UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 1, 2007 |

| |

CHINA BROADBAND, INC. (Exact name of registrant as specified in its charter) |

| |

Nevada (State or other jurisdiction of incorporation) | 000-19644 (Commission File Number) | 20-1778374 (IRS Employer Identification No.) |

| | | |

1900 Ninth Street, 3rd Floor Boulder, Colorado 80302 Telephone No.: (303) 449-7733 (Address and telephone number of Registrant's principal executive offices and principal place of business) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

ྎ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

ྎ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

ྎ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

ྎ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Forward Looking Statements

This Current Report Form 8-K and other reports filed by China Broadband, Inc., a Nevada corporation, formerly known as Alpha Nutra, Inc., (the “Company”), from time to time with the Securities and Exchange Commission (collectively the “Filings”), contain or may contain forward looking statements and information that are based upon beliefs of, and information currently available to, the management of the Company as well as estimates and assumptions made by its management. When used in the filings the words “may”, “will”, “should”, “estimates”, “anticipate”, “believe”, “estimate”, “expect”, “future”, “intend”, “plan” or the negative of these terms and similar expressions as they relate to the Company or its management, identify forward looking statements. Such statements reflect the current view of the Company and with respect to future events and are subject to risks, uncertainties, assumptions and other factors relating to the Company. Such forward-looking statements include statements regarding, among other things:

| · | our ability to satisfy our obligations under our agreements with respect to our acquisition of the cable broadband business of Jian Guangdian Jiahe Digital Television Co., Ltd. located in mainland People’s Republic of China (“China”), |

| · | our ability to raise an additional $2,600,000 approximate amount (based on current exchange rates for 20 million Renminbi) in order to make the second payment of our purchase price for the business, which must be paid within nine months of the closing of the acquisition in April 2007, |

| · | a complex and changing regulatory environment in China that currently permits only partial foreign ownership of Chinese businesses and that requires us to negotiate, acquire and maintain separate government licenses to operate each internet business that we would like to acquire (or any other business we would like to acquire in China), |

| · | our ability to implement complex operating and revenue sharing arrangements that will enable us to consolidate our financial statements with our prospective partially owned Chinese business, and to modify and adapt these business arrangements from time to time to satisfy United States accounting rules, |

| · | our ability to enter into agreements with, and to consummate acquisitions of, other broadband businesses in China in the Shandong region and elsewhere, |

| · | socio-economic changes in the regions in China that we intend to operate in that affect consumer internet subscriptions, |

| · | the ability of the Chinese government to terminate or elect to not renew any of our licenses for various reasons or to nationalize our industry, without refund, and |

| · | our anticipated needs for working capital. |

Although the Company believes that the expectations reflected in the forward looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, the Company does not intend to update any of the forward-looking statements to conform these statements to actual results. The following discussion should be read in conjunction with the Company’s financial statements and the related notes filed as an exhibit hereto.

Table of Contents

Item No. | Item Heading | Page No. |

| 1.01 | Entry into a Material Definitive Agreement | 4 |

| 2.01 | Completion of Acquisition or Disposition of Assets | 4 |

| 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant | 4 |

| 9.01 | Exhibits | 38 |

Item 1.01 Entry into a Material Definitive Agreement and Amendment of Material Definitive Agreement;

Item 2.01 Completion of Acquisition or Disposition of Assets; and

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

All references in this Form 8-K to the “Company,” “we,” “our,” or “us,” ” refer China Broadband, Inc., f/k/a Alpha Nutra, Inc., a Nevada corporation, and its operating subsidiaries as constituted subsequent to the closing of the Share Exchange Agreement with China Broadband Ltd., a Cayman Islands company, except where the context makes clear that the reference is only to China Broadband Ltd.

As previously reported in the Current Report on Form 8-K filed by the Company with the Securities and Exchange Commission on March 20, 2007, as amended on June 4, 2007 (date of report January 23, 2007), the Company acquired all of the outstanding capital stock of China Broadband Ltd., a Cayman Islands corporation (“China Broadband Cayman”) pursuant to a Share Exchange Agreement (the “Share Exchange”) dated as of January 23, 2007 by and between the Company, China Broadband Cayman and the four shareholders of China Broadband Cayman, resulting in China Broadband Cayman becoming a wholly owned subsidiary of the Company.

At the time of the closing of the Share Exchange, China Broadband Cayman was a party to a Cooperation Agreement with Jian Guangdian Jiahe Digital Television Co., Ltd. (“Jinan Parent”) to acquire a 51% controlling interest in an operating broadband cable internet company based in the City of Jinan in the Shandong Region of China. This operating cable broadband business is sometimes referred to herein as “Jinan Broadband.” The Cooperation Agreement provides that the operating business’ operations and pre-tax revenues would be assigned to our Jinan Broadband subsidiary for 20 years, effectively providing for an acquisition of the business. We have paid $2,570,679 of our net proceeds from the first closing of our private offering in January 2007, for payment to Jinan Parent in exchange for ownership by our China based Wholly Foreign Owned Entity (“WFOE”) of 51% interest in Jinan Broadband and entry into the Exclusive Cooperation Agreement and an Exclusive Service Agreement. This acquisition was completed in late March of 2007 with an effective date of April 1, 2007. The general business terms of this acquisition are, in relevant part, as follows:

| · | We received a business license from the local Industry and Commerce Bureau that enabled us to complete the acquisition and operate the business of Jinan Broadband, |

| · | Our WFOE, which is wholly owned by our China Broadband Cayman subsidiary, owns the 51% interest in Jinan Broadband with the seller of this business, Jinan Parent, owning the remaining 49% and maintaining certain control under the Exclusive Cooperation Agreement, |

| · | Within nine months of closing of the acquisition, the remaining approximate $2,600,000 (as may be adjusted to reflect currency exchange rates for 20,000,000 RMB at the time of making such payment) of the purchase price (or whatever portion of the purchase price remains unpaid), must be paid, |

| · | Jinan Parent, Jinan Broadband and Jinan Radio and Television Networks Center, entered into the Cooperation Agreement providing for the management terms and rights and revenue sharing rights between us and Jinan Parent, |

| · | Jinan Broadband entered into an Exclusive Service Agreement with Jinan Radio and Television Network and Jinan Parent pursuant to which the parties will cooperate and provide each other with technical services related to their respective broadband, cable and Internet content-based businesses with the payment of service fees to each other. |

No assurance can be made that we will be able to comply with the second large payment to be made as part of the consideration for the acquisition of Jinan Broadband. Additionally, no assurance can be made that we will be able to comply with the terms of the Exclusive Service Agreement or Exclusive Cooperation Agreement. There are numerous risks associated with this business and the foregoing is intended as a summary only and should not be reviewed without also reviewing our annual report for the year ended December 31, 2006 and other relevant filings.

We do not anticipate that revenues from operations will be sufficient to cover this cost. Therefore, we will be dependent on obtaining additional financing or suitable extensions.

This broadband cable internet business is our only operating business as of the date of this report. The below information relates to our business. Additional detail and information about this business may be found in our recently filed Annual Report on Form 10-KSB, and other subsequent filings relating thereto. These other filings also contain risks, cautionary statements relating to forward looking statements and additional updated detail relating to the business and operations of the Company as a result of such acquisition.

Description of Business

Pursuant to the terms of a Share Exchange, we acquired all of the shares of China Broadband Cayman on January 23, 2007, resulting in a change of control. At the time of the closing of the Share Exchange, China Broadband Cayman was a party to an agreement to acquire a 51% controlling interest in an operating broadband cable internet company based in the city of Jinan in the Shandong region of China, which acquisition was consummated effective as of April 1, 2007. Additionally, we sold 8,000,000 shares of common stock and sold 4,000,000 warrants to purchase common stock pursuant to a private financing in early 2007, which is described below, the first closing of which was held simultaneously with the closing of the Share Exchange transaction and the final closing of which was held in early May 2007. These transactions and the recently acquired business of Jinan Broadband are described in more detail below.

As a result of our acquisition of China Broadband Cayman and of Jinan Broadband, we changed our name from Alpha Nutra, Inc. to China Broadband, Inc., effective as of May 4, 2007.

The Company was formerly in the nutritional supplements business which it entered into in January 1, 2004 as part of a Plan of Reorganization approved by the United States Bankruptcy Court for the Southern District of California. The Company has no material business operations as of December 31, 2006 and, while we acquired China Broadband Cayman on January 23, 2007, we only completed our acquisition of a China based cable broadband business on April 1, 2007.

Historical Developments of Company

The Company was organized in 1988 under the name “TJB Enterprises, Inc.” as a blind pool/blank check company formed for the purpose of seeking a merger with a private operating company. We operated various businesses and underwent various reorganizations from inception through January of 2003. On January 2, 2003, we filed a Voluntary Petition for Bankruptcy and on November 6, 2004 a Plan of Reorganization was approved by the Honorable James Meyer, Judge, United States Bankruptcy Court for the Southern District of California.

On October 22, 2004, we reorganized our corporate structure and changed our domicile to Nevada by merging into a wholly owned subsidiary created for this purpose, Alpha Nutraceuticals, Inc.

On January 27, 2005, we changed our name to Alpha Nutra, Inc.

On June 30, 2005, we entered into a Stock and Asset Exchange Agreement with GMGH International, LLC and Golden Tones International, LLC whereby we sold our operating companies pursuant to which we exchanged 100% of the Avidia Nutrition interests and Let’s Talk Health, Inc. shares of common stock held by us for 100% of the Alpha Nutra, Inc. shares of common stock held by GMGH, Golden Tones and each of the respective owners of GMGH and Golden Tones. The 10,465,333 shares of common stock we received from GMGH, Golden Tones and the owners were retired. Accordingly, following the exchange, GMGH and Golden Tones owned 100% of Avidia Nutrition and Let’s Talk Health, Inc. We retained ownership of our wholly owned subsidiary, AlphaNutra.com, which currently has no business operations.

On June 30, 2005, we entered into a settlement agreement with Business Consulting Group Unlimited, Inc., a Nevada company, pursuant to which BCGU forgave the outstanding debt we owed BCGU in exchange for our payment to BCGU of $47,500 and 500,000 restricted shares of our common stock.

On January 23, 2007, pursuant to the Share Exchange Agreement entered into in January of 2007, we acquired all of the shares of China Broadband Cayman from its four shareholders resulting in such shareholders controlling the Company. At the time of the closing of the Share Exchange Agreement, China Broadband Cayman was a party to a Cooperation Agreement to acquire a 51% controlling interest in an operating broadband cable internet company based in the city of Jinan in the Shandong Region of China, which agreement became effective on April 1, 2007 and is the primary subject of this report. The Cooperation Agreement provides that the operating business’ operations and pre-tax revenues would be assigned to our Jinan Broadband subsidiary for 20 years, effectively providing for an acquisition of the business. In consideration for this 20 year business and management rights, we paid $2,600,000 and are required to pay an additional approximate $2,600,000 (based on current exchange rates for 20 million RMB) within nine months of completion of this acquisition. In addition, we entered into various agreements that relate to our revenue sharing obligations and management rights of this business. Moreover, Jinan Broadband entered into an Exclusive Service Agreement with Jinan Radio & Television Network, the only cable TV operator in Jinan, the capital city of Shandong, and Jinan Parent (as defined in the section entitled “Simultaneous Closing of Equity Financing”). Pursuant to the Exclusive Service Agreement, the parties will cooperate and provide each other with technical services related to their respective broadband, cable and Internet content-based businesses with the payment of service fees to each other. This business is our only operating business as of April of 2007.

Currently, our shares are thinly traded on the “pink sheets”. After the filing of this Current Report on Form 8-K with current consolidated financial statements, we intend to apply for listing of our common stock on the Over-the-Counter Bulletin Board Market System. No assurance can be made that we will be able to list our securities on the Over-the-Counter Bulletin Board.

Business Operations Prior to 2003

We were inactive from 1998 through 2003. Additionally, we do not believe that our nutritional supplement business was significant at any time thereafter.

Description of China Broadband Cable Business Operations, Acquired After December 31, 2006

Prior to the completion of our acquisition of Jinan Broadband in April of 2007, we were a blank check company without material operations.

Our acquisition of Jinan Broadband became effective as of April 1, 2007. The information below relates primarily to the business of Jinan Broadband both before and after the closing of this acquisition and to the terms of the acquisition itself.

A detailed description of the acquisition is included in the section titled “Recent Events” and “About Jinan Parent and Jinan Broadband” below.

Recent Events

Change of Control; Acquisition of China Broadband Cayman; Closing of $4,000,000 Financing

On January 23, 2007 we completed our acquisition of China Broadband Cayman resulting in a change of control of the Company, and simultaneously closed on the minimum of $3,000,000 in escrow in our private offering of common stock and warrants in order to cover the cost of our initial acquisition payment for an operating cable broadband business in the Jinan region of China (see “About Jinan Parent and Jinan Broadband,” below). Information relating to the Share Exchange and the private offering follows.

Change of Control; Acquisition of China Broadband Cayman on January 23, 2007

On January 23, 2007 and pursuant to a Share Exchange, between us, China Broadband Cayman and its four shareholders (the “Broadband Shareholders”), we acquired 100% of the outstanding capital stock of China Broadband Cayman from it’s four shareholders in exchange for 37,865,506 shares (the “Exchange Shares”) of common stock, par value $.001 per share, and assumed obligations of China Broadband Cayman under $325,000 principal amount of 7% Convertible Promissory Notes, which became convertible into 1,300,000 shares of our common stock and assumed other related obligations. All of the holders of these 7% Convertible Promissory Notes have requested conversion into our common stock effective as of February 28, 2007 and all interest has been paid through such date. Additional information relating to this change of control, and related financial statements, can be found in a Current Report on Form 8-K/A as amended, dated June 4, 2007.

Effective as of the closing date of the Share Exchange on January 23, 2007, new members of management were appointed to the Board and as executive officers, and our existing officers and directors, Mark L. Baum and James B. Panther, II, have resigned from all officer and director positions with the Company.

The material terms of the Share Exchange and related agreements with China Broadband Cayman are:

| · | We have acquired all of the shares of China Broadband Cayman from the four Broadband Shareholders in exchange for 37,865,506, shares of our Exchange Shares, resulting in China Broadband Cayman becoming our wholly owned subsidiary and its Broadband Shareholders owning over 78% of our common stock after the closing, |

| · | We have successfully funded the first of two payments of the acquisition of the 51% interest in Jinan Broadband of $2,570,679 required to be paid under the Cooperation Agreement, from the proceeds of our private offering (see “Completion of Acquisition by our WFOE of 51% interest in Jinan Broadband” below), |

| · | We have assumed liabilities of China Broadband Cayman under the $325,000 principal amount of 7% Convertible Promissory Notes, which were convertible at $.25 per share of our common stock for an aggregate of 1,300,000 shares and to pay interest thereon, all of which have since been converted as of February 28, 2007, with interest paid through such date, |

| · | We have agreed to assume certain obligations of China Broadband Cayman to issue, and have so issued, 48,000 shares to WestPark Capital, Inc., which acted as placement agent for China Broadband Cayman in connection with placement agent services rendered by it relating to the sale of its 7% Convertible Promissory Notes, in 2006, |

| · | We have agreed to register the Exchange Shares issued to the four Broadband shareholders, pursuant to a Registration Rights Agreement, and to assume obligations of China Broadband Cayman under its registration rights agreement, to register all shares issued upon conversion of the 7% Convertible Promissory Notes and the 48,000 shares issued to WestPark Capital, Inc., |

| · | We have issued 500,000 warrants to BCGU, LLC, an entity beneficially owned by Mark L. Baum, our outgoing director, executive officer and former principal shareholder, as consideration for professional and related services rendered, which warrants are exercisable at $.60 and expire on March 24, 2009, |

| · | We have agreed to a lockup agreement and anti dilution agreement with respect to the Exchange Shares and with respect to shares held beneficially by Mr. Baum, our outgoing executive officer and director and the former shareholders and principals of China Broadband Cayman, |

| · | We have issued 3,974,800 warrants exercisable at $.60 per share to Maxim Financial Corporation as a consulting fee and in exchange for funding operating and other business activities of China Broadband Cayman prior to the Share Exchange and in exchange for entering into a pass through lease with us and waiving past and future rent through December 2007 under such lease (see “Certain Relationships and Related Transactions and Director Independence”), |

| · | We entered into employment agreements with certain new members of management in connection with our recently acquired operations in China. |

Simultaneous Closing of Equity Financing

Simultaneously with the closing of the Share Exchange, and as a necessary condition thereto in order to fund our acquisition of the broadband business in China, we conducted the first closing of our private offering pursuant to which we entered into subscription agreements with investors for the sale of 6,000,000 shares of common stock and 3,000,000 Redeemable Common Stock Purchase Warrants, exercisable at $2.00 per share (the “Warrants”). This offering was also conducted through WestPark Capital, Inc. as placement agent, on a “best efforts, $3,000,000 minimum, $4,000,000 maximum” basis. Through early May of 2007, we raised an aggregate of $4,000,000 in this offering and sold an aggregate of 8,000,000 shares and 4,000,000 Warrants to accredited investors. We used $2,570,679 of the proceeds of this offering from the first closing to pay the first installment of our acquisition of a 51% interest in the China based broadband cable internet business spun off by Jinan Parent. This business acquisition, is our only initial operating business as of April 1, 2007. We granted the investors registration rights in connection with this offering and compensated WestPark Capital, Inc., our placement agent, a placement agent fee consisting of $320,000 plus expenses, and issued to them 640,000 warrants to purchase common stock at $.60 per share.

Completion of Acquisition by our WFOE of 51% interest in Jinan Broadband

We have paid $2,570,679 of our net proceeds from the first closing of our private offering in January 2007, for payment to Jinan Parent in exchange for ownership by our China based WFOE of 51% interest in Jinan Broadband and entry into the Exclusive Corporation Agreement and an Exclusive Service Agreement. This acquisition was completed in late March of 2007 with an effective date of April 1, 2007. The general business terms of this acquisition are, in relevant part, as follows:

| · | We received a business license from the local Industry and Commerce Bureau that, that enabled us to complete the acquisition and operate the business of Jinan Broadband, |

| · | Our WFOE, which is wholly owned by our China Broadband Cayman subsidiary, owns the 51% interest in Jinan Broadband with the seller of this business, Jinan Parent, owning the remaining 49% and maintaining certain control under the Cooperation Agreement, |

| · | Within nine months of closing of the acquisition, the remaining $2,600,000 (as may be adjusted to reflect currency exchange rates for 20,000,000 RMB at the time of making such payment) of the purchase price (or whatever portion of the purchase price remains unpaid), must be paid, |

| · | Jinan Parent, Jinan Broadband and Jinan Radio and Television Networks Center, entered into the Cooperation Agreement providing for the management terms and rights and revenue sharing rights between us and Jinan Parent, |

| · | Jinan Broadband entered into an Exclusive Service Agreement with Jinan Radio and Television Network and Jinan Parent pursuant to which the parties will cooperate and provide each other with technical services related to their respective broadband, cable and Internet content-based businesses with the payment of service fees to each other. |

About Jinan Parent and Jinan Broadband

Chinese Holding Company Structure

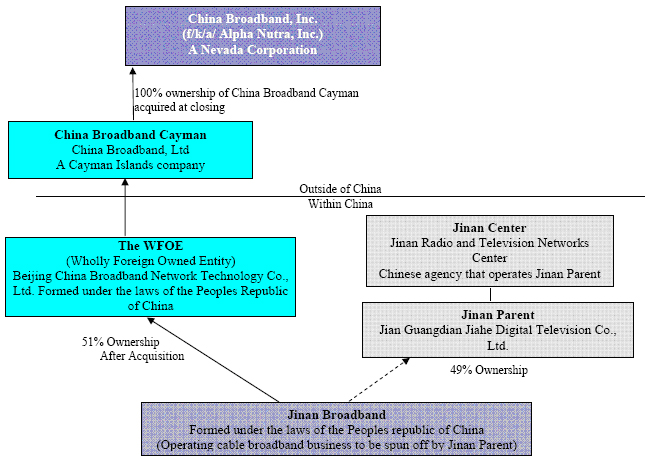

Our Company has an offshore holding structure commonly used by non-Chinese investors that acquire operations in China and make foreign investments of equity, since Chinese regulations do not readily permit foreign ownership of certain mainland Chinese businesses such as telecommunications or cable and related value-added services. Our wholly owned subsidiary after the Share Exchange, China Broadband Cayman, owns 100% of our wholly foreign owned entity (i.e., the “WFOE”), Beijing China Broadband Network Technology Co., Ltd., a Beijing, China corporation. Pursuant to the agreement, our WFOE in turn owns 51% of the operating company, Jinan Broadband, whose other 49% owners will be Jinan Parent and certain of its affiliates. Jinan Parent in turn is owned by Jinan Radio and Television Networks Center. Through the Exclusive Cooperation Agreement and one or more similar operating agreements among WFOE, Jinan Parent and Jinan Broadband, we will manage and control the operations of Jinan Broadband subject to certain oversight provisions, and receive the economic benefits derived from its operations. A diagram depicting our ownership structure is set forth below.

Investments in Chinese businesses involve a significant degree of regulatory risk in that the ownership of private enterprises in China is heavily regulated and subject to changing rules and regulations that could prevent us from recognizing revenues in our intended manner or from operating or controlling businesses in China. China also has the right to de-privatize the business that we are acquiring resulting in the loss of our business without recourse. (see “Risk Factors” section below).

The following chart depicts our corporate structure after the closing of the offering and the business acquisition.

Business Overview

Jinan Parent, the entity that sold its cable broadband business to us, is an emerging cable consolidator and operator in China’s cable broadband market. According to annual research report issued by CNNIC in July 2006, Jinan Parent is one of China’s top five cable broadband service providers among China’s over 1,000 municipal or county cable TV network operators. Jinan Broadband is, after the closing of our acquisition, a subsidiary that is 49% owned by Jinan Parent and 51% owned by our WFOE subsidiary, and is operated in accordance with the Exclusive Cooperation Agreement and one or more operating agreements, including the Exclusive Service Agreement. Jinan Broadband operates out of its base in Shandong where it has an exclusive cable broadband deployment partnership and Exclusive Service Agreement with Jinan Radio & Television Network, the only cable TV operator in Jinan, the capital city of Shandong, and Jinan Parent. Pursuant to the Exclusive Service Agreement, the parties will cooperate and provide each other with technical services related to their respective broadband, cable and Internet content-based businesses with the payment of service fees to each other.

According to the CNNIC (www.cnnic.net.cn) report in July 2006, broadband internet users reached approximately 77 million and total computers with broadband connections reached 28.15 million. However, most broadband users in China subscribe to broadband services offered by telecom companies. By comparison, according to statistics from the National Cable and Television Association, also known as the NCTA (www.ncta.com) and the State Administration of Radio Film & Television of the People’s Republic of China, commonly known as “SARFT” www.sarft.gov.cn in 2006, slightly less than 1/3 of total cable television households in the United States subscribe to broadband services offered by cable network companies. Based on information provided in the NCTA and SARFT set forth in the statistics referenced above, China has total cable television households of approximately 128 million in 2006 with approximately 1.3 million cable households (or, less than 1% of all cable households) subscribing for cable broadband services. In Shandong alone, there were approximately 10 million households with cable in 2006, with only 1% of these homes subscribing for cable broadband internet access. We intend to grow within the Jinan and Shandong regions by marketing to these existing cable television households and by expanding into new households where cable access is available.

Currently, the only broadband services available in the Jinan region are through cable and high speed internet lines. Additionally, satellite internet cable connections are not currently available in Jinan, China. We believe that China Net Com, Inc., which provides non-cable broadband internet service, serves 220,000 customers in Jinan. We also believe that we compete on the basis of more favorable rates and our ability to provide a variety of interactive media services through a partnership with Jinan Center. Finally, cable enjoys a high household penetration rate in urban areas and our internet service is competitively fast and reliable. (See www.jinan.gov.cn). The broadband internet business in China has limited competition, since we were granted an exclusive license and right to do so via cable in the Jinan region.

We also do not rely on any particular key internet customers for our business.

Business Strategies

Focus on Shandong Region

Jinan is the capital city of Shandong Province. Based on information available to us from www.Jinan.gov.cn, Shandong has a population of approximately 92 million and had the second highest gross domestic product (“GDP”) ranking in 2005 of 160 RMB. Based on information from Shandong Branch of SARFT (State Administration of Radio Film & Television), Shandong has a consolidated cable television customer base of approximately 10 million. Shandong currently has approximately 10 million households with cable television access, approximately 1% of whom subscribe for cable broadband internet access. Shandong is served by 17 municipal cable television operators, including Jinan Parent. With a population of approximately 5.9 million, Jinan Center serves approximately 1.3 million cable television households and has approximately 40,000 cable broadband internet users. All population and GDP statistics in this section are provided by Jinan Municipal Government and can be viewed without charge at (www.jinan.gov.cn).

We hope that our initial contract will allow us to fully exploit the cable markets in the Jinan region with our flagship subsidiary, Jinan Broadband, and we hope to bid on additional contracts in the Shandong region.

We believe that the Shandong regional market and high cable access rate provides great market potential for rolling out our core cable broadband services. We intend to develop and evolve our market strategy on an ongoing basis based on our results in the Shandong region.

At the cornerstone of Jinan Broadband’s regional rollout strategy is Jinan Radio and Television Network Centers’ (“Jinan Center”) flagship role in cable broadband services in Shandong, as well as throughout China. Because of it’s unique roll as a subsidiary of a cable network operator, Jinan Parent holds various licenses and contracts that we will be dependent upon in whole or in part, including, without limitation:

Description | | License/Permit |

| Internet Multi-media Content Transmission | | License No. 1502005; |

| Radio & Television Program Transmission & Operation Business | | Permit Shandong No. 1552013, |

| Radio & TV Program Production & Operation License | | Shandong No. 46, |

| PR China Value-added Telecom Service License | | Shandong No. B2-20050002, |

| PR China Value-added Telecom Service License | | Shandong B2-20051013. |

Through Jinan Broadband’s Exclusive Cooperation Agreement with Jinan Parent and Jinan Center, the Company enjoys benefits of the above licenses that allows the Company to roll out cable broadband services as well as to provide value-added services of radio and TV content in Shandong province.

Bundle with DTV Rollout

We believe that Chinese cable companies are exerting efforts to digitalize cable networks which we believe will increase the use and availability of digital STB (Set-top-box) in Shandong province. According to SARFT’s DTV timetable (China Cable TV Digitization Timetable (http://www.sarft.gov.cn/manage/publishfile/24/603.html), by 2008 certain of China’s coastal areas must deploy all digital cable television and shut down their analog television services step by step. By 2015, SARFT intends for the entire country to deploy all digital cable television and cease providing analog television transmission services. This will require the conversion of current “analog” cable customers into “digital” or pay television cable subscribers. Analog cable customers currently pay on average $1.50 per month for cable television service. Digital cable customers with STB shall pay $3.50 per month, as a basic fee. We hope to capitalize on the massive digitalization campaign initiated by SARFT, by bundling cable broadband services in the digital STB rollout campaign.

One of the key marketing strategies that we intend to employ is to bundle cable broadband service offerings within the digitalization campaign in the Jinan area. The terms of our exclusive service agreement with Jinan Parent and Jinan Center provide that they will provide us the first right to market and sell set-top-box bundled services when it is rolled out by them in the Jinan region. In order to push for digitalization, the cable operators in Shandong are subsidizing Set-top-boxes to offer them for free to selected high-end cable television customers. In new territories that do not already have cable, we may also be required to subsidize Set-top-boxes. Jinan Parent provides subsidies to plug-in cable broadband features on to the current Set-top-boxes platform. Our success will be dependent, in part, on our ability to work with Jinan Parent and Jinan Center to distribute such Set-top-boxes to selected cable television customers located in more affluent communities. While the cable broadband feature is offered as optional to digital Set-top-boxes users, with careful choice of deployment targets, we will attempt to convert as much as 30% of the digital cable television subscribers to cable broadband customers. 100% of the revenue of successfully converted cable broadband users goes to Jinan Broadband. Jinan Parent and Jinan Center enjoy returns through their 49% equity ownership in Jinan Broadband.

Deploy Value-added Services

To augment our product offerings and create other revenue sources, we work with strategic partners to deploy value-added services to our cable broadband customers.

China Broadband Cayman has recently executed a Memorandum of Understanding with VideOnline Communications Ltd., a Bermuda company (“VDO”). VDO develops, installs and operates a multi-media distribution network used in delivery of premium video content. This agreement calls for the formation of an exclusive partnership with Hollywood Studio films and Asia Studio films that are in partnership with VDO through a cable broadband platform and a digital TV platform in Shandong province.

VDO has been working over the last few years in the development of technologies that enhance security and ensure that users have a range of possible models for accessing premium content while enjoying easy-to-use delivery, with quality content, branded as “powered by” (O8), a system to deliver premium content over multi-media platforms.

Currently, we do not foresee consummating this transaction in the near future, and we are focusing instead on increasing the number of cable broadband users.

No assurance can be made that we will add these value-added services, or if added, that they will succeed.

Growth Strategy

We intend to increase our revenues primarily by increasing the areas in which we are permitted to operate and provide cable broadband service. If we are not able to expand by acquisition of new regions, then we will not be successful. We are currently in negotiation to acquire up to three additional territories, however, we have not entered into any definitive agreements or financial arrangements for these regions. A description of the regions we currently intend to expand our services to is set forth below. No assurance can be made that we will be able to acquire licenses to operate in these regions, or that if we do so, that we will be able to operate them profitably.

He Ze, Liao Cheng, and Dong Ying Cities

Our WFOE entered into a letter of intent in October 2006 with Shandong Radio & Television Network to initiate cable broadband services among its fully-owned cable networks in Liao Cheng, Dong Ying and He Ze. Based on information available to management, management believes that these three municipal cable operators currently serve approximately 500,000 cable TV households in the urban area, but have not yet introduced cable broadband service. These ventures will require that we invest in cable modem service infrastructure and pay for the telecom bandwidth to offer cable broadband services in these three cities. The municipal cable operators in these three cities will be in charge of daily operations to market and to offer cable broadband services in its regions. In return for this investment, 80% of the basic service gross profit generated from cable broadband services will be allocated to the company during the 10-year contract period. In 2005, the Average Revenue Per User (“ARPU”) for basic cable broadband service in Shandong was an average of $60 per year.

He Ze has a population of approximately 8.8 million, with approximately 240,000 cable television households. In 2005, He Ze’s GDP was approximately 39 billion RMB (www.heze.gov.cn). We also believe that He Ze is a crucial territory due to its large number of existing cable television households.

Liao Cheng has a population of approximately 5.6 million. Liao Cheng cable serves urban cable TV households of approximately 300,000. During 2005, Liao Cheng had a gross domestic product (“GDP”) of approximately 54 billion RMB. We believe that Liao Cheng is crucial territory due to its large number of existing cable television households.

Dong Ying is the location of the largest oil field in northern China and has a total population of approximately 1.8 million. Dong Ying cable currently serves approximately 100,000 urban cable TV households. Dong Ying’s GDP during 2005 was approximately 89 billion RMB (www.dongying.gov.cn). Management believes that the Dong Ying region is important to our success in that it represents one of the most affluent cities in Shandong and Northern China.

We currently do not intend to focus on the above regions, but are further exploring these opportunities with a preference for the He Ze region. Additionally, no assurance can be made that, even if we wish to acquire operating licenses in these regions, we will be able to consummate any of these acquisitions.

Customers

To most cable TV customers, cable broadband offers an alternative to DSL broadband services provided by local telecom carriers. We believe that cable operators have the natural advantage of bundling interactive value-added services like video-on-demand and other interactive content through its digital TV services. While telecom carriers are positioning themselves to offer value-added services of content nature to TV screens in the form of Internet Protocol Television, often referred to as “IPTV”, the high entry barriers on IPTV regulation in China still blocks the service offerings from telecom carriers.

Competition

We believe that local telecom carriers that offer non-cable internet services, represent our major competitors for cable broadband service. Telecom broadband service providers like China Netcom, a telecom carrier in the Shandong province of China, is a dominant broadband service provider in most of the Company’s target cities.

While telecom carriers hold last mile access like fixed phone lines to most urban households, we believe that cable operators enjoy more competitive advantage by owning last mile connections of a much larger bandwidth. In urban areas that we target, a large number of households have both fixed phone line and cable TV access. Many of these homes currently have phone line based internet access.

Cable operators in China have to purchase internet connections from telecom carriers. Local telecom carriers that we compete with, however, do not need to pay for internet connection bandwidth which increases their profit margins in this sector over broadband service providers.

Local telecom carriers are actively marketing broadband services on national, provincial, as well as local levels in China. We believe, however, that the ability for cable operators to bundle cable broadband with digital Set-top box marketing efforts will help increase penetration of cable broadband service. In addition, we believe that the quality of cable based broadband services is higher and more versatile. For example, we also believe that we could easily add voice over internet protocol telephony service (known as “VOIP”), with limited added costs to us or the end user. While we do not have current plans to provide VOIP service in the near future, we anticipate that, should we ever wish to enter into this business we would do so with a strategic partner and we estimate it would it would take 9 to 12 months from the date we determiner to enter into such business.

Intellectual Property and Other Agreements

We are not a party to any royalty agreements, labor contracts or franchise agreements, and other than our right to own and operate Jinan Broadband, we do not currently own any trademarks. We intend to apply for trademarks for the regions in which we operate, such as with respect to Jinan Broadband.

Development Activities

Prior to our acquisition of Jinan Broadband, Jinan Parent spent approximately $500,000 (unaudited) in 2005 and $700,000 (unaudited) in 2006 in the development of new technologies and the expansion of cable access. We have not invested any funds into the business of Jinan Broadband and do not foresee expending material sums on research and development in the near future.

Industry Structure and Government Regulation

There are various barriers to entry into the cable or internet service provider business in China. These barriers stem from both industry barriers and government regulation. Cable operators in China, such as our recently acquired Jinan Broadband businesses, are facing many challenges during the process of its evolution from single-system operators to multiple-system operators. The rates we charge and services we provide to cable customers are subject to government regulation and approval.

Industry Barrier

The radio and television broadcasting industries are highly regulated in China. Local broadcasters including national, provincial and municipal radio and television broadcasters are 100% state-owned assets. SARFT regulates the radio and television broadcasting industry. In China, the radio and television broadcasting industries are designed to serve the needs of government programming first, and to make profits next. The SARFT interest group controls broadcasting assets and broadcasting contents in China.

MII (Ministry of Information Industry) plays a similar role to SARFT in the telecom industry. As China’s telecom industry is much more deregulated than the broadcasting industry, MII has been always pushing the bottom line of content control of SARFT by trying to launch more telecom value-added services with content offering in nature, such as IPTV, broadband TV, etc. While China’s telecom industry has substantial financial backing, SARFT, and its regulator, the Propaganda Ministry under China’s Communist Party Central Committee, never relinquished ultimate regulatory control over content and broadcasting control.

The major internet regulatory barrier for cable operators to migrate into multiple-system operators and to be able to offer telecom services is the license barrier. Very few independent cable operators in China acquired full and proper broadband connection licenses from MII. The licenses, while awarded by MII, are given on very-fragmented regional market levels. With cable operators holding the last mile to access end users, SARFT cable operators pose a competitive threat to local telecom carriers. While internet connection licenses are deregulated to even the local private sector, MII still tries to utilize the license barrier to fence off threats from cable operators that falls under the SARFT interest group.

Our business is highly regulated and we are required to obtain government approval from the Ministry of Commerce of the People’s Republic of China, commonly referred to as MOFCOM, and other government agencies in China that approve transactions such as our acquisition of Jinan Broadband. Additionally, foreign ownership of business and assets in China is not permitted without specific government approval. For this reason, we acquired only 51% Jinan Broadband with the remaining 49% owned by the selling agency and revenue sharing and voting control is governed among the parties based on written agreements such as our Exercise Service Agreement and the Cooperating Agreement.

We do not have plans to provide value added services in the near future to our cable internet users and intend to expand by increasing the number of regions in which we are licensed to operate.

Lack of Economies of Scale

Up until 2005, China had over 2,000 independent cable operators on different levels. While SARFT pushed hard from the national level to call for national consolidation of cable networks, the consolidation mostly occurs on a provincial platform. The 30 provinces are highly variable in their consolidation efforts and processes. For most cable operators in China, on a stand-alone basis, they still lack the economies of scale to systematically rollout value-added services that can significantly upgrade ARPU. (See SARFT website, above).

SARFT has taken various steps to implement a separation scheme to achieve economies of scale in the value-added service and cable operation sector. First, SARFT has been separating cable network assets from broadcasting assets and currently allows state-owned-enterprises to hold up to 49% in the cable network infrastructure assets. Second, SARFT is separating the value-added services segment from the network infrastructure which tends to increase private investments.

Lack of Management Expertise

Current monthly cable sales are low, with small profit margins if any. As a result, we believe that the cable operators lack management expertise and marketing expertise to promote and launch more sophisticated forms of value-added services like cable broadband service.

Lack of Strategic Focus

Due to its highly-regulated nature, we believe that the radio and broadcasting industry does not have the same financial resources as the deregulated telecom industry in China, and that the priorities and goals of this industry are different from the telecom industry.

We believe that SARFT and its broadcasters are currently focusing on increasing subscription revenues by converting average Chinese television viewers from “analog” customers into “digital” (pay TV) customers. The financial resources and strategic focus are put on the massive digitalization efforts and on the set-top-boxes to be given away free of charge within digital television service bundling in most regions. Due to the lack of financial resources, the rollout of cable broadband services and other value-added services is moved lower on the SARFT priority list.

The above elements highlight the current challenges faced by local cable operators to rollout cable TV value added services in China.

Employees

As of or immediately after the closing of our acquisition of Jinan Broadband in April of 2007, we have two full time and one part time employees in the United States and two full time and one part time employees in Shandong, China.

RISK FACTORS

You should carefully consider the risks described below in conjunction with our forward looking statement related risks as set forth in the beginning of this report, as well as the other information in this report, when evaluating our business and future prospects. Should any of the following risks actually occur, our business, financial condition and results of operations could be seriously harmed. In that event, the market price of our common stock could decline and investors could lose all or a portion of the value of their investment in our common stock.

Risks Relating to Our Company

We are not current with our financial reporting obligations under the Securities Exchange Act of 1934, as amended, which will cause us to have difficulty raising money and we will not be able to apply for listing on the OTC Bulletin Board or any other exchange until we become current on such financial reporting obligations.

We are dependent upon our ability to raise capital to complete our business plan. Specifically, and without limitation, we will need an additional approximately $2,600,000 to satisfy the second payment for our acquisition of Jinan Broadband and will need additional capital to acquire licenses in additional regions. Our ability to raise capital would be greatly hindered if we are not able to become and remain current with our reporting obligations. Remaining current will depend, in part, on our ability to prepare and consolidate our financial statements with our Chinese subsidiaries. If we do not raise capital, or if we are unable to become listed or remain listed on a United States trading exchange or quotation system, our business will be adversely affected.

Our auditors have expressed substantial doubt in their report on our financial statements about our ability to continue as a going concern.

Our auditors have included an explanatory paragraph in their report dated as of March 28, 2007 on our consolidated financial statements for the year ended December 31, 2006, indicating that there is substantial doubt regarding our ability to continue as a going concern. The financial statements included elsewhere in this current report do not include any adjustments to asset values or recorded liability amounts that might be necessary in the event we are unable to continue as a going concern. If we are in fact unable to continue as a going concern, you may lose your entire investment in our company. We will therefore need immediate additional substantial capital in order to continue to operate.

No assurance can be made that we will be able to successfully complete our acquisition of Jinan Broadband since we face uncertainties with respect to our ability to complete the acquisition, such as:

We will have to raise additional capital of approximately $2,600,000 (based on current US exchange rates for 20,000,000 RMB) before the end of December, 2007, nine months after making our initial payment in this acquisition. We do not believe at this time that we will be able to fund this payment with revenues of Jinan Broadband. If we are unable to make this payment, we will be forced to re-negotiate our payment terms and risk the loss of the business. Specifically:

| · | We have entered into the Exclusive Cooperation Agreement and must operate our business within its confines. This agreement is subject to change and we also must comply with complex and changing rules in China that relate to foreign ownership of a Chinese business. |

| · | We may not be able to consolidate our financial statements or remain current with our financial reporting obligations due to policy changes or inability to maintain adequate records. |

| · | Since the government of China is particularly sensitive to outside influences on print and electronic media, we could face changes in public policy in China that would prevent or discourage foreign ownership of media companies. |

If any of the foregoing occurs we will be adversely affected.

We are currently in a growth-stage and may experience setbacks in business development and expansion.

We are subject to all of the risks inherent in the creation of a new business. As a growth-stage company, our cash flows may be insufficient to meet expenses relating to our operations and the growth of our business, and may be insufficient to allow us to service new and additional contracts.

We may have unknown liabilities that accrued prior to our merger.

The Company was formerly known as Alpha Nutra, Inc., and has had to management’s knowledge, no significant operations since June 2005. Prior to such time, Alpha Nutra was in the vitamins and nutritional supplements business. While we believe that no preexisting liabilities exist and will obtain limited indemnities from certain members of former management, no assurances can be made that AlphaNutra does not have any preexisting liabilities, commitments or restrictions that could result in a financial loss to us from completing this transaction or its consolidated audited financial statements.

No assurance can be made that we will be able to successfully operate Jinan Broadband and/or the broadband cable business.

The Broadband cable business of Jinan Broadband is our only initial business. This company has only approximately 40,000 broadband cable internet users as of late 2006. Additionally, the broadband cable businesses of other agencies in China are relatively new with little or no reliable comparable statistical or historic financial information available. Under our current letters of intent to enter into new territories, we will be responsible for the initial installation and roll-out to customers. We therefore have limited or no experience or know-how with respect to operating a cable internet business in China and little information can be obtained. Therefore we cannot assume that we will be able to mange our business effectively.

We do not own Jinan Parent or Jinan Center and if they or their ultimate shareholders or control persons violate our contractual arrangements with them, our business could be disrupted, our reputation may be harmed and we will have only limited rights and ability to enforce our rights against these parties.

Our operations are currently dependent upon our contractual relationships with Jinan Center and Jinan Parent. The terms of these agreements are often statements of general intent and do not detail the rights and obligations of the parties. Some of these contracts provide that the parties will enter into further agreements on the details of the services to be provided. Others contain price and payment terms that are subject to monthly adjustment. These provisions may be subject to differing interpretations, particularly on the details of the services to be provided and on price and payment terms. It may be difficult for us to obtain remedies or damages from these companies or their ultimate shareholders for breaching our agreements. Because we rely significantly on these companies for our business, the realization of any of these risks may disrupt our operations or cause degradation in the quality and service provided by, or a temporary or permanent shutdown of, the company. Our initial Exclusive Cooperation Agreement that enables us to own and operate the Jinan Broadband business, and the Exclusive Service Agreement in which the parties will cooperate and provide each other with technical services related to their respective broadband, cable and Internet content-based businesses, is for a term of ten years (presuming we make our next payment that is due) and 20 years, respectively. If we are unable to renew these agreements on favorable terms, or to enter into similar agreements with other parties, our business may not expand, and our operating expenses may increase.

Our future revenues depend on our ability to consistently bid and win new contracts and renew existing contracts and, therefore, our failure to effectively obtain future contracts could adversely affect our profitability.

Our future revenues and overall results of operations require us to successfully bid on new contracts and renew existing contracts. Contract proposals and negotiations are complex and frequently involve a lengthy bidding and selection process, which is affected by a number of factors, such as market conditions, equipment availability and required governmental approvals. If negative market conditions arise or if the required governmental approval is not provided we may not be able to pursue particular projects, which could adversely affect our profitability.

The success of our business is dependent on our ability to retain our existing key employees and to add and retain senior officers to our management.

We depend on the services of our existing key employees, in particular, Clive Ng and Yue Pu. Our success will largely depend on our ability to retain these key employees and to attract and retain qualified senior and middle level managers to our management team. We also do not have a full time internal Chief Financial Officer or financial controller for the consolidated companies. We have recruited executives and management in China to assist in our ability to manage the business and to recruit and oversee employees. While we believe we offer compensation packages that are consistent with market practice, we cannot be certain that we will be able to hire and retain sufficient personnel to support our cable broadband business. The loss of any of our key employees would significantly harm our business. We do not maintain key person life insurance on any of our employees.

Failure to achieve and maintain effective internal controls could have a material adverse effect on the trading price of our common stock and could prevent us from being listed in the OTC Bulletin Board or any other exchange or cause our delisting.

We are subject to the reporting obligations of the United States securities laws. The Securities and Exchange Commission, as required by the Sarbanes-Oxley Act of 2002, has adopted rules requiring public companies to include a report of management on such companies’ internal control over financial reporting in its annual report that contains an assessment by management of the effectiveness of such company’s internal control over financial reporting. In addition, an independent registered public accounting firm for a public company must attest to and report on management’s assessment of the effectiveness of the company’s internal control over financial reporting.

Management may not conclude that our internal control over our financial reporting is effective. Because of the complex and changing and regulatory enforcement and licensing rules in China, and because of our revenues sharing arrangements, it is possible our internal control will be lacking. If we fail to achieve and maintain the adequacy of our internal controls, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with the Sarbanes-Oxley Act. As a result, any failure to achieve and maintain effective internal controls over financial reporting could result in the loss of investor confidence in the reliability of our financial statements, could negatively impact the trading price of our common stock or cause the delisting of our shares from any trading market in which they are on.

Risks Related to Doing Business in China

The Chinese government may nationalize certain businesses or otherwise alter its policy with respect to foreign investment in China in a way that would prohibit or greatly hinder our ability to do business in China.

While the Chinese government currently advocates foreign investment into China, socio-political changes, war or economic changes and shifts could result in a change in China’s policy with respect to investment from non-Chinese businesses. The government agencies, for example, could prohibit ownership of businesses by foreigners or revoke licenses granted that we are dependant on, or otherwise alter our revenue sharing model. While we do not believe that the foregoing is likely in the near future, no assurance can be made that such events, all of which would adversely affect us, will not occur.

If our subsidiaries are restricted from paying dividends to us, our only internal source of funds would decrease.

We have no business other than that of Jinan Broadband. We are dependent on dividends and other distributions from our subsidiaries in order to recognize revenues. If these subsidiaries incur debt on their own behalf in the future, the instruments governing the debt may restrict their ability to pay dividends or make other distributions to us, which in turn would limit our ability to pay dividends on our common stock. Under current Chinese tax regulations, dividends paid to us are not subject to Chinese income tax, but tax authorities in China may require us to amend our contractual arrangements with the WFOE or Jinan Broadband and their respective shareholders or affiliates, and to enter into different arrangements with other agencies in a manner that would materially and adversely affect the ability of our subsidiaries to pay dividends and other distributions to us or that would prohibit us from forfeiting revenues or consolidating our financial statements in order to comply with SEC reporting obligations. In addition, Chinese legal restrictions permit payment of dividends only out of net income as determined in accordance with Chinese accounting standards and regulations.

The uncertain legal environment in China could limit the legal protections available to us.

The Chinese legal system is a civil law system based on written statutes. Unlike common law systems, it is a system in which decided legal cases have little precedent value. In the late 1970s, the Chinese government began to promulgate a comprehensive system of laws and regulations governing economic matters. The overall effect of legislation enacted over the past 20 years has significantly enhanced the protections afforded to foreign invested enterprises in China. However, these laws, regulations and legal requirements are relatively recent and are evolving rapidly, and their interpretation and enforcement involve uncertainties. These uncertainties could limit the legal protections available to foreign investors such as us.

Fluctuation in Renminbi exchange rates could adversely affect the value of our stock and any cash dividend declared on them.

Our required remaining payment for Jinan Broadband is based on current conversion rates between the U.S. dollar and the Chinese Renminbi, also commonly referred to as “RMB.” Additionally, our ability to bid for and acquire businesses in new regions is dependent on favorable exchange rates between the U.S. dollar and the Chinese Renminbi. The value of the Renminbi may fluctuate according to a number of factors. From 1994 to July 21, 2005, the conversion of Renminbi into foreign currencies, including U.S. dollars, was based on exchange rates published by the People’s Bank of China, which was set daily based on the previous day’s inter-bank foreign exchange market rates in China and current exchange rates on the world financial markets. During that period, the official exchange rate for the conversion of Renminbi to US dollars was generally stable. However, on July 21, 2005, as a result of the Renminbi rates being tied to a basket of currencies, the Renminbi was revalued and appreciated against the U.S. dollar. Additionally, global events and expenditures that deflate the value of the U.S. dollar will result in more expensive purchase prices of China based entities. There can be no assurance that such exchange rate will continue to remain stable in the future. Our revenues are primarily denominated in Renminbi, and any fluctuation in the exchange rate of Renminbi may affect the value of, and dividends, if any, payable on, our shares in foreign currency terms.

Restrictions on currency exchange may limit our ability to receive and use our revenues effectively.

Because almost all of our future revenues may be in the form of Renminbi, any future restrictions on currency exchanges may limit our ability to use revenue generated in Renminbi to fund our business activities outside China or to make dividend payments in U.S. dollars. Although the Chinese government introduced regulations in 1996 to allow greater convertibility of the Renminbi for current account transactions, significant restrictions still remain. Current account transactions include payments of dividends and trade and service-related foreign exchange transactions.

In contrast, capital account transactions, which include foreign direct investment and loans, must be approved by the State Administration for Foreign Exchange, or SAFE. We cannot be certain that the Chinese regulatory authorities will not impose more stringent restrictions on the convertibility of the Renminbi, especially with respect to foreign exchange transactions.

Risks Related to the Telecommunications and Internet

Industries in the People’s Republic of China

Increased government regulation of the telecommunications and Internet industries in China may result in the Chinese government requiring us to obtain additional licenses or other governmental approvals to conduct our business which, if unattainable, may restrict our operations.

The telecommunications industry, including Internet content providers, or ICP, is highly regulated by the Chinese government, the main relevant government authority being the Ministry of Information Industry, or MII. Prior to China’s entry into the WTO, the Chinese government generally prohibited foreign investors from taking any equity ownership in or operating any telecommunications business. ICP services are classified as telecommunications value-added services and therefore fell within the scope of this prohibition. This prohibition was partially lifted following China’s entry into the WTO allowing foreign investors to own interests in Chinese businesses. In addition, foreign and foreign invested enterprises are currently not able to apply for the required licenses for operating cable broadband services in China.

We cannot be certain that we will be granted any of the appropriate licenses, permits or clearance that we may need in the future. Moreover, we cannot be certain that any local or national ICP or telecommunications license requirements will not conflict with one another or that any given license will be deemed sufficient by the relevant governmental authorities for the provision of our services.

We rely exclusively on contractual arrangements with Jinan Parent and its approvals to operate as Internet content providers. We believe that our present operations are structured to comply with Chinese law. However, many Chinese regulations are subject to extensive interpretive powers of governmental agencies and commissions. We cannot be certain that the Chinese government will not take action to prohibit or restrict our business activities. We are uncertain as to whether the Chinese government will reclassify our business as a media or retail company, due to our acceptance of fees for Internet advertising, online games and wireless value-added and other services as sources of revenues, or as a result of our current corporate structure. Such reclassification could subject us to penalties or fines or significant restrictions on our business. Future changes in Chinese government policies affecting the provision of information services, including the provision of online services, Internet access, e-commerce services and online advertising, may impose additional regulatory requirements on us or our service providers or otherwise harm our business.

We may be unable to compete successfully against new entrants and established industry competitors.

The Chinese market for Internet content and services is intensely competitive and rapidly changing. Barriers to entry are relatively minimal, and current and new competitors can launch new websites at a relatively low cost. Many companies offer competitive products or services including Chinese language-based Web search, retrieval and navigation services, wireless value-added services, online games and extensive Chinese language content, informational and community features and e-mail. In addition, as a consequence of China joining the World Trade Organization, the Chinese government has partially lifted restrictions on foreign-invested enterprises so that foreign investors may hold in the aggregate up to approximately 51% of the total equity ownership in any value-added telecommunications business, including an Internet business, in China.

Currently, our competition comes from standard “telephone” internet providers. Any of our present or future competitors may offer products and services that provide significant performance, price, creativity or other advantages over those offered by us and, therefore, achieve greater market acceptance than ours.

Because many of our existing competitors, as well as a number of potential competitors, have longer operating histories in the Internet market, greater name and brand recognition, better connections with the Chinese government, larger customer bases and databases and significantly greater financial, technical and marketing resources than we have, we cannot assure you that we will be able to compete successfully against our current or future competitors. Any increased competition could reduce page views, make it difficult for us to attract and retain users, reduce or eliminate our market share, lower our profit margins and reduce our revenues.

Both the continual and foremost accessibility of internet service websites and the performance and reliability of our technical infrastructure are critical to our reputation and the ability of our internet services to attract and retain users and advertisers. Any system failure or performance inadequacy that causes interruptions or delays in the availability of our services or increases the response time of our services could reduce user satisfaction and traffic, which would reduce the internet service appeal to users of “high speed” internet usage. As the number of users and traffic increase, we cannot assure you that we will be able to scale our systems proportionately. In addition, any system failures and electrical outages could materially and adversely impact our business.

Computer viruses may cause delays or interruptions on our systems and may reduce our customer base and harm our reputation.

Computer viruses may cause delays or other service interruptions on our systems. In addition, the inadvertent transmission of computer viruses could expose us to a material risk of loss or litigation and possible liability. We may be required to expend significant capital and other resources to protect our internet service against the threat of such computer viruses and to alleviate any problems. Moreover, if a computer virus affecting our system is highly publicized, our reputation could be materially damaged and customers may cancel our service.

If our providers of bandwidth and server custody service fail to provide these services, our business could be materially curtailed.

We rely on affiliates of Jinan Parent to provide us with bandwidth and server custody service for Internet users. If Jinan Parent or their affiliates fail to provide such services or raise prices for their services, we may not be able to find a reliable and cost-effective substitute provider on a timely basis or at all. If this happens, our business could be materially curtailed.

Risks Relating to Our Securities

Our shares are very thinly traded and we do not anticipate this to change unless we are able to complete our consolidated additional financial statements in accordance with U.S. GAAP and remain current with our reports and succeed in implementing our business plan.

Our common stock is thinly traded on the “Pink Sheet” market system. There can be no assurance that there will be an active market for our shares either now or in the future. The market liquidity will be dependant, among other things, on our ability to complete our consolidated financial statements in accordance with U.S. GAAP, our ability to remain current with our financial reporting requirements under the Securities and Exchange Act of 1934, as amended, and the perception of our operating business and any steps that our management might take to bring us to the awareness of investors. Also, no assurances can be made that there will be any awareness generated. Consequently, investors may not be able to liquidate their investment or liquidate it at a price that reflects the value of the business. If a more active market should develop, the price may be highly volatile. Because there may be a low price for our stock, many brokerage firms may not be willing to effect transactions in the securities. Even if an investor finds a broker willing to effect a transaction in the common stock, the combination of brokerage commissions, transfer fees, taxes, if any, and any other selling costs may exceed the selling price. Further, many lending institutions will not permit the use of such common stock as collateral for any loans.

A substantial majority of our outstanding shares of common stock are "restricted securities" within the meaning of Rule 144 under the Securities Act.

Our restricted shares of common stock may be sold only pursuant to an effective registration statement or under the requirements of Rule 144 or other applicable exemption from registration under the Act and as required under applicable state securities laws. Rule 144 provides in essence that a person who has held restricted securities for a period of at least one year may, under certain conditions, sell every three months, in brokerage transactions, a number of shares that does not exceed the greater of 1.0% of a company's outstanding common stock or the average weekly trading volume during the four calendar weeks prior to the sale. There is no limit on the amount of restricted securities that may be sold by a non-affiliate after the restricted securities have been held by the owner for a period of two years or more. Our stockholders before the closing of the Exchange Agreement who owned 10% or more of our shares will likely be deemed an affiliate until 90 days after the exchange transaction was completed. After such 90-day period and assuming said shares have been held for more than two years, these stockholders may be able to sell their shares without volume restrictions. A sale under Rule 144 or under any other exemption from the Act, if available, or pursuant to subsequent registrations of our shares, may have a depressive effect upon the price of our shares in any active market that may develop.

Investors will have no control over activities of the company.

One of our shareholders, Clive Ng will indirectly beneficially own over 75% of our common stock. In addition, several other shareholders will own or control an additional 15%. As a practical matter, these persons will have control of the Company and all of our subsidiaries and will be able to assert significant influence over the election of directors and other matters presented for a vote of stockholders. Investors will not have a voice in management decisions and will exercise very little control.

Dilutive effects of issuing additional common stock.

There are additional authorized but unissued shares of common stock and “blank check” preferred stock of the Company that may be later issued by our management for any purpose without the consent or vote of the stockholders. Investors may be further diluted in their percentage ownership in the Company on an as-converted basis in the event additional shares are issued by China Broadband in the future.

Our board of directors may issue blank check preferred stock with rights and privileges greater than those of the Shares.

Our articles of incorporation authorize the issuance of shares of “blank check” preferred stock, the rights, preferences, designations and limitations of which may be set by the board of directors. While no preferred stock is currently outstanding or subject to be issued, the articles of incorporation have authorized issuance of up to 5,000,000 shares of preferred stock (“Preferred Stock”) in the discretion of the board of directors. Such Preferred Stock may be issued upon filing of amended Articles of Incorporation and the payment of required fees; no further shareholder action is required. If issued, the rights, preferences, designations and limitations of such Preferred Stock would be set by the board of directors and could operate to the disadvantage of the outstanding common stock. Such terms could include, among others, preferences as to dividends and distributions on liquidation.

There is no established public trading market for our securities and one may never develop. This could adversely affect the ability of investors in our Company to sell their securities in the public market.

We are currently listed on the Pink Sheets and are not eligible for listing on the OTC Bulletin Board market system until we become current with all of our reports and remain current for a period of time. Even if we do eventually list our securities on the OTC Bulletin Board, we cannot predict the extent to which a trading market will develop or how liquid that market might become. Accordingly, holders of our common stock may be required to retain their shares for an indefinite period of time.