SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

x | Definitive Proxy Statement | |||||

¨ | Definitive Additional Materials | |||||

¨ | Soliciting Material Under Rule 14a-12 |

Callaway Golf Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1. | Title of each class of securities to which transaction applies: |

| 2. | Aggregate number of securities to which transaction applies: |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4. | Proposed maximum aggregate value of transaction: |

| 5. | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1. | Amount Previously Paid: |

| 2. | Form, Schedule or Registration Statement No.: |

| 3. | Filing Party: |

| 4. | Date Field: |

April 1, 2010

Dear Shareholder:

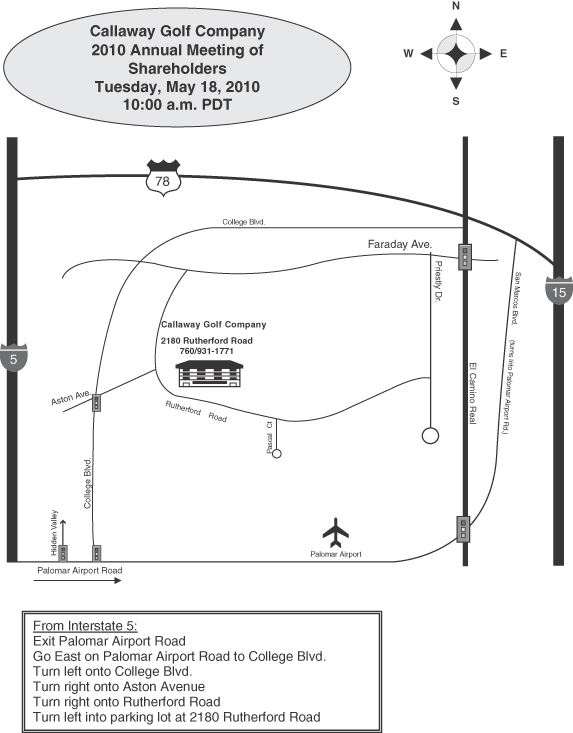

You are cordially invited to attend the Annual Meeting of Shareholders of Callaway Golf Company, which will be held on Tuesday, May 18, 2010, at Callaway Golf Company, located at 2180 Rutherford Road, Carlsbad, California 92008, commencing at 10:00 a.m. (PDT). A map is provided on the back page of these materials for your reference. Your Board of Directors and management look forward to greeting personally those shareholders who are able to attend.

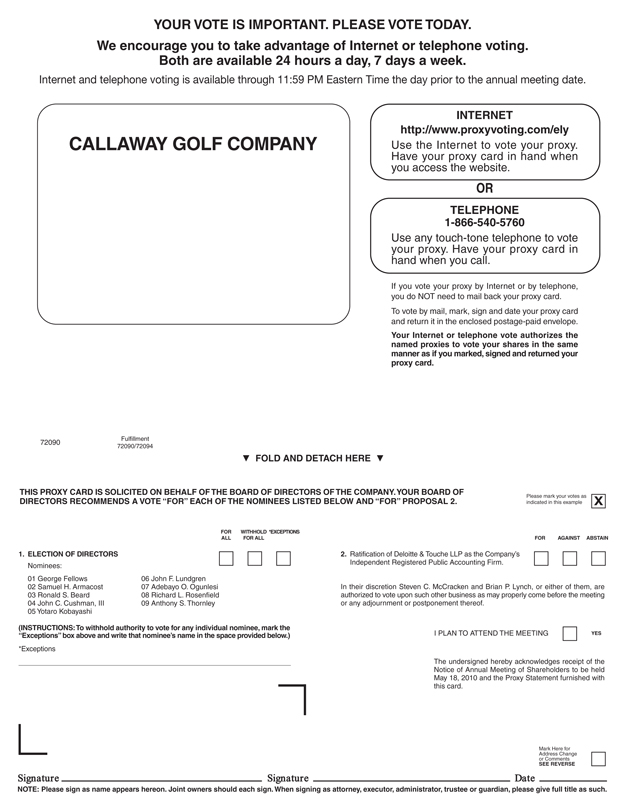

At the meeting, your Board of Directors will ask shareholders to (i) elect nine directors and (ii) ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm. These matters are described more fully in the accompanying Proxy Statement, which you are urged to read thoroughly. Your Board of Directors recommends a vote “FOR” each of the nominees and “FOR” ratification of the appointment of the Company’s independent registered public accounting firm.

It is important that your shares are represented and voted at the meeting whether or not you plan to attend. Accordingly, you are requested to return a proxy as promptly as possible either by voting through the Internet or telephone or by signing, dating, and returning a proxy card in accordance with the enclosed instructions.

If your shares are held in a brokerage account, there are new rules in effect this year that will affect how your shares are voted. In general, under applicable New York Stock Exchange rules, if you do not provide your broker with instructions on how to vote your shares, your broker may not vote your shares except with regard to routine matters. In the past, the election of directors was considered to be a routine matter and your broker was able to vote your shares without instructions from you. As a result of recent amendments to the New York Stock Exchange rules, the election of directors is no longer considered to be a routine matter and your broker will not be able to vote on the election of directors without your instructions. Accordingly, if your broker sends a request for instructions on how to vote, you are requested to provide those instructions to your broker so that your vote can be counted.

Sincerely, |

|

George Fellows |

| President and Chief Executive Officer |

CALLAWAY GOLF COMPANY

2180 Rutherford Road

Carlsbad, California 92008

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Meeting Date: May 18, 2010

To Our Shareholders:

The 2010 Annual Meeting of Shareholders (the “Annual Meeting”) of Callaway Golf Company, a Delaware corporation, (the “Company”) is scheduled to be held at Callaway Golf Company, located at 2180 Rutherford Road, Carlsbad, California 92008, commencing at 10:00 a.m. (PDT), on Tuesday, May 18, 2010, to consider and vote upon the following matters described in this notice and the accompanying Proxy Statement:

| 1. | to elect as directors the nine nominees named in the accompanying Proxy Statement; |

| 2. | to ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2010; and |

| 3. | to transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

The Board of Directors has nominated the following nine individuals to stand for election to the Board of Directors at the Annual Meeting: George Fellows, Samuel H. Armacost, Ronald S. Beard, John C. Cushman, III, Yotaro Kobayashi, John F. Lundgren, Adebayo O. Ogunlesi, Richard L. Rosenfield and Anthony S. Thornley. All nine individuals are currently members of the Company’s Board of Directors. For more information concerning these individuals, please see the accompanying Proxy Statement.

The Board of Directors has fixed the close of business on March 22, 2010 as the record date for determination of shareholders entitled to receive notice of and to vote at the Annual Meeting or any adjournment or postponement thereof, and only record holders of common stock at the close of business on that day will be entitled to vote. At the record date, 64,391,104 shares of Common Stock were issued and outstanding. In order to constitute a quorum for the conduct of business at the Annual Meeting, it is necessary that holders of a majority of all outstanding shares of Common Stock of the Company be present in person or represented by proxy.

TO ASSURE REPRESENTATION AT THE ANNUAL MEETING, SHAREHOLDERS ARE URGED TO RETURN A PROXY AS PROMPTLY AS POSSIBLE EITHER BY VOTING THROUGH THE INTERNET OR TELEPHONE OR BY SIGNING, DATING, AND RETURNING A PROXY CARD IN ACCORDANCE WITH THE ENCLOSED INSTRUCTIONS. IF YOUR SHARES ARE HELD IN A BROKERAGE ACCOUNT, YOUR BROKER WILL ASK FOR INSTRUCTIONS ON HOW TO VOTE YOUR SHARES. YOU ARE URGED TO RETURN THE VOTING INTRUCTIONS TO YOUR BROKER AS PROMPTLY AS POSSIBLE TO ENSURE YOUR SHARES WILL BE VOTED. ANY SHAREHOLDER ATTENDING THE ANNUAL MEETING MAY VOTE IN PERSON EVEN IF HE OR SHE PREVIOUSLY RETURNED A PROXY.

If you plan to attend the Annual Meeting in person, we would appreciate your response by so indicating when returning the proxy.

| By Order of the Board of Directors, |

|

| Brian P. Lynch |

| Corporate Secretary |

Carlsbad, California

April 1, 2010

CALLAWAY GOLF COMPANY

2180 Rutherford Road

Carlsbad, California 92008

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

Meeting Date: May 18, 2010

GENERAL INFORMATION

Purpose

This Proxy Statement and accompanying proxy card will first be made available to shareholders on the Internet on or about April 8, 2010 in connection with the solicitation of proxies by the Board of Directors of Callaway Golf Company, a Delaware corporation (the “Company”). The proxies are for use at the 2010 Annual Meeting of Shareholders of the Company, which is scheduled to be held on Tuesday, May 18, 2010, at Callaway Golf Company, located at 2180 Rutherford Road, Carlsbad, California 92008, commencing at 10:00 a.m. (PDT), and at any meetings held upon adjournment or postponement thereof (the “Annual Meeting”). The record date for the Annual Meeting is the close of business on March 22, 2010 (the “Record Date”). Only holders of record of the Company’s common stock, $.01 par value (the “Common Stock”), on the Record Date are entitled to notice of the Annual Meeting and to vote at the Annual Meeting.

Quorum and Voting

Whether or not you plan to attend the Annual Meeting in person, please return a proxy indicating how you wish your shares to be voted as promptly as possible. You may return a proxy either by voting through the Internet or telephone or by signing, dating and returning a proxy card. Please follow the accompanying instructions. Any shareholder who returns a proxy has the power to revoke it at any time prior to its effective use either by filing with the corporate secretary of the Company a written instrument revoking it, or by returning (by mail, telephone or Internet) another later-dated proxy, or by attending the Annual Meeting and voting in person. If you sign and return your proxy but do not indicate how you want to vote your shares for each proposal, then for any proposal for which you do not so indicate, your shares will be voted at the Annual Meeting in accordance with the recommendation of the Board of Directors. The Board of Directors recommends a vote“FOR” each of the nominees for election as director as set forth in this Proxy Statement and“FOR” ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2010. By returning the proxy (either by mail, telephone or Internet), unless you notify the corporate secretary of the Company in writing to the contrary, you are also authorizing the proxies to vote with regard to any other matter which may properly come before the Annual Meeting or any adjournment or postponement thereof. The Company does not currently know of any such other matter. If there were any such additional matters, the proxies would vote your shares in accordance with the recommendation of the Board of Directors.

At the Record Date, there were 64,391,104 shares of the Company’s Common Stock issued and outstanding. No other securities of the Company entitled to vote were outstanding at the Record Date. The presence, either in person or by proxy, of persons entitled to vote a majority of the Company’s outstanding Common Stock is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Abstentions may be specified for all proposals except the election of directors. Under the rules of the New York Stock Exchange (“NYSE”), brokers who hold shares in street name for customers do not have the authority to vote on certain items when they have not received instructions from beneficial owners (“broker non-votes”). Abstentions and

1

broker non-votes are counted for purposes of determining a quorum. Abstentions are counted in the tabulation of votes cast and have the same effect as voting against a proposal. Broker non-votes are not considered as having voted for purposes of determining the outcome of a vote.

Holders of Common Stock have one vote for each share on any matter that may be presented for consideration and action by the shareholders at the Annual Meeting, except that shareholders have cumulative voting rights with respect to the election of directors. Cumulative voting rights entitle each shareholder to cast as many votes as are equal to the number of directors to be elected multiplied by the number of shares owned by such shareholder, which votes may be cast for one candidate or distributed among two or more candidates. A shareholder may exercise cumulative voting rights by indicating on the proxy card the manner in which such votes should be allocated (Internet and telephone voting cannot accommodate cumulative voting). The nine nominees for director receiving the highest number of votes at the Annual Meeting will be elected. A return of a proxy giving authority to vote for the nominees named in this Proxy Statement will also give discretion to the designated proxies to cumulate votes and cast such votes in favor of the election of some or all of the applicable director nominees in their sole discretion.

Solicitation of Proxies

The cost of preparing, assembling, printing and mailing this Proxy Statement and the accompanying proxy card, and the cost of soliciting proxies relating to the Annual Meeting, will be borne by the Company. The Company may request banks and brokers to solicit their customers who beneficially own Common Stock listed of record in the name of such bank or broker or other third party, and will reimburse such banks, brokers and third parties for their reasonable out-of-pocket expenses for such solicitations. The solicitation of proxies by mail may be supplemented by telephone, facsimile, Internet and personal solicitation by directors, officers and other employees of the Company, but no additional compensation will be paid to such individuals. The Company has retained the firm of The Altman Group, Inc to assist in the solicitation of proxies for a base fee of approximately $5,500, plus out-of-pocket expenses.

Householding

With regard to the delivery of annual reports and proxy statements, under certain circumstances the Securities and Exchange Commission (“SEC”) permits a single set of such documents to be sent to any household at which two or more shareholders reside if they appear to be members of the same family. Each shareholder, however, still receives a separate proxy card. This procedure, known as “householding,” reduces the amount of duplicate information received at a household and reduces mailing and printing costs as well. A number of banks, brokers and other firms have instituted householding and have previously sent a notice to that effect to certain of the Company’s beneficial shareholders whose shares are registered in the name of the bank, broker or other firm. As a result, unless the shareholders receiving such notice gave contrary instructions, only one annual report and one annual proxy statement will be mailed to an address at which two or more such shareholders reside. If any shareholder residing at such an address wishes to receive a separate annual report or annual proxy statement in the future, such shareholder should telephone the householding election system (toll-free) at 1-800-542-1061. In addition, (i) if any shareholder who previously consented to householding desires to receive a separate copy of the annual report or annual proxy statement for each shareholder at his or her same address, or (ii) if any shareholder shares an address with another shareholder and both shareholders of such address desire to receive only a single copy of the annual report or annual proxy statement, then such shareholder should contact his or her bank, broker or other firm in whose name the shares are registered or contact the Company as follows: Callaway Golf Company, ATTN: Investor Relations, 2180 Rutherford Road, Carlsbad, CA 92008, telephone (760) 931-1771.

2

Other Matters

The main purpose of the Annual Meeting of Shareholders is to conduct the business described in this Proxy Statement. On some occasions in the past, the Company has chosen to expand the scope of the meeting to include presentations on portions of the Company’s business and to conduct a question and answer session with the Company’s leadership. At the upcoming Annual Meeting, it is the Company’s intention to have a brief presentation by the Chief Executive Officer after the completion of all business, followed by a short question and answer period. Due to legal and practical constraints, including regulations regarding the selective disclosure of material information, and consistent with the fact that the main purpose of the Annual Meeting is to conduct the necessary business of the Company, a significant, substantive presentation on the Company’s current or expected performance is not planned.

3

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Introduction

Corporate governance is the system by which corporations ensure that they are managed ethically and in the best interests of the Company’s shareholders. The Company is committed to maintaining high standards of corporate governance. A copy of the Company’s Corporate Governance Guidelines is available on the Company’s website at www.callawaygolf.com under Investor Relations — Corporate Governance.

One of the most important aspects of corporate governance is the election of a Board of Directors to oversee the operation of the business and affairs of the Company. The Company’s Bylaws provide that the Company’s directors shall be elected at each annual meeting of shareholders. As a result, as discussed below, the first proposal the shareholders will be asked to vote upon at the Annual Meeting is the election of the nine nominees named in this Proxy Statement as directors to serve until the 2011 annual meeting of shareholders and until their successors are elected and qualified.

In today’s business environment, the selection of a qualified independent auditor has become a key aspect of corporate governance. The Board of Directors has asked that shareholders ratify the Audit Committee’s selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2010.

Proposal No. 1 — Election Of Directors

Independence.The Company’s Bylaws and Corporate Governance Guidelines provide that a substantial majority of the Company’s directors must be independent. A director is independent only if the director is not an employee of the Company and the Board has determined that the director has no direct or indirect material relationship to the Company. To be independent, a director must also satisfy any other independence requirements under applicable law or regulation and the listing standards of the NYSE. In evaluating a particular relationship, the Board considers the materiality of the relationship to the Company, to the director and, if applicable, to an organization with which the director is affiliated. To assist in its independence evaluation, the Board adopted categorical independence standards, which are listed on Exhibit A attached to the Company’s Corporate Governance Guidelines, which are available on the Company’s website at www.callawaygolf.com under Investor Relations — Corporate Governance. Compliance with these internal and NYSE independence standards is reviewed at least annually. The Board has determined that each of the eight current non-management directors is independent; therefore, a substantial majority of the members of the Board are independent. George Fellows, the Company’s President and Chief Executive Officer, is the only current director who is not independent.

Director Qualifications.The Nominating and Corporate Governance Committee is responsible, among other things, for developing and recommending to the Board criteria for Board membership and for identifying and recruiting potential Board candidates based on the identified criteria in the context of the Board as a whole and in light of the Board’s needs at a particular time. The Nominating and Corporate Governance Committee has worked with the Board of Directors to identify certain minimum criteria that every director must meet: (1) a director must exhibit very high personal and professional ethics, integrity and values; (2) a director must not have any conflicting interest that would materially impair his or her ability to discharge the fiduciary duties of a director; (3) a director must be committed to the best interests of the Company’s shareholders and be able to represent fairly and equally all shareholders without favoring or advancing any particular shareholder or other constituency; and (iv) a director must be able to devote adequate time to his or her service as a director. A potential candidate will not be considered for a directorship unless he or she satisfies these threshold criteria.

In addition to these minimum threshold criteria, the Board of Directors believes that the Board, as a whole, should possess a combination of skills, professional experience, and diversity of backgrounds necessary to oversee the Company’s business. In this regard, the Board of Directors has determined that one or more Board members, among other things, should (i) be currently serving as an active executive of another corporation, (ii) have prior experience as a Chief Executive Officer or an operating executive with significant responsibility

4

for operating results, (iii) have public company executive experience, (iv) have public company Board experience, (iv) have corporate governance experience, (v) have executive compensation experience, and (vi) have consumer products experience. The Board also believes that at least one or more members should have functional expertise in each of finance, accounting, legal matters, investment banking, technology, manufacturing, international business, research and development, strategic planning, consumer sales and marketing experience, retail business experience, and mergers and acquisitions. Potential candidates are evaluated based upon the factors described above as well as their independence, education and relevant business and industry experience.

The Nominating and Corporate Governance Committee works with the Board of Directors to evaluate annually the composition of the Board to assess the skills and experience that are currently represented on the Board, as well as the skills and experience that the Board will find valuable in the future, given the Company’s current situation and strategic plans. This annual evaluation of the Board’s composition enables the Board to update the skills and experience it seeks in the Board as a whole, and in individual directors, as the Company’s needs evolve and change over time.In identifying director candidates from time to time, the Board or Nominating and Corporate Governance Committee may establish specific skills and experience that it believes the Company should seek in order to constitute a balanced and effective board. In addition, although the Board of Directors does not have a formal policy regarding diversity, the Board of Directors believes that ethnic, gender, and cultural diversity among Board members can provide distinct value and is important. In considering potential new candidates, the Board does consider whether the potential Board member would increase the ethnic, gender, or cultural diversity of the Board members.

Identification of Potential Candidates.The Nominating and Corporate Governance Committee uses a variety of methods for identifying director candidates, including professional search firms and recommendations from the Company’s officers, directors, shareholders or other persons. If a shareholder believes that he or she has identified an appropriate candidate who is willing to serve on the Company’s Board of Directors, the shareholder may submit a written recommendation to the Chair of the Nominating and Corporate Governance Committee c/o the Company’s Corporate Secretary at 2180 Rutherford Road, Carlsbad, California 92008. Such recommendation must include detailed biographical information concerning the recommended candidate, including a statement regarding the candidate’s qualifications. The Nominating and Corporate Governance Committee may require such further information and obtain such further assurances concerning the recommended candidate as it deems reasonably necessary. The Nominating and Corporate Governance Committee will review properly submitted shareholder candidates in the same manner as it evaluates all other director candidates. In addition to bringing potential qualified candidates to the attention of the Nominating and Corporate Governance Committee as discussed above, a nomination of a person for election to the Board of Directors at an annual meeting of shareholders may be made by shareholders who meet the qualifications set forth in the Company’s Bylaws and who make such nominations in accordance with the procedures set forth in the Company’s Bylaws, including the procedures described under the heading “Shareholder Proposals” in this Proxy Statement.

Nomination Process.The Nominating and Corporate Governance Committee believes that the continuing service of qualified incumbents promotes stability and continuity among the Board of Directors and contributes to the Board’s ability to function effectively. The continuing service of qualified incumbents also provides the Company with the benefit of the familiarity with and insight into the Company’s affairs that its directors have accumulated during their tenure. As a result, in considering candidates for nomination for each annual meeting of shareholders, the Committee first considers the Company’s incumbent directors who desire to continue their service on the Board. The Committee will generally recommend to the Board an incumbent director for re-election if the Committee has determined that (i) the incumbent director continues to satisfy the threshold criteria described above, (ii) the incumbent director has satisfactorily performed his or her duties as a director during the most recent term and (iii) there exists no reason why, in the Committee’s view, the incumbent director should not be re-elected. If a vacancy becomes available on the Board of Directors as a result of the death, resignation or removal of an incumbent director or as a result of action taken by the Board to increase the size of the Board, the Committee proceeds to identify candidates who meet the required criteria and attributes.

5

Nominees for Election.The Board of Directors has nominated all of the Company’s nine current directors to stand for election at the Annual Meeting to serve until the 2011 annual meeting of shareholders and until their respective successors are elected and qualified. Each nominee has consented to being named in this Proxy Statement as a nominee for election as director and has agreed to serve as a director if elected. If any one or more of such nominees should for any reason become unavailable for election, the persons named in the accompanying form of proxy may vote for the election of such substitute nominees as the Board of Directors may propose. The accompanying form of proxy contains a discretionary grant of authority with respect to this matter.

The nominees for election as directors at the Annual Meeting are set forth below:

Name | Positions with the Company | Director Since | ||

George Fellows | President and Chief Executive Officer | 2005 | ||

Ronald S. Beard | Chairman of the Board and Lead Independent Director | 2001 | ||

Samuel H. Armacost | Director | 2003 | ||

John C. Cushman, III | Director | 2003 | ||

Yotaro Kobayashi | Director | 1998 | ||

John F. Lundgren | Director | 2009 | ||

Adebayo O. Ogunlesi | Director | 2010 | ||

Richard L. Rosenfield | Director | 1994 | ||

Anthony S. Thornley | Director | 2004 |

Biographical Information of Nominees. Set forth below is certain biographical information about each of the nominees as well as information concerning the skills and qualifications that led the Board to conclude that the nominees should serve as directors:

George Fellows.Mr. Fellows, 67, is President and Chief Executive Officer of the Company as well as one of its Directors. He has served in such capacities since August 2005. Prior to joining the Company, during the period 2000 through July 2005, he served as President and Chief Executive Officer of GF Consulting, a management consulting firm, and served as Senior Advisor to Investcorp International, Inc. and J.P. Morgan Partners, LLC. Previously, Mr. Fellows was a member of senior management of Revlon, Inc. from 1993 to 1999, including his terms as President commencing 1995 and Chief Executive Officer commencing 1997. He is a member of the board of directors of VF Corporation (a global apparel company). Mr. Fellows also served as a member of the board of directors of Jack In The Box Corporation from August 2007 until September 2008. Mr. Fellows graduated with a B.S. degree from City College of New York, received an MBA from Columbia University, and completed the Advanced Management Program at Harvard University. Mr. Fellows was renominated to serve as a Director because the Board believes it is important to have the Chief Executive Officer serve on the Board as he is the one closest to the day to day operations of the Company and the opportunities and challenges facing the Company. Mr. Fellows has prior experience as a Chief Executive Officer of a public company, other public company Board experience, and experience with corporate governance, executive compensation, and consumer products. He also has functional experience in finance, investment banking, international business, strategic planning, the retail industry, and mergers and acquisitions.

Ronald S. Beard.Mr. Beard, 71, has served as a Director of the Company since June 2001, has held the position of Lead Independent Director since August 2002 and was appointed Chairman in August 2005. Mr. Beard is currently a partner in the Zeughauser Group, consultants to the legal industry. Mr. Beard is a retired former Partner of the law firm of Gibson, Dunn & Crutcher LLP. He joined the firm in 1964, served as Chairman of the firm from April 1991 until December 2001, and was also its Managing Partner from April 1991 until mid-1997. Mr. Beard served as the Company’s general outside counsel from 1998 until he joined the Board of Directors. Mr. Beard also serves as a Director of Javo Beverage Company. Mr. Beard served as a Board member of Document Sciences Corporation from December 2004 until March 2008 when it was sold. He received his law degree in 1964 from Yale Law School. Mr. Beard was renominated to serve on the Board of Callaway Golf

6

Company, among other reasons, due to his extensive experience with the Company as a Board member and previously as its primary outside legal advisor. Mr. Beard, among other things, has other public company board experience, and experience with corporate governance, executive compensation, as well as executive officer experience as Chairman of a leading global law firm. Mr. Beard also has functional expertise in finance, accounting, legal matters, international business, strategic planning, and mergers and acquisitions.

Samuel H. Armacost.Mr. Armacost, 71, has served as a Director of the Company since April 2003. Since 1981, he has been a director of SRI International (formerly Stanford Research Institute), an independent nonprofit research institute, and previously served as its Chairman from 1998 to March 2010. Mr. Armacost is a member of the board of directors of Sarnoff, Inc., a subsidiary of SRI International. He was Managing Director of Weiss, Peck & Greer LLC (an investment management and venture capital firm) from 1990 to 1998. He was Managing Director of Merrill Lynch Capital Markets from 1987 to 1990. Prior to that time he was President and Chief Executive Officer of BankAmerica Corporation from 1981 to 1986. He also served as Chief Financial Officer of BankAmerica Corporation from 1979 to 1981. Currently, Mr. Armacost serves as a member of the Board of Directors of Chevron Corporation, Exponent, Inc., Del Monte Foods Company and Franklin Resources, Inc. Mr. Armacost is a graduate of Denison University and received his MBA from Stanford University in 1964. Mr. Armacost was renominated to serve on the Board of Callaway Golf Company, among other reasons, due to his extensive experience with the Company as a Board member as well as his prior Chief Executive Officer experience of a public company, his other public company board experience, and his experience with corporate governance and executive compensation. He also has functional expertise in finance, accounting, investment banking, technology, international business, research and development, strategic planning, and mergers and acquisitions.

John C. Cushman, III.Mr. Cushman, 69, has served as a Director of the Company since April 2003 and is Chair of the Compensation and Management Succession Committee. He has been Chairman of Cushman & Wakefield, Inc. since it merged with Cushman Realty Corporation in 2001, which he co-founded in 1978. Mr. Cushman also serves as Director and Chief Executive Officer of Cushman Winery Corporation, which is the owner of Zaca Mesa Winery, and which he co-founded in 1972. He began his career with Cushman & Wakefield, Inc., a commercial real estate firm, from 1963 to 1978. Currently, Mr. Cushman also serves on the boards of the following privately held corporations: D.A. Cushman Realty Corporation, iCRETE LLC, Artoc Universal Properties (Cairo, Egypt) and Rock Creek Management, LLC. Mr. Cushman also served on the boards of La Quinta Corporation and La Quinta Properties Inc. from May 2003 until January 2006. Mr. Cushman is a 1963 graduate of Colgate University where he also earned an Honorary Doctorate in Humane Letters in 2008, and he completed the Advanced Management Program at Harvard University in 1977. Mr. Cushman was renominated to serve on the Board of Callaway Golf Company, among other reasons, due to his extensive experience with the Company as a Board member as well as current executive position with Cushman and Wakefield, his prior Chief Executive Officer experience, his other public company Board experience, and his experience with corporate governance and executive compensation. Mr. Cushman also has functional expertise in finance, international business, strategic planning, the retail industry, and mergers and acquisitions.

Yotaro Kobayashi.Mr. Kobayashi, 76, has served as a Director of the Company since June 1998. He is the former Chairman and Chief Executive Officer of Fuji Xerox Co., Ltd., a global developer of xerographic and document-related products. Mr. Kobayashi joined Fuji Photo Film Co., Ltd. in 1958, was assigned to Fuji Xerox Co., Ltd. in 1963, named President and Chief Executive Officer in 1978 and Chairman and Chief Executive Officer in 1992. He served as Chairman of the Board from 1999 through March 2006. Mr. Kobayashi served as Chief Corporate Advisor from March 2006 through March 2009. Mr. Kobayashi is also a Director of Sony Corporation, Nippon Telegraph and Telephone Corporation (NTT) and the American Productivity and Quality Center. He holds positions as Chairman of the International University of Japan, President of The Japan Folks Crafts Museum, Chairman of the Blackstone Group Japan Advisory Board, Chairman of the Advisory Board to Accenture as well as Life-Time Trustee of Keizai Doyukai. He is also on the Advisory Board of the Council on Foreign Relations and serves on the Board of Trustees of Keio University. He is a 1956 graduate of Keio University and received his MBA from The Wharton School in 1958. Mr. Kobayashi was renominated to serve

7

on the Board of Callaway Golf Company, among other reasons, due to his extensive experience with the Company as a Board member as well as prior Chief Executive Officer experience, his other public company board experience, as well as his experience with corporate governance and executive compensation matters. He also has functional expertise in technology, manufacturing, international business, research and development, strategic planning, consumer sales and marketing, and mergers and acquisitions.

John F. Lundgren.Mr. Lundgren, 58, has served as a Director of the Company since March 2009. He is President, Chief Executive Officer and a director of Stanley Black & Decker, Inc., the successor entity following the merger of The Stanley Works and Black and Decker which was completed on March 12, 2010. Prior to the merger, Mr. Lundgren served as Chairman and Chief Executive Officer of The Stanley Works, a worldwide supplier of consumer products, industrial tools and security solutions for professional, industrial and consumer use. Prior to joining The Stanley Works in 2004, Mr. Lundgren served as President — European Consumer Products, of Georgia Pacific Corporation and also held various positions in finance, manufacturing, corporate development and strategic planning with Georgia Pacific and its predecessor companies, namely James River Corporation from 1995 — 1997 and Fort James Corporation from 1997 — 2000. Mr. Lundgren began his business career in brand management at the Gillette Corporation. Mr. Lundgren has been a director of The Stanley Works since 2004 and is a member of the Board of Directors of the National Association of Manufacturers (NAM). Mr. Lundgren is a graduate of Dartmouth College and received his MBA from Stanford University. Mr. Lundgren was renominated to serve on the Board of Callaway Golf Company, among other reasons, due to his prior experience with the Company as a Board member as well as his current position of Chief Executive Officer of a public company, his prior operating experience, and his experience with corporate governance and executive compensation matters. Mr. Lundgren also has functional expertise in accounting, manufacturing, international business, strategic planning, and consumer sales and marketing.

Adebayo O. Ogunlesi. Mr. Ogunlesi, 56, was appointed to the Company’s Board of Directors in January 2010. He is Chairman and Managing Partner of Global Infrastructure Management, LLC, which is a private equity firm with over $5 billion in assets and which invests worldwide in infrastructure assets in the energy, transport, and water and waste industry sectors. Prior to founding Global Infrastructure Management, Mr. Ogunlesi spent 23 years at Credit Suisse where he held senior positions, including Executive Vice Chairman and Chief Client Officer and prior to that Global Head of Investment Banking. Mr. Ogunlesi also serves on the boards of Kosmos Energy Holdings and African Finance Corporation. Mr. Ogunlesi holds a B.A. (First Class Honours) in Politics, Philosophy and Economics from Oxford University, and a J.D. (magna cum laude) from Harvard Law School and M.B.A. from Harvard Business School. Prior to joining Credit Suisse, he was an attorney with the New York law firm of Cravath, Swaine & Moore. From 1980 to 1981, he served as a Law Clerk to the Honorable Thurgood Marshall, Associate Justice of the United States Supreme Court. Mr. Ogunlesi was renominated to serve on the Board of Callaway Golf Company, among other reasons, due to prior service on the Company’s Board of Directors, his current executive officer position, and his experience with investment banking, legal matters, corporate governance and executive compensation. Mr. Ogunlesi also has functional expertise in finance, international business, strategic planning, and mergers and acquisitions.

Richard L. Rosenfield.Mr. Rosenfield, 64, has served as a Director of the Company since April 1994 and is the Chair of the Nominating and Corporate Governance Committee. He is co-founder, co-Chairman, co-President and co-Chief Executive Officer of California Pizza Kitchen, Inc., a casual dining full service pizza restaurant chain founded in 1985. In 2002, Mr. Rosenfield co-founded and served as co-President of LA Food Show, Inc., a Los Angeles restaurant company that is now owned by California Pizza Kitchen, Inc. From 1973 to 1985, Mr. Rosenfield was a principal and partner of the law firm of Flax & Rosenfield, a private law firm in Beverly Hills, California. From 1969 to 1973, Mr. Rosenfield served as an attorney in the U.S. Department of Justice. He is a 1969 graduate of DePaul University College of Law. Mr. Rosenfield was renominated to serve on the Board of Callaway Golf Company, among other reasons, due to his extensive experience with the Company as a Board member as well as his current Chief Executive Officer experience, his other public company board experience, and his experience with corporate governance and executive compensation. Mr. Rosenfield also has functional expertise in legal matters, international business, strategic planning, consumer sales and marketing, the retail industry, and mergers and acquisitions.

8

Anthony S. Thornley.Mr. Thornley, 63, has served as a Director of the Company since April 2004. He is the Chair and designated “Financial Expert” of the Audit Committee. From February 2002 to July 2005, he served as President and Chief Operating Officer of QUALCOMM Incorporated, the San Diego-based company that pioneered and developed technologies used in wireless networks throughout much of the world. He previously served as QUALCOMM’s Chief Financial Officer beginning in 1994, while also holding titles of Vice President, Senior Vice President and Executive Vice President. Prior to joining QUALCOMM, Mr. Thornley worked for Nortel Networks for 16 years, serving in various financial and information systems management positions including Vice President of Public Networks, Vice President of Finance NT World Trade, and Corporate Controller Northern Telecom Limited. Before Nortel, Mr. Thornley worked for Coopers & Lybrand. Mr. Thornley is a director of Airvana Inc. (provider of network infrastructure products), Cavium Networks (a semiconductor company), Transdel Pharmaceuticals, Inc., Proximetry, Inc. (a privately held wireless network management company), Gorgon Media (a privately held specialized investment company) and KMF Audio, Inc. (a privately held microphone company) and also serves as Chief Financial Officer of KMF Audio. Mr. Thornley received his degree in chemistry from Manchester University, England, and is qualified as a chartered accountant. Mr. Thornley was renominated to serve on the Board of Callaway Golf Company, among other reasons, due to his extensive experience with the Company as a Board member as well as his prior executive and operational experience, his other public company board experience, and his experience with corporate governance and executive compensation matters. He also has functional expertise in finance, accounting, technology, manufacturing, international business matters, research and development, strategic planning, consumer sales and marketing, and mergers and acquisitions.

Vote Required

Assuming a quorum is present, the nine nominees receiving the highest number of votes cast at the Annual Meeting will be elected as directors. You may vote “for” or “withhold” your vote with respect to the election of any or all of the nominees.

Majority Vote Policy

The Company’s Corporate Governance Guidelines set forth the Company’s procedure regarding a director who is elected but receives a majority of “withheld” votes. In an uncontested election of directors, any nominee who has a greater number of votes “withheld” from his or her election than votes “for” such election (a “Majority Withheld Vote”) is required to submit in writing an offer to resign. The Nominating and Corporate Governance Committee would consider, among other things, the reasons for the Majority Withheld Vote and make a recommendation to the Board of Directors whether or not to accept the resignation offer. The Board of Directors would consider the recommendation of the Nominating and Corporate Governance Committee and would determine whether to accept the resignation. The Board of Directors would disclose the basis for its determination. Full details of this procedure are set forth in the Company’s Corporate Governance Guidelines, posted on its website atwww.callawaygolf.com under Investor Relations — Corporate Governance.

YOUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES LISTED ABOVE.

Board Leadership Structure

The Board currently separates the positions of Chairman and Chief Executive Officer. Having these positions separate permits our Chief Executive Officer to focus on day-to-day business and allows our Chairman to lead the Board in its oversight responsibilities. Mr. Ronald S. Beard has served as non-executive Chairman of the Board since August 2005 and Mr. George Fellows has served as President and Chief Executive Officer since August 2005. Although Mr. Beard is an independent director, the Company does not require that the Chairman be an independent director.

9

The Board of Directors, however, does believe that strong, independent Board leadership is a critical aspect of effective corporate governance. The Board has therefore established the position of Lead Independent Director, which must be held by an independent director. Mr. Beard is currently the designated Lead Independent Director and he has served in that role since August 2002. The Lead Independent Director coordinates the activities of the independent directors and serves as a liaison between the Chief Executive Officer and the independent directors. The Lead Independent Director also presides at the executive sessions (without management) of the independent directors. A copy of the Charter for the Lead Independent Director position is available at the corporate governance section of the Company’s website at www.callawaygolf.com under Investor Relations — Corporate Governance — Board Membership.

Risk Oversight

Our Board of Directors oversees an enterprise-wide approach to risk management and works with the Audit Committee and management in executing its oversight responsibility for risk management. The Board generally oversees risks related to the Company’s strategic and operational objectives and is responsible for overseeing the amounts and types of risks taken by management in executing those objectives. In addition, the Board of Directors has delegated to the Audit Committee the responsibility for oversight of certain of the Company’s risk oversight and compliance matters, including oversight of (i) material legal proceedings and material contingent liabilities, (ii) the Company’s policies regarding risk assessment and management, (iii) the Company’s compliance programs with respect to legal and regulatory requirements and the Company’s Code of Conduct, (iv) related party transactions and conflicts of interest, and (v) the establishment of procedures for the receipt and handling of complaints regarding accounting, internal accounting controls and auditing matters.

On a day to day basis, it is management’s responsibility to manage risk and bring to the attention of the Board the significant risks facing the Company and the controls in place to manage those risks. As part of this responsibility, each year management conducts an enterprise risk management assessment, which is led by the Company’s corporate audit department. All members of management responsible for key business functions and operations participate in this assessment. The assessment includes an identification, and quantification of the potential impact, of the top risks facing the Company and the controls in place to mitigate such risks as well as possible opportunities to reduce such risks. This report is shared with the Audit Committee as well as the full Board of Directors.

Committees of the Board of Directors

The Board of Directors currently has three standing committees. They are the Audit Committee; the Compensation and Management Succession Committee and the Nominating and Corporate Governance Committee. The Board of Directors has adopted written charters for each of the three standing committees. A copy of each of the charters is available on the Company’s website atwww.callawaygolf.comunder Investor Relations — Corporate Governance — Board Committees. Upon request, the Company will provide to any person without charge a copy of such charters. Any such requests may be made by contacting the Company’s Investor Relations Department at the Company’s principal executive offices by telephone at (760) 931-1771 or by mail at 2180 Rutherford Road, Carlsbad, CA 92008. More detailed information about each committee is set forth below.

Audit Committee. The Audit Committee currently consists of Messrs. Thornley (Chair), Armacost, Beard and Lundgren. The Board of Directors has determined that each member of the Company’s Audit Committee is independent within the meaning of Section 10A(m)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Rule 10A-3 thereunder, and the applicable listing standards of the NYSE. The Board of Directors has also determined that each member of the Audit Committee is financially literate and has accounting or related financial management expertise within the meaning of the listing standards of the NYSE. In addition, the Board of Directors has determined that at least one member of the Audit Committee qualifies as an Audit Committee Financial Expert as defined by Item 407(d)(5) of Regulation S-K. The Board of Directors has

10

designated Mr. Thornley as the Audit Committee Financial Expert. The Board also believes that the collective experiences of the other members of the Audit Committee make them well qualified to serve on the Company’s Audit Committee. Shareholders should understand that Mr. Thornley’s designation as an Audit Committee Financial Expert is a Securities and Exchange Commission disclosure requirement, and it does not impose on Mr. Thornley any duties, obligations or liabilities that are greater than those which are generally imposed on him as a member of the Audit Committee and the Board, and his designation as an Audit Committee Financial Expert pursuant to this requirement does not affect the duties, obligations or liabilities of any other member of the Audit Committee or the Board.

The Audit Committee is responsible for representing the Board of Directors in discharging its oversight responsibility relating to risk management, the accounting, reporting and financial practices of the Company and its subsidiaries, including the integrity of the Company’s financial statements, as well as oversight of the Company’s internal audit function. The Audit Committee also has oversight responsibility with regard to the Company’s legal and regulatory matters and has sole authority for all matters relating to the Company’s independent registered public accounting firm, including the appointment, compensation, evaluation, retention and termination of such firm.

Compensation and Management Succession Committee. The Compensation and Management Succession Committee currently consists of Messrs. Cushman (Chair), Armacost, Beard and Rosenfield. All of the members of this Committee are independent directors as determined under the applicable independence standards described above, including the NYSE listing standards. The Committee is responsible for discharging the responsibilities of the Board relating to compensation of the Company’s executives and for assisting the Board with management succession issues and planning. The Committee, together with the other independent directors, sets the compensation of the Chief Executive Officer. The Committee sets the compensation of the other executive officers in consultation with the Chief Executive Officer. The Compensation and Management Succession Committee also reviews compensation and benefits plans affecting employees in addition to those applicable to executive officers.

Nominating and Corporate Governance Committee.The Nominating and Corporate Governance Committee currently consists of Messrs. Rosenfield (Chair), Armacost, Beard, Cushman, Kobayashi, Lundgren and Thornley. All of the members of this Committee are independent directors as determined under the applicable independence standards described above, including the NYSE listing standards. The Committee is responsible for identifying and recommending to the Board individuals who are qualified to serve on the Board of Directors and recommending candidates who should stand for election at each annual meeting of shareholders. The Committee is also responsible for oversight of the Company’s corporate governance practices, including the Company’s Corporate Governance Guidelines, and evaluation of the effectiveness of the Board and Board Committees.

Meetings and Director Attendance

During 2009, the Company’s Board of Directors met 13 times and the independent directors met in executive session at five of those meetings and determined that there was no need to meet in executive session at the other meetings; the Audit Committee met 12 times; the Compensation and Management Succession Committee met 10 times; and the Nominating and Corporate Governance Committee met five times. In addition to meetings, the members of the Board of Directors and its committees sometimes take action by written consent in lieu of a meeting, which is permitted under Delaware corporate law, or discuss Company business without calling a formal meeting. During 2009, all of the Company’s directors then serving attended in excess of 75% of the meetings of the Board of Directors and committees of the Board of Directors on which they served. Mr. Ogunlesi was not appointed to the Board of Directors until January 2010. All of the Board members are expected to attend the annual meetings of shareholders and all then appointed directors attended the 2009 annual shareholders’ meeting.

11

Director Compensation

Directors who are not employees of the Company are paid an annual base cash compensation, additional daily cash compensation for attendance at meetings of the Board of Directors and its committees, and are reimbursed for their expenses in attending meetings. The annual base cash compensation is $45,000. Directors also receive $1,500 per day per Board or committee meeting attended. Non-employee directors who serve as Chairs of committees of the Board of Directors are paid an additional $300 per day per committee meeting attended. In recognition of the significant amount of time they are required to spend on Company business between meetings, the Lead Independent Director, the Chair of the Audit Committee and the Chair of the Compensation and Management Succession Committee are paid additional annual cash retainers of $30,000, $10,000 and $5,000, respectively. For additional information see “Compensation of Executive Officers and Directors — Director Compensation in Fiscal Year 2009” included in this Proxy Statement.

During 2009, the non-employee directors participated in the Callaway Golf Company Amended and Restated 2001 Non-Employee Directors Stock Incentive Plan (the “2001 Plan”), which was approved, as amended and restated, by the Company’s shareholders at the Company’s 2006 annual meeting. As so amended and restated, the 2001 Plan authorizes the grant of various equity awards, including stock options, restricted stock and restricted stock units. It is the Company’s current practice that upon the initial election or appointment of a new director and for each year of continuing service, a director is granted stock options, restricted stock, restricted stock units or a combination thereof pursuant to the 2001 Plan. Such initial and continuing service awards are made as of the date of appointment or re-election in the form and amount as determined by the Board of Directors on the recommendation of the Compensation Committee. With the exception of Mr. Lundgren and Mr. Ogunlesi, each of the non-employee directors were granted 7,310 restricted stock units in 2009 as continuing service awards, as described in “Compensation of Executive Officers and Directors — Director Compensation in Fiscal Year 2009.” Upon his initial appointment to the Board, Mr. Lundgren was granted 11,574 restricted stock units with a grant date value of $75,000. Mr. Ogunlesi joined the Board of Directors on January 25, 2010 and in connection with his appointment was granted 9,225 restricted stock units with a grant date value of $75,000. Subject to certain anti-dilution and weighting adjustments, a maximum of 500,000 shares are approved for issuance upon the exercise of awards granted under the 2001 Plan.

The Company has a policy that the non-employee directors should promote the Company’s products by using the Company’s current products whenever they play golf. To assist the directors in complying with this policy, non-employee directors are entitled to receive a limited amount of golf club products of the Company, free of charge, for their own personal use and the use of immediate family members residing in their households. The directors also receive a limited amount of other products (e.g., golf balls and accessories) free of charge and the right to purchase a limited amount of additional golf clubs, balls and accessories at a discount that are not material in amount.

Communications with the Board

Shareholders and other interested parties may contact the Company’s Lead Independent Director or the non-management directors as a group by email at:Non-managementdirectors@callawaygolf.com,or by mail to: Board of Directors, Callaway Golf Company, 2180 Rutherford Road, Carlsbad, California 92008. The Corporate Secretary’s office reviews all incoming communications and filters out solicitations and junk mail. All legitimate non-solicitation and non-junk mail communications are reviewed for distribution to the non-management directors or for handling as appropriate as directed by the Lead Independent Director.

Corporate Governance Guidelines and Code of Conduct

The Board of Directors has adopted and published on its website its Corporate Governance Guidelines to provide the Company’s shareholders and other interested parties with insight into the Company’s corporate governance practices. The Nominating and Corporate Governance Committee is responsible for overseeing these

12

guidelines and for reporting and making recommendations to the Board concerning these guidelines. The Corporate Governance Guidelines cover, among other things, board composition and director qualification standards, responsibilities of the Board of Directors, Board compensation, committees of the Board of Directors and other corporate governance matters.

The Board of Directors has also adopted a Code of Conduct that applies to all of the Company’s employees, including its senior financial and executive officers, as well as the Company’s directors. The Company’s Code of Conduct covers the basic standards of conduct applicable to all directors, officers and employees of the Company, as well as the Company’s Conflicts of Interest and Ethics Policy and other specific compliance standards and related matters. The Company will promptly disclose any waivers of, or amendments to, any provision of the Code of Conduct that applies to the Company’s directors and senior financial and executive officers on its website atwww.callawaygolf.com.

The Corporate Governance Guidelines and Code of Conduct are available on the Company’s website at www.callawaygolf.com under Investor Relations — Corporate Governance and — Corporate Overview, respectively. Upon request, the Company will provide to any person without charge a copy of the Company’s Corporate Governance Guidelines or Code of Conduct. Any such requests may be made by contacting the Company’s Investor Relations department at the Company’s principal executive offices by telephone at (760) 931-1771 or by mail at 2180 Rutherford Road, Carlsbad, California 92008.

13

REPORT OF THE AUDIT COMMITTEE

Audit Committee Duties and Responsibilities

The duties and responsibilities of the Audit Committee are set forth in its written charter. In summary, they are:

| • | Review and discuss with the Company’s independent registered public accounting firm the scope and results of the annual audit and any reports with respect to interim periods. |

| • | Review and discuss with management and the Company’s independent registered public accounting firm the annual and quarterly financial statements of the Company, including any significant financial reporting issues and judgments, the effects of regulatory and accounting initiatives and off-balance sheet structures on the Company’s financial statements, disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in reports filed with the Securities and Exchange Commission, and any major issues regarding the Company’s accounting principles and financial statements. |

| • | Review and discuss the Company’s policies with respect to earnings press releases and other disclosures of financial information and/or guidance. |

| • | Responsibility and sole authority for all matters relating to the Company’s independent registered public accounting firm, including the appointment, compensation, evaluation, retention and termination of such firm. |

| • | Approval of all services to be performed by the Company’s independent registered public accounting firm, including pre-approval of any permissible non-audit services. |

| • | Recommend to the Board, based on its review and discussions with management and the Company’s independent registered public accounting firm, whether the financial statements should be included in the Annual Report on Form 10-K. |

| • | Review and consider the independence of the Company’s independent registered public accounting firm. |

| • | Obtain and review a report by the Company’s independent registered public accounting firm on their internal quality control procedures and any material issues raised by the most recent internal quality control review or peer review. |

| • | Review and discuss with the principal internal auditor of the Company the scope and results of the internal audit program, and the adequacy and effectiveness of internal controls. |

| • | Review and discuss the adequacy and effectiveness of the Company’s disclosure controls and procedures. |

| • | Review material pending legal proceedings and material contingent liabilities. |

| • | Oversee the Company’s compliance programs with respect to legal and regulatory requirements and the Company’s Code of Conduct policies, including review of related party transactions and other conflict of interest issues. |

| • | Review and discuss the Company’s policies with respect to risk assessment and risk management, and oversee the Company’s legal and regulatory compliance programs, Code of Conduct, and conflict of interest policies. |

| • | Establish procedures for handling complaints about accounting, internal controls and audit matters. |

| • | Evaluate annually the performance of the Audit Committee and the adequacy of its charter. |

Consistent with and in furtherance of its chartered duties, the Audit Committee has adopted (i) a written policy restricting the hiring of candidates for accounting or financial reporting positions if such candidates have

14

certain current or former relationships with the Company’s independent registered public accounting firm; (ii) procedures for the receipt, retention and treatment of complaints regarding accounting or auditing matters and the confidential submission by employees of any concerns regarding such accounting or auditing matters; (iii) a written policy governing the preapproval of audit and non-audit fees and services to be performed by the Company’s independent registered public accounting firm; and (iv) a written policy requiring management to report to the Committee transactions with the Company’s officers or certain other parties.

In general, the Audit Committee represents the Board of Directors in discharging its general oversight responsibilities for the Company and its subsidiaries in the areas of accounting, auditing, financial reporting, risk assessment and management, and internal controls. Management has the responsibility for the preparation, presentation and integrity of the Company’s financial statements and for its financial reporting process and the Company’s independent registered public accounting firm is responsible for expressing an opinion on the conformance of the Company’s financial statements to accounting principles generally accepted in the United States. The Audit Committee is responsible for reviewing and discussing with management and the Company’s independent registered public accounting firm the Company’s annual and quarterly financial statements and financial reporting process and for providing advice, counsel and direction on such matters based upon the information it receives, its discussions with management and the independent registered public accounting firm and the experience of the Audit Committee members in business, financial and accounting matters.

The Company has an internal audit department that, among other things, is responsible for objectively reviewing and evaluating the adequacy and effectiveness of the Company’s system of internal controls, including controls relating to the reliability of the Company’s financial reporting. The internal audit department reports directly to the Audit Committee and, for administrative purposes, to the Chief Financial Officer.

2009 Audit Committee Activities

During 2009, the Audit Committee met formally 12 times. Messrs. Armacost, Beard, and Thornley served on the Committee throughout 2009, with Mr. Thornley serving as Chair of the Committee. Mr. Lundgren was appointed to the Committee in May 2009. The Board has determined that throughout 2009 all members of the Audit Committee met all applicable independence requirements of the NYSE and SEC during the time they served on the Committee, and that all members of the Audit Committee were financially literate and had accounting or related financial management expertise within the meaning of the NYSE listing standards. In addition, the Audit Committee has designated Mr. Thornley as the Audit Committee Financial Expert. Shareholders should understand that this designation is a Securities and Exchange Commission disclosure requirement and does not impose on Mr. Thornley any duties, obligations or liabilities that are greater than those which are generally imposed on him as a member of the Audit Committee and the Board, and his designation as an Audit Committee Financial Expert pursuant to this requirement does not affect the duties, obligations or liabilities of him or any other member of the Audit Committee or the Board. The Audit Committee appointed Deloitte & Touche LLP (“Deloitte”) to serve as the Company’s independent registered public accounting firm for 2009.

The Audit Committee reviewed and discussed with management and Deloitte the Company’s quarterly and audited annual financial statements for the year ended December 31, 2009. The Committee also reviewed the report of management contained in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2009, as well as Deloitte’s Report of Independent Registered Public Accounting Firm included in the Company’s Annual Report on Form 10-K related to its audit of the consolidated financial statements and financial statement schedule. The Audit Committee discussed with Deloitte the matters that the auditors are required to discuss with the Audit Committee pursuant to Statement on Auditing Standards No. 114, “The Auditor’s Communication With Those Charged With Governance” and SEC Regulation S-X, Rule 2-07, “Communication with Audit Committees.”

During the course of 2009, the Audit Committee also oversaw management’s evaluation of the Company’s internal controls over financial reporting. The principal internal auditor and management documented, tested and

15

evaluated the Company’s system of internal control over financial reporting in accordance with the requirements of Section 404 of the Sarbanes-Oxley Act of 2002 and related regulations. The Audit Committee was kept apprised of the progress of the evaluation and provided oversight and advice during the process. In connection with this oversight, the Committee received periodic updates provided by the principal internal auditor, management and Deloitte at least quarterly at a Committee meeting. Upon completion of the evaluation, the principal internal auditor and management reported to the Committee regarding the effectiveness of the Company’s internal control over financial reporting and the Committee reviewed and discussed with Deloitte its Report of Independent Registered Public Accounting Firm included in the Company’s Annual Report on Form 10-K related to its audit of the effectiveness of internal control over financial reporting. The Committee continues to oversee the Company’s efforts related to its internal control over financial reporting.

In accordance with the Sarbanes-Oxley Act of 2002 and applicable rules of the Securities and Exchange Commission, it is the Audit Committee’s policy that all non-audit services to be performed by the Company’s independent registered public accounting firm must be preapproved by the Audit Committee. During 2009, the Committee approved all non-audit services performed by Deloitte, which consisted only of limited tax related services as is permitted under the rules of the Securities and Exchange Commission.

In addition, the Audit Committee has received from Deloitte the written disclosures and the letter required by Public Company Accounting Oversight Board (“PCAOB”) Rule 3526 (Communications with Audit Committees Concerning Independence) and has discussed with Deloitte its independence. Although such letter is only required annually, as a matter of procedure the Audit Committee requests that Deloitte provide such letter at least quarterly and such letter was provided at least quarterly during 2009. The Audit Committee actively engaged in a dialogue with Deloitte with respect to any disclosed relationships or services that might impact Deloitte’s objectivity and independence.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the Company’s audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2009, for filing with the Securities and Exchange Commission.

MEMBERSOFTHE AUDIT COMMITTEE

Anthony S. Thornley(Chair)

Samuel H. Armacost

Ronald S. Beard

John F. Lundgren

The preceding “Report of the Audit Committee” shall not be deemed soliciting material or to be filed with the Securities and Exchange Commission, nor shall any information in this report be incorporated by reference into any past or future filing under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent the Company specifically incorporates it by reference into such filing.

16

INFORMATION CONCERNING INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Proposal No. 2 — Ratification of Independent Registered Public Accounting Firm

The Audit Committee, which is comprised entirely of independent directors, has appointed Deloitte & Touche LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2010. Deloitte has served as the Company’s independent registered public accounting firm since December 2002. Information concerning the services performed by Deloitte and the fees for such services for 2009 and 2008 are set forth below under “Fees of Independent Registered Public Accounting Firm.” Representatives of Deloitte are expected to attend the Annual Meeting, where they are expected to be available to respond to questions, and if they desire, to make a statement.

At the Annual Meeting, shareholders will be asked to ratify the appointment of Deloitte as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2010. Pursuant to the Sarbanes-Oxley Act of 2002 and the listing standards of the NYSE, the Audit Committee is directly responsible for the appointment of the Company’s independent registered public accounting firm. Ratification of this appointment is not required to be submitted to shareholders and a shareholder vote on this matter is advisory only. Nonetheless, as a matter of good corporate governance, the Company is seeking ratification of the appointment of Deloitte. If the shareholders do not ratify the appointment, the Audit Committee will reconsider its appointment of Deloitte. Because the Audit Committee is directly responsible for appointing the Company’s independent registered public accounting firm, however, the ultimate decision to retain or appoint Deloitte in the future as the Company’s independent registered public accounting firm will be made by the Audit Committee based upon the best interests of the Company at that time.

Vote Required and Recommendation of the Board of Directors

The affirmative vote of the holders of a majority of shares of Common Stock represented and voting, in person or by proxy, at the Annual Meeting is required to ratify the appointment of Deloitte as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2010. Abstentions will be treated as being present and entitled to vote on the matter and, therefore, will have the effect of votes against the proposal. A “broker non-vote” is treated as not being entitled to vote on the matter and, therefore, is not counted for purposes of determining whether the proposal has been approved.

YOUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF DELOITTE AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2010.

Fees of Independent Registered Public Accounting Firm

Audit Fees.Audit fees include fees for (i) the audit of the Company’s annual financial statements, (ii) the review of the Company’s interim financial statements, (iii) the audit of the Company’s internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002 and (iv) statutory audits and related services for the Company’s international subsidiaries. Audit fees also include other services that generally only the independent auditor can reasonably provide, including comfort letters, statutory audits, attest services, and consents and assistance with and review of documents filed with the SEC. The aggregate fees for audit services performed by Deloitte in 2009 were $1,701,700, compared to fees of $1,569,277 in 2008. Audit fees for 2009 include $157,200 for professional services rendered in connection with the Company’s issuance of preferred stock in June 2009.

Audit-Related Fees.Audit-related fees include fees for assurance and related services that are reasonably related to the performance of the audit or review of the Company’s financial statements. The aggregate fees for audit-related services performed by Deloitte for 2009 and 2008 were $32,860 and $266,683, respectively. The

17

fees for 2009 were incurred primarily in connection with the audit of the financial statements for the Company’s 401(k) Retirement Investment Plan. The fees for 2008 were incurred primarily in connection with due diligence services related to potential acquisitions and the audit of the financial statements for the Company’s 401(k) Retirement Investment Plan.

Tax Fees.Tax fees include fees for services performed by the professional staff in the tax department of the independent registered public accounting firm except for those tax services that could be classified as audit or audit-related services. For 2009 and 2008, the tax fees paid to Deloitte totaled $95,049 and $145,000, respectively, and were incurred in connection with domestic tax compliance and tax advice, including the preparation of amended tax returns.

All Other Fees.All other fees include fees for all services except those described above. There were no such other non-audit fees in 2009. The aggregate of such other non-audit fees billed by Deloitte for 2008 was $616,318, which was in connection with the previously reported consulting services provided by Deloitte Consulting with regard to the Company’s procurement of indirect goods and services and the planning and management of inventory. Deloitte completed the consulting services in March 2008.

None of the fees listed above were approved by the Audit Committee in reliance on a waiver from pre-approval under Rule 2-01(c)(7)(i)(C) of Regulation S-X.

Policy for Preapproval of Auditor Fees and Services

The Audit Committee has adopted a policy that all audit, audit-related, tax and any other non-audit service to be performed by the Company’s independent registered public accounting firm must be preapproved by the Audit Committee. It is the Company’s policy that all such services be preapproved prior to the commencement of the engagement. The Audit Committee is also required to preapprove the estimated fees for such services, as well as any subsequent changes to the terms of the engagement. The Audit Committee has also delegated the authority (within specified limits) to the Chair of the Audit Committee to preapprove such services if it is not practical to wait until the next Audit Committee meeting to seek such approval. The Audit Committee Chair is required to report to the Audit Committee at the following Audit Committee meeting any such services approved by the Chair under such delegation.

The Audit Committee will only approve those services that would not impair the independence of the independent registered public accounting firm and which are consistent with the rules of the SEC and PCAOB. The Audit Committee policy specifically provides that the following non-audit services will not be preapproved: (i) bookkeeping or other services related to the Company’s accounting records or financial statements, (ii) financial information systems design and implementation services, (iii) appraisal or valuation services, fairness opinions or contribution-in-kind reports, (iv) actuarial services, (v) internal audit outsourcing services, (vi) management functions, (vii) human resources, (viii) broker-dealer, investment adviser or investment banking services, (ix) legal services and (x) expert services unrelated to an audit for the purpose of advocating the Company’s interests in litigation or in a regulatory or administrative proceeding or investigation.

Under this policy, the Audit Committee meets at least annually to review and where appropriate approve the audit and non-audit services to be performed by the Company’s independent registered public accounting firm. Any subsequent requests to have the independent registered public accounting firm perform any additional services must be submitted to the Audit Committee by the Chief Financial Officer, together with the independent registered public accounting firm, which request must include an affirmation from each that the requested services are consistent with the SEC and PCAOB’s rules on auditor independence.

18

BENEFICIAL OWNERSHIP OF THE COMPANY’S SECURITIES