Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

x | Definitive Proxy Statement | |||||

¨ | Definitive Additional Materials | |||||

¨ | Soliciting Material Under Rule 14a-12 |

Callaway Golf Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1. | Title of each class of securities to which transaction applies: |

| 2. | Aggregate number of securities to which transaction applies: |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4. | Proposed maximum aggregate value of transaction: |

| 5. | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1. | Amount Previously Paid: |

| 2. | Form, Schedule or Registration Statement No.: |

| 3. | Filing Party: |

| 4. | Date Filed: |

Table of Contents

July 29, 2009

Dear Shareholder:

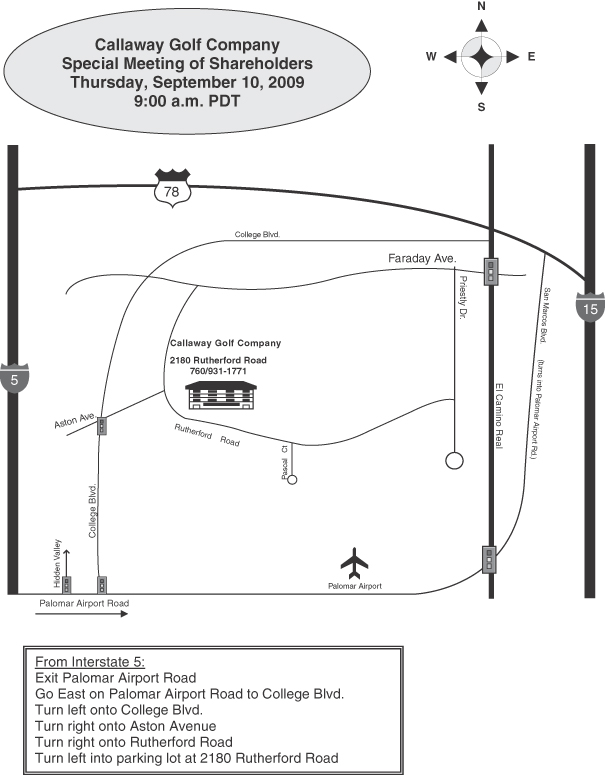

You are cordially invited to attend a special meeting of shareholders of Callaway Golf Company, which will be held on Thursday, September 10, 2009, at Callaway Golf Company, 2180 Rutherford Road, Carlsbad, California, 92008, commencing at 9:00 a.m. (PDT).

The specific proposal being submitted to shareholders at the upcoming special meeting relates to our 7.50% Series B Cumulative Perpetual Convertible Preferred Stock which we sold in June 2009 for $140 million in a private offering to qualified institutional buyers. In order to comply with New York Stock Exchange requirements, at the special meeting, shareholders will be asked to consider and vote on a proposal to approve the issuance of additional shares of our common stock which would be issued upon conversion of the preferred stock. If shareholder approval is not obtained by September 13, 2009, then the Company is subject to certain significant penalties. This matter is described more fully in the accompanying proxy statement, which you are urged to read thoroughly. Your Board of Directors recommends a vote “FOR” the proposal.

A special meeting of shareholders is different from an annual meeting of shareholders. A special meeting is called and held for the sole purpose of taking action on the proposals brought before the meeting. At the upcoming meeting, therefore, the shareholders will be asked to vote upon the specific proposal discussed above and no general business presentation or report is planned. Also, the realities of the modern day proxy process are such that almost all shareholders submit their voting instructions in advance of the meeting and as a result it is anticipated that the meeting will last only a few minutes. It is not expected that a large turn-out of management or Board members will be required.

It is important that your shares are represented and voted at the meeting whether or not you plan to attend. Accordingly, you are requested to return a proxy as promptly as possible either by voting through the Internet or telephone or by signing, dating, and returning a proxy card in accordance with the enclosed instructions.

| Sincerely, |

|

| George Fellows |

| President and Chief Executive Officer |

Table of Contents

CALLAWAY GOLF COMPANY

2180 Rutherford Road

Carlsbad, California 92008

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

Meeting Date: September 10, 2009

To Our Shareholders:

A special meeting of shareholders of Callaway Golf Company, a Delaware corporation (the “Company”), is scheduled to be held at Callaway Golf Company, 2180 Rutherford Road, Carlsbad, California 92008, commencing at 9:00 a.m. (PDT), on Thursday, September 10, 2009, to consider and vote upon the following matters described in this notice and the accompanying proxy statement:

| 1. | to approve the issuance of the shares of the Company’s common stock issuable upon conversion of the Company’s 7.50% Series B Cumulative Perpetual Convertible Preferred Stock that equals or exceeds 20% of the voting power or the number of shares of the Company’s common stock outstanding immediately prior to the original issuance of the preferred stock; and |

| 2. | to transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

These matters are described more fully in the accompanying proxy statement, which you are urged to read thoroughly. The Company’s Board of Directors recommends a vote “FOR” Proposal No. 1.

The Board of Directors has fixed the close of business on July 24, 2009 as the record date for determination of shareholders entitled to receive notice of and to vote at the special meeting or any adjournment or postponement thereof, and only record holders of common stock at the close of business on that day will be entitled to vote. On the record date, 64,477,314 shares of the Company’s common stock were issued and outstanding. In order to constitute a quorum for the conduct of business at the special meeting, it is necessary that holders of a majority of all outstanding shares of the Company’s common stock be present in person or represented by proxy.

TO ASSURE REPRESENTATION AT THE SPECIAL MEETING, SHAREHOLDERS ARE URGED TO RETURN A PROXY AS PROMPTLY AS POSSIBLE EITHER BY VOTING THROUGH THE INTERNET OR TELEPHONE OR BY SIGNING, DATING, AND RETURNING A PROXY CARD IN ACCORDANCE WITH THE ENCLOSED INSTRUCTIONS. ANY SHAREHOLDER ATTENDING THE SPECIAL MEETING MAY VOTE IN PERSON EVEN IF HE OR SHE PREVIOUSLY RETURNED A PROXY.

| By Order of the Board of Directors, |

|

| Brian P. Lynch |

| Corporate Secretary |

Carlsbad, California

July 29, 2009

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held

on September 10, 2009: Our proxy statement for the Special Meeting of Shareholders is available at

www.callawaygolf.com/2009specialmeeting.

Table of Contents

PROXY STATEMENT

| 1 | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 2 | ||

| 2 | ||

| 3 | ||

Proposal No. 1 — Issuance of Common Stock Upon Conversion of Preferred Stock | 4 | |

| 4 | ||

| 4 | ||

| 4 | ||

| 5 | ||

| 6 | ||

| 9 | ||

| 9 | ||

| 10 | ||

| 13 | ||

| 13 | ||

Shareholder Proposals for the 2010 Annual Meeting of Shareholders | 14 | |

| 14 |

| Appendix A: | Certificate of the Powers, Designations, Preferences and Rights of the 7.50% Series B Cumulative Perpetual Convertible Preferred Stock | |||

i

Table of Contents

CALLAWAY GOLF COMPANY

2180 Rutherford Road

Carlsbad, California 92008

PROXY STATEMENT

SPECIAL MEETING OF SHAREHOLDERS

Meeting Date: September 10, 2009

Date, Time, Place and Purpose of the Special Meeting

This proxy statement and accompanying proxy card will first be mailed to shareholders on or about August 7, 2009 in connection with the solicitation of proxies by the Board of Directors of Callaway Golf Company, a Delaware corporation (the “Company”). The proxies are for use at a special meeting of shareholders of the Company, which is scheduled to be held on Thursday, September 10, 2009, at Callaway Golf Company, 2180 Rutherford Road, Carlsbad, California 92008, commencing at 9:00 a.m. (PDT), and at any meetings held upon adjournment or postponement thereof. The purpose of the special meeting is for the Company’s shareholders to consider and vote on the issuance of additional shares of common stock that may be issued upon conversion of our 7.50% Series B Cumulative Perpetual Convertible Preferred Stock, which we refer to as the preferred stock. Based on the initial conversion rate and subject to certain adjustments, such number of shares initially amounts to approximately 7 million shares of common stock that may be issued upon conversion of the preferred stock in addition to the approximately 12.9 million shares that are already permitted to be issued upon conversion of the preferred stock. Please see the information under the caption “Description of the Preferred Stock” below and the Certificate of Designations for the preferred stock, which is attached to this proxy statement as Appendix A, for additional information on the preferred stock, including a description of applicable conversion rate adjustments.

All holders of record of our common stock, $.01 par value, which we refer to as the common stock, as of the close of business on July 24, 2009 (the “Record Date”) are entitled to receive notice of the special meeting and to vote at the special meeting.

Whether or not you plan to attend the special meeting in person, please return a proxy as promptly as possible. You may return a proxy either by voting through the Internet or telephone or by signing, dating and returning a proxy card. Please follow the accompanying instructions. Any shareholder who returns a proxy has the power to revoke it at any time prior to its effective use either by filing with the corporate secretary of the Company a written instrument revoking it, or by returning (by mail, telephone or Internet) another later-dated proxy, or by attending the special meeting and voting in person. If you sign and return your proxy but do not indicate how you want to vote your shares for each proposal, then for any proposal for which you do not so indicate, your shares will be voted at the special meeting in accordance with the recommendation of the Board of Directors. The Board of Directors recommends a vote“FOR”the issuance of the shares of the common stock issuable upon conversion of the Company’s 7.50% Series B Cumulative Perpetual Convertible Preferred Stock that equals or exceeds 20% of the voting power or the number of shares of common stock outstanding immediately prior to the original issuance of the preferred stock. By returning the proxy (either by mail, telephone or Internet), unless you notify the corporate secretary of the Company in writing to the contrary, you are also authorizing the proxies to vote with regard to any other matter that may properly come before the special

1

Table of Contents

meeting or any adjournment or postponement thereof. The Company does not currently know of any such other matter. If there are any such additional matters, the proxies will vote your shares in accordance with the recommendation of the Board of Directors.

On the Record Date, there were 64,477,314 shares of common stock issued and outstanding. The presence, either in person or by proxy, of persons entitled to vote a majority of the Company’s outstanding common stock is necessary to constitute a quorum for the transaction of business at the special meeting. Abstentions may be specified for all proposals.

Under the rules of the New York Stock Exchange (“NYSE”), brokers who hold shares in street name for customers do not have the authority to vote on certain items when they have not received instructions from beneficial owners (“broker non-votes”). Abstentions and broker non-votes are counted for purposes of determining a quorum. Abstentions are counted in the tabulation of votes cast and have the same effect as voting against a proposal. Broker non-votes are not considered as having voted for purposes of determining the outcome of a vote. The proposal to approve the issuance of the shares of common stock issuable upon conversion of the Company’s 7.50% Series B Cumulative Perpetual Convertible Preferred Stock that equals or exceeds 20% of the voting power or the number of shares of common stock outstanding immediately prior to the original issuance of the preferred stock (Proposal No. 1) is considered non-routine and brokers may not vote on such proposal if they do not receive instructions from the beneficial owners. Holders of common stock have one vote for each share on any matter that may be presented for consideration and action by the shareholders at the special meeting.

The cost of preparing, assembling, printing and mailing this proxy statement and the accompanying proxy card, and the cost of soliciting proxies relating to the special meeting, will be borne by the Company. The Company may request banks, brokers or other nominees to solicit their customers who beneficially own common stock listed of record in the name of such bank, broker or other nominees, and will reimburse such banks, brokers and other nominees for their reasonable out-of-pocket expenses for such solicitations. The solicitation of proxies by mail may be supplemented by telephone, facsimile, Internet and personal solicitation by directors, officers and other employees of the Company, but no additional compensation will be paid to such individuals. The Company has retained The Altman Group to assist in the solicitation of proxies for a base fee of approximately $5,500, plus out-of-pocket expenses.

With regard to the delivery of annual reports and proxy statements, under certain circumstances the Securities and Exchange Commission (“SEC”) permits a single set of such documents to be sent to any household at which two or more shareholders reside if they appear to be members of the same family. Each shareholder, however, still receives a separate proxy card. This procedure, known as “householding,” reduces the amount of duplicate information received at a household and reduces mailing and printing costs as well. A number of banks, brokers and other nominees have instituted householding and have previously sent a notice to that effect to certain of the Company’s beneficial shareholders whose shares are registered in the name of the bank, broker or other nominee. As a result, unless the shareholders receiving such notice gave contrary instructions, only one proxy statement will be mailed to an address at which two or more such shareholders reside. If any shareholder residing at such an address wishes to receive a separate proxy statement in the future, such shareholder should telephone the householding election system (toll-free) at 1-800-542-1061. In addition, (i) if any shareholder who previously consented to householding desires to receive a separate copy of the proxy statement for each shareholder at his or her same address, or (ii) if any shareholder shares an address with another shareholder and both shareholders of such address desire to receive only a single copy of the proxy statement, then such shareholder should contact his or her bank, broker or other nominee in whose name the shares are registered or contact the Company as follows: Callaway Golf Company, ATTN: Investor Relations, 2180 Rutherford Road, Carlsbad, CA 92008, telephone (760) 931-1771.

2

Table of Contents

The main purpose of the special meeting of shareholders is to conduct the business described in this proxy statement. A special meeting of shareholders is different from an annual meeting of shareholders. A special meeting is called and held for the sole purpose of taking action on the proposals brought before the meeting. At the upcoming meeting, therefore, the shareholders will be asked to vote upon the specific proposal discussed in this proxy statement and no general business presentation or report is planned. Also, the realities of the modern day proxy process are such that almost all shareholders submit their voting instructions in advance of the meeting and as a result it is anticipated that the meeting will last only a few minutes. Furthermore, it is not expected that a large turn-out of management or Board members will be required.

3

Table of Contents

PROPOSAL NO. 1 — ISSUANCE OF COMMON STOCK UPON CONVERSION OF PREFERRED STOCK

As we previously reported, unfavorable economic conditions and foreign currency exchange rates have had a significant adverse effect upon our 2009 earnings. As a result, during the second quarter of 2009, we believed it was likely that we would be in violation of the financial covenants under our line of credit as of June 30, 2009 unless we took action. We worked with our internal and outside financial and legal advisors and considered various alternative courses of action. Ultimately, we concluded that a capital infusion from a preferred stock offering was the best alternative and was in the best interests of the Company and our shareholders.

On June 15, 2009, we sold 1,400,000 shares of our 7.50% Series B Cumulative Perpetual Convertible Preferred Stock (which we refer to as our preferred stock) in a private offering to qualified institutional buyers and received gross proceeds of $140 million. We used the net proceeds from the offering of approximately $134 million to pay down our line of credit and ended the second quarter of 2009 with no outstanding debt and approximately $50 million in cash. Without this capital infusion we would not have been in compliance with the financial covenants at June 30, 2009. If this had occurred, we would have been in default under the line of credit, which would have permitted the lenders to accelerate the maturity of the line of credit, to require immediate payment of amounts owed under the line of credit, and to take other actions, all of which would have had a significant adverse effect upon our liquidity, business and operations. The preferred stock offering therefore allowed us to remain in compliance with the financial covenants under the line of credit and to retain the very favorable pricing and other terms of our existing line of credit, as well as provided us with operational and financial flexibility to invest in and operate our business.

The terms of the preferred stock provide for cumulative dividends from the date of original issue at a rate of 7.50% per annum of the $100 liquidation preference per share (equivalent to an annual rate of $7.50 per share), subject to adjustment in certain circumstances. Please see the information under the caption “Description of the Preferred Stock” below and the Certificate of Designations for the preferred stock, which is attached to this proxy statement as Appendix A, for additional information on the preferred stock.

NYSE Shareholder Approval Requirement

Because our common stock is listed on the NYSE, we are subject to NYSE rules and regulations. NYSE Listed Company Manual Section 312.03(c) requires shareholder approval prior to the issuance or sale of securities convertible into shares of our common stock in any transaction or series of transactions if (1) the shares of common stock will have upon issuance voting power equal to 20% or more of the voting power outstanding before the issuance of the convertible securities or (2) the number of shares of common stock to be issued will upon issuance equal 20% or more of the number of shares of common stock outstanding before the issuance of the convertible securities. At the time of original issuance of the preferred stock, 20% of our common stock outstanding was 12,895,907 shares (the “Exchange Cap”). Because of such rules and regulations, it was necessary to structure the private offering such that the preferred stock could not be converted entirely into shares of our common stock until we obtained the necessary shareholder approval to issue common stock upon conversion of the preferred stock equal to or in excess of the Exchange Cap. Based on the initial conversion rate and subject to certain adjustments, such number of shares initially amounts to an additional 6,962,253 shares of common stock. In connection with the offering of the preferred stock, we agreed to submit this proposal to a vote of our shareholders at a special meeting. Accordingly, we are seeking shareholder approval of the issuance of such additional shares of our common stock equal to or in excess of the Exchange Cap upon conversion of the preferred stock.

Consequences if Shareholders Approve the Proposal

Conversion of Preferred Stock; Issuance of Shares. If shareholders approve this Proposal No. 1, then the holders of the preferred stock may at their option convert any or all of their preferred stock into shares of our common stock at any time at an initial conversion rate of 14.1844 shares per share of preferred stock, which is

4

Table of Contents

equivalent to an initial conversion price of approximately $7.05 per share. The conversion rate is subject to adjustment in certain circumstances. Please see the information under the caption “Description of the Preferred Stock” below and Section 7 of the Certificate of Designations for the preferred stock, which is attached to this proxy statement as Appendix A, for additional information on the preferred stock, including a description of applicable conversion rate adjustments. In addition, if shareholders approve the issuance prior to September 13, 2009, the dividend rate on the preferred stock will remain at 7.50% per year.

Rights of Investors; Registration Rights. The rights and privileges associated with shares of our common stock issued upon conversion of the preferred stock will be identical to the rights and privileges associated with the common stock held by our existing common shareholders, including voting rights.

Holders of the preferred stock have certain registration rights with respect to shares of our common stock issuable upon conversion of the preferred stock. Any such shares of our common stock that are sold pursuant to an effective registration statement will be freely transferable without restriction under the Securities Act of 1933, as amended, unless they are sold to an affiliate of the Company. This free transferability may materially and adversely impact the market price of our common stock if large quantities of our common stock are issued upon conversion of the preferred stock and sold into the market.

Dilution. If shareholders approve this Proposal No. 1, we may issue approximately 7 million additional shares of common stock upon conversion, based on the initial conversion rate. The number of shares of our common stock issuable upon conversion of the preferred stock may increase as a result of any adjustments to the conversion rate that may be required by the terms of the preferred stock. Please see the information under the caption “Description of the Preferred Stock” below and Section 7 of the Certificate of Designations for the preferred stock, which is attached to this proxy statement as Appendix A, for additional information on the preferred stock, including a description of applicable conversion rate adjustments. Assuming that all of the preferred stock had already converted into shares of common stock in an amount up to the Exchange Cap, the issuance of the additional shares would constitute approximately 9% of both the voting power and the number of shares of our common stock outstanding. Without such shareholder approval, we would only be permitted to issue common stock upon conversion in an amount up to the Exchange Cap. As a result, depending on the number of shares of our common stock outstanding at the time of conversion of the preferred stock, our existing shareholders may incur substantial dilution of their voting power and may own a significantly smaller percentage of our outstanding common stock if Proposal No. 1 is passed.

Consequences if Shareholders Do Not Approve the Proposal

Cash Payments Upon Conversion. If shareholders do not approve this Proposal No. 1, then we will not be able to issue shares of our common stock upon conversion of the preferred stock equal to or in excess of the Exchange Cap. We will be required to make a cash payment, in lieu of the shares of common stock that holders would otherwise be entitled to receive, upon conversion of the preferred stock as long as our debt instruments permit such payment and assets are legally available to pay such amounts. As a result, depending on the timing and the amount of any such cash payment upon conversion, such cash payment could have a significant adverse effect upon the Company’s liquidity and financial condition and could significantly impact the Company’s ability to meet its other financial obligations or invest in its business. In addition, if we are not permitted to deliver cash upon conversion when required to make such payments, preferred stock shareholders may be entitled to elect two additional directors to serve on our Board of Directors.

Dividends. If shareholders do not approve this Proposal No. 1 by September 13, 2009, then the dividend rate on the preferred stock will be increased by 300 basis points to a rate of 10.5% per year until the date on which our shareholders subsequently approve the issuance of such shares of common stock upon conversion of the preferred stock. Please see the information under the caption “Description of the Preferred Stock” below and the Certificate of Designations for the preferred stock, which is attached to this proxy statement as Appendix A, for additional information on the preferred stock, including a description of dividend rate adjustments. Assuming all shares of preferred stock are outstanding at such time, the Company would be obligated to pay to the preferred

5

Table of Contents

stock shareholders each year approximately $4.2 million of additional aggregate preferred stock dividend payments if shareholders do not approve this Proposal No. 1 by September 13, 2009.

Shareholders’ Meetings. If shareholders do not approve this Proposal No. 1 by September 13, 2009, then we may seek to obtain shareholder approval to permit the issuance of shares of our common stock upon conversion of the preferred stock at future shareholder meetings to reduce the increased dividend rate from 10.5% to the initial dividend rate of 7.50%.

Description of the Preferred Stock

The following is a summary of the material terms and provisions of the powers, designations, preferences and rights of the preferred stock, as contained in the Certificate of the Powers, Designations, Preferences and Rights of the 7.50% Series B Cumulative Perpetual Convertible Preferred Stock ($0.01 Par Value) (Liquidation

Preference $100 Per Share) (the “Certificate of Designations”), which is attached to this proxy statement as Appendix A and is included as an exhibit to the Company’s Current Report on Form 8-K, filed with the SEC on June 15, 2009. Shareholders are urged to read the Certificate of Designations relating to the preferred stock in its entirety.

Authorized Shares. Our Board of Directors has designated 1,400,000 shares of preferred stock as 7.50% Series B Cumulative Perpetual Convertible Preferred Stock. Shares of the preferred stock have a par value of $0.01 per share.

Dividend Rights. Dividends will be cumulative from the date of original issue at the annual rate of 7.50% of the liquidation preference of the preferred stock, payable quarterly on the 15th day of March, June, September and December, commencing September 15, 2009. Any dividends must be declared by our Board of Directors and must come from funds that are legally available for dividend payments. In addition, our line of credit contains limitations on when we are able to pay cash dividends on our capital stock, including the preferred stock, and the amount of cash dividends that we are able to pay. As discussed above, the dividend rate on the preferred stock may be increased in certain circumstances, including if our shareholders fail to approve the issuance of the shares of our common stock upon conversion of the preferred stock equal to or in excess of the Exchange Cap.

Ranking. The preferred stock will rank, with respect to distribution rights and rights upon our liquidation, winding-up or dissolution:

| • | junior to all of our existing and future debt obligations, including convertible or exchangeable debt securities; |

| • | senior to our common stock and to any other of our equity securities that by their terms rank junior to the preferred stock with respect to distribution rights or payments upon our liquidation, winding-up or dissolution; |

| • | on a parity with other series of our preferred stock or other equity securities that we may later authorize and that by their terms are on a parity with the preferred stock; and |

| • | junior to any equity securities that we may later authorize and that by their terms rank senior to the preferred stock. |

While any shares of preferred stock are outstanding, we may not authorize or issue any equity securities that rank senior to the preferred stock without the affirmative vote of the holders of at least two-thirds of the preferred stock.

Conversion Rights and Settlement. Unless we redeem the preferred stock, the preferred stock can be converted at the holders’ option at any time into shares of common stock at an initial conversion rate of 14.1844 shares of common stock for each share of preferred stock (equivalent to a conversion price of approximately $7.05 per share). As discussed above, we are obligated to seek shareholder approval of the issuance of the shares

6

Table of Contents

of our common stock upon conversion of the preferred stock equal to or in excess of the Exchange Cap, and if our shareholders fail to approve Proposal No. 1, then we will be required to make a payment to holders in cash in lieu of issuing the shares of common stock in excess of the Exchange Cap that holders would otherwise be entitled to receive upon conversion of the preferred stock. The initial conversion rate with respect to the preferred stock is subject to adjustment in certain events. In addition, our line of credit contains limitations on when we are able to make cash payments on our capital stock, including the preferred stock, and the amount of cash we are able to pay.

Anti-Dilution Adjustments. The conversion rate of the preferred stock is subject to customary anti-dilution adjustments if we:

| • | issue shares of our common stock as a dividend or distribution on shares of our common stock to all holders of our common stock, or if we effect a share split or share combination; |

| • | distribute to all holders of our common stock any rights, warrants or options entitling them to subscribe for or purchase shares of our common stock at a less than current market price; |

| • | distribute shares of our capital stock, evidence of indebtedness or other assets or property to all holders of our common stock, excluding: dividends, distributions, rights, warrants or options referred to in the first two bullets above; dividends or distributions paid exclusively in cash; and spin-offs; |

| • | distribute to all of our common shareholders capital stock of any class or series, or similar equity interest, of or relating to one of our subsidiaries or other business units, which we refer to as a spin-off; |

| • | make any cash dividend or distribution to all holders of outstanding shares of our common stock (excluding any dividend or distribution in connection with our liquidation, dissolution or winding-up) during any of our quarterly fiscal periods in an aggregate amount that, together with other cash dividends or distributions made during such quarterly fiscal period, exceeds the product of $0.01, which we refer to as the reference dividend, multiplied by the number of shares of our common stock outstanding on the record date for such distribution; or |

| • | make a payment in respect of a tender offer or exchange offer for shares of our common stock to the extent that the cash and value of any other consideration included in the payment per share of our common stock exceeds the closing sale price per share of our common stock on the trading day next succeeding the last date on which tenders or exchanges may be made pursuant to such tender offer or exchange offer. |

Business Combinations.

If any of the following events occur, each of which we refer to as a business combination, then each share of preferred stock outstanding immediately prior to such event will remain outstanding but will become convertible into the kind and amount of stock, other securities or other property or assets (including cash or any combination thereof) that the holder of shares of the preferred stock would have owned or been entitled to receive upon such business combination as if such holder of shares of our preferred stock held a number of shares of our common stock equal to the conversion rate in effect on the effective date for such business combination, multiplied by the number of shares of our preferred stock held by such holder of shares of our preferred stock:

| • | any recapitalization, reclassification or change of our common stock (other than changes resulting from a subdivision or combination); |

| • | a consolidation, merger or combination involving us into any other person, or any merger of another person into us, except for a merger that does not result in a reclassification, conversion, exchange or cancellation of common stock; |

| • | a sale, transfer, conveyance or lease to another person of all or substantially all of our property and assets (other than to one or more of our subsidiaries); or |

| • | a statutory share exchange. |

7

Table of Contents

Adjustment to Conversion Rate upon a Failure to Pay Dividends. If we fail to pay the full amount of any quarterly dividend on the preferred stock, the conversion rate will be adjusted.

Adjustment to Conversion Rate upon a Fundamental Change. If holders of shares of our preferred stock elect to convert their shares of our preferred stock in connection with a fundamental change that occurs on or prior to June 15, 2012, we will increase the conversion rate for shares of our preferred stock surrendered for conversion by a number of additional shares determined based on the stock price at the time of such fundamental change and the effective date of such fundamental change.

A fundamental change generally will be deemed to occur at such time as:

| • | we consolidate with or merge with or into another person (other than a subsidiary of ours) and our outstanding voting securities are reclassified into, converted for or converted into the right to receive any other property or security, or we sell, convey, transfer or lease all or substantially all of our properties and assets to any person (other than a subsidiary of ours); provided that none of these circumstances will be a fundamental change if persons that beneficially own our voting securities immediately prior to the transaction own, directly or indirectly, a majority of the voting securities of the surviving or transferee person immediately after the transaction in substantially the same proportion as their ownership of our voting securities immediately prior to the transaction; |

| • | any “person” or “group” (as such terms are used for purposes of Sections 13(d) and 14(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), whether or not applicable), other than us or any of our subsidiaries or any employee benefit plan of us or such subsidiary, is or becomes the “beneficial owner,” directly or indirectly, of more than 50% of the total voting power in the aggregate of all classes of our capital stock then outstanding and entitled to vote generally in elections of directors; or |

| • | during any period of 12 consecutive months after the date of original issuance of the preferred stock, persons who at the beginning of such 12-month period constituted our Board of Directors, together with any new persons whose election was approved by a vote of a majority of the persons then still comprising our Board of Directors who were either members of the Board of Directors at the beginning of such period or whose election, designation or nomination for election was previously so approved, cease for any reason to constitute a majority of our Board of Directors. |

However, a fundamental change will not be deemed to have occurred in the case of a merger or consolidation described in the first bullet point above if (i) 90% or more of the consideration in the aggregate paid for the common stock (and cash payments pursuant to dissenters’ appraisal rights) in the merger or consolidation consists of common stock of a United States company traded on a national securities exchange (or which will be so traded or quoted when issued or exchanged in connection with such transaction) and (ii) the market capitalization of the company acquiring the common stock is equal to or greater than $500 million on the trading date immediately preceding the day on which such merger or consolidation is publicly announced.

Rights of Holders of Preferred Stock upon a Fundamental Change. In the event of a fundamental change when the stock price of our common stock is less than $5.92 per share, then holders will have a special right to convert some or all of their preferred stock on the fundamental change conversion date into a number of shares of our common stock per $100 liquidation preference equal to such liquidation preference, plus an amount equal to accrued and unpaid dividends to, but not including, the fundamental change conversion date, divided by 97.5% of the market price of our common stock. In the event that holders exercise that special conversion right, we have the right to repurchase for cash all or any part of such holders’ preferred stock as to which the conversion right was exercised at a repurchase price equal to 100% of the liquidation preference of the preferred stock to be repurchased plus an amount equal to accrued and unpaid dividends to, but not including, the fundamental change conversion date. If we elect to exercise our repurchase right, holders will not have the special conversion right described in this paragraph.

8

Table of Contents

Company’s Conversion Option. On or prior to June 15, 2012, we may elect to mandatorily convert some or all of the preferred stock if the daily volume weighted average price of our common stock has exceeded 150% of the conversion price for at least 20 out of 30 consecutive trading days, ending on the trading day prior to our issuance of a press release announcing the exercise of the conversion option.

Dividend Make-Whole Payment. If we elect to mandatorily convert some or all of the preferred stock prior to June 15, 2012, we will make an additional payment on the preferred stock equal to the aggregate amount of cumulative dividends that would have accrued and become payable on the preferred stock from June 15, 2009 through and including June 15, 2012, less any dividends already paid on the preferred stock. This additional payment is payable by us in cash or, at our option, in shares of our common stock, or a combination of cash and shares of our common stock.

Liquidation Preference. The preferred stock has a liquidation preference of $100 per share of preferred stock, plus accrued and unpaid dividends. In the event of any voluntary or involuntary liquidation, winding-up or dissolution of the Company, the holders of shares of the preferred stock will be entitled to receive and to be paid out of our assets legally available for distribution to our shareholders, before any distribution is made to holders of shares of common stock or any of our other stock ranking junior to the shares of preferred stock upon liquidation.

Optional Redemption. On or after June 20, 2012, we may redeem the preferred stock, in whole or in part, at our option at a redemption price equal to 100% of the liquidation preference of the preferred stock to be purchased, together with accrued dividends to, but excluding, the redemption date.

Maturity Date. The preferred stock has no maturity date, and we are not required to redeem the preferred stock at any time. Accordingly, the preferred stock will remain outstanding indefinitely unless a holder of shares of the preferred stock or we decide to convert it or we decide to redeem it, or we elect to repurchase it upon a fundamental change.

Voting Rights. Except as provided by law and in other limited situations, holders of the preferred stock will not be entitled to any voting rights. However, holders will, among other things, be entitled to vote as a separate class to elect two directors if we have not paid the equivalent of six or more quarterly dividends, whether or not consecutive, or we are unable to issue common stock or pay cash upon conversion of the preferred stock. These voting rights will continue until we pay the full accrued and unpaid dividends or are able to give effect to any conversions, as applicable, on the preferred stock.

The affirmative vote of the holders of a majority of shares of common stock represented and voting, in person or by proxy, at the special meeting is required to approve the issuance of the shares of our common stock upon conversion of our preferred stock equal to or in excess of the Exchange Cap. Abstentions and broker non-votes are counted for purposes of determining a quorum. Abstentions are counted in the tabulation of votes cast and have the same effect as voting against the proposal. A “broker non-vote” is treated as not being entitled to vote on this proposal and, therefore, is not counted for purposes of determining whether this proposal has been approved.

Recommendation of the Board of Directors

YOUR BOARD OF DIRECTORS RECOMMENDS A VOTE“FOR” APPROVAL OF THE PROPOSAL TO APPROVE THE ISSUANCE OF THE SHARES OF THE COMPANY’S COMMON STOCK ISSUABLE UPON CONVERSION OF OUR PREFERRED STOCK EQUAL TO OR IN EXCESS OF 20% OF THE VOTING POWER OR THE NUMBER OF SHARES OF THE COMPANY’S COMMON STOCK OUTSTANDING IMMEDIATELY PRIOR TO THE ORIGINAL ISSUANCE OF THE PREFERRED STOCK.

9

Table of Contents

BENEFICIAL OWNERSHIP OF THE COMPANY’S SECURITIES

The following table sets forth information regarding the beneficial ownership of the Company’s common stock as of June 30, 2009 (except as otherwise noted) by (i) each person who is known by the Company to own beneficially more than 5% of the Company’s outstanding common stock, (ii) each director of the Company, (iii) each of the named executive officers of the Company and (iv) all directors of the Company, named executive officers and other executive officers of the Company as a group. As of June 30, 2009, there were 64,479,536 shares of common stock issued and outstanding.

| Shares Beneficially Owned | |||||

Name and Address of Beneficial Owner(1) | Amount | Percent | |||

NFJ Investment Group LLC(2) 2100 Ross Avenue, Suite 700 Dallas, TX 75201 | 4,545,600 | 7.05 | % | ||

Barclays Global Investors, NA and related entities(3) 400 Howard Street San Francisco, CA 94105 | 4,290,584 | 6.64 | % | ||

Royce & Associates, LLC(4) 1414 Avenue of the Americas New York, NY 10019 | 3,307,566 | 5.13 | % | ||

AXA Financial, Inc.(5) 1290 Avenue of the Americas New York, NY 10104 | 3,807,561 | 5.91 | % | ||

Cramer Rosenthal McGlynn, LLC(6) 520 Madison Avenue New York, NY 10022 | 3,647,154 | 5.66 | % | ||

Fisher Investments(7) 13100 Skyline Blvd. Woodside, CA 94062 | 3,471,000 | 5.38 | % | ||

Union Bank of California, N.A., Trustee for the Callaway Golf Company Grantor Stock Trust(8) 530 B. Street San Diego, CA 92101 | 1,178,050 | 1.83 | % | ||

Samuel H. Armacost(9) | 52,000 | * | |||

Ronald S. Beard(10) | 55,445 | * | |||

John C. Cushman, III(11) | 48,145 | * | |||

George Fellows(12) | 793,831 | 1.22 | % | ||

Bradley J. Holiday(13) | 426,527 | * | |||

Yotaro Kobayashi(14) | 37,945 | * | |||

David A. Laverty(15) | 48,683 | * | |||

John F. Lundgren(16) | — | * | |||

Steven C. McCracken(17) | 278,985 | * | |||

Richard L. Rosenfield(18) | 66,045 | * | |||

Anthony S. Thornley(19) | 36,945 | * | |||

Thomas T. Yang(20) | 57,003 | * | |||

All directors, named executive officers and other executive officers as a group (12 persons)(21) | 1,901,554 | 2.88 | % | ||

| * | Less than one percent |

| (1) | Except as otherwise indicated, the address for all persons shown on this table is c/o Callaway Golf Company, 2180 Rutherford Road, Carlsbad, California 92008. Unless otherwise indicated in the footnotes to this table, and subject to community property laws where applicable, to the knowledge of the Company each |

10

Table of Contents

of the shareholders named in this table has sole voting and investment power with respect to the shares shown as beneficially owned by that shareholder. Furthermore, as indicated in the following footnotes, the number of shares a holder is deemed to beneficially own for purposes of this table includes shares issuable upon exercise of stock options if the options may be exercised on or before August 29, 2009, irrespective of the price at which the Company’s common stock is trading on the NYSE. All of the options reflected in this table were at exercise prices above the trading price of the Company’s common stock on the NYSE, which was $5.07 on June 30, 2009. In addition, as indicated in the following footnotes, the number of shares a holder is deemed to beneficially own for purposes of this table (a) includes unvested shares of restricted stock granted under the Company’s equity-based compensation plans and (b) excludes unvested restricted stock units (“RSUs”) granted under such plans. Until vested, the shares of restricted stock and RSUs are subject to forfeiture and subject to restrictions on transfer. The holder of unvested restricted stock shares may vote the shares and is entitled to receive dividends; the holder of unvested RSUs may not vote the shares but is entitled to receive dividend equivalents thereon. |

| (2) | This information is based upon a Schedule 13G filed by NFJ Investment Group LLC with the Securities and Exchange Commission on February 17, 2009. This schedule also reported that NFJ Investment Group LLC has sole voting power with respect to 4,494,700 shares and sole dispositive power with respect to 4,545,600 shares. |

| (3) | This information is based upon a Schedule 13G filed by Barclays Global Investors, NA, Barclays Global Fund Advisors, Barclays Global Investors, Ltd, Barclays Global Investors Japan Limited, Barclays Global Investors Canada Limited, Barclays Global Investors Australia Limited and Barclays Global Investors (Deutschland AG) with the Securities and Exchange Commission on February 5, 2009. This schedule also reported that the reporting persons have sole voting power with respect to 3,635,980 shares and sole dispositive power with respect to 4,290,584 shares. |

| (4) | This information is based upon a Schedule 13G/A filed by Royce & Associates, LLC with the Securities and Exchange Commission on January 23, 2009. This schedule also reported that Royce & Associates, LLC has sole voting and dispositive power with respect to all such shares. |

| (5) | This information is based upon a Schedule 13G filed jointly by AXA Assurances I.A.R.D. Mutuelle, AXA Assurances Vie Mutuelle, AXA and AXA Financial, Inc. with the Securities and Exchange Commission on February 13, 2009. This schedule also reported that the reporting persons have sole voting power with respect to 3,360,021 shares and sole dispositive power with respect to 3,807,561 shares. |

| (6) | This information is based upon a Schedule 13G filed by Cramer Rosenthal McGlynn, LLC with the Securities and Exchange Commission on February 13, 2009. This schedule also reported that Cramer Rosenthal McGlynn, LLC has sole voting power with respect to 3,539,704 shares, sole dispositive power with respect to 3,615,154 shares and shared dispositive power with respect to 32,000 shares. |

| (7) | This information is based upon a Schedule 13G filed by Fisher Investments with the Securities and Exchange Commission on May 29, 2009. This schedule also reported that Fisher Investments has sole voting power with respect to 1,677,950 shares and sole dispositive power with respect to 3,471,000 shares. |

| (8) | The Callaway Golf Company Grantor Stock Trust (the “GST”) holds Company common stock pursuant to a trust agreement creating the GST in connection with the prefunding of certain obligations of the Company under various employee benefit plans. Both the GST and Union Bank of California, N.A., (the “Trustee”) disclaim beneficial ownership of all shares of common stock. The Trustee has no discretion in the manner in which the Company’s common stock held by the GST will be voted. The trust agreement provides that employees who hold unexercised options as of the Record Date under the Company’s stock option plans and employees who have purchased stock under the Company’s Employee Stock Purchase Plan during the twelve months preceding the Record Date will, in effect, determine the manner in which shares of the Company’s common stock held in the GST are voted. The Trustee will vote the common stock held in the GST in the manner directed by those employees who submit voting instructions for the shares. |

The number of shares as to which any one employee can direct the vote will depend upon how many employees submit voting instructions to the Trustee. If all employees entitled to submit such instructions do so, as of July 24, 2009, the following named executive officers and group would have the right to direct the vote of the following approximate share amounts: Mr. Fellows — 283,218, Mr. Holiday — 73,512, Mr. Laverty — 22,737, Mr. McCracken — 50,263 and Mr. Yang — 23,855 and all current executive officers as a group 453,584. If fewer than all of the eligible employees submit voting instructions, then the

11

Table of Contents

foregoing amounts would be higher. The trust agreement further provides that all voting instructions received by the Trustee will be held in confidence and not disclosed to any person including the Company.

| (9) | Includes 32,000 shares issuable upon exercise of options held by Mr. Armacost, which are currently exercisable or become exercisable on or before August 29, 2009. Mr. Armacost’s non-option shares are held in a family trust with his wife as a co-trustee. Excludes 3,945 Deferred Stock Units which become payable upon Mr. Armacost’s termination of Continuous Service that qualifies as a “separation from service” for purposes of Section 409A of the code. Also, excludes 2,834 RSUs, 3,898 RSUs, and 7,310 RSUs, which are scheduled to vest on June 5, 2010, May 20, 2011 and May 19, 2012, respectively. |

| (10) | Includes 44,000 shares issuable upon exercise of options held by Mr. Beard, which are currently exercisable or become exercisable on or before August 29, 2009. Mr. Beard’s spouse has shared voting and investment power for his non-option shares. Excludes 2,834 RSUs, 3,898 RSUs and 7,310 RSUs, which are scheduled to vest on June 5, 2010, May 20, 2011 and May 19, 2012, respectively. |

| (11) | Includes 32,000 shares issuable upon exercise of options held by Mr. Cushman, which are currently exercisable or become exercisable on or before August 29, 2009. All non-option shares are held jointly with his spouse. Excludes 2,834 RSUs, 3,898 RSUs and 7,310 RSUs, which are scheduled to vest on June 5, 2010, May 20, 2011 and May 19, 2012, respectively. |

| (12) | Includes 673,782 shares issuable upon exercise of options held by Mr. Fellows, which are currently exercisable or become exercisable on or before August 29, 2009. Excludes 77,960 RSUs, 73,867 RSUs, 72,771 RSUs and 137,123 RSUs, which are scheduled to vest on January 16, 2010, January 14, 2011, December 15, 2011 and January 29, 2012, respectively. |

| (13) | Includes 417,284 shares issuable upon exercise of options held by Mr. Holiday, which are currently exercisable or become exercisable on or before August 29, 2009. Excludes 9,745 RSUs, 8,080 RSUs and 14,998 RSUs, which are scheduled to vest on January 16, 2010, January 14, 2011 and January 29, 2012, respectively. |

| (14) | Includes 34,000 shares issuable upon exercise of options held by Mr. Kobayashi, which are currently exercisable or become exercisable on or before August 29, 2009. Excludes 2,834 RSUs, 3,898 RSUs and 7,310 RSUs, which are scheduled to vest on June 5, 2010, May 20, 2011 and May 19, 2012, respectively. |

| (15) | Includes 40,997 shares issuable upon exercise of options held by Mr. Laverty, which are currently exercisable or become exercisable on or before August 29, 2009. Also includes 5,871 shares of restricted stock, which are scheduled to vest on August 1, 2009. Excludes 2,199 RSUs, 5,069 RSUs, 8,080 RSUs and 14,998 RSUs, which are scheduled to vest on January 16, 2010, August 22, 2010, January 14, 2011 and January 29, 2012, respectively. |

| (16) | Excludes 11,680 RSUs, which are scheduled to vest on March 4, 2012. |

| (17) | Includes 244,339 shares issuable upon exercise of options held by Mr. McCracken, which are currently exercisable or become exercisable on or before August 29, 2009. Also includes 25,995 shares held by the McCracken/Waggener Family Trust for which Mr. McCracken is a trustee with voting and dispositive powers over such shares. Also includes 1,500 shares held by Mr. McCracken’s spouse. Excludes 9,745 RSUs, 8,080 RSUs and 14,998 RSUs which are scheduled to vest on January 16, 2010, January 14, 2011, and January 29, 2012, respectively. |

| (18) | Includes 34,000 shares issuable upon exercise of options held by Mr. Rosenfield, which are currently exercisable or become exercisable on or before August 29, 2009. Also includes 8,000 shares held in a trust for the benefit of Mr. Rosenfield’s children and 50 shares held by Mr. Rosenfield’s spouse. Excludes 2,834 RSUs, 3,898 RSUs and 7,310 RSUs, which are scheduled to vest on June 5, 2010, May 20, 2011 and May 19, 2012, respectively. |

| (19) | Includes 26,000 shares issuable upon exercise of options held by Mr. Thornley, which are currently exercisable or become exercisable on or before August 29, 2009. Excludes 2,834 RSUs, 3,898 RSUs and 7,310 RSUs, which are scheduled to vest on June 5, 2010, May 20, 2011 and May 19, 2012, respectively. |

| (20) | Includes 49,046 shares issuable upon exercise of options held by Mr. Yang, which are currently exercisable or become exercisable on or before August 29, 2009. Also includes 6,214 shares of restricted stock, which vested on July 20, 2009. Excludes 7,309 RSUs, 8,080 RSUs and 14,998 RSUs, which are scheduled to vest on January 16, 2010, January 14, 2011 and January 29, 2012, respectively. |

| (21) | Includes 1,627,448 shares issuable upon exercise of options held by these individuals, which are currently exercisable or become exercisable on or before August 29, 2009. Includes shares held by family trusts and family members as noted above. Includes 12,085 shares of restricted stock and excludes 587,977 RSUs, all of which remain subject to future vesting. |

12

Table of Contents

We file annual, quarterly and current reports, proxy statements and other information with the SEC under the Exchange Act. You may read and copy any document that we file at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at (800) SEC-0330. The SEC also maintains a website that contains reports, proxy statements, information statements and other information about issuers, like Callaway Golf Company, that file electronically with the SEC. The address of that website is www.sec.gov. In addition, our common stock is listed on the New York Stock Exchange and similar information concerning us can be inspected and copied at the offices of the New York Stock Exchange, Inc., 20 Broad Street, New York, New York 10005. You are encouraged to read the information that we file with the SEC, which discloses important information about us to you in those documents. This information includes any filing we have made with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act.Our proxy statement for the Special Meeting of Shareholders is available at www.callawaygolf.com/2009specialmeeting.

We are incorporating by reference specified documents that we file with the SEC, which means: incorporated documents are considered part of this proxy statement; we are disclosing important information to you by referring you to those documents; and information we subsequently file with the SEC will automatically update and supersede information contained in this proxy statement and in our other filings with the SEC. We incorporate by reference Items 7, 7A, 8 and 9 from Part I of the Company’s Annual Report on Form 10-K for the year ended December 31, 2008, filed on February 27, 2009; and Items 1, 2 and 3 from Part I of the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2009, filed on May 4, 2009, and any other items in that Quarterly Report expressly updating the above reference items from our Annual Report on Form 10-K.

This proxy statement incorporates important business and financial information about us from other documents that are not included in or delivered with this proxy statement. We will provide to you a copy of any or all of the above filings that have been incorporated by reference into this proxy statement, excluding exhibits to those filings, upon your request, at no cost. Requests should be directed to:

Callaway Golf Company

2180 Rutherford Road

Carlsbad, California 92008

Attention: Corporate Secretary

Telephone: 760-931-1771

13

Table of Contents

SHAREHOLDER PROPOSALS FOR THE 2010 ANNUAL MEETING OF SHAREHOLDERS

If a shareholder desires to nominate someone for election to the Board of Directors at, or to bring any other business before, the 2010 annual meeting of shareholders, then such shareholder must comply with the procedures set forth in Article II of the Company’s bylaws in addition to any other applicable requirements and must give timely written notice of the matter to the corporate secretary of the Company. To be timely, written notice must be delivered to the corporate secretary at the principal executive offices of the Company not less than 90 days nor more than 120 days prior to the first anniversary of this year’s Annual Meeting, provided, however, that in the event that the date of the 2010 annual meeting is more than 30 days before or more than 60 days after such anniversary date, then such notice to be timely must be delivered to the corporate secretary not more than 120 days prior to the 2010 annual meeting and not less than the later of (i) 90 days prior to such annual meeting or (ii) 10 days following the date of the first public announcement of the scheduled date of the 2010 annual meeting. Any such notice to the corporate secretary must include all of the information specified in the Company’s Bylaws.

If a shareholder desires to have a proposal included in the Company’s proxy statement and proxy card for the 2010 annual meeting of shareholders, then, in addition to the notices required by the immediately preceding paragraph and in addition to other applicable requirements (including certain rules and regulations promulgated by the Securities and Exchange Commission), the Company must receive notice of such proposal in writing at the Company’s principal executive offices in Carlsbad, California no later than December 10, 2009, provided, however, that if the date of the 2010 annual meeting of shareholders is more than 30 days before or after the first anniversary of this year’s Annual Meeting (i.e., the 2009 Annual Meeting of Shareholders), then such notice must be received by the corporate secretary of the Company a reasonable time before the Company begins to print and mail its proxy materials for the 2010 annual meeting.

Our Board of Directors and management know of no matters other than those listed in the attached Notice of the special meeting which are likely to be brought before the special meeting. However, if any other matters should properly come before the special meeting or any adjournment or postponement thereof, the persons named in the proxy will vote all proxies given to them in accordance with the recommendation of the Board of Directors.

Each shareholder is urged to return a proxy as soon as possible. Any questions should be addressed to Callaway Golf Company, ATTN: Investor Relations, at 2180 Rutherford Road, Carlsbad, California 92008, telephone (760) 931-1771.

| By Order of the Board of Directors, |

Brian P. Lynch |

| Corporate Secretary |

Carlsbad, California

July 29, 2009

14

Table of Contents

APPENDIX A

CERTIFICATE OF THE POWERS, DESIGNATIONS,

PREFERENCES AND RIGHTS OF THE

7.50% SERIES B CUMULATIVE PERPETUAL CONVERTIBLE PREFERRED STOCK

($0.01 PAR VALUE)

(LIQUIDATION PREFERENCE $100 PER SHARE)

OF

CALLAWAY GOLF COMPANY

PURSUANT TO SECTION 151(g) OF THE GENERAL CORPORATION LAW

OF THE STATE OF DELAWARE

THE UNDERSIGNED, being the Secretary of Callaway Golf Company, a Delaware corporation (the “Company”), DOES HEREBY CERTIFY that, pursuant to the provisions of Section 151(g) of the General Corporation Law of the State of Delaware, the following resolutions were duly adopted by the Board of Directors of the Company, and pursuant to authority conferred upon the Board of Directors by the provisions of the Certificate of Incorporation of the Company, as amended (the “Certificate of Incorporation”), the Board of Directors of the Company adopted resolutions fixing the designation and the relative powers, preferences, rights, qualifications, limitations and restrictions of such stock. These composite resolutions are as follows:

FIRST, that pursuant to authority expressly granted to and vested in the Board of Directors of the Company by the provisions of the Certificate of Incorporation, the issuance of a series of preferred stock, par value $0.01 per share, which shall consist of up to 1,400,000 of the 3,000,000 shares of preferred stock which the Company now has authority to issue, be, and the same hereby is, authorized, and the Board hereby fixes the powers, designations, preferences and relative, participating, optional and other special rights, and the qualifications, limitations and restrictions thereof (in addition to the powers, designations, preferences and relative, participating, optional or other special rights, and the qualifications, limitations or restrictions thereof, set forth in the Certificate of Incorporation which may be applicable to the preferred stock of this series) as follows:

1.Number of Shares and Designation. 1,400,0000 shares of the preferred stock, par value $0.01 per share, of the Company are hereby constituted as a series of the preferred stock designated as 7.50% Series B Cumulative Perpetual Convertible Preferred Stock (the “Series B Preferred Stock”).

2.Definitions. For purposes of the Preferred Stock, in addition to those terms otherwise defined herein, the following terms shall have the meanings indicated:

“Additional Common Stock” shall have the meaning specified in Section 7(l).

“Additional Payment” shall have the meaning specified in Section 7(n)(vi).

“Affiliate” of any specified person shall mean any other person directly or indirectly controlling or controlled by or under direct or indirect common control with such specified person. For the purposes of this definition, “control,” when used with respect to any specified person means the power to direct or cause the direction of the management and policies of such person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise; and the terms “controlling” and “controlled” have meanings correlative to the foregoing.

[Certificate of Designations]

A-1

Table of Contents

“Board of Directors” shall mean the Board of Directors of the Company or a committee of such Board duly authorized to act for it hereunder.

“Board Resolution” means a copy of a resolution certified by the Secretary or an Assistant Secretary of the Company to have been duly adopted by the Board of Directors and to be in full force and effect on the date of such certification, and delivered to the Transfer Agent.

“Business Combination” shall have the meaning specified in Section 7(e).

“Business Day” means each Monday, Tuesday, Wednesday, Thursday and Friday which is not a day on which the banking institutions in The City of New York, New York are authorized or obligated by law or executive order to close or be closed.

“Cash Payment Directors” has the meaning specified in Section 7(p).

“Closing Sale Price” of the Common Stock on any date means the closing sale price per share (or if no closing sale price is reported, the average of the closing bid and ask prices or, if more than one in either case, the average of the average closing bid and the average closing ask prices) on such date as reported on the New York Stock Exchange (or such other principal national securities exchange on which the Common Stock is then listed or authorized for quotation or, if not so listed or authorized for quotation, the average of the mid-point of the last bid and ask prices for the Common Stock on the relevant date from each of at least three nationally recognized independent investment banking firms selected by us for this purpose).

“Commission” shall mean the Securities and Exchange Commission.

“Common Stock” shall mean the common stock, par value $0.01 per share, of the Company at the date hereof. Subject to the provisions of Section 7(e), shares issuable on conversion of the Series B Preferred Stock shall include only shares of such class or shares of any class or classes resulting from any reclassification or reclassifications thereof and which have no preference in respect of dividends or of amounts payable in the event of any voluntary or involuntary liquidation, dissolution or winding up of the Company and which are not subject to redemption by the Company; provided that if at any time there shall be more than one such resulting class, the shares of each such class then so issuable shall be substantially in the proportion which the total number of shares of such class resulting from all such reclassifications bears to the total number of shares of all such classes resulting from all such reclassifications.

“Company” shall mean Callaway Golf Company, a Delaware corporation, and shall include its successors and assigns.

“Conversion Default” has the meaning specified in Section 7(p).

“Conversion Notice” has the meaning specified in Section 7(b).

“Conversion Price” shall mean $100 divided by the Conversion Rate.

“Conversion Rate” shall have the meaning specified in Section 7(a) and shall be adjusted, without limitation, as a result of any adjustment to the Conversion Rate pursuant to Section 7 hereof.

“Custodian” shall mean BNY Mellon Shareowner Services LLC, as custodian with respect to the Global Certificate, or any successor entity thereto.

“Daily VWAP” means the daily volume weighted average price of the Company’s Common Stock on such day on the national securities exchange on which the Common Stock is listed or quoted for trading as reported by Bloomberg L.P. (based on a trading day from 9:30 a.m. (New York City time) to 4:02 p.m. (New York City time).

A-2

Table of Contents

“Delayed Dividends” has the meaning specified in Section 3(f).

“Deposit Bank” has the meaning specified in Section 5(b).

“Depositary” means, with respect to the Series B Preferred Stock issuable or issued in the form of a Global Certificate, the person specified in Section 13 as the Depositary with respect to the Series B Preferred Stock, until a successor shall have been appointed and become such pursuant to the applicable provisions of this Certificate, and thereafter “Depositary” shall mean or include such successor. The foregoing sentence shall likewise apply to any subsequent successor or successors.

“Dividend Payment Date” shall have the meaning specified in Section 3(a).

“Dividend Payment Record Date” shall have the meaning specified in Section 3(a).

“Dividend Periods” shall mean quarterly dividend periods commencing on the 15th day of March, June, September and December of each year and ending on and including the day preceding the fifteenth day of the next succeeding Dividend Period.

“Effective Date” shall have the meaning specified in Section 7(l).

“Event” shall have the meaning specified in Section 9(f).

“Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

“Exchange Cap” shall have the meaning specified in Section 7(p).

“5-day VWAP” means the average of the daily volume weighted average price of our common stock on the national securities exchange on which the common stock is listed or quoted for trading as reported by Bloomberg L.P. (based on a trading day from 9:30 a.m. (New York City time) to 4:02 p.m. (New York City time)) for the relevant 5 trading days when such formula is used.

“Fundamental Change” shall have the meaning specified in Section 7(l).

“Fundamental Change Conversion Rate” shall have the meaning specified in Section 7(k).

“Fundamental Change Conversion Right” shall have the meaning specified in Section 7(k).

“Fundamental Change Repurchase Price” shall have the meaning specified in Section 7(k).

“Global Certificate” shall have the meaning specified in Section 13.

“holder,” “holder of shares of Series B Preferred Stock,” or “holder of the Series B Preferred Stock,” as applied to any share of Series B Preferred Stock, or other similar terms (but excluding the term “beneficial holder”), shall mean any person in whose name at the time a particular share of Series B Preferred Stock is registered on the Company’s stock records, which shall include the books of the Transfer Agent in respect of the Company and any stock transfer books of the Company.

“Issue Date” shall mean the first date on which shares of the Series B Preferred Stock are issued.

“Line of Credit” means the amended and restated credit agreement (amending and restating the Company’s credit agreement of November 10, 2003) with Bank of America, N.A., as administrative agent and the lenders named therein.

“Liquidation”has the meaning specified in Section 4(a).

A-3

Table of Contents

“Mandatory Conversion” shall have the meaning specified in Section 7(n)(i).

“Mandatory Conversion Date” shall have the meaning specified in Section 7(n)(ii).

“Mandatory Conversion Notice” has the meaning specified in Section 7(n)(ii).

“Market Price” shall mean with respect to any Fundamental Change Conversion Date, the average of the Closing Sales Prices of our Common Stock for the ten consecutive Trading Days ending on the third Trading Day prior to the Fundamental Change Conversion Date, appropriately adjusted to take into account the occurrence, during the period commencing on the first Trading Day of such Trading Day period and ending on the Fundamental Change Conversion Date of any event requiring an adjustment of the Conversion Rate; provided that in no event shall the market price be less than $0.01, subject to adjustment for share splits and combinations, reclassifications and similar events.

“Officers’ Certificate”, when used with respect to the Company, shall mean a certificate signed by (a) one of the President, the Chief Executive Officer, Executive or Senior Vice President or any Vice President (whether or not designated by a number or numbers or word added before or after the title “Vice President”) and (b) by one of the Treasurer or any Assistant Treasurer, Secretary or any Assistant Secretary or Controller of the Company, which is delivered to the Transfer Agent.

“Parity Preferred” shall have the meaning specified in Section 7(p).

“Preferred Directors” shall have the meaning specified in Section 9(b).

“Preferred Dividend Default” shall have the meaning specified in Section 9(b).

“person” shall mean a corporation, an association, a partnership, an individual, a joint venture, a joint stock company, a trust, a limited liability company, an unincorporated organization or a government or an agency or a political subdivision thereof.

“Reference Dividend” has the meaning specified in Section 7(d)(iv).

“Securities Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Series B Preferred Stock” has the meaning specified in Section 1.

“spin-off” shall have the meaning specified in Section 7(d)(iii).

“Stock Price” shall have the meaning specified in Section 7(l).

“Subsidiary” means a corporation more than 50% of the outstanding voting stock of which is owned, directly or indirectly, by the Company or by one or more other Subsidiaries, or by the Company and one or more other Subsidiaries. For the purposes of this definition, “voting stock” means stock which ordinarily has voting power for the election of directors, whether at all times or only so long as no senior class of stock has such voting power by reason of any contingency.

“10-day VWAP” has the meaning specified in Section 7(o).

“Trading day” means a day during which trading in securities generally occurs on the New York Stock Exchange or, if the Company’s Common Stock is not listed on the New York Stock Exchange, then a day during

A-4

Table of Contents

which trading in securities generally occurs on the principal U.S. securities exchange on which the Common Stock is listed or, if the Common Stock is not listed on a U.S. national or regional securities exchange, then on the principal other market on which the Common Stock is then traded or quoted.

“Transfer Agent” means BNY Mellon Shareowner Services LLC or such other agent or agents of the Company as may be designated by the Board of Directors of the Company as the transfer agent for the Series B Preferred Stock.

3.Dividends.

(a) Holders of the Series B Preferred Stock are entitled to receive, when, as and if declared by the Board of Directors, out of the funds of the Company legally available therefor, cash dividends at the annual rate of 7.50% of the liquidation preference for each share of Series B Preferred Stock, payable in equal quarterly installments on March 15, May 15, September 15 and December 15 (each a “Dividend Payment Date”), commencing September 15, 2009 (and, in the case of any accrued but unpaid dividends, at such additional times and for such interim periods, if any, as determined by the Board of Directors). If September 15, 2009 or any other Dividend Payment Date shall be on a day other than a Business Day, then the Dividend Payment Date shall be on the next succeeding Business Day. Dividends on the Series B Preferred Stock will be cumulative from the Issue Date, whether or not in any Dividend Period or Periods there shall be funds of the Company legally available for the payment of such dividends and whether or not such dividends are authorized or declared, and will be payable to holders of record as they appear on the stock books of the Company at the close of business on such record dates (each such date, a “Dividend Payment Record Date”), which shall be not more than 30 days nor less than 10 days preceding the Dividend Payment Dates thereof, as shall be fixed by the Board of Directors. Dividends on the Series B Preferred Stock shall accrue (whether or not declared) on a daily basis from the Issue Date subject to the terms of Section 3(b) hereof, and accrued dividends for each Dividend Period shall accumulate to the extent not paid on the Dividend Payment Date first following the Dividend Period for which they accrue. As used herein, the term “accrued” with respect to dividends includes both accrued and accumulated dividends.

(b) The amount of dividends payable per share for each full Dividend Period for the Series B Preferred Stock shall be computed by dividing the annual dividend rate by four (rounded down to the nearest one one-hundredth (1/100) of one cent). The amount of dividends payable for the initial Dividend Period on the Series B Preferred Stock, or any other period shorter or longer than a full Dividend Period on the Series B Preferred Stock, shall be computed on the basis of a 360-day year consisting of twelve 30-day months. Holders of shares of Series B Preferred Stock called for redemption on a redemption date falling between the close of business on a Dividend Payment Record Date and the opening of business on the corresponding Dividend Payment Date shall, in lieu of receiving such dividend on the Dividend Payment Date fixed therefor, receive such dividend payment together with all other accrued and unpaid dividends on the date fixed for redemption (unless such holders convert such shares in accordance with Section 7 hereof). Holders of shares of Series B Preferred Stock shall not be entitled to any dividends, whether payable in cash, property or stock, in excess of cumulative dividends, as herein provided. No interest, or sum of money in lieu of interest, shall be payable in respect of any dividend payment or payments on the Series B Preferred Stock which may be in arrears.