UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number:

811-05577

The Glenmede Fund, Inc.

(Exact Name of Registrant as Specified in Charter)

1 Lincoln Street, Floor 8

SFC0805

Boston, MA 02111

(Address of Principal Executive Offices)(Zip Code)

Michael P. Malloy, Esq.

Secretary

Faegre Drinker Biddle & Reath LLP

One Logan Square

Suite 2000

Philadelphia, PA 19103-6996

(Name and Address of Agent for Service)

Registrant’s Telephone Number, including Area Code:

1-800-442-8299

Date of Fiscal Year End: October 31

Date of Reporting Period: October 31, 2021

Item 1. Reports to Stockholders.

(a)

The Glenmede Fund, Inc.

The Glenmede Portfolios

Annual Report

October 31, 2021

The performance for the portfolios shown on pages 2 to 22 represents past performance and is not a guarantee of future results. A portfolio’s share price and investment return will vary with market conditions, and the principal value of shares, when redeemed, may be more or less than their original cost.

An investment in a portfolio is neither insured nor guaranteed by the U.S. Government, the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other governmental agency or bank.

Unlike actual fund performance, performance of an index does not reflect any expenses or transaction costs. A direct investment in an unmanaged index is not possible.

The reports concerning the portfolios included in this shareholder report may contain certain forwardlooking statements about the factors that may affect the performance of the portfolios in the future. These statements are based on the adviser’s predictions and expectations concerning certain future events and their expected impact on the portfolios, such as performance of the economy as a whole and of specific industry sectors, changes in the levels of interest rates, the impact of developing world events and other factors that may influence the future performance of the portfolios. The adviser believes these forwardlooking statements to be reasonable, although they are inherently uncertain and difficult to predict. Actual events may cause adjustments in portfolio management strategies from those currently expected to be employed.

The Glenmede Fund, Inc.

The Glenmede Portfolios

Table of Contents

| 2 |

| 5 |

| 23 |

| 26 |

| 29 |

| 29 |

| 35 |

| 41 |

| 47 |

| 49 |

| 66 |

| 170 |

| 194 |

| 195 |

| 195 |

| 196 |

| 197 |

| 198 |

| 199 |

| 208 |

| 212 |

| 213 |

| 215 |

| 219 |

The Glenmede Fund, Inc. and the Glenmede Portfolios

President’s Letter

Dear Shareholder:

We are pleased to present the annual report of the Glenmede family of funds for the fiscal year ended October 31, 2021. At the fiscal year end on October 31, 2021, The Glenmede Fund, Inc. and The Glenmede Portfolios (collectively, the “Glenmede Funds”) consisted of 18 Portfolios with total assets of $7.3 billion. During the fiscal year, no new portfolios were launched and one portfolio was closed: The Glenmede Fund, Inc. – Large Cap Value Portfolio.

The fiscal year was marked by improved investor sentiment in response to supportive fiscal/monetary policies, stronger than expected earnings and revenues, business re-openings, and medical advances against COVID-19. The enhanced outlook led to an equity rally during the fiscal year while fixed income markets were relatively flat comparatively.

A strong economic recovery combined with commitments from global central banks that monetary policies will remain accommodative for some time provided the underpinnings for the surge in equities. The COVID-19 vaccine developments and the certification of the U.S. election results provided additional catalysts for the equity rally. The fiscal year ended October 31, 2021 saw all major equity indices rally significantly with the S& P 500® Index1 gaining 42.9%. Small cap stocks, as represented by the Russell 2000® Index1, outpaced their large cap counterparts, rising 50.8%. International markets also rallied with the MSCI EAFE Index1 up 34.2% for the fiscal year.

As the economy continues to recover from the COVID-19 pandemic, the treasury curve steepened as long-term interest rates ascended. The Federal Reserve maintained its accommodative stance with Fed funds at the effective lower range. Inflation expectations grew as the year progressed and pushed long term rates even higher with the U.S. 10 Year treasury at 1.55% by the close of October 2021. The treasury yield curve flattened towards the end of the fiscal year as the market patiently waited for the Federal Reserve to unveil its tapering plan and U.S. 2-year treasury yields rose 23 basis points2 over the month of October. For the fiscal year ended October 31, 2021, the Bloomberg U.S. Aggregate Bond Index1 returned -0.48% and the Bloomberg Municipal 1-10 Year Blend Index1 returned a modest 1.28%. High yield debt performed the best with the Bloomberg High Yield Index1 returning 9.1%.

The Glenmede Quantitative U.S. Total Market Equity Portfolio achieved a five star (★★★★★) Overall Morningstar RatingTM3 among 392 Mid Cap Value Equity Funds for the period ended October 31, 2021 (based on risk adjusted returns). The Glenmede Equity Income Portfolio acheived a four star (★★★★) Overall Morningstar RatingTM3 among 1,146 Large Value Equity Funds for the period ended October 31, 2021 (based on risk adjusted returns). The Glenmede Secured Options Portfolio (Advisor Class) achieved a four star (★★★★) Overall Morningstar RatingTM3 among 88 Option-based Funds for the period ended October 31, 2021 (based on risk adjusted returns). The Glenmede Women in Leadership Equity Portfolio achieved a four star (★★★★) Overall Morningstar RatingTM3 among 1,146 Large Value Equity Funds for the period ended October 31, 2021 (based on risk adjusted returns).

We have included Portfolio Highlights for each individual fund in this report. We welcome any questions about the Glenmede Funds and thank our shareholders for their continued support.

Sincerely,

Kent E. Weaver, Jr.

President

November 23, 2021

Past performance is no guarantee of future results.

Mutual fund investing involves risks. Principal loss is possible. Shareholders should consult each Portfolio’s prospectus for a complete listing of risks associated with their Portfolio(s). Certain Portfolios invest in foreign securities which, especially in emerging markets, will involve greater volatility and political, economic and currency risks and differences in accounting methods. The Small Cap Equity Portfolio and Quantitative U.S. Small Cap Equity Portfolio invest in smaller companies, which will involve additional risks such as limited liquidity and greater volatility than larger companies. The Quantitative U.S. Large Cap Value Equity Portfolio may invest in IPOs and the market value of IPO shares could fluctuate considerably due to factors such as the absence of a prior public market, unseasoned trading, the small number of shares available for trading, and limited information about the issuer. Short sales by the Quantitative U.S. Long/Short Equity Portfolio and the Quantitative U.S. Total Market Equity Portfolio involve leverage risk, credit exposure to brokers that execute the short sales and have potentially unlimited losses. Use of derivatives by the Secured Options Portfolio and the Global Secured Options Portfolio may involve greater liquidity, counterparty, credit and pricing risks. The Muni Intermediate Portfolio, High Yield Municipal Portfolio and Short Term Tax Aware Fixed Income Portfolio invest in debt instruments of municipal issuers whose ability to meet their obligations may be affected by political and economic factors in the issuer’s region. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Income from tax-exempt funds may be subject to state and local taxes and a portion of such income may be subject to the federal alternative minimum tax for certain investors. Federal income tax rules will apply to any capital gains distributions. Investments in asset backed and mortgage backed securities by the Core Fixed Income Portfolio include additional risks that investors should be aware of such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. The High Yield Municipal Portfolio invests in “Junk Bonds” which are securities rated below investment grade and are high risk investments that have greater credit risk, are less liquid and have more volatile prices than investment grade bonds. The Secured Options Portfolio and the Global Secured Options Portfolio invest in options which have risks of unlimited losses of the underlying holdings due to unanticipated market movements and failure to correctly predict the direction of the securities prices, interest rates and currency exchange rates. Covered call writing may limit the upside of an underlying security. This investment may not be suitable for all investors. The application of the social, governance and/or environmental standards of the Responsible ESG U.S. Equity Portfolio and the women in leadership criteria of the Women in Leadership U.S. Equity Portfolio will affect each Portfolio’s exposure to certain issuers, industries, sectors, regions and countries and may impact the relative performance of these Portfolios, either positively or negatively, depending on whether such investments are in or out of favor. The Equity Income Portfolio invests in dividend paying stocks. Issuers that have paid regular dividends or distributions to shareholders may not continue to do so at the same level or at all in the future. Dividend paying securities can fall out of favor with the market, causing the Portfolio during such periods to underperform funds that do not focus on dividends.

Diversification does not assure a profit or protect against a loss in a declining market.

An investment in a Portfolio is neither insured nor guaranteed by the Federal Deposit Insurance Corporation, any other government agency or bank.

| 1 | The indices are defined on pages 23 to 25. |

| 2 | A basis point equals .01%. |

| 3 | ©2021 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. |

| | The Morningstar Rating™ for funds, or "star rating", is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-end mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product’s monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating™ for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating™ metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods. |

| | As of October 31, 2021, the Equity Income Portfolio was rated against the following numbers of U.S.-domiciled Large Value Equity funds over the following time periods: 1,146 funds overall and 1,146 funds in the last three years. With respect to these Large Value Equity funds, the Equity Income Portfolio received an Overall Morningstar Rating™ of ★★★★ stars and a Morningstar Rating™ of ★★★★ stars for the three-year period. As of October 31, 2021, the Secured Options Portfolio (Advisor Class and Institutional Class) was rated against the following numbers of Option-based funds over the following time periods: 88 funds overall, 88 funds in the last three years, 62 funds in the last five years and 11 funds in the last ten years. With respect to these Option-based |

| | funds, the Secured Options Portfolio (Advisor Class) received an Overall Morningstar Rating™ of ★★★★ stars and a Morningstar Rating™ of ★★★ stars, ★★★ stars and ★★★★★ stars for the three-, five- and ten year periods, respectively. With respect to these Option-based funds, the Secured Options Portfolio (Institutional Class) received an Overall Morningstar Rating™ of ★★★ stars and a Morningstar Rating™ of ★★★ stars, ★★★ stars and ★★★★★ stars for the three-, five- and ten year periods, respectively. As of October 31, 2021, the Quantitative U.S. Total Market Equity Portfolio was rated against the following numbers of U.S.- domiciled Mid-Cap Value funds over the following time periods: 392 funds overall, 392 funds in the last three years, 350 funds in the last five years and 254 funds in the last ten years. With respect to these Mid-Cap Value funds, the Quantitative U.S. Total Market Equity Portfolio received an Overall Morningstar Rating™ of ★★★★★ stars and a Morningstar Rating™ of ★★★★ stars, ★★★★★ stars and ★★★★★ stars for the three-, five- and ten-year periods, respectively. As of October 31, 2021, the Women in Leadership Equity Portfolio was rated against the following numbers of U.S.- domiciled Large Value funds over the following time periods: 1,146 funds overall, 1,146 funds in the last three years and 1,027 funds in the last five years. With respect to these Large Value funds, the Women in Leadership Equity Portfolio received an Overall Morningstar Rating™ of ★★★★ stars and a Morningstar Rating™ of ★★★★ stars and ★★★★ stars for the three- and five year periods, respectively. Past performance is no guarantee of future results. Ratings for other share classes may differ. |

| | This material must be preceded or accompanied by a current prospectus. |

| | The Glenmede Fund, Inc. and The Glenmede Portfolios are distributed by Quasar Distributors, LLC. 12/21. |

| | Bond ratings are grades given to bonds that indicate their credit quality as determined by a private independent rating service such as S&P Global Ratings. The firm evaluates a bond issuer’s financial strength, or its ability to pay a bond’s principal and interest in a timely fashion. Ratings are expressed as letters ranging from ’AAA’, which is the highest grade, to ’D’, which is the lowest grade. In limited situations when the rating agency has not issued a formal rating, the rating agency will classify the security as non-rated. |

| | A Portfolio’s holdings and allocations are subject to change and are not recommendations to buy or sell any security. Current and future portfolio holdings are subject to risk. Please refer to a Portfolio’s Schedule of Portfolio Investments contained in this report for a full listing of portfolio holdings. |

Quantitative U.S. Large Cap Core Equity Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2021

| Average Annual Total Return |

| | | | | Return After Taxes on | | | | |

| Quantitative U.S. Large Cap Core Equity Portfolio – Advisor Class | | Return

Before

Taxes | | Distributions | | Distributions

and Sales of

Fund Shares | | Russell 1000®

Index | | Morningstar

Large Blend

Average |

| Year ended 10/31/21 | | 43.77% | | 40.82% | | 27.11% | | 43.51% | | 41.27% |

| Five Years ended 10/31/21 | | 14.71% | | 13.11% | | 11.41% | | 19.16% | | 16.60% |

| Ten Years ended 10/31/21 | | 14.69% | | 13.60% | | 12.08% | | 16.30% | | 13.92% |

| Inception (02/27/04) through 10/31/211 | | 10.22% | | 9.52% | | 8.60% | | 10.62% | | 8.90% |

| Quantitative U.S. Large Cap Core Equity Portfolio – Institutional Class | | | | | | | | | | |

| Year ended 10/31/21 | | 44.10% | | 41.04% | | 27.31% | | 43.51% | | 41.27% |

| Five Years Ended 10/31/21 | | 14.94% | | 13.28% | | 11.58% | | 19.16% | | 16.60% |

| Inception (12/30/15) through 10/31/212 | | 13.18% | | 11.74% | | 10.25% | | 17.15% | | 14.83% |

For the fiscal year ended October 31, 2021, the Portfolio’s Advisor Class outperformed the Russell 1000® Index by 0.26% and the Morningstar Large Blend Average by 2.50%, respectively. The Portfolio was positively impacted from its relatively lower average market capitalization versus the Russell 1000® Index as the average stock (50.4%) outperformed the Index by about 6.9%. However, the Portfolio’s relative performance was negatively impacted from underexposure to Alphabet (GOOG 82.9%) and no exposure to Tesla (TSLA 187%). The Portfolio’s performance had net positive contributions from multifactor stock ranking models, including biases towards stocks with lower valuations, as the Russell 1000® Value Index outperformed the Russell 1000® Growth Index by about 0.5%. The Portfolio had positive relative stock performance in four of eleven sectors. The most favorable contributions from stock selection came in the information technology and consumer discretionary sectors. The most negative contributions from stock selection were in the communication services and materials. The Portfolio’s gross annual operating expense ratios, as stated in the February 28, 2021 Prospectuses, are 0.87% and 0.67% for the Advisor and Institutional Class shares, respectively. These ratios can fluctuate and may differ from the expense ratios disclosed in the Financial Highlights section of this report.

Hypothetical Illustration of $10,000 Invested in

Quantitative U.S. Large Cap Core Equity Portfolio - Advisor Class vs.

Russell 1000® Index and

Morningstar Large Blend Average

10/31/11 through 10/31/21

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns, other than after-tax returns, do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares. After-tax returns are calculated using the historical highest individual federal marginal income tax rates, do not reflect the impact of state and local taxes and are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or IRAs. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown. Performance of the Institutional Class will vary from the Advisor Class due to differences in fees.

| | 1 Returns are for the period beginning March 1, 2004 for Morningstar Large Blend Average. |

| | 2 Returns are for the period beginning January 1, 2016 for Morningstar Large Blend Average. |

| | The indices and certain terms are defined on pages 23 to 25. |

Quantitative U.S. Large Cap Growth Equity Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2021

| Average Annual Total Return |

| | | | | Return After Taxes on | | | | |

| Quantitative U.S. Large Cap Growth Equity Portfolio – Advisor Class | | Return

Before

Taxes | | Distributions | | Distributions

and Sales of

Fund Shares | | Russell 1000®

Growth Index | | Morningstar

Large Growth

Average |

| Year ended 10/31/21 | | 46.17% | | 41.57% | | 29.23% | | 43.21% | | 39.55% |

| Five Years ended 10/31/21 | | 20.97% | | 18.49% | | 16.33% | | 25.49% | | 22.35% |

| Ten Years ended 10/31/21 | | 17.85% | | 16.37% | | 14.74% | | 19.42% | | 16.89% |

| Inception (02/27/04) through 10/31/211 | | 12.17% | | 11.30% | | 10.32% | | 12.44% | | 10.61% |

| Quantitative U.S. Large Cap Growth Equity Portfolio – Institutional Class | | | | | | | | | | |

| Year ended 10/31/21 | | 46.47% | | 41.75% | | 29.40% | | 43.21% | | 39.55% |

| Five Years Ended 10/31/21 | | 21.21% | | 18.66% | | 16.50% | | 25.49% | | 22.35% |

| Inception (11/05/15) through 10/31/212 | | 17.53% | | 15.43% | | 13.67% | | 21.14% | | 18.44% |

For the fiscal year ended October 31, 2021, the Portfolio’s Advisor Class outperformed the Russell 1000® Growth Index by 2.96% and the Morningstar Large Growth Average by 6.62%, respectively. The Portfolio was positively impacted from relative underexposure to megacap companies such as Apple (AAPL, 38.5%) and Amazon (AMZN, 11.1%). However, the Portfolio’s relative performance was negatively impacted from underexposure to Alphabet (GOOG 82.9%) and no exposure to Tesla (TSLA 187%). The Portfolio’s performance had mixed contributions from multifactor stock ranking models, including biases towards stocks with lower valuations, better fundamentals and more positive earnings trends. The Portfolio benefitted from downside risk screens, avoiding stocks ranked poorly in multifactor sell models and negative earnings surprise signals. The Portfolio had positive relative stock performance in two of nine sectors. The most favorable contributions from stock selection came in the information technology and materials sectors. The most negative contributions from stock selection were in the communication services and health care sectors. The Portfolio’s gross annual operating expense ratios, as stated in the February 28, 2021 Prospectuses, are 0.88% and 0.68% for the Advisor and Institutional Class shares, respectively. These ratios can fluctuate and may differ from the expense ratios disclosed in the Financial Highlights section of this report.

Hypothetical Illustration of $10,000 Invested in

Quantitative U.S. Large Cap Growth Equity Portfolio-Advisor Class vs.

Russell 1000® Growth Index and Morningstar Large Growth Average

10/31/11 through 10/31/21

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns, other than after-tax returns, do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares. After-tax returns are calculated using the historical highest individual federal marginal income tax rates, do not reflect the impact of state and local taxes and are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or IRAs. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown. Performance of the Institutional Class will vary from the Advisor Class due to differences in fees.

| | 1 Returns are for the period beginning March 1, 2004 for Morningstar Large Growth Average. |

| | 2 Returns are for the period beginning December 1, 2015 for Morningstar Large Growth Average. |

| | The indices and certain terms are defined on pages 23 to 25. |

Quantitative U.S. Large Cap Value Equity Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2021

| Average Annual Total Return |

| | | | | Return After Taxes on | | | | |

| Quantitative U.S. Large Cap Value Equity Portfolio | | Return

Before

Taxes | | Distributions | | Distributions

and Sales of

Fund Shares | | Russell 1000®

Value Index | | Morningstar

Large Value

Average |

| Year ended 10/31/21 | | 46.66% | | 45.89% | | 27.67% | | 43.76% | | 43.70% |

| Inception (11/13/17) through 10/31/211 | | 8.93% | | 8.40% | | 6.84% | | 11.18% | | 10.01% |

For the fiscal year ended October 31, 2021, the Portfolio outperformed the Russell 1000® Value Index by 2.90% and the Morningstar Large Value Average by 2.96%, respectively. In the past year, the Portfolio’s performance had net positive contributions from multifactor ranking models, including biases towards stocks with lower valuations. Stocks in the Russell 1000® Value Index with lower valuations (Price/Earnings<20) had a total return of 56.0%. The Portfolio benefitted from leading industry group indicators, including relative overweightings in financials and underweightings in health care stocks. The Portfolio had positive relative stock performance in six of eleven sectors. The most favorable contributions from stock selection came in the information technology and communication services sectors. The most negative contributions from stock selection were in the materials and energy sectors. The Portfolio’s gross annual operating expense ratio, as stated in the February 28, 2021 Prospectus, is 2.66%. This ratio can fluctuate and may differ from the expense ratio disclosed in the Financial Highlights section of this report.

Hypothetical Illustration of $10,000 Invested in

Quantitative U.S. Large Cap Value Equity Portfolio vs.

Russell 1000® Value Index and

Morningstar Large Value Average

11/13/17 through 10/31/21

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance quoted reflects fee waivers and/or expense reimbursements in effect and would have been lower in their absence. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns, other than after-tax returns, do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares. After-tax returns are calculated using the historical highest individual federal marginal income tax rates, do not reflect the impact of state and local taxes and are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or IRAs. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown.

| | 1 Returns are for the period beginning December 1, 2017 for Morningstar Large Value Average. |

| | The indices and certain terms are defined on pages 23 to 25. |

Quantitative U.S. Small Cap Equity Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2021

| Average Annual Total Return |

| | | | | Return After Taxes on | | | | |

| Quantitative U.S. Small Cap Equity Portfolio | | Return

Before

Taxes | | Distributions | | Distributions

and Sales of

Fund Shares | | Russell 2000®

Index | | Morningstar

Small Blend

Average |

| Year ended 10/31/21 | | 58.45% | | 58.14% | | 34.62% | | 50.80% | | 54.25% |

| Inception (11/13/17) through 10/31/211 | | 11.55% | | 11.36% | | 9.05% | | 13.27% | | 10.09% |

For the fiscal year ended October 31, 2021, the Portfolio outperformed the Russell 2000® Index by 7.65% and the Morningstar Small Blend Average by 4.20%, respectively. In the past year, the Portfolio’s performance had net positive contributions from multifactor ranking models, including biases towards stocks with lower valuations. Stocks in the Russell 2000® Index with lower valuations (Price/Earnings<20) had a total return of 64.9%. The Portfolio benefitted from leading industry group indicators, including relative overweightings in financials/communication services and underweightings in health care/utilities stocks. The Portfolio had positive relative stock performance in seven of eleven sectors. The most favorable contributions from stock selection came in the health care and financials sectors. The most negative contributions from stock selection were in the energy and communication services sectors. The Portfolio’s gross annual operating expense ratio, as stated in the February 28, 2021 Prospectus, is 4.63%. This ratio can fluctuate and may differ from the expense ratio disclosed in the Financial Highlights section of this report.

Hypothetical Illustration of $10,000 Invested in

Quantitative U.S. Small Cap Equity Portfolio vs.

Russell 2000® Index and

Morningstar Small Blend Average

11/13/17 through 10/31/21

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance quoted reflects fee waivers and/or expense reimbursements in effect and would have been lower in their absence. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns, other than after-tax returns, do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares. After-tax returns are calculated using the historical highest individual federal marginal income tax rates, do not reflect the impact of state and local taxes and are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or IRAs. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown.

| | 1 Returns are for the period beginning December 1, 2017 for Morningstar Small Blend Average. |

| | The indices and certain terms are defined on pages 23 to 25. |

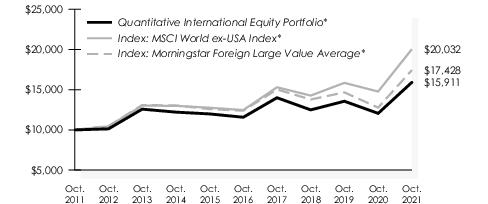

Quantitative International Equity Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2021

| Average Annual Total Return |

| | | | | Return After Taxes on | | | | |

| Quantitative International Equity Portfolio | | Return

Before

Taxes | | Distributions | | Distributions

and Sales of

Fund Shares | | MSCI World

ex-USA

Index | | Morningstar

Foreign Large

Value Average |

| Year ended 10/31/21 | | 31.96% | | 30.73% | | 18.90% | | 35.59% | | 36.44% |

| Five Years ended 10/31/21 | | 6.57% | | 6.10% | | 5.20% | | 9.95% | | 6.92% |

| Ten Years ended 10/31/21 | | 4.75% | | 4.38% | | 3.84% | | 7.19% | | 5.60% |

| Inception (11/17/88) through 10/31/211 | | 6.49% | | 5.32% | | 5.23% | | 5.19% | | 6.31% |

For the fiscal year ended October 31, 2021, the Portfolio underperformed the MSCI World excluding the United States Index (“MSCI World ex-USA Index”) by 3.63%. In the past year, the Portfolio was negatively impacted from its relatively lower average market capitalization versus the MSCI World ex-USA Index as the average stock (32.1%, equal-weighted) underperformed the Index by about 4.1%. The Portfolio’s performance had mixed contributions from multifactor stock ranking models, including biases towards stocks with lower valuations, better fundamentals and more positive earnings trends. Leading industry group indicators had minor effects on performance, including relative overweightings of financials/communication services/materials and underweightings of consumer discretionary/industrials/health care stocks. The Portfolio had positive relative stock performance in four of eleven sectors. The most favorable contributions from stock selection came in the consumer discretionary and utilities sectors. The most negative contributions from stock selection were in the energy and information technology sectors. The Portfolio’s gross annual operating expense ratio, as stated in the February 28, 2021 Prospectus, is 1.15%. This ratio can fluctuate and may differ from the expense ratio disclosed in the Financial Highlights section of this report.

Hypothetical Illustration of $10,000 Invested in

Quantitative International Equity Portfolio vs.

MSCI World ex-USA Index and

Morningstar Foreign Large Value Average

10/31/11 through 10/31/21

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance quoted above reflects fee waivers in effect during certain periods and would have been lower in their absence. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns other than after tax returns, do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares. After-tax returns are calculated using the historical highest individual federal marginal income tax rates, do not reflect the impact of state and local taxes and are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or IRAs. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown.

| | 1 Returns are for the period beginning December 1, 1988 for Morningstar Foreign Large Value Average. |

| | The indices and certain terms are defined on pages 23 to 25. |

Responsible ESG U.S. Equity Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2021

| Average Annual Total Return | |

| | | | | Return After Taxes on | | | | |

| Responsible ESG U.S. Equity Portfolio | | | | Distributions | | Distributions

and Sales of

Fund Shares | | Russell 1000®

Index | Morningstar

Large Blend

Average | |

| Year ended 10/31/21 | | 46.31% | | 45.92% | | 27.44% | | 43.51% | 41.27% | |

| Five Years ended 10/31/21 | | 15.91% | | 15.39% | | 12.70% | | 19.16% | 16.60% | |

| Inception (12/22/15) through 10/31/211 | | 15.07% | | 14.62% | | 12.14% | | 17.33% | 14.83% | |

For the fiscal year ended October 31, 2021, the Portfolio outperformed the Russell 1000® Index by 2.80% and the Morningstar Large Blend Average by 5.04%, respectively. The Portfolio selects stocks based on a combination of multi-factor models and ESG ratings (environmental, socially responsible and governance). The Portfolio was positively impacted from its relatively lower average market capitalization versus the Russell 1000® Index as the average stock (50.4%) outperformed the Index by about 6.9%. However, the Portfolio’s relative performance was negatively impacted from no exposure to Tesla (TSLA 187%). The Portfolio’s performance had net positive contributions from multifactor stock ranking models, including biases towards stocks with lower valuations. In addition, the Portfolio benefitted from exposure to companies with more favorable ESG ratings. The Portfolio had positive relative stock performance in five of eleven sectors. The most favorable contributions from stock selection came in the information technology and financial sectors. The most negative contributions from stock selection were in the health care and communication services sectors. The Portfolio’s gross annual operating expense ratio, as stated in the February 28, 2021 Prospectus, is 1.05%. This ratio can fluctuate and may differ from the expense ratio disclosed in the Financial Highlights section of this report.

Hypothetical Illustration of $10,000 Invested in

Responsible ESG U.S. Equity Portfolio vs.

Russell 1000® Index and

Morningstar Large Blend Average

12/22/15 through 10/31/21

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance quoted reflects fee waivers and/or expense reimbursements in effect and would have been lower in their absence. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns, other than after-tax returns, do not reflect taxes that a shareholder may pay on fund distributions or redemption of fund shares. After tax returns are calculated using the historical highest individual federal marginal income tax rates, do not reflect the impact of state and local taxes and are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or IRAs. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown.

| | 1 Returns are for the period beginning January 1, 2016 for Morningstar Large Blend Average. |

| | The indices and certain terms are defined on pages 23 to 25. |

Women in Leadership U.S. Equity Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2021

| Average Annual Total Return | |

| | | | | Return After Taxes on | | | | |

| Women in Leadership U.S. Equity Portfolio | | | | Distributions | | Distributions

and Sales of

Fund Shares | | Russell 1000®

Index | Morningstar

Large Value

Average | |

| Year ended 10/31/21 | | 43.94% | | 43.41% | | 26.04% | | 43.51% | 43.70% | |

| Five Years ended 10/31/21 | | 14.67% | | 14.15% | | 11.66% | | 19.16% | 12.38% | |

| Inception (12/22/15) through 10/31/211 | | 13.82% | | 13.32% | | 11.05% | | 17.33% | 11.67% | |

For the fiscal year ended October 31, 2021, the Portfolio outperformed the Russell 1000® Index by 0.43% and the Morningstar Large Value Average by 0.24%, respectively. The Portfolio selects stocks based on companies that meet specific women in leadership criteria by the inclusion of women in significant roles, including, but not limited to, a chairwoman, a female chief executive officer, female board members or women in management positions and gender diversity metrics. The Portfolio was positively impacted from its relatively lower average market capitalization versus the Russell 1000® Index as the average stock (50.4%) outperformed the Index by about 6.9%. However, the Portfolio’s relative performance was negatively impacted from no exposure to Tesla (TSLA 187%). The Portfolio’s performance had net positive contributions from multifactor stock ranking models, including biases towards stocks with lower valuations, as the Russell 1000® Value Index outperformed the Russell 1000® Growth Index by about 0.5%. The Portfolio had positive relative stock performance in four of eleven sectors. The most favorable contributions from stock selection came in the information technology and health care sectors. The most negative contributions from stock selection were in the industrials and communication services sectors. The Portfolio’s gross annual operating expense ratio, as stated in the February 28, 2021 Prospectus, is 1.08%. This ratio can fluctuate and may differ from expense ratio disclosed in Financial Highlights section of this report.

Hypothetical Illustration of $10,000 Invested in

Women in Leadership U.S. Equity Portfolio vs.

Russell 1000® Index and

Morningstar Large Value Average

12/22/15 through 10/31/21

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance quoted reflects fee waivers and/or expense reimbursements in effect and would have been lower in their absence. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns, other than after-tax returns, do not reflect taxes that a shareholder may pay on fund distributions or redemption of fund shares. After tax returns are calculated using the historical highest individual federal marginal income tax rates, do not reflect the impact of state and local taxes and are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or IRAs. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown.

| | 1 Returns are for the period beginning January 1, 2016 for Morningstar Large Value Average. |

| | The indices and certain terms are defined on pages 23 to 25. |

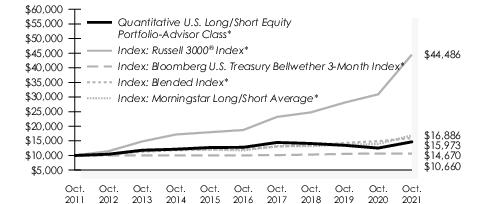

Quantitative U.S. Long/Short Equity Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2021

| Average Annual Total Return | |

| | | | | Return After Taxes on | | | | | | | | | |

| Quantitative U.S. Long/Short Equity Portfolio – Advisor Class | | | | Distributions | | Distributions

and Sales of

Fund Shares | | Russell 3000®

Index | | Bloomberg U.S

Treasury Bellwether

3-Month Index | | Blended

Index | | Morningstar

Long/Short

Average | |

| Year ended 10/31/21 | | 17.01% | | 17.01% | | 10.07% | | 43.90% | | 0.05% | | 11.91% | | 21.16% | |

| Five Years ended 10/31/21 | | 2.77% | | 2.72% | | 2.13% | | 18.91% | | 1.16% | | 6.47% | | 6.76% | |

| Ten Years ended 10/31/21 | | 3.91% | | 3.88% | | 3.09% | | 16.10% | | 0.64% | | 5.24% | | 4.98% | |

| Inception (09/29/06) through 10/31/211 | | 2.07% | | 1.99% | | 1.61% | | 10.83% | | 1.02% | | 4.12% | | 3.14% | |

| Quantitative U.S. Long/Short Equity Portfolio – Institutional Class | | | | | | | | | | | | | | | |

| Year ended 10/31/21 | | 17.25% | | 17.25% | | 10.21% | | 43.90% | | 0.05% | | 11.91% | | 21.16% | |

| Inception (09/13/19) through 10/31/212 | | 3.97% | | 3.92% | | 3.04% | | 24.90% | | 0.60% | | 7.72% | | 9.64% | |

For the fiscal year ended October 31, 2021, the Portfolio’s Advisor Class underperformed the Russell 3000® Index by 26.89% and outperformed the Bloomberg U.S. Treasury Bellwether 3-Month Index by 16.96%, respectively. The Portfolio outperformed a blended benchmark mix of 70% Bloomberg U.S. Treasury Bellwether 3 Month Index and 30% Russell 3000® Index by 5.10%. Over the past year, the average net equity exposure (long minus short equity position weights) for the Portfolio was about 34%. The Portfolio’s performance had favorable contributions from multifactor stock ranking models, including biases towards stocks with lower valuations and attractive fundamentals. The Portfolio’s long positions had positive relative stock performance in eight of eleven sectors. The most favorable contributions from stock selection came in the information technology and industrials sectors. The most negative contributions from stock selection were in the communication services and real estate sectors. The Portfolio’s long stock positions (51.7% return) outperformed the short positions (40.0% return) by about 11.7%. The Portfolio’s gross annual operating expense ratios, as stated in the February 28, 2021 Prospectuses, are 2.99%. and 2.59% for the Advisor and Institutional Class shares, respectively These ratios can fluctuate and may differ from the expense ratios disclosed in the Financial Highlights section of this report.

Hypothetical Illustration of $10,000 Invested in

Quantitative U.S. Long/Short Equity Portfolio-Advisor Class vs.

Russell 3000® Index, Bloomberg U.S. Treasury Bellwether 3-Month Index,

Blended Index and Morningstar Long/Short Average

10/31/11 through 10/31/21

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance quoted reflects fee waivers and/or expense reimbursements in effect and would have been lower in their absence. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns, other than after-tax returns, do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. After tax returns are calculated using the historical highest individual federal marginal income tax rates, do not reflect the impact of state and local taxes and are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or IRAs. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown. Performance of the Institutional Class will vary from the Advisor Class due to differences in fees.

| | 1 Returns are for the period beginning October 1, 2006 for Morningstar Long/Short Average. |

| | 2 Returns are for the period beginning October 1, 2019 for Morningstar Long/Short Average. |

| | The indices and certain terms are defined on pages 23 to 25. |

Quantitative U.S. Total Market Equity Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2021

| Average Annual Total Return | |

| | | | | Return After Taxes on | | | | |

| Quantitative U.S. Total Market Equity Portfolio | | | | Distributions | | Distributions

and Sales of

Fund Shares | | Russell 3000®

Index | Morningstar

Mid-Cap

Value Average | |

| Year ended 10/31/21 | | 66.37% | | 62.26% | | 40.74% | | 43.90% | 51.37% | |

| Five Years ended 10/31/21 | | 16.01% | | 14.43% | | 12.43% | | 18.91% | 11.66% | |

| Ten Years ended 10/31/21 | | 14.06% | | 13.06% | | 11.51% | | 16.10% | 11.77% | |

| Inception (12/21/06) through 10/31/211 | | 8.59% | | 7.93% | | 6.99% | | 10.50% | 7.79% | |

For the fiscal year ended October 31, 2021, the Portfolio outperformed the Russell 3000® Index by 22.47% and the Morningstar Mid-Cap Value Average by 15.00%, respectively. In the past year, the Portfolio was positively impacted from its relatively lower average market capitalization versus the Russell 3000® Index as the average stock (57.1% return, equal-weighted) outperformed the Index by about 13.2%. The Portfolio’s performance had favorable contributions from multifactor stock ranking models, including biases towards stocks with lower valuations and attractive fundamentals. The Portfolio’s long positions had positive relative stock performance in nine of eleven sectors. The most favorable contributions from stock selection came in the consumer discretionary and information technology sectors. Negative contributions from stock selection were in the financials and communication services sectors. The Portfolio’s long stock positions (61.9% return) outperformed the short positions (37.0% return) by about 24.9%. The Portfolio’s gross annual operating expense ratio, as stated in the February 28, 2021 Prospectus, is 2.57%. This ratio can fluctuate and may differ from the expense ratio disclosed in the Financial Highlights section of this report.

Hypothetical Illustration of $10,000 Invested in

Quantitative U.S. Total Market Equity Portfolio vs.

Russell 3000® Index and

Morningstar Mid-Cap Value Average

10/31/11 through 10/31/21

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance quoted reflects fee waivers and/or expense reimbursements in effect and would have been lower in their absence. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns, other than after-tax returns, do not reflect taxes that a shareholder may pay on fund distributions or redemption of fund shares. After tax returns are calculated using the historical highest individual federal marginal income tax rates, do not reflect the impact of state and local taxes and are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or IRAs. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown.

| | 1 Returns are for the period beginning January 1, 2007 for Morningstar Mid-Cap Value Average. |

| | The indices and certain terms are defined on pages 23 to 25. |

Strategic Equity Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2021

| Average Annual Total Return |

| | | | | Return After Taxes on | | | | | | |

| Strategic Equity Portfolio | | Return

Before

Taxes | | Distributions | | Distributions

and Sales of

Fund Shares | | S&P 500®

Index | | Dow Jones

Industrial Average | | Morningstar

Large Blend

Average |

| Year ended 10/31/21 | | 42.57% | | 40.59% | | 26.03% | | 42.91% | | 37.73% | | 41.27% |

| Five Years ended 10/31/21 | | 16.97% | | 15.58% | | 13.31% | | 18.93% | | 17.21% | | 16.60% |

| Ten Years ended 10/31/21 | | 14.55% | | 12.88% | | 11.57% | | 16.21% | | 14.32% | | 13.92% |

| Inception (07/20/89) through 10/31/211 | | 9.61% | | 8.23% | | 7.79% | | 10.76% | | 11.16% | | 9.11% |

For the fiscal year ended October 31, 2021, the Strategic Equity Portfolio returned 42.57%. The S&P 500® Index returned 42.91% for the same period. The first half of the fiscal year saw the Portfolio perform well versus the Index as more Portfolio holdings generated strong returns, partially reversing the trend from the prior year when returns for the Index were supported by strong outperformance by a relatively narrow group of mega-capitalization companies. But this was offset over the second half of the year as some of the prior leaders again outperformed, along with a small handful of stocks that the Portfolio generally avoids due to our view that their valuations have already been stretched. In total, the Portfolio’s strong absolute returns were relatively in-line with the Index for the year. The Portfolio seeks to generate outperformance over time by investing in those companies with strong profitability whose shares are trading at reasonable valuations relative to business fundamentals. The Portfolio’s gross annual operating expense ratio, as stated in the February 28, 2021 Prospectus, is 0.86%. This ratio can fluctuate and may differ from the expense ratio disclosed in the Financial Highlights section of this report.

Hypothetical Illustration of $10,000 Invested in

Strategic Equity Portfolio vs.

S&P 500® Index, Dow Jones Industrial Average and

Morningstar Large Blend Average

10/31/11 through 10/31/21

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns, other than after-tax returns, do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares. Aftertax returns are calculated using the historical highest individual federal marginal income tax rates, do not reflect the impact of state and local taxes and are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or IRAs. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown.

| | 1 Returns are for the period beginning August 1, 1989 for Morningstar Large Blend Average. |

| | The indices and certain terms are defined on pages 23 to 25. |

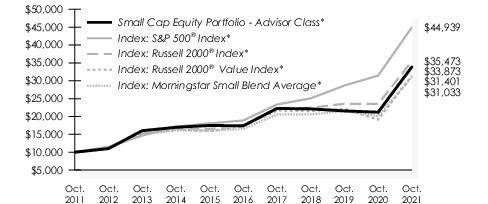

Small Cap Equity Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2021

| Average Annual Total Return | |

| Small Cap Equity Portfolio – Advisor Class | | | | Russell 2000®

Index | | Russell 2000®

Value Index | | S&P 500®

Index | | Morningstar

Small

Blend Average | |

| Year ended 10/31/21 | | 59.75% | | 50.80% | | 64.30% | | 42.91% | | 54.25% | |

| Five Years ended 10/31/21 | | 14.23% | | 15.52% | | 12.61% | | 18.93% | | 13.33% | |

| Ten Years ended 10/31/21 | | 12.98% | | 13.50% | | 12.12% | | 16.21% | | 11.93% | |

| Inception (03/01/91) through 10/31/211 | | 10.97% | | 10.58% | | 11.44% | | 10.83% | | 10.52% | |

| Small Cap Equity Portfolio – Institutional Class | | | | | | | | | | | |

| Year ended 10/31/21 | | 60.04% | | 50.80% | | 64.30% | | 42.91% | | 54.25% | |

| Five Years ended 10/31/21 | | 14.47% | | 15.52% | | 12.61% | | 18.93% | | 13.33% | |

| Ten Years ended 10/31/21 | | 13.20% | | 13.50% | | 12.12% | | 16.21% | | 11.93% | |

| Inception (01/02/98) through 10/31/212 | | 9.05% | | 8.62% | | 8.78% | | 8.77% | | 8.80% | |

For the fiscal year ended October 31, 2021, the Small Cap Equity Portfolio Advisor Class returned 59.75% and the Institutional Class returned 60.04%, compared to the Russell 2000® Index return of 50.80% and the Morningstar Small Blend Average return of 54.25%. The healthcare sector accounted for the largest share of the outperformance, followed by the financials and communication services sectors. The consumer discretionary sector was the worst performing sector on a relative basis. The Portfolio’s gross annual operating expense ratios, as stated in the February 28, 2021 Prospectuses are 0.94% and 0.74% for the Advisor and Institutional Class shares, respectively. These ratios can fluctuate and may differ from the expense ratios disclosed in the Financial Highlights section of this report.

Hypothetical Illustration of $10,000 Invested in

Small Cap Equity Portfolio-Advisor Class vs.

S&P 500® Index,

Russell 2000® Index,

Russell 2000® Value Index and

Morningstar Small Blend Average

10/31/11 through 10/31/21

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns shown do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Performance shown of the Institutional Class will vary from the Advisor Class due to differences in fees.

| | 1 Returns are for the period beginning April 1, 1991 for Morningstar Small Blend Average. |

| | 2 Returns are for the period beginning February 1, 1998 for Morningstar Small Blend Average. |

| | The indices and certain terms are defined on pages 23 to 25. |

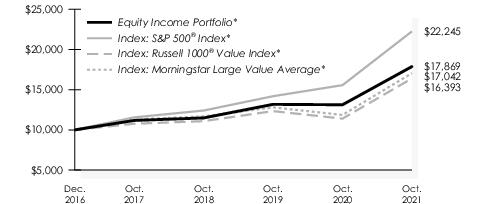

Equity Income Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2021

| Average Annual Total Return | |

| Equity Income Portfolio | | | | S&P 500®

Index | | Russell 1000®

Value Index | Morningstar

Large Value

Average | |

| Year ended 10/31/21 | | 36.12% | | 42.91% | | 43.76% | 43.70% | |

| Inception (12/21/16) through 10/31/211 | | 12.68% | | 17.88% | | 10.70% | 11.07% | |

For the fiscal year ended October 31, 2021, the Equity Income Portfolio returned 36.12% versus 42.91% for the S&P 500® Index and 43.76% for the Russell 1000® Value Index (the “Value Index”). The Portfolio’s underperformance versus the Value Index was concentrated in the first half of the year as the market recovery allowed more cyclical companies to recapture more of their prior year underperformance. As performance versus the Value Index improved in the second half of the year, relative performance versus the S&P 500® Index lagged given that benchmark being more driven by lower yielding, higher valuation stocks that the Portfolio avoids. The Portfolio seeks to drive attractive total returns over time from a combination of current and future dividends along with price appreciation in its holdings. The Portfolio’s gross annual operating expense ratio, as stated in the February 28, 2021 Prospectus, is 1.04%. This ratio can fluctuate and may differ from the expense ratio disclosed in the Financial Highlights section of this report.

Hypothetical Illustration of $10,000 Invested in

Equity Income Portfolio vs.

S&P 500® Index,

Russell 1000® Value Index and

Morningstar Large Value Average

12/21/16 through 10/31/21

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance quoted reflects fee waivers and/or expense reimbursements in effect and would have been lower in their absence. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns shown do not reflect taxes that a shareholder may pay on fund distributions or redemption of fund shares.

| | 1 Returns are for the period beginning January 1, 2017 for Morningstar Large Value Average. |

| | The indices and certain terms are defined on pages 23 to 25. |

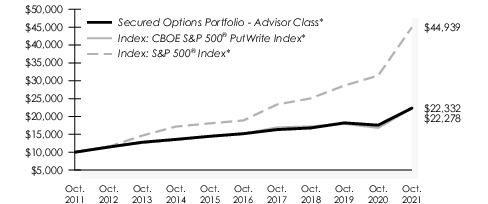

Secured Options Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2021

| Average Annual Total Return | | | | | | | |

| Secured Options Portfolio – Advisor Class | | | | CBOE S&P 500®

PutWrite

Index | | S&P 500®

Index | |

| Year ended 10/31/21 | | 27.08% | | 32.34% | | 42.91% | |

| Five Years ended 10/31/21 | | 8.01% | | 8.04% | | 18.93% | |

| Ten year ended 10/31/21 | | 8.37% | | 8.34% | | 16.21% | |

| Inception (06/30/10) through 10/31/21 | | 9.43% | | 8.99% | | 16.43% | |

| Secured Options Portfolio – Institutional Class | | | | | | | |

| Year ended 10/31/21 | | 27.36% | | 32.34% | | 42.91% | |

| Inception (11/09/16) through 10/31/21 | | 7.99% | | 7.80% | | 18.59% | |

For the fiscal year ended October 31, 2021, the Secured Options Portfolio invested in cash-secured put options on the S&P 500® Index in an effort to reduce equity volatility, obtain option premiums and provide more stable returns. For this period, the Portfolio’s Advisor Class experienced a total return of 27.08% while its benchmark, the CBOE S&P 500® PutWrite Index, had a return of 32.34%. The Portfolio’s underperformance was driven primarily by the Portfolio’s active strike selection process, which seeks to identify the more advantageously priced options that expire in less than 3-months. The more defensive and wider strike selection under-performed this year as the S&P 500® Index saw five months of mean price reversion between expirations. These conditions created a more favorable environment for tighter strike selection and an outlier to what the market typically experiences over an average of two months. The Portfolio’s use of cash-secured puts, which outperformed covered calls added to performance. Generally speaking, cash or cash-like instruments are pledged to fully collateralize cash-secured written put options. In lieu of cash secured put options, the Portfolio may also pledge long equities to fully collateralize covered call options. The Portfolio’s gross annual operating expense ratios, as stated in the February 28, 2021 Prospectuses, are 0.88% and 0.68% for the Advisor and Institutional Classes, respectively. These ratios can fluctuate and may differ from the expense ratios disclosed in the Financial Highlights section, of this report.

Hypothetical Illustration of $10,000 Invested in

Secured Options Portfolio - Advisor Class vs.

CBOE S&P 500® PutWrite Index

and S&P 500® Index

10/31/11 through 10/31/21

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns shown do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Performance shown of the Institutional Class will vary from the Advisor Class due to differences in fees.

| | The indices and certain terms are defined on pages 23 to 25. |

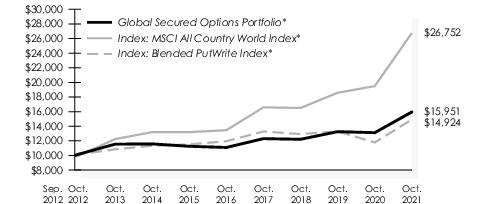

Global Secured Options Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2021

| Average Annual Total Return | |

| Global Secured Options Portfolio | | | | MSCI All

Country World

Index | Blended PutWrite

Index1 | |

| Year ended 10/31/21 | | 21.59% | | 37.28% | 26.65% | |

| Five Years ended 10/31/21 | | 7.53% | | 14.72% | 4.54% | |

| Inception (09/28/12) through 10/31/21 | | 5.27% | | 11.37% | 4.43% | |

For the fiscal year ended October 31, 2021, the Global Secured Options Portfolio invested in cash-secured put options on the S&P 500® Index, Russell 2000® Index, iShares MSCI EAFE ETF (EFA) and iShares MSCI Emerging Market ETF (EEM) in an effort to reduce equity volatility, obtain option premiums and provide more stable returns. For this period, the Portfolio had a total return of 21.59% while its benchmark, the MSCI All Country World (ACWI) Index, returned 37.28% and our Blended CBOE® PutWrite Index (“Blended PutWrite Index”) returned 26.65%. Our Blended PutWrite Index is comprised of 40% CBOE S&P 500® PutWrite T-W (PWT) Index, 10% CBOE Russell 2000® PutWrite (PUTR) Index, 40% CBOE MSCI EAFE PutWrite (PXEA) Index and 10% CBOE MSCI Emerging Markets PutWrite (PXEF) Index. The Portfolio’s underperformance relative to the Blended PutWrite Index was driven primarily by the Portfolio’s option selection process that seeks to identify the most advantageously priced put options that expire in less than 3-months. The more defensive and wider strike selection under-performed this year, primarily driven by the upside performance in the CBOE Russell 2000® PutWrite (PUTR) Index and CBOE MSCI EAFE PutWrite (PXEA) Index. Additionally, the mean reversion experienced in the S&P 500® Index, which is a more favorable environment for tighter strike selection and an outlier to what the market typically experiences, also contributed to the underperformance. The Portfolio’s underperformance relative to the MSCI All Country World Index was primarily driven by our lower exposure to equities during the global equity rally. Generally speaking, cash or cash-like instruments are pledged to fully collateralize cash-secured written put options. In lieu of cash secured put options, the Portfolio may also pledge long equities to fully collateralize covered call options. The Portfolio’s gross annual operating expense ratio, as stated in the February 28, 2021 Prospectus, is 2.16%. This ratio can fluctuate and may differ from the expense ratio disclosed in the Financial Highlights section of this report.

Hypothetical Illustration of $10,000 Invested in

Global Secured Options Portfolio vs.

MSCI All Country World Index

and Blended PutWrite Index

09/28/12 through 10/31/21

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance quoted above reflects expense reimbursements in effect during certain periods and would have been lower in their absence. The total return was affected by a deficiency dividend paid during the period. If the deficiency dividend was not paid total return would have been lower. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns shown do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares.

| | 1 The Portfolio has added a secondary options blended benchmark because the Investment Advisor believes that, given the Portfolio’s investment strategy, having a blended CBOE PutWrite Index for comparative purposes provides appropriate context when assessing the Portfolio’s performance. |

| | The indices and certain terms are defined on pages 23 to 25. |

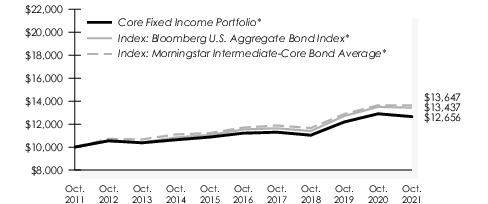

Core Fixed Income Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2021

| Average Annual Total Return | |

| Core Fixed Income Portfolio | | | | Bloomberg U.S. Aggregate

Bond Index | Morningstar

Intermediate - Core

Bond Average | |

| Year ended 10/31/21 | | -1.91% | | -0.48% | 0.00% | |

| Five Years ended 10/31/21 | | 2.44% | | 3.10% | 3.04% | |

| Ten Years ended 10/31/21 | | 2.38% | | 3.00% | 3.11% | |

| Inception (11/17/88) through 10/31/211 | | 5.50% | | 5.99% | 5.42% | |

The Core Fixed Income Portfolio returned -1.91% for the year ended October 31, 2021. The benchmark, the Bloomberg U. S. Aggregate Bond Index, returned -0.48% for the year and the Portfolio’s peer group, the Morningstar Intermediate – Core Bond Average, returned 0.00% for the year. The Portfolio’s underperformance versus the Bloomberg U.S. Aggregate Bond Index can be attributed to the Portfolio’s bias towards higher credit quality, and less corporate exposure to the long end of the curve. The Portfolio’s long corporate bonds returned 4.55% for the year versus the Portfolio’s intermediate corporate bonds, which returned 0.71%. The Index also holds over 14% of the lower tier BBB sector which returned 3.53% for the year, while the Portfolio holds none. The Portfolio’s performance versus its peer group can also be attributed to the Portfolio’s high credit quality bias, yield curve positioning, and low risk themes.

The Portfolio seeks to add value by monitoring yield curve exposure while utilizing sector and security selection. Diversification, liquidity, and low risk themes dominate the Portfolio’s investment discipline. The Portfolio’s gross annual operating expense ratio, as stated in the February 28, 2021 prospectus, is 0.54%. This ratio can fluctuate and may differ from the expense ratio disclosed in the Financial Highlights section of this report.

Hypothetical Illustration of $10,000 Invested in

Core Fixed Income Portfolio vs.

Bloomberg U.S. Aggregate Bond Index and

Morningstar Intermediate-Core Bond Average

10/31/11 through 10/31/21

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns shown do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares.

| | 1 Returns are for the period beginning December 1, 1988 for Morningstar Intermediate - Core Bond Average. |

| | The indices and certain terms are defined on pages 23 to 25. |

Short Term Tax Aware Fixed Income Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2021

| Average Annual Total Return |

| | | | | Return After Taxes on | | | | |

| Short Term Tax Aware Fixed Income Portfolio | | Return

Before

Taxes | | Distributions | | Distributions

and Sales of

Fund Shares | | BofA Merrill

Lynch 1-3 Year U.S.

Municipal Securities

Index | | Morningstar

Short-Term Bond

Average |

| Year ended 10/31/21 | | 0.15% | | -0.09% | | 0.20% | | 0.60% | | 1.25% |

| Five Years Ended 10/31/21 | | 1.16% | | 1.03% | | 0.98% | | 1.51% | | 2.11% |

| Inception (06/29/16) through 10/31/211 | | 1.08% | | 0.95% | | 0.91% | | 1.38% | | 2.06% |

For the fiscal year ended October 31, 2021, the Short Term Tax Aware Fixed Income Portfolio returned 0.15%. Its benchmark, the BofA Merrill Lynch 1-3 year U.S. Municipal Securities Index returned 0.60% and the Portfolio’s peer group, the Morningstar Short-Term Bond Average, returned 1.25%. The Portfolio benefitted from both duration positioning and ratings distribution, but felt some performance drag from sector/security selection. The tactical exposure to taxable securities, both corporate and municipal, was a positive contributor to relative performance. This tactical exposure was relatively steady through the period, ending the fiscal year at 23% as taxable municipal relative value remained attractive.

The Portfolio seeks to add value through active credit-quality and taxable exposure, as well as sector and security selection. Diversification, liquidity, and measured risk taking are the focus of the Portfolio’s investment discipline. The Portfolio’s gross annual operating expense ratio, as stated in the February 28, 2021 prospectus, is 0.54%. This rate can fluctuate and may differ from the expense ratio disclosed in the Financial Highlights in this report.

Hypothetical Illustration of $10,000 Invested in

Short Term Tax Aware Fixed Income Portfolio vs.

BofA Merrill Lynch 1-3 Year U.S. Municipal Securities Index and

Morningstar Short-Term Bond Average

06/29/16 through 10/31/21

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance quoted reflects fee waivers and/or expense reimbursements in effect and would have been lower in their absence. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns, other than after-tax returns, do not reflect taxes that the shareholder may pay on fund distributions or the redemption of fund shares. After-tax returns are calculated using the historical highest individual federal marginal income tax rates, do not reflect the impact of state and local taxes and are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or IRAs. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown.

| | 1 Returns are for the period beginning July 1, 2016 for Morningstar Short-Term Bond Average. |

| | The indices and certain terms are defined on pages 23 to 25. |

High Yield Municipal Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2021

| Average Annual Total Return | |

| High Yield Municipal Portfolio | | | | Bloomberg

Muni High Yield 5%

Tobacco Cap 2%

Issuer Cap Index | | Bloomberg

Muni BBB

Index | | Bloomberg

Municipal Bond

Index | Morningstar

High Yield

Muni

Average | |

| Year ended 10/31/21 | | 6.68% | | 10.55% | | 7.40% | | 2.64% | 8.09% | |

| Five Years ended 10/31/21 | | 4.26% | | 5.57% | | 5.01% | | 3.41% | 4.34% | |

| Inception (12/22/15) through 10/31/211 | | 4.59% | | 5.93% | | 4.93% | | 3.43% | 4.58% | |

The High Yield Municipal Portfolio (the “Portfolio”) trailed the Bloomberg Municipal High Yield 5% Tobacco Cap, 2% Issuer Cap Index, for the trailing 12 months through October 31, 2021. The Portfolio returned 6.68% while the Bloomberg Muni High Yield 5% Tobacco Cap 2% Issuer Cap Index returned 10.55%. With municipal rates moving higher over the year, the Portfolio’s shorter duration position contributed 0.31% to relative return. The sector and security selection were both negative contributors to the Portfolio’s relative return. The Portfolio maintained a bias to higher credit quality with spread valuations at expensive levels in anticipation of increased market volatility. Concerns about inflation and rising interest rates impacted the municipal markets, causing valuations to become more expensive until September 2021. As markets started to weaken the Portfolio started to selectively add risk at more attractive valuations. The Portfolio’s gross annual operating expense ratio, as stated in the February 28, 2021 prospectus, is 1.02%. This ratio can fluctuate and may differ from the expense ratio disclosed in the Financial Highlights section of this report.

Hypothetical Illustration of $10,000 Invested in

High Yield Municipal Portfolio vs.

Bloomberg Muni High Yield 5% Tobacco Cap 2% Issuer Cap Index,

Bloomberg Muni BBB Index,

Bloomberg Municipal Bond Index and

Morningstar High Yield Muni Average

12/22/15 through 10/31/21

| * | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance quoted reflects fee waivers and/or expense reimbursements in effect during certain periods and would have been lower in their absence. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns shown do not reflect taxes that a shareholder may pay on fund distributions or redemption of fund shares.

| | 1 Returns are for the period beginning January 1, 2016 for Morningstar High Yield Muni Average. |

| | The indices and certain terms are defined on pages 23 to 25. |

Muni Intermediate Portfolio

PORTFOLIO HIGHLIGHTS

October 31, 2021

| Average Annual Total Return | |

| Muni Intermediate Portfolio | | | | Bloomberg Municipal

1-10 Year

Blend Index | Morningstar

Muni National

Intermediate Average | |

| Year ended 10/31/21 | | 0.60% | | 1.28% | 3.07% | |

| Five Years ended 10/31/21 | | 2.32% | | 2.57% | 2.85% | |

| Ten Years ended 10/31/21 | | 2.27% | | 2.74% | 3.11% | |

| Inception (06/05/92) through 10/31/211 | | 3.83% | | 4.20% | 4.17% | |

For the fiscal year ended October 31, 2021, the Muni Intermediate Portfolio returned 0.60%. Its benchmark, the Bloomberg Municipal 1-10 Year Blend Index, returned 1.28% and the Portfolio’s peer group, the Morningstar Muni National Intermediate Average, returned 3.07% for the year. The Portfolio’s underperformance versus its benchmark was a function of the market’s insatiable demand for lower credit quality bonds in contrast to the Portfolio’s high credit quality mandate. The Portfolio was able to recover some of the performance drag through beneficial curve positioning and security selection.

The Portfolio seeks to add value through active yield curve and credit-quality exposure, as well as sector and security selection. Diversification, liquidity, and measured risk taking are the focus of the Portfolio’s investment discipline. The Portfolio’s gross annual operating expense ratio, as stated in the February 28, 2021 prospectus, is 0.25%. This rate can fluctuate and may differ from the expense ratio disclosed in the Financial Highlights in this report.

Hypothetical Illustration of $10,000 Invested in

Muni Intermediate Portfolio vs.

Bloomberg Municipal 1-10 Year Blend Index and

Morningstar Muni National Intermediate Average

10/31/11 through 10/31/21

| * | Index commenced 6/30/93. Thus Portfolio inception comparisons are not provided. |

| ** | Assumes the reinvestment of all dividends and distributions. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the total return shown. Please call the Fund at 1-800-442-8299 to obtain the most recent month-end returns. Returns shown do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares.

| | 1 Returns are for the periods beginning July 1, 1992 for Bloomberg Municipal 1-10 Year Blend Index and July 1, 1992 for Morningstar Muni National Intermediate Average. |

| | The indices and certain terms are defined on pages 23 to 25. |

THE GLENMEDE FUND, INC.