Budget and Fiscal Plan

2016/17 – 2018/19

February 16, 2016

National Library of Canada Cataloguing in Publication Data

British Columbia.

Budget and fiscal plan. –- 2002/03/2004/05-

Annual

Also available on the Internet.

Continues: British Columbia. Ministry of Finance and

Corporate Relations. Budget ... reports. ISSN 1207-5841

ISSN 1705-6071 = Budget and fiscal plan — British Columbia.

1. Budget — British Columbia — Periodicals. 2. British

Columbia — Appropriations and expenditures — Periodicals.

I. British Columbia. Ministry of Finance. II. Title.

HJ12.B742 352.48’09711’05 C2003-960048-3

TABLE OF CONTENTS

Budget and Fiscal Plan 2016/17 — 2018/19 | | February 16, 2016 |

Attestation by the Secretary to Treasury Board

Summary | 1 |

| |

Part 1: Three Year Fiscal Plan | |

Introduction | 5 |

Revenue | 8 |

Major Revenue Sources | 10 |

Expense | 18 |

Consolidated Revenue Fund Spending | 18 |

Management of the BC Public Service | 24 |

Recovered Expenses | 25 |

Operating Transfers | 26 |

Service Delivery Agency Spending | 26 |

Capital Spending | 26 |

Taxpayer-supported Capital Spending | 26 |

Self-supported Capital Spending | 31 |

Projects over $50 million | 32 |

Provincial Debt | 36 |

Risks to the Fiscal Plan | 38 |

Tables: | |

1.1 | Three Year Fiscal Plan | 5 |

1.2 | Comparison of Major Factors Underlying Revenue | 9 |

1.3 | Personal Income Tax Revenue | 10 |

1.4 | Corporate Income Tax Revenue | 11 |

1.5 | Sales Taxes Revenue | 11 |

1.6 | Crown Land Tenure Revenue | 12 |

1.7 | Federal Government Contributions | 14 |

1.8 | Revenue by Source | 16 |

1.9 | Expense by Ministry, Program and Agency | 17 |

1.10 | Health Per Capita Costs and Outcomes: Canadian Comparisons | 19 |

1.11 | Additional Support for Children, Families and Individuals in Need | 20 |

1.12 | Investments in Community Safety | 21 |

1.13 | Funding for Economic, Community and Skills Development | 23 |

1.14 | Encouraging Natural Resource Development | 23 |

1.15 | Capital Spending | 27 |

1.16 | Provincial Transportation Investments | 30 |

1.17 | Capital Expenditure Projects Greater Than $50 Million | 33 |

1.18 | Provincial Debt Summary | 36 |

1.19 | Provincial Borrowing Requirements | 37 |

1.20 | Reconciliation of Summary Results to Provincial Debt Changes | 38 |

1.21 | Key Fiscal Sensitivities | 38 |

Budget and Fiscal Plan — 2016/17 to 2018/19

Table of Contents

Topic Boxes: | |

BC Prosperity Fund | 43 |

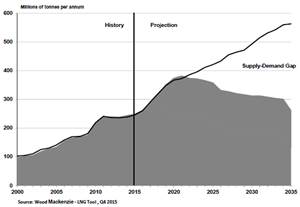

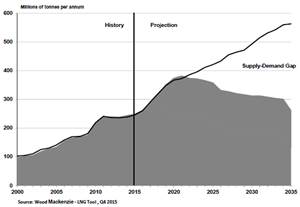

Liquefied Natural Gas — Update | 44 |

Direct Operating Debt | 46 |

Increasing Income Assistance Rates for Persons With Disabilities | 48 |

| |

Part 2: Tax Measures | |

Tax Measures — Supplementary Information | 50 |

Tables: | |

2.1 Summary of Tax Measures | 49 |

2.2 Impact of Medical Services Plan Premium Changes | 52 |

Topic Box: | |

Carbon Tax Report and Plan | 56 |

Commission on Tax Competitiveness | 59 |

Film and Television Tax Credits | 60 |

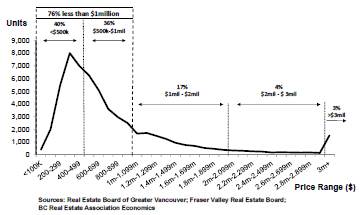

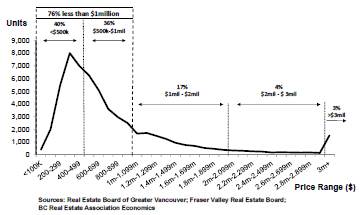

Housing Affordability | 62 |

Part 3: British Columbia Economic Review and Outlook | |

Summary | 67 |

British Columbia Economic Activity and Outlook | 67 |

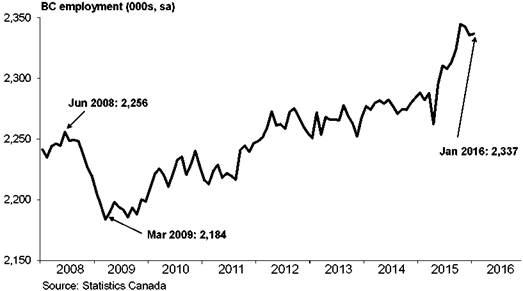

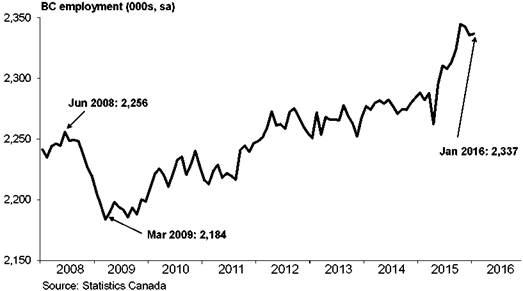

The Labour Market | 68 |

Consumer Spending and Housing | 69 |

Business and Government | 71 |

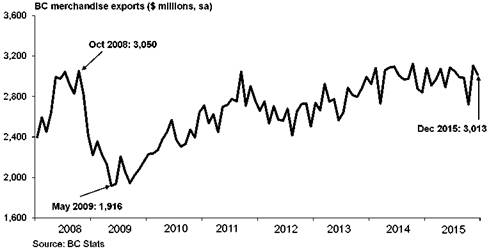

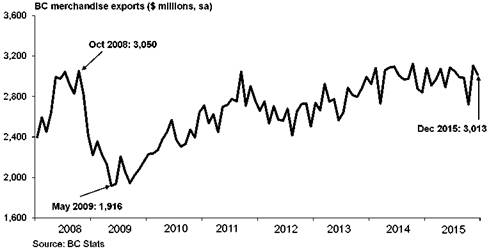

External Trade and Commodity Markets | 71 |

Demographics | 73 |

Inflation | 73 |

Risks to the Economic Outlook | 74 |

External Outlook | 74 |

United States | 74 |

Canada | 76 |

Europe | 78 |

China | 79 |

Financial Markets | 80 |

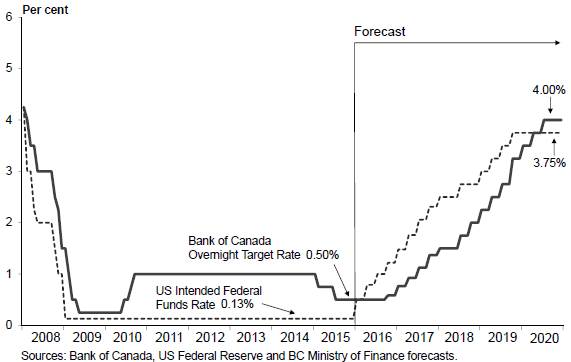

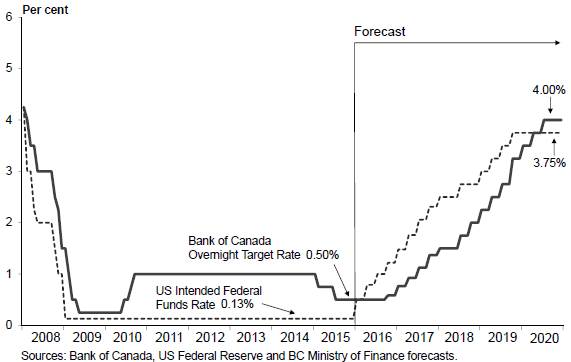

Interest Rates | 80 |

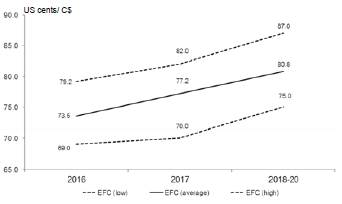

Exchange Rate | 81 |

Tables: | |

3.1 | British Columbia Economic Indicators | 68 |

3.2 | US Real GDP Forecast: Consensus vs Ministry of Finance | 76 |

3.3 | Canadian Real GDP Forecast: Consensus vs Ministry of Finance | 78 |

3.4 | Private Sector Canadian Interest Rate Forecasts | 81 |

3.5 | Private Sector Exchange Rate Forecasts | 82 |

3.6.1 | Gross Domestic Product: British Columbia | 83 |

3.6.2 | Selected Nominal Income and Other Indicators: British Columbia | 84 |

3.6.3 | Labour Market Indicators: British Columbia | 84 |

3.6.4 | Major Economic Assumptions | 85 |

Topic Box: | |

The Economic Forecast Council, 2016 | 86 |

Budget and Fiscal Plan — 2016/17 to 2018/19

ii

Table of Contents

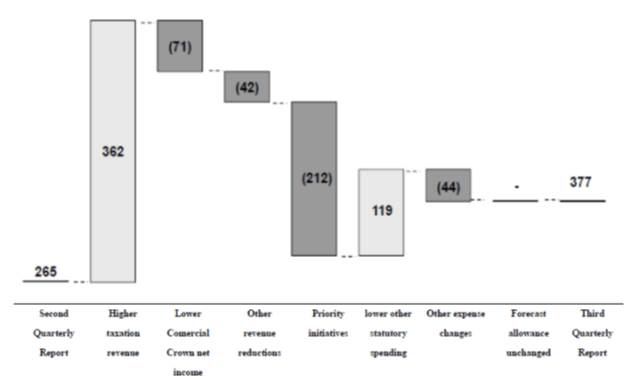

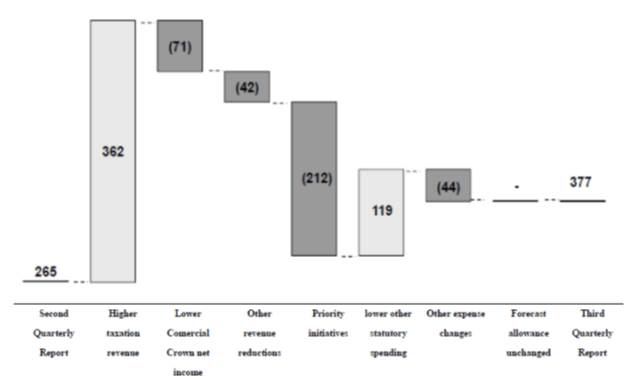

Part 4: 2015/16 Updated Financial Forecast (Third Quarterly Report) | |

Introduction | 91 |

Revenue | 93 |

Expense | 93 |

Contingencies | 94 |

Government Employment (FTEs) | 94 |

Provincial Capital Spending | 94 |

Provincial Debt | 95 |

Risks to the Fiscal Forecast | 96 |

Supplementary Schedules | 97 |

Tables: | | |

4.1 | 2015/16 Forecast Update | 91 |

4.2 | 2015/16 Financial Forecast Changes | 92 |

4.3 | 2015/16 Capital Spending Update | 94 |

4.4 | 2015/16 Provincial Debt Update | 95 |

4.5 | 2015/16 Operating Statement | 97 |

4.6 | 2015/16 Revenue by Source | 98 |

4.7 | 2015/16 Expense by Ministry, Program and Agency | 99 |

4.8 | 2015/16 Expense by Function | 100 |

4.9 | 2015/16 Capital Spending | 101 |

4.10 | 2015/16 Provincial Debt | 102 |

4.11 | 2015/16 Statement of Financial Position | 103 |

| | |

Appendix | | 105 |

Budget and Fiscal Plan — 2016/17 to 2018/19

iii

| February 16, 2016 |

As required by Section 7(d) of the Budget Transparency and Accountability Act (BTAA), and Section 4a(v) of the Carbon Tax Act, I confirm that Budget 2016 contains the following elements:

· Fiscal forecasts for 2016/17 to 2018/19 (provided in Part 1) and economic forecasts for 2016 to 2020 (provided in Part 3).

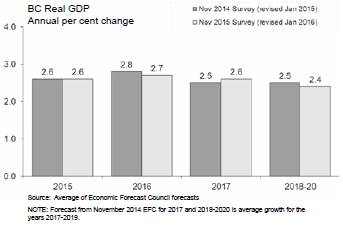

· A report on the advice received from the Economic Forecast Council (EFC) in late November 2015 (updated January 2016) on the economic growth outlook for British Columbia, including a range of forecasts for 2016 and 2017 (see Part 3, page 86).

· Material economic, demographic, fiscal, accounting policy and other assumptions and risks underlying Budget 2016 economic and fiscal forecasts. In particular:

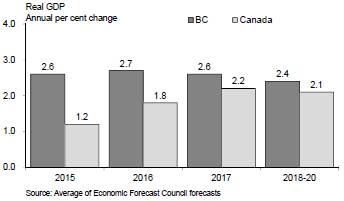

· The economic forecast reflects stable economic growth for British Columbia in an environment where the global economic situation remains mixed. While the US economy remains relatively stable, Europe’s economy is fragile, growth in China is slowing, and low commodity prices continue to weigh on the Canadian economy. Accordingly, the economic projections assumed in Budget 2016 are prudent relative to the average of the forecasts provided by the Economic Forecast Council.

· Personal and corporate income tax revenue forecasts include the preliminary 2014 income tax assessments and the latest projections for national corporate taxable income received from the federal government. The property transfer tax forecast assumes the level of housing activity in 2015/16 does not fully carry forward.

· Natural gas royalty forecasts continue to adopt a lower natural gas price forecast compared to the private sector average in order to maintain prudence against volatility.

· The economic and revenue forecasts both do not reflect any incremental activity or revenue from liquefied natural gas development; and also both do not assume either a continuation of the 2006 Softwood Lumber Agreement between Canada and the US or any potential litigation that could arise after the expiry of the US commitment not to launch countervailing duty or anti-dumping litigation before October 2016.

· Ministry budgets include base increases for the costs of collective agreements signed under government’s current wage mandate, including costs arising from the Economic Stability Dividend portion of the mandate.

· Forecast prudence totals $800 million in 2016/17 and $750 million in each of 2017/18 and 2018/19, being the sum of the Contingencies vote and the forecast allowance in each fiscal year.

· Budget 2016 includes spending projections for the Site C dam project and initial funding for planning costs for the George Massey Tunnel Replacement Project. Full spending projections for the George Massey Tunnel Replacement Project will be added to the capital plan upon approval of the final project business case by Treasury Board.

· The fiscal plan includes three-year financial projections for school districts, post-secondary institutions and health authorities, as provided by the Ministries of Education, Advanced Education and Health, respectively, based on plans submitted to the ministries by those entities, and for the other service delivery agencies and the commercial Crown corporations, as submitted directly to the Ministry of Finance by those organizations.

· A Revenue Neutral Carbon Tax Report for 2014/15 and 2015/16, and the Revenue Neutral Carbon Tax Plan for 2016/17 to 2018/19 (see Part 2: Tax Measures, page 56).

To the best of my knowledge, the three-year fiscal plan contained in Budget 2016 conforms to the standards and guidelines of generally accepted accounting principles for senior governments as outlined in Note 1 of the 2014/15 Public Accounts.

| /s/ Kim Henderson |

| Kim Henderson |

| Deputy Minister and |

| Secretary to Treasury Board |

| |

Budget and Fiscal Plan — 2016/17to 2018/19

Summary: BUDGET AND FISCAL PLAN — 2016/17 to 2018/19

| | Updated | | Budget | | | | | |

| | Forecast | | Estimate | | Plan | | Plan | |

($ millions) | | 2015/16 | | 2016/17 | | 2017/18 | | 2018/19 | |

Revenue | | 46,992 | | 48,066 | | 49,034 | | 50,141 | |

Expense | | (46,365 | ) | (47,452 | ) | (48,397 | ) | (49,418 | ) |

Allocation to the BC Prosperity Fund | | (100 | ) | — | | — | | — | |

Surplus before the BC Prosperity Fund and forecast allowance | | 527 | | 614 | | 637 | | 723 | |

BC Prosperity Fund | | 100 | | — | | — | | — | |

Forecast allowance | | (250 | ) | (350 | ) | (350 | ) | (350 | ) |

Surplus | | 377 | | 264 | | 287 | | 373 | |

Capital spending: | | | | | | | | | |

Taxpayer-supported capital spending | | 3,631 | | 4,251 | | 3,843 | | 3,872 | |

Self-supported capital spending | | 2,604 | | 3,108 | | 2,659 | | 2,886 | |

| | 6,235 | | 7,359 | | 6,502 | | 6,758 | |

Provincial Debt: | | | | | | | | | |

Taxpayer-supported debt | | 42,709 | | 43,227 | | 44,242 | | 45,089 | |

Self-supported debt | | 22,331 | | 24,113 | | 25,294 | | 26,452 | |

Total debt (including forecast allowance) | | 65,290 | | 67,690 | | 69,886 | | 71,891 | |

Taxpayer-supported debt-to-GDP ratio | | 17.4 | % | 17.0 | % | 16.7 | % | 16.3 | % |

Taxpayer-supported debt-to-revenue ratio | | 92.7 | % | 92.4 | % | 93.1 | % | 93.0 | % |

| | | | | | | | | |

| | 2015 | | 2016 | | 2017 | | 2018 | |

Economic Forecast: | | | | | | | | | |

Real GDP growth | | 2.4 | % | 2.4 | % | 2.3 | % | 2.3 | % |

Nominal GDP growth | | 3.3 | % | 4.0 | % | 4.3 | % | 4.3 | % |

Maintaining Balanced Results

Budget 2016 provides significant new investments in core programs while maintaining government’s ongoing commitment to disciplined and prudent fiscal planning. Government is presenting balanced budget results in each year of the fiscal plan for the fourth year in a row.

Over the fiscal plan period, government has committed $1.6 billion in funding increases to social supports, community safety and economic development, as well as fully funding the Economic Stability Dividend public sector compensation increases, while maintaining modest surpluses in all years of the fiscal plan. Key areas for increased expenditures in Budget 2016 over the next three years include:

· $673 million in additional support for children, families, and individuals in need;

· $128 million in operating costs for the new Okanagan Correctional Centre;

· $75 million for the Rural Dividend Program; and

· $213 million for the Economic Stability Dividend for all provincial public sector employees who have reached labour settlements.

Government is able to make these new commitments within a balanced budget framework due to improving revenues, as well as sizeable savings in debt servicing costs resulting from government’s success under its strategic debt management initiative. Over the three year fiscal plan period, interest costs are almost $500 million lower than forecasted in Budget 2015.

Budget 2016 will establish the BC Prosperity Fund, with an inaugural commitment of $100 million from the forecasted 2015/16 surplus. The BC Prosperity Fund will be a long-term legacy intended to:

· help eliminate the Province’s debt over time;

· make investments in health care, education, transportation, family supports and other priorities that provide future benefits to British Columbia; and

· preserve a share of today’s prosperity for future generations.

Budget and Fiscal Plan — 2016/17 to 2018/19

Summary

In order to achieve social policy and economic development objectives, government will initiate a number of tax policy measures in Budget 2016, including:

· introduction of a property transfer tax exemption for newly constructed homes up to $750,000 in value, effective February 17, 2016;

· introduction of a new farmers’ food donation tax credit, effective February 17, 2016;

· expansion of the seniors’ home renovation tax credit to persons with disabilities, effective February 17, 2016;

· extension of the BC mining flow-through share tax credit to the end of 2016;

· extension of the mining exploration tax credit for an additional three years to the end of 2019; and

· increase of the small business venture capital tax credit budget by $5 million.

Effective January 1, 2017, government is also making changes to the structure of Medical Services Plan premiums, including the exemption of children from the calculation of premiums. Premium assistance will also be enhanced by $70 million annually.

Steady Economic Growth

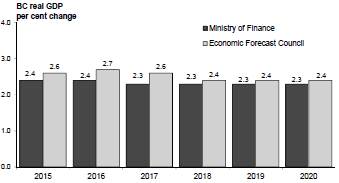

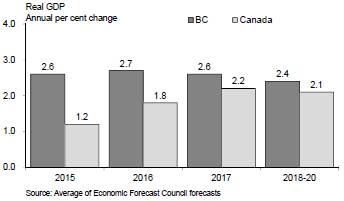

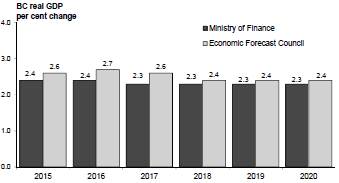

Following an estimated increase of 2.4 per cent in 2015, the Ministry of Finance forecasts British Columbia’s economy to grow by 2.4 per cent in 2016, 2.3 per cent in 2017 and 2.3 per cent per year in the medium-term.

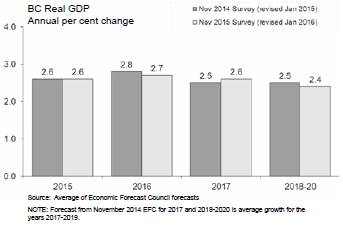

Prudent economic forecast

The Ministry’s estimate for BC real GDP growth is 0.3 percentage points lower, in both 2016 and 2017, than the outlook provided by the Economic Forecast Council. This prudence acknowledges the downside risks to the economic forecast and is one of the levels of prudence built into the fiscal plan.

The Ministry’s estimate for 2015 is slightly higher than expected in Budget 2015 as growth in retail sales, housing starts and employment exceeded expectations. While some of that domestic momentum is expected to continue into 2016, lower than expected commodity prices and dampened external demand are weighing on exports growth. As such, the Ministry’s real GDP outlook for 2016 and 2017 is relatively unchanged from Budget 2015.

Downside risks to BC’s economic outlook include:

· potential for a slowdown in domestic and Canadian economic activity;

· renewed weakness in the US economy, particularly as interest rates increase;

· fragility in Europe as governments and the financial system deal with elevated sovereign debt alongside weak economic growth;

· slower than anticipated economic activity in Asia, particularly in China, resulting in weaker demand for BC’s exports and downward pressure on global commodity prices;

· weaker than expected inflation; and

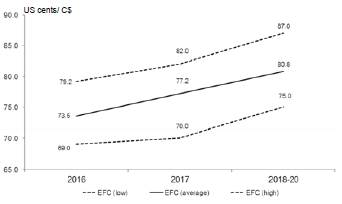

· exchange rate uncertainty.

Capital Spending

Taxpayer-supported infrastructure spending on hospitals, schools, post-secondary facilities, transit, and roads will total $12.0 billion over the fiscal plan period, and will be financed by $8.2 billion in borrowing with the remainder funded by third parties, such as the federal government, and from internal cash flows.

Self-supported spending on power projects, transportation infrastructure, and other capital assets will total $8.6 billion over the fiscal plan period, and will be financed by $5.2 billion in borrowing, with the remainder funded internally.

Strategic Debt Management

Government’s key debt affordability metric, taxpayer-supported debt to GDP ratio, continues its downward trend. The ratio is forecasted to be 17.4 per cent at the end of 2015/16, declining to 16.3 per cent over the fiscal plan period. This track is on average 0.2 percentage points below that estimated in Budget 2015.

Budget and Fiscal Plan — 2016/17 to 2018/19

2

Summary

Debt to GDP trend stable and improved

Government’s other debt affordability metric, taxpayer-supported debt to revenue, is also below that estimated at Budget 2015.

Debt to revenue below Budget 2015

Risks to the Fiscal Plan

The main risks to the government’s fiscal plan include:

· risks to the BC economic outlook, largely due to the continued uncertainty surrounding global economic activity;

· assumptions underlying revenue, including Crown corporation income forecasts, such as economic factors, commodity prices and weather conditions;

· potential changes to federal government allocations for health and social transfers and cost-sharing agreements, as well as impacts on the provincial income taxes arising from federal government tax policy changes;

· utilization rates for government services such as health care, children and family services, and income assistance;

· impacts of the expiration of the 2006 Softwood Lumber Agreement between Canada and the US; and

· the outcome of litigation, arbitrations, and negotiations with third parties, including the appeal of the BC Supreme Court decision on the teachers’ contract issue.

Government incorporates four main levels of prudence in its projections to mitigate the risks to the fiscal plan:

· The Ministry outlook for BC’s real GDP growth is lower than the outlook provided by the Economic Forecast Council (0.3 percentage points lower in 2016 and 0.3 percentage points lower in 2017).

· The natural gas revenue forecast incorporates additional prudence by using a price forecast that is within the 20th percentile of the private sector forecasts.

· Government has included a forecast allowance of $350 million in each year of the fiscal plan to guard against volatility including revenue changes.

· The fiscal plan also includes a Contingencies vote allocation of $450 million in 2016/17, and $400 million in each of 2017/18 and 2018/19, to help manage unexpected pressures and fund priority initiatives.

Conclusion

In summary, Budget 2016:

· provides a sustainable balanced budget framework built on disciplined fiscal planning and modest economic growth;

· reflects the benefits of a focus on debt management in the form of lower debt servicing costs providing affordable and new funding in key areas of government services;

· introduces tax measures targeted towards achieving social policy objectives and supporting government’s balanced budget commitment;

· makes investments in government’s capital infrastructure in support of government initiatives and service delivery; and

· continues strategic debt management in order to achieve lower costs, maintain debt affordability and support a AAA credit rating.

Budget and Fiscal Plan — 2016/17 to 2018/19

3

Part 1: THREE YEAR FISCAL PLAN

Table 1.1 Three Year Fiscal Plan

| | Updated | | Budget | | | | | |

| | Forecast | | Estimate | | Plan | | Plan | |

($ millions) | | 2015/16 | | 2016/17 | | 2017/18 | | 2018/19 | |

Revenue | | 46,992 | | 48,066 | | 49,034 | | 50,141 | |

Expense | | (46,365 | ) | (47,452 | ) | (48,397 | ) | (49,418 | ) |

Allocation to the BC Prosperity Fund | | (100 | ) | — | | — | | — | |

Surplus before the BC Prosperity Fund and forecast allowance | | 527 | | 614 | | 637 | | 723 | |

BC Prosperity Fund | | 100 | | — | | — | | — | |

Forecast allowance | | (250 | ) | (350 | ) | (350 | ) | (350 | ) |

Surplus | | 377 | | 264 | | 287 | | 373 | |

Capital spending: | | | | | | | | | |

Taxpayer-supported capital spending | | 3,631 | | 4,251 | | 3,843 | | 3,872 | |

Self-supported capital spending | | 2,604 | | 3,108 | | 2,659 | | 2,886 | |

| | 6,235 | | 7,359 | | 6,502 | | 6,758 | |

Provincial Debt: | | | | | | | | | |

Taxpayer-supported debt | | 42,709 | | 43,227 | | 44,242 | | 45,089 | |

Self-supported debt | | 22,331 | | 24,113 | | 25,294 | | 26,452 | |

Total debt (including forecast allowance) | | 65,290 | | 67,690 | | 69,886 | | 71,891 | |

Taxpayer-supported debt-to-GDP ratio | | 17.4 | % | 17.0 | % | 16.7 | % | 16.3 | % |

Taxpayer-supported debt-to-revenue ratio | | 92.7 | % | 92.4 | % | 93.1 | % | 93.0 | % |

Introduction

Budget 2016 presents significant new investments in core programs while continuing government’s practice of fiscal prudence. Excluding health care, government is providing $1.6 billion in additional funding compared to Budget 2015, including increases to social services, community safety and economic development, as well as fully funding the Economic Stability Dividend compensation increases, while maintaining modest surpluses in each year of the fiscal plan.

These new funding commitments are affordable within a balanced budget framework due to improving revenues to core government as well as sizeable interest cost savings resulting from the success of government’s strategic debt management efforts. Debt servicing costs over the three year fiscal plan are approximately $500 million less than forecasted at Budget 2015, and interest costs as a portion of revenue remains at historically low levels, averaging 3.7 cents per dollar of revenue.

Budget 2016 will establish the BC Prosperity Fund, with an inaugural commitment of $100 million from the forecasted 2015/16 surplus. The BC Prosperity Fund will be a long-term legacy intended to:

· help eliminate the Province’s debt over time;

· make investments in health care, education, transportation, family supports and other priorities that provide future benefits to British Columbia, and

· preserve a share of today’s prosperity for future generations.

Budget and Fiscal Plan — 2016/17 to 2018/19

Three Year Fiscal Plan

While this inaugural $100 million investment is modest, government may increase this amount when the final 2015/16 surplus is known. In addition, future government surpluses, which will include LNG revenues, will help grow the fund over time.

Government’s strategic debt management initiatives since Budget 2014 also ensure important infrastructure investments proceed while remaining within debt affordability constraints. Taxpayer-supported capital investments in hospitals, schools, post-secondary facilities, transit, and roads will total $12.0 billion over the fiscal plan period, a 12 per cent increase over Budget 2015 levels.

Self-supported spending on power projects, transportation infrastructure and other capital assets will total $8.6 billion over the fiscal plan period, and will be financed by $5.2 billion in borrowing, with the remainder funded internally. More information on the three year capital spending plan is found on page 26.

While total provincial debt is projected to be $71.9 billion by 2018/19, direct operating debt is projected to decline to $2.7 billion, the lowest level since 1984/85. Additional information on the debt outlook can be found in the Direct Operating Debt topic box on page 46.

Government continues to place emphasis on improving debt affordability. Debt to GDP continues its stable downward trend and is on average, 0.2 percentage points below the Budget 2015 forecasted track.

Chart 1.1 Debt to GDP trend stable and improved

The other key debt affordability metric, taxpayer-support debt to revenue, is also well under Budget 2015 estimates.

The major risks to the fiscal plan stem from changes in factors that government does not directly control. These include:

· risks to the BC economic outlook, largely due to the continued uncertainty surrounding global economic activity;

Budget and Fiscal Plan — 2016/17 to 2018/19

6

Three Year Fiscal Plan

Chart 1.2 Debt to revenue below Budget 2015

· assumptions underlying revenue, including commercial Crown corporation forecasts, such as economic factors, commodity prices and weather conditions;

· potential changes to federal government transfer allocations, cost-sharing agreements with the federal government and impacts on the provincial income taxes arising from federal government tax policy and budget changes;

· utilization rates for government services such as health care, children and family services, and income assistance;

· impacts of the expiration of the 2006 Softwood Lumber Agreement between Canada and the US; and

· the outcome of litigation, arbitrations, and negotiations with third parties, including the appeal of the Supreme Court of Canada decision on the teachers’ contract issue.

Government incorporates four main levels of prudence in its projections to mitigate the risks to the fiscal plan:

· The Ministry outlook for BC’s real GDP growth is lower than the outlook provided by the Economic Forecast Council (0.3 percentage points lower in 2016 and 2017).

· The natural gas revenue forecast incorporates additional prudence by using a price forecast that is within the 20th percentile of the private sector forecasts.

· Government has included a forecast allowance of $350 million in all years of the fiscal plan to guard against volatility including changes to revenue.

· The fiscal plan includes a Contingencies vote allocation of $450 million in 2016/17, and $400 million in 2017/18 and 2018/19, to help manage unexpected pressures and fund priority initiatives.

A complete discussion of the risks to the fiscal plan can be found beginning on page 38. Economic risks are discussed in Part 3: British Columbia Economic Review and Outlook.

Budget and Fiscal Plan — 2016/17 to 2018/19

7

Three Year Fiscal Plan

Revenue

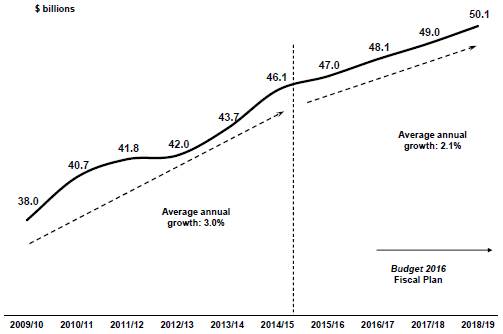

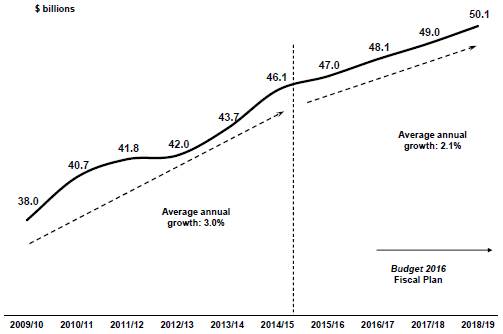

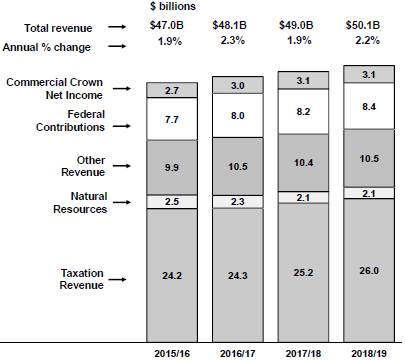

Chart 1.3 Revenue trends

Total revenue growth is expected to average 2.1 per cent annually over the four-year period to 2018/19. This reflects the impacts of 4.0 per cent average annual nominal GDP growth on taxation revenues and projected increases in fee revenues, investment earnings and federal government contributions. These improvements are partly offset by an expected declining trend in natural resource revenues.

In 2016/17, taxation revenue is forecast to grow only 0.3 per cent compared to 2015/16 due to the effects of one-time income and property transfer tax revenues recorded in 2015/16 that are not expected to fully carry forward and the termination of the temporary tax rate increase on individuals earning over $150,000. The two-year temporary tax rate increase was implemented effective January 1, 2014 and rescinded effective December 31, 2015. Over the next two years, taxation revenue sources are projected to average 3.4 per cent annual growth, consistent with the Ministry of Finance economic growth projections for nominal GDP, household income, net operating surplus, consumer expenditures and housing starts. The forecast also includes the impacts of tax measures detailed in Part 2: Tax Measures.

Natural resource revenue is forecast to decline 7.2 per cent in 2016/17 compared to 2015/16 mainly due to reduced revenue from the sale of Crown land leases, the impacts of lower commodity prices, and the effect of the expiration of the Canada-US 2006 Softwood Lumber Agreement, effective October 12, 2015. Over the next two years, average annual change in natural resource revenues is projected to decline 4.8 per cent as the effects of falling revenue from the sale of Crown land leases offsets the impacts of increasing commodity prices. Excluding Crown land tenures, natural resource revenue is expected to average 4.1 per cent annual growth over the next two years, in line with expected rising prices for natural gas, petroleum, lumber, coal and other mining commodities.

Revenue from fees, investment earnings and other miscellaneous sources is expected to average 2.2 per cent annual growth over the next three years, reflecting projected Medical Services Plan premium rate increases; measures to enhance premium assistance; and rising projections for post-secondary fee revenue and investment earnings. The revenue forecast incorporates estimates provided by ministries and taxpayer-supported agencies.

Budget and Fiscal Plan — 2016/17 to 2018/19

8

Three Year Fiscal Plan

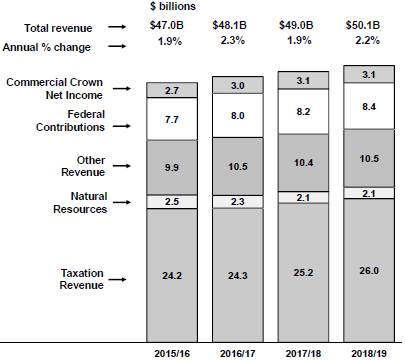

Chart 1.4 Revenue forecast

Federal government contributions are forecast to average 3.2 per cent annual growth over the next three years mainly due to expected increases in the Canada Health Transfer (CHT) and Canada Social Transfer (CST) disbursements.

Excluding ICBC, commercial Crown net income is expected to average 1.8 per cent annual growth over the next three years mainly reflecting relatively stable growth in the net income for BC Hydro, Liquor Distribution Branch and BC Lottery Corporation. More details on commercial Crown corporation net income are provided beginning on page 14.

Table 1.2 Comparison of Major Factors Underlying Revenue

Calendar Year | | February 16, 2016 | | February 17, 2015 | |

Per cent growth unless otherwise indicated | | 2015 | | 2016 | | 2017 | | 2018 | | 2015 | | 2016 | | 2017 | | 2018 | |

Real GDP | | 2.4 | | 2.4 | | 2.3 | | 2.3 | | 2.3 | | 2.4 | | 2.3 | | 2.3 | |

Nominal GDP | | 3.3 | | 4.0 | | 4.3 | | 4.3 | | 3.8 | | 4.3 | | 4.3 | | 4.3 | |

Household income | | 3.2 | | 3.6 | | 3.9 | | 3.9 | | 3.5 | | 3.8 | | 4.0 | | 4.0 | |

Net operating surplus | | -1.3 | | 3.7 | | 5.0 | | 5.0 | | 3.3 | | 6.3 | | 5.8 | | 5.8 | |

Consumer expenditures | | 5.2 | | 4.8 | | 4.7 | | 4.5 | | 4.3 | | 4.5 | | 4.5 | | 4.6 | |

Consumer expenditures on durable goods | | 8.7 | | 2.5 | | 1.9 | | 1.8 | | 1.3 | | 1.6 | | 1.5 | | 1.5 | |

Business investment | | 7.9 | | 5.6 | | 5.1 | | 4.6 | | 3.9 | | 4.5 | | 4.6 | | 4.7 | |

Residential investment | | 10.5 | | 6.8 | | 6.0 | | 4.8 | | 3.4 | | 4.7 | | 4.9 | | 4.9 | |

Retail sales | | 6.5 | | 4.3 | | 3.7 | | 3.6 | | 3.3 | | 3.7 | | 3.6 | | 3.6 | |

Employment | | 1.2 | | 1.2 | | 1.2 | | 1.2 | | 1.0 | | 1.2 | | 1.2 | | 1.2 | |

BC Housing starts | | 10.9 | | -6.5 | | -4.6 | | -3.6 | | -2.7 | | -0.2 | | -1.9 | | 0.0 | |

US Housing starts | | 10.8 | | -1.0 | | 0.0 | | 0.0 | | -0.6 | | 2.5 | | 2.4 | | 0.0 | |

SPF 2x4 price ($US/thousand board feet) | | $ | 282 | | $ | 288 | | $ | 300 | | $ | 300 | | $ | 344 | | $ | 340 | | $ | 340 | | $ | 340 | |

Pulp ($US/tonne) | | $ | 852 | | $ | 840 | | $ | 825 | | $ | 825 | | $ | 888 | | $ | 838 | | $ | 825 | | $ | 825 | |

Exchange rate (US cents/Canadian dollar) | | 78.2 | | 73.1 | | 76.8 | | 79.7 | | 85.3 | | 85.5 | | 87.0 | | 87.2 | |

Fiscal Year | | 2015/16 | | 2016/17 | | 2017/18 | | 2018/19 | | 2015/16 | | 2016/17 | | 2017/18 | | 2018/19 | |

Natural gas price ($Cdn/GJ at plant inlet) | | $ | 1.31 | | $ | 1.04 | | $ | 1.34 | | $ | 1.61 | | $ | 2.09 | | $ | 2.32 | | $ | 2.54 | | $ | 2.85 | |

Bonus bid average bid price per hectare ($) | | $ | 183 | | $ | 252 | | $ | 290 | | $ | 388 | | $ | 1,000 | | $ | 1,025 | | $ | 1,100 | | $ | 1,150 | |

Electricity price ($US/mega-watt hour, Mid-C) | | $ | 26 | | $ | 24 | | $ | 26 | | $ | 29 | | $ | 28 | | $ | 31 | | $ | 35 | | $ | 39 | |

Metallurgical coal price ($US/tonne, fob west coast) | | $ | 95 | | $ | 85 | | $ | 93 | | $ | 105 | | $ | 128 | | $ | 138 | | $ | 138 | | $ | 138 | |

Copper price ($US/lb) | | $ | 2.36 | | $ | 2.27 | | $ | 2.48 | | $ | 2.58 | | $ | 3.02 | | $ | 3.05 | | $ | 3.04 | | $ | 3.03 | |

Crown harvest volumes (million cubic metres) | | 62.0 | | 62.0 | | 62.0 | | 62.0 | | 63.0 | | 63.0 | | 64.0 | | 64.0 | |

Budget and Fiscal Plan — 2016/17 to 2018/19

9

Three Year Fiscal Plan

Major Revenue Sources

Key assumptions and sensitivities relating to revenue are provided in Appendix Table A5. The assumptions and factors that are the major drivers for preparing projections of individual revenue sources include sensitivities to provide the reader with a sense of potential impacts to revenue projections if there are changes to these underlying assumptions and factors. The following text references the forecasts of these assumptions and factors in explaining individual revenue sources. The 2016 Financial and Economic Review will include an estimation of the historical volatility of the economic assumptions. The major revenue components are:

Taxation revenue

Personal income tax base revenue (excluding tax measures and accounting adjustments for prior years) is forecast to average 4.5 per cent annual growth over the next three years, consistent with Budget 2016 projections of household and employee compensation income growth.

Table 1.3 Personal Income Tax Revenue

($ millions) | | 2015/16 | | 2016/17 | | 2017/18 | | 2018/19 | |

Base personal income tax revenue | | 7,834 | | 8,189 | | 8,585 | | 8,952 | |

Annual growth | | 2.2 | % | 4.5 | % | 4.8 | % | 4.3 | % |

Measures: | | | | | | | | | |

– temporary personal income tax rate increase for individuals with income over $150,000 (2 year limit) | | 210 | | — | | — | | — | |

– Budget 2016 tax measures | | (5 | ) | (4 | ) | (1 | ) | (4 | ) |

– Federal tax measures | | 25 | | 31 | | 27 | | 23 | |

Prior-Year adjustment | | 312 | | — | | — | | — | |

Budget 2016 revenue | | 8,376 | | 8,216 | | 8,611 | | 8,971 | |

Annual growth | | 3.7 | % | -1.9 | % | 4.8 | % | 4.2 | % |

Household income growth (calendar year) | | 3.2 | % | 3.6 | % | 3.9 | % | 3.9 | % |

Employee compensation income growth (calendar year) | | 3.3 | % | 3.9 | % | 4.0 | % | 4.1 | % |

Elasticity1 (calendar year basis, policy neutral) | | 0.6 | | 1.2 | | 1.3 | | 1.1 | |

1 Per cent growth in current year tax relative to per cent growth in personal income.

Due to the effects of prior-year adjustments in 2015/16 and the termination of the temporary tax rate increase effective December 31, 2015, personal income tax revenue is expected to decrease 1.9 per cent in 2016/17, followed by growth of 4.8 per cent and 4.2 per cent in the next two years.

Corporate income tax revenue forecasts are based on cash received from the federal government and annual projections reflect instalments and settlement adjustments for prior years. The revenue forecast is relatively unchanged in 2016/17 as the increase in instalments is offset by a reduction in the settlement payment for prior-years. Average annual growth over the next two years is forecast at 3.7 per cent mainly due to increases in instalments as national corporate taxable income and BC’s payment share are both projected to rise.

Budget and Fiscal Plan — 2016/17 to 2018/19

10

Three Year Fiscal Plan

The revenue forecast incorporates the federal government’s latest projections of national corporate taxable income and assumes that the general corporate income tax rate and the small business income tax rate remain at 11.0 per cent and 2.5 per cent, respectively. Further, calendar-year corporate income tax entitlement is forecast to rise in line with projected growth in the net operating surplus.

Table 1.4 Corporate Income Tax Revenue

($ millions) | | 2015/16 | | 2016/17 | | 2017/18 | | 2018/19 | |

Advance instalments from the federal government: | | | | | | | | | |

– Payment share | | 11.5 | % | 11.6 | % | 12.0 | % | 12.1 | % |

– Instalments | | 2,598 | | 2,729 | | 2,870 | | 2,964 | |

International Business Activity Act refunds | | (20 | ) | (20 | ) | (25 | ) | (25 | ) |

Prior-years’ settlement payment | | 210 | | 82 | | 114 | | 65 | |

Corporate income tax revenue | | 2,788 | | 2,791 | | 2,959 | | 3,004 | |

Annual per cent growth | | 5.8 | % | 0.1 | % | 6.0 | % | 1.5 | % |

Provincial sales tax revenue growth is expected to average 4.3 per cent annually over the next three years (excluding the one-time $50 million HST repayment in 2015/16), in line with expected increases in nominal GDP and consumer expenditures on taxable goods and services.

Table 1.5 Sales Taxes Revenue

($ millions) | | 2015/16 | | 2016/17 | | 2017/18 | | 2018/19 | |

Provincial sales taxes | | 5,956 | 1 | 6,296 | | 6,554 | | 6,819 | |

Annual per cent change (calendar year) | | 2015 | | 2016 | | 2017 | | 2018 | |

Consumer expenditures | | 5.2 | % | 4.8 | % | 4.7 | % | 4.5 | % |

Residential investment | | 10.5 | % | 6.8 | % | 6.0 | % | 4.8 | % |

Government expenditures | | 4.6 | % | 2.1 | % | 2.5 | % | 3.2 | % |

Nominal GDP | | 3.3 | % | 4.0 | % | 4.3 | % | 4.3 | % |

Retail sales | | 6.5 | % | 4.3 | % | 3.7 | % | 3.6 | % |

1 2015/16 forecast includes a —$50 million harmonized sales tax adjustment related to prior years.

Carbon tax revenue is forecast to average 1.6 per cent annual growth over the next three years. The forecast assumes that purchased volumes of natural gas will grow in line with real GDP and that consumption of gasoline is expected to remain flat. Carbon tax revenue is fully returned to taxpayers through tax reductions and credits. For more details on carbon tax recycling, see the Carbon Tax Report and Plan topic box on page 56.

Property tax revenue is expected to grow by an average of 4.3 per cent annually over the three year plan, in line with the outlook for BC housing starts and inflation. The forecast incorporates the impact of increasing the threshold for the phase-out of the home owner grant to $1.2 million from $1.1 million for the 2016 tax year.

Property transfer tax revenue is forecast to decline 16.8 per cent in 2016/17 reflecting an anticipated slowing of market activity and assuming a portion of the strong revenues received in 2015/16 do not carry forward. This decline is expected to be followed by an average annual decline of 3.7 per cent over the next two years in line with the outlook for BC housing starts.

More information on tax measures are detailed in Part 2: Tax Measures.

Budget and Fiscal Plan — 2016/17 to 2018/19

11

Three Year Fiscal Plan

Natural resource revenue

Natural gas royalties are expected to decline 15.2 per cent in 2016/17 mainly due to the impact of a lower natural gas price forecast. The royalties are forecast to increase at a 38.9 per cent average annual rate over the next two years, reflecting projections for higher prices and production volumes, partially offset by increased utilization of royalty programs and credits.

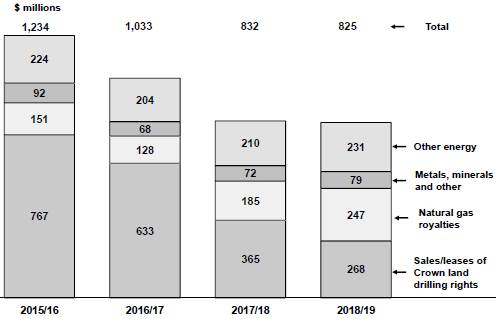

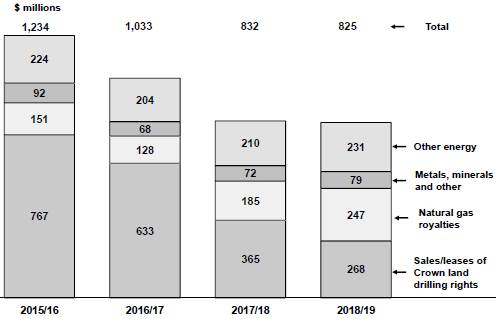

Chart 1.5 Revenue from energy, metals and minerals

The forecast assumes an average price of $1.04 ($Cdn/gigajoule, plant inlet) in 2016/17, down from $1.31 in 2015/16. The 2016/17 assumption is within the 20th percentile of the private sector forecasters, continuing the prudence incorporated in recent budgets. Prices are expected to rise in the next two years, averaging $1.34 in 2017/18 and $1.61 in 2018/19, in line with the growth of the average of the private sector forecasters. Natural gas royalty rates are sensitive to prices in the $1.25 and $2.75 range, hence the net effective royalty rate is expected to rise as natural gas prices increase.

See Appendix Table A6 for more details regarding natural gas price forecasts.

Sales and leases of Crown land drilling rights revenue: Over the next three years, revenue from the sale of Crown land tenures is forecast to decline 65 per cent from $767 million in 2015/16 to $268 million in 2018/19. Crown land tenure revenue has three main components:

· deferred cash sales representing one-ninth of the cash from the annual bonus bid auction sales in each of the previous eight years;

Table 1.6 Crown Land Tenure Revenue

($ millions) | | 2014/15 | | 2015/16 | | 2016/17 | | 2017/18 | | 2018/19 | |

Bonus bid auction sales: | | | | | | | | | | | |

Deferred revenue | | 732 | | 702 | | 568 | | 300 | | 202 | |

Current-year cash (one-ninth) | | 37 | | 2 | | 2 | | 2 | | 3 | |

Fees and rentals | | 65 | | 63 | | 63 | | 63 | | 63 | |

Total revenue | | 834 | | 767 | | 633 | | 365 | | 268 | |

Budget and Fiscal Plan — 2016/17 to 2018/19

12

Three Year Fiscal Plan

· one-ninth of the cash receipts from the current year bonus bid auction sales; and

· annual fees and rentals

Revenue is expected to decrease over the fiscal plan period reflecting declining amounts of deferred revenue recognition. This is a result of the very large bonus bid cash sales (occurring in the 2007/08 to 2009/10 period) being fully amortized over nine years compared to lower sales results in the past six years and a forecast for relatively weak sales over the next three years.

Mining and minerals: Revenue from mineral tax, fees and miscellaneous mining receipts is expected to decrease 26.1 per cent in 2016/17 mainly due to an outlook for lower metal and coal prices. Average annual revenue growth over the next two years is forecast at 7.8 per cent based on an expected recovery in mining commodity prices.

Other energy: Other energy revenue is comprised of electricity sales under the Columbia River Treaty, petroleum royalties and fees collected by the Oil and Gas Commission. These revenues are expected to fall 8.9 per cent in 2016/17 due to the effects of lower Mid-C electricity and oil prices, followed by an average annual increase of 6.4 per cent over the next two years as prices are forecast to rise.

Forests revenue is forecast to decline 2.5 per cent in 2016/17 mainly due to the impact of the expiry of the 2006 Softwood Lumber Agreement partially offset by higher stumpage revenue. Revenue growth is expected to average 1.0 per cent annually over the next two years mainly due to the impacts of higher stumpage rates. Total Crown land harvest levels are projected to be stable at 62 million cubic metres over the 2015/16 to 2018/19 period.

Other natural resource revenue is comprised of water rentals and fees for hunting and fishing licenses collected under the Wildlife Act. These sources are expected to increase by an annual average rate of 0.6 percent over the next three years.

Other revenue

Fees and licenses: Revenue growth is expected to average 3.3 per cent annually over the three year fiscal plan, mainly due to projected increases to Medical Services Plan premium rates in support of rising healthcare spending and increases in fee revenue collected by post-secondary institutions.

Investment earnings are projected to grow at a 5.4 per cent average annual rate over the three year fiscal plan, mainly due to increased earnings from fiscal agency loans. Investment income from fiscal agency loans has an offsetting expense resulting in no impact to the bottom line.

Miscellaneous revenue is forecast to decline an average 1.5 per cent annually over the next three years. Miscellaneous revenue includes the projected gains on sales of surplus properties. As well, the transfer of selected lands and buildings to non-profit societies in support of building housing capacity in the non-profit sector and ensuring its long term sustainability will result in the net value of the properties being reported as gains when transferred.

Budget and Fiscal Plan — 2016/17 to 2018/19

13

Three Year Fiscal Plan

Federal government transfers

Health and social transfers are expected to average 4.0 per cent annual growth over the three years of the fiscal plan, mainly reflecting increasing national cash transfers and a rising BC population share. The plan assumes the national CHT cash disbursement increases 6.0 per cent in 2016/17 followed by increases of 3.0 per cent and 3.4 per cent in last two years of the plan. The national CHT cash disbursement in 2017/18 will be based on a three year average (2015 to 2017) of Canada’s nominal GDP growth, subject to a minimum annual growth rate of 3.0 per cent. The national CST cash disbursement is projected to increase 3.0 per cent annually, consistent with the federal government forecast.

Table 1.7 Federal Government Contributions

($ millions) | | 2015/16 | | 2016/17 | | 2017/18 | | 2018/19 | |

Canada Health Transfer | | 4,444 | | 4,721 | | 4,875 | | 5,054 | |

Deferred health equipment grants | | 7 | | 3 | | — | | — | |

Canada Social Transfer | | 1,695 | | 1,747 | | 1,804 | | 1,863 | |

Total health and social transfers | | 6,146 | | 6,471 | | 6,679 | | 6,917 | |

Ministry cost recoveries | | 541 | | 529 | | 524 | | 524 | |

Transfers to post-secondary institutions | | 513 | | 514 | | 516 | | 519 | |

Transfers to taxpayer-supported Crown corporations | | 230 | | 238 | | 233 | | 202 | |

Transfers to other SUCH sector agencies | | 91 | | 93 | | 89 | | 89 | |

Disaster financial assistance contributions | | 1 | | 27 | | 18 | | 23 | |

Other transfers | | 137 | | 136 | | 136 | | 136 | |

Total other contributions | | 1,513 | | 1,537 | | 1,516 | | 1,493 | |

Total Federal Government Contributions | | 7,659 | | 8,008 | | 8,195 | | 8,410 | |

Other federal contributions are expected to decline 0.4 per cent annually, on average, over the next three years. Reduced funding includes projected contributions to the BC Housing Management Commission and ministry vote recoveries.

Commercial Crown corporations

British Columbia Hydro and Power Authority: BC Hydro’s net income is forecast to be $692 million in 2016/17. In accordance with it’s 10 Year Plan for rates, 2016/17 is the last year BC Hydro’s net income is calculated as an 11.84 per cent allowed return on deemed equity. Beginning in 2017/18, net income will increase at the forecast rate of increase in the British Columbia consumer price index, currently estimated to be 2 per cent, resulting in forecast net income of $706 million and $720 million for 2017/18 and 2018/19 respectively. BC Hydro forecasts include annual rate increases of 4 per cent, 3.5 per cent and 3 per cent from 2016/17 to 2018/19, pursuant to the rate caps laid out in the 10 Year Plan.

British Columbia Liquor Distribution Branch: LDB’s net income is projected to be $983 million in 2016/17, increasing to $1.0 billion by 2018/19. The increase reflects average annual growth of 1.6 per cent in net sales revenue over the fiscal plan period.

Budget and Fiscal Plan — 2016/17 to 2018/19

14

Three Year Fiscal Plan

British Columbia Lottery Corporation: BCLC reflects moderate net income growth over the fiscal plan period, from $1.2 billion in 2015/16 to $1.3 billion by 2018/19. Net income growth is attributed to Casino and Community Gaming and e-Gaming segments, with annual growth in net win at 0.9 per cent and 8.2 per cent, respectively. The corporation’s long-term health and profitability is being managed through a focus on strategic investments and continuous improvements in cost management.

For each year of the fiscal plan, government will distribute approximately $250 million (or approximately 20 per cent of the dividend) of its gaming income to charities and local governments. As well, $147 million of the gaming income retained by government will be allocated each year to the Health Special Account in support of health services.

Insurance Corporation of British Columbia: ICBC’s net income is forecast to average $125 million annually over the fiscal plan period. The outlook assumes average annual growth of 1.7 per cent in the number of insured vehicles and a 4.5 per cent average annual increase in current year claims costs.

ICBC is in its seventh year of a multi-year $400 million Transformation Program that is designed to promote upgraded systems and processes to facilitate better support for customers and business partners with less paperwork; and more efficient business practices. The Transformation Program, forecast to be complete in the fall of 2016, is being funded entirely from Optional insurance capital and therefore does not impact Basic insurance rates.

Transportation Investment Corporation: TI Corp manages the TReO toll system on the Port Mann Bridge and highway operations for 37 kilometers of Highway 1 between Langley and Vancouver. Bridge and highway construction was completed in 2015. Some construction continues off-highway and is scheduled to be completed on time in 2016/17 and within the $3.3 billion project budget.

The corporation is forecasting losses for the fiscal plan period, but will be profitable in future years and will recover capital costs for the improvement project through tolling over the longer term. Traffic forecasts indicate long term traffic growth on the Port Mann Bridge and TI Corp is expected to repay the project debt and meet all financial obligations by 2050.

Budget and Fiscal Plan — 2016/17 to 2018/19

15

Three Year Fiscal Plan

Table 1.8 Revenue by Source

| | Updated | | Budget | | | | | |

| | Forecast | | Estimate | | Plan | | Plan | |

($ millions) | | 2015/16 | | 2016/17 | | 2017/18 | | 2018/19 | |

Taxation revenue | | | | | | | | | |

Personal income | | 8,376 | | 8,216 | | 8,611 | | 8,971 | |

Corporate income | | 2,788 | | 2,791 | | 2,959 | | 3,004 | |

Sales 1 | | 5,956 | | 6,296 | | 6,554 | | 6,819 | |

Fuel | | 941 | | 948 | | 955 | | 963 | |

Carbon | | 1,216 | | 1,234 | | 1,252 | | 1,275 | |

Tobacco | | 755 | | 755 | | 755 | | 755 | |

Property | | 2,206 | | 2,305 | | 2,399 | | 2,504 | |

Property transfer | | 1,490 | | 1,239 | | 1,184 | | 1,150 | |

Insurance premium | | 510 | | 520 | | 530 | | 540 | |

| | 24,238 | | 24,304 | | 25,199 | | 25,981 | |

Natural resource revenue | | | | | | | | | |

Natural gas royalties | | 151 | | 128 | | 185 | | 247 | |

Forests | | 833 | | 812 | | 814 | | 828 | |

Other natural resources 2 | | 1,546 | | 1,407 | | 1,113 | | 1,050 | |

| | 2,530 | | 2,347 | | 2,112 | | 2,125 | |

Other revenue | | | | | | | | | |

Medical Services Plan premiums | | 2,425 | | 2,549 | | 2,665 | | 2,780 | |

Other fees and licences 3 | | 3,350 | | 3,446 | | 3,511 | | 3,589 | |

Investment earnings | | 1,143 | | 1,200 | | 1,276 | | 1,337 | |

Miscellaneous 4 | | 2,946 | | 3,210 | | 2,975 | | 2,812 | |

| | 9,864 | | 10,405 | | 10,427 | | 10,518 | |

Contributions from the federal government | | | | | | | | | |

Health and social transfers | | 6,146 | | 6,471 | | 6,679 | | 6,917 | |

Other federal government contributions 5 | | 1,513 | | 1,537 | | 1,516 | | 1,493 | |

| | 7,659 | | 8,008 | | 8,195 | | 8,410 | |

Commercial Crown corporation net income | | | | | | | | | |

BC Hydro | | 653 | | 692 | | 706 | | 720 | |

Liquor Distribution Branch | | 970 | | 983 | | 994 | | 1,003 | |

BC Lottery Corporation (net of payments to federal government) | | 1,221 | | 1,233 | | 1,250 | | 1,250 | |

ICBC | | (125 | ) | 95 | | 148 | | 130 | |

Transportation Investment Corporation (Port Mann) | | (86 | ) | (102 | ) | (106 | ) | (101 | ) |

Other 6 | | 68 | | 101 | | 109 | | 105 | |

| | 2,701 | | 3,002 | | 3,101 | | 3,107 | |

Total revenue | | 46,992 | | 48,066 | | 49,034 | | 50,141 | |

1 Includes provincial sales tax, HST/PST housing transition tax and harmonized sales tax related to prior years.

2 Columbia River Treaty, Crown land tenures, other energy and minerals, water rental and other resources.

3 Post-secondary, healthcare-related, motor vehicle, and other fees.

4 Includes reimbursements for healthcare and other services provided to external agencies, and other recoveries.

5 Includes contributions for health, education, community development, housing and social service programs, and transportation projects.

6 Includes Columbia Power Corporation, BC Railway Company, Columbia Basin Trust power projects, and post-secondary institutions self-supported subsidiaries.

Budget and Fiscal Plan — 2016/17 to 2018/19

16

Three Year Fiscal Plan

Table 1.9 Expense by Ministry, Program and Agency

| | Updated | | Budget | | | | | |

| | Forecast | | Estimate | | Plan | | Plan | |

($ millions) | | 2015/16 1 | | 2016/17 | | 2017/18 | | 2018/19 | |

| | | | | | | | | |

Office of the Premier | | 9 | | 9 | | 9 | | 9 | |

Aboriginal Relations and Reconciliation | | 87 | | 86 | | 88 | | 89 | |

Advanced Education | | 1,961 | | 1,986 | | 2,014 | | 2,042 | |

Agriculture | | 80 | | 81 | | 82 | | 82 | |

Children and Family Development | | 1,379 | | 1,451 | | 1,472 | | 1,486 | |

Community, Sport and Cultural Development | | 228 | | 259 | | 264 | | 264 | |

Education | | 5,549 | | 5,609 | | 5,667 | | 5,728 | |

Energy and Mines | | 41 | | 28 | | 28 | | 29 | |

Environment | | 150 | | 150 | | 149 | | 149 | |

Finance | | 262 | | 253 | | 279 | | 282 | |

Forests, Lands and Natural Resource Operations | | 922 | | 671 | | 671 | | 682 | |

Health | | 17,445 | | 17,968 | | 18,505 | | 19,065 | |

International Trade | | 49 | | 50 | | 51 | | 52 | |

Jobs, Tourism and Skills Training | | 196 | | 197 | | 198 | | 198 | |

Justice | | 475 | | 491 | | 498 | | 504 | |

Natural Gas Development | | 444 | | 453 | | 457 | | 459 | |

Public Safety and Solicitor General | | 668 | | 681 | | 708 | | 711 | |

Small Business and Red Tape Reduction | | 3 | | 4 | | 4 | | 4 | |

Social Development and Social Innovation | | 2,593 | | 2,739 | | 2,830 | | 2,868 | |

Technology, Innovation and Citizens’ Services | | 479 | | 492 | | 501 | | 503 | |

Transportation and Infrastructure | | 924 | | 858 | | 862 | | 867 | |

Total ministries and Office of the Premier | | 33,944 | | 34,516 | | 35,337 | | 36,073 | |

Management of public funds and debt | | 1,188 | | 1,168 | | 1,214 | | 1,241 | |

Contingencies | | 350 | | 450 | | 400 | | 400 | |

Funding for capital expenditures | | 855 | | 1,303 | | 1,262 | | 1,437 | |

Refundable tax credit transfers | | 1,071 | | 1,039 | | 1,043 | | 1,047 | |

Legislative and other appropriations | | 136 | | 132 | | 141 | | 134 | |

Total appropriations | | 37,544 | | 38,608 | | 39,397 | | 40,332 | |

Elimination of transactions between appropriations 2 | | (16 | ) | (16 | ) | (31 | ) | (47 | ) |

Prior year liability adjustments | | (33 | ) | — | | — | | — | |

Consolidated revenue fund expense | | 37,495 | | 38,592 | | 39,366 | | 40,285 | |

Expenses recovered from external entities | | 2,689 | | 2,790 | | 2,807 | | 2,885 | |

Funding provided to service delivery agencies | | (22,463 | ) | (23,185 | ) | (23,540 | ) | (24,085 | ) |

Ministry and special office direct program spending | | 17,721 | | 18,197 | | 18,633 | | 19,085 | |

Service delivery agency expense: | | | | | | | | | |

School districts | | 5,828 | | 5,861 | | 5,910 | | 5,975 | |

Universities | | 4,279 | | 4,426 | | 4,554 | | 4,680 | |

Colleges and institutes | | 1,167 | | 1,160 | | 1,177 | | 1,200 | |

Health authorities and hospital societies | | 13,584 | | 13,798 | | 14,126 | | 14,364 | |

Other service delivery agencies | | 3,786 | | 4,010 | | 3,997 | | 4,114 | |

Total service delivery agency expense | | 28,644 | | 29,255 | | 29,764 | | 30,333 | |

Total expense | | 46,365 | | 47,452 | | 48,397 | | 49,418 | |

1 Restated to reflect government’s current organization and accounting policies.

2 Reflects payments made under an agreement where an expense from a voted appropriation is recorded as revenue by a special account.

Budget and Fiscal Plan — 2016/17 to 2018/19

17

Three Year Fiscal Plan

Expense

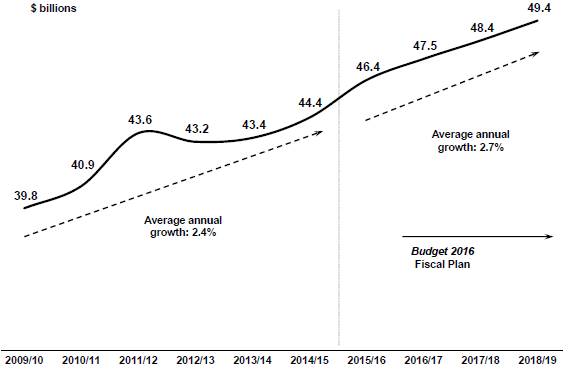

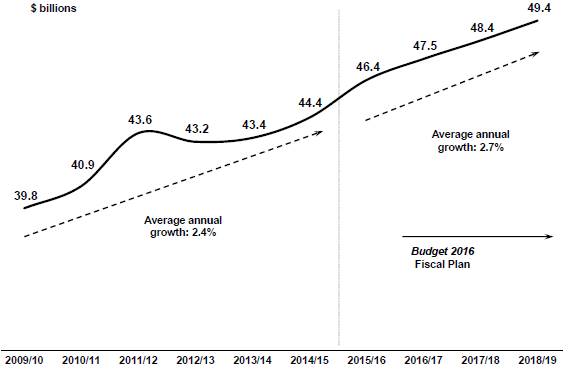

Budget 2016 provides for new investments while maintaining government’s commitment to disciplined and prudent fiscal management. Excluding the budget increase for the Ministry of Health in 2018/19, program spending includes new commitments of $1.6 billion over the three year fiscal plan compared to Budget 2015. The average annual growth in spending is expected to be 2.7 per cent and remains within the balanced budget obligation.

Chart 1.6 Expense trends

Government is able to provide funding increases now largely due to the benefits of controlled spending and the success of strategic debt management initiatives. Over the fiscal plan period, debt servicing costs are approximately $500 million less than forecasted in Budget 2015. It is these savings, working in concert with revenue improvements that have allowed for significant, targeted investments in key areas of importance to British Columbians.

Consolidated Revenue Fund Spending

Key expenditure priorities being addressed by Budget 2016, include those in the Ministry of Health, the Ministry of Social Development and Social Innovation and the Ministry of Children and Family Development. Expenditures are also higher in the Ministry of Forests, Lands and Natural Resource Operations, primarily to accommodate the Rural Dividend, which is a key government commitment announced at the Union of British Columbia Municipalities convention. A further annual expenditure across all ministries is for the Economic Stability Dividend wage increase, discussed in more detail below. The three year growth rate for the Ministry of Health in Budget 2016 is 3.0 per cent, which compares to an average 2.0 per cent annually for the remaining ministries.

Budget and Fiscal Plan — 2016/17 to 2018/19

18

Three Year Fiscal Plan

Health and Education

Health Care — Stable Annual Funding Increases

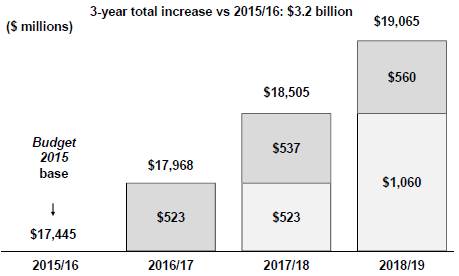

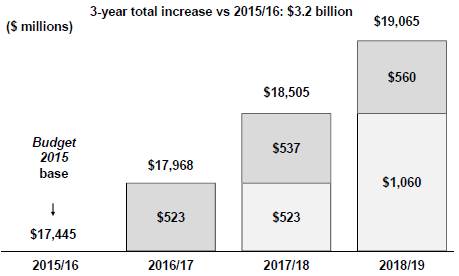

The Ministry of Health’s annual budget will increase by $523 million in 2016/17, and the ministry’s budget is targeted to reach over $19 billion by 2018/19. As noted above, the average rate of growth over the three year fiscal plan will be 3.0 per cent. These increases include funding for the health sector’s portion of the Economic Stability Dividend that will increase salaries for health care workers.

Chart 1.7 Ministry of Health budget increases

BC still leads the nation in important health outcomes while continuing to be third lowest in per capita health costs compared to other Canadian provinces, at $3,983 per person. BC also continues to rank best in terms of Life Expectancy, Cancer Mortality, and Mortality related to Diseases of the Heart and second best for Infant Mortality, according to the most recently available data.

Table 1.10 Health Per Capita Costs and Outcomes: Canadian Comparisons

| | 2015 Per | | Life | | Infant Mortality | | Cancer Mortality Rate | | Diseases of the Heart | |

| | Capita Health | | Expectancy at | | per 1000 Live | | per 100,000 | | Mortality Rate per | |

Province | | Care Costs ($) | | Birth (Years) | | Births | | Population | | 100,000 Population | |

Quebec | | 3,656 | | 81.8 | | 5.0 | | 170.1 | | 84.8 | |

Ontario | | 3,752 | | 82.0 | | 4.9 | | 148.1 | | 88.4 | |

British Columbia | | 3,983 | | 82.2 | | 3.8 | | 140.4 | | 83.7 | |

New Brunswick | | 4,175 | | 81.1 | | 5.7 | | 157.4 | | 100.4 | |

Prince Edward Island | | 4,282 | | 80.1 | | 3.5 | | 171.1 | | 105.9 | |

Nova Scotia | | 4,315 | | 80.2 | | 4.6 | | 174.1 | | 98.5 | |

Saskatchewan | | 4,621 | | 79.7 | | 5.5 | | 152.7 | | 113.3 | |

Manitoba | | 4,720 | | 79.8 | | 5.9 | | 159.3 | | 110.9 | |

Alberta | | 4,862 | | 81.3 | | 4.3 | | 142.2 | | 111.2 | |

Newfoundland | | 5,181 | | 79.9 | | 5.5 | | 175.0 | | 121.0 | |

Sources: Canadian Institute for Health Information, 2015 (cost data) and Statistics Canada (outcomes data).

Note: Outcomes data for Life Expectancy is of 2011; all other outcome data are as of 2012, which is the most recent data available.

Budget and Fiscal Plan — 2016/17 to 2018/19

19

Three Year Fiscal Plan

Post-Secondary Sector — Additional Funding for Educators

Budget 2016 increases funding for post-secondary institutions during the fiscal plan period. The rising three year track for the Ministry of Advanced Education reflects both Budget 2015’s increases for the 2014 Economic Stability Mandate wage funding for universities and colleges, as well as new funding in this year’s fiscal plan for the Economic Stability Dividend. In total, Budget 2016 adds $34 million over three years in the Ministry of Advanced Education’s allocation to fund the Dividend.

K-12 Education — Continued Increases to Fund Labour Agreements

The factors influencing the funding growth in Budget 2016 for the Province’s K-12 school system are consistent with those for the post-secondary sector. Budget 2015 presented a rising Ministry of Education three year budget track due to funding added for the 2014 BCTF and CUPE settlements, in addition to increases for independent schools enrolment. Budget 2016 includes new funding for the Economic Stability Dividend for public school teachers and unionized support staff. This amount totals $54 million over the period 2016/17 to 2018/19, and will increase remuneration for thousands of public school and school district employees.

Further, beginning in the 2018/19 fiscal year and consistent with the BCTF agreement, an additional $4.4 million ($6.25 million on a school year basis) is added to the Learning Improvement Fund (LIF), which currently is budgeted at $100 million annually. The LIF was established as part of Budget 2012 at $75 million, to provide additional resources to school districts to help address complex classroom needs.

Supporting Families and Others in Need

Budget 2016 provides an additional $673 million over the next three years for the Ministry of Social Development and Social Innovation and for the Ministry of Children and Family Development to support families and individuals most in need, as detailed in Table 1.11 and as described below.

Table 1.11 Additional Support for Children, Families and Individuals in Need

($ millions) | | 2016/17 | | 2017/18 | | 2018/19 | |

Income Assistance supports for those in need | | 44 | | 103 | | 103 | |

Increase to monthly Persons With Disabilities income assistance rates | | 36 | | 65 | | 69 | |

Increased contribution provided to Community Living BC | | 12 | | 2 | | 22 | |

Services and programs for children, youth, and their families | | 66 | | 74 | | 77 | |

Total | | 158 | | 244 | | 271 | |

Income Assistance

As a component of the $673 million, Budget 2016 provides an additional $250 million over the next three years for individuals and families in need to address caseload pressures for temporary income assistance, disability assistance, and related supplementary benefits.

Increase to Income Assistance Rates for Persons with Disabilities

In support of goals established in Accessibility 2024 — government’s plan to make BC the most progressive province in Canada for people with disabilities — and through

Budget and Fiscal Plan — 2016/17 to 2018/19

20

Three Year Fiscal Plan

consultations with British Columbians, Budget 2016 provides a three year total of $170 million to increase income assistance rates for Persons with Disabilities. The rate increase will take effect September 1, 2016.

Community Living BC

In Budget 2016, government’s contribution to Community Living BC will increase by $36 million over the fiscal plan period. The additional funding will support services for individuals with developmental disabilities and their families, and to address continued caseload growth and demand for services.

Caring for Children and Families

As part of the emphasis on responding to the needs of vulnerable children and families, Budget 2016 includes an additional $217 million over the next three years for the Ministry of Children and Family Development as follows:

· $152 million to strengthen programs and services which provide for the welfare of children and youth including: child protection, children and youth in care, and family supports;

· $11 million to support child care centres;

· $51 million for children and youth in care with special needs, and autism programs in recognition of increasing demand for services, and;

· $3 million for facilitating the adoption of children in care, including recruitment of adoptive families, promoting adoption, planning for permanency, and post adoptive assistance.

These new investments will fund 100 more front-line social workers, resources for further training, quality assurance, and technology, and responds to recommendations from the Plecas review of BC’s child welfare system.

Community Safety

Budget 2016 provides $128 million in new operating funding over the next three years for the new Okanagan Correctional Centre, including funding for over 240 additional corrections and other staff, once fully operational. This facility near Oliver is expected to be completed in late 2016 with operations beginning in early 2017. The Okanagan Correctional Centre will more than double corrections capacity in the BC interior.

A further $3 million over three years is added to Emergency Management BC’s budget in the Ministry of Transportation and Infrastructure in order to provide for increased planning and outreach related to potential natural disasters, such as earthquakes and floods.

Table 1.12 Investments in Community Safety | | | | | | | |

| | | | | | | |

($ millions) | | 2016/17 | | 2017/18 | | 2018/19 | |

Okanagan Correctional Centre Operating Costs: | | | | | | | |

Ministry of Public Safety and Solicitor General | | 10 | | 33 | | 33 | |

Ministry of Technology, Innovation and Citizens’ Services | | 12 | | 20 | | 20 | |

Emergency Management BC Planning and Outreach | | 1 | | 1 | | 1 | |

Total | | 23 | | 54 | | 54 | |

Budget and Fiscal Plan — 2016/17 to 2018/19

21

Three Year Fiscal Plan

Supporting Economic and Skills Development

A total of $143 million over three years is added to ministries in Budget 2016 in order to enhance key areas of the BC economy.

Rural Communities in Transition

The new Rural Dividend Program will provide $75 million over three years to help small communities strengthen and diversify their economies. Funding will be available to eligible communities with a population of 25,000 or under.

Venture Capital

As part of its innovation agenda, in December 2015 government created the $100 million BC Tech Fund to encourage venture capital investment and help deliver on BC’s Technology Strategy. In order to ensure appropriate governance and oversight of the investment strategies to be pursued, almost $3 million in new funding over three years is included in Budget 2016.

Marketing BC’s Forest Products

Continued support to expand overseas markets for the province’s more traditional export products is also important to the BC economy. Therefore Budget 2016 provides Forestry Innovation Investment Ltd. (FII), a Crown corporation, with an additional $5 million over three years for enhanced forest product marketing activities in India. This follows several years of similar work by FII in China, where sales of BC forest products have grown considerably over the last decade.

Tourism Investments

To help support tourism in rural communities, it is critical to maintain key assets. Budget 2016 adds almost $6 million during the fiscal plan period for maintenance of historic sites.

Investing in Transportation

A further $36 million over three years is added for highways maintenance activities and contract cost increases. The latter investment is also integral to ensuring efficient movement of goods and people throughout the province. Within communities, people also need to move efficiently, and therefore an incremental $7 million in funding is provided to BC Transit over the fiscal plan period for service expansion outside of Metro Vancouver.

Agricultural Land Commission

Budget 2016 provides an additional $3 million over three years to support the Agricultural Land Commission, which oversees the Agricultural Land Reserve, a provincial land use zone that recognizes agriculture as a priority use and guides non-agricultural uses. This additional funding will be directed to providing more efficient application reviews, enhanced compliance and enforcement activities, and increased support for the operation of regional panels.

Budget and Fiscal Plan — 2016/17 to 2018/19

22

Three Year Fiscal Plan

Youth Skills Training

Enhancing the skills of young people is also key to growing the economy. As part of the Skills and Jobs Blueprint Strategy agenda, Budget 2016 adds $8 million over three years to the funding provided to the Industry Training Authority to increase youth trades training spaces in programs such as Accelerated Credit Enrolment in Industry Training (ACE-IT).

Table 1.13 Funding for Economic, Community and Skills Development |

($ millions) | | 2016/17 | | 2017/18 | | 2018/19 | |

Rural Dividend Program | | 25 | | 25 | | 25 | |

Managing Government’s Venture Capital Initiative | | 1 | | 1 | | 1 | |

Marketing BC Forest Products in India | | 1 | | 2 | | 2 | |

Maintaining Heritage Tourism Properties | | 2 | | 2 | | 2 | |

Increased Funding for Highways Maintenance | | 12 | | 12 | | 12 | |

Additional Funding for BC Transit | | — | | 2 | | 5 | |

Increased Funding for the Agricultural Land Commission | | 1 | | 1 | | 1 | |

Additional Support for Youth Trades Training | | 2 | | 3 | | 3 | |

Total | | 44 | | 48 | | 51 | |

Encouraging Resource Development

The natural resource industries continue to be the backbone of BC’s rural economies. Providing the social license for resource development is critical to the province’s economic prosperity, and government continues to work seriously towards the development of a Liquefied Natural Gas (LNG) industry. To support this commitment, Budget 2016 provides $19 million over three years to support ongoing activities related to the responsible use of natural resources in the province, in particular for oil and gas development, as companies from around the world continue to pursue investment opportunities in BC.

This funding is provided to the Ministries of Aboriginal Relations and Reconciliation, Environment, Forests Lands and Natural Resource Operations, and Natural Gas Development to support a stable and predictable environment for investment decisions.

More specifically, the funding will facilitate:

· First Nations engagement, consultation and negotiations to complete agreements that support resource development;

· coordinated and timely processing with respect to the Province’s regulatory and permitting requirements;

· engagement and consultation with industry, community and other stakeholders; and

· activities related to land disposition, parks and protected areas management, and environmental stewardship.

Table 1.14 Encouraging Natural Resource Development |

($ millions) | | 2016/17 | | 2017/18 | | 2018/19 | |

Ministry of Aboriginal Relations and Reconciliation | | 2 | | 2 | | 1 | |

Ministry of Environment | | 1 | | 1 | | 1 | |

Ministry of Forests, Lands and Natural Resource Operations | | 3 | | 3 | | 2 | |

Ministry of Natural Gas Development | | 1 | | 1 | | 1 | |

Total | | 7 | | 7 | | 5 | |

Budget and Fiscal Plan — 2016/17 to 2018/19

23

Three Year Fiscal Plan

Open and Transparent Government

In support of government’s commitment to openness and transparency, and to specifically help address recommendations from the Office of the Information and Privacy Commissioner and David Loukadelis’ F15-03 investigative report, Budget 2016 provides $9 million over the next three years for a new corporate information and records management office.

Measures for the Environment

A further $13 million has been identified in 2015/16 within the Innovative Clean Energy Fund, in support of government’s energy and environmental priorities. This includes additional funding for the Clean Energy Vehicle Program to provide British Columbians incentives when considering the greener choices for their transportation needs.

Management of the BC Public Service

Full-time equivalent (FTE) staff utilization is projected to increase from 27,000 FTEs in 2015/16 to 27,400 FTEs in 2016/17 based primarily on the need to hire additional social workers, as well as additional staff required for the new Okanagan Correctional Centre.

Going forward, FTE utilization is projected to increase again in 2017/18 to 27,600 due to continued hiring of new social workers and finalizing hiring for the new correctional centre, before stabilizing in 2018/19.

Chart 1.8 Managing FTEs

Public Sector Compensation: The Economic Stability Dividend

There are about 313,000 members covered by more than 180 collective agreements throughout the BC public sector. Over 80 per cent of these individuals have now reached either tentative or ratified settlements under the 2014 Economic Stability Mandate. Remaining groups yet to conclude new agreements include several in the post-secondary sector, a small number of Crown agencies, as well as nurses in the health sector — government is working towards concluding settlements for 100 per cent of these groups by March 31, 2016.

To date, ministry budgets have been adjusted to reflect funding needs of the 2014 Economic Stability Mandate. In Budget 2016, increases totaling $205 million have been added to ministry budgets in 2018/19 to fund general wage increases for the fifth and final year of the 2014 Economic Stability Mandate.

Budget and Fiscal Plan — 2016/17 to 2018/19

24

Three Year Fiscal Plan

A key opportunity provided to encourage negotiated settlements within the 2014 Economic Stability Mandate is the commitment for additional wage increases if actual annual provincial real economic growth (GDP) exceeds the independent Economic Forecast Council’s forecasted growth for that year as published in provincial budgets. There is potential for further GDP-dependent increases during the last four years of negotiated agreements.

In Budget 2014, the Council’s forecast was for 2.3 per cent real GDP growth for 2014, while actual 2014 growth reported by Statistics Canada in November 2015 was 3.2 per cent. As a result, all individuals in the provincial public sector who have reached finalized labour agreements are entitled to an additional general wage increase equivalent to one-half of the 0.9 percentage point positive difference, or an ongoing wage increase of 0.45 per cent annually.

In Budget 2016, all ministries have received collective budget increases totaling $213 million over the three year fiscal plan to fund the Economic Stability Dividend in respect of 2014.

Going forward, the Council’s forecast of 2.6 per cent real GDP growth for 2015, as published in Budget 2015, will be the benchmark for comparing against Statistics Canada results in November 2016 and consequently the eligibility for an Economic Stability Dividend in respect of 2015. As shown in the topic box on page 86, the Council estimates that BC’s real economic growth in 2015 was 2.6 per cent, unchanged from its previous forecast year ago. However, should actual growth turn out to be higher than the Council’s forecast, any resultant costs will be managed within the fiscal plan.

Recovered Expenses

Government projects it will incur $8.5 billion in program spending over the fiscal plan period whose costs will be recovered from third parties.

Recovered costs include an estimated $3.0 billion in interest payments from commercial Crown corporations through the fiscal agency loan program and from sinking fund investment returns.

A total of $1.6 billion of programs will be delivered with funding from the federal government, such as the Labour Market Development Agreement, the Canada Jobs Fund, integrated workplace solutions, and child and family support programs.

$1.5 billion in government spending is supported by other miscellaneous sources, including hospital expansion costs recovered from regional health boards, MSP and PharmaCare costs paid by agencies and other jurisdictions, and employee health benefits costs collected from participating government agencies.

$2.4 billion in remaining cost recoveries will be invested in a variety of programs, including industry-funded regulatory programs recovered through fees, and fees recovered for collections services rendered.

Government reports the expenses incurred and the recoveries as revenue. The offsetting nature of these amounts results in no net impact to government’s fiscal plan.

Budget and Fiscal Plan — 2016/17 to 2018/19

25

Three Year Fiscal Plan

Operating Transfers

Approximately 60 per cent of ministry spending takes the form of transfers paid to service delivery agencies for the provision of services on behalf of government. These transfers will total $70.8 billion over the three year fiscal plan period and will support education, health care, social services, housing, and transportation programs delivered by the agencies. These service delivery agencies include the SUCH sector (schools, universities, colleges and health organizations), Community Living BC, BC Housing Management Commission, BC Transit, and the BC Transportation Financing Authority.

Service Delivery Agency Spending

Service delivery agency spending is projected to total $30.3 billion by 2018/19, reflecting an increase of $1.7 billion over the fiscal plan period.

School district spending is projected to rise from $5.8 billion in 2015/16 to $6.0 billion by 2018/19 — an increase of $147 million, or 2.5 per cent over the three year period. This spending increase is primarily due to salary and benefits cost increases relating to the agreements reached under government’s negotiating mandates, partially offset by savings anticipated in the areas of administration and support services.