UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05583

Franklin Templeton Variable Insurance Products Trust

(Exact name of registrant as specified in charter)

One Franklin Parkway,

San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway,

San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: (650) 312-2000

Date of fiscal year end: 12/31

Date of reporting period: 06/30/20

| Item 1. | Reports to Stockholders. |

Internet Delivery of Shareholder Reports: Effective January 1, 2021, as permitted by regulations adopted by the SEC, you may not be receiving paper copies of the Fund’s annual or semiannual shareholder reports by mail, unless you specifically request them from the insurance company that offers your variable annuity or variable life insurance contract or your financial intermediary. Instead of delivering paper copies of the report, the insurance company may choose to make the reports available on a website, and will notify you by mail each time a shareholder report is posted and provide you with a website link to access the report. Instructions for requesting paper copies will be provided by your insurance company.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the insurance company or your financial intermediary electronically by following the instructions provided by the insurance company or by contacting your financial intermediary.

You may elect to receive all future Fund shareholder reports in paper free of charge from the insurance company. You can inform the insurance company or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by following the instructions provided by the insurance company or by contacting your financial intermediary. Your election to receive reports in paper will apply to all portfolio companies available under your contract with the insurance company.

This notice is not legally a part of the shareholder report.

Franklin Templeton Variable Insurance

Products Trust Semiannual Report

*Not part of the semiannual report. Retain for your records.

| | | | | | | | |

| | | | | |

| Not FDIC Insured | | | | | May Lose Value | | | | | No Bank Guarantee |

MASTER CLASS – 4

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

Important Notes to

Performance Information

Performance data is historical and cannot predict or guarantee future results. Principal value and investment return will fluctuate with market conditions, and you may have a gain or loss when you withdraw your money. Inception dates of the funds may have preceded the effective dates of the subaccounts, contracts or their availability in all states.

When reviewing the index comparisons, please keep in mind that indexes have a number of inherent performance differentials over the funds. First, unlike the funds, which must hold a minimum amount of cash to maintain liquidity,

indexes do not have a cash component. Second, the funds are actively managed and, thus, are subject to management fees to cover salaries of securities analysts or portfolio managers in addition to other expenses. Indexes are unmanaged and do not include any commissions or other expenses typically associated with investing in securities. Third, indexes often contain a different mix of securities than the fund to which they are compared. Additionally, please remember that indexes are simply a measure of performance and cannot be invested in directly.

Franklin Allocation VIP Fund

This semiannual report for Franklin Allocation VIP Fund covers the period ended June 30, 2020.

Class 4 Performance Summary as of June 30, 2020

The Fund’s Class 4 Shares posted a -1.37% total return* for the six-month period ended June 30, 2020.

*On May 1, 2019, the Fund’s investment strategies changed. Performance prior to May 1, 2019, is attributable to the Fund’s performance before the strategy change. The Fund has an expense reduction contractually guaranteed through 4/30/21. Fund investment results reflect the expense reduction; without this reduction, the results would have been lower.

Performance reflects the Fund’s Class 4 operating expenses, but does not include any contract fees, expenses or sales charges. If they had been included, performance would be lower. These charges and deductions, particularly for variable life policies, can have a significant effect on contract values and insurance benefits. See the contract prospectus for a complete description of these expenses, including sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown.

FRANKLIN ALLOCATION VIP FUND

Fund Goal and Main Investments

The Fund seeks capital appreciation, with income as a secondary goal. Under normal market conditions, the Fund allocates approximately 60% of its assets to the equity asset class and 40% of its assets to the fixed income asset class by allocating the Fund’s assets among various sleeves (investment strategies).

Fund Risks

All investments involve risks, including possible loss of principal. Unexpected events and their aftermaths, such as the spread of deadly diseases; natural, environmental or man-made disasters; financial, political or social disruptions; terrorism and war; and other tragedies or catastrophes, can cause investor fear and panic, which can adversely affect the economies of many companies, sectors, nations, regions and the market in general, in ways that cannot necessarily be foreseen. Because the Fund invests in underlying funds, and the Fund’s performance is directly related to the performance of the underlying funds held by it, the ability of the Fund to achieve its investment goals is directly related to the ability of the underlying funds to meet their investment goals. Additionally, because these underlying funds may engage in a variety of investment strategies involving certain risks, the Fund may be subject to these same risks. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bonds are affected by changes in interest rates and the creditworthiness of their issuers. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds adjust to a rise in interest rates, the Fund’s share price may decline. Higher yielding, lower rated corporate bonds entail a greater degree of credit risk compared to investment-grade securities. Foreign investing carries additional risks such as currency and market volatility and political or social instability, risks that are heightened in developing countries. Value securities may not increase in price as anticipated or may decline further in value. The Fund’s prospectus also includes a description of the main investment risks.

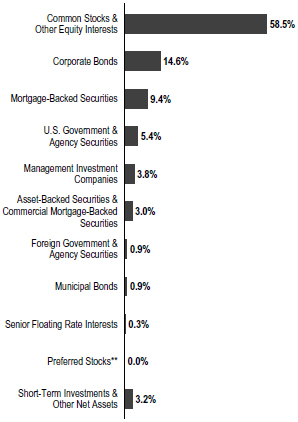

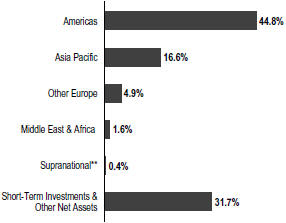

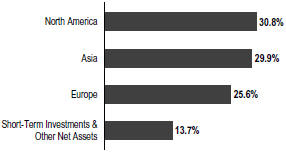

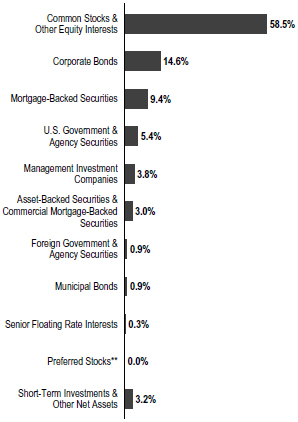

Asset Allocation*

Based on Total Net Assets as of 6/30/20

*The asset allocation is based on the Statement of Investments (SOI), which classifies each underlying fund into a broad asset class.

**Rounds to less than 0.1%.

Performance Overview

You can find the Fund’s six-month total return in the Performance Summary. In comparison, the Fund’s benchmark, the Standard & Poor’s® 500 Index (S&P 500®), posted a -3.08% total return. The Fund’s other benchmarks, the Bloomberg Barclays U.S. Aggregate Bond Index posted a +6.14% total return; the MSCI World ex USA Index-NR posted a -11.20% total return; and the Linked Allocation VIP Fund Benchmark posted a -0.81% total return.1,2

1. Source: Morningstar.

2. Source: FactSet. The Linked Allocation VIP Fund benchmark was calculated internally and rebalanced monthly and was composed of 40% S&P 500, 40% Bloomberg Barclays U.S. Aggregate Bond Index and 20% MSCI World ex USA Index-NR.

One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio. Please see Index Descriptions following the Fund Summaries.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

FRANKLIN ALLOCATION VIP FUND

Economic and Market Overview

Global developed and emerging market equities, as measured by the MSCI All Country World Index (USD), posted a -5.99% total return during the six months under review.1 Stocks fell sharply in early 2020 as countries around the world implemented lockdown measures in an effort to slow the spread of the novel coronavirus (COVID-19). Global supply chain disruptions, business and personal restrictions, and subdued consumer spending drove many investors to sell equity holdings in favor of perceived safe investments such as government bonds and cash. While global equities, notably in the U.S., rebounded in April and May amid optimism about easing lockdown restrictions, concerns about a second wave of infections hindered equities in June, as investors weighed the possibility of renewed restrictions.

In the U.S., government mandates to mitigate the COVID-19 pandemic severely impacted the economy beginning in March 2020. As a result, the unemployment rate surged to 14.7% in April, as many businesses, particularly those involved in hospitality, retail and travel, announced mass layoffs.3 According to the National Bureau of Economic Research, the longest U.S. economic expansion in history ended in February 2020 as the country slipped into a severe recession. Nonetheless, near period-end, there were signs that a recovery was underway, as jobless claims fell considerably from their peak in early April, retail sales rose sharply in May, and the unemployment rate fell to 11.1% in June.3 Along with optimism about improved treatments and potential vaccines for COVID-19, the positive economic signals contributed to a significant equity rebound in April and May. However, an increase in COVID-19 infections in many states throughout June pressured U.S. stocks.

The U.S. Federal Reserve (Fed) made significant efforts to support the U.S. economy. In March 2020, as the pandemic began to severely impact the economy and financial markets, the Fed implemented two emergency rate cuts, lowering the federal funds target rate to a range of 0.00%–0.25%, and announced sweeping quantitative easing measures aimed at ensuring credit flow to borrowers and supporting credit markets with unlimited amounts of bond purchasing.

In the eurozone, some analysts forecasted a significant contraction in 2020, particularly in southern European countries, as the magnitude of the economic disruption

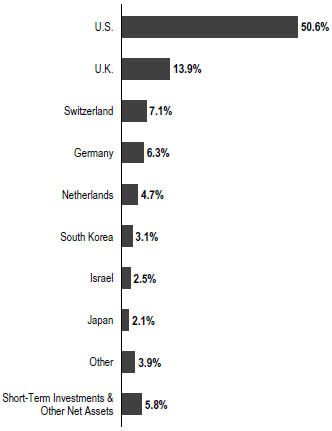

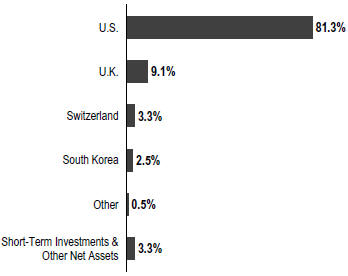

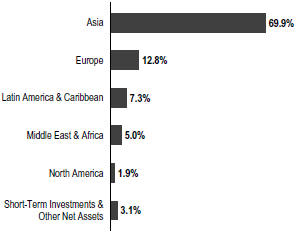

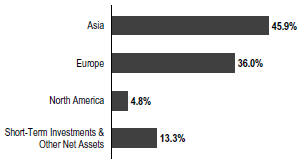

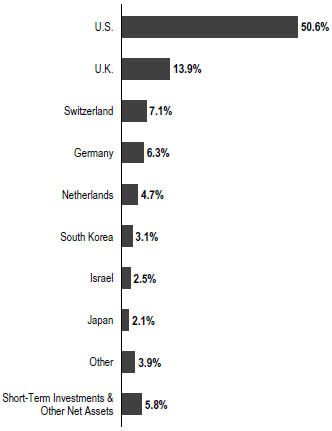

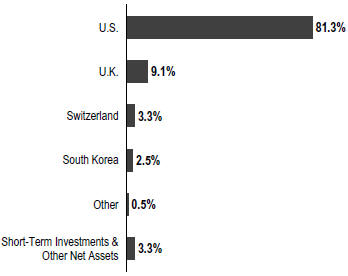

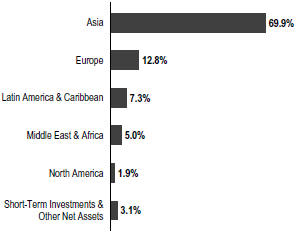

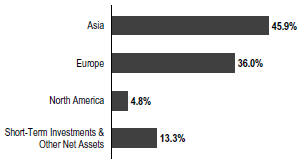

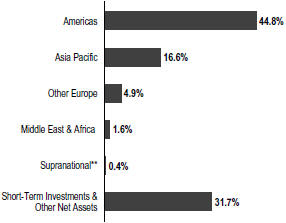

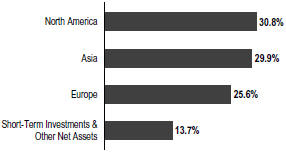

Geographic Composition

Based on Total Net Assets as of 6/30/20

caused by the pandemic became apparent. European developed market equities, as measured by the MSCI Europe Index (USD), posted a -12.43% total return for the period.1 To stimulate growth, the European Central Bank implemented a broad bond-buying program, and many countries passed fiscal stimulus measures.

Asian developed and emerging market equities, as measured by the MSCI All Country Asia Index (USD), posted a -5.51% total return during the six-month period.1 The onset of the pandemic brought dramatically slower economic activity in Asia, as businesses halted operations and manufacturing and export activity declined sharply in the region’s major economies. Asian markets generally advanced toward period-end, bolstered by fiscal stimulus measures and economies reopening throughout the region.

Emerging market stocks, as measured by the MSCI Emerging Markets Index (USD), posted a -9.67% total return due primarily to the COVID-19 pandemic.1 A sharp decrease in prices for oil and other natural resources also hurt emerging market economies reliant on these exports. In the last quarter of the reporting period, however, investor optimism led to a stock rally, particularly in emerging market countries that had successfully lowered infection rates.

3. Source: U.S. Bureau of Labor Statistics.

See www.franklintempletondatasources.com for additional data provider information.

FRANKLIN ALLOCATION VIP FUND

Investment Strategy

The Fund seeks to achieve its investment goals by allocating its assets among the broad asset classes of equity and fixed income investments through a variety of investment strategies or “sleeves” managed by the investment manager or its affiliates, which include Franklin U.S. Smart Beta Equity Strategy, Franklin Total Return Strategy, Franklin Growth Strategy, Templeton Foreign Strategy, Franklin International Growth Strategy, Franklin U.S. Government Securities Strategy, Franklin Rising Dividends Strategy, Franklin Investment Grade Corporate Strategy, Templeton Global Bond VIP Fund Strategy, Franklin International Core Equity Strategy, Franklin U.S. Core Equity (IU) Strategy, Franklin Emerging Market Core Equity (IU) Strategy and Franklin U.S. Core Bond Strategy. The Fund is structured as a multi-manager fund (meaning the Fund’s assets are managed by multiple sub-advisors), with the investment manager having overall responsibility for the Funds’ investments. Allocation to each sleeve will generally not exceed 20% and will vary with market conditions. However, under normal market conditions, no sleeve constitutes a majority of the Fund’s assets.

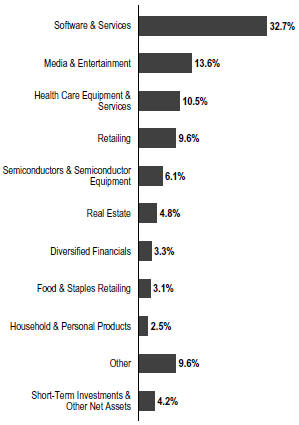

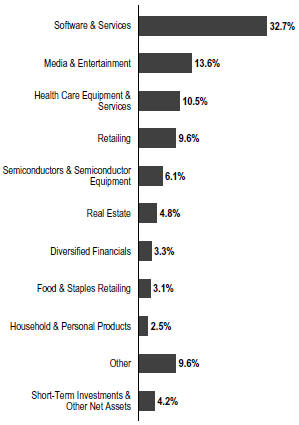

Top 10 Holdings

6/30/20

| | | | |

Company Sector/Industry | | % of Total Net Assets | |

Templeton Global Bond VIP Fund | | | 3.8 | % |

Diversified Financials | | | | |

Microsoft Corp. | | | 1.6 | % |

Software & Services | | | | |

Apple Inc. | | | 1.1 | % |

Technology Hardware & Equipment | | | | |

Amazon.com Inc. | | | 0.8 | % |

Retailing | | | | |

Texas Instruments Inc. | | | 0.6 | % |

Semiconductors & Semiconductor Equipment | | | | |

Mastercard Inc. | | | 0.5 | % |

Software & Services | | | | |

Accenture PLC | | | 0.5 | % |

Software & Services | | | | |

NIKE Inc. | | | 0.5 | % |

Consumer Durables & Apparel | | | | |

Johnson & Johnson | | | 0.5 | % |

Pharmaceuticals, Biotechnology & Life Sciences | | | | |

Air Products and Chemicals Inc. | | | 0.5 | % |

Materials | | | | |

Manager’s Discussion

The Fund’s performance can be attributed largely to its allocation among the underlying sleeves and their investments in domestic and foreign equities, fixed income securities, and short-term investments and other net assets. The allocation to the sleeves did not change over the period.

During the six months under review, the Franklin Growth Strategy outperformed the S&P 500, the Franklin Rising Dividends Strategy underperformed the S&P 500, the Templeton Foreign Strategy underperformed the MSCI All Country World ex USA Index-NR, the Franklin International Growth Strategy outperformed the MSCI World ex-USA Index, the U.S. Smart Beta Equity Strategy underperformed the Russell 1000® Index, the Franklin International Core Equity Strategy outperformed the MSCI EAFE Index, the Franklin U.S. Government Securities Strategy underperformed the Bloomberg Barclays U.S. Government Index: Intermediate Component, the Franklin Investment-Grade Corporate Strategy outperformed the Bloomberg Barclays U.S. Corporate Investment-Grade Index, the Templeton Global Bond VIP Fund outperformed the J.P. Morgan Global Government Bond Index, the Franklin U.S. Core Bond Strategy underperformed the Bloomberg Barclays U.S. Aggregate Bond Index.

Thank you for your participation in Franklin Allocation VIP Fund. We look forward to serving your Future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of June 30, 2020, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

FRANKLIN ALLOCATION VIP FUND

Class 4 Fund Expenses

As an investor in a variable insurance contract (Contract) that indirectly provides for investment in an underlying mutual fund, you can incur transaction and/or ongoing expenses at both the Fund level and the Contract Level: (1) transaction expenses can include sales charges (loads) on purchases, surrender fees, transfer fees and premium taxes; and (2) ongoing expenses can include management fees, distribution and service (12b-1) fees, contract fees, annual maintenance fees, mortality and expense risk fees and other fees and expenses. All mutual funds and Contracts have some types of ongoing expenses. The table below shows Fund-level ongoing expenses and can help you understand these costs and compare them with those of other mutual funds offered through the Contract. The table assumes a $1,000 investment held for the six months indicated. Please refer to the Fund prospectus for additional information on operating expenses.

Actual Fund Expenses

The table below provides information about the actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of ongoing Fund expenses but does not include the effect of ongoing Contract expenses, is used to calculate the “Ending Account Value.” You can estimate the Fund-level expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number under the headings “Actual” and “Fund-Level Expenses Paid During Period” (if Fund-Level Expenses Paid During Period were $ 7.50, then 8.6 x $ 7.50 = $64.50). In this illustration, the estimated expenses paid this period at the Fund level are $64.50.

Hypothetical Example for Comparison with Other Mutual Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other mutual funds offered through the Contract. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds offered through the Contract.

Please note that expenses shown in the table are meant to highlight ongoing costs at the Fund level only and do not reflect any ongoing expenses at the Contract level, or transaction expenses at either the Fund or Contract levels. In addition, while the Fund does not have transaction expenses, if the transaction and ongoing expenses at the Contract level were included, the expenses shown below would be higher. You should consult your Contract prospectus or disclosure document for more information.

| | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | Actual (actual return after expenses) | | | | Hypothetical (5% annual return before expenses) | | | | |

| | | | | | | | | |

Share Class | | Beginning

Account

Value 1/1/20 | | | | Ending

Account Value 6/30/20 | | Fund-Level

Expenses

Paid During

Period

1/1/20–6/30/201, 2 | | | | Ending

Account

Value 6/30/20 | | Fund-Level

Expenses

Paid During

Period

1/1/20–6/30/201, 2 | | | | Net

Annualized

Expense

Ratio1, 2 |

Class 4 | | $1,000 | | | | $986.30 | | $4.40 | | | | $1,020.44 | | $4.47 | | | | 0.89% |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 182/366 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

Financial Highlights

Franklin Allocation VIP Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended June 30, 2020 (unaudited) | | | Year Ended December 31, | |

| | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | | | | |

Class 1 | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Per share operating performance | | | | | | | | | | | | | | | | | | | | | | | | |

(for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value, beginning of period | | | $ 6.86 | | | | $ 6.37 | | | | $ 7.44 | | | | $ 7.13 | | | | $ 6.80 | | | | $ 7.47 | |

| | | | | | |

| Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment incomeb | | | 0.07 | | | | 0.11 | c | | | 0.23 | c | | | 0.21 | c | | | 0.21 | c | | | 0.26 | c |

| | | | | | |

Net realized and unrealized gains (losses) | | | (0.17 | ) | | | 1.11 | | | | (0.89 | ) | | | 0.63 | | | | 0.64 | | | | (0.68 | ) |

| | | | | | |

Total from investment operations | | | (0.10 | ) | | | 1.22 | | | | (0.66 | ) | | | 0.84 | | | | 0.85 | | | | (0.42 | ) |

| | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income | | | (0.12 | ) | | | (0.27 | ) | | | (0.24 | ) | | | (0.22 | ) | | | (0.29 | ) | | | (0.24 | ) |

| | | | | | |

Net realized gains | | | (1.80 | ) | | | (0.46 | ) | | | (0.17 | ) | | | (0.31 | ) | | | (0.23 | ) | | | (0.01 | ) |

| | | | | | |

| Total distributions | | | (1.92 | ) | | | (0.73 | ) | | | (0.41 | ) | | | (0.53 | ) | | | (0.52 | ) | | | (0.25 | ) |

| | | | | | |

| Net asset value, end of period | | | $ 4.84 | | | | $ 6.86 | | | | $ 6.37 | | | | $ 7.44 | | | | $ 7.13 | | | | $ 6.80 | |

| | | | | | |

Total returnd | | | (1.09)% | | | | 20.04% | | | | (9.34)% | | | | 12.17% | | | | 13.43% | | | | (5.93)% | |

| | | | | | |

| Ratios to average net assetse | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Expenses before waiver and payments by affiliates | | | 0.59% | | | | 0.44% | | | | 0.12% | | | | 0.12% | | | | 0.11% | | | | 0.11% | |

| | | | | | |

Expenses net of waiver and payments by affiliates | | | 0.54%f | | | | 0.39% | | | | 0.10% | | | | 0.10% | | | | 0.10% | | | | 0.10% | |

| | | | | | |

Net investment income | | | 2.32% | | | | 1.55% | | | | 3.13% | | | | 2.75% | | | | 3.09% | | | | 3.51% | |

| | | | | | |

| Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets, end of period (000’s) | | | $804 | | | | $842 | | | | $984 | | | | $1,047 | | | | $1,025 | | | | $1,083 | |

| | | | | | |

Portfolio turnover rate | | | 49.61% | | | | 170.79% | | | | 2.23% | | | | 1.28% | | | | 0.10% | | | | 0.26% | |

Portfolio turnover rate excluding mortgage dollar rolls | | | 42.14% | g | | | 158.11% | g | | | 2.23% | | | | 1.28% | | | | 0.10% | | | | 0.26% | |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cRecognition of net investment income by the Fund is affected by the timing of declaration of dividends by the Underlying Funds and exchange traded funds in which the Fund invests.

dTotal return does not include fees, charges or expenses imposed by the variable annuity and life insurance contracts for which Franklin Templeton Variable Insurance Products Trust serves as an underlying investment vehicle. Total return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fBenefit of expense reduction rounds to less than 0.01%.

gSee Note 1(f) regarding mortgage dollar rolls.

| | | | |

| | | |

| FFA-6 | | Semiannual Report | The accompanying notes are an integral part of these financial statements. | | |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FINANCIAL HIGHLIGHTS

Franklin Allocation VIP Fund (continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended June 30, 2020 (unaudited) | | | Year Ended December 31, | |

| | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | | | | |

Class 2 | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Per share operating performance | | | | | | | | | | | | | | | | | | | | | | | | |

(for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value, beginning of period | | | $ 6.81 | | | | $ 6.32 | | | | $ 7.39 | | | | $ 7.08 | | | | $ 6.75 | | | | $ 7.42 | |

| | | | | | |

| Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment incomeb | | | 0.06 | | | | 0.09 | c | | | 0.21 | c | | | 0.18 | c | | | 0.19 | c | | | 0.24 | c |

| | | | | | |

Net realized and unrealized gains (losses) | | | (0.18 | ) | | | 1.11 | | | | (0.89 | ) | | | 0.64 | | | | 0.64 | | | | (0.68 | ) |

| | | | | | |

Total from investment operations | | | (0.12 | ) | | | 1.20 | | | | (0.68 | ) | | | 0.82 | | | | 0.83 | | | | (0.44 | ) |

| | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income | | | (0.10 | ) | | | (0.25 | ) | | | (0.22 | ) | | | (0.20 | ) | | | (0.27 | ) | | | (0.22 | ) |

| | | | | | |

Net realized gains | | | (1.80 | ) | | | (0.46 | ) | | | (0.17 | ) | | | (0.31 | ) | | | (0.23 | ) | | | (0.01 | ) |

| | | | | | |

| Total distributions | | | (1.90 | ) | | | (0.71 | ) | | | (0.39 | ) | | | (0.51 | ) | | | (0.50 | ) | | | (0.23 | ) |

| | | | | | |

| Net asset value, end of period | | | $ 4.79 | | | | $ 6.81 | | | | $ 6.32 | | | | $ 7.39 | | | | $ 7.08 | | | | $ 6.75 | |

| | | | | | |

Total returnd | | | (1.43)% | | | | 19.86% | | | | (9.65)% | | | | 11.98% | | | | 13.18% | | | | (6.21)% | |

| | | | | | |

| Ratios to average net assetse | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Expenses before waiver and payments by affiliates | | | 0.84% | | | | 0.69% | | | | 0.37% | | | | 0.37% | | | | 0.36% | | | | 0.36% | |

| | | | | | |

Expenses net of waiver and payments by affiliates | | | 0.79%f | | | | 0.64% | | | | 0.35% | | | | 0.35% | | | | 0.35% | | | | 0.35% | |

| | | | | | |

Net investment income | | | 2.07% | | | | 1.30% | | | | 2.88% | | | | 2.50% | | | | 2.84% | | | | 3.26% | |

| | | | | | |

| Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets, end of period (000’s) | | | $371,639 | | | | $403,040 | | | | $390,300 | | | | $480,402 | | | | $474,669 | | | | $480,715 | |

| | | | | | |

Portfolio turnover rate | | | 49.61% | | | | 170.79% | | | | 2.23% | | | | 1.28% | | | | 0.10% | | | | 0.26% | |

| | | | | | |

Portfolio turnover rate excluding mortgage dollar rolls | | | 42.14% | g | | | 158.11% | g | | | 2.23% | | | | 1.28% | | | | 0.10% | | | | 0.26% | |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cRecognition of net investment income by the Fund is affected by the timing of declaration of dividends by the Underlying Funds and exchange traded funds in which the Fund invests.

dTotal return does not include fees, charges or expenses imposed by the variable annuity and life insurance contracts for which Franklin Templeton Variable Insurance Products Trust serves as an underlying investment vehicle. Total return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fBenefit of expense reduction rounds to less than 0.01%.

gSee Note 1(f) regarding mortgage dollar rolls.

| | | | | | |

| | | |

| | The accompanying notes are an integral part of these financial statements. | Semiannual Report | | | FFA-7 | |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

FINANCIAL HIGHLIGHTS

Franklin Allocation VIP Fund (continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended June 30, 2020 (unaudited) | | | Year Ended December 31, | |

| | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | | | | |

Class 4 | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Per share operating performance | | | | | | | | | | | | | | | | | | | | | | | | |

(for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value, beginning of period | | | $ 6.97 | | | | $ 6.46 | | | | $ 7.53 | | | | $ 7.21 | | | | $ 6.87 | | | | $ 7.54 | |

| | | | | | |

| Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment incomeb | | | 0.06 | | | | 0.08 | c | | | 0.20 | c | | | 0.18 | c | | | 0.19c | | | | 0.23 | c |

| | | | | | |

Net realized and unrealized gains (losses) | | | (0.18 | ) | | | 1.13 | | | | (0.89 | ) | | | 0.64 | | | | 0.64 | | | | (0.68 | ) |

| | | | | | |

Total from investment operations | | | (0.12 | ) | | | 1.21 | | | | (0.69 | ) | | | 0.82 | | | | 0.83 | | | | (0.45 | ) |

| | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income | | | (0.09 | ) | | | (0.24 | ) | | | (0.21 | ) | | | (0.19 | ) | | | (0.26 | ) | | | (0.21 | ) |

| | | | | | |

Net realized gains | | | (1.80 | ) | | | (0.46 | ) | | | (0.17 | ) | | | (0.31 | ) | | | (0.23 | ) | | | (0.01 | ) |

| | | | | | |

| Total distributions | | | (1.89 | ) | | | (0.70 | ) | | | (0.38 | ) | | | (0.50 | ) | | | (0.49 | ) | | | (0.22 | ) |

| | | | | | |

| Net asset value, end of period | | | $ 4.96 | | | | $ 6.97 | | | | $ 6.46 | | | | $ 7.53 | | | | $ 7.21 | | | | $ 6.87 | |

| | | | | | |

Total returnd | | | (1.37)% | | | | 19.56% | | | | (9.58)% | | | | 11.78% | | | | 12.92% | | | | (6.24)% | |

| | | | | | |

| Ratios to average net assetse | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Expenses before waiver and payments by affiliates | | | 0.94% | | | | 0.79% | | | | 0.47% | | | | 0.47% | | | | 0.46% | | | | 0.46% | |

| | | | | | |

Expenses net of waiver and payments by affiliates | | | 0.89%f | | | | 0.74% | | | | 0.45% | | | | 0.45% | | | | 0.45% | | | | 0.45% | |

| | | | | | |

Net investment income | | | 1.97% | | | | 1.20% | | | | 2.78% | | | | 2.40% | | | | 2.74% | | | | 3.16% | |

| | | | | | |

| Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets, end of period (000’s) | | | $378,968 | | | | $406,693 | | | | $393,385 | | | | $528,862 | | | | $530,403 | | | | $550,825 | |

| | | | | | |

Portfolio turnover rate | | | 49.61% | | | | 170.79% | | | | 2.23% | | | | 1.28% | | | | 0.10% | | | | 0.26% | |

| | | | | | |

Portfolio turnover rate excluding mortgage dollar rolls | | | 42.14% | g | | | 158.11% | g | | | 2.23% | | | | 1.28% | | | | 0.10% | | | | 0.26% | |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cRecognition of net investment income by the Fund is affected by the timing of declaration of dividends by the Underlying Funds and exchange traded funds in which the Fund invests.

dTotal return does not include fees, charges or expenses imposed by the variable annuity and life insurance contracts for which Franklin Templeton Variable Insurance Products Trust serves as an underlying investment vehicle. Total return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fBenefit of expense reduction rounds to less than 0.01%.

gSee Note 1(f) regarding mortgage dollar rolls.

| | | | |

| | | |

| FFA-8 | | Semiannual Report | The accompanying notes are an integral part of these financial statements. | | |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

Statement of Investments, June 30, 2020 (unaudited)

Franklin Allocation VIP Fund

| | | | | | | | | | | | | | |

| | | | | Country/

Organization | | | Shares/

Rights | | | Value | |

| | | | |

| | Common Stocks and Other Equity Interests 58.5% | | | | | | | | | | | | |

| | Automobiles & Components 0.7% | | | | | | | | | | | | |

| | Aptiv PLC | | | United States | | | | 7,000 | | | $ | 545,440 | |

| | Bayerische Motoren Werke AG | | | Germany | | | | 8,162 | | | | 521,021 | |

| | Cie Generale des Etablissements Michelin SCA | | | France | | | | 8,517 | | | | 887,674 | |

| a | | Faurecia SE | | | France | | | | 3,230 | | | | 126,891 | |

| a | | Fiat Chrysler Automobiles NV | | | United Kingdom | | | | 36,368 | | | | 367,942 | |

| | General Motors Co. | | | United States | | | | 18,814 | | | | 475,994 | |

| | Gentex Corp. | | | United States | | | | 8,426 | | | | 217,138 | |

| | Honda Motor Co. Ltd. | | | Japan | | | | 16,200 | | | | 418,830 | |

| | Isuzu Motors Ltd. | | | Japan | | | | 67,200 | | | | 610,669 | |

| | Lear Corp. | | | United States | | | | 1,868 | | | | 203,649 | |

| a | | Peugeot SA | | | France | | | | 25,032 | | | | 410,467 | |

| | Toyota Industries Corp. | | | Japan | | | | 6,500 | | | | 345,492 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 5,131,207 | |

| | | | | | | | | | | | | | |

| | | | |

| | Banks 1.2% | | | | | | | | | | | | |

| | Banco de Sabadell SA | | | Spain | | | | 242,207 | | | | 85,090 | |

| a | | Bank of Ireland Group PLC | | | Ireland | | | | 32,153 | | | | 66,246 | |

| a | | FinecoBank Banca Fineco SpA | | | Italy | | | | 135,215 | | | | 1,829,846 | |

| | Housing Development Finance Corp. Ltd. | | | India | | | | 27,108 | | | | 629,974 | |

| | ING Groep NV | | | Netherlands | | | | 149,749 | | | | 1,043,793 | |

| | Kasikornbank PCL, fgn | | | Thailand | | | | 96,700 | | | | 293,867 | |

| | KB Financial Group Inc. | | | South Korea | | | | 29,025 | | | | 823,885 | |

| | KBC Groep NV | | | Belgium | | | | 24,134 | | | | 1,386,404 | |

| | Shinhan Financial Group Co. Ltd. | | | South Korea | | | | 14,863 | | | | 360,143 | |

| | Shinsei Bank Ltd. | | | Japan | | | | 8,000 | | | | 96,762 | |

| | Standard Chartered PLC | | | United Kingdom | | | | 211,107 | | | | 1,144,321 | |

| | Sumitomo Mitsui Financial Group Inc. | | | Japan | | | | 30,100 | | | | 849,476 | |

| | Sumitomo Mitsui Financial Group Inc., ADR | | | Japan | | | | 112,000 | | | | 629,440 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 9,239,247 | |

| | | | | | | | | | | | | | |

| | | | |

| | Capital Goods 5.9% | | | | | | | | | | | | |

| | 3M Co. | | | United States | | | | 8,752 | | | | 1,365,225 | |

| | Allegion PLC | | | United States | | | | 4,871 | | | | 497,914 | |

| | Allison Transmission Holdings Inc. | | | United States | | | | 2,215 | | | | 81,468 | |

| | Amada Co. Ltd. | | | Japan | | | | 13,500 | | | | 110,536 | |

| | AMETEK Inc. | | | United States | | | | 4,018 | | | | 359,089 | |

| a | | Andritz AG | | | Austria | | | | 3,171 | | | | 115,607 | |

| | Atlas Copco AB | | | Sweden | | | | 7,152 | | | | 265,723 | |

| | Atlas Copco AB, A | | | Sweden | | | | 11,437 | | | | 486,992 | |

| | BAE Systems PLC | | | United Kingdom | | | | 77,090 | | | | 460,938 | |

| | BWX Technologies Inc. | | | United States | | | | 8,401 | | | | 475,833 | |

| | CAE Inc. | | | Canada | | | | 15,000 | | | | 243,306 | |

| | Carlisle Cos. Inc. | | | United States | | | | 3,400 | | | | 406,878 | |

| | Caterpillar Inc. | | | United States | | | | 3,346 | | | | 423,269 | |

| | CK Hutchison Holdings Ltd. | | | Hong Kong | | | | 152,000 | | | | 984,283 | |

| | Cummins Inc. | | | United States | | | | 4,550 | | | | 788,333 | |

| a | | Dassault Aviation SA | | | France | | | | 253 | | | | 232,106 | |

| | Deere & Co. | | | United States | | | | 3,086 | | | | 484,965 | |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

STATEMENT OF INVESTMENTS (UNAUDITED)

Franklin Allocation VIP Fund (continued)

| | | | | | | | | | | | | | |

| | | | | Country/

Organization | | | Shares/

Rights | | | Value | |

| | | | |

| | Common Stocks and Other Equity Interests (continued) | | | | | | | | | | | | |

| | Capital Goods (continued) | | | | | | | | | | | | |

| | Donaldson Co. Inc. | | | United States | | | | 8,500 | | | $ | 395,420 | |

| | Dover Corp. | | | United States | | | | 8,900 | | | | 859,384 | |

| | Emerson Electric Co. | | | United States | | | | 18,102 | | | | 1,122,867 | |

| | Epiroc AB, A | | | Sweden | | | | 9,709 | | | | 121,643 | |

| | Epiroc AB, B | | | Sweden | | | | 17,653 | | | | 216,773 | |

| | Fastenal Co. | | | United States | | | | 34,853 | | | | 1,493,103 | |

| | Ferguson PLC | | | United Kingdom | | | | 15,500 | | | | 1,267,330 | |

| | Fortive Corp. | | | United States | | | | 6,517 | | | | 440,940 | |

| | Geberit AG | | | Switzerland | | | | 1,568 | | | | 786,721 | |

| | General Dynamics Corp. | | | United States | | | | 8,887 | | | | 1,328,251 | |

| | Graco Inc. | | | United States | | | | 4,752 | | | | 228,048 | |

| | GrafTech International Ltd. | | | United States | | | | 844 | | | | 6,735 | |

| | Honeywell International Inc. | | | United States | | | | 19,445 | | | | 2,811,553 | |

| | Huntington Ingalls Industries Inc. | | | United States | | | | 1,176 | | | | 205,200 | |

| | Illinois Tool Works Inc. | | | United States | | | | 10,617 | | | | 1,856,382 | |

| a | | Ingersoll-Rand Inc. | | | United States | | | | 5,626 | | | | 158,203 | |

| | Johnson Controls International PLC | | | United States | | | | 22,400 | | | | 764,736 | |

| | Kingspan Group PLC | | | Ireland | | | | 2,612 | | | | 168,606 | |

| | Komatsu Ltd. | | | Japan | | | | 22,800 | | | | 466,956 | |

| | Kone OYJ, B | | | Finland | | | | 6,442 | | | | 444,261 | |

| | Kurita Water Industries Ltd. | | | Japan | | | | 4,000 | | | | 111,272 | |

| | Lennox International Inc. | | | United States | | | | 502 | | | | 116,961 | |

| | Lockheed Martin Corp. | | | United States | | | | 6,731 | | | | 2,456,277 | |

| | Masco Corp. | | | United States | | | | 2,247 | | | | 112,822 | |

| a | | Mercury Systems Inc. | | | United States | | | | 3,640 | | | | 286,322 | |

| | Mitsubishi Electric Corp. | | | Japan | | | | 54,100 | | | | 706,614 | |

| | MSC Industrial Direct Co. Inc., A | | | United States | | | | 1,257 | | | | 91,522 | |

| | MTU Aero Engines AG | | | Germany | | | | 7,900 | | | | 1,375,272 | |

| | Northrop Grumman Corp. | | | United States | | �� | | 7,855 | | | | 2,414,941 | |

| | nVent Electric PLC | | | United States | | | | 15,900 | | | | 297,807 | |

| | Obayashi Corp. | | | Japan | | | | 27,400 | | | | 257,600 | |

| | Otis Worldwide Corp. | | | United States | | | | 7,237 | | | | 411,496 | |

| | PACCAR Inc. | | | United States | | | | 4,976 | | | | 372,454 | |

| | Pentair PLC | | | United States | | | | 13,900 | | | | 528,061 | |

| | Raytheon Technologies Corp. | | | United States | | | | 50,395 | | | | 3,105,340 | |

| | Rockwell Automation Inc. | | | United States | | | | 3,621 | | | | 771,273 | |

| | Roper Technologies Inc. | | | United States | | | | 8,700 | | | | 3,377,862 | |

| | Schneider Electric SE | | | France | | | | 6,764 | | | | 752,338 | |

| | Siemens AG | | | Germany | | | | 4,442 | | | | 523,830 | |

| | Sinopec Engineering Group Co. Ltd. | | | China | | | | 615,000 | | | | 264,064 | |

| | SKF AB, B | | | Sweden | | | | 15,639 | | | | 292,313 | |

| | Snap-on Inc. | | | United States | | | | 1,016 | | | | 140,726 | |

| | Stanley Black & Decker Inc. | | | United States | | | | 4,652 | | | | 648,396 | |

| | Sumitomo Heavy Industries Ltd. | | | Japan | | | | 4,500 | | | | 98,420 | |

| | Toro Co. | | | United States | | | | 3,572 | | | | 236,967 | |

| | Trane Technologies PLC | | | United States | | | | 6,456 | | | | 574,455 | |

| | W.W. Grainger Inc. | | | United States | | | | 3,289 | | | | 1,033,272 | |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

STATEMENT OF INVESTMENTS (UNAUDITED)

Franklin Allocation VIP Fund (continued)

| | | | | | | | | | | | | | |

| | | | | Country/

Organization | | | Shares/

Rights | | | Value | |

| | | | |

| | Common Stocks and Other Equity Interests (continued) | | | | | | | | | | | | |

| | Capital Goods (continued) | | | | | | | | | | | | |

| | Watsco Inc. | | | United States | | | | 809 | | | $ | 143,759 | |

| | Yangzijiang Shipbuilding Holdings Ltd. | | | Singapore | | | | 98,600 | | | | 66,379 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 44,494,392 | |

| | | | | | | | | | | | | | |

| | | | |

| | Commercial & Professional Services 1.6% | | | | | | | | | | | | |

| | Adecco Group AG | | | Switzerland | | | | 6,392 | | | | 301,291 | |

| | Cintas Corp. | | | United States | | | | 6,084 | | | | 1,620,534 | |

| a | | Copart Inc. | | | United States | | | | 6,003 | | | | 499,870 | |

| a | | CoStar Group Inc. | | | United States | | | | 300 | | | | 213,201 | |

| | Equifax Inc. | | | United States | | | | 3,190 | | | | 548,297 | |

| | Experian PLC | | | United Kingdom | | | | 45,000 | | | | 1,579,384 | |

| a | | IAA Inc. | | | United States | | | | 1,139 | | | | 43,931 | |

| | IHS Markit Ltd. | | | United States | | | | 21,309 | | | | 1,608,829 | |

| | KAR Auction Services Inc. | | | United States | | | | 1,042 | | | | 14,338 | |

| | ManpowerGroup Inc. | | | United States | | | | 57 | | | | 3,919 | |

| | Matthews International Corp., A | | | United States | | | | 5,800 | | | | 110,780 | |

| | Persol Holdings Co. Ltd. | | | Japan | | | | 6,900 | | | | 95,129 | |

| | Randstad NV | | | Netherlands | | | | 4,940 | | | | 220,873 | |

| | Recruit Holdings Co. Ltd. | | | Japan | | | | 11,000 | | | | 378,292 | |

| | RELX PLC | | | United Kingdom | | | | 36,436 | | | | 843,305 | |

| | Republic Services Inc. | | | United States | | | | 3,900 | | | | 319,995 | |

| | Robert Half International Inc. | | | United States | | | | 4,264 | | | | 225,267 | |

| | Rollins Inc. | | | United States | | | | 4,605 | | | | 195,206 | |

| | SGS SA | | | Switzerland | | | | 267 | | | | 654,055 | |

| | Verisk Analytics Inc. | | | United States | | | | 8,961 | | | | 1,525,162 | |

| | Wolters Kluwer NV | | | Netherlands | | | | 11,387 | | | | 889,311 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 11,890,969 | |

| | | | | | | | | | | | | | |

| | | | |

| | Consumer Durables & Apparel 1.5% | | | | | | | | | | | | |

| a | | Adidas AG | | | Germany | | | | 785 | | | | 206,948 | |

| | Bandai Namco Holdings Inc. | | | Japan | | | | 1,500 | | | | 78,957 | |

| | Barratt Developments PLC | | | United Kingdom | | | | 19,371 | | | | 119,052 | |

| | The Berkeley Group Holdings PLC | | | United Kingdom | | | | 4,927 | | | | 253,731 | |

| | Burberry Group PLC | | | United Kingdom | | | | 7,850 | | | | 155,111 | |

| a | | Capri Holdings Ltd. | | | United States | | | | 4,944 | | | | 77,275 | |

| | Carter’s Inc. | | | United States | | | | 1,386 | | | | 111,850 | |

| | D.R. Horton Inc. | | | United States | | | | 2,668 | | | | 147,941 | |

| | Garmin Ltd. | | | United States | | | | 4,296 | | | | 418,860 | |

| | Hanesbrands Inc. | | | United States | | | | 5,102 | | | | 57,602 | |

| | Hasbro Inc. | | | United States | | | | 3,501 | | | | 262,400 | |

| | Hermes International | | | France | | | | 878 | | | | 737,110 | |

| | Leggett & Platt Inc. | | | United States | | | | 3,927 | | | | 138,034 | |

| a | | Lululemon Athletica Inc. | | | United States | | | | 3,432 | | | | 1,070,818 | |

| a | | Moncler SpA | | | Italy | | | | 5,423 | | | | 208,515 | |

| | NIKE Inc., B | | | United States | | | | 40,408 | | | | 3,962,005 | |

| a | | NVR Inc | | | United States | | | | 112 | | | | 364,980 | |

| | Pandora AS | | | Denmark | | | | 4,400 | | | | 240,280 | |

a | | Persimmon PLC | | | United Kingdom | | | | 8,975 | | | | 253,996 | |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

STATEMENT OF INVESTMENTS (UNAUDITED)

Franklin Allocation VIP Fund (continued)

| | | | | | | | | | | | | | |

| | | | | Country/

Organization | | | Shares/

Rights | | | Value | |

| | | | |

| | Common Stocks and Other Equity Interests (continued) | | | | | | | | | | | | |

| | Consumer Durables & Apparel (continued) | | | | | | | | | | | | |

| | PulteGroup Inc. | | | United States | | | | 3,970 | | | $ | 135,099 | |

| | Sekisui Chemical Co. Ltd. | | | Japan | | | | 13,100 | | | | 187,693 | |

| | Sekisui House Ltd. | | | Japan | | | | 25,600 | | | | 488,759 | |

| | Sony Corp. | | | Japan | | | | 7,700 | | | | 531,532 | |

| | Tapestry Inc. | | | United States | | | | 9,480 | | | | 125,894 | |

| | Taylor Wimpey PLC | | | United Kingdom | | | | 87,452 | | | | 154,347 | |

| | VF Corp. | | | United States | | | | 9,705 | | | | 591,423 | |

| | Whirlpool Corp. | | | United States | | | | 525 | | | | 68,003 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 11,148,215 | |

| | | | | | | | | | | | | | |

| | | | |

| | Consumer Services 1.0% | | | | | | | | | | | | |

| | Carnival Corp. | | | United States | | | | 11,718 | | | | 192,409 | |

| | Choice Hotels International Inc. | | | United States | | | | 1,034 | | | | 81,583 | |

| | Darden Restaurants Inc. | | | United States | | | | 4,295 | | | | 325,432 | |

| | Domino’s Pizza Inc. | | | United States | | | | 1,302 | | | | 481,011 | |

| | H&R Block Inc. | | | United States | | | | 7,332 | | | | 104,701 | |

| | Las Vegas Sands Corp. | | | United States | | | | 17,329 | | | | 789,163 | |

| | McDonald’s Corp. | | | United States | | | | 13,301 | | | | 2,453,635 | |

| | Six Flags Entertainment Corp. | | | United States | | | | 1,814 | | | | 34,847 | |

| | Starbucks Corp. | | | United States | | | | 10,065 | | | | 740,683 | |

| a | | TAL Education Group, ADR | | | China | | | | 23,000 | | | | 1,572,740 | |

| | Wyndham Destinations Inc. | | | United States | | | | 1,962 | | | | 55,289 | |

| | Yum! Brands Inc. | | | United States | | | | 11,125 | | | | 966,874 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 7,798,367 | |

| | | | | | | | | | | | | | |

| | | | |

| | Diversified Financials 2.2% | | | | | | | | | | | | |

| | 3i Group PLC | | | United Kingdom | | | | 40,649 | | | | 418,546 | |

| | American Express Co. | | | United States | | | | 3,590 | | | | 341,768 | |

| a | | Amundi SA | | | France | | | | 2,687 | | | | 211,215 | |

| a | | Berkshire Hathaway Inc., B | | | United States | | | | 6,469 | | | | 1,154,781 | |

| | BlackRock Inc. | | | United States | | | | 1,465 | | | | 797,092 | |

| | Challenger Ltd. | | | Australia | | | | 17,538 | | | | 54,303 | |

| | The Charles Schwab Corp. | | | United States | | | | 17,831 | | | | 601,618 | |

| | Daiwa Securities Group Inc. | | | Japan | | | | 33,500 | | | | 140,730 | |

| | Deutsche Boerse AG | | | Germany | | | | 9,427 | | | | 1,705,916 | |

| | EXOR NV | | | Netherlands | | | | 3,689 | | | | 211,720 | |

| | FactSet Research Systems Inc. | | | United States | | | | 1,114 | | | | 365,916 | |

| | Flow Traders | | | Netherlands | | | | 10,867 | | | | 388,782 | |

| | Hargreaves Lansdown PLC | | | United Kingdom | | | | 11,932 | | | | 240,612 | |

| | Hong Kong Exchanges and Clearing Ltd. | | | Hong Kong | | | | 24,800 | | | | 1,056,267 | |

| | Intercontinental Exchange Inc. | | | United States | | | | 8,255 | | | | 756,158 | |

| | Intermediate Capital Group PLC | | | United Kingdom | | | | 74,000 | | | | 1,180,534 | |

| | Invesco Ltd. | | | United States | | | | 7,131 | | | | 76,730 | |

| | Japan Exchange Group Inc. | | | Japan | | | | 2,600 | | | | 60,216 | |

| | Lazard Ltd., A | | | United States | | | | 3,513 | | | | 100,577 | |

| | M&G PLC | | | United Kingdom | | | | 112,702 | | | | 234,010 | |

| | Magellan Financial Group Ltd. | | | Australia | | | | 5,399 | | | | 220,439 | |

| | MarketAxess Holdings Inc. | | | United States | | | | 1,105 | | | | 553,517 | |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

STATEMENT OF INVESTMENTS (UNAUDITED)

Franklin Allocation VIP Fund (continued)

| | | | | | | | | | | | | | |

| | | | | Country/

Organization | | | Shares/

Rights | | | Value | |

| | | | |

| | Common Stocks and Other Equity Interests (continued) | | | | | | | | | | | | |

| | Diversified Financials (continued) | | | | | | | | | | | | |

| | MFA Financial Inc. | | | United States | | | | 4,330 | | | $ | 10,782 | |

| | Mitsubishi UFJ Lease & Finance Co. Ltd. | | | Japan | | | | 16,800 | | | | 80,167 | |

| | Moody’s Corp. | | | United States | | | | 2,363 | | | | 649,187 | |

| | Morningstar Inc. | | | United States | | | | 545 | | | | 76,829 | |

| | MSCI Inc. | | | United States | | | | 2,378 | | | | 793,824 | |

| | Nasdaq Inc. | | | United States | | | | 1,600 | | | | 191,152 | |

| a | | Natixis SA | | | France | | | | 39,782 | | | | 104,917 | |

| | Nomura Holdings Inc. | | | Japan | | | | 46,600 | | | | 209,401 | |

| | ORIX Corp. | | | Japan | | | | 46,500 | | | | 577,402 | |

| | Partners Group Holding AG | | �� | Switzerland | | | | 780 | | | | 710,340 | |

| | S&P Global Inc. | | | United States | | | | 2,099 | | | | 691,579 | |

| | Santander Consumer USA Holdings Inc. | | | United States | | | | 3,125 | | | | 57,531 | |

| | SEI Investments Co. | | | United States | | | | 3,055 | | | | 167,964 | |

| | Singapore Exchange Ltd. | | | Singapore | | | | 34,000 | | | | 204,608 | |

| | State Street Corp. | | | United States | | | | 2,700 | | | | 171,585 | |

| | T. Rowe Price Group Inc. | | | United States | | | | 7,039 | | | | 869,316 | |

| | Tradeweb Markets Inc. | | | United States | | | | 2,100 | | | | 122,094 | |

| | UBS Group AG | | | Switzerland | | | | 4,941 | | | | 57,064 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 16,617,189 | |

| | | | | | | | | | | | | | |

| | | | |

| | Energy 1.3% | | | | | | | | | | | | |

| | Ampol Ltd. | | | Australia | | | | 10,004 | | | | 203,815 | |

| | BP PLC | | | United Kingdom | | | | 168,151 | | | | 644,167 | |

| | Cabot Oil & Gas Corp., A | | | United States | | | | 6,007 | | | | 103,200 | |

| | Chevron Corp. | | | United States | | | | 6,700 | | | | 597,841 | |

| | Cimarex Energy Co. | | | United States | | | | 1,926 | | | | 52,946 | |

| | ConocoPhillips | | | United States | | | | 15,805 | | | | 664,126 | |

| | Eni SpA | | | Italy | | | | 9,775 | | | | 93,695 | |

| | EOG Resources Inc. | | | United States | | | | 6,000 | | | | 303,960 | |

| | Equinor ASA | | | Norway | | | | 51,818 | | | | 746,655 | |

| | Exxon Mobil Corp. | | | United States | | | | 28,776 | | | | 1,286,863 | |

| | Galp Energia SGPS SA, B | | | Portugal | | | | 38,527 | | | | 446,873 | |

| | HollyFrontier Corp. | | | United States | | | | 2,216 | | | | 64,707 | |

| | Husky Energy Inc. | | | Canada | | | | 82,500 | | | | 271,040 | |

| | Neste Oil OYJ | | | Finland | | | | 8,059 | | | | 316,498 | |

| | ONEOK Inc. | | | United States | | | | 3,393 | | | | 112,715 | |

| | Phillips 66 | | | United States | | | | 10,544 | | | | 758,114 | |

| | Royal Dutch Shell PLC, B | | | United Kingdom | | | | 45,465 | | | | 689,235 | |

| | SBM Offshore NV | | | Netherlands | | | | 46,666 | | | | 687,586 | |

| | Tenaris SA | | | Italy | | | | 20,416 | | | | 132,664 | |

| | Total SA | | | France | | | | 22,632 | | | | 872,577 | |

| | Valero Energy Corp. | | | United States | | | | 12,245 | | | | 720,251 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 9,769,528 | |

| | | | | | | | | | | | | | |

| | | | |

| | Food & Staples Retailing 1.3% | | | | | | | | | | | | |

| | Casey’s General Stores Inc. | | | United States | | | | 947 | | | | 141,595 | |

| | Coles Group Ltd. | | | Australia | | | | 13,349 | | | | 158,661 | |

| | Costco Wholesale Corp. | | | United States | | | | 4,887 | | | | 1,481,787 | |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

STATEMENT OF INVESTMENTS (UNAUDITED)

Franklin Allocation VIP Fund (continued)

| | | | | | | | | | | | | | |

| | | | | Country/

Organization | | | Shares/

Rights | | | Value | |

| | | | |

| | Common Stocks and Other Equity Interests (continued) | | | | | | | | | | | | |

| | Food & Staples Retailing (continued) | | | | | | | | | | | | |

| a | | Jeronimo Martins SGPS SA | | | Portugal | | | | 7,526 | | | $ | 131,693 | |

| | Koninklijke Ahold Delhaize NV | | | Netherlands | | | | 45,170 | | | | 1,230,957 | |

| | The Kroger Co. | | | United States | | | | 14,920 | | | | 505,042 | |

| | Lawson Inc. | | | Japan | | | | 2,000 | | | | 100,601 | |

| | Matsumotokiyoshi Holdings Co. Ltd. | | | Japan | | | | 15,700 | | | | 570,516 | |

| | Seven & i Holdings Co. Ltd. | | | Japan | | | | 8,500 | | | | 278,065 | |

| | Seven & I Holdings Co. Ltd., ADR | | | Japan | | | | 24,600 | | | | 399,750 | |

| a | | Sprouts Farmers Market Inc. | | | United States | | | | 2,539 | | | | 64,973 | |

| | Sundrug Co. Ltd. | | | Japan | | | | 20,200 | | | | 668,533 | |

| | Sysco Corp. | | | United States | | | | 15,175 | | | | 829,466 | |

| | Walgreens Boots Alliance Inc. | | | United States | | | | 17,826 | | | | 755,644 | |

| | Walmart Inc. | | | United States | | | | 20,575 | | | | 2,464,474 | |

| | Welcia Holdings Co. Ltd. | | | Japan | | | | 1,000 | | | | 80,787 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 9,862,544 | |

| | | | | | | | | | | | | | |

| | | | |

| | Food, Beverage & Tobacco 2.4% | | | | | | | | | | | | |

| a | | a2 Milk Co. Ltd. | | | New Zealand | | | | 4,168 | | | | 54,558 | |

| | Altria Group Inc. | | | United States | | | | 30,176 | | | | 1,184,408 | |

| | Anheuser-Busch InBev SA/NV | | | Belgium | | | | 1,207 | | | | 59,495 | |

| | Brown-Forman Corp., A | | | United States | | | | 1,586 | | | | 91,306 | |

| | Brown-Forman Corp., B | | | United States | | | | 10,899 | | | | 693,830 | |

| | Calbee Inc. | | | Japan | | | | 3,300 | | | | 91,211 | |

| | The Coca-Cola Co. | | | United States | | | | 27,892 | | | | 1,246,215 | |

| | Constellation Brands Inc., A | | | United States | | | | 3,204 | | | | 560,540 | |

| | Flowers Foods Inc. | | | United States | | | | 5,437 | | | | 121,571 | |

| | General Mills Inc. | | | United States | | | | 18,181 | | | | 1,120,859 | |

| | The Hershey Co. | | | United States | | | | 5,251 | | | | 680,635 | |

| | Hormel Foods Corp. | | | United States | | | | 8,792 | | | | 424,390 | |

| | Imperial Brands PLC | | | United Kingdom | | | | 35,970 | | | | 684,720 | |

| | Ingredion Inc. | | | United States | | | | 1,870 | | | | 155,210 | |

| | J M Smucker Co/The | | | United States | | | | 2,302 | | | | 243,575 | |

| | Kellogg Co. | | | United States | | | | 4,386 | | | | 289,739 | |

| | Kirin Holdings Co. Ltd. | | | Japan | | | | 39,200 | | | | 826,326 | |

| | Lamb Weston Holdings Inc. | | | United States | | | | 3,132 | | | | 200,229 | |

| | McCormick & Co. Inc. | | | United States | | | | 5,900 | | | | 1,058,519 | |

| | Mondelez International Inc., A | | | United States | | | | 8,669 | | | | 443,246 | |

| a | | Monster Beverage Corp. | | | United States | | | | 25,224 | | | | 1,748,528 | |

| | Nestle SA | | | Switzerland | | | | 3,119 | | | | 345,805 | |

| | Orkla ASA | | | Norway | | | | 8,204 | | | | 72,045 | |

| | PepsiCo Inc. | | | United States | | | | 23,188 | | | | 3,066,845 | |

| | Philip Morris International Inc. | | | United States | | | | 17,946 | | | | 1,257,297 | |

| | Suntory Beverage & Food Ltd. | | | Japan | | | | 5,300 | | | | 206,797 | |

| | Tyson Foods Inc. | | | United States | | | | 8,574 | | | | 511,953 | |

| b | | WH Group Ltd., Reg S | | | Hong Kong | | | | 435,500 | | | | 376,354 | |

| | Yamazaki Baking Co. Ltd. | | | Japan | | | | 6,100 | | | | 104,781 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 17,920,987 | |

| | | | | | | | | | | | | | |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

STATEMENT OF INVESTMENTS (UNAUDITED)

Franklin Allocation VIP Fund (continued)

| | | | | | | | | | | | | | |

| | | | | Country/

Organization | | | Shares/

Rights | | | Value | |

| | | | |

| | Common Stocks and Other Equity Interests (continued) | | | | | | | | | | | | |

| | Health Care Equipment & Services 3.5% | | | | | | | | | | | | |

| | Abbott Laboratories | | | United States | | | | 21,260 | | | $ | 1,943,802 | |

| | Baxter International Inc. | | | United States | | | | 2,315 | | | | 199,322 | |

| | Becton Dickinson and Co. | | | United States | | | | 8,200 | | | | 1,962,014 | |

| | Cerner Corp. | | | United States | | | | 7,697 | | | | 527,629 | |

| | Chemed Corp. | | | United States | | | | 371 | | | | 167,347 | |

| | Cochlear Ltd. | | | Australia | | | | 10,700 | | | | 1,404,588 | |

| | Coloplast AS, B | | | Denmark | | | | 3,667 | | | | 571,512 | |

| | CVS Health Corp. | | | United States | | | | 7,000 | | | | 454,790 | |

| | Danaher Corp. | | | United States | | | | 6,787 | | | | 1,200,145 | |

| | Dentsply Sirona Inc. | | | United States | | | | 5,700 | | | | 251,142 | |

| a | | Edwards Lifesciences Corp. | | | United States | | | | 7,321 | | | | 505,954 | |

| | Fisher & Paykel Healthcare Corp. Ltd. | | | New Zealand | | | | 11,382 | | | | 262,205 | |

| | GN Store Nord AS | | | Denmark | | | | 25,000 | | | | 1,338,128 | |

| a | | Haemonetics Corp. | | | United States | | | | 5,724 | | | | 512,642 | |

| | HCA Healthcare Inc. | | | United States | | | | 5,464 | | | | 530,336 | |

| | Hoya Corp. | | | Japan | | | | 5,000 | | | | 478,795 | |

| a | | IDEXX Laboratories Inc. | | | United States | | | | 645 | | | | 212,953 | |

| a | | Intuitive Surgical Inc. | | | United States | | | | 2,822 | | | | 1,608,060 | |

| a | | Laboratory Corp. of America Holdings | | | United States | | | | 3,110 | | | | 516,602 | |

| a | | LivaNova PLC | | | United Kingdom | | | | 21,000 | | | | 1,010,730 | |

| | Medipal Holdings Corp. | | | Japan | | | | 6,000 | | | | 115,804 | |

| | Medtronic PLC | | | United States | | | | 17,500 | | | | 1,604,750 | |

| a | | Premier Inc., A | | | United States | | | | 636 | | | | 21,802 | |

| | Quest Diagnostics Inc. | | | United States | | | | 5,173 | | | | 589,515 | |

| | ResMed Inc. | | | United States | | | | 3,990 | | | | 766,080 | |

| | Sinopharm Group Co. Ltd., H | | | China | | | | 121,600 | | | | 312,626 | |

| | Stryker Corp. | | | United States | | | | 14,092 | | | | 2,539,238 | |

| | Suzuken Co. Ltd. | | | Japan | | | | 2,900 | | | | 108,343 | |

| | Teleflex Inc. | | | United States | | | | 3,284 | | | | 1,195,310 | |

| | UnitedHealth Group Inc. | | | United States | | | | 2,600 | | | | 766,870 | |

| | Universal Health Services Inc., B | | | United States | | | | 1,389 | | | | 129,024 | |

| a | | Varian Medical Systems Inc. | | | United States | | | | 1,904 | | | | 233,278 | |

| a | | Veeva Systems Inc. | | | United States | | | | 400 | | | | 93,768 | |

| | West Pharmaceutical Services Inc. | | | United States | | | | 8,100 | | | | 1,840,077 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 25,975,181 | |

| | | | | | | | | | | | | | |

| | | | |

| | Household & Personal Products 1.3% | | | | | | | | | | | | |

| | Church & Dwight Co. Inc. | | | United States | | | | 7,316 | | | | 565,527 | |

| | Clorox Co. | | | United States | | | | 4,417 | | | | 968,957 | |

| | Colgate-Palmolive Co. | | | United States | | | | 31,604 | | | | 2,315,309 | |

| a | | Essity AB, B | | | Sweden | | | | 9,223 | | | | 298,987 | |

| | Estee Lauder Cos. Inc., A | | | United States | | | | 7,118 | | | | 1,343,024 | |

| | Kimberly-Clark Corp. | | | United States | | | | 7,114 | | | | 1,005,564 | |

| | Nu Skin Enterprises Inc., A | | | United States | | | | 1,539 | | | | 58,836 | |

| | The Procter & Gamble Co. | | | United States | | | | 21,338 | | | | 2,551,385 | |

| | Unilever NV | | | United Kingdom | | | | 3,053 | | | | 162,765 | |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

STATEMENT OF INVESTMENTS (UNAUDITED)

Franklin Allocation VIP Fund (continued)

| | | | | | | | | | | | | | |

| | | | | Country/

Organization | | | Shares/

Rights | | | Value | |

| | | | |

| | Common Stocks and Other Equity Interests (continued) | | | | | | | | | | | | |

| | Household & Personal Products (continued) | | | | | | | | | | | | |

| | Unilever PLC | | | United Kingdom | | | | 5,139 | | | $ | 277,192 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 9,547,546 | |

| | | | | | | | | | | | | | |

| | | | |

| | Insurance 0.5% | | | | | | | | | | | | |

| | Admiral Group PLC | | | United Kingdom | | | | 7,784 | | | | 220,737 | |

| | Aflac Inc. | | | United States | | | | 9,100 | | | | 327,873 | |

| | AIA Group Ltd. | | | Hong Kong | | | | 104,540 | | | | 978,237 | |

| | Allianz SE | | | Germany | | | | 1,938 | | | | 395,980 | |

| | American National Insurance Co. | | | United States | | | | 258 | | | | 18,594 | |

| | Assured Guaranty Ltd. | | | United States | | | | 1,941 | | | | 47,380 | |

| | Aviva PLC | | | United Kingdom | | | | 103,080 | | | | 349,363 | |

| a | | CNP Assurances | | | France | | | | 7,394 | | | | 85,751 | |

| | Direct Line Insurance Group PLC | | | United Kingdom | | | | 60,093 | | | | 201,487 | |

| | Erie Indemnity Co., A | | | United States | | | | 3,000 | | | | 575,700 | |

| | Fidelity National Financial Inc. | | | United States | | | | 2,105 | | | | 64,539 | |

| | Japan Post Insurance Co. Ltd. | | | Japan | | | | 9,400 | | | | 123,858 | |

| | Medibank Private Ltd. | | | Australia | | | | 29,647 | | | | 61,457 | |

| | MS&AD Insurance Group Holdings Inc. | | | Japan | | | | 6,400 | | | | 176,248 | |

| | NN Group NV | | | Netherlands | | | | 1,839 | | | | 61,799 | |

| | RenaissanceRe Holdings Ltd. | | | United States | | | | 565 | | | | 96,632 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 3,785,635 | |

| | | | | | | | | | | | | | |

| | | | |

| | Materials 3.3% | | | | | | | | | | | | |

| | Air Products and Chemicals Inc. | | | United States | | | | 15,272 | | | | 3,687,577 | |

| | Albemarle Corp. | | | United States | | | | 15,630 | | | | 1,206,792 | |

| a | | ArcelorMittal SA | | | France | | | | 46,281 | | | | 490,158 | |

| | BHP Group PLC | | | United Kingdom | | | | 14,994 | | | | 306,811 | |

| | Celanese Corp. | | | United States | | | | 9,041 | | | | 780,600 | |

| | Covestro AG | | | Germany | | | | 12,999 | | | | 495,065 | |

| | Eastman Chemical Co. | | | United States | | | | 2,905 | | | | 202,304 | |

| | Ecolab Inc. | | | United States | | | | 9,621 | | | | 1,914,098 | |

| | EMS-Chemie Holding AG | | | Switzerland | | | | 344 | | | | 267,255 | |

| | Evraz PLC | | | Russia | | | | 20,712 | | | | 73,381 | |

| | Fortescue Metals Group Ltd. | | | Australia | | | | 61,175 | | | | 594,637 | |

| | International Flavors & Fragrances Inc. | | | United States | | | | 2,516 | | | | 308,109 | |

| | Johnson Matthey PLC | | | United Kingdom | | | | 11,509 | | | | 299,727 | |

| | Koninklijke DSM NV | | | Netherlands | | | | 12,000 | | | | 1,665,668 | |

| | Linde PLC | | | United Kingdom | | | | 14,985 | | | | 3,178,468 | |

| | LyondellBasell Industries NV, A | | | United States | | | | 11,096 | | | | 729,229 | |

| | Martin Marietta Materials Inc. | | | United States | | | | 2,363 | | | | 488,125 | |

| | NewMarket Corp. | | | United States | | | | 243 | | | | 97,317 | |

| | Nitto Denko Corp. | | | Japan | | | | 6,500 | | | | 368,486 | |

| | Nucor Corp. | | | United States | | | | 4,370 | | | | 180,962 | |

| | Packaging Corp. of America | | | United States | | | | 2,231 | | | | 222,654 | |

| | Reliance Steel & Aluminum Co. | | | United States | | | | 536 | | | | 50,882 | |

| | Rio Tinto Ltd. | | | Australia | | | | 9,594 | | | | 656,840 | |

| | Rio Tinto PLC | | | Australia | | | | 7,923 | | | | 445,861 | |

| | Royal Gold Inc. | | | United States | | | | 493 | | | | 61,290 | |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

STATEMENT OF INVESTMENTS (UNAUDITED)

Franklin Allocation VIP Fund (continued)

| | | | | | | | | | | | | | |

| | | | | Country/

Organization | | | Shares/

Rights | | | Value | |

| | | | |

| | Common Stocks and Other Equity Interests (continued) | | | | | | | | | | | | |

| | Materials (continued) | | | | | | | | | | | | |

| | Shin-Etsu Chemical Co. Ltd. | | | Japan | | | | 400 | | | $ | 46,945 | |

| | Sonoco Products Co. | | | United States | | | | 2,993 | | | | 156,504 | |

| | Steel Dynamics Inc. | | | United States | | | | 4,132 | | | | 107,804 | |

| | Sumitomo Metal Mining Co. Ltd. | | | Japan | | | | 24,100 | | | | 678,892 | |

| | Symrise AG | | | Germany | | | | 14,000 | | | | 1,635,708 | |

| | Taiheiyo Cement Corp. | | | Japan | | | | 5,000 | | | | 116,171 | |

| | Tosoh Corp. | | | Japan | | | | 30,800 | | | | 423,096 | |

| | Umicore SA | | | Belgium | | | | 36,000 | | | | 1,699,195 | |

| | Valvoline Inc. | | | United States | | | | 2,681 | | | | 51,824 | |

| | Wheaton Precious Metals Corp. | | | Canada | | | | 21,490 | | | | 945,209 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 24,633,644 | |

| | | | | | | | | | | | | | |

| | | | |

| | Media & Entertainment 2.1% | | | | | | | | | | | | |

| a | | Alphabet Inc., A | | | United States | | | | 2,146 | | | | 3,043,135 | |

| a | | AMC Networks Inc., A | | | United States | | | | 1,108 | | | | 25,916 | |

| | Ascential PLC | | | United Kingdom | | | | 324,885 | | | | 1,165,435 | |

| a | | Baidu Inc., ADR | | | China | | | | 5,625 | | | | 674,381 | |

| | Cable One Inc. | | | United States | | | | 555 | | | | 985,042 | |

| | Cinemark Holdings Inc. | | | United States | | | | 2,017 | | | | 23,296 | |

| | Comcast Corp., A | | | United States | | | | 38,307 | | | | 1,493,207 | |

| a | | CTS Eventim AG & Co. KGaA | | | Germany | | | | 24,000 | | | | 1,002,055 | |

| | CyberAgent Inc. | | | Japan | | | | 35,000 | | | | 1,720,378 | |

| a | | Facebook Inc., A | | | United States | | | | 12,128 | | | | 2,753,905 | |

| | The Interpublic Group of Cos. Inc. | | | United States | | | | 8,214 | | | | 140,952 | |

| | Kakaku.com Inc. | | | Japan | | | | 5,700 | | | | 145,203 | |

| a | | Match Group Inc. | | | United States | | | | 1,348 | | | | 144,304 | |

| a | | Match Group Inc. | | | United States | | | | 2,007 | | | | 649,064 | |

| | Nippon Television Holdings Inc. | | | Japan | | | | 13,500 | | | | 146,218 | |

| | Omnicom Group Inc. | | | United States | | | | 6,512 | | | | 355,555 | |

| | Tokyo Broadcasting System Holdings Inc. | | | Japan | | | | 14,900 | | | | 238,346 | |

| a | | Ubisoft Entertainment SA | | | France | | | | 1,485 | | | | 122,963 | |

| | The Walt Disney Co. | | | United States | | | | 10,412 | | | | 1,161,042 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 15,990,397 | |

| | | | | | | | | | | | | | |

| | | | |

| | Pharmaceuticals, Biotechnology & Life Sciences 5.9% | | | | | | | | | | | | |

| a | | 10X Genomics Inc., A | | | United States | | | | 900 | | | | 80,379 | |

| | AbbVie Inc. | | | United States | | | | 25,727 | | | | 2,525,877 | |

| | Agilent Technologies Inc. | | | United States | | | | 7,385 | | | | 652,612 | |

| | Amgen Inc. | | | United States | | | | 12,284 | | | | 2,897,304 | |

| | Astellas Pharma Inc. | | | Japan | | | | 27,800 | | | | 464,248 | |

| | AstraZeneca PLC, ADR | | | United Kingdom | | | | 12,114 | | | | 640,709 | |

| | Bayer AG | | | Germany | | | | 21,485 | | | | 1,592,402 | |

| a | | Biogen Inc. | | | United States | | | | 4,887 | | | | 1,307,517 | |

| | Bristol-Myers Squibb Co. | | | United States | | | | 26,105 | | | | 1,534,974 | |

| a | | Bristol-Myers Squibb Co., rts., 2/01/49 | | | United States | | | | 5,723 | | | | 20,488 | |

| a | | Catalent Inc. | | | United States | | | | 20,489 | | | | 1,501,844 | |

| | Chugai Pharmaceutical Co. Ltd. | | | Japan | | | | 3,600 | | | | 192,744 | |

| | CSL Ltd. | | | Australia | | | | 12,186 | | | | 2,423,310 | |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

STATEMENT OF INVESTMENTS (UNAUDITED)

Franklin Allocation VIP Fund (continued)

| | | | | | | | | | | | | | |

| | | | | Country/

Organization | | | Shares/

Rights | | | Value | |

| | | | |

| | Common Stocks and Other Equity Interests (continued) | | | | | | | | | | | | |

| | Pharmaceuticals, Biotechnology & Life Sciences (continued) | | | | | | | | | | | | |

| a | | Deciphera Pharmaceuticals Inc. | | | United States | | | | 3,500 | | | $ | 209,020 | |

| | Eli Lilly and Co. | | | United States | | | | 7,262 | | | | 1,192,275 | |

| a | | Exelixis Inc. | | | United States | | | | 7,348 | | | | 174,441 | |

| a | | Galapagos NV | | | Belgium | | | | 1,565 | | | | 308,869 | |

| a | | Genmab A/S | | | Denmark | | | | 2,200 | | | | 741,752 | |

| | Gilead Sciences Inc. | | | United States | | | | 21,800 | | | | 1,677,292 | |

| a | | GW Pharmaceuticals PLC, ADR | | | United Kingdom | | | | 1,326 | | | | 162,727 | |

| | Hikma Pharmaceuticals PLC | | | United Kingdom | | | | 45,000 | | | | 1,234,799 | |

| a | | Illumina Inc. | | | United States | | | | 3,446 | | | | 1,276,226 | |

| a | | Iovance Biotherapeutics Inc. | | | United States | | | | 2,500 | | | | 68,625 | |

| | Johnson & Johnson. | | | United States | | | | 26,655 | | | | 3,748,493 | |

| | Merck & Co. Inc. | | | United States | | | | 22,963 | | | | 1,775,729 | |

| a | | Mettler-Toledo International Inc. | | | United States | | | | 3,480 | | | | 2,803,314 | |

| a | | Neurocrine Biosciences Inc. | | | United States | | | | 2,809 | | | | 342,698 | |

| | Novartis AG | | | Switzerland | | | | 12,343 | | | | 1,075,335 | |

| | Novo Nordisk AS, B | | | Denmark | | | | 15,177 | | | | 988,650 | |

| | Orion OYJ | | | Finland | | | | 1,749 | | | | 84,809 | |

| | Pfizer Inc. | | | United States | | | | 70,822 | | | | 2,315,879 | |

| a | | PTC Therapeutics Inc. | | | United States | | | | 2,300 | | | | 116,702 | |

| a | | Reata Pharmaceuticals Inc. | | | United States | | | | 700 | | | | 109,214 | |

| a | | Regeneron Pharmaceuticals Inc. | | | United States | | | | 1,113 | | | | 694,122 | |

| | Roche Holding AG | | | Switzerland | | | | 8,164 | | | | 2,828,414 | |

| | Sanofi | | | France | | | | 12,151 | | | | 1,239,104 | |

| | Santen Pharmaceutical Co. Ltd. | | | Japan | | | | 50,000 | | | | 920,473 | |

| | Sartorius Stedim Biotech | | | France | | | | 1,200 | | | | 304,218 | |

| | Shionogi & Co. Ltd. | | | Japan | | | | 3,500 | | | | 219,567 | |

| | Takeda Pharmaceutical Co. Ltd., ADR | | | Japan | | | | 69,900 | | | | 1,253,307 | |

| a | | Waters Corp. | | | United States | | | | 3,696 | | | | 666,758 | |

| a | | WuXi Biologics (Cayman) Inc. | | | China | | | | 6,500 | | | | 119,311 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 44,486,531 | |

| | | | | | | | | | | | | | |

| | | | |

| | Real Estate 1.5% | | | | | | | | | | | | |

| | American Tower Corp. | | | United States | | | | 6,129 | | | | 1,584,592 | |

| a | | Aroundtown SA | | | Germany | | | | 36,347 | | | | 208,315 | |

| | CapitaLand Mall Trust | | | Singapore | | | | 39,200 | | | | 55,624 | |

| | CK Asset Holdings Ltd. | | | Hong Kong | | | | 140,330 | | | | 841,524 | |

| | Crown Castle International Corp. | | | United States | | | | 6,785 | | | | 1,135,470 | |

| | Daito Trust Construction Co. Ltd. | | | Japan | | | | 3,000 | | | | 276,484 | |

| | EPR Properties | | | United States | | | | 2,325 | | | | 77,027 | |

| | Equinix Inc. | | | United States | | | | 1,198 | | | | 841,355 | |

| | Gaming and Leisure Properties Inc. | | | United States | | | | 5,396 | | | | 186,702 | |

| | Gecina SA | | | France | | | | 1,959 | | | | 241,929 | |

| | Goodman Group | | | Australia | | | | 7,321 | | | | 75,529 | |

| | Kerry Properties Ltd. | | | Hong Kong | | | | 27,500 | | | | 71,434 | |

| | Kimco Realty Corp. | | | United States | | | | 10,578 | | | | 135,822 | |

| | Link REIT | | | Hong Kong | | | | 11,100 | | | | 91,132 | |

| | Mitsui Fudosan Co. Ltd. | | | Japan | | | | 32,700 | | | | 580,907 | |

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

STATEMENT OF INVESTMENTS (UNAUDITED)

Franklin Allocation VIP Fund (continued)

| | | | | | | | | | | | | | |

| | | | | Country/

Organization | | | Shares/

Rights | | | Value | |

| | | | |

| | Common Stocks and Other Equity Interests (continued) | | | | | | | | | | | | |

| | Real Estate (continued) | | | | | | | | | | | | |

| | National Retail Properties Inc. | | | United States | | | | 5,357 | | | $ | 190,066 | |

| | OMEGA Healthcare Investors Inc. | | | United States | | | | 6,649 | | | | 197,675 | |

| | Public Storage | | | United States | | | | 5,214 | | | | 1,000,515 | |

| | Realty Income Corp. | | | United States | | | | 9,590 | | | | 570,605 | |

| | Segro PLC | | | United Kingdom | | | | 39,210 | | | | 433,644 | |

| | Simon Property Group Inc. | | | United States | | | | 7,737 | | | | 529,056 | |

| | Spirit Realty Capital Inc. | | | United States | | | | 3,149 | | | | 109,774 | |

| | STORE Capital Corp. | | | United States | | | | 5,795 | | | | 137,979 | |

| | Sun Hung Kai Properties Ltd. | | | Hong Kong | | | | 23,500 | | | | 300,216 | |

| | Swire Pacific Ltd., A | | | Hong Kong | | | | 69,500 | | | | 369,374 | |

| | Ventas Inc. | | | United States | | | | 6,506 | | | | 238,250 | |

| | VEREIT Inc. | | | United States | | | | 30,782 | | | | 197,928 | |

| | WP Carey Inc. | | | United States | | | | 3,880 | | | | 262,482 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 10,941,410 | |

| | | | | | | | | | | | | | |

| | | | |

| | Retailing 3.7% | | | | | | | | | | | | |