UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July, 2024

Commission file number: 1-10110

BANCO BILBAO VIZCAYA ARGENTARIA, S.A.

(Exact name of Registrant as specified in its charter)

BANK BILBAO VIZCAYA ARGENTARIA, S.A.

(Translation of Registrant’s name into English)

Calle Azul 4,

28050 Madrid Spain

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

BBVA 2Q24 Earnings July 31, 2024

2Q24 Earnings 2 Disclaimer This document is only provided for information purposes and is not intended to provide financial advice and, therefore, does not constitute, nor should it be interpreted as, an offer to sell, exchange or acquire, or an invitation for offers to acquire securities issued by any of the aforementioned companies, or to contract any financial product. Any decision to purchase or invest in securities or contract any financial product must be made solely and exclusively on the basis of the information made available to such effects by the company in relation to each specific matter. The information contained in this document is subject to and should be read in conjunction with all other publicly available information of the issuer. This document contains forward-looking statements that constitute or may constitute “forward-looking statements” (within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995) with respect to intentions, objectives, expectations or estimates as of the date hereof, including those relating to future targets of both a financial and non-financial nature (such as environmental, social or governance (“ESG”) performance targets). Forward-looking statements may be identified by the fact that they do not refer to historical or current facts and include words such as “believe”, “expect”, “estimate”, “project”, “anticipate”, “duty”, “intend”, “likelihood”, “risk”, “VaR”, “purpose”, “commitment”, “goal”, “target” and similar expressions or variations of those expressions. They include, for example, statements regarding future growth rates or the achievement of future targets, including those relating to ESG performance. The information contained in this document reflects our current expectations and targets, which are based on various assumptions, judgments and projections, including non-financial considerations such as those related to sustainability, which may differ from and not be comparable to those used by other companies. Forward-looking statements are not guarantees of future results, and actual results may differ materially from those anticipated in the forward-looking statements as a result of certain risks, uncertainties and other factors. These factors include, but are not limited to, (1) market conditions, macroeconomic factors, domestic and international stock market movements, exchange rates, inflation and interest rates; (2) regulatory and oversight factors, political and governmental guidelines, social and demographic factors; (3) changes in the financial condition, creditworthiness or solvency of our clients, debtors or counterparties, such as changes in default rates, as well as changes in consumer spending, savings and investment behavior, and changes in our credit ratings; (4) competitive pressures and actions we take in response thereto; (5) performance of our IT, operations and control systems and our ability to adapt to technological changes; (6) climate change and the occurrence of natural or man-made disasters, such as an outbreak or escalation of hostilities; and (7) our ability to appropriately address any ESG expectations or obligations (related to our business, management, corporate governance, disclosure or otherwise), and the cost thereof. In the particular case of certain targets related to our ESG performance, such as, decarbonization targets or alignment of our portfolios, the achievement and progress towards such targets will depend to a large extent on the actions of third parties, such as clients, governments and other stakeholders, and may therefore be materially affected by such actions, or lack thereof, as well as by other exogenous factors that do not depend on BBVA (including, but not limited to, new technological developments, regulatory developments, military conflicts, the evolution of climate and energy crises, etc.). Therefore, these targets may be subject to future revisions. The factors mentioned in the preceding paragraphs could cause actual future results to differ substantially from those set forth in the forecasts, intentions, objectives, targets or other forward-looking statements included in this document or in other past or future documents. Accordingly, results, including those related to ESG performance targets, among others, may differ materially from the statements contained in the forward-looking statements. Recipients of this document are cautioned not to place undue reliance on such forward-looking statements. Past performance or growth rates are not indicative of future performance, results or share price (including earnings per share). Nothing in this document should be construed as a forecast of results or future earnings. BBVA does not intend, and undertakes no obligation, to update or revise the contents of this or any other document if there are any changes in the information contained therein, or including the forward-looking statements contained in any such document, as a result of events or circumstances after the date of such document or otherwise except as required by applicable law. This document may contain summarised information or information that has not been audited, and its recipients are invited to consult the documentation and public information filed by BBVA with stock market supervisory bodies, in particular, the prospectuses and periodical information filed with the Spanish Securities Exchange Commission (CNMV) and the Annual Report on Form 20-F and information on Form 6-K that are filed with the US Securities and Exchange Commission. Distribution of this document in other jurisdictions may be prohibited, and recipients into whose possession this document comes shall be solely responsible for informing themselves about, and observing any such restrictions. By accepting this document you agree to be bound by the foregoing restrictions.

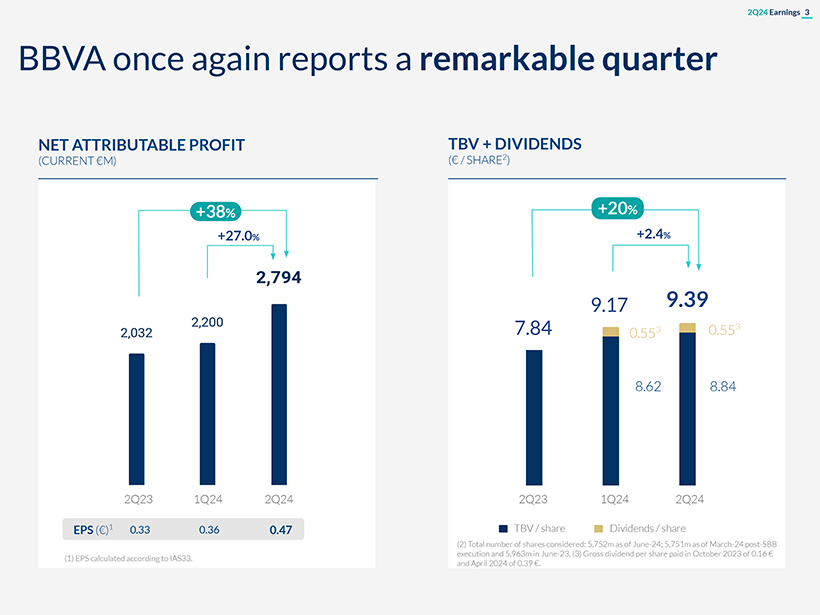

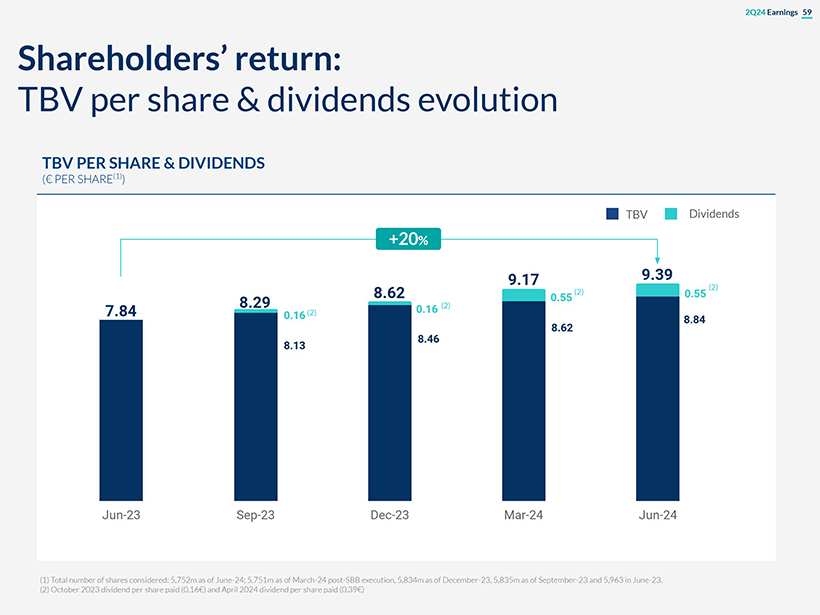

2Q24 Earnings 3 (1) EPS calculated according to IAS33. NET ATTRIBUTABLE PROFIT (CURRENT €M) 2Q23 1Q24 2Q24 EPS (€)1 0.33 0.36 0.47 +38% +27.0% TBV + DIVIDENDS (€ / SHARE2) 7.84 2Q23 1Q24 2Q24 9.17 9.39 0.553 0.553 8.62 8.84 +2.4% +20% TBV / share Dividends / share BBVA once again reports a remarkable quarter (2) Total number of shares considered: 5,752m as of June-24; 5,751m as of March-24 post-SBB execution and 5,963m in June-23. (3) Gross dividend per share paid in October 2023 of 0.16 € and April 2024 of 0.39 €.

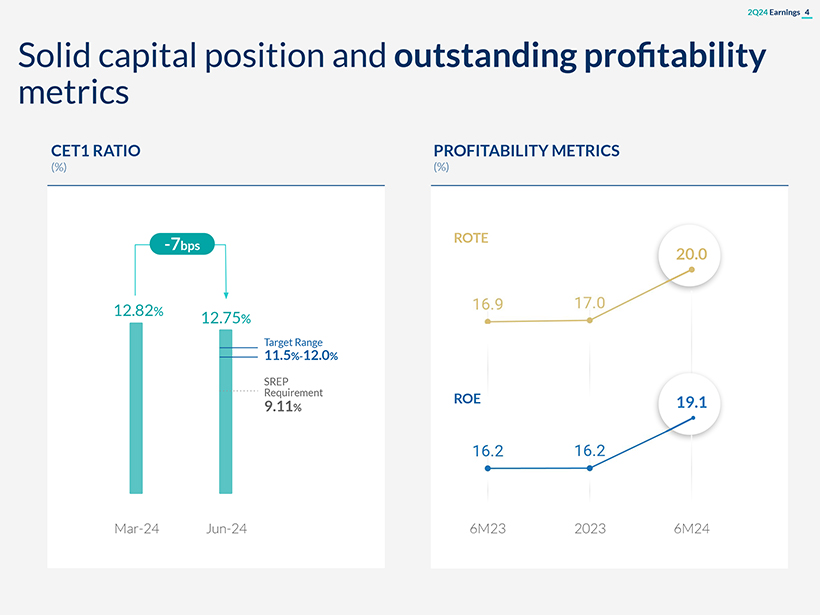

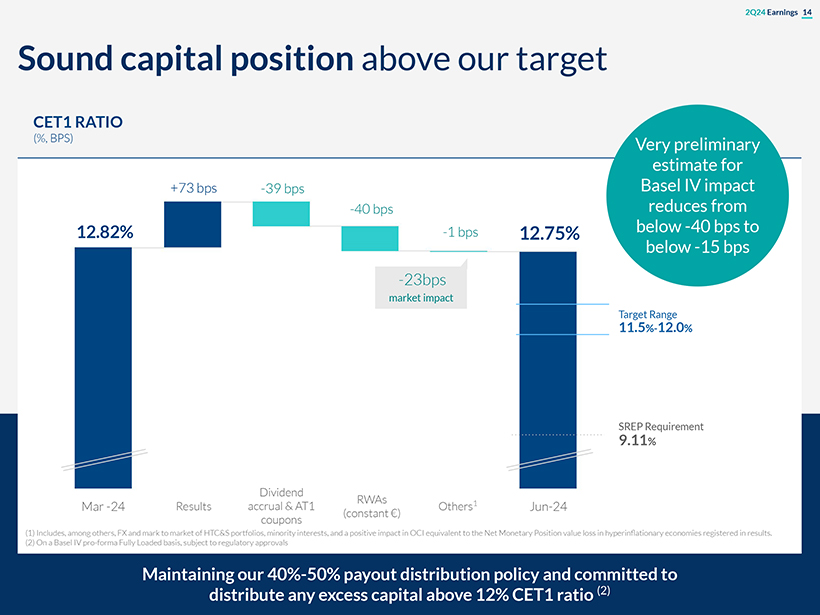

2Q24 Earnings 4 Solid capital position and outstanding profitability metrics PROFITABILITY METRICS (%) ROE 6M23 2023 6M24 ROTE 20.0 19.1CET1 RATIO (%) Jun-24 SREP Requirement 9.11% Target Range 11.5%-12.0% 12.75% Mar-24 12.82% -7bps

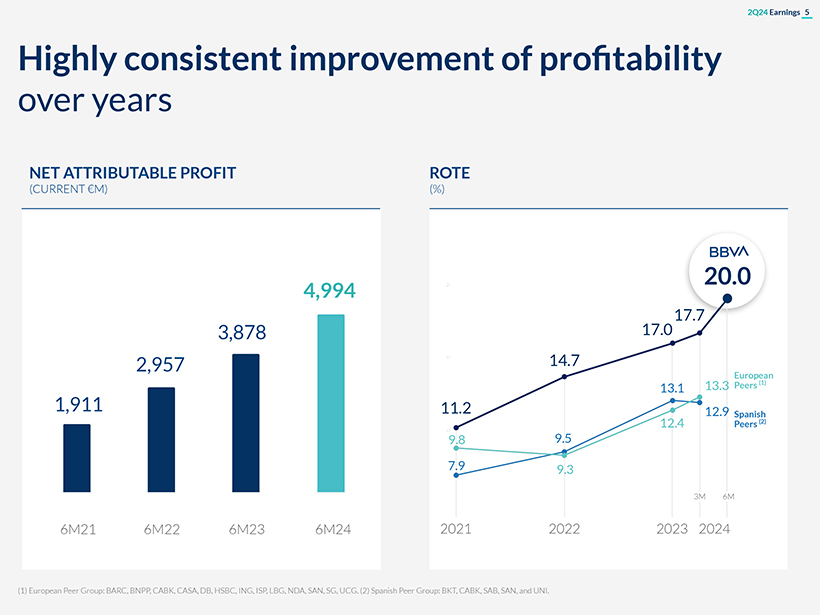

2Q24 Earnings 5 Highly consistent improvement of profitability over years NET ATTRIBUTABLE PROFIT (CURRENT €M) 6M21 2,957 3,878 4,994 6M22 6M23 6M24 1,911 ROTE (%) 14.7 17.0 2022 2023 12.4 9.3 9.5 13.1 11.2 9.8 7.9 (1) European Peer Group: BARC, BNPP, CABK, CASA, DB, HSBC, ING, ISP, LBG, NDA, SAN, SG, UCG. (2) Spanish Peer Group: BKT, CABK, SAB, SAN, and UNI. 2021 20.0 17.7 3M 6M 2024 European Peers (1) Spanish Peers (2) 13.3 12.9

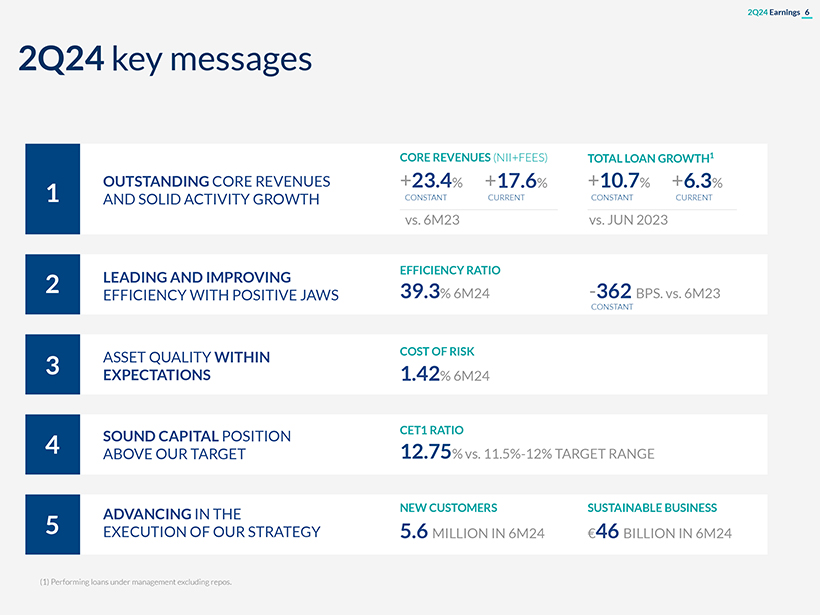

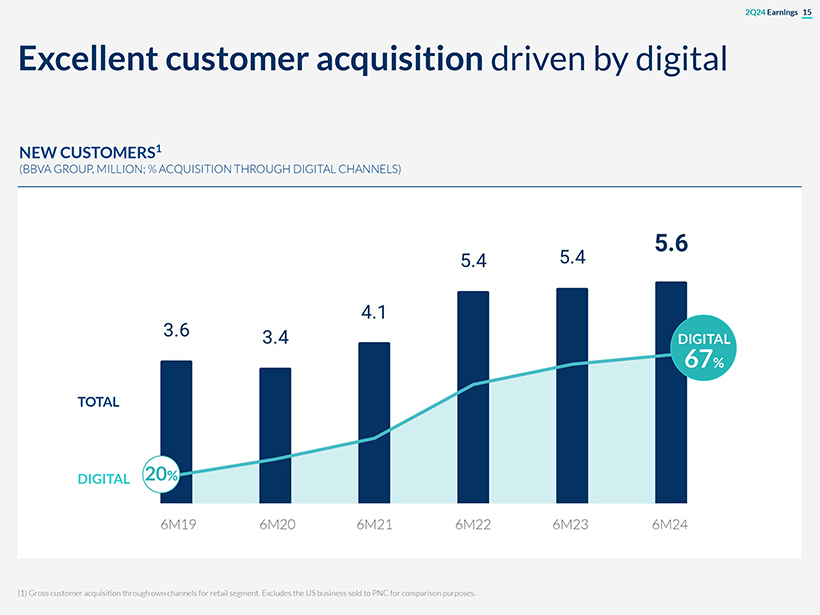

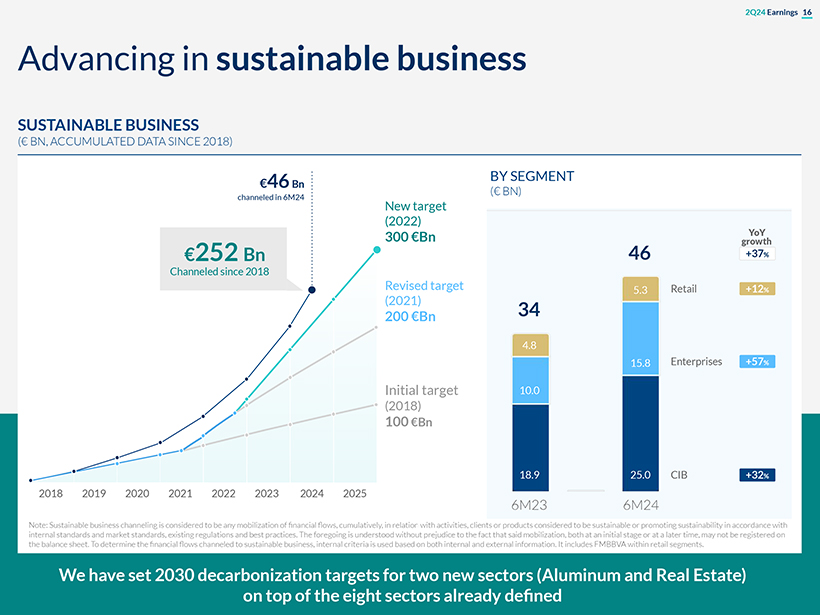

2Q24 Earnings 6 (1) Performing loans under management excluding repos. OUTSTANDING CORE REVENUES AND SOLID ACTIVITY GROWTH LEADING AND IMPROVING EFFICIENCY WITH POSITIVE JAWS ASSET QUALITY WITHIN EXPECTATIONS SOUND CAPITAL POSITION ABOVE OUR TARGET CORE REVENUES (NII+FEES) ADVANCING IN THE EXECUTION OF OUR STRATEGY TOTAL LOAN GROWTH1 EFFICIENCY RATIO COST OF RISK NEW CUSTOMERS SUSTAINABLE BUSINESS +23.4% +10.7% 39.3% 6M24 -362 BPS. vs. 6M23 1.42% 6M24 5.6 MILLION IN 6M24 46 BILLION IN 6M24 2Q24 key messages CET1 RATIO 12.75% vs. 11.5%-12% TARGET RANGE 1 2 3 4 5 +17.6% +6.3% vs. 6M23 vs. JUN 2023 CONSTANT CURRENT CONSTANT CURRENT CONSTANT

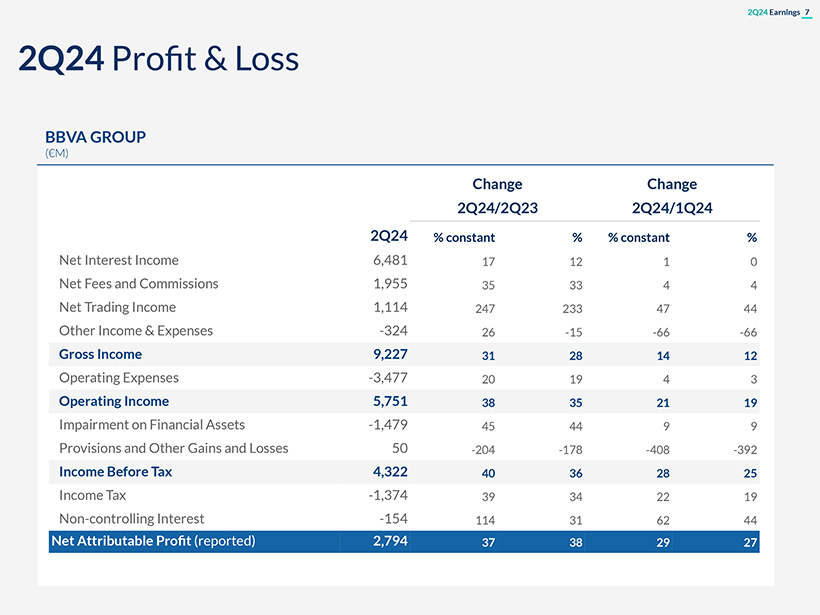

2Q24 Earnings 7 Change Change 2Q24/2Q23 2Q24/1Q24 2Q24 % constant % % constant % Net Interest Income 6,481 17 12 1 0 Net Fees and Commissions 1,955 35 33 4 4 Net Trading Income 1,114 247 233 47 44 Other Income & Expenses -324 26 -15 -66 -66 Gross Income 9,227 31 28 14 12 Operating Expenses -3,477 20 19 4 3 Operating Income 5,751 38 35 21 19 Impairment on Financial Assets -1,479 45 44 9 9 Provisions and Other Gains and Losses 50 -204 -178 -408 -392 Income Before Tax 4,322 40 36 28 25 Income Tax -1,374 39 34 22 19 Non-controlling Interest -154 114 31 62 44 Net Attributable Profit (reported) 2,794 37 38 29 27 2Q24 Profit & Loss BBVA GROUP (€M)

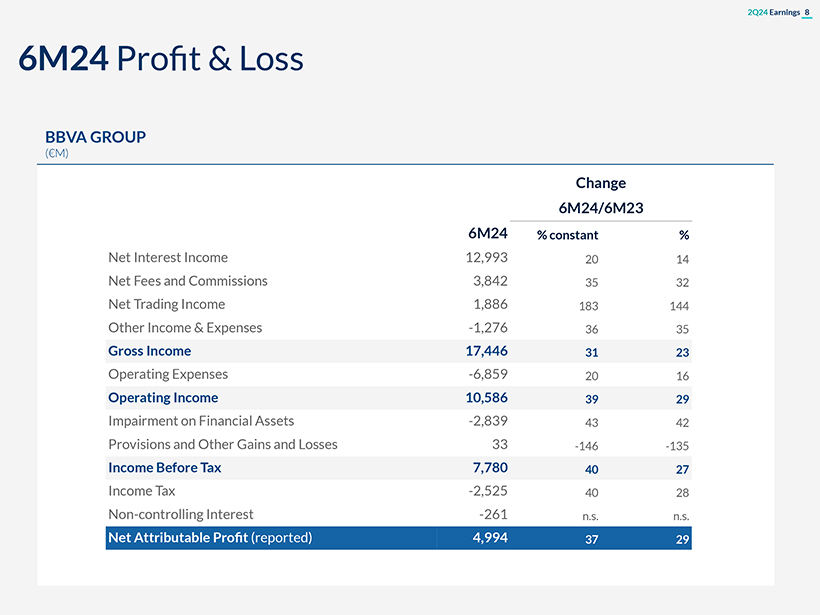

2Q24 Earnings 8 6M24 Profit & Loss Change 6M24/6M23 6M24 % constant % Net Interest Income 12,993 20 14 Net Fees and Commissions 3,842 35 32 Net Trading Income 1,886 183 144 Other Income & Expenses -1,276 36 35 Gross Income 17,446 31 23 Operating Expenses -6,859 20 16 Operating Income 10,586 39 29 Impairment on Financial Assets -2,839 43 42 Provisions and Other Gains and Losses 33 -146 -135 Income Before Tax 7,780 40 27 Income Tax -2,525 40 28 Non-controlling Interest -261 n.s. n.s. Net Attributable Profit (reported) 4,994 37 29 BBVA GROUP (€M)

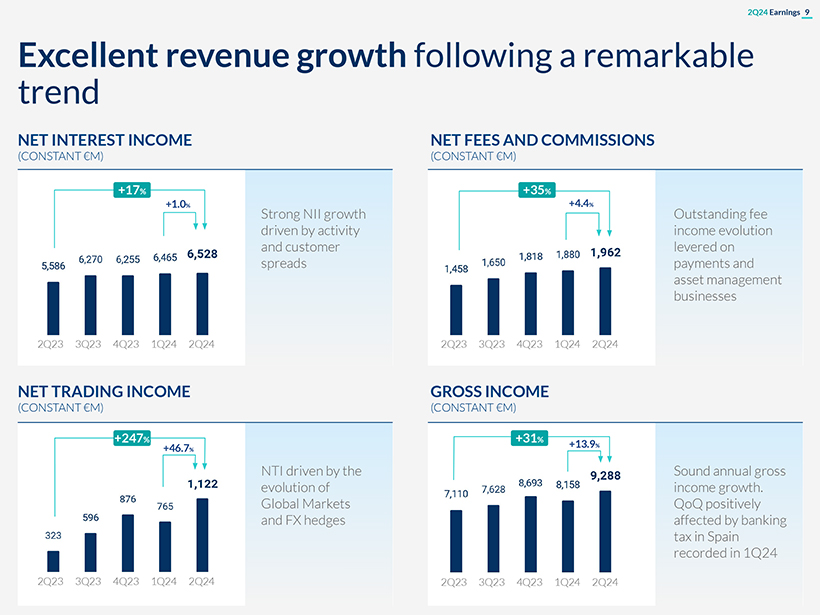

2Q24 Earnings 9 NET INTEREST INCOME (CONSTANT €M) NET FEES AND COMMISSIONS (CONSTANT €M) NET TRADING INCOME (CONSTANT €M) GROSS INCOME (CONSTANT €M) Strong NII growth driven by activity and customer spreads Outstanding fee income evolution levered on payments and asset management businesses NTI driven by the evolution of Global Markets and FX hedges Sound annual gross income growth. QoQ positively affected by banking tax in Spain recorded in 1Q24 2Q23 3Q23 4Q23 1Q24 2Q24 2Q23 3Q23 4Q23 1Q24 2Q24 2Q23 3Q23 4Q23 1Q24 2Q24 2Q23 3Q23 4Q23 1Q24 2Q24 +17% +35% +247% +31% Excellent revenue growth following a remarkable trend +1.0% +4.4% +46.7% +13.9% 5,586 6,270 6,255 6,465 6,528 1,458 1,650 1,818 1,880 1,962 323 596 876 765 1,122 7,110 7,628 8,693 8,158 9,288

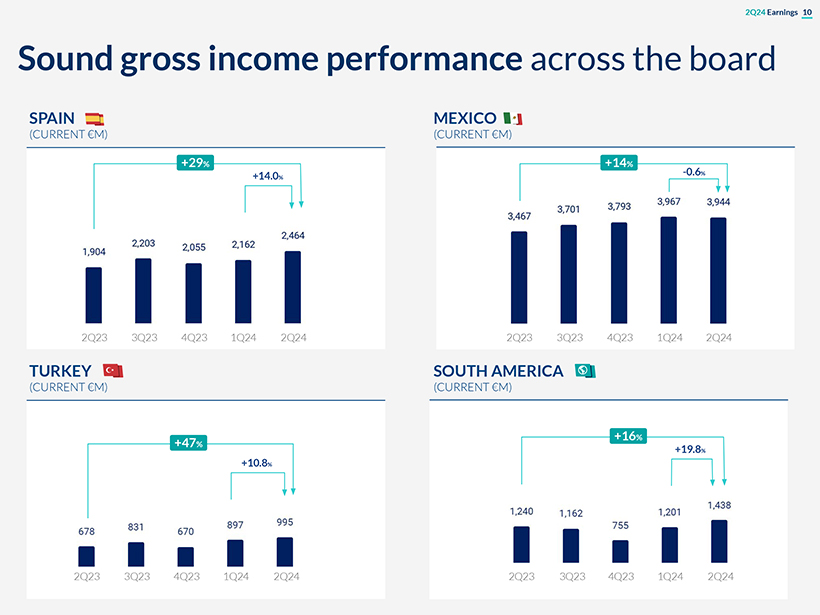

2Q24 Earnings 10 Sound gross income performance across the board TURKEY (CURRENT €M) SOUTH AMERICA (CURRENT €M) 2Q23 3Q23 4Q23 1Q24 2Q24 2Q23 3Q23 4Q23 1Q24 2Q24 +19.8% +10.8% SPAIN (CURRENT €M) MEXICO (CURRENT €M) 2Q23 3Q23 4Q23 1Q24 2Q24 2Q23 3Q23 4Q23 1Q24 2Q24 +14% -0.6% +29% +14.0% +16% +47% 1,904 2,203 2,055 2,162 2,464 3,467 3,701 3,793 3,967 3,944 678 831 670 897 995 1,240 1,162 755 1,201 1,438

2Q24 Earnings 11 Strong performance in Spain and Mexico will continue to be supported by activity growth Jun’23 Sep’23 Dec’23 Mar’24 Jun’24 TOTAL LOAN GROWTH (YOY, CONSTANT €) BBVA GROUP +8.3% Consumer + Credit Cards Mid-sized companies +5.5% Consumer + SMEs Credit Cards +17.4% +16.6% SPAIN MEXICO Jun’23 Sep’23 Dec’23 Mar’24 Jun’24 Jun’23 Sep’23 Dec’23 Mar’24 Jun’24 TOTAL LOAN GROWTH (YOY, CURRENT €) KEY SEGMENTS (YOY JUN’24, CURRENT €) TOTAL LOAN GROWTH (YOY, CONSTANT €) KEY SEGMENTS (YOY JUN’24, CONSTANT €) 7.3% 6.9% 7.3% 9.5% 10.7% -1.4% -1.8% -0.9% 0.8% 2.4% 11.1% 11.2% 10.6% 808% 12.6%

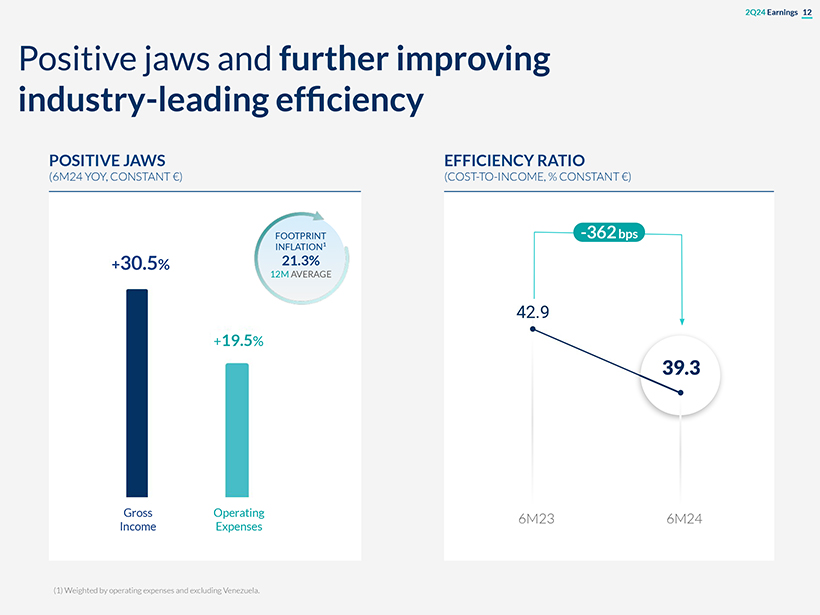

2Q24 Earnings 12 Positive jaws and further improving industry-leading efficiency 6M23 6M24 +30.5% +19.5% Operating Expenses Gross Income POSITIVE JAWS (6M24 YOY, CONSTANT €) EFFICIENCY RATIO (COST-TO-INCOME, % CONSTANT €) (1) Weighted by operating expenses and excluding Venezuela. FOOTPRINT INFLATION1 21.3% 12M AVERAGE 39.3 -362 bps 42.9

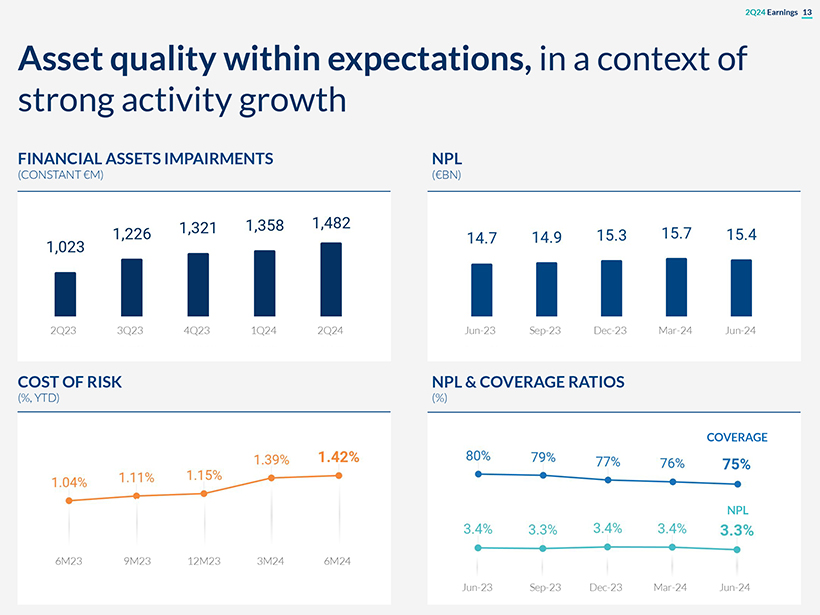

2Q24 Earnings 13 COST OF RISK (%, YTD) NPL & COVERAGE RATIOS (%) COVERAGE NPL Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Asset quality within expectations, in a context of strong activity growth 2Q23 3Q23 4Q23 1Q24 2Q24 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 6M23 9M23 12M23 3M24 6M24 FINANCIAL ASSETS IMPAIRMENTS (CONSTANT M) NPL (€BN) 1,023 1,226 1,321 1,358 1,482 14.7 14.9 15.3 15.7 15.4 1.04% 1.11% 1.15% 1.39% 1.39% 1.42% 80% 79% 77% 76% 75% 3.4% 3.3% 3.4% 3.4% 3.3%

2Q24 Earnings 14 (1) Includes, among others, FX and mark to market of HTC&S portfolios, minority interests, and a positive impact in OCI equivalent to the Net Monetary Position value loss in hyperinflationary economies registered in results. (2) On a Basel IV pro-forma Fully Loaded basis, subject to regulatory approvals Sound capital position above our target CET1 RATIO (%, BPS) SREP Requirement 9.11% Target Range 11.5%-12.0% Results Dividend accrual & AT1 coupons RWAs (constant €) Mar -24 Others1 Jun-24 12.75% -39 bps -40 bps 12.82% +73 bps -1 bps market impact -23bps Very preliminary estimate for Basel IV impact reduces from below -40 bps to below -15 bps Maintaining our 40%-50% payout distribution policy and committed to distribute any excess capital above 12% CET1 ratio (2)

2Q24 Earnings 15 Excellent customer acquisition driven by digital NEW CUSTOMERS1 (BBVA GROUP, MILLION; % ACQUISITION THROUGH DIGITAL CHANNELS) (1) Gross customer acquisition through own channels for retail segment. Excludes the US business sold to PNC for comparison purposes. TOTAL DIGITAL DIGITAL 67% 20% 6M19 6M20 6M21 6M22 6M23 6M24 3.6 3.4 4.1 5.4 5.4 5.6

2Q24 Earnings 16 SUSTAINABLE BUSINESS (€ BN, ACCUMULATED DATA SINCE 2018) Advancing in sustainable business 6M23 6M24 18.9 10.04.8 25.0 15.8 5.3 Retail Enterprises CIB +12% +57% +32% 46 BY SEGMENT (€ BN) YoY growth 34 +37% Note: Sustainable business channeling is considered to be any mobilization of financial flows, cumulatively, in relation with activities, clients or products considered to be sustainable or promoting sustainability in accordance with internal standards and market standards, existing regulations and best practices. The foregoing is understood without prejudice to the fact that said mobilization, both at an initial stage or at a later time, may not be registered on the balance sheet. To determine the financial flows channeled to sustainable business, internal criteria is used based on both internal and external information. It includes FMBBVA within retail segments. New target (2022) 300 €Bn 2018 2019 2020 2021 2022 2023 2024 Channeled since 2018 €252 Bn 2025 Initial target (2018) 100 €Bn Revised target (2021) 200 €Bn €46 Bn channeled in 6M24 We have set 2030 decarbonization targets for two new sectors (Aluminum and Real Estate) on top of the eight sectors already defined

2Q24 Earnings 17 LARGER CORPORATES INVESTED IN GROWTH3 FAMILIES BOUGHT THEIR HOME2 SMEs AND SELF – EMPLOYED BOOSTED THEIR BUSINESS2 LOAN GROWTH1 Positive impact on society through our activity 70,000 +10.7% INCLUSIVE GROWTH FINANCING 11 €Bn 75,000 MOBILIZED 340,000 IN 6M24 BBVA GROUP (1) Performing loans under management excluding repos. (2) New loans in 6M24. (3) Corporates with BBVA lending as of June 2024. +6.3% (YOY, CONSTANT €) (YOY, CURRENT €)

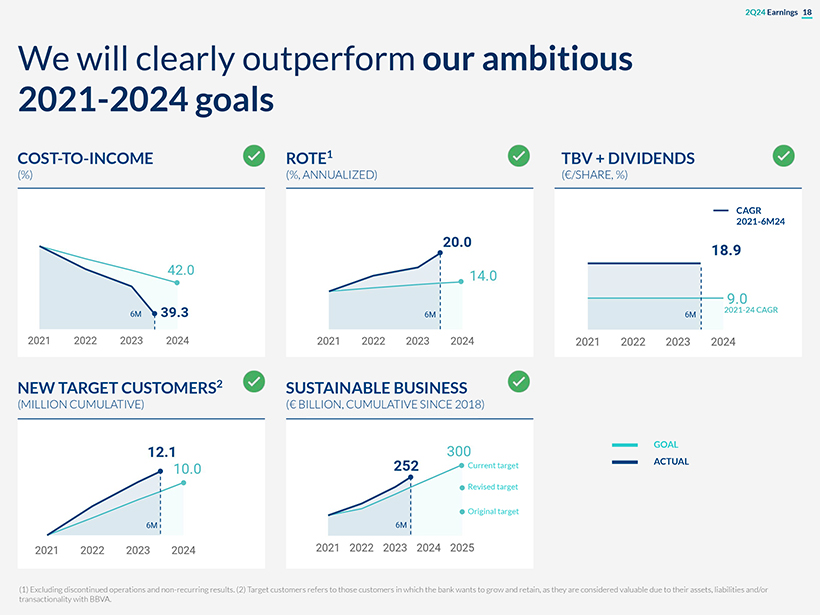

2Q24 Earnings 18 Original target Revised target (1) Excluding discontinued operations and non-recurring results. (2) Target customers refers to those customers in which the bank wants to grow and retain, as they are considered valuable due to their assets, liabilities and/or transactionality with BBVA. We will clearly outperform our ambitious 2021-2024 goals COST-TO-INCOME (%) ROTE1 (%, ANNUALIZED) TBV + DIVIDENDS (€/SHARE, %) NEW TARGET CUSTOMERS2 (MILLION CUMULATIVE) SUSTAINABLE BUSINESS (€ BILLION, CUMULATIVE SINCE 2018) 2021-24 CAGR CAGR 2021-6M24 6M GOAL ACTUAL 6M 6M 6M 6M Current target 42.0 39.3 2021 2022 2023 2024 2021 2022 2023 2024 2021 2022 2023 2024 2021 2022 2023 2024 2021 2022 2023 2024 2025 20.0 14.0 18.9 9.0 12.1 10.0 252 300

BBVA 2Q24 Earnings 19 Business Areas SPAIN MEXICO TURKEY SOUTH AMERICA

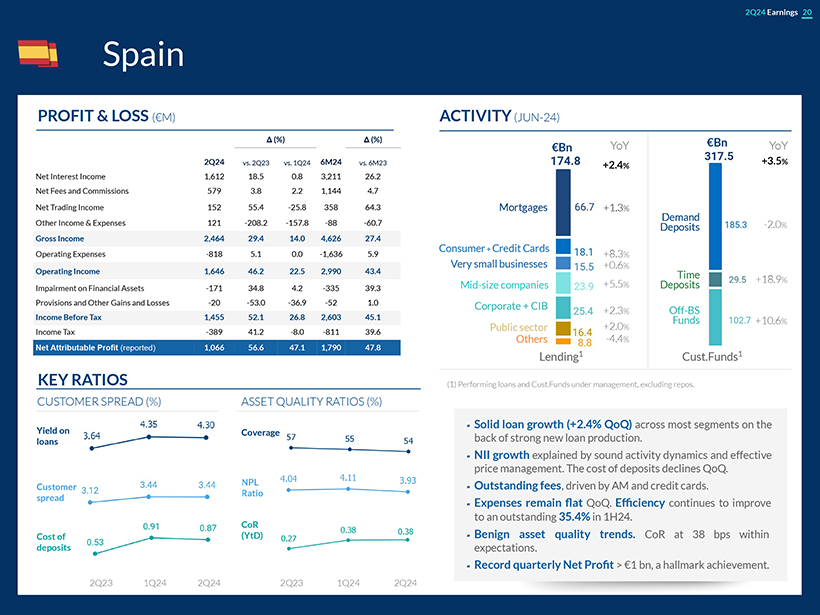

2Q24 Earnings 20 €Bn Spain PROFIT & LOSS (€M) ACTIVITY (JUN-24) KEY RATIOS CUSTOMER SPREAD (%) ASSET QUALITY RATIOS (%) Coverage CoR (YtD) Yield on loans Cost of deposits 2Q23 1Q24 2Q24 2Q23 1Q24 2Q24 €Bn YoY YoY Mortgages Consumer + Credit Cards Very small businesses Mid-size companies Corporate + CIB Public sector Others +1.3%+8.3% +0.6% +5.5% +2.3% +2.0% -4.4% -2.0% +18.9% +10.6% (1) Performing loans and Cust.Funds under management, excluding repos. Demand Deposits Off-BS Funds Time Deposits Lending1 Cust.Funds1 +2.4% +3.5% NPL Ratio Customer spread Ä (%) Ä (%) 2Q24 vs. 2Q23 vs. 1Q24 6M24 vs. 6M23Net Interest Income 1,612 18.5 0.8 3,211 26.2 Net Fees and Commissions 579 3.8 2.2 1,144 4.7 Net Trading Income 152 55.4 -25.8 358 64.3 Other Income & Expenses 121 -208.2 -157.8 -88 -60.7 Gross Income 2,464 29.4 14.0 4,626 27.4 Operating Expenses -818 5.1 0.0 -1,636 5.9 Operating Income 1,646 46.2 22.5 2,990 43.4 Impairment on Financial Assets -171 34.8 4.2 -335 39.3 Provisions and Other Gains and Losses -20 -53.0 -36.9 -52 1.0 Income Before Tax 1,455 52.1 26.8 2,603 45.1 Income Tax -389 41.2 -8.0 -811 39.6 Net Attributable Profit (reported) 1,066 56.6 47.1 1,790 47.8 Solid loan growth (+2.4% QoQ) across most segments on the back of strong new loan production. NII growth explained by sound activity dynamics and effective price management. The cost of deposits declines QoQ. Outstanding fees, driven by AM and credit cards. Expenses remain flat QoQ. Efficiency continues to improve to an outstanding 35.4% in 1H24. Benign asset quality trends. CoR at 38 bps within expectations. Record quarterly Net Profit > €1 bn, a hallmark achievement. 174.8 66.7 18.1 15.5 23.9 25.4 16.4 8.8 317.5 185.3 29.5 102.7 3.64 4.35 4.30 3.12 3.44 3.44 0.53 0.91 0.87 57 55 54 4.04 4.11 3.93 0.27 0.38 0.38

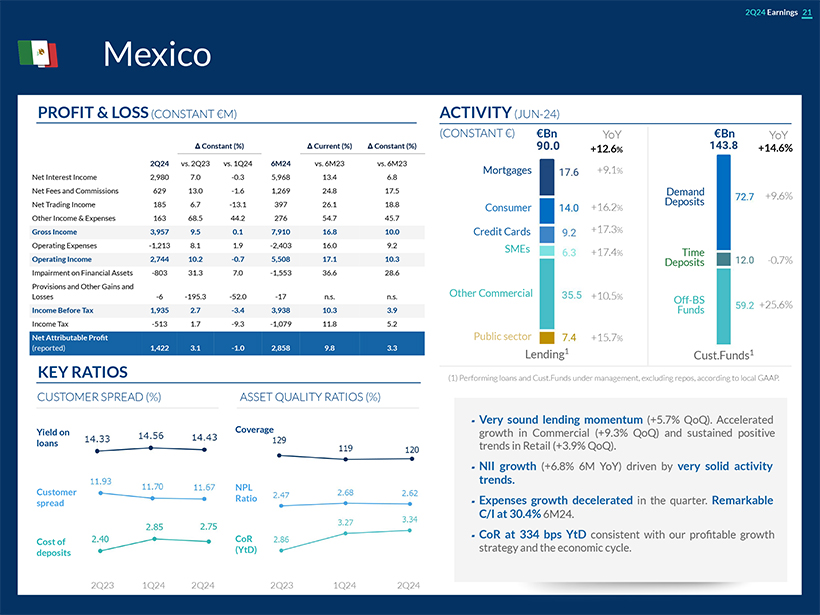

2Q24 Earnings 21 Mexico €Bn PROFIT & LOSS (CONSTANT €M) ACTIVITY (JUN-24) Mortgages Consumer Credit Cards SMEs Other Commercial Public sector (CONSTANT €) +14.6% +9.6% -0.7% +25.6% +12.6% +9.1% +16.2% +17.3% +10.5% +15.7% (1) Performing loans and Cust.Funds under management, excluding repos, according to local GAAP. Lending1 Cust. Funds1 Demand Deposits Off-BS Funds Time Deposits ASSET QUALITY RATIOS (%) KEY RATIOS YoY Yield on loans Cost of deposits 2Q23 1Q24 2Q24 CoR (YtD) NPL Ratio +17.4% Customer spread YoY Coverage CUSTOMER SPREAD (%) 2Q23 1Q24 2Q24 €Bn Ä Constant (%) Ä Current (%) Ä Constant (%) 2Q24 vs. 2Q23 vs. 1Q24 6M24 vs. 6M23 vs. 6M23 Net Interest Income 2,980 7.0 -0.3 5,968 13.4 6.8 Net Fees and Commissions 629 13.0 -1.6 1,269 24.8 17.5 Net Trading Income 185 6.7 -13.1 397 26.1 18.8 Other Income & Expenses 163 68.5 44.2 276 54.7 45.7 Gross Income 3,957 9.5 0.1 7,910 16.8 10.0 Operating Expenses -1,213 8.1 1.9 -2,403 16.0 9.2 Operating Income 2,744 10.2 -0.7 5,508 17.1 10.3 Impairment on Financial Assets -803 31.3 7.0 -1,553 36.6 28.6 Provisions and Other Gains and Losses -6 -195.3 -52.0 -17 n.s. n.s. Income Before Tax 1,935 2.7 -3.4 3,938 10.3 3.9 Income Tax -513 1.7 -9.3 -1,079 11.8 5.2 Net Attributable Profit (reported) 1,422 3.1 -1.0 2,858 9.8 3.3 Very sound lending momentum (+5.7% QoQ). Accelerated growth in Commercial (+9.3% QoQ) and sustained positive trends in Retail (+3.9% QoQ). NII growth (+6.8% 6M YoY) driven by very solid activity trends. Expenses growth decelerated in the quarter. Remarkable C/I at 30.4% 6M24. CoR at 334 bps YtD consistent with our profitable growth strategy and the economic cycle. 90.0 17.6 14.0 9.2 6.3 35.5 7.4 143.8 72.7 12.0 59.2 14.33 14.56 14.43 11.93 11.70 11.67 2.40 2.85 2.75 129 119 120 2.47 2.68 2.62 2.86 3.27 3.34

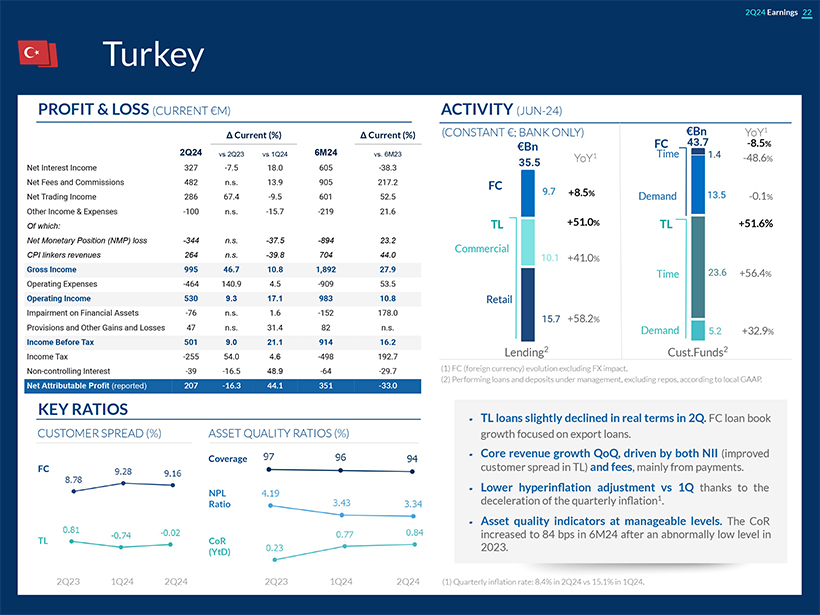

2Q24 Earnings 22 Turkey Demand Demand Time Coverage NPL Ratio CoR (YtD) FC TL YoY1 €Bn YoY1 €Bn +8.5% +51.0% +41.0% +58.2% (1) FC (foreign currency) evolution excluding FX impact. (2) Performing loans and deposits under management, excluding repos, according to local GAAP. +51.6% +56.4% +32.9% -8.5% -48.6% -0.1% Retail Commercial TL FC TL FC Time CUSTOMER SPREAD (%) ASSET QUALITY RATIOS (%) KEY RATIOS Lending2 Cust.Funds2 PROFIT & LOSS (CURRENT M) ACTIVITY (JUN-24) (CONSTANT €; BANK ONLY) 2Q23 1Q24 2Q24 2Q23 1Q24 2Q24 (1) Quarterly inflation rate: 8.4% in 2Q24 vs 15.1% in 1Q24. Ä Current (%) Ä Current (%) 2Q24 vs 2Q23 vs 1Q24 6M24 vs. 6M23 Net Interest Income 327 -7.5 18.0 605 -38.3 Net Fees and Commissions 482 n.s. 13.9 905 217.2 Net Trading Income 286 67.4 -9.5 601 52.5 Other Income & Expenses -100 n.s. -15.7 -219 21.6 Of which: Net Monetary Position (NMP) loss -344 n.s. -37.5 -894 23.2 CPI linkers revenues 264 n.s. -39.8 704 44.0 Gross Income 995 46.7 10.8 1,892 27.9 Operating Expenses -464 140.9 4.5 -909 53.5 Operating Income 530 9.3 17.1 983 10.8 Impairment on Financial Assets -76 n.s. 1.6 -152 178.0 Provisions and Other Gains and Losses 47 n.s. 31.4 82 n.s. Income Before Tax 501 9.0 21.1 914 16.2 Income Tax -255 54.0 4.6 -498 192.7 Non-controlling Interest -39 -16.5 48.9 -64 -29.7 Net Attributable Profit (reported) 207 -16.3 44.1 351 -33.0 TL loans slightly declined in real terms in 2Q. FC loan book growth focused on export loans. Core revenue growth QoQ, driven by both NII (improved customer spread in TL) and fees, mainly from payments. Lower hyperinflation adjustment vs 1Q thanks to the deceleration of the quarterly inflation1. Asset quality indicators at manageable levels. The CoR increased to 84 bps in 6M24 after an abnormally low level in 2023. 35.5 9.7 10.1 15.7 43.7 1.4 13.5 23.6 5.2 8.78 9.28 9.16 0.81 -0.74 -0.02 97 96 94 4.19 3.34 3.34 0.23 0.77 0.84

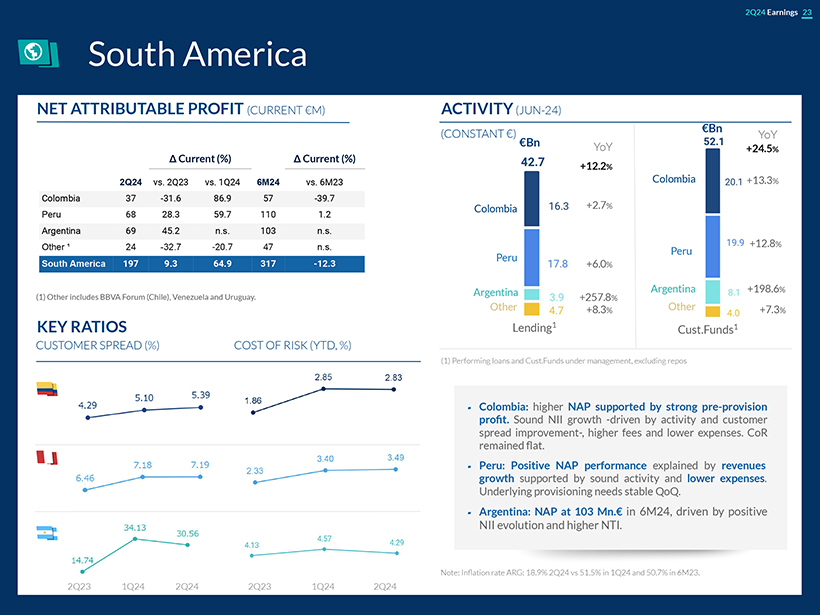

2Q24 Earnings 23 South America +12.2% Colombia Peru Argentina Other ACTIVITY (JUN-24) KEY RATIOS (CONSTANT €) €Bn Colombia Peru Other +2.7% +6.0% +257.8% +8.3% +13.3% +198.6% +7.3% +12.8% (1) Performing loans and Cust.Funds under management, excluding repos (1) Other includes BBVA Forum (Chile), Venezuela and Uruguay. Argentina CUSTOMER SPREAD (%) COST OF RISK (YTD, %) YoY YoY Lending1 Cust.Funds1 2Q23 1Q24 2Q24 2Q23 1Q24 2Q24 +24.5% NET ATTRIBUTABLE PROFIT (CURRENT €M) Colombia: higher NAP supported by strong pre-provision profit. Sound NII growth -driven by activity and customer spread improvement-, higher fees and lower expenses. CoR remained flat. Peru: Positive NAP performance explained by revenues growth supported by sound activity and lower expenses. Underlying provisioning needs stable QoQ. Argentina: NAP at 103 Mn.€ in 6M24, driven by positive NII evolution and higher NTI. €Bn Note: Inflation rate ARG: 18.9% 2Q24 vs 51.5% in 1Q24 and 50.7% in 6M23. Ä Current (%) Ä Current (%) 2Q24 vs. 2Q23 vs. 1Q24 6M24 vs. 6M23 Colombia 37 -31.6 86.9 57 -39.7 Peru 68 28.3 59.7 110 1.2 Argentina 69 45.2 n.s. 103 n.s. Other ¹ 24 -32.7 -20.7 47 n.s. South America 197 9.3 64.9 317 -12.3 42.7 16.3 17.8 3.9 4.7 52.1 20.1 19.9 8.1 4.0 4.29 5.10 5.39 6.46 7.18 7.19 14.74 34.13 30.56 1.86 2.85 2.83 2.33 3.40 3.49 4.13 4.57 4.29

2Q24 Earnings 24 Takeaways BBVA once again reports a remarkable quarter Excellent core revenues evolution on the back of activity growth On track to clearly exceed our ambitious 2021-2024 goals Significant progress in the execution of our strategy focused on digitization, innovation and sustainability Outstanding shareholder value creation and profitability metrics ROTE 20% TBV + DIVIDENDS (YoY) +20% EFFICIENCY 39% At the top of the European Banking Sector

BBVA 2Q24 Earnings 25 Update on the Offer to Banco Sabadell Shareholders

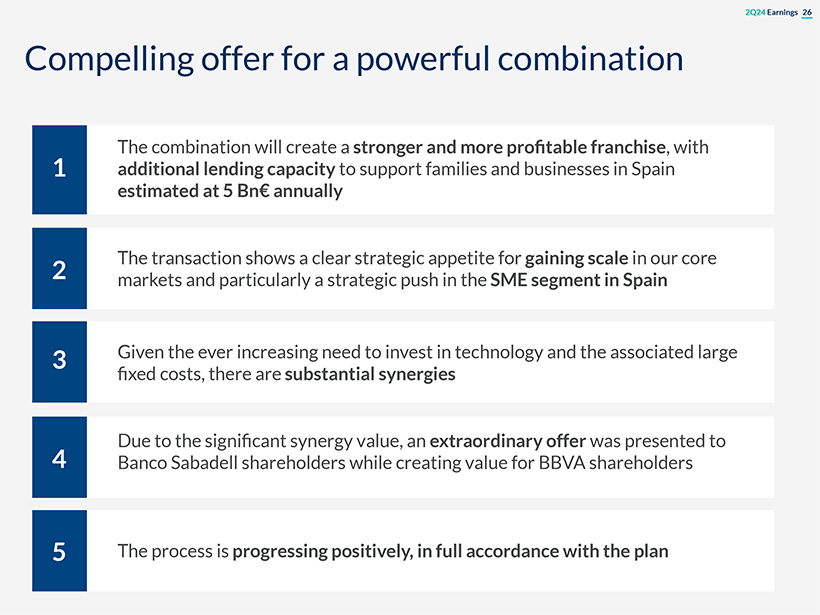

2Q24 Earnings 26 Compelling offer for a powerful combination 1 The combination will create a stronger and more profitable franchise, with additional lending capacity to support families and businesses in Spain estimated at 5 Bn€ annually 2 The transaction shows a clear strategic appetite for gaining scale in our core markets and particularly a strategic push in the SME segment in Spain 3 Given the ever increasing need to invest in technology and the associated large fixed costs, there are substantial synergies 4 Due to the significant synergy value, an extraordinary offer was presented to Banco Sabadell shareholders while creating value for BBVA shareholders 5 The process is progressing positively, in full accordance with the plan

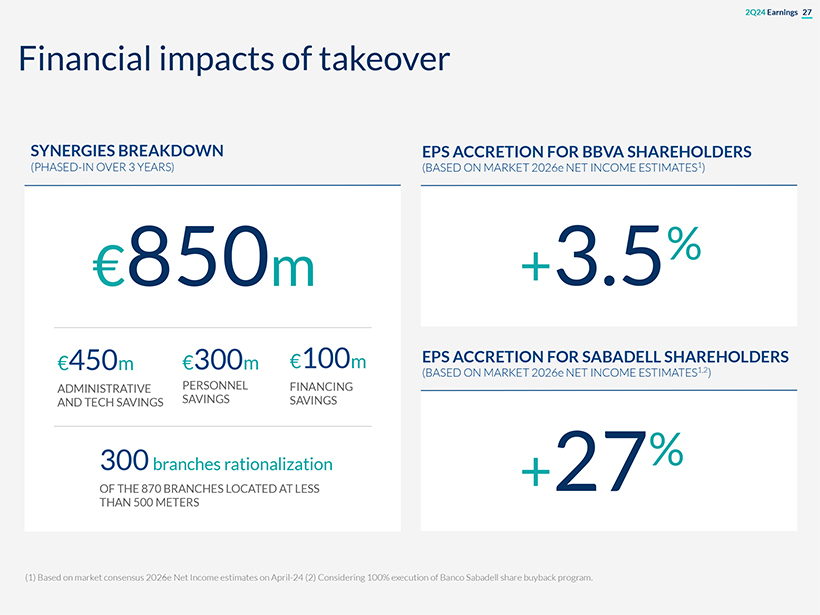

2Q24 Earnings 27 Financial impacts of takeover EPS ACCRETION FOR SABADELL SHAREHOLDERS (BASED ON MARKET 2026e NET INCOME ESTIMATES1,2) SYNERGIES BREAKDOWN (PHASED-IN OVER 3 YEARS) 850m ADMINISTRATIVE AND TECH SAVINGS 450m PERSONNEL SAVINGS 300m OF THE 870 BRANCHES LOCATED AT LESS THAN 500 METERS 300 branches rationalization FINANCING SAVINGS 100m (1) Based on market consensus 2026e Net Income estimates on April-24 (2) Considering 100% execution of Banco Sabadell share buyback program. +27% EPS ACCRETION FOR BBVA SHAREHOLDERS (BASED ON MARKET 2026e NET INCOME ESTIMATES1) +3.5%

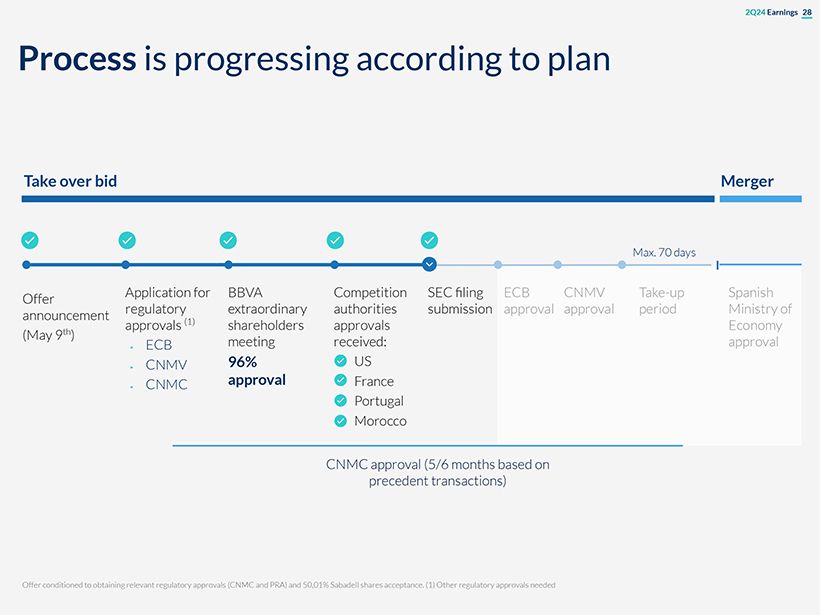

2Q24 Earnings 28 Process is progressing according to plan Application for regulatory approvals (1) ECB CNMV CNMC BBVA extraordinary shareholders meeting 96% approval Competition authorities approvals received: US France Portugal Morocco ECB approval CNMC approval (5/6 months based on precedent transactions) Offer announcement (May 9th) Offer conditioned to obtaining relevant regulatory approvals (CNMC and PRA) and 50,01% Sabadell shares acceptance. (1) Other regulatory approvals needed Max. 70 days SEC filing submission CNMV approval Spanish Ministry of Economy approval Take over bid Merger Take-up period

BBVA 2Q24 Earnings 29 Net Attributable Profit evolution Gross Income breakdown ALCO portfolio, NII sensitivity and LCRs & NSFRs P&L Accounts by business unit Customer spread by country Stages breakdown by business area CET1 Sensitivity to market impacts CET1 evolution YtD & RWAs by business area Book Value of the main subsidiaries TBV per share & dividends evolution MREL Digital metrics 01 02 03 04 05 06 07 09 10 11 12 08 Annex

BBVA 2Q24 Earnings 30 01 Net Attributable Profit evolution

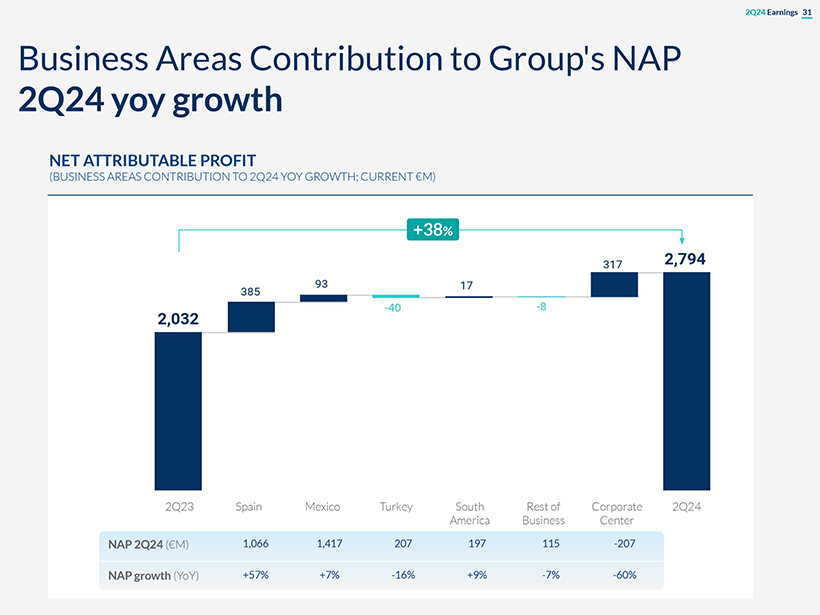

2Q24 Earnings 31 2Q23 Spain Mexico Turkey South America Rest of Business Corporate Center 2Q24 NET ATTRIBUTABLE PROFIT (BUSINESS AREAS CONTRIBUTION TO 2Q24 YOY GROWTH; CURRENT €M) NAP 2Q24 (€M) NAP growth (YoY) 1,066 1,417 207 197 115 -207 +57% +7% -16% +9% -7% -60% Business Areas Contribution to Group’s NAP 2Q24 yoy growth +38% 2,032 385 93 -40 17 -8 317 2,794

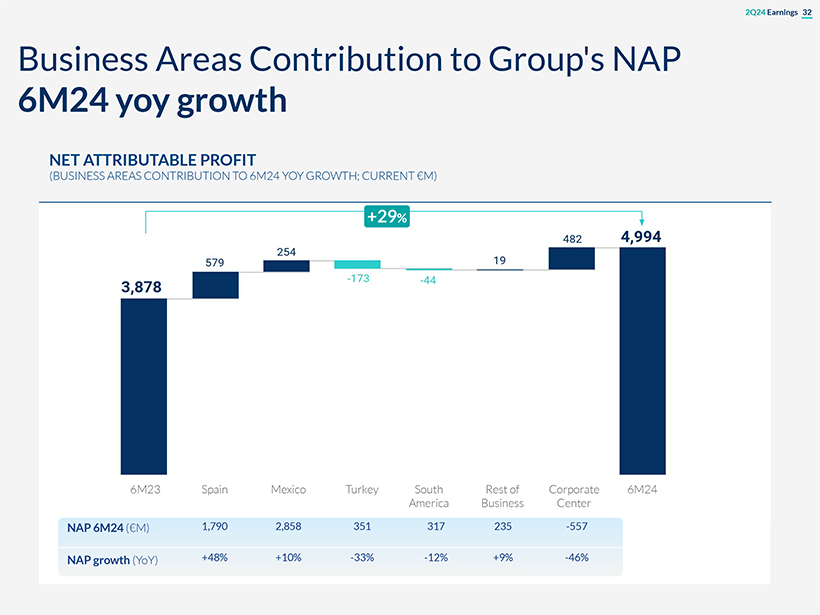

2Q24 Earnings 32 6M23 Spain Mexico Turkey South America Rest of Business Corporate Center 6M24 NET ATTRIBUTABLE PROFIT (BUSINESS AREAS CONTRIBUTION TO 6M24 YOY GROWTH; CURRENT €M) +29% Business Areas Contribution to Group’s NAP 6M24 yoy growth NAP 6M24 (€M) 1,790 2,858 351 317 235 -557 NAP growth (YoY) +48% +10% -33% -12% +9% -46% 3,878 579 254 -173 -44 19 482 4,994

BBVA 2Q24 Earnings 33 02 Gross Income breakdown

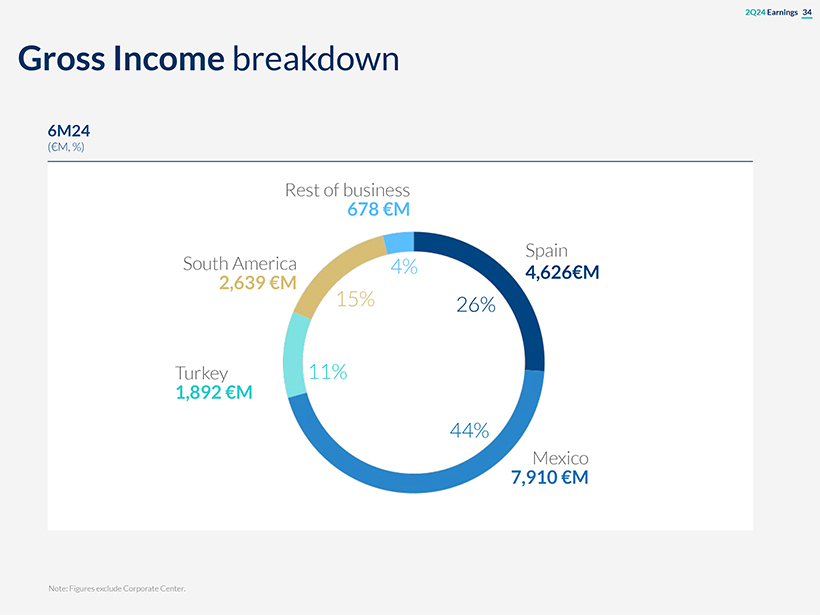

2Q24 Earnings 34 6M24 (€M, %) Note: Figures exclude Corporate Center. Spain 4,626€M Turkey 1,892 €M Mexico 7,910 €M

South America 2,639 €M Rest of business 678 €M 4% 26% 44% 11% 15% Gross Income breakdown

BBVA 2Q24 Earnings 35 03 P&L Accounts by business unit Rest of Business Corporate Center Turkey (hyperinflation adjustment) Argentina (hyperinflation adjustment) Colombia Peru

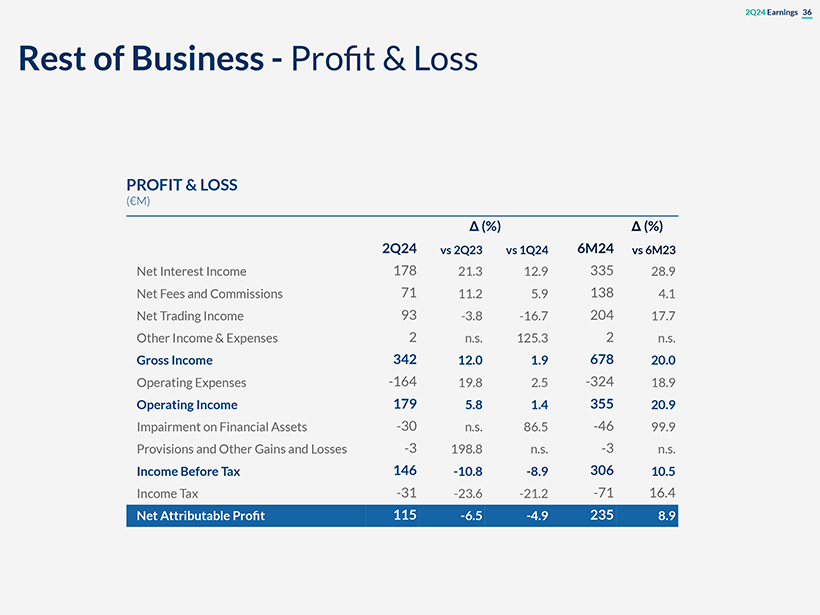

2Q24 Earnings 36 (%) (%) 2Q24 vs 2Q23 vs 1Q24 6M24 vs 6M23 Net Interest Income 178 21.3 12.9 335 28.9 Net Fees and Commissions 71 11.2 5.9 138 4.1 Net Trading Income 93 -3.8 -16.7 204 17.7 Other Income & Expenses 2 n.s. 125.3 2 n.s. Gross Income 342 12.0 1.9 678 20.0 Operating Expenses -164 19.8 2.5 -324 18.9 Operating Income 179 5.8 1.4 355 20.9 Impairment on Financial Assets -30 n.s. 86.5 -46 99.9 Provisions and Other Gains and Losses -3 198.8 n.s. -3 n.s. Income Before Tax 146 -10.8 -8.9 306 10.5 Income Tax -31 -23.6 -21.2 -71 16.4 Net Attributable Profit 115 -6.5 -4.9 235 8.9 Rest of Business - Profit & Loss PROFIT & LOSS (€M)

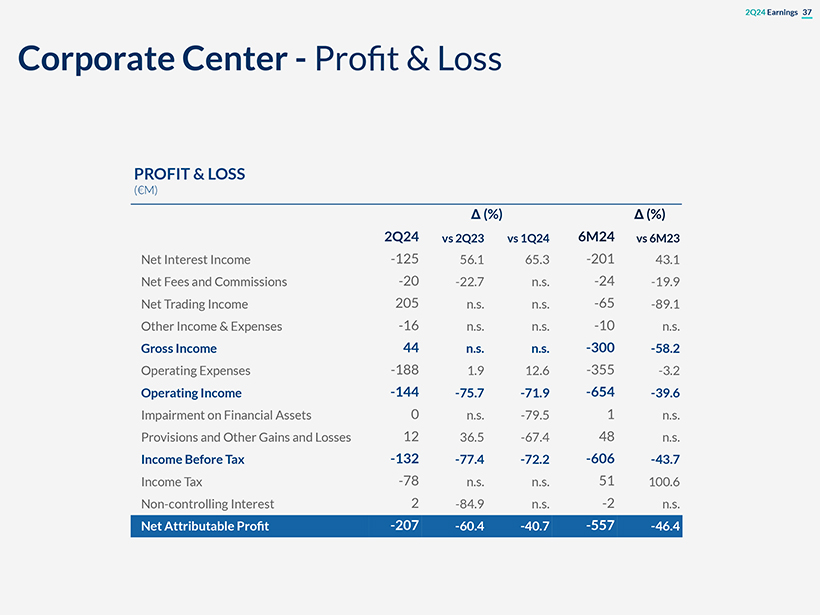

2Q24 Earnings 37 (%) (%) 2Q24 vs 2Q23 vs 1Q24 6M24 vs 6M23 Net Interest Income -125 56.1 65.3 -201 43.1 Net Fees and Commissions -20 -22.7 n.s. -24 -19.9 Net Trading Income 205 n.s. n.s. -65 -89.1 Other Income & Expenses -16 n.s. n.s. -10 n.s. Gross Income 44 n.s. n.s. -300 -58.2 Operating Expenses -188 1.9 12.6 -355 -3.2 Operating Income -144 -75.7 -71.9 -654 -39.6 Impairment on Financial Assets 0 n.s. -79.5 1 n.s. Provisions and Other Gains and Losses 12 36.5 -67.4 48 n.s. Income Before Tax -132 -77.4 -72.2 -606 -43.7 Income Tax -78 n.s. n.s. 51 100.6 Non-controlling Interest 2 -84.9 n.s. -2 n.s. Net Attributable Profit -207 -60.4 -40.7 -557 -46.4 PROFIT & LOSS (€M) Corporate Center - Profit & Loss

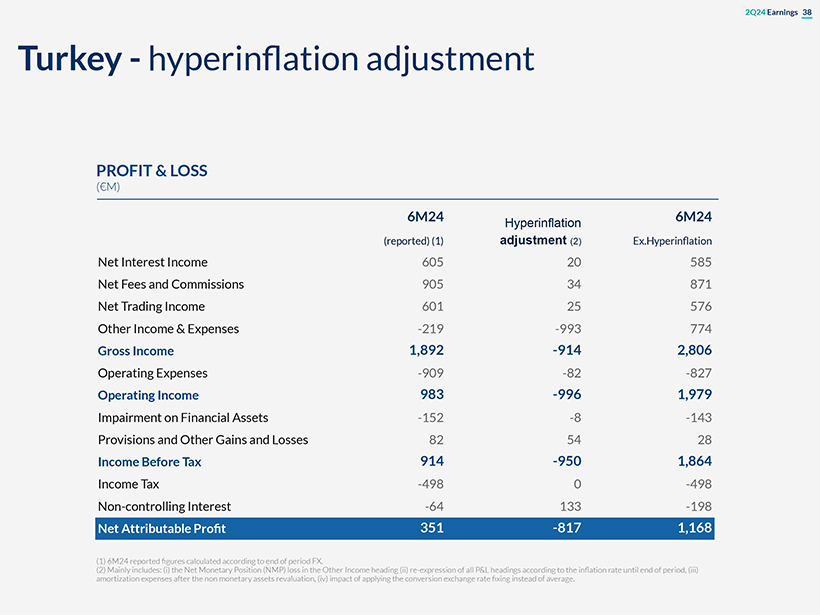

2Q24 Earnings 38 (1) 6M24 reported figures calculated according to end of period FX. (2) Mainly includes: (i) the Net Monetary Position (NMP) loss in the Other Income heading (ii) re-expression of all P&L headings according to the inflation rate until end of period, (iii) amortization expenses after the non monetary assets revaluation, (iv) impact of applying the conversion exchange rate fixing instead of average. PROFIT & LOSS (€M) Turkey - hyperinflation adjustment 6M24 Hyperinflation adjustment (2) 6M24 (reported) (1) Ex.Hyperinflation Net Interest Income 605 20 585 Net Fees and Commissions 905 34 871 Net Trading Income 601 25 576 Other Income & Expenses -219 -993 774 Gross Income 1,892 -914 2,806 Operating Expenses -909 -82 -827 Operating Income 983 -996 1,979 Impairment on Financial Assets -152 -8 -143 Provisions and Other Gains and Losses 82 54 28 Income Before Tax 914 -950 1,864 Income Tax -498 0 -498 Non-controlling Interest -64 133 -198 Net Attributable Profit 351 -817 1,168

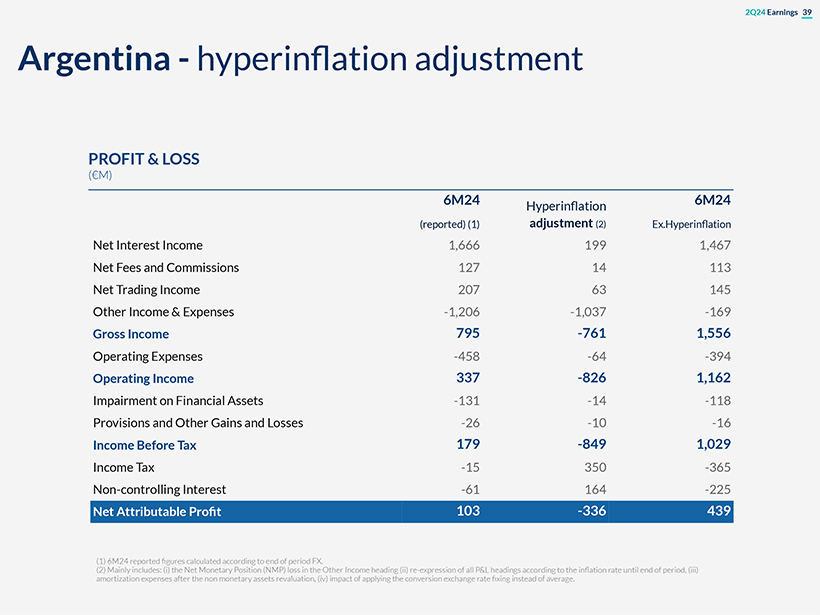

2Q24 Earnings 39 PROFIT & LOSS (€M) Argentina - hyperinflation adjustment 6M24 Hyperinflation adjustment (2) 6M24 (reported) (1) Ex.Hyperinflation Net Interest Income 1,666 199 1,467 Net Fees and Commissions 127 14 113 Net Trading Income 207 63 145 Other Income & Expenses -1,206 -1,037 -169 Gross Income 795 -761 1,556 Operating Expenses -458 -64 -394 Operating Income 337 -826 1,162 Impairment on Financial Assets -131 -14 -118 Provisions and Other Gains and Losses -26 -10 -16 Income Before Tax 179 -849 1,029 Income Tax -15 350 -365 Non-controlling Interest -61 164 -225 Net Attributable Profit 103 -336 439 (1) 6M24 reported figures calculated according to end of period FX. (2) Mainly includes: (i) the Net Monetary Position (NMP) loss in the Other Income heading (ii) re-expression of all P&L headings according to the inflation rate until end of period, (iii) amortization expenses after the non monetary assets revaluation, (iv) impact of applying the conversion exchange rate fixing instead of average.

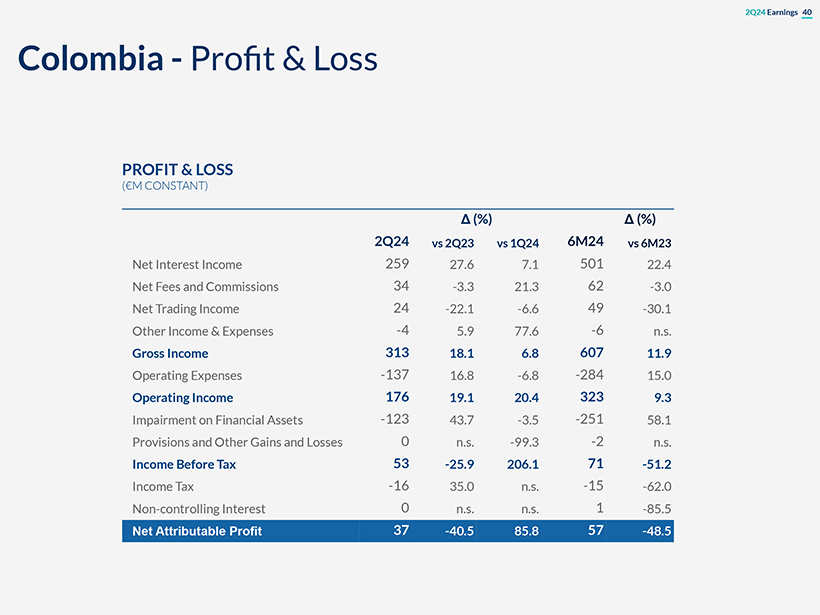

2Q24 Earnings 40 (%) (%) 2Q24 vs 2Q23 vs 1Q24 6M24 vs 6M23 Net Interest Income 259 27.6 7.1 501 22.4 Net Fees and Commissions 34 -3.3 21.3 62 -3.0 Net Trading Income 24 -22.1 -6.6 49 -30.1 Other Income & Expenses -4 5.9 77.6 -6 n.s. Gross Income 313 18.1 6.8 607 11.9 Operating Expenses -137 16.8 -6.8 -284 15.0 Operating Income 176 19.1 20.4 323 9.3 Impairment on Financial Assets -123 43.7 -3.5 -251 58.1 Provisions and Other Gains and Losses 0 n.s. -99.3 -2 n.s. Income Before Tax 53 -25.9 206.1 71 -51.2 Income Tax -16 35.0 n.s. -15 -62.0 Non-controlling Interest 0 n.s. n.s. 1 -85.5 Net Attributable Profit 37 -40.5 85.8 57 -48.5 PROFIT & LOSS (€M CONSTANT) Colombia - Profit & Loss

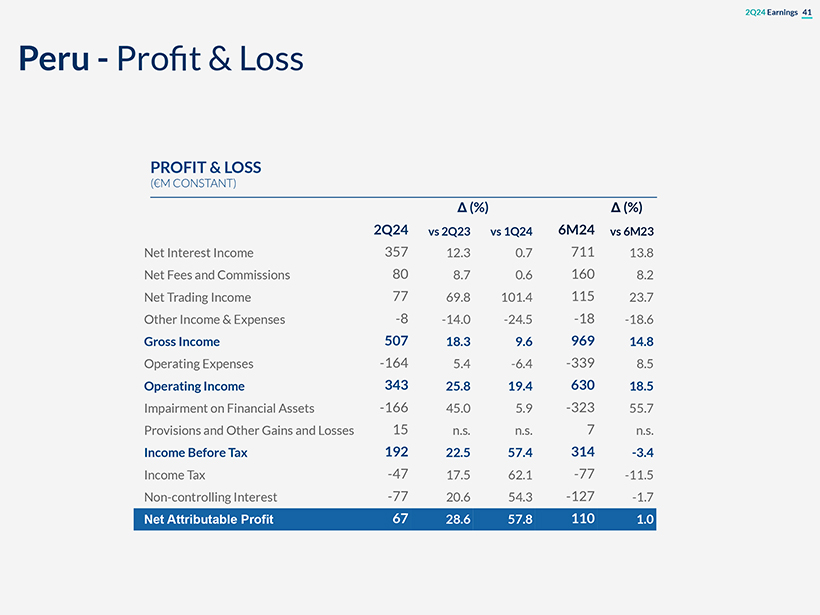

2Q24 Earnings 41 Peru - Profit & Loss PROFIT & LOSS (€M CONSTANT) (%) (%) 2Q24 vs 2Q23 vs 1Q24 6M24 vs 6M23 Net Interest Income 357 12.3 0.7 711 13.8 Net Fees and Commissions 80 8.7 0.6 160 8.2 Net Trading Income 77 69.8 101.4 115 23.7 Other Income & Expenses -8 -14.0 -24.5 -18 -18.6 Gross Income 507 18.3 9.6 969 14.8 Operating Expenses -164 5.4 -6.4 -339 8.5 Operating Income 343 25.8 19.4 630 18.5 Impairment on Financial Assets -166 45.0 5.9 -323 55.7 Provisions and Other Gains and Losses 15 n.s. n.s. 7 n.s. Income Before Tax 192 22.5 57.4 314 -3.4 Income Tax -47 17.5 62.1 -77 -11.5 Non-controlling Interest -77 20.6 54.3 -127 -1.7 Net Attributable Profit 67 28.6 57.8 110 1.0

BBVA 2Q24 Earnings 42 04 Customer Spread by country

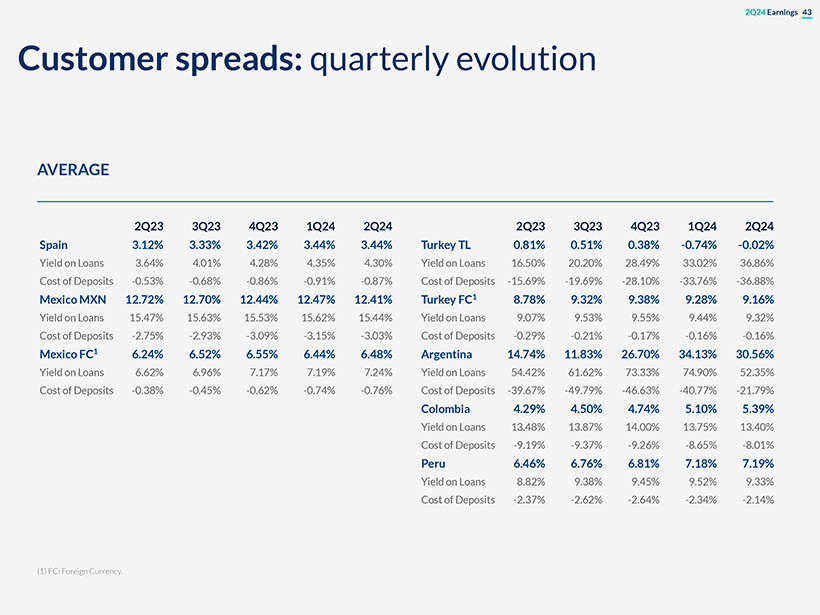

2Q24 Earnings 43 Customer spreads: quarterly evolution AVERAGE 2Q23 3Q23 4Q23 1Q24 2Q24 Spain 3.12% 3.33% 3.42% 3.44% 3.44% Yield on Loans 3.64% 4.01% 4.28% 4.35% 4.30% Cost of Deposits -0.53% -0.68% -0.86% -0.91% -0.87% Mexico MXN 12.72% 12.70% 12.44% 12.47% 12.41% Yield on Loans 15.47% 15.63% 15.53% 15.62% 15.44% Cost of Deposits -2.75% -2.93% -3.09% -3.15% -3.03% Mexico FC1 6.24% 6.52% 6.55% 6.44% 6.48% Yield on Loans 6.62% 6.96% 7.17% 7.19% 7.24% Cost of Deposits -0.38% -0.45% -0.62% -0.74% -0.76% 2Q23 3Q23 4Q23 1Q24 2Q24 Turkey TL 0.81% 0.51% 0.38% -0.74% -0.02% Yield on Loans 16.50% 20.20% 28.49% 33.02% 36.86% Cost of Deposits -15.69% -19.69% -28.10% -33.76% -36.88% Turkey FC1 8.78% 9.32% 9.38% 9.28% 9.16% Yield on Loans 9.07% 9.53% 9.55% 9.44% 9.32% Cost of Deposits -0.29% -0.21% -0.17% -0.16% -0.16% Argentina 14.74% 11.83% 26.70% 34.13% 30.56% Yield on Loans 54.42% 61.62% 73.33% 74.90% 52.35% Cost of Deposits -39.67% -49.79% -46.63% -40.77% -21.79% Colombia 4.29% 4.50% 4.74% 5.10% 5.39% Yield on Loans 13.48% 13.87% 14.00% 13.75% 13.40% Cost of Deposits -9.19% -9.37% -9.26% -8.65% -8.01% Peru 6.46% 6.76% 6.81% 7.18% 7.19% Yield on Loans 8.82% 9.38% 9.45% 9.52% 9.33% Cost of Deposits -2.37% -2.62% -2.64% -2.34% -2.14% (1) FC: Foreign Currency.

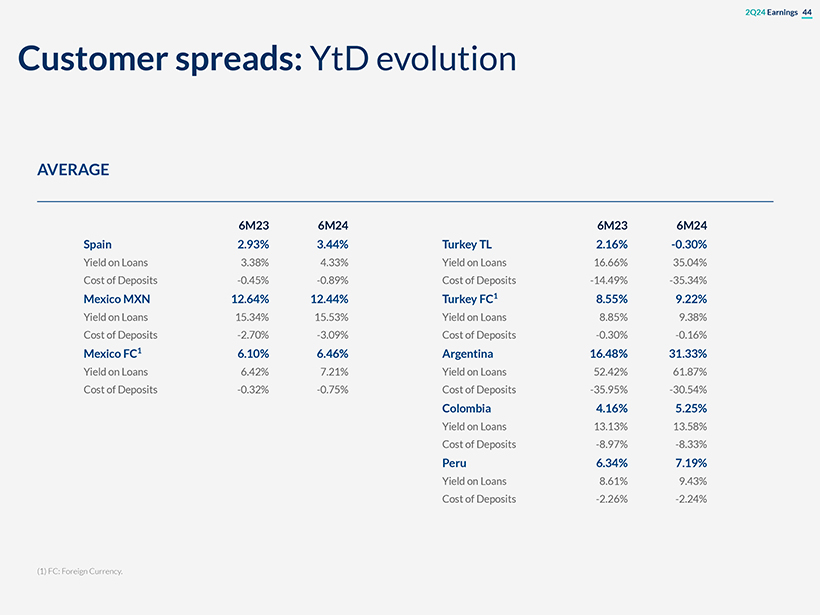

2Q24 Earnings 44 Customer spreads: YtD evolution AVERAGE 6M23 6M24 Spain 2.93% 3.44% Yield on Loans 3.38% 4.33% Cost of Deposits -0.45% -0.89% Mexico MXN 12.64% 12.44% Yield on Loans 15.34% 15.53% Cost of Deposits -2.70% -3.09% Mexico FC1 6.10% 6.46% Yield on Loans 6.42% 7.21% Cost of Deposits -0.32% -0.75% 6M23 6M24 Turkey TL 2.16% -0.30% Yield on Loans 16.66% 35.04% Cost of Deposits -14.49% -35.34% Turkey FC1 8.55% 9.22% Yield on Loans 8.85% 9.38% Cost of Deposits -0.30% -0.16% Argentina 16.48% 31.33% Yield on Loans 52.42% 61.87% Cost of Deposits -35.95% -30.54% Colombia 4.16% 5.25% Yield on Loans 13.13% 13.58% Cost of Deposits -8.97% -8.33% Peru 6.34% 7.19% Yield on Loans 8.61% 9.43% Cost of Deposits -2.26% -2.24% (1) FC: Foreign Currency.

BBVA 2Q24 Earnings 45 05 Stages breakdown by business areas

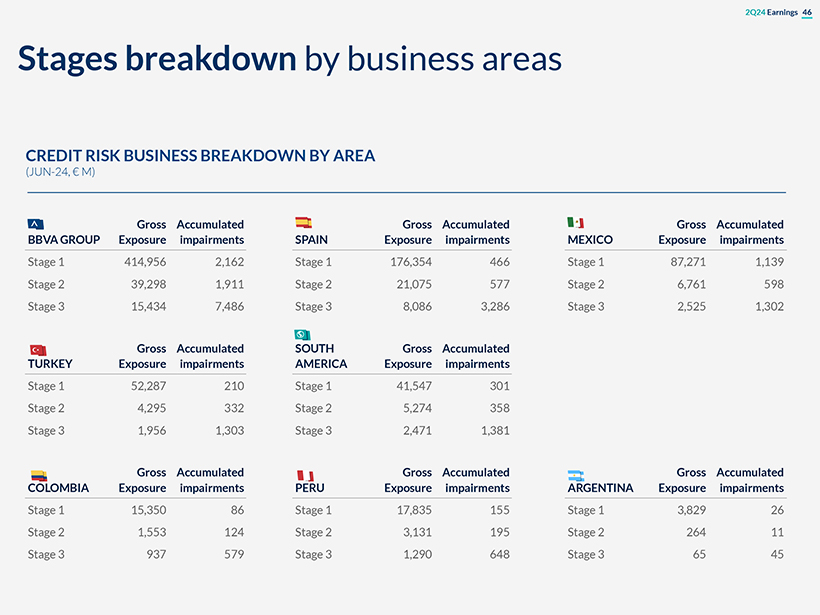

2Q24 Earnings 46 Stages breakdown by business areas CREDIT RISK BUSINESS BREAKDOWN BY AREA (JUN-24, € M) BBVA GROUP Gross Exposure Accumulated impairments Stage 1 414,956 2,162 Stage 2 39,298 1,911 Stage 3 15,434 7,486 TURKEY Gross Exposure Accumulated impairments Stage 1 52,287 210 Stage 2 4,295 332 Stage 3 1,956 1,303 COLOMBIA Gross Exposure Accumulated impairments Stage 1 15,350 86 Stage 2 1,553 124 Stage 3 937 579 SPAIN Gross Exposure Accumulated impairments Stage 1 176,354 466 Stage 2 21,075 577 Stage 3 8,086 3,286 SOUTH AMERICA Gross Exposure Accumulated impairments Stage 1 41,547 301 Stage 2 5,274 358 Stage 3 2,471 1,381 PERU Gross Exposure Accumulated impairments Stage 1 17,835 155 Stage 2 3,131 195 Stage 3 1,290 648 MEXICO Gross Exposure Accumulated impairments Stage 1 87,271 1,139 Stage 2 6,761 598 Stage 3 2,525 1,302 ARGENTINA Gross Exposure Accumulated impairments Stage 1 3,829 26 Stage 2 264 11 Stage 3 65 45

BBVA 2Q24 Earnings 47 06 ALCO Portfolio, NII Sensitivity and LCRs & NSFRs

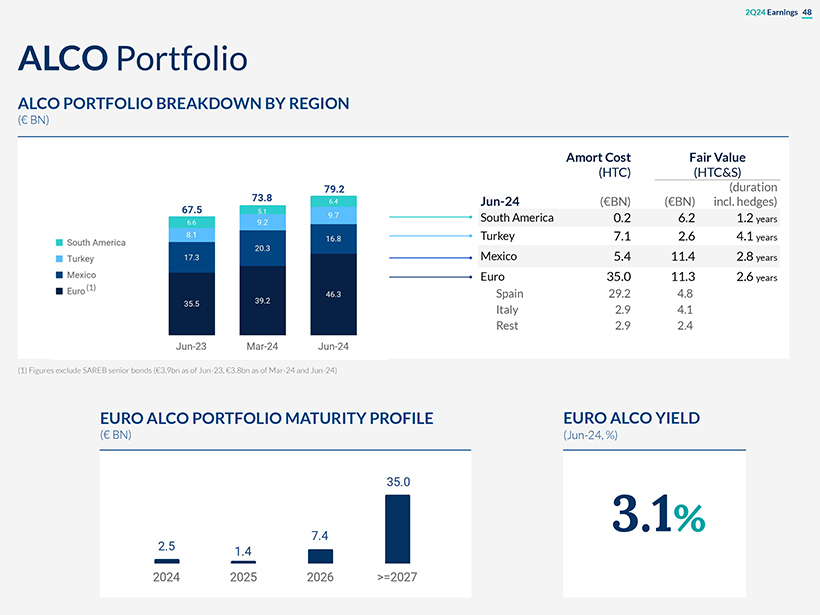

2Q24 Earnings 48 ALCO Portfolio ALCO PORTFOLIO BREAKDOWN BY REGION (€ BN) South America Turkey Mexico Euro (1) 67.5 6.6 8.1 17.3 35.5 Jun-23 73.8 5.1 9.2 20.3 39.2 Mar-24 79.2 6.4 9.7 16.8 46.3 Jun-24 Amort Cost (HTC) Fair Value (HTC&S) (duration Jun-24 (€BN) (€BN) incl. hedges) South America 0.2 6.2 1.2 years Turkey 7.1 2.6 4.1 years Mexico 5.4 11.4 2.8 years Euro 35.0 11.3 2.6 years Spain 29.2 4.8 Italy 2.9 4.1 Rest 2.9 2.4 (1) Figures exclude SAREB senior bonds (€3.9bn as of Jun-23, €3.8bn as of Mar-24 and Jun-24) EURO ALCO PORTFOLIO MATURITY PROFILE (€ BN) 2.5 2024 1.4 2025 7.4 2026 35.0 >=2027 EURO ALCO YIELD (Jun-24, %) 3.1%

2Q24 Earnings 49 NII sensitivity to interest rates movements ESTIMATED IMPACT ON NII IN THE NEXT 12 MONTHS TO PARALLEL INTEREST RATE MOVEMENTS (TO +100 BPS INTEREST RATES INCREASE, %) +4% +2.3% EURO BALANCE SHEET MEXICO Note: NII sensitivities to parallel interest rates movements as of May-24, using our dynamic internal model. Mexico NII sensitivity for +100 bps breakdown: MXN sensitivity c.+1.6%; USD sensitivity +0.7%.

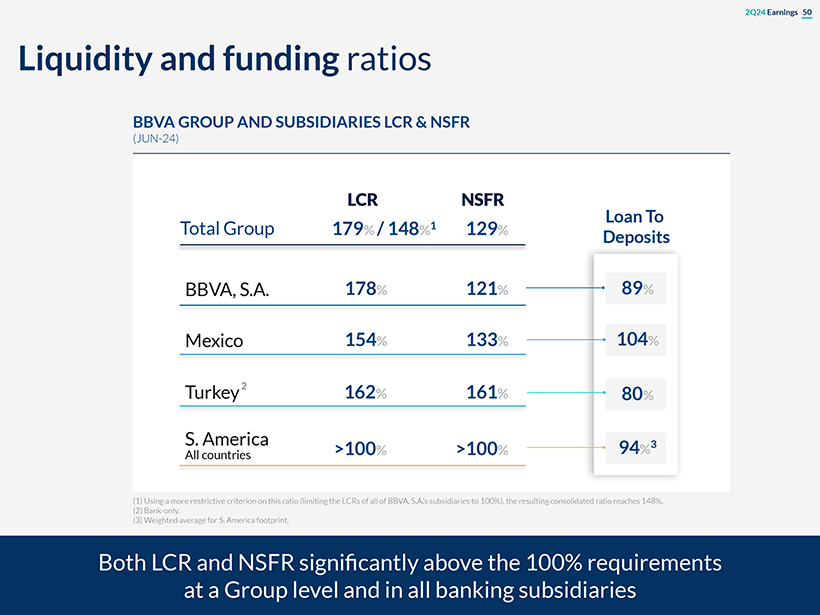

2Q24 Earnings 50 Liquidity and funding ratios BBVA GROUP AND SUBSIDIARIES LCR & NSFR (JUN-24) LCR NSFR Loan To Total Group 179% / 148%1 129% Deposits BBVA, S.A. 178% 121% 89% Mexico 154% 133% 104% Turkey 2 162% 161% 80% S. America >100% >100% 94%3 All countries (1) Using a more restrictive criterion on this ratio (limiting the LCRs of all of BBVA, S.A.’s subsidiaries to 100%), the resulting consolidated ratio reaches 148%. (2) Bank-only. (3) Weighted average for S. America footprint. Both LCR and NSFR significantly above the 100% requirements at a Group level and in all banking subsidiaries

BBVA 2Q24 Earnings 51 07 CET1 Sensitivity to market impacts

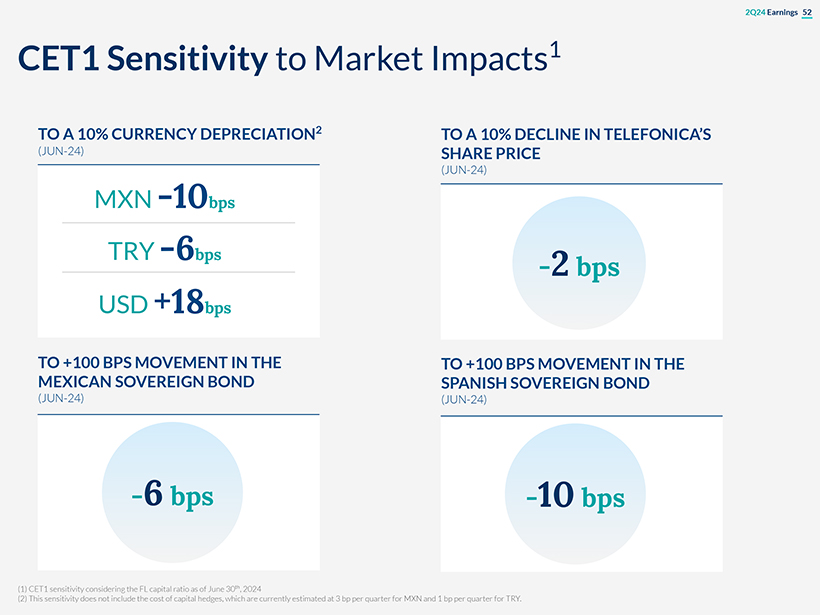

2Q24 Earnings 52 CET1 Sensitivity to Market Impacts1 TO A 10% CURRENCY DEPRECIATION2 (JUN-24) MXN -10bps TRY -6bps USD +18bps TO +100 BPS MOVEMENT IN THE MEXICAN SOVEREIGN BOND (JUN-24) -6 bps TO A 10% DECLINE IN TELEFONICA’S SHARE PRICE (JUN-24) -2 bps TO +100 BPS MOVEMENT IN THE SPANISH SOVEREIGN BOND (JUN-24) -10 bps (1) CET1 sensitivity considering the FL capital ratio as of June 30th, 2024 (2) This sensitivity does not include the cost of capital hedges, which are currently estimated at 3 bp per quarter for MXN and 1 bp per quarter for TRY.

BBVA 2Q24 Earnings 53 08 CET1 evolution YtD & RWAs by business area

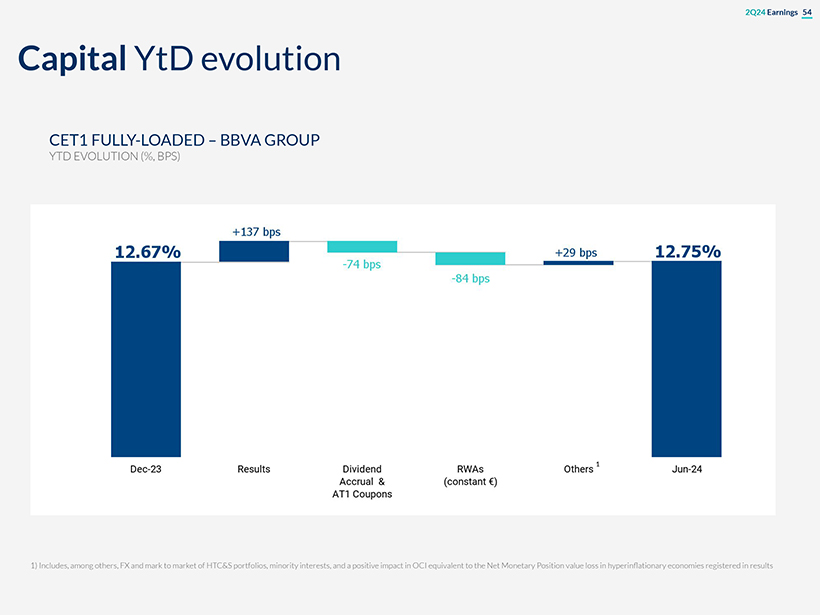

2Q24 Earnings 54 Capital YtD evolution CET1 FULLY-LOADED – BBVA GROUP YTD EVOLUTION (%, BPS) 12.67% + 137 bbps – 74 bps – 84 bps + 29 bps 12.75% Dec-23 Results Dividend Accrual & AT1 Coupons RWAs (constant €) Others1 Jun-24 1) Includes, among others, FX and mark to market of HTC&S portfolios, minority interests, and a positive impact in OCI equivalent to the Net Monetary Position value loss in hyperinflationary economies registered in results

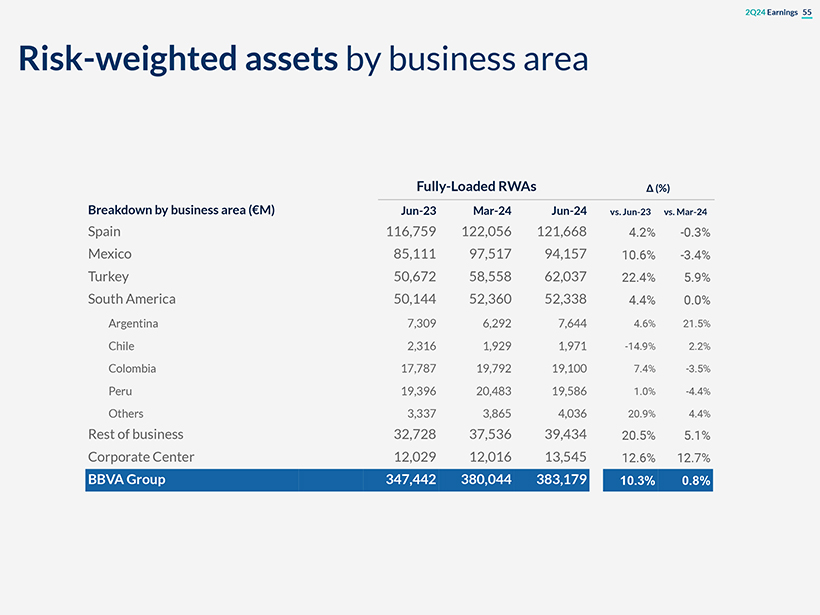

2Q24 Earnings 55 Risk-weighted assets by business area Fully-Loaded RWAs (%) Breakdown by business area (€M) Jun-23 Mar-24 Jun-24 vs. Jun-23 vs. Mar-24 Spain 116,759 122,056 121,668 4.2% -0.3% Mexico 85,111 97,517 94,157 10.6% -3.4% Turkey 50,672 58,558 62,037 22.4% 5.9% South America 50,144 52,360 52,338 4.4% 0.0% Argentina 7,309 6,292 7,644 4.6% 21.5% Chile 2,316 1,929 1,971 -14.9% 2.2% Colombia 17,787 19,792 19,100 7.4% -3.5% Peru 19,396 20,483 19,586 1.0% -4.4% Others 3,337 3,865 4,036 20.9% 4.4% Rest of business 32,728 37,536 39,434 20.5% 5.1% Corporate Center 12,029 12,016 13,545 12.6% 12.7% BBVA Group 347,442 380,044 383,179 10.3% 0.8%

BBVA 2Q24 Earnings 56 09 Book Value of the main subsidiaries

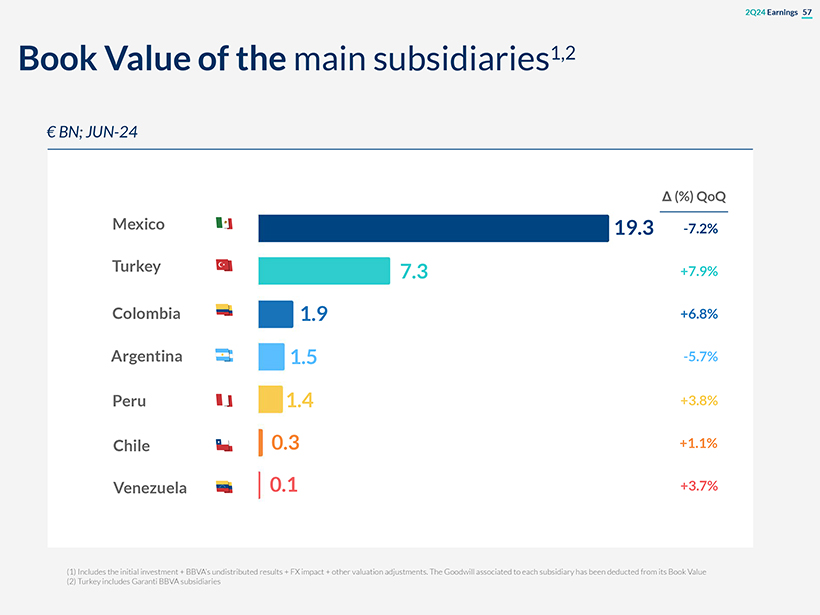

2Q24 Earnings 57 Book Value of the main subsidiaries1,2 € BN; JUN-24 Δ (%) QoQ Mexico 19.3 -7.2% Turkey 7.3 +7.9% Colombia 1.9 +6.8% Argentina 1.5 -5.7% Peru 1.4 +3.8% Chile 0.3 +1.1% Venezuela 0.1 +3.7% (1) Includes the initial investment + BBVA’s undistributed results + FX impact + other valuation adjustments. The Goodwill associated to each subsidiary has been deducted from its Book Value (2) Turkey includes Garanti BBVA subsidiaries

BBVA 2Q24 Earnings 58 10 TBV per share & dividends evolution

2Q24 Earnings 59 Shareholders’ return: TBV per share & dividends evolution TBV PER SHARE & DIVIDENDS (€ PER SHARE(1)) TBV Dividends +20% 7.84 8.29 0.16 (2) 8.13 8.62 0.16 (2) 8.46 9.17 0.55 (2) 8.62 9.39 0.55 (2) 8.84 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 (1) Total number of shares considered: 5,752m as of June-24; 5,751m as of March-24 post-SBB execution, 5,834m as of December-23, 5,835m as of September-23 and 5,963 in June-23. (2) October 2023 dividend per share paid (0.16€) and April 2024 dividend per share paid (0.39€)

BBVA 2Q24 Earnings 60 11 MREL

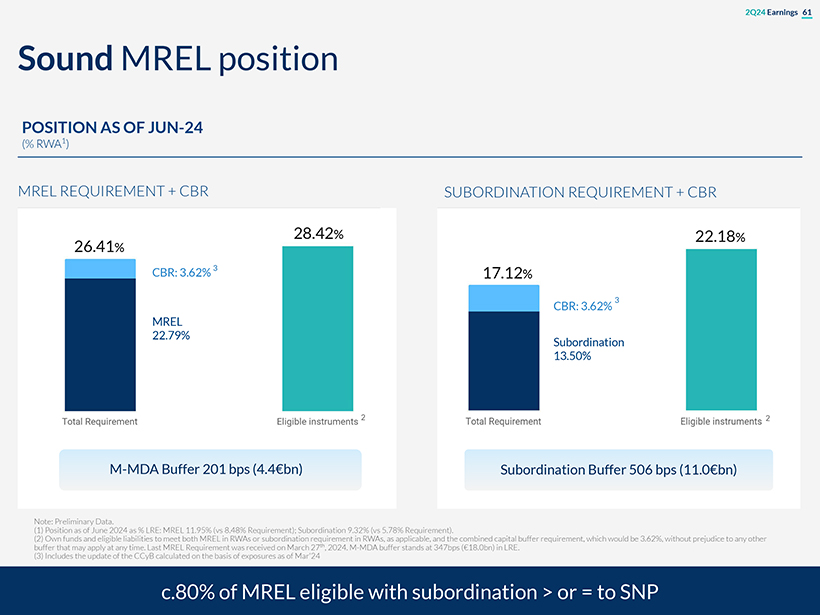

2Q24 Earnings 61 Sound MREL position POSITION AS OF JUN-24 (% RWA1) MREL REQUIREMENT + CBR SUBORDINATION REQUIREMENT + CBR 26.41% 28.42% CBR: 3.62%3 MREL 22.79% Total Requirement Eligible instruments 2 17.12% 22.18% CBR: 3.62% 3 Subordination 13.50% Total Requirement Eligible instruments 2 M-MDA Buffer 201 bps (4.4€bn) Subordination Buffer 506 bps (11.0€bn) Note: Preliminary Data. (1) Position as of June 2024 as % LRE: MREL 11.95% (vs 8.48% Requirement); Subordination 9.32% (vs 5.78% Requirement). (2) Own funds and eligible liabilities to meet both MREL in RWAs or subordination requirement in RWAs, as applicable, and the combined capital buffer requirement, which would be 3.62%, without prejudice to any other buffer that may apply at any time. Last MREL Requirement was received on March 27th, 2024. M-MDA buffer stands at 347bps (€18.0bn) in LRE. (3) Includes the update of the CCyB calculated on the basis of exposures as of Mar’24 c.80% of MREL eligible with subordination > or = to SNP

BBVA 2Q24 Earnings 62 12 Digital metrics

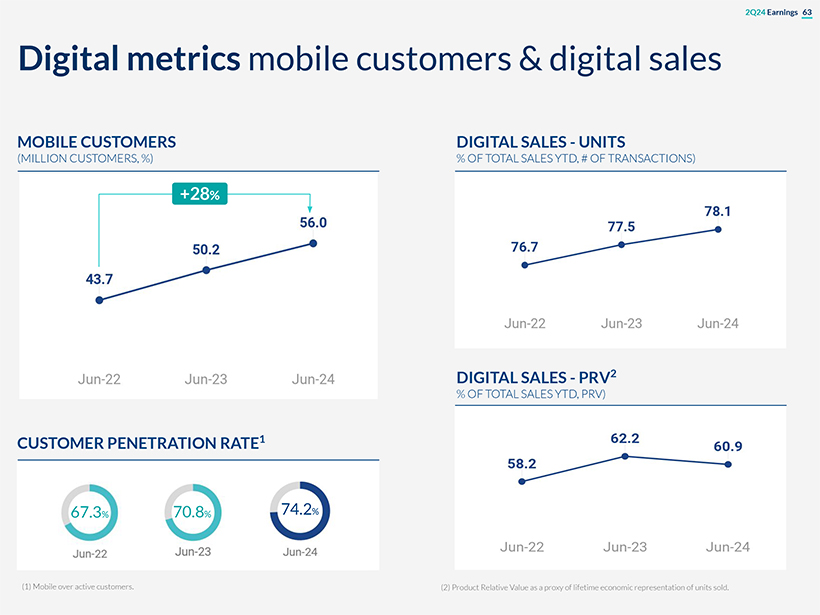

2Q24 Earnings 63 Digital metrics mobile customers & digital sales MOBILE CUSTOMERS (MILLION CUSTOMERS, %) +28% 43.7 50.2 56.0 Jun-22 Jun-23 Jun-24 CUSTOMER PENETRATION RATE1 67.3% 70.8% 74.2% Jun-22 Jun-23 Jun-24 DIGITAL SALES—UNITS % OF TOTAL SALES YTD, # OF TRANSACTIONS) 76.7 – 77.5 78.1 Jun-22 Jun-23 Jun-24 DIGITAL SALES—PRV2 % OF TOTAL SALES YTD, PRV) 58.2 62.2 60.9 Jun-22 Jun-23 Jun-24 (1) Mobile over active customers. (2) Product Relative Value as a proxy of lifetime economic representation of units sold.

BBVA

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Banco Bilbao Vizcaya Argentaria, S.A. | ||

| Date: July 31, 2024 | By: /s/ MªÁngeles Peláez Morón | |

| Name: MªÁngeles Peláez Morón | ||

| Title: Head of Accounting & Regulatory Reporting | ||