| OMB APPROVAL |

OMB Number: 3235-0570 Expires: January 31, 2014 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05646

(Exact name of registrant as specified in charter)

| 100 William Street, Suite 200 Wellesley, Massachusetts | 02481 |

| (Address of principal executive offices) | (Zip code) |

Nicole M. Tremblay, Esq.

| Weston Financial Group, Inc. 100 William Street, Suite 200 Wellesley, MA 02481 |

(Name and address of agent for service)

Registrant's telephone number, including area code: (781) 235-7055

Date of fiscal year end: October 31, 2012

Date of reporting period: April 30, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

| New Century Capital New Century Balanced New Century Opportunistic New Century International New Century Alternative Strategies

SEMI-ANNUAL REPORT Six Months Ended April 30, 2012 (Unaudited) |

| 100 William Street, Suite 200, Wellesley MA 02481 | 781-239-0445 | 888-639-0102 | Fax 781-237-1635 |

CONTENTS

| LETTER TO SHAREHOLDERS | 2-3 |

| | |

| NEW CENTURY PORTFOLIOS | |

| New Century Capital Portfolio | |

| Portfolio Information | 4 |

| Schedule of Investments | 5-6 |

| New Century Balanced Portfolio | |

| Portfolio Information | 7 |

| Schedule of Investments | 8-9 |

| New Century Opportunistic Portfolio | |

| Portfolio Information | 10 |

| Schedule of Investments | 11-12 |

| New Century International Portfolio | |

| Portfolio Information | 13 |

| Schedule of Investments | 14-15 |

| New Century Alternative Strategies Portfolio | |

| Portfolio Information | 16 |

| Schedule of Investments | 17-18 |

| Statements of Assets and Liabilities | 19 |

| Statements of Operations | 20 |

| Statements of Changes in Net Assets | 21-23 |

| Financial Highlights | 24-28 |

| Notes to Financial Statements | 29-38 |

| About Your Portfolios’ Expenses | 39-41 |

Dear Fellow Shareholders:

I am pleased to present our Semi-Annual Report for the six-month period ended April 30, 2012. This Report presents important financial information for each of the New Century Portfolios. I also invite you to visit our website at www.newcenturyportfolios.com for additional information.

Over the six-month period ended April 30, 2012, U.S. markets experienced a strong rally, with a modest decline during the latter part of April. In fact, the first quarter of 2012 represented the largest quarterly rally in almost three years. Improved labor markets, increases in consumer spending, and strong corporate profits resulted in positive news for the U.S. International markets, however, remain a focus. Concerns about Europe are increasing once again as several European economies face the challenges of managing excessive debt and implementing austerity measures, while continuing to promote growth.

In New Century’s Annual Report dated October 31, 2011, we outlined a litany of global economic and political issues as major headwinds that we believe created volatility in the markets. Since then, very few of those issues have been resolved, and volatility remains. The last two months of 2011 and the first calendar quarter of 2012 saw volatility pick up, albeit on the positive side, after the downward slide experienced in mid-2011. In the face of these headwinds, the Portfolios are positioned with the current economic and political question marks as a backdrop to our diversified allocation approach. For instance, we continue to follow the uncertainty of the countries in the European Union. Given the lack of a clear agreed-upon solution in Europe, our preference is to invest more heavily in the United States, or in Emerging Market economies that continue to offer stronger growth rates while maintaining the ability to control inflation or other concerns via their central banks. Regarding domestic investments, we continue to favor Large-Cap companies that have a global footprint. Large-Cap companies are currently holding record levels of cash, and many continue to pay attractive dividends, which may reduce volatility and cushion returns in the face of exogenous market events. Below is a summary of each Portfolios’ performance and an overview of each Portfolio’s market positioning based on our current thematic views.

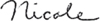

During the six-month period ended April 30, 2012, New Century Capital Portfolio reduced its allocation to both the Utilities and Natural Resource sectors in favor of Diversified Large-Cap Markets. During the period, New Century Capital Portfolio gained 9.75% as compared to the S&P 500® Composite Index which gained 12.77%.

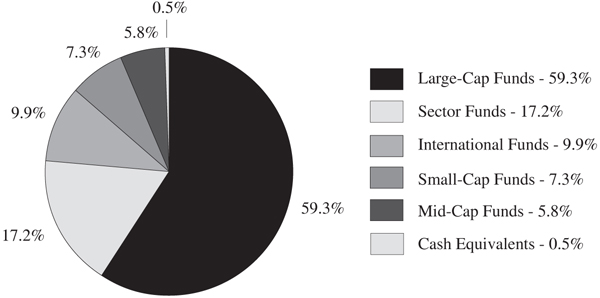

Over the same six-month period, New Century Balanced Portfolio gradually increased its equity allocation to approximately 60%, while reducing the fixed income allocation to approximately 40%. Within the fixed income allocation, the Portfolio decreased its allocation to Foreign, U.S. Government, and Corporate Bonds while increasing its allocation to the High-Yield Bond sector and Large-Cap equities sector. The Portfolio also reduced its allocation to Utilities. During the period, New Century Balanced Portfolio gained 6.53%, as compared to the 12.77% gain by the S&P 500® Composite Index and 2.08% gain by the Barclays Intermediate Government/Credit Index.

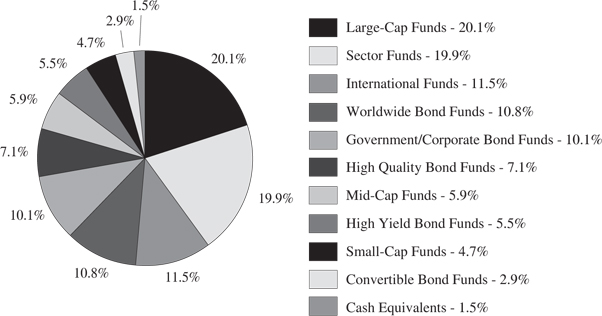

New Century Opportunistic Portfolio reduced its exposure to the Natural Resources and the Mid-Cap equity sectors and increased its allocation to Large-Cap equities sector. During the six-month period ended April 30, 2012, New Century Opportunistic Portfolio gained 10.11% as compared to the Russell 3000 Growth Index which gained 13.86%.

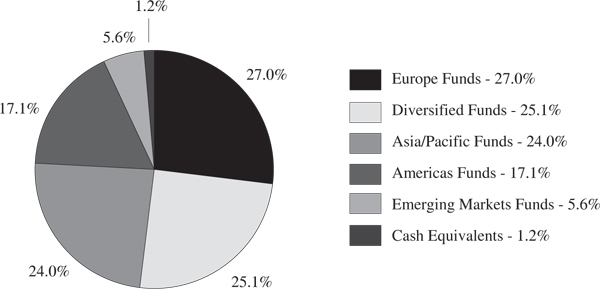

New Century International Portfolio slightly reduced its allocation to the Americas, European and Global Energy sectors. The Portfolio continues to monitor its thematic long-term allocations which include exposure to Natural Resources and Emerging Markets. During the six-month period ended April 30, 2012, both the U.S. and Emerging Markets outperformed the Developed Foreign Markets. In the Portfolio’s European allocation, we have been favoring core European economies and countries outside of the Euro Zone. During the period, New Century International Portfolio gained 4.07%, while the International Equity Markets, as measured by the MSCI EAFE Index, gained 2.44%.

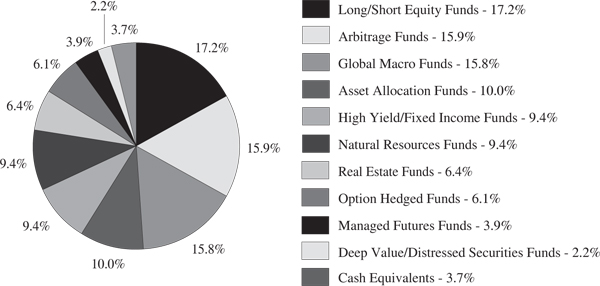

During the six-month period ended April 30, 2012, New Century Alternative Strategies Portfolio maintained diversified positions in ten distinct investment categories. The Portfolio reduced its exposure to the Asset Allocation and Global Macro categories. The Portfolio increased its cash and High-Yield allocations. New Century Alternative Strategies Portfolio gained 4.49% during the period, as compared to the Barclays Intermediate Government/Credit Index, which gained 2.08%, and the S&P 500® Composite Index which gained 12.77%.

While future performance is always unpredictable, we believe that New Century’s investment philosophy - diversification, risk assessment and long-term focus - will maximize risk-adjusted returns.

New Century is committed to its shareholders and appreciates your selecting New Century as part of your long-term investment strategy.

Sincerely,

|  |  |

| Nicole M. Tremblay President, CEO | Wayne M. Grzecki Portfolio Manager | Ronald A. Sugameli Portfolio Manager |

|  |

Susan K. Arnold Portfolio Manager | Andre M. Fernandes Portfolio Manager |

Investors should take into consideration the investment objectives, risks, charges and expenses of the New Century Portfolios carefully before investing. The prospectus contains these details and other information and should be read carefully before investing. Principal value of an investment will fluctuate and shares when redeemed may be worth more or less than your original investment. Past performance is not indicative of future results. Portfolio and opinions expressed herein are subject to change.

NEW CENTURY CAPITAL PORTFOLIO PORTFOLIO INFORMATION April 30, 2012 (Unaudited) |

Asset Allocation (% of Net Assets) |

| Top Ten Long-Term Holdings |

| Security Description | | % of Net Assets |

| Wells Fargo Advantage Growth Fund - Administrator Class | | 7.5% |

| iShares Dow Jones U.S. Energy Sector Index Fund | | 6.9% |

| iShares S&P 500 Growth Index Fund | | 6.6% |

| iShares S&P 500 Index Fund | | 6.4% |

| MFS Growth Fund - Class I | | 6.2% |

| Vanguard Dividend Growth Fund - Investor Shares | | 6.1% |

| Vanguard 500 Index Fund - Investor Shares | | 4.7% |

| iShares S&P SmallCap 600 Growth Index Fund | | 4.2% |

| iShares Russell 1000 Index Fund | | 3.3% |

| Fidelity Select Utilities Growth Portfolio | | 3.3% |

NEW CENTURY CAPITAL PORTFOLIO SCHEDULE OF INVESTMENTS April 30, 2012 (Unaudited) |

INVESTMENT COMPANIES — 99.5% | | | | | | |

| Large-Cap Funds — 59.3% | | | | | | |

| Amana Trust Income Fund | | | 27,265 | | | $ | 920,465 | |

| American Funds AMCAP Fund - Class A | | | 138,376 | | | | 2,939,111 | |

| BlackRock Equity Dividend Fund - Institutional Shares | | | 112,986 | | | | 2,219,039 | |

| Columbia Dividend Opportunity Fund - Class A | | | 276,084 | | | | 2,377,084 | |

| Gabelli Asset Fund (The) - Class I Shares | | | 45,334 | | | | 2,354,654 | |

iShares Russell 1000 Index Fund (a) | | | 40,000 | | | | 3,100,800 | |

iShares Russell 1000 Value Index Fund (a) | | | 14,800 | | | | 1,026,972 | |

iShares S&P 500 Growth Index Fund (a) | | | 80,900 | | | | 6,095,006 | |

iShares S&P 500 Index Fund (a) | | | 42,350 | | | | 5,940,858 | |

iShares S&P 500 Value Index Fund (a) | | | 44,300 | | | | 2,838,301 | |

MFS Growth Fund - Class I (b) | | | 116,126 | | | | 5,764,514 | |

Morgan Stanley Institutional Opportunity Portfolio - Class P (b) | | | 138,408 | | | | 2,430,451 | |

| Vanguard 500 Index Fund - Investor Shares | | | 33,811 | | | | 4,359,866 | |

| Vanguard Dividend Growth Fund - Investor Shares | | | 342,100 | | | | 5,678,854 | |

Wells Fargo Advantage Growth Fund - Administrator Class (b) | | | 162,934 | | | | 6,962,185 | |

| | | | | | | | 55,008,160 | |

| Sector Funds — 17.2% | | | | | | | | |

Fidelity Select Health Care Portfolio (b) | | | 18,480 | | | | 2,475,169 | |

| Fidelity Select Utilities Growth Portfolio | | | 55,510 | | | | 3,083,029 | |

iShares Dow Jones U.S. Energy Sector Index Fund (a) | | | 156,200 | | | | 6,405,762 | |

iShares S&P North American Natural Resources Index Fund (a) | | | 19,100 | | | | 741,462 | |

PowerShares Dynamic Pharmaceuticals Portfolio (a) | | | 59,300 | | | | 1,896,414 | |

SPDR Gold Trust (a) (b) (c) | | | 8,000 | | | | 1,295,040 | |

| | | | | | | | 15,896,876 | |

| International Funds — 9.9% | | | | | | | | |

| Aberdeen Emerging Markets Institutional Fund - Institutional Class | | | 122,255 | | | | 1,777,587 | |

| First Eagle Global Fund - Class A | | | 12,868 | | | | 621,251 | |

| Harding, Loevner International Equity Portfolio - Institutional Class | | | 128,016 | | | | 1,888,242 | |

iShares MSCI EAFE Index Fund (a) | | | 30,500 | | | | 1,639,375 | |

iShares MSCI Emerging Markets Index Fund (a) | | | 40,900 | | | | 1,725,980 | |

| Oppenheimer International Growth Fund - Class Y | | | 53,481 | | | | 1,540,263 | |

| | | | | | | | 9,192,698 | |

| Small-Cap Funds — 7.3% | | | | | | | | |

iShares S&P SmallCap 600 Growth Index Fund (a) | | | 47,200 | | | | 3,865,208 | |

iShares S&P SmallCap 600 Value Index Fund (a) | | | 37,500 | | | | 2,890,125 | |

| | | | | | | | 6,755,333 | |

See accompanying notes to financial statements.

NEW CENTURY CAPITAL PORTFOLIO SCHEDULE OF INVESTMENTS (Continued) |

INVESTMENT COMPANIES — 99.5% (Continued) | | | | | | |

| Mid-Cap Funds — 5.8% | | | | | | |

iShares S&P MidCap 400 Growth Index Fund (a) | | | 12,600 | | | $ | 1,414,728 | |

iShares S&P MidCap 400 Value Index Fund (a) | | | 31,600 | | | | 2,687,580 | |

SPDR S&P MidCap 400 ETF Trust (a) | | | 7,200 | | | | 1,297,440 | |

| | | | | | | | 5,399,748 | |

| | | | | | | | | |

Total Investment Companies (Cost $68,060,919) | | | | | | $ | 92,252,815 | |

MONEY MARKET FUNDS — 0.6% | | | | | | |

Invesco STIT-STIC Prime Portfolio (The) - Institutional Class, 0.00% (d) (Cost $530,203) | | | 530,203 | | | $ | 530,203 | |

| | | | | | | | | |

Total Investments at Value — 100.1% (Cost $68,591,122) | | | | | | $ | 92,783,018 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (0.1%) | | | | | | | (92,697 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 92,690,321 | |

| (a) | Exchange-traded fund. |

| | |

| (b) | Non-income producing security. |

| | |

| (c) | For federal income tax purposes, structured as a grantor trust. |

| | |

| (d) | Variable rate security. The rate shown is the 7-day effective yield as of April 30, 2012. |

See accompanying notes to financial statements.

NEW CENTURY BALANCED PORTFOLIO PORTFOLIO INFORMATION April 30, 2012 (Unaudited) |

Asset Allocation (% of Net Assets) |

| Top Ten Long-Term Holdings |

| Security Description | | % of Net Assets |

| Templeton Global Bond Fund - Class A | | 8.4% |

| Loomis Sayles Bond Fund - Institutional Class | | 7.2% |

| First Eagle Global Fund - Class A | | 6.5% |

| iShares S&P 500 Index Fund | | 5.9% |

| Loomis Sayles Institutional High Income Fund | | 5.5% |

| American Funds AMCAP Fund - Class A | | 5.4% |

| iShares Dow Jones U.S. Energy Sector Index Fund | | 5.4% |

| Dodge & Cox Income Fund | | 5.2% |

| Harding, Loevner International Equity Portfolio - Institutional Class | | 5.0% |

| SPDR S&P MidCap 400 ETF Trust | | 4.8% |

NEW CENTURY BALANCED PORTFOLIO SCHEDULE OF INVESTMENTS April 30, 2012 (Unaudited) |

INVESTMENT COMPANIES — 98.5% | | | | | | |

| Large-Cap Funds — 20.1% | | | | | | |

| American Funds AMCAP Fund - Class A | | | 173,046 | | | $ | 3,675,490 | |

iShares Russell 1000 Growth Index Fund (a) | | | 19,600 | | | | 1,293,600 | |

iShares Russell 1000 Value Index Fund (a) | | | 20,300 | | | | 1,408,617 | |

iShares S&P 500 Index Fund (a) | | | 28,300 | | | | 3,969,924 | |

Vanguard Dividend Appreciation ETF (a) | | | 14,500 | | | | 846,075 | |

Wells Fargo Advantage Growth Fund - Investor Class (b) | | | 59,739 | | | | 2,429,001 | |

| | | | | | | | 13,622,707 | |

| Sector Funds — 19.9% | | | | | | | | |

Consumer Staples Select Sector SPDR Fund (a) | | | 76,300 | | | | 2,607,171 | |

Fidelity Select Health Care Portfolio (b) | | | 6,525 | | | | 873,935 | |

| Fidelity Select Utilities Growth Portfolio | | | 26,852 | | | | 1,491,343 | |

iShares Dow Jones U.S. Energy Sector Index Fund (a) | | | 89,100 | | | | 3,653,991 | |

iShares S&P North American Natural Resources Index Fund (a) | | | 31,800 | | | | 1,234,476 | |

PowerShares Dynamic Food & Beverage Portfolio (a) | | | 72,700 | | | | 1,438,006 | |

PowerShares Dynamic Pharmaceuticals Portfolio (a) | | | 40,100 | | | | 1,282,398 | |

SPDR Gold Trust (a) (b) (c) | | | 5,300 | | | | 857,964 | |

| | | | | | | | 13,439,284 | |

| International Funds — 11.5% | | | | | | | | |

| First Eagle Global Fund - Class A | | | 91,530 | | | | 4,419,087 | |

| Harding, Loevner International Equity Portfolio - Institutional Class | | | 229,733 | | | | 3,388,559 | |

| | | | | | | | 7,807,646 | |

| Worldwide Bond Funds — 10.8% | | | | | | | | |

| Loomis Sayles Global Bond Fund - Institutional Class | | | 96,357 | | | | 1,636,136 | |

| Templeton Global Bond Fund - Class A | | | 431,592 | | | | 5,653,854 | |

| | | | | | | | 7,289,990 | |

| Government/Corporate Bond Funds — 10.1% | | | | | | | | |

| Loomis Sayles Bond Fund - Institutional Class | | | 331,148 | | | | 4,871,187 | |

| Vanguard Intermediate-Term Investment-Grade Fund - Admiral Shares | | | 190,101 | | | | 1,933,326 | |

| | | | | | | | 6,804,513 | |

| High Quality Bond Funds — 7.1% | | | | | | | | |

| Calvert Bond Portfolio - Class I | | | 80,147 | | | | 1,283,952 | |

| Dodge & Cox Income Fund | | | 257,700 | | | | 3,520,179 | |

| | | | | | | | 4,804,131 | |

| Mid-Cap Funds — 5.9% | | | | | | | | |

iShares S&P MidCap 400 Value Index Fund (a) | | | 9,000 | | | | 765,450 | |

SPDR S&P MidCap 400 ETF Trust (a) | | | 17,980 | | | | 3,239,996 | |

| | | | | | | | 4,005,446 | |

| High Yield Bond Funds — 5.5% | | | | | | | | |

| Loomis Sayles Institutional High Income Fund | | | 499,584 | | | | 3,691,922 | |

See accompanying notes to financial statements.

NEW CENTURY BALANCED PORTFOLIO SCHEDULE OF INVESTMENTS (Continued) |

INVESTMENT COMPANIES — 98.5% (Continued) | | | | | | |

| Small-Cap Funds — 4.7% | | | | | | |

iShares S&P SmallCap 600 Growth Index Fund (a) | | | 22,500 | | | $ | 1,842,525 | |

iShares S&P SmallCap 600 Value Index Fund (a) | | | 17,200 | | | | 1,325,604 | |

| | | | | | | | 3,168,129 | |

| Convertible Bond Funds — 2.9% | | | | | | | | |

| Allianz AGIC Convertible Fund - Institutional Shares | | | 35,540 | | | | 985,873 | |

| Calamos Convertible Fund - Class I | | | 60,948 | | | | 1,008,088 | |

| | | | | | | | 1,993,961 | |

| | | | | | | | | |

Total Investment Companies (Cost $54,229,684) | | | | | | $ | 66,627,729 | |

MONEY MARKET FUNDS — 1.6% | | | | | | |

Invesco STIT-STIC Prime Portfolio (The) - Institutional Class, 0.00% (d) (Cost $1,074,208) | | | 1,074,208 | | | $ | 1,074,208 | |

| | | | | | | | | |

Total Investments at Value — 100.1% (Cost $55,303,892) | | | | | | $ | 67,701,937 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (0.1%) | | | | | | | (82,791 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 67,619,146 | |

| (a) | Exchange-traded fund. |

| | |

| (b) | Non-income producing security. |

| | |

| (c) | For federal income tax purposes, structured as a grantor trust. |

| | |

| (d) | Variable rate security. The rate shown is the 7-day effective yield as of April 30, 2012. |

See accompanying notes to financial statements.

NEW CENTURY OPPORTUNISTIC PORTFOLIO PORTFOLIO INFORMATION April 30, 2012 (Unaudited) |

Asset Allocation (% of Net Assets) |

| Top Ten Long-Term Holdings |

| Security Description | | % of Net Assets |

| iShares S&P 500 Growth Index Fund | | 14.6% |

| Wells Fargo Advantage Growth Fund - Administrator Class | | 12.8% |

| Technology Select Sector SPDR Fund | | 8.8% |

| iShares MSCI Emerging Markets Index Fund | | 8.5% |

| iShares S&P 500 Value Index Fund | | 7.3% |

| Brown Advisory Growth Equity Fund - Institutional Shares | | 6.9% |

| SPDR S&P MidCap 400 ETF Trust | | 5.6% |

| iShares S&P North American Natural Resources Index Fund | | 4.8% |

| Vanguard Growth ETF | | 3.9% |

| Oppenheimer Developing Markets Fund - Class Y Shares | | 3.8% |

NEW CENTURY OPPORTUNISTIC PORTFOLIO SCHEDULE OF INVESTMENTS April 30, 2012 (Unaudited) |

INVESTMENT COMPANIES — 97.3% | | | | | | |

| Large-Cap Funds — 45.5% | | | | | | |

Brown Advisory Growth Equity Fund - Institutional Shares (b) | | | 67,658 | | | $ | 1,007,434 | |

iShares S&P 500 Growth Index Fund (a) | | | 28,200 | | | | 2,124,588 | |

iShares S&P 500 Value Index Fund (a) | | | 16,500 | | | | 1,057,155 | |

Vanguard Growth ETF (a) | | | 8,000 | | | | 566,080 | |

Wells Fargo Advantage Growth Fund - Administrator Class (b) | | | 43,314 | | | | 1,850,798 | |

| | | | | | | | 6,606,055 | |

| Sector Funds — 24.3% | | | | | | | | |

Fidelity Select Health Care Portfolio (b) | | | 2,813 | | | | 376,816 | |

iShares Dow Jones U.S. Energy Sector Index Fund (a) | | | 13,200 | | | | 541,332 | |

iShares S&P North American Natural Resources Index Fund (a) | | | 18,100 | | | | 702,642 | |

PowerShares Dynamic Pharmaceuticals Portfolio (a) | | | 14,700 | | | | 470,106 | |

SPDR Gold Trust (a) (b) (c) | | | 1,000 | | | | 161,880 | |

Technology Select Sector SPDR Fund (a) | | | 42,800 | | | | 1,275,440 | |

| | | | | | | | 3,528,216 | |

| International Funds — 13.4% | | | | | | | | |

| Harding, Loevner International Equity Portfolio - Institutional Class | | | 11,052 | | | | 163,014 | |

iShares MSCI Emerging Markets Index Fund (a) | | | 29,300 | | | | 1,236,460 | |

| Oppenheimer Developing Markets Fund - Class Y Shares | | | 16,672 | | | | 551,181 | |

| | | | | | | | 1,950,655 | |

| Mid-Cap Funds — 9.2% | | | | | | | | |

| Meridian Growth Fund | | | 11,136 | | | | 522,489 | |

SPDR S&P MidCap 400 ETF Trust (a) | | | 4,502 | | | | 811,261 | |

| | | | | | | | 1,333,750 | |

| Small-Cap Funds — 4.9% | | | | | | | | |

| Gabelli Small Cap Growth Fund (The) - Class I | | | 13,431 | | | | 473,699 | |

iShares S&P SmallCap 600 Growth Index Fund (a) | | | 2,900 | | | | 237,481 | |

| | | | | | | | 711,180 | |

| | | | | | | | | |

Total Investment Companies (Cost $10,735,728) | | | | | | $ | 14,129,856 | |

See accompanying notes to financial statements.

NEW CENTURY OPPORTUNISTIC PORTFOLIO SCHEDULE OF INVESTMENTS (Continued) |

MONEY MARKET FUNDS — 2.6% | | | | | | |

Invesco STIT-STIC Prime Portfolio (The) - Institutional Class, 0.00% (d) (Cost $374,936) | | | 374,936 | | | $ | 374,936 | |

| | | | | | | | | |

Total Investments at Value — 99.9% (Cost $11,110,664) | | | | | | $ | 14,504,792 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.1% | | | | | | | 17,080 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 14,521,872 | |

| (a) | Exchange-traded fund. |

| | |

| (b) | Non-income producing security. |

| | |

| (c) | For federal income tax purposes, structured as a grantor trust. |

| | |

| (d) | Variable rate security. The rate shown is the 7-day effective yield as of April 30, 2012. |

See accompanying notes to financial statements.

NEW CENTURY INTERNATIONAL PORTFOLIO PORTFOLIO INFORMATION April 30, 2012 (Unaudited) |

Asset Allocation (% of Net Assets) |

| Top Ten Long-Term Holdings |

| Security Description | | % of Net Assets |

| iShares MSCI Germany Index Fund | | 5.6% |

| iShares S&P Latin America 40 Index Fund | | 5.4% |

| Matthews Pacific Tiger Fund - Class I | | 5.3% |

| Harding, Loevner International Equity Portfolio - Institutional Class | | 5.1% |

| iShares MSCI Canada Index Fund | | 4.5% |

| iShares MSCI United Kingdom Index Fund | | 4.5% |

| ProShares Ultra MSCI Japan | | 4.5% |

| iShares S&P Global Energy Sector Index Fund | | 4.4% |

| Fidelity Canada Fund | | 4.4% |

| iShares MSCI Switzerland Index Fund | | 4.3% |

NEW CENTURY INTERNATIONAL PORTFOLIO SCHEDULE OF INVESTMENTS April 30, 2012 (Unaudited) |

INVESTMENT COMPANIES — 98.8% | | | | | | |

| Europe Funds — 27.0% | | | | | | |

| Columbia European Equity Fund - Class A | | | 188,476 | | | $ | 1,093,162 | |

| Franklin Mutual European Fund - Class A | | | 118,098 | | | | 2,332,429 | |

iShares MSCI Germany Index Fund (a) | | | 152,000 | | | | 3,426,080 | |

iShares MSCI Sweden Index Fund (a) | | | 58,000 | | | | 1,643,140 | |

iShares MSCI Switzerland Index Fund (a) | | | 105,600 | | | | 2,620,992 | |

iShares MSCI United Kingdom Index Fund (a) | | | 156,546 | | | | 2,747,382 | |

Vanguard MSCI Europe ETF (a) | | | 57,700 | | | | 2,593,038 | |

| | | | | | | | 16,456,223 | |

| Diversified Funds — 25.1% | | | | | | | | |

| Columbia Acorn International Select Fund - Class A | | | 59,974 | | | | 1,649,877 | |

| Harding, Loevner International Equity Portfolio - Institutional Class | | | 212,227 | | | | 3,130,344 | |

iShares MSCI EAFE Growth Index Fund (a) | | | 20,200 | | | | 1,170,590 | |

iShares MSCI EAFE Index Fund (a) | | | 17,500 | | | | 940,625 | |

iShares MSCI EAFE Value Index Fund (a) | | | 21,600 | | | | 981,720 | |

iShares S&P Global Energy Sector Index Fund (a) | | | 68,700 | | | | 2,699,223 | |

iShares S&P Global Infrastructure Index Fund (a) | | | 26,200 | | | | 930,624 | |

iShares S&P Global Materials Sector Index Fund (a) | | | 19,100 | | | | 1,185,728 | |

| Oppenheimer International Growth Fund - Class Y | | | 26,606 | | | | 766,241 | |

| Templeton Institutional Funds - Foreign Smaller Companies Series | | | 101,459 | | | | 1,791,761 | |

| | | | | | | | 15,246,733 | |

| Asia/Pacific Funds — 24.0% | | | | | | | | |

| Fidelity Japan Fund | | | 161,007 | | | | 1,598,801 | |

iShares FTSE/Xinhua China 25 Index Fund (a) | | | 61,500 | | | | 2,332,695 | |

iShares MSCI Australia Index Fund (a) | | | 105,800 | | | | 2,522,272 | |

iShares MSCI Pacific ex-Japan Index Fund (a) | | | 49,700 | | | | 2,191,770 | |

| Matthews Pacific Tiger Fund - Class I | | | 143,625 | | | | 3,231,567 | |

ProShares Ultra MSCI Japan (a) (b) | | | 46,300 | | | | 2,731,700 | |

| | | | | | | | 14,608,805 | |

| Americas Funds — 17.1% | | | | | | | | |

| Fidelity Canada Fund | | | 50,045 | | | | 2,684,397 | |

iShares MSCI Canada Index Fund (a) | | | 97,600 | | | | 2,767,936 | |

iShares MSCI Mexico Investable Market Index Fund (a) | | | 26,800 | | | | 1,656,776 | |

iShares S&P Latin America 40 Index Fund (a) | | | 72,300 | | | | 3,307,002 | |

| | | | | | | | 10,416,111 | |

| Emerging Markets Funds — 5.6% | | | | | | | | |

iShares MSCI Emerging Markets Index Fund (a) | | | 34,000 | | | | 1,434,800 | |

Vanguard Emerging Markets Stock Index Fund (a) | | | 45,800 | | | | 1,947,874 | |

| | | | | | | | 3,382,674 | |

| | | | | | | | | |

Total Investment Companies (Cost $43,279,977) | | | | | | $ | 60,110,546 | |

See accompanying notes to financial statements.

NEW CENTURY INTERNATIONAL PORTFOLIO SCHEDULE OF INVESTMENTS (Continued) |

MONEY MARKET FUNDS — 1.3% | | | | | | |

Invesco STIT-STIC Prime Portfolio (The) - Institutional Class, 0.00% (c) (Cost $789,411) | | | 789,411 | | | $ | 789,411 | |

| | | | | | | | | |

Total Investments at Value — 100.1% (Cost $44,069,388) | | | | | | $ | 60,899,957 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (0.1%) | | | | | | | (61,394 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 60,838,563 | |

| (a) | Exchange-traded fund. |

| | |

| (b) | Non-income producing security. |

| | |

| (c) | Variable rate security. The rate shown is the 7-day effective yield as of April 30, 2012. |

See accompanying notes to financial statements.

NEW CENTURY ALTERNATIVE STRATEGIES PORTFOLIO PORTFOLIO INFORMATION April 30, 2012 (Unaudited) |

Asset Allocation (% of Net Assets) |

| Top Ten Long-Term Holdings |

| Security Description | | % of Net Assets |

| Marketfield Fund | | 5.8% |

| Calamos Market Neutral Income Fund - Class A | | 5.6% |

| Wasatch Long/Short Fund | | 5.4% |

| First Eagle Global Fund - Class A | | 5.3% |

| FPA Crescent Fund | | 5.3% |

| Merger Fund (The) | | 4.2% |

| BlackRock Global Allocation Fund - Class A | | 4.1% |

| TFS Market Neutral Fund | | 3.9% |

| Arbitrage Fund - Class I | | 3.8% |

| Templeton Global Bond Fund - Class A | | 3.8% |

NEW CENTURY ALTERNATIVE STRATEGIES PORTFOLIO SCHEDULE OF INVESTMENTS April 30, 2012 (Unaudited) |

INVESTMENT COMPANIES — 96.3% | | | | | | |

| Long/Short Equity Funds — 17.2% | | | | | | |

Marketfield Fund (b) | | | 455,061 | | | $ | 6,889,622 | |

| TFS Market Neutral Fund | | | 308,079 | | | | 4,645,836 | |

| Wasatch Long/Short Fund | | | 469,247 | | | | 6,367,684 | |

Weitz Partners III Opportunity Fund - Institutional Class (b) | | | 195,162 | | | | 2,523,443 | |

| | | | | | | | 20,426,585 | |

| Arbitrage Funds — 15.9% | | | | | | | | |

| Arbitrage Fund - Class I | | | 342,821 | | | | 4,501,245 | |

| Calamos Market Neutral Income Fund - Class A | | | 533,896 | | | | 6,716,407 | |

| Merger Fund (The) | | | 312,385 | | | | 4,938,811 | |

| Touchstone Merger Arbitrage Fund - Institutional Shares | | | 263,153 | | | | 2,789,426 | |

| | | | | | | | 18,945,889 | |

| Global Macro Funds — 15.8% | | | | | | | | |

| BlackRock Global Allocation Fund - Class A | | | 251,152 | | | | 4,869,828 | |

| First Eagle Global Fund - Class A | | | 131,304 | | | | 6,339,380 | |

| Ivy Asset Strategy Fund - Class A | | | 169,999 | | | | 4,365,569 | |

| Mutual Global Discovery Fund - Class Z | | | 108,610 | | | | 3,187,715 | |

| | | | | | | | 18,762,492 | |

| Asset Allocation Funds — 10.0% | | | | | | | | |

| Berwyn Income Fund | | | 317,772 | | | | 4,242,256 | |

| FPA Crescent Fund | | | 222,128 | | | | 6,317,334 | |

| Greenspring Fund | | | 55,649 | | | | 1,318,316 | |

| | | | | | | | 11,877,906 | |

| High Yield/Fixed Income Funds — 9.4% | | | | | | | | |

| Forward Credit Analysis Long/Short Fund - Institutional Class | | | 350,070 | | | | 3,021,108 | |

| Ivy High Income Fund - Class A Shares | | | 149,209 | | | | 1,247,385 | |

| Loomis Sayles Institutional High Income Fund | | | 324,488 | | | | 2,397,970 | |

| Templeton Global Bond Fund - Class A | | | 342,865 | | | | 4,491,531 | |

| | | | | | | | 11,157,994 | |

| Natural Resources Funds — 9.4% | | | | | | | | |

| Highbridge Dynamic Commodities Strategy Fund - Select Class | | | 97,992 | | | | 1,764,837 | |

JPMorgan Alerian MLP Index ETN (e) | | | 27,000 | | | | 1,080,270 | |

Market Vectors Gold Miners ETF (a) | | | 34,000 | | | | 1,577,260 | |

| PIMCO CommodityRealReturn Strategy Fund - Class A | | | 262,233 | | | | 1,728,116 | |

RS Global Natural Resources Fund - Class A (b) | | | 25,870 | | | | 949,946 | |

SPDR Gold Trust (a) (b) (c) | | | 10,500 | | | | 1,699,740 | |

SteelPath MLP Select 40 Fund - Institutional Class (b) | | | 116,234 | | | | 1,282,066 | |

| Vanguard Precious Metals and Mining Fund - Investor Shares | | | 56,910 | | | | 1,059,669 | |

| | | | | | | | 11,141,904 | |

| Real Estate Funds — 6.4% | | | | | | | | |

| ING Global Real Estate Fund - Class I | | | 224,088 | | | | 3,811,728 | |

Vanguard REIT ETF (a) | | | 58,000 | | | | 3,797,260 | |

| | | | | | | | 7,608,988 | |

See accompanying notes to financial statements.

NEW CENTURY ALTERNATIVE STRATEGIES PORTFOLIO SCHEDULE OF INVESTMENTS (Continued) |

INVESTMENT COMPANIES — 96.3% (Continued) | | | | | | |

| Option Hedged Funds — 6.1% | | | | | | |

Eaton Vance Enhanced Equity Income Fund II (d) | | | 50,000 | | | $ | 545,000 | |

Eaton Vance Risk-Managed Diversified Equity Income Fund (d) | | | 60,000 | | | | 621,000 | |

Eaton Vance Tax-Managed Buy-Write Income Fund (d) | | | 70,000 | | | | 945,000 | |

Eaton Vance Tax-Managed Buy-Write Opportunities Fund (d) | | | 100,000 | | | | 1,290,000 | |

| Gateway Fund - Class A | | | 143,023 | | | | 3,881,653 | |

| | | | | | | | 7,282,653 | |

| Managed Futures Funds — 3.9% | | | | | | | | |

| ASG Managed Futures Strategy Fund - Class Y | | | 131,153 | | | | 1,303,661 | |

| MutualHedge Frontier Legends Fund - Class I Shares | | | 335,457 | | | | 3,327,736 | |

| | | | | | | | 4,631,397 | |

| Deep Value/Distressed Securities Funds — 2.2% | | | | | | | | |

Fairholme Fund (The) (b) | | | 46,458 | | | | 1,396,513 | |

Royce Value Trust, Inc. (d) | | | 87,041 | | | | 1,195,943 | |

| | | | | | | | 2,592,456 | |

| | | | | | | | | |

Total Investment Companies (Cost $102,384,189) | | | | | | $ | 114,428,264 | |

MONEY MARKET FUNDS — 3.8% | | | | | | |

Invesco STIT—STIC Prime Portfolio (The) - Institutional Class, 0.00% (f) (Cost $4,516,177) | | | 4,516,177 | | | $ | 4,516,177 | |

| | | | | | | | | |

Total Investments at Value — 100.1% (Cost $106,900,366) | | | | | | $ | 118,944,441 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (0.1%) | | | | | | | (61,830 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 118,882,611 | |

| (a) | Exchange-traded fund. |

| | |

| (b) | Non-income producing security. |

| | |

| (c) | For federal income tax purposes, structured as a grantor trust. |

| | |

| (d) | Closed-end fund. |

| | |

| (e) | Exchange-traded note. |

| | |

| (f) | Variable rate security. The rate shown is the 7-day effective yield as of April 30, 2012. |

See accompanying notes to financial statements.

NEW CENTURY PORTFOLIOS STATEMENTS OF ASSETS AND LIABILITIES April 30, 2012 (Unaudited) |

| | New Century Capital Portfolio | | | New Century Balanced Portfolio | | | New Century Opportunistic Portfolio | | | New Century International Portfolio | | | New Century Alternative Strategies Portfolio | |

| ASSETS | | | | | | | | | | | | | | | |

| Investments in securities: | | | | | | | | | | | | | | | |

| At acquisition cost | | $ | 68,591,122 | | | $ | 55,303,892 | | | $ | 11,110,664 | | | $ | 44,069,388 | | | $ | 106,900,366 | |

| At value (Note 1A) | | $ | 92,783,018 | | | $ | 67,701,937 | | | $ | 14,504,792 | | | $ | 60,899,957 | | | $ | 118,944,441 | |

| Dividends receivable | | | 65 | | | | 6,412 | | | | 33 | | | | 51 | | | | 1,143 | |

| Receivable for capital shares sold | | | 1,230 | | | | 2,175 | | | | 30,000 | | | | 1,195 | | | | 15,154 | |

| Other assets | | | 11,026 | | | | 8,534 | | | | 3,108 | | | | 8,075 | | | | 13,674 | |

| TOTAL ASSETS | | | 92,795,339 | | | | 67,719,058 | | | | 14,537,933 | | | | 60,909,278 | | | | 118,974,412 | |

| | | | | | | | | | | | | | | | | | | | | |

| LIABILITIES | | | | | | | | | | | | | | | | | | | | |

| Payable for capital shares redeemed | | | — | | | | 24,000 | | | | — | | | | — | | | | 744 | |

| Payable to Adviser (Note 2) | | | 77,754 | | | | 56,610 | | | | 7,738 | | | | 51,110 | | | | 74,860 | |

| Payable to Distributor (Note 3) | | | 18,600 | | | | 11,649 | | | | 2,955 | | | | 12,200 | | | | 6,400 | |

| Other accrued expenses | | | 8,664 | | | | 7,653 | | | | 5,368 | | | | 7,405 | | | | 9,797 | |

| TOTAL LIABILITIES | | | 105,018 | | | | 99,912 | | | | 16,061 | | | | 70,715 | | | | 91,801 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSETS | | $ | 92,690,321 | | | $ | 67,619,146 | | | $ | 14,521,872 | | | $ | 60,838,563 | | | $ | 118,882,611 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net assets consist of: | | | | | | | | | | | | | | | | | | | | |

| Paid-in capital | | $ | 67,604,565 | | | $ | 57,193,887 | | | $ | 12,614,137 | | | $ | 48,441,665 | | | $ | 117,031,778 | |

| Accumulated undistributed net investment income (loss) | | | 24,908 | | | | 43,270 | | | | (20,314 | ) | | | 283,772 | | | | (308,211 | ) |

| Accumulated net realized gains (losses) on investments | | | 868,952 | | | | (2,016,056 | ) | | | (1,466,079 | ) | | | (4,717,443 | ) | | | (9,885,031 | ) |

Net unrealized appreciation on investments | | | 24,191,896 | | | | 12,398,045 | | | | 3,394,128 | | | | 16,830,569 | | | | 12,044,075 | |

| Net assets | | $ | 92,690,321 | | | $ | 67,619,146 | | | $ | 14,521,872 | | | $ | 60,838,563 | | | $ | 118,882,611 | |

| | | | | | | | | | | | | | | | | | | | | |

| Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 5,273,781 | | | | 4,730,988 | | | | 1,333,906 | | | | 4,391,580 | | | | 9,780,988 | |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value, offering price and redemption price per share (a) | | $ | 17.58 | | | $ | 14.29 | | | $ | 10.89 | | | $ | 13.85 | | | $ | 12.15 | |

| (a) | Redemption price may differ from the net asset value per share depending upon the length of time held (Note 1B). |

See accompanying notes to financial statements.

NEW CENTURY PORTFOLIOS STATEMENTS OF OPERATIONS For the Six Months Ended April 30, 2012 (Unaudited) |

| | New Century Capital Portfolio | | | New Century Balanced Portfolio | | | New Century Opportunistic Portfolio | | | New Century International Portfolio | | | New Century Alternative Strategies Portfolio | |

| INVESTMENT INCOME | | | | | | | | | | | | | | | |

| Dividends | | $ | 677,234 | | | $ | 1,118,176 | | | $ | 81,153 | | | $ | 730,993 | | | $ | 1,742,639 | |

| | | | | | | | | | | | | | | | | | | | | |

| EXPENSES | | | | | | | | | | | | | | | | | | | | |

| Investment advisory fees (Note 2) | | | 447,009 | | | | 326,945 | | | | 67,644 | | | | 298,772 | | | | 428,357 | |

| Distribution costs (Note 3) | | | 107,596 | | | | 65,655 | | | | 16,911 | | | | 70,219 | | | | 95,205 | |

| Accounting fees | | | 19,487 | | | | 18,280 | | | | 15,679 | | | | 18,000 | | | | 20,727 | |

| Administration fees (Note 2) | | | 17,208 | | | | 13,439 | | | | 5,230 | | | | 12,537 | | | | 21,196 | |

| Legal and audit fees | | | 14,435 | | | | 11,317 | | | | 4,462 | | | | 10,596 | | | | 17,691 | |

| Trustees’ fees and expenses (Note 2) | | | 14,375 | | | | 10,540 | | | | 2,212 | | | | 9,599 | | | | 18,408 | |

| Transfer agent fees | | | 10,500 | | | | 10,500 | | | | 10,500 | | | | 10,500 | | | | 10,500 | |

| Custody and bank service fees | | | 8,668 | | | | 6,789 | | | | 2,045 | | | | 6,380 | | | | 10,768 | |

| Insurance expense | | | 3,784 | | | | 2,664 | | | | 570 | | | | 2,777 | | | | 4,930 | |

| Postage & supplies | | | 3,785 | | | | 2,923 | | | | 1,655 | | | | 2,696 | | | | 3,163 | |

| Other expenses | | | 5,479 | | | | 4,922 | | | | 3,680 | | | | 4,813 | | | | 6,016 | |

| Total expenses | | | 652,326 | | | | 473,974 | | | | 130,588 | | | | 446,889 | | | | 636,961 | |

Less fees waived by the Adviser (Note 2) | | | — | | | | — | | | | (29,121 | ) | | | — | | | | — | |

| Net expenses | | | 652,326 | | | | 473,974 | | | | 101,467 | | | | 446,889 | | | | 636,961 | |

| | | | | | | | | | | | | | | | | | | | | |

NET INVESTMENT INCOME (LOSS) | | | 24,908 | | | | 644,202 | | | | (20,314 | ) | | | 284,104 | | | | 1,105,678 | |

| | | | | | | | | | | | | | | | | | | | | |

| REALIZED AND UNREALIZED GAINS ON INVESTMENTS | | | | | | | | | | | | | | | | | | | | |

| Net realized gains on investments | | | 475,196 | | | | 431,860 | | | | 72,489 | | | | 86,407 | | | | 1,779,730 | |

| Capital gain distributions from regulated investment companies | | | 400,834 | | | | 396,058 | | | | 102,594 | | | | 89,604 | | | | 554,515 | |

| Net change in unrealized appreciation (depreciation) on investments | | | 7,475,118 | | | | 2,725,008 | | | | 1,162,827 | | | | 1,903,931 | | | | 1,660,831 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS | | | 8,351,148 | | | | 3,552,926 | | | | 1,337,910 | | | | 2,079,942 | | | | 3,995,076 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 8,376,056 | | | $ | 4,197,128 | | | $ | 1,317,596 | | | $ | 2,364,046 | | | $ | 5,100,754 | |

See accompanying notes to financial statements.

NEW CENTURY PORTFOLIOS STATEMENTS OF CHANGES IN NET ASSETS |

| | | New Century Capital Portfolio | | | New Century Balanced Portfolio | |

| | Six Months Ended April 30, 2012 (Unaudited) | | | | | | Six Months Ended April 30, 2012 (Unaudited) | | | | |

| FROM OPERATIONS | | | | | | | | | | | | |

| Net investment income (loss) | | $ | 24,908 | | | $ | (240,474 | ) | | $ | 644,202 | | | $ | 919,575 | |

Net realized gains from security transactions | | | 475,196 | | | | 7,967,498 | | | | 431,860 | | | | 991,946 | |

Capital gain distributions from regulated investment companies | | | 400,834 | | | | 144,757 | | | | 396,058 | | | | 79,337 | |

Net change in unrealized appreciation (depreciation) on investments | | | 7,475,118 | | | | (3,383,909 | ) | | | 2,725,008 | | | | 788,079 | |

| Net increase in net assets from operations | | | 8,376,056 | | | | 4,487,872 | | | | 4,197,128 | | | | 2,778,937 | |

| | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | | | | | |

| From net investment income (Note 1E) | | | — | | | | — | | | | (828,337 | ) | | | (941,153 | ) |

From net realized gains on security transactions (Note 1E) | | | (497,600 | ) | | | — | | | | — | | | | — | |

Decrease in net assets from distributions to shareholders | | | (497,600 | ) | | | — | | | | (828,337 | ) | | | (941,153 | ) |

| | | | | | | | | | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | | | | | | | | | |

| Proceeds from shares sold | | | 1,464,010 | | | | 3,892,082 | | | | 1,659,459 | | | | 3,406,806 | |

Proceeds from redemption fees collected (Note 1B) | | | — | | | | — | | | | 369 | | | | 326 | |

Net asset value of shares issued in reinvestment of distributions to shareholders | | | 476,833 | | | | — | | | | 792,109 | | | | 901,552 | |

| Payments for shares redeemed | | | (5,730,948 | ) | | | (13,044,041 | ) | | | (2,783,829 | ) | | | (6,443,866 | ) |

Net decrease in net assets from capital share transactions | | | (3,790,105 | ) | | | (9,151,959 | ) | | | (331,892 | ) | | | (2,135,182 | ) |

| | | | | | | | | | | | | | | | | |

TOTAL INCREASE (DECREASE) IN NET ASSETS | | | 4,088,351 | | | | (4,664,087 | ) | | | 3,036,899 | | | | (297,398 | ) |

| | | | | | | | | | | | | | | | | |

| NET ASSETS | | | | | | | | | | | | | | | | |

| Beginning of period | | | 88,601,970 | | | | 93,266,057 | | | | 64,582,247 | | | | 64,879,645 | |

| End of period | | $ | 92,690,321 | | | $ | 88,601,970 | | | $ | 67,619,146 | | | $ | 64,582,247 | |

| | | | | | | | | | | | | | | | | |

| ACCUMULATED UNDISTRIBUTED NET INVESTMENT INCOME | | $ | 24,908 | | | $ | — | | | $ | 43,270 | | | $ | 227,405 | |

| | | | | | | | | | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | | | | | | | | | |

| Shares sold | | | 86,856 | | | | 237,739 | | | | 120,616 | | | | 246,569 | |

| Shares reinvested | | | 29,877 | | | | — | | | | 59,467 | | | | 66,437 | |

| Shares redeemed | | | (343,953 | ) | | | (788,882 | ) | | | (201,807 | ) | | | (466,920 | ) |

| Net decrease in shares outstanding | | | (227,220 | ) | | | (551,143 | ) | | | (21,724 | ) | | | (153,914 | ) |

| Shares outstanding, beginning of period | | | 5,501,001 | | | | 6,052,144 | | | | 4,752,712 | | | | 4,906,626 | |

| Shares outstanding, end of period | | | 5,273,781 | | | | 5,501,001 | | | | 4,730,988 | | | | 4,752,712 | |

See accompanying notes to financial statements.

NEW CENTURY PORTFOLIOS STATEMENTS OF CHANGES IN NET ASSETS |

| | | New Century Opportunistic Portfolio | | | New Century International Portfolio | |

| | Six Months Ended April 30, 2012 (Unaudited) | | | | | | Six Months Ended April 30, 2012 (Unaudited) | | | | |

| FROM OPERATIONS | | | | | | | | | | | | |

| Net investment income (loss) | | $ | (20,314 | ) | | $ | (54,968 | ) | | $ | 284,104 | | | $ | 434,905 | |

Net realized gains from security transactions | | | 72,489 | | | | 563,851 | | | | 86,407 | | | | 2,781,204 | |

Capital gain distributions from regulated investment companies | | | 102,594 | | | | — | | | | 89,604 | | | | — | |

Net change in unrealized appreciation (depreciation) on investments | | | 1,162,827 | | | | (110,711 | ) | | | 1,903,931 | | | | (8,139,613 | ) |

Net increase (decrease) in net assets from operations | | | 1,317,596 | | | | 398,172 | | | | 2,364,046 | | | | (4,923,504 | ) |

| | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | | | | | |

| From net investment income (Note 1E) | | | — | | | | — | | | | (434,898 | ) | | | (374,706 | ) |

| | | | | | | | | | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | | | | | | | | | |

| Proceeds from shares sold | | | 443,578 | | | | 2,342,894 | | | | 1,115,878 | | | | 4,989,543 | |

Proceeds from redemption fees collected (Note 1B) | | | — | | | | 39 | | | | 163 | | | | 1,213 | |

Net asset value of shares issued in reinvestment of distributions to shareholders | | | — | | | | — | | | | 429,919 | | | | 370,045 | |

| Payments for shares redeemed | | | (468,260 | ) | | | (1,225,190 | ) | | | (3,898,687 | ) | | | (7,747,872 | ) |

Net increase (decrease) in net assets from capital share transactions | | | (24,682 | ) | | | 1,117,743 | | | | (2,352,727 | ) | | | (2,387,071 | ) |

| | | | | | | | | | | | | | | | | |

TOTAL INCREASE (DECREASE) IN NET ASSETS | | | 1,292,914 | | | | 1,515,915 | | | | (423,579 | ) | | | (7,685,281 | ) |

| | | | | | | | | | | | | | | | | |

| NET ASSETS | | | | | | | | | | | | | | | | |

| Beginning of period | | | 13,228,958 | | | | 11,713,043 | | | | 61,262,142 | | | | 68,947,423 | |

| End of period | | $ | 14,521,872 | | | $ | 13,228,958 | | | $ | 60,838,563 | | | $ | 61,262,142 | |

| | | | | | | | | | | | | | | | | |

| ACCUMULATED UNDISTRIBUTED NET INVESTMENT INCOME (LOSS) | | $ | (20,314 | ) | | $ | — | | | $ | 283,772 | | | $ | 434,566 | |

| | | | | | | | | | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | | | | | | | | | |

| Shares sold | | | 41,609 | | | | 228,401 | | | | 83,089 | | | | 335,837 | |

| Shares reinvested | | | — | | | | — | | | | 33,852 | | | | 24,653 | |

| Shares redeemed | | | (45,436 | ) | | | (124,792 | ) | | | (292,147 | ) | | | (539,081 | ) |

| Net increase (decrease) in shares outstanding | | | (3,827 | ) | | | 103,609 | | | | (175,206 | ) | | | (178,591 | ) |

| Shares outstanding, beginning of period | | | 1,337,733 | | | | 1,234,124 | | | | 4,566,786 | | | | 4,745,377 | |

| Shares outstanding, end of period | | | 1,333,906 | | | | 1,337,733 | | | | 4,391,580 | | | | 4,566,786 | |

See accompanying notes to financial statements.

NEW CENTURY PORTFOLIOS STATEMENTS OF CHANGES IN NET ASSETS |

| | | New Century Alternative Strategies Portfolio | |

| | Six Months Ended April 30, 2012 (Unaudited) | | | | |

| FROM OPERATIONS | | | | | | |

| Net investment income | | $ | 1,105,678 | | | $ | 1,877,881 | |

| Net realized gains from security transactions | | | 1,779,730 | | | | 1,155,274 | |

| Capital gain distributions from regulated investment companies | | | 554,515 | | | | 559,407 | |

| Net change in unrealized appreciation (depreciation) on investments | | | 1,660,831 | | | | (2,090,130 | ) |

| Net increase in net assets from operations | | | 5,100,754 | | | | 1,502,432 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From net investment income (Note 1E) | | | (1,636,766 | ) | | | (1,655,004 | ) |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 8,809,013 | | | | 12,085,063 | |

| Proceeds from redemption fees collected (Note 1B) | | | 244 | | | | 618 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 1,604,814 | | | | 1,628,407 | |

| Payments for shares redeemed | | | (9,836,454 | ) | | | (34,007,680 | ) |

| Net increase (decrease) in net assets from capital share transactions | | | 577,617 | | | | (20,293,592 | ) |

| | | | | | | | | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | 4,041,605 | | | | (20,446,164 | ) |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 114,841,006 | | | | 135,287,170 | |

| End of period | | $ | 118,882,611 | | | $ | 114,841,006 | |

| | | | | | | | | |

| ACCUMULATED UNDISTRIBUTED NET INVESTMENT INCOME (LOSS) | | $ | (308,211 | ) | | $ | 222,877 | |

| | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

| Shares sold | | | 739,800 | | | | 995,488 | |

| Shares reinvested | | | 139,792 | | | | 134,357 | |

| Shares redeemed | | | (833,240 | ) | | | (2,792,202 | ) |

| Net increase (decrease) in shares outstanding | | | 46,352 | | | | (1,662,357 | ) |

| Shares outstanding, beginning of period | | | 9,734,636 | | | | 11,396,993 | |

| Shares outstanding, end of period | | | 9,780,988 | | | | 9,734,636 | |

See accompanying notes to financial statements.

NEW CENTURY CAPITAL PORTFOLIO FINANCIAL HIGHLIGHTS |

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Period | |

| | | Six Months Ended April 30, 2012 | | | | |

| | (Unaudited) | | | | | | | | | | | | | | | | |

| PER SHARE OPERATING PERFORMANCE | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 16.11 | | | $ | 15.41 | | | $ | 13.26 | | | $ | 11.76 | | | $ | 20.68 | | | $ | 17.23 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.00 | (a) | | | (0.04 | ) | | | (0.03 | ) | | | 0.03 | | | | 0.02 | | | | (0.06 | ) |

| Net realized and unrealized gains (losses) on investments | | | 1.56 | | | | 0.74 | | | | 2.21 | | | | 1.50 | | | | (7.94 | ) | | | 3.51 | |

| Total from investment operations | | | 1.56 | | | | 0.70 | | | | 2.18 | | | | 1.53 | | | | (7.92 | ) | | | 3.45 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

Distributions from net investment income | | | — | | | | — | | | | (0.03 | ) | | | (0.03 | ) | | | (0.14 | ) | | | — | |

Distributions from net realized gains | | | (0.09 | ) | | | — | | | | — | | | | — | | | | (0.86 | ) | | | — | |

| Total distributions | | | (0.09 | ) | | | — | | | | (0.03 | ) | | | (0.03 | ) | | | (1.00 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Proceeds from redemption fees collected | | | — | | | | — | | | | 0.00 | (a) | | | 0.00 | (a) | | | 0.00 | (a) | | | 0.00 | (a) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of period | | $ | 17.58 | | | $ | 16.11 | | | $ | 15.41 | | | $ | 13.26 | | | $ | 11.76 | | | $ | 20.68 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

TOTAL RETURN (b) | | | 9.75% | (c) | | | 4.54% | | | | 16.47% | | | | 13.05% | | | | (40.06% | ) | | | 20.02% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000’s) | | $ | 92,690 | | | $ | 88,602 | | | $ | 93,266 | | | $ | 85,000 | | | $ | 84,119 | | | $ | 144,228 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets (d) | | | 1.46% | (f) | | | 1.42% | | | | 1.40% | | | | 1.41% | | | | 1.29% | | | | 1.25% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Ratio of net investment income (loss) to average net assets (d) (e) | | | 0.06% | (f) | | | (0.25% | ) | | | (0.20% | ) | | | 0.27% | | | | 0.08% | | | | (0.32% | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover | | | 1% | (c) | | | 60% | | | | 10% | | | | 4% | | | | 27% | | | | 21% | |

| (a) | Amount rounds to less than $0.01 per share. |

| | |

| (b) | Total return is a measure of the change in the value of an investment in the Portfolio over the periods covered, which assumes dividends or capital gains distributions, if any, are reinvested in shares of the Portfolio. Returns shown do not reflect the taxes a shareholder would pay on Portfolio distributions, if any, or the redemption of Portfolio shares. |

| | |

| (c) | Not annualized. |

| | |

| (d) | The ratios of expenses and net investment income (loss) to average net assets do not reflect the Portfolio’s proportionate share of expenses of the underlying investment companies in which the Portfolio invests. |

| | |

| (e) | Recognition of net investment income (loss) by the Portfolio is affected by the timing of the declaration of dividends by the underlying investment companies in which the Portfolio invests. |

| | |

| (f) | Annualized. |

See accompanying notes to financial statements.

NEW CENTURY BALANCED PORTFOLIO FINANCIAL HIGHLIGHTS |

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Period | |

| | | Six Months Ended April 30, 2012 | | | | |

| | (Unaudited) | | | | | | | | | | | | | | | | |

| PER SHARE OPERATING PERFORMANCE | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 13.59 | | | $ | 13.22 | | | $ | 11.93 | | | $ | 10.54 | | | $ | 16.13 | | | $ | 14.57 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.14 | | | | 0.20 | | | | 0.15 | | | | 0.22 | | | | 0.25 | | | | 0.19 | |

| Net realized and unrealized gains (losses) on investments | | | 0.73 | | | | 0.37 | | | | 1.30 | | | | 1.39 | | | | (4.69 | ) | | | 1.56 | |

| Total from investment operations | | | 0.87 | | | | 0.57 | | | | 1.45 | | | | 1.61 | | | | (4.44 | ) | | | 1.75 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

Distributions from net investment income | | | (0.17 | ) | | | (0.20 | ) | | | (0.16 | ) | | | (0.22 | ) | | | (0.30 | ) | | | (0.19 | ) |

Distributions from net realized gains | | | — | | | | — | | | | — | | | | — | | | | (0.85 | ) | | | — | |

| Total distributions | | | (0.17 | ) | | | (0.20 | ) | | | (0.16 | ) | | | (0.22 | ) | | | (1.15 | ) | | | (0.19 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Proceeds from redemption fees collected | | | 0.00 | (a) | | | 0.00 | (a) | | | — | | | | — | | | | 0.00 | (a) | | | 0.00 | (a) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of period | | $ | 14.29 | | | $ | 13.59 | | | $ | 13.22 | | | $ | 11.93 | | | $ | 10.54 | | | $ | 16.13 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

TOTAL RETURN (b) | | | 6.53% | (c) | | | 4.29% | | | | 12.23% | | | | 15.57% | | | | (29.46% | ) | | | 12.09% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000’s) | | $ | 67,619 | | | $ | 64,582 | | | $ | 64,880 | | | $ | 61,578 | | | $ | 62,423 | | | $ | 95,052 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets (d) | | | 1.45% | (f) | | | 1.43% | | | | 1.44% | | | | 1.45% | | | | 1.38% | | | | 1.35% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Ratio of net investment income to average net assets (d) (e) | | | 1.97% | (f) | | | 1.39% | | | | 1.20% | | | | 2.07% | | | | 1.71% | | | | 1.21% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover | | | 7% | (c) | | | 17% | | | | 7% | | | | 13% | | | | 22% | | | | 28% | |

| (a) | Amount rounds to less than $0.01 per share. |

| | |

| (b) | Total return is a measure of the change in the value of an investment in the Portfolio over the periods covered, which assumes dividends or capital gains distributions, if any, are reinvested in shares of the Portfolio. Returns shown do not reflect the taxes a shareholder would pay on Portfolio distributions, if any, or the redemption of Portfolio shares. |

| | |

| (c) | Not annualized. |

| | |

| (d) | The ratios of expenses and net investment income to average net assets do not reflect the Portfolio’s proportionate share of expenses of the underlying investment companies in which the Portfolio invests. |

| | |

| (e) | Recognition of net investment income by the Portfolio is affected by the timing of the declaration of dividends by the underlying investment companies in which the Portfolio invests. |

| | |

| (f) | Annualized. |

See accompanying notes to financial statements.

NEW CENTURY OPPORTUNISTIC PORTFOLIO FINANCIAL HIGHLIGHTS |

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Period | |

| | | Six Months Ended April 30, 2012 | | | | |

| | (Unaudited) | | | | | | | | | | | | | | | | |

| PER SHARE OPERATING PERFORMANCE | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 9.89 | | | $ | 9.49 | | | $ | 7.97 | | | $ | 7.08 | | | $ | 11.78 | | | $ | 9.45 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | (0.02 | ) | | | (0.04 | ) | | | (0.02 | ) | | | 0.01 | | | | (0.05 | ) | | | (0.05 | ) |

| Net realized and unrealized gains (losses) on investments | | | 1.02 | | | | 0.44 | | | | 1.55 | | | | 0.88 | | | | (4.26 | ) | | | 2.38 | |

| Total from investment operations | | | 1.00 | | | | 0.40 | | | | 1.53 | | | | 0.89 | | | | (4.31 | ) | | | 2.33 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

Distributions from net investment income | | | — | | | | — | | | | (0.01 | ) | | | — | | | | (0.05 | ) | | | — | |

Distributions from net realized gains | | | — | | | | — | | | | — | | | | — | | | | (0.34 | ) | | | — | |

| Total distributions | | | — | | | | — | | | | (0.01 | ) | | | — | | | | (0.39 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Proceeds from redemption fees collected | | | — | | | | 0.00 | (a) | | | 0.00 | (a) | | | 0.00 | (a) | | | 0.00 | (a) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of period | | $ | 10.89 | | | $ | 9.89 | | | $ | 9.49 | | | $ | 7.97 | | | $ | 7.08 | | | $ | 11.78 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

TOTAL RETURN (b) | | | 10.11% | (c) | | | 4.21% | | | | 19.19% | | | | 12.57% | | | | (37.74% | ) | | | 24.66% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000’s) | | $ | 14,522 | | | $ | 13,229 | | | $ | 11,713 | | | $ | 11,316 | | | $ | 10,587 | | | $ | 14,935 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Ratios of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Before expense reimbursement and waived fees (d) | | | 1.93% | (f) | | | 1.91% | | | | 2.03% | | | | 2.08% | | | | 1.79% | | | | 1.88% | |

After expense reimbursement and waived fees (d) | | | 1.50% | (f) | | | 1.50% | | | | 1.50% | | | | 1.50% | | | | 1.50% | | | | 1.50% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Ratios of net investment income (loss) to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Before expense reimbursement and waived fees (d) (e) | | | (0.73% | )(f) | | | (0.81% | ) | | | (0.77% | ) | | | (0.47% | ) | | | (0.89% | ) | | | (0.88% | ) |

After expense reimbursement and waived fees (d) (e) | | | (0.30% | )(f) | | | (0.40% | ) | | | (0.24% | ) | | | 0.11% | | | | (0.60% | ) | | | (0.50% | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover | | | 4% | (c) | | | 24% | | | | 7% | | | | 10% | | | | 56% | | | | 47% | |

| (a) | Amount rounds to less than $0.01 per share. |

| | |

| (b) | Total return is a measure of the change in the value of an investment in the Portfolio over the periods covered, which assumes dividends or capital gains distributions, if any, are reinvested in shares of the Portfolio. Returns shown do not reflect the taxes a shareholder would pay on Portfolio distributions, if any, or the redemption of Portfolio shares. |

| | |

| (c) | Not annualized. |

| | |

| (d) | The ratios of expenses and net investment income (loss) to average net assets do not reflect the Portfolio’s proportionate share of expenses of the underlying investment companies in which the Portfolio invests. |

| | |

| (e) | Recognition of net investment income (loss) by the Portfolio is affected by the timing of the declaration of dividends by the underlying investment companies in which the Portfolio invests. |

| | |

| (f) | Annualized. |

See accompanying notes to financial statements.

NEW CENTURY INTERNATIONAL PORTFOLIO FINANCIAL HIGHLIGHTS |

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Period | |

| | | Six Months Ended April 30, 2012 | | | | |

| | (Unaudited) | | | | | | | | | | | | | | | | |

| PER SHARE OPERATING PERFORMANCE | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 13.41 | | | $ | 14.53 | | | $ | 12.70 | | | $ | 10.08 | | | $ | 20.06 | | | $ | 15.06 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.07 | | | | 0.10 | | | | 0.09 | | | | 0.13 | | | | 0.28 | | | | 0.03 | |

| Net realized and unrealized gains (losses) on investments | | | 0.47 | | | | (1.14 | ) | | | 1.82 | | | | 2.61 | | | | (9.47 | ) | | | 5.61 | |

| Total from investment operations | | | 0.54 | | | | (1.04 | ) | | | 1.91 | | | | 2.74 | | | | (9.19 | ) | | | 5.64 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

Distributions from net investment income | | | (0.10 | ) | | | (0.08 | ) | | | (0.08 | ) | | | (0.12 | ) | | | (0.33 | ) | | | (0.06 | ) |

Distributions from net realized gains | | | — | | | | — | | | | — | | | | — | | | | (0.46 | ) | | | (0.58 | ) |

| Total distributions | | | (0.10 | ) | | | (0.08 | ) | | | (0.08 | ) | | | (0.12 | ) | | | (0.79 | ) | | | (0.64 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Proceeds from redemption fees collected | | | 0.00 | (a) | | | 0.00 | (a) | | | 0.00 | (a) | | | 0.00 | (a) | | | 0.00 | (a) | | | 0.00 | (a) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of period | | $ | 13.85 | | | $ | 13.41 | | | $ | 14.53 | | | $ | 12.70 | | | $ | 10.08 | | | $ | 20.06 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

TOTAL RETURN (b) | | | 4.07% | (c) | | | (7.22% | ) | | | 15.07% | | | | 27.45% | | | | (47.52% | ) | | | 38.62% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000’s) | | $ | 60,839 | | | $ | 61,262 | | | $ | 68,947 | | | $ | 89,449 | | | $ | 76,234 | | | $ | 147,416 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Ratios of expenses to average net assets (d) | | | 1.50% | (f) | | | 1.46% | | | | 1.45% | | | | 1.44% | | | | 1.29% | (g) | | | 1.35% | (g) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Ratios of net investment income to average net assets (d) (e) | | | 0.95% | (f) | | | 0.63% | | | | 0.57% | | | | 1.23% | | | | 1.66% | (g) | | | 0.11% | (g) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover | | | 1% | (c) | | | 13% | | | | 4% | | | | 11% | | | | 34% | | | | 10% | |

| (a) | Amount rounds to less than $0.01 per share. |

| | |

| (b) | Total return is a measure of the change in the value of an investment in the Portfolio over the periods covered, which assumes dividends or capital gains distributions, if any, are reinvested in shares of the Portfolio. Returns shown do not reflect the taxes a shareholder would pay on Portfolio distributions, if any, or the redemption of Portfolio shares. |

| | |

| (c) | Not annualized. |

| | |

| (d) | The ratios of expenses and net investment income to average net assets do not reflect the Portfolio’s proportionate share of expenses of the underlying investment companies in which the Portfolio invests. |

| | |

| (e) | Recognition of net investment income by the Portfolio is affected by the timing of the declaration of dividends by the underlying investment companies in which the Portfolio invests. |

| | |

| (f) | Annualized. |

| | |

| (g) | Absent the recoupment of fees previously waived and expenses reimbursed by the Adviser, the ratios of expenses to average net assets would have been 1.28% and 1.32% and the ratios of net investment income to average net assets would have been 1.68% and 0.14% for the years ended October 31, 2008 and 2007, respectively (Note 2). |

See accompanying notes to financial statements.

NEW CENTURY ALTERNATIVE STRATEGIES PORTFOLIO FINANCIAL HIGHLIGHTS |

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Period | |

| | | Six Months Ended April 30, 2012 | | | | |

| | (Unaudited) | | | | | | | | | | | | | | | | |

| PER SHARE OPERATING PERFORMANCE | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 11.80 | | | $ | 11.87 | | | $ | 11.11 | | | $ | 10.14 | | | $ | 13.93 | | | $ | 13.03 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.12 | | | | 0.17 | | | | 0.08 | | | | 0.14 | | | | 0.27 | | | | 0.18 | |

| Net realized and unrealized gains (losses) on investments | | | 0.40 | | | | (0.09 | ) | | | 0.83 | | | | 1.15 | | | | (3.39 | ) | | | 1.34 | |

| Total from investment operations | | | 0.52 | | | | 0.08 | | | | 0.91 | | | | 1.29 | | | | (3.12 | ) | | | 1.52 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

Distributions from net investment income | | | (0.17 | ) | | | (0.15 | ) | | | (0.15 | ) | | | (0.32 | ) | | | (0.36 | ) | | | (0.32 | ) |

Distributions from net realized gains | | | — | | | | — | | | | — | | | | — | | | | (0.31 | ) | | | (0.30 | ) |

| Total distributions | | | (0.17 | ) | | | (0.15 | ) | | | (0.15 | ) | | | (0.32 | ) | | | (0.67 | ) | | | (0.62 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Proceeds from redemption fees collected | | | 0.00 | (a) | | | 0.00 | (a) | | | 0.00 | (a) | | | 0.00 | (a) | | | 0.00 | (a) | | | 0.00 | (a) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of period | | $ | 12.15 | | | $ | 11.80 | | | $ | 11.87 | | | $ | 11.11 | | | $ | 10.14 | | | $ | 13.93 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

TOTAL RETURN (b) | | | 4.49% | (c) | | | 0.62% | | | | 8.21% | | | | 13.16% | | | | (23.44% | ) | | | 12.09% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000’s) | | $ | 118,883 | | | $ | 114,841 | | | $ | 135,287 | | | $ | 139,168 | | | $ | 136,999 | | | $ | 128,117 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets (d) | | | 1.12% | (f) | | | 1.09% | | | | 1.10% | | | | 1.06% | | | | 1.00% | | | | 1.06% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Ratio of net investment income to average net assets (d) (e) | | | 1.94% | (f) | | | 1.48% | | | | 0.74% | | | | 1.46% | | | | 1.46% | | | | 1.07% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover | | | 15% | (c) | | | 31% | | | | 22% | | | | 27% | | | | 17% | | | | 8% | |

| (a) | Amount rounds to less than $0.01 per share. |

| | |

| (b) | Total return is a measure of the change in the value of an investment in the Portfolio over the periods covered, which assumes dividends or capital gains distributions, if any, are reinvested in shares of the Portfolio. Returns shown do not reflect the taxes a shareholder would pay on Portfolio distributions, if any, or the redemption of Portfolio shares. |

| | |

| (c) | Not annualized. |

| | |

| (d) | The ratios of expenses and net investment income to average net assets do not reflect the Portfolio’s proportionate share of expenses of the underlying investment companies in which the Portfolio invests. |

| | |

| (e) | Recognition of net investment income by the Portfolio is affected by the timing of the declaration of dividends by the underlying investment companies in which the Portfolio invests. |

| | |

| (f) | Annualized. |

See accompanying notes to financial statements.

NEW CENTURY PORTFOLIOS NOTES TO FINANCIAL STATEMENTS April 30, 2012 (Unaudited) |

| (1) | SIGNIFICANT ACCOUNTING POLICIES |

New Century Portfolios (“New Century”) is organized as a Massachusetts business trust which is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company and currently offers shares of five series: New Century Capital Portfolio, New Century Balanced Portfolio, New Century Opportunistic Portfolio, New Century International Portfolio and New Century Alternative Strategies Portfolio (together, the “Portfolios” and each, a “Portfolio”). New Century Capital Portfolio and New Century Balanced Portfolio commenced operations on January 31, 1989. New Century Opportunistic Portfolio and New Century International Portfolio commenced operations on November 1, 2000, and New Century Alternative Strategies Portfolio commenced operations on May 1, 2002.

Weston Financial Group, Inc. (the “Adviser”), a wholly-owned subsidiary of The Washington Trust Company, serves as the investment adviser to each Portfolio. Weston Securities Corporation (the “Distributor”), a wholly-owned subsidiary of Washington Trust Bancorp, Inc., serves as the distributor and principal underwriter to each Portfolio.

The investment objective of New Century Capital Portfolio is to provide capital growth, with a secondary objective to provide income, while managing risk. This Portfolio seeks to achieve its objectives by investing primarily in shares of other registered investment companies that emphasize investments in equities (domestic and foreign).

The investment objective of New Century Balanced Portfolio is to provide income, with a secondary objective to provide capital growth, while managing risk. This Portfolio seeks to achieve its objectives by investing primarily in shares of other registered investment companies that emphasize investments in equities (domestic and foreign), fixed income securities (domestic and foreign), or in a composite of such securities. This Portfolio maintains at least 25% of its assets in fixed income securities by selecting registered investment companies that invest in such securities.

The investment objective of New Century Opportunistic Portfolio is to provide capital growth, without regard to current income, while managing risk. This Portfolio seeks to achieve its objective by investing primarily in shares of registered investment companies that emphasize investments in equities (domestic and foreign), fixed income securities that seek appreciation such as high-yield, lower rated debt securities (domestic or foreign), or other securities that are selected by those investment companies to achieve growth.

The investment objective of New Century International Portfolio is to provide capital growth, with a secondary objective to provide income, while managing risk. This Portfolio seeks to achieve its objectives by investing primarily in shares of registered investment companies that emphasize investments in equities and fixed income securities (foreign, worldwide, emerging markets and domestic).

NEW CENTURY PORTFOLIOS

NOTES TO FINANCIAL STATEMENTS (Continued)

April 30, 2012 (Unaudited)

The investment objective of New Century Alternative Strategies Portfolio is to provide long-term capital appreciation, with a secondary objective to earn income, while managing risk. This Portfolio seeks to achieve its objectives by investing primarily in shares of other registered investment companies that emphasize alternative strategies.

The price of shares of each Portfolio fluctuates daily and there is no assurance that the Portfolios will be successful in achieving their stated investment objectives.

The following is a summary of significant accounting policies consistently followed by the Portfolios in the preparation of their financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

Investments in shares of other open-end investment companies are valued at their net asset value as reported by such companies. The Portfolios may also invest in closed-end investment companies, exchange-traded funds, and to a certain extent, directly in securities when the Adviser deems it appropriate. Investments in closed-end investment companies, exchange-traded funds and direct investments in securities are valued at market prices, as described in the paragraph below. The net asset value as reported by open-end investment companies may be based on fair value pricing; to understand the fair value pricing process used by such companies, consult their most current prospectus.

Investments in securities traded on a national securities exchange or included in NASDAQ are generally valued at the last reported sales price, the closing price or the official closing price; and securities traded in the over-the-counter market and listed securities for which no sale is reported on that date are valued at the last reported bid price. It is expected that fixed income securities will ordinarily be traded in the over-the-counter market. When market quotations are not readily available, fixed income securities may be valued on the basis of prices provided by an independent pricing service. Other assets and securities for which no quotations are readily available or for which quotations the Adviser believes do not reflect market value are valued at their fair value as determined in good faith by the Adviser under the procedures established by the Board of Trustees, and will be classified as Level 2 or 3 (see page 31 and 32) within the fair value hierarchy, depending on the inputs used. Factors in determining portfolio investments subject to fair value determination include, but are not limited to, the following: only a bid price or an asked price is available; the spread between bid and asked prices is substantial; infrequency of sales; thinness of market; the size of reported trades; a temporary lapse in the provision of prices by any reliable pricing source; and actions of the securities or future markets, such as the suspension or limitation of trading. Short-term investments (those with remaining maturities of 60 days or less) may be valued at amortized cost which approximates market value.

NEW CENTURY PORTFOLIOS

NOTES TO FINANCIAL STATEMENTS (Continued)

April 30, 2012 (Unaudited)

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements. Various inputs are used in determining the value of the Portfolios’ investments. These inputs are summarized in the three broad levels listed below:

| • | Level 1 – quoted prices in active markets for identical securities |

| • | Level 2 – other significant observable inputs |

| • | Level 3 – significant unobservable inputs |

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level of the fair value hierarchy within which the fair value measurement of that security is determined to fall in its entirety is the lowest level input that is significant to the fair value measurement.

The following is a summary of the inputs used to value each Portfolio’s investments by security type as of April 30, 2012:

| New Century Capital Portfolio | |

| | | | | | | | | | | | | |