UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K/A

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 23, 2007 |

| |

CHINA BROADBAND, INC. (Exact name of registrant as specified in its charter) (Formerly known as Alpha Nutra, Inc.) |

| |

Nevada (State or other jurisdiction of incorporation) | 000-19644 (Commission File Number) | 20-1778374 (IRS Employer Identification No.) |

| | | |

1900 Ninth Street, 3rd Floor Boulder, Colorado 80302 Telephone No.: (303) 449-7733 (Address and telephone number of Registrant's principal executive offices and principal place of business) |

2038 Corte Del Nogal, Suite 110 Carlsbad, California 92011 (Former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

ྎ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

ྎ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

ྎ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

ྎ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Forward Looking Statements

This Current Report Form 8-K/A and other reports filed by China Broadband, Inc., a Nevada corporation formerly known as Alpha Nutra, Inc., (the “Company” or “China Broadband”), from time to time with the Securities and Exchange Commission (collectively the “Filings”), contain or may contain forward looking statements and information that are based upon beliefs of, and information currently available to, the management of the Company as well as estimates and assumptions made by its management. When used in the filings the words “may”, “will”, “should”, “estimates”, “anticipate”, “believe”, “estimate”, “expect”, “future”, “intend”, “plan” or the negative of these terms and similar expressions as they relate to the Company or its management, identify forward looking statements. Such statements reflect the current view of the Company and with respect to future events and are subject to risks, uncertainties, assumptions and other factors relating to the Company. Such forward-looking statements include statements regarding, among other things:

| | · | our ability to satisfy our obligations under our agreements with respect to our acquisition of the cable broadband business of Jian Guangdian Jiahe Digital Television Co., Ltd. located in mainland People’s Republic of China (“China”), |

| | · | our ability to raise an additional 20 Million Renminbi (approximately $2,600,000 based on current exchange rates) in order to make the second payment of our purchase price for the business, which must be paid within nine months of the closing of the acquisition described in this report, |

| | · | a complex and changing regulatory environment in China that currently permits only partial foreign ownership of Chinese businesses and thatch th Chinese and United States accounting rules, ed Chinese business, \rmit us to consolidate requires us to negotiate, acquire and maintain separate government licenses to operate each internet business that we would like to acquire (or any other business we would like to acquire in China), |

| | · | our ability to implement complex operating and revenue sharing arrangements that will enable us to consolidate our financial statements with our prospective partially owned Chinese business, and to modify and adapt these business arrangements from time to time to satisfy United States accounting rules, |

| | · | our ability to enter into agreements with and to consummate acquisitions of other broadband businesses in China in the Shandong and other regions of China, |

| | · | socio-economic changes in the regions in China that we intend to operate in that affect consumer internet subscriptions, |

| | · | the ability of the Chinese government to terminate or elect to not renew any of our licenses for various reasons or to nationalize our industry, without refund, |

| | · | our anticipated needs for working capital. |

Although the Company believes that the expectations reflected in the forward looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, Registrant does not intend to update any of the forward-looking statements to conform these statements to actual results. The following discussion should be read in conjunction with the Company’s pro forma financial statements and the related notes that will be filed herein.

Amendment No. 2 and Restatement of Current Report on Form 8-K,

Dated January 23, 2007, as initially filed on March 20, 2007 and as amended on June 4, 2007

This Current Report on Form 8-K/A, Amendment No. 2, amends, restates and replaces in its entirety, the Current Reports on Form 8-K and Form 8-K/A, date of report: January 23, 2007, as initially filed on March 20, 2007 and as amended on June 4, 2007, respectively. This report was first filed under our previous name, Alpha Nutra, Inc., however, as the Company has changed its name as of May 4, 2007, this filing refers to the Company in all respects under its new name, China Broadband, Inc. In addition, and without limitation, this Current Report on Form 8-K/A contains, as exhibits, the audited financial statements of China Broadband, Ltd. from August 2, 2006 (inception) to December 31, 2006 and consolidated financial statements which are required to be filed as a result of the closing of the Share Exchange (as hereinafter defined) pursuant to which 100% of the shares of China Broadband, Ltd., a Cayman Islands company, were acquired by the Company. (See Item 9.01, Exhibits, below).

Table of Contents

Item No. | Item Heading | Page No. |

| | | |

| 1.01 | Entry into a Material Definitive Agreement | 2 |

| | | |

| 2.01 | Completion of Acquisition or Disposition of Assets | 6 |

| | | |

| 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant | 10 |

| | | |

| 3.02 | Unregistered Sales of Equity Securities | 11 |

| | | |

| 5.01 | Changes in Control of Registrant | 12 |

| | | |

| 5.02 | Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers | 12 |

| | Management | 13 |

| | Principal Stockholders | 17 |

| | | |

| 9.01 | Exhibits | 21 |

Item 1.01 Entry into a Material Definitive Agreement and Amendment of Material Definitive Agreement

See “Share Exchange Agreement With China Broadband Ltd.” below and Items 2.01, 3.02, 5.01 and 5.02 below, which are incorporated herein by reference.

All references in this Form 8-K/A to the “Company,” “we,” “our,” or “us,” ” refer China Broadband, Inc., f/k/a Alpha Nutra, Inc., a Nevada corporation, and its operating subsidiaries as constituted subsequent to the closing of the Share Exchange Agreement with China Broadband Ltd., a Cayman Islands company, except where th e context makes clear that the reference is only to China Broadband Ltd. Information about the Company and the principal terms of the Share Exchange (as defined below) are set forth below.

This Current Report on Form 8-K/A amends and restates in it’s entirety, the Current Reports of the Company dated January 23, 2007 (which was originally filed on March 20, 2007 under our previous name, “Alpha Nutra, Inc.”), and as amended on June 4, 2007, and is being filed to update certain information and file the audited financial statements of China Broadband, Ltd. from August 2, 2006 (inception) to December 31, 2006 relating to the Share Exchange (as defined below).

Share Exchange Agreement With China Broadband Ltd.

On January 23, 2007 (the “Closing Date”) and pursuant to a Share Exchange Agreement dated as of January 23, 2007 (the “Exchange Agreement”), between us, China Broadband Ltd, a Cayman Islands company (“China Broadband Cayman”) and its four shareholders (the “Broadband Shareholders”), we acquired 100% of the outstanding capital stock (the “Broadband Shares”) of China Broadband Cayman from it’s four Broadband Shareholders in exchange for 100% of the outstanding shares of China Broadband Cayman, resulting in China Broadband Cayman becoming our wholly owned subsidiary (said transaction being referred to herein as the “Share Exchange.”). This transaction resulted in a change of control of the Company.

In exchange therefore and pursuant to the terms of the Exchange Agreement, we issued 37,865,506 shares (the “Exchange Shares”) of Common Stock, par value $.001 per share (the “Common Stock”) and assumed obligations of China Broadband Cayman including the $325,000 principal amount of 7% Convertible Promissory Notes (the “Convertible Notes”), which become convertible into 1,300,000 shares of common stock and other related obligations. All of the holders of these Convertible Notes have requested conversion into our Common Stock as of February 28, 2007.

Effective as of the Closing Date of the Share Exchange on January 23, 2007, new members of management were appointed to the Board and as executive officers, and our existing officers and directors, Mark L. Baum and James B. Panther, II, have resigned from all officer and director positions with the Company.

We have not acquired any material assets as a result of the Share Exchange and have not commenced operations as of January 23, 2007, the date of the first report. Nonetheless, as a result of the Share Exchange, we assumed or entered into, various material agreements described in the subsection of Item 1.01 below titled “Agreements Assumed or Entered Into in Connection with Share Exchange and November 2006 Offering” and in Item 2.01 below.

These agreements resulted in our acquisition of business operations effective as of April 1, 2007, which is the subject of a separate Current Report on Form 8-K.

Accounting Treatment

As a result of this transaction there is a change of control of and we are deemed to be the legal surviving acquirer in the Share Exchange and therefore, the assets and liabilities and historical operations of China Broadband Cayman and its wholly owned subsidiary based and organized in the People’s Republic of China called Beijing Zhong Kuan Hua Shi Network Information Technology Co., Ltd. (the “WFOE”) will be reflected in our financial statements.

Simultaneous Closing of Equity Financing

Simultaneously with the Closing of the Share Exchange, and as a necessary condition thereto in order to fund our acquisition of the broadband business in China, Alpha Nutra conducted the first closing of our private offering (the “November 2006 Offering”), pursuant to which we entered into subscription agreements with investors with respect to issuance of 6,000,000 shares of Common Stock (the “Offering Shares”) and 3,000,000 Redeemable Common Stock Purchase Warrants, exercisable at $2.00 per share (the “Warrants”). The aggregate gross proceeds of the November 2006 Offering was $4,000,000, with 8,000,000 Offering Shares and 4,000,000 Warrants subscribed for by an aggregate of 41 accredited investors. Pursuant to the Exchange Agreement and the terms of the November 2006 Offering, we used $2,563,488 of the proceeds of the November 2006 Offering to pay the first installment of our acquisition of a 51% interest in the China based broadband cable internet business spun off by Jian Guangdian Jiahe Digital Television Co., Ltd. This business acquisition, which is described in more detail in a separate Current Report on Form 8-K, is our only initial operating business after the Share Exchange. Additional information relating to this offering and related agreements is set forth in the subsection titled “Agreements Assumed or Entered Into In Connection with Share Exchange and November 2006 Offering” in this Item 1.01 below, and in the section titled “Item 3.02 Unregistered Sales of Equity Securities” below.

Incorporation By Reference

Specific information relating to the Share Exchange and the November 2006 Offering, and related contract obligations entered into or assumed thereby is set forth in this Item 1.01 and in Items 2.01 and 3.02 below and information relating to the resulting change of control of the Company is disclosed in Item 5.01 and 5.02 below, the provisions of which are incorporated by reference herein.

Share Exchange Agreement

Our subsidiary after the Closing Date of the Share Exchange, China Broadband Cayman, has, through its WFOE subsidiary based in mainland China, entered into a Cooperation Agreement (the “Cooperation Agreement”) with Jian Guangdian Jiahe Digital Television Co., Ltd (“Jinan Parent”) on December 26, 2006, pursuant to which, among other things, it has agreed to acquire a 51% interests of Jia He Broadband Ltd. (“Jinan Broadband”), a “joint venture” company formed for the purposes of holding the broadband cable internet business of Jinan Parent. The Cooperation Agreement relates to the terms of the acquisition of Jinan Broadband. At the closing of this transaction, the parties are also required to enter into a Exclusive Service Agreement relating to the shared management and revenue rights of the Company and Jinan Parent, which will own the other 49% of Jinan Broadband.

The material terms of the Exchange Agreement and related agreements with China Broadband Cayman:

| | · | We have acquired all of the shares of China Broadband Cayman from the four Broadband Shareholders in exchange for 37,865,506, shares of our Exchange Shares, resulting in China Broadband Cayman becoming our wholly owned subsidiary and its former Broadband Shareholders owning over 78% of our Common Stock after the Closing Date in addition to 2,000,000 shares to be issued and held in escrow which were to be cancelled on a share for share basis, upon issuance of shares in connection with any equity offerings consummated prior to August of 2007, all of which shares will not be issued as a result of the maximum offering amount of 8,000,000 Offering Shares having been sold in the November 2006 Offering, |

| | · | We have funded in escrow, the first of two payments of the acquisition of the 51% interest in Jinan Broadband of $2,563,488 required to be paid under the Cooperation Agreement, from the proceeds of the November 2006 Offering (see “Acquisition by our WFOE of 51% interest in Jinan Broadband” below), |

| | · | We have assumed liabilities of China Broadband Cayman under the $325,000 principal amount of Convertible Notes, which were exercisable at $.25 per share of our Common Stock for an aggregate of 1,300,000 shares, and to pay interest thereon, all of which notes have been converted as of February 28, 2007, with interest paid by us through such date from the proceeds of the November 2006 Offering, |

| | · | We have agreed to assume certain obligations of China Broadband Cayman to issue, and have so issued, 48,000 shares to a placement agent of China Broadband Cayman in connection placement agent services rendered by it in connection with the sale of Convertible Notes (the “WestPark Shares”), |

| | · | We have agreed to register the Exchange Shares pursuant to a Registration Rights Agreement, and to assume obligations of China Broadband Cayman under its registration rights agreement, to register all 1,300,000 shares underlying the Convertible Notes and the WestPark Shares, |

| | · | We have issued 500,000 warrants (the “BCGU Warrants”) to BCGU, LLC, an entity beneficially owned by Mark L. Baum, our outgoing director, executive officer and principal shareholder, as consideration for professional and related services rendered, which warrants are exercisable at $.60 and expire on March 24, 2009, |

| | · | We have agreed to a lockup agreement and anti dilution agreement with respect to the Exchange Shares and with respect to shares held by Mr. Baum, our outgoing executive officer and director and the former shareholders and principals of China Broadband Cayman (see “Lock-Up Agreements” below), |

| | · | We have issued 3,974,800 warrants to Maxim Financial Corporation as a consulting fee and in exchange for funding operating and other business activities of China Broadband Cayman prior to the Share Exchange and in exchange for entering into a pass through lease with us and waiving past and future rent through December 2007 under such lease. (see “Certain Relationships and Related Party Transactions” below). |

Agreements Assumed or Entered Into In Connection with Share Exchange and November 2006 Offering

In connection with our acquisition of China Broadband Cayman, and in addition to the Exchange Agreement described above, we have assumed or entered into, the following material agreements.

| · | Convertible Notes. Pursuant to the Exchange Agreement, we have assumed China Broadband Cayman’s obligations under the Convertible Notes held by 11 investors, in the aggregate principal amount of $325,000 on September 22, 2006, in connection with a bridge financing of China Broadband Cayman (the “Broadband Note Financing”). The Broadband Note Financing was made in contemplation of a prospective business combination and acquisition of the Chinese based broadband cable internet business. The Convertible Notes, by their terms, provide that China Broadband Cayman shall require that any acquiring parent company of China Broadband Cayman, agree to assume the obligations of the Convertible Notes in the event of a business combination and are convertible into such number of shares as equals 2.6% of the acquiring parent company (or approximately $.25 per share), or 1,300,000 shares presuming that 50,000,000 shares of our common stock are outstanding at the time of conversion, including the shares issuable upon conversion. Our assumption of these notes includes our assumptions under the Note Purchase Agreement and Registration Rights Agreement (the “Broadband Registration Rights Agreement”) entered into with these investors in connection with the Broadband Note Financing and pursuant to which we have agreed, among other things, to file a registration statement within 3 months of a business combination, with respect to the sale of the shares issuable upon conversion of such Convertible Notes. Interest through the date of repayment (or conversion, as the case may be) is payable to these note holders in cash. All of these Convertible Notes have been converted in to the 1,300,000 shares of Common Stock as of February 28, 2007 and all interest through such date has been paid in cash. (See “Broadband Registration Rights Agreement,” below). |

| · | 2006 WestPark Shares. Pursuant to the Exchange Agreement, we have also agreed to assume the obligations of China Broadband Cayman with respect to issuance of obligations to purchase 48,000 shares of Common Stock to WestPark Capital, Inc. as part of the consideration paid to them as a placement agent in connection with the sale of the Convertible Notes (i.e the WestPark Shares) in the Broadband Note Financing. We are required to register the shares issuable upon exercise of the WestPark Shares pursuant to the Broadband Registration Rights Agreement. (See “Broadband Registration Rights Agreement,” below). |

| · | Broadband Registration Rights Agreement. We have also agreed to assume China Broadband Cayman’s obligations under the Broadband Registration Rights Agreement entered into in connection with the issuance of Convertible Notes on September 22, 2006. The Broadband Registration Rights Agreement requires, among other terms, that we register all shares issuable upon conversion of the Convertible Notes within three months after the Closing Date and that if such registration statement is not declared effective by the SEC on or prior to the four month anniversary of the Closing Date, we are required to issue, on the last day of each succeeding month thereafter until a registration statement is effective, to each investor therein such number of shares of Common Stock as equals 2.5% (the “Bonus Shares”) of the shares and Bonus Shares held by or issuable to such person under the 7% Convertible Promissory Notes or 2006 Bridge Warrants. This agreement also allows the majority of holders of shares that are registrable under this agreement to select counsel in the event of an underwritten offering. We do not believe that we will be able to timely obtain effectiveness of a registration statement of these securities at this time. |

| · | Employment Agreement with Jiang Bing. We have entered into an employment agreement with Jiang Bing, our Vice Chairman and Director, who will hold similar executive positions of our operating subsidiaries. Pursuant to this employment agreement, Mr. Bing will receive compensation of $120,000 per annum, plus a bonus and other medical and similar benefits. This term of this employment agreement terminates on July 7, 2009. The Company and Mr. Bing have agreed to defer all cash compensation until the closing of any qualifying offering with gross proceeds of $5,000,000 or greater. Mr. Bing has since resigned as director and officer positions with the Company as of May 18, 2007 for personal reasons not relating to the Company or its business and his employment has been terminated by agreement of the parties without compensation paid or to be paid under said employment agreement. |

| · | Employment Agreement with Clive Ng. We have entered into an employment agreement with Mr. Ng, our President and Chairman of the Board of Directors, who will hold similar executive positions of our operating subsidiaries. Pursuant to this employment agreement, Mr. Ng will receive compensation of $250,000 per annum, plus a bonus and other medical and similar benefits. This term of this employment agreement terminates on July 7, 2009. The Company and Mr. Ng have agreed to defer all cash compensation until the closing of any qualifying offering with gross proceeds of $5,000,000 or greater. |

| · | Employment Agreement with Yue Pu. We have entered into an employment agreement with Mr. Pu, our Chief Executive Officer and Director, who will hold similar executive positions of our operating subsidiaries. Pursuant to this employment agreement, Mr. Pu will receive compensation of $120,000 per annum, plus a bonus and other medical and similar benefits. This term of this employment agreement terminates on July 7, 2009. The Company and Mr. Pu have agreed to defer all cash compensation until the closing of any qualifying offering with gross proceeds of $5,000,000 or greater. |

| · | Lock-Up Agreement with BCGU. Pursuant to the terms of the Exchange Agreement, we entered into a Lock-Up Agreement with BCGU, Mark L. Baum and Mr. Panther, our directors and executive officers and the former Broadband Shareholders, pursuant to which only up to 5% of each such shareholders shares may be sold each month, on a cumulative basis. The provisions of this agreement may be waived by the Company only if it determines in good faith that the trading of the Company’s common stock will not be adversely affected and if such waiver is made pro rata among all persons subject to the Lock Up Agreement. |

| · | November 2006 Offering Registration Rights Agreement and Subscription Agreements. We have also entered into a Registration Rights Agreement with the Broadband Shareholders, BCGU, Westpark, as placement agent and the November 2006 Offering investors with respect to all Common Stock issued or issuable to such persons upon exercise of warrants. We have also entered into subscription agreements with the investors in this offering. This Registration Rights Agreement is similar to the Broadband Registration Rights Agreement entered into in connection with the Broadband Note Financing on September 22, 2006, except that the company agreed that it will not file a registration statement with respect to such shares until at least 91 days after the Closing Date. |

| · | Westpark Warrants. We have issued 640,000 warrants to purchase common stock to WestPark Capital Inc. as part of the consideration for acting as placement agent in the November 2006 Offering (the “WestPark Warrants”). The WestPark Warrants are exercisable at $.60 per share and expire on March 24, 2009. |

| · | Consulting Agreement and Lease of Office Space in Boulder Colorado. We have entered into a year to year lease to rent office space and facilities in Boulder Colorado from Maxim Financial Corporation. This lease covers 1,000 square feet of office space and related services, which we primarily use as our United States corporate offices. The monthly lease rate is $2,000 per month. This lease may be terminated for any reason by Maxim Financial Corporation on 30 days notice. Pursuant to our consulting agreement with it, Maxim Financial Corporation has waived its past fees since July of 2006 for China Broadband Cayman and all future rental fees through December 31, 2007. (See also Share Exchange in Item 1.01 above and “Certain Relationships and Related Party Transactions” in Items 5.02 and 5.03 below). |

Item 2.01 Completion of Acquisition or Disposition of Assets

As of the original date of this report on January 23, 2007, and as of the subsequent filing thereof, we were still a shell company with minimal or no operations. Accordingly, information relating to the description of our business and Management Discussion and Analysis and related financial information as filed in our Annual Report on Form 10-KSB for the year ended December 31, 2005 and the Quarterly Reports on Form 10-QSB for the quarters ended March, June and September of 2006 (collectively the “Company Reports”) are incorporated by reference herein.

Additionally, and without limitation, information required by Items 401, 402, 403, 404 and 407(a) of Regulation SB as required to be provided herein as in effect prior to the Share Exchange are incorporated by reference herein from such Company Reports and all such information reflecting the company and its management after the Share Exchange are provided in Items 5.01 and 5.02 below and incorporated by reference herein.

The below information relates to our prospective business. Additional detail and information about this business may be found in our recently filed Annual Report on Form 10-KSB, and the Current Report on Form 8-K relating to the completion of the acquisition of the Jinan Broadband Business, Date of Report, April 1, 2007, and other subsequent filings relating thereto. These other filings also contain risks, cautionary statements relating to forward looking statements and additional updated detail relating to the business and operations of the Company as a result of such acquisition.

Acquisition by our WFOE of 51% interest in Jinan Broadband

We have paid $2,563,488 of our net proceeds from the first closing of our private November 2006 Offering in January 2007, for payment to Jinan Parent in exchange for ownership by our China based Wholly Foreign Owned Entity (“WFOE”) of 51% interest in Jinan Broadband and entry into the Corporation Agreement and an Exclusive Service Agreement. This acquisition was completed, and our purchase price was released from escrow, in late March of 2007 with an effective date of April 1, 2007. The general business terms of this acquisition are, in relevant part, as follows:

| | · | We received a business license from the local Industry and Commerce Bureau that enabled us to complete the acquisition and operate the business of Jinan Broadband, |

| | · | Our WFOE, which is wholly owned by our China Broadband Cayman subsidiary, owns the 51% interest in Jinan Broadband with the seller of this business, Jinan Parent, owning the remaining 49% and maintaining certain control under the Cooperation Agreement, |

| | · | Within nine months of closing of the acquisition, the remaining $2,600,000 (as may be adjusted to reflect currency exchange rates for 20,000,000 RMB at the time of making such payment) of the purchase price (or whatever portion of the purchase price remains unpaid), must be paid, |

| · | Jinan Parent, Jinan Broadband and Jinan Radio and Television Networks Center entered into the Cooperation Agreement providing for the management terms and rights and revenue sharing rights between us and Jinan Parent. |

| · | Jinan Broadband entered into an Exclusive Service Agreement with Jinan Radio and Television Network and Jinan Parent pursuant to which the parties will cooperate and provide each other with technical services related to their respective broadband, cable and Internet content-based businesses with the payment of service fees to each other. |

No assurance can be made that we will be able to comply with the second large payment to be made as part of the consideration for the acquisition of Jinan Broadband. Additionally, no assurance can be made that we will be able to comply with the terms of the Exclusive Service Agreement or Cooperation Agreement. There are numerous risks associated with this business and the foregoing is intended as a summary only and should not be reviewed without also reviewing our annual report for the year ended December 2006 and other relevant filings.

We do not anticipate that revenues from operations will be sufficient to cover the cost of the remaining $2,600,000 of the purchase price for our Jinan Broadband business. Therefore, we will be dependent on obtaining additional financing or suitable extensions in order to complete this acquisition.

Description of Business

Prior to the completion of our Acquisition of Jinan Broadband, we are still a blank check company without material operations. The following is a brief description of the business to be acquired and other information relating to the Company.

About Jinan Parent and Jinan Broadband

Jinan Parent, the entity that will be selling its cable broadband business to us, is an emerging cable consolidator and operator in China’s cable broadband market. According to annual research report issued by CNNIC on July 2006, Jinan Parent is one of China’s top five cable broadband service providers among China’s over 1,000 municipal or county cable TV network operators. Jinan Broadband will, at the closing our acquisition of this business, be a subsidiary of Jinan Parent, which will be owned 51% by us and 49% by Jinan Parent and will be operated in accordance with the Cooperation Agreement and one or more operating agreements. Jinan Broadband operates out of its base in Shandong where it has an exclusive cable broadband deployment partnership with Jinan Radio & Television Network, the only cable TV operator in Jinan, the capital city of Shandong.

Initial Focus on Shandong Region

Jinan is the capital city of Shandong Province. With population of 5.9 million, Jinan cable serves 1.3 million cable TV households. Jinan scored GDP of 160 billion RMB Yuan in year 2005. Jinan cable has 40,000 cable broadband users. (All population and GDP statistics in this section are provided by Jinan Municipal Government and can be viewed without charge as (www.jinan.gov.cn).

We hope that our initial contract will allow us to fully exploit the cable markets in the Shandong region with our flagship subsidiary, Jinan Broadband. With 92 million in population, Shandong is No. 2 in China’s 2005 provincial Gross Domestic Product ranking (based on information from the China Statistics Bureau), of which 43.5% lives in urban area where cable TV network has a higher penetration rate. Based on information from Shandong Branch of SARFT (State Administration of Radio Film & Television), Shandong has a consolidated cable TV customer base of 10 million households served by 17 municipal cable TV operators. Jinan Radio & Television Network reaches 1.3 million cable TV households among the total 10 million.

We believe that the Shandong regional market provides great market potential for rolling out our core cable broadband services. We intend to develop and evolve our market strategy on an ongoing basis based on our results in the Shandong region.

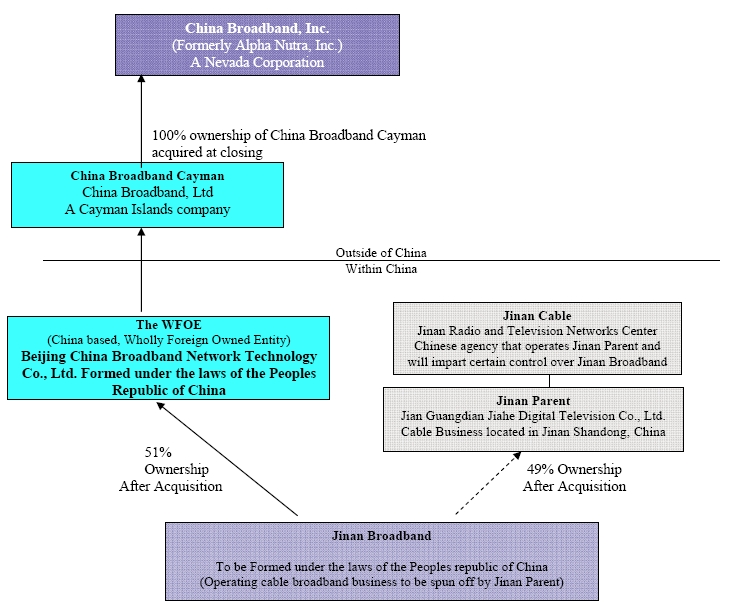

The following chart depicts our corporate structure after the closing of the offering and Acquisition

Description of Property

Effective immediately after the Share Exchange, and as a result of our acquisition of China Broadband Cayman, our principal executive offices in the United States located at 1900 Ninth Street, 3rd Floor Boulder, Colorado 80302, under a lease with Maxim Financial Corporation. This lease is for 1,000 of office space and shared administrative services. This lease is an at cost lease with all lease payments waived by Maxim Financial Corporation through December of 2007 pursuant to the consulting agreement with them

LEGAL PROCEEDINGS

Neither China Broadband, Inc., f/k/a Alpha Nutra, Inc., China Broadband Cayman, nor any of its or our controlled affiliates, are a party to any litigation.

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Effective as of May 16, 2007, the symbol for our common stock which is trading on the Pink Sheets, was changed to “CBBD” to reflect our name change to China Broadband, Inc. Prior to such time the symbol for our common stock was “APNA”. While trading on the Pink Sheets, the letters “.PK” are added to the end of our four letter identifier. Trading in the common stock in the over-the-counter market has been limited and sporadic and the quotations set forth below are not necessarily indicative of actual market conditions. Further, these prices reflect inter-dealer prices without retail mark-up, mark-down, or commission, and may not necessarily reflect actual transactions. As of May 17, 2007 the closing price for our common stock was $3.00.

Fiscal Years: | | | | | |

2006 | | High | | Low | |

| December 31, 2006 | | $ | 2.75 | | $ | 1.50 | |

| September 30, 2006 | | $ | 4.00 | | $ | 5.00 | |

| June 30, 2006 | | $ | 4.00 | | $ | 5.00 | |

| March 31, 2006 | | $ | 4.00 | | $ | 5.00 | |

2005 | | | | | | | |

| December 31, 2005 | | $ | 0.10 | | $ | 0.10 | |

| September 30, 2005 | | $ | 0.10 | | $ | 0.10 | |

| June 30, 2005 | | $ | 0.25 | | $ | 0.25 | |

| March 31, 2005 | | $ | 0.50 | | $ | 0.25 | |

As of May 14, 2007 there were 294 record holders of our common stock and 50,048,000 shares of common stock issued and outstanding. The transfer agent of our common stock is Transfer Online, Inc.

RECENT SALES OF UNREGISTERED SECURITIES

See Item 1.01, Item 2.01 and Item 3.02, the provisions of which are incorporated herein by reference.

DESCRIPTION OF SECURITIES

Our Articles of Organization provide for an authorized capital of 100,000,000 shares, of which 95,000,000 are common stock, $.001 par value and 5,000,000 shares are blank check preferred stock. As of immediately prior to the Closing of the Share Exchange on January 23, 2007, we had approximately 2,534,494 shares of our common stock issued and outstanding with 37,865,506 (plus two million escrow shares) issued in the Share Exchange, and an additional 8,000,000 shares issued to 41 investors in the November 2006 Offering for a total of 50,048,000 shares issued and outstanding immediately after the closing of the Share Exchange (after taking effect of return of certain escrow shares). We have no shares of preferred stock issued or reserved for issuance, and our board of directors has never designated the rights, preferences or privileges of any preferred stock.

In addition to the foregoing, we have issued warrants and Convertible Notes, the descriptions of which are set forth in Item 1.01, 2.01 and 3.02 herein which are incorporated by reference herein.

Common Stock

The following statement is a brief summary of certain provisions relating to our common stock:

Dividends. The holders of common stock are entitled to receive, ratably, dividends when, as and if declared by the Board of Directors out of funds legally available therefore.

Liquidation Preference. In the event of our liquidation, dissolution or winding up, the holders of common stock are entitled, subject to the rights of holders of our preferred stock, if any, to share ratably in all assets remaining available for distribution to them after payment of liabilities and after provision is made for each class of stock, if any, having preference over the common stock.

Conversion. The holders of common stock have no conversion rights and they are not subject to further calls or assessments by us.

Preemption. The holders of common stock have no preemptive rights and they are not subject to further calls or assessments by us.

Voting Rights. The holders of common stock are entitled to one vote for each share held of record on all matters on which the holders of common stock are entitled to vote.

Preferred Stock

The board may issue from time to time, one or more classes of preferred stock, in one or more series, each with liquidation preferences, voting rights, anti-dilution protections, pre-emptive rights or other rights, benefits or privileges that are superior, equal or inferior to the rights, preferences and privileges of the holders of common stock and, that could have the effect of preventing or delaying a change of control, or that would dilute the benefits and rights given to common stock holders in the event of a change of control or in the event of a liquidation. In addition, preferred stock holders may be given rights to veto or approve certain matters without consent of other stockholders or to appoint one or more directors and to approve or disapprove of certain contracts. Currently, the Board has not designated any shares or series of preferred stock and has no present intentions to designate or issue such shares.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of the Registrant

As of May 18, 2007, we do not have any off balance sheet arrangements, as defined in Section 303(c) of Regulation S-B. Off balance sheet arrangements include, without limitation, contractual arrangements with any entity whose financial information is not consolidated with our own, under which we have:

| | · | Guaranteed any obligation of such other entity; |

| | · | A retained or contingent interest in assets transferred to such unconsolidated entity or similar arrangement that serves as credit, liquidity or market risk support to that entity for such assets; |

| | · | Any obligation under certain derivative instruments; |

| | · | Any obligation under a material variable interest held by the registrant in an unconsolidated entity that provides financing, liquidity, market risk or credit risk support to the registrant, or engages in leasing, hedging or research and development services with the registrant. |

Additionally, we do not have any relationships or transactions with persons or entities that derive benefits from any non-independent relationships other than related party transactions discussed herein.

Item 3.02 Unregistered Sales of Equity Securities

Issuances of Shares Under Share Exchange; Change of Control on January 23, 2007

As part of the consideration for the Broadband Shares acquired from the Broadband Shareholders (all of which are listed below), and as more fully described under Item 2.01 of this Form 8-K/A, China Broadband, Inc. issued to the four Broadband Shareholders 37,865,506 shares of common stock which were not registered. The share issuances were made pro-rata to each Broadband Shareholder based on such shareholders’ ownership of China Broadband Cayman shares prior to the Share Exchange. The share issuances, were as follows:

Name | | No. of Shares Issued | |

| 88 Holdings, Inc. | | | 3,582,753 | |

| Stephen P. Cherner | | | 1,900,000 | |

| MVR Investments, LLC | | | 1,382,753 | |

| China Broadband Partners, Ltd | | | 31,000,000 | |

| Total | | | 37,865,506 | |

88 Holdings, Inc. and China Broadband Partners, Ltd. (“Partners”) are both owned and controlled by Clive Ng who has been appointed as a director and as an executive officer at closing of the Share Exchange.

In addition, 2,000,000 shares of our Common Stock were to be issued to the Broadband Shareholders, pro - rata in escrow, the provisions of which provide that such shares are to be returned for cancellation to the extent that greater then 6,000,000 shares are issued in any private placement of equity or convertible debt securities prior to August of 2007. As a result of the issuance of the maximum share offering amount of 8,000,000 shares in the November 2006 Offering, none of the escrow shares have been or will be issued.

We have also issued 3,974,800 warrants, exercisable at $.60 per share, which expire on March 24, 2009, to Maxim Financial Corporation in connection with our sub lease of space from them and our consulting agreement with them (See Item 5.02 below, the provisions of which are incorporated herein).

Finally, as a result of the Share Exchange, we assumed China Broadband Cayman’s obligations to issue 1,300,000 restricted shares of our Common Stock upon conversion of the $325,000 principal amount of Convertible Notes and to issue 48,000 shares to Westpark Capital, Inc. for acting as placement agent with respect to the sale of these Convertible Notes. All noteholders have converted their Convertible Notes as of January 28, 2007 and the holders thereof have received their 1,300,000 shares, and all interest has been paid through such date.

The issuance of the common stock and (including the common stock held in escrow) in the Share Exchange was exempt from registration under the Securities Act pursuant to Section 4(2) in that it did not involve a public offering of securities.

Issuances of Shares Pursuant to November 2006 Offering

Pursuant to the November 2006 Offering, Alpha Nutra offered, on a private basis and to a limited number of accredited investors only, up to 160 units (the “Units”) at a purchase price of $25,000 per Unit, each Unit consisting of 50,000 Offering Shares and 25,000 warrants, pursuant to which an aggregate of up to 8,000,000 Offering Shares and 4,000,000 Warrants may be sold. The Units were offered and sold through WestPark Capital, Inc. as placement agent on a “best efforts, $3,000,000 or 120 Unit (or 6,000,000 shares and 3,000,000 Warrants) minimum and a $4,000,000 or 160 Unit maximum (or 8,000,000 Shares and 4,000,000 Warrants)” basis. The terms of the offering provided that the first closing could only occur if the minimum offering amount had been met and subscribed for in escrow and the Share Exchange was entered into and to be consummated simultaneously with the November 2006 Offering. In addition, the offering terms required that a substantial portion of the proceeds would be allocated towards the acquisition of Jinan Broadband by our WFOE subsidiary after the Acquisition.

The first closing of the November 2006 Offering, with $3,000,000 gross proceeds, occurred simultaneously with the closing of the Share Exchange on January 23, 2007. $2,563,488 of proceeds from our November 2006 Offering was wired into escrow in China for use in connection with the escrow of the first payment under the Cooperation Agreement described above. We sold an additional 2,000,000 shares and 1,000,000 Warrants in subsequent closings resulting in our sale of the maximum aggregate gross proceeds in this offering of $4,000,000, and an aggregate of 8,000,000 shares and 4,000,000 Warrants issued in this offering to 41 accredited investors. We paid $320,000 in cash (plus expenses) and issued 640,000 WestPark Warrants exercisable at $.60 per share to Westpark Capital, Inc. as a placement agent fee for the offering. The issuance of the stock and Warrants in the November 2006 Offering was exempt from registration under the Securities Act pursuant to Section 4(2) and Rule 506 of Regulation D of the Securities Act, as amended, in that it did not involve a public offering of securities and securities were only offered and sold to a limited number of Accredited Investors only, as such term is defined in Rule 501 of Regulation D.

Lock Up Agreements

All Offering Shares and all 1,300,000 issued-per conversion of 7% Convertible Promissory Notes are subject to a lock - up provision pursuant to which shareholders may only sell up to 10% of such shareholders initial share ownership after the November 2006 Offering during any 30 day period on a cumulative basis, provided that no greater then 20% may be sold by such shareholder during any single 30 day period. Investors in this offering who have invested greater than $250,000 may sell up to 15% of their initial number of shares each month, on a cumulative basis, with a maximum of 25% during any 30 day period. We may waive in whole or in part on a pari pasu basis among all of the “locked up” shareholders, the lock-up requirement if our management believes, in its sole discretion, that such release would be in the best interest of the Company.

Item 5.01 Change in Control of Registrant

and

Item 5.02 Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers

As a result of the closing of the Share Exchange described in Item 1.01 and Item 2.01 (which description is incorporated herein by reference) on January 23, 2007, the four Broadband Shareholders, Partners, 88 Holdings, MVR Investments, LLC and Stephen P. Cherner acquired greater then 78% of our issued and outstanding Common Stock. Clive Ng is the beneficial owner and control person of both Partners and 88 Holdings. These persons and entities now have complete control over the Company’s affairs and finances.

Pursuant to the Exchange Agreement, new directors and executive officers of the Company and its subsidiaries have been appointed and Mark L. Baum and James B. Panther, II, our sole directors and officers prior to the Closing Date, resigned as officers and directors.

Additional information relating to the business being acquired and to such officers and directors, their share ownership and relation to the Company, is set forth in Items 1.01, 2.01 and 3.01 above and Item 5.02 below, and is incorporated herein by reference.

Despite the change of control, we are still a “shell” company and have nominal or no operations as of the Share Exchange.

No assurance can be made that we will be able to mark our second payment for the business acquisition of Jinan Broadband.

Information relating to the Company’s business and other information required to be provided herein as set forth or incorporated by reference into Item 2.01 above are incorporated by reference herein.

MANAGEMENT

Prior to the Share Exchange, our only two directors and officers were Mark L. Baum, Esq. (our former President and CFO) and James B. Panther, II (our former Secretary) both of which resigned effective as of the Share Exchange.

The officers of the Company immediately after the Share Exchange on January 23, 2007 and as of the date hereof are as follows:

Name of Individual | Age | Position |

| Clive Ng | 45 | President, Chairman of the Board of Directors |

| Yue Pu | 34 | Chief Executive Officer, Director |

| Jiang Bing | 42 | Vice Chairman, Director (Resigned May 18, 2007) |

Clive Ng, Chairman. In 2006, Mr. Ng co-founded 88 Holdings LLC as a management company strategically focused on investing in and growing media companies, primarily in Asia. From 1998 to 2004, he co-founded and was CEO of Pacific Media Plc, a T-commerce company headquartered in Hong Kong (LSE:PCM) and with principal operations in mainland China. From 1992 to 2006, Mr. Ng sat on the Board of Directors for Pacific Media. From 1991 to 1994, he arranged for United International Holdings Inc. (since renamed UnitedGlobalCom, NASDAQ:UCOMA), a US cable company, to enter the Asian market. In 1992, he co-founded TVB Superchannel Europe, a Chinese language broadcaster in Europe. In addition, from 1999 to 2002, Mr. Ng was Chairman and founder of Asiacontent (NASDAQ:IASIA), one of the first Asian internet companies to list in the US and was part of a joint venture consisting of NBCi, MTVi, C-NET, CBS Sportsline and DoubleClick in Asia. In 1998, Mr. Ng was one of the initial investors and founder of E*TRADE Asia, a partnership with E*TRADE Financial Corp (NYSE: ET). In 1999, Mr. Ng was also a founding shareholder of MTV Japan, with H&Q Asia Pacific and MTV Networks (a division of Viacom Inc).

Pu Yue , Chief Executive Officer. Mr. Pu Yue carries with him more than a decade of Chinese media industry experience spanning across publishing, Internet and TV sectors. From 2005 to 2006, Mr. Pu was with China Media Networks, the TV media arm of HC International, as BD director, before starting up Jinan Broadband in 2006. From 2003 to 2005, Mr. Pu was with Outlook Weekly of Xinhua News Agency as a strategic advisor and BD director, facilitating China's leading national news week to launch a new weekly magazine entitled “Oriental Weekly” under its portfolio. From 1999 to 2000, he was BD Director and a member of the founding team for Macau 5-Star Satellite TV and successfully raised 20 million USD for the Satellite TV venture in 2000. From 1997 to 1999, he joined Economic Daily, and was head of the Internet arm of one of China's most popular business and entrepreneur magazines, where he spearheaded the set-up of 10,000 member readership club on Internet. From 1993 to 1997, Mr. Pu was an intelligence officer with China's National Security Service and a logistics specialist with a joint venture between Crown Cork & Seal and John Swire & Sons in Beijing. Mr. Pu received an MBA from Jones Graduate School of Business of Rice University in 2002 and Bachelor in Law from University of International Relations in China in 1993.

Mr. Jiang Bing, Vice Chairman. Mr. Bing has over 20 years of technical and operation experience in radio & broadcasting and cable network industry. Mr. Bing is currently and has since early 2006 been, Chairman of Jinan Municipal Cable Network Co. Ltd., the largest municipal cable operator in the Shandong, which doubled its net profit in the first three quarters since the start of his tenure. Mr. Jiang Bing is also Chairman of Jinan Jia He Digital TV Company. Presently, and since 1997, Mr. Bing was an executive officer of Jinan Radio & Television Broadcasting Cable Network. Between 1992 and 1997 Mr. Bing held various positions with Jinan Cable TV Network where he eventually was appointed as deputy chief. Mr. Jiang Bing started his career as a maintenance engineer at Jinan Automobile Company. Mr. Bing has resigned from all positions with the Company as of May 18, 2007 for personal reasons.

Audit Committee

Because we are not an issuer listed on a national securities exchange or listed in an automated inter-dealer quotation system of a national securities association, we are not required to have an audit committee. Although we hope to have an audit committee established at some time in the near future, we have not done so yet.

Since we have not established such a committee, we have not identified any member of such a committee as a financial expert.

Family Relationships

None.

Involvement in Certain Legal Proceedings.

No officer or director of the Company has, during the last five years: (i) been convicted in or is currently subject to a pending a criminal proceeding; (ii) been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to any federal or state securities or banking laws including, without limitation, in any way limiting involvement in any business activity, or finding any violation with respect to such law, nor (iii) has any bankruptcy petition been filed by or against the business of which such person was an executive officer or a general partner, whether at the time of the bankruptcy of for the two years prior thereto.

Compliance with Section 16(a) of the Exchange Act

Section 16(a) of the Exchange Act requires our directors and executive officers, and persons who beneficially own more than 10% of a registered class of our equity securities, to report their initial beneficial ownership and any subsequent changes in that beneficial ownership of our securities to the Commission. Directors, executive officers and beneficial owners of more than 10% of our Company’s common stock are required by SEC regulations to furnish us with copies of all Section 16(a) forms that they file. Messers. Ng, Bing and Pu have all filed a Form 3 relating to the foregoing transaction subsequent to the requisite filing date.

Code of Ethics

To date, we have not adopted a Code of Ethics as described in Item 406 of Regulation S-B. Given our recent Acquisition, we have not yet had the opportunity to adopt a code of ethics. However, we intend to adopt a code of ethics as soon as practicable.

EXECUTIVE COMPENSATION

We currently have an employment agreement in place with Mr. Ng, Mr. Yue Pu and Mr. Jiang as described in Item 1.01 above, the provisions of which are incorporated herein. However, Mr. Ng and Mr. Pu have agreed to defer compensation until the closing of a financing transaction with gross proceeds of $5,000,000 or over.

We believe that we have executed the Share Exchange and all of the related transactions set forth above on terms no less favorable to us than we could have obtained from unaffiliated third parties on an arms-length transaction. Additionally, all of the foregoing transactions have been approved by both a majority of the board and a majority of disinterested directors. It is our intention to ensure that all future transactions including loans or any other transactions or commitments between us, our officers and directors and their affiliates are approved by a majority of the board of disinterested board members, and are on terms obtained at an arms-length transactions that are no less favorable to us than we could obtain from unaffiliated third parties. Moreover, it is our intention to obtain estimates from unaffiliated third parties for similar goods or services to ascertain whether such transactions with affiliates are on terms that are no less favorable to us than are otherwise available from unaffiliated third parties.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In October of 2006 we entered into a letter of intent to acquire all of the shares of China Broadband Cayman. Prior to such time none of the Broadband Shareholders as principals of China Broadband Cayman, had any affiliation with the Company or its affiliates.

Pursuant to the Share Exchange Agreement, we have acquired China Broadband Cayman on January 23, 2007 in exchange for, among other things, (i) 3,582,753 shares of Common Stock to 88 Holdings, Inc., and 31,000,000 shares of Common Stock to Partners, both of which are entities owned or controlled by Mr. Clive Ng, 1,900,000 shares of Common Stock to Stephen P. Cherner and 1,382,753 shares of Common Stock to MVR Investment, LLC and (ii) assumption by us of $325,000 7% Convertible Promissory Notes which by their terms were convertible into 2.6% of the outstanding common stock of the Company (1,300,0000, based on 50,000,000 shares outstanding). Additionally, Maxim Financial Corporation has also acquired 300,000 shares of Common Stock from an entity owned by our existing director and shareholder prior to the Share Exchange, Mark L. Baum.

Our acquisition of China Broadband Cayman was negotiated on an arms length basis between the principals of China Broadband Cayman and our principal officer and director, Mr. Baum. There was no relationship between the parties prior to such transaction.

Consulting Agreement with Maxim Financial Corporation

Prior to the Share Exchange, the formation and operations of China Broadband Cayman, including the expenses relating to our acquisition in China, were funded by Maxim Financial Corporation, Boulder Colorado (“Maxim Financial”), which is one of the principal Broadband Shareholders, Stephen P. Cherner, prior to the Share Exchange. Maxim Financial and its principals own an aggregate of 2,200,000 shares of common stock of which 1,900,000 were received as a result of the Share Exchange, and 200,000 Offering Shares and 100,000 Warrants were acquired in the November 2006 Offering at the same price and terms as provided to all other investors. Since July of 2006 and through the closing date on January 23, 2007, Maxim Financial Corporation has paid the following expenses on our behalf:

| | · | Maxim has covered the costs for two employees for purposes of providing administrative and accounting services for China Broadband Cayman, |

| | · | Maxim has provided lease space, for 1,000 Sq. feet of office and related space at cost, the cost of which will was discharged under the terms of the consulting agreement with Maxim, and which space is still occupied by us, |

| | · | Maxim loaned approximately $50,000 to cover legal, travel and other expenses relating to the Acquisition and related transactions. |

We have also entered into a consulting agreement with Maxim effective as of January 24th, 2007, pursuant to which, among other things:

| | · | Maxim agreed to discharge all of China Broadband Cayman’s debt obligations to it under the office lease since July of 2006 and to enter into a sublease for such space, at cost, rent under which will be waived through December 31, 2007, |

| | · | Maxim agreed to provide consulting and office related services through December 31, 2007, |

| | · | We agreed to reimburse Maxim for all past out of pocket, legal, travel and other expenses relating to the Acquisition, |

| | · | We issued to Maxim 3,974,800 warrants, exercisable at $.60 per share, which expire on March 24, 2009, and agreed to reimburse Maxim Financial for all travel, legal, administrative and related costs relating to our acquisition and financial restructuring activities. |

We believe that the entry into the office lease with Maxim and all transactions entered into with Maxim were at terms no less favorable to us then as otherwise available to us in arm’s length transactions with third parties.

Conflicts of Interest

Certain potential conflicts of interest are inherent in the relationships between our officers and directors of and us.

Conflicts Relating to Officers and Directors

A controlling majority of our shares are owned directly or indirectly by Clive Ng, our Chairman and President. As such, Mr. Ng will have the ability to control our business decisions and appointment or removal of all officers and directors.

From time to time, one or more of our affiliates may form or hold an ownership interest in and/or manage other businesses both related and unrelated to the type of business that we own and operate. These persons expect to continue to form, hold an ownership interest in and/or manage additional other businesses which may compete with ours with respect to operations, including financing and marketing, management time and services and potential customers. These activities may give rise to conflicts between or among the interests of ours and our subsidiaries and Jinan Parent and our and other businesses with which our affiliates are associated. Our affiliates are in no way prohibited from undertaking such activities, and neither we nor our shareholders will have any right to require participation in such other activities.

Further, because we intend to transact business with some of our officers, directors and affiliates, as well as with firms in which some of our officers, directors or affiliates have a material interest, potential conflicts may arise between the respective interests of the Company and China Broadband and these related persons or entities. We believe that such transactions will be effected on terms at least as favorable to us as those available from unrelated third parties.

With respect to transactions involving real or apparent conflicts of interest, we have not adopted any policies and procedures which require that: (i) the fact of the relationship or interest giving rise to the potential conflict be disclosed or known to the directors who authorize or approve the transaction prior to such authorization or approval, (ii) the transaction be approved by a majority of our disinterested outside directors, and (iii) the transaction be fair and reasonable to us at the time it is authorized or approved by our directors.

PRINCIPAL STOCKHOLDERS

The following table sets forth certain information regarding our common stock beneficially owned as of May 18, 2007 for (i) each shareholder we know to be the beneficial owner of 5% or more of our outstanding common stock, (ii) each of our executive officers and directors, and (iii) all executive officers and directors as a group. In general, a person is deemed to be a "beneficial owner" of a security if that person has or shares the power to vote or direct the voting of such security, or the power to dispose or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which the person has the right to acquire beneficial ownership within 60 days. To the best of our knowledge, subject to community and martial property laws, all persons named have sole voting and investment power with respect to such shares, except as otherwise noted. At May 18, 2007, we had 50,048,000 shares of common stock outstanding with 5,114,800 shares issuable upon exercise of warrants at $.60 per share and 4,000,000 shares issuable upon exercise of the common stock purchase warrants.

Name of Beneficial Owner | Amount of Beneficial Ownership(1) | Percent of Beneficial Ownership (1) |

Clive Ng (2) 88 Holdings, Inc. (3) China Broadband Partners, Ltd. (3) | 3,582,753 31,000,000 | 72.1% |

| Jiang Bing (4) | 0 | 0% |

| Pu Yue (5) | 0 | 0% |

| Mark L. Baum, Esq. (6) | 3,000,000 (6) | 5.9% |

| James B. Panther, II | 3,000,000 (6) | 5.9% |

All directors and executive officers | 36,017,753 | 72.1% |

(1) Indicates shares held on the date hereof.

(2) The address of Clive Ng is c/o China Broadband Ltd., 1900 Ninth Street, 3rd Floor, Boulder, Colorado 80302.

(3) Mr. Ng controls and owns 100% beneficial ownership over these entities.

(4) The address of Jiang Bing is No. 32, Jing Shi Yi Road, Jinan, Shandong 250014. Mr. Bing resigned as a director effective as of May 18, 2007.

(5) The address of Pu Yue is Apartment 2001, Bld. 2 , No. 1 Xiangheyman Road, Dongcheng District, Beijing, China 100028.

(6) Indicates shares held by BCGU, LLC which is owned by Mr. Baum and Mr. Panther, our former directors and executive officers, before the closing of the Share Exchange. The address of Mark Baum is c/o 2038 Corte Del Nogal, Suite 110, Carlsbad, California 92011. Share amounts include warrants to purchase 500,000 shares exercisable at $.60 per share issued at the closing of the November 2006 offering, all of which are exercisable within 60 days of the date of the first closing of the offering.

INDEMNIFICATION OF DIRECTORS AND OFFICERS

Pursuant to the provisions of Nevada Revised Statutes, or NRS, 78.7502, every Nevada corporation has authority to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending, or completed action, suit or proceeding, except an action by or in the right of the corporation, by reason of the fact that such person is or was a director, officer, employee, or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee, or agent of another corporation, partnership, joint venture, trust, or other enterprise, against expenses, including attorneys’ fees, judgments, fines, and amounts paid in settlement actually and reasonably incurred in connection with the action, suit, or proceeding if such person acted in good faith and in a manner which such person reasonably believed to be in or not opposed to the best interest of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause or belief his conduct was unlawful.

Pursuant to the provisions of NRS 78.7502, every Nevada corporation also has the authority to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending, or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that such person is or was a director, officer, employee, or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee, or agent of another corporation, partnership, joint venture, trust, or other enterprise against expenses including amounts paid in settlement and attorneys’ fees actually and reasonably incurred by such person in connection with the defense or settlement of the action or suit if such person acted in good faith and in a manner which such person reasonably believed to be in or not opposed to the best interests of the corporation. No indemnification shall be made, however, for any claim, issue or matter as to which a person has been adjudged by a court of competent jurisdiction to be liable to the corporation or for amounts paid in settlement to the corporation, unless and only to the extent that the court determines that in view of all the circumstances, the person is fairly and reasonably entitled to indemnity for such expenses as the court deems proper.

To the extent any person referred to in the two immediately preceding paragraphs is successful on the merits or otherwise in defense of any action, suit, or proceeding, the NRS provides that such person must be indemnified by the corporation against expenses including attorneys’ fees, actually and reasonably incurred by him in connection with the defense.

NRS 78.751 requires the corporation to obtain a determination that any discretionary indemnification is proper under the circumstances. Such a determination must be made by the corporation’s stockholders; its board of directors by majority vote of a quorum consisting of directors who were not parties to the action, suit, or proceeding; or under certain circumstances, by independent legal counsel.

Our certificate of incorporation provides that we shall indemnify our directors and officers to the fullest extent provided by the Nevada corporations law; provided that we may condition the payment of indemnification claims made prior to the final disposition of a proceeding on the officer or director providing us with an undertaking that he or she will reimburse us for all payments advanced if it is ultimately established the officer or director was not entitled to indemnification.

In addition, NRS 78.138.7 provides that directors and officers are not personally liable to the corporation or its stockholders for any damages resulting from their breach of fiduciary duties unless it is proven that the act or omission constituted a breach of fiduciary duty and the breach involved intentional misconduct, fraud, or a knowing violation of law.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We file reports, proxy statements and other information with the Securities and Exchange Commission, or SEC. You may read and copy these reports, proxy statements and other information at the SEC's Public Reference Room at 100 F St., N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the Public Reference Room. The SEC maintains an internet site at http://www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC, including our company. We will provide, at our cost, a copy of our Annual Report on Form 10-KSB upon request of shareholders.

Item 9.01 Financial Statements and Exhibits.

(a) Financial statements of businesses acquired. The following financial information is filed as Exhibit 99.1 to this Current Report and is incorporated herein by reference:

Audited financial statements of China Broadband, Ltd. from August 2, 2006 (inception) to December 31, 2006.

(b) Pro forma financial information. The following pro forma financial information is filed as Exhibit 99.2 to this Current Report and is incorporated herein by reference:

Unaudited pro forma combined financial statements of Alpha Nutra, Inc. and China Broadband, Ltd. for years ended December 31, 2006 and December 31, 2005.

(c) Shell company transactions.

N/A

(d) Exhibits.

The Exhibits to this report are listed in the Index to Exhibits which immediately follows the signature page hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | |

| | CHINA BROADBAND, INC., (f/k/a Alpha Nutra, Inc. ) |

| | |

Date: August 7, 2007 | By: | /s/ Clive Ng |

| |

Principal Financial Officer and Principal Executive Officer |

| | |

INDEX TO EXHIBITS

Exhibits | Description |

| 4.1 | Form of Registration Rights Agreement entered into with Respect to November 2006 Offering. * |

| | |

| 4.2 | Form of Convertible Note issued by China Broadband, Ltd., assumed by Alpha Nutra, Inc. * |

| | |

| 10.1 | Cooperation Agreement, dated as of December 26, 2006, between China Broadband, Ltd, a Cayman Island company and Jinan Guangdian Jiahe Digital Television Co., Ltd. * |

| | |

| 10.2 | Share Exchange Agreement entered into by and among the Company, China Broadband, Ltd., and its shareholders, dated as of January 23, 2007.** |

| | |

| 10.3 | Form of Subscription Agreement, with respect to November 2006 Offering.* |

| | |

| 10.4 | Form of Redeemable Warrant issued to investors in November 2006 Offering.* |

| | |

| 10.5 | Form of Non-Redeemable Consulting Warrant issued to Maxim Financial Corporation, exercisable at $.60 per share. |

| | |

| 10.6 | Employment Agreement entered into between Alpha Nutra, Inc., and Clive Ng., dated as of January 24, 2007. * |

| | |

| 10.7 | Employment Agreement entered into between Alpha Nutra, Inc., and Jiang Bing, dated as of January 24, 2007. * |

| | |

| 10.8 | Employment Agreement entered into between Alpha Nutra, Inc. and Yue Pu, dated as of January 24, 2007. * |

| | |

| 10.9 | Consulting Agreement with Maxim Financial Corporation. *** |

| | |

| 10.10 | Form of 500,000 Share Common Stock Purchase Warrant issued to BCGU, LLC, exercisable at $.60 per share.** |

| | |

| 99.1 | Audited financial statements of China Broadband, Ltd. from August 2, 2006 (inception) to December 31, 2006. |

| | |

| 99.2 | Unaudited Pro Forma Combined Balance Sheets of Alpha Nutra, Inc. and China Broadband, Ltd. as of December 31, 2006 and December 31, 2005 and Unaudited Pro Forma Combined Statements of Operation for years ended December 31, 2006 and December 31, 2005. |

* Previously filed as Exhibit to original filing of Current Report on Form 8-K, date of Report January 23, 2007, as filed on March 20, 2007.

** Previously filed as Exhibit to Annual Report on Form 10-KSB for year ended December 31, 2006.

*** Previously filed as Exhibit to amended filing of Current Report on Form 8-K, date of Report January 23, 2007, as filed on June 4, 2007.