| | |

| | | Market Value Adjustment (“MVA”) |

| Aggregate MVAis the total of | | |

| all MVAs applied due to a | We apply an MVA to amounts transferred or withdrawn from GAA prior to |

| transfer or withdrawal. | the end of a guaranteed term. To accommodate early withdrawals or transfers, |

| | we may need to liquidate certain assets or use cash that could otherwise be |

| Calculation of the Aggregate | invested at current interest rates. When we sell assets prematurely we could |

| MVA–In order to satisfy a | realize a profit or loss depending upon market conditions. |

| transfer or withdrawal, | | |

| amounts may be withdrawn | The MVA reflects changes in interest rates since the deposit period. When |

| from more than one guaranteed | interest rates increase after the deposit period, the value of the investment |

| term, with more than one | decreases and the market value adjustment amount may be negative. |

| guaranteed interest rate. In | Conversely, when interest rates decrease after the deposit period, the value of |

| order to determine the MVA | the investment increases and the market value adjustment amount may be |

| applicable to such a transfer or | positive. Therefore, the application of an MVA may increase or decrease the |

| withdrawal, the MVAs | amount withdrawn from a guaranteed term to satisfy a withdrawal or transfer |

| applicable toeach guaranteed | request. |

| termwill be added together, in | | |

| order to determine the | An MVA applied to a withdrawal or transfer from GAA will be calculated as |

| “aggregate MVA.” | an “aggregate MVA,” which is the sum of all MVAs applicable due to the |

| | withdrawal. See the sidebar on this page for an example of the calculation of |

| Example:$1,000 withdrawal, | the | aggregate MVA. The following withdrawals will be subject to an |

| two guaranteed terms. | aggregate MVA only if it is positive: |

| | · | Withdrawals due to the election of a lifetime income option; and |

| MVA1 = $10, MVA2 = - $30 | · | Withdrawals due to the death of the participant (if paid within the first six |

| $10 + -$30 = - $20. | | months following death). For certain contracts issued in the state of New |

| Aggregate MVA = - $20. | | York, this provision also applies in the event of disability, as defined in |

| | | the contract. |

| Example:$1,000 withdrawal, | | |

| two guaranteed terms. | All other withdrawals will be subject to an aggregate MVA, regardless of |

| whether it is positive or negative, including: |

| MVA1 = $30, MVA2 = - $10 | · | Withdrawals due to the election of a nonlifetime income option; |

| $30 + - $10 = $20. | · | Payments due to the death of the participant, if paid more than six months |

| Aggregate MVA = $20. | | following death (or disability, if applicable under your contract); and |

| | · | Full or partial withdrawals during the accumulation phase (except for |

| | | withdrawals at the end of a guaranteed term or pursuant to the maturity |

| | | value transfer provision). See“Maturity of a Guaranteed Term”and |

| | | “Maturity Value Transfer Provision.” |

| |

| Should two or more guaranteed terms have the same guaranteed interest rate and mature on the same date, we |

| will calculate an MVA applicable to each. |

| |

| Under some contracts, election of a systematic distribution option, as described in the contract prospectus, will not |

| result in an MVA being applied to amounts withdrawn from GAA. |

| |

| Under certain contracts that guarantee a death benefit equal to the greater of the “adjusted purchase total” or the |

| current account value (excluding loans), the calculation of the current account value will include the aggregate MVA |

| only if it is positive, regardless of whether the death benefit is paid within six months following death. See the |

| “Death Benefit”section of the contract prospectus. Under some of these contracts, an election to defer payment of |

| the death benefit will result in the application of the aggregate MVA, whether positive or negative, when the |

| beneficiary elects to begin distribution of the death benefit. |

| |

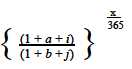

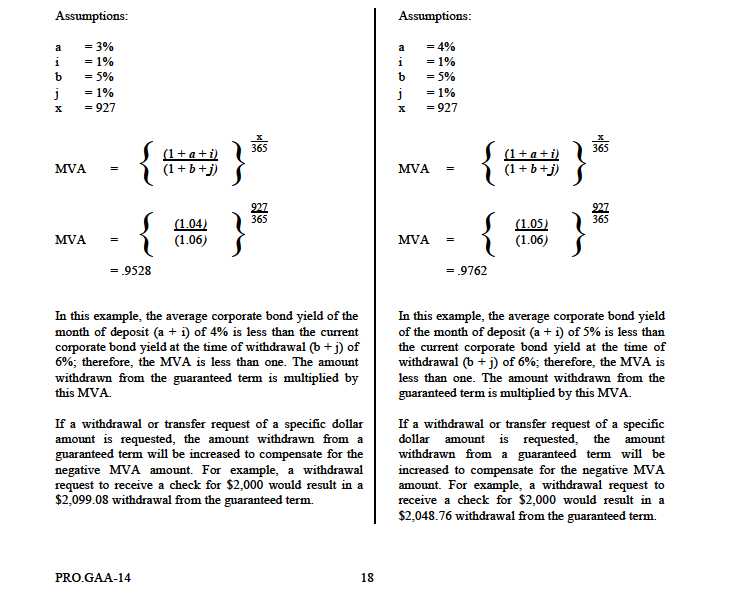

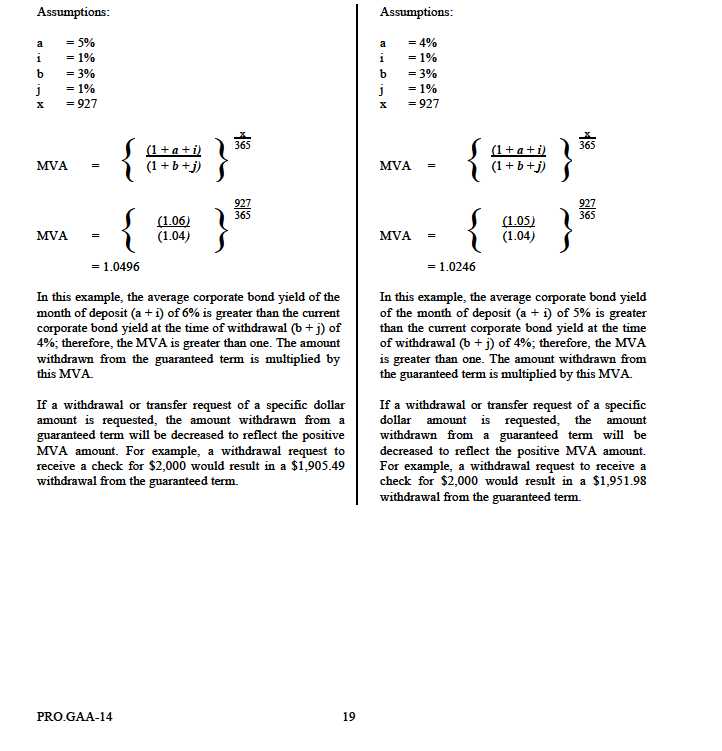

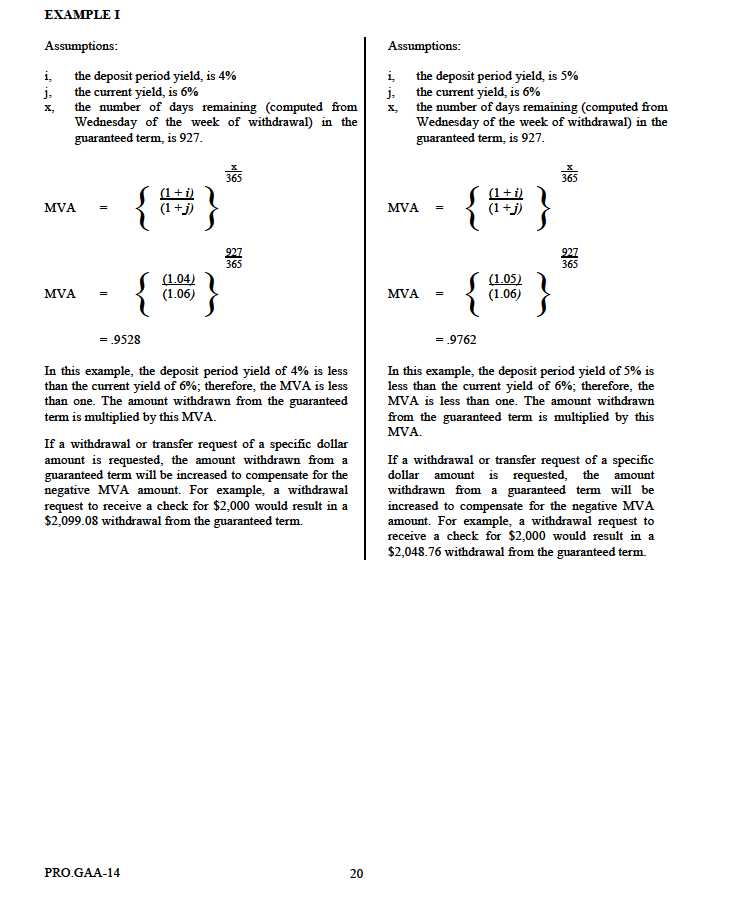

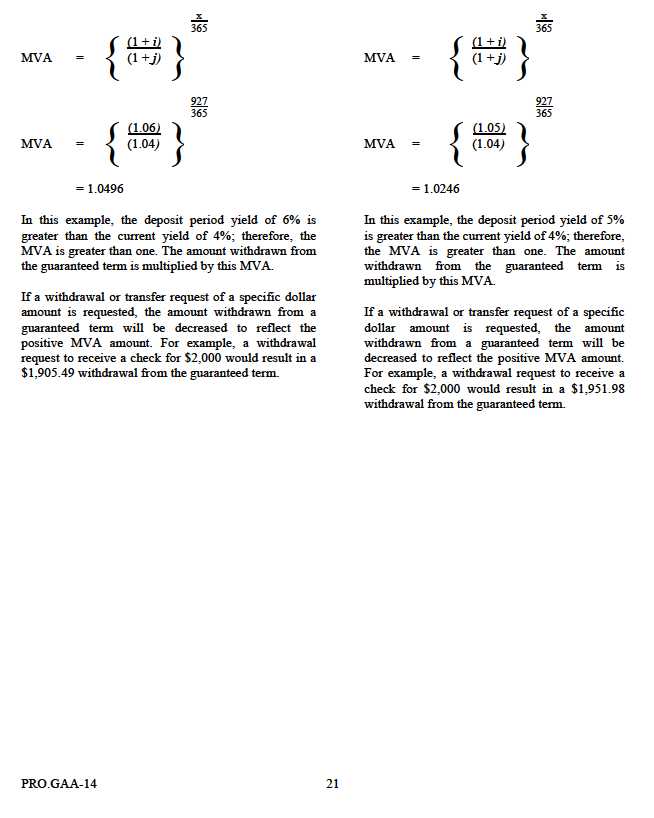

| Calculation of the MVA | | |

| |

| There are two methods for calculating the MVA, and the method that applies to you will be set forth in your |

| contract.You should check your contract to see which method of calculating the MVA applies to you. |

| |

| |

| |

| |

| PRO.GAA-14 | | 11 |