UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July, 2024

Commission file number: 1-10110

BANCO BILBAO VIZCAYA ARGENTARIA, S.A.

(Exact name of Registrant as specified in its charter)

BANK BILBAO VIZCAYA ARGENTARIA, S.A.

(Translation of Registrant’s name into English)

Calle Azul, 4

28050 Madrid

Spain

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

| | | | | |

| Form 20-F [X] | Form 40-F [ ] |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

Main data

| | | | | | | | | | | | | | | |

| BBVA GROUP MAIN DATA (CONSOLIDATED FIGURES) |

| 30-06-24 | ∆ % | 30-06-23 | | 31-12-23 |

| Balance sheet (millions of euros) | | | | | |

| Total assets | 759,534 | (0.4) | 762,456 | | 775,558 |

| Loans and advances to customers (gross) | 405,021 | 6.3 | 380,949 | | 388,912 |

| Deposits from customers | 430,984 | 7.1 | 402,344 | | 413,487 |

| Total customer funds | 611,959 | 9.7 | 558,083 | | 577,853 |

| Total equity | 57,091 | 8.6 | 52,568 | | 55,265 |

| Income statement (millions of euros) | | | | | |

| Net interest income | 12,993 | 13.9 | 11,410 | | 23,089 |

| Gross income | 17,446 | 23.3 | 14,148 | | 29,542 |

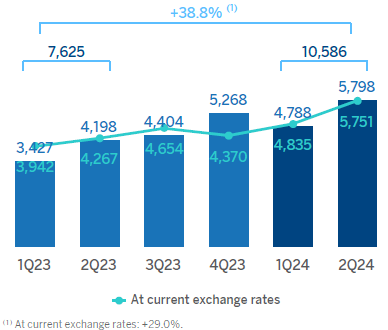

| Operating income | 10,586 | 29.0 | 8,209 | | 17,233 |

| Net attributable profit (loss) | 4,994 | 28.8 | 3,878 | | 8,019 |

| The BBVA share and share performance ratios | | | | | |

| Number of shares outstanding (million) | 5,763 | (3.4) | 5,965 | | 5,838 |

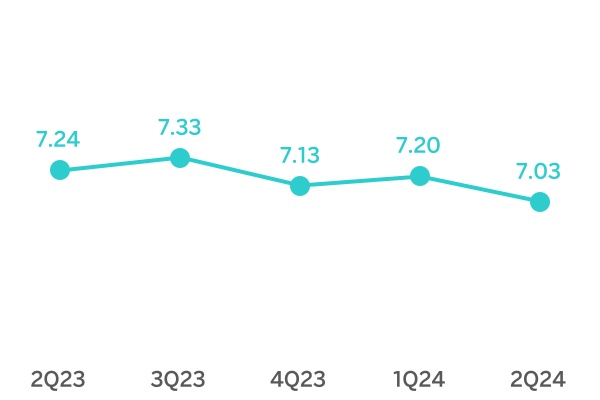

| Share price (euros) | 9.35 | 33.0 | 7.03 | | 8.23 |

| Adjusted earning (loss) per share (euros) ⁽¹⁾ | 0.84 | 30.6 | 0.64 | | 1.32 |

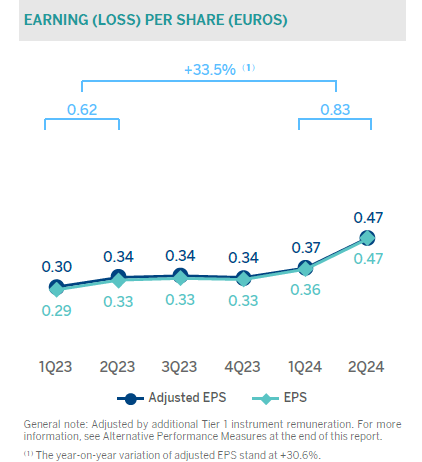

| Earning (loss) per share (euros) ⁽¹⁾ | 0.83 | 33.5 | 0.62 | | 1.29 |

| Book value per share (euros) ⁽¹⁾ | 9.26 | 12.5 | 8.23 | | 8.86 |

| Tangible book value per share (euros) ⁽¹⁾ | 8.84 | 12.7 | 7.84 | | 8.46 |

| Market capitalization (millions of euros) | 53,898 | 28.5 | 41,949 | | 48,023 |

| | | | | |

| Significant ratios (%) | | | | | |

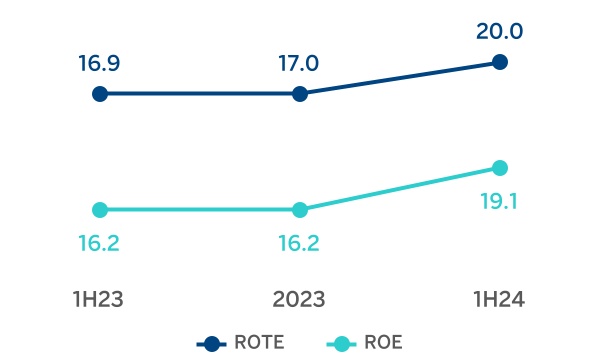

| ROE (net attributable profit (loss)/average shareholders' funds +/- average accumulated other comprehensive income) ⁽¹⁾ | 19.1 | | 16.2 | | 16.2 |

| ROTE (net attributable profit (loss)/average shareholders' funds excluding average intangible assets +/- average accumulated other comprehensive income) ⁽¹⁾ | 20.0 | | 16.9 | | 17.0 |

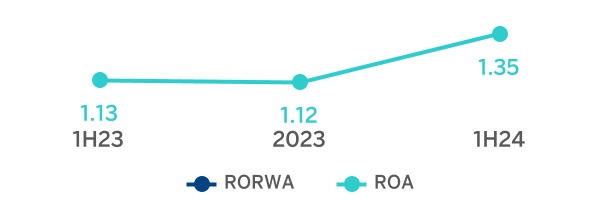

| ROA (profit (loss) for the period / average total assets - ATA) ⁽¹⁾ | 1.35 | | 1.13 | | 1.12 |

| RORWA (profit (loss) for the period / average risk-weighted assets - RWA)⁽¹⁾ | 2.80 | | 2.40 | | 2.38 |

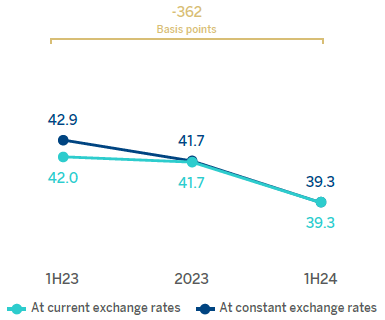

| Efficiency ratio ⁽¹⁾ | 39.3 | | 42.0 | | 41.7 |

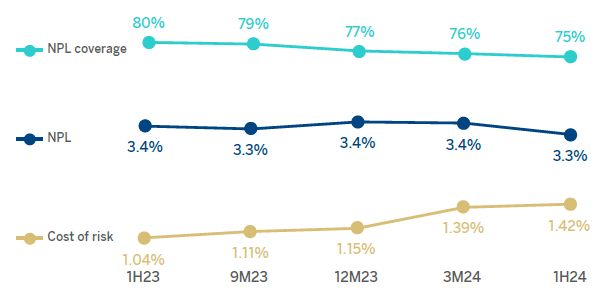

| Cost of risk ⁽¹⁾ | 1.42 | | 1.04 | | 1.15 |

| NPL ratio ⁽¹⁾ | 3.3 | | 3.4 | | 3.4 |

| NPL coverage ratio ⁽¹⁾ | 75 | | 80 | | 77 |

| Capital adequacy ratios (%) | | | | | |

| CET1 fully-loaded | 12.75 | | 12.99 | | 12.67 |

| CET1 phased-in ⁽²⁾ | 12.75 | | 12.99 | | 12.67 |

| Total ratio phased-in ⁽²⁾ | 16.77 | | 16.79 | | 16.58 |

| Other information | | | | | |

| Number of active customers (million) ⁽³⁾ | 75.5 | 6.5 | 70.8 | | 73.1 |

| Number of shareholders ⁽⁴⁾ | 721,403 | (7.4) | 778,810 | | 742,194 |

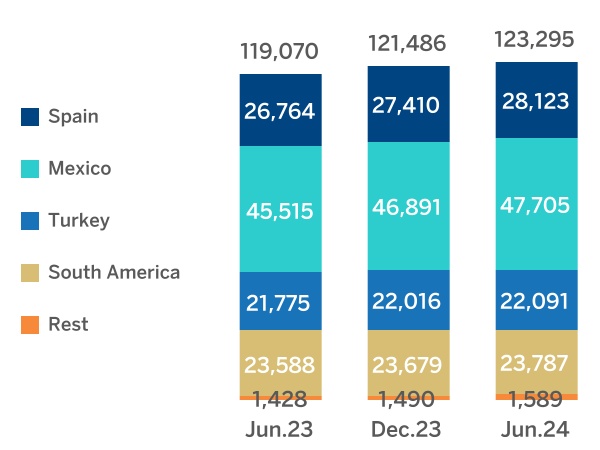

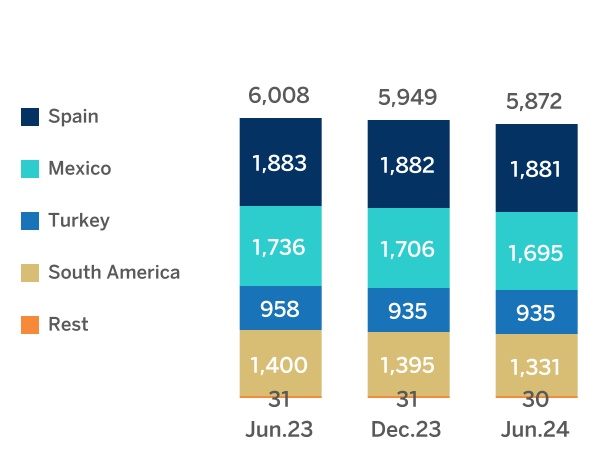

| Number of employees | 123,295 | 3.5 | 119,070 | | 121,486 |

| Number of branches | 5,872 | (2.3) | 6,008 | | 5,949 |

| Number of ATMs | 30,725 | 2.8 | 29,891 | | 30,301 |

| ⁽¹⁾ For more information, see Alternative Performance Measures at the end of this report. |

| ⁽²⁾ Phased-in ratios include the temporary treatment on the impact of IFRS 9, calculated in accordance with Article 473 bis amendments of the Capital Requirements Regulation (CRR), introduced by the Regulation (EU) 2020/873. For the periods shown in this table, there are no differences between phased-in and fully-loaded ratios due to the aforementioned temporary treatment. |

| ⁽³⁾ Reported figures include clients from Italy, as well as an adjustment for homogenization of criteria in Peru and Venezuela with the rest of the countries. |

| ⁽⁴⁾ See footnote to table of structural distribution of shareholders in the Capital and shareholders chapter of this report. |

|

|

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

Contents

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

Highlights

Results and business activity

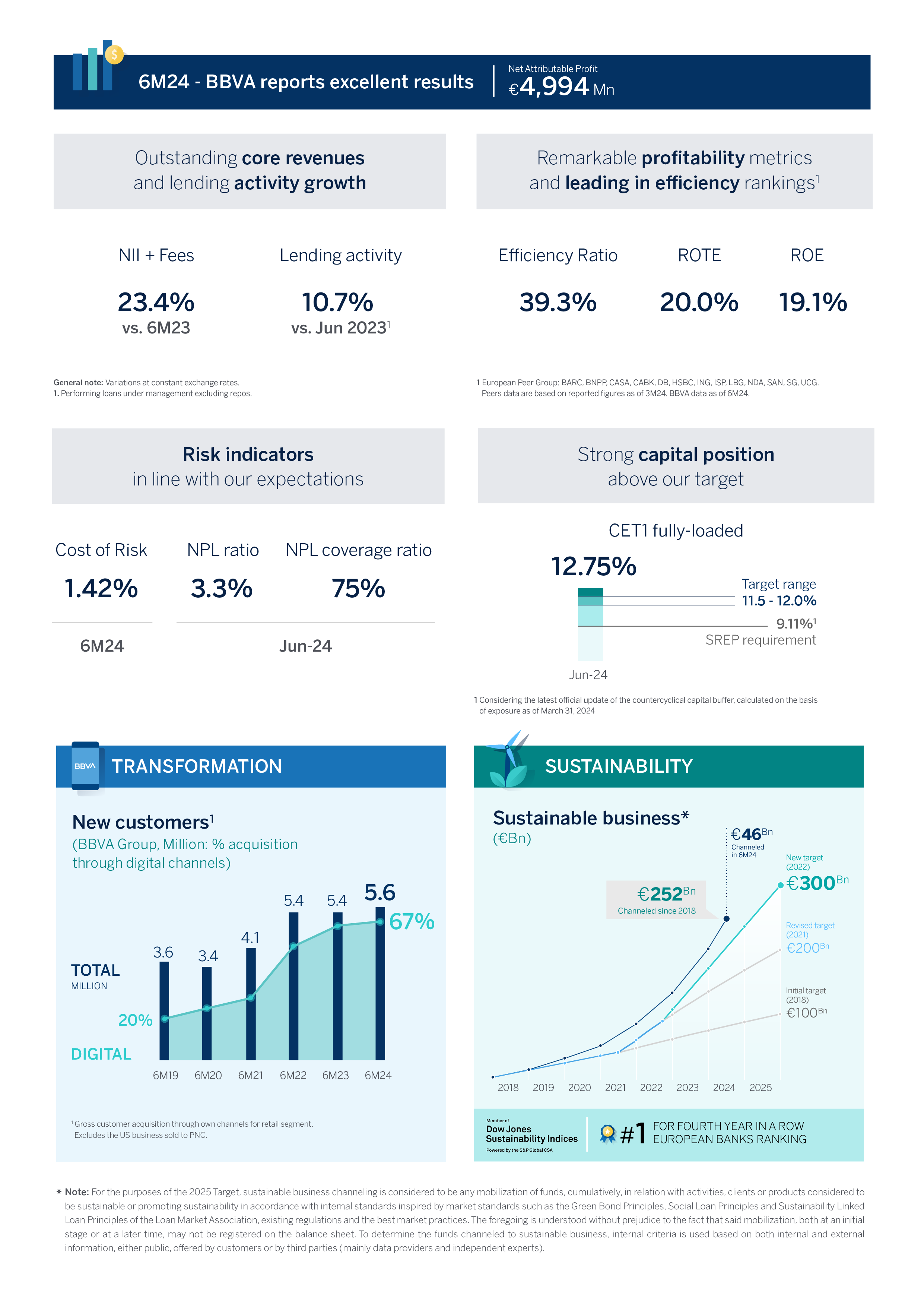

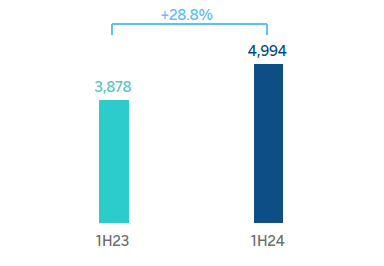

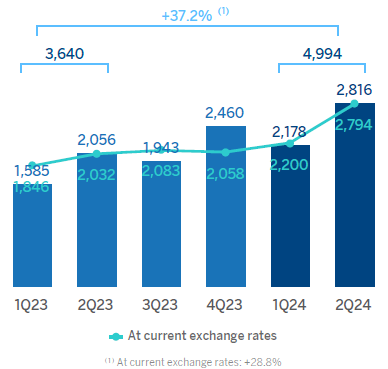

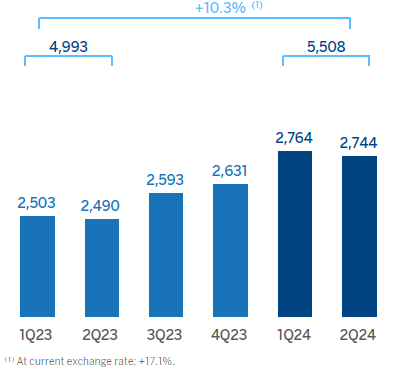

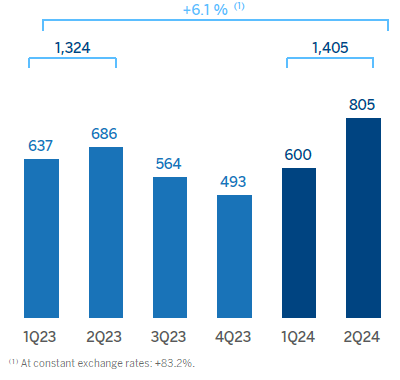

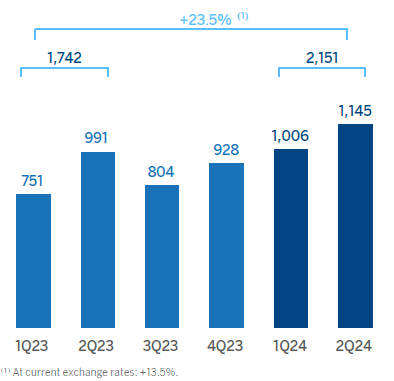

The BBVA Group generated a net attributable profit of €4,994m in the first half of 2024, again driven by the performance of recurring revenues of the banking business. Thus, the net interest income grew at a year-on-year rate of 13.9% and net fees and commissions by 32.1%. These results represent an increase of 28.8% compared to the same period of the previous year, 37.2% excluding the impact of the evolution of currencies.

Accumulated results at the end of the first half of 2024 include the recording of the total estimated annual amount of the temporary tax on credit institutions and financial credit institutions for €285m, included in the other operating income and expenses line of the income statement.

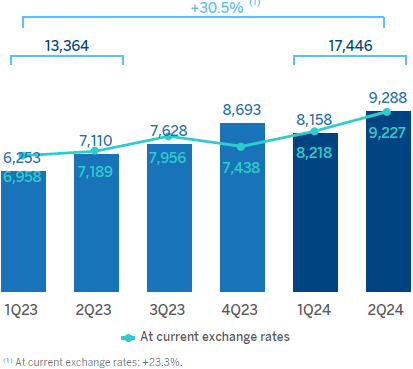

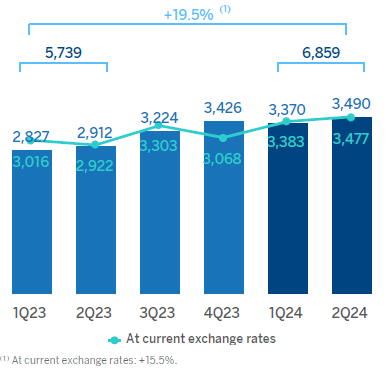

Operating expenses increased by 19.5% at Group level at constant exchange rates, affected by an environment of still high inflation in the countries where the Group has a presence, the growth of the workforce in most of them and the higher level of investments, in line with those made in recent years. Thanks to the remarkable growth in gross income (+30.5%, in constant terms), greater than the growth in operating expenses, the efficiency ratio stood at 39.3% as of June 30, 2024, with an improvement of 362 basis points, in constant terms, compared to the ratio recorded 12 months earlier, in constant terms.

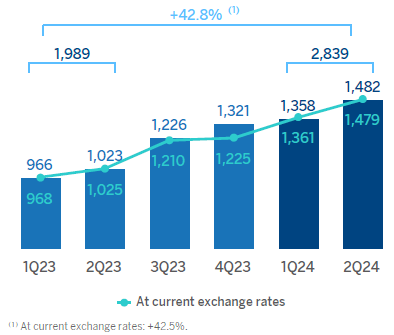

The provisions for impairment on financial assets increased (+42.8% in year-on-year terms and at constant exchange rates), with higher requirements linked to the growth in retail products, the most profitable in line with the Group´s strategy.

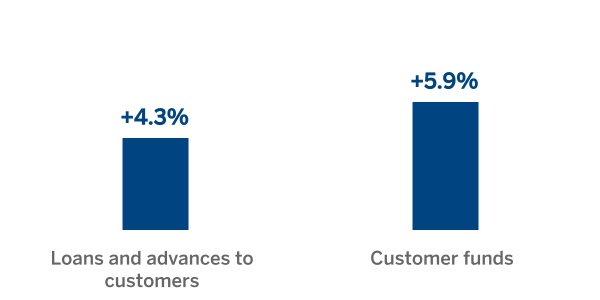

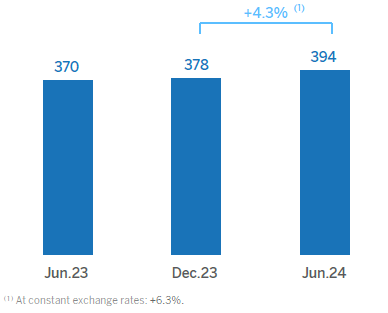

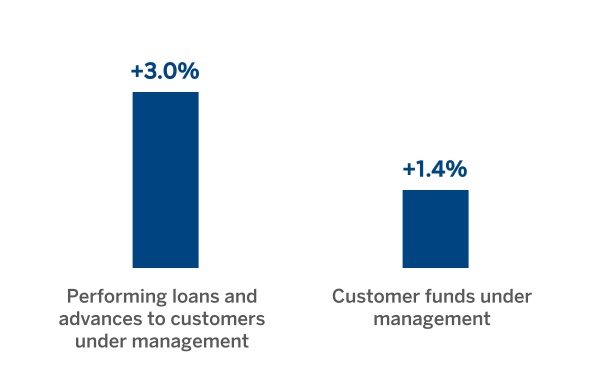

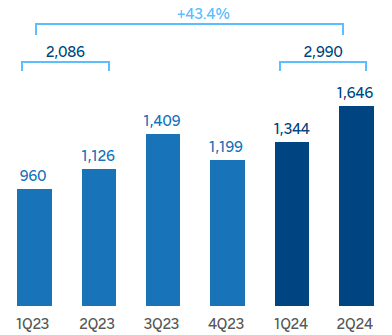

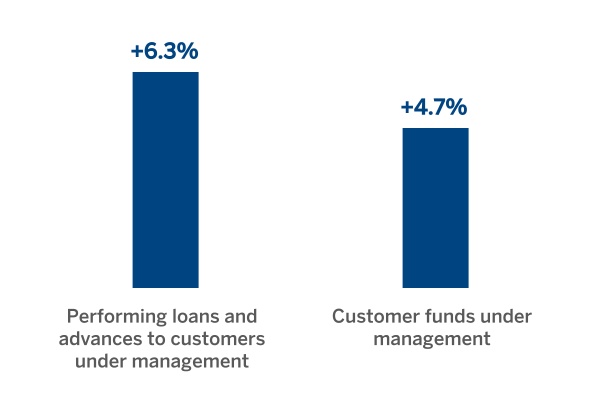

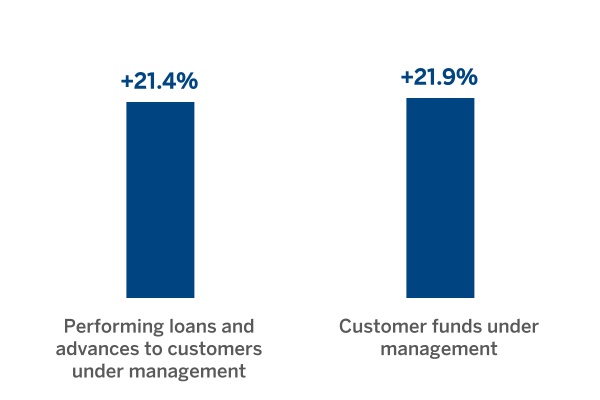

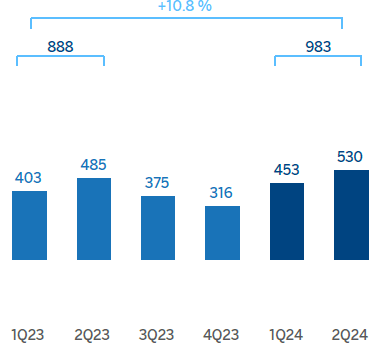

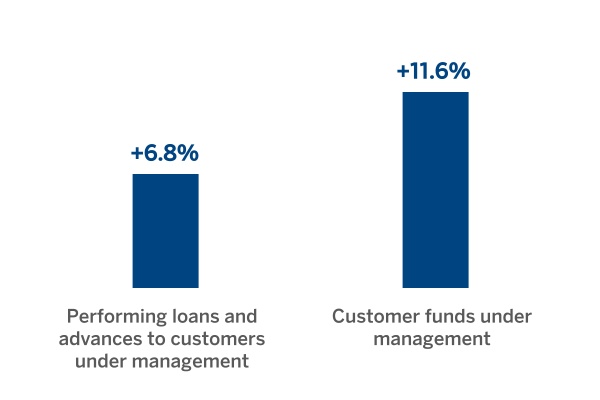

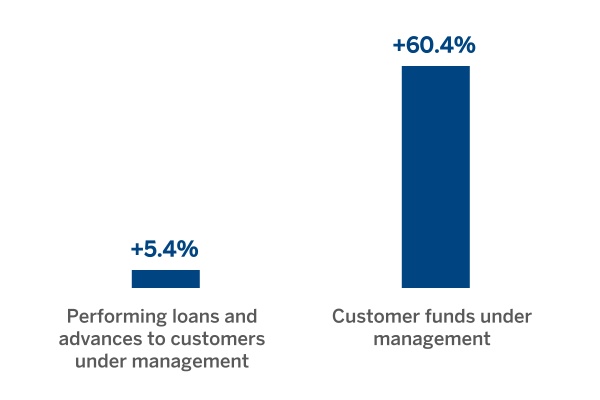

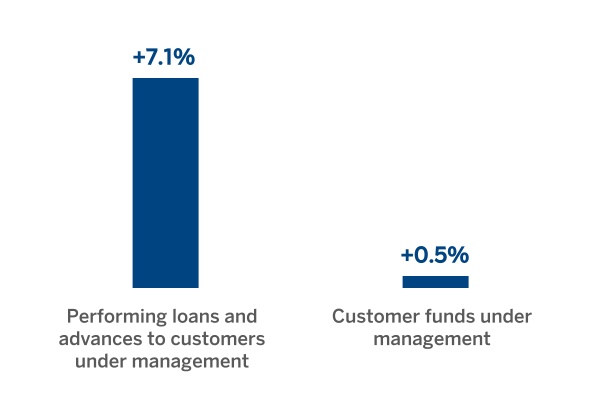

Loans and advances to customers recorded an increase of 4.3% compared to the end of December 2023, particularly driven by the evolution of corporate loans (+5.1% at Group level), and by the positive performance of loans of all segments to individuals.

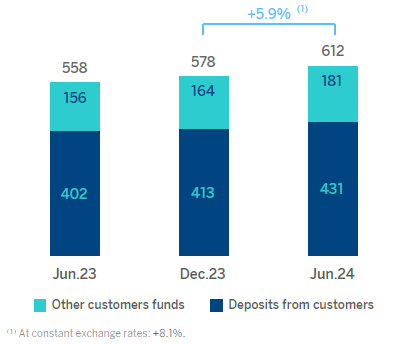

Customer funds increased by 5.9% compared to the end of the previous year. This favorable performance was due to the growth in both deposits from customers, which increased by 4.2%, as well as in the evolution of off-balance sheet funds, that shows a greater dynamism and grew by 10.1%.

| | |

| LOANS AND ADVANCES TO CUSTOMERS AND TOTAL CUSTOMER FUNDS (VARIATION COMPARED TO 31-12-2023) |

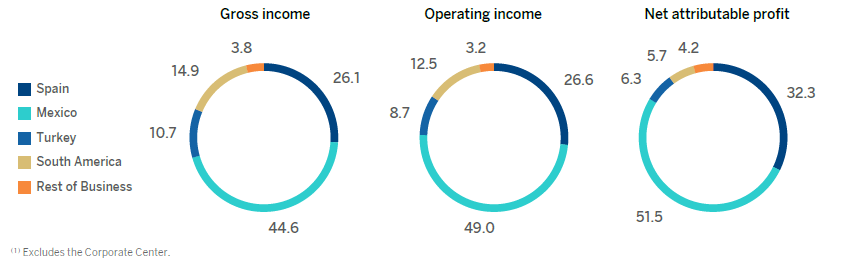

Business areas

According to the accumulated results of the business areas at the end of the first half of 2024 and excluding the effect of currencies fluctuation in those areas where it has an impact, in each of them it is worth mentioning:

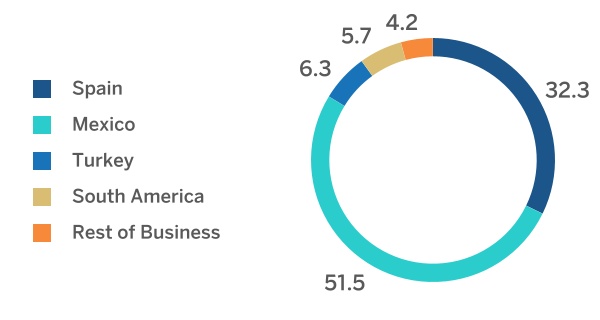

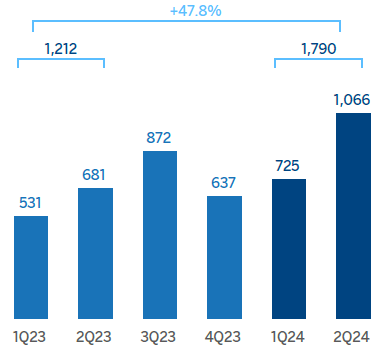

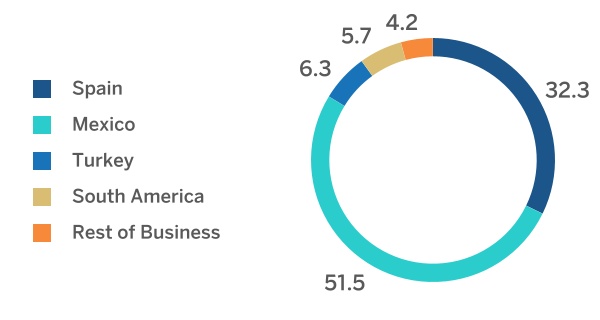

–Spain generated a net attributable profit of €1,790m, that is 47.8% higher than in the same period of the previous year, mainly supported by the favorable evolution of every line item of the gross income. These solid results include the negative impact of €285m due to the recording of the estimated annual amount of the temporary tax on credit institutions and financial credit institutions.

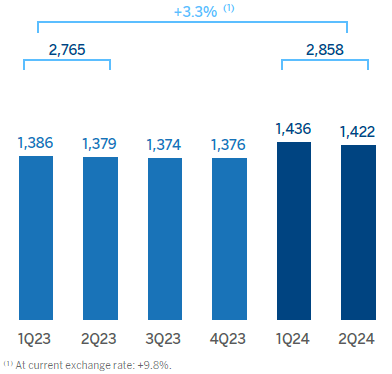

–BBVA Mexico achieved a cumulative net attributable profit of €2,858m, representing an increase of 3.3% compared to the same period of the previous year, mainly due to the strength of the recurring income from the banking business.

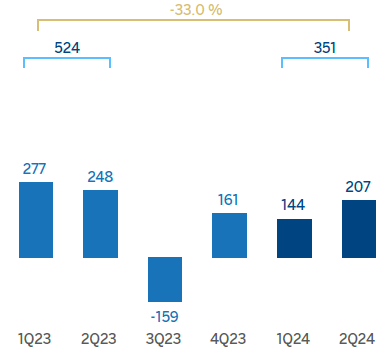

–Turkey generated a net attributable profit of €351m, with an improvement in the contribution to the Group's results in the second quarter of the year.

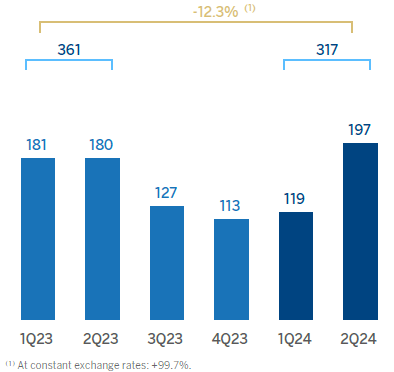

–South America generated a cumulative net attributable profit of €317m, which represents a year-on-year increase of 99.7%, driven by the good performance of recurring income and the net trading income (hereinafter, NTI).

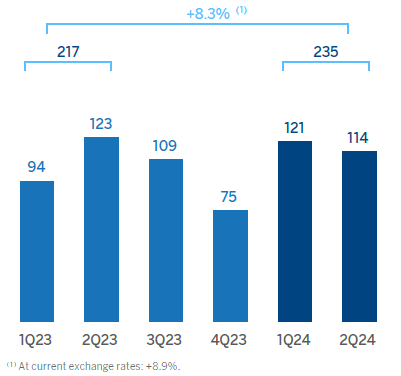

–Rest of Business achieved an accumulated net attributable profit of €235m, 8.3% higher than in the same period of the previous year, favored by the performance of the net interest income and the NTI.

The Corporate Center recorded a net attributable loss of €-557m, which is an improvement compared with the €-1,039m recorded in the same period of the previous year, mainly due to the evolution of the NTI.

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

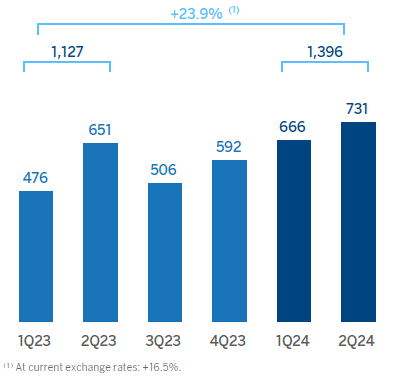

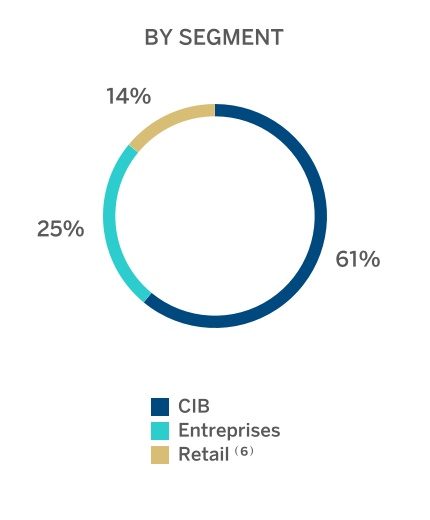

Lastly, and for a broader understanding of the Group's activity and results, supplementary information is provided below for the wholesale business, Corporate & Investment Banking (CIB), carried out by BBVA in the countries where it operates. CIB generated a net attributable profit of €1,396m. These results represent an increase of 23.9% on a year-on-year basis and reflect the contribution of the diversification of products and geographical areas, as well as the progress of the Group's wholesale businesses in its strategy, leveraged on globality and sustainability, with the purpose of being relevant to its clients.

| | |

| NET ATTRIBUTABLE PROFIT (LOSS) (MILLIONS OF EUROS) |

| | |

| NET ATTRIBUTABLE PROFIT BREAKDOWN ⁽¹⁾ (PERCENTAGE. 1H24) |

⁽¹⁾ Excludes the Corporate Center.

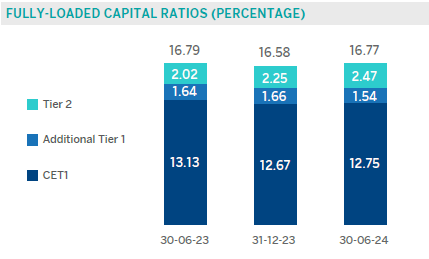

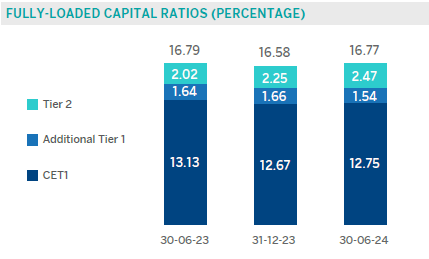

Solvency

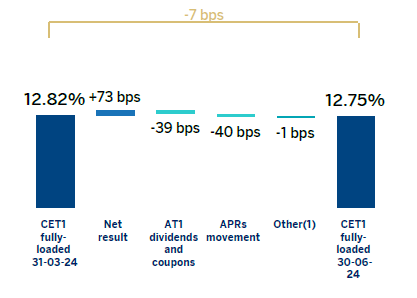

The CET1 fully loaded ratio of the BBVA Group stood at 12.75% as of June 30, 2024, which allows maintaining a large management buffer over the Group's CET1 requirement as of that date (9.11%1), and which is also above the Group's target management range of 11.5 - 12.0% CET1.

Purchase offer to the Banco Sabadell shareholders

On April 30, 2024, due to a media report, BBVA published an inside information notice (información privilegiada) stating that it had informed the chairman of the Board of Directors of Banco de Sabadell, S.A. (the "Target Company") of the interest of BBVA’s Board of Directors in initiating negotiations to explore a possible merger between the two entities. On the same date, BBVA sent to the chairman of the Target Company the written proposal for the merger of the two entities. The content of the written proposal sent to the Board of Directors of the Target Company was published on May 1, 2024 by BBVA through the publication of an inside information notice (información privilegiada) with the CNMV.

On May 6, 2024, the Target Company published an inside information notice (información privilegiada) informing of the rejection of the proposal by its Board of Directors.

Following such rejection, on May 9, 2024, BBVA announced, through the publication of an inside information notice (información privilegiada) (the "Prior Announcement"), the decision to launch a voluntary tender offer (the "Offer") for the acquisition of all of the issued shares of the Target Company, being a total of 5,440,221,447 ordinary shares with a par value of €0.125 each (representing 100% of the Target Company’s share capital). The consideration offered by BBVA to the shareholders of the Target Company consists of one (1) newly issued share of BBVA for each four and eighty-three hundredths (4.83) ordinary shares of the Target Company (the "Consideration"), subject to certain adjustments in the case of dividend distribution in accordance with what was indicated in the Prior Announcement.

Pursuant to the provisions of Royal Decree 1066/2007, of July 27, on the rules governing tender offers ("Royal Decree 1066/2007"), the Offer is subject to mandatory clearance by the CNMV. Additionally, pursuant to the provisions of Law 10/2014 and Royal Decree 84/2015, the acquisition by BBVA of control of the Target Company resulting from the Offer is subject to the duty of prior notification to the Bank of Spain and the obtention of the non-opposition of the European Central Bank. In accordance with the provisions of article 26.2 of Royal Decree 1066/2007, the CNMV will not authorize the Offer until the express or tacit non-opposition of the European Central Bank has been obtained and evidenced.

In addition, completion of the Offer is also subject to the satisfaction of the conditions specified in the Prior Announcement, in particular (i) the acceptance of the Offer by holders of shares representing at least 50.01% of the share capital of the Target Company, (ii) approval by BBVA’s General Shareholders’ Meeting of the increase of BBVA’s share capital through the issue of new ordinary shares through non-cash contributions in an amount that is sufficient to fully cover the Consideration offered to the shareholders of the Target Company (which condition was satisfied on July 5, 2024, as described below), (iii) the express or tacit authorization of the economic concentration resulting from the Offer by the Spanish antitrust authorities, and (iv) the express or tacit authorization of the indirect acquisition of control of the Target Company’s banking subsidiary in the United Kingdom, TSB Bank PLC, by the United Kingdom Prudential Regulation Authority (PRA).

1 Considering the last official update of the countercyclical capital buffer, calculated on the basis of exposure as of March 31, 2024.

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

On July 5, 2024, the BBVA’s Extraordinary General Shareholders' Meeting resolved to authorize, with 96% votes in favor, an increase in the share capital of BBVA of up to a maximum nominal amount of €551,906,524.05 through the issuing and putting into circulation of up to 1,126,339,845 ordinary shares of €0.49 par value each to fully cover the Consideration offered to the shareholders of the Target Company.

The closing of the Offer is expected to be completed in between approximately 6 and 8 months from the date of the Prior Announcement and the detailed terms of the Offer will be set out in the prospectus, which was submitted to CNMV together with the request for the authorization of the Offer on May 24, 2024, and will be published after obtaining the mandatory clearance of the CNMV.

Sustainability

Channeling sustainable business

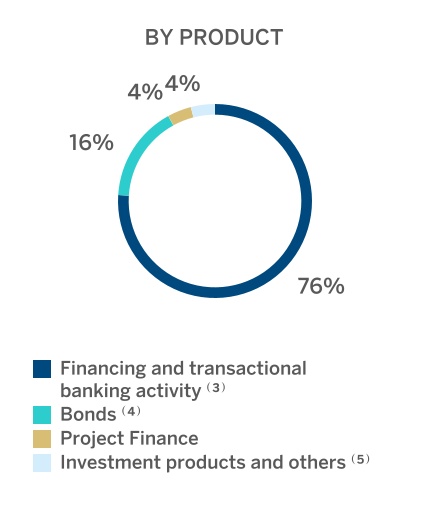

| | |

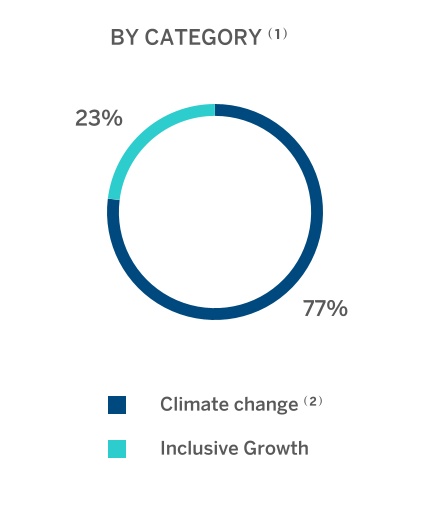

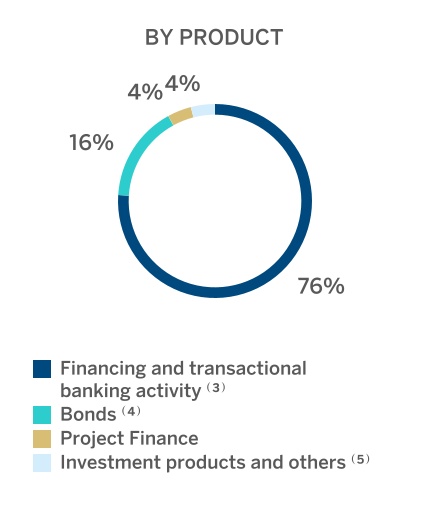

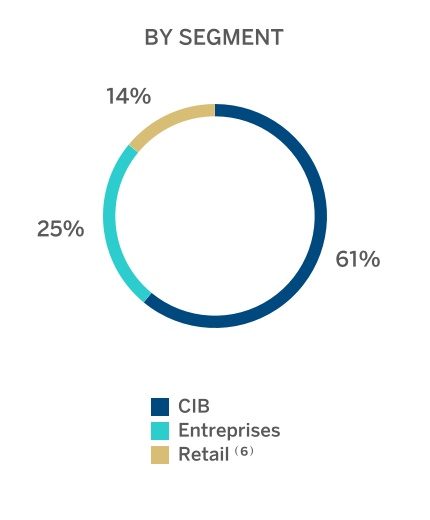

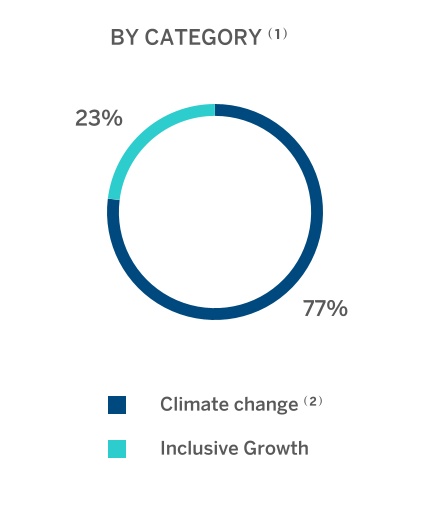

| SUSTAINABLE BUSINESS BREAKDOWN (PERCENTAGE OF THE AMOUNT CHANNELED 2018-JUNE 2024) |

(1) In those cases where it is not feasible or sufficient information is not available to allow an exact distribution between the categories of climate change and inclusive growth, internal estimates are made based on the available information.

(2) Also includes Natural Capital.

(3) Primarily includes products whose funds are used for activities considered sustainable (according to both internal and market standards, existing regulations and best practices), products granted to clients considered sustainable taking into account their revenues from sustainable activities (in accordance with existing regulations and/or internal standards) or in line with company-level certifications of recognized prestige in the market, as well as sustainability linked products (according to both internal and market standards and best practices), such as those linked to environmental and/or social indicators.

(4) Bonds (green, social, sustainability or sustainability-linked) in which BBVA acts as bookrunner.

(5) Investment products art.8 or 9 under Sustainable Finance Disclosure Regulation (SFDR) or similar criteria outside the EU managed, intermediated or marketed by BBVA. "Other" includes deposits under the Sustainable Transaction Banking Framework until its replacement by the CIB Sustainable Products Framework (both Frameworks published on the bank's website), insurance policies related to energy efficiency and inclusive growth and electric vehicle autorenting, mainly.

(6) Includes the activity of the BBVA Microfinance Foundation (BBVAMF), which is not part of the consolidated Group and which has channeled around €8.4 billion in the period from 2018 to June 2024 to support vulnerable entrepreneurs with microcredits.

Regarding the objective of channeling €300 billion between 2018 and 20252 as part of the sustainability strategy, the BBVA Group has channeled an approximate total of €252 billion in sustainable business between 2018 and June 2024, of which approximately 77% corresponds to the area of promoting the fight against climate change and the remaining 23% to promote inclusive growth. The amount channeled includes financing, intermediation, investment, off-balance sheet and insurance transactions. These operations have contractual maturity or redemption dates, so the above mentioned accumulated figure does not represent the amount reflected on the balance sheet.

During the first half of 2024, around €46 billion was channeled, of which around €26 billion corresponds to the second quarter of 2024, a new quarterly record for the Group. This channeling of the first half of 2024 represents an increase of around 37% compared to the same half of 2023.

Of the amount channeled in the first half of 2024, around €5.3 billion corresponds to retail business, representing a growth of 12% compared with the same period of the previous year. During the second quarter, around €2.8 billion was channeled. BBVA has continued to promote customized digital solutions aimed at the mass consumer market, offering retail customers a vision of the potential savings they can obtain by adopting energy-saving measures in their homes and transportation. During the second quarter

2 For the purposes of the Goal 2025, channeling is considered to be any mobilization of financial flows, cumulatively, in relation with activities, clients or products considered to be sustainable or promoting sustainability in accordance with internal standards inspired by existing regulations, market standards such as the Green Bond Principles, the Social Bond Principles and the Sustainability Linked Bond Principles of the International Capital Markets Association, as well as the Green Loan Principles, Social Loan Principles and the Sustainability Linked Loan Principles of the Loan Market Association, existing regulations, and best market practices. The foregoing is understood without prejudice to the fact that said mobilization, both at an initial stage or at a later time, may not be registered on the balance sheet. To determine the financial flows channeled to sustainable business, internal criteria is used based on both internal and external information, either from public sources, provided by customers or by a third party (mainly data providers and independent experts).

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

of 2024, the good performance of channeling related to the acquisition of hybrid or electric vehicles stands out, with a total of around €164 million channeled, representing a 13% growth compared to the same period of the previous year.

Between January and June 2024, the commercial business (enterprises) mobilized around €15.8 billion, representing a growth of 57% compared to the same period of the previous year. In the second quarter of 2024, approximately €9 billion was channeled, while continuing to advise corporate customers on sustainable solutions that enable potential economic savings with a focus on cross-cutting issues, such as energy efficiency, vehicle fleet renewal or water footprint reduction. It is worth highlighting the financing allocated to agribusiness, water and circular economy with around €655 million during the second quarter of 2024, which represents an increase of 74% compared to the same period of the previous year.

CIB has channeled around €25 billion during the first half of the year, representing a 32% growth compared to the same period of the previous year. During this quarter, around €13.8 billion have been mobilized. In the wholesale segment, BBVA has continued to promote the financing of clean technologies and renewable energy projects, as well as confirming linked to sustainability, among other strategic lines. In terms of channeling in the second quarter of 2024, the financing of renewable energy projects stood out, which contributed around €402 million during the quarter, more than doubled the amount compared to the same period of the previous year.

Relevant advances in the field of sustainability

•Intermediate emission reduction targets for 20303

Following the publication of its interim 2030 emissions reduction targets for the aviation and shipping sectors at the end of 2023, and following the defined roadmap, BBVA published in May 2024 interim 2030 funded emissions reduction targets for two additional sectors: aluminum and real estate (both commercial and residential)4.

In the case of aluminum, BBVA has set its target to align its financing portfolio with the decarbonization trajectory determined by the International Aluminum Institute (IAI) to reduce global emissions by 28% by 2030. This means achieving a percentage deviation of 0% or less from this decarbonization path by 2030.

In the case of the BBVA Group's real estate portfolio, different targets have been set for the Commercial Real Estate segment, where the objective is to reduce the intensity of its financing portfolio by 44% between 2023 and 2030, and for the Residential Real Estate segment, with a reduction target for that period of 30%5.

•Issuance of a biodiversity bond

In May 2024, BBVA Colombia and the International Finance Corporation (IFC) have announced the issuance of a biodiversity bond. BBVA Colombia will issue the bond of up to $70 million and the proceeds will be used to finance projects focused on reforestation, regeneration of natural forests on degraded lands, mangrove conservation or rehabilitation, climate-smart agriculture, and wildlife habitat restoration, among others.

3 The achievement and progressive progress of the decarbonization targets will depend to a large extent on the actions of third parties, such as customers, governments and other stakeholders, and may therefore be materially affected by such actions, or lack thereof, as well as by other exogenous factors that do not depend on BBVA (including, but not limited to, new technological and regulatory developments, military conflicts, the evolution of climate and energy crises, etc.). Consequently, these objectives may be subject to future revisions.

4 The geographic scope of the intermediate 2030 emission reduction target for the real estate sector is Spain.

5 BBVA has established its targets following the CRREM (Carbon Risk Real Estate Monitor) methodology, which defines a metric in terms of emissions intensity (Kg CO2e per square meter per year).

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

Macroeconomic environment

Economic growth, in general, has been stronger than expected and inflation has stopped its downward trend in recent months. Although restrictive monetary conditions continue to affect the economy through traditional channels, their effects on the dynamics of activity and prices have been partially offset by factors such as the expansionary tone of fiscal policy, the dynamism of the services sector and the still high liquidity.

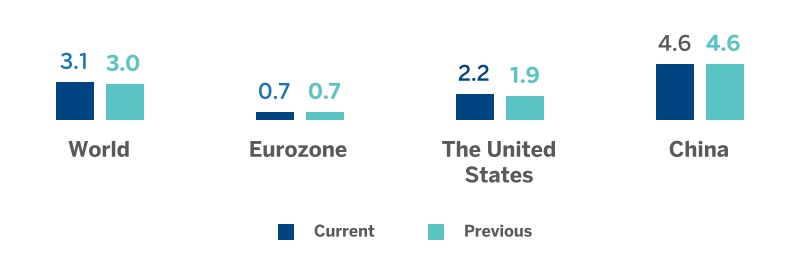

Despite the recent resilience, according to BBVA Research, it is most likely that further moderation in demand paves the way for relatively low global GDP growth and a slowdown in inflation from its current levels over the coming months. Specifically, global growth would reduce from 3.3% in 2023 to 3.1% in 2024, a sightly higher forecast than previous one (+3.0%). In the United States, growth is expected to continue soften, but better than expected data in recent months supports an upward revision of the GDP growth forecast for 2024 to 2.2%, 30 basis points above the previous forecast and 30 basis points below the growth recorded in 2023. In the Eurozone, the growth forecast for 2024 remains unchanged at 0.7%; activity would continue to recover gradually after remaining practically stagnant for much of 2023, when GDP grew just 0.5%. In China, despite the dynamism of the first months of the year, a series of structural factors are expected to continue to weigh negatively and GDP is expected to grow 4.6% in 2024 with no change compared to the previous forecast and below the growth observed in 2023 (+5.2%).

In this context of moderate growth and prospects for a further slowdown of inflation, the ECB has decided to cut its interest rates by 25 basis points in June, to 3.75% of deposit facility rates, and it is expected that the Fed will begin soon its cycle of easing monetary conditions. Benchmark interest rates would be reduced, according to BBVA Research forecasts, to around 5.0% in the United States and 3.25% in the Eurozone, after two cuts of 25 basis points in each geographic area during the second half of 2024. Interest rates are expected to continue falling throughout 2025. However, they are expected to remain relatively high, above the levels before the coronavirus pandemic, due to potential inflationary pressures caused by the geopolitical factors, such as the war in Ukraine and the armed conflict in Middle East, and to other factors like protectionist policies, an expansionary fiscal stance and climatic shocks. Indeed, these factors, as well as the current political context in the United States and Europe, increase the uncertainty about the evolution of the global economy and the risk of having a higher inflation and interest rates than expected as of the date of publication of this report.

| | |

| GDP GROWTH ESTIMATES IN 2024 (PERCENTAGE. YEAR-ON-YEAR VARIATION) |

Source: BBVA Research estimates.

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

Group

Quarterly evolution of results

The results obtained by the BBVA Group in the second quarter of 2024 stood at 2,794 million euros, 27.0% above the previous quarter, with the following trends standing out:

–Favorable evolution of recurring income, with Turkey´s performance standing out.

–Excellent performance of NTI, due to the exchange rate hedges of the Corporate Center.

–Favorable evolution of the other operating income and expenses line, mainly explained by a lower hyperinflation adjustment in Argentina, and by the temporary tax on credit institutions and financial credit institutions, recorded in the first quarter of the year 2024.

–Increase of operating expenses and in impairment on financial assets, in line with the growth strategy in the most profitable segments.

| | | | | | | | | | | | | | | | | | | | | | | |

| CONSOLIDATED INCOME STATEMENT: QUARTERLY EVOLUTION (MILLIONS OF EUROS) |

| | | 2024 | | 2023 |

| | | 2Q | 1Q | | 4Q | 3Q | 2Q | 1Q |

| Net interest income | | | 6,481 | 6,512 | | 5,246 | 6,434 | 5,768 | 5,642 |

| Net fees and commissions | | | 1,955 | 1,887 | | 1,694 | 1,685 | 1,470 | 1,439 |

| Net trading income | | | 1,114 | 772 | | 753 | 658 | 334 | 438 |

| Other operating income and expenses | | | (324) | (952) | | (255) | (820) | (383) | (561) |

| Gross income | | | 9,227 | 8,218 | | 7,438 | 7,956 | 7,189 | 6,958 |

| Operating expenses | | | (3,477) | (3,383) | | (3,068) | (3,303) | (2,922) | (3,016) |

| Personnel expenses | | | (1,855) | (1,778) | | (1,693) | (1,756) | (1,530) | (1,551) |

| Other administrative expenses | | | (1,238) | (1,229) | | (1,025) | (1,169) | (1,054) | (1,127) |

| Depreciation | | | (384) | (375) | | (349) | (378) | (337) | (339) |

| Operating income | | | 5,751 | 4,835 | | 4,370 | 4,654 | 4,267 | 3,942 |

| Impairment on financial assets not measured at fair value through profit or loss | | | (1,479) | (1,361) | | (1,225) | (1,210) | (1,025) | (968) |

| Provisions or reversal of provisions | | | 19 | (57) | | (163) | (81) | (115) | (14) |

| Other gains (losses) | | | 31 | 40 | | (49) | 2 | 50 | (16) |

| Profit (loss) before tax | | | 4,322 | 3,458 | | 2,932 | 3,365 | 3,178 | 2,944 |

| Income tax | | | (1,374) | (1,151) | | (799) | (1,226) | (1,028) | (950) |

| Profit (loss) for the period | | | 2,949 | 2,307 | | 2,133 | 2,139 | 2,150 | 1,994 |

| Non-controlling interests | | | (154) | (107) | | (75) | (56) | (118) | (148) |

| | | | | | | | | |

| | | | | | | | | |

| Net attributable profit (loss) | | | 2,794 | 2,200 | | 2,058 | 2,083 | 2,032 | 1,846 |

| Adjusted earning (loss) per share (euros) ⁽¹⁾ | | | 0.47 | 0.37 | | 0.34 | 0.34 | 0.34 | 0.30 |

| Earning (loss) per share (euros) ⁽¹⁾ | | | 0.47 | 0.36 | | 0.33 | 0.33 | 0.33 | 0.29 |

| ⁽¹⁾ Adjusted by additional Tier 1 instrument remuneration. For more information, see Alternative Performance Measures at the end of this report. |

|

|

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

Year-on-year evolution of results

The BBVA Group generated a net attributable profit of €4,994m in the first half of 2024, again driven by the performance of recurring revenues of the banking business. Thus, the net interest income grew at a year-on-year rate of 13.9% and net fees and commissions by 32.1%. These results represent an increase of 28.8% compared to the same period of the previous year.

These results include the recording for the total annual amount paid for the temporary tax on credit institutions and financial credit institutions6 for €285m, included in the other operating income and expenses line of the income statement.

| | | | | | | | | | | | | | |

| CONSOLIDATED INCOME STATEMENT (MILLIONS OF EUROS) |

| | | ∆ % at constant | |

| 1H24 | ∆ % | exchange rates | 1H23 |

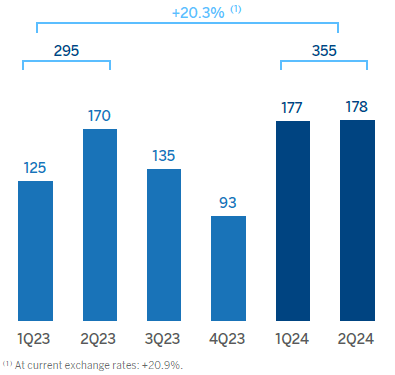

| Net interest income | 12,993 | 13.9 | 20.3 | 11,410 |

| Net fees and commissions | 3,842 | 32.1 | 35.4 | 2,909 |

| Net trading income | 1,886 | 144.2 | 183.0 | 773 |

| Other operating income and expenses | (1,276) | 35.2 | 35.6 | (944) |

| Gross income | 17,446 | 23.3 | 30.5 | 14,148 |

| Operating expenses | (6,859) | 15.5 | 19.5 | (5,938) |

| Personnel expenses | (3,633) | 17.9 | 22.5 | (3,081) |

| Other administrative expenses | (2,467) | 13.1 | 17.9 | (2,181) |

| Depreciation | (759) | 12.3 | 11.8 | (676) |

| Operating income | 10,586 | 29.0 | 38.8 | 8,209 |

| Impairment on financial assets not measured at fair value through profit or loss | (2,839) | 42.5 | 42.8 | (1,993) |

| Provisions or reversal of provisions | (38) | (70.3) | (65.1) | (129) |

| Other gains (losses) | 71 | 107.8 | 94.6 | 34 |

| Profit (loss) before tax | 7,780 | 27.1 | 39.8 | 6,122 |

| Income tax | (2,525) | 27.6 | 40.4 | (1,978) |

| Profit (loss) for the period | 5,255 | 26.8 | 39.6 | 4,144 |

| Non-controlling interests | (261) | (1.9) | 108.2 | (266) |

| Net attributable profit (loss) | 4,994 | 28.8 | 37.2 | 3,878 |

| Adjusted earning (loss) per share (euros) ⁽¹⁾ | 0.84 | | | 0.64 |

| Earning (loss) per share (euros) ⁽¹⁾ | 0.83 | | | 0.62 |

| ⁽¹⁾ Adjusted by additional Tier 1 instrument remuneration. For more information, see Alternative Performance Measures at the end of this report. |

| | | | |

|

|

|

Unless expressly indicated otherwise, for a better understanding of the changes under the main headings of the Group's income statement, the rates of change provided below refer to constant exchange rates. When comparing two dates or periods in this report, the impact of changes in the exchange rates against the euro of the currencies of the countries in which BBVA operates is sometimes excluded, assuming that exchange rates remain constant. For this purpose, the average exchange rate of the currency of each geographical area of the most recent period is used for both periods, except for those countries whose economies have been considered hyperinflationary, for which the closing exchange rate of the most recent period is used.

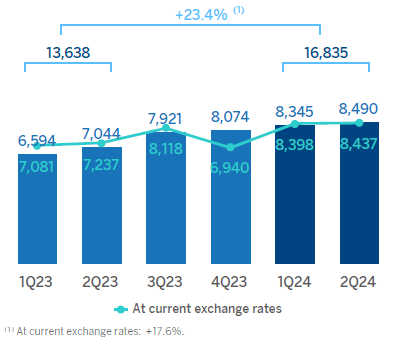

The accumulated net interest income as of June 30, 2024 was higher than in the same period of the previous year (+20.3%), with increases in all business areas except for Turkey, as a result of the dynamism that lending activity has shown during the first half of the year. The good evolution in South America and Spain is noteworthy.

Positive evolution in the net fees and commissions line, which increased by 35.4% in year-on-year terms due to the favorable performance in payment systems and, to a lesser extent, asset management. The contribution of Turkey and, to a lesser extent, of Mexico stand out in this line.

6 In compliance with Law 38/2022, of December 27, which establishes the obligation to pay a patrimonial benefit of a public and non-taxable nature during the years 2023 and 2024 for credit institutions that operate in Spanish territory whose sum of total interest income and fee and commission income corresponding to the year 2019 is equal to or greater than €800m.

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

| | |

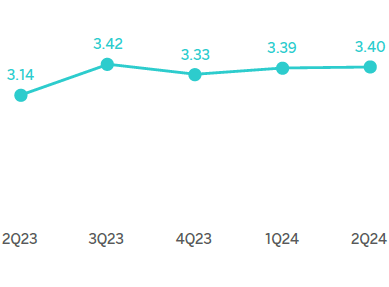

| NET INTEREST INCOME / AVERAGE TOTAL ASSETS (PERCENTAGE AT CONSTANT EXCHANGE RATES) |

| | |

| NET INTEREST INCOME PLUS NET FEES AND COMMISSIONS (MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES) |

At the end of June 2024, NTI grew by 183.0%, mainly explained by the favorable results from hedging foreign currency positions especially of the Mexican peso, recorded in the Corporate Center and, to a lesser extent, by the positive performance of this line in all business areas. Regarding the contribution of Global Markets, included in this line, the evolution of Spain and Mexico stands out.

The other operating income and expenses line accumulated as of June 30, 2024 a result that compares negatively with the same date of the same period of last year, mainly due to the recording in the line of a more negative adjustment for hyperinflation in Argentina in this exercise, partially offset by the lack of contribution to the European Single Resolution Fund after completion of its construction stage7. This line also reflects the total estimated amount of the temporary tax on credit institutions and financial credit institutions for year 2024 registered in the first quarter of the year and 60 million higher than the annual amount estimated for year 2023, registered in the first quarter of that year. For its part, the results of the insurance business had a favorable evolution.

| | |

| GROSS INCOME (MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES) |

On a year-on-year basis, the increase in operating expenses increased at the Group level stood at 19.5%, a rate that is below the inflation rates observed in the countries in which the Group operates (an average of 21.3% on average in the last 12 months8).

Thanks to the remarkable growth in gross income (+30.5%, in constant terms), the efficiency ratio stood at 39.3% as of June 30, 2024, with an improvement of 362 basis points compared to the ratio recorded 12 months earlier.

7 The Single Resolution Fund, whose funds would be allocated to the resolution of financial entities in certain circumstances, has been increasing during a transitional period of eight years (2016-2023) with the objective of reaching at least 1% of the deposits covered by the Member States that make up the Single Resolution Mechanism at the end of 2023.

8 Weighted by operating expenses and excluding Venezuela.

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

| | |

| OPERATING EXPENSES (MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES) |

| | |

| EFFICIENCY RATIO (PERCENTAGE) |

The impairment on financial assets not measured at fair value through profit or loss (impairment on financial assets) at the end of June 2024 was 42.8% higher than in the same period of the previous year, with higher requirements linked to the growth in retail products, the most profitable in line with the Group´s strategy. All business areas required greater loan-loss provisions, highlighting Mexico and South America.

| | |

| OPERATING INCOME (MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES) |

| | |

| IMPAIRMENT ON FINANCIAL ASSETS (MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES) |

The provisions or reversal of provisions line (hereinafter, provisions) registered at the end of June 30, 2024 lower provisions compared to the same period of the previous year, mainly originated in Turkey.

On the other hand, the other gains (losses) line ended June 2024 with a balance of €71m, which compares favorably with the result of the previous year when collecting the positive impact of the evaluation of real state in Turkey and the reversal of impairments for investments in associates, recorded in Corporate Center.

As a result of the above, the BBVA Group generated a net attributable profit of €4,994m between January and June of the year 2024, which compares very positively with the result of the same period of the previous year (+37.2%). These solid results are supported by the favorable evolution of the banking business recurring income, which offsets the higher operating expenses and the increase in provisions for impairment losses on financial assets.

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

The cumulative net attributable profits, in millions of euros and accumulated at the end of June 2024 for the business areas that compose the Group were as follows: €1,790m in Spain, €2,858m in Mexico, €351m in Turkey, €317m in South America and €235m in Rest of Business.

| | |

| NET ATTRIBUTABLE PROFIT (LOSS) (MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES) |

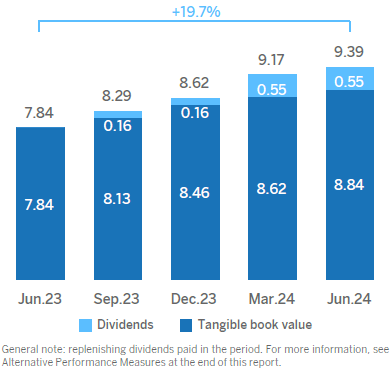

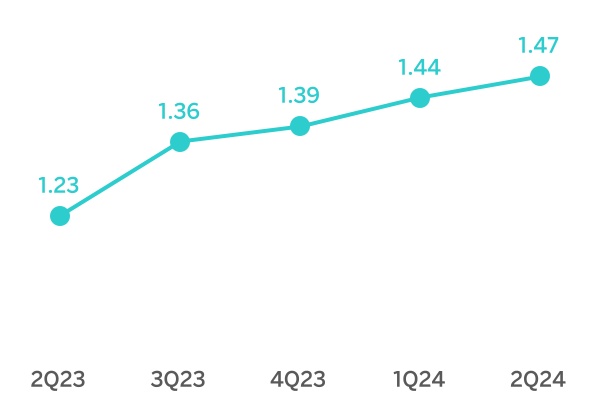

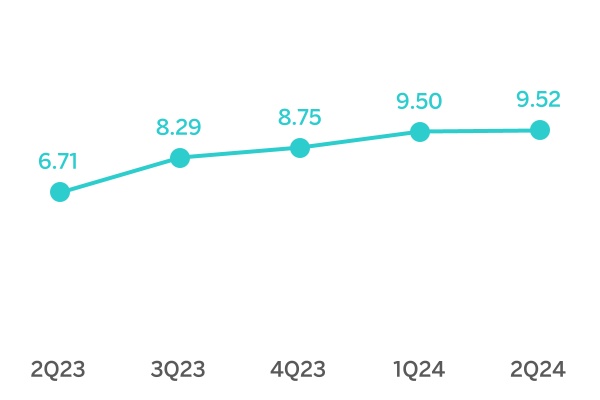

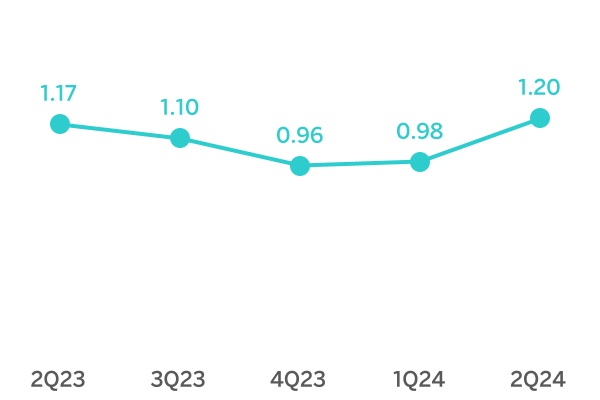

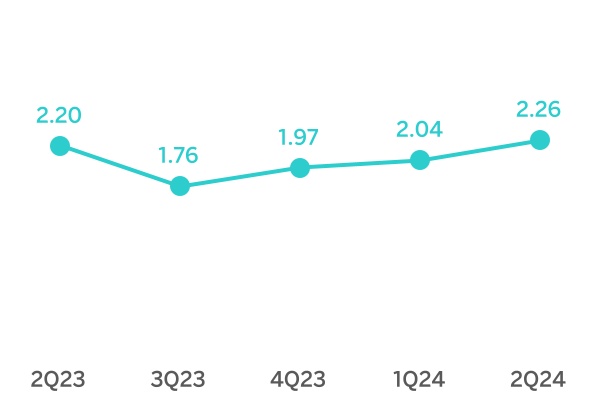

The Group's excellent performance has also allowed to accelerate value creation, as reflected in the growth of the tangible book value per share and dividends, which as of the end of June 2024 was 19.7% higher than in the same period of the previous year.

| | |

| TANGIBLE BOOK VALUE PER SHARE AND DIVIDENDS (EUROS) |

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

Lastly, the Group’s profitability indicators improved in year-on-year terms supported by the favorable performance of results.

| | |

| ROE AND ROTE (PERCENTAGE) |

| | |

| ROA AND RORWA (PERCENTAGE) |

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

Balance sheet and business activity

The most relevant aspects related to the evolution of the Group's balance sheet and business activity as of June 30, 2024 are summarized below:

–Loans and advances to customers recorded an increase of 4.3% compared to the end of December 2023, particularly driven by the evolution of corporate loans (+5.1% at Group level), and by the positive performance of loans of all segments to individuals, especially consumer loans and credit cards, that together grew by 4.9%.

–Customer funds increased by 5.9% compared to the end of 2023. This favorable performance was due to the growth in both deposits from customers, which increased by 4.2% due to both the positive evolution of time deposits in most of the business areas, especially Rest of Business and Turkey, and to the increase in off-balance sheet funds, which grew by 10.1%, outstanding the good performance in Mexico and Spain.

| | | | | | | | | | | | | | |

| CONSOLIDATED BALANCE SHEET (MILLIONS OF EUROS) |

| 30-06-24 | ∆ % | 31-12-23 | 30-06-23 |

| Cash, cash balances at central banks and other demand deposits | 45,055 | (40.3) | 75,416 | 71,858 |

| Financial assets held for trading | 123,821 | (12.2) | 141,042 | 141,721 |

| Non-trading financial assets mandatorily at fair value through profit or loss | 10,584 | 21.1 | 8,737 | 8,019 |

| Financial assets designated at fair value through profit or loss | 856 | (10.4) | 955 | 1,004 |

| Financial assets at fair value through accumulated other comprehensive income | 60,691 | (2.4) | 62,205 | 63,979 |

| Financial assets at amortized cost | 481,213 | 6.5 | 451,732 | 438,841 |

| Loans and advances to central banks and credit institutions | 28,959 | 17.6 | 24,627 | 24,311 |

| Loans and advances to customers | 393,803 | 4.3 | 377,643 | 369,761 |

| Debt securities | 58,450 | 18.2 | 49,462 | 44,769 |

| Investments in joint ventures and associates | 964 | (1.2) | 976 | 929 |

| Tangible assets | 9,650 | 4.3 | 9,253 | 8,892 |

| Intangible assets | 2,379 | 0.7 | 2,363 | 2,284 |

| Other assets | 24,322 | 6.3 | 22,878 | 24,928 |

| Total assets | 759,534 | (2.1) | 775,558 | 762,456 |

| Financial liabilities held for trading | 93,546 | (23.1) | 121,715 | 127,332 |

| Other financial liabilities designated at fair value through profit or loss | 14,935 | 12.3 | 13,299 | 12,577 |

| Financial liabilities at amortized cost | 565,752 | 1.5 | 557,589 | 541,671 |

| Deposits from central banks and credit institutions | 49,436 | (18.1) | 60,349 | 59,961 |

| Deposits from customers | 430,984 | 4.2 | 413,487 | 402,344 |

| Debt certificates | 69,061 | 0.5 | 68,707 | 63,158 |

| Other financial liabilities | 16,271 | 8.1 | 15,046 | 16,207 |

| Liabilities under insurance and reinsurance contracts | 11,520 | (4.9) | 12,110 | 11,537 |

| Other liabilities | 16,690 | 7.1 | 15,580 | 16,771 |

| Total liabilities | 702,443 | (2.5) | 720,293 | 709,888 |

| Non-controlling interests | 3,851 | 8.1 | 3,564 | 3,517 |

| Accumulated other comprehensive income | (16,416) | 1.0 | (16,254) | (16,919) |

| Shareholders’ funds | 69,656 | 2.5 | 67,955 | 65,970 |

| Total equity | 57,091 | 3.3 | 55,265 | 52,568 |

| Total liabilities and equity | 759,534 | (2.1) | 775,558 | 762,456 |

| Memorandum item: | | | | |

| Guarantees given | 64,731 | 7.9 | 60,019 | 55,326 |

|

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

| | | | | | | | | | | | | | |

| LOANS AND ADVANCES TO CUSTOMERS (MILLIONS OF EUROS) |

| 30-06-24 | ∆ % | 31-12-23 | 30-06-23 |

| Public sector | 23,313 | 0.2 | 23,269 | 23,729 |

| Individuals | 174,604 | 3.9 | 168,123 | 165,553 |

| Mortgages | 94,362 | 1.1 | 93,358 | 92,679 |

| Consumer | 44,238 | 3.6 | 42,695 | 41,016 |

| Credit cards | 23,207 | 7.4 | 21,609 | 20,044 |

| Other loans | 12,797 | 22.3 | 10,461 | 11,813 |

| Business | 192,431 | 5.1 | 183,076 | 177,881 |

| Non-performing loans | 14,672 | 1.6 | 14,444 | 13,787 |

| Loans and advances to customers (gross) | 405,021 | 4.1 | 388,912 | 380,949 |

| Allowances ⁽¹⁾ | (11,218) | (0.5) | (11,269) | (11,188) |

| Loans and advances to customers | 393,803 | 4.3 | 377,643 | 369,761 |

| ⁽¹⁾ Allowances include valuation adjustments for credit risk throughout the expected residual life in those financial instruments that have been acquired (mainly originating from the acquisition of Catalunya Banc, S.A.). As of June 30, 2024, December 31, 2023 and June 30, 2023 the remaining amount was €122m, €142m and €162m respectively. |

| | |

| LOANS AND ADVANCES TO CUSTOMERS (BILLIONS OF EUROS) |

| | |

| CUSTOMER FUNDS (BILLIONS OF EUROS) |

| | | | | | | | | | | | | | |

| CUSTOMER FUNDS (MILLIONS OF EUROS) |

| 30-06-24 | ∆ % | 31-12-23 | 30-06-23 |

| Deposits from customers | 430,984 | 4.2 | 413,487 | 402,344 |

| Current accounts | 316,246 | (0.4) | 317,543 | 308,688 |

| Time deposits | 100,617 | 9.9 | 91,524 | 89,277 |

| Other deposits | 14,120 | 219.5 | 4,420 | 4,378 |

| Other customer funds | 180,975 | 10.1 | 164,367 | 155,739 |

| Mutual funds and investment companies and customer portfolios ⁽¹⁾ | 145,599 | 10.4 | 131,849 | 124,793 |

| Pension funds | 29,948 | 5.7 | 28,326 | 27,051 |

| Other off-balance sheet funds | 5,427 | 29.5 | 4,192 | 3,895 |

| Total customer funds | 611,959 | 5.9 | 577,853 | 558,083 |

| ⁽¹⁾ Includes the customer portfolios in Spain, Mexico, Colombia and Peru. |

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

Capital and shareholders

Capital base

The CET1 fully loaded ratio of the BBVA Group stood at 12.75% as of June 30, 2024, which allows maintaining a large management buffer over the Group's CET1 requirement as of that date (9.11%9), and which is also above the Group's target management range of 11.5 - 12.0% CET1.

During the second quarter, the Group’s CET1 fully loaded decreased by 7 basis points with respect to the March level (12.82%).

The strong earnings generation during the second quarter, higher than in the first quarter, net of shareholder remuneration and payment of capital instruments (CoCos), generated a positive contribution of +34 basis points to CET1 ratio, which, together with the offsetting in equity of the negative effect in results of value loss of the net monetary position in hyperinflationary economies, made it possible to absorb the growth of risk-weighted assets (RWA) derived from the organic growth of activity in constant terms (consumption of -40 basis points), in line with the Group's strategy of continuing to promote profitable growth.

Among the remaining impacts, in addition to the one referred to from hyperinflationary economies, it is worth highlighting those associated with market variables, which drained -23 basis points of the ratio, where the negative evolution in the quarter due to the evolution of the main currencies (highlighting the impact of the evolution of the Mexican peso), and, to a lesser extent, the valuation of fixed income portfolios stand out.

| | | | | | |

| Quarterly evolution of the CET1 fully-loaded ratio |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) Includes, among others, FX and mark to market of HTC&S portfolios, minority interests, and a positive impact in OCI equivalent to the Net Monetary Position value loss in hyperinflationary economies registered in results. |

The AT1 fully loaded ratio showed an increase of +19 basis points compared to March 31, 2024. In this period, BBVA S.A completed an issuance for an amount of €750 million Contingent Convertible instruments (CoCos) in June 2024.

The Tier 2 fully loaded ratio has not experienced a significant variation (-2 basis points in the quarter), only impacted by the growth of RWA.

As a consequence of the foregoing, the consolidated fully loaded total capital ratio stood at 16.77% as of June 30, 2024, above the total capital requirements (13.27%).

9 Considering the last official update of the countercyclical capital buffer, calculated on the basis of exposure as of March 31, 2024.

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

| | | | | | | | | | | | | | | | | | | | | | |

| CAPITAL BASE (MILLIONS OF EUROS) | |

| Phased-in (1) | | Fully-loaded (1) | |

| 30-06-24 ⁽²⁾ | 31-12-23 | 30-06-23 | | 30-06-24 ⁽²⁾ | 31-12-23 | 30-06-23 | |

| Common Equity Tier 1 (CET1) | 48,861 | 46,116 | 45,146 | | 48,861 | 46,116 | 45,146 | |

| Tier 1 | 54,776 | 52,150 | 51,316 | | 54,776 | 52,150 | 51,316 | |

| Tier 2 | 9,467 | 8,182 | 7,021 | | 9,467 | 8,182 | 7,021 | |

| Total capital (Tier 1 + Tier 2) | 64,243 | 60,332 | 58,337 | | 64,243 | 60,332 | 58,337 | |

| Risk-weighted assets | 383,179 | 363,915 | 347,442 | | 383,179 | 363,915 | 347,442 | |

| CET1 (%) | 12.75 | 12.67 | 12.99 | | 12.75 | 12.67 | 12.99 | |

| Tier 1 (%) | 14.30 | 14.33 | 14.77 | | 14.30 | 14.33 | 14.77 | |

| Tier 2 (%) | 2.47 | 2.25 | 2.02 | | 2.47 | 2.25 | 2.02 | |

| Total capital ratio (%) | 16.77 | 16.58 | 16.79 | | 16.77 | 16.58 | 16.79 | |

| ⁽¹⁾ The difference between the phased-in and fully-loaded ratios arises from the temporary treatment of certain capital items, mainly of the impact of IFRS 9, to which the BBVA Group has adhered voluntarily (in accordance with article 473bis of the CRR and the subsequent amendments introduced by the Regulation (EU) 2020/873). For the periods shown in this table, there are no differences between phased-in and fully-loaded ratios due to the aforementioned temporary treatment. | |

| ⁽²⁾ Preliminary data. | |

As of June 30, 2024, the phased-in leverage ratio stood at 6.77%10 (6.77% fully loaded), increasing 29 basis points since March 2024.

| | | | | | | | | | | | | | | |

| LEVERAGE RATIO (FULLY-LOADED) | | | | |

| 30-06-24 | 31-12-23 | 30-06-23 | | | | |

| Exposure to Leverage Ratio (Fully-Loaded) (million euros) | 809,063 | 797,888 | 792,045 | | | | |

| Leverage ratio (Fully-Loaded) (%) | 6.77 | | 6.54 | | 6.48 | | | | | |

With respect to the MREL ratios11 achieved as of June 30, 2024, these were 28.42% and 11.95%, respectively for MREL in RWA and MREL in LR, reaching the subordinated ratios of both 22.18% and 9.32%, respectively. A summarizing table is shown below:

| | | | | | | | | | | | | | | |

| MREL | | | | |

| 30-06-24 | 31-12-23 | 30-06-23 | | | | |

| Total own funds and eligible liabilities (million euros) | 54,157 | 49,398 | 51,194 | | | | |

| Total RWA of the resolution group (million euros) | 218,340 | 214,757 | 207,087 | | | | |

| RWA ratio (%) | 28.42 | | 26.36 | | 28.05 | | | | | |

| Total exposure for the Leverage calculation (million euros) | 519,267 | 517,470 | 516,459 | | | | |

| Leverage ratio (%) | 11.95 | | 10.94 | | 11.25 | | | | | |

10 Preliminary leverage ratio as of the date of publication

11 Calculated at subconsolidated level according to the resolution strategy MPE (“Multiple Point of Entry”) of the BBVA Group, established by the SRB. The resolution group is made up of Banco Bilbao Vizcaya Argentaria, S.A. and subsidiaries that belong to the same European resolution group. That implies the ratios are calculated under the subconsolidated perimeter of the resolution group. Preliminary MREL ratios as of the date of publication

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

On March 27, 2024 the Group made public that it had received a communication from the Bank of Spain regarding its MREL 22.79%12. In addition, BBVA must reach, also as from March 27, 2024, a volume of own funds and eligible liabilities in terms of total exposure considered for purposes of calculating the leverage ratio of 8.48% (the “MREL in LR”)13. These requirements do not include the current combined capital requirement, which, according to current regulations and supervisory criteria, is 3.62%14. Given the structure of the resolution group's own funds and eligible liabilities, as of June 30, 2024, the Group meets the aforementioned requirements.

Likewise, with the aim of reinforcing compliance with these requirements, BBVA has made several debt issuances during the first half of 2024. For more information on these issuances, see "Structural risks" section within the "Risk management" chapter.

Shareholder remuneration

Regarding shareholder remuneration, as approved by the General Shareholders´ Meeting on March 15, 2024, in its first item on the agenda, on April 10, 2024, a cash payment of €0.39 gross per each outstanding BBVA share entitled to receive such amount was made against the 2023 results, as an additional shareholder remuneration for the financial year 2023. Thus, the total amount of cash distributions for 2023, taking into account the €0.16 gross per share that was distributed in October 2023, amounted to €0.55 gross per share.

Total shareholder remuneration includes, in addition to the cash payments mentioned above, the remuneration resulting from BBVA's buyback program for the repurchase of own shares announced on January 30, 2024 for a maximum amount of €781m, and which started being executed on March 1, 2024. BBVA announced the completion of the share buyback program upon reaching the maximum monetary amount, having acquired 74,654,915 own shares, between March 4 and April 9, 2024, representing, approximately, 1.28% of BBVA's share capital as of such date. On May 24, 2024, BBVA notified through an Other Relevant Information notice a partial execution of the share capital reduction resolution adopted by the Annual General Shareholders’ Meeting of BBVA held on March 15, 2024, under item 3 of the agenda through the reduction of BBVA’s share capital in a nominal amount of €36,580,908.35 and the consequent redemption, charged to unrestricted reserves, of 74,654,915 own shares of €0.49 par value each acquired derivatively by BBVA in execution of the own share buyback program scheme and which were held as treasury shares.

As of June 30, 2024, BBVA’s share capital amounted to €2,824,009,877.85 divided into 5,763,285,465 shares.

| | | | | | | | | | | | | | | |

| SHAREHOLDER STRUCTURE (30-06-24) |

| Shareholders | | Shares outstanding |

| Number of shares | Number | % | | Number | % |

| Up to 500 | 310,613 | 43.1 | | | 57,201,029 | 1.0 | |

| 501 to 5,000 | 322,333 | 44.7 | | | 570,781,301 | 9.9 | |

| 5,001 to 10,000 | 47,618 | 6.6 | | | 333,879,512 | 5.8 | |

| 10,001 to 50,000 | 36,834 | 5.1 | | | 704,068,308 | 12.2 | |

| 50,001 to 100,000 | 2,579 | 0.4 | | | 176,073,985 | 3.1 | |

| 100,001 to 500,000 | 1,168 | 0.2 | | | 206,344,567 | 3.6 | |

| More than 500,001 | 258 | 0.04 | | | 3,714,936,763 | 64.5 | |

| Total | 721,403 | 100 | | | 5,763,285,465 | 100 | |

| Note: in the case of shares kept by investors through a custodian placed outside Spain, only the custodian will be considered as a shareholder, which is who appears registered in the accounting record of book entries, so the number of shareholders stated does not consider those indirect holders. |

On July 5, 2024, BBVA held an Extraordinary General Shareholders' Meeting in Bilbao. Among the agreements adopted was approval of an increase in the share capital of BBVA,S.A. up to a maximum nominal amount of €551,906,524.05, by issuing and putting into circulation of up to 1,126,339,845 ordinary shares with a par value of €0.49 each of them, for the purpose of covering the consideration of the voluntary tender offer for the acquisition of up to 100% of the shares of Banco de Sabadell, S.A. launched by BBVA.

12 The subordination requirement in RWA is 13.5%.

13 The subordination requirement in Leverage ratio is 5.78%.

14 Considering the last official update of the countercyclical capital buffer, calculated on the basis of exposure as of March 31, 2024.

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

Ratings

During the first half of 2024, BBVA’s rating has continued to demonstrate its strength and all agencies have maintained their rating in the A category. In March, Moody´s changed its long-term outlook on the senior preferred debt from stable to positive (maintaining its rating in A3) after a similar action on the Spanish Sovereign rating and reflecting the expectations of the agency that the profitability levels of the bank will continue being high and that the pressures on the quality of assets will remain contained. Also, in March, DBRS communicated the result of its annual revision of BBVA confirming the rating in A (high) with a stable outlook. Additionally, S&P reviewed BBVA´s rating and outlook unchanged in June (A, stable), and for its part, Fitch have maintained without changes BBVA´s rating and outlook (A-, stable), during the first six months of the year. The following table shows the credit ratings and outlooks assigned by the agencies:

| | | | | | | | | | | |

| RATINGS |

| Rating agency | Long term (1) | Short term | Outlook |

| DBRS | A (high) | R-1 (middle) | Stable |

| Fitch | A- | F-2 | Stable |

| Moody's | A3 | P-2 | Positive |

| Standard & Poor's | A | A-1 | Stable |

(1) Ratings assigned to long term senior preferred debt. Additionally, Moody’s and Fitch assign A2 and A- rating, respectively, to BBVA’s long term deposits. |

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

Risk management

Credit risk

Uncertainty within the macroeconomic environment remains high, and the geopolitical turbulence at the time of preparation of this report could increase the biases towards more negative scenarios, with higher than expected interest rates, and more persistent inflation, which can affect credit demand and hinder the payment capacity of families and business.

For the estimation of expected losses, the models include individual and collective estimates, taking into account the macroeconomic forecasts in accordance with IFRS 9. Thus, the estimate at the end of the first half of 2024 includes the effect on expected losses of updating macroeconomic forecasts, which take into account the current global environment. Additionally, the Group may complement the expected losses either by considering additional risk drivers, or by incorporating sectorial particularities or those that may affect a set of operations or borrowers, following a formal internal process established for the purpose.

By region, the evolution during the first half of the year has been uneven. In Spain, growth forecasts for 2024 have been revised upwards, and the household debt levels are far from the historical highs, whereas in Mexico, less dynamism in activity is observed while we await a gradual cycle of monetary policy normalization. The uncertainty in Turkey continues, although growth remains solid. Despite changes in economic policy, asset quality indicators for the system remain at limited levels. Finally, South America is moving towards macroeconomic normalization, with inflation gradually approaching the established goals and growth converging towards its potential levels.

BBVA Group's credit risk indicators

The evolution of the Group’s main credit risk indicators is summarized below:

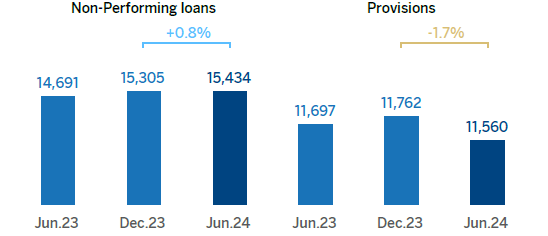

–Credit risk increased in the first half of the year by 1.6% (+3.5% in constant terms), with generalized growth at constant exchange rates in all geographical areas.

–Non-performing loans decreased by -1.8% at the Group level between the end of March and June 2024, favored by the evolution of the exchange rate (+0.1% in constant terms), and leveraged in Spain, which has been favored by the execution of portfolio sales in June, and to a lesser extent, by the evolution of Rest of Business, mainly due to the recovery of a specific client. On the contrary, increases in constant terms in the rest of the geographical areas, where growth was concentrated in retail portfolios.

| | |

| NON-PERFORMING LOANS AND PROVISIONS (MILLIONS OF EUROS) |

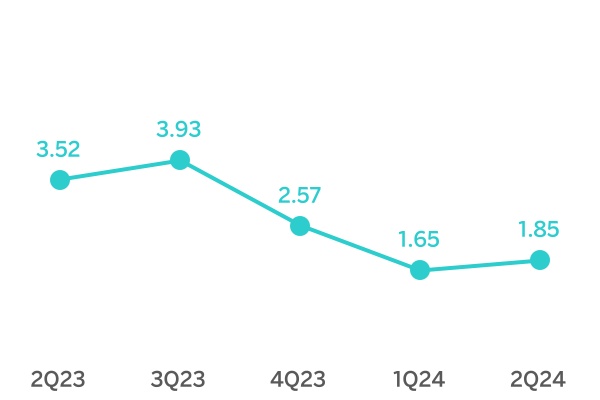

–The NPL ratio decreased with respect to the previous quarter, standing at 3.3% at June 30, 2024, favored by the growth of the portfolio and the evolution of the non-performing loans mentioned above.

–The NPL coverage ratio ended the quarter at 75%, at similar levels compared to the previous quarter, with decreases in Spain, Turkey, South America, and increases in Mexico and Rest of Business.

–The cumulative cost of risk as of June 30, 2024 stood at 1.42%, which is above the previous quarter, yet in line with the expectations and associated with the growth in profitable portfolios. By business areas, Spain and South America showed stability, Turkey was at normalized levels and Mexico has been affected by the requirements of the retail portfolios.

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

| | |

| NPL AND NPL COVERAGE RATIOS AND COST OF RISK (PERCENTAGE) |

| | | | | | | | | | | | | | | | | |

| CREDIT RISK ⁽¹⁾ (MILLIONS OF EUROS) |

| 30-06-24 | 31-03-24 | 31-12-23 | 30-09-23 | 30-06-23 |

| Credit risk | 469,687 | 462,457 | 448,840 | 444,984 | 436,174 |

| Stage 1 | 414,956 | 405,765 | 392,528 | 394,329 | 386,711 |

| Stage 2 | 39,298 | 40,975 | 41,006 | 35,791 | 34,772 |

| Stage 3 (non-performing loans) | 15,434 | 15,716 | 15,305 | 14,864 | 14,691 |

| Provisions | 11,560 | 11,943 | 11,762 | 11,751 | 11,697 |

| Stage 1 | 2,162 | 2,198 | 2,142 | 2,143 | 2,107 |

| Stage 2 | 1,911 | 2,130 | 2,170 | 2,198 | 2,181 |

| Stage 3 (non-performing loans) | 7,486 | 7,615 | 7,450 | 7,410 | 7,409 |

| NPL ratio (%) | 3.3 | 3.4 | 3.4 | 3.3 | 3.4 |

| NPL coverage ratio (%) ⁽²⁾ | 75 | 76 | 77 | 79 | 80 |

| ⁽¹⁾ Includes gross loans and advances to customers plus guarantees given. |

| ⁽²⁾ The NPL coverage ratio includes the valuation adjustments for credit risk throughout the expected residual life in those financial instruments that have been acquired (mainly originating from the acquisition of Catalunya Banc, S.A.). If these valuation corrections had not been taken into account, the NPL coverage ratio would have stood at 74% as of June 30, 2024. |

| | | | | | | | | | | | | | | | | |

| NON-PERFORMING LOANS EVOLUTION (MILLIONS OF EUROS) |

| 2Q24 ⁽¹⁾ | 1Q24 | 4Q23 | 3Q23 | 2Q23 |

| Beginning balance | 15,716 | 15,305 | 14,864 | 14,691 | 14,141 |

| Entries | 2,925 | 3,184 | 3,038 | 2,898 | 2,875 |

| Recoveries | (1,497) | (1,530) | (1,373) | (1,538) | (1,394) |

| Net variation | 1,428 | 1,655 | 1,665 | 1,360 | 1,481 |

| Write-offs | (1,209) | (1,216) | (983) | (830) | (877) |

| Exchange rate differences and other | (501) | (27) | (241) | (357) | (54) |

| Period-end balance | 15,434 | 15,716 | 15,305 | 14,864 | 14,691 |

| Memorandum item: | | | | | |

| Non-performing loans | 14,672 | 14,938 | 14,444 | 13,947 | 13,787 |

| Non performing guarantees given | 761 | 778 | 862 | 918 | 905 |

| ⁽¹⁾ Preliminary data. |

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

Structural risks

Liquidity and funding

Liquidity and funding management at BBVA promotes the financing of the recurring growth of the banking business at suitable maturities and costs using a wide range of funding sources. BBVA's business model, risk appetite framework and funding strategy are designed to reach a solid funding structure based on stable customer deposits, mainly retail (granular). As a result of this model, deposits have a high degree of assurance in each geographical area, close to 55% in Spain and Mexico. It is important to note that, given the nature of BBVA's business, lending is mainly financed through stable customer funds.

One of the key elements in the BBVA Group's liquidity and funding management is the maintenance of large high-quality liquidity buffers in all geographical areas. In this respect, the Group has maintained during the last 12 months an average volume of high-quality liquid assets (HQLA) of €132.7 billion, of which 97% corresponded to maximum quality assets (level 1 in the liquidity coverage ratio, LCR).

Due to its subsidiary-based management model, BBVA is one of the few major European banks that follows the Multiple Point of Entry (MPE) resolution strategy: the parent company sets the liquidity policies, but the subsidiaries are self-sufficient and responsible for managing their own liquidity and funding (taking deposits or accessing the market with their own rating). This strategy limits the spread of a liquidity crisis among the Group's different areas and ensures the adequate transmission of the cost of liquidity and financing to the price formation process.

The BBVA Group maintains a solid liquidity position in every geographical area in which it operates, with ratios well above the minimum required:

–The LCR requires banks to maintain a volume of high-quality liquid assets sufficient to withstand liquidity stress for 30 days. BBVA Group's consolidated LCR remained comfortably above 100% during the first half of 2024 and stood at 148% as of June 30, 2024. It should be noted that, given the MPE nature of BBVA, this ratio limits the numerator of the LCR for subsidiaries of BBVA S.A. to 100% of their net outflows, therefore, the resulting ratio is below that of the individual units (the LCR of the main components was 178% in BBVA, S.A., 154% in Mexico and 162% in Turkey). Without considering this restriction, the Group's LCR ratio was 179%.

–The net stable funding ratio (NSFR) requires banks to maintain a stable funding profile in relation to the composition of their assets and off-balance sheet activities. The BBVA Group's NSFR ratio stood at 129% as of June 30, 2024.

The breakdown of these ratios in the main geographical areas in which the Group operates is shown below:

| | | | | | | | | | | | | | |

| LCR AND NSFR RATIOS (PERCENTAGE. 30-06-24) |

| BBVA, S.A. | Mexico | Turkey | South America |

| LCR | 178% | 154% | 162% | All countries >100 |

| NSFR | 121% | 133% | 161% | All countries >100 |

|

In addition to the above, the most relevant aspects related to the main geographical areas are the following:

–BBVA, S.A. has maintained a strong position with a large high-quality liquidity buffer, having repaid the entire TLTRO III program, maintaining at all times the regulatory liquidity metrics well above the set minimums. During the first half of 2024, commercial activity has been broadly neutral in terms of liquidity, with growth in both customer deposits and lending activity.

–BBVA Mexico shows a solid liquidity situation, even though the credit gap increased in the first half of the year as a consequence of the outflows of deposits and strong dynamism of credit growth. Despite that, the cost of funds has been efficiently managed.

–In Turkey, in the first half of 2024, the lending gap in local currency remained stable (however, the performance by quarter has been very different, with an increase in the gap in the first quarter and a reduction in the second one). Regarding the credit gap in foreign currency, an increase was recorded, mainly originated by the outflow of deposits during the fist half of the year due to dedollarization. Liquidity buffer has been reduced, mainly due to the increase in the currency gap and the reserve requirement. Garanti BBVA continues to maintain a stable liquidity position with comfortable ratios. On the other hand, the Central Bank of Turkey has continued updating the measures to continue with the dedollarization process of the economy and control the inflation.

–In South America, the liquidity situation remains adequate throughout the region. In BBVA Argentina, the growth of excess liquidity slowed thanks to the increase loans in the quarter, which has equaled the growth of deposits. However, in the second half of the year, the growth in deposits exceeded the loans in local currency and with small differences in foreign currency. In BBVA Colombia, the credit gap decreased in the first half of the year with a growth in deposits much higher than loans. BBVA Peru has shown a decrease in lending gap in the first half of 2024 with a growth in deposits higher than loans.

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

The main wholesale financing transactions carried out by the BBVA Group during the first half of 2024 are listed below:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuer | Type of issue | Date of issue | Nominal (millions) | Currency | Coupon | Early redemption | Maturity date |

| BBVA, S.A. | Senior preferred | Jan-24 | 1,250 | EUR | 3.875% | — | Jan-34 |

| Tier 2 | Feb-24 | 1,250 | EUR | 4.875% | Nov-30 to Feb-31 | Feb-36 |

| Senior preferred | Mar-24 | 1,000 | USD | 5.381% | — | Mar-29 |

| Senior non-preferred | Mar-24 | 1,000 | USD | 6.033% | — | Mar-35 |

| Senior preferred (green bond) | Mar-24 | 1,000 | EUR | 3.500% | — | Mar-31 |

| Senior preferred | Jun-24 | 1,000 | EUR | 3 month Euribor rate + 45 basis points | — | Jun-27 |

| Senior preferred | Jun-24 | 750 | EUR | 3.625% | — | Jun-30 |

| AT1 (CoCo) | Jun-24 | 750 | EUR | 6.875% | Dec-30 to Jun-31 | Perpetual |

Additionally, BBVA, S.A. redeemed two capital issuances in the first half of 2024: in February 2024, a Tier 2 issuance of subordinated bonds issued in February 2019, for an amount of €750m and, in March 2024, an AT1 issued in 2019 on its first date of optional redemption, for an amount of €1 billion.

BBVA Mexico issued in January 2024 Tier 2 bonds for USD 900m with a maturity of 15 years and an early repayment option in 10 years with a coupon of 8.125%. Additionally, on April 10 2024, BBVA Mexico issued bank stock certificates for 15 billion Mexican pesos in two tranches. The first one was placed at a term of three and a half years, with a variable TIIE rate (Interbank Equilibrium Interest Rate) for one-day Funding plus 32 basis points, amounting to a total of 8.4 billion Mexican pesos. The second tranche was issued for seven years, with a fixed rate of 10.35%, for a total of 6.6 billion Mexican pesos.

In Turkey, Garanti BBVA issued in February 2024 Tier 2 10-year bonds for an amount of USD 500m, with a coupon of 8.375% and an early redemption option in 5 years. Additionally, in June 2024, Garanti BBVA renewed the total syndicated loan based on environmental, social and governance (ESG) criteria, which consists of two separate tranches of USD 241m (SOFR+2.5%) and €179m (Euribor+2.25%), respectively.

For its part, BBVA Peru issued Tier 2 bonds in the international market for USD 300m, with a 6.20% coupon, a 10.25-year maturity and an early redemption option in the fifth year.

BBVA Colombia, together with the International Finance Corporation (IFC) and the Inter-American Development Bank (IDB) announced the launch of a green biodiversity bond for an amount of up to USD 70m and a term of 3 years. On 12 July 2024, thereunder a first tranche of USD 15m was announced. For more information, see the Sustainability section at the beginning of this report.

In conclusion, the first half of 2024 has turned into one of the historically more actives in terms of issuance of wholesale funding of BBVA, S.A., with €8 billion funded in 8 tranches. If we also consider the issuance activity of BBVA Mexico, BBVA Turkey and BBVA Peru, this access to international markets increases by USD 1.7 billion, which shows the strength of the Group´s access to wholesale markets from its main issuance units.

Foreign exchange

Foreign exchange risk management aims to reduce both the sensitivity of the capital ratios and the net attributable profit variability to currency fluctuations.

The performance of the Group's main currencies during the first half of 2024 has been uneven. Due to its relevance for the Group, it should be noted the evolution of the Mexican peso, which has depreciated 4.3% against the euro due to the results of the June 2024 presidential elections. According to the Chilean peso, the Argentine peso and the Colombian peso registered depreciations of 4.0%, 8.5% and 5.1% respectively, with respect to the euro. Regarding the Turkish lira, this currency accumulates a depreciation of 7.2% which is much lower than the carry-trade of the currency.

The USD and the Peruvian sol registered an appreciation of 3.2% and 0.5% respectively, regards to the euro.

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

| | | | | | | | | | | | | | | | | | |

| EXCHANGE RATES (EXPRESSED IN CURRENCY/EURO) |

| Year-end exchange rates | | Average exchange rates |

| | ∆ % on | ∆ % on | | | ∆ % on |

| 30-06-24 | 30-06-23 | 31-12-23 | | 1H24 | 1H23 |

| U.S. dollar | 1.0705 | 1.5 | 3.2 | | 1.0812 | — |

| Mexican peso | 19.5654 | (5.1) | (4.3) | | 18.5017 | 6.2 |

| Turkish lira ⁽¹⁾ | 35.1868 | (19.5) | (7.2) | | — | — |

| Peruvian sol | 4.0857 | (3.6) | 0.5 | | 4.0485 | 0.2 |

| Argentine peso ⁽¹⁾ | 975.85 | (71.5) | (8.5) | | — | — |

| Chilean peso | 1,018.07 | (14.3) | (4.0) | | 1,016.30 | (14.2) |

| Colombian peso | 4,451.25 | 2.3 | (5.1) | | 4,237.50 | 17.1 |

| ⁽¹⁾ According to IAS 21 "The effects of changes in foreign exchange rates", the year-end exchange rate is used for the conversion of the Turkey and Argentina income statement. |

In relation to the hedging of the capital ratios, BBVA covers, in aggregate, 70% of its subsidiaries' capital excess. The sensitivity of the Group's CET1 fully-loaded ratio to 10% depreciations in major currencies is estimated at: +18 basis points for the U.S. dollar, -10 basis points for the Mexican peso and -6 basis points for the Turkish lira15. With regard to the hedging of results, BBVA hedges between 40% and 50% of the aggregate net attributable profit it expects to generate in the next 12 months. For each currency, the final amount hedged depends on its expected future evolution, the costs and the relevance of the incomes related to the Group's results as a whole.

Interest rate

Interest rate risk management seeks to limit the impact that BBVA may suffer, both in terms of net interest income (short-term) and economic value (long-term), from adverse movements in the interest rate curves in the various currencies in which the Group operates. BBVA carries out this work through an internal procedure, pursuant to the guidelines established by the European Banking Authority (EBA), with the aim of analyzing the potential impact that could derive from a range of scenarios on the Group's different balance sheets.

The model is based on assumptions intended to realistically mimic the behavior of the balance sheet. The assumptions regarding the behavior of accounts with no explicit maturity and prepayment estimates are specially relevant. These assumptions are reviewed and adapted at least once a year according to the evolution in observed behaviors.

At the aggregate level, BBVA continues to have a positive sensitivity toward interest rate increases in the net interest income.

In the first half of 2024, inflation were more persistent than expected. This has caused the market to reduce its interest rate expectations for 2024 in Europe and in the United States and to expect the first rate fall from the Fed towards the fall, while the ECB began its reduction cycle in June. The above, together with some geopolitical uncertainties, has triggered a rise in sovereign bond yields and has led to a negative performance in most debt portfolios of the Group. For their part, peripheral rate curve spreads remain well supported, even slightly narrowing in the first half of the year, although they have suffered some volatility due to the political situation in France. In Mexico, the central bank cut for the first time in three years the official interest rate, in line with the monetary policy actions of most South American countries, where by end-2023 interest rate cuts had begun, which have continued during the first half of 2024. In Turkey, the Central Bank of Turkey has continued the tightening of its monetary policy launched in June 2023.

By area, the main features are:

–Spain has a balance sheet characterized by a lending portfolio with high proportion of variable-rate loans (mortgages and corporate lending) and liabilities composed mainly by customer demand deposits. The ALCO portfolio acts as a management lever and hedge for the balance sheet, mitigating its sensitivity to interest rate fluctuations. In an environment of high rates, the exposure of the net interest income to movements in balance sheet interest rates has been reduced in the last quarters.

On the other hand, at its June meeting the ECB carried out the first reduction, by 25 basis points, in official interest rates, after nine months in which interest rates had remained unchanged. Thus by the end of June, the reference interest rate stood at 4.25%, the marginal deposit facility rate at 3.75% and the marginal loan facility rate at 4.50%. Additionally, the ECB announced in March the changes on its operative framework, highlighting that, from September on, the spread between the benchmark interest rate and that of the deposit facility will be reduced to 15 basis points, and in June it confirmed that it will reduce holdings of securities acquired under the Pandemic Emergency Purchase Program (PEPP) in the second half of the year, expecting to end reinvestments at the end of 2024.

–Mexico continues to show a balance between fixed and variable interest rates balances, which results in a limited sensitivity to interest rates fluctuations. In terms of assets that are most sensitive to interest rate changes, the commercial portfolio stood out, while consumer loans and mortgages are mostly at a fixed rate. With regard to customer funds, the high proportion of non-interest bearing deposits, which are insensitive to interest rate movements, should be highlighted. The ALCO portfolio is invested primarily in fixed-rate sovereign bonds with limited maturities. The monetary policy rate stood at 11.00% at the end of the first half of 2024, 25 basis points below the end-of-year level of 2023.