UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05583

Franklin Templeton Variable Insurance Products Trust

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: (650) 312-2000

Date of fiscal year end: 12/31

Date of reporting period: 06/30/11

| Item 1. | Reports to Stockholders. |

JUNE 30, 2011

FRANKLIN TEMPLETON

VARIABLE INSURANCE PRODUCTS TRUST

SEMIANNUAL

REPORT

FRANKLIN TEMPLETON VARIABLE INSURANCE

PRODUCTS TRUST SEMIANNUAL REPORT

TABLEOF CONTENTS

| i | ||||

| FFC-1 | ||||

| FH-1 | ||||

| FI-1 | ||||

| FRD-1 | ||||

| FSV-1 | ||||

| FSC-1 | ||||

| FSI-1 | ||||

| FFA-1 | ||||

| MGD-1 | ||||

| MI-1 | ||||

| MS-1 | ||||

| TD-1 | ||||

| TD-8 | ||||

| TF-1 | ||||

| TGB-1 | ||||

| TG-1 | ||||

| I-1 | ||||

| SI-1 |

*Not part of the semiannual report

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

MASTER CLASS 4

IMPORTANT NOTESTOPERFORMANCE INFORMATION

Performance data is historical and cannot predict or guarantee future results. Principal value and investment return will fluctuate with market conditions, and you may have a gain or loss when you withdraw your money. Inception dates of the funds may have preceded the effective dates of the subaccounts, contracts, or their availability in all states.

When reviewing the index comparisons, please keep in mind that indexes have a number of inherent performance differentials over the funds. First, unlike the funds, which must hold a minimum amount of cash to maintain liquidity, indexes do not have a cash component. Second, the funds are actively managed and, thus, are subject to management fees to cover salaries of securities analysts or portfolio managers in addition to other expenses. Indexes are unmanaged and do not include any commissions or other expenses typically associated with investing in securities. Third, indexes often contain a different mix of securities than the fund to which they are compared. Additionally, please remember that indexes are simply a measure of performance and cannot be invested in directly.

i

FRANKLIN FLEX CAP GROWTH SECURITIES FUND

This semiannual report for Franklin Flex Cap Growth Securities Fund covers the period ended June 30, 2011.

Performance Summary as of 6/30/11

Franklin Flex Cap Growth Securities Fund – Class 4 delivered a +5.30% total return* for the six-month period ended 6/30/11.

*The investment manager and administrator have contractually agreed to waive or assume certain expenses so that common expenses of the Fund (excluding Rule 12b-1 fees and acquired fund fees and expenses) do not exceed 0.68% (other than certain nonroutine expenses) until 4/30/12. If the manager and administrator had not waived fees, the Fund’s total returns would have been lower.

Performance reflects the Fund’s Class 4 operating expenses, but does not include any contract fees, expenses or sales charges. If they had been included, performance would be lower. These charges and deductions, particularly for variable life policies, can have a significant effect on contract values and insurance benefits. See the contract prospectus for a complete description of these expenses, including sales charges.

Franklin Flex Cap Growth Securities Fund – Class 4

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares.

Current performance may differ from figures shown.

FFC-1

FRANKLIN FLEX CAP GROWTH SECURITIES FUND

This semiannual report for Franklin Flex Cap Growth Securities Fund covers the period ended June 30, 2011.

Performance Summary as of 6/30/11

Franklin Flex Cap Growth Securities Fund – Class 2 delivered a +5.35% total return* for the six-month period ended 6/30/11.

*The investment manager and administrator have contractually agreed to waive or assume certain expenses so that common expenses of the Fund (excluding Rule 12b-1 fees and acquired fund fees and expenses) do not exceed 0.68% (other than certain nonroutine expenses) until 4/30/12. If the manager and administrator had not waived fees, the Fund’s total returns would have been lower.

Performance reflects the Fund’s Class 2 operating expenses, but does not include any contract fees, expenses or sales charges. If they had been included, performance would be lower. These charges and deductions, particularly for variable life policies, can have a significant effect on contract values and insurance benefits. See the contract prospectus for a complete description of these expenses, including sales charges.

Franklin Flex Cap Growth Securities Fund – Class 2

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares.

Current performance may differ from figures shown.

FFC-1

Fund Goal and Main Investments: Franklin Flex Cap Growth Securities Fund seeks capital appreciation. The Fund normally invests predominantly in equity securities of companies that the manager believes have the potential for capital appreciation.

Performance Overview

You can find the Fund’s six-month total return in the Performance Summary. The Fund underperformed its benchmarks, the Russell 1000® Growth Index, which generated a +6.83% total return, and the Russell 3000® Growth Index, which produced a +6.98% total return, for the same period.1

Economic and Market Overview

The U.S. economy expanded despite geopolitical and inflationary pressures from around the globe during the six-month period ended June 30, 2011. Business activity increased and consumer spending stayed above pre-recession levels. The U.S. has been a key engine in a sustained global manufacturing expansion as international trade volume continued to increase, albeit at a moderate pace. Worldwide demand for capital goods aided U.S. manufacturing profits and increased employment in the industry.

The unemployment rate improved in the first quarter when job creation began to gain some traction. However, government payrolls continued to trend down and job creation slowed in the second quarter, causing the unemployment rate to end the period at 9.2%.2 Consumer spending rose for 11 consecutive months through May but declined in June as concerns about job growth and rising gasoline and food prices dampened consumer confidence. To offset the disruption of global oil supply caused by the conflicts in Libya, the International Energy Agency announced in June the release of 60 million barrels of oil in July from strategic reserves of the U.S. and 27 other nations. The U.S. financial system appeared closer to a full recovery, although the country still faced challenges dealing with housing market weakness and massive debt at period-end.

Inflation at the consumer, producer and trade levels rose across much of the world, but in the U.S. it remained relatively contained. As a result, the Federal Reserve Board (Fed) maintained its accommodative monetary policy while ending its second round of quantitative easing

1. Source: © 2011 Morningstar. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio. Please see Index Descriptions following the Fund Summaries.

2. Source: Bureau of Labor Statistics.

Fund Risks: The Fund’s investments in stocks may offer the potential for long-term gains but can be subject to short-term price fluctuations. Smaller and midsize company securities can increase the risk of greater price fluctuations, particularly over the short term. Smaller, newer or unseasoned companies can also be particularly sensitive to changing economic conditions, and their prospects for growth are less certain than those of larger, more established companies. Foreign investing involves additional risks, including currency fluctuations, economic instability, market volatility, and political and social instability. The Fund may from time to time have significant investments in particular sectors such as technology, which can be highly volatile. The manager applies various techniques and analyses in making investment decisions for the Fund, but there can be no guarantee that these decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

FFC-2

on June 30. The Fed said, however, it would continue to purchase Treasuries with proceeds from maturing debt in an effort to support economic growth.

Investors’ attitudes shifted with each release of economic, regulatory and geopolitical news, causing equity market volatility to increase globally. U.S. investors weathered international events that included revolutions and civil unrest across the Middle East and North Africa, the multiple crises triggered by Japan’s earthquake and tsunami, and sovereign debt worries and credit downgrades in Europe. Ultimately, stock indexes produced solid gains during the six months under review as domestic and global equity markets rose amid generally improving economic signs and record-high corporate earnings growth.

Investment Strategy

We use fundamental, bottom-up research to seek companies meeting our criteria of growth potential, quality and valuation. In seeking sustainable growth characteristics, we look for companies we believe can produce sustainable earnings and cash flow growth, evaluating the long-term market opportunity and competitive structure of an industry to target leaders and emerging leaders. We define quality companies as those with strong and improving competitive positions in attractive markets. We also believe important attributes of quality are experienced and talented management teams as well as financial strength reflected in the capital structure, gross and operating margins, free cash flow generation and returns on capital employed. Our valuation analysis includes a range of potential outcomes based on an assessment of multiple scenarios. In assessing value, we consider whether security prices fully reflect the balance of the sustainable growth opportunities relative to business and financial risks.

Manager’s Discussion

During the six months under review, most sectors represented in the Fund’s portfolio contributed to absolute performance as the broad market delivered solid returns. Stock selection in the information technology and materials sectors benefited the Fund’s performance relative to the Russell 3000 Growth Index.3 Major contributors from the information technology sector included data integration and business software solutions provider Informatica and complete programmable logic solutions developer Xilinx. Visa and MasterCard, the world’s largest payment networks, boosted relative returns as their share prices

3. The information technology sector comprises semiconductors and semiconductor equipment, software and services, and technology hardware and equipment in the SOI.

FFC-3

surged at period-end following the Fed’s decision to cap debit-card transaction fees. Chemical and advanced materials producer Celanese in the materials sector produced strong returns as the company delivered better-than-expected first quarter earnings and raised its long-term earnings growth outlook. Outside of these sectors, a new health care holding, worldwide health care solutions and services company Cerner, which benefited from demand driven by federal stimulus, health care reform and other regulatory requirements, also supported the Fund’s performance.4

In contrast, stock selection in the consumer discretionary, financials and health care sectors weighed on the Fund’s relative performance.5 In the consumer discretionary sector, worldwide hotel operator and franchisor Marriott International declined in value due to a slower growth rate in its domestic market and weakness in its timeshare unit, which the company planned to spin off under the name Marriott Vacations Worldwide. Insurance business holding company Aflac in the financials sector hurt relative returns as the company recorded losses tied to investments in Greek, Irish and Portuguese banks. A health care sector detractor was prescription pharmaceutical product developer Salix Pharmaceuticals, which failed to gain expanded Food and Drug Administration approval for its key drug, and we sold it by period-end. Stock selection and an underweighted allocation in the energy sector, where coal explorer and miner Alpha Natural Resources was a major detractor, also hindered relative results. Although our information technology holdings generally benefited the Fund’s absolute and relative performance, lower-than-expected semiconductor capital expenditure negatively affected the shares of some equipment providers including Lam Research, which supplies wafer fabrication and equipment to the worldwide semiconductor industry.

Thank you for your participation in Franklin Flex Cap Growth Securities Fund. We look forward to serving your future investment needs.

4. The health care sector comprises health care equipment and services; and pharmaceuticals, biotechnology and life sciences in the SOI.

5. The consumer discretionary sector comprises automobiles and components, consumer durables and apparel, consumer services, media, and retailing in the SOI. The financials sector comprises banks, diversified financials and insurance in the SOI.

The foregoing information reflects our analysis, opinions and portfolio holdings as of June 30, 2011, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

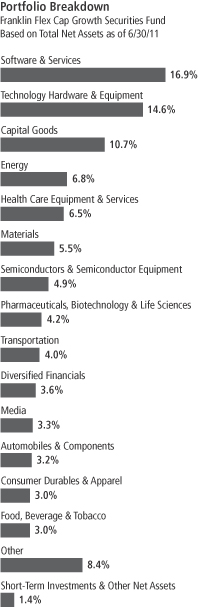

Top 10 Holdings

Franklin Flex Cap Growth Securities Fund

6/30/11

| Company Sector/Industry | % of Total Net Assets | |||

| Apple Inc. | 4.1% | |||

| Technology Hardware & Equipment | ||||

| Praxair Inc. | 2.4% | |||

| Materials | ||||

| EMC Corp. | 2.2% | |||

| Technology Hardware & Equipment | ||||

| Celanese Corp. | 2.0% | |||

| Materials | ||||

| Johnson Controls Inc. | 1.9% | |||

| Automobiles & Components | ||||

| International Business Machines Corp. | 1.8% | |||

| Software & Services | ||||

| United Technologies Corp. | 1.8% | |||

| Capital Goods | ||||

| Kansas City Southern | 1.8% | |||

| Transportation | ||||

| Oracle Corp. | 1.7% | |||

| Software & Services | ||||

| Polo Ralph Lauren Corp. | 1.6% | |||

| Consumer Durables & Apparel | ||||

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

FFC-4

Fund Expenses

As an investor in a variable insurance contract (Contract) that indirectly provides for investment in an underlying mutual fund, you can incur transaction and/or ongoing expenses at both the Fund level and the Contract level.

| • | Transaction expenses can include sales charges (loads) on purchases, surrender fees, transfer fees and premium taxes. |

| • | Ongoing expenses can include management fees, distribution and service (12b-1) fees, contract fees, annual maintenance fees, mortality and expense risk fees and other fees and expenses. All mutual funds and Contracts have some types of ongoing expenses. |

The expenses shown in the table are meant to highlight ongoing expenses at the Fund level only and do not include ongoing expenses at the Contract level, or transaction expenses at either the Fund or Contract levels. While the Fund does not have transaction expenses, if the transaction and ongoing expenses at the Contract level were included, the expenses shown below would be higher. You should consult your Contract prospectus or disclosure document for more information.

The table shows Fund-level ongoing expenses and can help you understand these expenses and compare them with those of other mutual funds offered through the Contract. The table assumes a $1,000 investment held for the six months indicated. Please refer to the Fund prospectus for additional information on operating expenses.

Actual Fund Expenses

The first line (Actual) of the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of ongoing Fund expenses, but does not include the effect of ongoing Contract expenses.

You can estimate the Fund-level expenses you incurred during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6.

| 2. | Multiply the result by the number under the heading “Fund-Level Expenses Incurred During Period.” |

If Fund-Level Expenses Incurred During Period were $7.50, then 8.6 x $7.50 = $64.50.

In this illustration, the estimated expenses incurred this period at the Fund level are $64.50.

Franklin Flex Cap Growth Securities Fund – Class 4

FFC-5

Hypothetical Example for Comparison with Other Mutual Funds

Information in the second line (Hypothetical) of the table can help you compare ongoing expenses of the Fund with those of other mutual funds offered through the Contract. This information may not be used to estimate the actual ending account balance or expenses you incurred during the period. The hypothetical “Ending Account Value” is based on the Fund’s actual expense ratio and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Fund-Level Expenses Incurred During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds offered through a Contract.

| Class 4 | Beginning Account Value 1/1/11 | Ending Account Value 6/30/11 | Fund-Level Expenses Incurred During Period* 1/1/11–6/30/11 | |||||||||

Actual | $ | 1,000 | $ | 1,053.00 | $ | 5.24 | ||||||

Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,019.69 | $ | 5.16 | ||||||

*Expenses are calculated using the most recent six-month annualized expense ratio, net of expense waivers, for the Fund’s Class 4 shares (1.03%), which does not include any ongoing expenses of the Contract for which the Fund is an investment option, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period.

FFC-6

Franklin Templeton Variable Insurance Products Trust

Financial Highlights

Franklin Flex Cap Growth Securities Fund

| Six Months Ended June 30, 2011 (unaudited) | Year Ended December 31, | |||||||||||||||||||||||

| Class 2 | 2010 | 2009 | 2008 | 2007 | 2006 | |||||||||||||||||||

Per share operating performance | ||||||||||||||||||||||||

(for a share outstanding throughout the period) | ||||||||||||||||||||||||

Net asset value, beginning of period | $ | 12.70 | $ | 10.93 | $ | 8.22 | $ | 12.72 | $ | 11.14 | $ | 10.59 | ||||||||||||

Income from investment operationsa: | ||||||||||||||||||||||||

Net investment income (loss)b | (0.02 | ) | (0.02 | ) | (— | )c | — | c | 0.04 | 0.02 | ||||||||||||||

Net realized and unrealized gains (losses) | 0.70 | 1.79 | 2.71 | (4.49 | ) | 1.55 | 0.53 | |||||||||||||||||

Total from investment operations | 0.68 | 1.77 | 2.71 | (4.49 | ) | 1.59 | 0.55 | |||||||||||||||||

Less distributions from net investment income | — | — | — | (0.01 | ) | (0.01 | ) | (— | )c | |||||||||||||||

Net asset value, end of period | $ | 13.38 | $ | 12.70 | $ | 10.93 | $ | 8.22 | $ | 12.72 | $ | 11.14 | ||||||||||||

Total returnd | 5.35% | 16.19% | 32.97% | (35.31)% | 14.32% | 5.20% | ||||||||||||||||||

Ratios to average net assetse | ||||||||||||||||||||||||

Expenses before waiver and payments by affiliates | 1.17% | 1.18% | 1.19% | 1.21% | 1.25% | 1.32% | ||||||||||||||||||

Expenses net of waiver and payments by affiliates | 0.93% | 0.93% | 0.93% | f | 0.93% | 0.93% | f | 0.93% | f | |||||||||||||||

Net investment income (loss) | (0.23)% | (0.17)% | (0.01)% | 0.04% | 0.31% | 0.19% | ||||||||||||||||||

Supplemental data | ||||||||||||||||||||||||

Net assets, end of period (000’s) | $ | 214,379 | $ | 227,774 | $ | 244,768 | $ | 195,425 | $ | 206,218 | $ | 60,520 | ||||||||||||

Portfolio turnover rate | 31.80% | 60.00% | 33.64% | 32.76% | 30.15% | 67.01% | ||||||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cAmount rounds to less than $0.01 per share.

dTotal return does not include fees, charges or expenses imposed by the variable annuity and life insurance contracts for which the Franklin Templeton Variable Insurance Products Trust serves as an underlying investment vehicle. Total return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fBenefit of expense reduction rounds to less than 0.01%.

The accompanying notes are an integral part of these financial statements.

FFC-7

Franklin Templeton Variable Insurance Products Trust

Financial Highlights (continued)

Franklin Flex Cap Growth Securities Fund

| Six Months Ended June 30, 2011 (unaudited) | Year Ended December 31, | |||||||||||||||

| Class 4 | 2010 | 2009 | 2008a | |||||||||||||

Per share operating performance | ||||||||||||||||

(for a share outstanding throughout the period) | ||||||||||||||||

Net asset value, beginning of period | $ | 12.63 | $ | 10.88 | $ | 8.21 | $ | 11.22 | ||||||||

Income from investment operationsb: | ||||||||||||||||

Net investment income (loss)c | (0.02 | ) | (0.03 | ) | (0.01 | ) | — | d | ||||||||

Net realized and unrealized gains (losses) | 0.69 | 1.78 | 2.69 | (2.98 | ) | |||||||||||

Total from investment operations | 0.67 | 1.75 | 2.68 | (2.98 | ) | |||||||||||

Less distributions from net investment income | — | — | (0.01 | ) | (0.03 | ) | ||||||||||

Net asset value, end of period | $ | 13.30 | $ | 12.63 | $ | 10.88 | $ | 8.21 | ||||||||

Total returne | 5.30% | 16.08% | 32.69% | (26.68)% | ||||||||||||

Ratios to average net assetsf | ||||||||||||||||

Expenses before waiver and payments by affiliates | 1.27% | 1.28% | 1.29% | 1.31% | ||||||||||||

Expenses net of waiver and payments by affiliates | 1.03% | 1.03% | 1.03% | g | 1.03% | |||||||||||

Net investment income (loss) | (0.33)% | (0.27)% | (0.11)% | (0.06)% | ||||||||||||

Supplemental data | ||||||||||||||||

Net assets, end of period (000’s) | $ | 265,911 | $ | 263,746 | $ | 218,798 | $ | 50,268 | ||||||||

Portfolio turnover rate | 31.80% | 60.00% | 33.64% | 32.76% | ||||||||||||

aFor the period February 29, 2008 (effective date) to December 31, 2008.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

cBased on average daily shares outstanding.

dAmount rounds to less than $0.01 per share.

eTotal return does not include fees, charges or expenses imposed by the variable annuity and life insurance contracts for which the Franklin Templeton Variable Insurance Products Trust serves as an underlying investment vehicle. Total return is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

The accompanying notes are an integral part of these financial statements.

FFC-8

Franklin Templeton Variable Insurance Products Trust

Statement of Investments, June 30, 2011 (unaudited)

| Franklin Flex Cap Growth Securities Fund | Shares | Value | ||||||

Common Stocks 98.6% | ||||||||

Automobiles & Components 3.2% | ||||||||

aBorgWarner Inc. | 80,180 | $ | 6,477,742 | |||||

Johnson Controls Inc. | 213,800 | 8,906,908 | ||||||

| 15,384,650 | ||||||||

Banks 0.6% | ||||||||

Wells Fargo & Co. | 102,450 | 2,874,747 | ||||||

Capital Goods 10.7% | ||||||||

Cummins Inc. | 72,420 | 7,494,746 | ||||||

Danaher Corp. | 90,250 | 4,782,348 | ||||||

Emerson Electric Co. | 89,080 | 5,010,750 | ||||||

Flowserve Corp. | 22,280 | 2,448,349 | ||||||

General Electric Co. | 178,170 | 3,360,286 | ||||||

Joy Global Inc. | 62,360 | 5,939,166 | ||||||

Precision Castparts Corp. | 37,420 | 6,161,203 | ||||||

Rockwell Automation Inc. | 84,630 | 7,342,499 | ||||||

United Technologies Corp. | 97,990 | 8,673,095 | ||||||

| 51,212,442 | ||||||||

Commercial & Professional Services 1.3% | ||||||||

aStericycle Inc. | 71,540 | 6,375,645 | ||||||

Consumer Durables & Apparel 3.0% | ||||||||

NIKE Inc., B | 75,720 | 6,813,286 | ||||||

Polo Ralph Lauren Corp. | 57,900 | 7,678,119 | ||||||

| 14,491,405 | ||||||||

Consumer Services 1.5% | ||||||||

Arcos Dorados Holdings Inc. (Argentina) | 35,990 | 759,029 | ||||||

Marriott International Inc., A | 71,270 | 2,529,373 | ||||||

Wynn Resorts Ltd. | 26,730 | 3,836,824 | ||||||

| 7,125,226 | ||||||||

Diversified Financials 3.6% | ||||||||

BlackRock Inc. | 31,180 | 5,980,636 | ||||||

JPMorgan Chase & Co. | 65,630 | 2,686,892 | ||||||

Lazard Ltd., A | 115,810 | 4,296,551 | ||||||

T. Rowe Price Group Inc. | 71,270 | 4,300,432 | ||||||

| 17,264,511 | ||||||||

Energy 6.8% | ||||||||

aAlpha Natural Resources Inc. | 75,720 | 3,440,717 | ||||||

aConcho Resources Inc. | 57,900 | 5,318,115 | ||||||

aFMC Technologies Inc. | 57,900 | 2,593,341 | ||||||

Halliburton Co. | 80,180 | 4,089,180 | ||||||

aPetrohawk Energy Corp. | 253,890 | 6,263,466 | ||||||

Schlumberger Ltd. | 44,540 | 3,848,256 | ||||||

SM Energy Co. | 97,990 | 7,200,305 | ||||||

| 32,753,380 | ||||||||

Food, Beverage & Tobacco 3.0% | ||||||||

aHansen Natural Corp. | 37,860 | 3,064,767 | ||||||

Mead Johnson Nutrition Co., A | 92,620 | 6,256,481 | ||||||

PepsiCo Inc. | 71,270 | 5,019,546 | ||||||

| 14,340,794 | ||||||||

FFC-9

Franklin Templeton Variable Insurance Products Trust

Statement of Investments, June 30, 2011 (unaudited) (continued)

| Franklin Flex Cap Growth Securities Fund | Shares | Value | ||||||

Common Stocks (continued) | ||||||||

Health Care Equipment & Services 6.5% | ||||||||

aAllscripts Healthcare Solutions Inc. | 159,642 | $ | 3,100,247 | |||||

aCerner Corp. | 106,900 | 6,532,659 | ||||||

aDaVita Inc. | 30,290 | 2,623,417 | ||||||

aEdwards Lifesciences Corp. | 57,900 | 5,047,722 | ||||||

aExpress Scripts Inc. | 106,910 | 5,771,002 | ||||||

aIntuitive Surgical Inc. | 8,020 | 2,984,322 | ||||||

Universal Health Services Inc., B | 48,990 | 2,524,455 | ||||||

aVarian Medical Systems Inc. | 35,640 | 2,495,513 | ||||||

| 31,079,337 | ||||||||

Household & Personal Products 0.5% | ||||||||

The Procter & Gamble Co. | 40,090 | 2,548,521 | ||||||

Insurance 1.8% | ||||||||

ACE Ltd. | 36,530 | 2,404,405 | ||||||

Aflac Inc. | 133,620 | 6,237,381 | ||||||

| 8,641,786 | ||||||||

Materials 5.5% | ||||||||

Celanese Corp., A | 178,170 | 9,498,243 | ||||||

Ecolab Inc. | 102,440 | 5,775,567 | ||||||

Praxair Inc. | 104,230 | 11,297,490 | ||||||

| 26,571,300 | ||||||||

Media 3.3% | ||||||||

aDIRECTV, A | 126,090 | 6,407,894 | ||||||

aDiscovery Communications Inc., C | 160,350 | 5,860,792 | ||||||

The Walt Disney Co. | 89,080 | 3,477,683 | ||||||

| 15,746,369 | ||||||||

Pharmaceuticals, Biotechnology & Life Sciences 4.2% | ||||||||

aCelgene Corp. | 67,710 | 4,084,267 | ||||||

aGilead Sciences Inc. | 75,190 | 3,113,618 | ||||||

aHuman Genome Sciences Inc. | 92,940 | 2,280,748 | ||||||

aIllumina Inc. | 36,000 | 2,705,400 | ||||||

Merck & Co. Inc. | 80,180 | 2,829,552 | ||||||

aWaters Corp. | 53,450 | 5,117,303 | ||||||

| 20,130,888 | ||||||||

Retailing 1.7% | ||||||||

aAmazon.com Inc. | 14,250 | 2,913,982 | ||||||

aHomeAway Inc. | 11,700 | 452,790 | ||||||

aPriceline.com Inc. | 9,360 | 4,791,665 | ||||||

| 8,158,437 | ||||||||

Semiconductors & Semiconductor Equipment 4.9% | ||||||||

Avago Technologies Ltd. (Singapore) | 97,990 | 3,723,620 | ||||||

aFirst Solar Inc. | 15,590 | 2,062,089 | ||||||

aFreescale Semiconductor Holdings I Ltd. | 45,440 | 835,642 | ||||||

aLam Research Corp. | 60,940 | 2,698,423 | ||||||

Microchip Technology Inc. | 191,530 | 7,260,902 | ||||||

Xilinx Inc. | 182,620 | 6,660,152 | ||||||

| 23,240,828 | ||||||||

Software & Services 16.9% | ||||||||

aBottomline Technologies Inc. | 111,360 | 2,751,706 | ||||||

aCitrix Systems Inc. | 89,080 | 7,126,400 | ||||||

FFC-10

Franklin Templeton Variable Insurance Products Trust

Statement of Investments, June 30, 2011 (unaudited) (continued)

| Franklin Flex Cap Growth Securities Fund | Shares | Value | ||||||

Common Stocks (continued) | ||||||||

Software & Services (continued) | ||||||||

aCognizant Technology Solutions Corp., A | 69,490 | $ | 5,096,397 | |||||

FactSet Research Systems Inc. | 44,190 | 4,521,521 | ||||||

aFortinet Inc. | 133,620 | 3,646,490 | ||||||

aInformatica Corp. | 122,050 | 7,131,381 | ||||||

International Business Machines Corp. | 50,780 | 8,711,309 | ||||||

MasterCard Inc., A | 22,280 | 6,713,855 | ||||||

aNuance Communications Inc. | 191,530 | 4,112,149 | ||||||

Oracle Corp. | 253,890 | 8,355,520 | ||||||

aRed Hat Inc. | 146,990 | 6,746,841 | ||||||

aSalesforce.com Inc. | 37,420 | 5,574,831 | ||||||

aTaleo Corp., A | 106,910 | 3,958,877 | ||||||

Visa Inc., A | 80,180 | 6,755,967 | ||||||

|

| |||||||

| 81,203,244 | ||||||||

|

| |||||||

Technology Hardware & Equipment 14.6% | ||||||||

aAcme Packet Inc. | 46,320 | 3,248,422 | ||||||

aApple Inc. | 58,170 | 19,525,924 | ||||||

aAruba Networks Inc. | 100,000 | 2,955,000 | ||||||

aEMC Corp. | 384,750 | 10,599,862 | ||||||

aF5 Networks Inc. | 35,630 | 3,928,208 | ||||||

aFabrinet | 115,810 | 2,811,867 | ||||||

FLIR Systems Inc. | 115,810 | 3,903,955 | ||||||

aFusion-io-Inc. | 5,350 | 160,982 | ||||||

National Instruments Corp. | 144,990 | 4,304,753 | ||||||

aNetApp Inc. | 115,810 | 6,112,452 | ||||||

QUALCOMM Inc. | 111,360 | 6,324,134 | ||||||

aTrimble Navigation Ltd. | 159,460 | 6,320,994 | ||||||

|

| |||||||

| 70,196,553 | ||||||||

|

| |||||||

Telecommunication Services 1.0% | ||||||||

aAmerican Tower Corp., A | 93,540 | 4,894,948 | ||||||

|

| |||||||

Transportation 4.0% | ||||||||

C.H. Robinson Worldwide Inc. | 32,250 | 2,542,591 | ||||||

Expeditors International of Washington Inc. | 84,630 | 4,332,210 | ||||||

FedEx Corp. | 40,090 | 3,802,536 | ||||||

aKansas City Southern | 145,000 | 8,602,850 | ||||||

|

| |||||||

| 19,280,187 | ||||||||

|

| |||||||

Total Common Stocks (Cost $334,537,874) | 473,515,198 | |||||||

|

| |||||||

Short Term Investments (Cost $45,892,789) 9.5% | ||||||||

Money Market Funds 9.5% | ||||||||

a,bInstitutional Fiduciary Trust Money Market Portfolio | 45,892,789 | 45,892,789 | ||||||

|

| |||||||

Total Investments (Cost $380,430,663) 108.1% | 519,407,987 | |||||||

Other Assets, less Liabilities (8.1)% | (39,117,657 | ) | ||||||

|

| |||||||

Net Assets 100.0% | $ | 480,290,330 | ||||||

|

| |||||||

aNon-income producing.

bSee Note 7 regarding investments in the Institutional Fiduciary Trust Money Market Portfolio.

The accompanying notes are an integral part of these financial statements.

FFC-11

Franklin Templeton Variable Insurance Products Trust

Financial Statements

Statement of Assets and Liabilities

June 30, 2011 (unaudited)

| Franklin Flex Cap Growth Securities Fund | ||||

Assets: | ||||

Investments in securities: | ||||

Cost - Unaffiliated issuers | $ | 334,537,874 | ||

Cost - Sweep Money Fund (Note 7) | 45,892,789 | |||

Total cost of investments | $ | 380,430,663 | ||

Value - Unaffiliated issuers | $ | 473,515,198 | ||

Value - Sweep Money Fund (Note 7) | 45,892,789 | |||

Total value of investments | 519,407,987 | |||

Receivables: | ||||

Investment securities sold | 34,319,581 | |||

Capital shares sold | 289,927 | |||

Dividends | 237,206 | |||

Other assets | 15,790 | |||

Total assets | 554,270,491 | |||

Liabilities: | ||||

Payables: | ||||

Investment securities purchased | 5,952,069 | |||

Capital shares redeemed | 67,360,127 | |||

Affiliates | 552,298 | |||

Accrued expenses and other liabilities | 115,667 | |||

Total liabilities | 73,980,161 | |||

Net assets, at value | $ | 480,290,330 | ||

Net assets consist of: | ||||

Paid-in capital | $ | 377,065,109 | ||

Undistributed net investment income (loss) | (750,054 | ) | ||

Net unrealized appreciation (depreciation) | 138,977,324 | |||

Accumulated net realized gain (loss) | (35,002,049 | ) | ||

Net assets, at value | $ | 480,290,330 | ||

Class 2: | ||||

Net assets, at value | $ | 214,379,431 | ||

Shares outstanding | 16,024,934 | |||

Net asset value and maximum offering price per share | $ | 13.38 | ||

Class 4: | ||||

Net assets, at value | $ | 265,910,899 | ||

Shares outstanding | 19,988,104 | |||

Net asset value and maximum offering price per share | $ | 13.30 | ||

The accompanying notes are an integral part of these financial statements.

FFC-12

Franklin Templeton Variable Insurance Products Trust

Financial Statements (continued)

Statement of Operations

for the six months ended June 30, 2011 (unaudited)

| Franklin Flex Cap Growth Securities Fund | ||||

Investment income: | ||||

Dividends | $ | 1,823,307 | ||

Expenses: | ||||

Management fees (Note 3a) | 1,663,605 | |||

Administrative fees (Note 3b) | 652,802 | |||

Distribution fees: (Note 3c) | ||||

Class 2 | 292,685 | |||

Class 4 | 505,054 | |||

Unaffiliated transfer agent fees | 383 | |||

Custodian fees (Note 4) | 3,484 | |||

Reports to shareholders | 58,569 | |||

Professional fees | 17,689 | |||

Trustees’ fees and expenses | 987 | |||

Other | 10,635 | |||

Total expenses | 3,205,893 | |||

Expenses waived/paid by affiliates (Note 3e) | (632,532 | ) | ||

Net expenses | 2,573,361 | |||

Net investment income (loss) | (750,054 | ) | ||

Realized and unrealized gains (losses): | ||||

Net realized gain (loss) from investments | 20,831,449 | |||

Net change in unrealized appreciation (depreciation) on investments | 6,809,817 | |||

Net realized and unrealized gain (loss) | 27,641,266 | |||

Net increase (decrease) in net assets resulting from operations | $ | 26,891,212 | ||

The accompanying notes are an integral part of these financial statements.

FFC-13

Franklin Templeton Variable Insurance Products Trust

Financial Statements (continued)

Statements of Changes in Net Assets

| Franklin Flex Cap Growth Securities Fund | ||||||||

| Six Months Ended June 30, 2011 (unaudited) | Year Ended December 31, 2010 | |||||||

Increase (decrease) in net assets: | ||||||||

Operations: | ||||||||

Net investment income (loss) | $ | (750,054 | ) | $ | (1,037,499 | ) | ||

Net realized gain (loss) from investments | 20,831,449 | (4,167,287 | ) | |||||

Net change in unrealized appreciation (depreciation) on investments | 6,809,817 | 66,627,082 | ||||||

Net increase (decrease) in net assets resulting from operations | 26,891,212 | 61,422,296 | ||||||

Capital share transactions: (Note 2) | ||||||||

Class 2 | (25,559,404 | ) | (46,447,755 | ) | ||||

Class 4 | (12,561,212 | ) | 12,979,114 | |||||

Total capital share transactions | (38,120,616 | ) | (33,468,641 | ) | ||||

Net increase (decrease) in net assets | (11,229,404 | ) | 27,953,655 | |||||

Net assets: | ||||||||

Beginning of period | 491,519,734 | 463,566,079 | ||||||

End of period | $ | 480,290,330 | $ | 491,519,734 | ||||

Undistributed net investment income (loss) included in net assets: | ||||||||

End of period | $ | (750,054 | ) | $ | — | |||

The accompanying notes are an integral part of these financial statements.

FFC-14

Franklin Templeton Variable Insurance Products Trust

Notes to Financial Statements (unaudited)

Franklin Flex Cap Growth Securities Fund

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Franklin Templeton Variable Insurance Products Trust (Trust) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as an open-end investment company, consisting of twenty separate funds. The Franklin Flex Cap Growth Securities (Fund) is included in this report. The financial statements of the remaining funds in the Trust are presented separately. Shares of the Fund are generally sold only to insurance company separate accounts to fund the benefits of variable life insurance policies or variable annuity contracts. At June 30, 2011, 76.47% of the Fund’s shares were held through one insurance company. The Fund offers two classes of shares: Class 2 and Class 4. Each class of shares differs by its distribution fees, voting rights on matters affecting a single class and its exchange privilege.

The following summarizes the Fund’s significant accounting policies.

a. Financial Instrument Valuation

The Fund’s investments in securities and other financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. Under procedures approved by the Trust’s Board of Trustees, the Fund may utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Equity securities listed on an exchange or on the NASDAQ National Market System are valued at the last quoted sale price or the official closing price of the day, respectively. Foreign equity securities are valued as of the close of trading on the foreign stock exchange on which the security is primarily traded, or the NYSE, whichever is earlier. The value is then converted into its U.S. dollar equivalent at the foreign exchange rate in effect at the close of the NYSE on the day that the value of the security is determined. Over-the-counter securities are valued within the range of the most recent quoted bid and ask prices. Securities that trade in multiple markets or on multiple exchanges are valued according to the broadest and most representative market. Certain equity securities are valued based upon fundamental characteristics or relationships to similar securities. Investments in open-end mutual funds are valued at the closing net asset value.

The Fund has procedures to determine the fair value of securities and other financial instruments for which market prices are not readily available or which may not be reliably priced. Under these procedures, the Fund primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. The Fund may also use an income-based valuation approach in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed.

Trading in securities on foreign securities stock exchanges and over-the-counter markets may be completed before the daily close of business on the NYSE. Occasionally, events occur between the time at which trading in a foreign security is completed and the close of the NYSE that might call into question the reliability of the value of a portfolio security held by the Fund. As a result, differences may arise between the value of the Fund’s portfolio securities as determined at the foreign market close and the latest indications of value at the close of the NYSE. In order to minimize the potential for these differences, the investment manager monitors price movements following the close of trading in foreign stock markets through a series of country specific market proxies (such as baskets of American Depository Receipts, futures contracts and exchange traded funds). These price movements are measured against established trigger thresholds for each specific market proxy to assist in determining if an event has occurred that may call into question the reliability of the values of the foreign securities held by the Fund. If such an event occurs, the securities may be valued using fair value procedures, which may include the use of independent pricing services.

FFC-15

Franklin Templeton Variable Insurance Products Trust

Notes to Financial Statements (unaudited) (continued)

Franklin Flex Cap Growth Securities Fund

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued)

b. Foreign Currency Translation

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. The Fund may enter into foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of securities, income and expense items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. Portfolio securities and assets and liabilities denominated in foreign currencies contain risks that those currencies will decline in value relative to the U.S. dollar. Occasionally, events may impact the availability or reliability of foreign exchange rates used to convert the U.S. dollar equivalent value. If such an event occurs, the foreign exchange rate will be valued at fair value using procedures established and approved by the Trust’s Board of Trustees.

The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments on the Statement of Operations.

Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest, and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period.

c. Income Taxes

It is the Fund’s policy to qualify as a regulated investment company under the Internal Revenue Code. The Fund intends to distribute to shareholders substantially all of its taxable income and net realized gains to relieve it from federal income and excise taxes. As a result, no provision for U.S. federal income taxes is required. The Fund files U.S. income tax returns as well as tax returns in certain other jurisdictions. The Fund records a provision for taxes in its financial statements including penalties and interest, if any, for a tax position taken on a tax return (or expected to be taken) when it fails to meet the more likely than not (a greater than 50% probability) threshold and based on the technical merits, the tax position may not be sustained upon examination by the tax authorities. As of June 30, 2011, and for all open tax years, the Fund has determined that no provision for income tax is required in the Fund’s financial statements. Open tax years are those that remain subject to examination and are based on each tax jurisdiction statute of limitation.

The Fund may be subject to foreign taxation related to income received, capital gains on the sale of securities and certain foreign currency transactions in the foreign jurisdictions in which it invests. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests. When a capital gain tax is determined to apply the Fund records an estimated deferred tax liability for unrealized gains on these securities in an amount that would be payable if the securities were disposed of on the valuation date.

d. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Estimated expenses are accrued daily. Dividend income is recorded on the ex-dividend date except that certain dividends from foreign securities are recognized as soon as the Fund is notified of the ex-dividend date. Distributions to shareholders are recorded on the ex-dividend date and are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

FFC-16

Franklin Templeton Variable Insurance Products Trust

Notes to Financial Statements (unaudited) (continued)

Franklin Flex Cap Growth Securities Fund

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued)

d. Security Transactions, Investment Income, Expenses and Distributions (continued)

Common expenses incurred by the Trust are allocated among the funds based on the ratio of net assets of each fund to the combined net assets of the Trust. Fund specific expenses are charged directly to the fund that incurred the expense.

Realized and unrealized gains and losses and net investment income, not including class specific expenses, are allocated daily to each class of shares based upon the relative proportion of net assets of each class. Differences in per share distributions, by class, are generally due to differences in class specific expenses.

e. Accounting Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

f. Guarantees and Indemnifications

Under the Trust’s organizational documents, its officers and trustees are indemnified by the Trust against certain liabilities arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust, on behalf of the Fund, enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred. Currently, the Trust expects the risk of loss to be remote.

2. SHARES OF BENEFICIAL INTEREST

At June 30, 2011, there were an unlimited number of shares authorized (without par value). Transactions in the Fund’s shares were as follows:

| Six Months Ended June 30, 2011 | Year Ended December 31, 2010 | |||||||||||||||

| Class 2 Shares: | Shares | Amount | Shares | Amount | ||||||||||||

Shares sold | 1,457,418 | $ | 19,198,361 | 2,712,486 | $ | 30,583,993 | ||||||||||

Shares redeemed | (3,371,464 | ) | (44,757,765 | ) | (7,177,369 | ) | (77,031,748 | ) | ||||||||

Net increase (decrease) | (1,914,046 | ) | $ | (25,559,404 | ) | (4,464,883 | ) | $ | (46,447,755 | ) | ||||||

Class 4 Shares: | ||||||||||||||||

Shares sold | 4,396,198 | $ | 57,493,181 | 9,474,153 | $ | 105,454,276 | ||||||||||

Shares redeemed | (5,287,150 | ) | (70,054,393 | ) | (8,700,670 | ) | (92,475,162 | ) | ||||||||

Net increase (decrease) | (890,952 | ) | $ | (12,561,212 | ) | 773,483 | $ | 12,979,114 | ||||||||

FFC-17

Franklin Templeton Variable Insurance Products Trust

Notes to Financial Statements (unaudited) (continued)

Franklin Flex Cap Growth Securities Fund

3. TRANSACTIONS WITH AFFILIATES

Franklin Resources, Inc. is the holding company for various subsidiaries that together are referred to as Franklin Templeton Investments. Certain officers and trustees of the Fund are also officers and/or directors of the following subsidiaries:

| Subsidiary | Affiliation | |

Franklin Advisers, Inc. (Advisers) | Investment manager | |

Franklin Templeton Services, LLC (FT Services) | Administrative manager | |

Franklin Templeton Distributors, Inc. (Distributors) | Principal underwriter | |

Franklin Templeton Investor Services, LLC (Investor Services) | Transfer agent |

a. Management Fees

The Fund pays an investment management fee to Advisers based on the average daily net assets of the Fund as follows:

| Annualized Fee Rate | Net Assets | |

| 0.750% | Up to and including $100 million | |

| 0.650% | Over $100 million, up to and including $250 million | |

| 0.600% | Over $250 million, up to and including $10 billion | |

| 0.550% | Over $10 billion, up to and including $12.5 billion | |

| 0.525% | Over $12.5 billion, up to and including $15 billion | |

| 0.500% | In excess of $15 billion |

b. Administrative Fees

The Fund pays an administrative fee to FT Services of 0.25% per year of the average daily net assets of the Fund.

c. Distribution Fees

The Trust’s Board of Trustees has adopted distribution plans for Class 2 and Class 4 shares pursuant to Rule 12b-1 under the 1940 Act. Under the Fund’s compensation distribution plans, the Fund pays Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to 0.35% per year of its average daily net assets of each class. The Board of Trustees has agreed to limit the current rate to 0.25% per year for Class 2.

d. Transfer Agent Fees

Investor Services, under terms of an agreement, performs shareholder servicing for the Fund and is not paid by the Fund for the services.

e. Waiver and Expense Reimbursements

FT Services has contractually agreed in advance to waive or limit its respective fees and to assume as its own expense certain expenses otherwise payable by the fund so that the common expenses (i.e. a combination of management fees, administrative fees, and other expenses, but excluding distribution fees, and acquired fund fees and expenses) for each class of the Fund do not exceed 0.68% (other than certain non-routine expenses or costs, including those relating to litigation, indemnification, reorganizations, and liquidations) until April 30, 2012.

4. EXPENSE OFFSET ARRANGEMENT

The Fund has entered into an arrangement with its custodian whereby credits realized as a result of uninvested cash balances are used to reduce a portion of the Fund’s custodian expenses. During the period ended June 30, 2011, there were no credits earned.

FFC-18

Franklin Templeton Variable Insurance Products Trust

Notes to Financial Statements (unaudited) (continued)

Franklin Flex Cap Growth Securities Fund

5. INCOME TAXES

For tax purposes, capital losses may be carried over to offset future capital gains, if any. At December 31, 2010, the capital loss carryforwards were as follows:

Capital loss carryforwards expiring in: | ||||

2013 | $ | 233,183 | ||

2014 | 2,517,251 | |||

2015 | 777,263 | |||

2016 | 15,495,131 | |||

2017 | 30,645,725 | |||

2018 | 4,113,202 | |||

|

| |||

| $ | 53,781,755 | |||

|

|

Under the Regulated Investment Company Modernization Act of 2010, the Fund will be permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. Post-enactment capital loss carryforwards will retain their character as either short-term or long-term capital losses rather than being considered short-term as under previous law. Any post-enactment capital losses generated will be required to be utilized prior to the losses incurred in pre-enactment tax years.

At June 30, 2011, the cost of investments and net unrealized appreciation (depreciation) for income tax purposes were as follows:

Cost of investments | $ | 381,889,071 | ||

|

| |||

Unrealized appreciation | $ | 138,942,605 | ||

Unrealized depreciation | (1,423,689 | ) | ||

|

| |||

Net unrealized appreciation (depreciation) | $ | 137,518,916 | ||

|

|

Net investment income (loss) differs for financial statement and tax purposes primarily due to differing treatment of pass-through entity income.

Net realized gains (losses) differ for financial statement and tax purposes primarily due to differing treatments of wash sales and pass-through entity income.

6. INVESTMENT TRANSACTIONS

Purchases and sales of investments (excluding short term securities) for the period ended June 30, 2011, aggregated $160,439,965 and $196,871,568, respectively.

7. INVESTMENTS IN INSTITUTIONAL FIDUCIARY TRUST MONEY MARKET PORTFOLIO

The Fund invests in the Institutional Fiduciary Trust Money Market Portfolio (Sweep Money Fund), an open-end investment company managed by Advisers. Management fees paid by the Fund are reduced on assets invested in the Sweep Money Fund, in an amount not to exceed the management and administrative fees paid by the Sweep Money Fund.

8. CREDIT FACILITY

The Fund, together with other U.S. registered and foreign investment funds (collectively, Borrowers), managed by Franklin Templeton Investments, are borrowers in a joint syndicated senior unsecured credit facility totaling $750 million (Global Credit

FFC-19

Franklin Templeton Variable Insurance Products Trust

Notes to Financial Statements (unaudited) (continued)

Franklin Flex Cap Growth Securities Fund

8. CREDIT FACILITY (continued)

Facility) which matures on January 20, 2012. This Global Credit Facility provides a source of funds to the Borrowers for temporary and emergency purposes, including the ability to meet future unanticipated or unusually large redemption requests.

Under the terms of the Global Credit Facility, the Fund shall, in addition to interest charged on any borrowings made by the Fund and other costs incurred by the Fund, pay its share of fees and expenses incurred in connection with the implementation and maintenance of the Global Credit Facility, based upon its relative share of the aggregate net assets of all of the Borrowers, including an annual commitment fee of 0.08% based upon the unused portion of the Global Credit Facility, which is reflected in other expenses on the Statement of Operations. During the period ended June 30, 2011, the Fund did not use the Global Credit Facility.

9. FAIR VALUE MEASUREMENTS

The Fund follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Fund’s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Fund’s investments and are summarized in the following fair value hierarchy:

| • | Level 1 – quoted prices in active markets for identical securities |

| • | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speed, credit risk, etc.) |

| • | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

For movements between the levels within the fair value hierarchy, the Fund has adopted a policy of recognizing the transfers as of the date of the underlying event which caused the movement.

At June 30, 2011, all of the Fund’s investments in securities carried at fair value were in Level 1 inputs. For detailed categories, see the accompanying Statement of Investments.

10. NEW ACCOUNTING PRONOUNCEMENTS

In May 2011, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2011-04, Fair Value Measurement (Topic 820): Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and International Financial Reporting Standards (IFRS). The amendments in the ASU will improve the comparability of fair value measurements presented and disclosed in financial statements prepared in accordance with U.S. GAAP and IFRS and include new guidance for certain fair value measurement principles and disclosure requirements. The ASU is effective for interim and annual periods beginning after December 15, 2011. The Fund is currently evaluating the impact, if any, of applying this provision.

11. SUBSEQUENT EVENTS

The Fund has evaluated subsequent events through the issuance of the financial statements and determined that no events have occurred that require disclosure.

FFC-20

FRANKLIN HIGH INCOME SECURITIES FUND

This semiannual report for Franklin High Income Securities Fund covers the period ended June 30, 2011.

Performance Summary as of 6/30/11

Franklin High Income Securities Fund – Class 4 delivered a +4.55% total return for the six-month period ended 6/30/11.

Performance reflects the Fund’s Class 4 operating expenses, but does not include any contract fees, expenses or sales charges. If they had been included, performance would be lower. These charges and deductions, particularly for variable life policies, can have a significant effect on contract values and insurance benefits. See the contract prospectus for a complete description of these expenses, including sales charges.

Franklin High Income Securities Fund – Class 4

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown.

FH-1

Fund Goals and Main Investments: Franklin High Income Securities Fund seeks a high level of current income with capital appreciation as a secondary goal. The Fund normally invests primarily to predominantly in high yield, lower rated debt securities and preferred stocks.

Performance Overview

You can find the Fund’s six-month total return in the Performance Summary. In comparison, the Fund’s benchmark, the Credit Suisse (CS) High Yield Index, posted a +4.84% total return for the period under review.1 The Fund’s peers, as measured by the Lipper VIP High Current Yield Funds Classification Average, posted a +4.38% total return.2

Economic and Market Overview

As consumer spending rose during the six-month reporting period, the U.S. economy expanded, although the pace of growth slowed. The Federal Reserve Board (Fed) announced in November it intended to buy $600 billion of longer term Treasury securities by the end of the second quarter of 2011. It sought to promote a stronger recovery and help maintain inflation levels the Fed believed consistent with its dual mandate to foster maximum employment and price stability. Despite the Fed’s actions, the economic recovery stalled. U.S. home prices fell sharply during the first quarter of 2011, and unemployment remained stubbornly high. After showing solid improvement during the period, manufacturing activity weakened partly because of auto supply-chain disruptions following Japan’s natural disasters.

Geopolitical instability in North Africa and the Middle East drove up oil prices for most of the period. However, investor concerns over weak economic data caused crude oil prices to drop from their six-month high of $114 per barrel on April 29 to $95 at period-end. Storms and droughts in several states reduced crop yields, pushing up grain prices. As oil and food prices rose, the pace of inflation accelerated during the period.

Despite turmoil in North Africa and the Middle East, the multiple crises triggered by Japan’s earthquake and headwinds facing the U.S. economy, generally favorable economic improvements and positive corporate earnings reports gave investors confidence. While equity and fixed

1. Source: © 2011 Morningstar.

2. Source: Lipper Inc.

One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio. Please see Index Descriptions following the Fund Summaries.

Fund Risks: Because the Fund invests in bonds and other debt obligations, its share price and yield will be affected by interest rate movements. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. The Fund invests primarily to predominantly in high yield, lower rated (junk) bonds, which generally have greater price swings and higher risk of default and loss of principal than investment-grade bonds. Foreign investing, especially in developing markets, involves additional risks including currency fluctuations, economic instability, market volatility, and political and social instability. Derivative instruments may be volatile and illiquid, may give rise to leverage and may involve a small investment relative to the risk assumed. Bank loans, corporate loans and loan participations involve credit, interest rate and illiquidity risks. The manager applies various techniques and analyses in making investment decisions for the Fund, but there can be no guarantee that these decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

FH-2

income markets performed well overall for the six months under review, investors reacted to reports on the Greek debt crisis by seeking the perceived safe haven of U.S. Treasuries. At period-end, the Greek government approved an austerity bill to secure a bailout loan from international creditors, which helped relieve investor anxiety.

Although the high yield market lost some steam in 2010’s fourth quarter, market sentiment was generally positive in early 2011 with a rally that extended through May. In June, however, a confluence of factors weighed heavily on equity markets, which in turn pressured the high yield market. Increased oil prices coupled with still weak U.S. housing data and spotty consumer confidence heightened concerns about the domestic economic recovery. Overseas, Greece’s fiscal crisis was coming to a head, which also increased market volatility. These factors combined to make investors skittish, leading to technical selling pressure in June as some high yield mutual fund investors redeemed shares. This selling contributed to the high yield market’s first negative monthly total return of 2011.

Investment Strategy

We are research-driven, fundamental investors who rely on a team of analysts to provide in-depth industry expertise and use qualitative and quantitative analyses to evaluate companies. As bottom-up investors, we focus primarily on individual securities. We also consider sectors when choosing investments. In selecting securities for the Fund’s investment portfolio, we do not rely principally on ratings assigned by rating agencies, but perform our own independent analysis to evaluate an issuer’s creditworthiness. We consider a variety of factors, including an issuer’s experience and managerial strength, its sensitivity to economic conditions and its current financial condition. We may also enter into various transactions involving certain currency-, interest rate- or credit-related derivative instruments for hedging purposes, to enhance returns or to obtain exposure to various market sectors.

Manager’s Discussion

With continued overall strength in the high yield market, Franklin High Income Securities Fund generated a positive total return for the six-month period ended June 30, 2011. The Fund performed in line with its benchmark, the CS High Yield Index, and its peer group, the Lipper VIP High Current Yield Funds Classification Average.

Overall, given the health of corporate balance sheets and indications the U.S. economy would slowly continue to improve, somewhat offset by

FH-3

tighter high yield spreads relative to U.S. Treasury securities, we maintained a generally neutral risk stance for most of the reporting period. In addition, as typical, we drew on our fundamental research process to set the Fund’s industry positioning. Within that framework, we over- and underweighted certain industries relative to our benchmark in an effort to outperform the benchmark CS High Yield Index.

For instance, given our lack of confidence that the U.S. housing market had bottomed, we underweighted the building industry, which underperformed the benchmark index.3 Although the industry rallied in the latter part of 2010 on hopes homebuyers would return in force, actual housing data continued to disappoint the market during the review period, causing bonds to sell off and, ultimately, underperform the index. Our underweighted positioning therefore aided relative performance. Similarly, we continued to be cautious regarding a strong consumer recovery and therefore underweighted the retail industry.4 This industry showed periodic pockets of strength but underperformed the CS High Yield Index for the six months under review. The paper industry was another poor performer.5 Companies in this industry faced declining demand and heavy price competition as well as increased input costs in some subsectors. Thus, we limited our exposure and underweighted the industry, which benefited relative Fund performance.

Although some Fund industry positioning enhanced relative performance, certain weightings had a negative impact. For example, the Fund’s weightings in the technology, financials and industrials sectors hindered relative performance.6 Although the Fund increased its technology sector exposure during the period, it remained slightly underweighted versus the benchmark index while the sector finished among the index’s top performers. Some bonds in the sector rallied as certain large-capitalization, highly leveraged issuers experienced improved operating results and used the debt markets to improve liquidity. Our relatively underweighted financials sector exposure also negatively impacted performance as the sector was a strong performer. Conversely, the Fund was overweighted in the industrials sector as a result of our bottom-up analysis. However, the sector slightly underperformed the benchmark index as it suffered more than many other

3. Building holdings are in consumer durables and apparel, and materials in the SOI.

4. Retail holdings are in food and staples retailing, and retailing in the SOI.

5. Paper holdings are in materials in the SOI.

6. Technology holdings are in semiconductors and semiconductor equipment, software and services, and technology hardware and equipment in the SOI. Financials holdings are in banks, commercial and professional services, diversified financials, and real estate in the SOI. Industrials holdings are in capital goods, commercial and professional services, materials, and transportation in the SOI.

Top 10 Sectors/Industries

Franklin High Income Securities Fund

6/30/11

| % of Total Net Assets | ||||

| Energy | 19.9% | |||

| Media | 9.1% | |||

| Telecommunication Services | 8.4% | |||

| Materials | 8.2% | |||

| Diversified Financials | 5.8% | |||

| Health Care Equipment & Services | 5.7% | |||

| Consumer Services | 5.4% | |||

| Automobiles & Components | 5.3% | |||

| Capital Goods | 4.9% | |||

| Utilities | 3.8% | |||

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

FH-4

sectors during the market’s June sell-off. Therefore, the Fund’s overweighted positioning negatively impacted relative performance.

Thank you for your participation in Franklin High Income Securities Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of June 30, 2011, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

FH-5

Fund Expenses

As an investor in a variable insurance contract (Contract) that indirectly provides for investment in an underlying mutual fund, you can incur transaction and/or ongoing expenses at both the Fund level and the Contract level.

| • | Transaction expenses can include sales charges (loads) on purchases, surrender fees, transfer fees and premium taxes. |

| • | Ongoing expenses can include management fees, distribution and service (12b-1) fees, contract fees, annual maintenance fees, mortality and expense risk fees and other fees and expenses. All mutual funds and Contracts have some types of ongoing expenses. |

The expenses shown in the table are meant to highlight ongoing expenses at the Fund level only and do not include ongoing expenses at the Contract level, or transaction expenses at either the Fund or Contract levels. While the Fund does not have transaction expenses, if the transaction and ongoing expenses at the Contract level were included, the expenses shown below would be higher. You should consult your Contract prospectus or disclosure document for more information.

The table shows Fund-level ongoing expenses and can help you understand these expenses and compare them with those of other mutual funds offered through the Contract. The table assumes a $1,000 investment held for the six months indicated. Please refer to the Fund prospectus for additional information on operating expenses.

Actual Fund Expenses

The first line (Actual) of the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of ongoing Fund expenses, but does not include the effect of ongoing Contract expenses.

You can estimate the Fund-level expenses you incurred during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6.

| 2. | Multiply the result by the number under the heading “Fund-Level Expenses Incurred During Period.” |

If Fund-Level Expenses Incurred During Period were $7.50, then 8.6 x $7.50 = $64.50.

In this illustration, the estimated expenses incurred this period at the Fund level are $64.50.

Franklin High Income Securities Fund – Class 4

FH-6

Hypothetical Example for Comparison with Other Mutual Funds

Information in the second line (Hypothetical) of the table can help you compare ongoing expenses of the Fund with those of other mutual funds offered through the Contract. This information may not be used to estimate the actual ending account balance or expenses you incurred during the period. The hypothetical “Ending Account Value” is based on the Fund’s actual expense ratio and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Fund-Level Expenses Incurred During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds offered through a Contract.

| Class 4 | Beginning Account Value 1/1/11 | Ending Account Value 6/30/11 | Fund-Level 1/1/11–6/30/11 | |||||||||

Actual | $ | 1,000 | $ | 1,045.50 | $ | 4.67 | ||||||

Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,020.23 | $ | 4.61 | ||||||

*Expenses are calculated using the most recent six-month annualized expense ratio for the Fund’s Class 4 shares (0.92%), which does not include any ongoing expenses of the Contract for which the Fund is an investment option, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period.

FH-7

Franklin Templeton Variable Insurance Products Trust

Financial Highlights

Franklin High Income Securities Fund

Six Months June 30, 2011 | Year Ended December 31, | |||||||||||||||||||||||

| Class 1 | 2010 | 2009 | 2008 | 2007 | 2006 | |||||||||||||||||||

Per share operating performance | ||||||||||||||||||||||||

(for a share outstanding throughout the period) | ||||||||||||||||||||||||

Net asset value, beginning of period | $ | 6.63 | $ | 6.26 | $ | 4.68 | $ | 6.72 | $ | 6.96 | $ | 6.82 | ||||||||||||

Income from investment operationsa: | ||||||||||||||||||||||||

Net investment incomeb | 0.25 | 0.49 | 0.46 | 0.50 | 0.51 | 0.49 | ||||||||||||||||||

Net realized and unrealized gains (losses) | 0.07 | 0.32 | 1.50 | (1.92 | ) | (0.30 | ) | 0.12 | ||||||||||||||||

Total from investment operations | 0.32 | 0.81 | 1.96 | (1.42 | ) | 0.21 | 0.61 | |||||||||||||||||

Less distributions from net investment income | (0.42 | ) | (0.44 | ) | (0.38 | ) | (0.62 | ) | (0.45 | ) | (0.47 | ) | ||||||||||||

Net asset value, end of period | $ | 6.53 | $ | 6.63 | $ | 6.26 | $ | 4.68 | $ | 6.72 | $ | 6.96 | ||||||||||||

Total returnc | 4.79% | 13.71% | 42.99% | (23.16)% | 3.02% | 9.48% | ||||||||||||||||||

Ratios to average net assetsd | ||||||||||||||||||||||||

Expenses before expense reduction | 0.57% | 0.61% | 0.63% | 0.66% | 0.61% | 0.64% | ||||||||||||||||||

Expenses net of expense reduction | 0.57% | 0.61% | 0.63% | e | 0.66% | e | 0.61% | e | 0.63% | |||||||||||||||

Net investment income | 7.41% | 7.71% | 8.33% | 8.30% | 7.38% | 7.14% | ||||||||||||||||||

Supplemental data | ||||||||||||||||||||||||

Net assets, end of period (000’s) | $ | 46,047 | $ | 48,051 | $ | 48,855 | $ | 38,225 | $ | 61,286 | $ | 77,641 | ||||||||||||

Portfolio turnover rate | 25.12% | 60.80% | 26.41% | 21.75% | 40.65% | 37.99% | ||||||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.