UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05631

Lee Financial Mutual Fund, Inc.

(Exact name of registrant as specified in charter)

3113 Olu Street

Honolulu, HI 96816-1425

(Address of principal executive offices) (Zip code)

Nancy P. O’Hara

Drinker Biddle & Reath LLP

One Logan Square

Suite #2000

Philadelphia, PA 19103-6996

(Name and address of agent for service)

Registrant's telephone number, including area code: 808-988-8088

Date of fiscal year end: September 30

Date of reporting period: March 31, 2016

Item 1. Reports to Stockholders.

SEMI-ANNUAL REPORT

March 31, 2016

Lee Financial Tactical Fund

May 2, 2016

Dear fellow shareholder,

On June 10, 2011, the Lee Financial Tactical Fund (the “Fund”) commenced operations as a new series of Lee Financial Mutual Fund, Inc. The investment objective of the Fund is to achieve long-term capital appreciation and preservation of capital while lowering volatility.

The Fund had a beginning net asset value (“NAV”) of $10.60 per share on October 1, 2015 and a closing NAV of $11.20 per share on March 31, 2016. On December 17, 2015 the Fund paid a distribution of $0.08 per share, which resulted in a 6.47%* total return for the six month period ended March 31, 2016 versus 8.49%* for the Fund’s benchmark index, the S&P 500 Index.

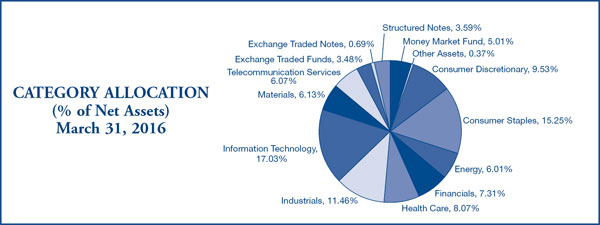

Detracting from the Fund’s relative results against its benchmark index was the Fund portfolio’s performance in the technology and consumer discretionary sectors, whereas the largest contributors were the financials and telecommunication services sectors.

U.S. equity markets went through a fairly dramatic swing in performance for the six months ended March 31, 2016. From peak to trough in this time period, the S&P 500 Index had a decrease of 13%. This was noteworthy considering the volatility that investors had just experienced in August and September of 2015. We believe some of the possible reasons for this performance included the declining price of oil, worries of the Federal Open Market Committee tightening monetary policy, and concerns about the economic viability of international equity markets. The portfolio manager continued to invest primarily in equity securities of U.S. companies by investing in large, medium and/or small capitalization securities, mainly with market capitalizations at the time of purchase of $2 billion or greater. At the end of the reporting period, the Fund held 86.86% of its net assets in common stocks.

During the six-month period ended March 31, 2016, the Fund portfolio also held structured notes, fixed income exchange traded funds and exchange traded notes to develop an asset allocation strategy that provides a more diversified portfolio in an attempt to create protection in down markets. At the end of the reporting period, the Fund held 7.76% of net assets in these investment categories.

At March 31, 2016, the Fund had a cash allocation of 5.01% in the Federated Government Obligation-I money market fund.

On the following pages you will find our March 31, 2016 Semi-Annual Report. If you have any questions or would like us to provide information about the Fund to your family or friends, please call us at (808) 988-8088 or (800) 354-9654.

On a final note, we would like to express our appreciation for the confidence you have placed in our firm in the management of your assets.

Warmest Aloha,

Terrence K.H. Lee

President and CEO

| * | Return is not annualized. |

Before investing, read the prospectus carefully. Please carefully consider the Fund’s investment objective, risks, and charges and expenses before investing. The prospectus contains this and other information about the Fund. This Semi-Annual Report must be accompanied or preceded by a prospectus.

The Fund’s yield, share price and investment return fluctuate so that you may receive more or less than your original investment upon redemption. Low volatility investing does not guarantee a profit or protect against a loss in a generally declining market. Past performance is no guarantee of future results. The Fund is a series of Lee Financial Mutual Fund, Inc.

Mutual fund investing involves risks. Principal loss is possible. The Lee Financial Tactical Fund’s investments in structured notes may subject the Fund to greater interest rate, credit and counterparty risks and costs than traditional equity funds. The price of structured notes may be volatile and they may have a limited trading market, making it difficult to value or sell them. Structured notes are also subject to risks of debt instruments, including interest rate and call risks, but may have a greater risk of loss than a typical debt security of the same maturity and credit quality. In exchange for the issuer’s guarantee of full or partial payment of principal on maturity, the upside return the Fund could achieve on its investment may be capped or limited and the issuer’s guarantee is generally available only if the Fund holds the structured note to maturity. The Fund may also invest in options which may be more volatile and less liquid, increasing the risk of loss when compared to traditional securities. The Fund may also invest in foreign securities which, especially in emerging markets, involve greater volatility and political, economic, regulatory and currency risks and differences in accounting methods. The Fund may invest in small, mid or large companies. Investment in smaller companies involves additional risks such as limited liquidity and greater volatility than larger companies. The Fund’s investments in other investment companies, including exchange traded funds, subjects the Fund to those risks affecting that investment company, including a possible decrease in the value of the underlying securities. The Fund will also incur brokerage costs when it purchases exchange traded funds and will incur its pro rata share of the underlying investment company’s expenses. Writing call options is a highly specialized activity which involves greater liquidity, counterparty and equity price risks. The Fund's investments in exchange traded notes are subject to credit risk and the value of the exchange traded note may decline due to a downgrade in the issuer's credit rating, despite the underlying index remaining unchanged. This is not a complete list of risks that may affect the Fund. For additional information concerning the risks applicable to the Fund, please see the Fund’s prospectus.

The S&P 500 Index is an unmanaged market capitalization weighted index comprised of 500 widely held common stocks. The S&P 500 Index is generally considered representative of the stock market as a whole. It is not possible to invest directly in an unmanaged index.

Lee Financial Securities, Inc., member FINRA, is the distributor for Lee Financial Mutual Fund, Inc. Lee Financial Securities, Inc. is a wholly owned subsidiary of Lee Financial Group Hawaii, Inc., a registered investment advisor with the SEC.

May 25, 2016

This report may contain certain forward-looking statements about factors that may affect the performance of the Fund in the future. These statements are based on the predictions and expectations of Lee Financial Group Hawaii, Inc., the Fund’s investment manager (the “Investment Manager”) concerning certain future events, such as performance of the economy, changes in interest rates and other factors that may impact the performance of the Fund. The Investment Manager believes that these forward looking statements are reasonable, although they are inherently uncertain and difficult to predict. Actual events may cause adjustments in portfolio management strategies from those currently expected to be employed.

YOUR FUND’S EXPENSES

As a Fund shareholder, you can incur the following costs:

| • | Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. |

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the period indicated.

Actual Fund Expenses

The first line (Actual) for the share class listed in the table below provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period, by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. If an account had an $8,600 value, the $8,600 ¸ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for the share class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs. Therefore, the second line is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. Please refer to the Fund prospectus for additional information on operating expenses.

| | Beginning Account Value 10/01/2015 | Ending Account Value 03/31/2016 | Expenses Paid During Period* 10/01/15 - 03/31/16 |

| Lee Financial Tactical Fund | | | |

| Actual | $1,000.00 | $1,064.70 | $6.30 |

| Hypothetical | $1,000.00 | $1,018.90 | $6.16 |

| * | Expenses are equal to the annualized expense ratio (1.22%), which is net of fee waivers, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period. |

| LEE FINANCIAL TACTICAL FUND |

| |

| SCHEDULE OF INVESTMENTS |

| |

| March 31, 2016 (Unaudited) |

COMMON STOCK - 86.86%

| | | | | | | |

| | | Shares | | | Value | |

| CONSUMER DISCRETIONARY – 9.53% | | | | | | |

| The Home Depot, Inc. | | | 18,000 | | | $ | 2,401,740 | |

Toyota Motor Corporation - ADR (a) | | | 18,500 | | | | 1,966,920 | |

| | | | | | | | 4,368,660 | |

| | | | | | | | | |

| CONSUMER STAPLES – 15.25% | | | | | | | | |

| CVS Health Corporation | | | 24,600 | | | | 2,551,758 | |

| Costco Wholesale Corporation | | | 16,700 | | | | 2,631,586 | |

| The Procter & Gamble Company | | | 22,000 | | | | 1,810,820 | |

| | | | | | | | 6,994,164 | |

| | | | | | | | | |

| ENERGY – 6.01% | | | | | | | | |

| Exxon Mobil Corporation | | | 19,500 | | | | 1,630,005 | |

| Phillips 66 | | | 13,000 | | | | 1,125,670 | |

| | | | | | | | 2,755,675 | |

| | | | | | | | | |

| FINANCIALS – 7.31% | | | | | | | | |

| The Goldman Sachs Group, Inc. | | | 9,000 | | | | 1,412,820 | |

| Welltower Inc. | | | 28,000 | | | | 1,941,520 | |

| | | | | | | | 3,354,340 | |

| | | | | | | | | |

| HEALTH CARE – 8.07% | | | | | | | | |

| Gilead Sciences, Inc. | | | 13,200 | | | | 1,212,552 | |

| Novo Nordisk A/S ADR | | | 22,000 | | | | 1,192,180 | |

| Teva Pharmaceutical Industries Ltd. - ADR | | | 24,250 | | | | 1,297,618 | |

| | | | | | | | 3,702,350 | |

| | | | | | | | | |

| INDUSTRIALS – 11.46% | | | | | | | | |

AECOM (a) | | | 33,000 | | | | 1,016,070 | |

| Lockheed Martin Corporation | | | 6,500 | | | | 1,439,750 | |

| Raytheon Company | | | 13,850 | | | | 1,698,425 | |

XPO Logistics, Inc. (a) | | | 35,800 | | | | 1,099,060 | |

| | | | | | | | 5,253,305 | |

See accompanying notes to financial statements.

| LEE FINANCIAL TACTICAL FUND |

| |

| SCHEDULE OF INVESTMENTS – (Continued) |

| |

| March 31, 2016 (Unaudited) |

| | | | | | | |

| | | Shares | | | Value | |

| INFORMATION TECHNOLOGY – 17.03% | | | | | | |

Alphabet Inc. (a) | | | 3,420 | | | $ | 2,609,118 | |

| Apple Inc. | | | 18,300 | | | | 1,994,517 | |

| Cisco Systems, Inc. | | | 42,000 | | | | 1,195,740 | |

PayPal Holdings, Inc. (a) | | | 18,000 | | | | 694,800 | |

| Visa Inc. | | | 17,200 | | | | 1,315,456 | |

| | | | | | | | 7,809,631 | |

| | | | | | | | | |

| MATERIALS – 6.13% | | | | | | | | |

| The Dow Chemical Company | | | 20,000 | | | | 1,017,200 | |

| Nucor Corporation | | | 37,900 | | | | 1,792,670 | |

| | | | | | | | 2,809,870 | |

| | | | | | | | | |

| TELECOMMUNICATION SERVICES – 6.07% | | | | | | | | |

| Verizon Communications | | | 51,500 | | | | 2,785,120 | |

| | | | | | | | 2,785,120 | |

| | | | | | | | | |

| Total Common Stocks (Cost $34,859,198) | | | | | | $ | 39,833,115 | |

| | | | | | | | | |

| EXCHANGE TRADED FUNDS – 3.48% | | | | | | | | |

| Vanguard Intermediate-Term Bond Index Fund | | | 18,500 | | | $ | 1,595,995 | |

| | | | | | | | 1,595,995 | |

| | | | | | | | | |

| Total Exchange Traded Funds (Cost $1,555,511) | | | | | | $ | 1,595,995 | |

| | | | | | | | | |

| EXCHANGE TRADED NOTES – 0.69% | | | | | | | | |

iPath® S&P 500 VIX Short-Term FuturesTM(a) | | | 18,000 | | | $ | 316,980 | |

| | | | | | | | 316,980 | |

| | | | | | | | | |

| Total Exchange Traded Notes (Cost $458,276) | | | | | | $ | 316,980 | |

See accompanying notes to financial statements.

| LEE FINANCIAL TACTICAL FUND |

| |

| SCHEDULE OF INVESTMENTS – (Continued) |

| |

| March 31, 2016 (Unaudited) |

| | | Shares | | | Value | |

| STRUCTURED NOTES – 3.59% | | | | | | |

| | | | | | | |

Credit Suisse Capped Buffered Return Equity Securities Linked to the Russell 2000® Index due 02/15/2017 (a) Return at maturity of 100% of the appreciation, if any, of the Russell 2000® Index up to cap of 15.20% and losses of 100% of the depreciation of the Russell 2000® Index in excess of 15%. | | | 500,000 | | | $ | 466,850 | |

| | | | | | | | | |

Credit Suisse Capped Buffered Return Equity Securities Linked to the MSCI EAFE® Index due 05/11/2017 (a) Return at maturity of 100% of the appreciation, if any, of the MSCI EAFE® Index up to cap of 15.60% and losses of 100% of the depreciation of the MSCI EAFE® Index in excess of 12%. | | | 400,000 | | | | 396,600 | |

| | | | | | | | | |

Deutsche Bank Capped Buffered Notes Linked to the S&P 500® Index due 08/12/2016 (a) Return at maturity of 100% of the appreciation, if any, of the S&P 500® Index up to cap of 12.30% and losses of 100% of the depreciation of the S&P 500® Index in excess of 12%. | | | 300,000 | | | | 304,200 | |

| | | | | | | | | |

Deutsche Bank Uncapped Buffered Notes Linked to the EURO STOXX 50® Index due 09/08/2016 (a) Return at maturity of 100% of the appreciation, if any, of the EURO STOXX 50® Index and losses of 100% of the depreciation of the EURO STOXX 50® Index in excess of 10%. | | | 500,000 | | | | 480,600 | |

| Total Structured Notes (Cost $1,700,000) | | | | | | $ | 1,648,250 | |

| | | | | | | | | |

| MONEY MARKET FUND – 5.01% | | | | | | | | |

| | | | | | | | | |

| Federated Government Obligation-I | | | 2,298,169 | | | $ | 2,298,169 | |

| Money Market Fund (Cost $2,298,169) | | | | | | $ | 2,298,169 | |

Total Investments (Cost $40,871,154) (b) | | | 99.63 | % | | | 45,692,509 | |

| Other Assets Less Liabilities | | | 0.37 | % | | | 167,855 | |

| Net Assets | | | 100.00 | % | | $ | 45,860,364 | |

| | | | | | | | | |

(a) Non-Income producing security. | | | | | | | | |

(b) Aggregate cost for federal income tax purposes is $40,871,154. | | | | | | | | |

| | | | | | | | | |

| At March 31, 2016 unrealized appreciation (depreciation) of securities for federal income tax purposes is as follows: | | | | | |

| Gross unrealized appreciation | | $ | 5,228,835 | |

| Gross unrealized (depreciation) | | | (407,480 | ) |

| Net unrealized appreciation | | $ | 4,821,355 | |

See accompanying notes to financial statements.

| LEE FINANCIAL TACTICAL FUND |

| |

| STATEMENT OF ASSETS AND LIABILITIES |

| |

| March 31, 2016 (Unaudited) |

| | | Tactical | |

| | | Fund | |

| ASSETS | | | |

| Investments at market value | | | |

(Identified cost $40,871,154) (Note 1 (A)) | | $ | 45,692,509 | |

| Income receivable | | | 61,838 | |

| Subscriptions receivable | | | 145,362 | |

| Other Assets | | | 25,174 | |

| Total assets | | | 45,924,883 | |

| | | | | |

| LIABILITIES | | | | |

| Redemptions payable | | | 10,067 | |

| Management fee payable | | | 24,925 | |

| Administration fee payable | | | 757 | |

| Distribution Plan payable | | | 3,035 | |

| Shareholder Servicing fee payable | | | 3,835 | |

| Transfer Agent fee payable | | | 2,301 | |

| Chief Compliance Officer fee payable | | | 1,881 | |

| Director’s fee payable | | | 435 | |

| Director’s expenses payable | | | 466 | |

| Accrued expenses | | | 16,817 | |

| Total liabilities | | | 64,519 | |

| | | | | |

| NET ASSETS | | $ | 45,860,364 | |

| (Applicable to 4,096,391 shares outstanding, $0.01 par value, 20,000,000 shares authorized) | | | | |

| | | | | |

| NET ASSET VALUE, OFFERING AND REPURCHASE PRICE PER SHARE, INVESTOR CLASS SHARES | | $ | 11.20 | |

| | | | | |

| NET ASSETS | | | | |

| At March 31, 2016, net assets consisted of: | | | | |

| Paid-in capital | | $ | 42,416,089 | |

| Undistributed net investment income | | | 115,055 | |

| Accumulated net realized (loss) on investments | | | (1,492,135 | ) |

| Net unrealized appreciation on investments | | | 4,821,355 | |

| | | | | |

| | | $ | 45,860,364 | |

See accompanying notes to financial statements.

| LEE FINANCIAL TACTICAL FUND |

| |

| STATEMENT OF OPERATIONS |

| |

| For the six months ended March 31, 2016 (Unaudited) |

| | | | |

| | | Tactical | |

| | | Fund | |

| INVESTMENT INCOME | | | |

| Dividend Income (Foreign tax withheld $9,881) | | $ | 475,215 | |

| Interest income | | | 1,740 | |

| Total investment income | | | 476,955 | |

| | | | | |

| Expenses | | | | |

Management fee (Note 2) | | | 208,214 | |

Distribution costs (Notes 2 and 3) | | | 12,810 | |

Transfer Agent fee (Note 2) | | | 13,584 | |

Shareholder Services fee (Note 2) | | | 22,640 | |

Administration fee (Note 2) | | | 4,527 | |

| Accounting fee | | | 21,960 | |

| Legal and Audit fees | | | 19,607 | |

| Custodian fee | | | 3,843 | |

| Insurance | | | 1,327 | |

| Registration fee | | | 15,138 | |

Chief Compliance Officer fee (Note 2) | | | 10,969 | |

| Director’s fee | | | 1,487 | |

| Director’s expenses | | | 864 | |

| Printing fee | | | 742 | |

| Mailing fee | | | 238 | |

| Total expenses | | | 337,950 | |

| | | | | |

Management fees waived (Note 2) | | | (61,055 | ) |

| Net Expenses | | | 276,895 | |

| Net investment income | | | 200,060 | |

| | | | | |

| NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | | | | |

| Net realized (loss) on transactions from: | | | | |

| Investments | | | (622,327 | ) |

| Options | | | - | |

| | | | | |

| Net change in unrealized appreciation on transactions from: | | | | |

| Investments | | | 3,286,762 | |

| Options | | | - | |

| Net realized and unrealized gain on investments | | | 2,664,435 | |

| | | | | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 2,864,495 | |

See accompanying notes to financial statements.

LEE FINANCIAL TACTICAL FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | For The Six Months Ended March 31, 2016 (Unaudited) | | | For The Year Ended September 30, 2015 | |

| INCREASE (DECREASE) IN NET ASSETS FROM | | | | | | |

| Operations | | | | | | |

| Net investment income | | $ | 200,060 | | | $ | 278,621 | |

| Net realized (loss) on investments | | | (622,327 | ) | | | (314,865 | ) |

| (Decrease) Increase in unrealized appreciation of investments | | | 3,286,762 | | | | (2,869,063 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 2,864,495 | | | | (2,905,307 | ) |

| Distributions to shareholders from: | | | | | | | | |

| Net investment income | | | | | | | | |

($0.08 and $0.00++ per share, respectively) | | | (350,013 | ) | | | (10,827 | ) |

| Capital gains | | | | | | | | |

| ($0.00 and $0.70 per share, respectively) | | | - | | | | (2,454,630 | ) |

| Total distributions to shareholders | | | (350,013 | ) | | | (2,465,457 | ) |

Capital share transactions (a) | | | | | | | | |

| (Decrease) Increase in net assets resulting from capital share transactions | | | (2,347,161 | ) | | | 11,495,051 | |

| Total increase in net assets | | | 167,321 | | | | 6,124,287 | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 45,693,043 | | | | 39,568,756 | |

End of period (including undistributed net investment income of $115,055 and $265,008, respectively) | | $ | 45,860,364 | | | $ | 45,693,043 | |

(a) Summary of capital share activity follows:

| | | | | | | | | | | | | |

| | | For The Six Months Ended March 31, 2016 (Unaudited) | | | For The Year Ended September 30, 2015 | |

| | | Shares | | | Value | | | Shares | | | Value | |

| Shares sold | | | 161,076 | | | $ | 1,742,118 | | | | 1,241,660 | | | $ | 14,664,504 | |

| Shares issued on reinvestment of distributions | | | 31,877 | | | | 350,013 | | | | 212,539 | | | | 2,465,457 | |

| | | | 192,953 | | | | 2,092,131 | | | | 1,454,199 | | | | 17,129,961 | |

| Shares redeemed | | | (406,327 | ) | | | (4,439,292 | ) | | | (483,684 | ) | | | (5,634,910 | ) |

| Net (decrease) increase | | | (213,374 | ) | | $ | (2,347,161 | ) | | | 970,515 | | | $ | 11,495,051 | |

| ++ | Less than $0.01 per share. |

See accompanying notes to financial statements.LEE FINANCIAL TACTICAL FUND

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout each period)

| | | For The Six Months Ended March 31, 2016 | | |

Years and Period Ended September 30, | |

| | | (Unaudited) | | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | | 2011* | |

| Net asset value | | | | | | | | | | | | | | | | | | | |

| Beginning of period | | $ | 10.60 | | | $ | 11.85 | | | $ | 11.26 | | | $ | 10.42 | | | $ | 9.17 | | | $ | 10.00 | |

| Income from investment operations | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.05 | | | | 0.07 | | | | 0.00 | | | | 0.03 | | | | (0.01 | ) | | | (0.03 | ) |

Net gain (loss) on securities (both realized and unrealized) | | | 0.63 | | | | (0.62 | ) | | | 1.62 | | | | 0.93 | | | | 1.26 | | | | (0.80 | ) |

| Total from investment operations | | | 0.68 | | | | (0.55 | ) | | | 1.62 | | | | 0.96 | | | | 1.25 | | | | (0.83 | ) |

| Less distributions | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.08 | ) | | | (0.00 | )++ | | | (0.01 | ) | | | (0.02 | ) | | | - | | | | - | |

| Distributions from capital gains | | | - | | | | (0.70 | ) | | | (1.02 | ) | | | (0.10 | ) | | | - | | | | - | |

| Total distributions | | | (0.08 | ) | | | (0.70 | ) | | | (1.03 | ) | | | (0.12 | ) | | | - | | | | - | |

| End of period | | $ | 11.20 | | | $ | 10.60 | | | $ | 11.85 | | | $ | 11.26 | | | $ | 10.42 | | | $ | 9.17 | |

| Total return | | | 6.47 | %+ | | | -5.10 | % | | | 15.05 | % | | | 9.34 | % | | | 13.63 | % | | | -8.30 | %+ |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000’s) | | $ | 45,860 | | | $ | 45,693 | | | $ | 39,569 | | | $ | 37,140 | | | $ | 30,695 | | | $ | 20,910 | |

Ratio of expenses to average net assets before fee waivers (a) | | | 1.49 | %** | | | 1.57 | % | | | 1.68 | % | | | 1.77 | % | | | 1.93 | % | | | 2.28 | %** |

Ratio of expenses to average net assets after fee waivers (a) | | | 1.22 | %** | | | 1.22 | % | | | 1.33 | % | | | 1.42 | % | | | 1.77 | % | | | 2.28 | %** |

Ratio of net investment income to average net assets before fee waivers (a) | | | 0.61 | %** | | | 0.26 | % | | | -0.32 | % | | | -0.08 | % | | | -0.30 | % | | | -1.58 | %** |

Ratio of net investment income to average net assets after fee waivers (a) | | | 0.88 | %** | | | 0.61 | % | | | 0.03 | % | | | 0.27 | % | | | -0.14 | % | | | -1.58 | %** |

| Portfolio turnover | | | 53.55 | %+ | | | 104.02 | % | | | 68.25 | % | | | 228.93 | % | | | 81.84 | % | | | 18.42 | %+ |

| * | Commenced operations June 10, 2011. |

| ++ | Less than $0.01 per share. |

| (a) | Does not include expenses of the investment companies in which the Fund invests. |

See accompanying notes to financial statements.LEE FINANCIAL TACTICAL FUND

NOTES TO FINANCIAL STATEMENTS

March 31, 2016 (Unaudited)

| (1) | ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Lee Financial Tactical Fund (“Fund”) is a series of Lee Financial Mutual Fund, Inc. which is registered under the Investment Company Act of 1940 as a non-diversified open-end management investment company. Lee Financial Mutual Fund, Inc. currently has two investment portfolios, including the Fund which is currently offering one Class of Shares: Investor Shares.

The investment objective of the Fund is to achieve long-term capital appreciation and preservation of capital while lowering volatility. The Fund seeks to achieve its objective by normally investing primarily in equity securities of U.S. companies and allocating a portion of total assets to structured notes. The Fund also may invest in exchange traded funds (“ETFs”) that invest in domestic or foreign securities, foreign securities, real estate investment trusts, fixed income securities, short-term debt instruments, cash and cash equivalents, and convertible bonds and convertible preferred stock. It also may write and purchase covered call and put options.

Structured notes are specially designed debt instruments whose principal and interest payments are linked to, and whose values rise or fall in response to, the value of an index, basket of securities, interest rate benchmark or other financial asset. Structured notes are subject to interest rate risk. They are also subject to credit risk with respect both to the issuer and, if applicable, to the underlying security. The price of structured notes may be volatile and they may have a limited trading market, making it difficult to value them or sell them at an acceptable price. In exchange for the issuer’s guarantee of full or partial payment of principal on maturity, the upside return the Fund could achieve on its investment may be capped or limited and the issuer’s guarantee is generally available only if the Fund holds the structured note to maturity. There may be higher fees and costs associated with structured notes than other types of investments. In some cases, the Fund may enter into agreements with an issuer of structured notes to purchase a minimum amount of those notes over time. Structured notes are also subject to counterparty risk, which is the risk that the other party to the transaction will not fulfill its contractual obligations.

The Fund may write (sell) covered call options on securities. If the option is exercised by the purchaser prior to the expiration, the Fund is required to deliver the underlying security against payment of the exercise price. Writing call options is a highly specialized activity and entails greater than ordinary investment risks. The successful use of options depends in part on the future price fluctuations and the degree of correlation between the options and the securities markets. The value of the Fund’s positions in options will fluctuate in response to changes in the value of the underlying security or index, as applicable. Portfolio assets covering written options cannot be sold while the option is outstanding, unless replaced with similar assets. As a result there is a possibility that segregation of a large percentage of the Fund’s assets could affect its portfolio management as well as the ability of the Fund to meet redemption requests or other current obligations. Unusual market conditions or the lack of a ready market for any particular option at a specific time may reduce the effectiveness of the Fund’s option strategies. Over-the-counter options may be considered illiquid and are also subject to counterparty risk, which is the risk that the other party to the contract will not fulfill its contractual obligation to complete the transaction with the Fund. The Fund did not enter into any options transactions during the semi-annual period ended March 31, 2016.

LEE FINANCIAL TACTICAL FUND

NOTES TO FINANCIAL STATEMENTS – (Continued)

March 31, 2016 (Unaudited)

The Fund’s investments in other investment companies subjects it to those risks affecting the investment company, including the possibility that the value of the underlying securities held by the investment company could decrease. The Fund will incur its pro rata share of the underlying investment company’s expenses. The Fund may purchase ETFs which may trade at a discount to its net asset value. Investors in the Fund will indirectly bear fees and expenses charged by the underlying investment companies in which the Fund invests in addition to the Fund’s direct fees and expenses. The Fund will also incur brokerage costs when it purchases shares of ETFs. In addition, the Fund will be affected by losses of the underlying ETF and the level of risk arising from the investment practices of the underlying ETF.

The Fund may invest in exchange-traded notes (“ETNs”), which are a type of unsecured, unsubordinated debt security. ETNs are traded on a major exchange, but investors may also hold the ETN until maturity. ETNs do not make periodic coupon payments and provide no principal protection. The value of an ETN may be influenced by the length of time to maturity, supply and demand, volatility and lack of liquidity in underlying markets, changes in the applicable interest rates, changes in the issuer’s credit rating and economic, legal, political or geographic events that affect the referenced index. The value of the ETN may drop due to a downgrade in the issuer’s credit rating, despite the underlying index remaining unchanged.

The Fund may purchase fixed income securities which will change in value in response to interest rate changes and other factors, such as the perception of the issuer's creditworthiness. For example, the value of fixed income securities will generally decrease when interest rates rise, which may cause the value of the Fund to decrease. In addition, an underlying fund's investment in fixed income securities with longer maturities will fluctuate more in response to interest rate changes.

Portfolio securities that are fixed income (debt) securities are valued by an independent pricing agent using methodologies that it believes are appropriate, including actual market transactions, broker-dealer supplied valuations, matrix pricing, or other electronic data processing techniques designed to identify market values for such securities, in accordance with procedures established in good faith by the Board of Directors. Structured notes are valued at the closing price or evaluated bid as provided daily by independent pricing agents. Equity securities listed on a securities exchange or an automated quotation system for which quotations are readily available will be valued at the last quoted sale price on the principal exchange on which they are traded on the valuation date (or at approximately 4:00 p.m. Eastern Time if a security’s principal exchange is normally open at that time), or, if there is no such reported sale on the valuation date, at the closing bid price. Securities traded over-the-counter will be valued at the last reported sale price on the NASDAQ Trade Reporting Facility, Alternative Display Facility or other facility that reports trades of over-the-counter securities. If there is no such reported sale on the valuation date, over-the-counter securities will be valued at the most recently quoted bid price. NASDAQ listed securities are valued at the NASDAQ Official Closing Price. Options listed for trading on a securities exchange or board of trade will be valued at the last quoted sale price or, in the absence of a sale, at the mean of the closing bid and ask prices. In the absence of a last quoted sales price or mean price, options are valued at the closing ask price (for short positions). Futures contracts and options thereon, which are traded on commodities exchanges, are valued at their daily settlement value as of the close of such commodities exchanges. Redeemable securities issued by open-end investment companies are valued at the investment company’s applicable net asset value. Exchange-traded open-end investment companies, closed-end investment companies and notes are priced as equity securities. Foreign securities are often principally traded on markets that close at different hours than U.S. markets. Such securities will be valued at their most recent closing prices on the relevant principal exchange even if the close of that exchange is earlier than the time of the Fund’s net asset value (“NAV”) calculation. However, securities traded in foreign markets which remain open as of the time of the NAV calculation will be valued at the most recent sales price as of the time of the NAV calculation. In addition, prices for certain foreign securities may be obtained from the Fund’s approved independent pricing agents. Securities with remaining maturities of 60 days or less are valued on the amortized cost basis as reflecting fair value.

LEE FINANCIAL TACTICAL FUND

NOTES TO FINANCIAL STATEMENTS – (Continued)

March 31, 2016 (Unaudited)

Securities for which market quotations are not readily available or for which available prices are believed to be suspect will be valued at “fair value” using methods determined in good faith by or at the direction of the Board of Directors. For these purposes, “fair value” means the price that the Investment Manager reasonably expects the Fund could receive from an arm’s-length buyer upon the current sale of the securities within seven (7) days, after considering all appropriate factors and indications of value available to them. Such value will be cost if the Investment Manager determines such valuation is appropriate after considering a multitude of factors in accordance with established procedures.

The Fund utilizes various methods to measure the fair value of most of its investments on a recurring basis. U.S. generally accepted accounting principles (“GAAP”) establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access.

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Changes in valuation techniques may result in transfers in/out changing an investment’s assigned level within the hierarchy.

The following is a description of the valuation techniques applied to the Fund’s major categories of financial instruments measured at fair value on a recurring basis:

LEE FINANCIAL TACTICAL FUND

NOTES TO FINANCIAL STATEMENTS – (Continued)

March 31, 2016 (Unaudited)

Common Stocks, Exchange–Traded Funds and Exchange–Traded Notes, to the extent these securities are actively traded and valuation adjustments are not applied, are categorized in Level 1 of the fair value hierarchy. Preferred stock and other equities traded on inactive markets or valued by reference to similar instruments are categorized in Level 2 of the fair value hierarchy.

Structured Notes are categorized in Level 2 of the fair value hierarchy.

Investment in registered open-end investment management companies are categorized as Level 1 of the fair value hierarchy.

Options listed for trading on a securities exchange or board of trade, and which are actively traded, are categorized in Level 1 of the fair value hierarchy.

The following is a summary of the inputs used in valuing the Fund’s investments, as of March 31, 2016. The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities.

Valuation Inputs at Reporting Date:

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets | | | | | | | | | | | | |

| Common Stocks | | $ | 39,833,115 | | | $ | -0- | | | $ | -0- | | | $ | 39,833,115 | |

| Exchange Traded Funds | | $ | 1,595,995 | | | $ | -0- | | | $ | -0- | | | $ | 1,595,995 | |

| Exchange Traded Notes | | $ | 316,980 | | | $ | -0- | | | $ | -0- | | | $ | 316,980 | |

| Structured Notes | | $ | -0- | | | $ | 1,648,250 | | | $ | -0- | | | $ | 1,648,250 | |

| Money Market Fund | | $ | 2,298,169 | | | $ | -0- | | | $ | -0- | | | $ | 2,298,169 | |

| Total Investments | | $ | 44,044,259 | | | $ | 1,648,250 | | | $ | -0- | | | $ | 45,692,509 | |

Liabilities | | | | | | | | | | | | | | | | |

| Written covered call options | | $ | -0- | | | $ | -0- | | | $ | -0- | | | $ | -0- | |

There were no transfers in to and out of Levels 1 and 2 during the current period presented.

The following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value during the course of the March 31, 2016 period.

| | | | |

| | | Structured Notes at Value | |

| Balance as of 09/30/2015 | | $ | -0- | |

| Realized gain (loss) | | $ | - | |

| Change in unrealized appreciation (depreciation) | | $ | - | |

| Purchases (sales) | | $ | 400,000 | |

| Transfers in and/or (out) of Level 3 | | $ | (400,000 | ) |

| Balance as of 03/31/2016 | | $ | -0- | |

LEE FINANCIAL TACTICAL FUND

NOTES TO FINANCIAL STATEMENTS – (Continued)

March 31, 2016 (Unaudited)

It is the Fund’s policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute their taxable income, if any, to their shareholders. Therefore, no federal income tax provision is required.

The Fund has reviewed all open tax years for all major jurisdictions, which is the Federal jurisdiction, and concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. As of September 30, 2015, open Federal tax

years include the tax year ended September 30, 2012 through September 30, 2015. The Fund

has no examination in progress and is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

In order to avoid imposition of the excise tax applicable to regulated investment companies, the Fund intends to declare each year as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts, if any, from prior years.

On December 22, 2010, the Regulated Investment Company Modernization Act of 2010 (the “Act”) was enacted. The Act modernizes several of the federal income and excise tax provisions related to regulated investment companies such as the Fund, and, with certain exceptions, is effective for taxable years beginning after December 22, 2010. Among the changes made are changes to the capital loss carryforward rules allowing for capital losses to be carried forward indefinitely. At September 30, 2015, the Lee Financial Tactical Fund did not have any capital loss carryforwards to offset current year gains.

The Fund incurred net capital losses of $758,834 after October 31, 2014. Net capital losses incurred after October 31, and within the taxable year are deemed to arise on the first business day of the Fund’s next taxable year.

| (C) | SECURITY TRANSACTIONS, INVESTMENT INCOME AND DISTRIBUTIONS TO SHAREHOLDERS |

Security transactions are recorded on the trade date. Interest income is recorded on the accrual basis. Net realized gains and losses from investment transactions are reported on an identified cost basis. Interest income is recognized using the accrual method and includes accretion of original issue and market discount and amortization of premium. Dividend income is recognized on the ex-dividend date, except that certain dividends from foreign securities are recorded as soon as the information becomes available after the ex-dividend date. The Fund intends to pay income dividends at least annually.

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

The net asset value per share for the Fund is determined by calculating the total value of the Fund’s assets, deducting its total liabilities and dividing the result by the number of shares outstanding.

LEE FINANCIAL TACTICAL FUND

NOTES TO FINANCIAL STATEMENTS – (Continued)

March 31, 2016 (Unaudited)

| (2) | INVESTMENT MANAGEMENT FEE AND OTHER TRANSACTIONS WITH AFFILIATES |

Lee Financial Group Hawaii, Inc. (“LFG”) provides the Fund with management and administrative services pursuant to a management agreement and administrative services agreement, respectively. Effective February 1, 2016, LFG agreed to reduce its annualized management fee from 1.00% to 0.75%. In accordance with the terms of the administrative services agreement, LFG also receives compensation at the annual rate of up to 0.05% of the Fund’s average daily net assets. The Investment Manager has voluntarily agreed to waive 0.10% of its 0.75% management fees through January 31, 2017. For the period ended March 31, 2016, the Fund was allocated and incurred $10,969 for the Chief Compliance Officer fee which was payable to LFG.

The Fund’s distributor, Lee Financial Securities, Inc. (“LFS”), a wholly-owned subsidiary of LFG, did not receive any compensation for costs incurred in connection with the sale of the Fund’s shares (See Note 3).

Lee Financial Recordkeeping, Inc. (“LFR”), a wholly-owned subsidiary of LFG, serves as the transfer agent for the Fund. In accordance with the terms of the transfer agent agreement, LFR receives compensation at the annual rate of 0.06% of the Fund’s average daily net assets. LFR has delegated certain of its duties and responsibilities to Ultimus Fund Solutions, LLC as sub-transfer agent. LFR also provides the Fund with certain clerical, bookkeeping and shareholder services pursuant to a service agreement approved by the Fund’s directors. As compensation for these services LFR receives a fee, computed daily and payable monthly, at an annualized rate of 0.10% of the Fund’s average daily net assets.

Certain officers and directors of the Fund are also officers of LFG, LFS and LFR.

The Fund’s Board of Directors, including a majority of the Directors who are not “interested persons” of the Fund, as defined in the Investment Company Act of 1940, adopted a distribution plan pursuant to Rule 12b-1 of the Act. Rule 12b-1 regulates the manner in which a regulated investment company may assume costs of distributing and promoting the sales of its shares.

The Plan provides that the Lee Financial Tactical Fund Investor Class may incur certain costs, which may not exceed 0.25% per annum of the Fund’s average daily net assets, for payment to the distributor for items such as advertising expenses, selling expenses, commissions or travel, reasonably intended to result in sales of shares of the Fund.

| (4) | PURCHASES AND SALES OF SECURITIES |

Purchases and sales of securities aggregated $22,229,845 and $22,915,141, respectively, for the Fund during the six month period October 1, 2015 through March 31, 2016.

LEE FINANCIAL TACTICAL FUND

NOTES TO FINANCIAL STATEMENTS – (Continued)

March 31, 2016 (Unaudited)

(5) TAX COMPONENTS OF CAPITAL AND DISTRIBUTIONS TO SHAREHOLDERS

The tax character of distributions paid during the years ended September 30, 2015 and 2014 were as follows:

| | | Ordinary Income | | | Long-Term Capital Gains | | | Total Distributions | |

| Lee Financial Tactical Fund | | | | | | | | | |

| 2015 | | $ | 545,201 | | | $ | 1,920,256 | | | $ | 2,465,457 | |

| 2014 | | $ | 1,282,525 | | | $ | 2,097,098 | | | $ | 3,379,623 | |

The tax character of distributable earnings at September 30, 2015 were as follows:

| | | Undistributed Net Investment Income | | | Undistributed Capital Gains | | | Capital Loss Carryforwards | | | Post October Losses | | | Unrealized Gain/ (Loss)* | | | Total Distributable Earnings | |

| Lee Financial Tactical Fund | | $ | 265,008 | | | $ | - | | | $ | - | | | $ | (758,834 | ) | | $ | 1,423,619 | | | $ | 929,793 | |

* The difference between book basis and tax basis unrealized appreciation is attributable to wash sales.

Accounting principles generally accepted in the United States of America require that certain components of net assets be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. The primary difference relates to tax adjustments related to the redesignation of the character of dividends for tax purposes. For the year ended September 30, 2015, the Lee Financial Tactical Fund’s undistributed net investment income was increased by $211 and accumulated net realized loss on investments was decreased by $211.

(6) NEW ACCOUNTING PRONOUNCEMENT

In May 2015, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2015-07 Disclosure for Investments in Certain Entities that Calculate Net Asset Value per Share (or Its Equivalent). The amendments in ASU No. 2015-07 remove the requirement to categorize within the fair value hierarchy investments measured using the net asset value per share (“NAV”) practical expedient. The ASU also removes certain disclosure requirements for investments that qualify, but do not utilize, the NAV practical expedient. The amendments in the ASU are effective for fiscal years beginning after December 15, 2015, and interim periods within those fiscal years. The Fund’s management is currently evaluating the impact these changes will have on the Fund’s financial statements and related disclosures.

(7) SUBSEQUENT EVENTS DISCLOSURE

In preparing the Fund’s financial statements as of March 31, 2016, the Fund’s management considered the impact of subsequent events for potential recognition or disclosure in these financial statements.

Disclosure Regarding Approval of the Amendment to the Investment Management Agreement

Lee Financial Tactical Fund (Unaudited)

At a meeting held on October 21, 2015, the Board of Directors (the “Board”) of Lee Financial Mutual Fund, Inc. (the “Fund”) considered and approved Lee Financial Group Hawaii, Inc.’s (“LFG”) proposal to amend the Investment Management Agreement between the Fund and LFG with respect to the Lee Financial Tactical Fund (the “Portfolio”), a series of Lee Financial Mutual Fund, Inc., to lower the annualized management fee from 1.00% to 0.75% of the Portfolio’s average daily net assets effective February 1, 2016. In addition LFG proposed to reduce its management fee waiver of 0.35% to 0.10% fee effective February 1, 2016 through January 31, 2017. The reduction in the management fee and the corresponding reduction in the level of the fee waiver would not change current net management fee of 0.65% of the average daily net assets of the Portfolio.

Prior to the meeting, the Board had received detailed information from LFG, which consisted of the same information that the Board reviewed at the July 29, 2015 Board meeting in considering the renewal of the Investment Management Agreement. The Board also considered the Fund CCO’s confirmation that there had been no material changes or updates to that information, other than the proposed reduction of the management fee and fee waiver for the Portfolio. This information together with other information provided by LFG and the information provided to the Board throughout the course of the year formed the primary (but not exclusive) basis for the Board's determinations as summarized below. The information, material factors and conclusions that formed the basis for the Board's subsequent approval of the amendment to the Investment Management Agreement are described below.

During the course of the year, the Board received a wide variety of materials relating to the services provided by LFG, including reports on the Portfolio's investment results; portfolio composition; portfolio trading practices; and other information relating to the nature, extent and quality of services provided by LFG to the Fund and Portfolio. In addition, the Board reviewed and considered supplementary information and presentations by LFG that included materials regarding the Portfolio's investment results; management fee; performance; financial and profitability information regarding LFG; descriptions of various functions such as compliance monitoring and portfolio trading, brokerage and soft-dollar commission practices; and information about the experience and qualifications of the personnel providing investment management and administrative services to the Portfolio. Further, an independent third party prepared an analytical report which provided comparative management fee, expense and performance information for the Portfolio and its peer group.

The Board received assistance regarding legal and industry standards from independent counsel to the independent Directors of the Board. The Board discussed the approval of the amendment to the agreement with LFG representatives. In deciding to recommend the approval of the amendment to the agreement, the Board did not identify any single issue or particular information that, in isolation, was the controlling factor. This summary describes the most important, but not all, of the factors considered by the Board.

The Board members considered the investment management fee for the Portfolio and the contractual fee waiver and the comparative cost of similar services being paid by other similar mutual funds and LFG’s other similarly managed clients. The Board also considered Mr. Lee’s representation that there would be no change in the nature, quality or level of services provided by LFG to the Portfolio and the Board reflected on their evaluation of the nature, extent and quality of services and the experience and qualifications of the personnel providing those services that occurred at the July 29, 2015 contract renewal meeting. The Board members also considered that the reduction in the management fee and the corresponding reduction in the fee waiver would have no impact on LFG’s profitability, costs of services provided, and benefits derived by LFG from its relationship with the Portfolio. In addition, the Board members considered that these reductions would not have any impact on the net expense ratio or performance of the Portfolio. The Board members also considered that the proposed change in the management fee would not impact its evaluation of economies of scale as the Portfolio grows.

No single factor was determinative of the Board's decision to amend the Portfolio’s Investment Management Agreement, but rather the Board based their determination on the total mix of information available to them. Based on their review, including their consideration of each of the factors referred to above, the Board, including all of the Fund’s Independent Directors of the Board present, concluded that the Portfolio’s Investment Management Agreement and the compensation, as amended, is determined to be fair and reasonable in light of such services provided and expenses incurred under the Agreement.

LEE FINANCIAL TACTICAL FUND (Unaudited)

Shareholder Information

Household Delivery of Shareholder Documents: Only one Prospectus, Annual and Semi-Annual Report will be sent to shareholders with the same last name and address on their Fund account, unless you request multiple copies. If you would like to receive separate copies, please call us at (808) 988-8088. We will begin sending you additional copies within 30 days. If your shares are held through a service provider, please contact them directly.

Business Continuity Plan Summary Disclosure Statement:Lee Financial Mutual Fund, Inc., Lee Financial Group Hawaii, Inc., Lee Financial Securities, Inc. and Lee Financial Recordkeeping, Inc. have developed Business Continuity Plans on how we will respond to events that significantly disrupt our business. Since the timing and impact of disasters and disruptions is unpredictable, we will have to be flexible in responding to actual events as they occur. Contacting Us - If after a significant business disruption you cannot contact us as you usually do at (808) 988-8088, you should go to our website at www.LeeHawaii.com. Please visit our website at www.LeeHawaii.com for the Business Continuity Plan Disclosure Statement.

Proxy Voting Policies and Procedures

The Fund has established Proxy Voting Policies and Procedures (“Policies”) that the Fund uses to determine how to vote proxies relating to portfolio securities. Shareholders may request copies of the Policies free of charge by calling (808) 988-8088 or by sending a written request to Lee Financial Group Hawaii, Inc., 3113 Olu Street, Honolulu, HI 96816-1425. Copies of the Fund’s proxy voting records are posted on the Securities and Exchange Commission’s website at www.sec.gov and the Fund’s website at www.LeeHawaii.com and reflect the 12-month period beginning July 1, 2014 and ending June 30, 2015.

Quarterly Statement of Investments

The Fund files a complete statement of investments with the Securities and Exchange Commission for the first and third quarters for each fiscal year on Form N-Q. Shareholders may view the filed Form N-Q by visiting the Commission’s website at www.sec.gov or the Fund’s website at www.LeeHawaii.com. The filed form may also be viewed and copied at the Commission’s Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

INVESTMENT MANAGER

Lee Financial Group Hawaii, Inc.

3113 Olu Street

Honolulu, Hawaii 96816-1425

DISTRIBUTOR

Lee Financial Securities, Inc.

3113 Olu Street

Honolulu, Hawaii 96816-1425

FUND ACCOUNTANT

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, Ohio 45246

CUSTODIAN

MUFG Union Bank, N.A.

350 California Street, 6th Floor

San Francisco, California 94104

LEGAL COUNSEL

Drinker Biddle & Reath LLP

One Logan Square

Suite #2000

Philadelphia, Pennsylvania 19103-6996

TRANSFER AGENT

Lee Financial Recordkeeping, Inc.

3113 Olu Street

Honolulu, Hawaii 96816-1425

May 2, 2016

Dear fellow shareholder,

The Hawaii Municipal Fund is in the midst of its 28th year of operations. During that time we have experienced a myriad of economic changes, both good and bad – such as the rise and fall of oil prices, bull markets, bear markets, and the rise and fall of interest rates.

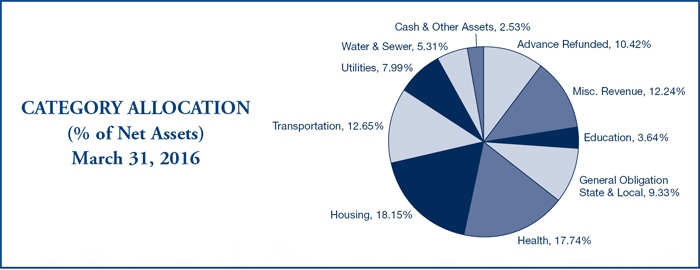

In spite of continued unpredictable economic times coupled with a volatile political environment, the Hawaii Municipal Fund has maintained its investment objective which is to provide a high level of current income exempt from federal and Hawaii state income taxes, consistent with preservation of capital and prudent investment management. The Fund consists of primarily investment grade municipal securities issued by or on behalf of the State of Hawaii or any of its political subdivisions or agencies that pay interest that is exempt from regular federal and State of Hawaii income tax.

As shareholders of the Fund, we are earning tax-free income* and supporting local projects designed to support and enrich our community. The money raised through municipal bonds is commonly used to build and upgrade schools, hospitals, roads, airports, and sewer systems. These projects create jobs and improve the quality of life here in the islands.

During the past six months, the Federal Open Market Committee (“FOMC”) finally increased the federal funds rate for the first time since June 2006. On December 16, 2015, rates were raised from a range of 0%-0.25%, to 0.25%-0.50%. In our opinion, this was a very modest increase as the FOMC forecasted additional gradual interest rate hikes dependent upon economic conditions. Given the continuing volatility in the international markets and the lack of inflation growth in the U.S. economy, it’s not clear whether there will be more rate increases in the near future.

We continue to believe that municipal bonds are attractive investments for long term investors. The Fund’s portfolio manager has been strategically investing in shorter term, higher quality bonds in anticipation of rising interest rates.

The Fund had a beginning net asset value (“NAV”) of $11.21 per share on October 1, 2015 and a closing NAV of $11.31 per share on March 31, 2016. The Fund’s $0.10 per share increase in NAV combined with the net income distribution of $0.15 per share resulted in a total return of 2.23%+ for the six month reporting period ended March 31, 2016. During the same period, the return for the Fund’s benchmark index, the Barclays Capital Municipal Bond Index, was 3.20%+. The Fund’s portfolio had a shorter effective maturity than the Barclays Capital Municipal Bond Index which detracted from the Fund’s relative results against its benchmark index.

Thank you for your continued support and referrals. On the following pages you will find our March 31, 2016 Semi-Annual Report. If you have any questions or would like us to provide information about the Fund to your family or friends, please call us at (808) 988-8088.

| Warmest Aloha, |

|

Terrence K.H. Lee |

| President and CEO |

| * | Some income may be subject to the federal alternative minimum tax for certain investors. Income may also be subject to capital gains taxes. |

+ | Return is not annualized. |

Before investing, read the prospectus carefully. Please carefully consider the Fund’s investment objective, risks, and charges and expenses before investing. The prospectus contains this and other information about the Fund. This Semi-Annual Report must be accompanied or preceded by a prospectus.

The Fund’s yield, share price and investment return fluctuate so that you may receive more or less than your original investment upon redemption. Past performance is no guarantee of future results. The Fund is a series of Lee Financial Mutual Fund, Inc.

Mutual fund investing includes risks. Principal loss is possible. The Fund’s investments in municipal bonds subjects the Fund to interest rate, credit, call and geographic concentration risk. This is not a complete list of risks that may affect the Fund. For additional information concerning the risks applicable to the Fund, please see the Fund’s prospectus.

The Barclays Capital Municipal Bond Index consists of a broad selection of investment grade general obligation and revenue bonds of maturities ranging from one year to 30 years. It is an unmanaged index representative of the tax-exempt bond market. This index is made up of all investment grade municipal bonds issued after December 31, 1990 having a remaining maturity of at least one year. It is not possible to invest directly in an unmanaged index.

Lee Financial Securities, Inc., member FINRA, is the distributor for Lee Financial Mutual Fund, Inc.

Lee Financial Securities, Inc. is a wholly owned subsidiary of Lee Financial Group Hawaii, Inc., a registered investment advisor with the SEC.

May 25, 2016

This report may contain certain forward-looking statements about factors that may affect the performance of the Fund in the future. These statements are based on the predictions and expectations of Lee Financial Group Hawaii, Inc., the Fund’s investment manager, (the “Investment Manager”), concerning certain future events, such as performance of the economy, changes in interest rates and other factors that may impact the performance of the Fund. The Investment Manager believes that these forward looking statements are reasonable, although they are inherently uncertain and difficult to predict. Actual events may cause adjustments in portfolio management strategies from those currently expected to be employed.

YOUR FUND’S EXPENSES

As a Fund shareholder, you can incur the following costs:

| • | Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. |

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for the share class listed in the table below provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period, by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, the $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for the share class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs. Therefore, the second line is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. Please refer to the Fund prospectus for additional information on operating expenses.

| | Beginning Account Value 10/01/2015 | Ending Account Value 03/31/2016 | Expenses Paid During Period* 10/01/15 – 03/31/16 |

| Hawaii Municipal Fund Investor Class | | | |

| Actual | $1,000.00 | $1,022.30 | $5.26 |

| Hypothetical | $1,000.00 | $1,019.80 | $5.25 |

| * | Expenses are equal to the annualized expense ratio (1.04%), multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period. |

HAWAII MUNICIPAL FUND

SCHEDULE OF INVESTMENTS

March 31, 2016 (Unaudited)

| Par Value | | | | | | Value (Note 1 (A)) | |

| | | | HAWAII MUNICIPAL BONDS - 97.44% | | | |

| | | | Hawaii County | | | |

| | | | General Obligation Bonds – 1.99% | | | |

| $ | 1,755,000 | | | 5.000%, | 07/15/21 | | $ | 1,921,444 | |

| | 1,210,000 | | | 5.000%, | 03/01/25 | | | 1,391,403 | |

| | | | | | | | | 3,312,847 | |

| | | | | Hawaii State | | | | |

| | | | | General Obligation Bonds - 9.02% | | | | |

| | 2,000,000 | | | 5.000%, | 10/01/24 | | | 2,510,680 | |

| | 2,340,000 | | | 5.000%, | 06/01/25 | | | 2,637,016 | |

| | 1,660,000 | | | 5.000%, | 06/01/25 | | | 1,865,176 | |

| | 2,000,000 | | | 4.000%, | 10/01/26 | | | 2,340,380 | |

| | 270,000 | | | 5.000%, | 05/01/27 | | | 293,142 | |

| | 1,535,000 | | | 5.000%, | 05/01/27 | | | 1,666,565 | |

| | 45,000 | | | 5.000%, | 05/01/27 | | | 48,730 | |

| | 1,000,000 | | | 5.000%, | 08/01/29 | | | 1,220,340 | |

| | 2,000,000 | | | 5.000%, | 08/01/30 | | | 2,430,480 | |

| | | | | | | | | 15,012,509 | |

| | | | | Airport Systems Revenue Bonds - 8.15% | | | | |

| | 1,000,000 | | | 5.000%, | 07/01/24 | | | 1,145,260 | |

| | 665,000 | | | 5.250%, | 07/01/26 | | | 775,968 | |

| | 8,780,000 | | | 5.250%, | 07/01/27 | | | 10,241,168 | |

| | 1,200,000 | | | 5.250%, | 07/01/28 | | | 1,395,924 | |

| | | | | | | | | 13,558,320 | |

| | | | | Certificates of Participation - State Office Buildings - 3.29% | | | | |

| | 4,200,000 | | | 5.000%, | 05/01/17 | | | 4,389,336 | |

| | 500,000 | | | 4.000%, | 05/01/19 | | | 540,210 | |

| | 500,000 | | | 4.000%, | 05/01/20 | | | 545,880 | |

| | | | | | | | | 5,475,426 | |

| | | | | Department of Budget & Finance Special Purpose Revenue Bonds

Hawaiian Electric Company, Inc. – 7.99% | | | | |

| | 5,000,000 | | | 4.650%, | 03/01/37 | | | 5,106,850 | |

| | 7,200,000 | | | 6.500%, | 07/01/39 | | | 8,191,512 | |

| | | | | | | | | 13,298,362 | |

See accompanying notes to financial statements.

HAWAII MUNICIPAL FUND

SCHEDULE OF INVESTMENTS – (Continued)

March 31, 2016 (Unaudited)

| Par Value | | | | | | Value (Note 1 (A)) | |

| | | | Hawaii Pacific Health – 5.20% | | | |

| $ | 775,000 | | | 4.625%, | 07/01/21 | | $ | 878,184 | |

| | 6,000,000 | | | 5.500%, | 07/01/40 | | | 6,676,020 | |

| | 200,000 | | | 5.750%, | 07/01/40 | | | 224,866 | |

| | 750,000 | | | 5.500%, | 07/01/43 | | | 877,537 | |

| | | | | | | | | 8,656,607 | |

| | | | | | | | | | |

| | | | | Hawaii Mid-Pacific Institute – 2.24% | | | | |

| | 2,085,000 | | | 5.000%, | 01/01/26 | | | 2,089,108 | |

| | 1,635,000 | | | 4.625%, | 01/01/36 | | | 1,635,294 | |

| | | | | | | | | 3,724,402 | |

| | | | | Kahala Nui – 7.03% | | | | |

| | 300,000 | | | 3.350%, | 11/15/19 | | | 301,749 | |

| | 300,000 | | | 3.600%, | 11/15/20 | | | 301,692 | |

| | 250,000 | | | 3.800%, | 11/15/21 | | | 251,392 | |

| | 500,000 | | | 5.000%, | 11/15/21 | | | 551,275 | |

| | 1,065,000 | | | 4.625%, | 11/15/27 | | | 1,073,435 | |

| | 1,200,000 | | | 5.000%, | 11/15/27 | | | 1,339,104 | |

| | 3,200,000 | | | 5.125%, | 11/15/32 | | | 3,486,688 | |

| | 4,055,000 | | | 5.250%, | 11/15/37 | | | 4,385,888 | |

| | | | | | | | | 11,691,223 | |

| | | | | | | | | | |

| | | | | Queen’s Health Systems – 5.07% | | | | |

| | 2,000,000 | | | 5.000%, | 07/01/23 | | | 2,438,560 | |

| | 1,000,000 | | | 5.000%, | 07/01/25 | | | 1,250,930 | |

| | 4,000,000 | | | 5.000%, | 07/01/35 | | | 4,740,480 | |

| | | | | | | | | 8,429,970 | |

| | | | | | | | | | |

| | | | | Department of Hawaiian Home Lands – 2.70% | | | | |

| | 1,000,000 | | | 5.875%, | 04/01/34 | | | 1,123,340 | |

| | 3,000,000 | | | 6.000%, | 04/01/39 | | | 3,362,250 | |

| | | | | | | | | 4,485,590 | |

| | | | | | | | | | |

| | | | | Hawaiian Home Lands – COP Kapolei – 3.84% | | | | |

| | 210,000 | | | 3.750%, | 11/01/16 | | | 213,056 | |

| | 950,000 | | | 4.125%, | 11/01/23 | | | 966,064 | |

| | 5,100,000 | | | 5.000%, | 11/01/31 | | | 5,213,424 | |

| | | | | | | | | 6,392,544 | |

See accompanying notes to financial statements.

HAWAII MUNICIPAL FUND

SCHEDULE OF INVESTMENTS – (Continued)

March 31, 2016 (Unaudited)

| Par Value | | | | | | Value (Note 1 (A)) | |

| | | | Department of Transportation Airports COP – 5.11% | | | |

| $ | 1,000,000 | | | 5.000%, | 08/01/23 | | $ | 1,198,100 | |

| | 1,420,000 | | | 5.250%, | 08/01/24 | | | 1,699,712 | |

| | 725,000 | | | 5.250%, | 08/01/25 | | | 860,292 | |

| | 2,570,000 | | | 5.250%, | 08/01/26 | | | 3,028,822 | |

| | 1,000,000 | | | 5.000%, | 08/01/27 | | | 1,146,840 | |

| | 500,000 | | | 5.000%, | 08/01/28 | | | 569,865 | |

| | | | | | | | | 8,503,631 | |

| | | | | | | | | | |

| | | | | Harbor Capital Improvements Revenue Bonds – 2.21% | | | | |

| | 1,665,000 | | | 5.375%, | 01/01/17 | | | 1,670,328 | |

| | 2,005,000 | | | 5.250%, | 01/01/21 | | | 2,011,556 | |

| | | | | | | | | 3,681,884 | |

| | | | | | | | | | |

| | | | | Hawaii Health Systems – 0.44% | | | | |

| | 730,000 | | | 4.700%, | 02/15/19 | | | 735,147 | |

| | | | | | | | | | |

| | | | | Highway Revenue – 2.29% | | | | |

| | 1,640,000 | | | 5.000%, | 01/01/26 | | | 1,955,454 | |

| | 1,500,000 | | | 5.000%, | 01/01/27 | | | 1,859,490 | |

| | | | | | | | | 3,814,944 | |

| | | | | | | | | | |

| | | | | Housing Authority | | | | |

| | | | | HFDC Rental Housing System Revenue Bonds – 3.88% | | | | |

| | 810,000 | | | 4.750%, | 07/01/22 | | | 864,772 | |

| | 600,000 | | | 4.750%, | 07/01/23 | | | 637,686 | |

| | 895,000 | | | 5.000%, | 07/01/24 | | | 954,097 | |

| | 100,000 | | | 5.000%, | 07/01/25 | | | 105,966 | |

| | 990,000 | | | 6.000%, | 07/01/26 | | | 1,078,724 | |

| | 1,055,000 | | | 6.000%, | 07/01/27 | | | 1,148,188 | |

| | 785,000 | | | 6.000%, | 07/01/28 | | | 853,083 | |

| | 750,000 | | | 6.000%, | 07/01/29 | | | 813,840 | |

| | | | | | | | | 6,456,356 | |

| | | | | | | | | | |

| | | | | HFDC Multi-Family-Kuhio Park – 3.54% | | | | |

| | 2,430,000 | | | 4.750%, | 10/01/27 | | | 2,628,604 | |

| | 3,000,000 | | | 4.950%, | 04/01/29 | | | 3,265,560 | |

| | | | | | | | | 5,894,164 | |

See accompanying notes to financial statements.

HAWAII MUNICIPAL FUND

SCHEDULE OF INVESTMENTS – (Continued)

March 31, 2016 (Unaudited)

| Par Value | | | | | | Value (Note 1 (A)) | |

| | | | HFDC Multi-Family-Iwilei Apartments– 2.58% | | | |

| $ | 165,000 | | | 3.300%, | 01/01/26 | | $ | 170,071 | |

| | 4,000,000 | | | 3.750%, | 01/01/31 | | | 4,124,760 | |

| | | | | | | | | 4,294,831 | |

| | | | | HFDC Multi-Family-Kooloaula Apartments– 2.27% | | | | |

| | 210,000 | | | 3.125%, | 09/01/22 | | | 211,810 | |

| | 3,435,000 | | | 4.000%, | 09/01/33 | | | 3,569,515 | |

| | | | | | | | | 3,781,325 | |

| | | | | University of Hawaii - Revenue Bonds – 5.88% | | | | |

| | 100,000 | | | 4.000%, | 07/15/16 | | | 100,967 | |

| | 1,000,000 | | | 5.000%, | 10/01/18 | | | 1,095,750 | |

| | 1,000,000 | | | 5.000%, | 10/01/19 | | | 1,130,560 | |

| | 1,500,000 | | | 5.000%, | 10/01/23 | | | 1,533,285 | |

| | 3,355,000 | | | 4.500%, | 07/15/26 | | | 3,392,643 | |

| | 2,500,000 | | | 5.000%, | 07/15/29 | | | 2,531,525 | |

| | | | | | | | | 9,784,730 | |

| | | | | Honolulu City & County | | | | |

| | | | | General Obligation Bonds – 1.38% | | | | |

| | 700,000 | | | 5.000%, | 08/01/26 | | | 830,375 | |

| | 700,000 | | | 5.000%, | 10/01/29 | | | 869,057 | |

| | 500,000 | | | 5.000%, | 11/01/33 | | | 599,090 | |

| | | | | | | | | 2,298,522 | |

| | | | | Multi-Family – Waipahu – 1.09% | | | | |

| | 1,810,000 | | | 6.900%, | 06/20/35 | | | 1,815,883 | |

| | | | | | | | | |

| | | | | Water System Revenue Bonds

Board of Water Supply – 3.24% | | | | |

| | 2,000,000 | | | 5.000%, | 07/01/29 | | | 2,434,960 | |

| | 2,500,000 | | | 5.000%, | 07/01/32 | | | 2,958,700 | |

| | | | | | | | | 5,393,660 | |

| | | | | Wastewater System Revenue Bonds – 2.07% | | | | |

| | 1,750,000 | | | 5.000%, | 07/01/26 | | | 2,190,808 | |

| | 1,000,000 | | | 5.000%, | 07/01/26 | | | 1,257,650 | |

| | | | | | | | | 3,448,458 | |

See accompanying notes to financial statements.HAWAII MUNICIPAL FUND

SCHEDULE OF INVESTMENTS – (Continued)

March 31, 2016 (Unaudited)

| Par Value | | | | | | Value (Note 1 (A)) | |

| | | | Kauai County | | | |

| | | | General Obligation Bonds – 1.39% | | | |

| $ | 400,000 | | | 3.125%, | 08/01/23 | | $ | 435,528 | |

| | 770,000 | | | 5.000%, | 08/01/24 | | | 914,290 | |

| | 880,000 | | | 3.625%, | 08/01/25 | | | 952,301 | |

| | | | | | | | | 2,302,119 | |

| | | | | Kukuiula Development – 2.09% | | | | |

| | 1,090,000 | | | 5.625%, | 05/15/33 | | | 1,135,911 | |

| | 2,250,000 | | | 5.750%, | 05/15/42 | | | 2,343,802 | |

| | | | | | | | | 3,479,713 | |

| | | | | Maui County | | | | |

| | | | | General Obligation Bonds – 1.46% | | | | |

| | 1,000,000 | | | 5.000%, | 09/01/23 | | | 1,251,600 | |

| | 1,000,000 | | | 4.000%, | 09/01/28 | | | 1,170,690 | |

| | | | | | | | | 2,422,290 | |

| | | | | | | | | | |

| | | | | Total Hawaii Municipal Bonds (Cost $153,779,009) | | $ | 162,145,457 | |

See accompanying notes to financial statements.

HAWAII MUNICIPAL FUND

SCHEDULE OF INVESTMENTS – (Continued)

March 31, 2016 (Unaudited)

| Par Value | | | | | | | Value (Note 1 (A)) | |

| | | | VIRGIN ISLANDS MUNICIPAL BONDS - 0.03% | | | |

| | | | Virgin Islands | | | | |

| | | | Public Finance Authority, Series A - 0.03% | | | | |

| $ | 45,000 | | | 7.300%, | 10/01/18 | | | | $ | 49,042 | |

| | | | | | | | | | | | |

| | | | | Total Virgin Islands Municipal Bonds (Cost $44,831) | | | | $ | 49,042 | |

| | | | | | | | | | | | |

| | | | | Total Investments (Cost $153,823,840) (a) | 97.47 | % | | $ | 162,194,499 | |

| | | | | Other Assets Less Liabilities | 2.53 | % | | | 4,205,903 | |

| | | | | Net Assets | 100.00 | % | | $ | 166,400,402 | |

| (a) Aggregate cost for federal income tax purposes is $153,764,536. |

| |

| At March 31, 2016, unrealized appreciation (depreciation) of securities for federal income tax purposes is as follows: |

| | Gross unrealized appreciation | | $ | 8,435,881 | |

| | Gross unrealized (depreciation) | | | (5,918 | ) |

| | Net unrealized appreciation | | $ | 8,429,963 | |

See accompanying notes to financial statements.

HAWAII MUNICIPAL FUND

STATEMENT OF ASSETS AND LIABILITIES

March 31, 2016 (Unaudited)

| | | Municipal Fund | |

| ASSETS | | | |

| Investments at market value | | | |

(Identified cost $153,823,840) (Note 1 (A)) | | $ | 162,194,499 | |

| Cash | | | 2,215,749 | |

| Interest receivable | | | 2,127,975 | |

| Subscription receivable | | | 155,276 | |

| Other assets | | | 7,063 | |

| Total assets | | | 166,700,562 | |

| LIABILITIES | | | | |

| Distributions payable | | | 110,007 | |