UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-05583

Franklin Templeton Variable Insurance Products Trust

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: (650)312-2000

Date of fiscal year end: 12/31

Date of reporting period: 12/31/18

| Item 1. | Reports to Stockholders. |

| | |

| | Annual Report December 31, 2018 |

Franklin Templeton Variable Insurance

Products Trust

Internet Delivery of Shareholder Reports: Effective January 1, 2021, as permitted by regulations adopted by the SEC, you may not be receiving paper copies of the Fund’s annual or semiannual shareholder reports by mail, unless you specifically request them from the insurance company that offers your variable annuity or variable life insurance contract or your financial intermediary. Instead of delivering paper copies of the report, the insurance company may choose to make the reports available on a website, and will notify you by mail each time a shareholder report is posted and provide you with a website link to access the report. Instructions for requesting paper copies will be provided by your insurance company.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the insurance company or your financial intermediary electronically by following the instructions provided by the insurance company or by contacting your financial intermediary.

You may elect to receive all future Fund shareholder reports in paper free of charge from the insurance company. You can inform the insurance company or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by following the instructions provided by the insurance company or by contacting your financial intermediary. Your election to receive reports in paper will apply to all portfolio companies available under your contract with the insurance company.

This notice is not legally a part of the shareholder report.

Franklin Templeton Variable Insurance

Products Trust Annual Report

*Not part of the annual report. Retain for your records.

|

| |

| Not FDIC Insured | May Lose Value | No Bank Guarantee |

MASTER CLASS – 1

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

Important Notes to

Performance Information

Performance data is historical and cannot predict or guarantee future results. Principal value and investment return will fluctuate with market conditions, and you may have a gain or loss when you withdraw your money. Inception dates of the funds may have preceded the effective dates of the subaccounts, contracts or their availability in all states.

When reviewing the index comparisons, please keep in mind that indexes have a number of inherent performance differentials over the funds. First, unlike the funds, which must hold a minimum amount of cash to maintain liquidity, indexes do not

have a cash component. Second, the funds are actively managed and, thus, are subject to management fees to cover salaries of securities analysts or portfolio managers in addition to other expenses. Indexes are unmanaged and do not include any commissions or other expenses typically associated with investing in securities. Third, indexes often contain a different mix of securities than the fund to which they are compared. Additionally, please remember that indexes are simply a measure of performance and cannot be invested in directly.

VIP P1 07/18

SUPPLEMENT DATED JULY 10, 2018

TO THE PROSPECTUS DATED MAY 1, 2018

OF

FRANKLIN FLEX CAP GROWTH VIP FUND

FRANKLIN FOUNDING FUNDS ALLOCATION VIP FUND

FRANKLIN GLOBAL REAL ESTATE VIP FUND

FRANKLIN GROWTH AND INCOME VIP FUND

FRANKLIN INCOME VIP FUND

FRANKLIN LARGE CAP GROWTH VIP FUND

FRANKLIN MUTUAL GLOBAL DISCOVERY VIP FUND

FRANKLIN MUTUAL SHARES VIP FUND

FRANKLIN RISING DIVIDENDS VIP FUND

FRANKLIN SMALL CAP VALUE VIP FUND

FRANKLINSMALL-MID CAP GROWTH VIP FUND

FRANKLIN STRATEGIC INCOME VIP FUND

FRANKLIN U.S. GOVERNMENT SECURITIES VIP FUND

FRANKLIN VOLSMART ALLOCATION VIP FUND

TEMPLETON DEVELOPING MARKETS VIP FUND

TEMPLETON FOREIGN VIP FUND

TEMPLETON GLOBAL BOND VIP FUND

TEMPLETON GROWTH VIP FUND

(EACHASERIESOF FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST)

I. The following replaces the third paragraph in the prospectus under “Additional Information, All Funds – Fund Account Information – Fund Account Policies – Calculating Share Price:”

The Fund calculates the NAV per share each business day as of 1 p.m. Pacific time or the regularly scheduled close of the New York Stock Exchange (NYSE), whichever is earlier. The Fund does not calculate the NAV on days the NYSE is closed for trading, which include New Year’s Day, Martin Luther King Jr. Day, President’s Day, Good Friday, Memorial Day, Independence Day, Labor Day, Thanksgiving Day and Christmas Day. If the NYSE has a scheduled early close, the Fund’s share price would be determined as of the time of the close of the NYSE. If, due to weather or other special or unexpected circumstances, the NYSE has an unscheduled early close on a day that it has opened for business, the Fund reserves the right to consider that day as a regular business day and accept purchase and redemption orders and calculate its share price as of the normally scheduled close of regular trading on the NYSE.

Please keep this supplement with your prospectus for future reference.

This page intentionally left blank.

Franklin Founding Funds Allocation VIP Fund

This annual report for Franklin Founding Funds Allocation VIP Fund covers the fiscal year ended December 31, 2018.

Class 1 Performance Summary as of December 31, 2018

Average annual total return of Class 1 shares* represents the average annual change in value, assuming reinvestment of dividends and capital gains. Average returns smooth out variations in returns, which can be significant; they are not the same asyear-by-year results.

| | | | | | | | | | | | |

| | | |

| Periods ended 12/31/18 | | 1-Year | | | 5-Year | | | 10-Year | |

Average Annual Total Return | | | -9.34% | | | | +2.26% | | | | +8.62% | |

*The Fund has an expense reduction contractually guaranteed through 4/30/19. Fund investment results reflect the expense reduction; without this reduction, the results would have been lower.

Performance reflects the Fund’s Class 1 operating expenses, but doesnotinclude any contract fees, expenses or sales charges. If they had been included, performance would be lower. These charges and deductions, particularly for variable life policies, can have a significant effect on contract values and insurance benefits. See the contract prospectus for a complete description of these expenses, including sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown.

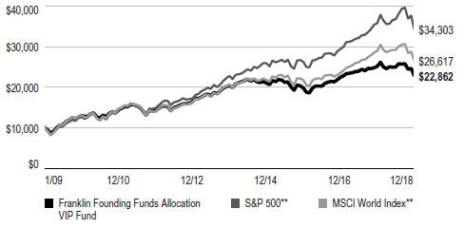

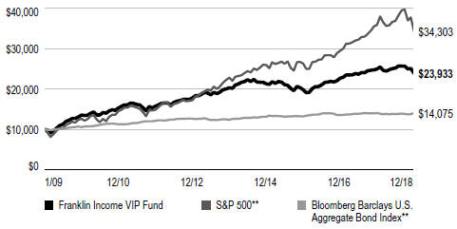

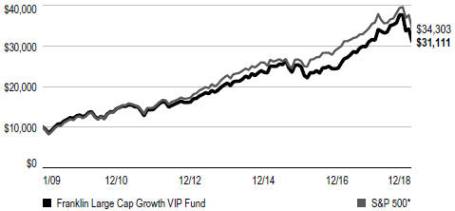

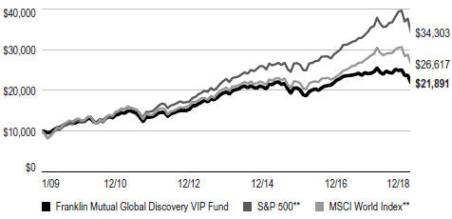

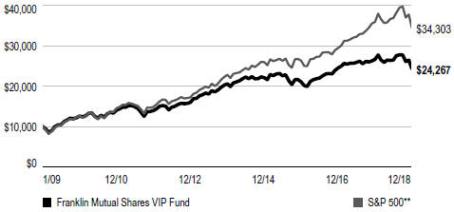

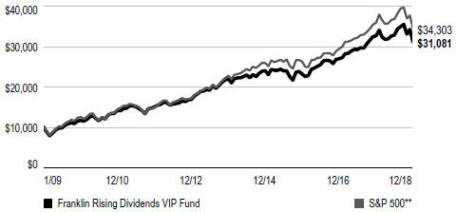

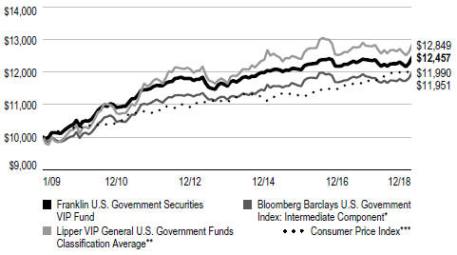

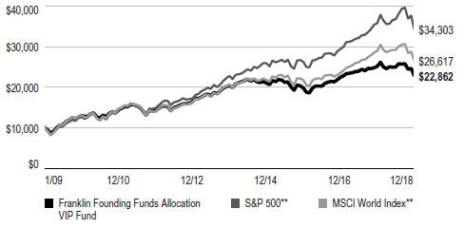

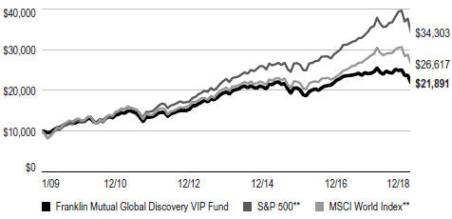

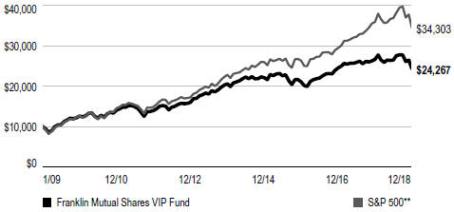

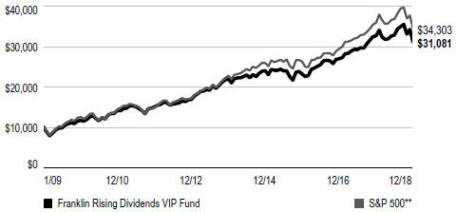

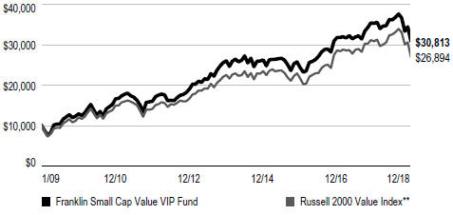

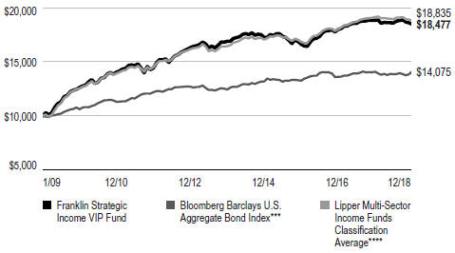

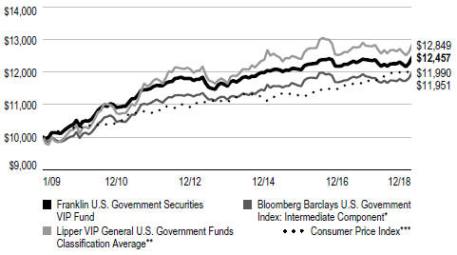

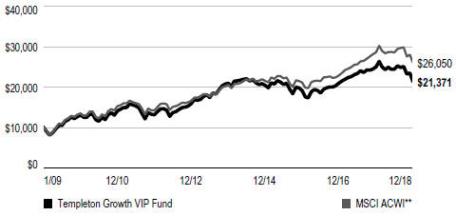

Total Return Index Comparison for a Hypothetical $10,000 Investment (1/1/09–12/31/18)

The graph below shows the change in value of a hypothetical $10,000 investment in the Fund over the indicated period and includes reinvestment of any income or distributions. The Fund’s performance* is compared to the performance of the Standard & Poor’s® 500 Index (S&P 500®) and the MSCI World Index. One cannot invest directly in an index, and an index is not representative of the Fund��s portfolio.Please see Important Notes to Performance Information preceding the Fund Summaries.

**Source: Morningstar. Please see Index Descriptions following the Fund Summaries.

FRANKLIN FOUNDING FUNDS ALLOCATION VIP FUND

Fund Goal and Main Investments

The Fund seeks capital appreciation, with income as a secondary goal. Under normal market conditions, the Fund invests equal portions in Class 1 shares of Franklin Income VIP Fund, Franklin Mutual Shares VIP Fund and Templeton Growth VIP Fund.

Fund Risks

All investments involve risks, including possible loss of principal. Because the Fund invests in underlying funds, and the Fund’s performance is directly related to the performance of the underlying funds held by it, the ability of the Fund to achieve its investment goals is directly related to the ability of the underlying funds to meet their investment goals. Additionally, because these underlying funds may engage in a variety of investment strategies involving certain risks, the Fund may be subject to these same risks. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bonds are affected by changes in interest rates and the creditworthiness of their issuers. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds adjust to a rise in interest rates, the Fund’s share price may decline. Higher yielding, lower rated corporate bonds entail a greater degree of credit risk compared to investment-grade securities. Foreign investing carries additional risks such as currency and market volatility and political or social instability, risks that are heightened in developing countries. Value securities may not increase in price as anticipated or may decline further in value. The Fund’s prospectus also includes a description of the main investment risks.

Performance Overview

You can find the Fund’sone-year total return in the Performance Summary. In comparison, the S&P 500 had a-4.38% total return and the MSCI World Index had a-8.20% total return for the same period.1

Economic and Market Overview

The global economy expanded during the 12 months under review, despite weakness in certain regions. Global developed and emerging market stocks were aided at certain points during

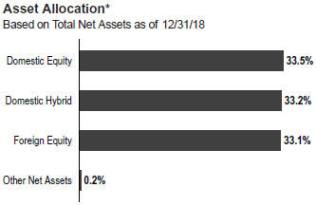

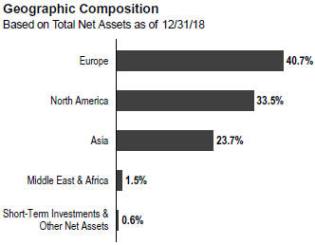

*The asset allocation is based on the Statement of Investments (SOI), which classifies each underlying fund into a broad asset class.

the period by higher crude oil prices, upbeat economic data, easing trade tensions and encouraging corporate earnings reports, as well as indications of a slower pace of interest-rate increases from the U.S. Federal Reserve (Fed).

However, various factors weighed on global markets during the period, including concerns about tighter regulation of technology companies, political uncertainties in the U.S. and the European Union, and major central banks’ interest-rate path and unwinding of monetary stimulus measures. Markets were further pressured by U.S. trade disputes with its allies and China, and their impact on global growth and corporate earnings. In this environment, global stocks, as measured by the MSCI All Country World Index, had a-8.93% total return for the 12 months ended December 31, 2018.1

The U.S. economy grew during the12-month period. After moderating for three consecutive quarters, the economy grew faster in 2018’s second quarter, driven by consumer spending, business investment, exports and government spending. However, growth moderated in the third quarter due to declines in exports and housing investment. The unemployment rate declined from 4.1% in December 2017 to 3.9% at period-end.2 Annual inflation, as measured by the Consumer Price Index, decreased from 2.1% in December 2017 to 1.9% at period-end.2 The Fed raised its target range for the federal funds rate four times during the period, to 2.25%–2.50%, and continued reducing its balance sheet as part of an ongoing plan to normalize monetary policy. At its December meeting, the

1. Source: Morningstar.

One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio. Please see Index Descriptions following the Fund Summaries.

2. Source: US Bureau of Labor Statistics.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

FRANKLIN FOUNDING FUNDS ALLOCATION VIP FUND

Fed reduced the projected 2019 rate increases to two, compared to three projected previously.

In Europe, the U.K.’s quarterly economic growth moderated in 2018’s first quarter, but accelerated in 2018’s second and third quarters. The Bank of England raised its key policy rate once during the review period. After moderating in 2018’s first quarter, the eurozone’s quarterly growth remained stable in the second quarter, but eased in the third quarter. The bloc’s annual inflation rate ended the period higher than in December 2017. The European Central Bank (ECB) kept its benchmark interest rate unchanged during the period. In December 2018, the ECB confirmed its plan to conclude its bond purchase program at the end of 2018 and reiterated it expects key interest rates to remain unchanged through the summer of 2019.

In Asia, Japan’s quarterly gross domestic product (GDP) grew in 2018’s second quarter, following a contraction in the first quarter, but contracted again in the third quarter. The Bank of Japan left its benchmark interest rate unchanged during the period and continued its monetary stimulus measures.

In emerging markets, Brazil’s quarterly GDP growth remained stable in 2018’s first and second quarters, but accelerated in the third quarter. The Central Bank of Brazil lowered its benchmark interest rate twice during the period. Russia’s annual GDP growth rate accelerated in 2018’s first and second quarters, but moderated in the third quarter. After lowering its key rate twice early in the period, the Bank of Russia raised it twice in the period’s second half to curtail inflation risks. China’s annual GDP grew at a stable rate in 2018’s first quarter, but it moderated in the second and third quarters. The People’s Bank of China left its benchmark interest rate unchanged during the period, but it took measures to improve financial liquidity to mitigate the negative effects of the U.S.-China trade dispute and support economic growth. Overall, emerging market stocks, as measured by the MSCI Emerging Markets Index, had a-14.25% total return during the period.1

Investment Strategy

The Fund normally invests its assets in an equally weighted combination of Class 1 shares of Franklin Income VIP Fund, Franklin Mutual Shares VIP Fund and Templeton Growth VIP Fund. These underlying funds, in turn, invest in a variety of U.S. and foreign equity securities and, to a lesser extent, fixed income and money market securities, each following a value-oriented approach. As market conditions affect the underlying funds, we rebalance the Fund’s allocations seeking to maintain equal weightings of approximately 331⁄3% of total net assets in each underlying fund whenever the actual

allocations exceed plus or minus 3% of the fixed allocation percentages.

Manager’s Discussion

The Fund’s performance can be attributed largely to its allocation among the underlying funds and their investments in domestic and foreign equities, fixed income securities, and short-term investments and other net assets.

During the 12 months under review, Franklin Income VIP Fund – Class 1 performed in line with the S&P 500 and Franklin Mutual Shares VIP Fund – Class 1 underperformed the index. Templeton Growth VIP Fund – Class 1 underperformed the MSCI World Index.

Thank you for your participation in Franklin Founding Funds Allocation VIP Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of December 31, 2018, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

FRANKLIN FOUNDING FUNDS ALLOCATION VIP FUND

Class 1 Fund Expenses

As an investor in a variable insurance contract (Contract) that indirectly provides for investment in an underlying mutual fund, you can incur transaction and/or ongoing expenses at both the Fund level and the Contract Level: (1) transaction expenses can include sales charges (loads) on purchases, surrender fees, transfer fees and premium taxes; and (2) ongoing expenses can include management fees, distribution and service (12b-1) fees, contract fees, annual maintenance fees, mortality and expense risk fees and other fees and expenses. All mutual funds and Contracts have some types of ongoing expenses. The table below shows Fund-level ongoing expenses and can help you understand these costs and compare them with those of other mutual funds offered through the Contract. The table assumes a $1,000 investment held for the six months indicated. Please refer to the Fund prospectus for additional information on operating expenses.

Actual Fund Expenses

The table below provides information about the actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of ongoing Fund expenses but does not include the effect of ongoing Contract expenses, is used to calculate the “Ending Account Value.” You can estimate the Fund-level expenses you paid during the period by following these steps (ofcourse, your account value and expenses will differ from those in this illustration):Divide your account value by $1,000 (ifyour account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number under the headings “Actual” and “Fund-Level Expenses Paid During Period” (ifFund-Level Expenses Paid During Period were $ 7.50, then 8.6 × $7.50 = $64.50). In this illustration, the estimated expenses paid this period at the Fund level are $64.50.

Hypothetical Example for Comparison with Other Mutual Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other mutual funds offered through the Contract. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds offered through the Contract.

Please note that expenses shown in the table are meant to highlight ongoing costs at the Fund level only and do not reflect any ongoing expenses at the Contract level, or transaction expenses at either the Fund or Contract levels. In addition, while the Fund does not have transaction expenses, if the transaction and ongoing expenses at the Contract level were included, the expenses shown below would be higher. You should consult your Contract prospectus or disclosure document for more information.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | Actual (actual return after expenses) | | | | | | Hypothetical (5% annual return before expenses) | | | | | | | |

| | | | | | | | |

Share Class | | Beginning Account

Value 7/1/18 | | | Ending Account

Value 12/31/18 | | | Fund-Level Expenses

Paid During Period

7/1/18–12/31/181,2 | | | | | | Ending Account

Value 12/31/18 | | | Fund-Level Expenses

Paid During Period

7/1/18–12/31/181,2 | | | | | | Net

Annualized

Expense

Ratio2 | |

Class 1 | | | $1,000 | | | | $913.90 | | | | $0.48 | | | | | | | | $1,024.70 | | | | $0.51 | | | | | | | | 0.10% | |

1. Expenses are equal to the annualized expense ratio for thesix-month period as indicated above — in the far right column — multiplied by the simple average account value over the period indicated, and then multiplied by 184/365 to reflect theone-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include any ongoing expenses of the Contract for which the Fund is an investment option or acquired fund fees and expenses.

FFA P1 11/18

SUPPLEMENT DATED NOVEMBER 5, 2018

TO THE PROSPECTUS

DATED MAY 1, 2018

OF

FRANKLIN FOUNDING FUNDS ALLOCATION VIP FUND

(ASERIESOF FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST)

The prospectus is amended as follows:

I. The Board of Trustees of Franklin Templeton Variable Insurance Products Trust (Trust) recently approved a proposal to reposition the Franklin Founding Funds Allocation VIP Fund (Fund), a series of the Trust, subject to shareholder approval of certain matters. Among other things, the repositioning of the Fund as a directly managed allocation fund would involve entering into investment management andsub-advisory arrangements with various Franklin Templeton advisers, changing the name of the Fund to the “Franklin Allocation VIP Fund” and modifying the Fund’s principal investment strategies.

It is anticipated that in December 2018 shareholders of the Fund will receive a proxy statement requesting their votes on certain proposals related to the repositioning and other matters. If such proposals are approved by the Fund’s shareholders, the repositioning is currently expected to be completed on or about May 1, 2019.

The Fund reserves the right to change the above at any time.

Please keep this supplement with your prospectus for future reference.

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

Financial Highlights

Franklin Founding Funds Allocation VIP Fund

| | | | | | | | | | | | | | | | | | | | |

| |

| | | Year Ended December 31, | |

| | | | | |

| | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

| Class 1 | | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(for a share outstanding throughout the year) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, beginning of year | | | $ 7.44 | | | | $ 7.13 | | | | $ 6.80 | | | | $ 7.47 | | | | $ 7.47 | |

| | | | |

| | | | | |

| Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment incomeb,c | | | 0.23 | | | | 0.21 | | | | 0.21 | | | | 0.26 | | | | 0.22 | |

| | | | | |

Net realized and unrealized gains (losses) | | | (0.89 | ) | | | 0.63 | | | | 0.64 | | | | (0.68 | ) | | | 0.02 | |

| | | | |

Total from investment operations | | | (0.66 | ) | | | 0.84 | | | | 0.85 | | | | (0.42 | ) | | | 0.24 | |

| | | | |

| | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income | | | (0.24 | ) | | | (0.22 | ) | | | (0.29 | ) | | | (0.24 | ) | | | (0.23 | ) |

| | | | | |

Net realized gains | | | (0.17 | ) | | | (0.31 | ) | | | (0.23 | ) | | | (0.01 | ) | | | (0.01 | ) |

| | | | |

Total distributions | | | (0.41 | ) | | | (0.53 | ) | | | (0.52 | ) | | | (0.25 | ) | | | (0.24 | ) |

| | | | |

Net asset value, end of year | | | $ 6.37 | | | | $ 7.44 | | | | $ 7.13 | | | | $ 6.80 | | | | $ 7.47 | |

| | | | |

| | | | | |

Total returnd | | | (9.34)% | | | | 12.17% | | | | 13.43% | | | | (5.93)% | | | | 3.05% | |

| | | | | |

| Ratios to average net assets | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses before waiver and payments by affiliatese | | | 0.12% | | | | 0.12% | | | | 0.11% | | | | 0.11% | | | | 0.11% | |

| | | | | |

Expenses net of waiver and payments by affiliatese | | | 0.10% | | | | 0.10% | | | | 0.10% | | | | 0.10% | | | | 0.10% | |

| | | | | |

Net investment incomec | | | 3.13% | | | | 2.75% | | | | 3.09% | | | | 3.51% | | | | 2.88% | |

| | | | | |

| Supplemental data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of year (000’s) | | | $984 | | | | $1,047 | | | | $1,025 | | | | $1,083 | | | | $1,114 | |

| | | | | |

Portfolio turnover rate | | | 2.23% | | | | 1.28% | | | | 0.10% | | | | 0.26% | | | | 4.80% | |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cRecognition of net investment income by the Fund is affected by the timing of declaration of dividends by the Underlying Funds in which the Fund invests.

dTotal return does not include fees, charges or expenses imposed by the variable annuity and life insurance contracts for which Franklin Templeton Variable Insurance Products Trust serves as an underlying investment vehicle.

eDoes not include expenses of the Underlying Funds in which the Fund invests. The weighted average indirect expenses of the Underlying Funds was 0.66% for the year ended December 31, 2018.

| | | | |

| | | |

| FFA-6 | | Annual Report | The accompanying notes are an integral part of these financial statements. | | |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FINANCIAL HIGHLIGHTS

Franklin Founding Funds Allocation VIP Fund(continued)

| | | | | | | | | | | | | | | | | | | | |

| |

| | | Year Ended December 31, | |

| | | | | |

| | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

Class 2 | | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(for a share outstanding throughout the year) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, beginning of year | | | $ 7.39 | | | | $ 7.08 | | | | $ 6.75 | | | | $ 7.42 | | | | $ 7.42 | |

| | | | |

| | | | | |

| Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment incomeb,c | | | 0.21 | | | | 0.18 | | | | 0.19 | | | | 0.24 | | | | 0.20 | |

| | | | | |

Net realized and unrealized gains (losses) | | | (0.89 | ) | | | 0.64 | | | | 0.64 | | | | (0.68 | ) | | | 0.02 | |

| | | | |

Total from investment operations | | | (0.68 | ) | | | 0.82 | | | | 0.83 | | | | (0.44 | ) | | | 0.22 | |

| | | | |

| | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income | | | (0.22 | ) | | | (0.20 | ) | | | (0.27 | ) | | | (0.22 | ) | | | (0.21 | ) |

| | | | | |

Net realized gains | | | (0.17 | ) | | | (0.31 | ) | | | (0.23 | ) | | | (0.01 | ) | | | (0.01 | ) |

| | | | |

Total distributions | | | (0.39 | ) | | | (0.51 | ) | | | (0.50 | ) | | | (0.23 | ) | | | (0.22 | ) |

| | | | |

Net asset value, end of year | | | $ 6.32 | | | | $ 7.39 | | | | $ 7.08 | | | | $ 6.75 | | | | $ 7.42 | |

| | | | |

| | | | | |

Total returnd | | | (9.65)% | | | | 11.98% | | | | 13.18% | | | | (6.21)% | | | | 2.85% | |

| | | | | |

| Ratios to average net assets | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses before waiver and payments by affiliatese | | | 0.37% | | | | 0.37% | | | | 0.36% | | | | 0.36% | | | | 0.36% | |

| | | | | |

Expenses net of waiver and payments by affiliatese | | | 0.35% | | | | 0.35% | | | | 0.35% | | | | 0.35% | | | | 0.35% | |

| | | | | |

Net investment incomec | | | 2.88% | | | | 2.50% | | | | 2.84% | | | | 3.26% | | | | 2.63% | |

| | | | | |

| Supplemental data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of year (000’s) | | | $390,300 | | | | $480,402 | | | | $474,669 | | | | $480,715 | | | | $557,704 | |

| | | | | |

Portfolio turnover rate | | | 2.23% | | | | 1.28% | | | | 0.10% | | | | 0.26% | | | | 4.80% | |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cRecognition of net investment income by the Fund is affected by the timing of declaration of dividends by the Underlying Funds in which the Fund invests.

dTotal return does not include fees, charges or expenses imposed by the variable annuity and life insurance contracts for which Franklin Templeton Variable Insurance Products Trust serves as an underlying investment vehicle.

eDoes not include expenses of the Underlying Funds in which the Fund invests. The weighted average indirect expenses of the Underlying Funds was 0.66% for the year ended December 31, 2018.

| | | | | | |

| | | |

| | The accompanying notes are an integral part of these financial statements. | Annual Report | | | FFA-7 | |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FINANCIAL HIGHLIGHTS

Franklin Founding Funds Allocation VIP Fund(continued)

| | | | | | | | | | | | | | | | | | | | |

| |

| | | Year Ended December 31, | |

| | | | | |

| | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

| Class 4 | | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(for a share outstanding throughout the year) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, beginning of year | | | $ 7.53 | | | | $ 7.21 | | | | $ 6.87 | | | | $ 7.54 | | | | $ 7.54 | |

| | | | |

| | | | | |

| Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment incomeb,c | | | 0.20 | | | | 0.18 | | | | 0.19 | | | | 0.23 | | | | 0.20 | |

| | | | | |

Net realized and unrealized gains (losses) | | | (0.89 | ) | | | 0.64 | | | | 0.64 | | | | (0.68 | ) | | | 0.02 | |

| | | | |

Total from investment operations | | | (0.69 | ) | | | 0.82 | | | | 0.83 | | | | (0.45 | ) | | | 0.22 | |

| | | | |

| | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income | | | (0.21 | ) | | | (0.19 | ) | | | (0.26 | ) | | | (0.21 | ) | | | (0.21 | ) |

| | | | | |

Net realized gains | | | (0.17 | ) | | | (0.31 | ) | | | (0.23 | ) | | | (0.01 | ) | | | (0.01 | ) |

| | | | |

Total distributions | | | (0.38 | ) | | | (0.50 | ) | | | (0.49 | ) | | | (0.22 | ) | | | (0.22 | ) |

| | | | |

Net asset value, end of year | | | $ 6.46 | | | | $ 7.53 | | | | $ 7.21 | | | | $ 6.87 | | | | $ 7.54 | |

| | | | |

| | | | | |

Total returnd | | | (9.58)% | | | | 11.78% | | | | 12.92% | | | | (6.24)% | | | | 2.75% | |

| | | | | |

| Ratios to average net assets | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses before waiver and payments by affiliatese | | | 0.47% | | | | 0.47% | | | | 0.46% | | | | 0.46% | | | | 0.46% | |

| | | | | |

Expenses net of waiver and payments by affiliatese | | | 0.45% | | | | 0.45% | | | | 0.45% | | | | 0.45% | | | | 0.45% | |

| | | | | |

Net investment incomec | | | 2.78% | | | | 2.40% | | | | 2.74% | | | | 3.16% | | | | 2.53% | |

| | | | | |

| Supplemental data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of year (000’s) | | | $393,385 | | | | $528,862 | | | | $530,403 | | | | $550,825 | | | | $702,324 | |

| | | | | |

Portfolio turnover rate | | | 2.23% | | | | 1.28% | | | | 0.10% | | | | 0.26% | | | | 4.80% | |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cRecognition of net investment income by the Fund is affected by the timing of declaration of dividends by the Underlying Funds in which the Fund invests.

dTotal return does not include fees, charges or expenses imposed by the variable annuity and life insurance contracts for which Franklin Templeton Variable Insurance Products Trust serves as an underlying investment vehicle.

eDoes not include expenses of the Underlying Funds in which the Fund invests. The weighted average indirect expenses of the Underlying Funds was 0.66% for the year ended December 31, 2018.

| | | | |

| | | |

| FFA-8 | | Annual Report | The accompanying notes are an integral part of these financial statements. | | |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

Statement of Investments, December 31, 2018

| | | | | | | | | | |

Franklin Founding Funds Allocation VIP Fund | |

| | | | | Shares | | | Value | |

| | | |

| | Investments in Underlying Funds 99.8% | | | | | | | | |

| | | Domestic Equity 33.5% | | | | | | |

| a | | Franklin Mutual Shares VIP Fund, Class 1 | | | 14,842,790 | | | $ | 262,865,813 | |

| | | | | | | | | | |

| | | Domestic Hybrid 33.2% | | | | | | |

| a | | Franklin Income VIP Fund, Class 1 | | | 17,074,938 | | | | 260,563,549 | |

| | | | | | | | | | |

| | | Foreign Equity 33.1% | | | | | | |

| a | | Templeton Growth VIP Fund, Class 1 | | | 20,860,740 | | | | 259,507,605 | |

| | | | | | | | | | |

| | | |

| | Total Investments in Underlying Funds (Cost $ 638,939,461) | | | | | | | 782,936,967 | |

| | | |

| | Other Assets, less Liabilities 0.2% | | | | | | | 1,731,903 | |

| | | | | | | | | | |

| | | |

| | Net Assets 100.0% | | | | | | $ | 784,668,870 | |

| | | | | | | | | | |

aSee Note 3(d) regarding investments in Underlying Funds.

| | | | | | |

| | | |

| | The accompanying notes are an integral part of these financial statements. | Annual Report | | | FFA-9 | |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

Financial Statements

Statement of Assets and Liabilities

December 31, 2018

| | | | |

| |

| | | Franklin Founding

Funds Allocation

VIP Fund | |

Assets: | | | | |

Investments in securities: | | | | |

Cost - Controlled affiliates (Note 3d) | | $ | 202,630,726 | |

Cost -Non-controlled affiliates (Note 3d) | | | 436,308,735 | |

| | | | |

Value - Controlled affiliates (Note 3d) | | $ | 259,507,605 | |

Value -Non-controlled affiliates (Note 3d) | | | 523,429,362 | |

Cash | | | 1,652,238 | |

Receivables: | | | | |

Investment securities sold | | | 100,000 | |

Capital shares sold | | | 915,922 | |

Other assets | | | 116 | |

| | | | |

Total assets | | | 785,605,243 | |

| | | | |

Liabilities: | | | | |

Payables: | | | | |

Capital shares redeemed | | | 383,351 | |

Administrative fees | | | 60,130 | |

Distribution fees | | | 414,196 | |

Reports to shareholders | | | 48,959 | |

Accrued expenses and other liabilities | | | 29,737 | |

| | | | |

Total liabilities | | | 936,373 | |

| | | | |

Net assets, at value | | $ | 784,668,870 | |

| | | | |

Net assets consist of: | | | | |

Paid-in capital | | $ | 598,839,513 | |

Total distributable earnings (loss) | | | 185,829,357 | |

| | | | |

Net assets, at value | | $ | 784,668,870 | |

| | | | |

| |

| Class 1: | | | | |

Net assets, at value | | $ | 984,078 | |

| | | | |

Shares outstanding | | | 154,435 | |

| | | | |

Net asset value and maximum offering price per share | | $ | 6.37 | |

| | | | |

| |

| Class 2: | | | | |

Net assets, at value | | $ | 390,300,175 | |

| | | | |

Shares outstanding | | | 61,729,115 | |

| | | | |

Net asset value and maximum offering price per share | | $ | 6.32 | |

| | | | |

| |

| Class 4: | | | | |

Net assets, at value | | $ | 393,384,617 | |

| | | | |

Shares outstanding | | | 60,922,444 | |

| | | | |

Net asset value and maximum offering price per share | | $ | 6.46 | |

| | | | |

| | | | |

| | | |

| FFA-10 | | Annual Report | The accompanying notes are an integral part of these financial statements. | | |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FINANCIAL STATEMENTS

Statement of Operations

for the year ended December 31, 2018

| | | | |

| |

| | | Franklin Founding

Funds Allocation

VIP Fund | |

Investment income: | | | | |

Dividends: | | | | |

Controlled affiliates (Note 3d) | | $ | 6,862,014 | |

Non-controlled affiliates (Note 3d) | | | 23,048,469 | |

| | | | |

Total investment income | | | 29,910,483 | |

| | | | |

Expenses: | | | | |

Administrative fees (Note 3a) | | | 925,679 | |

Distribution fees: (Note 3b) | | | | |

Class 2 | | | 1,122,300 | |

Class 4 | | | 1,671,408 | |

Reports to shareholders | | | 82,848 | |

Professional fees | | | 37,428 | |

Trustees’ fees and expenses | | | 6,835 | |

Other | | | 20,588 | |

| | | | |

Total expenses | | | 3,867,086 | |

Expenses waived/paid by affiliates (Note 3e) | | | (145,358 | ) |

| | | | |

Net expenses | | | 3,721,728 | |

| | | | |

Net investment income | | | 26,188,755 | |

| | | | |

Realized and unrealized gains (losses): | | | | |

Net realized gain (loss) from: | | | | |

Investments: | | | | |

Controlled affiliates (Note 3d) | | | 8,019,382 | |

Non-controlled affiliates (Note 3d) | | | 12,999,950 | |

Capital gain distributions from Underlying Funds: | | | | |

Controlled affiliates (Note 3d) | | | 25,478,331 | |

Non-controlled affiliates (Note 3d) | | | 10,870,531 | |

| | | | |

Net realized gain (loss) | | | 57,368,194 | |

| | | | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments: | | | | |

Controlled affiliates (Note 3d) | | | (83,880,006 | ) |

Non-controlled affiliates (Note 3d) | | | (82,426,366 | ) |

| | | | |

Net change in unrealized appreciation (depreciation) | | | (166,306,372 | ) |

| | | | |

Net realized and unrealized gain (loss) | | | (108,938,178 | ) |

| | | | |

Net increase (decrease) in net assets resulting from operations | | $ | (82,749,423 | ) |

| | | | |

| | | | | | |

| | | |

| | The accompanying notes are an integral part of these financial statements. | Annual Report | | | FFA-11 | |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FINANCIAL STATEMENTS

Statements of Changes in Net Assets

| | | | | | | | |

| |

| | | Franklin Founding Funds Allocation VIP Fund | |

| |

| | | Year Ended December 31, | |

| | |

| | | 2018 | | | 2017 | |

Increase (decrease) in net assets: | | | | | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 26,188,755 | | | $ | 25,006,932 | |

Net realized gain (loss) | | | 57,368,194 | | | | 32,208,741 | |

Net change in unrealized appreciation (depreciation) | | | (166,306,372 | ) | | | 57,408,783 | |

| | | | |

Net increase (decrease) in net assets resulting from operations | | | (82,749,423 | ) | | | 114,624,456 | |

| | | | |

Distributions to shareholders: (Note 1c) | | | | | | | | |

Class 1 | | | (60,348 | ) | | | (77,907 | ) |

Class 2 | | | (24,442,861 | ) | | | (33,015,869 | ) |

Class 4 | | | (24,951,975 | ) | | | (35,554,538 | ) |

| | | | |

Total distributions to shareholders | | | (49,455,184 | ) | | | (68,648,314 | ) |

| | | | |

Capital share transactions: (Note 2) | | | | | | | | |

Class 1 | | | 99,087 | | | | (23,477 | ) |

Class 2 | | | (25,472,556 | ) | | | (15,665,134 | ) |

Class 4 | | | (68,063,868 | ) | | | (26,073,212 | ) |

| | | | |

Total capital share transactions | | | (93,437,337 | ) | | | (41,761,823 | ) |

| | | | |

Net increase (decrease) in net assets | | | (225,641,944 | ) | | | 4,214,319 | |

Net assets: | | | | | | | | |

Beginning of year | | | 1,010,310,814 | | | | 1,006,096,495 | |

| | | | |

End of year (Note 1c) | | $ | 784,668,870 | | | $ | 1,010,310,814 | |

| | | | |

| | | | |

| | | |

| FFA-12 | | Annual Report | The accompanying notes are an integral part of these financial statements. | | |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

Notes to Financial Statements

Franklin Founding Funds Allocation VIP Fund

1. Organization and Significant Accounting Policies

Franklin Templeton Variable Insurance Products Trust (Trust) is registered under the Investment Company Act of 1940 (1940 Act) as anopen-end management investment company, consisting of eighteen separate funds and applies the specialized accounting and reporting guidance in U.S. Generally Accepted Accounting Principles (U.S. GAAP). Franklin Founding Funds Allocation VIP Fund (Fund) is included in this report. The Fund invests primarily in other funds of the Trust (Underlying Funds). Shares of the Fund are generally sold only to insurance company separate accounts to fund the benefits of variable life insurance policies or variable annuity contracts. The Fund offers three classes of shares: Class 1, Class 2 and Class 4. Each class of shares may differ by its distribution fees, voting rights on matters affecting a single class and its exchange privilege.

The accounting policies of the Underlying Funds are outlined in their respective shareholder reports. A copy of the Underlying Funds’ shareholder reports is available on the U.S. Securities and Exchange Commission (SEC) website at sec.gov. The Underlying Funds’ shareholder reports are not covered by this report.

The following summarizes the Fund’s significant accounting policies.

a. Financial Instrument Valuation

The Fund’s investments in financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. The Fund calculates the net asset value (NAV) per share each business day as of 4 p.m. Eastern time or the regularly scheduled close of the New York Stock Exchange (NYSE), whichever is earlier. Under compliance policies and procedures approved by the Trust’s Board of Trustees (the Board), the Fund’s administrator has responsibility for oversight of valuation, including leading the cross-functional Valuation Committee (VC). The Fund may utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Investments in the Underlying Funds are valued at their closing NAV each trading day.

b. Income Taxes

It is the Fund’s policy to qualify as a regulated investment company under the Internal Revenue Code. The Fund intends to distribute to shareholders substantially all of its taxable income and net realized gains to relieve it from federal income and if applicable, excise taxes. As a result, no provision for U.S. federal income taxes is required.

The Fund may recognize an income tax liability related to its uncertain tax positions under U.S. GAAP when the uncertain tax position has a less than 50% probability that it will be sustained upon examination by the tax authorities based on its technical merits. As of December 31, 2018, the Fund has determined that no tax liability is required in its financial statements related to uncertain tax positions for any open tax years (or expected to be taken in future tax years). Open tax years are those that remain subject to examination and are based on the statute of limitations in each jurisdiction in which the Fund invests.

c. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Estimated expenses are accrued daily. Dividend income and capital gain distributions by Underlying Funds are recorded on theex-dividend date. Distributions to shareholders are recorded on theex-dividend date. Distributable earnings are determined according to income tax regulations (tax basis) and may differ from earnings recorded in accordance with U.S. GAAP. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.*

Common expenses incurred by the Trust are allocated among the Funds based on the ratio of net assets of each Fund to the combined net assets of the Trust or based on the ratio of number of shareholders of each Fund to the combined number of shareholders of the Trust. Fund specific expenses are charged directly to the Fund that incurred the expense.

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

NOTES TO FINANCIAL STATEMENTS

Franklin Founding Funds Allocation VIP Fund(continued)

1. Organization and Significant Accounting Policies(continued)

c. Security Transactions, Investment Income, Expenses and Distributions(continued)

The Fund indirectly bears its proportionate share of expenses from the Underlying Funds. Since the Underlying Funds have varied expense levels and the Fund may own different proportions of the Underlying Funds at different times, the amount of expenses incurred indirectly by the Fund will vary.

Realized and unrealized gains and losses and net investment income, excluding class specific expenses, are allocated daily to each class of shares based upon the relative proportion of net assets of each class. Differences in per share distributions by class are generally due to differences in class specific expenses.

d. Accounting Estimates

The preparation of financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and

liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

e. Guarantees and Indemnifications

Under the Trust’s organizational documents, its officers and trustees are indemnified by the Trust against certain liabilities arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust, on behalf of the Fund, enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred. Currently, the Trust expects the risk of loss to be remote.

*Effective during the current reporting period, it is no longer required to present certain line items in the Statements of Changes in Net Assets. The below prior period amounts affected by this change are shown as they were in the prior year Statements of Changes in Net Assets.

For the year ended December 31, 2017, distributions to shareholders were as follows:

| | | | |

Distributions from net investment income: | | | | |

Class 1 | | $ | (32,261 | ) |

Class 2 | | | (12,990,591 | ) |

Class 4 | | | (13,655,260 | ) |

Distributions from net realized gains: | | | | |

Class 1 | | | (45,646 | ) |

Class 2 | | | (20,025,278 | ) |

Class 4 | | | (21,899,278 | ) |

For the year ended December 31, 2017, undistributed net investment income included in net assets was $27,465,052.

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

NOTES TO FINANCIAL STATEMENTS

Franklin Founding Funds Allocation VIP Fund(continued)

2. Shares of Beneficial Interest

At December 31, 2018, there were an unlimited number of shares authorized (without par value). Transactions in the Fund’s shares were as follows:

| | | | | | | | | | | | | | | | | | | | |

| |

| | | Year Ended December 31, | |

| | | |

| | | 2018 | | | | | | 2017 | |

| | | | | |

| | | Shares | | | Amount | | | | | | Shares | | | Amount | |

| | | | | |

| Class 1 Shares: | | | | | | | | | | | | | | | | | | | | |

Shares sold | | | 17,451 | | | $ | 125,360 | | | | | | | | 15,386 | | | $ | 112,506 | |

Shares issued in reinvestment of distributions | | | 8,536 | | | | 60,348 | | | | | | | | 11,035 | | | | 77,907 | |

Shares redeemed | | | (12,205 | ) | | | (86,621 | ) | | | | | | | (29,626 | ) | | | (213,890 | ) |

| | | | |

Net increase (decrease) | | | 13,782 | | | $ | 99,087 | | | | | | | | (3,205 | ) | | $ | (23,477 | ) |

| | | | |

| Class 2 Shares: | | | | | | | | | | | | | | | | | | | | |

Shares sold | | | 4,193,705 | | | $ | 28,329,864 | | | | | | | | 3,596,772 | | | $ | 26,184,474 | |

Shares issued in reinvestment of distributions | | | 3,476,936 | | | | 24,442,861 | | | | | | | | 4,703,115 | | | | 33,015,869 | |

Shares redeemed | | | (10,985,773 | ) | | | (78,245,281 | ) | | | | | | | (10,329,852 | ) | | | (74,865,477 | ) |

| | | | |

Net increase (decrease) | | | (3,315,132 | ) | | $ | (25,472,556 | ) | | | | | | | (2,029,965 | ) | | $ | (15,665,134 | ) |

| | | | |

| Class 4 Shares: | | | | | | | | | | | | | | | | | | | | |

Shares sold | | | 1,130,901 | | | $ | 8,277,821 | | | | | | | | 2,459,253 | | | $ | 18,233,389 | |

Shares issued in reinvestment of distributions | | | 3,475,205 | | | | 24,951,975 | | | | | | | | 4,965,718 | | | | 35,554,538 | |

Shares redeemed | | | (13,897,304 | ) | | | (101,293,664 | ) | | | | | | | (10,802,755 | ) | | | (79,861,139 | ) |

| | | | |

Net increase (decrease) | | | (9,291,198 | ) | | $ | (68,063,868 | ) | | | | | | | (3,377,784 | ) | | $ | (26,073,212 | ) |

| | | | |

3. Transactions with Affiliates

Franklin Resources, Inc. is the holding company for various subsidiaries that together are referred to as Franklin Templeton. Certain officers and/or trustees of the Fund are also officers and directors of the following subsidiaries:

| | |

| |

| Subsidiary | | Affiliation |

Franklin Templeton Services, LLC (FT Services) | | Administrative manager |

Franklin Templeton Distributors, Inc. (Distributors) | | Principal underwriter |

Franklin Templeton Investor Services, LLC (Investor Services) | | Transfer agent |

a. Administrative Fees

The Fund pays an administrative fee to FT Services of 0.10% per year of the average daily net assets of the Fund for administrative services including monitoring and rebalancing the percentage of the Fund’s investments in the Underlying Funds.

b. Distribution Fees

The Board has adopted distribution plans for Class 2 and Class 4 shares pursuant to Rule 12b-1 under the 1940 Act. Under the Fund’s compensation distribution plans, the Fund pays Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to 0.35% per year of its average daily net assets of each class. The Board has agreed to limit the current rate to 0.25% per year for Class 2. The plan year, for purposes of monitoring compliance with the maximum annual plan rates, is February 1 through January 31.

(continued)

3. Transactions with Affiliates(continued)

c. Transfer Agent Fees

Investor Services, under terms of an agreement, performs shareholder servicing for the Fund and is not paid by the Fund for the services.

d. Investments in Underlying Funds

The Fund invests in Underlying Funds which are managed by affiliates of the Fund’s administrative manager, FT Services. The Fund does not invest in Underlying Funds for the purpose of exercising a controlling influence over the management or policies.

Investments in Underlying Funds for the year ended December 31, 2018, were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Underlying Funds | | Number of Shares Held at Beginning of Year | | | Gross Additions | | | Gross Reductions | | | Number of Shares Held at End of Year | | | Value at End of Year | | | Dividend Income | | | Realized Gain (Loss) | | | Net Change in Unrealized Appreciation (Depreciation) | |

| Controlled Affiliates | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Templeton Growth VIP Fund, Class 1 | | | 20,714,775 | | | | 2,870,791 | | | | (2,724,826 | ) | | | 20,860,740 | | | $ | 259,507,605 | | | $ | 6,862,014 | | | $ | 33,497,713 | a | | $ | (83,880,006 | ) |

| | | | | | | | | | | | | | | | | | | | |

| Non-Controlled Affiliates | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Franklin Income VIP Fund, Class 1 | | | 20,134,973 | | | | 1,315,294 | | | | (4,375,329 | ) | | | 17,074,938 | | | | 260,563,549 | | | | 15,250,044 | | | | 5,211,707 | | | | (31,570,800 | ) |

Franklin Mutual Shares VIP Fund, Class 1 | | | 16,254,912 | | | | 1,268,701 | | | | (2,680,823 | ) | | | 14,842,790 | | | | 262,865,813 | | | | 7,798,425 | | | | 18,658,774 | a | | | (50,855,566 | ) |

| | | | | | | | | | | | | | | | | | | | |

TotalNon-Controlled Affiliates | | | | | | | | | | | | | | | | | | $ | 523,429,362 | | | $ | 23,048,469 | | | $ | 23,870,481 | | | $ | (82,426,366 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total Affiliated Securities | | | | | | | | | | | | | | | | | | $ | 782,936,967 | | | $ | 29,910,483 | | | $ | 57,368,194 | | | $ | (166,306,372 | ) |

| | | | | | | | | | | | | | | | | | | | |

aIncludes capital gain distributions received.

e. Waiver and Expense Reimbursements

FT Services has contractually agreed in advance to waive or limit its fees and to assume as its own expense certain expenses otherwise payable by the Fund so that the expenses (excluding distribution fees, and acquired fund fees and expenses) and certainnon-routine expenses or costs, including those relating to litigation, indemnification, reorganizations, and liquidations) for each class of the Fund do not exceed 0.10%, based on the average net assets of each class until April 30, 2019. Total expenses waived or paid are not subject to recapture subsequent to the Fund’s fiscal year end.

4. Income Taxes

The tax character of distributions paid during the years ended December 31, 2018 and 2017, was as follows:

| | | | | | | | |

| | |

| | | 2018 | | | 2017 | |

Distributions paid from: | | | | | | | | |

Ordinary income | | $ | 29,280,715 | | | $ | 28,262,149 | |

Long term capital gain | | | 20,174,469 | | | | 40,386,165 | |

| | | | |

| | $ | 49,455,184 | | | $ | 68,648,314 | |

| | | | |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

NOTES TO FINANCIAL STATEMENTS

Franklin Founding Funds Allocation VIP Fund(continued)

At December 31, 2018, the cost of investments, net unrealized appreciation (depreciation), undistributed ordinary income and undistributed long term capital gains for income tax purposes were as follows:

| | | | |

Cost of investments | | $ | 678,111,544 | |

| | | | |

Unrealized appreciation | | $ | 143,997,507 | |

Unrealized depreciation | | | (39,172,084 | ) |

| | | | |

Net unrealized appreciation (depreciation) | | $ | 104,825,423 | |

| | | | |

Distributable earnings: | | | | |

Undistributed ordinary income | | $ | 28,490,096 | |

Undistributed long term capital gains | | | 52,513,831 | |

| | | | |

Total distributable earnings | | $ | 81,003,927 | |

| | | | |

Differences between income and/or capital gains as determined on a book basis and a tax basis are primarily due to differing treatments of short term capital gains distributions from Underlying Funds and wash sales.

5. Investment Transactions

Purchases and sales of Underlying Funds (excluding short term securities) for the year ended December 31, 2018, aggregated $20,600,000 and $168,339,264, respectively.

6. Credit Facility

The Fund, together with other U.S. registered and foreign investment funds (collectively, Borrowers), managed by Franklin Templeton, are borrowers in a joint syndicated senior unsecured credit facility totaling $2 billion (Global Credit Facility) which matured on February 8, 2019. This Global Credit Facility provides a source of funds to the Borrowers for temporary and emergency purposes, including the ability to meet future unanticipated or unusually large redemption requests. Effective February 8, 2019, the Borrowers renewed the Global Credit Facility for a one year term, maturing February 7, 2020, for a total of $2 billion.

Under the terms of the Global Credit Facility, the Fund shall, in addition to interest charged on any borrowings made by the Fund and other costs incurred by the Fund, pay its share of fees and expenses incurred in connection with the implementation and maintenance of the Global Credit Facility, based upon its relative share of the aggregate net assets of all of the Borrowers, including an annual commitment fee of 0.15% based upon the unused portion of the Global Credit Facility. These fees are reflected in other expenses in the Statement of Operations. During the year ended December 31, 2018, the Fund did not use the Global Credit Facility.

7. Fair Value Measurements

The Fund follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Fund’s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Fund’s financial instruments and are summarized in the following fair value hierarchy:

| | • | | Level 1 – quoted prices in active markets for identical financial instruments |

| | • | | Level 2 – other significant observable inputs (including quoted prices for similar financial instruments, interest rates, prepayment speed, credit risk, etc.) |

| | • | | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of financial instruments) |

The input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level.

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

NOTES TO FINANCIAL STATEMENTS

Franklin Founding Funds Allocation VIP Fund(continued)

7. Fair Value Measurements(continued)

At December 31, 2018 , all of the Fund’s investments in financial instruments carried at fair value were valued using Level 1 inputs. For detailed categories, see the accompanying Statement of Investments.

8. Subsequent Events

The Fund has evaluated subsequent events through the issuance of the financial statements and determined that no events have occurred that require disclosure other than those already disclosed in the financial statements, except for the following:

On October 23, 2018, the Board approved a plan to reposition the Fund to a direct investment fund with an actively managed dynamic allocation strategy. This will involve entering into an investment management arrangement with Franklin Advisers, Inc. (Advisers) andsub-advisory arrangements with various Franklin Templeton affiliated advisers, changing the name of the Fund to “Franklin Allocation VIP Fund” and modifying the Fund’s principal investment strategies. The services to be provided by Advisers to the Fund will include investment advisory services as well as administrative services, for which the Fund would pay an overall investment management fee of 0.55%. Thesub-advisory fees are paid by Advisers and are not an additional expense to the Fund. The repositioning was approved by the shareholders on January 17, 2019 and is expected to be completed on or about May 1, 2019.

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Franklin Templeton Variable Insurance Products Trust and Shareholders of Franklin Founding Funds Allocation VIP Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the statement of investments, of Franklin Founding Funds Allocation VIP Fund (the “Fund”) as of December 31, 2018, the related statement of operations for the year ended December 31, 2018, the statement of changes in net assets for each of the two years in the period ended December 31, 2018, including the related notes, and the financial highlights for each of the five years in the period ended December 31, 2018 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2018, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended December 31, 2018 and the financial highlights for each of the five years in the period ended December 31, 2018 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of December 31, 2018 by correspondence with the transfer agent. We believe that our audits provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

San Francisco, California

February 15, 2019

We have served as the auditor of one or more investment companies in the Franklin Templeton Group of Funds since 1948.

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

Tax Information (unaudited)

Franklin Founding Funds Allocation VIP Fund

Under Section 852(b)(3)(C) of the Internal Revenue Code, the Fund hereby reports the maximum amount allowable but no less than $20,174,469 as a long term capital gain dividend for the fiscal year ended December 31, 2018.

Under Section 854(b)(1)(A) of the Internal Revenue Code, the Fund hereby reports 30.36% of the ordinary income dividends as income qualifying for the dividends received deduction for the fiscal year ended December 31, 2018.

During the year ended December 31, 2018, the Fund, a qualified fund of funds under Section 852(g)(2) of the Internal Revenue Code, received an allocation of foreign taxes paid from one or more of its underlying funds. The Fund elects to treat foreign taxes paid as allowed under Section 853 of the Internal Revenue Code. This election will allow shareholders of record as of the 2019 distribution date, to treat its proportionate share of foreign taxes paid by the underlying funds as having been paid directly by them. The shareholder shall consider these amounts as foreign taxes paid in the tax year in which they receive the Fund distribution.

Franklin Global Real Estate VIP Fund

This annual report for Franklin Global Real Estate VIP Fund covers the fiscal year ended December 31, 2018.

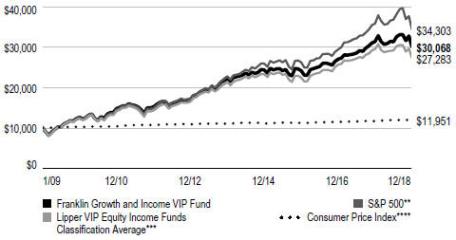

Class 1 Performance Summary as of December 31, 2018

Average annual total return of Class 1 shares represents the average annual change in value, assuming reinvestment of dividends and capital gains. Average returns smooth out variations in returns, which can be significant; they are not the same asyear-by-year results.

| | | | | | | | | | | | |

| | | |

| Periods ended 12/31/18 | | 1-Year | | | 5-Year | | | 10-Year | |

Average Annual Total Return | | | -6.52% | | | | +3.94% | | | | +8.09% | |

Performance reflects the Fund’s Class 1 operating expenses, but doesnotinclude any contract fees, expenses or sales charges. If they had been included, performance would be lower. These charges and deductions, particularly for variable life policies, can have a significant effect on contract values and insurance benefits. See the contract prospectus for a complete description of these expenses, including sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown.

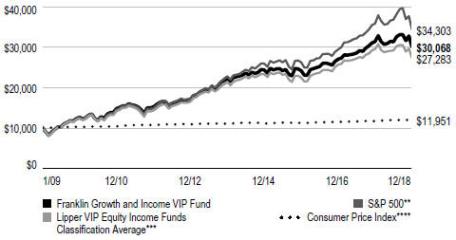

Total Return Index Comparison for a Hypothetical $10,000 Investment (1/1/09–12/31/18)

The graph below shows the change in value of a hypothetical $10,000 investment in the Fund over the indicated period and includes reinvestment of any income or distributions. The Fund’s performance is compared to the performance of the FTSE® EPRA®/NAREIT® Developed Index. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.Please see Important Notes to Performance Information preceding the Fund Summaries.

*Source: Morningstar. Please see Index Descriptions following the Fund Summaries.

FRANKLIN GLOBAL REAL ESTATE VIP FUND

Fund Goal and Main Investments

The Fund seeks high total return. Under normal market conditions, the Fund invests at least 80% of its net assets in investments of companies located anywhere in the world that operate in the real estate sector, including: real estate investment trusts (REITs) and similar REIT-like entities domiciled outside the U.S.; companies qualifying under U.S. federal tax law as REITs; and companies that derive at least half of their assets or revenues from the ownership, management, development or sale of residential or commercial real estate (such as real estate operating or service companies).

What is a REIT?

A REIT is a type of real estate company that is dedicated to owning and usually operating income-producing real estate properties such as apartments, hotels, industrial properties, office buildings or shopping centers. Equity REITs generally receive income from rents received, are generally operated by experienced property management teams and typically concentrate on a specific geographic region or property type.

Fund Risks

All investments involve risks, including possible loss of principal. The Fund concentrates in real estate securities, which involve special risks, such as declines in the value of real estate and increased susceptibility to adverse economic or regulatory developments affecting the sector. The Fund’s investments in REITs involve additional risks; since REITs typically are invested in a limited number of projects or in a particular market segment, they are more susceptible to adverse developments affecting a single project or market segment than more broadly diversified investments. Foreign investing, especially in emerging markets, involves additional risks such as currency and market volatility, as well as political and social instability. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

Performance Overview

You can find the Fund’s one-year total return in the Performance Summary. In comparison, the FTSE EPRA/NAREIT Developed Index had a -4.74% total return for the same period.1

Economic and Market Overview

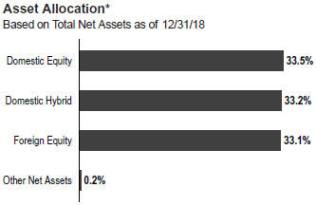

The global economy expanded during the 12 months under review, despite weakness in certain regions. Global developed and emerging market stocks were aided at certain points during the period by higher crude oil prices, upbeat economic data, easing trade tensions and encouraging corporate earnings reports, as well as indications of a slower pace of interest-rate increases from the U.S. Federal Reserve (Fed).

However, various factors weighed on global markets during the period, including concerns about tighter regulation of technology companies, political uncertainties in the U.S. and

1. Source: Morningstar.

One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio. Please see Index Descriptions following the Fund Summaries.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

FRANKLIN GLOBAL REAL ESTATE VIP FUND

the European Union, and major central banks’ interest-rate path and unwinding of monetary stimulus measures. Markets were further pressured by U.S. trade disputes with its allies and China, and their impact on global growth and corporate earnings. In this environment, global stocks, as measured by the MSCI All Country World Index, had a-8.93% total return for the 12 months ended December 31, 2018.1

The U.S. economy grew during the12-month period. After moderating for three consecutive quarters, the economy grew faster in 2018’s second quarter, driven by consumer spending, business investment, exports and government spending. However, growth moderated in the third quarter due to declines in exports and housing investment. The unemployment rate declined from 4.1% in December 2017 to 3.9% at period-end.2 Annual inflation, as measured by the Consumer Price Index, decreased from 2.1% in December 2017 to 1.9% at period-end.2 The Fed raised its target range for the federal funds rate four times during the period, to 2.25%–2.50%, and continued reducing its balance sheet as part of an ongoing plan to normalize monetary policy. At its December meeting, the Fed reduced the projected 2019 rate increases to two, compared to three projected previously.

In Europe, the U.K.’s quarterly economic growth moderated in 2018’s first quarter, but accelerated in 2018’s second and third quarters. The Bank of England raised its key policy rate once during the review period. After moderating in 2018’s first quarter, the eurozone’s quarterly growth remained stable in the second quarter, but eased in the third quarter. The bloc’s annual inflation rate ended the period higher than in December 2017. The European Central Bank (ECB) kept its benchmark interest rate unchanged during the period. In December 2018, the ECB confirmed its plan to conclude its bond purchase program at the end of 2018 and reiterated it expects key interest rates to remain unchanged through the summer of 2019.

In Asia, Japan’s quarterly gross domestic product (GDP) grew in 2018’s second quarter, following a contraction in the first quarter, but contracted again in the third quarter. The Bank of Japan left its benchmark interest rate unchanged during the period and continued its monetary stimulus measures.

In emerging markets, Brazil’s quarterly GDP growth remained stable in 2018’s first and second quarters, but accelerated in the third quarter. The Central Bank of Brazil lowered its benchmark interest rate twice during the period. Russia’s

| | | | |

| Top 10 Countries | | | |

| 12/31/18 | | | |

| |

| | | % of Total

Net Assets | |

| U.S. | | | 52.0% | |

| Japan | | | 10.9% | |

| Hong Kong | | | 7.8% | |

| Germany | | | 6.1% | |

| Australia | | | 5.5% | |

| U.K. | | | 4.9% | |

| Singapore | | | 3.2% | |

| France | | | 2.9% | |

| Sweden | | | 2.7% | |

| Canada | | | 2.2% | |

annual GDP growth rate accelerated in 2018’s first and second quarters, but moderated in the third quarter. After lowering its key rate twice early in the period, the Bank of Russia raised it twice in the period’s second half to curtail inflation risks. China’s annual GDP grew at a stable rate in 2018’s first quarter, but it moderated in the second and third quarters. The People’s Bank of China left its benchmark interest rate unchanged during the period, but it took measures to improve financial liquidity to mitigate the negative effects of the U.S.-China trade dispute and support economic growth. Overall, emerging market stocks, as measured by the MSCI Emerging Markets Index, had a-14.25% total return during the period.1

Investment Strategy

We seek to limit price volatility by investing across markets and property types. When selecting investments for the Fund’s portfolio, we apply a“bottom-up” stock selection process that incorporates macro-level views in the evaluation process. Our portfolio construction process combinesbottom-up analysis of individual stock and real estate market fundamentals andtop-down macro overlays to provide country/regional, property type, and company size perspectives in identifying international/local cyclical and thematic trends that highlight investment opportunities.

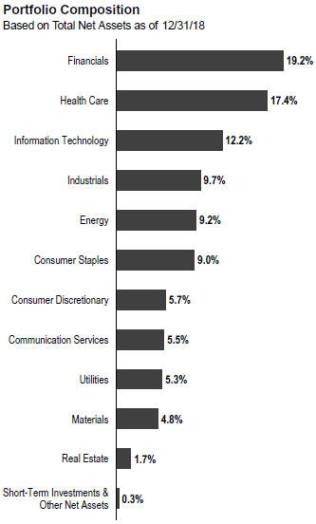

Manager’s Discussion

During the 12 months under review, key detractors from the Fund’s performance relative to the FTSE EPRA/NAREIT Developed Index included stock selection in the office space

2. Source: U.S. Bureau of Labor Statistics.

FRANKLIN GLOBAL REAL ESTATE VIP FUND

sector.3 Shares of Brandywine Realty Trust, a Philadelphia-based office REIT, underperformed partially due to broader negative investor sentiment towards office REITs. We believe Brandywine’s near-term lease rolls, above-average leverage and recent earnings guidance, which came in below investor expectation, also pressured the stock.

Stock selection and an overweighting in the diversified sector also hampered relative results.4 Shares of City Developments, the largest private developer in Singapore, were a major detractor during the period. After private home prices continued to rise in the first half of 2018, the Singaporean government announced it would raise the Additional Buyers Stamp Duty and tightenloan-to-value ratios in an effort to cool down the property market. While the government’s move was meant to bepre-emptive, property developers weresold-off in response to the government intervention. In the second half of 2018, concerns over rising interest rates and an overheated equity market weighed on City Developments’ share performance as investors turned more risk-averse.

Other significant detractors included shares of Weyerhaeuser, an integrated timber, land and forest products company that owns or controls more than 13 million acres of timberlands in the U.S. and Canada. The company harvests trees to produce a variety of softwood lumber and other wood products. Weyerhaeuser faced multiple headwinds in the third quarter of 2018, including severe weather and uncertain trade policy with China affecting its export business. The lumber and oriented strand board (also known as flakeboard) markets were unusually volatile, with lumber prices seeing a record decline after reaching a peak in June. Additionally, the outlook for U.S. housing starts has moderated following a slew of weaker-than-expected housing market data. While we believe Weyerhaeuser has a quality portfolio, strong balance sheet and an attractive valuation, we sold our position in the company during the period on account of the softening in its fundamental outlook.

Conversely, an underweighting in the struggling retail property sector supported relative performance over the period, as did an overweighting and stock selection in the residential sector.5Shares of Deutsche Wohnen, which owns residential properties in Germany, contributed to results. Rents in the Berlin residential market, which comprises the majority of the company’s portfolio, continue to increase due to demand exceeding supply. Management has continued to see further

| | | | |

| Top 10 Holdings | | | |

| 12/31/18 | | | |

| |

Company Sector/Industry, Country | | % of Total

Net Assets | |

Simon Property Group Inc. Retail REITs, U.S. | | | 4.5% | |

Prologis Inc. Industrial REITs, U.S. | | | 3.3% | |

Equity Residential Residential REITs, U.S. | | | 2.7% | |

Mitsui Fudosan Co. Ltd. Diversified Real Estate Activities, Japan | | | 2.7% | |