Exhibit 99.4

2007

British Columbia

Financial and Economic

Review

67th Edition

(July 2007)

Table of Contents

Introduction | 1 |

General Description of the Province | 2 |

Geography | 2 |

Physiography | 2 |

Climate and Vegetation | 3 |

Population | 3 |

| |

Chapter One — Economic Review | 5 |

2006 Overview | 6 |

External Environment | 6 |

United States Economy | 6 |

Canadian Economy | 7 |

International Economy | 7 |

Financial Markets | 8 |

British Columbia Economy | 9 |

Exports | 10 |

Population | 12 |

Labour and Income Developments | 13 |

Prices and Wages | 13 |

Consumer Expenditure and Housing | 14 |

Industrial Structure and Performance | 15 |

High Tech | 16 |

Tourism | 16 |

Conclusion | 17 |

| |

Charts | |

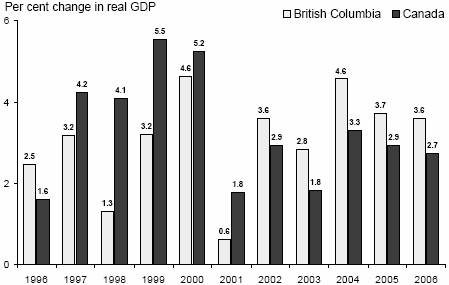

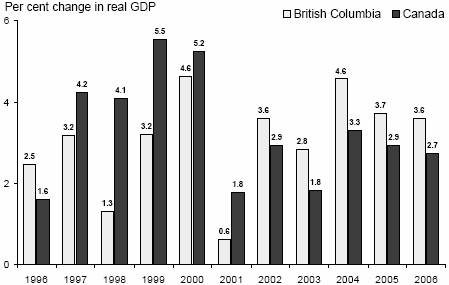

1.1 | Canada and British Columbia economic growth | 6 |

1.2 | External economic growth | 8 |

1.3 | Canadian dollar | 8 |

1.4 | British Columbia real GDP by component | 9 |

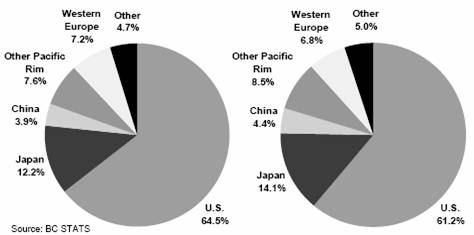

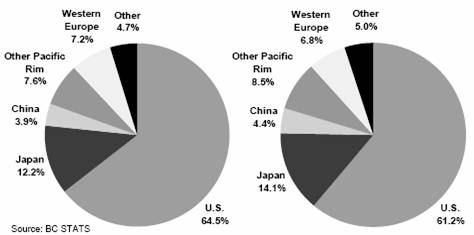

1.5 | Export shares by market | 10 |

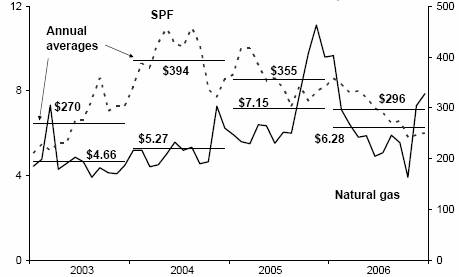

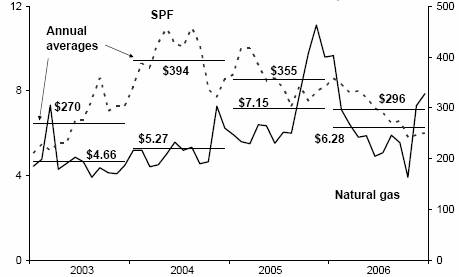

1.6 | Lumber and natural gas prices | 11 |

1.7 | British Columbia population by age and sex, 2006 | 12 |

1.8 | British Columbia Building permits by category | 14 |

1.9 | Service industries in British Columbia | 15 |

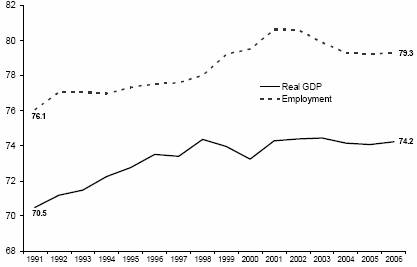

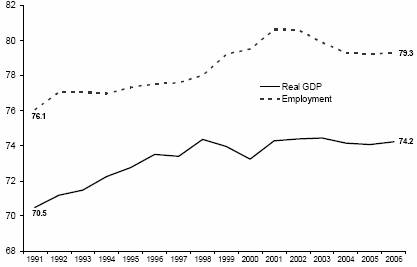

1.10 | Trends in high technology sector in British Columbia | 16 |

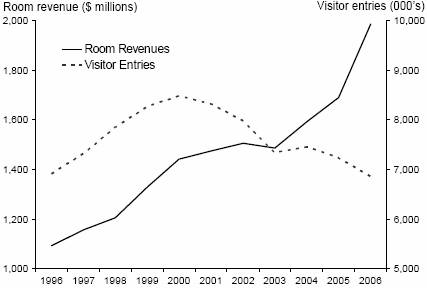

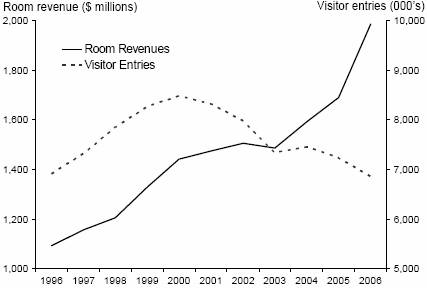

1.11 | Visitor entries to British Columbia | 17 |

1.12 | British Columbia Tourism industry | 17 |

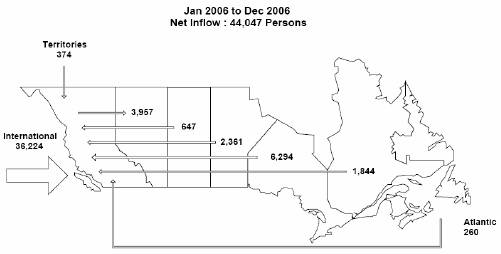

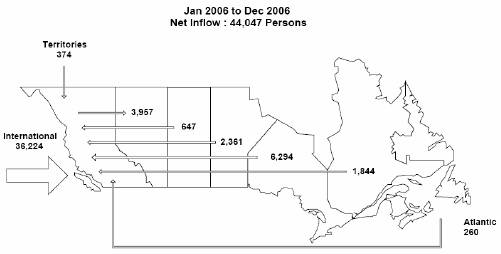

Map 1.1 Net interprovincial and international migration in BC, 2006 | 12 |

| |

Tables | |

1.1 | British Columbia Population and Labour Market Statistics | 13 |

1.2 | Price and Earnings Indices | 14 |

| | | |

2007 Financial and Economic Review — July 2007

ii

Appendix 1 — Economic Review | | 19 |

Tables | |

A1.1A | Aggregate and Labour Market Indicators | 20 |

A1.1B | Prices, Earnings and Financial Indicators | 21 |

A1.1C | Other Indicators | 22 |

A1.1D | Commodity Production Indicators | 23 |

A1.2 | British Columbia Real GDP at Market Prices, Expenditure Based | 24 |

A1.3 | British Columbia GDP at Basic Prices, by Industry | 25 |

A1.4 | British Columbia GDP, Income Based | 26 |

A1.5 | Employment by Industry in British Columbia | 27 |

A1.6 | Capital Investment by Industry | 28 |

A1.7 | British Columbia International Goods Exports by Major Market and Selected Commodities, 2006 | 29 |

A1.8 | British Columbia International Goods Exports by Market Area | 30 |

A1.9 | Historical Commodity Prices (in U.S. Dollars) | 31 |

A1.10 | British Columbia Forest Sector Economic Activity Indicators | 32 |

A1.11 | Historical Value of Mineral, Petroleum and Natural Gas Shipments | 33 |

A1.12 | Petroleum and Natural Gas Activity Indicators | 33 |

A1.13 | Supply and Consumption of Electrical Energy in British Columbia | 34 |

A1.14 | British Columbia High-Technology Sector Activity | 35 |

| | |

Chapter Two — Financial Review | 37 |

| |

2006/07 Overview | 38 |

| |

Revenue | 41 |

| |

Commercial Crown Corporations Net Income | 46 |

| |

Expense | 47 |

| |

Consolidated Revenue Fund Expense | 47 |

Other Expenses | 49 |

| |

Full-Time Equivalents (FTEs) | 50 |

| |

Provincial Capital Spending | 54 |

| |

Provincial Debt | 58 |

Taxpayer-supported Debt | 59 |

Self-supported Debt | 59 |

Surplus-Change in Debt Reconciliation | 60 |

| |

Statement of Financial Position | 61 |

| |

Credit Rating | 67 |

| |

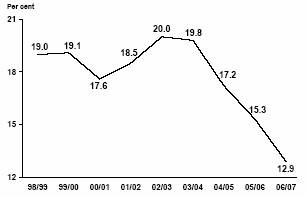

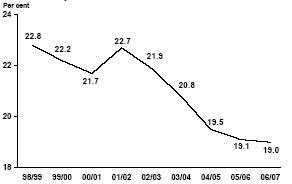

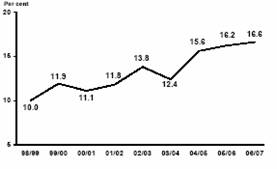

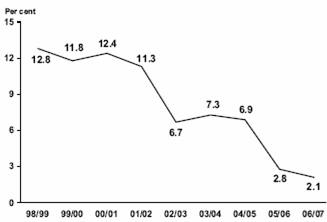

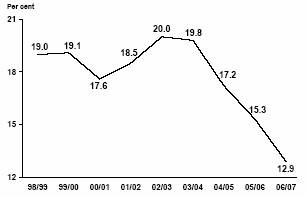

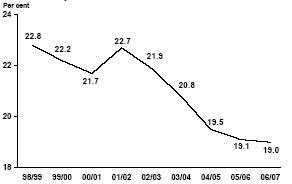

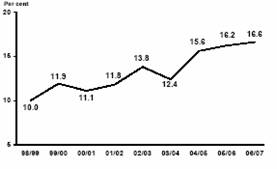

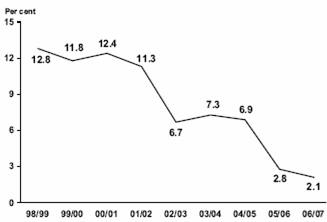

Debt Indicators | 68 |

| |

Topic Boxes | |

Expense by Function | 51 |

Review of the Province’s Financial Condition | 62 |

| |

Charts | |

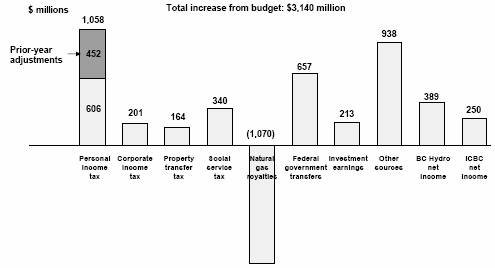

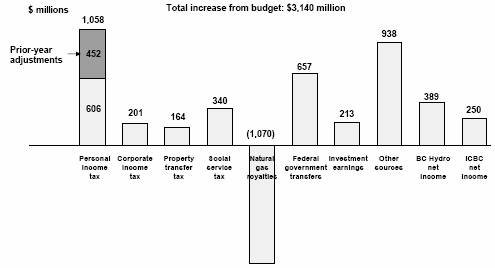

2.1 | 2006/07 Surplus – Major Changes from Budget 2006 | 39 |

2.2 | Revenue Changes from Budget 2006 | 41 |

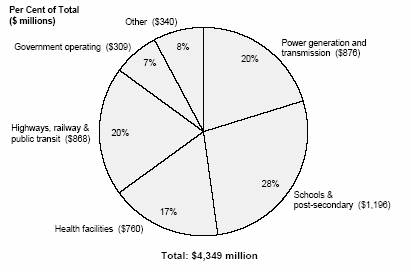

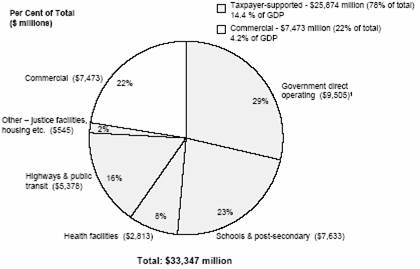

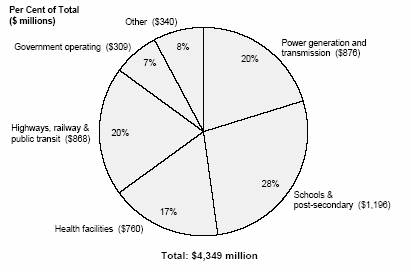

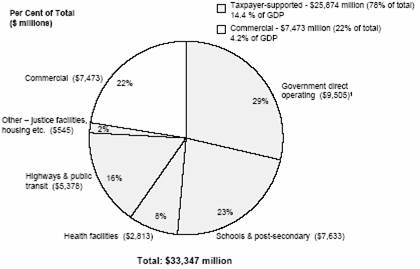

2.3 | Capital Spending, 2006/07 | 54 |

| | | | |

iii

2.4 | Provincial Debt Components | 58 |

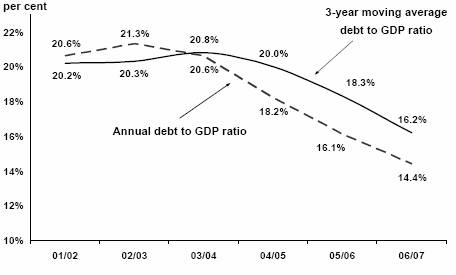

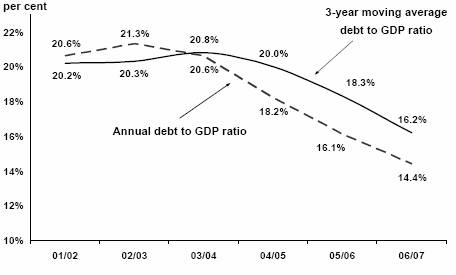

2.5 | Taxpayer-supported Debt to GDP Ratio | 59 |

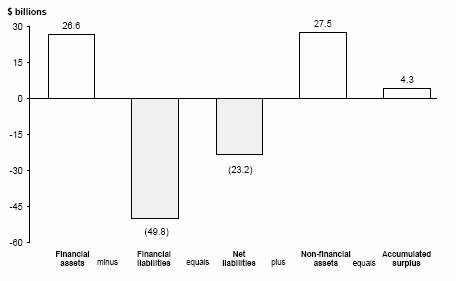

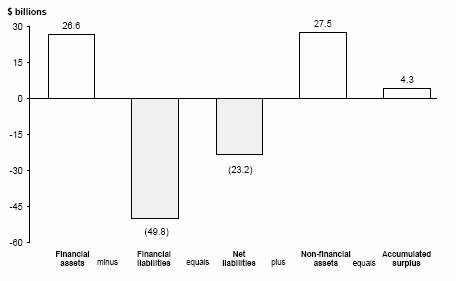

2.6 | Statement of Financial Position | 61 |

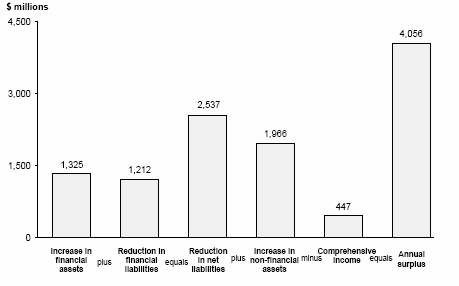

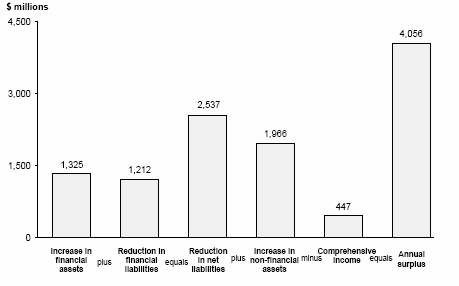

2.7 | 2006/07 Changes in Financial Position | 66 |

| | |

Tables | |

| |

2.1 | Operating Statement | 38 |

2.2 | Operating Statement – Changes from Budget 2006 | 40 |

2.3 | Revenue by Source | 42 |

2.4 | Expense by Ministry, Program and Agency | 43 |

2.5 | Major Factors Underlying Revenue | 44 |

2.6 | Restated Budget by Ministry, Program and Agency | 48 |

2.7 | Full-Time Equivalents (FTEs) Utilization | 50 |

2.8 | Capital Spending | 55 |

2.9 | Capital Spending – Changes from Budget 2006 | 56 |

2.10 | 2006/07 Capital Expenditure Projects Greater Than $50 Million | 57 |

2.11 | Provincial Debt Summary | 58 |

2.12 | Debt – Changes from Budget 2006 | 60 |

2.13 | Reconciliation of Summary Surplus to Debt Decrease – 2006/07 | 60 |

2.14 | Net Liabilities and Accumulated Surplus (Deficit) | 61 |

2.15 | Interprovincial Comparison of Credit Ratings, July 2007 | 67 |

2.16 | Key Debt Indicators – 2002/03 to 2006/07 | 68 |

| | |

Appendix 2 — Financial Review | 69 |

| |

Government’s Financial Statements | 70 |

Government Reporting Entity | 70 |

Compliance with GAAP | 70 |

Accounting Policy Updates | 71 |

| |

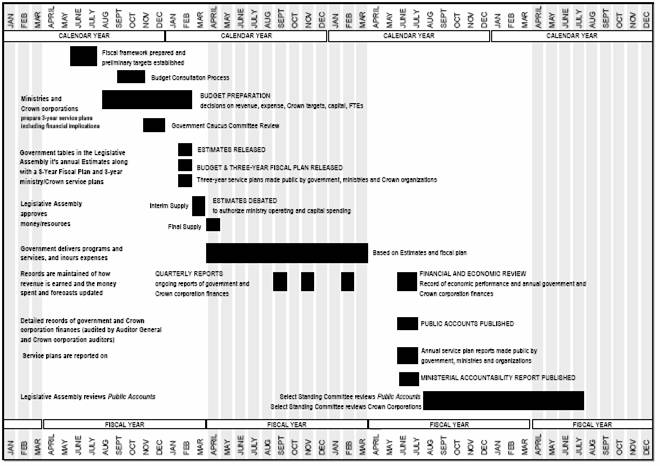

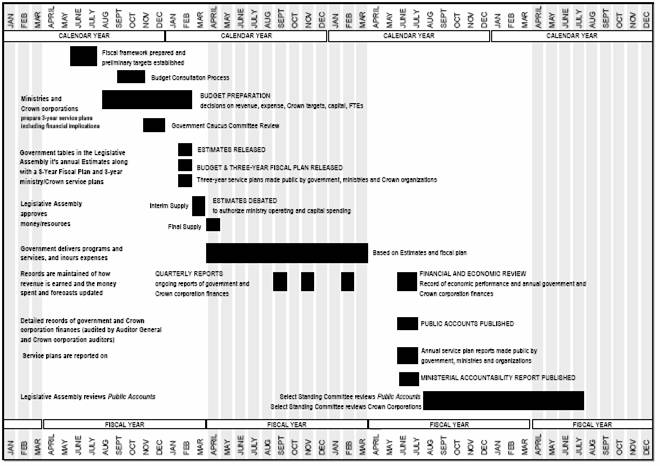

The Annual Financial Cycle | 71 |

| |

Unfunded Pension Liabilities | 73 |

| |

Adjustments to the Accumulated Deficit | 74 |

| |

Supplementary Schedules | 75 |

| |

Charts | | |

A2.1 | Financial Planning and Reporting Cycle Overview | 72 |

| | |

Tables | |

A2.1 | Pension Plan Balances | 74 |

A2.2 | Summary of Changes in Accumulated Deficit from the balances reported in the | |

| 2005/06 Public Accounts | 75 |

A2.3 | Operating Statement Update Since the Third Quarterly Report | 76 |

A2.4 | Operating Statement – 1998/99 to 2006/07 | 77 |

A2.5 | Statement of Financial Position – 1998/99 to 2006/07 | 78 |

A2.6 | Changes in Financial Position – 1998/99 to 2006/07 | 79 |

A2.7 | Revenue by Source – 1998/99 to 2006/07 | 80 |

A2.8 | Revenue by Source Supplementary Information – 1998/99 to 2006/07 | 81 |

A2.9 | Expense by Function – 1998/99 to 2006/07 | 82 |

A2.10 | Expense by Function Supplementary Information – 1998/99 to 2006/07 | 83 |

iv

A2.11 Service Delivery Agency Operating Results – 1998/99 to 2006/07 | 84 |

A2.12 Capital Spending – 1998/99 to 2006/07 | 87 |

A2.13 Provincial Debt – 1998/99 to 2006/07 | 88 |

A2.14 Provincial Debt Supplementary Information – 1998/99 to 2006/07 | 89 |

A2.15 Historical Operating Statement Surplus (Deficit) | 90 |

A2.16 Historical Provincial Debt Summary | 91 |

A2.17 Full-Time Equivalents (FTEs) – 1998/99 to 2006/07 | 92 |

A2.18 Provincial Taxes (as of June 2007) | 93 |

A2.19 Interprovincial Comparisons of Tax Rates – 2007 | 96 |

A2.20 Summary of Tax Changes Announced in 2007 | 97 |

| |

Chapter Three — Commercial Crown Corporations Review | 99 |

| |

Introduction | 100 |

| |

BC Hydro and Power Authority | 100 |

| |

BC Liquor Distribution Branch | 102 |

| |

BC Lottery Corporation | 104 |

| |

BC Railway Company | 105 |

| |

Insurance Corporation of BC | 107 |

| |

BC Transmission Corporation | 109 |

| |

Columbia Power Corporation | 110 |

| |

Provincial Capital Commission | 112 |

| |

Charts | |

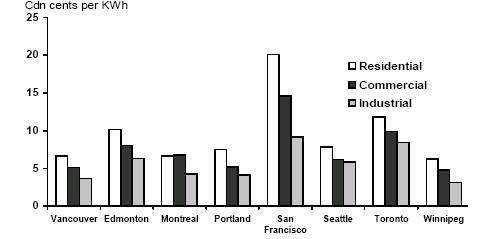

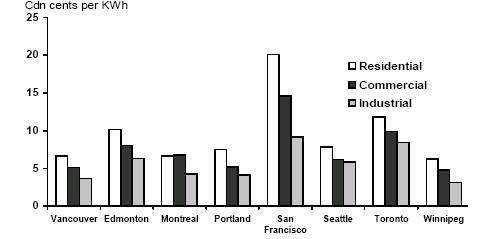

3.1 | Electricity Price Competitiveness | 102 |

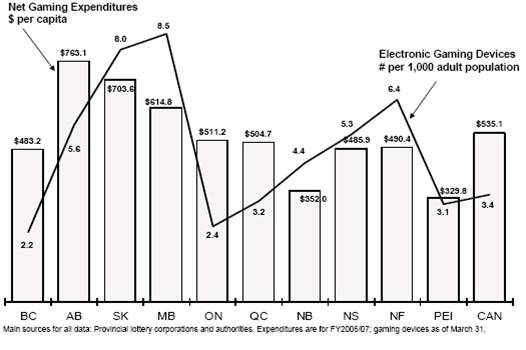

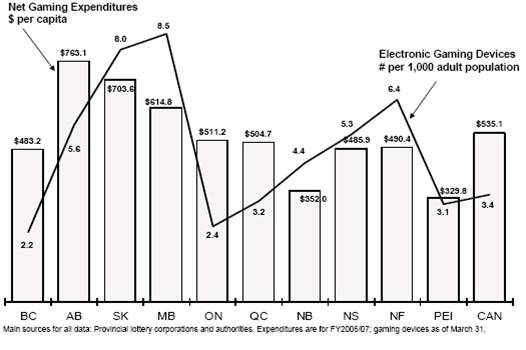

3.2 | Interprovincial Gaming Comparisons | 105 |

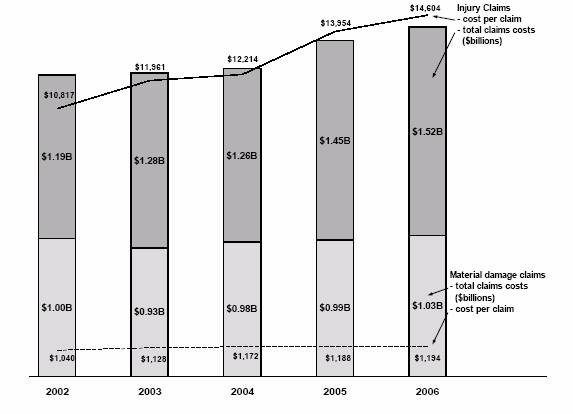

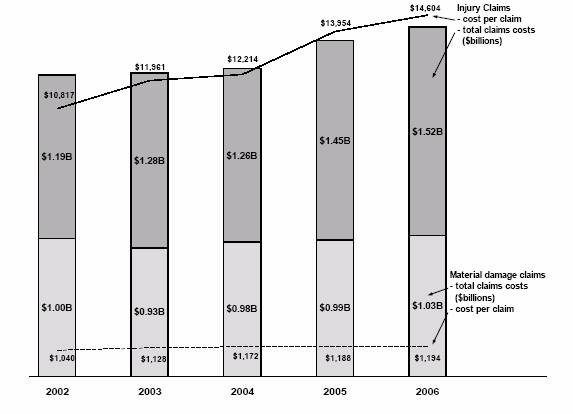

3.3 | ICBC Claims | 108 |

| |

Tables | |

3.1 | British Columbia Hydro and Power Authority Five-Year Income Statement | 101 |

3.2 | Liquor Distribution Branch Five-Year Income Statement | 103 |

3.3 | British Columbia Lottery Corporation Five-Year Income Statement | 104 |

3.4 | British Columbia Railway Company Five-Year Income Statement | 106 |

3.5 | Insurance Corporation of British Columbia Five-Year Income Statement | 107 |

3.6 | British Columbia Transmission Corporation Five-Year Income Statement | 109 |

3.7 | Columbia Power Corporation Five-Year Income Statement | 111 |

3.8 | Provincial Capital Commission Five-Year Income Statement | 112 |

| |

Appendix 3 — Constitutional Framework | 113 |

| |

Constitutional Framework | 114 |

| |

Provincial Government | 114 |

Legislature | 114 |

Executive | 115 |

Judiciary | 115 |

Provincial Government Jurisdiction | 116 |

v

Introduction

General Description of the Province

British Columbia is located on Canada’s Pacific coast, and has a land and freshwater area of 95 million hectares. It is Canada’s third largest province and comprises 9.5 per cent of the country’s total land area.

Geography

The province is nearly four times the size of Great Britain, 2.5 times larger than Japan and larger than any American state except Alaska. BC’s 7,022-kilometre coastline supports a large shipping industry through ice-free, deep-water ports. The province has about 8.5 million hectares of grazing land, 1.8 million hectares of lakes and rivers, and 950,000 hectares of agricultural land that is capable of supporting a wide range of crops.

Physiography

BC is characterized by mountainous topography, but also has substantial areas of lowland and plateau country. The province has four basic regions, a northwesterly trending mountain system on the coast, a similar mountain system on the east, and an extensive area of plateau country between the two. The northeastern corner of the province is lowland, a segment of the continent’s Great Plains.

The western system of mountains averages about 300 kilometres in width and extends along the entire BC coast and the Alaska panhandle. The Coast Mountains contain some of the tallest peaks in the province. The western system includes the Insular Mountains that form the basis of Vancouver Island and the Queen Charlotte Islands. These islands help to shelter the waters off the mainland coast of BC, which form an important transportation route for people and products.

The interior of the province is a plateau of rolling forest and grassland, 600 to 1,200 metres in average elevation. North of Prince George the interior becomes mountainous, but plateau terrain returns just south of the Yukon boundary in the area drained by the Liard River. The southern interior’s water system is dominated by the Fraser River, which has a drainage area covering about one-quarter of the province. The Rocky Mountains, in the eastern mountain system, rise abruptly on the southern BC–Alberta boundary and are cut by passes that provide dramatic overland transportation routes into the province. The Rocky Mountain Trench lies immediately to the west of the Rockies. This extensive valley, the longest in North America, is a geological fault zone separating different earth plates. It is the source of many of BC’s major rivers, including the Peace, Columbia and Fraser.

2

Introduction

Climate and Vegetation

Coastal BC has abundant rainfall and mild temperatures associated with a maritime climate. The Pacific coast has an average annual rainfall of between 155 and 440 centimetres, while the more sheltered coasts of eastern Vancouver Island and the mainland along the Strait of Georgia average between 65 and 150 centimetres. Canada’s longest frost-free periods of over 180 days per year are enjoyed along the edges of the coastal zone and far inland along the Fraser River valley. Temperatures fall quickly up the steep slopes of the Coast Mountains. The predominant trees in this coastal region are the western hemlock, western red cedar and balsam (amabilis fir) in the wetter parts, and Douglas fir and grand fir in the drier areas.

BC’s interior region has a mainly continental type of climate, although not as severe as that of the Canadian prairies. Considerable variation in climate occurs, especially in winter, as mild Pacific storms bring relief from cold spells. The southern interior has the driest and warmest climate of the province. In the valleys, annual precipitation ranges from less than 30 centimetres to 50 centimetres, while daily temperatures can average over 20 degrees Celsius in July and just under freezing in January. The climate becomes more extreme further north and precipitation increases. The frost-free period in the north is short and variable. Lodgepole pine is the dominant tree of commercial value in the interior.

The northeast region of the province is an extension of the western prairie region of Alberta. It has a continental climate that is more extreme than that of the northern interior region. However, it does have long hot summers and a frost-free period long enough to grow grain, forage and other crops.

Population

BC is the third largest Canadian province in terms of population, which was estimated at 4.3 million persons or about 13.2 per cent of Canadians on July 1, 2006. BC’s population grew at an average annual compound rate of 1.0 per cent between 1997 and 2006, in line with the 1.0 per cent average annual growth rate of the Canadian population as a whole.

Vancouver, a principal Canadian shipping, manufacturing and services centre, has the largest urban population in BC and was the third largest metropolitan area in Canada with a population of 2,180,737 persons in 2006. Victoria, the province’s capital, is located on Vancouver Island and its regional district had a population of 353,710 persons in 2006.

3

Chapter One

Economic Review(1)

(1) Reflects information available as of June 26, 2007.

Chapter 1 – Economic Review

2006 Overview

British Columbia’s economy expanded 3.6 per cent in 2006, slightly below the 3.7 per cent growth the province experienced in 2005. The domestic economy continued to drive overall GDP growth, while the high Canadian dollar hindered BC’s net exports. Investment and consumer expenditure led BC’s economic expansion through 2006.

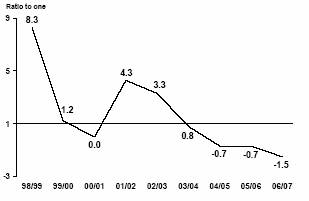

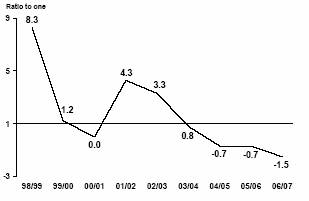

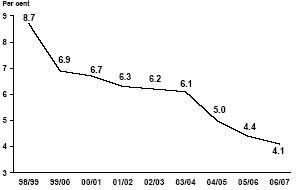

Chart 1.1 Canada and British Columbia economic growth

Source: Statistics Canada, April 2007 Provincial Economic Accounts

Healthy real consumer spending on goods and services took place in 2006, rising 5.3 per cent from the previous year. BC’s housing sector also continued its strong showing in 2006 despite a declining housing market in the US. The province’s employed population grew faster than its labour force in 2006, causing the annual unemployment rate to plunge to 4.8 per cent. This drop of 1.1 percentage points from 2005 to 2006 resulted in the lowest annual unemployment rate in 30 years.

External Environment

The global economy continued to grow at a fervent pace, with global real GDP increasing by 5.4 per cent in 2006. The US continued its healthy economic growth, posting an annual increase of 3.3 per cent. Developing Asian countries expanded at a rate of 9.4 per cent in 2006, with China’s economy surging ahead at a blistering growth rate of 10.7 per cent.

United States Economy

The US economy grew by 3.3 per cent in 2006, supported by continued increases in household spending and strong non-residential investment. This fairly robust growth comes in the face of a rapidly declining domestic housing market, in which housing starts dropped by 12.6 per cent for the year. However, the US labour market showed improvement as the unemployment rate fell 0.5 percentage points to 4.6 per cent, making 2006 the third consecutive year that this rate has declined.

6

Its growing trade deficit continued to weigh down the United States’ current account balance in 2006. The current account deficit reached $811 billion for the year, as imports of goods and services expanded at a faster rate than exports. The growing current account and budget deficits combined with a rapidly softening housing market put further downward pressure on the US dollar throughout the year.

Canadian Economy

Statistics Canada recently rebased its national real GDP figures to a base year of 2002. The information that follows uses the recent rebased estimates, which differ from preliminary national GDP estimates that were released with the Provincial Economic Accounts in April 2007. Canada’s real GDP increased 2.8 per cent in 2006, a small drop from the 3.1 per cent growth seen in the previous year. Final domestic demand rose by 4.7 per cent, creeping up slightly from 4.5 per cent growth in 2005. Canadian economic growth in 2006 slowed significantly after the first quarter and hovered between 1.3 and 1.5 per cent annualized quarterly growth for the final three quarters of the year.

The current account surplus was $23.6 billion in 2006, or 1.6 per cent of nominal GDP, compared to 2.0 per cent of nominal GDP in 2005. Real exports rose just 0.7 per cent compared to 2.2 per cent in 2005 (likely due to the strong Canadian dollar), while real imports of goods and services increased by 5.0 per cent in 2006.

Nominal corporate profits rose 5.0 per cent during the year, after increasing by 11.9 per cent in 2005. Real business investment continued its strong performance in 2006, expanding 7.1 per cent, with large increases in machinery and equipment investment as well as non-residential investment.

Canada saw steady employment gains in 2006, as employment rose by 1.9 per cent on the year. This increase is higher than in 2005, when employment grew by 1.4 per cent. The construction, forestry, and finance, insurance and real estate sectors saw significant growth in 2006, while the number of manufacturing jobs declined by 4.1 per cent.

Although the number of new housing starts in Canada increased by only 0.8 per cent over the previous year’s level, these still remained at historically high levels. Canadian retail sales increased by 6.4 per cent in 2006, with large gains made in furniture, home electronics and home improvement stores.

International Economy

Japanese economic growth improved in 2006 as real GDP increased by 2.2 per cent, up from 1.9 per cent in the previous year.

The European economy improved as well, growing by 2.8 per cent in 2006, up substantially from the 1.6 per cent increase observed in 2005. Strong GDP growth in the German and French economies contributed to this overall improvement in 2006.

7

The International Monetary Fund estimates that world growth in real GDP improved to 5.4 per cent in 2006 from 4.9 per cent in 2005. Rapidly expanding Asian economies are keeping world economic growth at a high rate. China’s economy grew by an astounding 10.7 per cent in 2006, after expanding by 10.4 per cent in 2005. GDP growth in India reached 9.2 per cent in 2006, and the Commonwealth of Independent States(2) expanded by 7.7 per cent.

Chart 1.2 External economic growth

Per cent change in real GDP

Source: International Monetary Fund

Financial Markets

The Bank of Canada’s overnight target rate rose steadily throughout the first half of 2006, beginning at 3.25 per cent and reaching 4.25 per cent for both the third and fourth quarters. The US federal funds target rate followed a similar pattern for 2006, starting at 4.25 per cent and reaching 5.25 per cent for the latter half of the year.

Chart 1.3 Canadian dollar

US cents/Canadian $

Source: Bank of Canada

(2) The Commonwealth of Independent States includes Azerbaijan, Armenia, Belarus, Georgia, Kazakhstan, Kyrgyzstan, Moldova, Russia, Tajikistan, Turkmenistan, Uzbekistan and Ukraine.

8

The value of the Canadian dollar climbed steadily against the US dollar during the first half of 2006. The loonie averaged 88.2 cents US for the year, up 5.6 cents US from 2005. The Canadian dollar noon-rate peaked at 91.0 cents US on June 12, 2006, but declined to 85.8 cents by year end.

British Columbia Economy(3)

British Columbia’s economy grew 3.6 per cent in 2006, slightly slower than last year’s 3.7 per cent increase. BC’s strong performance in 2006 was fuelled mainly by continued improvement in domestic economic activity.

Chart 1.4 British Columbia real GDP by component

Annual per cent change

Source: Statistics Canada

Last year saw robust gains in real consumer spending, as demand for both goods and services remained strong. The housing market also continued its expansion through 2006, as housing starts grew by 5.1 per cent and residential investment expanded by 15.3 per cent. In 2005, housing starts grew by 5.3 per cent and residential investment increased by 12.7 per cent.

Employment in BC grew by 3.1 per cent in 2006, while the labour force increased by 1.8 per cent. This caused the unemployment rate to fall from 5.9 per cent in 2005 to 4.8 per cent in 2006.

Real business investment rose 9.5 per cent in 2006, fuelled by a 6.6 per cent increase in residential construction investment, a 9.2 per cent jump in non-residential investment and a 14.9 per cent leap in machinery and equipment investment.

Investment figures for 2007 include spending on major capital projects across the province including:

• Sea-to-Sky Highway Improvement Project;

• UBC Life Sciences Centre;

(3) GDP estimates are based on Statistics Canada’s preliminary Provincial Accounts for 2006, released in April 2007. Further information on British Columbia’s economic performance will be released in November 2007, when Statistics Canada releases revised GDP data for 2006 and previous years.

9

• Abbotsford Regional Hospital and Cancer Centre;

• UniverCity at Simon Fraser University;

• Coal Harbour Redevelopment;

• Big White Ski Resort Expansion;

• Highland Valley Copper Mine Expansion; and

• Vancouver Island Transmission Reinforcement Project.

Overall, the nominal value of BC’s manufacturing shipments climbed by 2.5 per cent in 2006. Manufacturers of primary metal, fabricated metal products and computer and electronic equipment all experienced solid shipment growth in 2006. At the same time, however, the value of shipments of wood products from BC fell by 12.3 per cent.

Exports

The value of BC’s current dollar foreign merchandise exports declined by about $686 million (or 2.0 per cent) in 2006. Exports to the US, BC’s largest trading partner, dropped by 7.1 per cent after increasing by 9.5 per cent in 2005. This significant drop is largely due to declines in the values of forestry and energy exports. Exports to Japan, however, continued to rise steadily through 2006, growing by 13.0 per cent after increasing 9.4 per cent in 2005. BC’s exports to the Pacific Rim (excluding Japan) also showed strength in 2006, as they jumped in value by 10.6 per cent. Increases in the value of Pacific Rim exports, as in 2005, were led by rapid growth in exports to China and South Korea. Exports to India also saw significant gains during the year. Appendix Tables A1.7 and A1.8 provide further detail on exports by major market and commodity.

Chart 1.5 Export shares by market

BC origin merchandise | BC origin merchandise |

exports 2005 = $34.1 billion | exports 2006 = $33.4 billion |

The US was the destination of a slightly smaller share of British Columbia’s international exports in 2006 than in 2005. The US accounted for 61.2 per cent of the total after taking in 64.6 per cent in 2005. The Pacific Rim (including Japan) took in 27.0 per cent of BC’s total international exports in 2006, up from the 23.7 per cent these countries purchased in 2005.

10

Strong external demand and high commodity prices were the main reasons for the boost in the value of BC’s exports in 2006. The high Canadian dollar put some downward pressure on exports, but not enough to curtail the expansion led by demand and prices.

Current dollar energy product exports plunged by 17.3 per cent in 2006 to $6.4 billion, after surging up by 71.0 per cent in 2005. The value of metallic mineral product exports rose 32.5 per cent to $3.6 billion, while the value of wood product exports fell 7.4 per cent to $8.8 billion and pulp and paper exports increased 2.9 per cent to $4.8 billion. Lumber product prices declined again in 2006, while the prices of pulp and newsprint both rose substantially.

• Lumber prices averaged $296 US per thousand board feet in 2006, down from $355 US in 2005.

• Pulp prices jumped in 2006, averaging $674 US per tonne, up from $611 US in the previous year.

• Newsprint prices rose again to average $667 US per tonne in 2006, compared to $608 US per tonne in 2005.

Chart 1.6 Lumber and natural gas prices

Natural gas | Spruce pine fir lumber |

$US/MmBTU, Sumas | $US/000 bd feet |

Source: Madison’s Lumber Reporter and Ministry of Energy and Mines

The year 2006 saw the value of real imports again rise faster than that of real exports. While imports jumped by 6.3 per cent on the year, exports rose by only 2.4 per cent, resulting in a decline in BC’s trade balance. Exports of services grew at a higher rate than imports of services, although both were strong in 2006. Overall, imports from international trade rose by 9.3 per cent in 2006, while interprovincial imports grew by 2.4 per cent. BC’s volume of exports to other provinces and countries also grew by 2.4 per cent on the year.

11

Population

British Columbia welcomed 44,047 net migrants into the province in 2006, including 36,224 from international sources and 7,823 from other Canadian provinces and territories. Historically, BC’s population has grown faster than Canada’s due to relatively strong net inflows of people from other provinces and countries. From 1998 to 2002, BC’s population growth slowed due to a net outflow of people to other parts of Canada. However, this trend has changed course since 2003, returning to a net positive inflow of migrants from other provinces.

Map 1.1 Net interprovincial and international migration in BC, 2006

British Columbia’s population is aging, as the province’s baby boom generation is currently between their early 40s and late 50s (see Chart 1.7). As a result, there will be a substantial increase in the number of retired British Columbians over the next few years. The bust generation (born during a period of lower birth rates) is currently in their mid 20s to early 30s, with the baby boom echo generation currently hovering around 20 years old.

Chart 1.7 British Columbia population by age and sex, 2006

Age (years)

Source: BC STATS and Statistics Canada

12

Labour and Income Developments

BC’s annual average employment rose by 3.1 per cent, or 65,000 jobs, in 2006. This rate of increase was second highest to Alberta’s, which experienced employment gains of 4.8 per cent in that year. BC’s unemployment rate in 2006 dropped to 4.8 per cent from 5.9 per cent in 2005, representing the lowest average annual rate in 30 years.

Total employment in British Columbia’s goods-producing sector rose by 2.9 per cent, or 12,900 jobs. Employment in the construction sector had another strong year, as it climbed by about 11,300 jobs, or 6.7 per cent. Employment in the primary industries expanded by 2,300 jobs, or 3.0 per cent.

Employment in BC’s service industries grew 3.1 per cent in 2006, down slightly from the 3.2 per cent growth seen in 2005. The health and welfare services industry created a substantial number of jobs to the economy, adding an additional 14,800 new employees. Education and related services grew by 6.8 per cent, or 9,900 jobs. BC’s retail and wholesale trade industry also had a strong performance in 2006 in terms of employment gains, with an increase of 19,100 jobs, or 5.7 per cent. The number of British Columbians employed in finance, insurance and real estate rose by 3.8 per cent, or 5,100 positions compared to the previous year. The most significant job losses on the service side occurred in the accommodation and food services sector and the public administration sector (see Table A1.5 for more details).

British Columbia’s labour force grew by 1.8 per cent in 2006 after expanding by 1.9 per cent in 2005.

Table 1.1 British Columbia Population and Labour Market Statistics

| | Units | | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | |

| | | | | | | | | | | | | |

Population (as at July 1) | | (thousands) | | 4,115 | | 4,155 | | 4,203 | | 4,258 | | 4,310 | |

| | (% change) | | 0.9 | | 1.0 | | 1.2 | | 1.3 | | 1.2 | |

| | | | | | | | | | | | | |

Net Migration | | | | | | | | | | | | | |

International | | (persons) | | 30,227 | | 31,374 | | 31,095 | | 38,843 | | 36,224 | |

Interprovincial | | (persons) | | (5,216 | ) | 4,055 | | 7,551 | | 4,811 | | 7,823 | |

| | | | | | | | | | | | | |

Labour Force | | (thousands) | | 2,148 | | 2,191 | | 2,222 | | 2,263 | | 2,305 | |

| | (% change) | | 3.1 | | 2.0 | | 1.4 | | 1.9 | | 1.8 | |

| | | | | | | | | | | | | |

Employment | | (thousands) | | 1,965 | | 2,015 | | 2,063 | | 2,131 | | 2,196 | |

| | (% change) | | 2.3 | | 2.5 | | 2.4 | | 3.3 | | 3.1 | |

| | | | | | | | | | | | | |

Unemployment Rate | | (%) | | 8.5 | | 8.0 | | 7.2 | | 5.9 | | 4.8 | |

Source: Statistics Canada

Prices and Wages

BC’s Consumer Price Index (CPI) increased by 1.7 per cent in 2006, following a gain of 2.0 per cent in 2005. Gasoline prices continued to rise in 2006, climbing by 6.9 per cent, while shelter and food costs increased at a modest rate through 2006, up 2.4 per cent and 1.9 per cent, respectively.

13

Table 1.2 Price and Earnings Indices

| | Units | | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | |

| | | | | | | | | | | | | |

Consumer Price Index | | (1992=100) | | 117.9 | | 120.4 | | 122.8 | | 125.3 | | 127.5 | |

(British Columbia) | | (% change) | | 2.3 | | 2.1 | | 2.0 | | 2.0 | | 1.7 | |

| | | | | | | | | | | | | |

Average weekly earnings | | ($) | | 668.0 | | 683.7 | | 686.7 | | 704.5 | | 726.0 | |

| | (% change) | | 3.1 | | 2.3 | | 0.4 | | 2.6 | | 3.1 | |

| | | | | | | | | | | | | |

Labour income (1) | | ($ millions) | | 72,900 | | 75,605 | | 80,158 | | 85,402 | | 92,434 | |

| | (% change) | | 4.1 | | 3.7 | | 6.0 | | 6.5 | | 8.2 | |

| | | | | | | | | | | | | |

Personal income (1) | | ($ millions) | | 113,451 | | 117,059 | | 123,487 | | 130,481 | | 139,867 | |

| | (% change) | | 2.8 | | 3.2 | | 5.5 | | 5.7 | | 7.2 | |

| | | | | | | | | | | | | |

Corporate profits (pre-tax)(1) | | ($ millions) | | 11,389 | | 12,705 | | 17,009 | | 20,011 | | 21,673 | |

| | (% change) | | (2.6 | ) | 11.6 | | 33.9 | | 17.6 | | 8.3 | |

(1) As of April 2007 Provincial Economic Accounts

Source: Statistics Canada

The year 2006 saw salaries and supplementary labour income increase by 8.2 per cent, signaling robust employment gains and also reflecting a boost from the payout of provincial public sector signing bonuses. This in turn led to an increase of 7.2 per cent in total personal income. Corporate profits also pushed higher in 2006, rising 8.3 per cent, due in part to high prices for BC’s commodities and resources.

Consumer Expenditure and Housing

Real consumer spending in BC averaged 5.3 per cent growth in 2006 due to robust demand in both the goods and services sectors. The increase in consumer spending on goods was also reflected by the 6.8 per cent rise in the total value of retail sales in 2006.

Housing starts in BC continued to increase in 2006, rising by 5.1 per cent compared to the 5.3 per cent jump seen in 2005. Growth in housing starts has slowed in the last couple of years from the 21.0 per cent increase seen in 2003 and the 25.8 per cent seen in 2004.

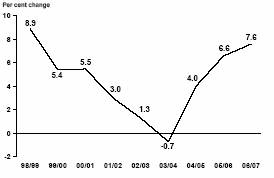

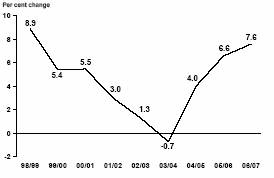

Chart 1.8 BC Building permits by category

Per cent change

Source: Statistics Canada

14

The continued strength of BC’s housing market was also demonstrated in 2006 by the value of residential building permits, which jumped by 9.3 per cent. The strength of the province’s housing sector in 2006 was the result of several factors, as another year of strong employment growth, low mortgage rates and the scarcity of available rental and market properties combined to create attractive conditions for consumers.

The value of non-residential building permits in BC jumped by 22.1 per cent in 2006 to reach $3.9 billion. Commercial permits rose by 32.2 per cent, institutional permits climbed by 9.1 per cent and industrial permits rose by 3.7 per cent.

Industrial Structure and Performance

The province’s rich endowment of natural resources and their development historically formed the backbone of British Columbia’s economic structure. In the past, the economy was largely based on primary and secondary forest production. Other natural resource sectors, such as agriculture, mining (including oil and gas) and fishing (including aquaculture) also contributed significantly.

In recent years, a more diversified economy has emerged, supported by many non-resource activities such as film, tourism, high-technology industries including software and biotechnology, and other value-added industries. The British Columbia economy matured into a more broadly based structure that became less vulnerable to changes in international markets for natural resources.

In 2006, BC’s goods-based industries grew at a similar pace to its service industries. GDP in the construction sector grew 10.1 per cent in 2006, largely driven by the continued strength in the residential housing market. Manufacturing also grew fairly steadily in 2006, with real GDP rising 2.4 per cent over 2005. Growth in the forestry and logging industry was 2.3 per cent in 2006 after a gain of 3.1 per cent in 2005.

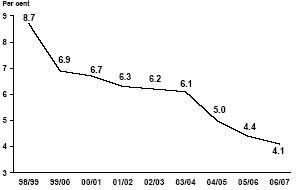

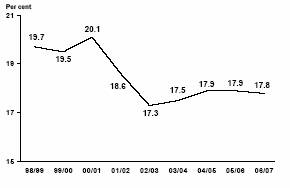

Chart 1.9 Service industries in BC

Per cent of total

Source: Statistics Canada

15

Service-producing industries continued to generate about three quarters of the total provincial gross domestic product in 2006. Industries within the service sector include: transportation, communications and storage; wholesale and retail trade; finance, insurance and real estate; community, business and personal services; and public administration and defense.

High Tech

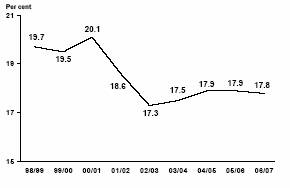

British Columbia’s high technology sector is a leading performer in the provincial economy, outperforming other sectors in revenue, employment, and wage and salary growth in most years. After the 2001 global crash in high tech that also had a negative effect on BC’s high technology industries, this sector has been seen positive GDP growth since 2002 (information for 2006 is unavailable).

Real GDP generated by the high tech sector rose by 2.4 per cent in 2005 to $8.7 billion. Revenues expanded by 2.2 per cent, and wages and salaries climbed 4.8 per cent. The total number of people working in the province’s high tech sector expanded by 2.9 per cent in 2005 to reach 70,490 total jobs (see Table A1.14 for further detail).

Chart 1.10 Trends in high technology sector in BC

Annual % Change

Source: BC STATS

Tourism

Canada’s strengthening dollar hampered tourism in BC last year, leading to fewer visits from the US. The total number of visitors entering BC in 2006 fell 5.2 per cent, following a 3.0 per cent decrease in 2005. The number of US visitors entering BC in 2006 dropped by 6.5 per cent from the previous year, while the number of overseas visitors fell by 0.5 per cent. Despite the overall decline in total international visitors, overall tourism revenues continued to climb in 2006, rising 7.8 per cent over 2005, reflecting strength in domestic tourism.

16

Chart 1.11 Visitor entries to BC

Sources: Statistics Canada

Chart 1.12 BC Tourism industry

Source: BC STATS

Conclusion

British Columbia’s economy expanded 3.6 per cent in 2006, primarily due to strong growth in its domestic market. Both the goods-producing and service-producing industries performed well, with strong demand for BC resources and high commodity prices. Real business investment improved by 9.5 per cent due to strong gains in both non-residential investment and machinery and equipment investment.

Employment in BC rose 3.1 per cent in 2006, marking another strong year for job growth in the province. BC’s annual unemployment rate fell to an average of 4.8 per cent, its lowest rate in 30 years.

17

Appendix 1

Economic Review

Appendix 1 – Economic Review

Table A1.1A Aggregate and Labour Market Indicators

| | | | | | Real GDP | | Personal | | Capital | | Business | | | | | | Unemployment | |

| | Population (1) | | Nominal GDP | | (chained) | | income | | investment | | incorporations | | Labour force | | Employment | | rate | |

| | (thousands) | | ($ millions) | | ($1997 millions) | | ($ millions) | | ($ millions) | | (number) | | (thousands) | | (thousands) | | (per cent) | |

1980 | | 2,743 | | — | | — | | — | | — | | 21,381 | | 1,357 | | 1,266 | | 6.7 | |

1981 | | 2,824 | | 44,869 | | 79,745 | | 37,220 | | — | | 23,368 | | 1,416 | | 1,320 | | 6.8 | |

1982 | | 2,873 | | 45,024 | | 74,877 | | 40,425 | | — | | 11,432 | | 1,427 | | 1,253 | | 12.1 | |

1983 | | 2,905 | | 47,477 | | 75,349 | | 41,634 | | — | | 13,787 | | 1,446 | | 1,245 | | 13.9 | |

1984 | | 2,946 | | 49,840 | | 75,930 | | 43,734 | | — | | 14,052 | | 1,465 | | 1,245 | | 15.0 | |

1985 | | 2,974 | | 53,540 | | 81,203 | | 46,588 | | — | | 15,581 | | 1,491 | | 1,274 | | 14.6 | |

1986 | | 3,004 | | 56,547 | | 81,355 | | 48,911 | | — | | 17,067 | | 1,524 | | 1,327 | | 12.9 | |

1987 | | 3,050 | | 62,515 | | 86,373 | | 52,903 | | — | | 18,691 | | 1,567 | | 1,378 | | 12.1 | |

1988 | | 3,115 | | 69,408 | | 91,395 | | 58,298 | | — | | 18,703 | | 1,599 | | 1,435 | | 10.3 | |

1989 | | 3,198 | | 75,582 | | 94,400 | | 65,009 | | — | | 21,817 | | 1,659 | | 1,508 | | 9.1 | |

1990 | | 3,291 | | 79,350 | | 95,722 | | 72,038 | | — | | 19,550 | | 1,703 | | 1,560 | | 8.4 | |

1991 | | 3,373 | | 81,849 | | 95,897 | | 75,336 | | 17,370 | | 18,528 | | 1,751 | | 1,578 | | 9.9 | |

1992 | | 3,468 | | 87,242 | | 98,373 | | 78,610 | | 17,979 | | 20,406 | | 1,800 | | 1,617 | | 10.1 | |

1993 | | 3,567 | | 94,077 | | 102,770 | | 81,914 | | 18,875 | | 22,955 | | 1,848 | | 1,668 | | 9.7 | |

1994 | | 3,676 | | 100,512 | | 105,669 | | 85,703 | | 21,353 | | 25,774 | | 1,918 | | 1,743 | | 9.1 | |

1995 | | 3,777 | | 105,670 | | 108,194 | | 90,056 | | 20,591 | | 23,846 | | 1,951 | | 1,786 | | 8.5 | |

1996 | | 3,874 | | 108,865 | | 110,857 | | 92,661 | | 19,408 | | 22,848 | | 1,988 | | 1,816 | | 8.7 | |

1997 | | 3,949 | | 114,383 | | 114,383 | | 95,925 | | 22,552 | | 22,958 | | 2,031 | | 1,861 | | 8.4 | |

1998 | | 3,983 | | 115,641 | | 115,883 | | 98,135 | | 20,819 | | 20,759 | | 2,038 | | 1,858 | | 8.8 | |

1999 | | 4,011 | | 120,921 | | 119,604 | | 101,465 | | 21,152 | | 21,009 | | 2,065 | | 1,894 | | 8.3 | |

2000 | | 4,039 | | 131,333 | | 125,145 | | 107,624 | | 21,799 | | 21,515 | | 2,080 | | 1,931 | | 7.1 | |

2001 | | 4,078 | | 133,514 | | 125,924 | | 110,369 | | 23,414 | | 19,749 | | 2,083 | | 1,922 | | 7.7 | |

2002 | | 4,115 | | 138,193 | | 130,445 | | 113,451 | | 23,732 | | 21,262 | | 2,148 | | 1,965 | | 8.5 | |

2003 | | 4,155 | | 145,763 | | 134,131 | | 117,059 | | 25,434 | | 23,243 | | 2,191 | | 2,015 | | 8.0 | |

2004 | | 4,203 | | 157,540 | | 140,263 | | 123,487 | | 29,665 | | 25,428 | | 2,222 | | 2,063 | | 7.2 | |

2005 | | 4,258 | | 168,855 | | 145,501 | | 130,481 | | 33,254 | | 28,593 | | 2,263 | | 2,131 | | 5.9 | |

2006 | | 4,310 | | 179,701 | | 150,741 | | 139,867 | | 37,576 | | 30,667 | | 2,305 | | 2,196 | | 4.8 | |

| | | | | | | | Personal | | Capital | | Business | | | | | | Unemployment | |

| | Population (1) | | Nominal GDP | | Real GDP | | income | | investment | | incorporations | | Labour force | | Employment | | rate | |

| | (% change) | | (% change) | | (% change) | | (% change) | | (% change) | | (% change) | | (% change) | | (% change) | | (change) | |

1981 | | 2.9 | | — | | — | | — | | — | | 9.3 | | 4.3 | | 4.2 | | 0.1 | |

1982 | | 1.7 | | 0.3 | | (6.1 | ) | 8.6 | | — | | (51.1 | ) | 0.8 | | (5.0 | ) | 5.3 | |

1983 | | 1.1 | | 5.4 | | 0.6 | | 3.0 | | — | | 20.6 | | 1.3 | | (0.7 | ) | 1.8 | |

1984 | | 1.4 | | 5.0 | | 0.8 | | 5.0 | | — | | 1.9 | | 1.3 | | 0.0 | | 1.1 | |

1985 | | 1.0 | | 7.4 | | 6.9 | | 6.5 | | — | | 10.9 | | 1.8 | | 2.3 | | (0.4 | ) |

1986 | | 1.0 | | 5.6 | | 0.2 | | 5.0 | | — | | 9.5 | | 2.2 | | 4.2 | | (1.7 | ) |

1987 | | 1.5 | | 10.6 | | 6.2 | | 8.2 | | — | | 9.5 | | 2.8 | | 3.8 | | (0.8 | ) |

1988 | | 2.1 | | 11.0 | | 5.8 | | 10.2 | | — | | 0.1 | | 2.0 | | 4.1 | | (1.8 | ) |

1989 | | 2.6 | | 8.9 | | 3.3 | | 11.5 | | — | | 16.6 | | 3.8 | | 5.1 | | (1.2 | ) |

1990 | | 2.9 | | 5.0 | | 1.4 | | 10.8 | | — | | (10.4 | ) | 2.6 | | 3.4 | | (0.7 | ) |

1991 | | 2.5 | | 3.1 | | 0.2 | | 4.6 | | — | | (5.2 | ) | 2.8 | | 1.1 | | 1.5 | |

1992 | | 2.8 | | 6.6 | | 2.6 | | 4.3 | | 3.5 | | 10.1 | | 2.8 | | 2.5 | | 0.2 | |

1993 | | 2.9 | | 7.8 | | 4.5 | | 4.2 | | 5.0 | | 12.5 | | 2.7 | | 3.1 | | (0.4 | ) |

1994 | | 3.0 | | 6.8 | | 2.8 | | 4.6 | | 13.1 | | 12.3 | | 3.8 | | 4.5 | | (0.6 | ) |

1995 | | 2.8 | | 5.1 | | 2.4 | | 5.1 | | (3.6 | ) | (7.5 | ) | 1.7 | | 2.4 | | (0.6 | ) |

1996 | | 2.6 | | 3.0 | | 2.5 | | 2.9 | | (5.7 | ) | (4.2 | ) | 1.9 | | 1.7 | | 0.2 | |

1997 | | 1.9 | | 5.1 | | 3.2 | | 3.5 | | 16.2 | | 0.5 | | 2.1 | | 2.4 | | (0.3 | ) |

1998 | | 0.9 | | 1.1 | | 1.3 | | 2.3 | | (7.7 | ) | (9.6 | ) | 0.4 | | (0.1 | ) | 0.4 | |

1999 | | 0.7 | | 4.6 | | 3.2 | | 3.4 | | 1.6 | | 1.2 | | 1.3 | | 1.9 | | (0.5 | ) |

2000 | | 0.7 | | 8.6 | | 4.6 | | 6.1 | | 3.1 | | 2.4 | | 0.7 | | 1.9 | | (1.2 | ) |

2001 | | 1.0 | | 1.7 | | 0.6 | | 2.6 | | 7.4 | | (8.2 | ) | 0.1 | | (0.5 | ) | 0.6 | |

2002 | | 0.9 | | 3.5 | | 3.6 | | 2.8 | | 1.4 | | 7.7 | | 3.1 | | 2.3 | | 0.8 | |

2003 | | 1.0 | | 5.5 | | 2.8 | | 3.2 | | 7.2 | | 9.3 | | 2.0 | | 2.5 | | (0.5 | ) |

2004 | | 1.2 | | 8.1 | | 4.6 | | 5.5 | | 16.6 | | 9.4 | | 1.4 | | 2.4 | | (0.8 | ) |

2005 | | 1.3 | | 7.2 | | 3.7 | | 5.7 | | 12.1 | | 12.4 | | 1.9 | | 3.3 | | (1.3 | ) |

2006 | | 1.2 | | 6.4 | | 3.6 | | 7.2 | | 13.0 | | 7.3 | | 1.8 | | 3.1 | | (1.1 | ) |

(1) As at July 1. Data take into account adjustments made for net census undercount in 1996 and 2001, and non-permanent residents.

Sources: Statistics Canada and BC STATS, Ministry of Finance, based on federal, provincial and industry data.

20

Table A1.1B Prices, Earnings and Financial Indicators

| | | | | | Average | | | | | | | | | | | | Conventional | |

| | BC | | Vancouver | | weekly | | Labour | | Personal income | | PDI | | Prime | | Can/US | | (5 year) | |

| | CPI | | CPI | | wage rate(1) | | income | | per capita | | per capita | | rate | | exchange rate | | mortgage rate | |

| | (2002=100) | | (2002=100) | | ($) | | ($ millions) | | (dollars) | | (dollars) | | (per cent) | | (US cents) | | (per cent) | |

1980 | | 45.4 | | 44.8 | | — | | — | | — | | — | | 14.3 | | 85.5 | | 14.5 | |

1981 | | 51.8 | | 51.2 | | — | | 25,637 | | 13,180 | | 10,792 | | 19.3 | | 83.4 | | 18.4 | |

1982 | | 57.3 | | 56.6 | | — | | 26,497 | | 14,071 | | 11,482 | | 15.8 | | 81.1 | | 18.0 | |

1983 | | 60.4 | | 59.7 | | — | | 27,018 | | 14,332 | | 11,590 | | 11.2 | | 81.1 | | 13.2 | |

1984 | | 62.8 | | 62.1 | | — | | 27,811 | | 14,845 | | 12,139 | | 12.1 | | 77.2 | | 13.6 | |

1985 | | 64.8 | | 64.0 | | — | | 29,100 | | 15,665 | | 12,781 | | 10.6 | | 73.2 | | 12.1 | |

1986 | | 66.7 | | 66.2 | | — | | 30,339 | | 16,282 | | 13,133 | | 10.5 | | 72.0 | | 11.2 | |

1987 | | 68.7 | | 68.2 | | — | | 32,837 | | 17,345 | | 13,854 | | 9.5 | | 75.4 | | 11.2 | |

1988 | | 71.2 | | 70.6 | | — | | 36,110 | | 18,715 | | 14,845 | | 10.8 | | 81.3 | | 11.6 | |

1989 | | 74.4 | | 73.8 | | — | | 40,295 | | 20,328 | | 16,149 | | 13.3 | | 84.5 | | 12.1 | |

1990 | | 78.4 | | 77.8 | | — | | 44,216 | | 21,889 | | 17,009 | | 14.1 | | 85.7 | | 13.4 | |

1991 | | 82.6 | | 81.9 | | — | | 46,296 | | 22,335 | | 17,313 | | 9.9 | | 87.3 | | 11.1 | |

1992 | | 84.8 | | 84.3 | | — | | 48,924 | | 22,667 | | 17,458 | | 7.5 | | 82.7 | | 9.5 | |

1993 | | 87.8 | | 87.3 | | — | | 51,312 | | 22,964 | | 17,806 | | 5.9 | | 77.5 | | 8.8 | |

1994 | | 89.5 | | 89.1 | | — | | 53,972 | | 23,314 | | 17,969 | | 6.9 | | 73.2 | | 9.5 | |

1995 | | 91.6 | | 91.3 | | — | | 56,768 | | 23,843 | | 18,302 | | 8.6 | | 72.9 | | 9.2 | |

1996 | | 92.4 | | 92.1 | | — | | 58,517 | | 23,919 | | 18,223 | | 6.1 | | 73.3 | | 7.9 | |

1997 | | 93.1 | | 92.6 | | 612.63 | | 60,681 | | 24,291 | | 18,482 | | 5.0 | | 72.2 | | 7.1 | |

1998 | | 93.4 | | 93.0 | | 621.21 | | 61,965 | | 24,638 | | 18,676 | | 6.6 | | 67.4 | | 6.9 | |

1999 | | 94.4 | | 93.9 | | 628.82 | | 64,045 | | 25,297 | | 19,300 | | 6.4 | | 67.3 | | 7.6 | |

2000 | | 96.1 | | 96.0 | | 639.37 | | 68,369 | | 26,646 | | 20,278 | | 7.3 | | 67.3 | | 8.4 | |

2001 | | 97.7 | | 97.8 | | 648.19 | | 70,044 | | 27,064 | | 20,925 | | 5.8 | | 64.6 | | 7.4 | |

2002 | | 100.0 | | 100.0 | | 668.04 | | 72,900 | | 27,570 | | 21,530 | | 4.2 | | 63.7 | | 7.0 | |

2003 | | 102.2 | | 102.0 | | 683.68 | | 75,605 | | 28,173 | | 21,958 | | 4.7 | | 71.4 | | 6.4 | |

2004 | | 104.2 | | 104.0 | | 686.74 | | 80,158 | | 29,381 | | 22,847 | | 4.0 | | 76.8 | | 6.2 | |

2005 | | 106.3 | | 106.0 | | 704.49 | | 85,402 | | 30,644 | | 23,731 | | 4.4 | | 82.5 | | 6.0 | |

2006 | | 108.1 | | 108.0 | | 726.02 | | 92,434 | | 32,448 | | 25,194 | | 5.8 | | 88.2 | | 6.7 | |

| | | | | | Average | | | | | | | | | | | | Conventional | |

| | BC | | Vancouver | | weekly | | Labour | | Personal income | | PDI | | Prime | | Can/US | | (5 year) | |

| | CPI | | CPI | | wage rate(1) | | income | | per capita | | per capita | | rate | | exchange rate | | mortgage rate | |

| | (% change) | | (% change) | | (% change) | | (% change) | | (% change) | | (% change) | | (change) | | (change) | | (change) | |

1981 | | 14.1 | | 14.3 | | — | | — | | — | | — | | 5.0 | | (2.1 | ) | 3.9 | |

1982 | | 10.6 | | 10.5 | | — | | 3.4 | | 6.8 | | 6.4 | | (3.5 | ) | (2.4 | ) | (0.3 | ) |

1983 | | 5.4 | | 5.5 | | — | | 2.0 | | 1.9 | | 0.9 | | (4.6 | ) | 0.1 | | (4.8 | ) |

1984 | | 4.0 | | 4.0 | | — | | 2.9 | | 3.6 | | 4.7 | | 0.9 | | (3.9 | ) | 0.4 | |

1985 | | 3.2 | | 3.1 | | — | | 4.6 | | 5.5 | | 5.3 | | (1.5 | ) | (4.0 | ) | (1.5 | ) |

1986 | | 2.9 | | 3.4 | | — | | 4.3 | | 3.9 | | 2.8 | | (0.1 | ) | (1.3 | ) | (0.9 | ) |

1987 | | 3.0 | | 3.0 | | — | | 8.2 | | 6.5 | | 5.5 | | (1.0 | ) | 3.4 | | (0.0 | ) |

1988 | | 3.6 | | 3.5 | | — | | 10.0 | | 7.9 | | 7.2 | | 1.3 | | 5.8 | | 0.4 | |

1989 | | 4.5 | | 4.5 | | — | | 11.6 | | 8.6 | | 8.8 | | 2.5 | | 3.2 | | 0.5 | |

1990 | | 5.4 | | 5.4 | | — | | 9.7 | | 7.7 | | 5.3 | | 0.7 | | 1.2 | | 1.3 | |

1991 | | 5.4 | | 5.3 | | — | | 4.7 | | 2.0 | | 1.8 | | (4.1 | ) | 1.6 | | (2.2 | ) |

1992 | | 2.7 | | 2.9 | | — | | 5.7 | | 1.5 | | 0.8 | | (2.5 | ) | (4.5 | ) | (1.6 | ) |

1993 | | 3.5 | | 3.6 | | — | | 4.9 | | 1.3 | | 2.0 | | (1.5 | ) | (5.2 | ) | (0.7 | ) |

1994 | | 1.9 | | 2.1 | | — | | 5.2 | | 1.5 | | 0.9 | | 0.9 | | (4.3 | ) | 0.8 | |

1995 | | 2.3 | | 2.5 | | — | | 5.2 | | 2.3 | | 1.9 | | 1.8 | | (0.4 | ) | (0.4 | ) |

1996 | | 0.9 | | 0.9 | | — | | 3.1 | | 0.3 | | (0.4 | ) | (2.6 | ) | 0.5 | | (1.2 | ) |

1997 | | 0.8 | | 0.5 | | — | | 3.7 | | 1.6 | | 1.4 | | (1.1 | ) | (1.1 | ) | (0.9 | ) |

1998 | | 0.3 | | 0.4 | | 1.4 | | 2.1 | | 1.4 | | 1.0 | | 1.6 | | (4.8 | ) | (0.1 | ) |

1999 | | 1.1 | | 1.0 | | 1.2 | | 3.4 | | 2.7 | | 3.3 | | (0.2 | ) | (0.1 | ) | 0.6 | |

2000 | | 1.8 | | 2.2 | | 1.7 | | 6.8 | | 5.3 | | 5.1 | | 0.8 | | 0.0 | | 0.8 | |

2001 | | 1.7 | | 1.9 | | 1.4 | | 2.4 | | 1.6 | | 3.2 | | (1.5 | ) | (2.8 | ) | (0.9 | ) |

2002 | | 2.4 | | 2.2 | | 3.1 | | 4.1 | | 1.9 | | 2.9 | | (1.6 | ) | (0.9 | ) | (0.4 | ) |

2003 | | 2.2 | | 2.0 | | 2.3 | | 3.7 | | 2.2 | | 2.0 | | 0.5 | | 7.7 | | (0.6 | ) |

2004 | | 2.0 | | 2.0 | | 0.4 | | 6.0 | | 4.3 | | 4.0 | | (0.7 | ) | 5.5 | | (0.2 | ) |

2005 | | 2.0 | | 1.9 | | 2.6 | | 6.5 | | 4.3 | | 3.9 | | 0.4 | | 5.7 | | (0.2 | ) |

2006 | | 1.7 | | 1.9 | | 3.1 | | 8.2 | | 5.9 | | 6.2 | | 1.4 | | 5.7 | | 0.7 | |

(1) Data prior to 1997 are not available.

Sources: Statistics Canada and BC STATS, Ministry of Finance, based on federal, provincial and industry data.

21

Table A1.1C Other Indicators

| | Manufacturing | | | | Housing | | Non-residential | | Tourism | | High-tech | | BC product | |

| | shipments | | Retail sales(1) | | starts | | building permits | | GDP(2) | | GDP(2) | | exports | |

| | ($ millions) | | ($ millions) | | (number) | | ($ millions) | | ($ millions) | | ($ millions) | | ($ millions) | |

1980 | | — | | — | | 37,546 | | 1,207 | | — | | — | | 12,708 | |

1981 | | — | | — | | 41,585 | | 1,335 | | — | | — | | 12,888 | |

1982 | | — | | — | | 19,807 | | 1,026 | | — | | — | | 12,353 | |

1983 | | — | | — | | 22,607 | | 775 | | — | | — | | 13,244 | |

1984 | | — | | — | | 16,169 | | 827 | | — | | — | | 15,748 | |

1985 | | — | | — | | 17,969 | | 812 | | — | | — | | 13,591 | |

1986 | | — | | — | | 20,687 | | 912 | | — | | — | | 13,033 | |

1987 | | — | | — | | 28,944 | | 999 | | — | | — | | 15,883 | |

1988 | | — | | — | | 30,487 | | 1,647 | | — | | — | | 17,822 | |

1989 | | — | | — | | 38,894 | | 1,812 | | — | | — | | 18,307 | |

1990 | | — | | — | | 36,720 | | 1,833 | | — | | — | | 16,605 | |

1991 | | — | | 25,022 | | 31,875 | | 1,803 | | — | | — | | 15,253 | |

1992 | | 24,398 | | 26,194 | | 40,621 | | 2,082 | | — | | — | | 16,336 | |

1993 | | 26,583 | | 28,463 | | 42,807 | | 1,944 | | — | | — | | 19,033 | |

1994 | | 30,333 | | 31,770 | | 39,408 | | 1,772 | | — | | — | | 22,856 | |

1995 | | 34,207 | | 34,219 | | 27,057 | | 1,966 | | — | | — | | 26,873 | |

1996 | | 32,932 | | 34,775 | | 27,641 | | 1,957 | | — | | — | | 25,717 | |

1997 | | 33,496 | | 36,591 | | 29,351 | | 1,960 | | 4,700 | | 5,105 | | 26,699 | |

1998 | | 31,757 | | 35,762 | | 19,931 | | 2,022 | | 4,854 | | 5,428 | | 25,942 | |

1999 | | 36,679 | | 36,373 | | 16,309 | | 2,104 | | 5,040 | | 5,534 | | 29,044 | |

2000 | | 40,699 | | 38,435 | | 14,418 | | 2,089 | | 5,280 | | 6,244 | | 33,639 | |

2001 | | 38,303 | | 40,719 | | 17,234 | | 2,125 | | 5,430 | | 6,277 | | 31,680 | |

2002 | | 38,610 | | 43,265 | | 21,625 | | 1,771 | | 5,559 | | 6,700 | | 28,828 | |

2003 | | 39,691 | | 44,421 | | 26,174 | | 1,880 | | 5,528 | | 7,289 | | 28,264 | |

2004 | | 42,303 | | 47,217 | | 32,925 | | 2,070 | | 5,909 | | 7,583 | | 30,992 | |

2005 | | 40,960 | | 49,286 | | 34,667 | | 3,212 | | 6,203 | | 7,835 | | 34,101 | |

2006 | | 41,974 | | 52,627 | | 36,443 | | 3,921 | | n.a. | | n.a. | | 33,415 | |

| | Manufacturing | | | | Housing | | Non-residential | | Tourism | | High-tech | | BC product | |

| | shipments | | Retail sales(1) | | starts | | building permits | | GDP(2) | | GDP(2) | | exports | |

| | (% change) | | (% change) | | (% change) | | (% change) | | (% change) | | (% change) | | (% change) | |

1981 | | — | | — | | 10.8 | | 10.7 | | — | | — | | 1.4 | |

1982 | | — | | — | | (52.4 | ) | (23.2 | ) | — | | — | | (4.2 | ) |

1983 | | — | | — | | 14.1 | | (24.5 | ) | — | | — | | 7.2 | |

1984 | | — | | — | | (28.5 | ) | 6.7 | | — | | — | | 18.9 | |

1985 | | — | | — | | 11.1 | | (1.7 | ) | — | | — | | (13.7 | ) |

1986 | | — | | — | | 15.1 | | 12.3 | | — | | — | | (4.1 | ) |

1987 | | — | | — | | 39.9 | | 9.6 | | — | | — | | 21.9 | |

1988 | | — | | — | | 5.3 | | 64.9 | | — | | — | | 12.2 | |

1989 | | — | | — | | 27.6 | | 10.0 | | — | | — | | 2.7 | |

1990 | | — | | — | | (5.6 | ) | 1.2 | | — | | — | | (9.3 | ) |

1991 | | — | | — | | (13.2 | ) | (1.6 | ) | — | | — | | (8.1 | ) |

1992 | | — | | 4.7 | | 27.4 | | 15.5 | | — | | — | | 7.1 | |

1993 | | 9.0 | | 8.7 | | 5.4 | | (6.7 | ) | — | | — | | 16.5 | |

1994 | | 14.1 | | 11.6 | | (7.9 | ) | (8.9 | ) | — | | — | | 20.1 | |

1995 | | 12.8 | | 7.7 | | (31.3 | ) | 11.0 | | — | | — | | 17.6 | |

1996 | | (3.7 | ) | 1.6 | | 2.2 | | (0.4 | ) | — | | — | | (4.3 | ) |

1997 | | 1.7 | | 5.2 | | 6.2 | | 0.1 | | — | | — | | 3.8 | |

1998 | | (5.2 | ) | (2.3 | ) | (32.1 | ) | 3.2 | | 3.3 | | 6.3 | | (2.8 | ) |

1999 | | 15.5 | | 1.7 | | (18.2 | ) | 4.0 | | 3.8 | | 2.0 | | 12.0 | |

2000 | | 11.0 | | 5.7 | | (11.6 | ) | (0.7 | ) | 4.8 | | 12.8 | | 15.8 | |

2001 | | (5.9 | ) | 5.9 | | 19.5 | | 1.7 | | 2.8 | | 0.5 | | (5.8 | ) |

2002 | | 0.8 | | 6.3 | | 25.5 | | (16.6 | ) | 2.4 | | 6.7 | | (9.0 | ) |

2003 | | 2.8 | | 2.7 | | 21.0 | | 6.1 | | (0.6 | ) | 8.8 | | (2.0 | ) |

2004 | | 6.6 | | 6.3 | | 25.8 | | 10.1 | | 6.9 | | 4.0 | | 9.6 | |

2005 | | (3.2 | ) | 4.4 | | 5.3 | | 55.2 | | 5.0 | | 3.3 | | 10.0 | |

2006 | | 2.5 | | 6.8 | | 5.1 | | 22.1 | | n.a. | | n.a. | | (2.0 | ) |

(1) Retail sales data have been revised from 1991 to 2005 and are now classified under the North American Industry Classification System (NAICS 2002).

(2) Data prior to 1997 are not available.

Sources: Statistics Canada and BC STATS, Ministry of Finance, based on federal, provincial and industry data.

22

Table A1.1D Commodity Production Indicators

| | Lumber | | Timber scale | | Pulp | | Newsprint, etc | | Oil & natural | | Coal | | Solid mineral | | Electric pwr | | Farm cash | | Landed value of | |

| | production | | billed | | shipments | | production | | gas production | | production | | shipments | | generated | | receipts | | seafood products | |

| | (thousand m(3)) | | (thousand m3) | | (000 tonnes) | | (000 tonnes) | | ($ millions) | | (000 tonnes) | | ($ millions) | | (GW.h) | | ($ millions) | | ($ millions) | |

1980 | | 28,269 | | 74,652 | | 3,266 | | 2,164 | | — | | 10,156 | | — | | 43,334 | | 779 | | 184 | |

1981 | | 24,598 | | 52,992 | | 2,854 | | 1,852 | | — | | 11,782 | | — | | 51,008 | | 877 | | 236 | |

1982 | | 23,855 | | 56,232 | | 2,662 | | 1,862 | | — | | 11,769 | | — | | 48,238 | | 962 | | 241 | |

1983 | | 30,773 | | 71,443 | | 3,221 | | 2,120 | | — | | 11,717 | | — | | 47,213 | | 917 | | 210 | |

1984 | | 30,884 | | 74,557 | | 2,836 | | 2,082 | | — | | 20,771 | | — | | 52,369 | | 1,005 | | 243 | |

1985 | | 32,994 | | 76,869 | | 3,298 | | 2,481 | | — | | 22,993 | | — | | 59,126 | | 1,061 | | 378 | |

1986 | | 31,468 | | 77,503 | | 3,628 | | 2,629 | | — | | 20,361 | | — | | 50,759 | | 1,106 | | 405 | |

1987 | | 37,336 | | 90,592 | | 4,136 | | 2,762 | | — | | 21,990 | | — | | 63,066 | | 1,122 | | 455 | |

1988 | | 36,736 | | 86,808 | | 4,141 | | 2,845 | | — | | 24,942 | | — | | 60,943 | | 1,206 | | 573 | |

1989 | | 35,952 | | 86,793 | | 4,189 | | 2,834 | | — | | 24,800 | | — | | 57,655 | | 1,255 | | 513 | |

1990 | | 33,514 | | 78,045 | | 3,547 | | 2,992 | | — | | 24,557 | | — | | 60,662 | | 1,299 | | 559 | |

1991 | | 31,406 | | 73,449 | | 4,014 | | 2,667 | | — | | 24,965 | | — | | 62,981 | | 1,342 | | 492 | |

1992 | | 33,396 | | 73,937 | | 3,825 | | 2,708 | | 890 | | 17,173 | | 2,577 | | 64,058 | | 1,404 | | 533 | |

1993 | | 33,935 | | 79,232 | | 4,040 | | 3,110 | | 1,089 | | 20,633 | | 2,415 | | 58,774 | | 1,446 | | 605 | |

1994 | | 33,671 | | 75,639 | | 4,763 | | 2,983 | | 1,270 | | 22,583 | | 2,632 | | 61,015 | | 1,538 | | 728 | |

1995 | | 32,611 | | 76,471 | | 4,572 | | 2,833 | | 1,040 | | 24,350 | | 3,438 | | 58,006 | | 1,586 | | 604 | |

1996 | | 32,671 | | 75,213 | | 4,390 | | 2,801 | | 1,333 | | 25,422 | | 3,004 | | 71,765 | | 1,706 | | 590 | |

1997 | | 31,562 | | 68,628 | | 4,532 | | 2,649 | | 1,588 | | 27,876 | | 3,047 | | 66,961 | | 1,739 | | 604 | |

1998 | | 30,238 | | 64,967 | | 4,462 | | 2,567 | | 1,574 | | 24,868 | | 2,893 | | 67,710 | | 1,814 | | 547 | |

1999 | | 32,397 | | 75,998 | | 4,995 | | 3,016 | | 2,091 | | 24,845 | | 2,445 | | 68,045 | | 1,906 | | 613 | |

2000 | | 34,346 | | 76,988 | | 5,152 | | 3,126 | | 4,783 | | 25,682 | | 2,891 | | 68,241 | | 2,048 | | 667 | |

2001 | | 32,606 | | 72,008 | | 4,710 | | 2,879 | | 5,666 | | 27,006 | | 2,867 | | 57,332 | | 2,224 | | 647 | |

2002 | | 35,501 | | 73,386 | | 4,477 | | 2,900 | | 4,251 | | 24,397 | | 2,864 | | 64,945 | | 2,195 | | 664 | |

2003 | | 36,031 | | 61,925 | | 4,762 | | 2,919 | | 6,230 | | 23,061 | | 2,914 | | 63,051 | | 2,283 | | 645 | |

2004 | | 39,879 | | 92,361 | | 4,724 | | 2,976 | | 6,784 | | 27,082 | | 3,674 | | 60,496 | | 2,402 | | 636 | |

2005 | | 41,013 | | 83,134 | | 4,932 | | 2,953 | | 8,967 | | 25,571 | | 4,925 | | 67,811 | | 2,390 | | 700 | |

2006 | | 41,051 | | 81,526 | | 4,736 | | 3,019 | | 7,050 | | 21,131 | | 5,620 | | 62,021 | | 2,342 | | n.a. | |

| | Lumber | | Timber scale | | Pulp | | Newsprint, etc | | Oil & natural | | Coal | | Solid mineral | | Electric pwr | | Farm cash | | Value of | |

| | production | | billed | | shipments | | production | | gas production | | production | | shipments | | generated | | receipts | | seafood products | |

| | (% change) | | (% change) | | (% change) | | (% change) | | (% change) | | (% change) | | (% change) | | (% change) | | (% change) | | (% change) | |

1981 | | (13.0 | ) | (29.0 | ) | (12.6 | ) | (14.4 | ) | — | | 16.0 | | — | | 17.7 | | 12.5 | | 28.3 | |

1982 | | (3.0 | ) | 6.1 | | (6.7 | ) | 0.5 | | — | | (0.1 | ) | — | | (5.4 | ) | 9.7 | | 2.1 | |

1983 | | 29.0 | | 27.1 | | 21.0 | | 13.9 | | — | | (0.4 | ) | — | | (2.1 | ) | (4.7 | ) | (12.9 | ) |

1984 | | 0.4 | | 4.4 | | (12.0 | ) | (1.8 | ) | — | | 77.3 | | — | | 10.9 | | 9.6 | | 15.7 | |

1985 | | 6.8 | | 3.1 | | 16.3 | | 19.2 | | — | | 10.7 | | — | | 12.9 | | 5.7 | | 55.6 | |

1986 | | (4.6 | ) | 0.8 | | 10.0 | | 6.0 | | — | | (11.4 | ) | — | | (14.2 | ) | 4.2 | | 7.1 | |

1987 | | 18.6 | | 16.9 | | 14.0 | | 5.1 | | — | | 8.0 | | — | | 24.2 | | 1.4 | | 12.3 | |

1988 | | (1.6 | ) | (4.2 | ) | 0.1 | | 3.0 | | — | | 13.4 | | — | | (3.4 | ) | 7.6 | | 25.9 | |

1989 | | (2.1 | ) | (0.0 | ) | 1.2 | | (0.4 | ) | — | | (0.6 | ) | — | | (5.4 | ) | 4.0 | | (10.5 | ) |

1990 | | (6.8 | ) | (10.1 | ) | (15.3 | ) | 5.5 | | — | | (1.0 | ) | — | | 5.2 | | 3.5 | | 9.0 | |

1991 | | (6.3 | ) | (5.9 | ) | 13.2 | | (10.8 | ) | — | | 1.7 | | — | | 3.8 | | 3.3 | | (12.0 | ) |

1992 | | 6.3 | | 0.7 | | (4.7 | ) | 1.5 | | — | | (31.2 | ) | — | | 1.7 | | 4.7 | | 8.3 | |

1993 | | 1.6 | | 7.2 | | 5.6 | | 14.8 | | 22.4 | | 20.1 | | (6.3 | ) | (8.2 | ) | 3.0 | | 13.5 | |

1994 | | (0.8 | ) | (4.5 | ) | 17.9 | | (4.1 | ) | 16.6 | | 9.5 | | 9.0 | | 3.8 | | 6.4 | | 20.3 | |

1995 | | (3.1 | ) | 1.1 | | (4.0 | ) | (5.0 | ) | (18.1 | ) | 7.8 | | 30.6 | | (4.9 | ) | 3.1 | | (17.0 | ) |

1996 | | 0.2 | | (1.6 | ) | (4.0 | ) | (1.1 | ) | 28.2 | | 4.4 | | (12.6 | ) | 23.7 | | 7.6 | | (2.3 | ) |

1997 | | (3.4 | ) | (8.8 | ) | 3.2 | | (5.4 | ) | 19.1 | | 9.7 | | 1.4 | | (6.7 | ) | 1.9 | | 2.4 | |

1998 | | (4.2 | ) | (5.3 | ) | (1.5 | ) | (3.1 | ) | (0.9 | ) | (10.8 | ) | (5.1 | ) | 1.1 | | 4.3 | | (9.4 | ) |

1999 | | 7.1 | | 17.0 | | 11.9 | | 17.5 | | 32.8 | | (0.1 | ) | (15.5 | ) | 0.5 | | 5.1 | | 12.1 | |

2000 | | 6.0 | | 1.3 | | 3.1 | | 3.6 | | 128.7 | | 3.4 | | 18.2 | | 0.3 | | 7.5 | | 8.8 | |

2001 | | (5.1 | ) | (6.5 | ) | (8.6 | ) | (7.9 | ) | 18.5 | | 5.2 | | (0.8 | ) | (16.0 | ) | 8.6 | | (3.0 | ) |

2002 | | 8.9 | | 1.9 | | (4.9 | ) | 0.7 | | (25.0 | ) | (9.7 | ) | (0.1 | ) | 13.3 | | (1.3 | ) | 2.6 | |

2003 | | 1.5 | | (15.6 | ) | 6.4 | | 0.7 | | 46.6 | | (5.5 | ) | 1.7 | | (2.9 | ) | 4.0 | | (2.9 | ) |

2004 | | 10.7 | | 49.2 | | (0.8 | ) | 2.0 | | 8.9 | | 17.4 | | 26.1 | | (4.1 | ) | 5.2 | | (1.4 | ) |

2005 | | 2.8 | | (10.0 | ) | 4.4 | | (0.8 | ) | 32.2 | | (5.6 | ) | 34.1 | | 12.1 | | (0.5 | ) | 10.1 | |

2006 | | 0.1 | | (1.9 | ) | (4.0 | ) | 2.2 | | (21.4 | ) | (17.4 | ) | 14.1 | | (8.5 | ) | (2.0 | ) | n.a. | |

Sources: Statistics Canada and BC STATS, Ministry of Finance, based on federal, provincial and industry data.

23

Table A1.2 British Columbia Real GDP at Market Prices, Expenditure Based

| | | | | | | | | | Machinery and | | | | | | | | | |

| | Consumer | | Government | | Residential | | Non-Residential | | Equipment | | Business | | | | | | | |

| | Expenditure | | Expenditure | | Investment | | Investment | | Investment | | Investment | | Exports | | Imports | | Real GDP | |

| | (millions of 1997 $ , chained) | |

1982 | | 43,500 | | 16,925 | | 4,173 | | 5,005 | | 3,260 | | 12,445 | | 26,193 | | 25,063 | | 74,877 | |

1983 | | 43,724 | | 16,949 | | 4,414 | | 5,365 | | 2,474 | | 12,003 | | 27,669 | | 26,953 | | 75,349 | |

1984 | | 45,023 | | 16,736 | | 4,195 | | 4,724 | | 2,651 | | 11,438 | | 30,047 | | 29,254 | | 75,930 | |

1985 | | 46,865 | | 17,144 | | 4,532 | | 4,424 | | 2,950 | | 11,822 | | 33,014 | | 30,179 | | 81,203 | |

1986 | | 48,025 | | 17,320 | | 4,986 | | 3,467 | | 2,842 | | 11,169 | | 34,514 | | 31,408 | | 81,355 | |

1987 | | 50,640 | | 17,440 | | 5,921 | | 3,690 | | 3,431 | | 12,932 | | 37,212 | | 34,106 | | 86,373 | |

1988 | | 53,193 | | 18,560 | | 6,596 | | 4,471 | | 4,465 | | 15,515 | | 39,388 | | 36,945 | | 91,395 | |

1989 | | 56,485 | | 18,891 | | 7,592 | | 4,954 | | 5,309 | | 17,866 | | 38,692 | | 40,402 | | 94,400 | |

1990 | | 58,858 | | 19,684 | | 7,730 | | 4,913 | | 5,344 | | 17,998 | | 38,359 | | 42,207 | | 95,722 | |

1991 | | 59,028 | | 20,925 | | 7,311 | | 5,160 | | 5,268 | | 17,743 | | 39,074 | | 42,706 | | 95,897 | |

1992 | | 60,930 | | 21,695 | | 8,986 | | 4,048 | | 5,151 | | 18,287 | | 40,473 | | 44,652 | | 98,373 | |

1993 | | 62,851 | | 22,015 | | 9,218 | | 3,862 | | 5,163 | | 18,371 | | 42,146 | | 44,328 | | 102,770 | |

1994 | | 65,500 | | 22,098 | | 9,270 | | 4,971 | | 5,903 | | 20,177 | | 44,723 | | 51,161 | | 105,669 | |

1995 | | 67,321 | | 21,759 | | 8,161 | | 5,001 | | 5,988 | | 19,136 | | 47,288 | | 51,747 | | 108,194 | |

1996 | | 69,812 | | 22,343 | | 8,286 | | 4,483 | | 5,807 | | 18,587 | | 47,795 | | 51,443 | | 110,857 | |

1997 | | 72,380 | | 22,266 | | 8,716 | | 5,791 | | 6,799 | | 21,306 | | 49,691 | | 55,143 | | 114,383 | |

1998 | | 73,585 | | 22,875 | | 7,543 | | 4,704 | | 7,340 | | 19,598 | | 51,092 | | 54,559 | | 115,883 | |

1999 | | 75,648 | | 22,761 | | 6,962 | | 5,000 | | 7,672 | | 19,676 | | 55,575 | | 57,889 | | 119,604 | |

2000 | | 77,953 | | 23,701 | | 7,036 | | 5,003 | | 8,209 | | 20,283 | | 60,346 | | 62,310 | | 125,145 | |

2001 | | 79,626 | | 24,838 | | 7,692 | | 5,852 | | 8,306 | | 21,924 | | 59,271 | | 62,464 | | 125,924 | |

2002 | | 82,341 | | 25,112 | | 8,913 | | 5,434 | | 8,042 | | 22,418 | | 60,017 | | 62,677 | | 130,445 | |

2003 | | 84,809 | | 25,137 | | 10,007 | | 6,227 | | 8,346 | | 24,659 | | 61,751 | | 66,124 | | 134,131 | |

2004 | | 88,488 | | 25,485 | | 11,502 | | 6,711 | | 9,002 | | 27,337 | | 65,583 | | 71,035 | | 140,263 | |

2005 | | 92,348 | | 25,858 | | 12,246 | | 6,659 | | 10,572 | | 29,371 | | 67,472 | | 75,088 | | 145,501 | |

2006 | | 97,213 | | 26,594 | | 13,052 | | 7,273 | | 12,151 | | 32,175 | | 69,089 | | 79,795 | | 150,741 | |

| | (annual percentage change) | |

1983 | | 0.5 | | 0.1 | | 5.8 | | 7.2 | | (24.1 | ) | (3.6 | ) | 5.6 | | 7.5 | | 0.6 | |

1984 | | 3.0 | | (1.3 | ) | (5.0 | ) | (11.9 | ) | 7.2 | | (4.7 | ) | 8.6 | | 8.5 | | 0.8 | |

1985 | | 4.1 | | 2.4 | | 8.0 | | (6.4 | ) | 11.3 | | 3.4 | | 9.9 | | 3.2 | | 6.9 | |

1986 | | 2.5 | | 1.0 | | 10.0 | | (21.6 | ) | (3.7 | ) | (5.5 | ) | 4.5 | | 4.1 | | 0.2 | |

1987 | | 5.4 | | 0.7 | | 18.8 | | 6.4 | | 20.7 | | 15.8 | | 7.8 | | 8.6 | | 6.2 | |

1988 | | 5.0 | | 6.4 | | 11.4 | | 21.2 | | 30.1 | | 20.0 | | 5.8 | | 8.3 | | 5.8 | |

1989 | | 6.2 | | 1.8 | | 15.1 | | 10.8 | | 18.9 | | 15.2 | | (1.8 | ) | 9.4 | | 3.3 | |

1990 | | 4.2 | | 4.2 | | 1.8 | | (0.8 | ) | 0.7 | | 0.7 | | (0.9 | ) | 4.5 | | 1.4 | |

1991 | | 0.3 | | 6.3 | | (5.4 | ) | 5.0 | | (1.4 | ) | (1.4 | ) | 1.9 | | 1.2 | | 0.2 | |

1992 | | 3.2 | | 3.7 | | 22.9 | | (21.6 | ) | (2.2 | ) | 3.1 | | 3.6 | | 4.6 | | 2.6 | |

1993 | | 3.2 | | 1.5 | | 2.6 | | (4.6 | ) | 0.2 | | 0.5 | | 4.1 | | (0.7 | ) | 4.5 | |

1994 | | 4.2 | | 0.4 | | 0.6 | | 28.7 | | 14.3 | | 9.8 | | 6.1 | | 15.4 | | 2.8 | |

1995 | | 2.8 | | (1.5 | ) | (12.0 | ) | 0.6 | | 1.4 | | (5.2 | ) | 5.7 | | 1.1 | | 2.4 | |

1996 | | 3.7 | | 2.7 | | 1.5 | | (10.4 | ) | (3.0 | ) | (2.9 | ) | 1.1 | | (0.6 | ) | 2.5 | |

1997 | | 3.7 | | (0.3 | ) | 5.2 | | 29.2 | | 17.1 | | 14.6 | | 4.0 | | 7.2 | | 3.2 | |

1998 | | 1.7 | | 2.7 | | (13.5 | ) | (18.8 | ) | 8.0 | | (8.0 | ) | 2.8 | | (1.1 | ) | 1.3 | |

1999 | | 2.8 | | (0.5 | ) | (7.7 | ) | 6.3 | | 4.5 | | 0.4 | | 8.8 | | 6.1 | | 3.2 | |

2000 | | 3.0 | | 4.1 | | 1.1 | | 0.1 | | 7.0 | | 3.1 | | 8.6 | | 7.6 | | 4.6 | |

2001 | | 2.1 | | 4.8 | | 9.3 | | 17.0 | | 1.2 | | 8.1 | | (1.8 | ) | 0.2 | | 0.6 | |

2002 | | 3.4 | | 1.1 | | 15.9 | | (7.1 | ) | (3.2 | ) | 2.3 | | 1.3 | | 0.3 | | 3.6 | |

2003 | | 3.0 | | 0.1 | | 12.3 | | 14.6 | | 3.8 | | 10.0 | | 2.9 | | 5.5 | | 2.8 | |

2004 | | 4.3 | | 1.4 | | 14.9 | | 7.8 | | 7.9 | | 10.9 | | 6.2 | | 7.4 | | 4.6 | |

2005 | | 4.4 | | 1.5 | | 6.5 | | (0.8 | ) | 17.4 | | 7.4 | | 2.9 | | 5.7 | | 3.7 | |

2006 | | 5.3 | | 2.8 | | 6.6 | | 9.2 | | 14.9 | | 9.5 | | 2.4 | | 6.3 | | 3.6 | |

Source: Statistics Canada

24

Table A1.3 British Columbia GDP at Basic Prices, by Industry

| | Crop and | | Fishing, | | Forestry | | Mining, | | | | | | | | Transportation Wholesale | | Finance, | | | | Public | | Real GDP | |

| | Animal | | Hunting and | | and | | Oil and Gas | | | | | | | | and | | and Retail Insurance and | | Other | | Administration | | at Basic | |

| | Production | | Trapping | | Logging | | Extraction | | Manufacturing | | Construction | | Utilities | | Warehousing | | Trade | | Real Estate | | Services | | and Defence | | Prices | |

| | (chained 1997 $ ) | |

1997 | | 907 | | 201 | | 3,185 | | 2,646 | | 11,479 | | 6,434 | | 2,468 | | 6,590 | | 10,982 | | 23,606 | | 29,807 | | 5,764 | | 104,554 | |

1998 | | 864 | | 131 | | 3,203 | | 2,804 | | 11,228 | | 5,932 | | 2,534 | | 6,679 | | 11,565 | | 23,903 | | 30,681 | | 5,821 | | 105,827 | |

1999 | | 930 | | 101 | | 3,026 | | 2,808 | | 12,809 | | 5,718 | | 2,576 | | 6,956 | | 11,738 | | 24,630 | | 31,187 | | 6,050 | | 109,008 | |

2000 | | 927 | | 115 | | 2,863 | | 2,821 | | 14,954 | | 5,635 | | 2,591 | | 7,458 | | 12,247 | | 25,055 | | 32,449 | | 6,236 | | 113,919 | |

2001 | | 1,084 | | 95 | | 2,872 | | 3,586 | | 13,634 | | 5,854 | | 2,024 | | 7,344 | | 12,596 | | 25,756 | | 33,270 | | 6,354 | | 115,139 | |

2002 | | 1,006 | | 115 | | 2,944 | | 3,697 | | 13,654 | | 6,153 | | 2,403 | | 7,413 | | 13,094 | | 26,765 | | 34,408 | | 6,546 | | 118,806 | |

2003 | | 1,063 | | 118 | | 3,071 | | 3,534 | | 13,751 | | 6,686 | | 2,408 | | 7,579 | | 13,564 | | 27,410 | | 35,432 | | 6,615 | | 121,769 | |

2004 | | 1,072 | | 114 | | 3,645 | | 3,526 | | 14,241 | | 7,557 | | 2,368 | | 8,148 | | 14,396 | | 28,631 | | 36,161 | | 6,690 | | 126,791 | |

2005 | | 1,084 | | 106 | | 3,760 | | 3,537 | | 14,674 | | 7,956 | | 2,587 | | 8,578 | | 15,243 | | 29,868 | | 36,849 | | 6,797 | | 131,139 | |

2006 | | 1,033 | | 99 | | 3,846 | | 3,514 | | 15,031 | | 8,758 | | 2,560 | | 8,944 | | 16,415 | | 31,006 | | 37,967 | | 6,961 | | 136,050 | |

| | (annual percentage change) | |

1998 | | (4.8 | ) | (35.0 | ) | 0.6 | | 6.0 | | (2.2 | ) | (7.8 | ) | 2.6 | | 1.4 | | 5.3 | | 1.3 | | 2.9 | | 1.0 | | 1.2 | |

1999 | | 7.7 | | (23.0 | ) | (5.5 | ) | 0.2 | | 14.1 | | (3.6 | ) | 1.7 | | 4.1 | | 1.5 | | 3.0 | | 1.6 | | 3.9 | | 3.0 | |

2000 | | (0.4 | ) | 14.5 | | (5.4 | ) | 0.5 | | 16.7 | | (1.4 | ) | 0.6 | | 7.2 | | 4.3 | | 1.7 | | 4.0 | | 3.1 | | 4.5 | |

2001 | | 17.0 | | (17.5 | ) | 0.3 | | 27.1 | | (8.8 | ) | 3.9 | | (21.9 | ) | (1.5 | ) | 2.9 | | 2.8 | | 2.5 | | 1.9 | | 1.1 | |

2002 | | (7.3 | ) | 21.0 | | 2.5 | | 3.1 | | 0.1 | | 5.1 | | 18.7 | | 0.9 | | 4.0 | | 3.9 | | 3.4 | | 3.0 | | 3.2 | |

2003 | | 5.7 | | 2.7 | | 4.3 | | (4.4 | ) | 0.7 | | 8.7 | | 0.2 | | 2.2 | | 3.6 | | 2.4 | | 3.0 | | 1.1 | | 2.5 | |

2004 | | 0.8 | | (3.1 | ) | 18.7 | | (0.2 | ) | 3.6 | | 13.0 | | (1.7 | ) | 7.5 | | 6.1 | | 4.5 | | 2.1 | | 1.1 | | 4.1 | |

2005 | | 1.2 | | (6.8 | ) | 3.1 | | 0.3 | | 3.0 | | 5.3 | | 9.2 | | 5.3 | | 5.9 | | 4.3 | | 1.9 | | 1.6 | | 3.4 | |

2006 | | (4.7 | ) | (7.2 | ) | 2.3 | | (0.6 | ) | 2.4 | | 10.1 | | (1.0 | ) | 4.3 | | 7.7 | | 3.8 | | 3.0 | | 2.4 | | 3.7 | |

Source: Statistics Canada

25

Table A1 .4 British Columbia GDP, Income Based

| | | | | | Interest and | | Accrued Net | | Net Income of | | | | | | Indirect | | Capital Cons. | | | | | | | |

| | | | Corporation | | Miscellaneous | | Income of | | Non-farm | | Inventory | | Net Domestic | | Taxes | | Allowances and | | | | GDP | | GDP at | |

| | Labour | | Profits before | | Investment | | Farm | | unincorporated | | Valuation | | Product at | | less | | Misc. Valuation | | Statistical | | at Market | | Basic | |

| | Income | | Taxes | | Income | | Operators | | Business | | Adjustment | | Basic Prices | | Subsidies | | Adjustments | | Discrapency | | Prices | | Prices | |

| | ($ millions) | |

1982 | | 26,497 | | 1,652 | | 4,384 | | (8 | ) | 2,366 | | (382 | ) | 36,927 | | 5,176 | | 5,674 | | (335 | ) | 45,024 | | 42,266 | |

1983 | | 27,018 | | 2,458 | | 4,188 | | 20 | | 2,834 | | (288 | ) | 38,924 | | 5,473 | | 6,001 | | (227 | ) | 47,477 | | 44,698 | |

1984 | | 27,811 | | 3,060 | | 4,554 | | 20 | | 3,067 | | (243 | ) | 40,795 | | 5,673 | | 6,381 | | (483 | ) | 49,840 | | 46,693 | |

1985 | | 29,100 | | 3,468 | | 4,939 | | 33 | | 3,433 | | (163 | ) | 43,360 | | 5,878 | | 6,917 | | (65 | ) | 53,540 | | 50,212 | |

1986 | | 30,339 | | 4,213 | | 4,893 | | 113 | | 3,745 | | (212 | ) | 45,603 | | 6,098 | | 7,337 | | 21 | | 56,547 | | 52,961 | |

1987 | | 32,837 | | 6,430 | | 5,085 | | 115 | | 3,954 | | (324 | ) | 50,679 | | 6,696 | | 7,517 | | 205 | | 62,515 | | 58,401 | |

1988 | | 36,110 | | 7,250 | | 5,820 | | 154 | | 4,283 | | (285 | ) | 56,076 | | 7,486 | | 8,044 | | 546 | | 69,408 | | 64,666 | |

1989 | | 40,295 | | 5,925 | | 7,183 | | 72 | | 4,580 | | (195 | ) | 60,769 | | 8,765 | | 8,748 | | 209 | | 75,582 | | 69,726 | |

1990 | | 44,216 | | 3,670 | | 7,887 | | 73 | | 4,796 | | 120 | | 63,803 | | 9,007 | | 9,590 | | (9 | ) | 79,350 | | 73,384 | |

1991 | | 46,296 | | 2,926 | | 7,650 | | 106 | | 5,067 | | (107 | ) | 64,888 | | 9,715 | | 10,016 | | 180 | | 81,849 | | 75,084 | |

1992 | | 48,924 | | 3,321 | | 7,586 | | 80 | | 5,563 | | (616 | ) | 68,325 | | 11,092 | | 10,601 | | 691 | | 87,242 | | 79,617 | |

1993 | | 51,312 | | 4,328 | | 8,035 | | 83 | | 6,034 | | (843 | ) | 72,905 | | 12,440 | | 11,258 | | 1,430 | | 94,077 | | 85,593 | |

1994 | | 53,972 | | 6,756 | | 8,649 | | 63 | | 6,665 | | (660 | ) | 79,662 | | 13,164 | | 12,043 | | (140 | ) | 100,512 | | 91,565 | |

1995 | | 56,768 | | 7,419 | | 8,808 | | 87 | | 6,758 | | (167 | ) | 83,942 | | 13,522 | | 12,882 | | (407 | ) | 105,670 | | 96,417 | |

1996 | | 58,517 | | 7,246 | | 8,731 | | 59 | | 7,173 | | (231 | ) | 85,950 | | 14,014 | | 13,494 | | (138 | ) | 108,865 | | 99,306 | |

1997 | | 60,681 | | 8,286 | | 8,444 | | 89 | | 7,780 | | 101 | | 90,040 | | 14,480 | | 14,526 | | (4 | ) | 114,383 | | 104,562 | |

1998 | | 61,965 | | 7,335 | | 8,355 | | 166 | | 8,285 | | (24 | ) | 90,860 | | 14,515 | | 15,050 | | (6 | ) | 115,641 | | 105,904 | |

1999 | | 64,045 | | 9,309 | | 8,365 | | 199 | | 8,723 | | (373 | ) | 95,125 | | 14,972 | | 15,659 | | 22 | | 120,921 | | 110,806 | |

2000 | | 68,369 | | 11,596 | | 10,184 | | 54 | | 9,078 | | (80 | ) | 104,232 | | 15,608 | | 16,526 | | (2 | ) | 131,333 | | 120,756 | |

2001 | | 70,044 | | 11,392 | | 8,834 | | 141 | | 9,637 | | 47 | | 105,163 | | 15,810 | | 17,539 | | 70 | | 133,514 | | 122,772 | |

2002 | | 72,900 | | 11,389 | | 8,828 | | 53 | | 10,591 | | (369 | ) | 108,406 | | 16,443 | | 18,341 | | 17 | | 138,193 | | 126,764 | |

2003 | | 75,605 | | 12,705 | | 9,023 | | 83 | | 11,289 | | 630 | | 114,478 | | 17,462 | | 19,031 | | (65 | ) | 145,763 | | 133,444 | |

2004 | | 80,158 | | 17,009 | | 9,583 | | 136 | | 12,108 | | (45 | ) | 124,319 | | 18,486 | | 19,968 | | 137 | | 157,540 | | 144,424 | |

2005 | | 85,402 | | 20,011 | | 9,914 | | 33 | | 12,814 | | 212 | | 133,942 | | 19,540 | | 20,934 | | (5 | ) | 168,855 | | 154,871 | |

2006 | | 92,434 | | 21,673 | | 9,749 | | (26 | ) | 13,504 | | (165 | ) | 142,891 | | 20,499 | | 21,946 | | 87 | | 179,701 | | 164,924 | |

| | (annual percentage change) | |

1983 | | 2.0 | | 48.8 | | (4.5 | ) | — | | 19.8 | | — | | 5.4 | | 5.7 | | 5.8 | | — | | 5.4 | | 5.8 | |

1984 | | 2.9 | | 24.5 | | 8.7 | | — | | 8.2 | | — | | 4.8 | | 3.7 | | 6.3 | | — | | 5.0 | | 4.5 | |

1985 | | 4.6 | | 13.3 | | 8.5 | | — | | 11.9 | | — | | 6.3 | | 3.6 | | 8.4 | | — | | 7.4 | | 7.5 | |

1986 | | 4.3 | | 21.5 | | (0.9 | ) | — | | 9.1 | | — | | 5.2 | | 3.7 | | 6.1 | | — | | 5.6 | | 5.5 | |

1987 | | 8.2 | | 52.6 | | 3.9 | | — | | 5.6 | | — | | 11.1 | | 9.8 | | 2.5 | | — | | 10.6 | | 10.3 | |

1988 | | 10.0 | | 12.8 | | 14.5 | | — | | 8.3 | | — | | 10.6 | | 11.8 | | 7.0 | | — | | 11.0 | | 10.7 | |

1989 | | 11.6 | | (18.3 | ) | 23.4 | | — | | 6.9 | | — | | 8.4 | | 17.1 | | 8.8 | | — | | 8.9 | | 7.8 | |

1990 | | 9.7 | | (38.1 | ) | 9.8 | | — | | 4.7 | | — | | 5.0 | | 2.8 | | 9.6 | | — | | 5.0 | | 5.2 | |

1991 | | 4.7 | | (20.3 | ) | (3.0 | ) | — | | 5.7 | | — | | 1.7 | | 7.9 | | 4.4 | | — | | 3.1 | | 2.3 | |

1992 | | 5.7 | | 13.5 | | (0.8 | ) | — | | 9.8 | | — | | 5.3 | | 14.2 | | 5.8 | | — | | 6.6 | | 6.0 | |

1993 | | 4.9 | | 30.3 | | 5.9 | | — | | 8.5 | | — | | 6.7 | | 12.2 | | 6.2 | | — | | 7.8 | | 7.5 | |

1994 | | 5.2 | | 56.1 | | 7.6 | | — | | 10.5 | | — | | 9.3 | | 5.8 | | 7.0 | | — | | 6.8 | | 7.0 | |

1995 | | 5.2 | | 9.8 | | 1.8 | | — | | 1.4 | | — | | 5.4 | | 2.7 | | 7.0 | | — | | 5.1 | | 5.3 | |

1996 | | 3.1 | | (2.3 | ) | (0.9 | ) | — | | 6.1 | | — | | 2.4 | | 3.6 | | 4.8 | | — | | 3.0 | | 3.0 | |

1997 | | 3.7 | | 14.4 | | (3.3 | ) | — | | 8.5 | | — | | 4.8 | | 3.3 | | 7.6 | | — | | 5.1 | | 5.3 | |

1998 | | 2.1 | | (11.5 | ) | (1.1 | ) | — | | 6.5 | | — | | 0.9 | | 0.2 | | 3.6 | | — | | 1.1 | | 1.3 | |

1999 | | 3.4 | | 26.9 | | 0.1 | | — | | 5.3 | | — | | 4.7 | | 3.1 | | 4.0 | | — | | 4.6 | | 4.6 | |

2000 | | 6.8 | | 24.6 | | 21.7 | | — | | 4.1 | | — | | 9.6 | | 4.2 | | 5.5 | | — | | 8.6 | | 9.0 | |

2001 | | 2.4 | | (1.8 | ) | (13.3 | ) | — | | 6.2 | | — | | 0.9 | | 1.3 | | 6.1 | | — | | 1.7 | | 1.7 | |

2002 | | 4.1 | | (0.0 | ) | (0.1 | ) | — | | 9.9 | | — | | 3.1 | | 4.0 | | 4.6 | | — | | 3.5 | | 3.3 | |

2003 | | 3.7 | | 11.6 | | 2.2 | | — | | 6.6 | | — | | 5.6 | | 6.2 | | 3.8 | | — | | 5.5 | | 5.3 | |

2004 | | 6.0 | | 33.9 | | 6.2 | | — | | 7.3 | | — | | 8.6 | | 5.9 | | 4.9 | | — | | 8.1 | | 8.2 | |

2005 | | 6.5 | | 17.6 | | 3.5 | | — | | 5.8 | | — | | 7.7 | | 5.7 | | 4.8 | | — | | 7.2 | | 7.2 | |

2006 | | 8.2 | | 8.3 | | (1.7 | ) | — | | 5.4 | | — | | 6.7 | | 4.9 | | 4.8 | | — | | 6.4 | | 6.5 | |

Source: Statistics Canada

26

Table A1.5 Employment by Industry in British Columbia

| | 1996 | | 1997 | | 1998 | | 1999 | | 2000 | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | |

| | (thousands) | |

Total – all industries | | 1,816 | | 1,861 | | 1,858 | | 1,894 | | 1,931 | | 1,922 | | 1,965 | | 2,015 | | 2,063 | | 2,131 | | 2,196 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Primary industries | | 86 | | 88 | | 84 | | 77 | | 82 | | 66 | | 67 | | 79 | | 72 | | 76 | | 79 | |

Agriculture | | 31 | | 34 | | 33 | | 28 | | 30 | | 26 | | 29 | | 33 | | 37 | | 39 | | 35 | |

Forestry, logging & support activities . | | 32 | | 32 | | 30 | | 30 | | 36 | | 25 | | 25 | | 28 | | 22 | | 22 | | 22 | |

Fishing, hunting and trapping | | 5 | | 5 | | 3 | | 4 | | 4 | | 5 | | 3 | | 5 | | 3 | | 2 | | 3 | |

Mining and oil & gas extraction | | 18 | | 16 | | 18 | | 15 | | 13 | | 11 | | 9 | | 13 | | 11 | | 14 | | 19 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Manufacturing | | 193 | | 196 | | 196 | | 192 | | 203 | | 195 | | 197 | | 207 | | 211 | | 198 | | 198 | |

Food, beverages & tobacco | | 24 | | 25 | | 26 | | 22 | | 23 | | 26 | | 27 | | 32 | | 31 | | 32 | | 24 | |

Wood products | | 43 | | 45 | | 43 | | 42 | | 46 | | 49 | | 44 | | 49 | | 47 | | 46 | | 45 | |

Paper | | 23 | | 23 | | 23 | | 22 | | 18 | | 15 | | 17 | | 14 | | 12 | | 12 | | 15 | |

Printing & related support activities | | 11 | | 10 | | 8 | | 9 | | 11 | | 9 | | 9 | | 8 | | 8 | | 8 | | 8 | |

Primary metals | | 11 | | 9 | | 9 | | 10 | | 11 | | 8 | | 6 | | 9 | | 7 | | 7 | | 7 | |

Metal fabrication | | 9 | | 11 | | 10 | | 12 | | 13 | | 14 | | 13 | | 14 | | 15 | | 18 | | 15 | |

Transportation equipment | | 9 | | 13 | | 13 | | 13 | | 13 | | 10 | | 13 | | 12 | | 12 | | 9 | | 10 | |

Machinery manufacturing | | 6 | | 9 | | 9 | | 8 | | 8 | | 7 | | 10 | | 9 | | 10 | | 10 | | 9 | |

Other manufacturing | | 56 | | 53 | | 55 | | 53 | | 61 | | 58 | | 58 | | 60 | | 71 | | 57 | | 64 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Construction | | 119 | | 123 | | 117 | | 114 | | 111 | | 111 | | 118 | | 120 | | 144 | | 168 | | 179 | |

General contractors | | 44 | | 41 | | 38 | | 42 | | 42 | | 40 | | 42 | | 47 | | 51 | | 66 | | 66 | |

Special trade contractors | | 76 | | 82 | | 79 | | 73 | | 69 | | 71 | | 77 | | 73 | | 93 | | 102 | | 113 | |

| | | | | | | | | | | | | | | | | | | | | | | |