| | |

| Amounts subject to the rate lock will not be deposited until the external transfer has been received, and will not be |

| credited interest until deposited. This could result in the deposit being credited interest for a shorter term than if a |

| rate lock had not been elected. The cost of providing a rate lock may be a factor we consider when determining the |

| guaranteed interest rate for a deposit period, which impacts the guaranteed interest rate for all investors in that |

| guaranteed term. | |

| |

| Fees and Other Deductions.We do not make deductions from amounts in GAA to cover mortality and expense |

| risks. Rather, we consider these risks when determining the credited rate. The following other types of charges may |

| be deducted from amounts held in, withdrawn or transferred from GAA: |

| · | Market Value Adjustment (“MVA”). An MVA may be applied to amounts transferred or withdrawn prior to |

| | the end of a guaranteed term, which reflects changes in interest rates since the deposit period. The MVA may |

| | be positive or negative, and therefore may increase or decrease the amount withdrawn to satisfy a transfer or |

| | withdrawal request. See“Market Value Adjustment.” |

| · | Tax Penalties and/or Tax Withholding. Amounts withdrawn may be subject to withholding for federal income |

| | taxes, as well as a 10% penalty tax for amounts withdrawn prior to your having attained age 59½. See |

| | “Taxation”; see also the“Tax Considerations”section of the contract prospectus. |

| · | Early Withdrawal Charge. An early withdrawal charge, which is a deferred sales charge, may apply to amounts |

| | withdrawn from the contract, in order to reimburse us for some of the sales and administrative expenses |

| | associated with the contract. See“Contract Charges”; see also the“Fees”section of the contract prospectus. |

| · | Maintenance Fee. An annual maintenance fee of up to $50 may be deducted pro rata from all funding options |

| | including GAA. See“Contract Charges”; see also the“Fees”section of the contract prospectus. |

| · | Transfer Fees. Under some contracts transfer fees of up to $10 per transfer may be deducted from amounts held |

| | in or transferred from GAA during the accumulation phase. See“Contract Charges”; see also the“Fees” |

| | section of the contract prospectus. | |

| · | Premium Taxes. We may deduct a charge for premium taxes of up to 4% from amounts in GAA. See |

| | “Contract Charges”;see also the“Fees”section of the contract prospectus. |

| · | Front End Sales Charges. Under some contracts, we may deduct front end sales charges of up to 6%. See |

| | “Contract Charges”; see also the“Fees”section of the contract prospectus. |

| |

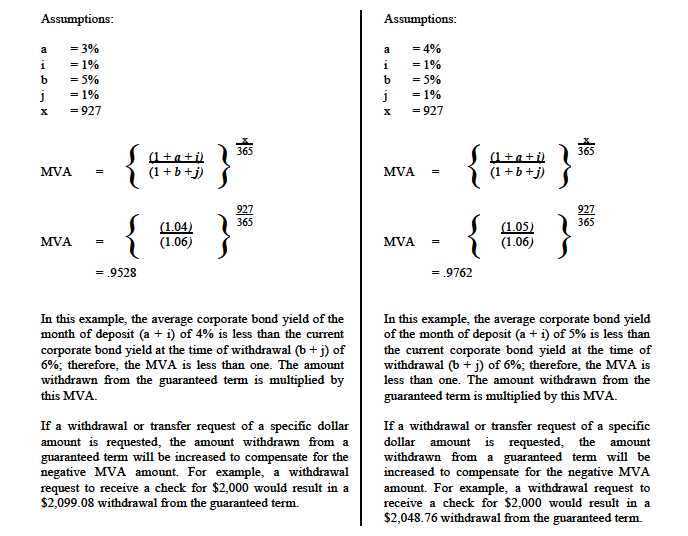

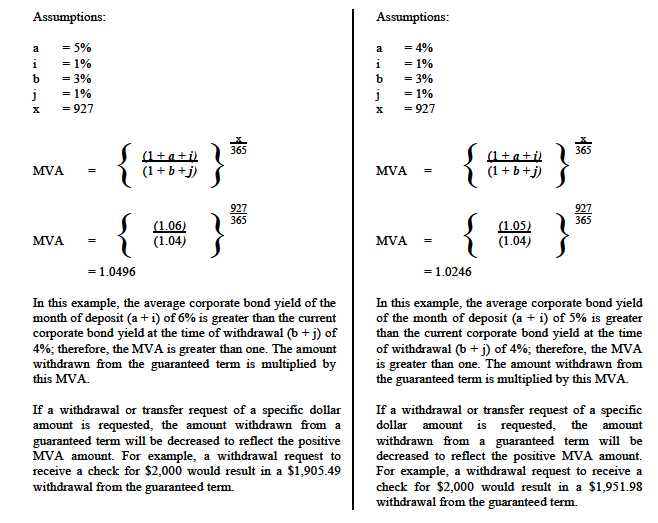

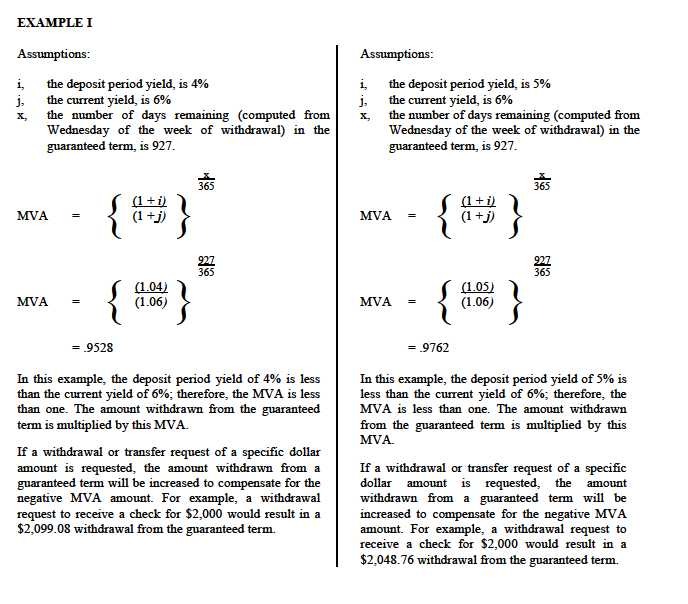

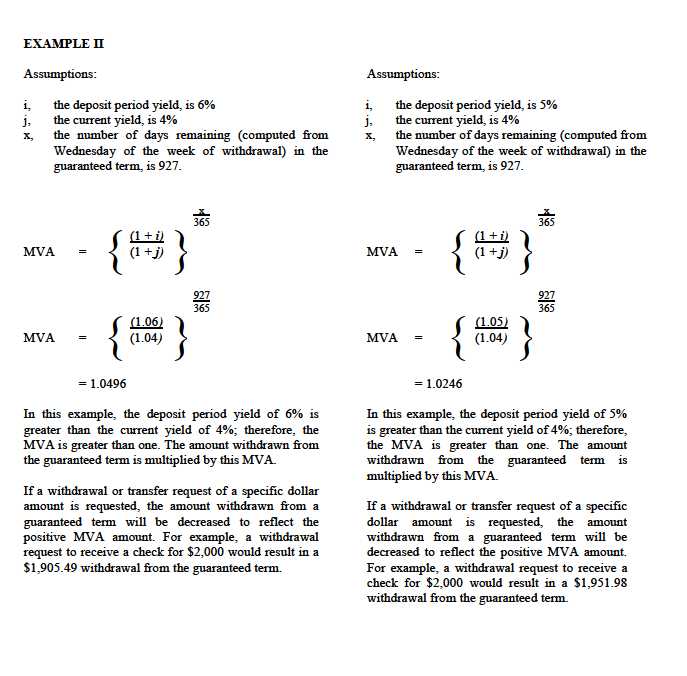

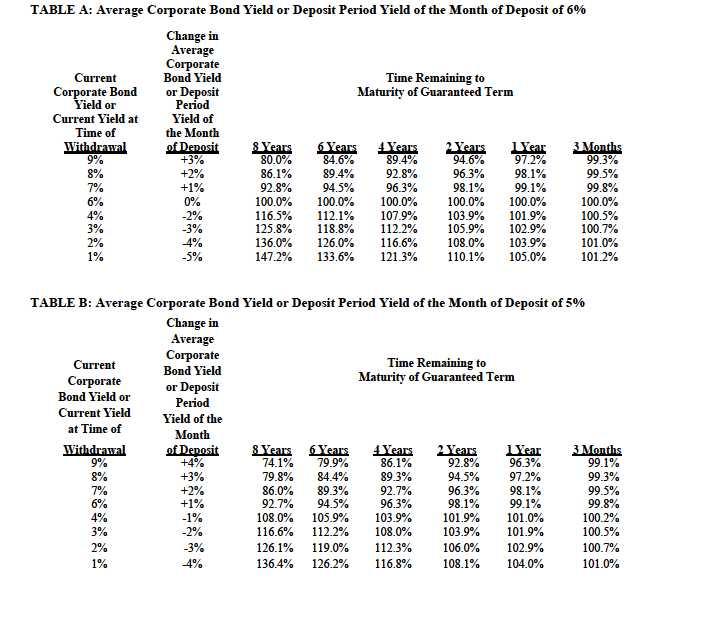

| Market Value Adjustment (“MVA”).If you withdraw or transfer all or part of your account value from GAA |

| before the guaranteed term is complete, an MVA may apply. The MVA reflects the change in the value of the |

| investment due to changes in interest rates since the date of deposit. The MVA may be positive or negative |

| depending upon interest rate activity at the time of withdrawal or transfer. |

| |

| Any MVA applied to a withdrawal or transfer from GAA will be calculated as an “aggregate MVA,” which is the |

| sum of all MVAs applicable due to the withdrawal. See the sidebar on page 11 for an example of the calculation of |

| the aggregate MVA. The following withdrawals will be subject to an aggregate MVA only if it is positive: |

| · | Withdrawals due to the election of a lifetime income option; and |

| · | Withdrawals due to the death of the participant (if paid within the first six months following death). For certain |

| | contracts issued in the state of New York, this provision also applies in the event of disability, as defined in the |

| | contract. | |

| |

| All other withdrawals will be subject to an aggregate MVA, regardless of whether it is positive or negative, |

| including: | |

| · | Withdrawals due to the election of a nonlifetime income option; |

| · | Payments due to the death of the participant, if paid more than six months following death (or disability, if |

| | applicable); and | |

| · | Full or partial withdrawals during the accumulation phase (except for withdrawals at the end of a guaranteed |

| | term or pursuant to the maturity value transfer provision - see“Maturity of a Guaranteed Term”and |

| | “Maturity Value Transfer Provision”). | |

| |

| Under certain contracts that guarantee a death benefit equal to the greater of the “adjusted purchase total” or the |

| current account value (excluding loans), the calculation of the current account value will include the aggregate MVA |

| only if it is positive, regardless of whether the death benefit is paid within six months following death. See the |

| “Death Benefit”section of the contract prospectus. Under some of these contracts, an election to defer payment of |

| the death benefit will result in the application of the aggregate MVA, whether positive or negative, when the |

| beneficiary elects to begin distribution of the death benefit. |

| |

| See“Description of the Guaranteed Accumulation Account”and“Market Value Adjustment.” |

| |

| |

| PRO.GAA-14 | 4 |