UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05583

Franklin Templeton Variable Insurance Products Trust

(Exact name of registrant as specified in charter)

One Franklin Parkway,

San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle,

One Franklin Parkway,

San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: (650) 312-2000

Date of fiscal year end: 12/31

Date of reporting period: 12/31/11

| Item 1. | Reports to Stockholders. |

DECEMBER 31, 2011

FRANKLIN TEMPLETON

VARIABLE INSURANCE PRODUCTS TRUST

ANNUAL

REPORT

FRANKLIN TEMPLETON VARIABLE INSURANCE

PRODUCTS TRUST ANNUAL REPORT

TABLEOF CONTENTS

*Not part of the annual report

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

MASTER CLASS – 3

IMPORTANT NOTESTOPERFORMANCE INFORMATION

Performance data is historical and cannot predict or guarantee future results. Principal value and investment return will fluctuate with market conditions, and you may have a gain or loss when you withdraw your money. Inception dates of the funds may have preceded the effective dates of the subaccounts, contracts, or their availability in all states.

When reviewing the index comparisons, please keep in mind that indexes have a number of inherent performance differentials over the funds. First, unlike the funds, which must hold a minimum amount of cash to maintain liquidity, indexes do not have a cash component. Second, the funds are actively managed and, thus, are subject to management fees to cover salaries of securities analysts or portfolio managers in addition to other expenses. Indexes are unmanaged and do not include any commissions or other expenses typically associated with investing in securities. Third, indexes often contain a different mix of securities than the fund to which they are compared. Additionally, please remember that indexes are simply a measure of performance and cannot be invested in directly.

i

SUPPLEMENT DATED JANUARY 3, 2012

TOTHE PROSPECTUS

DATED MAY 1, 2011

(Franklin Templeton Variable Insurance Products Trust)

In the section titled “Additional Information, All Funds” the following replaces all text under the heading “Market Timing Trading Policy”:

The board of trustees has adopted the following policies and procedures with respect to market timing (Market Timing Trading Policy):

Market timing generally. The Fund discourages and does not intend to accommodate short-term or frequent purchases and redemptions of fund shares, often referred to as “market timing,” and asks its Fund of Fund investors and participating Insurers for their cooperation in trying to discourage such activity in their separate accounts by Contract Owners and their financial advisors. The Fund intends to seek to restrict or reject such trading or take other action, as described below, if in the judgment of the Fund manager or transfer agent such trading may interfere with the efficient management of the Fund’s portfolio, may materially increase the Fund’s transaction costs, administrative costs or taxes, or may otherwise be detrimental to the interests of the Fund and its shareholders.

Market timing consequences. If information regarding trading activity in the Fund or in any other Franklin Templeton fund or non-Franklin Templeton fund is brought to the attention of the Fund’s manager or transfer agent and based on that information the Fund or its manager or transfer agent in their sole discretion conclude that such trading may be detrimental to the Fund as described in this Market Timing Trading Policy, the Fund may temporarily or permanently bar future purchases into the Fund or, alternatively, may limit the amount, number or frequency of any future purchases and/or the method by which an Insurer or a Fund of Funds may request future purchases and redemptions (including purchases and/or redemptions by an exchange or transfer between the Fund and any other mutual fund). In determining what actions should be taken, the Fund’s transfer agent may consider a variety of factors, including the potential impact of such remedial actions on the Fund and its shareholders. If the Fund is a “fund of funds,” the Fund’s transfer agent may take into account the impact of the trading activity and of any proposed remedial action on both the Fund and the underlying funds in which the Fund invests.

In considering trading activity, the Fund may consider, among other factors, trading history both directly and, if known, through financial intermediaries, in the Fund, in other Franklin Templeton funds, in non-Franklin Templeton mutual funds, or in accounts under common control or ownership.

Market timing through Insurers. As a Contract Owner you are also subject to this policy. An Insurer’s order for purchases and/or redemptions pursuant to a Contract Owner’s instructions (including purchases and/or redemptions by an exchange or transfer between the Fund and any mutual fund) are submitted pursuant to aggregated orders (Aggregated Orders). A fund of fund’s order for purchases and/or redemptions pursuant to its investors’ instructions are also submitted pursuant to Aggregated Orders. While the Fund will encourage Insurers and funds of funds to apply the Fund’s Market Timing Trading Policy to their investors, the Fund is limited in its ability to monitor the trading activity or enforce the Fund’s Market Timing

P-1

Trading Policy because Insurers and funds of funds have the relationships with, and are responsible for maintaining the account records of, the individual investors. For example, should it occur, the Fund may not be able to detect market timing that may be facilitated by financial intermediaries or made difficult to identify in the Aggregated Orders used by Insurers and Fund of Fund investors.

Therefore, the Fund or its agent selectively monitor the Aggregated Orders used by Insurers and Fund of Fund investors for purchases, exchange and redemptions in respect of all their investors and seek the cooperation of Insurers and Fund of Fund investors to apply the Fund’s Market Timing Trading Policy. There may be legal and technological limitations on the ability of an Insurer or Fund of Fund to impose trading restrictions and to apply the Fund’s Market Timing Trading Policy to their investors through such methods as implementing short-term trading limitations or restrictions, assessing the Fund’s redemption fee (if applicable) and monitoring trading activity for what might be market timing. As a result, the Fund may not be able to determine whether trading by Insurers or funds of funds in respect of their investors is contrary to the Fund’s Market Timing Trading Policy.

Risks from market timers. Depending on various factors, including the size of the Fund, the amount of assets the portfolio manager typically maintains in cash or cash equivalents and the dollar amount and number and frequency of trades and the types of securities in which the Fund typically invests, short-term or frequent trading may interfere with the efficient management of the Fund’s portfolio, increase the Fund’s transaction costs, administrative costs and taxes and/or impact Fund performance.

In addition, if the nature of the Fund’s portfolio holdings exposes the Fund to “arbitrage market timers,” the value of the Fund’s shares may be diluted if redeeming shareholders receive proceeds (and buying shareholders receive shares) based upon net asset values which do not reflect appropriate fair value prices. Arbitrage market timing occurs when an investor seeks to take advantage of the possible delay between the change in the value of a mutual fund’s portfolio holdings and the reflection of the change in the fund’s net asset value per share. A fund that invests significantly in foreign securities may be particularly vulnerable to arbitrage market timing. Arbitrage market timing in foreign investments may occur because of time zone differences between the foreign markets on which the Fund’s international portfolio securities trade and the time as of which the Fund’s NAV is calculated. Arbitrage market timers may purchase shares of the Fund based on events occurring after foreign market closing prices are established, but before calculation of the Fund’s NAV. One of the objectives of the Trust’s fair value pricing procedures is to minimize the possibilities of this type of arbitrage market timing (please see “Valuation – Foreign Securities – Potential Impact of Time Zones and Market Holidays”).

Since the Fund may invest significantly in securities that are, or may be, restricted, unlisted, traded infrequently, thinly traded, or relatively illiquid (relatively illiquid securities), the Fund may be particularly vulnerable to arbitrage market timing. An arbitrage market timer may seek to take advantage of a possible differential between the last available market prices for one or more of these relatively illiquid securities that are used to calculate the Fund’s net asset value and the latest indications of market values for those securities. One of the objectives of the Fund’s fair value pricing procedures is to minimize the possibilities of this type of arbitrage market timing (please see “Fair Valuation – Individual Securities” under the heading “Fund Account Policies”, below).

P-2

The Fund is currently using several methods to reduce the risk of market timing. These methods include:

| • | | seeking the cooperation of Insurers and funds of funds to assist the Fund in identifying potential market timing activity; |

| • | | committing staff to selectively review on a continuing basis recent trading activity in order to identify trading activity that may be contrary to the Fund’s Market Timing Trading Policy; |

| • | | monitoring potential price differentials following the close of trading in foreign markets to determine whether the application of fair value pricing procedures is warranted; and |

| • | | seeking the cooperation of financial intermediaries to assist the Fund in identifying market timing activity. |

Though these methods involve judgments that are inherently subjective and involve some selectivity in their application, the Fund seeks to make judgments and applications that are consistent with the interests of the Fund’s shareholders. There is no assurance that the Fund or its agents will gain access to any or all information necessary to detect market timing in Insurers’ separate accounts. While the Fund will seek to take actions (directly and with the assistance of Insurers) that will detect market timing, it cannot represent that such trading activity can be minimized or completely eliminated.

Revocation of market timing trades. Transactions placed in violation of a Fund’s Market Timing Trading Policy or exchange limit guidelines are not necessarily deemed accepted by the Fund and may be cancelled or revoked by the Fund, in full or in part, as soon as practicable following receipt by the Fund and prompt inquiry of the intermediary.

Please keep this supplement for future reference.

P-3

SUPPLEMENT DATED JANUARY 3, 2012

TOTHE STATEMENTOF ADDITIONAL INFORMATION

DATED MAY 1, 2011

(Franklin Templeton Variable Insurance Products Trust)

The Statement of Additional Information is amended as follows:

I. The section entitled “Glossary of Investments, Techniques, Strategies and Their Risks – Derivative instruments – Credit default swaps” is revised to read as follows:

Credit default swaps. The “buyer” of protection in a credit default swap agreement is obligated to pay the “seller” a periodic stream of payments over the term of the agreement in return for a payment by the “seller” that is contingent upon the occurrence of a credit event with respect to a specific underlying reference debt obligation (whether as a single debt instrument or as part of an index of debt instruments). The contingent payment by the seller generally is the face amount of the debt obligation, in return for the buyer’s obligation to make periodic cash payments and deliver in physical form the reference debt obligation or a cash payment equal to the then-current market value of that debt obligation at the time of the credit event. If no credit event occurs, the seller would receive a fixed rate of income throughout the term of the contract, while the buyer would lose the amount of its payments and recover nothing. The buyer is also subject to the risk that the seller will not satisfy its contingent payment obligation, if and when due.

Purchasing protection through a credit default swap may be used to attempt to hedge against a decline in the value of debt security or securities due to a credit event. The seller of protection under a credit default swap receives periodic payments from the buyer but is exposed to the risk that the value of the reference debt obligation declines due to a credit event and that it will have to pay the face amount of the reference obligation to the buyer. Selling protection under a credit default swap may also permit the seller to gain exposure that is similar to owning the reference debt obligation directly. As the seller of protection, the Fund would effectively add leverage to its portfolio because, in addition to its total assets, the Fund would be subject to the risk that there would be a credit event and the Fund would have to make a substantial payment in the future.

Generally, a credit event means bankruptcy, failure to timely pay interest or principal, obligation acceleration, or modified restructuring of the reference debt obligation. There may be disputes between the buyer or seller of a credit default swap agreement or within the swaps market as a whole as to whether or not a credit event has occurred or what the payout should be which could result in litigation. In some instances where there is a dispute in the credit default swap market, a regional Determinations Committee set up by ISDA may make an official binding determination regarding the existence of credit events under the terms of the ISDA Master Agreement.

ISDA’s Determination Committees are comprised principally of dealers in the OTC derivatives markets which may have a conflicting interest in the determination regarding the existence of a particular credit event. In addition, in the sovereign debt market, a credit default swap agreement may not provide the protection generally anticipated because the government issuer of the sovereign debt instruments may be able to restructure or renegotiate the debt in such a manner as to avoid triggering a credit event.

SAI-1

Moreover, (1) sovereign debt obligations may not incorporate common, commercially acceptable provisions, such as collective action clauses, or (2) the negotiated restructuring of the sovereign debt may be deemed non-mandatory on all holders. As a result, the determination committee might then not be able to determine, or may be able to avoid having to determine, that a credit event under the credit default agreement has occurred.

For these and other reasons, the buyer of protection in a credit default swap agreement is subject to the risk that certain occurrences, such as particular restructuring events affecting the value of the underlying reference debt obligation, or the restructuring of sovereign debt, may not be deemed credit events under the credit default swap agreement. Therefore, if the credit default swap was purchased as a hedge or to take advantage of an anticipated increase in the value of credit protection for the underlying reference obligation, it may not provide any hedging benefit or otherwise increase in value as anticipated. Similarly, the seller of protection in a credit default swap agreement is subject to the risk that certain occurrences may be deemed to be credit events under the credit default swap agreement, even if these occurrences do not adversely impact the value or creditworthiness of the underlying reference debt obligation.

Please keep this supplement for future reference.

SAI-2

TEMPLETON DEVELOPING MARKETS SECURITIES FUND

This annual report for Templeton Developing Markets Securities Fund covers the fiscal year ended December 31, 2011.

Performance Summary as of 12/31/11

Average annual total return of Class 3* shares represents the average annual change in value, assuming reinvestment of dividends and capital gains. Average returns smooth out variations in returns, which can be significant; they are not the same as year-by-year results.

Periods ended 12/31/11

| | | | | | | | | | | | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

Average Annual Total Return | | | -15.86% | | | | +0.78% | | | | +12.47% | |

*Since Class 3 shares were not offered until 5/1/04, performance prior to that date represents historical Class 2 performance. Since 5/1/04 (effective date), the average annual total return of Class 3 shares was +10.23%.

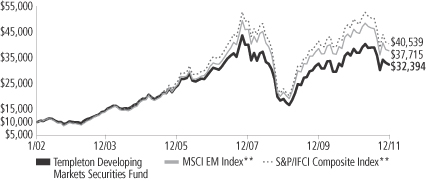

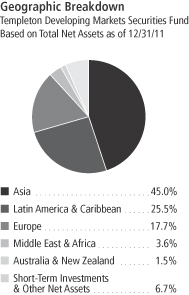

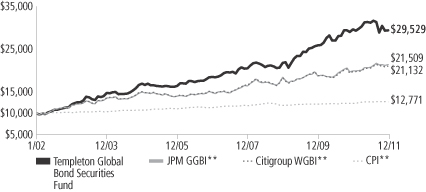

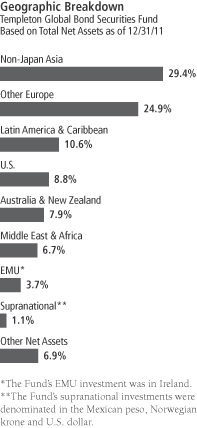

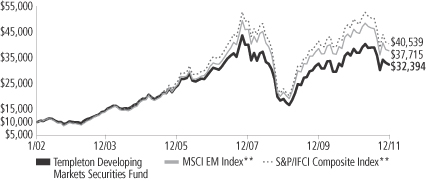

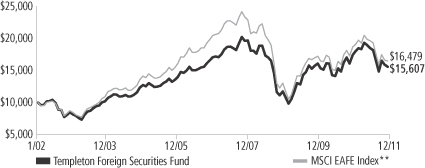

Total Return Index Comparison for a Hypothetical $10,000 Investment (1/1/02–12/31/11)

The graph below shows the change in value of a hypothetical $10,000 investment in the Fund over the indicated period and includes reinvestment of any income or distributions. The Fund’s performance* is compared to the performance of the MSCI Emerging Markets (EM) Index and the Standard & Poor’s®/International Finance Corporation Investable (S&P®/IFCI) Composite Index. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio. Please see Important Notes to Performance Information preceding the Fund Summaries.

**Source: © 2012 Morningstar. Please see Index Descriptions following the Fund Summaries.

Templeton Developing Markets Securities Fund Class 3

Performance reflects the Fund’s Class 3 operating expenses, but does not include any contract fees, expenses or sales charges. If they had been included, performance would be lower. These charges and deductions, particularly for variable life policies, can have a significant effect on contract values and insurance benefits. See the contract prospectus for a complete description of these expenses, including sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares.

Current performance may differ from figures shown.

TD-1

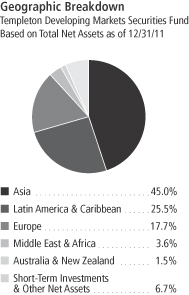

Fund Goal and Main Investments: Franklin Templeton Developing Markets Securities Fund seeks long-term capital appreciation. The Fund normally invests at least 80% of its net assets in emerging market investments.

Performance Overview

You can find the Fund’s one-year total return in the Performance Summary. In comparison, the MSCI EM Index had a -18.17% total return, and the S&P/IFCI Composite Index had a -19.03% total return for the same period.1 Please note that index performance numbers are for reference and we do not attempt to track an index but rather undertake investments on the basis of fundamental research.

Economic and Market Overview

The fundamental and financial strength of emerging markets was evident in 2011, as emerging market countries continued to report generally strong economic data, albeit a moderation from 2010. This strength, however, was not reflected in emerging market equity prices as the eurozone sovereign debt crisis and U.S. fiscal concerns led many investors to hold cash, shying away from many investments in developed and emerging markets.

Global stock prices were largely range bound in the first half of 2011. Markets, however, declined in August, largely due to S&P’s downgrade of the U.S. long-term sovereign credit rating to AA+ from AAA, and then again in September, as the prolonged eurozone sovereign debt crisis and lack of a comprehensive solution created significant confusion and volatility in global financial markets.

In October, however, global equity prices rallied, and emerging markets as measured by the MSCI EM Index recorded a double-digit return for the month. Investors welcomed strong corporate earnings reports, the release of positive U.S. economic data, and the European Union’s plans to recapitalize its banks and leverage the European Financial Stability Facility. This rally proved short-lived, and global equity markets corrected again in the final two months of 2011, largely due to the slow progress by European leaders to resolve the eurozone debt crisis.

Heightened volatility and increased uncertainty also gave investors reasons to lock in profits from 2009 and 2010, when many emerging

1. Source: © 2012 Morningstar. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio. Please see Index Descriptions following the Fund Summaries.

Fund Risks: All investments involve risks. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Investing in emerging or developing markets is subject to all the risks of foreign investing generally as well as additional, heightened risks, including currency fluctuations, economic instability, market volatility, political and social instability, the relatively smaller size and lesser liquidity of these markets, and less government supervision and regulation of business and industry practices. The Fund may have significant investments in one or more countries or in particular sectors or industries from time to time, and may carry greater risk of adverse developments in a country, sector or industry than a fund that invests more broadly. Smaller and midsize company securities can increase the risk of greater price fluctuations, particularly over the short term. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

TD-2

markets returned more than 100% in U.S. dollar (USD) terms, as measured by the components of the MSCI EM Index.1 Against this backdrop, emerging markets, as represented by the MSCI EM Index, declined -18.17% in USD terms in 2011.1

Within emerging markets, Southeast Asian stocks were among the better performers in 2011. Strong domestic demand, rising disposable incomes and relatively low unemployment made the region’s economies more resilient to global uncertainties. Relatively more export-dependent markets such as China and Taiwan, however, underperformed their regional peers. India was among the worst emerging market performers for the year due to high inflation and interest rates, a weak rupee and global economic uncertainties. Generally weaker emerging market currencies and a global commodity price correction adversely impacted Latin American markets.

Eastern European markets were among the poorest performers, largely due to their proximity to their western counterparts and a weaker euro rather than a significant deterioration in the region’s economies. South Africa significantly outperformed most of its emerging market counterparts in local currency terms but ended the period with double-digit declines in USD terms due to a weaker rand.

Investment Strategy

We employ a fundamental research, value-oriented, long-term investment approach. We focus on the market price of a company’s securities relative to our evaluation of its long-term earnings, asset value and cash flow potential. We also consider a company’s profit and loss outlook, balance sheet strength, cash flow trends and asset value in relation to the current price. Our analysis considers the company’s corporate governance behavior as well as its position in its sector, the economic framework and political environment. We invest in securities without regard to benchmark comparisons.

Manager’s Discussion

During the 12 months under review, major detractors from the Fund’s absolute performance were Brazil-based Vale, the world’s largest iron ore producer and second-largest nickel producer; Norilsk Nickel (Mining and Metallurgical Co. Norilsk Nickel), a Russia-based major producer of nickel, palladium, and other base and precious metals; and Tata Consultancy Services, one of India’s largest information technology consulting and services firms, with outsourcing services primarily in the

TD-3

Americas, Europe and India. Weak commodity metal prices and higher raw material costs weighed on Vale’s share price. However, at year-end we believed Vale could benefit from the long-term uptrend in commodity demand due to emerging market industrialization. Vale’s strong cash flow and attractive valuations, in our view, underscored our belief in its long-term potential. Investor concerns that Norilsk Nickel could become embroiled in Russian domestic politics after a major shareholder’s December announcement of his intention to run in the presidential election added to the adverse effects of metal price weakness on the company’s shares. In our long-term view, Norilsk Nickel’s strong global market share in base metal and platinum group metal production, huge reserves and low-cost nickel production put the company in a strong position. Tata’s share price performed poorly in U.S. dollar terms due to weakness in the Indian rupee, which reached a record low against the dollar in December. Based on our analysis, we believed Tata remained well positioned to benefit from the global outsourcing trend of services to Indian consulting companies.

Major contributors to absolute performance during the reporting period were Astra International, Indonesia’s leading car and motorcycle company; Brazil-based AmBev (Companhia de Bebidas das Americas), one of the world’s largest beer and soft drink producers; and Souza Cruz, Brazil’s major cigarette company. Astra is a leader in the Indonesian car and motorcycle markets, which have been enjoying strong secular growth trends. The company continued to benefit from Indonesia’s robust economic growth, higher incomes and affordable credit. The strong market positions of AmBev and Souza Cruz have allowed their businesses to achieve superior returns and build market share as consumers become wealthier and more discerning. In our view, the companies’ strong operations, low debt levels, good dividend yield and strong brands made them attractive investments.

It is important to recognize the effect of currency movements on the Fund’s performance. In general, if the value of the U.S. dollar goes up compared with a foreign currency, an investment traded in that foreign currency will go down in value because it will be worth fewer U.S. dollars. This can have a negative effect on Fund performance. Conversely, when the U.S. dollar weakens in relation to a foreign currency, an investment traded in that foreign currency will increase in value, which can contribute to Fund performance. For the 12 months ended December 31, 2011, the U.S. dollar rose in value relative to most

Top 10 Holdings

Templeton Developing Markets

Securities Fund

12/31/11

| | | | |

Company

Sector/Industry,

Country | | % of Total

Net Assets | |

| AmBev (Companhia de Bebidas das Americas) | | | 6.7% | |

| Beverages, Brazil | |

| PT Astra International Tbk | | | 6.3% | |

| Automobiles, Indonesia | |

| Vale SA, ADR, pfd., A | | | 5.0% | |

| Metals & Mining, Brazil | |

| Tata Consultancy Services Ltd. | | | 4.6% | |

| IT Services, India | |

| Souza Cruz SA | | | 3.9% | |

| Tobacco, Brazil | |

| LUKOIL Holdings, ADR | | | 3.5% | |

Oil, Gas & Consumable Fuels,

Russia | |

| President Chain Store Corp. | | | 3.3% | |

| Food & Staples Retailing, Taiwan | | | | |

| Itau Unibanco Holding SA, ADR | | | 3.3% | |

| Commercial Banks, Brazil | |

| Gazprom, ADR | | | 3.0% | |

Oil, Gas & Consumable Fuels,

Russia | |

| PT Bank Central Asia Tbk | | | 2.9% | |

| Commercial Banks, Indonesia | |

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments.

TD-4

currencies. As a result, the Fund’s performance was negatively affected by the portfolio’s investment predominantly in securities with non-U.S. currency exposure.

During the 12-month reporting period, we initiated positions in Australia, Malaysia and Qatar as we continued to search for what we considered to be attractive investment opportunities. We added construction, casinos and gaming, Internet software and services, specialty store and apparel retail companies. Key purchases included new positions in Australia-based BHP Billiton, a major diversified natural resources company with significant sales in emerging markets; Singapore-based SembCorp Marine, a premier global marine and offshore engineering group; and Anhui Conch Cement, one of China’s largest cement producers.

Conversely, we reduced the Fund’s investments in India, Brazil, Russia and China via Hong Kong-listed China H shares to focus on stocks we considered more attractively valued within our investment universe and raise funds for redemptions.2 We reduced the Fund’s holdings largely in diversified banks, oil and gas, diversified metals and mining, and automobile companies. Additionally, we sold our holdings in select companies that reached their target prices during the reporting period. Key sales included reductions of our positions in Brazilian financial conglomerate Itau Unibanco Holding and Chinese automobile manufacturer Guangzhou Automobile Group, as well as elimination of our holding in Brazilian cosmetics company Natura Cosmeticos.

Thank you for your participation in Templeton Developing Markets Securities Fund. We look forward to serving your future investment needs.

2. “China-H” denotes shares of China-incorporated, Hong Kong Stock Exchange-listed companies with most businesses in China.

The foregoing information reflects our analysis, opinions and portfolio holdings as of December 31, 2011, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

Top 10 Countries

Templeton Developing Markets

Securities Fund

12/31/11

| | | | |

| | | % of Total

Net Assets | |

| Brazil | | | 20.7% | |

| Russia | | | 14.8% | |

| Indonesia | | | 11.1% | |

| China | | | 8.8% | |

| India | | | 8.8% | |

| Thailand | | | 5.7% | |

| Hong Kong | | | 3.9% | |

| Chile | | | 3.3% | |

| Taiwan | | | 3.3% | |

| Singapore | | | 2.3% | |

TD-5

Fund Expenses

As an investor in a variable insurance contract (Contract) that indirectly provides for investment in an underlying mutual fund, you can incur transaction and/or ongoing expenses at both the Fund level and the Contract level.

| • | | Transaction expenses can include sales charges (loads) on purchases, redemption fees, surrender fees, transfer fees and premium taxes. |

| • | | Ongoing expenses can include management fees, distribution and service (12b-1) fees, contract fees, annual maintenance fees, mortality and expense risk fees and other fees and expenses. All mutual funds and Contracts have some types of ongoing expenses. |

The expenses shown in the table are meant to highlight ongoing expenses at the Fund level only and do not include ongoing expenses at the Contract level, or transaction expenses at either the Fund or Contract level. While the Fund does not have transaction expenses, if the transaction and ongoing expenses at the Contract level were included, the expenses shown below would be higher. You should consult your Contract prospectus or disclosure document for more information.

The table shows Fund-level ongoing expenses and can help you understand these expenses and compare them with those of other mutual funds offered through the Contract. The table assumes a $1,000 investment held for the six months indicated. Please refer to the Fund prospectus for additional information on operating expenses.

Actual Fund Expenses

The first line (Actual) of the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of ongoing Fund expenses, but does not include the effect of ongoing Contract expenses.

You can estimate the Fund-level expenses you incurred during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6.

| 2. | Multiply the result by the number under the heading “Fund-Level Expenses Incurred During Period.” |

If Fund-Level Expenses Incurred During Period were $7.50, then 8.6 x $7.50 = $64.50.

In this illustration, the estimated expenses incurred this period at the Fund level are $64.50.

Templeton Developing Markets Securities Fund Class 3

TD-6

Hypothetical Example for Comparison with Other Mutual Funds

Information in the second line (Hypothetical) of the table can help you compare ongoing expenses of the Fund with those of other mutual funds offered through the Contract. This information may not be used to estimate the actual ending account balance or expenses you incurred during the period. The hypothetical “Ending Account Value” is based on the Fund’s actual expense ratio and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Fund-Level Expenses Incurred During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds offered through a Contract.

| | | | | | | | | | | | |

| Class 3 | | Beginning

Account Value 7/1/11 | | | Ending

Account Value 12/31/11 | | | Fund-Level Expenses Incurred

During Period* 7/1/11–12/31/11 | |

Actual | | $ | 1,000 | | | $ | 832.00 | | | $ | 7.48 | |

Hypothetical (5% return before expenses) | | $ | 1,000 | | | $ | 1,017.04 | | | $ | 8.24 | |

*Expenses are calculated using the most recent six-month annualized expense ratio for the Fund’s Class 3 shares (1.62%), which does not include any ongoing expenses of the Contract for which the Fund is an investment option, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period.

TD-7

Franklin Templeton Variable Insurance Products Trust

Financial Highlights

Templeton Developing Markets Securities Fund

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| Class 1 | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| | | | |

Per share operating performance | | | | | | | | | | | | | | | | | | | | |

(for a share outstanding throughout the year) | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 11.40 | | | $ | 9.86 | | | $ | 6.11 | | | $ | 16.16 | | | $ | 13.92 | |

| | | | |

Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | |

Net investment incomeb | | | 0.17 | | | | 0.09 | | | | 0.12 | | | | 0.16 | | | | 0.32 | |

Net realized and unrealized gains (losses) | | | (1.94 | ) | | | 1.63 | | | | 4.02 | | | | (7.40 | ) | | | 3.51 | |

| | | | |

Total from investment operations | | | (1.77 | ) | | | 1.72 | | | | 4.14 | | | | (7.24 | ) | | | 3.83 | |

| | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.13 | ) | | | (0.18 | ) | | | (0.36 | ) | | | (0.37 | ) | | | (0.38 | ) |

Net realized gains | | | — | | | | — | | | | (0.03 | ) | | | (2.44 | ) | | | (1.21 | ) |

| | | | |

Total distributions | | | (0.13 | ) | | | (0.18 | ) | | | (0.39 | ) | | | (2.81 | ) | | | (1.59 | ) |

| | | | |

Redemption feesc | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | |

Net asset value, end of year | | $ | 9.50 | | | $ | 11.40 | | | $ | 9.86 | | | $ | 6.11 | | | $ | 16.16 | |

| | | | |

| | | | | |

Total returnd | | | (15.67)% | | | | 17.83% | | | | 73.32% | | | | (52.62)% | | | | 29.09% | |

Ratios to average net assets | | | | | | | | | | | | | | | | | | | | |

Expenses | | | 1.40% | | | | 1.49% | e | | | 1.45% | e | | | 1.52% | e | | | 1.48% | e |

Net investment income | | | 1.57% | | | | 0.87% | | | | 1.64% | | | | 1.52% | | | | 2.07% | |

| | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000’s) | | $ | 232,544 | | | $ | 347,242 | | | $ | 325,927 | | | $ | 234,213 | | | $ | 753,843 | |

Portfolio turnover rate | | | 14.90% | | | | 24.41% | | | | 56.58% | f | | | 75.11% | f | | | 98.32% | |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cAmount rounds to less than $0.01 per share.

dTotal return does not include fees, charges or expenses imposed by the variable annuity and life insurance contracts for which the Franklin Templeton Variable Insurance Products Trust serves as an underlying investment vehicle.

eBenefit of expense reduction rounds to less than 0.01%.

fExcludes the value of portfolio securities delivered as a result of redemptions in-kind.

The accompanying notes are an integral part of these financial statements.

TD-8

Franklin Templeton Variable Insurance Products Trust

Financial Highlights (continued)

Templeton Developing Markets Securities Fund

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| Class 2 | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| | | | |

Per share operating performance | | | | | | | | | | | | | | | | | | | | |

(for a share outstanding throughout the year) | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 11.30 | | | $ | 9.78 | | | $ | 6.04 | | | $ | 15.99 | | | $ | 13.79 | |

| | | | |

Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | |

Net investment incomeb | | | 0.14 | | | | 0.06 | | | | 0.11 | | | | 0.15 | | | | 0.27 | |

Net realized and unrealized gains (losses) | | | (1.92 | ) | | | 1.62 | | | | 3.98 | | | | (7.33 | ) | | | 3.49 | |

| | | | |

Total from investment operations | | | (1.78 | ) | | | 1.68 | | | | 4.09 | | | | (7.18 | ) | | | 3.76 | |

| | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.10 | ) | | | (0.16 | ) | | | (0.32 | ) | | | (0.33 | ) | | | (0.35 | ) |

Net realized gains | | | — | | | | — | | | | (0.03 | ) | | | (2.44 | ) | | | (1.21 | ) |

| | | | |

Total distributions | | | (0.10 | ) | | | (0.16 | ) | | | (0.35 | ) | | | (2.77 | ) | | | (1.56 | ) |

| | | | |

Redemption feesc | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | |

Net asset value, end of year | | $ | 9.42 | | | $ | 11.30 | | | $ | 9.78 | | | $ | 6.04 | | | $ | 15.99 | |

| | | | |

| | | | | |

Total returnd | | | (15.86)% | | | | 17.58% | | | | 72.59% | | | | (52.70)% | | | | 28.78% | |

Ratios to average net assets | | | | | | | | | | | | | | | | | | | | |

Expenses | | | 1.65% | | | | 1.74% | e | | | 1.70% | e | | | 1.77% | e | | | 1.73% | e |

Net investment income | | | 1.32% | | | | 0.62% | | | | 1.39% | | | | 1.27% | | | | 1.82% | |

| | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000’s) | | $ | 295,223 | | | $ | 392,546 | | | $ | 435,947 | | | $ | 264,186 | | | $ | 1,090,549 | |

Portfolio turnover rate | | | 14.90% | | | | 24.41% | | | | 56.58% | f | | | 75.11% | f | | | 98.32% | |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cAmount rounds to less than $0.01 per share.

dTotal return does not include fees, charges or expenses imposed by the variable annuity and life insurance contracts for which the Franklin Templeton Variable Insurance Products Trust serves as an underlying investment vehicle.

eBenefit of expense reduction rounds to less than 0.01%.

fExcludes the value of portfolio securities delivered as a result of redemptions in-kind.

The accompanying notes are an integral part of these financial statements.

TD-9

Franklin Templeton Variable Insurance Products Trust

Financial Highlights (continued)

Templeton Developing Markets Securities Fund

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| Class 3 | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| | | | |

Per share operating performance | | | | | | | | | | | | | | | | | | | | |

(for a share outstanding throughout the year) | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 11.23 | | | $ | 9.73 | | | $ | 6.02 | | | $ | 15.96 | | | $ | 13.78 | |

| | | | |

Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | |

Net investment incomeb | | | 0.14 | | | | 0.06 | | | | 0.10 | | | | 0.11 | | | | 0.24 | |

Net realized and unrealized gains (losses) | | | (1.91 | ) | | | 1.60 | | | | 3.97 | | | | (7.27 | ) | | | 3.52 | |

| | | | |

Total from investment operations | | | (1.77 | ) | | | 1.66 | | | | 4.07 | | | | (7.16 | ) | | | 3.76 | |

| | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.10 | ) | | | (0.16 | ) | | | (0.33 | ) | | | (0.34 | ) | | | (0.37 | ) |

Net realized gains | | | — | | | | — | | | | (0.03 | ) | | | (2.44 | ) | | | (1.21 | ) |

| | | | |

Total distributions | | | (0.10 | ) | | | (0.16 | ) | | | (0.36 | ) | | | (2.78 | ) | | | (1.58 | ) |

| | | | |

Redemption feesc | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | |

Net asset value, end of year | | $ | 9.36 | | | $ | 11.23 | | | $ | 9.73 | | | $ | 6.02 | | | $ | 15.96 | |

| | | | |

| | | | | |

Total returnd | | | (15.86)% | | | | 17.51% | | | | 72.63% | | | | (52.67)% | | | | 28.70% | |

Ratios to average net assets | | | | | | | | | | | | | | | | | | | | |

Expenses | | | 1.65% | | | | 1.74% | e | | | 1.70% | e | | | 1.77% | e | | | 1.73% | e |

Net investment income | | | 1.32% | | | | 0.62% | | | | 1.39% | | | | 1.27% | | | | 1.82% | |

| | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000’s) | | $ | 44,702 | | | $ | 66,484 | | | $ | 66,718 | | | $ | 32,953 | | | $ | 100,961 | |

Portfolio turnover rate | | | 14.90% | | | | 24.41% | | | | 56.58% | f | | | 75.11% | f | | | 98.32% | |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cAmount rounds to less than $0.01 per share.

dTotal return does not include fees, charges or expenses imposed by the variable annuity and life insurance contracts for which the Franklin Templeton Variable Insurance Products Trust serves as an underlying investment vehicle.

eBenefit of expense reduction rounds to less than 0.01%.

fExcludes the value of portfolio securities delivered as a result of redemptions in-kind.

The accompanying notes are an integral part of these financial statements.

TD-10

Franklin Templeton Variable Insurance Products Trust

Financial Highlights (continued)

Templeton Developing Markets Securities Fund

| | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| Class 4 | | 2011 | | | 2010 | | | 2009 | | | 2008a | |

| | | | |

Per share operating performance | | | | | | | | | | | | | | | | |

(for a share outstanding throughout the year) | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 11.30 | | | $ | 9.80 | | | $ | 6.09 | | | $ | 14.88 | |

| | | | |

Income from investment operationsb: | | | | | | | | | | | | | | | | |

Net investment income (loss)c | | | 0.13 | | | | 0.05 | | | | 0.09 | | | | (0.33 | ) |

Net realized and unrealized gains (losses) | | | (1.91 | ) | | | 1.61 | | | | 4.00 | | | | (5.65 | ) |

| | | | |

Total from investment operations | | | (1.78 | ) | | | 1.66 | | | | 4.09 | | | | (5.98 | ) |

| | | | |

Less distributions from: | | | | | | | | | | | | | | | | |

Net investment income | | | (0.10 | ) | | | (0.16 | ) | | | (0.35 | ) | | | (0.37 | ) |

Net realized gains | | | — | | | | — | | | | (0.03 | ) | | | (2.44 | ) |

| | | | |

Total distributions | | | (0.10 | ) | | | (0.16 | ) | | | (0.38 | ) | | | (2.81 | ) |

| | | | |

Redemption feesd | | | — | | | | — | | | | — | | | | — | |

| | | | |

Net asset value, end of year | | $ | 9.42 | | | $ | 11.30 | | | $ | 9.80 | | | $ | 6.09 | |

| | | | |

| | | | |

Total returne | | | (15.88)% | | | | 17.41% | | | | 72.45% | | | | (48.66)% | |

Ratios to average net assetsf | | | | | | | | | | | | | | | | |

Expenses | | | 1.75% | | | | 1.84% | g | | | 1.80% | g | | | 1.87% | g |

Net investment income | | | 1.22% | | | | 0.52% | | | | 1.29% | | | | 1.17% | |

| | | | |

Supplemental data | | | | | | | | | | | | | | | | |

Net assets, end of year (000’s) | | $ | 24,380 | | | $ | 37,198 | | | $ | 26,362 | | | $ | 7,208 | |

Portfolio turnover rate | | | 14.90% | | | | 24.41% | | | | 56.58% | h | | | 75.11% | h |

aFor the period February 29, 2008 (effective date) to December 31, 2008.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

cBased on average daily shares outstanding.

dAmount rounds to less than $0.01 per share.

eTotal return does not include fees, charges or expenses imposed by the variable annuity and life insurance contracts for which the Franklin Templeton Variable Insurance Products Trust serves as an underlying investment vehicle. Total return is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

hExcludes the value of portfolio securities delivered as a result of redemptions in-kind.

The accompanying notes are an integral part of these financial statements.

TD-11

Franklin Templeton Variable Insurance Products Trust

Statement of Investments, December 31, 2011

| | | | | | | | | | |

| Templeton Developing Markets Securities Fund | | Industry | | Shares | | | Value | |

Common Stocks 85.4% | | | | | | | | | | |

Australia 1.5% | | | | | | | | | | |

BHP Billiton Ltd. | | Metals & Mining | | | 250,162 | | | $ | 8,809,050 | |

| | | | | | | | | | |

Brazil 13.9% | | | | | | | | | | |

Companhia de Bebidas das Americas (AmBev) | | Beverages | | | 1,362,350 | | | | 39,922,880 | |

Itau Unibanco Holding SA, ADR | | Commercial Banks | | | 1,053,474 | | | | 19,552,477 | |

Souza Cruz SA | | Tobacco | | | 1,888,597 | | | | 23,222,283 | |

| | | | | | | | | | |

| | | | | | | | | 82,697,640 | |

| | | | | | | | | | |

Chile 2.2% | | | | | | | | | | |

Antofagasta PLC | | Metals & Mining | | | 704,479 | | | | 13,322,274 | |

| | | | | | | | | | |

China 8.8% | | | | | | | | | | |

Anhui Conch Cement Co. Ltd., H | | Construction Materials | | | 1,725,000 | | | | 5,119,518 | |

CNOOC Ltd. | | Oil, Gas & Consumable Fuels | | | 7,181,000 | | | | 12,593,055 | |

aGreat Wall Motor Co. Ltd., H | | Automobiles | | | 2,460,677 | | | | 3,592,830 | |

Guangzhou Automobile Group Co. Ltd., H | | Automobiles | | | 916,396 | | | | 764,588 | |

PetroChina Co. Ltd., H | | Oil, Gas & Consumable Fuels | | | 13,880,000 | | | | 17,317,385 | |

Tencent Holdings Ltd. | | Internet Software & Services | | | 137,000 | | | | 2,751,783 | |

aUni-President China Holdings Ltd. | | Food Products | | | 927,675 | | | | 555,415 | |

Yantai Changyu Pioneer Wine Co. Ltd., B | | Beverages | | | 532,700 | | | | 5,830,029 | |

Yanzhou Coal Mining Co. Ltd., H | | Oil, Gas & Consumable Fuels | | | 1,948,000 | | | | 4,158,556 | |

| | | | | | | | | | |

| | | | | | | | | 52,683,159 | |

| | | | | | | | | | |

Hong Kong 3.9% | | | | | | | | | | |

Dairy Farm International Holdings Ltd. | | Food & Staples Retailing | | | 1,014,733 | | | | 9,467,459 | |

Giordano International Ltd. | | Specialty Retail | | | 474,000 | | | | 342,992 | |

I.T Ltd. | | Specialty Retail | | | 3,540,000 | | | | 1,950,815 | |

Luk Fook Holdings (International) Ltd. | | Specialty Retail | | | 999,000 | | | | 3,485,811 | |

SJM Holdings Ltd. | | Hotels, Restaurants & Leisure | | | 1,885,000 | | | | 3,058,095 | |

VTech Holdings Ltd. | | Communications Equipment | | | 506,300 | | | | 5,078,254 | |

| | | | | | | | | | |

| | | | | | | | | 23,383,426 | |

| | | | | | | | | | |

India 8.8% | | | | | | | | | | |

Grasim Industries Ltd. | | Construction Materials | | | 31,224 | | | | 1,477,449 | |

Infosys Ltd. | | IT Services | | | 169,190 | | | | 8,824,273 | |

National Aluminium Co. Ltd. | | Metals & Mining | | | 1,578,595 | | | | 1,508,174 | |

Oil & Natural Gas Corp. Ltd. | | Oil, Gas & Consumable Fuels | | | 1,826,624 | | | | 8,853,174 | |

Tata Chemicals Ltd. | | Chemicals | | | 701,855 | | | | 4,121,900 | |

Tata Consultancy Services Ltd. | | IT Services | | | 1,258,688 | | | | 27,570,526 | |

| | | | | | | | | | |

| | | | | | | | | 52,355,496 | |

| | | | | | | | | | |

Indonesia 11.1% | | | | | | | | | | |

PT Astra International Tbk | | Automobiles | | | 4,610,000 | | | | 37,622,277 | |

PT Bank Central Asia Tbk | | Commercial Banks | | | 19,763,532 | | | | 17,436,808 | |

PT Bank Rakyat Indonesia (Persero) Tbk | | Commercial Banks | | | 15,197,500 | | | | 11,313,276 | |

| | | | | | | | | | |

| | | | | | | | | 66,372,361 | |

| | | | | | | | | | |

Malaysia 0.1% | | | | | | | | | | |

Genting Bhd. | | Hotels, Restaurants & Leisure | | | 179,000 | | | | 621,136 | |

| | | | | | | | | | |

Mexico 1.5% | | | | | | | | | | |

America Movil SAB de CV, L, ADR | | Wireless Telecommunication Services | | | 246,434 | | | | 5,569,409 | |

Kimberly Clark de Mexico SAB de CV, A | | Household Products | | | 650,871 | | | | 3,540,105 | |

| | | | | | | | | | |

| | | | | | | | | 9,109,514 | |

| | | | | | | | | | |

TD-12

Franklin Templeton Variable Insurance Products Trust

Statement of Investments, December 31, 2011 (continued)

| | | | | | | | | | |

| Templeton Developing Markets Securities Fund | | Industry | | Shares | | | Value | |

Common Stocks (continued) | | | | | | | | | | |

Nigeria 0.2% | | | | | | | | | | |

Nigerian Breweries PLC | | Beverages | | | 1,629,905 | | | $ | 948,117 | |

| | | | | | | | | | |

Pakistan 0.0%† | | | | | | | | | | |

MCB Bank Ltd. | | Commercial Banks | | | 126,042 | | | | 187,913 | |

| | | | | | | | | | |

Qatar 0.1% | | | | | | | | | | |

Industries Qatar | | Industrial Conglomerates | | | 20,901 | | | | 763,397 | |

| | | | | | | | | | |

Russia 14.8% | | | | | | | | | | |

Gazprom, ADR | | Oil, Gas & Consumable Fuels | | | 1,193,200 | | | | 12,744,569 | |

Gazprom, ADR (London Stock Exchange) | | Oil, Gas & Consumable Fuels | | | 470,200 | | | | 5,014,683 | |

bLUKOIL Holdings, ADR | | Oil, Gas & Consumable Fuels | | | 75,208 | | | | 4,001,066 | |

bLUKOIL Holdings, ADR (London Stock Exchange) | | Oil, Gas & Consumable Fuels | | | 317,168 | | | | 16,786,117 | |

Mining and Metallurgical Co. Norilsk Nickel, ADR | | Metals & Mining | | | 636,443 | | | | 9,756,671 | |

Sberbank RF | | Commercial Banks | | | 6,061,420 | | | | 14,842,988 | |

TNK-BP | | Oil, Gas & Consumable Fuels | | | 5,340,274 | | | | 13,760,276 | |

cUralkali OJSC, GDR, Reg S | | Chemicals | | | 311,996 | | | | 11,227,176 | |

| | | | | | | | | | |

| | | | | | | | | 88,133,546 | |

| | | | | | | | | | |

Singapore 2.3% | | | | | | | | | | |

Keppel Corp. Ltd. | | Industrial Conglomerates | | | 1,006,557 | | | | 7,216,853 | |

SembCorp Marine Ltd. | | Machinery | | | 2,165,000 | | | | 6,375,993 | |

| | | | | | | | | | |

| | | | | | | | | 13,592,846 | |

| | | | | | | | | | |

South Africa 2.3% | | | | | | | | | | |

Exxaro Resources Ltd. | | Metals & Mining | | | 94,600 | | | | 1,965,787 | |

Remgro Ltd. | | Diversified Financial Services | | | 504,061 | | | | 7,395,663 | |

Tiger Brands Ltd. | | Food Products | | | 130,520 | | | | 4,050,226 | |

| | | | | | | | | | |

| | | | | | | | | 13,411,676 | |

| | | | | | | | | | |

South Korea 0.9% | | | | | | | | | | |

SK Innovation Co. Ltd. | | Oil, Gas & Consumable Fuels | | | 43,125 | | | | 5,282,510 | |

| | | | | | | | | | |

Taiwan 3.3% | | | | | | | | | | |

President Chain Store Corp. | | Food & Staples Retailing | | | 3,628,075 | | | | 19,766,629 | |

| | | | | | | | | | |

Thailand 5.7% | | | | | | | | | | |

Kasikornbank PCL, fgn. | | Commercial Banks | | | 3,116,500 | | | | 12,292,230 | |

PTT Exploration and Production PCL, fgn. | | Oil, Gas & Consumable Fuels | | | 2,021,223 | | | | 10,789,675 | |

PTT PCL, fgn. | | Oil, Gas & Consumable Fuels | | | 938,100 | | | | 9,450,841 | |

Supalai PCL, fgn. | | Real Estate Management & Development | | | 3,888,100 | | | | 1,761,439 | |

| | | | | | | | | | |

| | | | | | | | | 34,294,185 | |

| | | | | | | | | | |

Turkey 1.5% | | | | | | | | | | |

Tupras-Turkiye Petrol Rafinerileri AS | | Oil, Gas & Consumable Fuels | | | 423,426 | | | | 8,985,167 | |

| | | | | | | | | | |

United Arab Emirates 1.1% | | | | | | | | | | |

Emaar Properties PJSC | | Real Estate Management & Development | | | 8,942,377 | | | | 6,256,730 | |

| | | | | | | | | | |

United Kingdom 1.4% | | | | | | | | | | |

Anglo American PLC | | Metals & Mining | | | 230,149 | | | | 8,426,299 | |

| | | | | | | | | | |

Total Common Stocks (Cost $346,162,340) | | | | | | | | | 509,403,071 | |

| | | | | | | | | | |

TD-13

Franklin Templeton Variable Insurance Products Trust

Statement of Investments, December 31, 2011 (continued)

| | | | | | | | | | |

| Templeton Developing Markets Securities Fund | | Industry | | Shares | | | Value | |

Preferred Stocks 7.9% | | | | | | | | | | |

Brazil 6.8% | | | | | | | | | | |

Banco Bradesco SA, ADR, pfd. | | Commercial Banks | | | 418,531 | | | $ | 6,981,097 | |

Itausa - Investimentos Itau SA, pfd. | | Commercial Banks | | | 642,096 | | | | 3,887,314 | |

Vale SA, ADR, pfd., A | | Metals & Mining | | | 1,440,625 | | | | 29,676,875 | |

| | | | | | | | | | |

| | | | | | | | | 40,545,286 | |

| | | | | | | | | | |

Chile 1.1% | | | | | | | | | | |

Embotelladora Andina SA, pfd., A | | Beverages | | | 1,918,947 | | | | 6,833,593 | |

| | | | | | | | | | |

Total Preferred Stocks (Cost $23,121,348) | | | | | | | | | 47,378,879 | |

| | | | | | | | | | |

Total Investments before Short Term Investments

(Cost $369,283,688) | | | | | | | | | 556,781,950 | |

| | | | | | | | | | |

Short Term Investments 7.1% | | | | | | | | | | |

Money Market Funds (Cost $40,518,516) 6.8% | | | | | | | | | | |

United States 6.8% | | | | | | | | | | |

d,eInstitutional Fiduciary Trust Money Market Portfolio | | | | | 40,518,516 | | | | 40,518,516 | |

| | | | | | | | | | |

fInvestments from Cash Collateral Received for Loaned Securities

(Cost $2,122,374) 0.3% | | | | | | | | | | |

Money Market Funds 0.3% | | | | | | | | | | |

United States 0.3% | | | | | | | | | | |

gBNY Mellon Overnight Government Fund, 0.039% | | | | | 2,122,374 | | | | 2,122,374 | |

| | | | | | | | | | |

Total Investments (Cost $411,924,578) 100.4% | | | | | | | | | 599,422,840 | |

Other Assets, less Liabilities (0.4)% | | | | | | | | | (2,573,365 | ) |

| | | | | | | | | | |

Net Assets 100.0% | | | | | | | | $ | 596,849,475 | |

| | | | | | | | | | |

See Abbreviations on page TD-26.

†Rounds to less than 0.1% of net assets.

aA portion or all of the security is on loan at December 31, 2011. See Note 1(c).

bAt December 31, 2011, pursuant to the Fund’s policies and the requirements of applicable securities law, the Fund may be restricted from trading these securities for a limited or extended period of time due to ownership limits and/or potential possession of material non-public information.

cSecurity was purchased pursuant to Regulation S under the Securities Act of 1933, which exempts from registration securities offered and sold outside of the United States. Such a security cannot be sold in the United States without either an effective registration statement filed pursuant to the Securities Act of 1933, or pursuant to an exemption from registration. This security has been deemed liquid under guidelines approved by the Trust’s Board of Trustees. At December 31, 2011, the value of this security was $11,227,176, representing 1.88% of net assets.

dNon-income producing.

eSee Note 7 regarding investments in the Institutional Fiduciary Trust Money Market Portfolio.

fSee Note 1(c) regarding securities on loan.

gThe rate shown is the annualized seven-day yield at period end.

The accompanying notes are an integral part of these financial statements.

TD-14

Franklin Templeton Variable Insurance Products Trust

Financial Statements

Statement of Assets and Liabilities

December 31, 2011

| | | | |

| | | Templeton

Developing Markets

Securities Fund | |

Assets: | | | | |

Investments in securities: | | | | |

Cost - Unaffiliated issuers | | $ | 371,406,062 | |

Cost - Sweep Money Fund (Note 7) | | | 40,518,516 | |

| | | | |

Total cost of investments | | $ | 411,924,578 | |

| | | | |

Value - Unaffiliated issuers | | $ | 558,904,324 | |

Value - Sweep Money Fund (Note 7) | | | 40,518,516 | |

| | | | |

Total value of investments (includes securities loaned in the amount of $1,993,705) | | | 599,422,840 | |

Foreign currency, at value and cost | | | 27,953 | |

Receivables: | | | | |

Investment securities sold | | | 298,006 | |

Capital shares sold | | | 1,044,669 | |

Dividends | | | 567,788 | |

Foreign tax | | | 51,726 | |

Other assets | | | 23 | |

| | | | |

Total assets | | | 601,413,005 | |

| | | | |

Liabilities: | | | | |

Payables: | | | | |

Investment securities purchased | | | 238,923 | |

Capital shares redeemed | | | 969,695 | |

Affiliates | | | 794,283 | |

Reports to shareholders | | | 297,351 | |

Payable upon return of securities loaned | | | 2,122,374 | |

Accrued expenses and other liabilities | | | 140,904 | |

| | | | |

Total liabilities | | | 4,563,530 | |

| | | | |

Net assets, at value | | $ | 596,849,475 | |

| | | | |

Net assets consist of: | | | | |

Paid-in capital | | $ | 538,777,200 | |

Undistributed net investment income | | | 2,273,752 | |

Net unrealized appreciation (depreciation) | | | 187,475,625 | |

Accumulated net realized gain (loss) | | | (131,677,102 | ) |

| | | | |

Net assets, at value | | $ | 596,849,475 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

TD-15

Franklin Templeton Variable Insurance Products Trust

Financial Statements (continued)

Statement of Assets and Liabilities (continued)

December 31, 2011

| | | | |

| | | Templeton

Developing Markets

Securities Fund | |

Class 1: | | | | |

Net assets, at value | | $ | 232,543,859 | |

| | | | |

Shares outstanding | | | 24,477,057 | |

| | | | |

Net asset value and maximum offering price per share | | $ | 9.50 | |

| | | | |

Class 2: | | | | |

Net assets, at value | | $ | 295,223,498 | |

| | | | |

Shares outstanding | | | 31,333,936 | |

| | | | |

Net asset value and maximum offering price per share | | $ | 9.42 | |

| | | | |

Class 3: | | | | |

Net assets, at value | | $ | 44,702,020 | |

| | | | |

Shares outstanding | | | 4,773,813 | |

| | | | |

Net asset value and maximum offering price per sharea | | $ | 9.36 | |

| | | | |

Class 4: | | | | |

Net assets, at value | | $ | 24,380,098 | |

| | | | |

Shares outstanding | | | 2,588,782 | |

| | | | |

Net asset value and maximum offering price per share | | $ | 9.42 | |

| | | | |

aRedemption price is equal to net asset value less redemption fees retained by the Fund.

The accompanying notes are an integral part of these financial statements.

TD-16

Franklin Templeton Variable Insurance Products Trust

Financial Statements (continued)

Statement of Operations

for the year ended December 31, 2011

| | | | |

| | | Templeton

Developing Markets

Securities Fund | |

Investment income: | | | | |

Dividends (net of foreign taxes of $2,230,499) | | $ | 21,338,029 | |

Interest | | | 22,148 | |

Income from securities loaned | | | 88,114 | |

| | | | |

Total investment income | | | 21,448,291 | |

| | | | |

Expenses: | | | | |

Management fees (Note 3a) | | | 8,287,243 | |

Administrative fees (Note 3b) | | | 985,804 | |

Distribution fees: (Note 3c) | | | | |

Class 2 | | | 855,545 | |

Class 3 | | | 140,593 | |

Class 4 | | | 112,586 | |

Unaffiliated transfer agent fees | | | 2,549 | |

Custodian fees (Note 4) | | | 481,218 | |

Reports to shareholders | | | 260,457 | |

Professional fees | | | 74,918 | |

Trustees’ fees and expenses | | | 2,872 | |

Other | | | 27,374 | |

| | | | |

Total expenses | | | 11,231,159 | |

| | | | |

Net investment income | | | 10,217,132 | |

| | | | |

Realized and unrealized gains (losses): | | | | |

Net realized gain (loss) from: | | | | |

Investments | | | 41,497,378 | |

Foreign currency transactions | | | (405,209 | ) |

| | | | |

Net realized gain (loss) | | | 41,092,169 | |

| | | | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments | | | (168,785,410 | ) |

Translation of other assets and liabilities denominated in foreign currencies | | | (3,998 | ) |

Change in deferred taxes on unrealized appreciation | | | 53,321 | |

| | | | |

Net change in unrealized appreciation (depreciation) | | | (168,736,087 | ) |

| | | | |

Net realized and unrealized gain (loss) | | | (127,643,918 | ) |

| | | | |

Net increase (decrease) in net assets resulting from operations | | $ | (117,426,786 | ) |

| | | | |

The accompanying notes are an integral part of these financial statements.

TD-17

Franklin Templeton Variable Insurance Products Trust

Financial Statements (continued)

Statements of Changes in Net Assets

| | | | | | | | |

| | | Templeton Developing Markets

Securities Fund | |

| | | Year Ended December 31, | |

| | | 2011 | | | 2010 | |

| | | | |

Increase (decrease) in net assets: | | | | | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 10,217,132 | | | $ | 5,592,076 | |

Net realized gain (loss) from investments and foreign currency transactions | | | 41,092,169 | | | | 49,761,078 | |

Net change in unrealized appreciation (depreciation) on investments, translation of other assets and liabilities denominated in foreign currencies and deferred taxes | | | (168,736,087 | ) | | | 68,457,067 | |

| | | | |

Net increase (decrease) in net assets resulting from operations | | | (117,426,786 | ) | | | 123,810,221 | |

| | | | |

Distributions to shareholders from: | | | | | | | | |

Net investment income: | | | | | | | | |

Class 1 | | | (3,575,470 | ) | | | (5,483,924 | ) |

Class 2 | | | (3,331,863 | ) | | | (5,656,521 | ) |

Class 3 | | | (556,039 | ) | | | (947,886 | ) |

Class 4 | | | (314,405 | ) | | | (471,295 | ) |

| | | | |

Total distributions to shareholders | | | (7,777,777 | ) | | | (12,559,626 | ) |

| | | | |

Capital share transactions: (Note 2) | | | | | | | | |

Class 1 | | | (64,505,854 | ) | | | (22,233,537 | ) |

Class 2 | | | (37,899,841 | ) | | | (97,764,544 | ) |

Class 3 | | | (11,807,405 | ) | | | (9,001,736 | ) |

Class 4 | | | (7,237,721 | ) | | | 6,238,252 | |

| | | | |

Total capital share transactions | | | (121,450,821 | ) | | | (122,761,565 | ) |

| | | | |

Redemption fees | | | 34,912 | | | | 26,367 | |

| | | | |

Net increase (decrease) in net assets | | | (246,620,472 | ) | | | (11,484,603 | ) |

Net assets: | | | | | | | | |

Beginning of year | | | 843,469,947 | | | | 854,954,550 | |

| | | | |

End of year | | $ | 596,849,475 | | | $ | 843,469,947 | |

| | | | |

Undistributed net investment income included in net assets: | | | | | | | | |

End of year | | $ | 2,273,752 | | | $ | 163,727 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

TD-18

Franklin Templeton Variable Insurance Products Trust

Notes to Financial Statements

Templeton Developing Markets Securities Fund

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Franklin Templeton Variable Insurance Products Trust (Trust) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as an open-end investment company, consisting of twenty separate funds. The Templeton Developing Markets Securities Fund (Fund) is included in this report. The financial statements of the remaining funds in the Trust are presented separately. Shares of the Fund are generally sold only to insurance company separate accounts to fund the benefits of variable life insurance policies or variable annuity contracts. The Fund offers four classes of shares: Class 1, Class 2, Class 3, and Class 4. Each class of shares differs by its distribution fees, voting rights on matters affecting a single class and its exchange privilege.

The following summarizes the Fund’s significant accounting policies.

a. Financial Instrument Valuation

The Fund’s investments in securities and other financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. Under procedures approved by the Trust’s Board of Trustees, the Fund may utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Equity securities listed on an exchange or on the NASDAQ National Market System are valued at the last quoted sale price or the official closing price of the day, respectively. Foreign equity securities are valued as of the close of trading on the foreign stock exchange on which the security is primarily traded, or the NYSE, whichever is earlier. The value is then converted into its U.S. dollar equivalent at the foreign exchange rate in effect at the close of the NYSE on the day that the value of the security is determined. Over-the-counter securities are valued within the range of the most recent quoted bid and ask prices. Securities that trade in multiple markets or on multiple exchanges are valued according to the broadest and most representative market. Certain equity securities are valued based upon fundamental characteristics or relationships to similar securities. Investments in open-end mutual funds and non-registered money market funds are valued at the closing net asset value.

The Fund has procedures to determine the fair value of securities and other financial instruments for which market prices are not readily available or which may not be reliably priced. Under these procedures, the Fund primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. The Fund may also use an income-based valuation approach in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed.

Trading in securities on foreign securities stock exchanges and over-the-counter markets may be completed before the daily close of business on the NYSE. Occasionally, events occur between the time at which trading in a foreign security is completed and the close of the NYSE that might call into question the reliability of the value of a portfolio security held by the Fund. As a result, differences may arise between the value of the Fund’s portfolio securities as determined at the foreign market close and the latest indications of value at the close of the NYSE. In order to minimize the potential for these differences, the investment manager monitors price movements following the close of trading in foreign stock markets through a series of country specific market proxies (such as baskets of American Depositary Receipts, futures contracts and exchange traded funds). These price movements are measured against established trigger thresholds for each specific market proxy to assist in determining if an event has occurred that may call into question the reliability of the values of the foreign securities held by the Fund. If such an event occurs, the securities may be valued using fair value procedures, which may include the use of independent pricing services.

TD-19

Franklin Templeton Variable Insurance Products Trust

Notes to Financial Statements (continued)

Templeton Developing Markets Securities Fund

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued)

b. Foreign Currency Translation

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. The Fund may enter into foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of securities, income and expense items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. Portfolio securities and assets and liabilities denominated in foreign currencies contain risks that those currencies will decline in value relative to the U.S. dollar. Occasionally, events may impact the availability or reliability of foreign exchange rates used to convert the U.S. dollar equivalent value. If such an event occurs, the foreign exchange rate will be valued at fair value using procedures established and approved by the Trust’s Board of Trustees.

The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments on the Statement of Operations.

Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest, and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period.

c. Securities Lending

The Fund participates in an agency based security lending program. The fund receives cash collateral against the loaned securities in an amount equal to at least 102% of the market value of the loaned securities. Collateral is maintained over the life of the loan in an amount not less than 100% of the market value of loaned securities, as determined at the close of fund business each day; any additional collateral required due to changes in security values is delivered to the fund on the next business day. The collateral is invested in a non-registered money fund by the fund’s custodian on the fund’s behalf. The fund receives income from the investment of cash collateral, in addition to lending fees and rebates paid by the borrower. The fund bears the market risk with respect to the collateral investment, securities loaned, and the risk that the agent may default on its obligations to the fund. The securities lending agent has agreed to indemnify the fund in the event of default by a third party borrower.

d. Income and Deferred Taxes

It is the Fund’s policy to qualify as a regulated investment company under the Internal Revenue Code. The Fund intends to distribute to shareholders substantially all of its taxable income and net realized gains to relieve it from federal income and excise taxes. As a result, no provision for U.S. federal income taxes is required.

The Fund may be subject to foreign taxation related to income received, capital gains on the sale of securities and certain foreign currency transactions in the foreign jurisdictions in which it invests. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests. When a capital gain tax is determined to apply the Fund records an estimated deferred tax liability in an amount that would be payable if the securities were disposed of on the valuation date.

The Fund recognizes the tax benefits of uncertain tax positions only when the position is “more likely than not” to be sustained upon examination by the tax authorities based on the technical merits of the tax position. As of December 31, 2011, and for all open tax years, the Fund has determined that no liability for unrecognized tax benefits is required in the Fund’s financial statements related to uncertain tax positions taken on a tax return (or expected to be taken on future tax returns). Open tax years are those that remain subject to examination and are based on each tax jurisdiction statute of limitation.

TD-20

Franklin Templeton Variable Insurance Products Trust

Notes to Financial Statements (continued)

Templeton Developing Markets Securities Fund

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued)

e. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Dividend income is recorded on the ex-dividend date except that certain dividends from foreign securities are recognized as soon as the Fund is notified of the ex-dividend date. Distributions to shareholders are recorded on the ex-dividend date and are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.