Exhibit 99.5

Public

Accounts

Ministry of Finance

Office of the

Comptroller General

For the Fiscal Year Ended

March 31, 2012

National Library of Canada Cataloguing in Publication Data

British Columbia. Office of the Comptroller General.

Public accounts for the year ended... — 2000/2001—

Annual.

Report year ends Mar. 31.

Continues: British Columbia. Ministry of Finance.

Public accounts. ISSN 1187—8657.

ISSN 1499—1659 = Public accounts—British Columbia.

Office of the Comptroller General

1. British Columbia—Appropriations and expenditures—Periodicals. 2. Revenue—British Columbia—Periodicals.

3. Finance, Public—British Columbia—Periodicals. 1. British Columbia. Ministry of Finance. 2. Title.

HJ13.B74 352.4’09711’05 C2001—960204—9

July 23, 2012

Victoria, British Columbia

Lieutenant Governor of the Province of British Columbia

MAY IT PLEASE YOUR HONOUR:

The undersigned has the honour to present the Public Accounts of the Government of the Province of British Columbia for the fiscal year ended March 31, 2012.

| KEVIN FALCON |

| Minister of Finance |

| |

| |

Ministry of Finance | |

Victoria, British Columbia | |

| |

| |

Honourable Kevin Falcon | |

Minister of Finance | |

I have the honour to submit herewith the Public Accounts of the Government of the Province of British Columbia for the fiscal year ended March 31, 2012.

Respectfully submitted,

| STUART NEWTON | |

| Comptroller General | |

British Columbia’s Public Accounts

Leading the Way

The Public Accounts demonstrate accountability back to the citizens of British Columbia for how government performed relative to its fiscal plan and provides a picture of the current financial state of the government in terms of its assets, liabilities and net debt.

Although the main focus of the Public Accounts is the Summary Financial Statements, representing the consolidated financial results and financial position of the province, the supporting notes and schedules form an integral part of the overall financial picture. The Budget Transparency and Accountability Act requires the province to follow generally accepted accounting principles (GAAP) for senior governments in Canada, as supported by regulations of Treasury Board. These standards are Canadian Public Sector Accounting Standards as established by the Public Sector Accounting Standards Board (PSAB) and are described in Note 1 to the Summary Financial Statements. Financial statements prepared in accordance with these standards include the financial balances and results of operations of all provincial government organizations including school districts, universities, colleges, institutes and health organizations (the SUCH sector).

British Columbia continues to be a leader among senior governments in terms of the scope of organizations it includes in its reporting entity. Despite the complexity of the reporting process, British Columbia remains committed to timely delivery of the Public Accounts and Summary Financial Statements each year. British Columbia also continues to focus on consistency in budgeting and financial reporting based on the comparability of its Estimates and Public Accounts and the focus on “one bottom line”; that is, the Summary Financial Statements of the province. British Columbia’s open and transparent financial reporting has played a significant part in the decision by major credit rating agencies to maintain the province’s high credit rating.

Responsibility for the preparation of the government’s financial statements resides with my office. The application of GAAP in the public sector environment can be challenging and often requires the use of professional judgment to determine what accounting treatment is most representative of the economic substance of transactions, and best serves the information needs of the different users of government financial statements. This judgment is based on full analysis of the transactions and programs, application of Canadian guidance, as well as consultation with standard setters and other jurisdictions to support consistent and comparable financial reporting across the country. In preparing the province’s financial statements, we must ensure they do not only comply with the technical requirements of Public Sector accounting, but also provide understandable information about government’s financial results and the financial position of the province. In addressing these issues, the province is supported by the independent Accounting Policy Advisory Committee created under the Budget Transparency and Accountability Act in 2001.

To provide financial statement users with assurance over the reliability of the financial statements, the Auditor General expresses his opinion on the Summary Financial Statements. This year, the Auditor General has expressed a qualified audit opinion and provided comments on areas he believes the financial statements have departed from Canadian GAAP. While our judgment in these areas differs from that of the Auditor General, those differences are identified and quantified in the audit opinion to ensure users are fully informed. We also address the accounting policies and how they are applied in the notes to the financial statements to ensure readers have all the information necessary to support their understanding of the financial statements.

Accounting standards continue to evolve both nationally and internationally. Government has provided direction to its individual entities in the selection of the standard they are to follow, including clarification on the application of existing standards. The objective is to ensure consistency across the reporting entity, and that transparency, comprehension and strong accountability are maintained. Many government organizations have changed the accounting standards they report under, with the remaining government organizations changing this year. Self—supporting Crowns, except for British Columbia Hydro and Power Authority, adopted International Financial Reporting Standards during fiscal year 2011/12. Most taxpayer—supported Crown corporations adopted Canadian Public Sector Accounting Standards during fiscal year 2011/12, with the remaining taxpayer—supported Crown agencies including Schools, Universities, Colleges and Institutes, and Health Authorities adopting Canadian Public Sector Accounting Standards for fiscal year 2012/13. These changes will enhance the transparency of financial reporting in the broader public sector by ensuring transactions are accounted for in an organization’s financial statements consistent with the province’s Summary Financial Statements.

I would like to thank the Select Standing Committee on Public Accounts of the Legislative Assembly, government ministries, Crown corporations, agencies, the SUCH sector and the Auditor General and his staff for their cooperation and support in preparing the 2011/12 Public Accounts.

Comments or questions regarding the Public Accounts documents are encouraged and much appreciated. Please direct your comments or questions to me by mail at PO Box 9413 STN PROV GOVT, Victoria BC V8W 9V1; e—mail at: Stuart.Newton@gov.bc.ca; by telephone at 250 387—6692, or by fax at 250 356—2001.

Further information on the government’s financial performance is also provided through the Consolidated Revenue Fund Extracts (available on the Internet — website http://www.fin.gov.bc.ca/ocg.htm). These extracts compare actual to planned spending of ministries on an appropriation basis, fulfilling ministries accountability back to the Legislative Assembly.

| STUART NEWTON | |

| Comptroller General | |

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2011/12

Contents

Overview (Unaudited) | |

Public Accounts Content | 9 |

Legislative Compliance and Accounting Policy Report | 10 |

Financial Statement Discussion and Analysis Report | 11 |

Highlights | 11 |

Economic Highlights | 12 |

Discussion and Analysis | 13 |

| |

Summary Financial Statements | |

Statement of Responsibility for the Summary Financial Statements of the Government of the Province of British Columbia | 33 |

Report of the Auditor General of British Columbia | 35 |

Consolidated Statement of Financial Position | 41 |

Consolidated Statement of Operations | 42 |

Consolidated Statement of Change in Net Liabilities | 43 |

Consolidated Statement of Cash Flow | 44 |

Notes to Consolidated Summary Financial Statements | 46 |

Reporting Entity | 83 |

Consolidated Statement of Financial Position by Sector | 86 |

Consolidated Statement of Operations by Sector | 90 |

Statement of Financial Position for Self—supported Crown Corporations and Agencies | 94 |

Summary of Results of Operations and Statement of Equity for Self—supported Crown Corporations and Agencies | 95 |

Consolidated Statement of Tangible Capital Assets | 96 |

Consolidated Statement of Guaranteed Debt | 97 |

| |

Supplementary Information (Unaudited) | |

Adjusted Net Income of Crown Corporations, Agencies and the SUCH Sector | 101 |

SUCH Statement of Financial Position | 104 |

SUCH Statement of Operations | 106 |

Consolidated Staff Utilization | 107 |

| |

Consolidated Revenue Fund Extracts (Unaudited) | |

Statement of Financial Position | 111 |

Statement of Operations | 113 |

Statement of Cash Flow | 114 |

Schedule of Net Revenue by Source | 116 |

Schedule of Comparison of Estimated Expenses to Actual Expenses | 118 |

Schedule of Financing Transaction Disbursements | 120 |

Schedule of Write—offs, Extinguishments and Remissions | 121 |

| |

Provincial Debt Summary | |

Overview of Provincial Debt (Unaudited) | 125 |

Provincial Debt (Unaudited) | 126 |

Change in Provincial Debt (Unaudited) | 127 |

Reconciliation of Summary Financial Statements’ Deficit (Surplus) to Change in Taxpayer—supported Debt and Total Debt (Unaudited) | 128 |

Reconciliation of Total Debt to Summary Financial Statements’ Debt (Unaudited) | 128 |

Change in Provincial Debt, Comparison to Budget (Unaudited) | 129 |

Interprovincial Comparison of Taxpayer—supported Debt as a Percentage of Gross Domestic Product (Unaudited) | 130 |

Interprovincial Comparison of Taxpayer—supported Debt Service Costs as a Percentage of Revenue (Unaudited) | 131 |

Report of the Auditor General of British Columbia on the Summary of Provincial Debt, Key Indicators of Provincial Debt, and Summary of Performance Measures | 133 |

Summary of Provincial Debt | 135 |

Key Indicators of Provincial Debt | 137 |

Summary of Performance Measures | 138 |

| |

Definitions (Unaudited) | 139 |

Acronyms (Unaudited) | 142 |

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2011/12

Public Accounts Content

Financial Statement Discussion and Analysis (Unaudited)—this section provides a written commentary on the Summary Financial Statements plus additional information on the financial performance of the provincial government.

Summary Financial Statements—these audited statements have been prepared to disclose the financial impact of the government’s activities. They aggregate the Consolidated Revenue Fund (CRF), the taxpayer—supported Crown corporations and agencies (government organizations), the self—supported Crown corporations and agencies (government business enterprises) and the school districts, universities, colleges, institutes and health organizations (SUCH) sector.

Supplementary Information (Unaudited)—this section provides supplementary schedules containing detailed information on the results of those Crown corporations and agencies that are part of the government reporting entity and the impact of the SUCH sector on the province’s financial statements.

Consolidated Revenue Fund Extracts (Unaudited)— the CRF reflects the core operations of the province as represented by the operations of government ministries and legislative offices. Its statements are included in an abridged form. The CRF Extracts include a summary of the CRF Statement of Financial Position, the CRF Statement of Operating Results, the CRF Statement of Cash Flow, a CRF Schedule of Net Revenue by Source, a CRF Schedule of Expenses, a CRF Schedule of Financing Transactions, and a CRF Schedule of Write—offs, Extinguishments and Remissions, as required by statute.

Provincial Debt Summary—this section presents unaudited schedules and unaudited statements that provide further details on provincial debt and reconcile the Summary Financial Statements debt to the province’s total debt. Also included are the audited Summary of Provincial Debt, Key Indicators of Provincial Debt and Summary of Performance Measures.

This publication is available on the Internet at: www.fin.gov.bc.ca

Additional Information Available (Unaudited)

The following information is available only on the Internet at: www.fin.gov.bc.ca

Consolidated Revenue Fund Supplementary Schedules—this section contains schedules that provide details of financial activities of the CRF, including details of expenses by ministerial appropriations, an analysis of statutory appropriations, Special Accounts and Special Fund balances and operating statements, and financing transactions.

Consolidated Revenue Fund Detailed Schedules of Payments—this section contains detailed schedules of salaries, wages, travel expenses, grants and other payments.

Financial Statements of Government Organizations and Enterprises—this section contains links to the audited financial statements of those Crown corporations, agencies and SUCH sector entities that are included in the government reporting entity.

9

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2011/12

Legislative Compliance and Accounting Policy Report

The focus of the province’s financial reporting is the Summary Financial Statements, which consolidate the operating and financial results of the province’s Crown corporations, agencies, school districts, universities, colleges, institutes and health organizations with the Consolidated Revenue Fund. These are general—purpose statements designed to meet, to the extent possible, the information needs of a variety of users.

The Public Accounts are prepared in accordance with the Financial Administration Act and the Budget Transparency and Accountability Act (BTAA).

The BTAA was amended in 2001 with the passing of Bill 5. Under section 20 of that Bill, the government has mandated that “all accounting policies and practices applicable to documents required to be made public under this Act for the government reporting entity must conform to generally accepted accounting principles.”

For senior governments, generally accepted accounting principles (GAAP) is generally considered to be the recommendations and guidelines of the Canadian Public Sector Accounting Board.

Section 4.1 of the BTAA established an Accounting Policy Advisory Committee (APAC) to advise Treasury Board on the implementation of GAAP for the government reporting entity (GRE). With the government’s transition to full GAAP for the 2004/05 year, the role of APAC changed to include the provision of advice on evolving developments in accounting standards by the accounting profession, as well as emerging issues within government.

10

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2011/12

Financial Statement Discussion and Analysis Report

Highlights

The highlights section provides a summary of the key events affecting the financial statements based on information taken from the Summary Financial Statements and Provincial Debt Summary included in the Public Accounts. The budget figures are from pages 3—7 of the Estimates—Fiscal Year Ending March 31, 2012.

· The province ended the year with a deficit of $1,840 million, compared to a budgeted deficit of $925 million. Taxation revenue increased by $1,006 million compared to 2010/11. Natural resource revenue and fees and licences also increased by $377 million over the previous year. Self-supported Crown corporation’s earnings revenue decreased by $247 million from the previous year. Program spending increased by $2,639 million in 2011/12 resulting from increased spending on health, education and social programs, as well as provision for the one-time repayment of HST transitional funding to the Federal government.

· In 2011/12, the province continued to invest in capital infrastructure. The province’s net investment to build and upgrade schools, universities, colleges, hospitals, roads and bridges was $1,426 million in 2011/12, $2,046 million in 2010/11, $1,679 million in 2009/10 and $1,914 million in 2008/09. Capital investment is financed through a combination of debt, partnerships with the private sector, cost sharing with partners such as Federal and Municipal governments, and other sources including cash and temporary investments.

· Total provincial debt, the most commonly used measure of debt, increased by $5,039 million in 2011/12 to finance capital infrastructure and support working capital requirements for programs and initiatives. The change in total provincial debt over the last five years, from 2007/08 to 2011/12, has been an increase of $15,556 million. For accounting purposes, financial statement debt increased by $4,845 million in 2011/12. A reconciliation of total provincial debt to financial statement debt is included on page 128 of the Public Accounts.

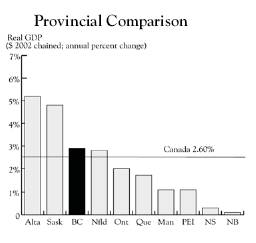

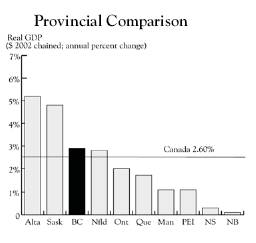

· In calendar year 2011, the provincial economy grew by 2.9% as measured by real GDP. This is greater than the national average rate of 2.6%. The province’s ratio of net liabilities to GDP increased by 1.2%.

· British Columbia continues to maintain a strong credit rating with all three major credit rating agencies. Dominion Bond Rating Service affirmed the province a rating of AA(high) while Standard & Poor’s and Moody’s Investors Services Inc. affirmed the province a rating of AAA and Aaa respectively, their highest possible ratings.

11

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2011/12

Financial Statement Discussion and Analysis Report

Economic Highlights

British Columbia’s economy grew by 2.9% in the 2011 calendar year, the third highest among provinces and greater than the national average of 2.6% for the year, according to preliminary data on real GDP by Industry Accounts data released by Statistics Canada. The estimated 2.9% growth for 2011 is above the government’s February 2012 budget forecast of 2.0%.

Real Gross Domestic Product in Calendar Year 2011

Growth was widespread across most industries with the exception of accommodation and food services, which saw a 0.8% contraction, and arts, entertainment and recreation, which fell by 4.4%. The utilities sector saw growth of 9.3%, construction increased by 6.7%, while mining, oil and gas extraction climbed by 5.9% in 2011. Financial, insurance, and real estate services and the transportation and warehousing sectors also saw steady increases in 2011.

Retail sales, an indicator of consumer spending, increased by 3.1% in 2011. Exports of goods from British Columbia grew 14.0% in 2011 despite the slow recovery of the US economy and a strong Canadian dollar.

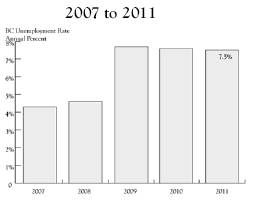

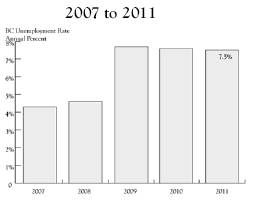

Unemployment Rate in Calendar Year 2011

British Columbia saw a slight drop in its annual unemployment rate in 2011, falling to 7.5% from the 7.6% observed in 2010. The unemployment rate in BC was higher than the national average of 7.4% in 2011. The average level of employment in 2011 was slightly above the record level in 2008 (by about 8,300 jobs).

Per Capita Information

Per capita information describes the amount of revenue received, amounts expended, and net liabilities incurred per person in the province over the last five years. Although revenue per capita increased this year, expense per capita also continued its increasing trend.

12

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2011/12

Financial Statement Discussion and Analysis Report

Discussion and Analysis

The detailed analysis section provides an overview of significant trends relating to the Statement of Operations, Statement of Financial Position and Provincial Debt.

Summary Accounts Surplus (Deficit)

| | In Millions | | Variance | |

| | | | | | | | 2011/12 | | 2011/12 | |

| | 2011/12 | | 2011/12 | | 2010/11 | | Actual | | vs | |

| | Budget | | Actual | | Actual | | to Budget | | 2010/11 | |

| | $ | | $ | | $ | | $ | | $ | |

Taxpayer—supported Programs and Agencies | | | | | | | | | | | |

Revenue | | 38,396 | | 38,318 | | 37,023 | | (78 | ) | 1,295 | |

Expense | | (41,912 | ) | (42,838 | ) | (40,199 | ) | (926 | ) | (2,639 | ) |

Taxpayer—supported net earnings | | (3,516 | ) | (4,520 | ) | (3,176 | ) | (1,004 | ) | (1,344 | ) |

Self—supported Crown corporation net earnings | | 2,941 | | 2,680 | | 2,927 | | (261 | ) | (247 | ) |

Surplus (deficit) before unusual items | | (575 | ) | (1,840 | ) | (249 | ) | (1,265 | ) | (1,591 | ) |

Forecast allowance | | (350 | ) | | | | | 350 | | 0 | |

Surplus (deficit) for the year | | (925 | ) | (1,840 | ) | (249 | ) | (915 | ) | (1,591 | ) |

The province ended the year with a deficit of $1,840 million, which was $915 million over the deficit forecast in the Budget and Fiscal Plan 2011/12 — 2013/14. The 2011/12 deficit of $1,840 million represented an increase of $1,591 million compared to the deficit of $249 million in fiscal year 2010/11. This increase was primarily due to the one—time repayment of HST transitional funding of $1,599 million.

During the 2011/12 fiscal year, the province continued to invest in capital projects. Investments in infrastructure, including the Fort St. John Hospital and Residential Care Centre, Jim Pattison Outpatient Care and Surgery Centre, Interior Heart and Surgical Centre, expansions to Kelowna General and Vernon Jubilee Hospitals, Northern Cancer Centre, Prince George, Children’s and Women’s Hospitals Redevelopment Project, eHealth, Surrey Memorial Hospital Critical Care Tower Project, Faculty of Pharmaceutical Sciences and the Centre for Drug Research and Development Building for UBC—V, the South Fraser Perimeter Road, BC Place development, and various upgrades and improvements to facilities in the Education sector, as well as the province’s power generation and transmission facilities, ensure future service potential is available to support the delivery of government programs and services to the public. BC has continued to invest in the capital infrastructure necessary to support economic growth in a period of uncertainty.

13

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2011/12

Financial Statement Discussion and Analysis Report

Components of Surplus (Deficit)

Revenue Analysis

Revenue analysis helps users understand the government’s finances in terms of its revenue sources and allows them to evaluate the revenue producing capacity of the government.

Revenue by Source

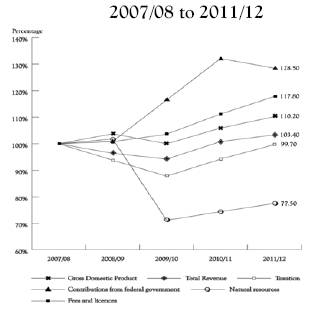

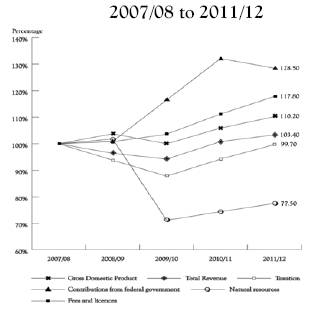

Revenue by source provides an outline of the primary sources of provincial revenue and how results change between those sources over time. Revenues are broken down into separate components of taxation, contributions from the federal government, natural resources and other sources, which include fees and licenses, contributions from self—supported Crown corporations, and investment income.

| | In Millions | |

| | 2007/08 | | 2008/09 | | 2009/10 | | 2010/11 | | 2011/12 | |

| | Actual | | Actual | | Actual | | Actual | | Actual | |

| | $ | | $ | | $ | | $ | | $ | |

Taxation | | 19,406 | | 18,197 | | 17,102 | | 18,197 | | 19,203 | |

Contributions from federal government | | 5,932 | | 5,985 | | 6,917 | | 7,997 | | 7,707 | |

Fees and licences | | 3,975 | | 4,007 | | 4,120 | | 4,432 | | 4,725 | |

Natural resources | | 3,741 | | 3,807 | | 2,646 | | 2,727 | | 2,811 | |

Miscellaneous | | 2,555 | | 2,619 | | 2,709 | | 2,803 | | 2,830 | |

Net earnings of self—supported Crown corporations | | 2,976 | | 2,863 | | 3,015 | | 2,927 | | 2,680 | |

Investment income | | 1,153 | | 821 | | 954 | | 867 | | 1,042 | |

| | | | | | | | | | | |

Total revenue | | 39,738 | | 38,299 | | 37,463 | | 39,950 | | 40,998 | |

Provincial revenues increased by $1,048 million in 2011/12. The improvement in provincial revenue was led by increases in tax revenue as well as minor increases in fees and licences revenue, natural resource revenue and investment income. Increases in these significant sources of revenue were offset by decreases in contributions from the federal government and the net earnings of self-supported Crown corporations.

In 2011/12, tax revenue increased by $1,006 million (6%) over 2010/11. The biggest change was personal income tax revenue increased by $500 million over 2010/11. Social services tax and the hotel room tax were replaced by the harmonized sales tax on July 1, 2010. Social services tax for the year was $62 million and harmonized sales tax was $5,779 million. Other taxes revenue increased by $207 million over 2010/11. These increases were offset by a decrease in corporate income tax revenue of $29 million and a decrease in property tax revenue of $7 million from 2010/11.

Contributions from the Federal government decreased by $290 million from the previous year as a result of the cessation of HST transitional funding and the completion of other federal transfer programs.

Natural resource revenues increased by $84 million (3%) from 2010/11 to 2011/12. Petroleum, natural gas and mineral royalties increased by $48 million (3%) and forest revenues increased by $37 million (8%) over 2010/11. Other sources of natural resource revenue decreased by $1 million from 2010/11.

14

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2011/12

Financial Statement Discussion and Analysis Report

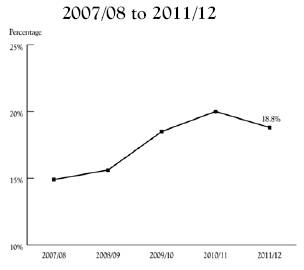

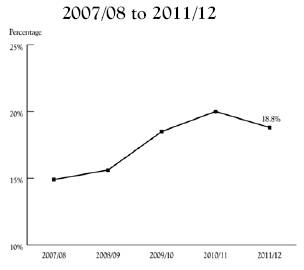

Own—source Revenue to GDP

The ratio of own—source revenue to GDP represents the amount of revenue the provincial government is taking from the whole provincial economy in the form of taxation, natural resource revenues, user fees and sales (own—source revenue is all revenue except for federal transfers).

Having decreased from a range of 17.6% to 15.7% in 2010/11, own—source revenue to GDP has remained stable in 2011/12 ending the year at 15.7%

Percentage Change in Revenue

Trend analysis of revenue provides users with information about significant changes in revenue over time and between sources. This enables users to evaluate past performance and assess potential implications for the future.

Total revenue increased in 2011/12. This improvement is due primarily to increases in taxation revenue and fees and licences revenue. Natural resource revenue continues to recover at a measured pace and federal contributions have slowed after two years of significant increases.

15

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2011/12

Financial Statement Discussion and Analysis Report

Natural Resource Revenue

The chart of natural resource revenue explains past trends of natural resource revenue in total and by major category. Natural resource revenue is among the most volatile revenue sources for the province because it is vulnerable to market fluctuations in commodity prices.

Petroleum, natural gas and mineral revenues increased by $48 million over 2010/11. Theses categories of natural resource revenue account for 64% of natural resource revenue.

Forestry revenue increased by $37 million in 2011/12 due to greater volume. The proportion of natural resource revenue derived from forestry increased to 17% in 2011/12.

Water and other resource revenue remained stable decreased by $1 million in the year.

Government—to—Government Transfers to Total Revenue

The ratio of government—to—government transfers to total revenue is an indicator of how dependent the province is on transfers from the federal government. An increasing trend shows more reliance and a decreasing trend shows less.

Federal transfers decreased by $290 million in 2011/12. This decrease was largely due to a decrease in federal transfers for infrastructure programs and a cessation of HST transition funding that had been received in previous years. This trend indicates a decrease in the province’s dependence on federal contributions as they return towards historical levels.

16

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2011/12

Financial Statement Discussion and Analysis Report

Expense Analysis

The following analysis helps users understand the impact of the government’s spending on the economy, the government’s allocation and use of resources, and the cost of government programs.

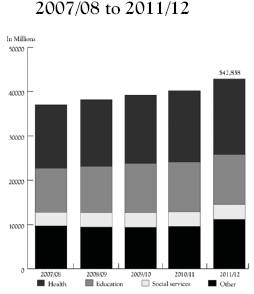

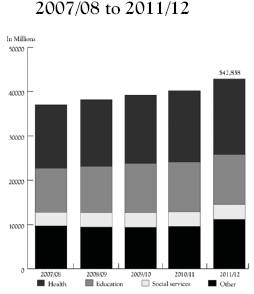

Expense by Function

Expense by function provides a summary of the major areas of government spending, and changes in spending over time. Functions, which indicate the purpose of expenditures, are defined by Statistics Canada’s Financial Management System of Government Statistics. The province uses the following functions: health, education, social services, interest, other, natural resources and economic development, protection of persons and property, transportation, and general government. The health, education and social services functions account for approximately 74% of the province’s total operating costs.

| | In Millions | |

| | 2007/08 | | 2008/09 | | 2009/10 | | 2010/11 | | 2011/12 | |

| | Actual | | Actual | | Actual | | Actual | | Actual | |

| | $ | | $ | | $ | | $ | | $ | |

Health | | 14,260 | | 15,089 | | 15,482 | | 16,114 | | 17,048 | |

Education | | 10,000 | | 10,466 | | 11,060 | | 11,171 | | 11,238 | |

Social services | | 3,045 | | 3,246 | | 3,365 | | 3,384 | | 3,435 | |

Interest | | 2,237 | | 2,158 | | 2,197 | | 2,252 | | 2,383 | |

Other | | 1,413 | | 1,677 | | 1,410 | | 1,211 | | 1,414 | |

Transportation | | 1,398 | | 1,422 | | 1,474 | | 1,580 | | 1,544 | |

Natural resources and economic development | | 1,959 | | 1,761 | | 1,984 | | 1,995 | | 1,518 | |

Protection of persons and property | | 1,579 | | 1,588 | | 1,535 | | 1,448 | | 1,512 | |

General government | | 1,106 | | 809 | | 783 | | 1,044 | | 2,746 | |

| | | | | | | | | | | |

Total expense | | 36,997 | | 38,216 | | 39,290 | | 40,199 | | 42,838 | |

Government spending has increased by 15.8% since 2007/08. Expenses increased by 7% in 2011/12 while revenues increased by 3% in the same period.

In 2011/12, the province increased spending on health by $934 million (6%), education by $67 million(1%) and social services by $51 million (2%). All other program spending in the province increased by $1,456 million (20%), which mainly reflects provision for the one—time repayment of HST transitional funding to the federal government. Interest costs increased by $131 million in 2011/12.

17

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2011/12

Financial Statement Discussion and Analysis Report

In 2011/12, provincial operating expenses were $42,838 million, a $2,639 million (7%) increase over 2010/11. Program spending has increased by $5,841 million (16%) since 2007/08 in line with government’s commitment to protect core public services including healthcare, education and social services.

Expense to GDP

The ratio of expense to GDP represents the amount of government spending in relation to the overall provincial economy.

Government spending as a percentage of GDP increased in 2011/12, indicating that government spending increased at a rate above economic growth as represented by GDP. This increase in spending is mainly related to provision for the one—time repayment of HST transitional funding to the federal government.

18

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2011/12

Financial Statement Discussion and Analysis Report

Changes in Actual Results from 2010/11 to 2011/12

| | In Millions | |

| | | | | | Surplus | |

| | Revenue | | Expense | | (Deficit) | |

| | $ | | $ | | $ | |

2010/11 (Deficit) | | 39,950 | | 40,199 | | (249 | ) |

Increase in taxation revenue | | 1,006 | | | | 1,006 | |

Decrease in federal contributions | | (290 | ) | | | (290 | ) |

Increase in natural resource revenue | | 84 | | | | 84 | |

Decrease in self—supported Crown corporation net earnings | | (247 | ) | | | (247 | ) |

Net increase in other revenue | | 495 | | | | 495 | |

One—time repayment of HST transitional funding | | | | 1,599 | | (1,599 | ) |

Increase in health expense | | | | 934 | | (934 | ) |

Increase in general government expense | | | | 103 | | (103 | ) |

Increase in education expense | | | | 67 | | (67 | ) |

Increase in protection | | | | 64 | | (64 | ) |

Decrease in other expenses | | | | (128 | ) | 128 | |

Subtotal of changes in actual results | | 1,048 | | 2,639 | | (1,591 | ) |

| | | | | | | |

| | 40,998 | | 42,838 | | | |

2011/12 (Deficit) | | | | | | (1,840 | ) |

| | | | | | | |

2010/11 Accumulated Surplus | | | | | | 4,274 | |

Accumulated other comprehensive income from self—supported Crown corporations and agencies | | | | | | 23 | |

| | | | | | | |

2011/12 Accumulated Surplus | | | | | | 2,457 | |

The net increase in revenue of $1,048 million over 2010/11 and increased program spending of $2,639 million, resulted in an increase in the deficit of $1,591 million over the prior year. The deficit of $1,840 million in 2011/12, offset by the accumulated other comprehensive income from self—supported Crown corporations and agencies of $23 million, resulted in an ending accumulated surplus of $2,457 million for 2011/12.

19

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2011/12

Financial Statement Discussion and Analysis Report

Changes from 2011/12 Budget

| | In Millions | |

| | | | | | Forecast | | Surplus | |

| | Revenue | | Expense | | Allowance | | (Deficit) | |

| | $ | | $ | | $ | | $ | |

(Deficit) per Budget March 2011 | | 41,337 | | 41,912 | | (350 | ) | (925 | ) |

Decreased natural resource revenue | | (289 | ) | | | | | (289 | ) |

Decreased self—supported Crown corporations earnings | | (261 | ) | | | | | (261 | ) |

Increased taxation revenue | | 189 | | | | | | 189 | |

Increased federal transfers | | 127 | | | | | | 127 | |

Increased investment earnings | | 5 | | | | | | 5 | |

Decreased other revenues | | (110 | ) | | | | | (110 | ) |

One—time repayment of HST transitional funding | | | | 1,599 | | | | (1,599 | ) |

Decreased health spending | | | | (429 | ) | | | 429 | |

Increased natural resource and economic development spending | | | | 171 | | | | (171 | ) |

Interest savings | | | | (170 | ) | | | 170 | |

Increased social services spending | | | | 58 | | | | (58 | ) |

Decreased education spending | | | | (56 | ) | | | 56 | |

Decreased other program spending | | | | (247 | ) | | | 247 | |

Forecast allowance | | | | | | 350 | | 350 | |

Subtotal of changes in actual results compared to budget | | (339 | ) | 926 | | 350 | | (915 | ) |

| | | | | | | | | |

Actual Results | | 40,998 | | 42,838 | | 0 | | (1,840 | ) |

Revenue was $339 million (1%) lower than the budgeted amount of $41,337 million and expenses were $926 million (2%) higher than the budget of $41,912 million. The most significant change from budget 2011/12 was the recognition of the one—time repayment of HST transitional funding.

Net Liabilities and Accumulated Surplus

In accordance with Canadian generally accepted accounting principles, the government’s Consolidated Statement of Financial Position is presented on a net liabilities basis. Net liabilities represent net future cash outflows resulting from past transactions and events. An analysis of net liabilities and accumulated surplus helps users to assess the government’s overall financial position and the future revenue required to pay for past transactions and events.

| | In Millions | | Variance | |

| | | | | | | | 2011/12 | | 2010/11 | |

| | 2011/12 | | 2011/12 | | 2010/11 | | Budget | | vs | |

| | Budget | | Actual | | Actual | | to Actual | | 2011/12 | |

| | $ | | $ | | $ | | $ | | $ | |

Financial assets | | 35,999 | | 34,385 | | 32,427 | | (1,614 | ) | 1,958 | |

Less: liabilities | | (71,392 | ) | (70,358 | ) | (64,589 | ) | 1,034 | | (5,769 | ) |

Net Liabilities | | (35,393 | ) | (35,973 | ) | (32,162 | ) | (580 | ) | (3,811 | ) |

Less: non—financial assets | | 38,262 | | 38,430 | | 36,785 | | 168 | | 1,645 | |

| | | | | | | | | | | |

Accumulated surplus | | 2,869 | | 2,457 | | 4,623 | | (412 | ) | (2,166 | ) |

20

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2011/12

Financial Statement Discussion and Analysis Report

The accumulated surplus represents the sum of the current and prior years’ operating results. At March 31, 2012, the accumulated surplus was $2,457 million, $412 million higher than budget. The $2,166 million increase in accumulated surplus compared to 2010/11 reflects the annual deficit of $1,840 million, plus the change in other comprehensive income of self—supported Crown corporations, which decreased by $326 million.

Financial assets were $1,614 million lower than budget estimates and $1,958 million higher than 2010/11. Compared to 2010/11, cash, cash equivalent, and temporary investments increased by $187 million and loans for the purchase of assets, recoverable from agencies increased by $1,899 million. This is offset by decreases in equity in self—supported Crown corporations and agencies of $19 million and other assets of $109 million.

Liabilities which decreased by $5,769 million over 2010/11, were $1,034 million higher than budget. Compared to 2010/11, self—supported debt increased by $1,912 million and taxpayer—supported debt increased by $2,933 million to fund infrastructure programs.

Non—financial assets typically represent resources, such as tangible capital assets, that the government can use in the future to provide services. Non—financial assets increased by $1,645 million over 2010/11 due to the government’s capital investment in hospitals and health facilities, transportation infrastructure and post—secondary institutions.

Accumulated Surplus

The accumulated surplus represents current and all prior years’ operating results. In 2010/11, the province had an accumulated surplus of $4,623 million which decreased to $2,457 million in 2011/12. Despite an annual deficit, the province remains in a strong financial position. The positive operating results of prior years provide the flexibility to protect core public services as the economy strengthens.

21

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2011/12

Financial Statement Discussion and Analysis Report

Components of Net Liabilities

Financial Assets

Trend analysis of financial assets provides users with information regarding the amount of resources available to the government that can be converted to cash to meet obligations or fund operations.

| | In Millions | |

| | 2007/08 | | 2008/09 | | 2009/10 | | 2010/11 | | 2011/12 | |

| | Actual | | Actual | | Actual | | Actual | | Actual | |

| | $ | | $ | | $ | | $ | | $ | |

Cash, cash equivalents, temporary investments and warehouse investments | | 5,936 | | 7,249 | | 2,901 | | 3,052 | | 3,239 | |

Accounts receivable | | 2,871 | | 2,588 | | 2,563 | | 2,408 | | 2,451 | |

Equity in self—supported Crown corporations and agencies | | 4,972 | | 5,579 | | 7,075 | | 6,695 | | 6,676 | |

Loans for the purchase of assets, recoverable from agencies | | 7,719 | | 9,149 | | 11,471 | | 12,947 | | 14,846 | |

Other financial assets | | 6,966 | | 5,751 | | 6,277 | | 7,325 | | 7,173 | |

| | | | | | | | | | | |

Total financial assets | | 28,464 | | 30,316 | | 30,287 | | 32,427 | | 34,385 | |

In 2011/12, financial assets increased by $1,958 million over 2010/11 primarily due to an increase in loans for the purchase of assets, recoverable from agencies to fund infrastructure projects. Recoverable capital loans increased by $1,899 million as the province provided funding to Crown agencies for capital projects and accounts receivable also increased by $43 million. These increases were offset by a decrease of $19 million from equity in self—supported Crown corporations and a decrease of $152 million in other financial assets, which includes a decrease of $389 million in due from other Crown corporations and agencies.

Liabilities

Trend analysis of liabilities provides users with information to understand and assess the demands on financial assets and the revenue raising capacity of government.

| | In Millions | |

| | 2007/08 | | 2008/09 | | 2009/10 | | 2010/11 | | 2011/12 | |

| | Actual | | Actual | | Actual | | Actual | | Actual | |

| | $ | | $ | | $ | | $ | | $ | |

Taxpayer—supported debt | | 28,512 | | 28,338 | | 31,135 | | 33,079 | | 36,012 | |

Self—supported debt | | 8,297 | | 11,330 | | 11,552 | | 13,030 | | 14,942 | |

Total financial statement debt | | 36,809 | | 39,668 | | 42,687 | | 46,109 | | 50,954 | |

Accounts payable and other liabilities | | 8,087 | | 7,420 | | 7,013 | | 7,628 | | 8,833 | |

Deferred revenue | | 7,475 | | 9,496 | | 10,083 | | 10,852 | | 10,571 | |

| | | | | | | | | | | |

Total liabilities | | 52,371 | | 56,584 | | 59,783 | | 64,589 | | 70,358 | |

In 2011/12, total liabilities increased by $5,769 million over 2010/11. Liabilities are obligations that must be settled at a future date by the transfer or use of assets. Financial statement debt increased by $4,845 million from 2010/11. Taxpayer—supported debt increased in 2011/12 by $2,933 million, while self—supported debt increased by $1,912 million. Information relating to the government’s debt management can be found in more detail in the analysis of the total provincial debt on page 26. Deferred revenue decreased by $281 million. The year end balance of accounts payable and other liabilities increased by $1,205 million. The large increase in accounts payable and other liabilities was mostly due to provision for the one—time repayment of HST transitional funding of $1,279 million.

22

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2011/12

Financial Statement Discussion and Analysis Report

Non—financial Assets

Trend analysis of non—financial assets provides users with information to assess the management of a government’s infrastructure and long—term non—financial assets.

| | In Millions | |

| | 2007/08 | | 2008/09 | | 2009/10 | | 2010/11 | | 2011/12 | |

| | Actual | | Actual | | Actual | | Actual | | Actual | |

| | $ | | $ | | $ | | $ | | $ | |

Tangible capital assets | | 28,698 | | 30,612 | | 32,291 | | 34,337 | | 35,763 | |

Other assets | | 1,888 | | 1,986 | | 2,187 | | 2,448 | | 2,667 | |

| | | | | | | | | | | |

Total non-financial assets | | 30,586 | | 32,598 | | 34,478 | | 36,785 | | 38,430 | |

Management of non—financial assets has a direct impact on the level and quality of services a government is able to provide to its constituents. Non—financial assets typically represent resources that government can use in the future to provide services. At March 31, 2012, non—financial assets were $38,430 million which was $1,645 million higher than 2010/11 and $7,844 million higher than 2007/08. The majority of the province’s non—financial assets represent capital expenditures for tangible capital assets net of amortization. The government has increased its investment in tangible capital assets by $1,426 million in 2011/12, $2,046 million in 2010/11, $1,679 million in 2009/10, $1,914 million in 2008/09 and $1,932 million in 2007/08 to ensure service potential is available to deliver programs and services in future periods. Capital expenditures are not included on the Consolidated Statement of Operations and have no effect on the current surplus. They reduce future surpluses in the form of amortization expense as the service potential of assets is used to deliver programs and services.

Change in Capital Stock

This measure shows the impact of net changes to the government’s stock of physical capital. Positive amounts demonstrate an investment in infrastructure to replace existing capital and provide service potential in future periods.

The net annual investment in capital was $1,426 million in 2011/12, and $8,997 million since 2007/08. Total capital stock has also increased steadily over that period which indicates that capital infrastructure is available to continue providing programs and services in future periods.

23

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2011/12

Financial Statement Discussion and Analysis Report

Net Liabilities and Accumulated Surplus

| | In Millions | |

| | 2007/08 | | 2008/09 | | 2009/10 | | 2010/11 | | 2011/12 | |

| | Actual | | Actual | | Actual | | Actual | | Actual | |

| | $ | | $ | | $ | | $ | | $ | |

Financial asset | | 28,464 | | 30,316 | | 30,287 | | 32,427 | | 34,385 | |

Less: liabilities | | (52,371 | ) | (56,584 | ) | (59,783 | ) | (64,589 | ) | (70,358 | ) |

Net liabilities | | (23,907 | ) | (26,268 | ) | (29,496 | ) | (32,162 | ) | (35,973 | ) |

Less: non—financial assets | | 30,586 | | 32,598 | | 34,478 | | 36,785 | | 38,430 | |

| | | | | | | | | | | |

Accumulated surplus | | 6,679 | | 6,330 | | 4,982 | | 4,623 | | 2,457 | |

Net liabilities increased by $3,811 million in 2011/12, due to increased spending on public services and investment in infrastructure. The liabilities include deferred revenue of $10,571 million that represents payments and transfers received that will be recognized as revenue in future periods.

While the financial measure of net liabilities has increased, the financial position of the province remains positive as total assets, including both financial assets and investments in capital stock, are greater than the liabilities of the province. Over the past five years, the province’s accumulated surplus has decreased by $4,222 million from $6,679 million in 2007/08 to an accumulated surplus of $2,457 million in 2011/12.

Non—financial Assets as a Portion of Liabilities

The chart provides an indication of what proportion of liabilities are used to fund capital infrastructure as opposed to funding working capital requirements including accounts payable and other operating liabilities, as well as revenue deferred to future periods. Over the past five years, the proportion of liabilities used to fund capital infrastructure has decreased slightly from 58.4% in 2007/08 to 54.6% in 2011/12.

24

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2011/12

Financial Statement Discussion and Analysis Report

Net Liabilities to GDP

The net liabilities to GDP ratio provides an indication of the province’s ability to maintain existing programs and meet existing creditor requirements without increasing the debt burden on the economy as a whole.

The government’s ratio of net liabilities to GDP increased in 2011/12 compared to 2010/11. The increase in net liabilities to GDP is the result of net liabilities increasing at a rate faster than the increase in economic growth as represented by GDP in 2011/12. Net liabilities includes deferred revenue that will be recognized as revenue in future periods as well as obligations to outside parties, including accounts payable and debt.

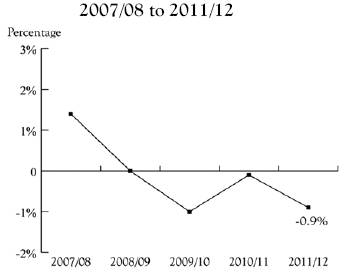

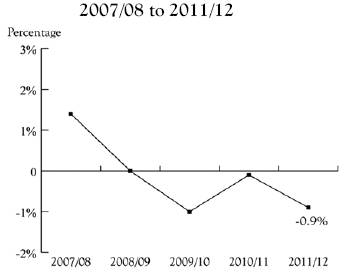

Surplus (Deficit) to GDP

The surplus (deficit) to GDP ratio is an indicator of sustainability that compares the province’s financial results to the overall results of the economy.

Results in the negative range of the chart indicate that government must take a greater share of GDP to support existing operations, reduce the debt burden, or invest in infrastructure.

25

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2011/12

Financial Statement Discussion and Analysis Report

Total Provincial Debt

Analysis of total provincial debt helps users to assess the extent of long—term liabilities and the government’s ability to meet future debt obligations.

| | In Millions | |

| | 2007/08

Actual | | 2008/09

Actual | | 2009/10

Actual | | 2010/11

Actual | | 2011/12

Actual | |

| | $ | | $ | | $ | | $ | | $ | |

Gross debt | | 36,809 | | 39,668 | | 42,687 | | 46,109 | | 50,954 | |

Less: sinking funds assets | | (2,649 | ) | (2,134 | ) | (1,329 | ) | (1,410 | ) | (1,491 | ) |

Third party guarantees and non—guaranteed debt | | 477 | | 480 | | 527 | | 455 | | 730 | |

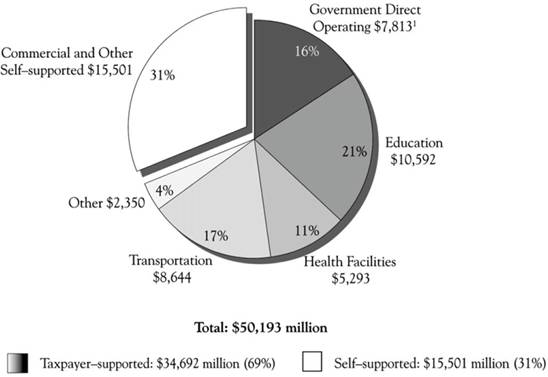

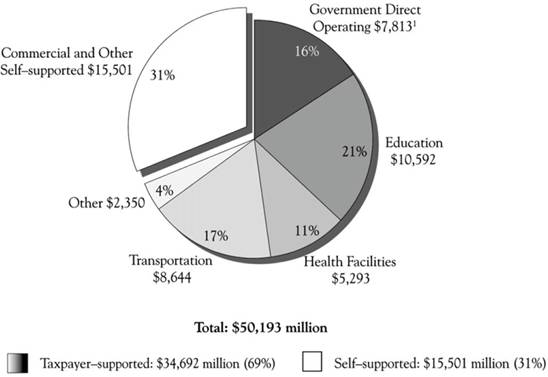

Total provincial debt | | 34,637 | | 38,014 | | 41,885 | | 45,154 | | 50,193 | |

When reporting to rating agencies, the province adds to its financial statement debt, all debt guarantees and the debt directly incurred by self—supported Crown corporations, reduced by sinking fund assets. This balance is referred to as the total provincial debt.

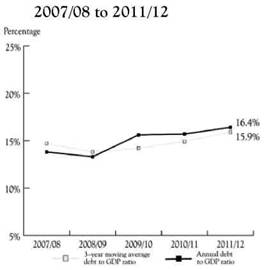

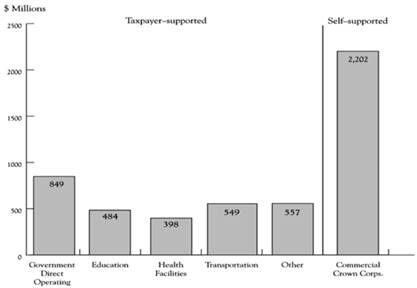

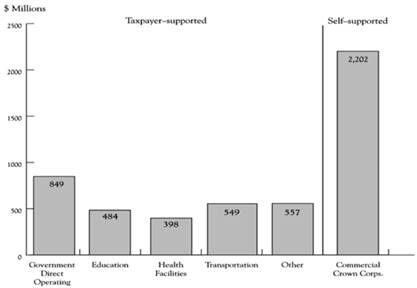

Total provincial debt is $761 million lower than the amounts reported in the province’s financial statements after deducting sinking funds held to pay down the debt, and the inclusion of debt guarantees and non—guaranteed debt. Overall, total provincial debt increased by $5,039 million in 2011/12 because the government borrowed to fund capital projects and working capital requirements. The largest increases in the debt of self—supported crown agencies were the debt of the British Columbia Hydro and Power Authority which increased by $1,268 million and the debt of Transportation Investment Corporation which increased by $631 million. BC Transportation Financing Authority debt increased by $502 million; health sector debt increased by $398 million; education sector debt increased by $484 million; and the debt of other taxpayer—supported entities increased by $604 million. Provincial government direct operating debt increased by $849 million compared to 2010/11.

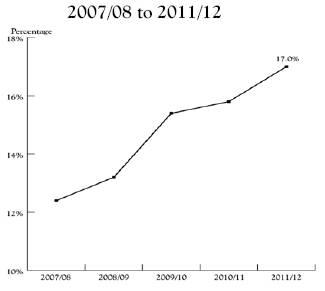

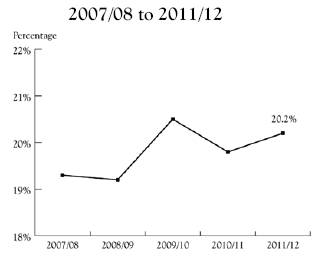

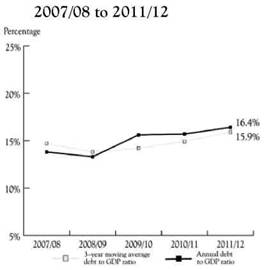

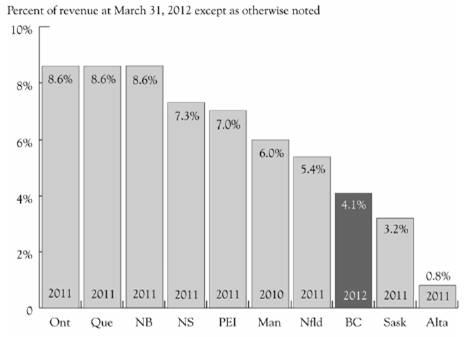

Taxpayer—supported debt to GDP

The ratio of taxpayer—supported debt to GDP is a key measure used by financial analysts and investors to assess a province’s ability to repay debt and is a key measure monitored by the bond rating agencies. An increasing ratio means that debt is growing faster than the economy.

26

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2011/12

Financial Statement Discussion and Analysis Report

Strong Credit Rating

Reflecting the province’s strong fiscal performance, British Columbia has maintained a strong and stable credit rating with all three credit rating agencies. In 2011/12, Moody’s Investors Service Inc. gave the province an Aaa (stable) credit rating (2011: Aaa); Standard and Poor’s gave the province an AAA (stable) credit rating (2011: AAA), and Dominion Bond Rating Services gave the province an AA(high) credit rating (2011: AA (high)).

Credit Ratings June 2012

Rating Agency(1) |

|

Jurisdiction | | Moody’s Investors

Service Inc. | | Standard and Poor’s | | Dominion Bond

Rating Service | |

British Columbia | | Aaa | | | AAA | | | AA (high) | |

Alberta | | Aaa | | | AAA | | | AAA | |

Saskatchewan | | Aa1 | | | AAA | | | AA | |

Manitoba | | Aa1 | | | AA | | | A (high) | |

Ontario | | Aa2 | | | AA– | | | AA (low) | |

Quebec | | Aa2 | | | A+ | | | A (high) | |

New Brunswick | | Aa2 | | | AA– | | | A (high) | |

Nova Scotia | | Aa2 | | | A+ | | | A | |

Prince Edward Island | | Aa2 | | | A | | | A (low) | |

Newfoundland | | Aa2 | | | A+ | | | A | |

Canada | | Aaa | | | AAA | | | AAA | |

(1)The rating agencies assign letter ratings to borrowers. The major categories, in descending order of credit quality, are: AAA/Aaa; AA/Aa; A; BBB/Baa; BB/Ba; and B. The “1”, “2”, “3”, “high”, “low”, “—”, and “+” modifiers show relative standing within the major categories. For example, AA+ exceeds AA.

A more comprehensive overview of provincial debt, including key debt indicators is located on pages 125—138.

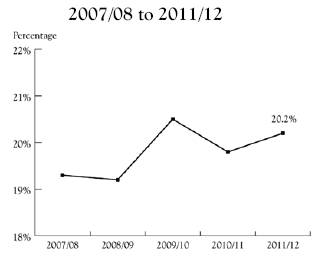

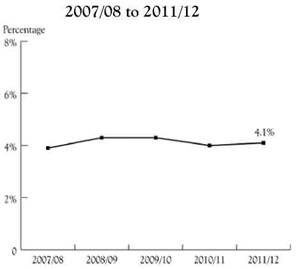

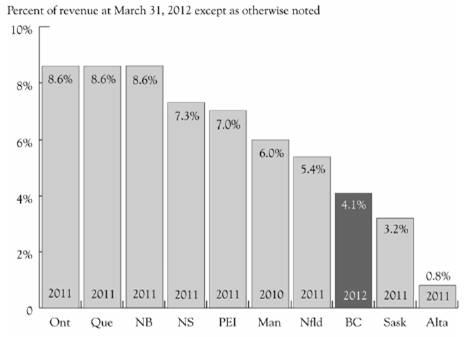

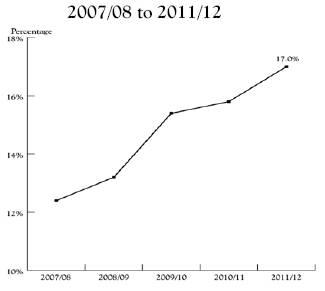

Public Debt Charges to Revenue (the Interest Bite)

The public debt charges to revenue indicator is often referred to as the “interest bite”. This provides users with the percentage of the province’s revenue used to pay interest on debt. The ratio is sensitive to the cost of debt arising from either increasing interest rates or increasing debt, as well as decreases in revenue.

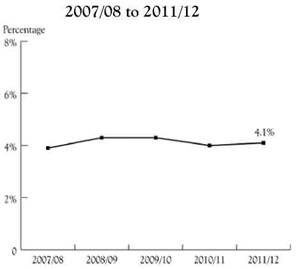

If an increasing proportion of provincial revenue is required to pay interest on provincial debt, less money is left to provide core public services. The interest bite has remained relatively stable over the last five years. In 2011/12, the province spent 4.1 cents of each revenue dollar on interest on the provincial debt.

27

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2011/12

Financial Statement Discussion and Analysis Report

Non—Hedged Foreign Currency Debt to Total Provincial Debt

The ratio of non—hedged foreign currency debt to total provincial debt shows the degree of vulnerability of a government’s public debt position to swings in exchange rates.

Since 2007/08, the government has significantly reduced its foreign currency debt, thereby reducing the province’s vulnerability to changes in exchange rates.

Risks and Uncertainties

The government’s main exposure to risks and uncertainties arises from variables which the government does not directly control. These include:

· economic factors such as commodity prices, personal income, retail sales, population growth, and unexpected shocks such as terrorism, floods and forest fires

· outcomes from litigation, arbitration, and negotiations with third parties

· changes in federal transfers

· utilization rates for government services such as health care, children and family services, or employment assistance

· exposure to interest rate fluctuations, foreign exchange rates and credit risk

· changes in Canadian generally accepted accounting principles

The following are the approximate effect of changes in some of the key variables on the deficit:

Key Fiscal Sensitivities | | | | | |

| | | | | |

Variable | | Increase Of | | Annual Fiscal Impact

($ millions) | |

Nominal GDP | | 1% | | $150 to $250 | |

Lumber prices (US$/thousand board feet) | | $50 | | $25 to $50(1) | |

Natural gas prices (Cdn$/gigajoule) | | $1 | | $350 to $390 | |

US exchange rate (US cents/Cdn$) | | 1 cent | | ($25) to ($40) | |

Interest rate | | 1 percentage point | | ($102) | |

Debt | | $500 million | | ($15) | |

(1) Sensitivity relates to stumpage revenue only. Depending on market conditions, changes in stumpage revenues may be offset by changes in border tax revenues.

28

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2011/12

Financial Statement Discussion and Analysis Report

Although the government is unable to directly control these variables, strategies have been implemented to mitigate these risks and uncertainties. The development of taxation, financial and corporate regulatory policy to reinforce British Columbia’s position as an attractive place to invest and create jobs will help offset the increase in competition for investment as a result of globalization of economic and financial markets. As in previous years, the government applied a forecast allowance in the budget to account for risks to revenue, expenditure, Crown corporations, and schools, universities, colleges and health organizations (SUCH) sector forecasts. The use of forecast allowances recognizes the uncertainties in predicting future economic developments.

Risk management in relation to debt is discussed in Note 19 on page 68 of the Notes to the Consolidated Summary Financial Statements.

29

Summary Financial Statements

Province of British Columbia

For the Fiscal Year Ended

March 31, 2012

Statement of Responsibility

for the Summary Financial Statements

of the Government of the Province of British Columbia

Responsibility for the integrity and objectivity of the Summary Financial Statements for the Government of the Province of British Columbia rests with the government. The Comptroller General prepares these financial statements in accordance with the Budget Transparency and Accountability Act (BTAA), which requires generally accepted accounting principles (GAAP) for senior governments in Canada, supported by regulations of Treasury Board under the BTAA. The fiscal year of the government is from April 1 to March 31 of the following year.

To fulfill its accounting and reporting responsibilities, the government maintains financial management and internal control systems. These systems give due consideration to costs, benefits and risks, and are designed to provide reasonable assurance that transactions are properly authorized by the Legislative Assembly, are executed in accordance with prescribed regulations and are properly recorded. This is done to maintain accountability of public money and safeguard the assets and properties of the Province of British Columbia under government administration. The Comptroller General of British Columbia maintains the accounts of British Columbia, a centralized record of the government’s financial transactions, and obtains additional information as required from ministries, Crown corporations, agencies, school districts, universities, colleges, institutes and health organizations to meet accounting and reporting requirements.

The Auditor General of British Columbia provides an independent opinion on the financial statements prepared by the government. The duties of the Auditor General in that respect are contained in section 11 of the Auditor General Act.

Annually, the financial statements are tabled in the legislature as part of the Public Accounts, and are referred to the Select Standing Committee on Public Accounts of the Legislative Assembly. The Select Standing Committee on Public Accounts reports to the Legislative Assembly with the results of its examination and any recommendations it may have with respect to the financial statements and accompanying audit opinions.

Approved on behalf of the Government of the Province of British Columbia:

| /s/ Kevin Falcon |

| KEVIN FALCON |

| Chair, Treasury Board |

INDEPENDENT AUDITOR’S REPORT

To the Legislative Assembly of the Province of British Columbia

Report on the Summary Financial Statements

I have audited the accompanying summary financial statements of the Government of the Province of British Columbia (“the Government”), which comprise the consolidated statement of financial position as at March 31, 2012, and the consolidated statements of operations, change in net liabilities and cash flow for the year then ended, and a summary of significant accounting policies and other explanatory information.

Government’s Responsibility for the Summary Financial Statements

Government is responsible for the preparation and fair presentation of these summary financial statements in accordance with Canadian public sector accounting standards, and for such internal control as it determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

Auditor’s Responsibility

My responsibility under the Auditor General Act is to express an opinion based on my audit as to whether these summary financial statements are presented fairly in accordance with generally accepted accounting principles. I conducted my audit in accordance with Canadian generally accepted auditing standards. Those standards require that I comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the summary financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the summary financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the summary financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by government, as well as evaluating the overall presentation of the summary financial statements.

In my view, the audit evidence I have obtained is sufficient and appropriate to provide a basis for my qualified audit opinion.

MINISTRY OF FINANCE

Independent Auditor’s Report – Summary Financial Statements

Basis for Qualified Opinion

Failure to fully consolidate the Transportation Investment Corporation

Government has prematurely classified the Transportation Investment Corporation as a government business enterprise, now consolidated in these summary financial statements using the modified equity basis as described in note 1 (c). Under Canadian public sector accounting standards, to be classified as a government business enterprise, an organization must maintain its operations and meet its liabilities from revenues received from outside the government reporting entity. As of March 31, 2012, the Transportation Investment Corporation does not have this characteristic and, therefore, is not properly classified as a government business enterprise. Had this organization been properly classified, it would have been accounted for using the full consolidation method and certain financial statement line items would have changed by a material amount.

Material changes to the summary financial statements, had the Transportation Investment Corporation been fully consolidated:

| | Increase/(decrease)

$ millions | |

| | 2012 | | 2011 | |

Consolidated statement of financial position: | | | | | |

Loans for purchase of assets, recoverable from agencies | | (1,779 | ) | (1,148 | ) |

Accounts payable and accrued liabilities | | 519 | | 440 | |

Taxpayer-supported debt | | 1,779 | | 1,148 | |

Self-supported debt | | (1,779 | ) | (1,148 | ) |

Tangible capital assets | | 2,331 | | 1,604 | |

Consolidated statement of operations: | | | | | |

Surplus (deficit) for the year | | (97 | ) | (20 | ) |

The increase to the deficit for the year relates to realized losses on interest rate hedging transactions that would be recorded as an expense if fully consolidated. Other line items in the consolidated statements of financial position and operations were also impacted by lesser amounts.

The supporting consolidated summary financial statements by sector (pages 86 to 93) and the supporting statements for self-supported Crown corporations and agencies (pages 94 and 95) would also be impacted by this inappropriate classification of the Transportation Investment Corporation and by the summary financial statement changes described above.

MINISTRY OF FINANCE

Independent Auditor’s Report – Summary Financial Statements

Had the Transportation Investment Corporation been properly classified as a taxpayer-supported Crown corporation, the presentation of contractual obligations in note 26 (c) in these summary financial statements would also differ. Contractual obligations for taxpayer-supported Crown corporations (transportation) would have increased by $661 million (2011: $1,114 million), and contractual obligations for self—supported Crown corporations (transportation) would have decreased by $661 million (2011: $1,114 million).

Failure to provide for earned natural gas producer royalty credits

No provision has been made in the summary financial statements for royalty credits earned by natural gas producers under the government’s deep-well drilling program. In this respect the summary financial statements are not in accordance with Canadian public sector accounting standards.

Had a provision been made prospectively, as required by Canadian public sector accounting standards when an issue is raised by an auditor in one period but not corrected until a subsequent period, accounts payable and accrued liabilities as at March 31, 2012, would have been greater by $702 million, natural resources and economic development expenses for the year then ended would have been greater by $702 million and the deficit for the year then ended would have been greater by $702 million.

Inappropriate deferral of government transfers revenue

Government’s accounting treatment for funds received from the Federal Government and other outside entities restricted for the purchase or construction of capital assets is to defer such transfers and recognize as revenue in the statement of operations on the same basis as the related assets are amortized. In this respect, the summary financial statements are not in accordance with Canadian public sector accounting standards which require transfers of a capital nature to be recorded in revenue when the funds provided have been used to purchase or construct the capital asset, or to the extent that stipulations imposed by the transferring entity give rise to an obligation, when the obligation is settled.

Had the correction been made prospectively, as required by Canadian public sector accounting standards when an issue is raised by an auditor in one period but not corrected until a subsequent period, deferred revenues as at March 31, 2012, would have been less by $279 million, contributions from the federal government would have been greater by $200 million, miscellaneous revenue would have been greater by $79 million and the deficit for the year then ended would have been less by $279 million.

MINISTRY OF FINANCE

Independent Auditor’s Report – Summary Financial Statements

Failure to disclose required government business enterprise financial information

In the other explanatory information, government is not disclosing condensed supplementary financial information about the financial position and results of operations of certain subsidiaries of government organizations that are accounted for as government business enterprises. In this respect the summary financial statements are not in accordance with Canadian public sector accounting standards.

Had this information been disclosed, the supporting statements for self-supported Crown corporations and agencies on pages 94 and 95 would have been different as follows:

· assets would have been greater by $1,122 million;

· liabilities other than debt would have been greater by $207 million;

· other debt would have been greater by $655 million

· equity would have been greater by $260 million;

· revenues would have been greater by $230 million;

· expenses would have been greater by $148 million; and

· net earnings would have been greater by $82 million.

Amounts in the condensed supplementary financial information reconciling net earnings of self-supported Crown corporations and agencies to equity in self-supported Crown corporations and agencies for the year would have also changed.

In addition, all of the investments in these subsidiaries should have been reported as investments in government business enterprises. Had this been done, equity in self-supported crown corporations and agencies, as reported on the consolidated statement of financial position, would have been greater by $241 million, and other investments would have been less by $241 million. The deficit for the year as reported in the consolidated statement of operations would not have been impacted.

Impact of audit qualifications on the recorded deficit for the year

If the summary financial statements were prepared fully in accordance with Canadian public sector accounting standards, the recorded deficit for the year would have been $520 million higher. The actual deficit for the year would therefore have been $2,360 million.

MINISTRY OF FINANCE

Independent Auditor’s Report – Summary Financial Statements

Qualified Opinion

In my opinion, except for the effects of the matters described in the Basis for Qualified Opinion paragraphs, the summary financial statements present fairly, in all material respects, the financial position of the Government of the Province of British Columbia as at March 31, 2012, and the results of its operations, change in its net liabilities, and its cash flows for the year then ended in accordance with Canadian public sector accounting standards, which is one of the financial reporting frameworks included in Canadian generally accepted accounting principles.

Basis of Accounting

Without modifying my opinion, I draw attention to Note 1(a) to the summary financial statements, which describes the basis of accounting used in the preparation of these financial statements. In this regard, I note that the basis of accounting under the Budget Transparency and Accountability Act is consistent in all respects with Canadian public sector accounting standards.

| | /s/ John Doyle, MAcc, CA |

Victoria, British Columbia | | John Doyle, MAcc, CA |

June 29, 2012 | | Auditor General |

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2011/12

Summary Financial Statements

Consolidated Statement of Financial Position

as at March 31, 2012

| | | | In Millions | |

| | Note | | 2012 | | 2011 | |

| | | | $ | | $ | |

Financial Assets | | | | | | | | | |

Cash and cash equivalents | | | | 2,177 | | 2,163 | |

Temporary investments | | | | 1,062 | | 889 | |

Accounts receivable | | 3 | | 2,451 | | 2,408 | |

Inventories for resale | | 4 | | 45 | | 41 | |

Due from other governments | | 5 | | 943 | | 979 | |

Due from self—supported Crown corporations and agencies | | 6 | | 476 | | 865 | |

Equity in self—supported Crown corporations and agencies | | 7 | | 6,676 | | 6,695 | |

Loans, advances and mortgages receivable | | 8 | | 1,624 | | 1,492 | |

Other investments | | 9 | | 2,594 | | 2,538 | |

Sinking fund investments | | 10 | | 1,491 | | 1,410 | |

Loans for purchase of assets, recoverable from agencies | | 11 | | 14,846 | | 12,947 | |

| | | | 34,385 | | 32,427 | |

Liabilities | | | | | | | |

Accounts payable and accrued liabilities | | 12 | | 6,467 | | 6,411 | |

Due to other governments | | 13 | | 2,204 | | 1,058 | |

Due to Crown corporations, agencies and trust funds | | 14 | | 52 | | 72 | |

Deferred revenue | | 15 | | 10,571 | | 10,852 | |

Employee pension plans | | 16 | | 110 | | 87 | |

Taxpayer—supported debt | | 17 | | 36,012 | | 33,079 | |

Self—supported debt | | 18 | | 14,942 | | 13,030 | |

| | | | 70,358 | | 64,589 | |

Net assets (liabilities) | | 20 | | (35,973 | ) | (32,162 | ) |

| | | | | | | |

Non—financial Assets | | | | | | | |

Tangible capital assets | | 21 | | 35,763 | | 34,337 | |

Restricted assets | | 22 | | 1,452 | | 1,362 | |

Prepaid program costs | | 23 | | 636 | | 635 | |

Other assets | | 24 | | 579 | | 451 | |

| | | | 38,430 | | 36,785 | |

Accumulated surplus (deficit) | | 25 | | 2,457 | | 4,623 | |

| | | | | | | |

Measurement uncertainty | | 2 | | | | | |

Contingencies and contractual obligations | | 26 | | | | | |

Significant events | | 32 | | | | | |

| | | | | | | | | |

The accompanying notes and supplementary statements are an integral part of these financial statements.

Prepared in accordance with Canadian generally accepted accounting principles.

| /s/ Stuart Newton | |

| STUART NEWTON | |

| Comptroller General | |

41

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2011/12

Summary Financial Statements

Consolidated Statement of Operations

for the Fiscal Year Ended March 31, 2012

| | In Millions | |

| | 2012 | | 2011 | |

| | Estimates

(Note 33) | | Actual | | Actual | |

| | $ | | $ | | $ | |

Revenue | | | | | | | |

Taxation (Note 27) | | 19,014 | | 19,203 | | 18,197 | |

Contributions from the federal government | | 7,580 | | 7,707 | | 7,997 | |

Fees and licences | | 4,707 | | 4,725 | | 4,432 | |

Natural resources (Note 28) | | 3,100 | | 2,811 | | 2,727 | |

Miscellaneous | | 2,958 | | 2,830 | | 2,803 | |

Net earnings of self—supported Crown corporations and agencies (Note 7) | | 2,941 | | 2,680 | | 2,927 | |

Investment income | | 1,037 | | 1,042 | | 867 | |

| | 41,337 | | 40,998 | | 39,950 | |

Expense (Note 29) | | | | | | | |

Health | | 17,477 | | 17,048 | | 16,114 | |

Education | | 11,294 | | 11,238 | | 11,171 | |

Social services | | 3,377 | | 3,435 | | 3,384 | |

Interest | | 2,553 | | 2,383 | | 2,252 | |

Other | | 1,823 | | 1,414 | | 1,211 | |

Transportation | | 1,617 | | 1,544 | | 1,580 | |

Natural resources and economic development | | 1,347 | | 1,518 | | 1,995 | |

Protection of persons and property | | 1,322 | | 1,512 | | 1,448 | |

General government | | 1,102 | | 2,746 | | 1,044 | |

| | 41,912 | | 42,838 | | 40,199 | |

Surplus (deficit) for the year before unusual items | | (575 | ) | (1,840 | ) | (249 | ) |

Forecast allowance | | (350 | ) | | | | |

Surplus (deficit) for the year | | (925 | ) | (1,840 | ) | (249 | ) |

Accumulated surplus (deficit)—beginning of year as restated (Note 25) | | | | 4,274 | | 4,523 | |

Accumulated surplus (deficit)—before other comprehensive income | | | | 2,434 | | 4,274 | |

Accumulated other comprehensive income from self—supported Crown corporations and agencies (see page 95)—end of year | | | | 23 | | 349 | |

Accumulated surplus (deficit)—end of year | | | | 2,457 | | 4,623 | |

The accompanying notes and supplementary statements are an integral part of these financial statements.

42

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2011/12

Summary Financial Statements

Consolidated Statement of Change in Net Liabilities

for the Fiscal Year Ended March 31, 2012

| | In Millions | |

| | 2012 | | 2011 | |

| | Estimates | | Actual | | Actual | |

| | $ | | $ | | $ | |

Surplus (deficit) for the year | | (925 | ) | (1,840 | ) | (249 | ) |

Effect of change in tangible capital assets: | | | | | | | |

Acquisition of tangible capital assets | | (4,105 | ) | (3,571 | ) | (4,111 | ) |

Amortization of tangible capital assets | | 2,107 | | 2,039 | | 1,978 | |

Disposals and valuation adjustments | | (18 | ) | 106 | | 87 | |

| | (2,016 | ) | (1,426 | ) | (2,046 | ) |

Effect of change in: | | | | | | | |

Restricted assets | | | | (90 | ) | (71 | ) |

Prepaid program costs | | 4 | | (1 | ) | (68 | ) |

Other assets | | (2 | ) | (128 | ) | (122 | ) |

| | 2 | | (219 | ) | (261 | ) |

Effect of self—supported Crown corporations’ and agencies’ other comprehensive income | | (136 | ) | (326 | ) | (110 | ) |

(Increase) in net liabilities | | (3,075 | ) | (3,811 | ) | (2,666 | ) |

Net (liabilities)—beginning of year | | (32,318 | ) | (32,162 | ) | (29,496 | ) |

Net (liabilities)—end of year (Note 20) | | (35,393 | ) | (35,973 | ) | (32,162 | ) |

The accompanying notes and supplementary statements are an integral part of these financial statements.

43

PROVINCE OF BRITISH COLUMBIA

PUBLIC ACCOUNTS 2011/12

Summary Financial Statements

Consolidated Statement of Cash Flow

for the Fiscal Year Ended March 31, 2012

| | In Millions | |

| | 2012 | | 2011 | |

| | Receipts | | Disbursements | | Net | | Net | |

| | $ | | $ | | $ | | $ | |

Operating Transactions | | | | | | | | | |

Surplus (deficit) for the year(1) | | | | | | (1,840 | ) | (249 | ) |

Non—cash items included in surplus (deficit): | | | | | | | | | |

Amortization of tangible capital asset | | | | | | 2,039 | | 1,978 | |

Amortization of public debt deferred revenue and deferred charges | | | | | | 28 | | 26 | |

Concessionary loan adjustments (decrease) increase | | | | | | (5 | ) | 15 | |

Valuation adjustment | | | | | | 208 | | 189 | |

Net earnings of self—supported Crown corporations and agencies | | | | | | (2,680 | ) | (2,927 | ) |

Temporary investments (increase) decrease | | | | | | (171 | ) | 102 | |

Accounts receivable (increase) decrease | | | | | | (225 | ) | 4 | |

Due from other governments decrease (increase) | | | | | | 36 | | (86 | ) |

Due from self—supported Crown corporations and agencies decrease (increase) | | | | | | 389 | | (657 | ) |

Accounts payable increase | | | | | | 55 | | 342 | |

Due to other governments increase | | | | | | 1,146 | | 233 | |

Due to Crown corporations, agencies and funds (decrease) increase | | | | | | (20 | ) | 6 | |

Employee pension plan increase | | | | | | 23 | | 34 | |

Items applicable to future operations (decrease) increase | | | | | | (444 | ) | 552 | |

Contributions of self—supported Crown corporations and agencies | | | | | | 2,358 | | 3,197 | |

Cash derived from operations | | | | | | 897 | | 2,759 | |

| | | | | | | | | |

Capital Transactions | | | | | | | | | |

Tangible capital assets (acquisitions) | | 123 | | (3,571 | ) | (3,448 | ) | (4,031 | ) |

Cash (used for) capital | | 123 | | (3,571 | ) | (3,448 | ) | (4,031 | ) |

| | | | | | | | | |

Investment Transactions | | | | | | | | | |

Loans, advances and mortgages receivable (issues) | | 167 | | (317 | ) | (150 | ) | (209 | ) |

Other investments—net (increase) | | | | (56 | ) | (56 | ) | (61 | ) |

Restricted assets—net (increase) | | | | (90 | ) | (90 | ) | (71 | ) |