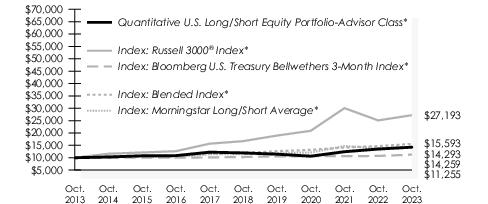

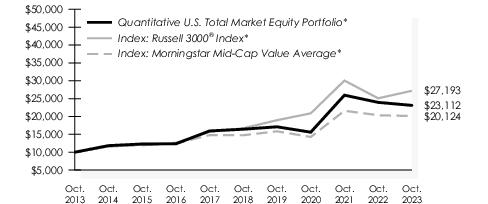

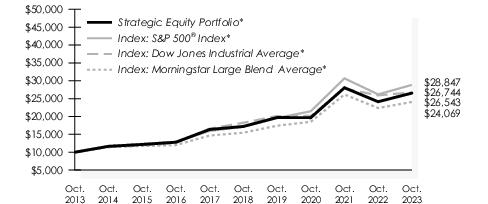

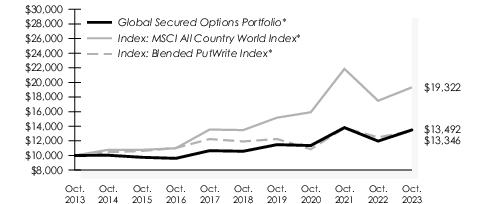

Indices — It is not possible to invest directly in an index.

The Blended Index is comprised of two benchmarks, weighted 70% Bloomberg U.S. Treasury Bellwethers 3-Month Index and 30% Russell 3000® Index.

The HY Municipal Blended Index is comprised of two benchmarks, weighted 75% Bloomberg Muni High Yield 5% Tobacco Cap 2% Issuer Cap Index and 25% Bloomberg Municipal Bond Index.

The Bloomberg U.S. Treasury Bellwethers 3-Month Index is a market value-weighted index of investment-grade fixed-rate public obligations of the U.S. Treasury with maturities of 3 months, excluding zero coupon strips.

The Bloomberg Municipal 1-10 Year Blend Index is a composite index made up of several different broad sub-indices: the Bloomberg Municipal 1-Year Index; the Bloomberg Municipal 3-Year Index; the Bloomberg Municipal 5-Year Index; the Bloomberg Municipal 7-Year Index and the Bloomberg Municipal 10-Year Index. The total of all these indices represents all maturities between 1-10 Years.

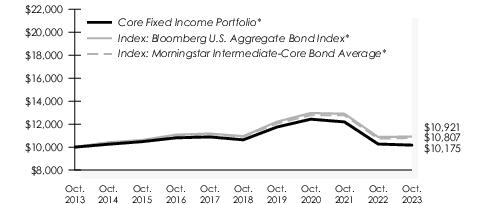

The Bloomberg U.S. Aggregate Bond Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. These major sectors are subdivided into more specific indices that are calculated and reported on a regular basis. Indexes are rebalanced by market capitalization each month.

The Bloomberg Muni High Yield 5% Tobacco Cap 2% Issuer Cap Index is an issuer constrained sub-index of the Bloomberg U.S. Municipal High Yield Index that caps issuer exposure to 2% and tobacco stocks to 5%.

The Bloomberg Municipal Bond Index is an unmanaged index of municipal bonds with maturities greater than two years.

The Bloomberg High Yield Index measures the USD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s Investor Services, Inc. ("Moody’s"), Fitch Ratings, Inc., and S&P Global Ratings ("S&P) is Ba1/BB+/BB+ or below. Bonds from issuers with an emerging markets country of risk, based on the indices’ EM country definition, are excluded.

The ICE BofAML 1-3 Year U.S. Municipal Securities Index is a subset of the ICE BofAML U.S. Municipal Securities Index including all securities with a remaining term to final maturity less than 3 years.

The CBOE S&P 500® PutWrite Index is a benchmark index that measures the performance of a hypothetical portfolio that sells S&P 500® Index (SPX) put options against collateralized cash reserves held in a money market account.

The MSCI All Country World Index is a market capitalization weighted index designed to provide a broad measure of equity-market performance throughout the world. The MSCI All Country World Index is comprised of stocks from both developed and emerging markets.

The MSCI World ex-USA Index captures large and mid cap representation across 22 of 23 Developed Markets countries--excluding the United States. With 982 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

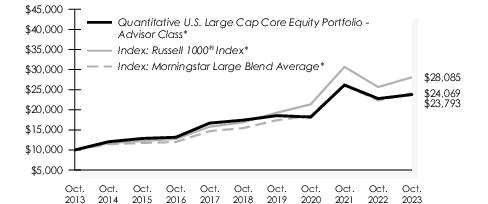

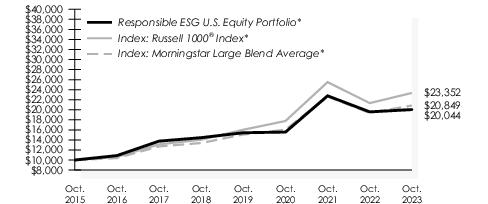

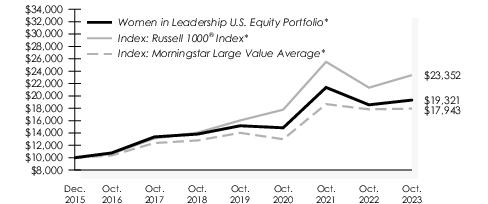

The Russell 1000® Index is an unmanaged market capitalization weighted total return index which is comprised of the 1,000 largest companies in the Russell 3000® Index.

The Russell 1000® Growth Index is an unmanaged capitalization weighted total return index which is comprised of securities in the Russell 1000® Index with greater than average growth orientation.

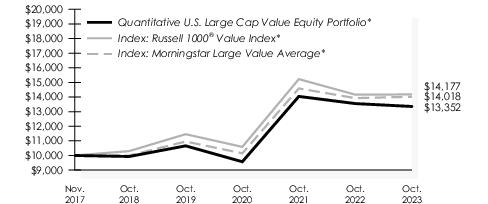

The Russell 1000® Value Index is an unmanaged capitalization weighted total return index which is comprised of those securities in the Russell 1000® Index with a less than average growth orientation.

The Russell 2000® Index is an unmanaged market capitalization weighted total return index which measures the performance of the 2,000 smallest companies in the Russell 3000® Index.

The Russell 2000® Value Index is an index measuring the performance of approximately 2,000 small-cap companies in the Russell 3000® Index, which is made up of 3,000 of the biggest U.S. stocks. The Russell 2000® Value Index serves as a benchmark for small-cap stocks in the United States.

The Russell 3000® Index is an unmanaged capitalization weighted total return index which is comprised of the 3,000 largest U.S. companies based on total market capitalization. The Index re-balances annually.

The S&P 500® Index is a market capitalization weighted index comprised of 500 widely held common stocks.

Morningstar Foreign Large Value Average funds invest mainly in a variety of big international stocks. Most of these funds divide their assets among a dozen or more developed markets, including Japan, Britain, France, and Germany. The blend style is assigned to funds where neither growth nor value characteristics predominate.