EXHIBIT 13

TABLE OF CONTENTS

Arrowhead Community Bank

Asian Bank of Arizona

Bank of Tucson

Camelback Community Bank

Mesa Bank

Southern Arizona Community Bank

Sunrise Bank of Albuquerque

Sunrise Bank of Arizona

Valley First Community Bank

Yuma Community Bank

Bank of Escondido

Bank of Feather River

Bank of San Francisco

Bank of Santa Barbara

Napa Community Bank

Point Loma Community Bank

Sunrise Bank of San Diego

Sunrise Community Bank

Fort Collins Commerce Bank

Larimer Bank of Commerce

Loveland Bank of Commerce

Ann Arbor Commerce Bank

Bank of Auburn Hills

Bank of Maumee

Bank of Michigan

Brighton Commerce Bank

Capitol National Bank

Detroit Commerce Bank

Elkhart Community Bank

Evansville Commerce Bank

Goshen Community Bank

Grand Haven Bank

Kent Commerce Bank

Macomb Community Bank

Muskegon Commerce Bank

Oakland Commerce Bank

Ohio Commerce Bank

Paragon Bank & Trust

Portage Commerce Bank

Bank of Belleville

Community Bank of Lincoln

Summit Bank of Kansas City

1st Commerce Bank

Bank of Las Vegas

Black Mountain Community Bank

Desert Community Bank

Red Rock Community Bank

USNY Bank

Bank of Bellevue

Bank of Everett

Bank of Tacoma

High Desert Bank

Issaquah Community Bank

Bank of Valdosta

Community Bank of Rowan

First Carolina State Bank

Peoples State Bank

Sunrise Bank of Atlanta

Bank of Fort Bend

Bank of Las Colinas

Amera Mortgage Corporation

Capitol Wealth

Dear Shareholder:

During the course of 2007, the American banking industry was bombarded with negative events leading to declines in earnings and, of course, market value reductions. The housing and mortgage industry fallout, margin compression and credit quality deterioration produced an economic tsunami affecting most every financial institution in the United States.

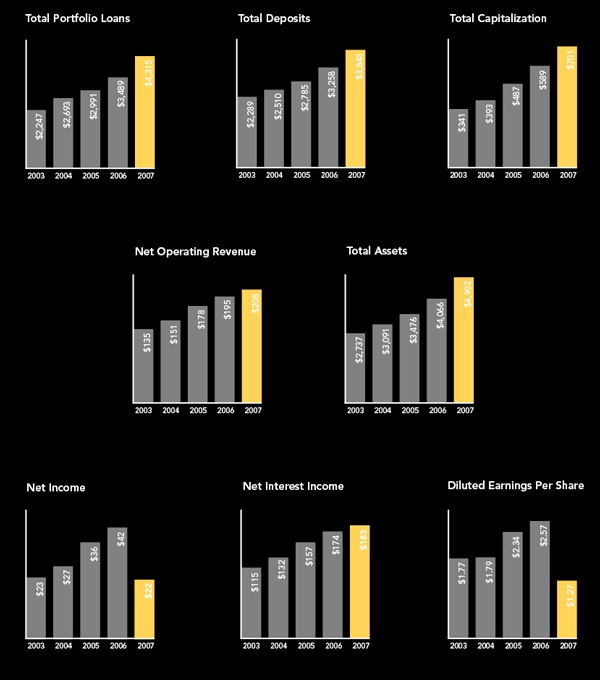

For Capitol Bancorp, earnings for the year were cut in half from $42.4 million ($2.57 per diluted share) to $21.9 million ($1.27 per diluted share). Capitol Bancorp’s stock price was reduced from $46.20 per share to $20.12 per share. Talk of recession shared the front page of our newspapers with the Iraq War and presidential politics.

Although the business of Capitol Bancorp banks is not based on subprime residential lending, we, like all financial institutions, are affected by it. It is during these times that it is important to stay focused on our objective as a community bank company — to develop a national affiliation of community banks which represents all major regions of the United States.

REGIONAL BALANCE

One of the risks of a small community bank is geographical concentration. It is a risk which is difficult to offset. If the community suffers economically, then there is a high probability that the community bank will suffer with it. When a series of affiliated community banks are clustered within the same region, then all are affected by the economic fortunes of that region. We have witnessed regional economic downturns throughout our history.

If a community bank company can be established with a material presence in every major region of the United States, then a regional weakness will not serve to derail the performance of the whole company. It is this point which reveals the underlying objective of Capitol Bancorp. Ironically, it is the weakened performance of the Great Lakes Region which vividly makes this point.

We have identified and are operating in 10 separate regions of the United States today. The Great Lakes Region has undergone a most difficult economic adjustment largely as a result of its auto industry concentration. Because we began in the Great Lakes Region years ago, we remain overly concentrated in this region today. Specifically, 41.7% of our total assets rest in the Great Lakes. Although this is down from 46.7% in 2006, it remains disproportionate to the other regions of the United States.

BANK DEVELOPMENT

The cover of this report suggests the feverish pace with which we have operated over the

2

past year, moving Capitol Bancorp a step closer to regional balance. In 2007 we added 11 new community banks, more than any other previous year in our history. This included two banks in Texas; two in California; two in Colorado; two in Washington; one in Oregon; one in New York; and one in Nebraska. New bank development promotes growth.Our asset growth rate for 2007 was 20.6%, moving from $4.1 billion to more than $4.9 billion over the course of the year. During that period portfolio loans increased from $3.5 billion to more than $4.3 billion representing an increase of 23.7%.

Unlike a new branch of an existing bank, the development of a new bank is a challenging undertaking. It requires a high level of direct, personal involvement by the officer group of Capitol Bancorp. Selection of the president and a board of directors is both crucial and time consuming. Location, staffing and the development of a marketing strategy each require large concentrations of time and energy. The regulatory process is cumbersome at best. Finally, raising the necessary local capital provides its own obstacles. This is why we are particularly pleased with the 11 successful development efforts of 2007.

IN 2008

As the cover of this report also portrays, we continue to follow our strategic highway to develop a regionally-balanced national affiliation of community banks. Over the course of the current year, we will continue to pursue our objective with the addition of several new bank affiliates. We will continue our intensified effort to promote an exemplary risk management program. We will continue to strengthen our core information technology, providing enhancements to the product offerings at our bank affiliates. In this regard, we expect to have completed our remote deposit project which began in 2007.

LOUIS ALLEN AND ROBERT CARR

The past year proved to be particularly difficult for all of us here at Capitol Bancorp with the passing of our dear friends and colleagues, Louis Allen and Robert Carr. Lou joined our Board of Directors in 1994 and served with distinction. He was particularly helpful to us over these years drawing on a lifetime of experience as a banker.

Bob was president of our first bank, Capitol National Bank, which opened in 1982. He served as a valuable mentor to many of the bank presidents who followed as we developed additional banks across the country. Bob ultimately served as vice chairman of Capitol Bancorp. He, along with a small handful of others, was truly a founder of Capitol Bancorp. We all learned a great deal about banking from Bob. He challenged every step taken by Capitol Bancorp as it grew; constantly reminding us that banking is a “people business.” We will continue to build on the legacy of Lou Allen and Bob Carr.

3

CONCLUSION

At year end Capitol Bancorp banks represented 60 bank presidents; 636 board of director seats; 60 different bank names; and operations in 17 states. There are today more than 1,700 employees. Our customers expect a high level of service from people without being forwarded to an 800 number.

As the “largest small bank company in America” we need to remain constantly vigilant to the importance of service and to the importance of the fact that “CBC banking” is, has been and will continue to be a “people business.”

Thank you for your support of our efforts.

JOSEPH D. REID

Chairman & CEO

Capitol Bancorp Limited

We have identified and are operating in 10 separate regions of the United States today.

We will continue to pursue our objective of a regionally-balanced national affiliation of community-based banks.

THE QUINTESSENTIAL

COMMUNITY BANKER

“Banking always has

been, and always will be,

a people business.”

Robert C. Carr

1939 - 2007

BOARD OF DIRECTORS

Joseph D. Reid

Chairman & CEO

Capitol Bancorp Limited

Michael L. Kasten

Vice Chairman, Capitol Bancorp Limited

Managing Partner

Kasten Investments, LLC

Lyle W. Miller

Vice Chairman, Capitol Bancorp Limited

President

L.W. Miller Holding Co.

David J. O’Leary

Secretary, Capitol Bancorp Limited

Chairman

O’Leary Paint Company

Paul R. Ballard

Retired President & CEO

Portage Commerce Bank

David L. Becker

Retired Founder

Becker Insurance Agency, PC

Douglas E. Crist

President

Developers of SW Florida, Inc.

Michael J. Devine

Attorney at Law

James C. Epolito

President & CEO

Michigan Economic Development

Corporation

Gary A. Falkenberg, DO

Gary A. Falkenberg, PC

Joel I. Ferguson

Chairman

Ferguson Development, LLC

Kathleen A. Gaskin

Associate Broker/State Appraiser

Tomie Raines, Inc. Realtors

H. Nicholas Genova

Chairman & CEO

Washtenaw News Co. Inc.

and H. N. Genova Development

Michael F. Hannley

President & CEO

Bank of Tucson

Richard A. Henderson

President

Henderson & Associates, PC

Lewis D. Johns

President

Mid-Michigan Investment Co.

John S. Lewis

President of Bank Performance

Capitol Bancorp Limited

Leonard Maas

President

L&M Maas Investments, LLC

Myrl D. Nofziger

President

Hoogenboom Nofziger

Cristin K. Reid

Corporate President

Capitol Bancorp Limited

Ronald K. Sable

President

Concord Solutions Ltd.

4

In millions, except per share amounts

5

John S. Lewis, Region President

7 Arrowhead Community Bank

8 Asian Bank of Arizona

9 Bank of Tucson

10 Camelback Community Bank

11 Mesa Bank

12 Southern Arizona Community Bank

13 Sunrise Bank of Albuquerque

14 Sunrise Bank of Arizona

15 Valley First Community Bank

16 Yuma Community Bank

6

ARROWHEAD COMMUNITY BANK

Arlene Kulzer, President & CEO

Individual success stories have been among the highlights of 2007. Arrowhead Community Bank has continued its steady growth trend and our associated financial institutions, including Capitol Wealth Advisors and Equipment Leasing Services, have both spurred and shared in that forward movement. Like all accomplished entrepreneurs, we understand success does not just come to those who want it — success is reserved for those who focus and pursue it.

Over the past year, Linda Reynolds, owner of Care from the Heart, a non-medical in-home care provider, realized her dream of owning her own building in the Sun City market. Reynolds shared her dream with West USA Realty agent Audrey Hickman and through their combined efforts they found a perfectly located — albeit a larger building than Reynolds required. Focusing on the desired end result, Reynolds and Hickman soon secured letters of interest and signed contracts from prospective tenants. At this point they sought the assistance of Arrowhead’s Deb Charlesworth, who assembled an attractive financing package.

When Dr. Amol Rakkar and his wife, Dr. Navjot Rakkar, mentioned their desire to prepare for their children’s education, Charlesworth introduced the Rakkars to our Capitol Wealth Advisors investment executive, Richard Oliver. After several Saturday sessions with the Rakkars, Oliver was able to establish a tax exempt account for their children’s future education and assist the doctors in investing in other products designed to provide them with peace of mind and financial security. The Rakkars were so impressed with the service they received they referred Dr. Sra to the bank.

After interviewing Dr. Sra, Charlesworth introduced him to an account executive at Equipment Leasing Services. The account executive was able to rewrite Dr. Sra’s equipment leases, saving him more than $25,000 per month in lease payments.

At Arrowhead Community Bank, our team members are committed to working with our strategic partners for the benefit of our loyal clients. This cooperative approach to business has been the key to our success in the past and it will continue to be the key to our future.

— Arlene Kulzer, President & CEO

Success is reserved for those who focus and pursue it.

17235 North 75th Avenue, Suite B100 | Glendale, AZ 85308

623.776.0800 | www.arrowheadcommunitybank.com

BOARD OF DIRECTORS

Shelley L. Bade

RPA, Principal

SL Bade & Associates LLC

Janet G. Betts

Attorney at Law

Jennings, Strouss & Salmon

W. Patrick Daggett, CPA

Daggett, McConachie & Moore,

CPAs, LLP

Michael J. Devine

Attorney at Law

Hon. Thomas R. Eggleston Sr.

Retired

Vice Mayor of Glendale

George L. Evans, PE, RLS

President & Co-Founder

Evans, Kuhn & Associates, Inc.

Richard J. Hilde

Retired CEO

EPW Inc.

David R. Hunter, DDS

Orthodontist

David R. Hunter DDS, PC

Arlene Kulzer

President & CEO

Arrowhead Community Bank

James J. McCue

Aviation Consultant

Sherwin Industries

Terrance C. Mead

Attorney at Law

Mead & Associates, PC

John C. Ogden

Retired CEO

SunCor Development Company

Richard A. Shelton

Agent

RE/MAX Desert Showcase

OFFICERS

John C. Ogden

Chairman

Michael J. Devine

Vice Chairman

Arlene Kulzer

President & CEO

James J. McCue

Secretary

W. Patrick Daggett

Chair, Directors Loan

Committee

Amy Lou Blunt

Executive Vice President & CCO

Deborah M. Charlesworth

Senior Vice President

Mary Catherine Mireles

Senior Vice President

Richard L. Oliver

Senior Vice President

William H. Smith

Senior Vice President

Michael T. Ganahl

Vice President

Stacey J. Morrison

Vice President

Ann L. Nestler

Vice President

Nancy M. Seid

Vice President

7

ASIAN BANK OF ARIZONA

Leslie M. Gin, President

Asian Bank of Arizona has been successful over the past year in establishing name recognition in our market area. Our multi-faceted marketing strategy is beginning to produce results.

Starting with our location in the COFCO Chinese Cultural Center, the bank is a part of the most identifiable Asian landmark in Arizona. The Community Art Wall inside the bank is a popular attraction for our diverse clientele. Art representing China, India, Japan and the Philippines was displayed in 2007.

Last year we were invited by the Arizona Chinese News to write a financial education article in the weekly Chinese-language newspaper with statewide readership. This has resulted in numerous inquiries, several new account openings and further name recognition for the bank. Due to the popularity of these articles, the Las Vegas Chinese Daily News, which recently expanded to the Phoenix area, also started publishing our articles for its two-city readership.

Asian Bank last year hosted the Greater Phoenix Chamber of Commerce monthly mixer for about 80 business members, many of whom had never been to the Chinese Cultural Center. Featuring food, entertainment and a free drawing, the two-hour event took place in the Chinese gardens next to the bank. Our guests were amazed by our beautiful and vibrant business center.

Asian Bank continues to host the monthly meetings for the Philippine Chamber of Commerce, the National Association of Asian American Professionals and the Chinese American Citizens Alliance. This “open door” strategy is yet another way to increase exposure for the bank while providing a worthwhile service for non-profit organizations.

In May 2007, I was recognized as a Friend of the Pan Asian Community Alliance in Tucson for championing cultural diversity and for philanthropic services and achievements. Last summer, I was also elected to the Maricopa County Community College Foundation Board.

In 2007 the bank added five new board members; four based in Phoenix and one in Tucson. All five have been active in providing lucrative business referrals.

Our multi-faceted marketing strategy is designed to build a bank that lasts, serving the diverse cultures that make up the American Southwest.

— Leslie M. Gin, President

Serving the diverse cultures that make up the American Southwest.

668 North 44th Street, Suite 123 | Phoenix, AZ 85008

602.263.8888 | www.asianbankaz.com

BOARD OF DIRECTORS

Jay A. Bansal

Attorney at Law

Law Offices of Jay A. Bansal

David M. Chei, DMD

Doctor of Dentistry

Somer Dental PLLC

Jae M. Chin

Business Owner

JC Prince LLC

Michael J. Devine

Attorney at Law

Leslie M. Gin

President

Asian Bank of Arizona

Robert E. Hite

President

Securitech, Inc.

John S. Lewis

President of Bank Performance

Capitol Bancorp Limited

Rano K. Singh-Sidhu

Business Owner

DPS Biotech SW

OFFICERS

John S. Lewis

Chairman

Michael J. Devine

Secretary

Leslie M. Gin

President

James A. Klussman

Executive Vice President & CCO

Bruce A. Kottwitz

Vice President

Ryan J. Mulligan

Vice President

Beverly F. Santiago

Vice President

Steven C. Soong

Vice President

8

BANK OF TUCSON

Michael F. Hannley, President & CEO

Bank of Tucson exceeded every financial goal we set for 2007. At the same time that we enjoyed our success we knew that providing “banking as usual” would not assure our continued prosperity. As a result, 2007 was a year of change. The change was driven primarily by an all-out effort to improve on the bank’s stellar performance while also delivering the type of cutting-edge financial products and services we needed in our arsenal to remain ahead of the competition.

Following an in-depth assessment of the bank’s first 11 years and extensive discussions with our board of directors, we adjusted our business plan to take advantage of the changing banking landscape. Our plans for “The Next 10” started with the bank doubling its physical size. We established an “e-banking” department. We provided remote capture of deposits and integrated Capitol Wealth Advisors and brokerage services into our main office in Tucson. At the same time, we are diligently attending to the needs of our customers. After all, it was this type of excellent customer service that was so successful for us during the first 11 years.

Our extraordinary customer service and financial success in Tucson is being replicated in Nogales, Arizona. The dramatic growth of the small loan office we launched four years ago led to the October 2007 opening of our signature building named “Bank of Tucson Business Center” in Nogales. This office, which concentrates on serving companies involved in cross-border commerce and industry, is already making significant contributions to our bottom line and giving our bank a growing presence in Mexico.

Our board of directors has also established an advisory board of entrepreneurs in the community. These new leaders are being trained in the business of banking and are being prepared for potential future openings on the board of directors. This is a crucial investment in our bank’s development.

With the enthusiastic participation of every member of the bank team, we will continue to capitalize on business opportunities made available by the changing economy as we set a new standard for community banking.

— Michael F. Hannley, President & CEO

Bank of Tucson exceeded every financial goal we set for 2007.

4400 East Broadway | Tucson, AZ 85711

520.321.4500 | www.bankoftucson.com

825 North Grand Avenue | Nogales, AZ 85621

520.397.9220 | Nogales Office

BOARD OF DIRECTORS

Bruce I. Ash

President & CEO

Paul Ash Management

Company, LLC

Slivy Edmonds Cotton

Chairman & CEO

Portico LLM Enterprises, LLC

Bradley H. Feder

Managing Partner

Simply Bits, LLC

Michael F. Hannley

President & CEO

Bank of Tucson

Michael J. Harris

Vice President

Long Realty Company

Richard F. Imwalle

President

Richard F. Imwalle & Associates

David Jeong, CPA

President

Jeong Lizardi, PC

Michael L. Kasten

Managing Partner

Kasten Investments, LLC

Burton J. Kinerk

Attorney at Law

Kinerk, Beal, Schmidt, Dyer &

Sethi, PC

Harold H. Kitay

Commercial Developer & Owner

Whirlygig Properties, LLC

Humberto S. Lopez

President

HSL Properties, Inc.

OFFICERS

Richard F. Imwalle

Chairman

Michael L. Kasten

Vice Chairman

Michael F. Hannley

President & CEO

Harold H. Kitay

Secretary

C. David Foust

Executive Vice President & CCO

Sandra L. Smithe

Executive Vice President & COO

David A. Esquivel

Senior Vice President

Catherine C. Garcia

Senior Vice President

Richard K. Mullen

Senior Vice President

Richard A. Garcia

Vice President

Lucian V. Moga

Vice President

Clay A. Naff

Vice President

Robert D. Placzek

Vice President

Patricia A. Taylor

Vice President

9

CAMELBACK COMMUNITY BANK

Gail E. Grace, President & CEO

For Camelback Community Bank, 2007 was a good, yet challenging year. We were fortunate to welcome new staff members who not only generated new customer relationships for the bank but who also benefited from our seasoned employees’ experience and expertise. Old and new alike, everyone was instrumental in Camelback Community Bank being named the #1 bank in its asset category in Ranking Arizona for the fourth consecutive year. We are very proud of this recognition and could not have achieved this without the loyalty of our customers.

Our focus continues to be on forming partnership relationships with our customers, being trusted advisors and helping them achieve their financial goals. We also recognize the importance of giving back to our community. Through various contributions and our staff’s involvement in a number of local organizations, we are helping meet the needs of our diverse community while also gaining positive publicity and exposure for our bank.

In 2008, Camelback Community Bank will celebrate its 10th year in business. Each year, we have continued to improve performance through the growth of our customer base, providing the very best customer service and offering a wide array of products to meet all of their financial needs. As part of recognizing our 10 years in business, we also underwent some renovations, creating a more pleasant environment for both our customers and staff.

The bank is expanding its reach within the Phoenix market. With the many ways in which we can deliver our products and services, we are not limited to serving only customers in our immediate area. Our customers are located throughout the Valley of the Sun and appreciate the ways we make banking as convenient as they need it — whether it’s through the various online options or the extensive ATM network available to them. We strive to keep pace with current technology so we always have the big bank offerings with the community bank delivery.

Camelback Community Bank is fortunate to have the very best staff with a high level of expertise. With our excellent staff and highly engaged board of directors, we have the team necessary to grow the bank profitably for the next 10 years.

— Gail E. Grace, President & CEO

Named the #1 bank in its asset category in Ranking Arizona for the fourth consecutive year.

2777 East Camelback Road, Suite 100 | Phoenix, AZ 85016

602.224.5800 | www.camelbackbank.com

BOARD OF DIRECTORS

Shirley A. Agnos

President Emerita

Arizona Town Hall

Cord D. Armstrong, CPA

Senior Tax Manager

CBIZ Accounting,

Tax & Advisory Services, LLC

Michael J. Devine

Attorney at Law

James L. Essert

Vice President

Portfolio Manager

ING Investment Management Co.

Gail E. Grace

President & CEO

Camelback Community Bank

S. Jill Hastings, JD

Principal

Pension Strategies, LLC

Robert V. Lester

President

Progressive Financial Concepts

Tammy A. Linn

President, Arizona Character

Education Foundation

Executive Director, United Way

Executive Director, United Way

of Yavapai County

Susan C. Mulligan

Community Volunteer

Barbara J. Ralston

Chairman

Camelback Community Bank

Robert S. Roda, DDS, MS

Roda & Sluyk Ltd.

Daniel A. Robledo

Senior Vice President

Land America Financial

Group, Inc.

Kenneth Van Winkle Jr.

Attorney at Law

Lewis & Roca, LLP

OFFICERS

Barbara J. Ralston

Chairman

Dan A. Robledo

Vice Chairman

Gail E. Grace

President & CEO

Shirley A. Agnos

Secretary

Timothy J. Hoekstra

Executive Vice President & CCO

Tricia A. Blaylock

Vice President

Darrin R. Davidson

Vice President

Todd W. Grady

Vice President

Jennifer S. Higgins

Vice President

William F. Von Hatten

Vice President

10

MESA BANK

Neil R. Barna, President & CEO

The success of our customers remains the focus of the Mesa Bank team. This will never change. “Our Clientele is our Sales Force” is the motto that guides our daily tasks. Along the way, dramatic events occur that pave the way and smooth our path so we retain the edge required to manage a successful financial entity.

In January, Mesa Bank began operations in our neighboring community of Chandler, Arizona, with East Valley Bank. Client demand required such a move in order to maintain the convenience and attention to service that customers have grown to expect. Newly appointed in 2007 as executive vice presidents, Sandra Zazula and Staci Charles oversee client needs at this location, complementing the fine service provided by our two other existing locations.

Our team of professional bankers set us apart from the rest. “Golden Honors for Golden Service” recognizes the best of the best employees in client relationship building each quarter. Nominations limited to fellow employees make this award even more special. The annual Mesa Bank client appreciation day at the Chicago Cubs’ spring training facility, organized by vice president Conrad Morin, has created a literal waiting list of excited customers. Portfolio manager Rick Sweetnam came up with the idea to spend an evening with employees and their families at an Arizona Diamondbacks baseball game. In only its second year, the turnout for this event doubled from the first year. Finally, the employee Team PICKLE (Professionalism, Integrity, Communication, Knowledge, Loyalty, Exemplified) customer appreciation event draws the attention of everyone that comes into the bank and is the brainchild of Sandra Zazula and her team of bank operations specialists.

Along the way, we celebrated our ninth year of operation by being named the 2007 Business of the Year by the Mesa Chamber of Commerce. We were recognized for our community involvement with the Crystal Award from A.T. Still University in Mesa. Both achievements resulted from our focus on the success of our customers.

It’s all about the client. It’s all about the team. Our success depends on it.

— Neil R. Barna, President & CEO

Named the 2007 Business of the Year by the Mesa Chamber of Commerce.

63 East Main Street, Suite 100 | Mesa, AZ 85201

480.649.5100 | www.mesabankers.com

1733 North Greenfield Road, Suite 101 | Mesa, AZ 85205

480.324.3500 | Mesa Falcon Field Office

1940 North Alma School Road | Chandler, AZ 85224

480.726.6500 | www.eastvalleybank.com | East Valley Bank

BOARD OF DIRECTORS

Neil R. Barna

President & CEO

Mesa Bank

Steve Chader

Operating Principal

Keller Williams Integrity First

Michael J. Devine

Attorney at Law

Debra L. Duvall, EdD

Superintendent

Mesa Public Schools

Robert R. Evans Sr.

President

Baron Resources, Inc.

Stewart A. Hogue

Principal

SALK Management, LLC

Philip S. Kellis

Partner

Dobson Ranch Inn

Ruth L. Nesbitt

Community Volunteer

Wayne C. Pomeroy

Owner

Pomeroy’s Men’s Stores

Daniel P. Skinner

Managing Member

LeBaron & Carroll LLC

Joseph A. Tameron

CPA & Partner

Skinner, Tameron &

Company, LLP

James K. Zaharis, EdD

President

The Zaharis Group

OFFICERS

Stewart A. Hogue

Chairman

Michael J. Devine

Vice Chairman

Neil R. Barna

President & CEO

Staci L. Charles

Executive Vice President

Rita E. Leaf

Executive Vice President & CCO

Sandra S. Zazula

Executive Vice President &

Secretary

Daniel R. Laux

Senior Vice President

Christine Bond

Vice President

Susan E. Haverstrom

Vice President

James G. LeCheminant

Vice President

Conrad B. Morin

Vice President

11

SOUTHERN ARIZONA COMMUNITY BANK

John P. Lewis, President & CEO

Southern Arizona Community Bank received its highest honor yet when it was presented with the Pinnacle Award by the Northern Pima County Chamber of Commerce in 2007. The award is given to the small business that has done the best job in improving the quality of life in Pima County. We believe this recognition reflects our strong commitment to community involvement and personal service.

One of our most important ongoing areas of community service is to help the businesses, property owners and public facilities on Mount Lemmon recover from devastating wildfires. The bank has provided construction and permanent financing for a number of homes and the rebuilding of the mountain community’s vital general store, which re-opened for business less than a year after it was destroyed. More recently, the bank earned applause for the dedication of the 2,300-square-foot Mount Lemmon community center. As a property owner and business leader, I am honored to serve as an elected member of the community center’s board of directors.

Last year, Southern Arizona Community Bank supported more than 30 nonprofit groups, helping to provide a brighter future for at-risk children, the disabled and the poor. This support has included providing internships for people at the Arizona School for the Deaf and Blind, participation in the American Cancer Society’s Relay for Life, and donations to Big Brothers & Big Sisters of Arizona. In the fall, we presented a minority middle school with a check for $110,000 made possible through the Arizona State Income Tax Credit Initiative. This bequest ultimately resulted in the Institute for Better Education, which administers this tax credit program for more than 140 schools, bringing its banking business to our bank.

The team at Southern Arizona Community Bank celebrated the bank’s ninth anniversary in August 2007. We are proud of the many achievements we have made as a bank and as individuals. Our goal is to build on these achievements so that we can look forward to experiencing even greater satisfaction in the years to come.

— John P. Lewis, President & CEO

Southern Arizona Community Bank was presented with the Pinnacle Award by the Northern Pima County Chamber of Commerce.

6400 North Oracle Road | Tucson, AZ 85704

520.219.5000 | www.southernarizonabank.com

BOARD OF DIRECTORS

William R. Assenmacher

President

TA Caid Industries, Inc.

Jody A. Comstock, MD

Physician & Owner

Skin Spectrum

Amram Dahukey, DPM

Physician & Owner

Premier Foot & Ankle Surgeons

Robert A. Elliott

President & Owner

The Elliott Accounting Group

Michael W. Franks

Principal

Seaver Franks Architects

Michael L. Kasten

Managing Partner

Kasten Investments, LLC

Yoram S. Levy

Partner

Triangle Ventures, LLC

John P. Lewis

President & CEO

Southern Arizona

Community Bank

Jim Livengood

Director of Athletics

University of Arizona

James A. Mather

Attorney at Law & CPA

Morgan E. North

President & Owner

Borderland Construction

Company, Inc.

Susan C. Ong

Broker/Owner

Broadstone, Ltd.

James M. Sakrison

Principal & Attorney at Law

Slutes, Sakrison & Rogers, PC

Jean M. Tkachyk

CFO

University Physicians Healthcare

Paul A. Zucarelli

Principal

CBIZ Benefits & Insurance

Services, Inc.

OFFICERS

Paul A. Zucarelli

Chairman

Michael L. Kasten

Vice Chairman

John P. Lewis

President & CEO

Robert A. Elliott

Secretary

Michael J. Trueba

Executive Vice

President & CCO

Terri R. Gomez

Senior Vice President

Minette Goldsmith

Vice President

Mindy C. Webb

Vice President & COO

12

SUNRISE BANK OF ALBUQUERQUE

Steven A. Marcum, President & CEO

The past year was a memorable one primarily because we completed the consolidation and relocation of our business into a historic building we believe is the premier banking facility in the heart of downtown Albuquerque. Located on legendary Route 66, the building’s construction coincided with the birth of the “Mother Road.” Starting in Chicago and ending in Los Angeles, Route 66 symbolized the “road to opportunity” and our building has stood as the landmark for banking in Albuquerque for many years.

We believe the relocation of Sunrise Bank of Albuquerque increases our visibility, enhances our image and provides the foundation for future growth based on relationship banking.

Relationship banking is the essential ingredient for any successful community bank and a fundamental component for our continued success. We will continue to recruit bank board members and seasoned bankers who understand this philosophy and can bring quality relationships to our bank. This strategy paid dividends last year as we saw significant growth and increased quality in our loan portfolio. Our challenge going forward will be to build a larger deposit base. To that end, we have attracted bankers with the experience and energy to replicate the success we enjoyed last year in lending.

We remain committed to giving back to the community we serve with both time and money and that commitment increased last year. For the third consecutive year, we reported 100 percent employee participation in the United Way of Central New Mexico campaign, with a healthy increase in total contributions. We also provided support to many other worthy organizations, including Big Brothers Big Sisters of Central New Mexico, the Juvenile Diabetes Research Foundation, The Food Pantry and Bernalillo County 4-H.

Moving to a historically significant landmark is not about looking back. It is about looking forward because we understand we are creating history each day. Our goal is to be the best community bank in Albuquerque. This is history in the making.

— Steven A. Marcum, President & CEO

Located on legendary Route 66, our building has stood as the landmark for banking in Albuquerque for many years.

219 Central Avenue NW, Suite 100 | Albuquerque, NM 87102

505.244.8000 | www.sunrisebankabq.com

BOARD OF DIRECTORS

Annette Arrigoni

Account Executive

Berger Briggs Real Estate and

Insurance, Inc.

Turner W. Branch

President

Branch Law Firm, PA

Helen A. Elliott, CPA

Elliott, Pohlman & Co., CPAs, PC

Steven A. Marcum

President & CEO

Sunrise Bank of Albuquerque

James Rogers

Chief Manager

Sunland Development Group LLC

Ronald K. Sable

President

Concord Solutions Ltd.

Todd A. Sandoval

President

Sandia Office Supply, Inc.

J. Brad Steward, CPA

Shareholder/Partner

Pulakos & Alongi, Ltd.

Stephen D. Todd

Chief of Bank Financial Analysis

Capitol Bancorp Limited

OFFICERS

Stephen D. Todd

Chairman

Ronald K. Sable

Vice Chairman

Steven A. Marcum

President & CEO

Robert J. Valdiviez

Executive Vice President & CCO

Benjamin R. Raskob

Senior Vice President

Michael J. Sanchez

Senior Vice President

Antoinette E. Creel

Vice President

Brad L. Sackett

Vice President

13

SUNRISE BANK OF ARIZONA

Douglas E. White, President & CEO

Sunrise Bank of Arizona’s outlook for the future is full of ambition, energy and optimism. Our team has a primary goal of being one of Arizona’s greatest community banks. To achieve this lofty goal we must execute our strategic roadmap to perfection.

We knew it would take a very talented group of skilled team members to grow our bank. In 2007, we added knowledgeable, experienced bankers to our retail, underwriting, client services, business development and commercial lending teams. All of these team members are exceptional banking professionals with tremendous skills. Combining our existing core team with our new additions makes Sunrise Bank of Arizona a formidable competitor within the state of Arizona.

Our board members are an integral part of our team and vital to our future. Their value to our bank has been proven many times in 2007. Our bank’s success in 2008 will be significantly enhanced by the number of referrals and opportunities presented to our team by our directors.

In 2008, we are reintroducing our bank to our community. We are the co-developer and presenter of a financial literacy program for charter schools. We also act as the title sponsor of the 5th Avenue Farmers Market in Scottsdale, Arizona. Our team is active and will increase our efforts with the Hispanic Chamber, United States Hispanic Chamber, Italian Chamber and the Scottsdale Chamber of Commerce. We are a sponsor of the Arcadia Pride 5K run and a contributor to Free Arts of Arizona, Mission of Mercy and the Boys & Girls Club. Every community contribution we make is specifically targeted to benefit children, cultural events, education and/or the arts.

Lastly, we have created two very important teams. The Creative Solutions team takes on our marketing and community challenges. Our Raving Fans team ensures that the recognition of our team members is always the most important thing we do. As we continue to grow our community bank, these two teams will be essential to our success.

— Douglas E. White, President & CEO

Our board members are an integral part of our team and vital to our future.

4350 East Camelback Road, Suite 100A | Phoenix, AZ 85018

480.624.2600 | www.sunrisebankofarizona.com

6263 North Scottsdale Road, Suite 100 | Scottsdale, AZ 85250

480.624.2600

BOARD OF DIRECTORS

Thomas W. Beal

President

Beal Benefit Solutions

Patrick M. Devine

Vice President

CB Richard Ellis Brokerage

Services

Richard E. Garcia

President &

Designated Broker

Garcia Realty

Advisors, Inc.

George B. Jackson

Financial Consultant

A. G. Edwards & Sons

Michael L. Kasten

Managing Partner

Kasten Investments, LLC

John S. Lewis

President of Bank

Performance

Capitol Bancorp Limited

Glen M. Lineberry

Principal

Lineberry Associates

Richard Lustiger

General Counsel

Harkins Theaters

Gregory G. McGill

Attorney at Law

Gregory G. McGill, P.C.

Andrew C. Pacheco

Attorney at Law

Sanders & Parks

Joe W. Panter

Partner

Wildflower Bread Co.

Whitestone Financial

Douglas E. White

President & CEO

Sunrise Bank of Arizona

OFFICERS

Michael L. Kasten

Chairman

Richard E. Garcia

Vice Chairman

Douglas E. White

President & CEO

Shari A. White

Secretary

David W. Tracy

Executive Vice President

& CCO

Tyrone D. Couch

Senior Vice President

Gary M. Gibbs

Senior Vice President

Mary S. Madison

Senior Vice President

Richard M. Manning

Senior Vice President

Cindy L. Batten

Vice President

Robert J. Cantazaro

Vice President

Jon M. Chase

Vice President

Byron E. Gaylord

Vice President

Cynthia J. Heaps

Vice President

Joseph M. Koller

Vice President

Jill J. Lowell

Vice President

Kristi M. Richards

Vice President

Alex Solis

Vice President

Eric A. Stellhorn

Vice President

14

VALLEY FIRST COMMUNITY BANK

Judith R. Egan, President & CEO

At Valley First Community Bank we achieved two milestones in 2007. We celebrated the bank’s 10th anniversary and relocated the bank to a larger and more visible location that will accommodate our growth for many years to come.

We also rededicated ourselves to delivering exceptional and unexpected service to our customers. That service delivery starts with our customer guarantee:

“We guarantee every customer that they will personally know at least three of our highly experienced bankers and one of them will always be available when they are needed.”

In addition to our guarantee, we execute several “points of light” that impress and delight our customers, setting us apart from our competition.

Each morning we post the names of scheduled visitors to our bank on the welcome board in our lobby. Every team member also records a new voice message every day so that all callers know whether that team member is present and when they can expect a return call.

Our loan officers are present at loan closings held at title or escrow companies to assist our customers in understanding the voluminous documents they are asked to sign.

Every new customer receives a personal letter from me thanking them for their business and offering them an opportunity to provide feedback on the service they received from our team members.

All of these “points of light” and many other things we do both surprise and delight our customers because they are unexpected and make our customers feel valued and recognized.

O. Robin Sweet, executive director, Gateway Academy: “This is the best banking experience to date. You define what personal banking is all about.”

Henry Scheinerman, president, Today’s Pool and Patio: “You are at the top in customer service. I model my business the same way — customer service is key.”

We look forward to continuing to “wow” our customers in 2008 and for years to come.

— Judith R. Egan, President & CEO

We guarantee every customer that they will personally know at least three of our highly experienced bankers…

7001 North Scottsdale Road, Suite 1000 | Scottsdale, AZ 85253

480.596.0883 | www.valleyfirstbank.com

BOARD OF DIRECTORS

Sam Kathryn Campana

Vice President & Executive Director

National Audubon Society, Inc.

Scott B. Cohen

Attorney at Law

Sacks Tierney PA

Judith R. Egan

President & CEO

Valley First Community Bank

William R. Fitzpatrick, CPA

Eide Bailly

Michael L. Kasten

Managing Partner

Kasten Investments, LLC

Frederick L. Kidder

Chief Executive Officer

Scottsdale Area Chamber of Commerce

Stewart Larsen

President & Broker

Holmes-Larsen Auction Marketing

Gordon D. Murphy

Retired Executive Vice President

Arizona Bankers Association

Eileen S. Rogers

President

Allegra Print & Imaging

Pamela L. Sparks

Historical Researcher & Archivist

Sparks, Tehan, & Ryley, PC Law Firm

OFFICERS

Gordon D. Murphy

Chairman

Michael L. Kasten

Vice Chairman

Sam Kathryn Campana

Secretary

Judith R. Egan

President & CEO

Roni M. Grodnick

Executive Vice President & CCO

Nancy E. Selby

Executive Vice President

Cheryl L. DeGroot

Vice President

Daniel R. Klenske

Vice President

Michele J. Yates

Vice President

15

YUMA COMMUNITY BANK

Katherine M. Brandon, President & CEO

Over the past seven years, the team at Yuma Community Bank has worked diligently to build our bank, yet each new challenging opportunity shows us that we are only getting started. There are more relationships to build, more contracts to be won and more deals to be done. At the same time, we are committed to supporting our community.

The Yuma marketplace has changed profoundly in the past 10 years and continues to grow. The opening of our new bank building on South 4th Avenue in 2005 led to numerous new business opportunities. Just two years later, we are expanding again with a new office in the high-growth area of the Foothills section of Yuma, which is about 15 miles east of our main office. The new office opened its doors in January of 2008.

A new opportunity presented itself when General Motors (GM) recently announced a partnership between the U.S. Army and GM to build a $120 million joint-use hot weather test track for GM. We were proud to support the community in its economic growth as a host sponsor at a GM welcome dinner event. The economic impact on Yuma County as a result of the project promises to be considerable.

Yuma Community Bank presented a financial education program to a group of seventh and eighth grade students at Centennial School. We plan to offer presentations to the same students as they move up in grades through high school graduation. The program is funded by a government grant to reduce the drop-out rate among at-risk teenagers. Offering these students the opportunity to learn banking basics may be the best way to help them develop good financial habits. Over the long-term, it can improve the economic outlook for an entire community and can create new business development opportunities for our bank.

As can be seen, Yuma Community Bank continues to grow along with Yuma County. As we grow, we will maintain our commitment to supporting our community as well.

— Katherine M. Brandon, President & CEO

We are expanding again with a new office in the high-growth area of the Foothills section of Yuma.

2285 South 4th Avenue | Yuma, AZ 85364

928.782.7000 | www.yumabank.com

11242 South Foothills Boulevard | Yuma, AZ 85367

928.945.3888

BOARD OF DIRECTORS

Katherine M. Brandon

President & CEO

Yuma Community Bank

Clarence B. Cheatham

Vice President

DPE Construction

Raymond R. Corona

Optometrist & President

Corona Optique

Lawrence L. Deason

Attorney at Law

Lawrence L. Deason, Ltd.

Michael Didier

Treasurer

Select Seed of Arizona, Inc.

Ram R. Krishna, MD

President

Ram R. Krishna, MD, PC

John T. Osterman

President

Osterman Financial Group

Ronald K. Sable

President

Concord Solutions Ltd.

David S. Sellers

President

Sellers Petroleum

John R. Sternitzke

Owner

Sternco Engineers, Inc.

Pamela K. Walsma

Attorney at Law

Westover, Shadle &

Walsma, PLC

Ronald S. Watson

Real Estate Associate

ERA Matt Fischer Realtor

Robert R. Woodman

Owner

Woodman Realty

Leonard C. Zazula

Corporate Cashier

Capitol Bancorp Limited

OFFICERS

Ronald S. Watson

Chairman

Ram R. Krishna, MD

Vice Chairman

Katherine M. Brandon

President & CEO

Pamela K. Walsma

Secretary

Keith L. Simmonds

Executive Vice President & CCO

Michael G. Barker

Senior Vice President

Theresa N. Wine

Senior Vice President

Terry R. Gadberry

Vice President

Kari M. Reily

Vice President

16

Scott R. Andrews, Region President

18 Bank of Escondido

19 Bank of Feather River

20 Bank of San Francisco

21 Bank of Santa Barbara

22 Napa Community Bank

23 Point Loma Community Bank

24 Sunrise Bank of San Diego

25 Sunrise Community Bank

17

BANK OF ESCONDIDO

Michael R. Peters, President & CEO

Bank of Escondido’s fourth full year of business in 2007 was very rewarding. Our success is related largely to our employees who have built strong professional relationships with customers, the community and with each other. We are proud of our bank’s family atmosphere.

We have benefited from our knowledgeable and influential local board of directors. Their advice and referrals enhance the bank’s performance and their community involvement reflects well on us all.

During 2007, the bank expanded two services that have been very successful. One was the Certificate of Deposit Account Registry Service (CDARS), which has provided individuals, nonprofits, local governments and businesses with FDIC insurance on deposits of up to $50 million. We were recognized as a leader with this product, placing more than $250 million with CDARS in 2007. The other service was wealth management with the addition of a Capitol Wealth Advisors investment executive at our bank.

Bank of Escondido and our employees are committed to improving the quality of life in our community. We are involved with local nonprofit organizations, such as the Escondido Children’s Museum. The bank and employees were also active in the area’s Breast Cancer 3-Day® benefiting Susan G. Komen for the Cure, raising more than $10,000 for the fight against the disease.

We are active with the Downtown Business Association of Escondido (DBA), which promotes economic development in the bank’s area of downtown. The DBA’s weekly Cruisin’ Grand Classic Car Show is a family friendly event, bringing more than 5,000 people to downtown every Friday night from April to October. Community bands perform on our patio during the show, enhancing the hometown feeling and bringing recognition to our bank.

Last June, I was privileged to be named the 2007 Business Leader of the Year by the Escondido Chamber of Commerce. This was a tremendous honor as previous recipients have been pillars of the community.

We market the bank through our quality service, referral network, sponsorships and community involvement rather than advertising. Our success comes primarily from satisfied clients who happily refer friends and associates to the bank. It’s a winning formula.

— Michael R. Peters, President & CEO

I was privileged to be named 2007 Business Leader of the Year by the Escondido Chamber of Commerce.

200 West Grand Avenue | Escondido, CA 92025

760.520.0400 | www.bankescondido.com

BOARD OF DIRECTORS

Scott R. Andrews

President, California Region

Capitol Bancorp Limited

Robert M. Cahan

President

Cahan Properties

Richard J. Fleck

President

Southland Paving, Inc.

Marvin L. Gilbert

President

North County Insurance

L. Richard Greenstein, MD

Anesthesiologist

Anesthesiologist Consultants

of California

Ronald G. Guiles

Senior Partner

GEM Educational Consultants

Mark E. Hayes

Owner

Mark E. Hayes, CPA

Joan M. Meyer, DPM

Podiatric Medicine

And Surgery

Michael F. Murphy

President

Computer Protection

Technology, Inc.

Michael R. Peters

President & CEO

Bank of Escondido

OFFICERS

Michael F. Murphy

Chairman

Christopher S. Burt

Secretary & Executive Vice President

Michael R. Peters

President & CEO

Michael C. Churchwell

Executive Vice President & CCO

Linda I. Blakley

Senior Vice President

Marty Estrada

Vice President

Helen M. Johnson

Vice President

David G. Mitchell

Vice President

Kirsten J. Younkin

Vice President

18

BANK OF FEATHER RIVER

Scott R. Andrews, Chairman

Bank of Feather River opened for business November 6, 2007. Ten days later, more than 200 business and community leaders joined our founding team members for the bank’s grand opening celebration.

The alliance with a Capitol Bancorp affiliate bank as a loan production office during the bank’s organizational phase allowed us to maintain and renew associations with long-time customers.

We have a veteran team of local community bankers in a market that is semi-rural and heavily agricultural. Some of us have been financing the local agricultural industry for 20 years. All of our team members have at least 10 years of experience and have worked together previously. We feel this local experience provides an exceptional advantage for our new bank.

We expect big things in 2008 and for years and decades to come. Our market is solid and growing. Bank of Feather River soon will be moving into a new building at a new location. This move will give us an opportunity to hold an open house and communicate our story to an ever-growing group of clients and prospects. This event will have special importance to both our team and the community since our new office will be located in a new, landmark building for the community. It is located in the heart of the commercially developing area of Yuba City. We will have good signage, high visibility and great traffic flow.

At this time our team, many of which have been involved in community events and service projects for many years, are now doing so under the banner of Bank of Feather River. So while we know our extracurricular work is benefiting deserving families and organizations, the publicity is also benefiting the bank and our shareholders.

The entire staff is extremely enthusiastic about the future of the Bank of Feather River. By serving the agricultural industry and the innovative entrepreneurs who are launching new businesses to serve our expanding community, we anticipate strong and steady growth for the distant future.

— Scott R. Andrews, Chairman

We have a veteran team of local community bankers…some of us have been financing the local agricultural industry for 20 years.

1227 Bridge Street, Suite D | Yuba City, CA 95991

530.755.3700 | www.bankoffeatherriver.com

BOARD OF DIRECTORS

Scott R. Andrews

President, California Region

Capitol Bancorp Limited

Dinesh Bajaj

President

Natural Fashions Inc.

dba Natural Nut

Brent W. Hastey

Owner

Hastey Consulting

Thomas A. Iverson, DDS, MS

Orthodontist – President

Iverson-Vota Dental Corp.

Murry D. Lewis

General Manager

Dow Lewis Motors, Inc.

Sean M. O’Neill

President

Genesis Engineering Inc.

Dennis J. Pedisich

President & CEO

Napa Community Bank

OFFICERS

Scott R. Andrews

Chairman

Adam Fasani

Senior Vice President

& CCO

Jeffrey W. Cryer

President

Feather River Bancorp

Liz Gates

Senior Vice President

& COO

Harman S. Gosal

Vice President

Mary Goss

Vice President

Barbara VanGilder

Vice President

19

BANK OF SAN FRANCISCO

Edward C. Obuchowski, President & CEO

Bank of San Francisco focuses on providing exceptional banking services to business, nonprofit and private banking clients throughout the Bay Area. Our experienced and talented staff is making heads turn our way.

During 2007, we were honored to have the civil and structural engineering firm, T.Y. Lin International, move its banking relationship to us. With more than 1,300 employees in offices throughout the U.S. and Asia, the firm serves clients around the world. In making the decision to change to Bank of San Francisco, T.Y. Lin International valued the experience and knowledge of our team as well as our local decision-making capability and our ability “to deliver” the credit, depository and cash management services needed to support its business.

Serving the banking needs of dental practices is a new market niche for us. This often entails financing the acquisition of practices, providing merchant account and depository services to practices and handling the personal banking needs of dentists. It has been a great way to combine our business and private banking capabilities. Our loan structures, quick credit decisions, team approach and relationship orientation are what our dental clients tell us differentiate us from the competition.

We are committed to serving the nonprofit sector. We were proud to have Lick-Wilmerding, a highly-regarded private high school, become a client. Our ability to design products that suited the school’s unique needs was a driving force in its decision to join Bank of San Francisco.

Our staff continues to be active in the community by serving on various boards and taking part in nonprofit events. For example, last year our employees taught a five-week Junior Achievement program at a local elementary school. We were able to assign an employee to each of the nine grades in the school, something Junior Achievement could not accomplish previously.

The bank’s clients, advisory board, board of directors, investors and referral network are key to helping us “spread the word” about Bank of San Francisco to the Bay Area’s business and nonprofit communities. It is through our “ambassadors” that we are building our bank.

— Edward C. Obuchowski, President & CEO

Serving the banking needs of dental practices…has been a great way to combine our business and private banking capabilities.

575 Market Street, Suite 2400 | San Francisco, CA 94105

415.744.6700 | www.bankofsf.com

BOARD OF DIRECTORS

Roberta Achtenberg

Chair, Board of Trustees

The California State University

Scott R. Andrews

President, California Region

Capitol Bancorp Limited

Joseph P. Cristiano

Chairman, The MCM Group

Former President & CEO

Kelly-Moore Paint Company

James R. Dobberstein

Managing Director & Principal

Shea Labagh Dobberstein CPAs

Arthur F. Evans

Chairman

AF Evans Company, Inc.

Susan E. Lowenberg

Vice President

Lowenberg Corporation

Kelly McCown

Co-Founder/Partner

McCown & Evans LLP

Susan S. Morse, CFA, CFP

Senior Advisor &

Chief Compliance Officer

Mosaic Financial Partners, Inc.

Edward C. Obuchowski

President & CEO

Bank of San Francisco

David J. O’Leary

Chairman

O’Leary Paint Company

George J. Vukasin Jr.

Executive Vice President

Peerless Coffee & Tea

OFFICERS

Joseph P. Cristiano

Chairman

Scott R. Andrews

Vice Chairman

Edward C. Obuchowski

President & CEO

Raymond C. Brown

Executive Vice President

& CCO

Wendy A. Ross

Executive Vice President

Joan T. Bolduc

Senior Vice President

Edward G. Damgen

Senior Vice President

Ikuo Ogata

Senior Vice President

Katherine J. Zinsser

Senior Vice President

Jollin H. Gonzales

Vice President

Lisa Lau

Vice President

& Secretary

Timothy R. Rosenthal

Vice President

20

BANK OF SANTA BARBARA

Andy L. Clark, President

Bank of Santa Barbara is an innovative hometown bank. We have a dynamic staff of seasoned banking professionals and an active board of directors composed of area business leaders who take their roles seriously. Their referrals and advice about business and marketing opportunities make them true partners in every sense of the word.

Over the past year, Bank of Santa Barbara was involved in several successful projects with our strategic partners that generated positive publicity for the bank. Working closely with our partners, our creative team of local bankers is positioning the bank for continued growth and high performance.

Early in the year, we organized, sponsored and moderated a seminar on buying and selling businesses that was attended by 83 local entrepreneurs, including 30 business clients. This seminar helped us co-brand with our strategic partners and solidify our image as a bank that is nimble, cutting-edge and entrepreneurial.

In May, we partnered with legal, accounting and investment firms to host a client appreciation event for more than 250 people at the Arroyo Hondo Preserve. This was an excellent example of hosting an event with co-sponsors whose reputation and client reach in the community are significant and positive.

When the Santa Barbara Breakers debuted last March, Bank of Santa Barbara signed on as a sponsor of the professional basketball team. It was a marketing bonanza for the bank. The paid sponsorship made Bank of Santa Barbara “The Official Bank of the Breakers,” a designation that appeared in all Breakers’ ads and promotional material. We received publicity at the games, throughout the community and on the Web.

Reaffirming our community commitment, the bank began collaborating with the University of California, Santa Barbara to offer a series of for-credit educational seminars for first-year college students. Most of the students are from the Chumash Indian Nation, which is located just north of Santa Barbara.

During 2007, our team made contributions of time and money to 47 local nonprofit organizations, including the Santa Barbara Museum of Natural History where we sponsored the ever popular Butterflies Alive exhibit.

Bank of Santa Barbara — we are more than a bank, we are Santa Barbara.

— Andy L. Clark, President

Signing on as a sponsor of the Santa Barbara Breakers was a marketing bonanza…

12 East Figueroa Street | Santa Barbara, CA 93101

805.730.7860 | www.bankofsantabarbara.com

BOARD OF DIRECTORS

Scott R. Andrews

President, California Region

Capitol Bancorp Limited

Greggory M. Bigger

President

Santa Barbara Bancorp

Ronald M. Blitzer

Co-founder

Be Green Packaging, LLC

Thomas E. Caesar

Senior Vice President

Hub International Insurance

Andy L. Clark

President

Bank of Santa Barbara

David W. Grotenhuis

Partner

Santa Barbara Capital

Michael F. Hannley

President & CEO

Bank of Tucson

John L. Kavanagh

President

Kavanagh Corporation

Craig A. Makela

President

Santa Barbara Olive Company

Frank E. McGinity, CPA

Partner

McGinity Nodar & Daley, LLP

Timothy O’Connor, MD

President

Ventura Radiation

Oncology Group

Robert M. Ornstein, Esq.

Senior Consultant

Visionworks Associates, LLC

Michael D. White

President

MDW Companies

OFFICERS

Scott R. Andrews

Chairman & CEO

Andy L. Clark

President

Robert H. Rothenberg

Executive Vice President,

Secretary

Greggory M. Bigger

Senior Vice President

Andrew E. Chung

Vice President

Michael D. Duhamel

Vice President

Lisa M. Howard

Vice President

Paveena Luangprasert

Vice President

Darla R. Mahon

Vice President

21

NAPA COMMUNITY BANK

Dennis J. Pedisich, President & CEO

At the start of 2007, Napa Community Bank was poised to capitalize on business opportunities — and capitalize we did! The city of Napa is experiencing a renaissance with unprecedented development in the downtown area, which sits at the southern end of the world-renowned Napa Valley. Among the most exciting projects in the downtown “Oxbow” district are two new luxury hotels — the Ritz-Carlton and the Westin Verasa. Another exciting project is the Oxbow Public Market.

We first met with the principals behind the Oxbow Public Market project in November 2005. From our first meeting we were determined to be part of this exciting retail project, which brings together purveyors of artisan foods, fine wines, locally-grown fresh produce, teas and other goods in a marketplace setting. In spite of hefty competition, we were able to secure the lead financing for the project and to help make it a reality this year. The principals have become great ambassadors for Napa Community Bank and have agreed to appear in one of our client testimonial ads in the local newspaper in early 2008.

Oxbow principal Bart Rhoades had this to say about our bank: “Napa Community Bank has been an indispensable partner in the Oxbow Market project, providing not only financing but also timely advice and insights. We couldn’t be happier with our relationship.”

This is one of many examples of how Napa Community Bank is living up to the company’s core value of entrepreneurship. We are proud to contribute to the economic vitality of the community. We not only create jobs as an employer, but we create jobs by providing financial services, which help local businesses grow and prosper.

As happy as we are with our growth and success in 2007, the management, staff and board of directors at Napa Community Bank are excited to build our bank with the support of Capitol Bancorp and play a growing role in the emergence of our corner of the country.

— Dennis J. Pedisich, President & CEO

The city of Napa is experiencing a renaissance with unprecedented development in the downtown area…

700 Trancas Street | Napa, CA 94558

707.227.9300 | www.napacommunitybank.com

BOARD OF DIRECTORS

Kevin S. Alfaro

Partner

G & J Seiberlich & Co., LLP

Thomas M. Andrews

Owner & CFO

Andrews & Thornley

Construction, Inc.

Geni A. Bennetts, MD

Medical Consulting

Charles H. Dickenson

Partner

Dickenson, Peatman & Fogarty

Jeffrey L. Epps

President

Epps Chevrolet

Betty L. O’Shaughnessy-Woolls

Owner

O’Shaughnessy Estate Winery

John R. Pappas, DDS, MD

Oral & Maxillo-Facial Surgery

ADVISORY DIRECTORS

Scott R. Andrews

President, California Region

Capitol Bancorp Limited

Richard A. Bennett

Retired

Superior Court Judge

Joseph P. Cristiano

Chairman, The MCM Group

Former President & CEO

Kelly-Moore Paint Company

William H. Dodd

Napa County Board

of Supervisors

Doug W. Hill

Vineyard Manager

Oak Knoll Farming, Inc.

Paul J. Krsek

Managing Partner

K & A Asset Management

Harold D. Morrison

President

Bridgeford Flying Service

David J. O’Leary

Chairman

O’Leary Paint Company

Dennis J. Pedisich

President & CEO

Napa Community Bank

Salvador S. Ramos

Vineyard Supervisor

Jaeger Vineyards

OFFICERS

Geni A. Bennetts, MD

Chairman

Jeffrey L. Epps

Vice Chairman

Dennis J. Pedisich

President & CEO

Charles H. Dickenson

Secretary

Douglas C. Haigh

Executive Vice President & CCO

James A. Barrett

Senior Vice President

Mark C. Richmond

Senior Vice President

Joen M. McDaniel

Senior Vice President

James K. Fehring

Vice President

Shiloh M. Fehring

Vice President

Patrick J. McArdle

Vice President

Sandra J. Re

Vice President

Sheila G. Rogers

Vice President

22

POINT LOMA COMMUNITY BANK

Anthony D. Calabrese Sr., President & CEO

Point Loma Community Bank has been very well received by the local community since opening in August 2004. Since inception, we have grown our deposits significantly each year and look forward to further growth opportunities in 2008.

We are proud to provide exceptional service to our nearly 2,000 customers, many of whom live in Point Loma. Our clientele receives a warm welcome every time they interact with our employees. We go above and beyond to ensure that our customers feel personally supported and we have often delivered meals during an illness when they are in need of a friend.

Community outreach efforts continue to be our primary focus. We are proud to sponsor the annual Point Loma Summer Concert Series and enjoy hosting these concerts where I act as their Master of Ceremonies. We also contribute significantly to local schools by providing volunteers and sponsorship funds to support educational development of the children in our community. In 2007, we launched a program to sponsor a Meals-on-Wheels route focused on bringing daily meals to the elderly in Point Loma. We also introduced a new college internship program at our office, providing our employees the opportunity to train and develop students from the University of California at San Diego. It should also be noted that our employees share the bank’s desire to give to others, shown by their 100 percent participation in the 2007–08 United Way Campaign.

With multiple years under our belt, we have implemented a strategic marketing plan developed to continue our growth momentum over the next several years. Our new plan focuses on print, radio and public television ads in local media reaching our specific target markets. We also coordinated a direct mail campaign resulting in healthy growth in our Home Equity Line commitments.

As a local business bank, we take pride in supporting our local economy by serving local businesses. We consider ourselves an extension of their staff and enjoy guiding them through their financial decisions.

Now that we are solidly positioned within our community, we are confident that 2008 will show continued market share and financial growth for Point Loma Community Bank!

— Anthony D. Calabrese Sr., President & CEO

We are proud to sponsor the annual Point Loma Summer Concert Series…

1350 Rosecrans Street | San Diego, CA 92106

619.243.7900 | www.pointlomabank.com

BOARD OF DIRECTORS

Scott R. Andrews

President, California Region

Capitol Bancorp Limited

Gregg W. Beaty, DMD

Center for Oral, Maxillofacial &

Implant Reconstructive Surgery

Anthony D. Calabrese Sr.

President & CEO

Point Loma Community Bank

Maurice P. Correia, CPA

Correia & Associates

Arthur DeFever

President

DeFever Marine Enterprises

William T. Fiedler

President

Fiedler Construction Company

Harold O. Grafton

President

Cement Cutting, Inc.

Theodore Griffith

President

Pacific Tugboat Service

& Pearson Marine Fuel

Marcia Haas

Owner/Managing Partner

Aristocrat Apartments

John S. Lewis

President of Bank Performance

Capitol Bancorp Limited

Julius S. Paeske Jr.

President

Commercial Facilities, Inc.

Richard D. Thorn

Attorney at Law & Owner

Ward & Thorn, A Professional

Law Corporation

Mark A. Winkler

Broker Associate

Prudential Realty

OFFICERS

John S. Lewis

Chairman

Anthony D. Calabrese Sr.

President & CEO

Donald H. Gruhl

Senior Vice President

Millicent M. McKibbin

Senior Vice President

Jill M. Faucher

Vice President

Leticia C. Trujillo

Vice President

23

SUNRISE BANK OF SAN DIEGO

Randall S. Cundiff, President & CEO

Our road to continued success is paved with a focus on the “blocking and tackling” of banking, sound fundamentals that have made us successful. Supporting our team with enhanced product knowledge and training are key components in this goal. Our solid foundation is inherent in the synergy of our team and is complimented by the enthusiasm we share for each other. The bank will continue to empower team members with tools to take ownership in developing and maintaining client relationships. Individual efforts that add value to our clients and contribute to the bottom line are the essence of our strategy.

This was present in two new relationships developed in 2007. We helped Bill Luther Property Management create efficiencies through the implementation and personal training for our cash management product. We saved the company time, money and energy by helping it convert to an energized, more efficient operation. In switching the company’s prior 25-year banking relationship to Sunrise Bank, owner Bill Luther said, “We have been absolutely amazed at the level and quality of service we have consistently received from the Sunrise team members. They have delivered everything promised and more. The service level has been excellent.”

Richard Simis, owner of Simac Construction was attracted to Sunrise Bank by his direct access to senior management. We earned his trust and confidence by developing a complete relationship to help him attain long-term growth for his company. “The knowledge, experience and attitude they brought forth just felt right,” he said. “Sunrise Bank reinstilled the relationship bank feel that we were looking for in a partner for the future.”

Product diversification was a reoccurring theme throughout the year. The success of our bank is reliant on strengthening our referral pipeline, utilizing all of the loan products available to us and boosting fee income from the use of our wide array of financial products and services. We continued to build on this plan in 2007 as it will be a key to our future success.

Implementing strategies for strengthening our client relationships was successful for us in 2007 and will continue to be the “blocking and tackling” for years to come.

— Randall S. Cundiff, President & CEO

Sunrise Bank reinstilled the relationship bank feel that we were looking for in a partner for the future.

4570 Executive Drive, Suite 110 | San Diego, CA 92121

858.625.9050 | www.sunrisebanksd.com

BOARD OF DIRECTORS

Scott R. Andrews

President, California Region

Capitol Bancorp Limited

Craig V. Castanos

Owner

Craig V. Castanos, CPA

Randall S. Cundiff

President & CEO

Sunrise Bank of San Diego

Michael R. Labelle

Senior Director

Studley

Jack J. Landers

Commercial Broker

Westland Insurance Brokers

John S. Lewis

President of Bank Performance

Capitol Bancorp Limited

John F. McColl

President

Trinity Capital Group

John M. Rooney

President

Torrey Financial Group

Elizabeth K. Strom

Leasing Director

The Irvine Company Office Properties

OFFICERS

John S. Lewis

Chairman

Randall S. Cundiff

President & CEO

Suzanne K. Gregory

Executive Vice President,

CCO & Secretary

John L. Brackett

Senior Vice President

Gregory S. Fletcher

Vice President

Mary Jane Gertino

Vice President

Robin Hill

Vice President

Miranda E. Klassen

Vice President

Carla M. Kraft

Vice President

Michael H. Markie

Vice President

Bert T. Woods

Vice President

24

SUNRISE COMMUNITY BANK

Stuart E. Bailey, President

Sunrise Community Bank joined the Capitol Bancorp family on February 27, 2007, opening our bank in temporary facilities. We moved to our new permanent 8,000 square foot building on April 1st and got down to the business of becoming the most unique community business bank in the Coachella Valley.

Our goal is to provide business customers with what we call our “Chamber of Commerce” philosophy. We are passionate about becoming our customers’ lifelong business partner, networking our customers through bank-sponsored functions, including our “Breakfast Club” where we invite small groups of related businesses to join our senior officers and board members for breakfast and collectively brainstorm solutions to local business challenges.

We are consistent leaders in providing an array of cash management products for our business customers including online banking, a lockbox product targeted to capture the homeowner association market, and an effective use of account analysis to attract new, profitable deposit relationships.

This year the bank’s mortgage department entered into a strategic partnership with the largest residential real estate company in our market, Keller Williams, to be their mortgage company of choice for over 300 Valley agents. This has led to a significant number of residential mortgage referrals and the expansion of our mortgage department.

Sunrise Community Bank is equally proud of being the first affiliate bank to embrace Capitol Bancorp’s vision of being in the insurance business. In August we joined with Capitol Wealth Advisors in the acquisition of BAIA Insurance Agency, LLC, a local group health and benefits insurance agency, now integrated within our bank’s family of business financial products.

What is our goal for our second full year in business? To add traditional wealth management and financial planning specialists, trust services and property and casualty insurance products. Our ultimate goal is to be the provider of choice in our market for a complete array of complementary financial services. And we’re well on our way!

— Stuart E. Bailey, President

We are proud of being the first affiliate bank to embrace Capitol Bancorp’s vision of being in the insurance business.

41990 Cook Street, Suite 701 | Palm Desert, CA 92211

760.346.6139 | www.sunrisecommunitybank.com

BOARD OF DIRECTORS

Scott R. Andrews

President, California Region

Capitol Bancorp Limited

Stuart E. Bailey

President

Sunrise Community Bank

Debra L. Clark

Partner

Godecke Clark