UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number: 1-10110

BANCO BILBAO VIZCAYA ARGENTARIA, S.A.

(Exact name of Registrant as specified in its charter)

BANK BILBAO VIZCAYA ARGENTARIA, S.A.

(Translation of Registrant’s name into English)

Kingdom of Spain

(Jurisdiction of incorporation or organization)

Plaza de San Nicolás, 4

48005 Bilbao

Spain

(Address of principal executive offices)

Ricardo Gómez Barredo

Paseo de la Castellana, 81

28046 Madrid

Spain

Telephone number +34 91 537 7000

Fax number +34 91 537 6766

(Name, Telephone, E-mail and /or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| | |

Title of Each Class | | Name of Each Exchange on which Registered |

American Depositary Shares, each representing the right to receive one ordinary share, par value €0.49 per share | | New York Stock Exchange |

| Ordinary shares, par value €0.49 per share | | New York Stock Exchange* |

Guarantee of Non-Cumulative Guaranteed Preferred Securities, Series C, liquidation preference $1,000 each, of BBVA International Preferred, S.A. Unipersonal | | New York Stock Exchange** |

| Guarantee of Guaranteed Fixed Rate Senior Notes due 2014 of BBVA U.S. Senior, S.A. Unipersonal | | New York Stock Exchange*** |

| Guarantee of Guaranteed Floating Rate Senior Notes due 2014 of BBVA U.S. Senior, S.A. Unipersonal | | New York Stock Exchange**** |

| Guarantee of Guaranteed Fixed Rate Senior Notes due 2015 of BBVA U.S. Senior, S.A. Unipersonal | | New York Stock Exchange*** |

| * | The ordinary shares are not listed for trading, but are listed only in connection with the registration of the American Depositary Shares, pursuant to requirements of the New York Stock Exchange. |

| ** | The guarantee is not listed for trading, but is listed only in connection with the registration of the corresponding Non-Cumulative Guaranteed Preferred Securities of BBVA International Preferred, S.A. Unipersonal (a wholly-owned subsidiary of Banco Bilbao Vizcaya Argentaria, S.A.). |

| *** | The guarantee is not listed for trading, but is listed only in connection with the registration of the corresponding Guaranteed Fixed Rate Senior Notes of BBVA U.S. Senior, S.A. Unipersonal (a wholly-owned subsidiary of Banco Bilbao Vizcaya Argentaria, S.A.). |

| **** | The guarantee is not listed for trading, but is listed only in connection with the registration of the corresponding Guaranteed Floating Rate Senior Notes of BBVA U.S. Senior, S.A. Unipersonal (a wholly-owned subsidiary of Banco Bilbao Vizcaya Argentaria, S.A.). |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

The number of outstanding shares of each class of stock of the Registrant as of December 31, 2013, was:

Ordinary shares, par value €0.49 per share—5,785,954,443

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No ¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check One):

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | |

| U.S. GAAP ¨ | | International Financial Reporting Standards as Issued by the International Accounting Standards Board x | | Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

BANCO BILBAO VIZCAYA ARGENTARIA, S.A.

TABLE OF CONTENTS

2

CERTAIN TERMS AND CONVENTIONS

The terms below are used as follows throughout this report:

| | • | | “BBVA”, “Bank”, the “Company”, the “Group” or the “BBVA Group” means Banco Bilbao Vizcaya Argentaria, S.A. and its consolidated subsidiaries unless otherwise indicated or the context otherwise requires. |

| | • | | “BBVA Bancomer” means Grupo Financiero BBVA Bancomer, S.A. de C.V. and its consolidated subsidiaries, unless otherwise indicated or the context otherwise requires. |

| | • | | “BBVA Compass” means BBVA Compass Bancshares, Inc. and its consolidated subsidiaries, unless otherwise indicated or the context otherwise requires. |

| | • | | “Consolidated Financial Statements” means our audited consolidated financial statements as of and for the years ended December 31, 2013, 2012 and 2011 prepared in accordance with the International Financial Reporting Standards adopted by the European Union (“EU-IFRS”) required to be applied under the Bank of Spain’s Circular 4/2004 and in compliance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS-IASB”). |

| | • | | “Latin America” refers to Mexico and the countries in which we operate in South America and Central America. |

First person personal pronouns used in this report, such as “we”, “us”, or “our”, mean BBVA, unless otherwise indicated or the context otherwise requires.

In this report, “$”, “U.S. dollars”, and “dollars” refer to United States Dollars and “€” and “euro” refer to Euro.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

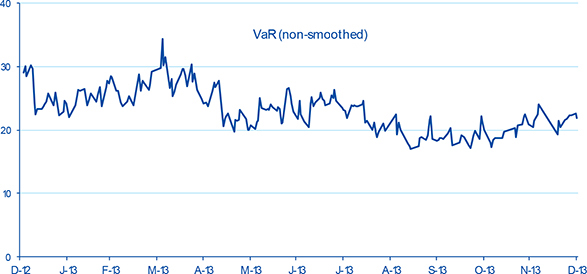

This Annual Report contains statements that constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) Section 21E of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may include words such as “believe”, “expect”, “estimate”, “project”, “anticipate”, “should”, “intend”, “probability”, “risk”, “VaR”, “target”, “goal”, “objective” and similar expressions or variations on such expressions and includes statements regarding future growth rates. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ materially from those in the forward-looking statements as a result of various factors. The accompanying information in this Annual Report, including, without limitation, the information under the items listed below, identifies important factors that could cause such differences:

| | • | | “Item 3. Key Information—Risk Factors”; |

| | • | | “Item 4. Information on the Company”; |

| | • | | “Item 5. Operating and Financial Review and Prospects”; and |

| | • | | “Item 11. Quantitative and Qualitative Disclosures About Market Risk”. |

Other important factors that could cause actual results to differ materially from those in forward-looking statements include, among others:

| | • | | general political, economic and business conditions in Spain, the European Union (“EU”), Latin America, the United States and other regions, countries or territories in which we operate; |

3

| | • | | changes in applicable laws and regulations, including increased capital and provision requirements; |

| | • | | the monetary, interest rate and other policies of central banks in Spain, the EU, the United States, Mexico and elsewhere; |

| | • | | changes or volatility in interest rates, foreign exchange rates (including the euro to U.S. dollar exchange rate), asset prices, equity markets, commodity prices, inflation or deflation; |

| | • | | ongoing market adjustments in the real estate sectors in Spain, Mexico and the United States; |

| | • | | the effects of competition in the markets in which we operate, which may be influenced by regulation or deregulation; |

| | • | | changes in consumer spending and savings habits, including changes in government policies which may influence investment decisions; |

| | • | | our ability to hedge certain risks economically; |

| | • | | downgrades in our credit ratings, including as a result of a decline in the Kingdom of Spain’s credit ratings; |

| | • | | the success of our acquisitions divestitures, mergers and strategic alliances; |

| | • | | our success in managing the risks involved in the foregoing, which depends, among other things, on our ability to anticipate events that cannot be captured by the statistical models we use; and |

| | • | | force majeure and other events beyond our control. |

Readers are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date hereof. We undertake no obligation to release publicly the result of any revisions to these forward-looking statements which may be made to reflect events or circumstances after the date hereof, including, without limitation, changes in our business or acquisition strategy or planned capital expenditures, or to reflect the occurrence of unanticipated events.

PRESENTATION OF FINANCIAL INFORMATION

Accounting Principles

Under Regulation (EC) no. 1606/2002 of the European Parliament and of the Council of July 19, 2002, all companies governed by the law of an EU Member State and whose securities are admitted to trading on a regulated market of any Member State must prepare their consolidated financial statements for the years beginning on or after January 1, 2005 in conformity with EU-IFRS. The Bank of Spain issued Circular 4/2004 of December 22, 2004 on Public and Confidential Financial Reporting Rules and Formats (as amended or supplemented from time to time, “Circular 4/2004”), which requires Spanish credit institutions to adapt their accounting system to the principles derived from the adoption by the European Union of EU-IFRS.

Differences between EU-IFRS required to be applied under the Bank of Spain’s Circular 4/2004 and IFRS-IASB are not material for the three years ended December 31, 2013. Accordingly, the Consolidated Financial Statements included in this Annual Report have been prepared in accordance with EU-IFRS required to be applied under the Bank of Spain’s Circular 4/2004 and in compliance with IFRS-IASB.

The financial information as of and for the years ended December 31, 2012, 2011, 2010 and 2009 may differ from previously reported financial information as of such dates and for such periods in our respective annual reports for certain prior years, mainly as a result of the implementation of changes in the accounting standards set out in IFRS 10 and 11 that came into force in 2013.

4

Statistical and Financial Information

The following principles should be noted in reviewing the statistical and financial information contained herein:

| | • | | Average balances, when used, are based on the beginning and the month-end balances during each year. We do not believe that such monthly averages present trends that are materially different from those that would be presented by daily averages. |

| | • | | The book value of BBVA’s ordinary shares held by its consolidated subsidiaries has been deducted from equity. |

| | • | | Unless otherwise stated, any reference to loans refers to both loans and advances. |

| | • | | Interest income figures include interest income on non-accruing loans to the extent that cash payments have been received in the period in which they are due. |

| | • | | Financial information with respect to subsidiaries may not reflect consolidation adjustments. |

| | • | | Certain numerical information in this Annual Report may not sum due to rounding. In addition, information regarding period-to-period changes is based on numbers which have not been rounded. |

PART I

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not Applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not Applicable.

| A. | Selected Consolidated Financial Data |

The historical financial information set forth below for the years ended December 31, 2013, 2012 and 2011 has been selected from, and should be read together with, the Consolidated Financial Statements included herein. The audited financial statements for 2010 and 2009 are not included in this document, and they instead can be found in the respective annual reports on Form 20-F for certain prior years previously filed by us.

5

For information concerning the preparation and presentation of the financial information contained herein, see “Presentation of Financial Information”.

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| | | (In Millions of Euros, Except Per Share/ADS Data (In Euros)) | |

Consolidated Statement of Income Data | | | | | | | | | | | | | | | | | | | | |

Interest and similar income | | | 23,512 | | | | 24,815 | | | | 23,229 | | | | 21,130 | | | | 23,773 | |

Interest and similar expenses | | | (9,612 | ) | | | (10,341 | ) | | | (10,505 | ) | | | (7,814 | ) | | | (9,893 | ) |

Net interest income | | | 13,900 | | | | 14,474 | | | | 12,724 | | | | 13,316 | | | | 13,880 | |

Dividend income | | | 235 | | | | 390 | | | | 562 | | | | 529 | | | | 443 | |

Share of profit or loss of entities accounted for using the equity method | | | 694 | | | | 1,039 | | | | 787 | | | | 331 | | | | 118 | |

Fee and commission income | | | 5,478 | | | | 5,290 | | | | 4,874 | | | | 4,864 | | | | 4,841 | |

Fee and commission expenses | | | (1,228 | ) | | | (1,134 | ) | | | (980 | ) | | | (831 | ) | | | (790 | ) |

Net gains (losses) on financial assets and liabilities | | | 1,608 | | | | 1,636 | | | | 1,070 | | | | 1,372 | | | | 821 | |

Net exchange differences | | | 903 | | | | 69 | | | | 410 | | | | 455 | | | | 651 | |

Other operating income | | | 4,995 | | | | 4,765 | | | | 4,212 | | | | 3,537 | | | | 3,395 | |

Other operating expenses | | | (5,627 | ) | | | (4,705 | ) | | | (4,019 | ) | | | (3,240 | ) | | | (3,145 | ) |

Administration costs | | | (9,701 | ) | | | (9,396 | ) | | | (8,634 | ) | | | (8,007 | ) | | | (7,486 | ) |

Depreciation and amortization | | | (1,095 | ) | | | (978 | ) | | | (810 | ) | | | (754 | ) | | | (690 | ) |

Provisions (net) | | | (609 | ) | | | (641 | ) | | | (503 | ) | | | (475 | ) | | | (446 | ) |

| | | | | |

Impairment losses on financial assets (net) | | | (5,612 | ) | | | (7,859 | ) | | | (4,185 | ) | | | (4,718 | ) | | | (5,473 | ) |

Impairment losses on other assets (net) | | | (467 | ) | | | (1,123 | ) | | | (1,883 | ) | | | (489 | ) | | | (1,619 | ) |

Gains (losses) on derecognized assets not classified as non-current assets held for sale | | | (1,915 | ) | | | 3 | | | | 44 | | | | 41 | | | | 20 | |

Negative goodwill | | | — | | | | 376 | | | | — | | | | 1 | | | | 99 | |

Gains (losses) in non-current assets held for sale not classified as discontinued operations | | | (399 | ) | | | (624 | ) | | | (271 | ) | | | 127 | | | | 859 | |

Operating profit before tax | | | 1,160 | | | | 1,582 | | | | 3,398 | | | | 6,059 | | | | 5,478 | |

Income tax | | | (46 | ) | | | 352 | | | | (158 | ) | | | (1,345 | ) | | | (1,085 | ) |

Profit from continuing operations | | | 1,114 | | | | 1,934 | | | | 3,240 | | | | 4,714 | | | | 4,394 | |

| | | | | |

Profit from discontinued operations (net) (3) | | | 1,866 | | | | 393 | | | | 245 | | | | 281 | | | | 201 | |

Profit | | | 2,981 | | | | 2,327 | | | | 3,485 | | | | 4,995 | | | | 4,595 | |

Profit attributable to parent company | | | 2,228 | | | | 1,676 | | | | 3,004 | | | | 4,606 | | | | 4,210 | |

Profit attributable to non-controlling interests | | | 753 | | | | 651 | | | | 481 | | | | 389 | | | | 385 | |

| | | | | |

Per share/ADS (1) Data | | | | | | | | | | | | | | | | | | | | |

Numbers of shares outstanding (at period end) | | | 5,785,954,443 | | | | 5,448,849,545 | | | | 4,903,207,003 | | | | 4,490,908,285 | | | | 3,747,969,121 | |

Profit attributable to parent company (2) | | | 0.40 | | | | 0.32 | | | | 0.62 | | | | 1.10 | | | | 1.02 | |

Dividends declared | | | 0.100 | | | | 0.200 | | | | 0.200 | | | | 0.270 | | | | 0.420 | |

| (1) | Each American Depositary Share (“ADS”) represents the right to receive one ordinary share. |

| (2) | Calculated on the basis of the weighted average number of BBVA’s ordinary shares outstanding during the relevant period including the average number of estimated shares to be converted and, for comparative purposes, a correction factor to account for the capital increases carried out in November 2010, April 2011, October 2011, April 2012, October 2012, April 2013 and October 2013, and excluding the weighted average number of treasury shares during the period (5,692 million, 5,622 million, 5,093 million, 4,388 million and 4,259 million shares in 2013, 2012, 2011, 2010 and 2009, respectively). With respect to the years ended December 31, 2013, 2012 and 2011, see Note 5 to the Consolidated Financial Statements. |

| (3) | For 2013, includes the capital gains from the sale of Afore Bancomer in Mexico and the South America pension fund administrators, as well as the earnings posted by these companies up to the date of these sales. |

6

| | | | | | | | | | | | | | | | | | | | |

| | | As of and for Year Ended December 31, | |

| | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| | | (In Millions of Euros, Except Percentages) | |

Consolidated Balance Sheet Data | | | | | | | | | | | | | | | | | | | | |

Total assets | | | 582,575 | | | | 621,072 | | | | 582,838 | | | | 552,738 | | | | 535,065 | |

Common stock | | | 2,835 | | | | 2,670 | | | | 2,403 | | | | 2,201 | | | | 1,837 | |

Loans and receivables (net) | | | 350,945 | | | | 371,347 | | | | 369,916 | | | | 364,707 | | | | 346,117 | |

Customer deposits | | | 300,490 | | | | 282,795 | | | | 272,402 | | | | 275,789 | | | | 254,183 | |

Debt certificates and subordinated liabilities | | | 74,676 | | | | 98,070 | | | | 96,427 | | | | 102,599 | | | | 117,817 | |

Non-controlling interest | | | 2,371 | | | | 2,372 | | | | 1,893 | | | | 1,556 | | | | 1,463 | |

Total equity | | | 44,850 | | | | 43,802 | | | | 40,058 | | | | 37,475 | | | | 30,763 | |

Consolidated ratios | | | | | | | | | | | | | | | | | | | | |

Profitability ratios: | | | | | | | | | | | | | | | | | | | | |

Net interest margin(1) | | | 2.32 | % | | | 2.38 | % | | | 2.29 | % | | | 2.38 | % | | | 2.56 | % |

Return on average total assets(2) | | | 0.5 | % | | | 0.4 | % | | | 0.6 | % | | | 0.9 | % | | | 0.9 | % |

Return on average equity(3) | | | 5.0 | % | | | 4.0 | % | | | 8.0 | % | | | 15.8 | % | | | 16.0 | % |

Credit quality data | | | | | | | | | | | | | | | | | | | | |

Loan loss reserve(4) | | | 14,995 | | | | 14,159 | | | | 9,139 | | | | 9,473 | | | | 8,805 | |

Loan loss reserve as a percentage of total loans and receivables (net) | | | 4.27 | % | | | 3.81 | % | | | 2.47 | % | | | 2.60 | % | | | 2.54 | % |

Non-performing asset ratio (NPA ratio)(5) | | | 6.9 | % | | | 5.1 | % | | | 4.0 | % | | | 4.1 | % | | | 4.3 | % |

Impaired loans and advances to customers | | | 25,445 | | | | 19,960 | | | | 15,416 | | | | 15,361 | | | | 15,197 | |

Impaired contingent liabilities to customers(6) | | | 410 | | | | 312 | | | | 217 | | | | 324 | | | | 405 | |

| | | | | | | | | | | | | | | | | | | | |

| | | 25,855 | | | | 20,272 | | | | 15,633 | | | | 15,685 | | | | 15,602 | |

| | | | | | | | | | | | | | | | | | | | |

Loans and advances to customers | | | 338,557 | | | | 356,278 | | | | 351,634 | | | | 348,253 | | | | 332,162 | |

Contingent liabilities to customers | | | 36,183 | | | | 36,891 | | | | 37,126 | | | | 35,816 | | | | 32,614 | |

| | | | | | | | | | | | | | | | | | | | |

| | | 374,740 | | | | 393,169 | | | | 388,760 | | | | 384,069 | | | | 364,776 | |

| | | | | | | | | | | | | | | | | | | | |

| (1) | Represents net interest income as a percentage of average total assets. |

| (2) | Represents profit as a percentage of average total assets. |

| (3) | Represents profit attributable to parent company as a percentage of average equity, excluding “Non-controlling interest”. |

| (4) | Represents impairment losses of loans and receivables to credit institutions, loans and advances to customers and debt securities. See Note 13 to the Consolidated Financial Statements. |

| (5) | Represents the sum of impaired loans and advances to customers and impaired contingent liabilities to customers divided by the sum of loans and advances to customers and contingent liabilities to customers. |

| (6) | We include contingent liabilities in the calculation of our non-performing asset ratio (NPA ratio). We believe that impaired contingent liabilities should be included in the calculation of our NPA ratio where we have reason to know, as of the reporting date, that they are impaired. The credit risk associated with contingent liabilities (consisting mainly of financial guarantees provided to third-parties on behalf of our customers) is evaluated and provisioned according to the probability of default of our customers’ obligations. If impaired contingent liabilities were not included in the calculation of our NPA ratio, such ratio would generally be higher for the periods covered, amounting to approximately 7.5%, 5.6%, 4.4%, 4.4% and 4.6% as of December 31, 2013, 2012, 2011, 2010 and 2009, respectively. |

Exchange Rates

Spain’s currency is the euro. Unless otherwise indicated, the amounts that have been converted to euro in this Annual Report have been done so at the corresponding exchange rate published by the European Central Bank (“ECB”) on December 31 of the relevant year.

For convenience in the analysis of the information, the following tables describe, for the periods and dates indicated, information concerning the noon buying rate for euro, expressed in dollars per €1.00. The term “noon

7

buying rate” refers to the rate of exchange for euros, expressed in U.S. dollars per euro, in the City of New York for cable transfers payable in foreign currencies as certified by the Federal Reserve Bank of New York for customs purposes.

| | | | |

Year ended December 31 | | Average (1) | |

2009 | | | 1.3955 | |

2010 | | | 1.3216 | |

2011 | | | 1.4002 | |

2012 | | | 1.2908 | |

2013 | | | 1.3303 | |

2014 (through April, 25, 2014) | | | 1.3728 | |

| (1) | Calculated by using the average of the exchange rates on the last day of each month during the period. |

| | | | | | | | |

Month ended | | High | | | Low | |

September 30, 2013 | | | 1.3537 | | | | 1.3120 | |

October 31, 2013 | | | 1.3810 | | | | 1.3490 | |

November 30, 2013 | | | 1.3606 | | | | 1.3357 | |

December 31, 2013 | | | 1.3816 | | | | 1.3552 | |

January 31, 2014 | | | 1.3682 | | | | 1.3500 | |

February 28, 2014 | | | 1.3806 | | | | 1.3507 | |

March 31, 2014 | | | 1.3927 | | | | 1.3731 | |

April 30, 2014 (through April 25, 2014) | | | 1.3898 | | | | 1.3704 | |

The noon buying rate for euro from the Federal Reserve Bank of New York, expressed in dollars per €1.00, on April 25, 2014, was $1.3838.

As of December 31, 2013, approximately 40% of our assets and approximately 40% of our liabilities were denominated in currencies other than euro. See Note 2.2.16 to our Consolidated Financial Statements.

For a discussion of our foreign currency exposure, please see “Item 11. Quantitative and Qualitative Disclosures About Market Risk—Market Risk Management—Market Risk in Non-Trading Portfolio in 2013—Structural Risk Structural Currency Risk”.

| B. | Capitalization and Indebtedness |

Not Applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not Applicable.

Risks Relating to Us and Our Business

The Bank is subject to substantial regulation, and regulatory and governmental oversight. Adverse regulatory developments or changes in government policy could have a material adverse effect on its business, results of operations and financial condition

The financial services industry is among the most highly regulated industries in the world. The Bank’s operations are subject to ongoing regulation and associated regulatory risks, including the effects of changes in laws, regulations, policies and interpretations, in Spain, the European Union, the United States and the other markets where it operates. This is particularly the case in the current market environment, which is witnessing increased

8

levels of government and regulatory intervention in the banking sector which the Bank expects to continue for the foreseeable future. As a result, we may further be subject to an increasing incidence or amount of liability or regulatory sanctions and may be required to make greater expenditures and devote additional resources to address potential liability.

The regulations which most significantly affect the Bank, or which could most significantly affect the Bank in the future, include regulations relating to capital and provisions requirements, which have become increasingly more strict in the past three years, steps taken towards achieving a fiscal and banking union in the European Union, and regulatory reforms in the United States. These risks are discussed in further detail below.

In addition, the Bank is subject to substantial regulation relating to other matters such as liquidity. The Bank considers that future liquidity standards could require maintaining a greater proportion of its assets in highly-liquid but lower-yielding financial instruments, which would negatively affect the Bank’s net interest margin.

The Bank is also subject to other regulations, such as those related to anti-money laundering, privacy protection and transparency and fairness in customer relations.

Moreover, the Bank’s regulators, as part of their supervisory function, periodically review the Bank’s allowance for loan losses. Such regulators may require the Bank to increase its allowance for loan losses or to recognize further losses. Any such additional provisions for loan losses, as required by these regulatory agencies, whose views may differ from those of the Bank’s management, could have an adverse effect on the Bank’s earnings and financial condition.

Recent Spanish regulatory developments include (i) Royal Decree-Law 2/2012, of February 3 and Law 8/2012 of October 30, which increased coverage requirements to be met by December 31, 2012 for performing and non-performing real estate assets, (ii) Law 9/2012, of November 14 (“Law 9/2012”) which established a new regime on restructuring and resolution of credit institutions and a statutory loss absorbency regime applicable within the framework of restructuring and resolution processes, which was based on the June 2012 draft of the proposed EU Recovery and Resolution Directive (“RRD”), and (iii) Royal Decree-Law 14/2013, of November 29 (“RD-L 14/2013”) which partially incorporated Capital Requirements Directive IV (“CRD IV”) into Spanish law. In addition, on February 5, 2014 a new Bank of Spain Circular 2/2014, of January 31, was published. By means of this new circular, the Bank of Spain has made certain regulatory determinations under the Capital Requirements Regulation (which is directly applicable in EU member states, without the need to be implemented by national laws) (“CRR”) pursuant to the delegation contained in RD-L 14/2013 including, among other things, certain rules concerning the applicable transitional regime on capital requirements and the treatment of deductions and. establishes a 4.5% common equity tier 1 requirement and a 6% tier 1 capital requirement.

Adverse regulatory developments or changes in government policy relating to any of the foregoing or other matters could have a material adverse effect on the Bank’s business, results of operations and financial condition. Furthermore, regulatory fragmentation, with some countries implementing new and more stringent standards or regulations, could adversely affect the Bank’s ability to compete with financial institutions based in other jurisdictions which do not need to comply with such new standards or regulations.

Capital requirements

Increasingly onerous capital requirements constitute one of the Bank’s main regulatory concerns.

As a Spanish financial institution, Banco Bilbao Vizcaya Argentaria, S.A. is subject to CRD IV, through which the European Union has implemented the Basel III capital standards and which are in the process of being phased in until January 1, 2019. The CRR entered into force on January 1, 2014 and the CRD IV Directive has already been partially implemented in Spain as of January 1, 2014 by RD-L 14/2013. RD-L 14/2013 has repealed, with effect from January 1, 2014, any Spanish regulatory provisions that may be incompatible with CRR.

Despite the CRD IV/Basel III framework setting minimum transnational levels of regulatory capital and a measured phase-in, many national authorities have started a race to the top for capital by gold-plating both requirements and the associated implementation calendars.

9

For example, in the last three years the Bank of Spain and the European Banking Authority (the “EBA”) have imposed new capital requirements in advance of the entering into force of CRD IV. These measures have included Bank of Spain Circular 3/2008 (“Circular 3/2008”) of May 22, on the calculation and control of minimum capital requirements, which was amended by Bank of Spain Circular 4/2011 (“Circular 4/2011”) and which implemented Capital Requirements Directive III in Spain. In addition, some of the requirements of Basel III were already implemented by the Spanish Government in 2011 with Royal Decree-Law 2/2011 (“RD-L 2/2011”) of February 18 (as amended by Law 9/2012) which established a new minimum requirement in terms of capital on risk-weighted assets (“Capital Principal”) and required such capital to be greater than 9% from January 1, 2013. RD-L 14/2013 repealed, with effect from January 1, 2014, Title I of Royal Decree-Law 2/2011, which imposed the minimum Capital Principal requirement with respect to credit institutions. Despite such repeal, the Bank of Spain has been given powers to prohibit or restrict, until December 31, 2014, any distributions of Tier 1 Capital by credit institutions (including the Bank) which would have been comprised in the minimum Capital Principal requirements stipulated in RD-L 2/2011, provided such distributions, in aggregate terms, imply not fulfilling by up to 20% of the minimum Capital Principal legally required as at December 31, 2013, the Capital Principal requirement on a temporary basis and any credit institution making any such distribution would further risk non-compliance with additional capital requirements that could be imposed by the Bank of Spain.

Furthermore, following an evaluation of the capital levels of 71 financial institutions throughout Europe (including the Bank) based on data available as of September 30, 2011, the EBA issued a recommendation on December 8, 2011 pursuant to which, on an exceptional and temporary basis, financial institutions based in the EU should reach a new minimum Core Tier 1 ratio (9%) by June 30, 2012. This recommendation has been replaced by the EBA recommendation of July 22, 2013 on the preservation of Core Tier 1 capital during the transition to CRD IV implementation. This new recommendation provides for the maintenance of a nominal floor of capital denominated in the relevant reporting currency of Core Tier 1 capital corresponding to the amount of capital needed as at June 30, 2012 to meet the requirements of the above recommendation of December 8, 2011. Competent authorities may waive this requirement for institutions which maintain a minimum of 7% of common equity Tier 1 capital under CRD IV rules applied after the transitional period.

Finally, in order to complete the implementation of CRD IV initiated by RD-L 14/2013, the Spanish Ministry of Economy and Competitiveness has prepared and recently published a draft of a new comprehensive law on the supervision and solvency of financial institutions.

Additionally, the Mexican government introduced the Basel III capital standards in 2012 and the Basel III transposition in the United States will be effective in 2015. This lack of uniformity may lead to an uneven playing field and to competition distortions. Moreover, regulatory fragmentation, with some countries bringing forward the application of Basel III requirements or increasing such requirements, could adversely affect a bank with global operations such as the Bank and could undermine its profitability.

At its meeting of January 12, 2014, the oversight body of the Basel Committee endorsed the definition of the leverage ratio set forth in CRD IV, to promote consistent disclosure, starting on January 1, 2015. There will be a mandatory minimum capital requirement on January 1, 2018, with an initial minimum leverage ratio of 3% that can be raised after calibration.

There can be no assurance that the implementation of these new standards or recommendations will not adversely affect the Bank’s ability to pay dividends, or require it to issue additional securities that qualify as regulatory capital, to liquidate assets, to curtail business or to take any other actions, any of which may have adverse effects on the Bank’s business, financial condition and results of operations. Furthermore, increased capital requirements may negatively affect the Bank’s return on equity and other financial performance indicators.

Tax treatment of deferred tax assets following the implementation of CRD IV

In addition to introducing new capital requirements, CRD IV provides that the deferred tax assets (“DTAs”) of a financial institution must be deducted from its regulatory capital (specifically from its core capital or CET1 Capital) for prudential reasons, as there is generally no guarantee that DTAs will retain their value in the event of the institution facing difficulties.

10

This new deduction introduced by CRD IV has a significant impact on Spanish banks due to the particularly restrictive nature of certain aspects of Spanish tax law. For example, in some EU countries when a bank reports a loss the tax authorities refund a portion of taxes paid in previous years but in Spain the bank must earn profits in subsequent years in order for this set-off to take place. Additionally, Spanish tax law does not recognize as tax-deductible certain amounts recorded as costs in the accounts of a bank, unlike the tax legislation of other EU countries.

Due to these differences and the greater impact of the requirements of CRD IV with respect to DTAs, the Spanish regulator implemented certain amendments to the Spanish Law on Corporate Income Tax (Royal Decree Law 4/2004 of March 5, as amended) through RD-L 14/2013. This provides for certain DTAs to be treated as a direct claim against the tax authorities if a Spanish bank is unable to reverse those temporary differences within 18 years or if it is liquidated, becomes insolvent or incurs accounting losses. This amendment will allow a Spanish bank not to deduct such DTAs from its regulatory capital.

However, there can be no assurance that the tax amendments implemented by RD-L 14/2013 will not be challenged by the European Commission, that the final interpretation of these amendments will not change (as further clarifying regulation is expected during 2014) and that Spanish banks will ultimately be allowed to maintain certain DTAs as regulatory capital. If this regulation is challenged, this may negatively affect the Bank’s regulatory capital and therefore its ability to pay dividends or require it to issue additional securities that qualify as regulatory capital, to liquidate assets, to curtail business or to take any other actions, any of which may have a material adverse effect on the Bank’s business, financial condition and results of operations.

Contributions for assisting in the restructuring of the Spanish banking sector

Royal Decree-Law 6/2013 of March 22, on protection for holders of certain savings and investment products and other financial measures, included a requirement for banks, including the Bank, to make an exceptional one-off contribution to the Deposit Guarantee Fund (Fondo de Garantía de Depósitos) in addition to the annual contribution to be made by member institutions, equal to €3.00 per each €1,000 of deposits held as of December 31, 2012. The purpose of such contribution was for the Deposit Guarantee Fund to be able to purchase at market prices the unlisted shares of certain Spanish financial institutions involved in restructuring or resolution processes under Law 9/2012 (none of which are part of the Group). There can be no assurance that additional funding requirements will not be imposed by the Spanish authorities for assisting in the restructuring of the Spanish banking sector.

Steps taken towards achieving an EU fiscal and banking union

In June 2012, a number of agreements were reached to reinforce the monetary union, including the definition of a broad roadmap towards a single banking and fiscal union. While support for a banking union in Europe exists and significant advances have been made in terms of the development of a single-rule book through CRD IV, there is ongoing debate on the extent and pace of integration. On September 13, 2012, the European Parliament approved a proposal for the creation of the Single Supervisory Mechanism, so that 128 of the largest EU banks (including the Bank) will come under the ECB’s direct oversight from November 2014. Other issues include the representation and voting power of non-Eurozone countries, the accountability of the ECB to European institutions as part of the Single Supervision Mechanism, the final status of the EBA, the development of a new bank resolution regime and the creation of a common deposit-guarantee scheme. In particular, the RRD and the Deposit Guarantee Schemes Directive were submitted to the European Parliament in June 2013. An agreement on the RRD was reached in the February 2014 ECOFIN. The final approval of the RRD is expected by April-May 2014. The RRD is expected to enter into force in 2015, but the bail-in tool will only be operational from 2016. The final regulation on direct recapitalization of banks by the European Stability Mechanism (ESM) is still pending. European leaders have also supported the reinforcement of the fiscal union but continue negotiating on how to achieve it.

Prior to the ECB assuming the supervision of European banks (including the Bank), the ECB is conducting, with the help of national supervisors, external advisors, consultants and other appraisers, a comprehensive assessment consisting of three elements: (i) a supervisory risk assessment, which will assess the main risks on the balance sheet including liquidity, funding and leverage; (ii) an asset quality review, which will focus on credit and

11

market risks; and (iii) a stress test to examine the need to strengthen capital or take other corrective measures which could affect the Group’s business, financial condition and results of operations. It is expected that the results of this comprehensive agreement will be released at the end of 2014.

Regulations adopted towards achieving a banking and/or fiscal union in the EU and decisions adopted by the ECB in its future capacity as the Bank’s main supervisory authority may have a material impact on the Bank’s business, financial condition and results of operations.

In addition, on January 29, 2014, the European Commission released its proposal on the structural reforms of the European banking sector that will impose new constraints on the structure of European banks. The proposal aims at ensuring the harmonization between the divergent national initiatives in Europe, and includes a prohibition of proprietary trading such as in the US Volcker Rule and a mechanism to require the separation of trading activities including market making such as in the UK Banking Reform.

Regulatory reforms initiated in the United States

The Bank’s operations may also be affected by other regulatory reforms in response to the financial crisis, including measures such as those concerning systemic financial institutions and the enactment in the United States in July 2010 of the Dodd-Frank Act. In July 2013, U.S. federal bank regulators issued final rules implementing many elements of the Basel III framework and other U.S. capital reforms. In December 2013, the Federal Reserve, the OCC, the FDIC, the CFTC and the SEC issued final rules to implement the Volcker Rule, as required by the Dodd-Frank Act. The Volcker Rule prohibits an insured depository institution, its affiliates and any company that controls an insured depository institution from engaging in proprietary trading and from investing in or sponsoring certain covered funds, such as hedge funds and private equity funds, in each case subject to certain limited exceptions. The final rules also impose significant compliance and reporting obligations.

In February 2014, the Federal Reserve approved a final rule to enhance its supervision and regulation of the U.S. operations of foreign banking organizations (“FBOs”) such as BBVA. Under this rule, FBOs with $50 billion or more in U.S. assets held outside of their U.S. branches and agencies (“Large FBOs”), such as BBVA, will be required to create a separately capitalized top-tier U.S. intermediate holding company (“IHC”) that will hold all of the Large FBO’s U.S. bank and nonbank subsidiaries, such as Compass Bank and BBVA Compass. The IHC will be subject to U.S. risk-based and leverage capital, liquidity, risk management, stress testing and other enhanced prudential standards on a consolidated basis. Under the final rule, a Large FBO that is subject to the IHC requirement may request permission from the Federal Reserve to establish multiple IHCs or use an alternative organizational structure. The final rule also permits the Federal Reserve to apply the IHC requirement in a manner that takes into account the separate operations of multiple foreign banks that are owned by a single Large FBO. Although U.S. branches and agencies of Large FBOs will not be required to be held beneath an IHC, such branches and agencies will be subject to liquidity, and, in certain circumstances, asset maintenance requirements. Large FBOs generally will be required to form IHCs and comply with enhanced prudential standards beginning July 1, 2016, although an IHC’s compliance with applicable U.S. leverage ratio requirements is generally delayed until January 1, 2018, and certain enhanced prudential standards will apply to BBVA’s top-tier U.S. bank holding company, BBVA Compass, beginning January 1, 2015. The Federal Reserve has stated that it will issue, at a later date, final rules to implement certain other enhanced prudential standards under the Dodd-Frank Act for large bank holding companies and Large FBOs, including single counterparty credit limits and an early remediation framework. The rule does not constitute any significant additional burden for FBOs that already organized their main US subsidiaries through a BHC structure such as BBVA. Indeed, those FBOs would have anyway been subject to US prudential standards.

In addition, the Federal Reserve and other U.S. regulators issued for public comment in October 2013 a proposed rule that would introduce a quantitative liquidity coverage ratio requirement on certain large banks and bank holding companies. The proposed liquidity coverage ratio is broadly consistent with the Basel Committee’s revised Basel III liquidity rules, but is more stringent in several important respects. The Federal Reserve has also stated that it intends, through future rulemakings, to apply the Basel III liquidity coverage ratio and net stable funding ratio to the U.S. operations of some or all large FBOs.

12

Although there remains uncertainty as to how regulatory implementation of these laws will occur, various elements of the new laws may cause changes that impact the profitability of the Bank’s business activities and require that it changes certain of its business practices, and could expose the Bank to additional costs (including increased compliance costs). These changes may also cause the Bank to invest significant management attention and resources to make any necessary changes.

Taxation of the financial sector

On February 14, 2013 the European Commission published its proposal for a Council Directive implementing a common financial transaction tax, which was intended to take effect on January 1, 2014 but negotiations are still ongoing. The proposed Directive aims to ensure that the financial sector makes a fair and substantial contribution to covering the costs of the recent crisis and creating a level playing field with other sectors from a taxation point of view. In Spain, legislation passed in March 2013 imposed extraordinary levies on deposits (see “—Contributions for assisting in the restructuring of the Spanish banking sector”) but the final terms of this tax are expected to be adopted in 2014, along with other tax reforms. It is expected that the Spanish Government will set a tax on outstanding deposits to be paid annually by banks, which will subsequently be distributed to regional authorities. There can be no assurance that additional national or transnational bank levies or financial transaction taxes will not be adopted by the authorities of the jurisdictions where the Bank operates. Any such additional levies and taxes could have a material adverse effect on the Bank’s business, financial condition, results of operations and prospects.

Withdrawals of deposits or other sources of liquidity may make it more difficult or costly for the Group to fund its business on favorable terms or cause the Group to take other actions

Historically, one of the Group’s principal sources of funds has been savings and demand deposits. Large-denomination time deposits may, under some circumstances, such as during periods of significant interest rate-based competition for these types of deposits, be a less stable source of deposits than savings and demand deposits. The level of wholesale and retail deposits may also fluctuate due to other factors outside the Group’s control, such as a loss of confidence (including as a result of political initiatives, including bail-in and/or confiscation and/or taxation of creditors’ funds) or competition from investment funds or other products. The expected introduction of national taxes on outstanding deposits could be negative for the market in Spain. Moreover, there can be no assurance that, in the event of a sudden or unexpected withdrawal of deposits or shortage of funds in the banking systems or money markets in which the Group operates, the Group will be able to maintain its current levels of funding without incurring higher funding costs or having to liquidate certain of its assets. In addition, if public sources of liquidity, such as the ECB extraordinary measures adopted in response to the financial crisis since 2008, are removed from the market, there can be no assurance that the Group will be able to maintain its current levels of funding without incurring higher funding costs or having to liquidate certain of its assets or taking additional deleverage measures.

The Group’s earnings and financial condition have been, and its future earnings and financial condition may continue to be, materially affected by depressed asset valuations resulting from poor market conditions

Financial markets, among other matters, reflect the perception of risk, economic conditions and economic policies in their present and short to mid-term future outlooks. Especially in 2012, negative growth expectations and lack of confidence that policy changes would solve problems led to steep falls in asset values and a severe reduction in market liquidity. Additionally, in dislocated markets, hedging and other risk management strategies may not be as effective as they are in more normal market conditions due in part to the decreasing credit quality of hedge counterparties. Severe market events such as the sovereign debt crisis, rising risk premiums and falls in share market prices, have resulted in the Group recording large write-downs on its credit market exposures in recent years. Any deterioration in economic and financial market conditions could lead to further impairment charges and write-downs.

13

The Group faces increasing competition in its business lines

The markets in which the Group operates are highly competitive and the Group believes that this trend will continue. In addition, the trend towards consolidation in the banking industry has created larger and stronger banks with which the Group must now compete, some of which have recently received public capital from the European Stability Mechanism. Foreign competitors or funds may consider acquiring the institutions who have received such public capital in future auctions, such as occurred with respect to Novagalicia Banco, which was acquired by Banesco, a Venezuelan bank.

The Group also faces competition from non-bank competitors, such as payment platforms, ecommerce businesses, department stores (for some credit products), automotive finance corporations, leasing companies, factoring companies, mutual funds, pension funds, insurance companies and public debt (as a result of the high yields which have recently been offered as a consequence of the sovereign debt crisis, there has been a crowding out effect in the financial markets).

There can be no assurance that this competition will not adversely affect the Group’s business, financial condition, cash flows and results of operations.

The Group’s business is particularly vulnerable to volatility in interest rates

The Group’s results of operations are substantially dependent upon the level of its net interest income, which is the difference between interest income from interest-earning assets and interest expense on interest-bearing liabilities. Interest rates are highly sensitive to many factors beyond its control, including fiscal and monetary policies of governments and central banks, regulation of the financial sectors in the markets in which it operates, domestic and international economic and political conditions and other factors. Changes in market interest rates can affect the interest rates that the Group receives on its interest-earning assets differently than the rates that it pays for its interest-bearing liabilities. This may, in turn, result in a reduction of the net interest income the Group receives, which could have a material adverse impact on its results of operations.

In addition, the high proportion of loans referenced to variable interest rates makes debt service on such loans more vulnerable to changes in interest rates. In addition, a rise in interest rates could reduce the demand for credit and the Group’s ability to generate credit for its clients, as well as contribute to an increase in the credit default rate. As a result of these and the above factors, significant changes or volatility in interest rates could have a material adverse impact on the Group’s business, financial condition or results of operations.

The Group has a substantial amount of commitments with personnel considered wholly unfunded due to the absence of qualifying plan assets

The Group’s commitments with personnel which are considered to be wholly unfunded are recognized under the heading “Provisions—Funds for Pensions and Similar Obligations” in its consolidated balance sheets included in the Consolidated Financial Statements. These amounts, which comprise “Post-employment benefits”, “Early retirements” and “Post-employment welfare benefits”, are considered wholly unfunded due to the absence of qualifying plan assets.

The Group faces liquidity risk in connection with its ability to make payments on these unfunded amounts which it seeks to mitigate, with respect to “Post-employment benefits”, by maintaining insurance contracts which were contracted with insurance companies owned by the Group. The insurance companies have recorded in their balance sheets specific assets (fixed interest deposit and bonds) assigned to the funding of these commitments. The insurance companies also manage derivatives (primarily swaps) to mitigate the interest rate risk in connection with the payments of these commitments. The Group seeks to mitigate liquidity risk with respect to “Early retirements” and “Post-employment welfare benefits” through oversight by the Assets and Liabilities Committee (“ALCO”) of the Group. The Group’s ALCO manages a specific asset portfolio to mitigate the liquidity risk regarding the payments of these commitments. These assets are government and covered bonds which are issued at fixed interest rates with maturities matching the aforementioned commitments. The Group’s ALCO also manages derivatives (primarily swaps) to mitigate the interest rate risk in connection with the payments of these commitments. Should the Bank fail to adequately manage liquidity risk and interest rate risk either as described above or otherwise, it could have a material adverse effect on the Group’s business, financial condition, cash flows and results of operations.

14

We may face risks related to our acquisitions and divestitures

Our mergers and acquisitions activity involves divesting our interests in some businesses and strengthening other business areas through acquisitions. We may not complete these transactions in a timely manner, on a cost-effective basis or at all. Even though we review the companies we plan to acquire, it is generally not feasible for these reviews to be complete in all respects. As a result, we may assume unanticipated liabilities, or an acquisition may not perform as well as expected. In addition, transactions such as these are inherently risky because of the difficulties of integrating people, operations and technologies that may arise. There can be no assurance that any of the businesses we acquire can be successfully integrated or that they will perform well once integrated. Acquisitions may also lead to potential write-downs due to unforeseen business developments that may adversely affect our results of operations.

Our results of operations could also be negatively affected by acquisition or divestiture-related charges, amortization of expenses related to intangibles and charges for impairment of long-term assets. We may be subject to litigation in connection with, or as a result of, acquisitions or divestitures, including claims from terminated employees, customers or third parties, and we may be liable for future or existing litigation and claims related to the acquired business or divestiture because either we are not indemnified for such claims or the indemnification is insufficient. These effects could cause us to incur significant expenses and could materially adversely affect our business, financial condition, cash flows and results of operations.

We are party to lawsuits, tax claims and other legal proceedings

Due to the nature of our business, we and our subsidiaries are involved in litigation, arbitration and regulatory proceedings in jurisdictions around the world, the financial outcome of which is unpredictable. An adverse outcome or settlement in these proceedings could result in significant costs and may have a material adverse effect on the Group’s business, financial condition, cash flows, results of operations and reputation. In addition, responding to the demands of litigation may divert management’s time and attention and financial resources. While we believe that we have provisioned such risks appropriately based on the opinions and advice of our legal advisors and in accordance with applicable accounting rules, it is possible that losses resulting from such risks, if proceedings are decided in whole or in part adversely to us, could exceed the amount of provisions made for such risks. See “Item 8. Financial information—Consolidated Statements and Other Financial Information—Legal proceedings” and Note 25 to the Consolidated Financial Statements for additional information on our legal, regulatory and arbitration proceedings.

Risks Relating to Spain and Europe

Economic conditions in the European Union and Spain could have a material adverse effect on our business, financial condition and results of operations

The crisis in worldwide financial and credit markets led to a global economic slowdown in recent years, with many economies around the world showing significant signs of weakness or slow growth. While there has been a significant reduction in risk premiums in Europe since the second half of 2012 and economic growth has resumed positive figures since the second quarter of 2013, the possibility of future deterioration of the economic scenario exists. Any such deterioration could adversely affect the cost and availability of funding for Spanish and European banks, including us, and the quality of our loan portfolio, require us to take impairments on our exposures to the sovereign debt of one or more countries in the Eurozone or otherwise adversely affect our business, financial condition and results of operations.

The probability of country defaults or rupture of the Eurozone has decreased significantly since 2012. However, if one or more EU Member States were to exit from the European Monetary Union (“EMU”), this could materially adversely affect the European and global economy, cause a redenomination of financial instruments or other contractual obligations from the euro to a different currency and substantially disrupt capital, interbank, banking and other markets, among other effects, any of which could have a material adverse effect on the Group’s business, results of operations, financial condition and cash flows. In addition, tensions among Member States of the EU, and Euro-skepticism in certain EU countries, could pose additional difficulties in the EU’s ability to react to an economic crisis.

15

In addition, the risk of low inflation (inflation continues to be positive but well below the 2% growth rate of harmonized indices of consumer prices) or deflation (i.e., a continued period with negative rates of inflation) in the Eurozone cannot be completely ruled out. If economic conditions in the European Union and Spain deteriorate as a result, this could have a material adverse effect on our business, financial condition and results of operations.

Additionally, certain upcoming events such as the European Parliamentary elections, could have an adverse impact on the progress that has been made in establishing a European banking union and strengthening the monetary union of the Eurozone or could otherwise cause instability in the Eurozone.

The Bank is dependent on its credit ratings and any reduction of its or the Kingdom of Spain’s credit ratings could materially and adversely affect the Group’s business, financial condition and results of operations

The Bank is rated by various credit rating agencies. The Bank’s credit ratings are an assessment by rating agencies of its ability to pay its obligations when due. Any actual or anticipated decline in the Bank’s credit ratings to below investment grade or otherwise may increase the cost of and decrease the Bank’s ability to finance itself in the capital markets, secured funding markets (by affecting its ability to replace downgraded assets with better rated ones), interbank markets, through wholesale deposits or otherwise, harm its reputation, require it to replace funding lost due to the downgrade, which may include the loss of customer deposits, and make third parties less willing to transact business with the Group or otherwise materially adversely affect its business, financial condition and results of operations. Furthermore, any decline in the Bank’s credit ratings to below investment grade or otherwise could breach certain of the Bank’s agreements or trigger additional obligations under such agreements, such as a requirement to post additional collateral, which could materially adversely affect the Group’s business, financial condition and results of operations.

Since the Bank has substantial operations in Spain, its credit ratings may be adversely affected by the assessment by rating agencies of the creditworthiness of the Kingdom of Spain. Any decline in the Kingdom of Spain’s sovereign credit ratings could result in a decline in the Bank’s credit ratings.

In addition, the Group holds a substantial amount of securities issued by the Kingdom of Spain, autonomous communities within Spain and other Spanish issuers. Any decline in the Kingdom of Spain’s credit ratings could also adversely affect the value of the Kingdom of Spain’s and other Spanish issuers’ respective securities held by the Group or otherwise materially adversely affect the Group’s business, financial condition and results of operations. Furthermore, the counterparties to many of the Group’s loan agreements could be similarly affected by any decline in the Kingdom of Spain’s credit rating, which could limit their ability to raise additional capital or otherwise adversely affect their ability to repay their outstanding commitments to the Group and, in turn, materially and adversely affect the Group’s business, financial condition and results of operations.

Since the Bank’s loan portfolio is highly concentrated in Spain, adverse changes affecting the Spanish economy could have a material adverse effect on its financial condition

The Group has historically developed its lending business in Spain, which continues to be its main place of business. The Group’s loan portfolio in Spain has been adversely affected by the deterioration of the Spanish economy since 2009. While the last quarter of 2013 showed signs of a slowdown of such deterioration pattern, given the concentration of the Group’s loan portfolio in Spain, any adverse changes affecting the Spanish economy are likely to have a significant adverse impact on the Group’s business financial condition and results of operations.

After rapid economic growth until 2007, Spanish gross domestic product (“GDP”) contracted in the period 2009-10 and 2012-13. The GDP is growing again since the second half of 2013 and the Bank’s Economic Research Department (“BBVA Research”) estimates that the Spanish economy will maintain this positive trend in the years to come based on the improvement of the foreign demand and the measures adopted by the authorities in response to the economic crisis, including the structural reforms to foster competitiveness and productivity and the measures to reduce the public deficit. However, in the case that foreign demand is lower than expected and/or the measures and

16

reforms do not contribute to enhancing competitiveness and productivity, the estimated positive scenario for the Spanish economy could be revised downwards. It is worth noting that the effects of the financial crisis were particularly pronounced in Spain given the country’s heightened need for foreign financing as reflected by its high current account and public deficit. Real or perceived difficulties in making the payments associated with this deficit can further damage Spain’s economic situation and increase the costs of financing its public deficit. The aforementioned may be exacerbated by the circumstances referred to below:

The Spanish economy is particularly sensitive to economic conditions in the rest of the euro area, the primary market for Spanish goods and services exports. Also, the interruption of the incoming recovery in the Eurozone might have a deep impact on Spanish economy growth.

Lastly, a change in the current recovery of the labor market might be very worrisome since it would affect households’ gross disposable income.

Exposure to the Spanish real estate market makes the Group vulnerable to developments in this market

In the years prior to 2008, population increase, economic growth, declines in unemployment rates and increases in levels of household disposable income, together with low interest rates within the EU, led to an increase in the demand for mortgage loans in Spain. This increased demand and the widespread availability of mortgage loans affected housing prices, which rose significantly. After this buoyant period, demand began to adjust in mid-2006. Since the last quarter of 2008, the supply of new homes has been adjusting sharply downward in the residential market in Spain, but a significant excess of unsold homes still exists in the market. Spanish real estate prices continued to decline during 2012 in light of deteriorating economic conditions. Housing demand has remained weak and housing transactions continued to decrease during 2013 but are expected to stabilize in 2014.

The Group has substantial exposure to the Spanish real estate market and the continuing deterioration of Spanish real estate prices could materially and adversely affect its business, financial condition and results of operations. The Group is exposed to the Spanish real estate market due to the fact that Spanish real estate assets secure many of its outstanding loans and due to the significant amount of Spanish real estate assets held on its balance sheet, including real estate received in lieu of payment for certain underlying loans. Furthermore, the Group has restructured certain of the loans it has made relating to real estate and the capacity of the borrowers to repay those restructured loans may be materially adversely affected by declining real estate prices.

If Spanish real estate prices fail to recover, the Group’s business may be materially adversely affected, which could materially and adversely affect its financial condition and results of operations.

Highly-indebted households and corporations could endanger the Group’s asset quality and future revenues

Spanish households and businesses have reached, in recent years, a high level of indebtedness, which represents increased risk for the Spanish banking system. In addition, the high proportion of loans referenced to variable interest rates makes debt service on such loans more vulnerable to upward movements in interest rates. Highly indebted households and businesses are less likely to be able to service debt obligations as a result of adverse economic events, which could have an adverse effect on the Group’s loan portfolio and, as a result, on its financial condition and results of operations. Moreover, the increase in households’ and businesses’ indebtedness also limits their ability to incur additional debt, decreasing the number of new products the Group may otherwise be able to sell them and limiting the Group’s ability to attract new customers in Spain satisfying its credit standards, which could have an adverse effect on the Group’s ability to achieve its growth plans.

Risks Relating to Latin America

Events in Mexico could adversely affect the Group’s operations

The Mexican operations are relevant to the Group. The Group faces several types of risks in Mexico which could adversely affect its banking operations in Mexico or the Group as a whole. Despite signs of recovery following Mexico’s recession in 2009, economic conditions remain uncertain in Mexico. In addition, drug-related violence remains as a significant challenge for Mexico.

17

The Mexican economy grew by 1.2% in 2013 and is expected to grow by 3.4% in 2014. However, part of 2013 was characterized by a more acute downturn than originally forecasted due to the considerable slowdown in the industrial sector, partially driven by the weak private demand and also a contraction in public demand. The slowdown in the rate of job creation and the contribution of salaries to disposable income in real terms have been significant factors underlying the downturn in domestic demand. Another fact to consider is the low foreign-currency inflows from remittances, which continue to decline.

Delinquency rates on loans have increased in the past three years. If there is an increase in unemployment rates (which were 4.9% in 2013, 5.0% in 2012 and 5.2% in 2011 and are expected to be 4.6% in 2014), as a result for example of a more pronounced or prolonged slowdown in Europe or the United States, such rates may increase.

In addition, average inflation was 3.8% in 2013, exceeding the target set by the Mexican Central Bank. Any tightening of the monetary policy, including to address upward inflationary pressures, could make it more difficult for customers of the Group’s mortgage and consumer loan products in Mexico to service their debts, which could have a material adverse effect on the business, financial condition, cash flows and results of operations of the Bank’s Mexican subsidiary or the Group as a whole.

In addition, the Bank’s operations are subject to regulatory risks, including the effects of changes in laws, regulations, policies and interpretations, in Mexico. On January 9, 2014, certain financial reforms which had been proposed in May 2013, were adopted. Such measures address the following matters (i) the establishment of a new mandate for development banks, (ii) the promotion of competition to reduce interest rates, (iii) the creation of incentives for banks to give more credit and (iv) the strengthening of the banking system.

Moreover, according to the mandate of the Law for Transparent and Ordered Financial Services in place (last modified in 2010), the Mexican National Commission for the Protection and Defense of Financial Services Users (Comisión Nacional para la Defensa de los Usuarios de los Servicios Financieros) (“Condusef”) has continued to request that banks submit several of their service contracts to revision by the Condusef (for example, contracts relating to credit cards and insurance), in order to check that they comply with the relevant transparency and clarity requirements. Condusef does not have systematic ways to evaluate and grade service contracts, and this reflects on a substantial variation in grades from one year to the next and no clear instructions for adequating such contracts. The Law Committee of the Banking Association (ABM) is coordinating the creation of a working group that is expected to propose improvements in the process. In addition, Condusef has asked banks to formulate new procedures so that beneficiaries of deposit accounts can collect the funds in the case of the death of the account owner. We may have to incur compliance costs in connection with any new measures adopted by Condusef.

Furthermore, the Anti-Money Laundering Law (Ley Federal para la Prevención e Identificación de Operaciones con Recursos de Procedencia Ilícita) became effective in July 2013. The Law establishes more severe penalties for non-compliance and sets forth enhanced information requirements for some transactions.

Any of the risks referred to above or risks that may result from other adverse developments in laws, regulations, public policies or otherwise in Mexico may adversely affect the business, financial condition, operating results and cash flows of the Bank’s Mexican subsidiary or the Group as a whole.

The Bank’s Latin American subsidiaries’ growth, asset quality and profitability may be affected by volatile macroeconomic conditions, including significant inflation and government default on public debt, in the Latin American countries where they operate

The Latin American countries in which the Group operates have experienced significant economic volatility in recent decades, characterized by recessions, foreign exchange crises and significant inflation. This volatility has resulted in fluctuations in the levels of deposits and in the relative economic strength of various segments of the economies to which the Group lends. Negative and fluctuating economic conditions, such as a changing interest rate environment, also affect the Group’s profitability by causing lending margins to decrease and leading to decreased demand for higher-margin products and services. In addition, significant inflation (such as inflation recently experienced by Venezuela and Argentina) and local currency devaluations (such as in Venezuela and Argentina) can negatively affect the Group’s results of operations.

18

The start of the withdrawal of monetary stimuli by the Federal Reserve in the U.S., and the slowing of economic activity in several emerging markets led to an increase in volatility in the international financial markets in recent years. Latin America, like other emerging markets, has been one of the hardest hit in this new environment, particularly as Latin America benefited significantly from the increase in liquidity and the expansion in demand by countries such as China in recent years.

Many of the main challenges for the region relate to the evolution of external factors, including the crisis in Europe or the fiscal adjustment measures in the U.S., and the increasing use of macro-prudential measures to control global liquidity, which could deter financial flows to enter in Latin American countries. In addition, inflationary pressure in some countries in the region (with inflation in some countries exceeding the relevant central banks’ targets) has led to different approaches from central banks when dealing with turbulence in the financial markets. Price overheating could leave Latin America economies more vulnerable to an adverse external shock since the more important role of exports in their GDP is making them more dependent on the maintenance of high terms of trade. Moreover, uncertainty on the evolution of the global economy and lower global liquidity will likely contribute to a slight depreciation in exchange rates in most countries. This would result in monetary policy being less likely to act as a stabilizer in case of domestic overheating. The region needs to promote reforms to increase productivity and to consolidate growth in the long term, as the sustainable growth of per capita income cannot be based only on capital accumulation and employment growth.

In addition, negative and fluctuating economic conditions in some Latin American countries could result in government defaults on public debt. This could affect the Group in two ways: directly, through portfolio losses, and indirectly, through instabilities that a default in public debt could cause to the banking system as a whole, particularly since commercial banks’ exposure to government debt is generally high in several Latin American countries in which the Group operates.

While the Group seeks to mitigate these risks through what it believes to be conservative risk policies, no assurance can be given that its Latin American subsidiaries’ growth, asset quality and profitability will not be further affected by volatile macroeconomic conditions in the Latin American countries in which it operates.

Latin American economies can be directly and negatively affected by adverse developments in other countries

Financial and securities markets in Latin American countries in which the Group operates are, to varying degrees, influenced by economic and market conditions in other countries in Latin America and beyond. The region’s growth decelerated in 2012 and 2013, registering a growth rate of 2.1% (considering Argentina, Brazil, Chile, Colombia, Peru and Venezuela), in particular due to the economic slowdown of Brazil and Argentina, and was 2.6% in 2013. The region is expected to grow by 2.4% in 2014. The international financial outlook for Latin America has become less benign in recent months. Latin America, together with other emerging markets, has been one of the hardest hit regions by the economic crisis, with capital outflows, increases in sovereign spreads, stock market falls and devaluations in exchange rates. There has also been an adjustment in the prices of some of the most important export commodities during 2013. In addition, the outlook for foreign balances in Latin America worsened in 2013 due to the above mentioned correction in raw material prices and weak foreign demand.