Exhibit 99.4

2015

British Columbia

Financial and Economic

Review

75th Edition

(July 2015)

2015 Financial and Economic Review — July 2015

Table of Contents

Part One — Economic Review | | 1 |

| 2014 Overview | | 3 |

| British Columbia Economy | | 3 |

| External Trade and Commodity Prices | | 5 |

| Population | | 7 |

| Labour Developments | | 7 |

| Inflation | | 8 |

| Consumer Expenditure and Housing | | 8 |

| Tourism | | 9 |

| External Environment | | 10 |

| United States | | 10 |

| Canada | | 10 |

| International Economy | | 11 |

| Financial Markets | | 12 |

| Conclusion | | 13 |

| | | |

| Charts | | |

| 1.1 Provincial economic growth | | 3 |

| 1.2 Composition of British Columbia real GDP by industry | | 4 |

| 1.3 British Columbia real GDP growth by industry | | 4 |

| 1.4 Export shares by market | | 5 |

| 1.5 Lumber and natural gas prices | | 6 |

| 1.6 Retail sales | | 9 |

| 1.7 Travellers to British Columbia | | 9 |

| 1.8 External economic growth | | 12 |

| 1.9 Canadian dollar | | 12 |

| | | |

| Map | | |

| 1.1 Net interprovincial and international migration in BC, 2014 | | 7 |

| | | |

| Tables | | |

| 1.1 British Columbia Population and Labour Market Statistics | | 7 |

| 1.2 Price and Earnings Indices | | 8 |

| | | |

Part Two — Financial Review | | 15 |

| 2014/15 Overview | | 17 |

| Revenue | | 18 |

| Expense | | 26 |

| Provincial Capital Spending | | 29 |

| Provincial Debt | | 35 |

| Pension Plans | | 40 |

| Contractual Obligations | | 42 |

| 2014/15 Public Accounts Audit Qualification | | 43 |

| | | |

| Charts | | |

| 2.1 2014/15 surplus — major changes from Budget 2014 | | 18 |

| 2.2 Revenue changes from Budget 2014 | | 18 |

| 2.3 Expense changes from Budget 2014 | | 26 |

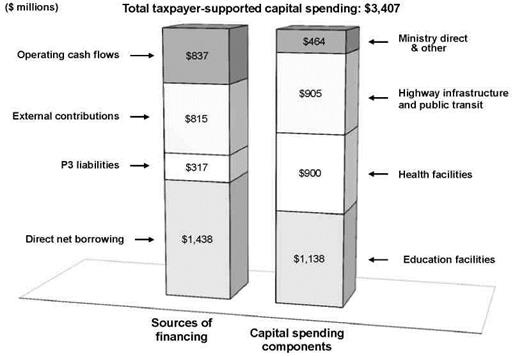

| 2.4 Capital spending, 2014/15 | | 29 |

| 2.5 Capital spending changes from Budget 2014 | | 31 |

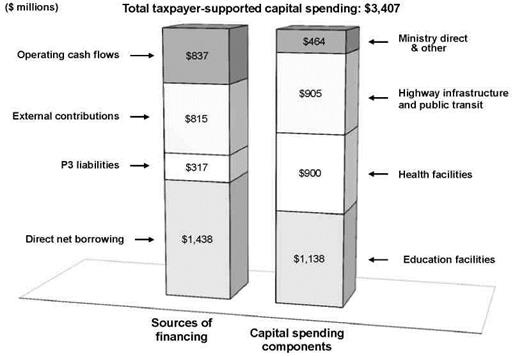

| 2.6 Financing taxpayer-supported capital spending | | 34 |

| | | | |

2015 Financial and Economic Review — July 2015

i

Table of Contents

| 2.7 Provincial debt components | | 35 |

| 2.8 Debt changes from updated Budget 2014 | | 37 |

| 2.9 Reconciliation of surplus to change in debt | | 38 |

| | | |

| Tables | | |

| 2.1 Operating Statement | | 17 |

| 2.2 Corporate Income Tax Revenue Changes from Budget 2014 | | 19 |

| 2.3 Consumption and Other Tax Revenue Changes from Budget 2014 | | 19 |

| 2.4 Energy and Mineral Revenue Changes from Budget 2014 | | 20 |

| 2.5 Forest Revenue Changes from Budget 2014 | | 21 |

| 2.6 Other Revenue Changes from Budget 2014 | | 21 |

| 2.7 Revenue by Source | | 24 |

| 2.8 Expense by Ministry, Program and Agency | | 25 |

| 2.9 Capital Spending | | 30 |

| 2.10 Capital Expenditure Projects Greater Than $50 Million | | 32 |

| 2.11 Provincial Debt Summary | | 36 |

| 2.12 Key Debt Indicators | | 39 |

| 2.13 Interprovincial Comparison of Credit Ratings, July 2015 | | 40 |

| 2.14 Pension Plan Balances | | 41 |

| 2.15 Taxpayer-supported Contractual Obligations | | 42 |

| | | |

Part 3 — Supplementary Information | | 45 |

| General Description of the Province | | 47 |

| Geography | | 47 |

| Physiography | | 47 |

| Climate and Vegetation | | 47 |

| Population | | 48 |

| Constitutional Framework | | 48 |

| Provincial Government | | 49 |

| Legislature | | 49 |

| Executive | | 49 |

| Judiciary | | 50 |

| Provincial Government Jurisdiction | | 50 |

| Annual Financial Cycle | | 50 |

| Planning and Budget Preparation | | 51 |

| Implementation and Reporting | | 51 |

| Evaluation | | 52 |

| Accountability | | 52 |

| Government’s Financial Statements | | 52 |

| Government Reporting Entity | | 52 |

| Compliance with GAAP | | 53 |

| | | |

| Topic Box | | |

| Summary of Tax Changes Announced in Budget 2015 | | 54 |

| | | |

| Charts | | |

| 3.1 Financial Planning and Reporting Cycle Overview | | 51 |

| | | | |

2015 Financial and Economic Review — July 2015

ii

Table of Contents

| Tables | | |

| 3.1 Provincial Taxes (as of July 2015) | | 58 |

| 3.2 Interprovincial Comparisons of Tax Rates — 2015 | | 63 |

| | | |

Appendix 1 — Economic Review Supplementary Tables | | 65 |

| | | |

| Tables | | |

| A1.1A Aggregate and Labour Market Indicators | | 66 |

| A1.1B Prices, Earnings and Financial Indicators | | 67 |

| A1.1C Other Indicators | | 68 |

| A1.1D Commodity Production Indicators | | 69 |

| A1.2 British Columbia Real GDP at Market Prices, Expenditure Based | | 70 |

| A1.3 British Columbia GDP at Basic Prices, by Industry | | 71 |

| A1.4 British Columbia GDP, Income Based | | 72 |

| A1.5 Employment by Industry in British Columbia | | 73 |

| A1.6 Capital Investment by Industry | | 74 |

| A1.7 British Columbia International Goods Exports by Major Market by Selected Commodities, 2014 | | 75 |

| A1.8 British Columbia International Goods Exports by Market Area | | 76 |

| A1.9 Historical Commodity Prices (in US Dollars) | | 77 |

| A1.10 British Columbia Forest Sector Economic Activity Indicators | | 78 |

| A1.11 Historical Value of Mineral, Petroleum and Natural Gas Shipments | | 79 |

| A1.12 Petroleum and Natural Gas Activity Indicators | | 79 |

| A1.13 Supply and Consumption of Electrical Energy in British Columbia | | 80 |

| A1.14 Components of British Columbia Population Change | | 81 |

| | | |

Appendix 2 — Financial Review Supplementary Tables | | 83 |

| | |

| Tables | | |

| A2.1 2014/15 Financial Forecasts — Year in Review | | 84 |

| A2.2 Operating Statement — 2003/04 to 2014/15 | | 85 |

| A2.3 Statement of Financial Position — 2003/04 to 2014/15 | | 86 |

| A2.4 Changes in Financial Position — 2003/04 to 2014/15 | | 87 |

| A2.5 Revenue by Source — 2003/04 to 2014/15 | | 88 |

| A2.6 Revenue by Source Supplementary Information — 2003/04 to 2014/15 | | 89 |

| A2.7 Expense by Function — 2003/04 to 2014/15 | | 90 |

| A2.8 Expense by Function Supplementary Information — 2003/04 to 2014/15 | | 91 |

| A2.9 Full-Time Equivalents (FTEs) — 2003/04 to 2014/15 | | 92 |

| A2.10 Capital Spending — 2003/04 to 2014/15 | | 93 |

| A2.11 Provincial Debt — 2003/04 to 2014/15 | | 94 |

| A2.12 Provincial Debt Supplementary Information — 2003/04 to 2014/15 | | 95 |

| A2.13 Key Provincial Debt Indicators — 2003/04 to 2014/15 | | 96 |

| A2.14 Historical Operating Statement Surplus (Deficit) | | 97 |

| A2.15 Historical Provincial Debt Summary | | 98 |

| | | | |

2015 Financial and Economic Review — July 2015

iii

| Part One |

| |

| |

| Economic Review 1 |

1 Reflects information available as of June 22, 2015

2015 Financial and Economic Review — July 2015

Part 1 — Economic Review

2014 Overview

British Columbia’s economy continued to improve in 2014, with its annual performance outpacing the Canadian average.

Similar to previous years, Statistics Canada published only real dollar industry-side GDP data in the preliminary release of its Provincial Economic Accounts in April 2015. As a result, the following analysis refers to real GDP figures at basic prices, as opposed to the usual market price definition.

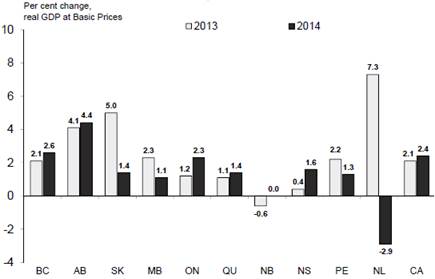

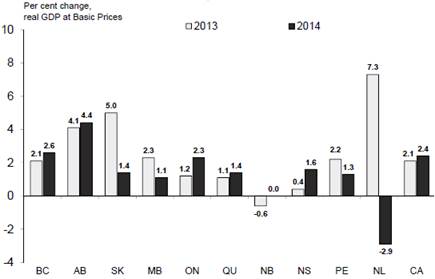

BC’s economy grew by 2.6 per cent in 2014 (the second highest rate among provinces), which was greater than the 2.1 per cent growth observed in 2013.

Chart 1.1 Provincial economic growth2

Source: Statistics Canada, April 2015 Preliminary Industry Accounts

Strong external demand for BC products pushed the value of BC’s international merchandise exports up by 7.1 per cent in 2014 compared to 2013. Meanwhile, shipments of manufactured goods grew by 6.7 per cent on the year.

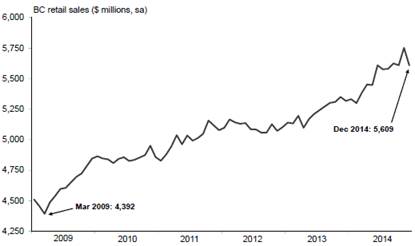

Domestically, BC employment rose by 0.6 per cent in 2014 and the unemployment rate fell to 6.1 per cent. Meanwhile, BC’s housing starts advanced by 4.8 per cent in 2014 to reach about 28,400 units, roughly in line with the average rate of construction observed over the past couple of decades. Retail sales grew by 5.6 per cent last year, while consumer prices rose by 1.0 per cent compared to 2013.

British Columbia Economy

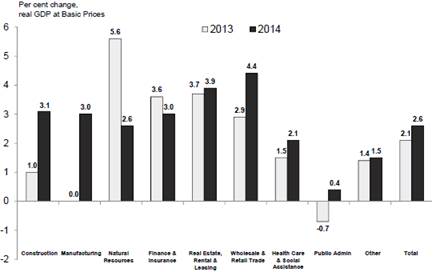

In 2014, service-producing industries represented about 75 per cent of BC’s real GDP and goods-producing industries accounted for around 25 per cent. Last year, the real estate, rental and leasing sector formed the largest share of the provincial economy (17.7 per cent). At the same time, construction made up the largest share of the goods-producing sector and accounted for 8.1 per cent of BC’s total real GDP in 2014.

2 Provincial and National real GDP estimates are based on Statistics Canada’s preliminary industry accounts, released in April 2015. Further information on British Columbia’s economic performance will be available in November 2015, when Statistics Canada releases revised GDP data for 2014 and previous years for the full income and expenditure accounts, including nominal data.

2015 Financial and Economic Review — July 2015

3

Part 1 — Economic Review

Chart 1.2 Composition of British Columbia real GDP by industry

Source: Statistics Canada (numbers may not add to 100 per cent due to rounding)

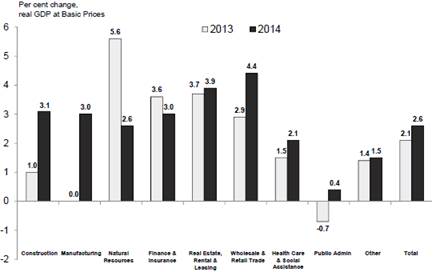

In total, BC’s real GDP increased by 2.6 per cent in 2014 after growing by 2.1 per cent in 2013. Annual gains were observed in both goods and service producing industries compared to 2013.

Real GDP in BC’s service-producing sectors increased by 2.6 per cent in 2014, up from the 2.2 per cent gain recorded in 2013. Notable annual growth was recorded in wholesale and retail trade (+4.4 per cent), in the real estate, rental and leasing sector (+3.9 per cent) as well as in transportation and warehousing (+3.6 per cent).

Meanwhile, output in BC’s goods-producing industries increased 2.4 per cent in 2014, following 1.5 per cent growth observed in 2013. Annual gains were broad-based, led by the construction sector (+3.1 per cent).

Chart 1.3 British Columbia real GDP growth by industry

Source: Statistics Canada, April 2015 Preliminary Industry Accounts

Note: Other includes: transportation and warehousing, educational services, and professional, scientific and technical services

2015 Financial and Economic Review — July 2015

4

Part 1 — Economic Review

External Trade and Commodity Prices

Exports by destination:

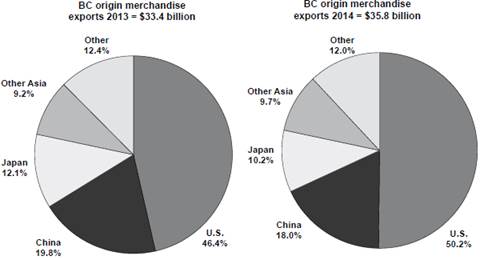

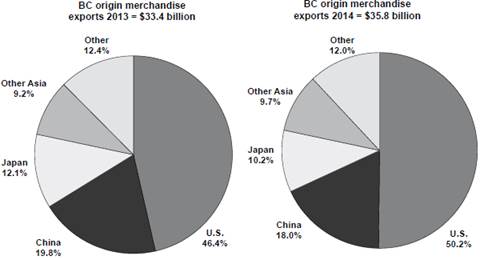

Despite a subdued global economic backdrop, the value of BC’s international merchandise exports reached a record high in 2014, up 7.1 per cent compared to the previous year, following annual growth of 6.2 per cent in 2013.

The value of BC goods exports to the US climbed 15.7 per cent in 2014, following annual growth of 10.6 per cent in 2013. Last year’s advance in exports to the US reflected broad-based gains, led by a 46.4 per cent jump in natural gas exports and a 19.2 per cent rise in softwood lumber exports.

By contrast, the value of BC merchandise exports to China decreased by 2.7 per cent in 2014 following eight consecutive years of double-digit growth. The annual decline in 2014 was primarily due to a sharp drop in coal (-33.4 per cent) exports, which more than offset annual gains in pulp (+7.9 per cent), machinery and equipment (+44.7 per cent), and copper ores and concentrates (+2.4 per cent) exports to China. Appendix Tables A1.7 and A1.8 provide further detail on exports by major market and commodity groups.

With the US economy gradually improving, the share of BC’s total goods exports to the US continued to increase in 2014, with 50.2 per cent sent south of the border. Meanwhile, exports to Pacific Rim destinations accounted for 42.9 per cent of BC’s total merchandise exports in 2014.

Chart 1.4 Export shares by market

Source: BC Stats

Note: Other Asia includes Hong Kong, Taiwan, South Korea and India

Commodity exports and prices:

Last year, significant gains were observed in exports of metallic mineral products (+19.1 per cent), machinery and equipment (+12.7 per cent) and wood products (+5.0 per cent). Meanwhile, exports of energy products fell for a third straight year, down 1.9 per cent (as a substantial decline in coal exports offset a gain in natural gas exports).

2015 Financial and Economic Review — July 2015

5

Part 1 — Economic Review

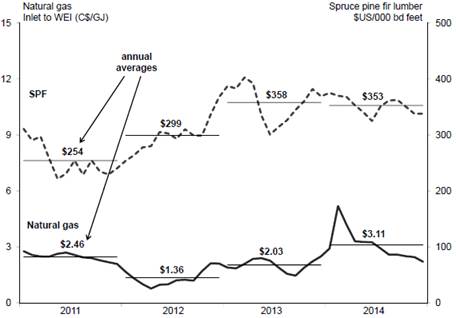

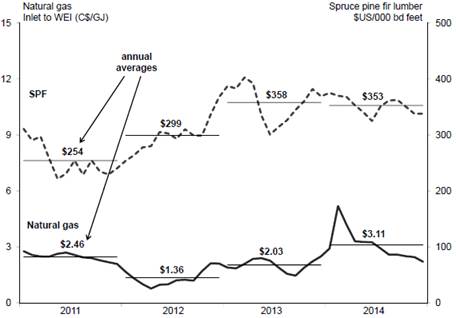

The Plant Inlet price of natural gas averaged $3.11 C/GJ in 2014, an increase of $1.08 C/GJ over 2013. Natural gas prices spiked during the cold winter months of early 2014 and then dropped fairly steadily through the course of the year.

Oil prices fell 50.5 per cent from mid-June to the end of 2014 due to a surging supply of oil in the global market alongside slowing energy demand. The daily West Texas Intermediate crude oil price averaged $93.17 US/barrel in 2014, a decline of $4.81 US/barrel compared to the previous year. For context, the WTI oil price ended the year at $53.45 US/barrel on December 31, 2014.

Lumber and newsprint prices moderated somewhat throughout 2014. At the same time, the price of pulp continued to improve on the year.

· following two years of double-digit growth, the price of lumber averaged $353 US/000 board feet in 2014, a slight decrease from $358 US/000 board observed in 2013;

· the price of pulp averaged $928 US per tonne in 2014, up from $864 US per tonne in 2013; and

· the price of newsprint dropped to $581 US per tonne in 2014 from $598 US per tonne in 2013.

Manufacturing shipments:

Shipments of BC’s manufactured goods grew by 6.7 per cent in 2014 following a gain of 3.1 per cent in 2013. Notable annual increases occurred for shipments of paper products (+8.8 per cent), wood products (+4.0 per cent) and food products (+6.6 per cent), while declines were observed for shipments of primary metal products (-4.8 per cent) and electrical equipment, appliance and components (-7.5 per cent).

Chart 1.5 Lumber and natural gas prices

Source: Madison’s Lumber Reporter and Ministry of Natural Gas Development

2015 Financial and Economic Review — July 2015

6

Part 1 — Economic Review

Population

BC’s population on July 1, 2014 was 4.63 million people, an increase of 1.1 per cent from the same date in 2013. In 2014, BC welcomed 33,890 persons via net international migration. Meanwhile, interprovincial migration in 2014 brought a net total of 10,042 persons into BC from other provinces, following two consecutive years of net outflows. A natural increase of 10,620 persons also added to the province’s growing population in 2014.

Map 1.1 Net interprovincial and international migration in BC, 2014

Net Population Movement For British Columbia

Jan 2014 to Dec 2014

Net Inflow : 43,932 Persons

Source: BC Stats

Labour Developments

Employment activity in the province continued to grow modestly in 2014 after a 0.1 per cent gain in 2013. BC’s economy created 12,800 jobs in 2014 (an annual increase of 0.6 per cent), with gains of around 6,100 full-time jobs and about 6,800 part-time jobs. BC’s unemployment rate averaged 6.1 per cent in 2014, down from 6.6 per cent in 2013. This decline was partly due to slow labour force growth, which remained relatively flat in 2014 compared to 2013.

Table 1.1 British Columbia Population and Labour Market Statistics

| | Units | | 2010 | | 2011 | | 2012 | | 2013 | | 2014 | |

| | | | | | | | | | | | | |

Population (as of July 1) | | (thousands) | | 4,466 | | 4,499 | | 4,543 | | 4,583 | | 4,631 | |

| | (% change) | | 1.3 | | 0.7 | | 1.0 | | 0.9 | | 1.1 | |

| | | | | | | | | | | | | |

Net Migration | | | | | | | | | | | | | |

International | | (persons) | | 33,385 | | 30,860 | | 31,345 | | 34,457 | | 33,890 | |

Interprovincial | | (persons) | | 6,212 | | 699 | | (4,596 | ) | (832 | ) | 10,042 | |

Labour Force | | (thousands) | | 2,405 | | 2,409 | | 2,429 | | 2,425 | | 2,425 | |

| | (% change) | | 1.3 | | 0.2 | | 0.8 | | (0.1 | ) | 0.0 | |

Employment | | (thousands) | | 2,223 | | 2,228 | | 2,263 | | 2,266 | | 2,278 | |

| | (% change) | | 1.4 | | 0.2 | | 1.6 | | 0.1 | | 0.6 | |

Unemployment Rate | | (%) | | 7.6 | | 7.5 | | 6.8 | | 6.6 | | 6.1 | |

Sources: BC Stats, Statistics Canada (CANSIM Tables 051-0001, 051-0037, 282-0002 – accessed June 2015)

2015 Financial and Economic Review — July 2015

7

Part 1 — Economic Review

BC’s goods-producing sectors led overall job growth in 2014, adding 7,800 jobs (or 1.8 per cent) compared to 2013. Significant gains in manufacturing (+9,700 jobs) more than offset annual declines in construction (-3,900 jobs) and natural resource (-500 jobs) sectors.

Employment in BC’s service industries increased by 5,000 jobs (or 0.3 per cent) in 2014 compared to 2013, led by gains in transportation and warehousing (+6,500 jobs) and accommodation and food services (+5,800 jobs). These improvements helped to offset weaker employment in areas such as business, building and other support services (-10,900 jobs) and retail and wholesale trade (-2,500 jobs) — see Appendix Table A1.5 for more details.

Inflation

After declining by 0.1 per cent in 2013, consumer price inflation in BC rose by 1.0 per cent in 2014. In 2014, prices increased for semi-durables, non-durables and services but remained flat for durable goods. Rising clothing prices contributed to the increase in semi-durables, while higher prices for rent, property taxes, home and mortgage insurance and water provided upward inflationary pressure on the services side. The aggregate price for non-durables also increased in 2014, as rising prices for items such as food and electricity offset falling gasoline prices (which declined steadily in the latter half of the year in-step with falling oil prices). Meanwhile, prices for durables remained unchanged in 2014 as lower prices for items such as household appliances offset higher prices for items such as passenger vehicles.

Table 1.2 Price and Earnings Indices

| | Units | | 2010 | | 2011 | | 2012 | | 2013 | | 2014 | |

| | | | | | | | | | | | | |

Consumer Price Index | | (2002=100) | | 113.8 | | 116.5 | | 117.8 | | 117.7 | | 118.9 | |

(British Columbia) | | (% change) | | 1.3 | | 2.4 | | 1.1 | | (0.1 | ) | 1.0 | |

| | | | | | | | | | | | | |

Average Weekly Wage Rate | | ($) | | 820.5 | | 838.2 | | 853.5 | | 879.8 | | 882.2 | |

| | (% change) | | 2.4 | | 2.2 | | 1.8 | | 3.1 | | 0.3 | |

| | | | | | | | | | | | | |

Compensation of Employees 1 | | ($ millions) | | 102,467 | | 106,964 | | 110,527 | | 114,898 | | n/a | |

| | (% change) | | 2.1 | | 4.4 | | 3.3 | | 4.0 | | n/a | |

| | | | | | | | | | | | | |

Primary Household Income 1 | | ($ millions) | | 142,110 | | 149,810 | | 155,744 | | 163,498 | | n/a | |

| | (% change) | | 2.9 | | 5.4 | | 4.0 | | 5.0 | | n/a | |

| | | | | | | | | | | | | |

Net Operating Surplus (corporations) 1 | | ($ millions) | | 22,421 | | 25,869 | | 23,090 | | 21,849 | | n/a | |

| | (% change) | | 31.0 | | 15.4 | | (10.7 | ) | (5.4 | ) | n/a | |

1 As of November 2014 Provincial Economic Accounts

Source: Statistics Canada (CANSIM Tables 326-0021, 282-0072, 384-0040, 384-0037 - accessed June 2015)

Consumer Expenditure and Housing

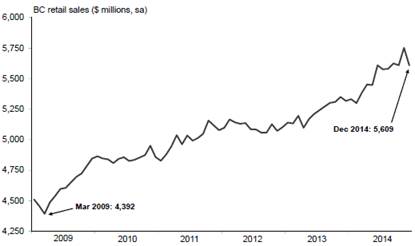

BC retail sales grew by 5.6 per cent in 2014. Growth was widespread, with the largest gains occurring in sales at automobile dealers (+9.7 per cent), food and beverage stores (+4.7 per cent) and general merchandise stores (+8.6 per cent). Strong consumer growth was partly due to increased tourism and interprovincial migration to the province during the year and a release of pent up demand from the previous year.

After contracting by 1.5 per cent in 2013, BC housing starts advanced by 4.8 per cent in 2014 to reach about 28,400 units —roughly in line with the average rate of construction observed over the past couple of decades. Annual growth was largely driven by single-detached houses, while starts of multiple-unit dwellings (such as condominiums) experienced smaller gains compared to 2013. Residential building permits (a leading indicator of potential new housing activity) grew by 7.0 per cent in 2014 over 2013.

2015 Financial and Economic Review — July 2015

8

Part 1 — Economic Review

Chart 1.6 Retail sales

Source: Statistics Canada (CANSIM table 080-0020 – accessed June 2015)

Like new home construction, home sales in BC benefited from a low interest rate environment in 2014. Home sales grew by 15.2 per cent in 2014 compared to the previous year, following a 7.8 per cent annual increase in 2013. Meanwhile, the average price for BC homes rose by 5.8 per cent in 2014 to reach about $568,400.

Tourism

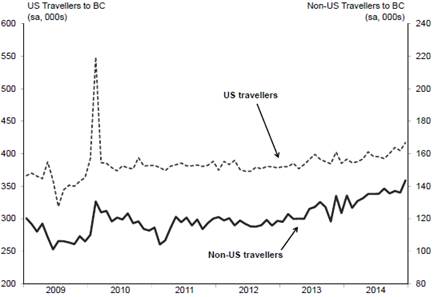

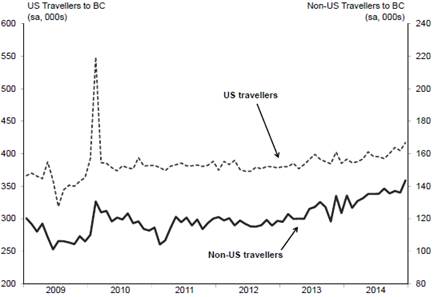

The number of international travellers to BC improved by 4.3 per cent in 2014, compared to the previous year, following 2.9 per cent growth in 2013. The number of non-US visitors advanced for a third straight year in 2014 and rose 9.0 per cent over 2013. At the same time, total US travellers increased for the second straight year and rose by 2.8 per cent in 2014, following annual growth of 2.1 per cent in 2013.

Chart 1.7 Travellers to British Columbia

Source: Statistics Canada (CANSIM table 427-0005 – accessed June 2015)

2015 Financial and Economic Review — July 2015

9

Part 1 — Economic Review

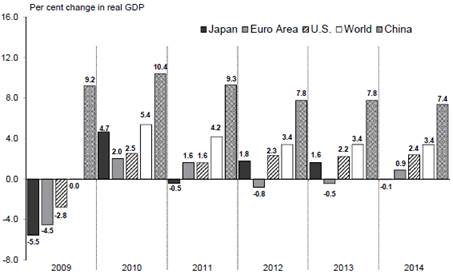

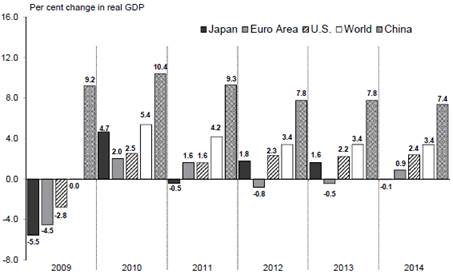

External Environment

The global economy continued its slow recovery in 2014 from the financial crisis that occurred in 2008/09. Overall, the world economy grew by 3.4 per cent in 2014, matching the gain recorded in 2013. Real GDP in the euro area rose 0.9 per cent in 2014, following two years of decline. Chinese real GDP growth slowed to 7.4 in 2014 following 7.8 per cent growth in 2013. Meanwhile, the Japanese economy contracted by 0.1 per cent in 2014 compared to 2013. US real GDP advanced by 2.4 per cent in 2014, a slight improvement from 2.2 per cent growth observed in 2013.

United States

US economic growth fluctuated significantly in 2014, with a weather-related contraction in the January to March quarter followed by an outsized expansion two quarters later. Overall, US real GDP expanded by 2.4 per cent in 2014, compared with an increase of 2.2 per cent in 2013. The slight increase in real GDP growth in 2014 primarily reflected a rise in non-residential fixed investment, an up-tick in consumer spending and a rise in state and local government spending compared to 2013. These improvements were partially offset by a decline in residential fixed investment and an increase to imports on the year.

US employment grew steadily throughout 2014 as the economy regained all of the jobs that were lost during the 2008/09 recession. Approximately 260,000 jobs were created on average each month in 2014, resulting in a 1.9 per cent increase in annual employment over 2013 levels. The unemployment rate dropped to average 6.2 per cent in 2014 from 7.4 per cent in 2013, but did so alongside falling labour force participation. In fact, last year the participation rate fell to its lowest rate since 1977, with an average of only 62.9 per cent of Americans who were eligible to work participating in the labour market.

The American housing market continued its gradual recovery in 2014, as housing starts grew by 8.7 per cent over 2013 to reach 1.01 million units — the highest level since 2007. However, US home sales struggled in 2014, with new home sales up just 1.9 per cent compared to the previous year while existing home sales fell by 2.9 per cent compared to 2013. Despite soft sales, national home prices rose by 6.6 per cent on the year.

The US current account deficit (the combined balances on trade in goods and services income, and net unilateral current transfers) increased from $376.8 billion in 2013 to reach $389.5 billion in 2014.

Canada

The Canadian economy grew by 2.4 per cent in 2014 following a 2.1 per cent increase in 2013, as real GDP advanced in every province except for New Brunswick (0.0 per cent) and Newfoundland and Labrador (-2.9 per cent). Canada’s services-producing industries output improved by 2.3 per cent in 2014, a slightly greater pace than the 2.0 per cent growth registered the previous year. At the same time, output in the country’s goods-producing sector increased by 2.6 per cent last year, up from 2.4 per cent in 2013.

2015 Financial and Economic Review — July 2015

10

Part 1 — Economic Review

Canada’s current account deficit narrowed for a second straight year in 2014 to reach $41.5 billion, after recording a balance of $56.3 billion the previous year. Renewed US demand and a reduced exchange rate helped support Canada’s trade sector last year, as the value of Canadian merchandise exports jumped 11.0 per cent compared to 2013. The increase in 2014 reflected broad-based gains, led by advances in exports of energy products (+16.7 per cent), consumer goods (12.8 per cent) and motor vehicles and parts (+8.8 per cent). Meanwhile, national manufacturing shipments rose 5.3 per cent in 2014 following an annual gain of just 0.3 per cent in 2013.

Canada’s labour market grew modestly in 2014, as national employment increased by 0.6 per cent (or 111,100 jobs) over 2013, making 2014 the slowest year for Canadian job creation since 2009. At the same time, the national unemployment rate ticked down 0.2 percentage points in 2014 to average 6.9 per cent for the year.

The number of Canadian housing starts edged up 0.7 per cent in 2014 to about 189,000 units, after falling 12.5 per cent in 2013. Further, residential building permits increased by 5.3 per cent on the year, following no growth in 2013. Canadian home sales advanced by 5.1 per cent compared to 2013, while the average home price rose 6.7 per cent to average $408,087 in 2014.

Canadian retail sales advanced by 4.6 per cent in 2014 compared to the previous year, improving on the 3.2 per cent annual increase that occurred in 2013. Nationally, consumer prices rose by 2.0 per cent over the previous year following an annual increase of just 0.9 per cent in 2013.

International Economy

Ongoing troubles in Europe weighed on economic growth and confidence throughout 2014. The euro area’s real GDP rose a modest 0.9 per cent in 2014 following two years of negative growth. Germany led overall growth, with an increase of 1.6 per cent in real GDP over 2013 while economic growth in France increased by just 0.4 per cent in 2014 compared to 2013. Meanwhile, Italy’s economy contracted for a third straight year, falling 0.4 per cent compared to 2013. In addition, euro area unemployment remained elevated throughout 2014 and the region slipped into deflation in December of that year.

Japanese real GDP faltered in 2014 as the economy struggled to weather the impact of a sales tax hike, which was implemented in April. The Japanese economy contracted by 0.1 per cent in 2014 following growth of 1.6 per cent in 2013. The deceleration was largely attributable to annual declines in both private consumption and private residential investment compared to the previous year. In addition, public investment was a notable soft spot, while exports had a positive impact on GDP.

China’s annual rate of economic growth continued to ease in 2014, increasing by 7.4 per cent, compared to the previous year, following 7.8 per cent growth in 2013. Although this pace is considerably faster than most other nations, it is slower than the annual growth rates observed in recent years.

2015 Financial and Economic Review — July 2015

11

Part 1 — Economic Review

Overall, the International Monetary Fund estimates that global real GDP expanded by 3.4 per cent in 2014, the same annual pace of growth observed in the previous two years. Five years after the global financial crisis, several nations continue to endure a long slow period of economic recovery.

Chart 1.8 External economic growth

Source: International Monetary Fund, April 2015

Financial Markets

The Bank of Canada held the overnight target rate at 1.00 per cent throughout 2014, where it had remained since September 2010. As reasons for holding the rate at 1.00 per cent, the Bank noted that Canada’s increase in inflation in 2014 was largely due to temporary effects. Further, the Bank cautioned that Canadian household imbalances presented a significant risk to financial stability.

Chart 1.9 Canadian Dollar

Source: Bank of Canada

2015 Financial and Economic Review — July 2015

12

Part 1 — Economic Review

The US Federal Reserve held its intended federal funds rate in the 0.00 to 0.25 per cent range throughout 2014. Reserve officials have maintained the rate in this highly accommodative range since December 2008. In December 2014, the Fed acknowledged that economic conditions may warrant keeping the target federal funds rate below levels historically viewed as normal for some time.

After beginning the year at 94.0 US cents, the Canadian dollar weakened in 2014, reflecting the combined effect of a stronger US dollar and slumping oil prices. Overall, the Canadian dollar averaged 90.5 US cents in 2014, down 6.6 US cents from 2013 — the largest annual drop since the late 1970s.

Conclusion

BC’s diverse economy continued to expand in 2014, as the province’s real GDP rose by 2.6 per cent on the year after growing by 2.1 per cent in 2013. BC’s economic growth in 2014 ranked second among Canadian provinces (behind Alberta) and outperformed the national average.

Domestically, employment in BC rose a modest 0.6 per cent in 2014, or by 12,800 jobs, reflecting an increase of around 6,100 full-time positions and about 6,800 part-time jobs. Meanwhile, BC’s annual unemployment rate dropped 0.5 percentage points to average 6.1 per cent on the year, lower than the national average of 6.9 per cent. This decline was partly due to slow labour force growth, which remained relatively flat on the year. Meanwhile, BC housing starts increased by 4.8 per cent in 2014 to reach about 28,400 units and BC retail sales saw solid gains of 5.6 per cent on the year.

Despite unbalanced global demand, the value of BC international merchandise exports climbed by 7.1 per cent in 2014 compared to 2013, driven by a pick-up in exports to the US. Shipments of manufactured goods also improved in 2014, growing by 6.7 per cent on the year after a 3.1 per cent gain in 2013.

2015 Financial and Economic Review — July 2015

13

2015 Financial and Economic Review — July 2015

Part 2 — Financial Review

2014/15 Overview

Table 2.1 Operating Statement

| | Budget | | Actual | | Actual | |

($ millions) | | 2014 1 | | 2014/15 | | 2013/14 1 | |

Revenue | | 44,800 | | 46,122 | | 43,728 | |

Expense | | (44,416 | ) | (44,439 | ) | (43,401 | ) |

Surplus before forecast allowance | | 384 | | 1,683 | | 327 | |

Forecast allowance | | (200 | ) | — | | — | |

Surplus | | 184 | | 1,683 | | 327 | |

| | | | | | | |

Capital spending: | | | | | | | |

Taxpayer-supported capital spending | | 4,030 | | 3,407 | | 3,151 | |

Self-supported capital spending | | 2,590 | | 2,488 | | 2,519 | |

| | 6,620 | | 5,895 | | 5,670 | |

Provincial Debt: | | | | | | | |

Taxpayer-supported debt | | 43,075 | | 41,880 | | 41,068 | |

Self-supported debt | | 21,463 | | 21,040 | | 19,625 | |

Total debt (including forecast allowance) | | 64,738 | | 62,920 | | 60,693 | |

Key debt affordability metrics: | | | | | | | |

Taxpayer-supported debt-to-revenue ratio | | 98.1 | % | 94.1 | % | 96.1 | % |

Taxpayer-supported debt-to-GDP ratio: | | | | | | | |

As previously reported | | 18.4 | % | | | 18.2 | % |

Impact of Statistics Canada update | | -0.3 | % | | | -0.3 | % |

| | 18.1 | % | 17.5 | % | 17.9 | % |

1 Figures have been restated to reflect government accounting policies in effect at March 31, 2015, and the impact of Statistics Canada methodology change for measuring economic growth.

The provincial government ended the 2014/15 fiscal year with a surplus of $1.7 billion, $1.5 billion higher than budget and up $1.4 billion from the previous year (see Table 2.1).

Revenues were $1,322 million higher than budget, mainly due to increased personal and corporate income tax revenues totaling $872 million, as well as a $405 million improvement in the net income from ICBC. (See Revenue section for further details.)

Total government expenses were $23 million higher than budget, as $326 million of statutory spending, predominately for natural disaster related costs and accrued pension liabilities, were partly offset by ministry savings, prior year liability adjustments, lower debt servicing costs, and other expense reductions totaling $303 million. (See Expense section for further details.)

As the revenue increases exceeded the expense increases, the $200 million budgeted forecast allowance was not required.

Taxpayer-supported infrastructure spending on hospitals, schools, post-secondary institutions, transit, roads and social housing of $3.4 billion was $623 million less than budget, mainly due to project scheduling delays. This spending has been deferred to future years.

Similarly, self-supported capital spending on hydroelectric and transportation projects, and in support of other commercial activities, was $102 million less than budget mainly due to timing differences on expenditures on BC Hydro’s power generation and transmission projects. (See Capital section for further details.)

2015 Financial and Economic Review — July 2015

17

Part 2 — Financial Review

Chart 2.1 2014/15 surplus — major changes from Budget 2014

Overall, government debt increased by $2.2 billion in 2014/15, compared to a budgeted increase of $3.1 billion. The lower increase is primarily due to improved operating results and weaker than anticipated capital spending. (See Debt section for further details.)

Financial information in this publication, including this chapter and Appendix 2, is sourced from the government’s 2014/15 Public Accounts.

Revenue

In 2014/15, revenue totaled $46.1 billion — $1.3 billion (or 3.0 per cent) higher than budget and up 5.5 per cent from 2013/14. Compared to budget, higher revenues from personal income, corporate income, and property transfer taxes, fees, investment earnings and commercial Crown corporation net income were partially offset by lower revenue from sales and other taxes, natural resources, miscellaneous sources and federal government transfers.

Chart 2.2 Revenue changes from Budget 2014

2015 Financial and Economic Review — July 2015

18

Part 2 — Financial Review

Income Tax Revenue

Personal income tax revenue was up $585 million mainly due to the effects of stronger 2013 tax assessments unknown at the end of 2013/14. This was partially offset by the effects of lower estimated 2014 and 2015 household income growth, reflecting relatively weak employment growth in 2014 and in the first three months of 2015. The Canada Revenue Agency administers the personal and corporate income taxes on behalf of the province and its tax assessments are finalized 12 months after year end. The higher 2013 assessments resulted in a one-time revenue gain of $386 million reflecting an under accrual in 2013/14.

Corporate income tax revenue was up $287 million mainly due to strong 2013 tax assessments which had the effect of increasing the settlement payment for 2013 as well as 2014/15 instalment payments from the federal government. The 2013 assessments reflected a 6.2 per cent increase in the BC corporate income tax base compared to a 5.4 per cent decline in BC net operating surplus.

Table 2.2 Corporate Income Tax Revenue Changes from Budget 2014

| | Revenue | | | | | | | |

| | changes | | | | Budget | | | |

| | ($ millions) | | Indicators ($ billions) | | 2014 | | Actual | |

Prior-year adjustment | | 116 | | 2013 BC corporate tax base | | 29.3 | | 30.6 | |

Advance instalments | | 177 | | 2013 National corporate tax base | | 263.4 | | 267.5 | |

International Business Activity Act | | | | | | | | | |

refunds | | (6 | ) | | | | | | |

| | 287 | | | | | | | |

Consumption and Other Tax Revenue

Harmonized sales tax (HST) revenue incurred a one-time $91 million loss related to entitlement for the 2010/11 to 2012/13 period based on updated information received from the federal government. Annual adjustments to HST revenue will continue until 2019/20; however it is expected that the impacts will diminish over time.

Provincial sales tax revenue was down $111 million from budget. The 2014/15 budget estimate was based on projected economic growth applied to a forecast of 2013/14 that was higher than actual results. The carry forward impacts of weaker 2013/14 results was partly offset by stronger sales activity during the year.

Table 2.3 Consumption and Other Tax Revenue Changes from Budget 2014

| | Revenue | | | | | | 2014/15 | |

| | changes | | | | Budget | | Public | |

| | ($ millions) | | Indicators (annual percent change) | | 2014 | | Accounts | |

Harmonized sales | | (91 | ) | Nominal consumer expenditures | | 4.2 | % | 4.7 | % |

Provincial sales | | (111 | ) | Nominal business investment | | 4.4 | % | 5.6 | % |

Total sales | | (202 | ) | | | | | | |

| | | | | | | | | |

Carbon | | (30 | ) | | | | | | |

Tobacco | | (28 | ) | BC consumer price index | | 1.5 | % | 1.0 | % |

Property transfer | | 261 | | BC housing starts | | -7.8 | % | 4.8 | % |

Insurance premium | | 32 | | Real GDP | | 2.0 | % | 2.2 | % |

Fuel | | (4 | ) | Nominal GDP | | 3.6 | % | 3.9 | % |

Property | | (2 | ) | | | | | | |

2015 Financial and Economic Review — July 2015

19

Part 2 — Financial Review

Carbon tax revenue was down $30 million from budget due to weaker sales across most fuel types — in particular, natural gas volumes.

Tobacco tax revenue was down $28 million from budget reflecting a decline in consumption volumes.

Insurance premium tax revenue was $32 million above budget due to higher than expected activity.

Property transfer tax revenue was $261 million higher than budget due to the effects of a strong housing market including the impact of increases in average property prices and the number of transactions.

Other tax revenues comprising of fuel and property were $6 million below budget.

Natural Resources Revenue

Natural gas royalties were $52 million above budget mainly due to higher production volumes, partly offset by a complementary increase in the utilization of royalty credit programs. Natural gas prices averaged $2.48 during 2014/15 ($Cdn/gigajoule, plant inlet), slightly higher than the budget estimate of $2.45.

Table 2.4 Energy and Mineral Revenue Changes from Budget 2014

| | Revenue | | | | | | | |

| | changes | | | | Budget | | | |

| | ($ millions) | | Indicators | | 2014 | | Actual | |

Natural gas royalties | | 52 | | Natural gas price ($Cdn/GJ, plant inlet) | | $ | 2.45 | | $ | 2.48 | |

| | | | Production (annual change) | | 8.2 | % | 9.3 | % |

Coal, metals and other minerals | | (85 | ) | Metallurgical coal price ($US/tonne) | | $ | 176 | | $ | 124 | |

| | | | Copper price ($US/lb) | | $ | 3.16 | | $ | 2.97 | |

Columbia River Treaty electricity sales | | (30 | ) | Electricity price ($US/Mwh) | | $ | 39.82 | | $ | 31.51 | |

| | | | Oil price ($US/bbl) | | $ | 95.12 | | $ | 80.85 | |

Sales of Crown land leases 1 | | 28 | | Bonus bid cash receipts ($ million) | | $ | 75 | | $ | 335 | |

| | | | Bonus bid price per hectare ($) | | $ | 750 | | $ | 2,544 | |

Other | | 5 | | Hectares disposed (thousands) | | 100 | | 132 | |

1 Sales of Crown land tenures are recognized over nine years.

Coal, metals and other minerals revenue was $85 million below budget, mainly due to the effects of lower-than-expected coal and copper prices and weaker production volumes.

Receipts from electricity sales under the Columbia River Treaty were $30 million below budget due to lower electricity prices.

Other energy-related revenue sources were $33 million above budget mainly due to higher sales of Crown land leases reflecting industry’s willingness to invest in BC through strong average bid prices.

2015 Financial and Economic Review — July 2015

20

Part 2 — Financial Review

Table 2.5 Forest Revenue Changes from Budget 2014

| | Revenue | | | | | | | |

| | changes | | | | Budget | | | |

| | ($ millions) | | Indicators | | 2014 | | Actual | |

Stumpage from timber tenures | | (101 | ) | SPF 2x4 ($US/1000 bf, calendar year) | | $ | 345 | | $ | 353 | |

BC Timber Sales | | 45 | | Total stumpage rate ($/m3 ) | | $ | 10.78 | | $ | 11.15 | |

Softwood Lumber Agreement border tax | | (7 | ) | Harvest volumes (million m3) | | 65.0 | | 57.6 | |

Vote recoveries | | 10 | | Export tax rate (percent) | | 0.8 | | 0.0 | |

Logging tax and other receipts | | 22 | | US lumber exports (billion bf)1 | | 6.9 | | 6.5 | |

| | (31 | ) | | | | | | |

1 Source: Department of Foreign Affairs, Trade and Development

Forests revenue was down $31 million from budget mainly due to lower stumpage revenue, reflecting lower Crown harvest volumes, interior stumpage rates and reduced entitlement of the federal government border tax collections. BC’s entitlement of border tax collections under the Softwood Lumber Agreement, 2006 was $7 million below budget as the effects of higher than expected lumber prices resulted in a zero export tax rate during the year. These declines were partly offset by higher BC Timber Sales stumpage rates and logging taxes as well as increased forest related recoveries.

Other natural resources revenue, comprising of water rentals and hunting and fishing licences, was $12 million below budget.

Other Taxpayer supported Sources

Other taxpayer supported revenue which includes fees, licences, investment earnings and other miscellaneous sources was up $47 million from budget mainly due to higher than expected revenue from SUCH sector entities, partly offset by lower sales of surplus assets.

Table 2.6 Other Revenue Changes from Budget 2014

| | Revenue | | | | | | | |

| | changes | | | | | | | |

| | ($ millions) | | | | | | | |

Fees | | 89 | | mainly higher revenue from SUCH sector entities | |

Miscellaneous sources | | (79 | ) | mainly lower revenue from SUCH sector and Crown agencies | |

Investment earnings | | 112 | | mainly higher earnings in general revenue and from SUCH sector and Crown agencies | |

Release of surplus assets | | (75 | ) | | | | | | |

Total other | | 47 | | | | | | | |

Federal Government Transfers

Federal government contributions were down $37 million reflecting a $24 million decline in other federal government transfers mainly due to lower funding to Crown agencies and for disaster financial assistance, partly offset by higher transfers to SUCH sector agencies. There is a further $13 million decrease in the Canada Health Transfer and Canada Social Transfer entitlements mainly with respect to prior years.

2015 Financial and Economic Review — July 2015

21

Part 2 — Financial Review

Commercial Crown Corporations

Commercial Crown corporation net income of $3.4 billion was $486 million higher than budgeted, and $670 million higher than 2013/14.

British Columbia Hydro and Power Authority

BC Hydro net income of $581 million was $1 million lower than plan.

In compliance with BC Utilities Commission (BCUC) orders, BC Hydro uses several regulatory accounts to better match costs and benefits for different generations of customers, smooth out the rate impact of large non-recurring costs, and defer to future periods differences between forecast and actual costs or revenues. At March 31, 2015 BC Hydro had 28 regulatory accounts totaling $5.4 billion — up $734 million from the prior year. The increase is mainly attributed to higher capital-like deferred balances ($373 million), higher non-current pension costs due to actuarial valuations ($317 million), higher energy deferral accounts due to lower domestic loads and lower surplus sales ($310 million), and impacts of rate smoothing over the 10-year rate plan ($166 million), partially offset by amortization of balances in the year ($491 million), and other changes. BC Hydro has mechanisms in place to collect 24 of the 26 regulatory accounts with balances remaining after year end (representing approximately 90 per cent of the total balances).

BC Hydro pays a dividend to government equivalent to 85 per cent of net income unless the payment would result in BC Hydro’s debt to equity ratio falling below 80:20. In such cases the payment is reduced until the ratio is restored. In 2014/15, the corporation’s dividend to government was $264 million (45 per cent of net income). BC Hydro has not paid a full dividend since 2005/06. Government has put in place a plan to phase out the payment of dividends by BC Hydro within five years as part of a ten-year plan to stabilize rate increases and that will eventually improve BC Hydro’s capital structure to a 60:40 debt to equity ratio.

More information about BC Hydro’s financial results and performance measures is provided in the corporation’s annual report available at its website: www.bchydro.com.

British Columbia Liquor Distribution Branch

LDB net income of $935 million was $73 million higher than plan, and $58 million over the prior year. The improved result was due to stronger volume sales across product categories, as well as a $37 million gain relating to the sale of the Vancouver Distribution Centre property not included in LDB’s budget plan. Excluding the gain on this sale, LDB’s results were 4.2 per cent ahead of plan.

LDB continues to support government’s plan to modernize the liquor industry in the province. As a part of this effort, LDB has updated systems and business processes, increased the separation between retail and wholesale operations, and implemented a new wholesale pricing model effective April 1, 2015.

More information about LDB’s financial results and performance measures is provided in the corporation’s annual report available at its website: www.bcldb.com.

2015 Financial and Economic Review — July 2015

22

Part 2 — Financial Review

British Columbia Lottery Corporation

BCLC net income of $1,245 million (net of payments to the federal government) was $62 million higher than plan reflecting higher net income from casino and community gaming operations, partially offset by lower net income from lottery and eGaming channels.

Casino and community gaming operations reported net income is $69 million higher than plan, mainly due to higher revenue from all table play including poker ($123 million up), partially offset by higher direct expenses ($56 million up) and other changes ($2 million up).

By contrast, lottery and eGaming operations reported net income is $8 million below plan driven mainly due to lower lottery revenue ($32 million down) offset by higher eGaming revenues ($12 million up) and other better-than-budget results ($12 million).

More information about BCLC’s financial results and performance measures is provided in the corporation’s annual report available at its website: www.bclc.com.

Insurance Corporation of British Columbia

On government’s fiscal year basis, ICBC’s net income of $657 million was $405 million higher than plan, and $521 million over the prior year. The improvement over plan is primarily attributed to higher investment earnings in the second half of the year (up $336 million) and higher earned premiums (up $85 million) due to vehicle growth and premiums written at a higher average rate as the result of the 2014 Basic rate increase of 5.2 per cent, effective November 1, 2014.

More information about ICBC’s financial results and performance measures is provided in the corporation’s annual report available at its website: www.icbc.com.

Other commercial Crown entities

The Transportation Investment Corporation’s net loss of $89 million was $10 million higher than the Budget 2014 plan, due to an extended and longer than anticipated period of traffic fluctuation following the introduction of tolling and the expiry of the introductory 50 per cent discount.

Net income from other commercial Crown entities was $43 million below plan mainly due to the reclassification of LDB’s Vancouver warehouse property gain ($37 million had been included in other commercial Crown corporation revenue for Budget 2014).

A detailed review of revenue changes by quarter is available in Appendix Table A2.1. Multi-year trends in provincial government revenue sources can be found in Appendix Tables A2.5 and A2.6.

2015 Financial and Economic Review — July 2015

23

Part 2 — Financial Review

Table 2.7 Revenue by Source

| | Budget | | Actual | | Actual | |

($ millions) | | 2014 1 | | 2014/15 | | 2013/14 1 | |

Taxation | | | | | | | |

Personal income | | 7,491 | | 8,076 | | 6,862 | |

Corporate income | | 2,348 | | 2,635 | | 2,427 | |

Sales 2 | | 5,964 | | 5,762 | | 5,303 | |

Fuel | | 936 | | 932 | | 917 | |

Carbon | | 1,228 | | 1,198 | | 1,222 | |

Tobacco | | 780 | | 752 | | 724 | |

Property | | 2,156 | | 2,154 | | 2,080 | |

Property transfer | | 804 | | 1,065 | | 937 | |

Insurance premium | | 450 | | 482 | | 458 | |

| | 22,157 | | 23,056 | | 20,930 | |

Natural resource | | | | | | | |

Natural gas royalties | | 441 | | 493 | | 445 | |

Other energy and minerals | | 1,313 | | 1,231 | | 1,298 | |

Forests | | 785 | | 754 | | 719 | |

Other natural resource 3 | | 471 | | 459 | | 493 | |

| | 3,010 | | 2,937 | | 2,955 | |

Other revenue | | | | | | | |

Medical Services Plan premiums | | 2,271 | | 2,254 | | 2,158 | |

Other fees 4 | | 3,065 | | 3,171 | | 3,052 | |

Investment earnings | | 1,091 | | 1,203 | | 1,113 | |

Miscellaneous | | 2,758 | | 2,679 | | 2,884 | |

Release of surplus assets | | 200 | | 125 | | 433 | |

| | 9,385 | | 9,432 | | 9,640 | |

Contributions from the federal government | | | | | | | |

Health transfer | | 4,200 | | 4,186 | | 4,280 | |

Social transfer | | 1,640 | | 1,641 | | 1,589 | |

Other federal contributions | | 1,523 | | 1,499 | | 1,633 | |

| | 7,363 | | 7,326 | | 7,502 | |

Commercial Crown corporation net income | | | | | | | |

BC Hydro | | 582 | | 581 | | 549 | |

Liquor Distribution Branch | | 862 | | 935 | | 877 | |

BC Lottery Corporation (net of payments to the federal government) | | 1,183 | | 1,245 | | 1,165 | |

ICBC | | 252 | | 657 | | 136 | |

Transportation Investment Corporation (Port Mann) | | (79 | ) | (89 | ) | (88 | ) |

Other 5 | | 85 | | 42 | | 62 | |

| | 2,885 | | 3,371 | | 2,701 | |

Total revenue | | 44,800 | | 46,122 | | 43,728 | |

1 Figures have been restated to reflect government accounting policies in effect at March 31, 2015.

2 Includes provincial sales tax and harmonized sales tax/social services tax/hotel room tax related to prior years.

3 Water rental and other resources.

4 Post-secondary, healthcare-related, motor vehicle, and other fees.

5 Includes Columbia Power Corporation, BC Railway Company, Columbia Basin Trust power projects, and post-secondary institutions self-supported subsidiaries.

2015 Financial and Economic Review — July 2015

24

Part 2 — Financial Review

Table 2.8 Expense by Ministry, Program and Agency

| | 2014/15 | | | |

| | Budget | | | | Actual | |

($ millions) | | 2014 1 | | Actual 2 | | 2013/14 1 | |

Office of the Premier | | 9 | | 8 | | 9 | |

Aboriginal Relations and Reconciliation | | 82 | | 84 | | 83 | |

Advanced Education | | 1,973 | | 1,971 | | 1,950 | |

Agriculture | | 80 | | 78 | | 76 | |

Children and Family Development | | 1,356 | | 1,355 | | 1,343 | |

Community, Sport and Cultural Development | | 221 | | 222 | | 181 | |

Education | | 5,387 | | 5,395 | | 5,370 | |

Energy and Mines | | 21 | | 30 | | 28 | |

Environment | | 134 | | 133 | | 130 | |

Finance | | 202 | | 247 | | 239 | |

Forests, Lands and Natural Resource Operations | | 593 | | 835 | | 619 | |

Health | | 16,936 | | 16,917 | | 16,387 | |

International Trade | | 34 | | 34 | | 37 | |

Jobs, Tourism and Skills Training | | 199 | | 199 | | 196 | |

Justice | | 1,155 | | 1,156 | | 1,155 | |

Natural Gas Development | | 401 | | 401 | | 371 | |

Social Development and Social Innovation | | 2,530 | | 2,529 | | 2,488 | |

Technology, Innovation and Citizens’ Services | | 490 | | 488 | | 525 | |

Transportation and Infrastructure | | 812 | | 812 | | 806 | |

Total ministries and Office of the Premier | | 32,615 | | 32,894 | | 31,993 | |

Management of public funds and debt | | 1,286 | | 1,198 | | 1,237 | |

Contingencies | | 300 | | 264 | | 202 | |

Funding for capital expenditures | | 1,048 | | 860 | | 740 | |

Refundable tax credit transfers | | 778 | | 864 | | 730 | |

Legislative and other appropriations | | 130 | | 125 | | 150 | |

| | 36,157 | | 36,205 | | 35,052 | |

Elimination of transactions between appropriations 3 | | (17 | ) | (17 | ) | (2 | ) |

Prior year liability adjustments | | — | | (130 | ) | (159 | ) |

Consolidated revenue fund expense | | 36,140 | | 36,058 | | 34,891 | |

Expenses recovered from external entities | | 2,599 | | 2,668 | | 2,883 | |

Funding provided to service delivery agencies | | (22,016 | ) | (21,734 | ) | (21,504 | ) |

Ministry and special office direct program spending | | 16,723 | | 16,992 | | 16,270 | |

Service delivery agency expense: | | | | | | | |

School districts | | 5,667 | | 5,339 | | 5,661 | |

Universities | | 4,152 | | 4,119 | | 4,079 | |

Colleges and institutes | | 1,125 | | 1,151 | | 1,137 | |

Health authorities and hospital societies | | 13,108 | | 13,154 | | 12,802 | |

Other service delivery agencies | | 3,743 | | 3,684 | | 3,452 | |

Total service delivery agency expense | | 27,795 | | 27,447 | | 27,131 | |

Subtotal expense | | 44,518 | | 44,439 | | 43,401 | |

Expenditure management | | (76 | ) | — | | — | |

Core Review | | (26 | ) | — | | — | |

Total expense | | 44,416 | | 44,439 | | 43,401 | |

1 Amounts have been restated to reflect government accounting policies and organization in effect at March 31, 2015.

2 Actual results for ministries and special offices reflect the accountabilities in the Balanced Budget and Ministerial Accountability Act . Under BBMAA, spending funded by the Contingencies Vote is not attributed to the various ministries, but is shown as a seperate accountability of the Minister of Finance.

3 Reflects payments made under an agreement where an expense from a voted appropriation is recorded as revenue by a special account.

2015 Financial and Economic Review — July 2015

25

Part 2 — Financial Review

Expense

In 2014/15, government expenses totaled $44.4 billion; $23 million higher than Budget 2014 and $1.0 billion (2.3 per cent) higher than the previous year.

Chart 2.3 Expense changes from Budget 2014

Consolidated Revenue Fund

Government’s continued fiscal discipline resulted in meeting core review and expenditure management objectives during 2014/15. Excluding statutory spending (discussed below) overall ministry spending was $47 million under budget. These savings include achieving the core review mandate of $26 million for the year, as well as savings elsewhere in ministry spending. In addition, fiscal plan improvements identified in the first Quarterly Report allowed government to remove the $76 million in expenditure management initiative for the year.

In addition to the ministry specific savings above, other expense reductions in the Consolidated Revenue Fund included $88 million in interest cost savings due to lower borrowing rates and revisions to timing of borrowing (Management of Public Funds and Debt Vote, net of eliminations), $36 million in unused allocations for Contingencies, and $5 million lower legislative and other appropriation spending. These savings were partially offset by higher tax credit transfers (mainly for film production and mining exploration) totaling $86 million.

Government used the Contingencies Vote as a prudent budgeting tool to fund priority initiatives and manage both current and future budget pressures. A total of $264 million of the $300 million allocation was spent on a variety of pressures, including:

· $64 million for various agreements with First Nations, including treaty and non-treaty related costs and LNG benefits amounts (Ministry of Aboriginal Relations and Reconciliation);

2015 Financial and Economic Review — July 2015

26

Part 2 — Financial Review

· $49 million in programs paid to communities including infrastructure projects, grants to community organizations, and the traffic fine revenue sharing and small community grant program (Ministry of Community, Sport, and Cultural Development);

· $65 million in payments to agencies outside the government reporting entity (Ministry of Education);

· $18 million for court related costs, provincial policing costs under the RCMP contract, and the Immediate Roadside Prohibition Program (Ministry of Justice);

· $18 million to manage income assistance case load pressures (Ministry of Social Development and Social Innovation);

· $15 million for Geoscience BC, costs related to the Mount Polley incident and other mining related costs (Ministry of Energy and Mines);

· $13 million in overseas and related initiatives (Ministry of International Trade);

· $6 million for the purchase of the Grace Islet property (Ministry of Forests, Lands and Natural Resource Operations); and

· $9 million in other areas.

As well, $7 million was paid directly from the Contingencies Vote to First Nations for accommodation costs related to government’s release of assets for its economic generation initiative.

During the year, government invoked standing statutory authority to cover $326 million in unforeseen costs. These included:

· $235 million in direct fire response costs (Ministry of Forests, Lands and Natural Resource Operations);

· $47 million for the amortization of the unfunded actuarial liability in the Teachers’ Pension Plan (Ministry of Finance);

· $13 million for emergency flood response costs under the Emergency Program Act (Ministry of Justice);

· $9 million in relation to the Clean Energy Fund (Ministry of Energy and Mines); and

· $22 million in other areas.

Liabilities accrued in prior years were adjusted downward by $130 million to reflect actuarial valuations and other updated information. These included reductions of:

· $59 million in the Ministry of Finance, primarily related to improved investment returns in relation to the long term disability benefits and self-insurance program reported as lower expenses;

· $50 million in the Ministry of Health, primarily related to accrued expenses for MSP payables and regional operations;

· $8 million in the Ministry of Aboriginal Relations and Reconciliation related to lower revenue sharing following lower mineral tax revenues;

· $4 million in the Ministry of Forests, Lands and Natural Resource Operations, primarily related to accrued costs for competitiveness and innovation initiatives; and

· $9 million of other adjustments.

2015 Financial and Economic Review — July 2015

27

Part 2 — Financial Review

Recovered Expenses

Program spending funded or co-funded by parties outside of government was $69 million higher than budget. The change reflects:

· $45 million increase in recoverable healthcare costs related to PharmaCare costs under Product Listing Agreements with drug companies and regional services provided to non-resident clients;

· $22 million in higher interest cost recoveries from commercial crowns due to impacts of foreign exchange rate changes;

· $14 million for immigration spending funded by the federal government;

· $11 million for higher than anticipated highway expansion and rehabilitation costs recovered from municipalities for work on their assets; and

· $13 million in other cost recovered program spending

partially offset by

· $25 million in lower recoveries in relation to employee health benefits managed for external parties; and

· $11 million reduction in free crown grants.

The above spending changes are offset by an equal net increase in revenue and as a result have no net impact on the fiscal plan.

Operating Transfers

Operating grants paid to government agencies were $95 million lower than budget. Contributing factors include a net reduction of $234 million in grants to school districts being impacted by strike action and a subsequent labour settlement, $31 million in lower payments to other service delivery agencies, and $5 million lower grants to post-secondary institutions, offset by $175 million in higher payments to health authorities and hospital societies to meet increased demands in the sector.

Service Delivery Agency Spending

Service delivery agency spending was $348 million lower than budget, representing a 1.3 per cent reduction in total budgeted expenses by agencies.

Lower spending by government agencies is largely attributed to lower spending by school districts. This occurred because of strike savings associated with the teacher labour disruption, partially offset by additional funding provided from the negotiated settlement reached in September 2014. Actual spending for the education sector was $328 million less than budget.

Post-secondary institution spending was $7 million lower than budget, reflecting a $33 million reduction in university spending, mainly due to reduced third party research grants, partially offset by a $26 million increase in college expenses, mainly in the area of operating costs and grants to third parties.

Health authority and hospital society spending was $46 million higher than projected; however the increase is net of a $90 million positive adjustment to the employee benefit

2015 Financial and Economic Review — July 2015

28

Part 2 — Financial Review

liability. Excluding the liability adjustment, spending was $136 million higher than planned, which was funded by the increase in grants provided to the health authorities identified in the Operating Transfers section above. The spending increase is mainly due to higher staffing and operating costs incurred to meet the growing demand for healthcare services delivered by these organizations.

An overall reduction of $59 million in other service delivery agency spending reflected lower transportation infrastructure spending ($44 million), lower housing subsidy costs ($10 million), and other net spending decreases ($5 million).

A detailed review of the above changes by quarter is available in Appendix Table A2.1. Further information on 2014/15 spending by function is provided in Appendix Table A2.7.

Provincial Capital Spending

Capital spending in 2014/15 totaled $5.9 billion — $3.4 billion on taxpayer-supported infrastructure and $2.5 billion on the self-supported infrastructure of commercial Crown corporations.

Spending on government direct capital (i.e. government ministry infrastructure, including IT systems, court houses and correctional institutions) as well as health and education facilities comprised an aggregate 40 per cent of total capital spending in 2014/15. While this spending is predominantly taxpayer financed, a portion is funded from third party contributions.

Chart 2.4 Capital spending, 2014/15

Spending on highways and public transportation is primarily taxpayer-supported, and reflects government’s transportation and transit investment plan. Roughly 8 per cent of total government spending in this category in 2014/15 was for the Port Mann Bridge replacement and associated Highway 1 improvements, which is a self-supported commercial project to be funded from tolls. This project is essentially complete.

2015 Financial and Economic Review — July 2015

29

Part 2 — Financial Review

Table 2.9 Capital Spending

| | Budget | | Actual | | Actual | |

($ millions) | | 2014 | | 2014/15 | | 2013/14 | |

Taxpayer-supported | | | | | | | |

Education facilities | | 1,394 | | 1,138 | | 973 | |

Health facilities | | 847 | | 900 | | 690 | |

Highways and public transit | | 1,180 | | 905 | | 1,097 | |

Government direct (ministries) | | 382 | | 326 | | 298 | |

Other | | 177 | | 138 | | 93 | |

Capital spending contingencies | | 50 | | — | | — | |

| | 4,030 | | 3,407 | | 3,151 | |

Self-supported commercial | | | | | | | |

Power generation and transmission | | 2,288 | | 2,197 | | 2,088 | |

Highways and public transit | | 83 | | 76 | | 202 | |

Other | | 219 | | 215 | | 229 | |

| | 2,590 | | 2,488 | | 2,519 | |

Total capital spending | | 6,620 | | 5,895 | | 5,670 | |

Spending on power generation and transmission projects is the largest single category of capital spending and is entirely self-supported. The spending primarily reflects BC Hydro’s refurbishment and expansion of its generating and transmission assets, as well as the Waneta Dam power expansion project undertaken by the Columbia Power Corporation (CPC).

Other capital spending includes taxpayer-supported spending on social housing, as well as spending by other commercial Crown corporations on IT systems and equipment.

Taxpayer-supported Capital Spending

In 2014/15, government spending on taxpayer-supported infrastructure was $623 million below budget.

Education facilities spending was $256 million less than budget reflecting:

· a $91 million decrease by school districts due to changes to project schedules, requiring the reprofiling of capital spending for several projects including Moody Middle School, Ecole Des Pionniers, Lord Nelson Elementary School, and the Lord Strathcona Elementary School seismic upgrade; and

· a $165 million decrease by post-secondary institutions, which is mainly attributed to project schedule and spending adjustments to contributor-funded projects, including the University of British Columbia’s Ponderosa and Orchard Commons Student Residences, Undergrad Teaching Labs and the Global Student Centre projects.

Health facilities spending was $53 million higher than budget, reflecting scheduling changes for various projects, including the Clinical and Systems Transformation, Children’s and Women’s Hospital, and North Island Hospitals projects.

Highways and public transit spending was $275 million less than budget, mainly due to changes to project planning and construction schedules, as well as changes in the timing of federal contributions towards project costs.

2015 Financial and Economic Review — July 2015

30

Part 2 — Financial Review

Chart 2.5 Capital spending changes from Budget 2014

Government direct spending was $106 million less than budget due to schedule and spending changes for various projects and unused project reserves. Other taxpayer-supported spending was $39 million lower than planned, partially due to social housing project scheduling changes.

The above scheduling changes do not represent a reduction in capital spending; rather, the spending has been deferred to future years.

Self-supported Capital Spending

Commercial Crown corporation spending on capital projects in 2014/15 was $102 million less than budget.

Power generation and transmission spending was $91 million less than planned mainly due to differences in the timing of expenditures on BC Hydro’s generation replacements and expansion initiative, various technology projects, and building development programs.

Highways spending by TI Corp on the Port Mann Bridge project was $7 million less than planned, mainly reflecting the contractor’s rescheduling of capital spending into 2015/16.

Other self-supported spending was $4 million less than budget, mainly reflecting lower spending by the BC Lottery Corporation on its gaming management system project and equipment replacement (down $21 million) and scheduling changes by other commercial Crown corporations (down $11 million). This lower spending was partially offset by higher than expected ($28 million) residential and commercial building investments on the UBC and Great Northern Way campuses.

Further details on capital spending are provided in Appendix Table A2.10.

Major Capital Projects

Significant capital projects (those with multi-year budgets totaling $50 million or more) are shown in Table 2.10. During 2014/15, $2.4 billion was invested in these larger projects that will provide long-term social and economic benefits for the province.

2015 Financial and Economic Review — July 2015

31

Part 2 — Financial Review

Table 2.10 Capital Expenditure Projects Greater Than $50 million 1

| | | | Project | | Estimated | | Anticipated | | Project Financing | |

| | Year of | | Cost to | | Cost to | | Total | | Internal/ | | P3 | | Federal | | Other | |

($ millions) | | Completion | | Mar 31, 2015 | | Complete | | Cost | | Borrowing | | Liability | | Gov’t | | Contrib’ns | |

Taxpayer-supported | |

School districts | | | | | | | | | | | | | | | | | |

Centennial Secondary | | 2015 | | 18 | | 43 | | 61 | | 61 | | — | | — | | — | |

Oak Bay Secondary | | 2015 | | 40 | | 12 | | 52 | | 50 | | — | | — | | 2 | |

Kitsilano Secondary | | 2015 | | 21 | | 43 | | 64 | | 60 | | — | | — | | 4 | |

Belmont Secondary | | 2015 | | 36 | | 20 | | 56 | | 30 | | — | | — | | 26 | |

Clayton North Secondary | | 2017 | | 1 | | 54 | | 55 | | 45 | | — | | — | | 10 | |

Seismic mitigation program | | 2023 | | 35 | | 1,265 | | 1,300 | | 1,300 | | — | | — | | — | |

Total school districts | | | | 151 | | 1,437 | | 1,588 | | 1,546 | | — | | — | | 42 | |

Post-secondary institutions | | | | | | | | | | | | | | | | | |

Emily Carr University of Art and Design – | | | | | | | | | | | | | | | | | |

Campus redevelopment at Great Northern Way | | | | | | | | | | | | | | | | | |

– Direct procurement | | 2017 | | 11 | | 52 | | 63 | | 42 | | | | — | | 21 | |

– P3 contract | | 2017 | | 7 | | 53 | | 60 | | — | | 60 | | — | | — | |

Total post secondary institutions | | | | 18 | | 105 | | 123 | | 42 | | 60 | | — | | 21 | |

Health facilities | | | | | | | | | | | | | | | | | |

Northern Cancer Control Strategy 2 | | | | | | | | | | | | | | | | | |

– Direct procurement | | 2014 | | 29 | | 1 | | 30 | | 27 | | — | | — | | 3 | |

– P3 contract | | 2012 | | 71 | | — | | 71 | | 54 | | 17 | | — | | — | |

Lions Gate Hospital (Mental Health) 2 | | | | | | | | | | | | | | | | | |

Redevelopment | | 2014 | | 47 | | 15 | | 62 | | 38 | | — | | — | | 24 | |

Lakes District Hospital | | 2015 | | 48 | | 7 | | 55 | | 46 | | — | | — | | 9 | |

Queen Charlotte/Haida Gwaii Hospital | | 2016 | | 21 | | 29 | | 50 | | 31 | | — | | — | | 19 | |

Surrey Emergency/Critical Care Tower | | | | | | | | | | | | | | | | | |

– Direct procurement | | 2016 | | 136 | | 58 | | 194 | | 174 | | — | | — | | 20 | |

– P3 contract | | 2014 | | 318 | | — | | 318 | | 139 | | 179 | | — | | — | |

Royal Inland Hospital | | 2016 | | 19 | | 61 | | 80 | | 47 | | — | | — | | 33 | |

North Island Hospitals | | | | | | | | | | | | | | | | | |

– Direct procurement | | 2017 | | 20 | | 106 | | 126 | | 73 | | — | | — | | 53 | |

– P3 contract | | 2017 | | 120 | | 360 | | 480 | | 60 | | 232 | | — | | 188 | |

Interior Heart and Surgical Centre | | | | | | | | | | | | | | | | | |

– Direct procurement | | 2017 | | 119 | | 129 | | 248 | | 213 | | — | | — | | 35 | |

– P3 contract | | 2015 | | 122 | | 11 | | 133 | | 4 | | 79 | | — | | 50 | |

Vancouver General Hospital – Joseph and Rosalie Segal Family Health Centre | | 2017 | | 17 | | 65 | | 82 | | 57 | | — | | — | | 25 | |

Children’s and Women’s Hospital | | | | | | | | | | | | | | | | | |

– Direct procurement | | 2019 | | 78 | | 231 | | 309 | | 177 | | — | | — | | 132 | |

– P3 contract | | 2017 | | 83 | | 286 | | 369 | | 168 | | 187 | | — | | 14 | |

Penticton Regional Hospital – Patient Care | | | | | | | | | | | | | | | | | |

Tower | | 2019 | | 2 | | 323 | | 325 | | 168 | | — | | — | | 157 | |

Clinical and systems transformation | | 2023 | | 130 | | 350 | | 480 | | 480 | | — | | — | | — | |

Total health facilities | | | �� | 1,380 | | 2,032 | | 3,412 | | 1,956 | | 694 | | — | | 762 | |

Transportation | | | | | | | | | | | | | | | | | |

South Fraser Perimeter Road | | | | | | | | | | | | | | | | | |

– Direct procurement | | 2014 | | 1,076 | | — | | 1,076 | | 728 | | — | | 348 | | — | |

– P3 contract | | 2014 | | 188 | | — | | 188 | | — | | 188 | | — | | — | |

Sierra Yoyo Desan Road upgrade | | 2015 | | 150 | | — | | 150 | | 150 | | — | | — | | — | |

Evergreen Line Rapid Transit | | | | | | | | | | | | | | | | | |

– Direct procurement | | 2016 | | 257 | | 278 | | 535 | | 320 | | — | | 74 | | 141 | |

– P3 contract | | 2016 | | 640 | | 256 | | 896 | | — | | 266 | | 350 | | 280 | |

Total transportation | | | | 2,311 | | 534 | | 2,845 | | 1,198 | | 454 | | 772 | | 421 | |

2015 Financial and Economic Review — July 2015

32

Part 2 — Financial Review

Table 2.10 Capital Expenditure Projects Greater Than $50 million 1 (continued)

| | | | Project | | Estimated | | Anticipated | | Project Financing | |

| | Year of | | Cost to | | Cost to | | Total | | Internal/ | | P3 | | Federal | | Other | |

($ millions) | | Completion | | Mar 31, 2015 | | Complete | | Cost | | Borrowing | | Liability | | Gov’t | | Contrib’ns | |

Other taxpayer-supported | | | | | | | | | | | | | | | | | |

Integrated Case Management system | | 2014 | | 182 | | — | | 182 | | 179 | | — | | 3 | | — | |

Single Room Occupancy Hotel renewal initiative | | | | | | | | | | | | | | | | | |

– Direct procurement | | 2016 | | 12 | | 13 | | 25 | | 23 | | — | | 2 | | — | |

– P3 contract | | 2016 | | 80 | | 38 | | 118 | | — | | 91 | | 27 | | — | |

Okanagan Correctional Centre | | | | | | | | | | | | | | | | | |

– Direct procurement | | 2016 | | 42 | | 49 | | 91 | | 91 | | — | | — | | — | |

– P3 contract | | 2016 | | 48 | | 81 | | 129 | | 8 | | 121 | | — | | — | |

Total other | | | | 364 | | 181 | | 545 | | 301 | | 212 | | 32 | | — | |

Total taxpayer-supported | | | | 4,224 | | 4,289 | | 8,513 | | 5,043 | | 1,420 | | 804 | | 1,246 | |

Self-supported | |

Transportation | | | | | | | | | | | | | | | | | |

Port Mann Bridge / Highway 1 | | 2017 | | 3,275 | | 44 | | 3,319 | | 3,319 | | — | | — | | — | |

Power generation and transmission | | | | | | | | | | | | | | | | | |

BC Hydro | | | | | | | | | | | | | | | | | |

– Vancouver City Central transmission 2 | | 2014 | | 171 | | 1 | | 172 | | 172 | | — | | — | | — | |

– Mica SF6 gas insulated switchgear replacement 2 | | 2014 | | 178 | | 21 | | 199 | | 199 | | — | | — | | — | |

– Northwest transmission line 2 | | 2014 | | 680 | | 36 | | 716 | | 329 | | — | | 130 | | 257 | |

– Iskut extension project 2 | | 2014 | | 164 | | 5 | | 169 | | 105 | | — | | — | | 64 | |

– Merritt area transmission | | 2015 | | 44 | | 21 | | 65 | | 65 | | — | | — | | — | |

– Smart metering and infrastructure program | | 2015 | | 728 | | 202 | | 930 | | 930 | | — | | — | | — | |

– Interior to Lower Mainland transmission line | | 2015 | | 616 | | 109 | | 725 | | 725 | | — | | — | | — | |

– GM Shrum units 1 to 5 turbine replacement | | 2015 | | 154 | | 118 | | 272 | | 272 | | — | | — | | — | |

– Surrey area substation project | | 2015 | | 45 | | 49 | | 94 | | 94 | | — | | — | | — | |

– Hugh Keenleyside spillway gate reliability upgrade | | 2015 | | 91 | | 32 | | 123 | | 123 | | — | | — | | — | |

– Upper Columbia capacity additions at Mica units 5 and 6 project | | 2015 | | 518 | | 196 | | 714 | | 714 | | — | | — | | — | |

– Long Beach area reinforcement | | 2015 | | 26 | | 30 | | 56 | | 56 | | — | | — | | — | |

– Dawson Creek/Chetwynd area transmission | | 2016 | | 221 | | 75 | | 296 | | 296 | | — | | — | | — | |

– Big Bend substation | | 2017 | | 19 | | 37 | | 56 | | 56 | | — | | — | | — | |

– Ruskin Dam safety and powerhouse upgrade | | 2017 | | 310 | | 438 | | 748 | | 748 | | — | | — | | — | |

– John Hart generating station replacement | | 2019 | | 281 | | 812 | | 1,093 | | 1,093 | | — | | — | | — | |

– Cheakamus Unit 1 and Unit 2 generator replacement | | 2019 | | 5 | | 69 | | 74 | | 74 | | — | | — | | — | |

– Peace River Site C clean energy project | | 2024 | | 444 | | 8,331 | | 8,775 | | 8,775 | | — | | — | | — | |

Columbia River power projects | | | | | | | | | | | | | | | | | |

– Waneta Dam power expansion 3 | 2018 | | 322 | | 28 | | 350 | | 350 | | — | | — | | — | |

Total power generation and transmission | | | | 5,017 | | 10,610 | | 15,627 | | 15,176 | | — | | 130 | | 321 | |

Other | | | | | | | | | | | | | | | | | |

British Columbia Lottery Corporation | | | | | | | | | | | | | | | | | |

– Gaming management system | | 2015 | | 93 | | 1 | | 94 | | 94 | | — | | — | | — | |

Insurance Corporation of British Columbia | | | | | | | | | | | | | | | | | |

– Business transformation program | | 2016 | | 232 | | 39 | | 271 | | 271 | | — | | — | | — | |