,646 | | | | 26,506,667 | | |

| Shares Outstanding3 | | | 4,713,870 | | | | 14,480,434 | | | | 2,579,137 | | |

| Net Asset Value Per Share | | $ | 16.95 | | | | — | | | $ | 10.28 | | |

Advisor Class — based on net assets of

$241,969,518 and shares outstanding of

14,480,367 (175,000,000

authorized shares) | | | — | | | $ | 16.71 | | | | — | | |

Institutional Class — based on net assets of

$1,128 and shares outstanding of 66.825 4

(75,000,000 authorized shares) | | | — | | | $ | 16.88 | | | | — | | |

| 1 Investments at cost | | $ | 77,773,957 | | | $ | 252,130,151 | | | $ | 23,105,739 | | |

| 2 Market value of securities on loan | | $ | 8,568,138 | | | $ | 62,059,628 | | | $ | 196,426 | | |

| 3 Authorized shares | | | 125,000,000 | | | | 250,000,000 | | | | 75,000,000 | | |

4 Net assets have been rounded for presentation purposes. The net asset value per share is as reported on October 31, 2005.

See Notes to Financial Statements.

25

THE GLENMEDE FUND, INC.

STATEMENTS OF ASSETS AND LIABILITIES — (Continued)

October 31, 2005

| | | International

Portfolio | | Philadelphia

International

Fund5 | | U.S.

Emerging

Growth

Portfolio6 | |

| Assets: | |

| Investments1: | |

| Investments at value2 | | $ | 841,140,946 | | | $ | 639,264,862 | | | $ | 17,313,108 | | |

| Repurchase agreements at value | | | — | | | | 9,727,993 | | | | 326,865 | | |

| Total investments | | | 841,140,946 | | | | 648,992,855 | | | | 17,639,973 | | |

| Foreign currency, at value (Note 1)4 | | | 131,118 | | | | 469,232 | | | | — | | |

| Receivable for securities sold | | | 426 | | | | 4,279,990 | | | | — | | |

| Receivable for fund shares sold | | | 186,200 | | | | 491,553 | | | | 20,000 | | |

| Receivable from shareholders | | | 1,290,769 | | | | — | | | | — | | |

| Dividends receivable | | | 1,920,847 | | | | 1,284,258 | | | | 12,869 | | |

| Interest receivable | | | 6,213 | | | | 3,755 | | | | 1,564 | | |

| Foreign tax reclaims receivable | | | 460,518 | | | | 178,888 | | | | — | | |

| Prepaid expenses | | | 35,759 | | | | 19,626 | | | | 403 | | |

| Total assets | | | 845,172,796 | | | | 655,720,157 | | | | 17,674,809 | | |

| Liabilities: | |

| Payable for fund shares redeemed | | | 975,832 | | | | 56,950 | | | | 4,000 | | |

| Payable for securities purchased | | | — | | | | 4,008,068 | | | | 204,658 | | |

Obligation to return securities lending

collateral | | | 31,510,571 | | | | 17,127,711 | | | | 3,231,407 | | |

| Due to bank | | | 481,501 | | | | — | | | | — | | |

| Payable for Directors' fees | | | — | | | | 582 | | | | — | | |

| Accrued expenses | | | 355,224 | | | | 508,724 | | | | 17,828 | | |

| Total liabilities | | | 33,323,128 | | | | 21,702,035 | | | | 3,457,893 | | |

| Net Assets | | $ | 811,849,668 | | | $ | 634,018,122 | | | $ | 14,216,916 | | |

| Net Assets consist of: | |

| Par value ($0.001 of shares outstanding) | | | 46,172 | | | | 36,251 | | | | 2,285 | | |

| Paid-in capital in excess of par value | | | 631,423,316 | | | | 544,565,910 | | | | 14,846,732 | | |

| Undistributed net investment income | | | — | | | | — | | | | — | | |

Accumulated net realized gain (loss) from

investment transactions | | | (1,048,241 | ) | | | (1,489,610 | ) | | | (2,274,130 | ) | |

Net unrealized appreciation (depreciation)

on investments | | | 181,428,421 | | | | 90,905,571 | | | | 1,642,029 | | |

| Total Net Assets | | | 811,849,668 | | | | 634,018,122 | | | | 14,216,916 | | |

| Shares Outstanding3 | | | 46,171,752 | | | | 36,250,804 | | | | 2,284,646 | | |

| Net Asset Value Per Share | | $ | 17.58 | | | $ | 17.49 | | | $ | 6.22 | | |

| 1 Investments at cost | | $ | 659,650,511 | | | $ | 558,038,078 | | | $ | 15,997,944 | | |

| 2 Market value of securities on loan | | $ | 29,996,035 | | | $ | 16,509,143 | | | $ | 3,100,303 | | |

| 3 Authorized shares | | | 225,000,000 | | | | 120,000,000 | | | | 75,000,000 | | |

4 The International Portfolio and Philadelphia International Fund had foreign currency cost of $132,100 and $473,041, respectively.

5 Effective July 1, 2005, Institutional International Portfolio changed its name to Philadelphia International Fund.

6 Effective February 27, 2005, Small Capitalization Growth Portfolio changed its name to U.S. Emerging Growth Portfolio.

See Notes to Financial Statements.

26

THE GLENMEDE FUND, INC.

STATEMENTS OF ASSETS AND LIABILITIES — (Concluded)

October 31, 2005

| | | Large

Cap

100

Portfolio | | Large

Cap

Growth

Portfolio | |

| Assets: | |

| Investments1: | |

| Investments at value2 | | $ | 53,214,004 | | | $ | 16,330,611 | | |

| Repurchase agreements at value | | | 882,799 | | | | 221,879 | | |

| Total investments | | | 54,096,803 | | | | 16,552,490 | | |