The accompanying notes are an integral part of these Consolidated Financial Statements.

The unaudited US dollar amounts are prepared on the basis set out in note 1.

The accompanying notes are an integral part of these Consolidated Financial Statements.

The unaudited US dollar amounts are prepared on the basis set out in note 1.

Back to Contents

Back to Consolidated Financial Statements Contents

|

| Notes to the Consolidated Financial Statements |

|

|

1. Basis of Consolidated Financial Statements

Statutory financial information

The Consolidated Financial Statements are prepared in accordance with applicable accounting standards and in conformity with UK GAAP, which differ in certain material respects from US GAAP – see note 36.

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Amounts in the Consolidated Financial Statements are stated in pounds sterling (£), the currency of the country in which the Company is incorporated. The translation into US dollars of the Consolidated Financial Statements as of, and for the financial year ended, 31 March 2005, is for convenience only and has been made at the Noon Buying Rate for cable transfers as announced by the Federal Reserve Bank of New York for customs purposes on 31 March 2005. This rate was $1.8888: £1. This translation should not be construed as a representation that the sterling amounts actually represented have been, or could be, converted into dollars at this or any other rate.

The Group’s material accounting policies are described below. For a discussion on the Group’s critical accounting estimates see “Operating and Financial Review and Prospects – Critical Accounting Estimates” elsewhere in this Annual Report.

Accounting convention

The Consolidated Financial Statements are prepared under the historical cost convention and in accordance with applicable accounting standards of the United Kingdom Accounting Standards Board and pronouncements of its Urgent Issues Task Force.

Basis of consolidation

The Consolidated Financial Statements include the accounts of the Company, its subsidiary undertakings and its share of the results of associated undertakings for financial statements made up to 31 March 2005. A listing of the Company’s principal subsidiary undertakings and associated undertakings is given in note 34.

Foreign currencies

Transactions in foreign currencies are recorded at the exchange rates ruling on the dates of those transactions, adjusted for the effects of any hedging arrangements. Foreign currency monetary assets and liabilities are translated into sterling at year end rates.

The results of international subsidiary undertakings, joint ventures and associated undertakings are translated into sterling at average rates of exchange. The adjustment to year end rates is taken to reserves. Exchange differences, which arise on the retranslation of international subsidiary undertakings’, joint ventures’ and associated undertakings’ balance sheets at the beginning of the year, and equity additions and withdrawals during the financial year, are dealt with as a movement in reserves.

Other translation differences are dealt with in the profit and loss account.

Turnover

Group turnover comprises turnover of the Company and its subsidiary undertakings and excludes sales taxes, discounts and sales between Group companies. Total Group turnover comprises Group turnover plus the Group’s share of the turnover of its associated undertakings and joint ventures.

Turnover from mobile telecommunications comprises amounts charged to customers in respect of monthly access charges, airtime usage, messaging, the provision of other mobile telecommunications services, including data services and information provision, fees for connecting customers to a mobile network, revenue from the sale of equipment, including handsets and revenue arising from agreements entered into with Partner Networks.

Access charges and airtime used by contract customers are invoiced and recorded as part of a periodic billing cycle and recognised as turnover over the related access period, with unbilled turnover resulting from services already provided from the billing cycle date to the end of each period accrued and unearned turnover from services provided in periods after each accounting period deferred. Revenue from the sale of prepaid credit is deferred until such time as the customer uses the airtime, or the credit expires.

Other turnover from mobile telecommunications primarily comprises equipment sales, which are recognised upon delivery to customers, and customer connection revenue. Customer connection revenue is recognised together with the related equipment revenue to the extent that the aggregate equipment and connection revenue does not exceed the fair value of the equipment delivered to the customer. Any customer connection revenue not recognised together with related equipment revenue is deferred and recognised over the period in which services are expected to be provided to the customer.

Revenue from data services and information provision is recognised when the Group has performed the related service and, depending on the nature of the service, is recognised either at the gross amount billed to the customer or the amount receivable by the Group as commission for facilitating the service.

Turnover from other businesses primarily comprises amounts charged to customers of the Group’s fixed line businesses, mainly in respect of access charges and line usage, invoiced and recorded as part of a periodic billing cycle.

Back to Contents

Back to Consolidated Financial Statements Contents

Derivative financial instruments

Transactions in derivative financial instruments are undertaken for risk management purposes only.

The Group uses derivative financial instruments to hedge its exposure to interest rate and foreign currency risk. To the extent that such instruments are matched against an underlying asset or liability, they are accounted for using hedge accounting.

Gains or losses on interest rate instruments are matched against the corresponding interest charge or interest receivable in the profit and loss account over the life of the instrument. For foreign exchange instruments, gains or losses and premiums or discounts are matched to the underlying transactions being hedged.

Termination payments made or received in respect of derivative financial instruments held for hedging purposes are spread over the life of the underlying exposure where the underlying exposure continues to exist. Where the underlying exposure ceases to exist, termination payments are taken to the profit and loss account.

Pensions

Costs relating to defined benefit plans, which are subject to periodic valuations calculated by professionally qualified actuaries, are charged against profits, within staff costs so that the expected costs of providing pensions are recognised during the period in which benefit is derived from the employees’ services.

The costs of the various pension schemes may vary from the funding, dependent upon actuarial advice, with any difference between pension cost and funding being treated as a provision or prepayment.

Defined contribution pension costs charged to the profit and loss account represent contributions payable in respect of the period.

Research and development and advertising costs

Expenditure on research and development and advertising is written off in the year in which it is incurred.

Goodwill

Goodwill is calculated as the surplus of fair value of consideration over fair value attributed to the identifiable net assets and liabilities (excluding goodwill) of subsidiary, joint venture and associated undertakings acquired.

For acquisitions made after the financial year ended 31 March 1998, goodwill is capitalised and held as a foreign currency denominated asset, where applicable. Goodwill is amortised on a straight line basis over its estimated useful economic life. For acquired network businesses, whose operations are governed by fixed term licences, the amortisation period is determined primarily by reference to the unexpired licence period and the conditions for licence renewal. The amortisation periods range between 3 and 20 years, with the exception of the goodwill arising on the formation of Verizon Wireless and the acquisition of interests in Vodafone Japan. The goodwill arising on the formation of Verizon Wireless is amortised over 25 years as the Group has assessed the renewal of Verizon Wireless’ licences as perfunctory and as such believes a useful economic life for the acquired business of greater than 20 years is appropriate. During the 2005 financial year, as a result of the acquisition of the minority stakes in Vodafone Japan as described in “Business Overview – History and Development of the Company”, the Group reviewed the amortisation period for goodwill arising on the acquisition of interests in Vodafone Japan, including acquisitions prior to 31 March 2004. The Group concluded that although licences in Japan are issued for a five year term with a presumption of renewal where there is a continuing need for spectrum, the licence issued is technology dependent. Accordingly, the amortisation period for this goodwill was increased from 16 years to 21 years. The effect of this change on the amortisation charge for the 2005 financial year is not material. For other acquisitions, including customer bases, the amortisation period for goodwill is typically between 3 and 10 years.

For acquisitions made before 1 April 1998, when FRS 10, “Goodwill and Intangible Assets”, was adopted, goodwill was written off directly to reserves. Goodwill written off directly to reserves is included in the profit and loss account when the related business is sold.

Other intangible fixed assets

Purchased intangible fixed assets, including licence fees, are capitalised at cost.

Network licence costs are amortised over the periods of the licences. Amortisation is charged from commencement of service of the network. The annual charge is calculated in proportion to the capacity of the network during the start up period and on a straight line basis thereafter.

Other intangible fixed assets are amortised over their expected useful economic life on a straight line basis.

Tangible fixed assets

Tangible fixed assets are stated at cost less accumulated depreciation.

Depreciation is not provided on freehold land. The cost of other tangible fixed assets is written off from the time they are brought into use, by equal instalments over their expected useful lives as follows:

| Freehold buildings | 25-50 years | |

| | | |

| Leasehold premises | the term of the lease | |

| | | |

| Equipment, fixtures and fittings | 3-10 years | |

The cost of tangible fixed assets includes directly attributable incremental costs incurred in their acquisition and installation.

Back to Contents

Back to Consolidated Financial Statements Contents

|

| Notes to the Consolidated Financial Statements continued |

|

| | |

| | |

| 2. | Accounting policies continued |

Investments

The Consolidated Financial Statements include investments in associated undertakings using the equity method of accounting. An associated undertaking is an entity in which the Group has a participating interest and, in the opinion of the directors, can exercise significant influence over its operational and financial policies. The Consolidated Profit and Loss Account includes the Group’s share of the operating profit or loss, exceptional items, interest income or expense and attributable taxation of those entities. The Balance Sheet shows the Group’s share of the net assets or liabilities of those entities, together with loans advanced and attributed goodwill.

The Consolidated Financial Statements include investments in joint ventures using the gross equity method of accounting. A joint venture is an entity in which the Group has a long-term interest and exercises joint control. Under the gross equity method, a form of the equity method of accounting, the Group’s share of the aggregate gross assets and liabilities underlying the investment in the joint venture is included in the Balance Sheet and the Group’s share of the turnover of the joint venture is disclosed in the Consolidated Profit and Loss Account.

Other investments, held as fixed assets, comprise equity shareholdings and other interests. They are stated at cost less provision for impairment. Dividend income is recognised upon receipt and interest when receivable.

Stocks

Stocks are valued at the lower of cost and estimated net realisable value.

Trade debtors

Trade debtors are accounted for at cost. Allowances are maintained for bad and doubtful debts for estimated losses resulting from the inability of customers to make required payments. Estimates are based on the ageing of the debt balances and historical experience. Debtors are written off when management deems them not to be collectable.

Taxation

Current tax, including UK corporation tax and foreign tax, is provided at amounts expected to be paid (or recovered) using the tax rates and laws that have been enacted or substantially enacted by the balance sheet date.

Deferred tax is provided in full on timing differences that exist at the balance sheet date and that result in an obligation to pay more tax, or a right to pay less tax in the future. The deferred tax is measured at the rate expected to apply in the periods in which the timing differences are expected to reverse, based on the tax rates and laws that are enacted or substantially enacted at the balance sheet date. Timing differences arise from the inclusion of items of income and expenditure in taxation computations in periods different from those in which they are included in the financial statements. Deferred tax is not provided on timing differences arising from the revaluation of fixed assets where there is no binding commitment to sell the asset. Deferred tax assets are recognised to the extent that it is regarded as more likely than not that they will be recovered. Deferred tax assets and liabilities are not discounted.

Leases

Rental costs under operating leases are charged to the profit and loss account in equal annual amounts over the periods of the leases.

Assets acquired under finance leases, which transfer substantially all the rights and obligations of ownership, are accounted for as though purchased outright. The fair value of the asset at the inception of the lease is included in tangible fixed assets and the capital element of the leasing commitment included in creditors. Finance charges are calculated on an actuarial basis and are allocated over each lease to produce a constant rate of charge on the outstanding balance.

Lease obligations which are satisfied by cash and other assets deposited with third parties are set-off against those assets in the Group’s balance sheet.

Back to Contents

Back to Consolidated Financial Statements Contents

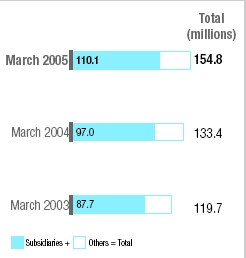

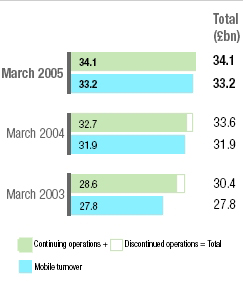

The Group’s business is principally the supply of mobile telecommunications services and products. Other operations primarily comprise fixed line telecommunications businesses.

Segmental information is provided on the basis of geographic regions, being the basis on which the Group manages its worldwide interests.

In October 2004, the Group announced changes in the regional structure of its operations. Germany, Italy and the UK now form their own regions. The Group’s remaining mobile operations, outside Asia Pacific and the Americas, now form the Other EMEA region. The results below are presented in accordance with the new regional structure.

Turnover is by origin, which is not materially different from turnover by destination.

| | Mobile telecommunications | | Other operations | | | |

| |

| |

| | | |

| | | | | | | | Other | | | | Asia | | | | | | Other | | Total | |

| | Germany | | Italy | | UK | | EMEA | | Americas | | Pacific | | Total | | Germany | | EMEA | | Group | |

| | £m | | £m | | £m | | £m | | £m | | £m | | £m | | £m | | £m | | £m | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Year ended 31 March 2005: | | | | | | | | | | | | | | | | | | | | |

| Segment turnover | 5,684 | | 5,565 | | 5,065 | | 8,614 | | – | | 8,531 | | 33,459 | | 1,108 | | – | | 34,567 | |

| Inter-segment turnover | (51 | ) | (44 | ) | (47 | ) | (129 | ) | – | | (4 | ) | (275 | ) | – | | – | | (275 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net turnover | 5,633 | | 5,521 | | 5,018 | | 8,485 | | – | | 8,527 | | 33,184 | | 1,108 | | – | | 34,292 | |

| Turnover between mobile and other operations | (110 | ) | – | | – | | (3 | ) | – | | (1 | ) | (114 | ) | (45 | ) | – | | (159 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

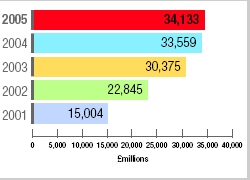

| Group turnover | 5,523 | | 5,521 | | 5,018 | | 8,482 | | – | | 8,526 | | 33,070 | | 1,063 | | – | | 34,133 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | | | | | | | | | |

| Operating (loss)/profit | (5,161 | ) | (1,522 | ) | 745 | | 382 | | (31 | ) | 217 | | (5,370 | ) | 65 | | 1 | | (5,304 | ) |

| Share of operating profit/(loss) in associated undertakings | – | | – | | – | | 337 | | 890 | | 4 | | 1,231 | | – | | (38 | ) | 1,193 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total Group operating (loss)/profit | (5,161 | ) | (1,522 | ) | 745 | | 719 | | 859 | | 221 | | (4,139 | ) | 65 | | (37 | ) | (4,111 | ) |

| Exceptional non-operating items | – | | – | | – | | (10 | ) | 3 | | 20 | | 13 | | – | | – | | 13 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| (Loss)/profit on ordinary activities before interest | (5,161 | ) | (1,522 | ) | 745 | | 709 | | 862 | | 241 | | (4,126 | ) | 65 | | (37 | ) | (4,098 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total Group operating (loss)/profit | (5,161 | ) | (1,522 | ) | 745 | | 719 | | 859 | | 221 | | (4,139 | ) | 65 | | (37 | ) | (4,111 | ) |

| Add back: | | | | | | | | | | | | | | | | | | | | |

| – Goodwill amortisation | 6,824 | | 3,779 | | 230 | | 2,349 | | 788 | | 729 | | 14,699 | | 1 | | – | | 14,700 | |

| | | | | | | | | | | | | | | | | | | | | |

| Subsidiaries | 6,824 | | 3,779 | | 230 | | 1,369 | | – | | 726 | | 12,928 | | 1 | | – | | 12,929 | |

| Associates | – | | – | | – | | 980 | | 788 | | 3 | | 1,771 | | – | | – | | 1,771 | |

| | | | | | | | | | | | | | | | | | | | | |

| – Exceptional operating items | – | | – | | – | | 315 | | – | | – | | 315 | | – | | – | | 315 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total Group operating profit/(loss) before goodwill amortisation | | | | | | | | | | | | | | | | | | | | |

| and exceptional items(1) | 1,663 | | 2,257 | | 975 | | 3,383 | | 1,647 | | 950 | | 10,875 | | 66 | | (37 | ) | 10,904 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | | | | | | | | | |

| Depreciation and amortisation charges, | | | | | | | | | | | | | | | | | | | | |

| excluding goodwill amortisation | 948 | | 700 | | 733 | | 1,086 | | – | | 1,300 | | 4,767 | | 173 | | – | | 4,940 | |

| Intangible and tangible fixed asset additions | 842 | | 721 | | 801 | | 1,548 | | – | | 1,150 | | 5,062 | | 128 | | – | | 5,190 | |

| | | | | | | | | | | | | | | | | | | | | |

| At 31 March 2005: | | | | | | | | | | | | | | | | | | | | |

| Net assets/(liabilities) and attributed goodwill | | | | | | | | | | | | | | | | | | | | |

| (before net borrowings): | | | | | | | | | | | | | | | | | | | | |

| – subsidiary undertakings | 36,674 | | 19,066 | | 4,603 | | 17,058 | | (2,001 | ) | 15,098 | | 90,498 | | 578 | | – | | 91,076 | |

| – share of associated undertakings | – | | – | | – | | 5,029 | | 14,286 | | 17 | | 19,332 | | – | | 66 | | 19,398 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | 36,674 | | 19,066 | | 4,603 | | 22,087 | | 12,285 | | 15,115 | | 109,830 | | 578 | | 66 | | 110,474 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | |

| Net debt | | | | | | | | | | | | | | | | | | | (8,339 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | | | | | | | | 102,135 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Note: |

| (1) | The Group considers its segment result to be Total Group operating profit before goodwill amortisation and exceptional items. |

| | |

Back to Contents

Back to Consolidated Financial Statements Contents

|

| Notes to the Consolidated Financial Statements continued |

|

| | |

| 3. | Segmental Analysis continued |

| | |

| | Mobile telecommunications | | Other operations | | | |

|

|

| | | | | | | | Other | | | | Asia | | | | | | Other | | Asia | | Total | |

| Germany | Italy | UK | EMEA | Americas | Pacific | Total | Germany | EMEA | Pacific | Group |

| £m | £m | £m | £m | £m | £m | £m | £m | £m | £m | £m |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Year ended 31 March 2004: | | | | | | | | | | | | | | | | | | | | | | |

| Segment turnover | 5,536 | | 5,312 | | 4,782 | | 7,627 | | – | | 8,896 | | 32,153 | | 1,002 | | – | | 1,126 | | 34,281 | |

| Inter-segment turnover | (42 | ) | (36 | ) | (38 | ) | (116 | ) | – | | (6 | ) | (238 | ) | – | | – | | – | | (238 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net turnover | 5,494 | | 5,276 | | 4,744 | | 7,511 | | – | | 8,890 | | 31,915 | | 1,002 | | – | | 1,126 | | 34,043 | |

Turnover between mobile and other

operations | (90 | ) | – | | – | | (5 | ) | – | | (105 | ) | (200 | ) | (55 | ) | – | | (229 | ) | (484 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Group turnover | 5,404 | | 5,276 | | 4,744 | | 7,506 | | – | | 8,785 | | 31,715 | | 947 | | – | | 897 | | 33,559 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | | | | | | | | | | | |

| Operating (loss)/profit | (5,254 | ) | (1,343 | ) | 825 | | 473 | | (21 | ) | 515 | | (4,805 | ) | (49 | ) | – | | 78 | | (4,776 | ) |

Share of operating profit/(loss) in joint

ventures andassociated undertakings | – | | – | | – | | 257 | | 297 | | 1 | | 555 | | (9 | ) | (1 | ) | 1 | | 546 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total Group operating (loss)/profit | (5,254 | ) | (1,343 | ) | 825 | | 730 | | 276 | | 516 | | (4,250 | ) | (58 | ) | (1 | ) | 79 | | (4,230 | ) |

| Exceptional non-operating items | (59 | ) | – | | – | | (3 | ) | 13 | | 2 | | (47 | ) | 2 | | 1 | | (59 | ) | (103 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(Loss)/profit on ordinary activities

before interest | (5,313 | ) | (1,343 | ) | 825 | | 727 | | 289 | | 518 | | (4,297 | ) | (56 | ) | – | | 20 | | (4,333 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total Group operating (loss)/profit | (5,254 | ) | (1,343 | ) | 825 | | 730 | | 276 | | 516 | | (4,250 | ) | (58 | ) | (1 | ) | 79 | | (4,230 | ) |

| Add back: | | | | | | | | | | | | | | | | | | | | | | |

| – Goodwill amortisation | 6,995 | | 3,837 | | 143 | | 2,412 | | 1,119 | | 701 | | 15,207 | | – | | – | | – | | 15,207 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Subsidiaries | 6,995 | | 3,837 | | 143 | | 1,424 | | – | | 696 | | 13,095 | | – | | – | | – | | 13,095 | |

| Associates | – | | – | | – | | 988 | | 1,119 | | 5 | | 2,112 | | – | | – | | – | | 2,112 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| – Exceptional operating items | – | | (351 | ) | 130 | | – | | (2 | ) | (5 | ) | (228 | ) | – | | – | | – | | (228 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total Group operating profit/(loss)

before goodwill amortisation and

exceptional items | 1,741 | | 2,143 | | 1,098 | | 3,142 | | 1,393 | | 1,212 | | 10,729 | | (58 | ) | (1 | ) | 79 | | 10,749 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | | | | | | | | | | | |

Depreciation and amortisation charges,

excluding goodwill amortisation | 740 | | 651 | | 508 | | 879 | | 4 | | 1,311 | | 4,093 | | 170 | | – | | 197 | | 4,460 | |

Intangible and tangible fixed asset

additions | 858 | | 700 | | 540 | | 1,141 | | – | | 1,366 | | 4,605 | | 115 | | – | | 41 | | 4,761 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| At 31 March 2004: | | | | | | | | | | | | | | | | | | | | | | |

Net assets/(liabilities) and attributed

goodwill (before net borrowings): | | | | | | | | | | | | | | | | | | | | | | |

| – subsidiary undertakings | 42,512 | | 22,041 | | 5,369 | | 18,735 | | (1,739 | ) | 14,956 | | 101,874 | | 319 | | – | | – | | 102,193 | |

| – share of associated undertakings | – | | – | | – | | 5,983 | | 15,047 | | 18 | | 21,048 | | – | | 178 | | – | | 21,226 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | 42,512 | | 22,041 | | 5,369 | | 24,718 | | 13,308 | | 14,974 | | 122,922 | | 319 | | 178 | | – | | 123,419 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | |

| Net debt | | | | | | | | | | | | | | | | | | | | | (8,488 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | | | | | | | | | | 114,931 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | | | | | | | | | | | |

Back to Contents

Back to Consolidated Financial Statements Contents

| | Mobile telecommunications | | Other operations | | | |

|

|

| | | | | | | | Other | | | | Asia | | | | | | Other | | Asia | | Total | |

| Germany | Italy | UK | EMEA | Americas | Pacific | Total | Germany | EMEA | Pacific | Group |

| £m | £m | £m | £m | £m | £m | £m | £m | £m | £m | £m |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Year ended 31 March 2003: | | | | | | | | | | | | | | | | | | | | | | |

| Segment turnover | 4,754 | | 4,397 | | 4,055 | | 6,219 | | 18 | | 8,596 | | 28,039 | | 924 | | – | | 2,616 | | 31,579 | |

| Inter-segment turnover | (32 | ) | (26 | ) | (29 | ) | (88 | ) | (13 | ) | (4 | ) | (192 | ) | – | | – | | – | | (192 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net turnover | 4,722 | | 4,371 | | 4,026 | | 6,131 | | 5 | | 8,592 | | 27,847 | | 924 | | – | | 2,616 | | 31,387 | |

Turnover between mobile and other

operations | (76 | ) | – | | – | | (1 | ) | – | | (228 | ) | (305 | ) | (70 | ) | – | | (637 | ) | (1,012 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Group turnover | 4,646 | | 4,371 | | 4,026 | | 6,130 | | 5 | | 8,364 | | 27,542 | | 854 | | – | | 1,979 | | 30,375 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | | | | | | | | | | | |

| Operating (loss)/profit | (5,030 | ) | (1,955 | ) | 1,090 | | 359 | | (117 | ) | 702 | | (4,951 | ) | (89 | ) | – | | (255 | ) | (5,295) | |

| Share of operating (loss)/profit in joint ventures and associated undertakings | – | | – | | – | | (13 | ) | (21 | ) | 2 | | (32 | ) | – | | (124 | ) | – | | (156 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total Group operating (loss)/profit | (5,030 | ) | (1,955 | ) | 1,090 | | 346 | | (138 | ) | 704 | | (4,983 | ) | (89 | ) | (124) | | (255 | ) | (5,451 | ) |

| Exceptional non-operating items | – | | – | | – | | (6 | ) | (28 | ) | (295 | ) | (329 | ) | 290 | | 58 | | (24 | ) | (5) | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(Loss)/profit on ordinary activities

before interest | (5,030 | ) | (1,955 | ) | 1,090 | | 340 | | (166 | ) | 409 | | (5,312 | ) | 201 | | (66) | | (279 | ) | (5,456 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total Group operating (loss)/profit | (5,030 | ) | (1,955 | ) | 1,090 | | 346 | | (138 | ) | 704 | | (4,983 | ) | (89 | ) | (124) | | (255 | ) | (5,451 | ) |

| Add back: | | | | | | | | | | | | | | | | | | | | | | |

| – Goodwill amortisation | 6,465 | | 3,543 | | 30 | | 1,991 | | 1,235 | | 717 | | 13,981 | | – | | 75 | | – | | 14,056 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Subsidiaries | 6,465 | | 3,543 | | 30 | | 1,127 | | – | | 710 | | 11,875 | | – | | – | | – | | 11,875 | |

| Associates | – | | – | | – | | 864 | | 1,235 | | 7 | | 2,106 | | – | | 75 | | – | | 2,181 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| – Exceptional operating items | – | | – | | – | | 50 | | 122 | | – | | 172 | | – | | – | | 404 | | 576 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total Group operating profit/(loss)

before goodwill amortisation and

exceptional items | 1,435 | | 1,588 | | 1,120 | | 2,387 | | 1,219 | | 1,421 | | 9,170 | | (89 | ) | (49) | | 149 | | 9,181 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | | | | | | | | | | | |

Depreciation and amortisation charges,

excluding goodwill amortisation | 565 | | 570 | | 417 | | 720 | | 15 | | 1,190 | | 3,477 | | 166 | | – | | 389 | | 4,032 | |

Intangible and tangible fixed asset

additions | 800 | | 732 | | 500 | | 1,188 | | 9 | | 1,393 | | 4,622 | | 135 | | – | | 186 | | 4,943 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | | | | | | | | | | | |

Back to Contents

Back to Consolidated Financial Statements Contents

|

| Notes to the Consolidated Financial Statements continued |

|

| | |

| 4. | Exceptional operating items |

| | |

| | 2005 | | 2004 | | 2003 | |

| £m | £m | £m |

|

|

|

|

|

| |

| Impairment of intangible and tangible fixed assets | (315 | ) | – | | (485 | ) |

| Contribution tax | – | | 351 | | – | |

| Reorganisation costs | – | | (123 | ) | (91 | ) |

|

|

|

|

|

| |

| | (315 | ) | 228 | | (576 | ) |

|

|

|

|

|

| |

The exceptional operating cost of £315 million in the year ended 31 March 2005 is due to an impairment of the carrying value of goodwill relating to Vodafone Sweden.

The net exceptional operating income for 2004 of £228 million comprises £351 million of expected recoveries and provision releases in relation to a contribution tax levy on Vodafone Italy and reorganisation costs of £123 million primarily relating to the Group’s operations in the UK.

The impairment charges for 2003 of £485 million relate to the carrying value of goodwill for Grupo Iusacell (£80 million) and tangible fixed assets in Japan Telecom (£405 million). Reorganisation costs of £91 million relate to the integration of Vizzavi and related restructuring of the Group’s internet portal activities.

| | 2005 | | 2004 | | 2003 | |

| |

|

|

| | | (1) | Continuing | | Discontinued | | | | Continuing | | Discontinued | | | |

| Total | operations | operations | Total | operations | operations | Total |

| £m | | £m | £m | £m | £m | £m | £m |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

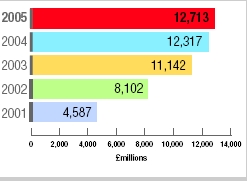

| Group turnover | 34,133 | | 32,741 | | 818 | | 33,559 | | 28,547 | | 1,828 | | 30,375 | |

| Cost of sales | (20,753 | ) | (18,986 | ) | (475 | ) | (19,461 | ) | (16,910 | ) | (986 | ) | (17,896 | ) |

| | | | | | | | | | | | | | | |

| Exceptional operating items | – | | 351 | | – | | 351 | | – | | – | | – | |

| Other cost of sales | (20,753 | ) | (19,337 | ) | (475 | ) | (19,812 | ) | (16,910 | ) | (986 | ) | (17,896 | ) |

| | | | | | | | | | | | | | | |

| Gross profit | 13,380 | | 13,755 | | 343 | | 14,098 | | 11,637 | | 842 | | 12,479 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Selling and distribution costs | (2,031 | ) | (2,065 | ) | (14 | ) | (2,079 | ) | (1,863 | ) | (20 | ) | (1,883 | ) |

| Administrative expenses | (16,653 | ) | (16,532 | ) | (263 | ) | (16,795 | ) | (14,826 | ) | (1,065 | ) | (15,891 | ) |

| | | | | | | | | | | | | | | |

| Goodwill amortisation | (12,929 | ) | (13,095 | ) | – | | (13,095 | ) | (11,875 | ) | – | | (11,875 | ) |

| Exceptional operating items | (315 | ) | (123 | ) | – | | (123 | ) | (91 | ) | (405 | ) | (496 | ) |

| Other administration expenses | (3,409 | ) | (3,314 | ) | (263 | ) | (3,577 | ) | (2,860 | ) | (660 | ) | (3,520 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total operating expenses | (18,684 | ) | (18,597 | ) | (277 | ) | (18,874 | ) | (16,689 | ) | (1,085 | ) | (17,774 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Operating loss | (5,304 | ) | (4,842 | ) | 66 | | (4,776 | ) | (5,052 | ) | (243 | ) | (5,295 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The results of Japan Telecom are analysed as discontinued operations in prior periods’ analyses.

| Note: |

| (1) | The results for the 2005 financial year entirely relate to continuing operations. |

| | |

Back to Contents

Back to Consolidated Financial Statements Contents

| | | | | | | |

| Operating loss has been arrived at after charging/(crediting): | |

| | | | | | | |

| | 2005 | | 2004 | | 2003 | |

| £m | £m | £m |

|

|

|

|

|

| |

| Staff costs (see note 31) | 2,293 | | 2,331 | | 2,278 | |

| Depreciation of tangible fixed assets: | | | | | | |

| Owned assets | 4,467 | | 4,181 | | 3,783 | |

| Leased assets | 61 | | 181 | | 196 | |

| Goodwill amortisation | 12,929 | | 13,095 | | 11,875 | |

| Impairment of intangible and tangible fixed assets | 315 | | – | | 485 | |

| Amortisation of other intangible fixed assets | 412 | | 98 | | 53 | |

| Research and development | 219 | | 171 | | 164 | |

| Advertising costs (including applicable staff costs) | 864 | | 990 | | 902 | |

| Bad debt expense | 224 | | 209 | | 193 | |

| Operating lease rentals: | | | | | | |

| Plant and machinery | 37 | | 98 | | 78 | |

| Other assets including fixed line rentals | 1,300 | | 1,254 | | 1,269 | |

| Own costs capitalised attributable to the construction or acquisition of tangible fixed assets | (301 | ) | (290 | ) | (207 | ) |

|

|

|

|

|

| |

| | | | | |

| The total amount charged by Deloitte & Touche LLP is analysed below: | |

| | | | | |

| | 2005 | | 2004 | |

| £m | £m |

|

|

|

| |

| Audit fees | 5 | | 4 | |

| Audit-related fees: | | | | |

| Audit regulatory reporting | – | | 2 | |

| Due diligence reviews | 1 | | 1 | |

| Tax fees: | | | | |

| Compliance | 1 | | 1 | |

| Other tax | 1 | | 1 | |

| All other fees: | | | | |

| IT consultancy | – | | 2 | |

| Other | 1 | | 1 | |

|

|

|

| |

| | 9 | | 12 | |

|

|

|

| |

| Analysed as: | | | | |

| | | | | |

| | 2005 | | 2004 | |

| £m | £m |

|

|

|

| |

| Charged to profit and loss account | 9 | | 10 | |

| Capitalised or charged to share premium account | – | | 2 | |

|

|

|

| |

| | 9 | | 12 | |

|

|

|

| |

| | | | | |

| | 2005 | | 2004 | |

| £m | £m |

|

|

|

| |

| UK companies | 3 | | 4 | |

| Overseas companies | 6 | | 8 | |

|

|

|

| |

| | 9 | | 12 | |

|

|

|

| |

| In addition to the above, the Group’s associated companies paid fees totalling £5 million to Deloitte & Touche LLP during the year ended 31 March 2005 (2004: £8 million). The Company audit fee for the year ended 31 March 2005 was £0.5 million (2004: £0.3 million). |

| |

Back to Contents

Back to Consolidated Financial Statements Contents

|

| Notes to the Consolidated Financial Statements continued |

|

|

| 5. | Operating loss continued |

| Joint ventures and associated undertakings |

| The Group’s share of the turnover and operating loss of joint ventures and associated undertakings is further analysed as follows: |

| | |

| | 2005 | | 2004 | | 2003 | |

| £m | £m | £m |

|

|

|

|

|

| |

| Share of turnover: | | | | | | |

| Joint ventures | – | | – | | 8 | |

| Associated undertakings | 11,648 | | 10,179 | | 8,769 | |

|

|

|

|

|

| |

| | 11,648 | | 10,179 | | 8,777 | |

|

|

|

|

|

| |

| | 2005 | | 2004 | | 2003 | |

| £m | £m | £m |

|

|

|

|

|

| |

| Share of operating profit/(loss): | | | | | | |

| Joint ventures | – | | – | | (39 | ) |

| Associated undertakings | 1,193 | | 546 | | (117 | ) |

|

|

|

|

|

| |

| | 1,193 | | 546 | | (156 | ) |

|

|

|

|

|

| |

| | | |

|

| |

| 6. | Exceptional non-operating items | |

| | 2005 | | 2004 | | 2003 | |

| £m | £m | £m |

|

|

|

|

|

| |

| Profit on disposal of fixed asset investments | 19 | | 12 | | 255 | |

| Share of associate profit/(loss) on disposal of investment | 5 | | (1 | ) | 55 | |

| Amounts written off fixed asset investments | (2 | ) | (6 | ) | (340 | ) |

| Loss on disposal of businesses | (9 | ) | (127 | ) | 22 | |

| Profit on disposal of tangible fixed assets | – | | 19 | | 3 | |

|

|

|

|

|

| |

| | 13 | | (103 | ) | (5 | ) |

|

|

|

|

|

| |

| The profit on disposal of fixed assets investments principally relates to the disposal of trade investments by Vodafone Japan. The loss on disposal of businesses for 2005 primarily relates to the loss on disposal incurred by the Group on the sale of a 16.9% stake in Vodafone Egypt reducing the Group’s controlling interest to 50.1%. |

| | | | | | | |

| The loss on disposal of businesses for the year ended 31 March 2004 primarily relates to the disposal of the Japan Telecom fixed line operations by the Group’s 66.7% owned subsidiary, Vodafone Holdings K.K. |

| | | | | | | |

| Amounts written off fixed asset investments for the year ended 31 March 2003 primarily relates to the Group’s interest in China Mobile. The profit on disposal of fixed asset investments for 2003 primarily relates to the disposal of the Group’s 23.6% interest in Bergemann GmbH, through which the Group’s stake in Ruhrgas AG was held. The share of associate profit on disposal of investment relates to the completion of the disposal for cash of AOL Europe shares by Cegetel Group S.A. |

Back to Contents

Back to Consolidated Financial Statements Contents

| 7. | Net interest payable and similar items |

| | 2005 | | 2004 | | 2003 | |

| £m | £m | £m |

|

|

|

|

|

| |

| Parent and subsidiary undertakings: | | | | | | |

| Interest receivable and similar income | (602 | ) | (592 | ) | (666 | ) |

|

|

|

|

|

| |

| Interest payable and similar charges: | | | | | | |

| Bank loans and overdrafts | 49 | | 46 | | 133 | |

| Other loans | 677 | | 820 | | 921 | |

| Tax liabilities | 261 | | 215 | | 55 | |

| Finance leases | 8 | | 10 | | 14 | |

|

|

|

|

|

| |

| | 995 | | 1,091 | | 1,123 | |

|

|

|

|

|

| |

| Group net interest payable | 393 | | 499 | | 457 | |

|

|

|

|

|

| |

| Share of joint ventures: | | | | | | |

| Interest payable and similar charges | – | | – | | 8 | |

|

|

|

|

|

| |

| Share of associated undertakings: | | | | | | |

| Interest receivable and similar income | (16 | ) | (7 | ) | (24 | ) |

| Interest payable and similar charges | 227 | | 222 | | 311 | |

|

|

|

|

|

| |

| | 211 | | 215 | | 287 | |

|

|

|

|

|

| |

| Share of joint ventures and associated undertakings net interest payable | 211 | | 215 | | 295 | |

|

|

|

|

|

| |

| | | | | | | |

|

|

|

|

|

| |

| Net interest payable and similar items | 604 | | 714 | | 752 | |

|

|

|

|

|

| |

| | | |

|

| |

| 8. | Tax on loss on ordinary activities | |

| | | | | | |

| | 2005 | | 2004 | | 2003 | |

| £m | £m | £m |

|

|

|

|

|

| |

| | | | | | | |

| United Kingdom corporation tax charge at 30% | 271 | | 209 | | 195 | |

|

|

|

|

|

| |

| Overseas corporation tax | | | | | | |

| Current tax: | | | | | | |

| Current year | 2,430 | | 2,264 | | 1,971 | |

| Prior year | (221 | ) | (159 | ) | 9 | |

|

|

|

|

|

| |

| | 2,209 | | 2,105 | | 1,980 | |

|

|

|

|

|

| |

| Total current tax | 2,480 | | 2,314 | | 2,175 | |

| Deferred tax – origination of and reversal of timing differences | (247 | ) | 736 | | 818 | |

| | | | | | | |

| United Kingdom deferred tax | 292 | | 426 | | 22 | |

| Overseas deferred tax | (539 | ) | 310 | | 796 | |

| | | | | | | |

| Tax on exceptional items | 3 | | 104 | | (37 | ) |

|

|

|

|

|

| |

| Total tax charge | 2,236 | | 3,154 | | 2,956 | |

|

|

|

|

|

| |

| Tax on loss on ordinary activities before exceptional items and exceptional tax credit | 2,832 | | 3,050 | | 2,993 | |

| Tax on exceptional items | 3 | | 104 | | (37 | ) |

| Exceptional tax credit | (599 | ) | – | | – | |

|

|

|

|

|

| |

| | 2,236 | | 3,154 | | 2,956 | |

|

|

|

|

|

| |

| | | | | | | |

| Parent and subsidiary undertakings | 1,698 | | 2,866 | | 2,624 | |

| Share of joint ventures | – | | – | | 17 | |

| Share of associated undertakings | 538 | | 288 | | 315 | |

|

|

|

|

|

| |

| | 2,236 | | 3,154 | | 2,956 | |

|

|

|

|

|

| |

Back to Contents

Back to Consolidated Financial Statements Contents

|

| Notes to the Consolidated Financial Statements continued |

|

| 8. | Tax on loss on ordinary activities continued |

| Factors affecting the tax charge for the year |

Refer to Operating and Financial Review and Prospects – Operating Results – Group Overview – 2005 financial year compared to 2004 financial year – Taxation.

Reconciliation of expected tax charge using the standard tax rate to the actual current tax charge

The differences between the Group’s expected tax charge, using the Group’s standard corporation tax rate of 36.0% in 2005 (36.4% in 2004 and 37.0% in 2003), comprising the average rates of tax payable across the Group and weighted in proportion to accounting profits, and the Group’s current tax charge for each of those years were as follows:

| | 2005 | | 2004 | | 2003 | |

| £m | £m | £m |

|

|

|

|

|

| |

| Expected tax credit at standard tax rate on loss on ordinary activities | (1,693 | ) | (1,837 | ) | (2,295 | ) |

| Goodwill amortisation | 5,292 | | 5,535 | | 5,196 | |

| Exceptional non-operating items | (5 | ) | 38 | | 2 | |

| Exceptional operating items | 113 | | (83 | ) | 213 | |

|

|

|

|

|

| |

| Expected tax charge at standard tax rate on profit on ordinary activities, | | | | | | |

| before goodwill amortisation and exceptional items | 3,707 | | 3,653 | | 3,116 | |

| Permanent differences | 93 | | 47 | | 140 | |

| Fixed asset timing differences | 12 | | (509 | ) | (404 | ) |

| Short term timing differences | (163 | ) | (18 | ) | (64 | ) |

| Deferred tax on overseas earnings | (322 | ) | (418 | ) | (424 | ) |

| Losses carried forward utilised/current year losses for which no credit taken | (171 | ) | 26 | | 278 | |

| Exceptional current tax credit | (166 | ) | – | | – | |

| Prior year adjustments | (289 | ) | (61 | ) | 4 | |

| Non taxable profits/non deductible losses | (148 | ) | (281 | ) | (239 | ) |

| International corporate tax rate differentials and other | (73 | ) | (125 | ) | (232 | ) |

|

|

|

|

|

| |

| Actual current tax charge (excluding tax on exceptional items) | 2,480 | | 2,314 | | 2,175 | |

|

|

|

|

|

| |

Reconciliation of expected tax charge using the UK statutory tax rate to the actual tax charge

The differences between the Group’s expected tax charge, using the UK corporation tax rate of 30% in 2005, 2004 and 2003 and the Group’s tax charge for each of those years were as follows:

| | 2005 | | 2004 | | 2003 | |

| £m | £m | £m |

|

|

|

|

|

| |

| Expected tax credit at UK corporation tax rate on loss on ordinary activities | (1,411 | ) | (1,514 | ) | (1,863 | ) |

| Goodwill amortisation | 4,410 | | 4,562 | | 4,217 | |

| Exceptional non-operating items | (4 | ) | 31 | | 2 | |

| Exceptional operating items | 95 | | (69 | ) | 173 | |

|

|

|

|

|

| |

| Expected tax charge at UK corporation tax rate, before goodwill amortisation and exceptional items | 3,090 | | 3,010 | | 2,529 | |

| Permanent differences | 118 | | 152 | | 165 | |

| Movement in valuation allowances against: | | | | | | |

| – Fixed asset timing differences | (22 | ) | (21 | ) | (40 | ) |

| – Short term timing differences | (197 | ) | (64 | ) | 60 | |

| – Losses carried forward utilised/current year losses for which no credit taken | (264 | ) | (26 | ) | 161 | |

| Prior year adjustments | (315 | ) | (61 | ) | (9 | ) |

| Net (over)/under charge relating to international associated undertakings | 23 | | (186 | ) | 8 | |

| Non taxable profits/non deductible losses | (148 | ) | (281 | ) | (239 | ) |

| International corporate tax rate differentials and other | 547 | | 527 | | 358 | |

|

|

|

|

|

| |

| Actual total tax charge (excluding tax on exceptional items and exceptional tax credit) | 2,832 | | 3,050 | | 2,993 | |

|

|

|

|

|

| |

Back to Contents

Back to Consolidated Financial Statements Contents

Factors affecting the tax charge in future years

Factors that may affect the Group’s future tax charge include the absence of one-off restructuring benefits, the resolution of open issues, future planning opportunities, corporate acquisitions and disposals, changes in tax legislation and rates, and the use of brought forward tax losses.

In particular, the Group’s subsidiary, Vodafone 2, is responding to an enquiry by the UK Inland Revenue with regard to the UK tax treatment of one of its Luxembourg holding companies under the controlled foreign companies rules. Further details in relation to this enquiry are included in “Risk Factors and Legal Proceedings”. At 31 March 2005, Vodafone has provided for £1,600 million tax and £157 million interest in respect of the potential UK tax liability that may arise in respect of this enquiry. At 31 March 2004, the respective provisions were £1,335 million and £62 million. Vodafone considers these amounts are sufficient to settle any assessments that may arise from the enquiry. However, the amount ultimately paid may differ materially from the amount accrued and, therefore, could affect the overall profitability of the Group in future periods. In the absence of any material unexpected developments, the provisions are likely to be reassessed when the views of the European Court of Justice become known, which is expected to be during 2006.

At 31 March 2005, the Group had the following trading and non-trading losses available for carry forward. These losses are available for offset against future trading and non-trading profits of certain Group and associated undertakings:

| | Expiring within | | Expiring within | | | | | |

| 5 years | 10 years | Unlimited | Total |

| £m | £m | £m | £m |

|

|

|

|

|

|

|

| |

| UK subsidiaries’ trading and non-trading losses | – | | – | | 2,035 | | 2,035 | |

| International subsidiaries’ trading and non-trading losses | 92 | | 1,035 | | 34,527 | | 35,654 | |

|

|

|

|

|

|

|

| |

The losses in respect of UK subsidiaries include an amount of £1,870 million that is only available for offset against future capital gains and since it is uncertain whether these losses will be utilised, no deferred tax asset has been recognised.

The losses in respect of international subsidiaries include amounts of £30,857 million (2004: £30,728 million) that have arisen in overseas holding companies as a result of revaluations of those companies’ investments for local GAAP purposes. Since it is uncertain whether these losses will be utilised, no deferred tax asset has been recognised. See note 21.

In addition to the losses described above, the Group has potential tax losses of £34,674 million (2004: £33,763 million) in respect of a write down in the value of investments in Germany. These losses have to date been denied by the German Tax Authorities. Vodafone is now in discussions with them regarding the availability of the losses, however the outcome of these discussions and the timing of the resolution are not yet known. The Group has not recognised the availability of the losses, nor the benefit arising from them, due to this uncertainty. If upon resolution a benefit is recognised, it may impact both the amount of current income taxes provided since the date of initial deduction and the amount of benefit from tax losses the Group will recognise. The recognition of these benefits could affect the overall profitability of the Group in future periods.

| | | | 2005 | | | | 2004 | | | | 2003 | |

| Pence per | Pence per | Pence per |

| 2005 | ordinary | 2004 | ordinary | 2003 | ordinary |

| £m | share | £m | share | £m | share |

|

|

|

|

|

|

|

|

|

|

|

| |

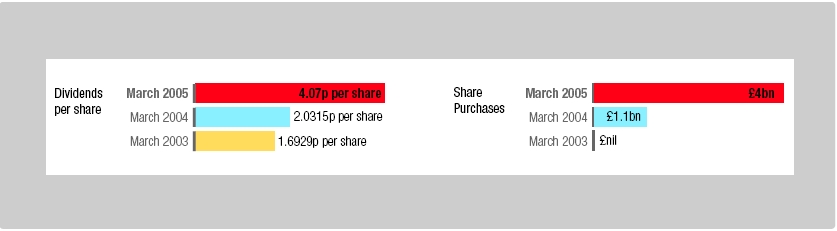

| Interim dividend paid | 1,263 | | 1.91 | | 650 | | 0.9535 | | 542 | | 0.7946 | |

| Proposed final dividend | 1,395 | | 2.16 | | 728 | | 1.0780 | | 612 | | 0.8983 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| | 2,658 | | 4.07 | | 1,378 | | 2.0315 | | 1,154 | | 1.6929 | |

|

|

|

|

|

|

|

|

|

|

|

| |

Shares held in treasury do not qualify for dividends. Dividends that would have been paid on these shares would have been £124 million for the year ended 31 March 2005 (2004: £9 million; 2003: £nil) had they qualified.

Back to Contents

Back to Consolidated Financial Statements Contents

|

| Notes to the Consolidated Financial Statements continued |

|

| | 2005 | | 2004 | | 2003 | |

|

|

|

|

|

| |

| Weighted average number of shares (millions) in issue during the year and used to | | | | | | |

| calculate basic and diluted loss per share: | 66,196 | | 68,096 | | 68,155 | |

| | | | | | | |

| | £m | | £m | | £m | |

|

|

|

|

|

| |

| | | | | | | |

| Loss for basic and diluted loss per share | (7,540 | ) | (9,015 | ) | (9,819 | ) |

| | | | | | | |

| | Pence | | Pence | | Pence | |

| per share | per share | per share |

|

|

|

|

|

| |

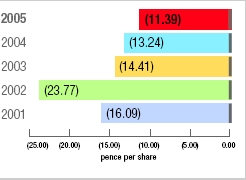

| Basic and diluted loss per share | (11.39 | ) | (13.24 | ) | (14.41 | ) |

| | | | | | | |

| | £m | | £m | | £m | |

|

|

|

|

|

| |

| Basic loss per share is stated inclusive of the following items: | | | | | | |

| Amortisation of goodwill | 14,700 | | 15,207 | | 14,056 | |

| Exceptional operating items | 315 | | (228 | ) | 576 | |

| Exceptional non-operating items | (13 | ) | 103 | | 5 | |

| Exceptional tax credit | (599 | ) | – | | – | |

| Tax on exceptional items | 3 | | 104 | | (37 | ) |

| Share of exceptional items attributable to minority interests | 26 | | 27 | | (139 | ) |

| | | | | | | |

| | Pence | | Pence | | Pence | |

| per share | per share | per share |

|

|

|

|

|

| |

| Amortisation of goodwill | 22.21 | | 22.33 | | 20.62 | |

| Exceptional operating items | 0.48 | | (0.33 | ) | 0.85 | |

| Exceptional non-operating items | (0.02 | ) | 0.15 | | 0.01 | |

| Exceptional tax credit | (0.91 | ) | – | | – | |

| Tax on exceptional items | – | | 0.15 | | (0.06 | ) |

| Share of exceptional items attributable to minority interests | 0.04 | | 0.04 | | (0.20 | ) |

Basic loss per share represents the net loss attributable to ordinary shareholders, being the loss on ordinary activities after taxation and minority interests. Diluted loss per share is the same as basic loss per share as it is considered that there are no dilutive potential ordinary shares.

Back to Contents

Back to Consolidated Financial Statements Contents

| 11.Intangible fixed assets |

| | | | | | | |

| Licence and |

| spectrum |

| Goodwill | fees | Total |

| £m | £m | £m |

|

|

|

|

|

| |

| Cost: | | | | | | |

| 1 April 2004 | 130,377 | | 15,063 | | 145,440 | |

| Exchange movements | 2,737 | | 244 | | 2,981 | |

| Acquisitions (note 25) | 1,757 | | – | | 1,757 | |

| Additions | – | | 124 | | 124 | |

| Disposals | (52 | ) | – | | (52 | ) |

|

|

|

|

|

| |

| 31 March 2005 | 134,819 | | 15,431 | | 150,250 | |

|

|

|

|

|

| |

| Accumulated amortisation and impairment: | | | | | | |

| 1 April 2004 | 51,597 | | 221 | | 51,818 | |

| Exchange movements | 1,323 | | 7 | | 1,330 | |

| Amortisation charge for the year | 12,929 | | 412 | | 13,341 | |

| Impairment | 315 | | – | | 315 | |

| Disposals | (18 | ) | – | | (18 | ) |

|

|

|

|

|

| |

| 31 March 2005 | 66,146 | | 640 | | 66,786 | |

|

|

|

|

|

| |

| Net book value: | | | | | | |

| 31 March 2005 | 68,673 | | 14,791 | | 83,464 | |

|

|

|

|

|

| |

| 31 March 2004 | 78,780 | | 14,842 | | 93,622 | |

|

|

|

|

|

| |

For acquisitions prior to 1 April 1998, the cumulative goodwill written off to reserves, net of the goodwill attributed to business disposals, was £723 million at 31 March 2005 (2004: £723 million).

In accordance with accounting standards, the Group regularly monitors the carrying value of its fixed assets. A review was undertaken at 31 March 2005 to assess whether the carrying value of assets was supported by the net present value of future cash flows derived from assets using cash flow projections for each asset in respect of the period to 31 March 2015.

The Group prepares and internally approves formal ten year plans for its businesses and uses these as the basis for its impairment reviews. The plans include cash flow projections for the mobile businesses which reflect continuing investment in network infrastructure to provide enhanced voice and data products and services, which are forecast to be significant drivers of future revenue growth. Capital expenditure is heaviest in the early years of the projections but is forecast to fall to 10% of revenue at Group level by the year ending 31 March 2008. Revenue growth is forecast from a combination of new customers and enhanced customer propositions. Data revenue is forecast to grow strongly throughout the ten year plan period. Voice revenue is forecast to benefit in the longer term from enhanced service offerings and traffic moving from fixed networks to mobile networks following a period of stabilisation reflecting the impact of price declines.

Accordingly, the directors believe that it is appropriate to use projections in excess of five years. For the years beyond 1 April 2015, forecast growth rates for mobile businesses do not exceed nominal GDP, using rates from independent sources, and are below nominal GDP for non-mobile businesses. The discount rates for the major markets reviewed were based on company specific pre-tax weighted average cost of capital percentages and ranged from 8.3% to 11.6%.

The results of the review undertaken at 31 March 2005 indicated that an impairment charge of £315 million was necessary in respect of goodwill held in relation to Vodafone Sweden (see note 4).

Back to Contents

Back to Consolidated Financial Statements Contents

|

Notes to the Consolidated Financial Statements continued |

|

| | Land and | | Equipment,

fixtures | | Network | | | |

| buildings | and fittings | infrastructure | Total |

| £m | £m | £m | £m |

|

|

|

|

|

|

|

| |

| Cost: | | | | | | | | |

| 1 April 2004 | 1,214 | | 5,979 | | 23,371 | | 30,564 | |

| Exchange movements | 9 | | 57 | | (37 | ) | 29 | |

| Additions | 126 | | 1,690 | | 3,250 | | 5,066 | |

| Disposals | (23 | ) | (274 | ) | (419 | ) | (716 | ) |

|

|

|

|

|

|

|

| |

| 31 March 2005 | 1,326 | | 7,452 | | 26,165 | | 34,943 | |

|

|

|

|

|

|

|

| |

| Accumulated depreciation and impairment: | | | | | | | | |

| 1 April 2004 | 293 | | 3,640 | | 8,548 | | 12,481 | |

| Exchange movements | 4 | | 27 | | – | | 31 | |

| Charge for the year | 86 | | 1,144 | | 3,298 | | 4,528 | |

| Disposals | (10 | ) | (184 | ) | (301 | ) | (495 | ) |

|

|

|

|

|

|

|

| |

| 31 March 2005 | 373 | | 4,627 | | 11,545 | | 16,545 | |

|

|

|

|

|

|

|

| |

| Net book value: | | | | | | | | |

| 31 March 2005 | 953 | | 2,825 | | 14,620 | | 18,398 | |

|

|

|

|

|

|

|

| |

| 31 March 2004 | 921 | | 2,339 | | 14,823 | | 18,083 | |

|

|

|

|

|

|

|

| |

| | | | | | | | | |

| The total net book value of land and buildings held by the Group comprises: | | | | | | | | |

| | | | | | 2005 | | 2004 | |

| £m | £m |

|

|

|

|

|

|

|

| |

| Freehold premises included in: | | | | | | | | |

| – Land and buildings | | | | | 597 | | 586 | |

| – Network infrastructure | | | | | 309 | | 284 | |

|

|

|

|

|

|

|

| |

| | | | | | 906 | | 870 | |

|

|

|

|

|

|

|

| |

| | | | | | | | | |

| Long-term leasehold premises included in: | | | | | | | | |

| – Land and buildings | | | | | 114 | | 115 | |

|

|

|

|

|

|

|

| |

| | | | | | | | | |

| Short term leasehold premises included in: | | | | | | | | |

| – Land and buildings | | | | | 242 | | 220 | |

| – Network infrastructure | | | | | 1,537 | | 1,348 | |

|

|

|

|

|

|

|

| |

| | | | | | 1,779 | | 1,568 | |

|

|

|

|

|

|

|

| |

| | | | | | | | | |

|

|

|

|

|

|

|

| |

| Total | | | | | 2,799 | | 2,553 | |

|

|

|

|

|

|

|

| |

| Network infrastructure and equipment include the following amounts in respect of finance leases: | | | | | | | |

| | | | | | 2005 | | 2004 | |

| £m | £m |

|

|

|

|

|

|

|

| |

| Cost | | | | | 309 | | 614 | |

| Accumulated depreciation | | | | | (184 | ) | (454 | ) |

|

|

|

|

|

|

|

| |

| Net book value | | | | | 125 | | 160 | |

|

|

|

|

|

|

|

| |

Liabilities under leases for network infrastructure assets, with an original cost of £104 million and net book value at 31 March 2005 of £20 million, have been unconditionally satisfied by call deposits and other assets, trust deed and set-off arrangements. Accordingly, lease liabilities and the corresponding financial assets in respect of these network infrastructure assets are not included in the Group’s balance sheet.

Back to Contents

Back to Consolidated Financial Statements Contents

| The cost of assets in the course of construction, which are not subject to depreciation, was: | | | |

| | | | |

| | 2005

£m | | |

|

| | |

| Land and buildings | 16 | | |

| Equipment, fixtures & fittings | 341 | | |

| Network infrastructure | 986 | | |

|

| | |

| Total | 1,343 | | |

|

| | |

| | | | |

|

| | |

|

| 13.Fixed asset investments |

| Associated undertakings |

| | | |

| | Group

£m | |

|

| |

| Share of net assets: | | |

| 1 April 2004 | 3,075 | |

| Exchange movements | (41 | ) |

| Share of retained results excluding goodwill amortisation | 152 | |

| Share of goodwill amortisation | (42 | ) |

|

| |

| 31 March 2005 | 3,144 | |

|

| |

| Capitalised goodwill: | | |

| 1 April 2004 | 18,151 | |

| Exchange movements | (173 | ) |

| Acquisitions (note 25) | 5 | |

| Goodwill amortisation | (1,729 | ) |

|

| |

| 31 March 2005 | 16,254 | |

|

| |

| | | |

| Net book value: | | |

| 31 March 2005 | 19,398 | |

|

| |

| 31 March 2004 | 21,226 | |

|

| |

|

For acquisitions of associated undertakings prior to 1 April 1998, the cumulative goodwill written off to reserves, net of the goodwill attributed to business disposals, was £467 million at 31 March 2005 (2004: £467 million).

The Group’s share of its associated undertakings comprises:

| | 2005

£m | | 2004

£m | |

|

|

|

| |

| Share of turnover of associated undertakings | 11,648 | | 10,179 | |

|

|

|

| |

| Share of assets: | | | | |

| Fixed assets | 8,895 | | 8,139 | |

| Current assets | 2,651 | | 2,263 | |

|

|

|

| |

| | 11,546 | | 10,402 | |

|

|

|

| |

| Share of liabilities: | | | | |

| Liabilities due within one year | 5,398 | | 4,695 | |

| Liabilities due after more than one year | 2,578 | | 2,197 | |

| Minority interests | 426 | | 435 | |

|

|

|

| |

| | 8,402 | | 7,327 | |

|

|

|

| |

| Share of net assets | 3,144 | | 3,075 | |

| Attributed goodwill net of accumulated amortisation and impairment | 16,254 | | 18,151 | |

|

|

|

| |

| | 19,398 | | 21,226 | |

|

|

|

| |

In addition, minority interests disclosed in the Consolidated Profit and Loss account for the year ended 31 March 2005 includes £45 million in respect of joint ventures and associated undertakings (2004: £61 million; 2003: £(20) million).

Back to Contents

Back to Consolidated Financial Statements Contents

|

| Notes to the Consolidated Financial Statements continued |

|

|

13.Fixed asset investments continued

| The Group’s principal associated undertakings and fixed asset investments are detailed in note 34. A summary of Verizon Wireless’ results is shown within note 36. |

| | | |

| Other fixed asset investments | | |

| | Group | |

| | £m | |

|

| |

| Cost: | | |

| 1 April 2004 | 2,079 | |

| Exchange movements | (112 | ) |

| Additions | 20 | |

| Disposals | (184 | ) |

|

| |

| 31 March 2005 | 1,803 | |

|

| |

| Amounts written off: | | |

| 1 April 2004 | 1,030 | |

| Exchange movements | (81 | ) |

| Amounts written off during the year | 2 | |

|

| |

| 31 March 2005 | 951 | |

|

| |

| Net book value: | | |

| 31 March 2005 | 852 | |

|

| |

| 31 March 2004 | 1,049 | |

|

| |

Other fixed asset investments include 3.3% of China Mobile (Hong Kong) Limited which is listed on the New York and Hong Kong Stock Exchanges. The market value of this investment at 31 March 2005 was £1,113 million (2004: £1,047 million).

The Company’s fixed asset investments comprise investments in subsidiary undertakings as follows:

| | £m | |

|

| |

| Cost: | | |

| 1 April 2004 | 110,939 | |

| Additions | 10 | |

| Disposals | (12,160 | ) |

|

| |

| 31 March 2005 | 98,789 | |

|

| |

| Amounts written off: | | |

| 1 April 2004 | 4,762 | |

|

| |

| 31 March 2005 | 4,762 | |

|

| |

| Net book value: | | |

| 31 March 2005 | 94,027 | |

|

| |

| 31 March 2004 | 106,177 | |

|

| |

Back to Contents

Back to Consolidated Financial Statements Contents

14.Stocks

| | | | 2005 | | 2004 | |

| | £m | | £m | |

|

|

|

|

|

| |

| Goods held for resale | | | 430 | | 458 | |

|

|

|

|

|

| |

| | | | | | | |

| Stocks are reported net of allowances for obsolescence, an analysis of which is as follows: | | | | | | |

| | 2005 | | 2004 | | 2003 | |

| | £m | | £m | | £m | |

|

|

|

|

|

| |

| Opening balance at 1 April | 193 | | 89 | | 126 | |

| Exchange adjustments | (4 | ) | (1 | ) | 2 | |

| Amounts (credited)/charged to the profit and loss account | (51 | ) | 107 | | (27 | ) |

| Assets written off | (15 | ) | (2 | ) | (12 | ) |

|

|

|

|

|

| |

| Closing balance at 31 March | 123 | | 193 | | 89 | |

| |

| | |

| |

| 15.Debtors | |

| | |

| | Group | | Company | |

| |

| |

| 2005 | | 2004 | | 2005 | | 2004 | |

| £m | | £m | | £m | | £m | |

|

|

|

|

|

|

|

| |

| Due within one year: | | | | | | | | |

| Trade debtors | 2,768 | | 2,593 | | – | | – | |

| Amounts owed by subsidiary undertakings | – | | – | | 76,303 | | 65,098 | |

| Amounts owed by associated undertakings | 23 | | 17 | | – | | – | |

| Taxation recoverable | 268 | | 372 | | 37 | | – | |

| Group relief receivable | – | | – | | 43 | | 132 | |

| Other debtors | 413 | | 491 | | 272 | | 310 | |

| Prepayments and accrued income | 2,130 | | 2,048 | | – | | – | |

|

|

|

|

|

|

|

| |

| | 5,602 | | 5,521 | | 76,655 | | 65,540 | |

|

|

|

|

|

|

|

| |

| Due after more than one year: | | | | | | | | |

| Trade debtors | 49 | | 37 | | – | | – | |

| Other debtors | 122 | | 76 | | – | | – | |

| Prepayments | 384 | | 302 | | – | | – | |

| Deferred taxation (note 21) | 1,541 | | 965 | | 83 | | 87 | |

|

|

|

|

|

|

|

| |

| | 2,096 | | 1,380 | | 83 | | 87 | |

|

|

|

|

|

|

|

| |

| | 7,698 | | 6,901 | | 76,738 | | 65,627 | |

| |

The Group’s deferred tax asset of £1,541 million at 31 March 2005 (2004: £965 million) relates to fixed asset timing differences of £206 million (2004: £nil) and short term timing differences and losses of £1,335 million (2004: £965 million). The directors are of the opinion, based on recent and forecast trading, that the level of future taxable profits and deferred tax liabilities will be sufficient to utilise the deferred tax asset being recognised.

The Company’s deferred tax asset of £83 million (2004: £87 million) is in respect of the closure of derivative financial instruments. The movement in the asset recognised has been charged to the Company’s profit and loss account for the year. There are no unrecognised deferred tax assets at 31 March 2005 (2004: £18 million).

Debtors are stated after allowances for bad and doubtful debts, an analysis of which is as follows:

| | 2005 | | 2004 | | 2003 | |

| £m | | £m | | £m | |

| |

| Opening balance at 1 April | 461 | | 520 | | 526 | |

| Exchange adjustments | 6 | | (20 | ) | 17 | |

| Amounts charged to the profit and loss account | 224 | | 209 | | 193 | |

| Acquisitions | – | | 11 | | 2 | |

| Disposals | – | | (21 | ) | – | |

| Debtors written off | (195 | ) | (238 | ) | (218 | ) |

|

|

|

|

|

| |

| Closing balance at 31 March | 496 | | 461 | | 520 | |

|

|

| |

Back to Contents

Back to Consolidated Financial Statements Contents

|

| Notes to the Consolidated Financial Statements continued |

|

|

16.Investments

| | Group | | Company | |

| |

| |

| 2005 | | 2004 | | 2005 | | 2004 | |

| £m | | £m | | £m | | £m | |

|

|

|

| |

|

|

| |

| Liquid investments | 816 | | 4,381 | | 28 | | – | |

|

|

|

|

|

|

|

| |

Group liquid investments principally comprise collateralised deposits and investments in commercial paper. The Company’s liquid investments comprise short term foreign exchange deals.

|

|

|

|

|

|

|

|

|

| 17.Creditors: amounts falling due within one year |

| |

| | Group | | Company | |

| |

| |

| 2005 | | 2004 | | 2005 | | 2004 | |

| £m | | £m | | £m | | £m | |

|

|

|

|

|

|

|

| |

| Bank overdrafts | 47 | | 42 | | – | | – | |

| Bank loans and other loans | 332 | | 2,000 | | 15 | | 956 | |

| Finance leases | 13 | | 12 | | – | | – | |

| Trade creditors | 2,887 | | 2,842 | | – | | – | |

| Amounts owed to subsidiary undertakings | – | | – | | 88,710 | | 93,553 | |

| Amounts owed to associated undertakings | 9 | | 8 | | – | | – | |

| Taxation | 4,759 | | 4,275 | | – | | – | |

| Other taxes and social security costs | 332 | | 367 | | – | | – | |

| Other creditors | 444 | | 741 | | 4 | | 71 | |

| Accruals and deferred income | 4,619 | | 4,011 | | 301 | | 371 | |

| Proposed dividend | 1,395 | | 728 | | 1,395 | | 728 | |

|

|

|

|

|

|

|

| |

| | 14,837 | | 15,026 | | 90,425 | | 95,679 | |

| |

| | | | | | | | | |

|

|

|

|

|

|

|

|

|

| 18.Creditors: amounts falling due after more than one year | |

| | |

| | Group | | Company | |

| |

| |

| |

| | 2005 | | 2004 | | 2005 | | 2004 | |

| | £m | | £m | | £m | | £m | |

|

|

|

|

|

|

|

| |