Exhibit 99.5

Public Accounts

For the Fiscal Year Ended

March 31, 2007

National Library of Canada Cataloguing in Publication Data

British Columbia. Office of the Comptroller General.

Public accounts for the year ended... – 2000/2001–

Annual.

Report year ends Mar. 31.

Continues: British Columbia. Ministry of Finance.

Public accounts. ISSN 1187–8657.

ISSN 1499–1659 = Public accounts–British Columbia.

Office of the Comptroller General

1. British Columbia–Appropriations and expenditures–Periodicals.

2. Revenue–British Columbia–Periodicals.

3. Finance, Public–British Columbia–Periodicals. 1. British Columbia. Ministry of Finance. 2. Title.

HJ13.B74 352.4’09711’05 C2001–960204–9

| July 11, 2007 |

| Victoria, British Columbia |

| |

Lieutenant Governor of the Province of British Columbia | |

MAY IT PLEASE YOUR HONOUR:

The undersigned has the honour to present the Public Accounts of the Government of the Province of British Columbia for the fiscal year ended March 31, 2007.

| CAROLE TAYLOR |

| Minister of Finance |

| |

| |

Ministry of Finance | |

Victoria, British Columbia | |

| |

| |

Honourable Carole Taylor

Minister of Finance

I have the honour to submit herewith the Public Accounts of the Government of the Province of British Columbia for the fiscal year ended March 31, 2007.

Respectfully submitted,

| CHERYL WENEZENKI–YOLLAND |

| Comptroller General |

British Columbia’s Public Accounts

Leading the Way

British Columbia is committed to leading best practices in public sector reporting. The Public Accounts are one of the more significant accountability documents of the provincial government. They demonstrate accountability to the citizens of British Columbia by providing audited financial statements and other information in a consistent, timely and understandable format. They allow the reader to see how government performed relative to its fiscal plan and provide a picture of the current financial state of the province in terms of its assets, liabilities and net debt.

The main focus of the Public Accounts is the Summary Financial Statements representing the consolidated financial results and financial position. These statements provide a whole of government view of how the province and its various organizations performed against the fiscal plan. Consistent with its legislative requirement to follow generally accepted accounting principles (GAAP), the province includes the financial balances and results of operations of school districts, universities, colleges, institutes and health organizations (the SUCH sector).

Further information is also provided through the Consolidated Revenue Fund Extracts (available on the Internet –website http://www.fin.gov.bc.ca/ocg/htm). These extracts compare actual to planned spending of ministries on an appropriation basis, which represents another significant accountability of ministries back to the Legislative Assembly.

Following inclusion of the SUCH sector in the province’s financial statements in 2004/05, the province has received, for the third year running, an audit opinion free of any audit qualifications. The province continues to improve the Public Accounts in terms of their usefulness to readers. Of particular note this year are the modifications to the financial highlights section to improve the readability and provide for a more meaningful discussion of the results achieved. Beyond editorial changes, two additional measures of government’s financial condition have been added, the change in capital stock and the surplus/deficit to gross domestic product (GDP). These financial measures help users understand: government’s ability to sustain existing government activities and infrastructure, the flexibility of government to fund additional activities, and the vulnerability of government to outside sources of funding. Trend information has been expanded to cover the four year period 2003/04 to date.

The way governments manage and deliver public service continues to evolve, therefore the accounting and reporting standards also need to evolve to recognize the new context and operational reality of public service. Emerging areas such as public private partnerships or private finance initiatives require guidance to ensure they are reported fairly and consistent with the principles of public sector accounting. While standards generally provide guidance on accounting, some of the more complex types of transactions require specific application guidance to be developed to ensure their treatment is consistent and correct across the broad entity. While determining the costs under public private partnership (P3) arrangements is easy, identifying how they should be allocated between the capital asset value and operating costs has been the subject of much debate within the accounting community.

In light of this, British Columbia has led the development of a new methodology to consistently value the costs for all provincial P3 arrangements. From the provincial perspective, the adoption of the new methodology has not resulted in any substantial changes to the way P3 assets are valued or reported. We are also working with standard setters and other jurisdictions to lead the development of international practice in the area of P3s. We will continue to revise our model and evaluate any required changes as standards develop and are adopted.

Public Sector financial accounting standards continue to evolve nationally and internationally. British Columbia remains committed to leading the development of consistent, principle based policies which are both relevant and reliable, and strive to better inform users of the government’s financial statements.

As a result of the province’s full compliance with GAAP, British Columbia continues to lead the country in terms of the organizations it includes in its reporting entity. As stated in previous years, we will continue to monitor the practices of other senior governments to determine if universities should be considered part of government in the long term. This year, there have been no significant changes to the reporting entity. There is a complete listing of the reporting entity for government on pages 71 –73.

Accounting policies are reviewed each year for continued relevance and consistency with GAAP. As GAAP changes, the province must change its policies accordingly. There have been no changes to the province’s accounting policies this year. The Province has chosen early adoption of the new disclosure guidance in the area of Asset Retirement Obligations to inform users of the future costs associated with using capital assets to deliver programs and services. Accounting policy and format changes are made in consultation with the independent Accounting Policy Advisory Committee created under the Budget Transparency and Accountability Act in 2001.

British Columbia continues to be a leader in budgeting and financial reporting based on the comparability of its Estimates and Public Accounts and the focus on “one bottom line”; that is, the Summary Financial Statements of the province. We will continue to change as accounting standards evolve and respond to the changing needs of the legislature and our financial statement readers. British Columbia’s open and transparent financial reporting has played a significant part in the decision by certain major credit rating agencies to once again increase the credit rating of the province.

I would like to thank the Select Standing Committee on Public Accounts of the Legislative Assembly, government ministries, Crown corporations, agencies, the SUCH sector and the Auditor General and his staff for their cooperation and support in preparing the 2006/07 Public Accounts. I would also like to acknowledge the dedication of staff of the Office of the Comptroller General—specifically, the Financial Reporting and Advisory Services Branch, who prepared the Public Accounts and supporting documents. The efforts of all participants were critical in an early completion date comparable with the best practitioners in Canada.

Comments or questions regarding the Public Accounts documents are encouraged and much appreciated. Please direct your comments or questions to me by mail at PO Box 9413 STN PROV GOVT, Victoria BC V8W 9V1; e–mail at: Cheryl.WenezenkiYolland@gov.bc.ca; or, by telephone at 250 387–6692, fax at 250 356–2001.

| CHERYL WENEZENKI–YOLLAND |

| Comptroller General |

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2006/07

Contents | | |

| | |

Overview (Unaudited) | | |

| | |

Public Accounts Content | | 9 |

| | |

Legislative Compliance and Accounting Policy Report | | 10 |

| | |

Financial Statement Discussion and Analysis Report | | 11 |

Highlights | | 11 |

Discussion and Analysis | | 13 |

| | |

Summary Financial Statements | | |

| | |

Statement of Responsibility for the Summary Financial Statements of the Government of the Province of British Columbia | | 29 |

Report of the Auditor General of British Columbia | | 31 |

Consolidated Statement of Financial Position | | 33 |

Consolidated Statement of Operations | | 34 |

Consolidated Statement of Change in Net Liabilities | | 35 |

Consolidated Statement of Cash Flow | | 36 |

Notes to Consolidated Summary Financial Statements | | 37 |

Reporting Entity | | 70 |

Consolidated Statement of Financial Position by Sector | | 73 |

Consolidated Statement of Operations by Sector | | 77 |

Statement of Financial Position for Self–supported Crown Corporations and Agencies | | 81 |

Summary of Results of Operations and Statement of Equity for Self–supported Crown Corporations and Agencies | | 82 |

Consolidated Statement of Tangible Capital Assets | | 83 |

Consolidated Statement of Guaranteed Debt | | 84 |

| | |

Supplementary Information (Unaudited) | | |

| | |

Adjusted Net Income of Crown Corporations, Agencies and the SUCH Sector | | 88 |

SUCH Statement of Financial Position | | 91 |

SUCH Statement of Operations | | 93 |

Consolidated Staff Utilization | | 94 |

| | |

Consolidated Revenue Fund Extracts (Unaudited) | | |

| | |

Statement of Operations | | 98 |

Schedule of Net Revenue by Source | | 99 |

Schedule of Comparison of Estimated Expenses to Actual Expenses | | 101 |

Schedule of Financing Transaction Disbursements | | 103 |

Schedule of Write–offs, Extinguishments and Remissions | | 104 |

| | |

Provincial Debt Summary | | |

| | |

Overview of Provincial Debt (Unaudited) | | 108 |

Provincial Debt (Unaudited) | | 109 |

Change in Provincial Debt (Unaudited) | | 110 |

Reconciliation of Summary Financial Statements’ Surplus to Change in Taxpayer– supported Debt and Total Debt (Unaudited) | | 111 |

Reconciliation of Total Debt to the Summary Financial Statements Debt (Unaudited) | | 111 |

Change in Provincial Debt, Comparison to Budget (Unaudited) | | 112 |

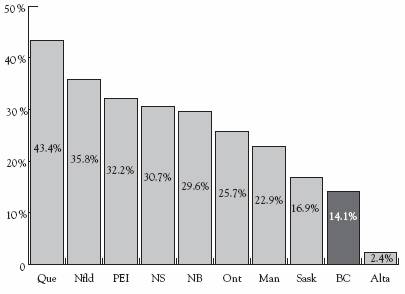

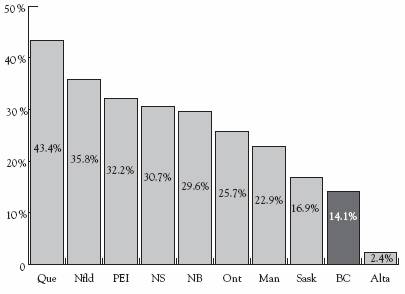

Interprovincial Comparison of Taxpayer–supported Debt as a Percentage of Gross Domestic Product (Unaudited) | | 113 |

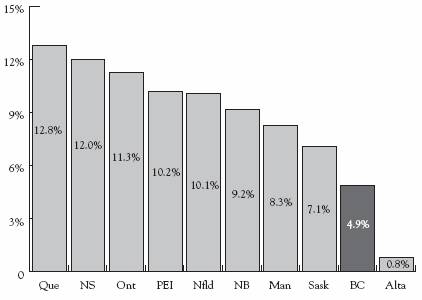

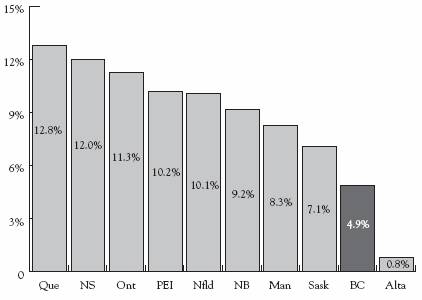

Interprovincial Comparison of Taxpayer–supported Debt Service Costs as a Percentage of Revenue (Unaudited) | | 114 |

Report of the Auditor General of British Columbia on the Summary of Provincial Debt, Key Indicators of Provincial Debt, and Summary of Performance Measures | | 116 |

Summary of Provincial Debt | | 118 |

Key Indicators of Provincial Debt | | 119 |

Summary of Performance Measures | | 120 |

| | |

Definitions (Unaudited) | | 121 |

| | |

Acronyms (Unaudited) | | 124 |

Public Accounts Content

Financial Statement Discussion and Analysis (Unaudited)—this section provides a written commentary on the Summary Financial Statements plus additional information on the financial performance of the provincial government.

Summary Financial Statements—these audited statements have been prepared to disclose the financial impact of the government’s activities. They aggregate the Consolidated Revenue Fund (CRF), the taxpayer–supported Crown corporations and agencies (government organizations), the self–supported Crown corporations and agencies (government enterprises) and the school districts, universities, colleges, institutes and health organizations (SUCH) sector.

Supplementary Information (Unaudited)—this section provides supplementary schedules containing detailed information on the results of those Crown corporations and agencies that are part of the government reporting entity and the impact of the SUCH sector on the province’s financial statements.

Consolidated Revenue Fund Extracts (Unaudited)—the CRF reflects the core operations of the province as represented by the operations of government ministries and legislative offices. Its statements are included in an abridged form. The CRF Extracts include a summary of the CRF operating result, a schedule of net revenue by source, a schedule of expenses, a schedule of financing transactions, and a schedule of write–offs, extinguishments and remissions, as required by statute.

Provincial Debt Summary–this section presents unaudited schedules and unaudited statements that provide further details on provincial debt and reconcile the Summary Financial Statements debt to the province’s total debt. Also included are the audited Summary of Provincial Debt, Key Indicators of Provincial Debt and Summary of Performance Measures.

This publication is available on the Internet at: www.fin.gov.bc.ca

Additional Information Available (Unaudited)

The following information is available only on the Internet at: www.fin.gov.bc.ca

Consolidated Revenue Fund Supplementary Schedules—this section contains schedules that provide details of financial activities of the CRF, including details of expenses by ministerial appropriations, an analysis of statutory appropriations, Special Accounts and Special Fund balances and operating statements, and financing transactions.

Consolidated Revenue Fund Detailed Schedules of Payments—this section contains detailed schedules of salaries, wages, travel expenses, grants and other payments.

Financial Statements of Government Organizations and Enterprises—this section contains links to the audited financial statements of those Crown corporations, agencies and SUCH sector entities that are included in the government reporting entity.

Summaries of Financial Statements of Corporations and Agencies to which the Financial Information Act applies—this section contains summaries of the financial statements of corporations, associations, boards, commissions, societies and public bodies required to report under the Financial Information Act (R.S.B.C. 1996, chap. 140, sec. 2).

9

Legislative Compliance and Accounting Policy Report

The focus of the province’s financial reporting is the Summary Financial Statements, which consolidate the operating and financial results of the province’s Crown corporations, agencies, school districts, universities, colleges, institutes and health organizations with the Consolidated Revenue Fund. These are general–purpose statements designed to meet, to the extent possible, the information needs of a variety of users.

The Public Accounts are prepared in accordance with the Financial Administration Act and the Budget Transparency and Accountability Act (BTAA).

The BTAA was amended in 2001 with the passing of Bill 5. Under section 20 of that Bill, the government has mandated that “all accounting policies and practices applicable to documents required to be made public under this Act for the government reporting entity must conform to generally accepted accounting principles.”

For senior governments, generally accepted accounting principles (GAAP) is generally considered to be the recommendations and guidelines of the Public Sector Accounting Board of the Canadian Institute of Chartered Accountants.

Section 4.1 of the BTAA established an Accounting Policy Advisory Committee (APAC) to advise Treasury Board on the implementation of GAAP for the government reporting entity (GRE). With the government’s transition to full GAAP for the 2004/05 year, the role of APAC changed to include the provision of advice on evolving developments in accounting standards by the accounting profession as well as emerging issues within government.

10

Financial Statement Discussion and Analysis Report

Highlights

The highlights section provides a summary of the key events affecting the financial statements.

The information contained within this section is taken from the Summary Financial Statements on pages 33–85. The budget figures are from pages 3–7 of the Estimates—Fiscal Year Ending March 31, 2007.

• The province ended the year with a surplus of $4,056 million. Taxation revenue increased by $1,589 million due to strong economic activity and personal income growth. There were also increases in one time transfers from the federal government ($561 million ) and increased earnings of self–supported Crown corporations ($465 million).

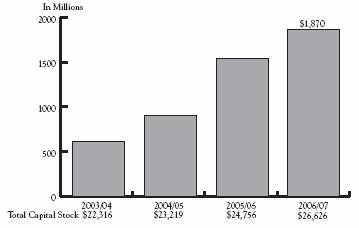

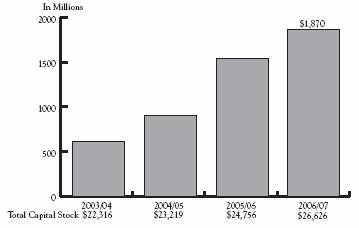

• 2006/07 also saw record investment in the infrastructure required to meet the needs of a growing economy and ensure that infrastructure is available to support current and future requirements for social programs. Total capital spending of $3,366 million, reduced by annual amortization and disposals totaling $1,496 million resulted in a net increase in infrastructure assets of $1,870 million.

• The surplus also provided for the reduction of total provincial debt by $1,038 million. The cumulative reduction in total debt in the four years since 2003/04 is $4,388 million. As reported in the financial statements (gross of sinking funds, guarantees and the direct debt of self–supported Crown corporations), debt was reduced by $1,309 million.

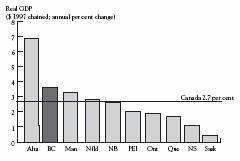

• In calendar year 2006 the province experienced strong economic growth of 3.6%, the second highest rate of growth among Canadian provinces.

• The financial statements of the province of British Columbia fully comply with generally accepted accounting principles for the public sector and received an unqualified audit opinion from the Office of the Auditor General.

• Recognizing governments commitment to sound financial management the province has received upgrades from all three major credit rating agencies. Dominion Bond Rating Service upgraded the province’s rating to AA (high). Standard & Poor’s and Moody’s Investors Services Inc. upgraded their ratings to AAA and Aaa respectively, their highest possible ratings.

11

Economic Highlights

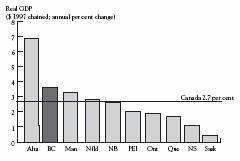

British Columbia’s economy grew by 3.6% in calendar 2006, the second strongest growth among provinces and above the national average of 2.7%, according to preliminary results from Statistics Canada. The estimated 3.6% growth last year exceeds government’s February 2006 budget forecast of 3.3%.

Real Gross Domestic Product in Calendar Year 2006

Economic growth in British Columbia was fuelled by robust domestic activity in 2006. Real business investment grew by 9.5%, with growth in both residential construction (6.6%), non–residential construction (9.2%) and machinery and equipment investment (14.9%). Real consumer spending, which accounts for about two–thirds of all economic activity in the province, grew by 5.3% in 2006.

Despite the continued rise of the Canadian dollar against the US dollar in 2006, total exports of goods and services grew by 2.4%. Imports of goods and services from other countries and other provinces grew by 6.3% in 2006.

Provincial Comparison

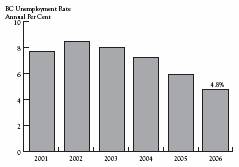

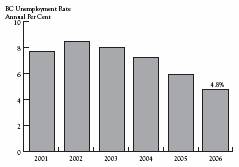

Unemployment Rate in Calendar Year 2006

British Columbia’s economic growth was accompanied by a marked drop in the annual unemployment rate to 4.8% (the lowest in 30 years) and strong labour income growth of 8.2%.

2001 to 2006

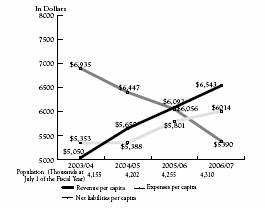

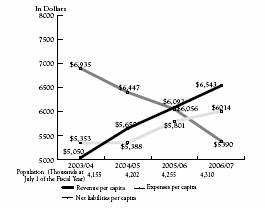

Per Capita Information

Per capita information indicates the amount of revenue received, amounts expended, and net liabilities incurred per person in the province.

2003/04 to 2006/07

12

Discussion and Analysis

The detailed analysis section provides an overview of significant trends relating to the statement of operations, statement of financial position and the provincial debt.

Summary Accounts Surplus (Deficit)

| | In Millions | | Variance | |

| | | | | | | | 2006/07 | | 2006/07 | |

| | 2006/07 | | 2006/07 | | 2005/06 | | Actual | | vs | |

| | Budget | | Actual | | Actual | | to Budget | | 2005/06 | |

| | $ | | $ | | $ | | $ | | $ | |

Taxpayer–supported Programs and Agencies | | | | | | | | | | | |

Revenue | | 33,393 | | 35,819 | | 33,753 | | 2,426 | | 2,066 | |

Expense | | (33,914 | ) | (34,448 | ) | (32,883 | ) | (534 | ) | (1,565 | ) |

Taxpayer–supported net earnings | | (521 | ) | 1,371 | | 870 | | 1,892 | | 501 | |

Self–supported Crown corporation net earnings | | 1,971 | | 2,685 | | 2,220 | | 714 | | 465 | |

Surplus (deficit) before unusual items | | 1,450 | | 4,056 | | 3,090 | | 2,606 | | 966 | |

Forecast allowance | | (850 | ) | | | | | 850 | | 0 | |

Surplus (deficit) for the year | | 600 | | 4,056 | | 3,090 | | 3,456 | | 966 | |

The province ended the year with a surplus of $4,056 million, $3,456 million higher than budget, reflecting robust economic performance, higher than anticipated federal transfers and earnings from self-supported Crown corporations. Compared to the previous year, the 2006/07 results were $966 million higher.

The higher than expected surplus over the last few years has allowed the province to invest in infrastructure while reducing provincial debt. The 2006/07 surplus of $4,056 million resulted in a net annual investment in infrastructure of $1,870 million, made up of gross capital spending of $3,366 million less amortization and disposals of $1,496 million, and a reduction in total financial statement debt of $1,309 million. The $3,090 million surplus in 2005/06 and the $4,056 million surplus in 2006/07 helped finance these projects:

• $1.66 billion for post–secondary facilities including the North Cariboo Community Campus in Quesnel, and the University of Victoria’s Engineering and Computer Science Building

• $0.61 billion for the K–12 school system including Pacific Heights Elementary school in Surrey and L’Ecole Victor Brodeur in Esquimalt

• $1.61 billion for health facilities and equipment including the Mental Health Building for Children at BC Children’s and Women’s Hospitals and cancer treatment vaults at the BC Cancer Agency’s Vancouver Centre

• $1.53 billion for roads and bridges including the Cariboo connector program, Kicking Horse Canyon Phase I and the Yoho bridge

BC will continue to invest in building and upgrading schools, universities, colleges, hospitals, roads and bridges to meet the needs of a growing economy.

Analysis of the provinces surplus also identifies risks to continued strong performances in future periods. Volatility in sources of revenue, particularly natural resources revenue, indicates that higher than expected revenues cannot be counted on in future periods. Changing demographics and a tightening labour market pose a risk to increasing GDP and an increasing tax base. Dependence on one time transfers from the Federal Government is also a risk that must be monitored closely. Mitigating these risks is the moderate rate of increase in operating expenses to ensure sustainability in the future.

13

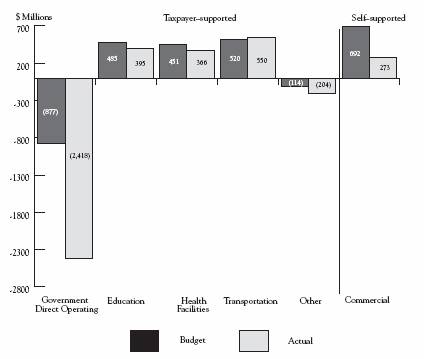

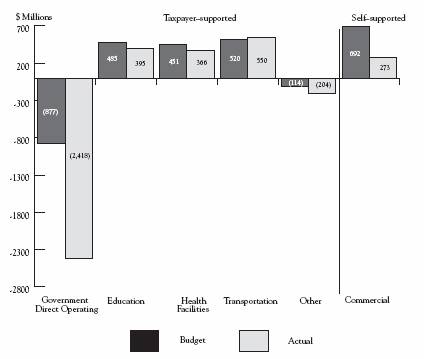

Components of Surplus (deficit)

Revenue Analysis

Revenue analysis helps users understand the government’s finances in terms of its revenue sources and to evaluate the revenue–producing capacity of the government.

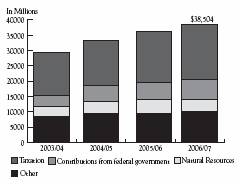

Revenue by Source

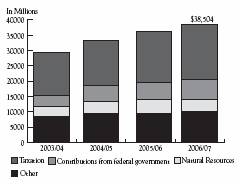

Revenue by source provides an outline of the primary sources of provincial revenue and changes between sources over time. Revenues are broken down into separate components of taxation; contributions from the federal government; natural resources and other sources, which includes contributions from self-supported Crown corporations, fees and licenses, and investment income.

| | | | In Millions | | | |

| | 2003/04 | | 2004/05 | | 2005/06 | | 2006/07 | |

| | Actual | | Actual | | Actual | | Actual | |

| | $ | | $ | | $ | | $ | |

Taxation | | 13,830 | | 14,917 | | 16,429 | | 18,018 | |

Contributions from federal government | | 3,619 | | 5,222 | | 5,825 | | 6,386 | |

Natural resources | | 3,309 | | 3,973 | | 4,567 | | 3,982 | |

Fees and licences | | 3,531 | | 3,621 | | 3,666 | | 3,791 | |

Miscellaneous | | 1,968 | | 2,240 | | 2,317 | | 2,610 | |

Net earnings of self-supported Crown corporations | | 1,955 | | 2,562 | | 2,220 | | 2,685 | |

Investment income | | 950 | | 833 | | 949 | | 1,032 | |

Total revenue | | 29,162 | | 33,368 | | 35,973 | | 38,504 | |

The province has experienced steady growth in revenues over the last four years. This growth is mainly due to strong economic performance, resulting in increased tax revenue. Federal contributions have also increased as a proportion of total revenues. Natural resource revenues have decreased in 2006/07 reversing a trend over the past several years due to a decline in natural gas prices. Average prices declined 29% in 2006/07 while volumes declined 1%.

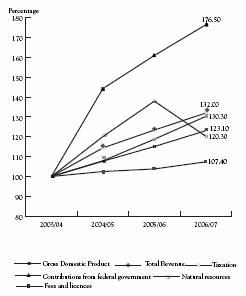

2003/04 to 2006/07

In 2006/07 tax revenue increased by $1,589 million (10%) over the prior year and $4,188 million (30%) since 2003/04. Personal income tax, social services tax, property transfer tax and corporate income tax all increased over the previous year. The most significant increase was in personal income tax which increased by $1,067 million over 2005/06. The increase in tax revenue is a result of strong economic activity including personal and labour income growth.

Contributions from the federal government increased in 2006/07 by $561 million (10%) from 2005/06 mainly reflecting the one time payment received from the federal government to fund capital projects in British Columbia. The trend in federal government transfers has been increasing steadily since 2003/04, but one time grants based on federal surpluses may not be available in future years.

14

Natural resources revenues decreased in 2006/07 by $585 million (13%) from 2005/06 due to a decline in natural gas prices. The decrease is mostly attributable to declining natural gas royalties, which was offset by higher forestry revenues derived from the Softwood Lumber Export Tax, and higher metal prices. Natural resource revenues are volatile because they are subject to fluctuation in commodity prices.

Commercial Crown corporation income increased in 2006/07 by $465 million (21%). The increase in 2006/07 resulted from an increase in British Columbia Hydro and Power Authority’s (BC Hydro) income due to lower energy costs; the Insurance Corporation of British Columbia (ICBC) experiencing lower claim costs and higher premium revenue; and stronger casino revenues in the British Columbia Lottery Corporation (BCLC ).

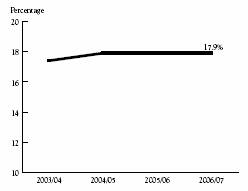

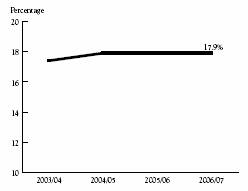

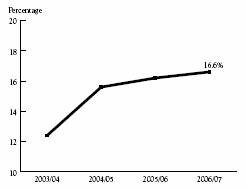

Own–source Revenue to GDP

The ratio of own–source revenue to GDP represents the amount of income government is taking from the whole provincial economy in the form of taxation, natural resource revenues, user fees and sales (own–source revenue is all revenue except for federal transfers). Own–source revenue to GDP has remained constant around 18% for the last four years. This indicates the government has not increased the proportion received from the economy to meet its obligations and fund increases to social programs and infrastructure.

2003/04 to 2006/07

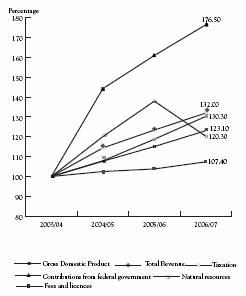

Percentage Change in Revenue

Trend analysis of revenue provides users with information about significant changes in revenue over time and between sources, enabling users to evaluate past performance and assess potential implications for the future.

Increases in total taxation revenue have been consistent with the change in gross domestic product (GDP). Fees and licences have remained steady over the last four years while natural resources have shown significant increases over two years with the current year decline reflecting a decrease in natural gas royalties. Federal transfers revenue have exceeded GDP growth over the last three years indicating an increased share of federal surplus being invested in provincial programs and infrastructure.

2003/04 to 2006/07

15

Natural Resources Revenue

Natural resource revenues are among the most volatile revenue sources for the province because they are vulnerable to market fluctuations in commodity prices.

The increasing trend in natural resource revenue from 2003/04 to 2005/06 reversed in 2006/07 as a result of a decrease in natural gas prices. Natural gas royalties decreased $714 million over 2005/06 which was offset by increases in royalties for minerals and energy and increased revenues from the Softwood Lumber Export Tax. The proportion of natural resource revenue attributable to natural gas royalties has decreased from 42% to 30% in the year.

2003/04 to 2006/07

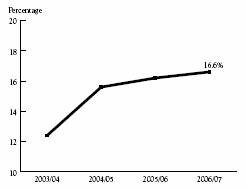

Government–to–Government Transfers to Total Revenue

The ratio of government–to–government transfers to total revenue indicates the vulnerability of the province to changes in transfers from the federal government. The increase in the proportion of federal government transfers to total revenue outlines an increasing dependence on federal government transfers to fund provincial programs and investment in infrastructure.

The significant increase in 2004/05 reflects equalization program adjustments to the 2003/04 fiscal year. Smaller increases in subsequent years represent one time payments to fund specific provincial programs and infrastructure investments.

2003/04 to 2006/07

16

Expense Analysis

The following analysis helps users understand the impact of the government’s spending on the economy, the government’s allocation and use of resources, and the cost of government programs.

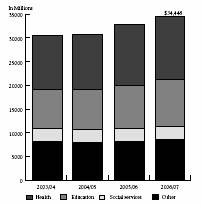

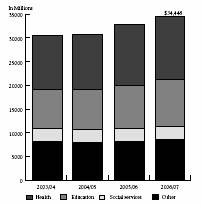

Expense by Function

Expense by function provides a summary of the major areas of government spending, and changes in spending over time. Functions are broken down into separate components of health, education, social services, which make up 75% of the province’s total operating expense, and other functions which includes interest, other, natural resources and economic development, protection of persons and property, transportation, and general government.

| | In Millions | |

| | 2003/04 | | 2004/05 | | 2005/06 | | 2006/07 | |

| | Actual | | Actual | | Actual | | Actual | |

| | $ | | $ | | $ | | $ | |

Health | | 11,250 | | 11,529 | | 12,838 | | 13,253 | |

Education | | 8,237 | | 8,512 | | 9,047 | | 9,774 | |

Social services | | 2,753 | | 2,598 | | 2,798 | | 2,892 | |

Interest | | 2,437 | | 2,294 | | 2,181 | | 2,234 | |

Other | | 1,075 | | 1,027 | | 1,094 | | 1,278 | |

Natural resources and economic development | | 1,631 | | 1,686 | | 1,630 | | 1,664 | |

Protection of persons and property | | 1,364 | | 1,206 | | 1,416 | | 1,334 | |

Transportation | | 1,120 | | 1,308 | | 1,203 | | 1,251 | |

General government | | 490 | | 505 | | 676 | | 768 | |

Total operating expense | | 30,357 | | 30,665 | | 32,883 | | 34,448 | |

Restructuring exit expense | | 123 | | | | | | | |

Total expense | | 30,480 | | 30,665 | | 32,883 | | 34,448 | |

Government spending has increased moderately since 2003/04 in line with affordability. Expenses have increased by 5% in 2006/07 while revenues increased by 10% in the same period, and GDP by 3.6%. The main increases in spending relate to increased wages and operating expense in the health sector, which were paid for partially from the funding received from the federal government; increased education funding reflecting post–secondary seat expansion; and increased funding to school districts.

2003/04 to 2006/07

In 2006/07, provincial operating expense totaled $34,448 million, a $1,565 million (5%) increase over 2005/06 operating expense and a $3,968 million (13%) increase over 2003/04. Health expense increased due to increases in salaries, operational costs and additional staffing. An increase of $727 million (8%) in education expense reflects the increase in salaries for schools, universities and colleges, including teacher and support staff bonuses; operating costs related to new research facilities for universities; increased staffing to fund smaller class sizes in schools and 4,394 new student spaces for colleges and universities. Social services costs increased $94 million from 2005/06 as a result of increased funding for social programs.

Other expenses have increased by $184 million over 2005/06; including additional spending on the 2010 Olympic venues and increased grant expense of BC Housing Management Commission.

17

Expense To GDP

The ratio of expense to GDP represents the amount of government spending in relation to the overall provincial economy. Government spending, as a percentage of GDP decreased slightly in 2006/07, after remaining constant from 2004/05 to 2005/06. This indicates that the economy is growing faster than spending in the province’s health, education and social services sectors.

2003/04 to 2006/07

Changes in Actual Results from 2005/06 to 2006/07

| | In Millions | |

| | Revenue | | Expense | | Surplus | |

| | $ | | $ | | $ | |

2005/06 Surplus | | 35,973 | | 32,883 | | 3,090 | |

Increase in taxation revenue | | 1,589 | | | | 1,589 | |

Increase in federal contributions | | 561 | | | | 561 | |

Decrease in natural resources revenue | | (585 | ) | | | (585 | ) |

Net increase in other revenue | | 501 | | | | 501 | |

Increase in self-supported Crown corporation net earnings | | 465 | | | | 465 | |

Increase in health expense | | | | 415 | | (415 | ) |

Increase in education expense | | | | 727 | | (727 | ) |

Increase in general government expense | | | | 92 | | (92 | ) |

Increase in other expenses | | | | 331 | | (331 | ) |

Subtotal of changes in actual results | | 2,531 | | 1,565 | | 966 | |

| | 38,504 | | 34,448 | | | |

2006/07 Surplus | | | | | | 4,056 | |

| | | | | | | |

2005/06 Accumulated (Deficit) | | | | | | (167 | ) |

Other comprehensive income from self-supported Crown corporation and agencies | | | | | | 447 | |

2006/07 Accumulated Surplus | | | | | | 4,336 | |

Revenue increased by $2,531 million or 7% over 2005/06 due to the increases in taxation revenue and federal transfers, as well as increases from BC Hydro, and other self–supported Crown corporations earnings. These increases were partly offset by the decline in natural gas revenues due to lower prices. Federal government contributions increased $561 million from 2005/06 due to British Columbia’s share of health transfers under the First Ministers’ Accord and a one time capital transfer of $408 million related to post secondary education, public transit, affordable housing and off–reserve housing. The increase in federal government transfers was partially offset by a decrease in equalization entitlements.

18

Personal and corporate income tax revenue rose by $1,179 million in the year. Personal income tax revenue increased by $1,067 over prior year due to a higher 2005 tax base, reflecting stronger growth in 2005 and 2006. Corporate income tax revenues increased due to improved economic conditions offset by lower instalments from the federal government as a result of lower growth in 2006 national corporate profits. The growth in personal and business incomes in 2006 combined with strong demand for residential and commercial property led to an increase of $410 million in other taxation revenues –mainly social service and property transfer taxes.

The $585 million decrease in natural resources revenue was due to a decline in natural gas royalties and lower market prices for electricity as a result of lower natural gas prices, plenty of water in the Pacific Northwest and low demand. This was offset by $156 million received under the Softwood Lumber Agreement 2006 border tax, and higher than anticipated mineral and metal prices. Revenue increases also included a $465 million increase in commercial Crown corporation net income. BC Hydro, ICBC and BCLC all experienced improvements in net income.

Expenses increased $1,565 million (5%) from 2005/06 in part due to an increase in salaries resulting from contract negotiations in 2006, increased spending on healthcare, education, and higher forest fire fighting costs.

Changes from 2006/07 Budget

| | In Millions | |

| | | | | | Forecast | | | |

| | Revenue | | Expense | | Allowance | | Surplus | |

| | $ | | $ | | $ | | $ | |

Surplus per Budget February 2006 | | 35,364 | | 33,914 | | (850 | ) | 600 | |

Increase in taxation revenue | | 1,800 | | | | | | 1,800 | |

Decreased natural resource revenue | | (870 | ) | | | | | (870 | ) |

Increased self–supported Crown corporations earnings | | 714 | | | | | | 714 | |

Increased investment earnings | | 213 | | | | | | 213 | |

Increased federal transfers | | 657 | | | | | | 657 | |

Increased other revenues | | 626 | | | | | | 626 | |

Interest savings | | | | (70 | ) | | | 70 | |

Negotiating framework incentives | | | | 264 | | | | (264 | ) |

Program spending | | | | 340 | | | | (340 | ) |

Unused forecast allowance | | | | | | 850 | | 850 | |

Subtotal of changes in actual results compared to budget | | 3,140 | | 534 | | 850 | | 3,456 | |

Actual Results | | 38,504 | | 34,448 | | 0 | | 4,056 | |

Revenue was $3,140 million (9%) higher than budget due to the effects of robust economic performance, income growth, increased earnings from self–supported Crown corporations, and increased federal transfers due to a one time transfer of infrastructure funding.

Revenue from personal and corporate income taxes was $1,259 million higher than budget, of which $684 million represented better than expected 2005 tax return results. Increases in other taxation revenues, including social service tax revenue and property transfer tax are indicators of increased consumer spending and a strong housing market.

19

Natural resource revenue was $870 million lower than budget reflecting lower gas prices. This was offset by an increase in Softwood Lumber Border Tax. Improvements over budget in earnings from self—supported Crowns are mainly derived from: higher premiums and rate increases on basic insurance from Insurance Corporation of British Columbia and higher earnings of BC Hydro resulting from lower energy costs and the inclusion of regulatory transfers in income. The increase in federal transfers included a one time payment to fund capital projects in British Columbia of $408 million.

Expenses were $534 million higher than budget including $264 million dollars spent under the incentive payments for contracts negotiated before their expiry date in 2006/07. Increased expense of $340 million in other programs was offset by interest costs being $70 million below budget.

The forecast allowance was not used as a result of the increased revenues over budget which is indicative of British Columbia’s strong and robust economy.

Net Liabilities and Accumulated Surplus (Deficit)

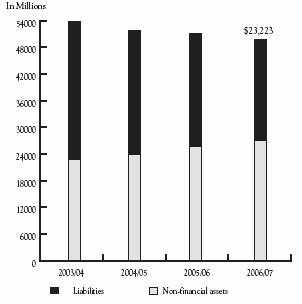

Analysis of net liabilities and accumulated surplus provides users with information to assess the government’s overall financial position. Net liabilities are the amounts repayable by government before financing future operations.

In accordance with Canadian generally accepted accounting principles, the government’s statement of financial position is presented on a net liabilities basis. Net liabilities represent the difference between a government’s financial assets and its liabilities and is a measure of the future revenue required to pay for past transactions and events.

| | In Millions | | Variance | |

| | | | | | | | 2006/07 | | 2006/07 | |

| | 2006/07 | | 2006/07 | | 2005/06 | | Actual | | vs | |

| | Budget | | Actual | | Actual | | to Budget | | 2005/06 | |

| | $ | | $ | | $ | | $ | | $ | |

Financial assets | | 24,285 | | 26,585 | | 25,260 | | 2,300 | | 1,325 | |

Less: liabilities | | (53,051 | ) | (49,818 | ) | (51,030 | ) | (3,233 | ) | (1,212 | ) |

| | | | | | | | | | | |

Net Liabilities | | (28,766 | ) | (23,233 | ) | (25,770 | ) | (5,533 | ) | (2,537 | ) |

Less: non–financial assets | | 27,797 | | 27,569 | | 25,603 | | (228 | ) | 1,966 | |

Accumulated surplus (deficit) | | (969 | ) | 4,336 | | (167 | ) | (5,305 | ) | (4,503 | ) |

The accumulated surplus (deficit) represents the sum of the current and prior years’ operating results. At March 31, 2007, the accumulated surplus totaled $4,336 million, $5,305 million higher than budget due to a higher than forecast surplus. The $4,503 million change from deficit to surplus from the previous year reflects the 2006/07 operating surplus plus other comprehensive income of self–supported Crown corporations.

Financial assets ended the year $2,300 million higher than budget including a $1,166 million increase in cash and temporary investments, a $732 million increase in other financial assets and accounts receivable, a $837 million increase in equity in self–supported Crown, offset by a $435 million reduction in recoverable capital loans. Liabilities were $3,233 million lower than budget and $1,212 million less than the prior year, primarily due to a reduction in taxpayer–supported debt. Other changes from budget reflect the forecast allowance that was not required, and changes in deferred revenue and self–supported debt.

Non–financial assets typically represent resources that the government can use in the future to provide services, such as tangible capital assets. Non–financial assets increased by $1,966 million over the prior year due to the government’s increased capital investment in the post–secondary education, health facilities and transportation sectors.

20

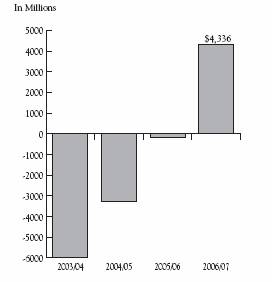

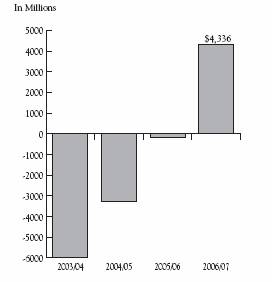

Accumulated Surplus (Deficit)

The accumulated deficit has been eliminated this fiscal year providing a strong and stable economic future for British Columbians. The province has reduced the accumulated deficit by $10,296 million over the last four years as a result of the growing economy and sound fiscal management.

The accumulated surplus (deficit) represents the sum of the current and all prior years’ operating results. As at March 31, 2007 the accumulated surplus totaled $4,336 million.

2003/04 to 2006/07

Components of Net Liabilities

Financial Assets

Analysis of financial assets provides users with information regarding the amount of resources available to the government that can be converted to cash if required to meet obligations.

| | In Millions | |

| | 2003/04 | | 2004/05 | | 2005/06 | | 2006/07 | |

| | Actual | | Actual | | Actual | | Actual | |

| | $ | | $ | | $ | | $ | |

Cash, cash equivalents and temporary investments | | 2,690 | | 3,583 | | 3,869 | | 3,367 | |

Accounts receivable | | 2,792 | | 2,607 | | 2,564 | | 2,842 | |

Equity in self-supported Crown corporations and agencies | | 3,020 | | 3,168 | | 3,448 | | 4,396 | |

Loans for purchases of assets recoverable from agencies | | 7,512 | | 6,901 | | 6,916 | | 7,170 | |

Other financial assets | | 8,120 | | 8,527 | | 8,463 | | 8,810 | |

Total financial assets | | 24,134 | | 24,786 | | 25,260 | | 26,585 | |

In 2006/07, financial assets increased by $1,325 million. The main areas resulting in the increase were the investment in self-supported Crown corporations of $948 million, which relates to the increase in earnings from self-supported Crown corporations and an increase in loans for purchase of assets recoverable from agencies of $254 million. Cash, cash equivalents and temporary investments decreased by $502 million in the year.

21

Liabilities

Analysis of liabilities provides users with information to understand and assess the demands on financial assets.

| | In Millions | |

| | 2003/04 | | 2004/05 | | 2005/06 | | 2006/07 | |

| | Actual | | Actual | | Actual | | Actual | |

| | $ | | $ | | $ | | $ | |

Taxpayer-supported debt | | 33,386 | | 32,018 | | 30,289 | | 28,841 | |

Self-supported debt | | 8,555 | | 7,889 | | 7,758 | | 7,897 | |

Total financial statement debt | | 41,941 | | 39,907 | | 38,047 | | 36,738 | |

Accounts payable and other liabilities | | 7,007 | | 6,788 | | 7,289 | | 7,094 | |

Deferred revenue | | 4,003 | | 5,181 | | 5,694 | | 5,986 | |

Total liabilities | | 52,951 | | 51,876 | | 51,030 | | 49,818 | |

Total financial statement debt decreased $1,309 million from 2005/06 and is $5,203 million lower than 2003/04. The decrease in debt is due to government’s continuing operating surplus and reduced working capital requirements. Information relating to the government’s debt management can be found in more detail in the analysis of the total provincial debt on page 24.

Non-financial Assets

Analysis of non-financial assets provides users with information to assess the management of a government’s infrastructure and long-term non-financial assets.

| | In Millions | |

| | 2003/04 | | 2004/05 | | 2005/06 | | 2006/07 | |

| | Actual | | Actual | | Actual | | Actual | |

| | $ | | $ | | $ | | $ | |

Tangible capital assets | | 22,316 | | 23,219 | | 24,756 | | 26,626 | |

Other assets | | 541 | | 614 | | 847 | | 943 | |

Total non-financial assets | | 22,857 | | 23,833 | | 25,603 | | 27,569 | |

Management of non-financial assets has a direct impact on the level and quality of services a government is able to provide to its constituents. Non-financial assets typically represent resources that government can use in the future to provide services. At March 31, 2007, non-financial assets totaled $27,569 million which was $1,966 million higher than 2005/06 and $4,712 million higher than 2003/04. The majority of the province’s non-financial assets reflects capital expenditures for tangible capital assets. The government has increased its investment in tangible capital assets by $1,870 million in 2006/07, $1,537 million in 2005/06, $903 million in 2004/05, and $610 million in 2003/04 to ensure service potential in future periods.

Change in Capital Stock

This measure shows the impact of net changes to the governments stock of physical capital. An increasing trend demonstrates investment in infrastructure to provide service potential in future periods. The net value of total assets is also provided to allow users to assess the significance of annual changes.

Net annual investment increased by $1,870 million in 2006/07 and by $4,920 million since 2003/04. Total capital stock has also increased steadily over that period demonstrating that capital infrastructure is available to provide service in future periods

2003/04 to 2006/07

22

Net Liabilities and Accumulated Surplus(Deficit)

| | In Millions | |

| | 2003/04 | | 2004/05 | | 2005/06 | | 2006/07 | |

| | Actual | | Actual | | Actual | | Actual | |

| | $ | | $ | | $ | | $ | |

Financial assets | | 24,134 | | 24,786 | | 25,260 | | 26,585 | |

Less: liabilities | | (52,951 | ) | (51,876 | ) | (51,030 | ) | (49,818 | ) |

| | | | | | | | | |

Net liabilities | | (28,817 | ) | (27,090 | ) | (25,770 | ) | (23,233 | ) |

Less: non-financial assets | | 22,857 | | 23,833 | | 25,603 | | 27,569 | |

Accumulated surplus (deficit) | | (5,960 | ) | (3,257 | ) | (167 | ) | 4,336 | |

Net liabilities have decreased consistently each year since 2003/04. The accumulated surplus totaling $4,336 million is a $4,503 million increase from the previous year and $10,296 million increase since 2003/04. Although the province continues to invest in capital infrastructure, successive surpluses have meant these investments did not require additional borrowing.

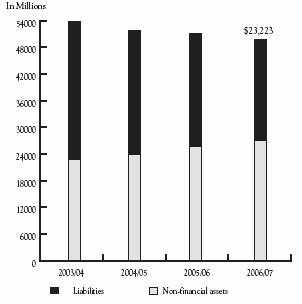

Change in Net Liabilities

Improvement in the net liabilities position provides capacity for increased capital infrastructure investment.

Net liabilities have declined steadily over the last three years and the province moved from a deficit to a surplus in 2006/07. However, the relationship between net liabilities and non-financial assets has changed significantly. Between fiscal years 2003/04 and 2006/07, a greater proportion of liabilities have arisen from government’s investment in infrastructure projects offset by the decline in the province’s accumulated operating deficit. This trend is indicative of BC’s strong economy reflected in continued surpluses.

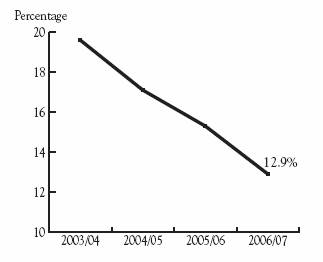

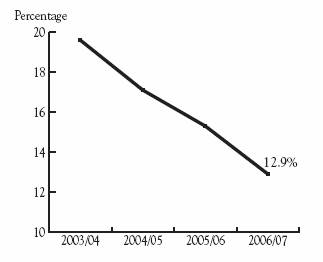

Net Liabilities to GDP

The net liabilities to GDP ratio provides an indication of the province’s ability to maintain existing programs and meet existing creditor requirements without increasing the debt burden on the economy.

The government’s net liabilities to GDP has declined consistently between 2003/04 and 2006/07, decreasing the financial burden on the provincial economy and on future taxpayers. The decrease in net liabilities to GDP indicates the province is improving its ability to sustain program spending without a negative impact on the economy.

2003/04 to 2006/07

2003/04 to 2006/07

23

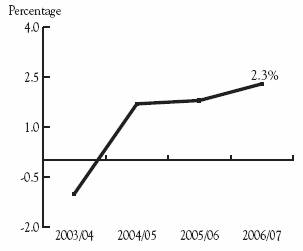

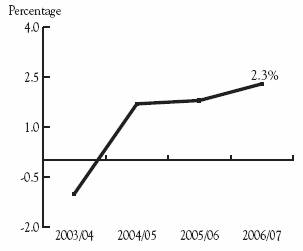

Surplus (Deficit) to GDP

The surplus (deficit) to GDP ratio is an indicator of sustainability. The consistent positive trend since 2003/04 shows that government operating requirements are decreasing at a greater rate than growth in GDP. An increasing trend means that government can maintain existing operations and reduce the debt burden or invest in infrastructure without a negative impact on the economy.

2003/04 to 2006/07

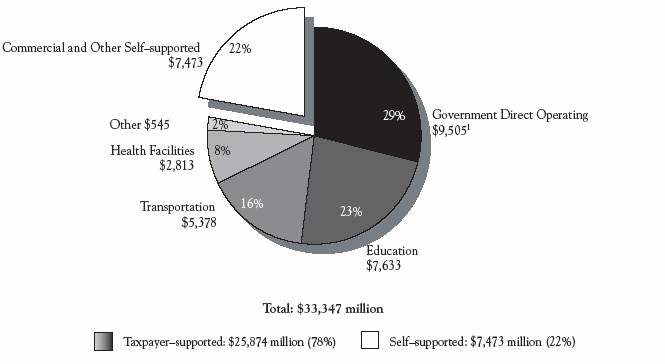

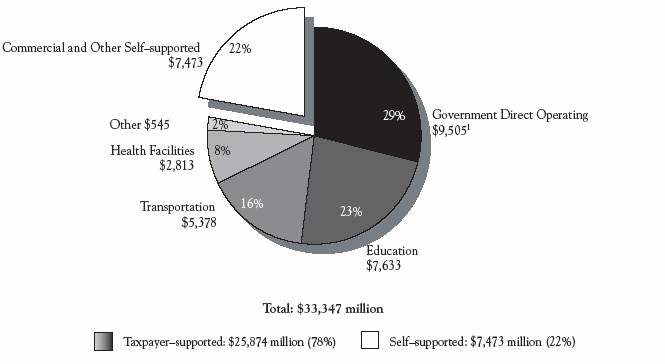

Total Provincial Debt

Analysis of total provincial debt helps users to assess the extent of long-term liabilities and the government’s ability to meet future debt obligations.

| | In Millions | |

| | 2003/04 | | 2004/05 | | 2005/06 | | 2006/07 | |

| | Actual | | Actual | | Actual | | Actual | |

| | $ | | $ | | $ | | $ | |

Gross debt | | 41,941 | | 39,907 | | 38,047 | | 36,738 | |

Less: sinking funds assets | | (4,619 | ) | (4,515 | ) | (4,059 | ) | (3,798 | ) |

Third party guarantees and non-guaranteed debt | | 413 | | 447 | | 397 | | 407 | |

Total provincial debt | | 37,735 | | 35,839 | | 34,385 | | 33,347 | |

When reporting to rating agencies, the province adds to its financial statement debt, all debt guarantees and the debt directly incurred by self-supported Crown corporations reduced by sinking fund assets. This balance is referred to as the total provincial debt.

Total provincial debt is $3,391 million lower than the amounts reported in the province’s financial statements after deducting sinking funds held to pay down the debt and the inclusion of debt guarantees and non-guaranteed debt. The debt decreased by $1,038 million in 2006/07 is primarily due to the operating surplus reducing the requirement to borrow. As at March 31, 2007, the total provincial debt was $33,347 million, $3,243 million lower than budget and $1,038 million lower than 2005/06. This includes $25,874 million of taxpayer-supported debt, which was $2,009 million lower than budget and $1,311 million lower than 2005/06.

The government is commited to maintain a downward trend in the taxpayer-supported debt to GDP ratio. A declining ratio means that debt will not grow faster than the economy, so that future generations will not be left with a debt burden that they cannot afford. The ratio of taxpayer-supported debt to GDP is a key measure used by financial analysts and investors to assess a province’s ability to repay debt and is a key measure monitored by the bond rating agencies.

24

Strong Credit Rating

Reflecting the province’s strong fiscal performance, British Columbia has received credit rating upgrades from all three credit rating agencies. In 2006/07, Moody’s Investors Service Inc. upgraded the province to Aaa (2006: Aa1); Standard and Poor’s upgraded the province to AAA (2006: AA), and Dominion Bond Rating Services upgraded the province to AA (high) (2006: AA).

Credit Ratings June 2007

Rating Agency(1)

| | Moody’s Investors | | | | Dominion Bond | |

Province | | Service Inc. | | Standard and Poor’s | | Rating Service | |

British Columbia | | Aaa | | AAA | | AA (high) | |

Alberta | | Aaa | | AAA | | AAA | |

Saskatchewan | | Aa1 | | AA | | AA(low) | |

Manitoba | | Aa1 | | AA- | | A(high | |

Ontario | | Aa1 | | AA | | AA | |

Quebec | | Aa2 | | A+ | | A(high) | |

New Brunswick | | Aa1 | | AA- | | A(high) | |

Nova Scotia | | Aa2 | | A | | A | |

Prince Edward Island | | Aa2 | | A | | A(low) | |

Newfoundland | | Aa2 | | A | | A(low) | |

Canada | | Aaa | | AAA | | AAA/AA(high) | |

(1) The rating agencies assign letter ratings to borrowers. The major categories, in descending order of credit quality, are: AAA/Aaa; AA/Aa; A; BBB/Baa; BB/Ba; and B. The “1”, “2”, “3”, “high”, “low”, “—”, and “+” modifiers show relative standing within the major categories. For example, AA+ exceeds AA.

A more comprehensive overview of provincial debt, including key debt indicators is located on pages 109.

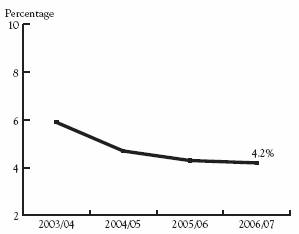

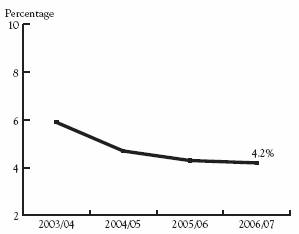

Public Debt Charges to Revenue (the Interest Bite)

The public debt charges to revenue indicator is often referred to as the “interest bite”. This provides users with the percentage of the province’s revenue used to pay interest on debt. If a decreasing proportion of provincial revenue is used to pay interest on provincial debt, more money is left to provide government services.

The interest bite has decreased over the last 3 years. In 2006/07, the province spent 4.2 cents of each revenue dollar on interest on the provincial debt.

2003/04 to 2006/07

25

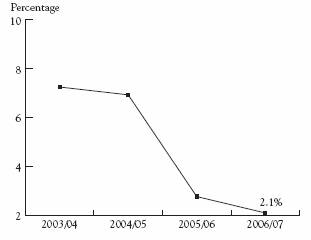

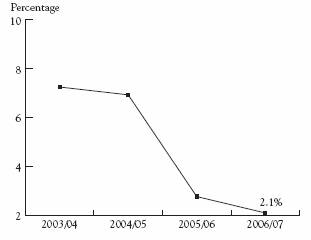

Non-Hedged Foreign Currency Debt to Total Provincial Debt

The ratio of non-hedged foreign currency debt to total provincial debt shows the degree of vulnerability of a government’s public debt position to swings in exchange rates.

Since 2003/04, the government has reduced its foreign currency debt, thereby reducing the province’s vulnerability to changes in exchange rates.

2003/04 to 2006/07

Risks and Uncertainties

The government’s main exposure to risks and uncertainties arises from variables which the government does not directly control. These include:

• economic factors such as commodity prices, personal income, retail sales, population growth, and unexpected shocks such as terrorism, avian flu and forest fires

• outcomes from litigation, arbitration and negotiations with third parties

• changes in federal transfers

• Utilization rates for government services such as health care, children and family services, or employment assistance

• exposure to interest rate fluctuations, foreign exchange rates and credit risk

• changes in generally accepted accounting principles

The following are the approximate effect of changes in some of the key variables on the surplus.

Key Fiscal Sensitivities(1)

Variable | | Increase Of | | Annual Fiscal Impact | |

| | | | ($ millions) | |

Nominal GDP | | 1% | | $150 to $250 | |

Lumber prices (US$/thousand board feet) | | $50 | | $75 to $125(2) | |

Natural gas prices (Cdn$/gigajoule) | | $1 | | $300 to $350 | |

Interest rate | | 1 percentage point | | $(90) | |

Debt | | $500 million | | $(23) | |

(1) Individual circumstances and inter-relationships between the variables may cause the actual variances to be higher or lower than the estimates shown.

(2) Sensitivity relates to stumpage revenue only. Depending on market conditions, changes in stumpage revenues may be offset by changes in border tax revenues.

Although the government is unable to directly control these variables, strategies have been implemented to mitigate these risks and uncertainties. The development of taxation, financial and corporate regulatory policy to reinforce British Columbia’s position as an attractive place to invest and create jobs will help offset the increase in competition for investment as a result of globalization of economic and financial markets. The government will continue to apply a forecast allowance in the budget to account for risks to revenue, expenditure, Crown corporation and schools, universities, colleges and health authorities (SUCH) sector forecasts. The use of forecast allowances recognizes the uncertainties in predicting future economic developments.

Risk management in relation to debt is discussed in Note 19 on page 56 of the Notes to the Consolidated Financial Statements.

26

Summary Financial Statements

Province of British Columbia

For the Fiscal Year Ended

March 31, 2007

Statement of Responsibility

for the Summary Financial Statements

of the Government of the Province of British Columbia

Responsibility for the integrity and objectivity of the Summary Financial Statements for the Government of the Province of British Columbia rests with the government. The Comptroller General prepares these financial statements in accordance with generally accepted accounting principles for senior governments as recommended by the Public Sector Accounting Board of The Canadian Institute of Chartered Accountants. The fiscal year of the government is from April 1 to March 31 of the following year.

To fulfill its accounting and reporting responsibilities, the government maintains financial management and internal control systems. These systems give due consideration to costs, benefits and risks, and are designed to provide reasonable assurance that transactions are properly authorized by the Legislative Assembly, are executed in accordance with prescribed regulations and are properly recorded. This is done to maintain accountability of public money and safeguard the assets and properties of the Province of British Columbia under government administration. The Comptroller General of British Columbia maintains the accounts of British Columbia, a centralized record of the government’s financial transactions, and obtains additional information as required from ministries, Crown corporations, agencies, school districts, universities, colleges, institutes and health organizations to meet accounting and reporting requirements.

The Auditor General of British Columbia provides an independent opinion on the financial statements prepared by the government. The duties of the Auditor General in that respect are contained in section 11 of the Auditor General Act.

Annually, the financial statements are tabled in the legislature as part of the Public Accounts, and are referred to the Select Standing Committee on Public Accounts of the Legislative Assembly. The Select Standing Committee on Public Accounts reports to the Legislative Assembly with the results of its examination and any recommendations it may have with respect to the financial statements and accompanying audit opinions.

Approved on behalf of the Government of the Province of British Columbia:

|

|

| CAROLE TAYLOR |

| Chair, Treasury Board |

| |

Report of the Auditor General

of British Columbia

| | |

| | ON THE

SUMMARY FINANCIAL STATEMENTS

OF THE GOVERNMENT OF THE

PROVINCE OF BRITISH COLUMBIA | | |

To the Legislative Assembly

of the Province of British Columbia

I have audited the summary financial statements of the Government of the Province of British Columbia consisting of the consolidated statement of financial position as at March 31, 2007, and the consolidated statements of operations, change in net liabilities, and cash flow for the year then ended. These financial statements are the responsibility of the Government. My responsibility is to express an opinion on these financial statements based on my audit.

I conducted my audit in accordance with Canadian generally accepted auditing standards. Those standards require that I plan and perform the audit to obtain reasonable assurance whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by the Government, as well as evaluating the overall financial statement presentation.

In my opinion, these summary financial statements present fairly, in all material respects, the financial position of the Government of the Province of British Columbia as at March 31, 2007 and the results of its operations, change in net liabilities and cash flow for the year then ended, in accordance with Canadian generally accepted accounting principles.

| |

|

Victoria, British Columbia

June 15, 2007 | | Errol Price, CA

Acting Auditor General |

Summary Financial Statements

Consolidated Statement of Financial Position

as at March 31, 2007

| | | | In Millions | |

| | Note | | 2007 | | 2006 | |

| | | | $ | | $ | |

Financial Assets | | | | | | | |

| | | | | | | |

Cash and cash equivalents | | | | 2,418 | | 2,934 | |

Temporary investments | | | | 949 | | 935 | |

Accounts receivable | | 3 | | 2,842 | | 2,564 | |

Inventories for resale | | 4 | | 75 | | 93 | |

Due from other governments | | 5 | | 881 | | 674 | |

Due from self-supported Crown corporations and agencies | | 6 | | 554 | | 443 | |

Equity in self-supported Crown corporations and agencies | | 7 | | 4,396 | | 3,448 | |

Loans, advances and mortgages receivable | | 8 | | 992 | | 951 | |

Other Investments | | 9 | | 2,510 | | 2,243 | |

Sinking fund investments | | 10 | | 3,798 | | 4,059 | |

Loans for purchase of assets, recoverable from agencies | | 11 | | 7,170 | | 6,916 | |

| | | | 26,585 | | 25,260 | |

Liabilities | | | | | | | |

| | | | | | | |

Accounts payable and accrued liabilities | | 12 | | 6,072 | | 6,230 | |

Due to other governments | | 13 | | 915 | | 913 | |

Due to Crown corporations, agencies and trust funds | | 14 | | 105 | | 144 | |

Deferred revenue | | 15 | | 5,986 | | 5,694 | |

Employee pension plans | | 16 | | 2 | | 2 | |

Taxpayer-supported debt | | 17 | | 28,841 | | 30,289 | |

Self-supported debt | | 18 | | 7,897 | | 7,758 | |

| | | | 49,818 | | 51,030 | |

Net assets (liabilities) | | 20 | | (23,233 | ) | (25,770 | ) |

| | | | | | | |

Non-financial Assets | | | | | | | |

| | | | | | | |

Tangible capital assets | | 21 | | 26,626 | | 24,756 | |

Prepaid program costs | | 22 | | 592 | | 532 | |

Other assets | | 23 | | 351 | | 315 | |

| | | | 27,569 | | 25,603 | |

Accumulated surplus (deficit) | | 24 | | 4,336 | | (167 | ) |

| | | | | | | |

Measurement uncertainty | | 2 | | | | | |

Contingencies and contractual obligations | | 25 | | | | | |

Restricted assets | | 26 | | | | | |

Significant events | | 31 | | | | | |

Subsequent events | | 34 | | | | | |

The accompanying notes and supplementary statements are an integral part of these financial statements.

Prepared in accordance with Canadian generally accepted accounting principles.

|

| |

CHERYL WENEZENKI-YOLLAND |

Comptroller General |

33

Summary Financial Statements

Consolidated Statement of Operations

for the Fiscal Year Ended March 31, 2007

| | In Millions | |

| | 2007 | | 2006 | |

| | Estimates | | | | | |

| | (Note 32) | | Actual | | Actual | |

| | $ | | $ | | $ | |

Revenue | | | | | | | |

| | | | | | | |

Taxation (Note 27) | | 16,218 | | 18,018 | | 16,429 | |

Contributions from the federal government | | 5,729 | | 6,386 | | 5,825 | |

Natural resources | | 4,852 | | 3,982 | | 4,567 | |

Fees and licences | | 3,622 | | 3,791 | | 3,666 | |

Miscellaneous | | 2,153 | | 2,610 | | 2,317 | |

Net earnings of self-supported Crown corporations and agencies (Note 7) | | 1,971 | | 2,685 | | 2,220 | |

Investment income | | 819 | | 1,032 | | 949 | |

| | 35,364 | | 38,504 | | 35,973 | |

Expense (Note 28) | | | | | | | |

| | | | | | | |

Health | | 12,833 | | 13,253 | | 12,838 | |

Education | | 9,162 | | 9,774 | | 9,047 | |

Social services | | 3,040 | | 2,892 | | 2,798 | |

Interest | | 2,304 | | 2,234 | | 2,181 | |

Other | | 1,953 | | 1,278 | | 1,094 | |

Natural resources and economic development | | 1,483 | | 1,664 | | 1,630 | |

Protection of persons and property | | 1,301 | | 1,334 | | 1,416 | |

Transportation | | 1,173 | | 1,251 | | 1,203 | |

General government | | 665 | | 768 | | 676 | |

| | 33,914 | | 34,448 | | 32,883 | |

Surplus (deficit) for the year before unusual items | | 1,450 | | 4,056 | | 3,090 | |

Forecast allowance | | (850 | ) | | | | |

Surplus (deficit) for the year | | 600 | | 4,056 | | 3,090 | |

| | | | | | | |

Accumulated surplus (deficit)—beginning of year as restated (Note 24) | | | | (167 | ) | (3,257 | ) |

Other comprehensive income from self-supported Crown corporations and agencies (see page 83) | | | | 447 | | 0 | |

Accumulated surplus (deficit)—end of year | | | | 4,336 | | (167 | ) |

The accompanying notes and supplementary statements are an integral part of these financial statements.

34

Summary Financial Statements

Consolidated Statement of Change in Net Liabilities

for the Fiscal Year Ended March 31, 2007

| | In Millions | |

| | 2007 | | 2006 | |

| | Estimates(1) | | Actual | | Actual | |

| | $ | | $ | | $ | |

| | | | | | | |

Surplus (deficit) for the year | | 600 | | 4,056 | | 3,090 | |

Effect of change in tangible capital assets | | | | | | | |

Acquisition of tangible capital assets | | (3,488 | ) | (3,366 | ) | (3,101 | ) |

Amortization of tangible capital assets | | 1,430 | | 1,475 | | 1,376 | |

Disposals and valuation adjustments | | (98 | ) | 21 | | 187 | |

| | (2,156 | ) | (1,870 | ) | (1,538 | ) |

Effect of change in | | | | | | | |

Prepaid program costs | | 6 | | (60 | ) | (70 | ) |

Other assets | | | | (36 | ) | (164 | ) |

| | 6 | | (96 | ) | (234 | ) |

| | | | | | | |

Effect of self-supported Crown corporations and agencies other comprehensive income | | | | 447 | | | |

(Increase) decrease in net liabilities | | (1,550 | ) | 2,537 | | 1,318 | |

Net assets (liabilities)—beginning of year | | (27,216 | ) | (25,770 | ) | (27,088 | ) |

Net assets (liabilities)—end of year (Note 20) | | (28,766 | ) | (23,233 | ) | (25,770 | ) |

(1) Certain budget numbers have been restated to be consistent with the reporting of actuals on the gross basis.

The accompanying notes and supplementary statements are an integral part of these financial statements.

35

Summary Financial Statements

Consolidated Statement of Cash Flow

for the Fiscal Year Ended March 31, 2007

| | In Millions | |

| | 2007 | | 2006 | |

| | Receipts | | Disbursements | | Net | | Net | |

| | $ | | $ | | $ | | $ | |

Operating Transactions | | | | | | | | | |

| | | | | | | | | |

Surplus (deficit) for the year(1) | | | | | | 4,056 | | 3,090 | |

Non-cash items included in surplus (deficit) | | | | | | | | | |

Amortization of tangible capital assets | | | | | | 1,475 | | 1,376 | |

Amortization of public debt deferred revenue and deferred charges | | | | | | (5 | ) | (76 | ) |

Concessionary loan adjustments (decreases) | | | | | | | | (1 | ) |

Valuation adjustments | | | | | | 121 | | 215 | |

Net earnings of self-supported Crown corporations and agencies | | | | | | (2,685 | ) | (2,220 | ) |

Temporary investments decreases (increases) | | | | | | (14 | ) | 43 | |

Accounts receivable decreases (increases) | | | | | | (348 | ) | (116 | ) |

Due from other governments decreases (increases) | | | | | | (207 | ) | (40 | ) |

Due from self-supported Crown corporations and agencies (increases) decreases | | | | | | (111 | ) | 101 | |

Accounts payable increases (decreases) | | | | | | (158 | ) | 489 | |

Due to other governments increases (decreases) | | | | | | 2 | | 22 | |

Due to Crown corporations, agencies and trust funds increases (decreases) | | | | | | (39 | ) | (8 | ) |

Employee pension plans payments | | | | | | | | (1 | ) |

Items applicable to future operations increases | | | | | | 194 | | 257 | |

Contributions of self-supported Crown corporations and agencies | | | | | | 2,184 | | 1,940 | |

Cash derived from (used for) operations | | | | | | 4,465 | | 5,071 | |

| | | | | | | | | |

Capital Transactions | | | | | | | | | |

| | | | | | | | | |

Tangible capital assets (acquisitions) | | 7 | | (3,366 | ) | (3,359 | ) | (2,926 | ) |

Cash derived from (used for) capital | | 7 | | (3,366 | ) | (3,359 | ) | (2,926 | ) |

| | | | | | | | | |

Investment Transactions | | | | | | | | | |

| | | | | | | | | |

Loans, advances and mortgages receivable (issues) | | 109 | | (178 | ) | (69 | ) | (211 | ) |

Other investments—net decreases (increases) | | | | (269 | ) | (269 | ) | (258 | ) |

Sinking fund investments | | 462 | | (201 | ) | 261 | | 456 | |

Cash derived from (used for) investments | | 571 | | (648 | ) | (77 | ) | (13 | ) |

Sub-total cash (requirements) | | | | | | 1,029 | | 2,132 | |

| | | | | | | | | |

Financing Transactions(2) | | | | | | | | | |

| | | | | | | | | |

Public debt (decreases) increases | | 16,494 | | (17,774 | ) | (1,280 | ) | (1,752 | ) |

Derived from Warehouse Borrowing Program investment | | 500 | | (500 | ) | | | | |

Derived from (used for) purchase of assets, recoverable from agencies | | (4,269 | ) | 4,004 | | (265 | ) | (52 | ) |

Cash derived from (used for) financing | | 12,725 | | (14,270 | ) | (1,545 | ) | (1,804 | ) |

Increase (decrease) in cash and cash equivalents | | | | | | (516 | ) | 328 | |

Cash and cash equivalents—beginning of year | | | | | | 2,934 | | 2,606 | |

Cash and cash equivalents—end of year | | | | | | 2,418 | | 2,934 | |

| | | | | | | | | |

Cash and cash equivalents are made up of: | | | | | | | | | |

Cash | | | | | | 1,070 | | 1,265 | |

Cash equivalents | | | | | | 1,348 | | 1,669 | |

| | | | | | 2,418 | | 2,934 | |

(1) Interest received during the year was $1,013 million (2006: $944 million). Interest paid during the year was $2,167 million (2006: $2,137 million). Interest received is made up of interest income from the statement of operations in the amount of $1,032 million (2006: $949 million) less the change in accrued interest receivable in the amount of $19 million (2006: $5 million). Interest paid is made up of interest expense from the statement of operations in the amount of $2,234 million (2006: $2,181 million) less the change in accrued interest payable in the amount of $67 million (2006: $44 million).

(2) Financing transaction receipts are from debt issues and disbursements are for debt repayments.

The accompanying notes and supplementary statements are an integral part of these financial statements.

36

Notes to Consolidated Summary Financial Statements

for the Fiscal Year Ended March 31, 2007

1. Significant Accounting Policies

(a) BASIS OF ACCOUNTING

The government’s Summary Financial Statements are prepared in accordance with generally accepted accounting principles (GAAP) for senior governments as required by the Budget Transparency and Accountability Act (BTAA) and as recommended by the independent Public Sector Accounting Board of The Canadian Institute of Chartered Accountants.

(b) REPORTING ENTITY

These financial statements include the accounts of organizations that meet the criteria of control (by the province) as established under GAAP. The reporting entity also includes government partnerships.

A list of organizations included in these consolidated financial statements may be found on page 71 – 73. Trusts administered by government or government organizations are excluded from the reporting entity.

(c) PRINCIPLES OF CONSOLIDATION

Taxpayer–supported Crown corporations, agencies, and the school districts, universities, colleges, institutes, health organizations (SUCH) and the Consolidated Revenue Fund (CRF) are consolidated using the full consolidation method. The government’s interests in government partnerships are recorded on a proportional consolidation basis.

Self-supported Crown corporations, agencies, entities and government business partnerships are consolidated using the modified equity basis of consolidation.

The definitions of these consolidation methods can be found on page 122.

Adjustments are made for Crown corporations, agencies and entities whose fiscal year ends are different from the government’s fiscal year end of March 31. These Crown corporations, agencies and entities consist of the British Columbia Assessment Authority, the Insurance Corporation of British Columbia, the British Columbia Railway Company, and all school districts.

The basis for segment disclosure is the major functions of government as defined by Statistics Canada’s Financial Management System of Government Statistics. This is used to prepare the sector information found on page 74 – 81.

(d) SPECIFIC ACCOUNTING POLICIES

Revenue

All revenue is recorded on an accrual basis except when the accruals cannot be determined with a reasonable degree of certainty or when their estimation is impracticable. The exception is corporate income tax, which is recorded on a cash basis.

Government transfers are recognized as revenues in the period during which the transfer is authorized and any eligibility criteria are met. Government transfers are deferred if they are restricted for specific programs such as health transfers.

Tax credits/offsets are accrued on the same basis as the associated tax revenues and reduce gross taxation revenue but are not considered valuation allowances.

Expense

The cost of all goods consumed and services received during the year is expensed. Interest expense includes debt servicing costs such as amortization of discounts and premiums, foreign exchange gains and losses, and issue costs.

Pension expense is calculated as the cost of pension benefits earned by employees during the year, interest on the pension benefits liability, net of pension plan assets, and amortization of the government’s share of any experience gains or losses, less contributions made by members. The estimated total cost of government’s share of plan amendments related to past service is expensed in the year the plan is amended.

37

Government transfers include grants, entitlements and transfers under agreements, as defined in the definitions on page 123. Government transfers are recognized as expenses in the period in which the events giving rise to the transfer occurred, as long as the transfer is authorized, eligibility criteria have been met and a reasonable estimate of the amount can be made. Transfers are deferred if the amount represents prepaid operating expenses.

Assets

Assets are recorded to the extent they represent cash and claims upon outside parties, items held for resale to outside parties, prepaid expenses, deferred charges or tangible capital assets acquired as a result of events and transactions prior to year end.

Financial Assets

Cash and cash equivalents include cash on hand, demand deposits and short-term highly liquid investments that are readily convertible to known amounts of cash and that are subject to an insignificant risk of changes in value. These short-term investments generally have a maturity of three months or less and are held for the purpose of meeting short-term cash commitments rather than for investing.

Temporary investments and Warehouse Program Investments include short-term investments recorded at the lower of cost or market value. The fair values of short-term investments approximate their carrying values because of the short-term maturity of these instruments.

Inventories for resale include property that has been purchased, or for which development costs have been incurred, and that is held for ultimate resale or lease to outside parties. Inventories for resale are recorded at the lower of cost or net realizable value.

Equity in self-supported Crown corporations and agencies represents the province’s investment (including long-term advances) in those self-supported Crown corporations and agencies at cost, adjusted for increases/decreases in the investees’ net assets, and other comprehensive income.

Loans for purchase of assets recoverable from agencies are recorded at maturity value, less unamortized premium or discount, deferred foreign exchange gains or losses and sinking fund balances. Premium/discount is amortized on a constant yield basis.

Loans and advances are recorded at cost less adjustment for any prolonged impairment in value. Mortgages receivable are recorded at the principal amount less valuation allowance, are secured by real estate and are repayable over periods ranging up to 30 years. Concessionary loans and mortgages are recorded at net present value at issue and related present value discounts are expensed. Valuation allowances are made when collectibility is considered doubtful. Interest is recognized on an accrual basis except when collection is uncertain it is recognized on the cash basis.

Other investments are recorded at the lower of cost of acquisition (which may be adjusted by attributed income) or estimated current value. Valuation adjustments are made when the value of investments is impaired.

Sinking fund investments are cash and marketable securities held specifically for the purpose of repaying outstanding debt at maturity.

Tangible Capital Assets