*

Mr. Aylward is an “interested person” as defined in the 1940 Act by reason of his position as President and Chief Executive Officer of Virtus Investment Partners, Inc. (“Virtus”), the ultimate parent company of the Adviser, and various positions with its affiliates.

(1)

The business address of each current Director is c/o (the applicable Fund), 101 Munson Street, Suite 104, Greenfield, MA 01301.

(2)

Each Director currently serves a one to three-year term concurrent with the class of Directors for which he serves.

(3)

The “Fund Complex” includes those registered investment companies that hold themselves out to investors as related companies for purposes of investment and investor services or for which an Adviser or an affiliate of an Adviser, including the Subadvisers, serves as investment adviser.

(4)

Mr. Wright serves as the one member of each Fund’s Advisory Board. He was appointed to one three-year term that expires in September 2019. He is not a voting member of any of the Funds’ Boards of Directors and he provides advice to the Boards, as requested.

Director Nominee Qualifications

Each Board has determined that each Director and Director Nominee should serve as such based on several factors (none of which alone is decisive). Among the factors the Board considered when concluding that an individual should serve as a Director were the following: (i) availability and commitment to attend meetings and perform the responsibilities of a Director, (ii) personal and professional background, (iii) educational background, (iv) financial expertise, (v) ability, judgment, personal attributes and expertise, and (vi) familiarity with the Fund or its service providers. In respect of each Director and Director Nominee, the individual’s professional accomplishments and prior experience, including, in some cases, in fields related to the operations of the Fund, were a significant factor in the determination that the individual should serve as a Director of the Fund.

Following is a summary of various qualifications, experiences and skills of each Director and Director Nominee (in addition to business experience during the past five years as set forth in the table above) that contributed to the Board’s conclusion that an individual should serve on the Board. References to the qualifications, attributes and skills of a Director and Director Nominee do not constitute the holding out of any Director or Director Nominee as being an expert under Section 7 of the Securities Act of 1933, as amended, or the rules and regulations of the SEC.

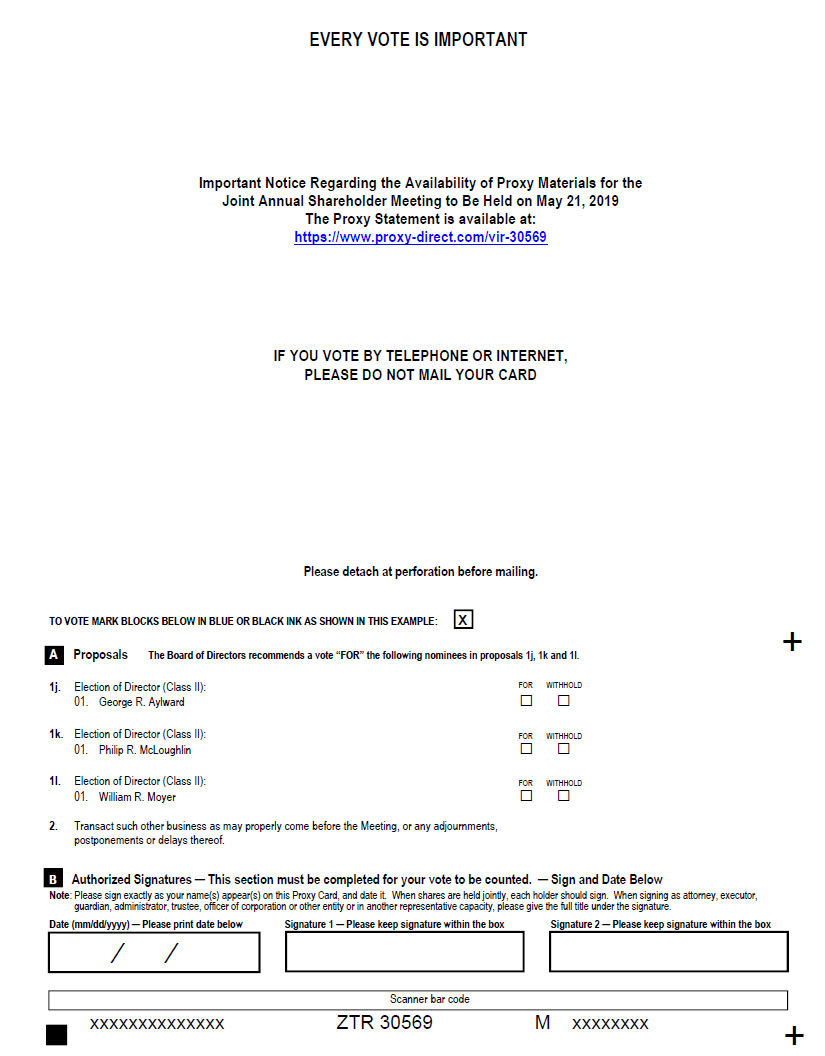

George R. Aylward. In addition to his positions with the Funds, Mr. Aylward is a Director and the President and Chief Executive Officer of Virtus, the ultimate parent company of the Adviser. He also holds various executive positions with the Adviser, and previously held such positions with the former parent company of Virtus. He therefore has experience in all aspects of the development and management of registered investment companies, and the handling of various financial, staffing, regulatory and operational issues. Mr. Aylward is a certified public accountant and holds an MBA, and he also serves as an officer and director of other closed-end funds managed by the Adviser and its affiliates.

Philip R. McLoughlin. Mr. McLoughlin has an extensive legal, financial and asset management background. In 1971, he joined Phoenix Investment Partners, Ltd. (then, Phoenix Equity Planning Corp.), the predecessor of Virtus Investment Partners, Inc., as Assistant Counsel with responsibility for various compliance and legal functions. During his tenure, Mr. McLoughlin assumed responsibility for most functions in the firm’s advisory, broker-dealer and fund management operations, and eventually ascended to the role of President. Mr. McLoughlin then served as General Counsel, and later Chief Investment Officer, of Phoenix Mutual Life Insurance Company, the parent company of Phoenix Investment Partners. Among other functions, he served as the senior management liaison to the boards of directors of the insurance company’s mutual funds and closed-end funds, and had direct oversight responsibility for the funds’ portfolio managers. In 1994, Mr. McLoughlin was named Chief Executive Officer of Phoenix Investment Partners, and continued in that position, as well as Chief Investment Officer of Phoenix Mutual Life Insurance Company, until his retirement in 2002.