- BBVA Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Banco Bilbao Vizcaya Argentaria (BBVA) 6-KCurrent report (foreign)

Filed: 30 Apr 20, 2:43pm

|

UNITED STATES SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM6-K

REPORT OF FOREIGN ISSUER PURSUANT TO RULE13a-16 OR15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of April, 2020

Commission file number:1-10110

BANCO BILBAO VIZCAYA ARGENTARIA, S.A.

(Exact name of Registrant as specified in its charter)

BANK BILBAO VIZCAYA ARGENTARIA, S.A.

(Translation of Registrant’s name into English)

Calle Azul 4,

28050 Madrid

Spain

(Address of principal executive offices)

|

Indicate by check mark whether the registrant files or will file annual reports under cover of Form20-F or Form40-F:

Form20-F X | Form40-F |

Indicate by check mark if the registrant is submitting the Form6-K in paper as permitted by RegulationS-T Rule 101(b)(1):

Yes | No X |

Indicate by check mark if the registrant is submitting the Form6-K in paper as permitted by RegulationS-T Rule 101(b)(7):

Yes | No X |

|

|

1Q20 Results April 30th, 2020

Disclaimer This document is only provided for information purposes and does not constitute, nor should it be interpreted as, an offer to sell or exchange or acquire, or an invitation for offers to buy securities issued by any of the aforementioned companies. Any decision to buy or invest in securities in relation to a specific issue must be made solely and exclusively on the basis of the information set out in the pertinent prospectus filed by the company in relation to such specific issue. No one who becomes aware of the information contained in this report should regard it as definitive, because it is subject to changes and modifications. This document contains or may contain forward looking statements (in the usual meaning and within the meaning of the US Private Securities Litigation Reform Act of 1995) regarding intentions, expectations or projections of BBVA or of its management on the date thereof, that refer to or incorporate various assumptions and projections, including projections about the future earnings of the business. The statements contained herein are based on our current projections, but the actual results may be substantially modified in the future by various risks and other factors that may cause the results or final decisions to differ from such intentions, projections or estimates. These factors include, without limitation, (1) the market situation, macroeconomic factors, regulatory, political or government guidelines, (2) domestic and international stock market movements, exchange rates and interest rates, (3) competitive pressures, (4) technological changes, (5) alterations in the financial situation, creditworthiness or solvency of our customers, debtors or counterparts. These factors could cause or result in actual events differing from the information and intentions stated, projected or forecast in this document or in other past or future documents. BBVA does not undertake to publicly revise the contents of this or any other document, either if the events are not as described herein, or if such events lead to changes in the information contained in this document. This document may contain summarised information or information that has not been audited, and its recipients are invited to consult the documentation and public information filed by BBVA with stock market supervisory bodies, in particular, the prospectuses and periodical information filed with the Spanish Securities Exchange Commission (CNMV) and the Annual Report on Form 20-F and information on Form 6-K that are filed with the US Securities and Exchange Commission. Distribution of this document in other jurisdictions may be prohibited, and recipients into whose possession this document comes shall be solely responsible for informing themselves about, and observing any such restrictions. By accepting this document you agree to be bound by the foregoing restrictions.

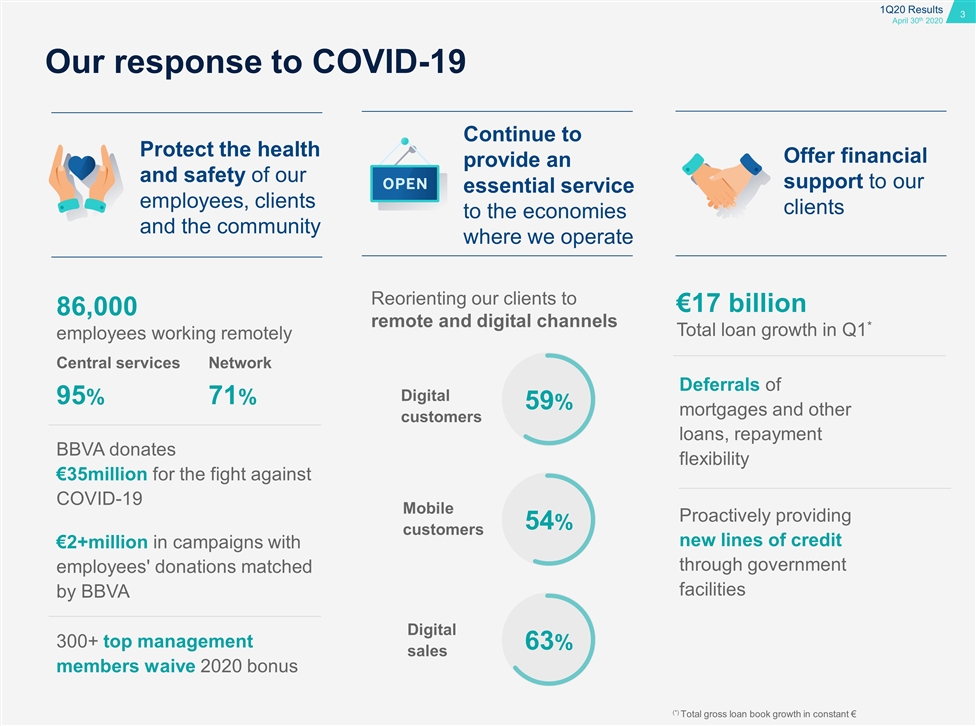

Our response to COVID-19 Protect the health and safety of our employees, clients and the community Continue to provide an essential service to the economies where we operate Offer financial support to our clients 95% 86,000 employees working remotely Central services Network 71% BBVA donates €35million for the fight against COVID-19 €2+million in campaigns with employees' donations matched by BBVA 300+ top management members waive 2020 bonus 59% Reorienting our clients to remote and digital channels Digital customers Mobile customers Digital sales €17 billion Total loan growth in Q1* Deferrals of mortgages and other loans, repayment flexibility Proactively providing new lines of credit through government facilities 54% 63% (*) Total gross loan book growth in constant €

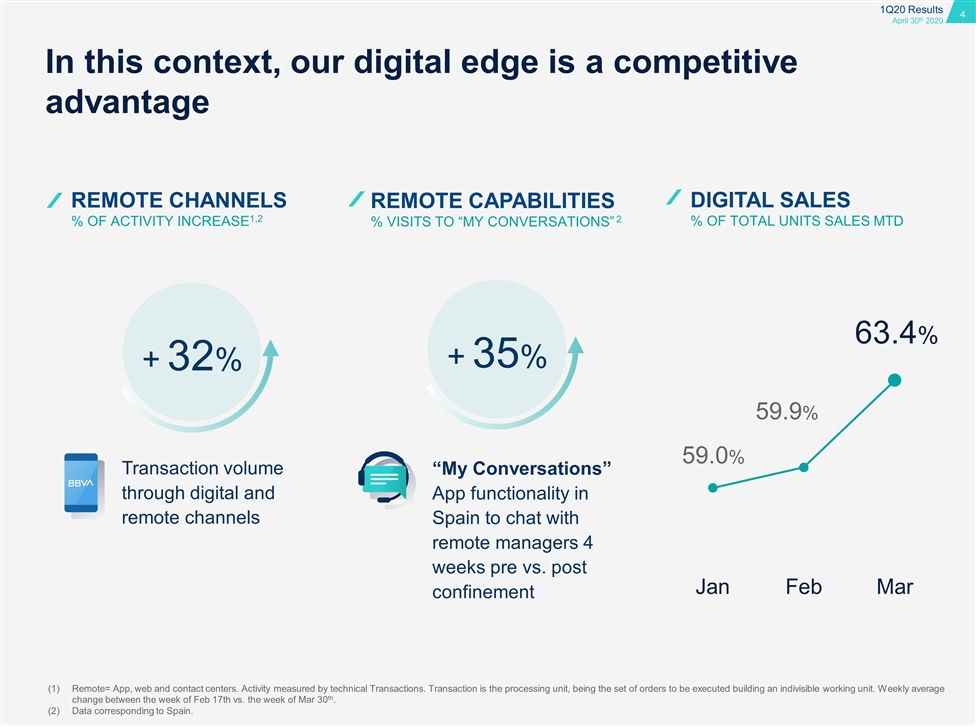

DIGITAL SALES % OF TOTAL UNITS SALES MTD REMOTE channels % OF ACTIVITY INCREASE1,2 REMOTe capabilities % VISITS TO “MY CONVERSATIONS” 2 Remote= App, web and contact centers. Activity measured by technical Transactions. Transaction is the processing unit, being the set of orders to be executed building an indivisible working unit. Weekly average change between the week of Feb 17th vs. the week of Mar 30th. Data corresponding to Spain. In this context, our digital edge is a competitive advantage 59.0% 59.9% 63.4% + 32% Transaction volume through digital and remote channels + 35% “My Conversations” App functionality in Spain to chat with remote managers 4 weeks pre vs. post confinement

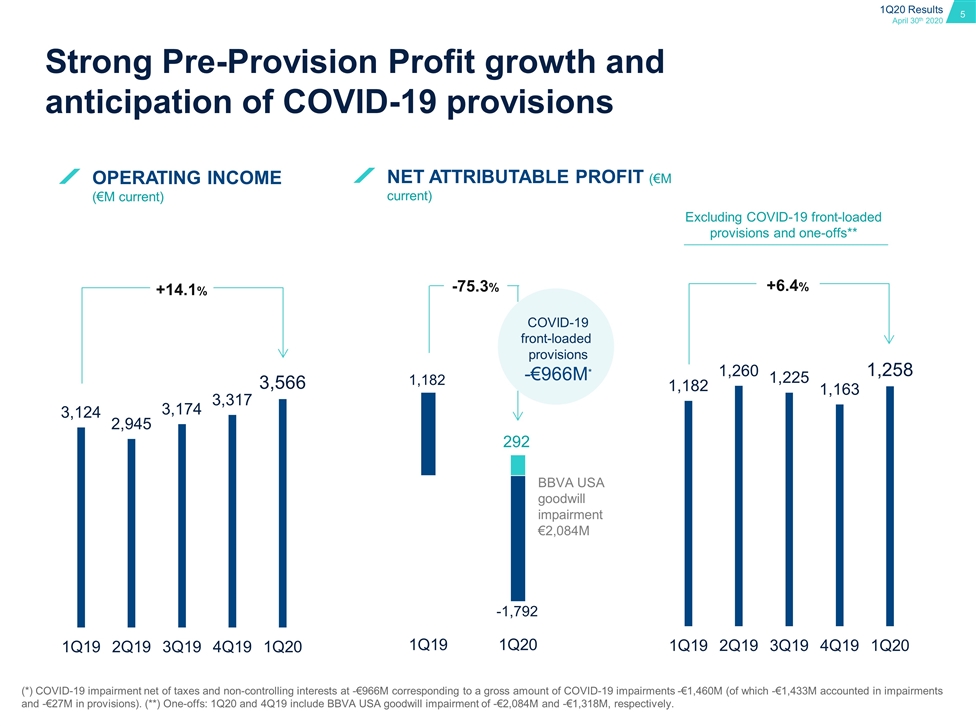

Strong Pre-Provision Profit growth and anticipation of COVID-19 provisions OPERATING INCOME (€M current) +14.1% NET ATTRIBUTABLE PROFIT (€M current) COVID-19 front-loaded provisions -€966M* -75.3% (*) COVID-19 impairment net of taxes and non-controlling interests at -€966M corresponding to a gross amount of COVID-19 impairments -€1,460M (of which -€1,433M accounted in impairments and -€27M in provisions). (**) One-offs: 1Q20 and 4Q19 include BBVA USA goodwill impairment of -€2,084M and -€1,318M, respectively. BBVA USA goodwill impairment €2,084M Excluding COVID-19 front-loaded provisions and one-offs** +6.4%

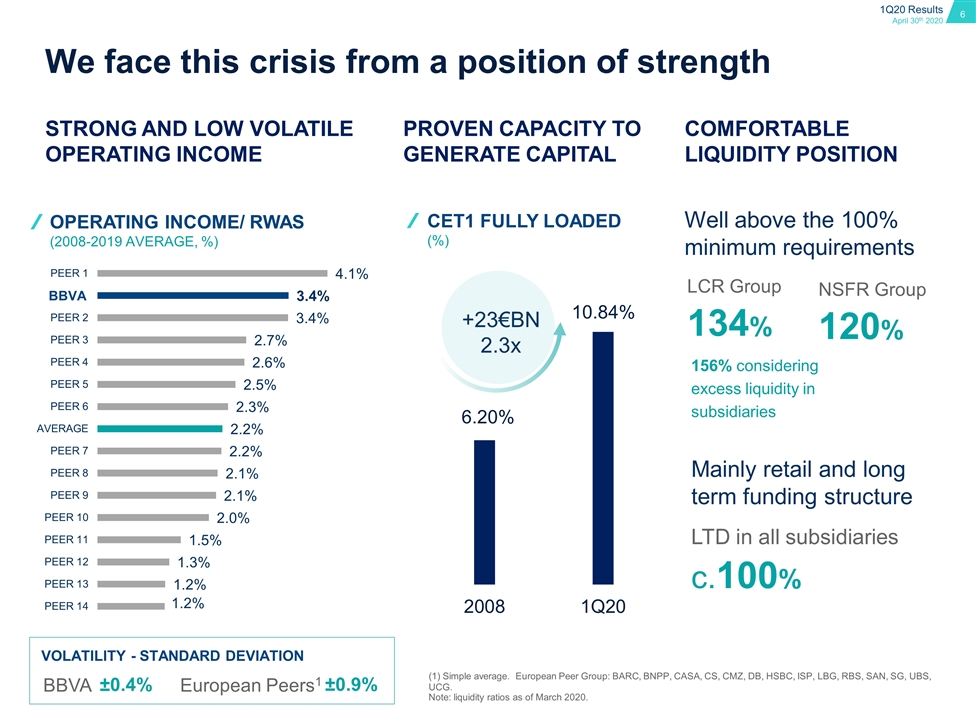

We face this crisis from a position of strength Note: liquidity ratios as of March 2020. STRONG AND LOW VOLATILE OPERATING INCOME PROVEN CAPACITY TO GENERATE CAPITAL COMFORTABLE LIQUIDITY POSITION OPERATING INCOME/ RWAs (2008-2019 average, %) CET1 FULLY LOADED (%) LCR Group 134% NSFR Group 120% Well above the 100% minimum requirements 156% considering excess liquidity in subsidiaries Mainly retail and long term funding structure LTD in all subsidiaries c.100% BBVA VOLATILITY - STANDARD DEVIATION BBVA ±0.4% European Peers1 ±0.9% (1) Simple average. European Peer Group: BARC, BNPP, CASA, CS, CMZ, DB, HSBC, ISP, LBG, RBS, SAN, SG, UBS, UCG. +23€BN 2.3x

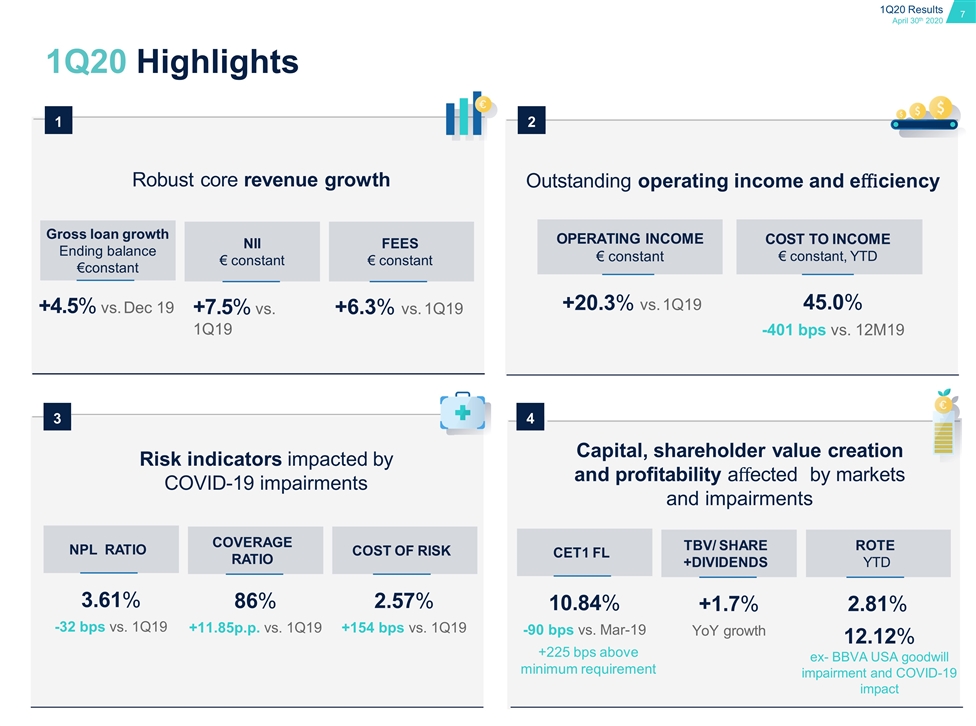

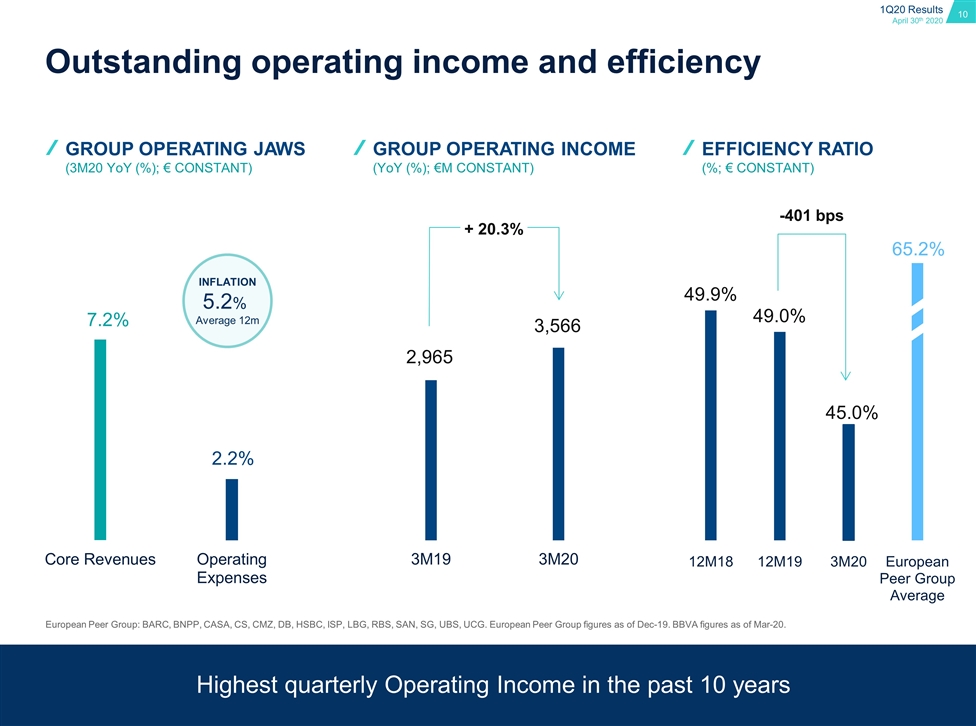

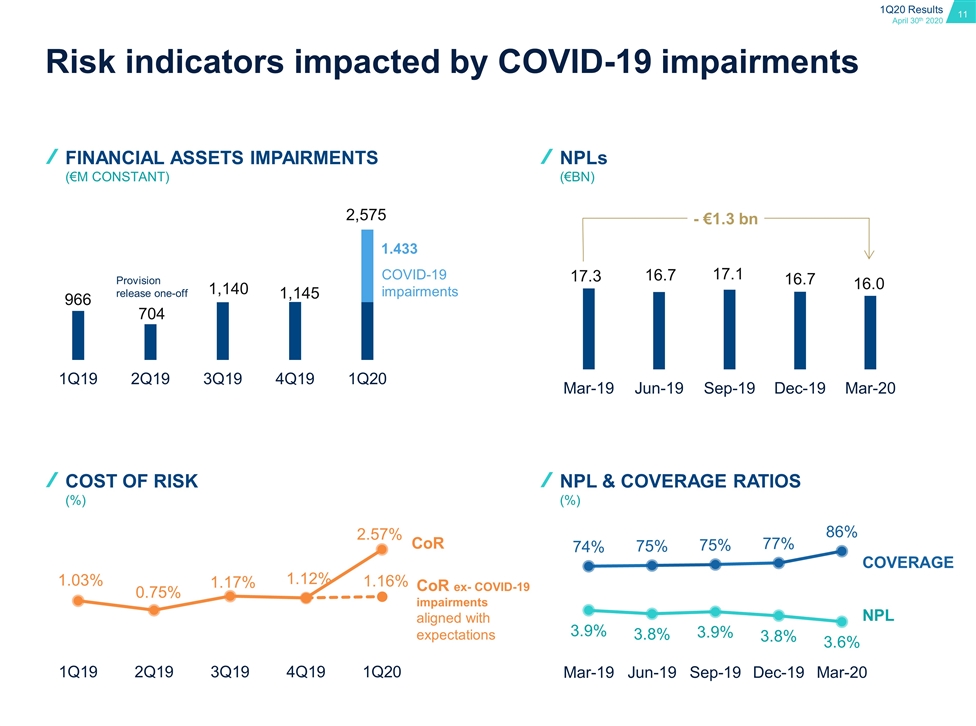

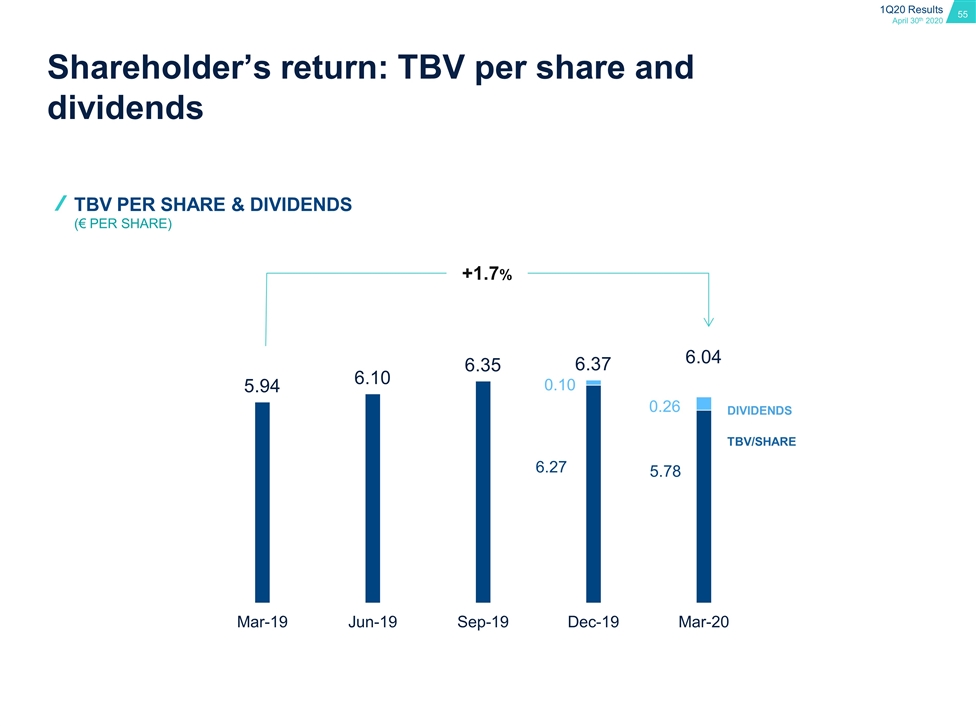

1Q20 Highlights +7.5% vs. 1Q19 +6.3% vs. 1Q19 Robust core revenue growth 1 +20.3% vs. 1Q19 45.0% -401 bps vs. 12M19 COST TO INCOME € constant, YTD OPERATING INCOME € constant 2 Outstanding operating income and efficiency Risk indicators impacted by COVID-19 impairments Capital, shareholder value creation and profitability affected by markets and impairments 3 4 NPL RATIO COVERAGE RATIO COST OF RISK 3.61% -32 bps vs. 1Q19 86% +11.85p.p. vs. 1Q19 2.57% +154 bps vs. 1Q19 CET1 FL TBV/ SHARE +DIVIDENDS ROTE YTD 10.84% -90 bps vs. Mar-19 +1.7% YoY growth 2.81% +225 bps above minimum requirement 12.12% ex- BBVA USA goodwill impairment and COVID-19 impact Gross loan growth Ending balance €constant NII € constant FEES € constant +4.5% vs. Dec 19

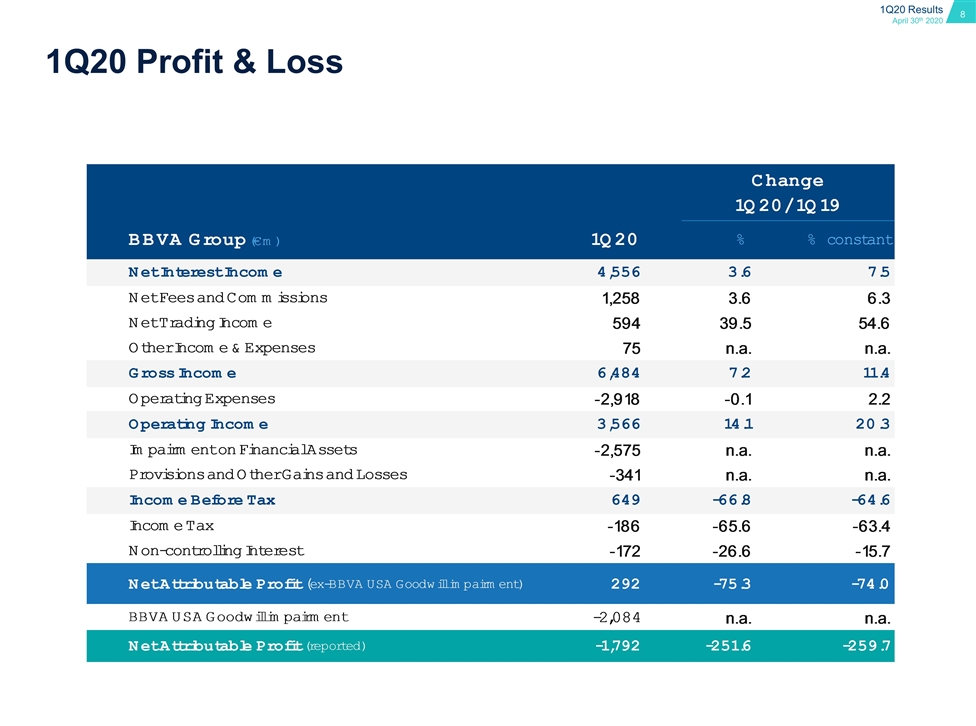

1Q20 Profit & Loss

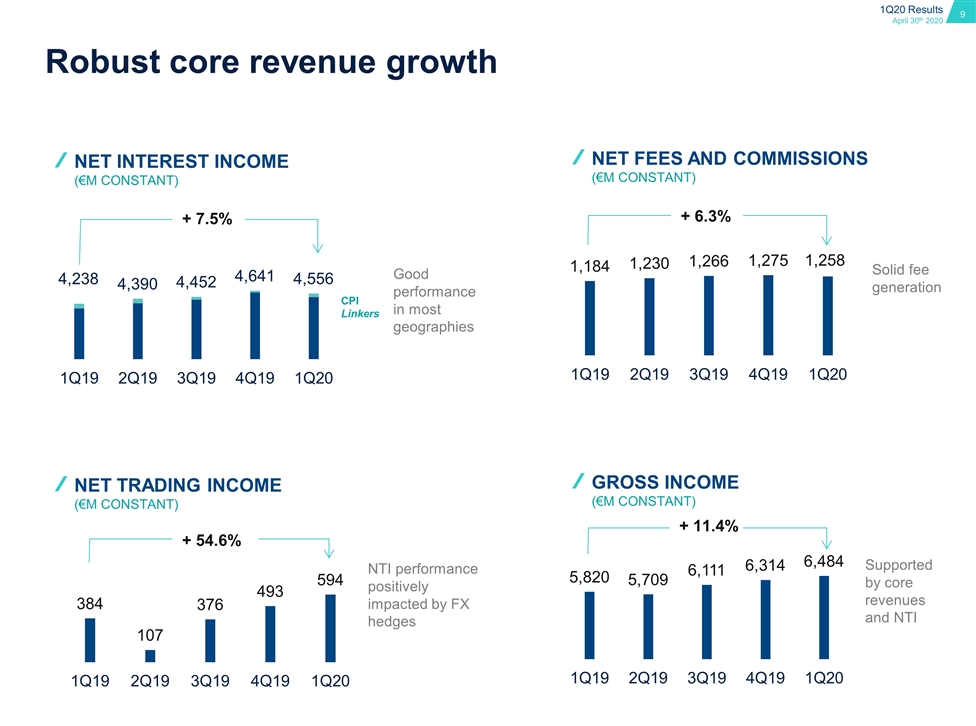

Robust core revenue growth + 6.3% + 54.6% NET FEES AND COMMISSIONS (€M CONSTANT) NET TRADING INCOME (€M CONSTANT) GROSS INCOME (€M CONSTANT) Solid fee generation NTI performance positively impacted by FX hedges Supported by core revenues and NTI + 11.4% + 7.5% NET INTEREST INCOME (€M CONSTANT) Good performance in most geographies CPI Linkers

Outstanding operating income and efficiency -401 bps GROUP OPERATING JAWS (3M20 YoY (%); € CONSTANT) GROUP OPERATING INCOME (YoY (%); €M CONSTANT) EFFICIENCY RATIO (%; € CONSTANT) European Peer Group: BARC, BNPP, CASA, CS, CMZ, DB, HSBC, ISP, LBG, RBS, SAN, SG, UBS, UCG. European Peer Group figures as of Dec-19. BBVA figures as of Mar-20. + 20.3% Highest quarterly Operating Income in the past 10 years INFLATION 5.2% Average 12m

- €1.3 bn NPLs (€BN) NPL & Coverage ratios (%) COVERAGE NPL Risk indicators impacted by COVID-19 impairments Cost of risk (%) CoR CoR ex- COVID-19 impairments aligned with expectations Financial Assets Impairments (€M CONSTANT) Provision release one-off COVID-19 impairments

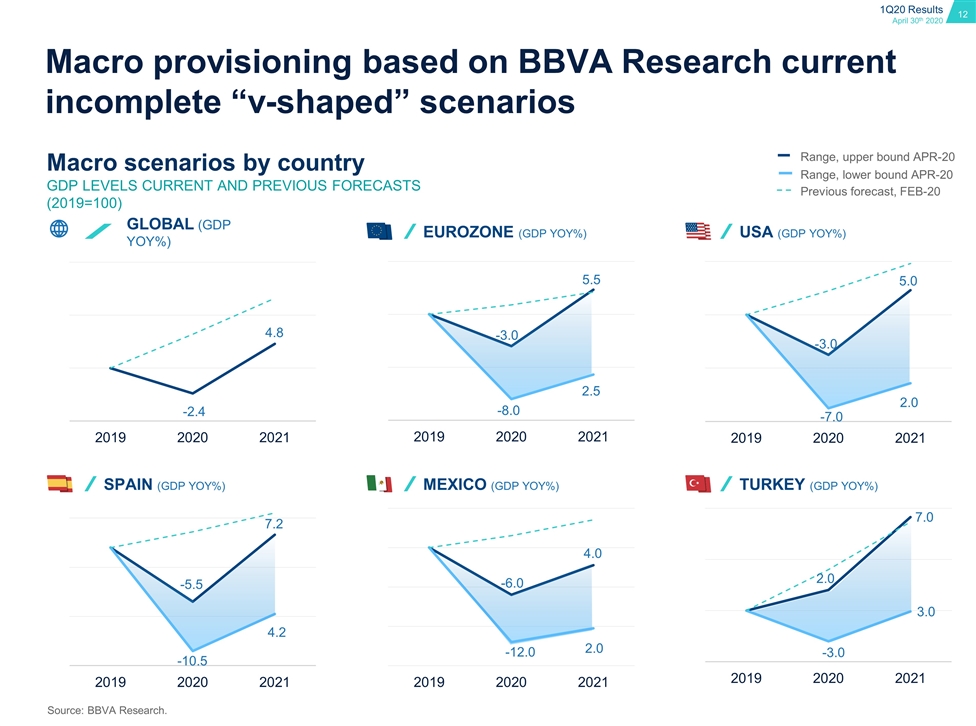

Macro provisioning based on BBVA Research current incomplete “v-shaped” scenarios EUROZONE (GDP YoY%) USA (GDP YoY%) SPAIN (GDP YoY%) MEXICO (GDP YoY%) TURKEY (GDP YoY%) GLOBAL (GDP YoY%) Source: BBVA Research. Previous forecast, FEB-20 Range, upper bound Apr-20 Range, lower bound Apr-20 5.5 -3.0 -8.0 2.5 5.0 -3.0 -7.0 2.0 -2.4 4.8 7.2 -5.5 -10.5 4.2 4.0 -6.0 -12.0 2.0 7.0 2.0 -3.0 3.0 Macro scenarios by country GDP LEVELS CURRENT AND PREVIOUS FORECASTS (2019=100)

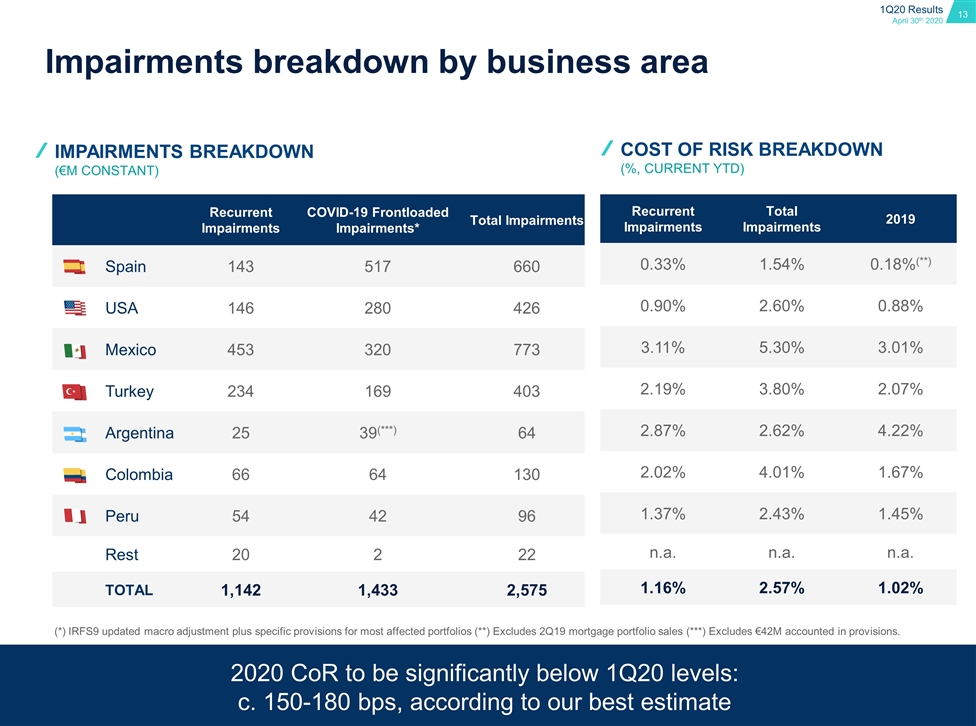

Impairments breakdown by business area Recurrent Impairments COVID-19 Frontloaded Impairments* Total Impairments Spain 143 517 660 USA 146 280 426 Mexico 453 320 773 Turkey 234 169 403 Argentina 25 39(***) 64 Colombia 66 64 130 Peru 54 42 96 Rest 20 2 22 TOTAL 1,142 1,433 2,575 IMPAIRMENTS BREAKDOWN (€M CONSTANT) cost OF RISK BREAKDOWN (%, CURRENT YTD) Recurrent Impairments Total Impairments 2019 0.33% 1.54% 0.18%(**) 0.90% 2.60% 0.88% 3.11% 5.30% 3.01% 2.19% 3.80% 2.07% 2.87% 2.62% 4.22% 2.02% 4.01% 1.67% 1.37% 2.43% 1.45% n.a. n.a. n.a. 1.16% 2.57% 1.02% (*) IRFS9 updated macro adjustment plus specific provisions for most affected portfolios (**) Excludes 2Q19 mortgage portfolio sales (***) Excludes €42M accounted in provisions. 2020 CoR to be significantly below 1Q20 levels: c. 150-180 bps, according to our best estimate

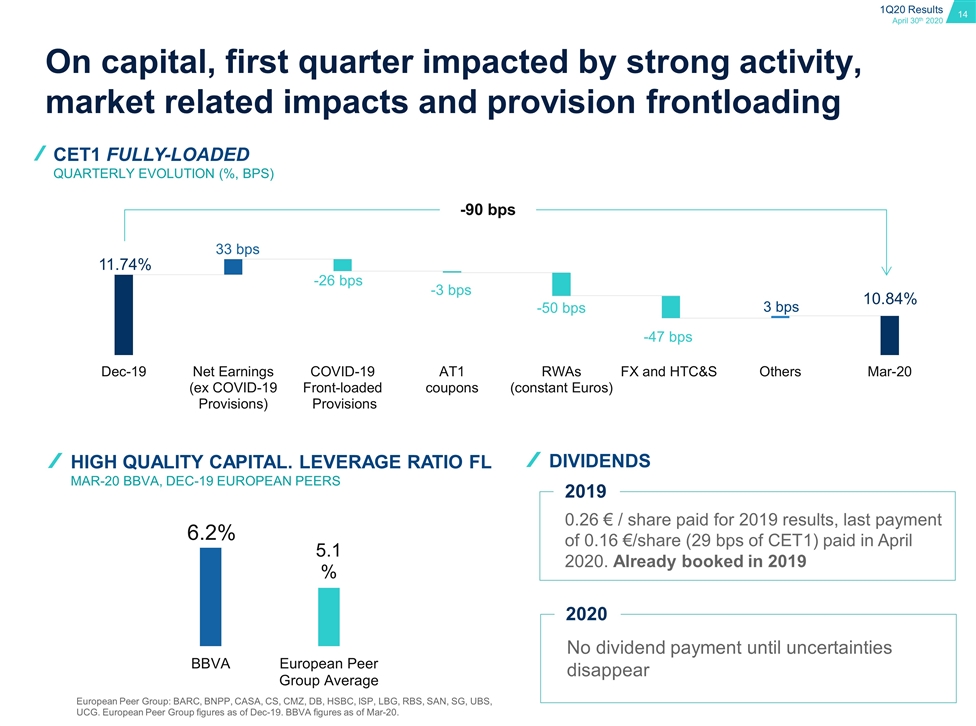

On capital, first quarter impacted by strong activity, market related impacts and provision frontloading CET1 fully-loaded QUARTERLY EVOLUTION (%, BPS) Solid and high quality capital position, well above minimum requirement -90 bps High quality capital. leverage ratio FL MAR-20 BBVA, DEC-19 EUROPEAN PEERS 2019 DIVIDENDS 0.26 € / share paid for 2019 results, last payment of 0.16 €/share (29 bps of CET1) paid in April 2020. Already booked in 2019 2020 No dividend payment until uncertainties disappear European Peer Group: BARC, BNPP, CASA, CS, CMZ, DB, HSBC, ISP, LBG, RBS, SAN, SG, UBS, UCG. European Peer Group figures as of Dec-19. BBVA figures as of Mar-20.

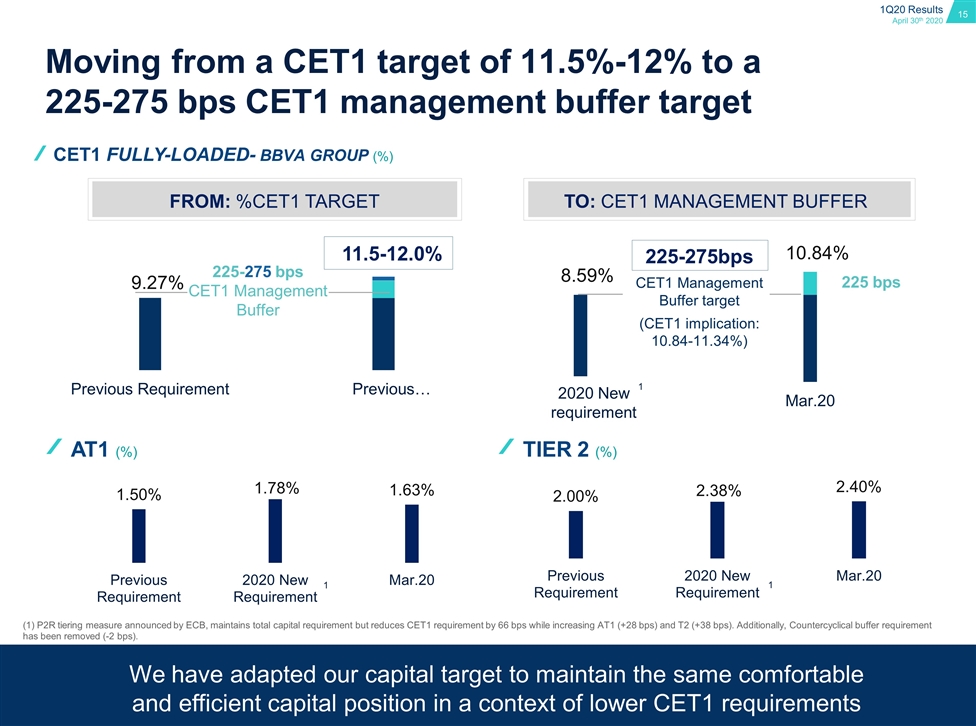

We have adapted our capital target to maintain the same comfortable and efficient capital position in a context of lower CET1 requirements Moving from a CET1 target of 11.5%-12% to a 225-275 bps CET1 management buffer target CET1 fully-loaded- BBVA GROUP (%) FROM: %CET1 Target TO: CET1 MANAGEMENT BUFFER 11.5-12.0% 225-275 bps CET1 Management Buffer (1) P2R tiering measure announced by ECB, maintains total capital requirement but reduces CET1 requirement by 66 bps while increasing AT1 (+28 bps) and T2 (+38 bps). Additionally, Countercyclical buffer requirement has been removed (-2 bps). 10.84% 225-275bps CET1 Management Buffer target (CET1 implication: 10.84-11.34%) AT1 (%) TIER 2 (%) 2020 New requirement 1 1 1 225 bps

BBVA reaches an agreement with Allianz to boost its non-life insurance business in Spain Strategic Long Term Alliance Non-Life Insurance business is strategic for BBVA This alliance strengthens our innovative products offer, leveraging on capabilities of a leading global industrial partner like Allianz It also reinforces our strategic priority to help our clients improve their financial health, offering the best products and services Sound Economics (1) Impacts in P/L and Solvency calculated only with the Fixed Price (€277M) €300M1 Net impact on P&L Impact on CET1 FL1 €377M Total Price for 50% Stake + 7bps

Business Areas

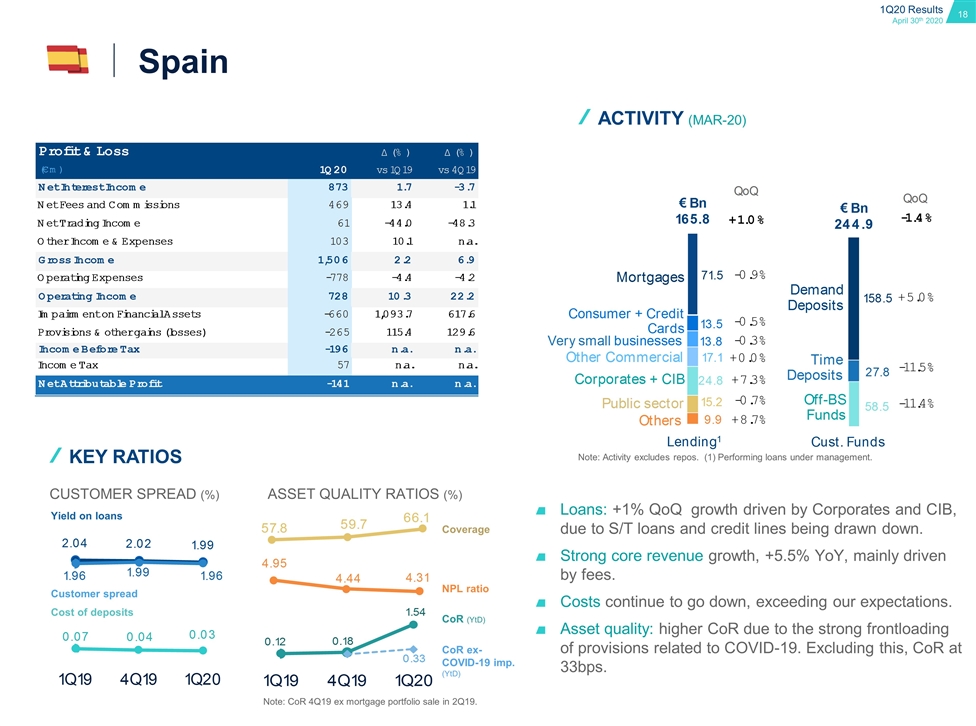

Spain Customer Spread (%) Asset Quality ratios (%) Yield on loans Customer spread Cost of deposits Coverage NPL ratio CoR (YtD) Key Ratios CoR ex-COVID-19 imp. (YtD) Note: Activity excludes repos. (1) Performing loans under management. ACTIVITY (MAR-20) Note: CoR 4Q19 ex mortgage portfolio sale in 2Q19. Loans: +1% QoQ growth driven by Corporates and CIB, due to S/T loans and credit lines being drawn down. Strong core revenue growth, +5.5% YoY, mainly driven by fees. Costs continue to go down, exceeding our expectations. Asset quality: higher CoR due to the strong frontloading of provisions related to COVID-19. Excluding this, CoR at 33bps.

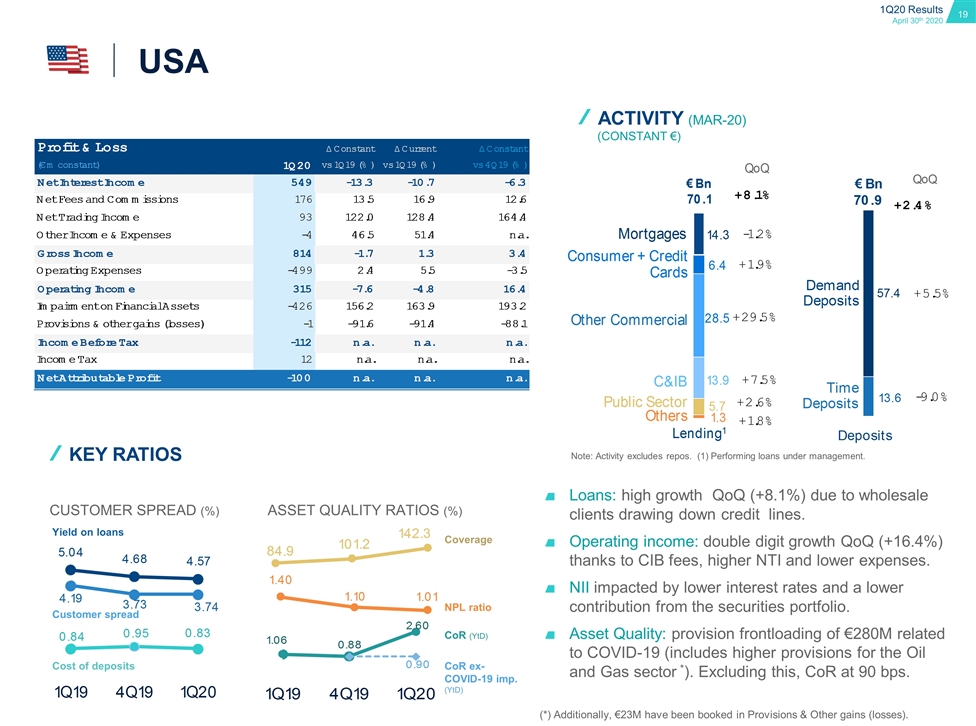

Customer Spread (%) Asset Quality ratios (%) Coverage NPL ratio Yield on loans Customer spread Cost of deposits ACTIVITY (MAR-20) Key Ratios (CONSTANT €) Note: Activity excludes repos. (1) Performing loans under management. CoR (YtD) CoR ex-COVID-19 imp. (YtD) USA Loans: high growth QoQ (+8.1%) due to wholesale clients drawing down credit lines. Operating income: double digit growth QoQ (+16.4%) thanks to CIB fees, higher NTI and lower expenses. NII impacted by lower interest rates and a lower contribution from the securities portfolio. Asset Quality: provision frontloading of €280M related to COVID-19 (includes higher provisions for the Oil and Gas sector *). Excluding this, CoR at 90 bps. (*) Additionally, €23M have been booked in Provisions & Other gains (losses).

Customer Spread (%) Asset Quality ratios (%) Yield on loans Customer spread Cost of deposits Key Ratios ACTIVITY (MAR-20) (CONSTANT €) (1) Performing loans and Cust. Funds under management, excluding repos, according to local GAAP Coverage NPL ratio CoR (YtD) CoR ex-COVID-19 imp. (YtD) Mexico Loans: strong growth QoQ (+4% excl. FX) driven by commercial segments due to drawdown of credit lines, leading to market share gains (+55 bps QoQ) Resilient Operating Income (+6% YoY) with revenues and positive operating jaws as the main levers. NII impacted by lower lending yields and a loan mix effect (growth biased to commercial segments). Asset quality: Significant frontloading of COVID-19 related provisions (€320M). Excluding this, CoR at 311 bps.

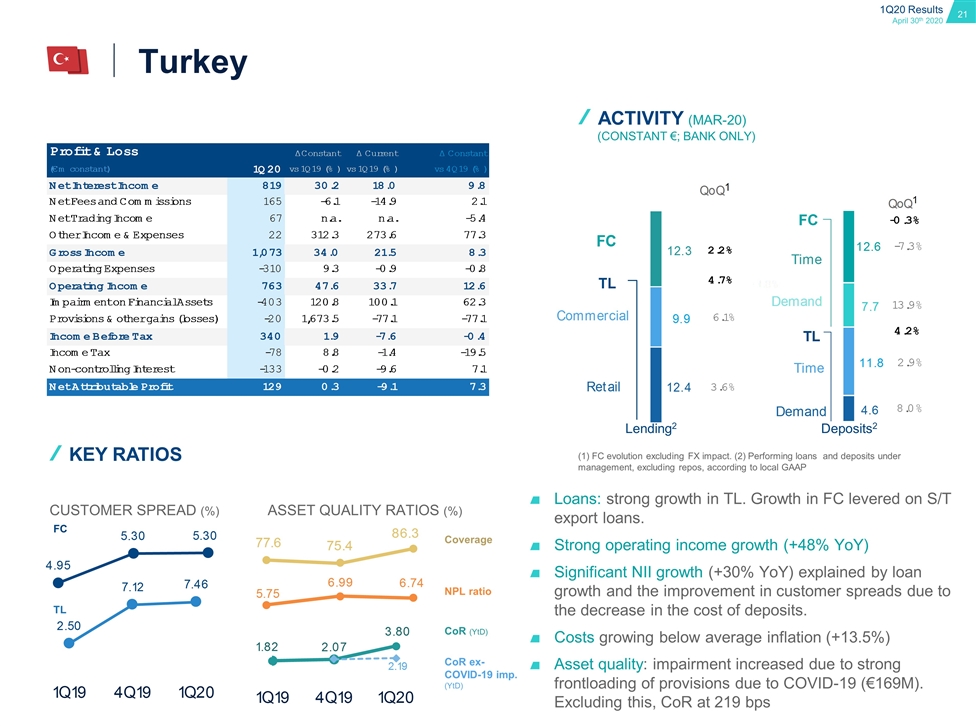

Lending2 Deposits2 Customer Spread (%) Asset Quality ratios (%) TL FC (1) FC evolution excluding FX impact. (2) Performing loans and deposits under management, excluding repos, according to local GAAP Key Ratios ACTIVITY (MAR-20) (CONSTANT €; bank only) Coverage NPL ratio CoR (YtD) CoR ex-COVID-19 imp. (YtD) Turkey Loans: strong growth in TL. Growth in FC levered on S/T export loans. Strong operating income growth (+48% YoY) Significant NII growth (+30% YoY) explained by loan growth and the improvement in customer spreads due to the decrease in the cost of deposits. Costs growing below average inflation (+13.5%) Asset quality: impairment increased due to strong frontloading of provisions due to COVID-19 (€169M). Excluding this, CoR at 219 bps

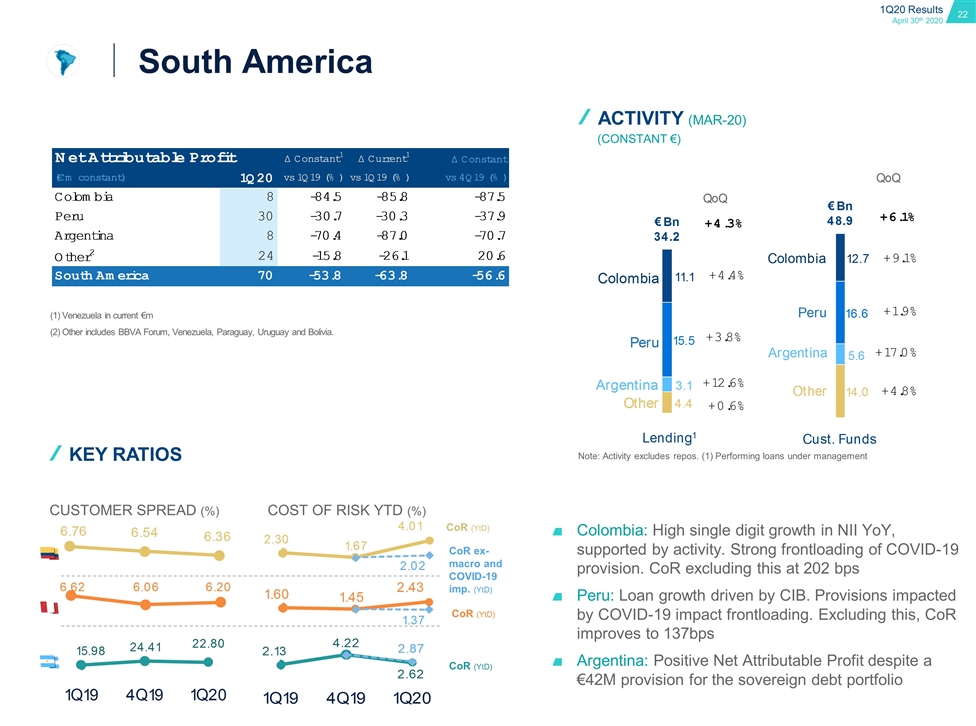

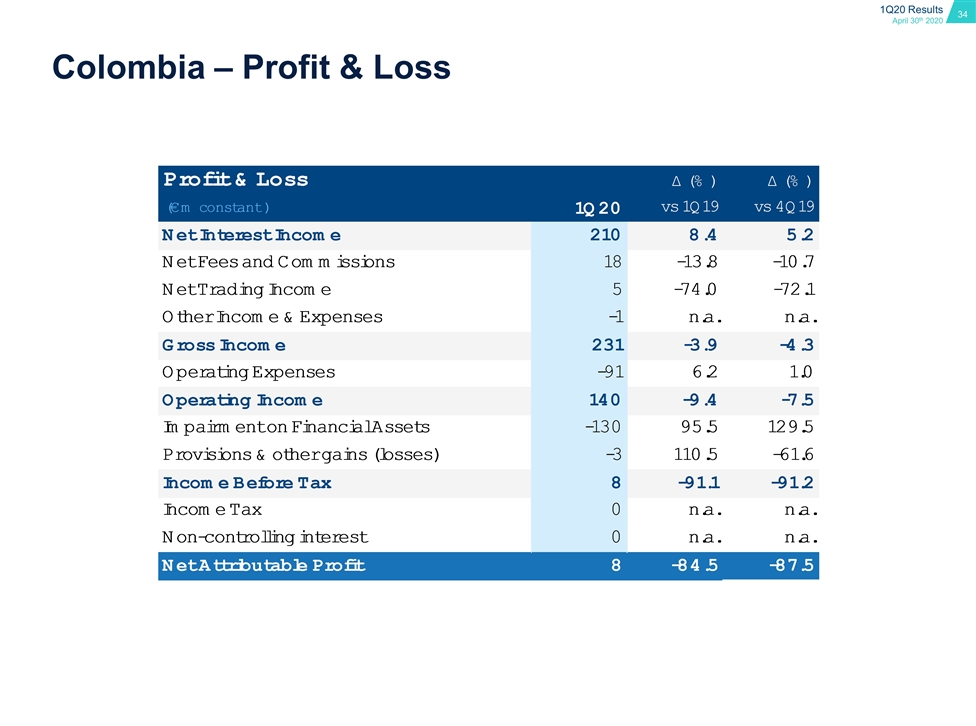

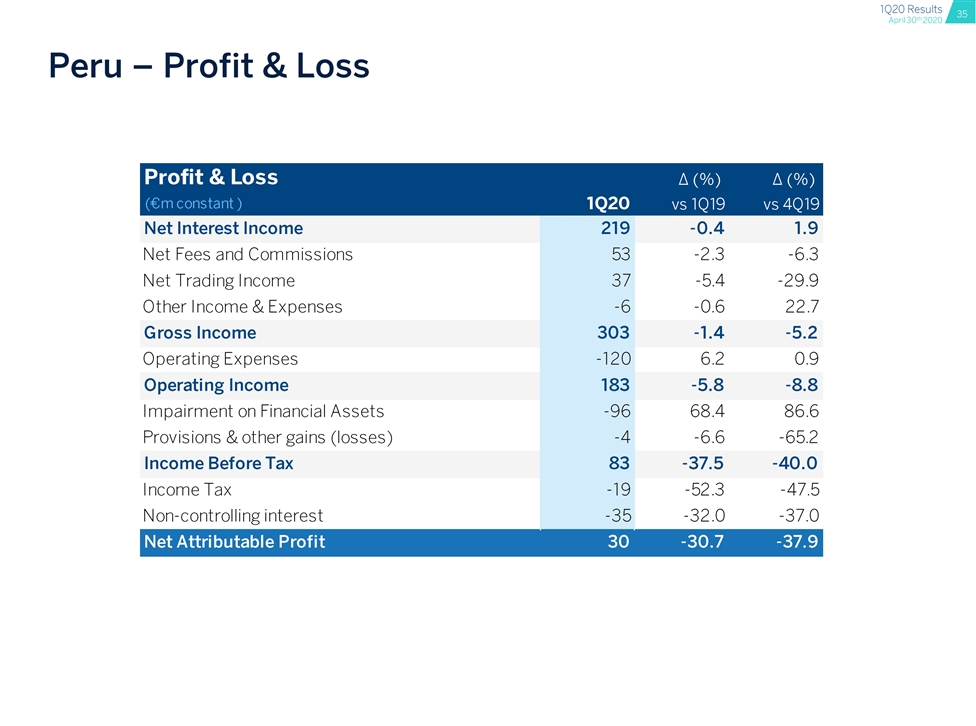

(1) Venezuela in current €m (2) Other includes BBVA Forum, Venezuela, Paraguay, Uruguay and Bolivia. Customer Spread (%) Cost of risk ytd (%) Key Ratios (CONSTANT €) ACTIVITY (MAR-20) CoR ex-macro and COVID-19 imp. (YtD) Note: Activity excludes repos. (1) Performing loans under management CoR (YtD) South America Colombia: High single digit growth in NII YoY, supported by activity. Strong frontloading of COVID-19 provision. CoR excluding this at 202 bps Peru: Loan growth driven by CIB. Provisions impacted by COVID-19 impact frontloading. Excluding this, CoR improves to 137bps Argentina: Positive Net Attributable Profit despite a €42M provision for the sovereign debt portfolio CoR (YtD) CoR (YtD)

Outlook and Final Remarks

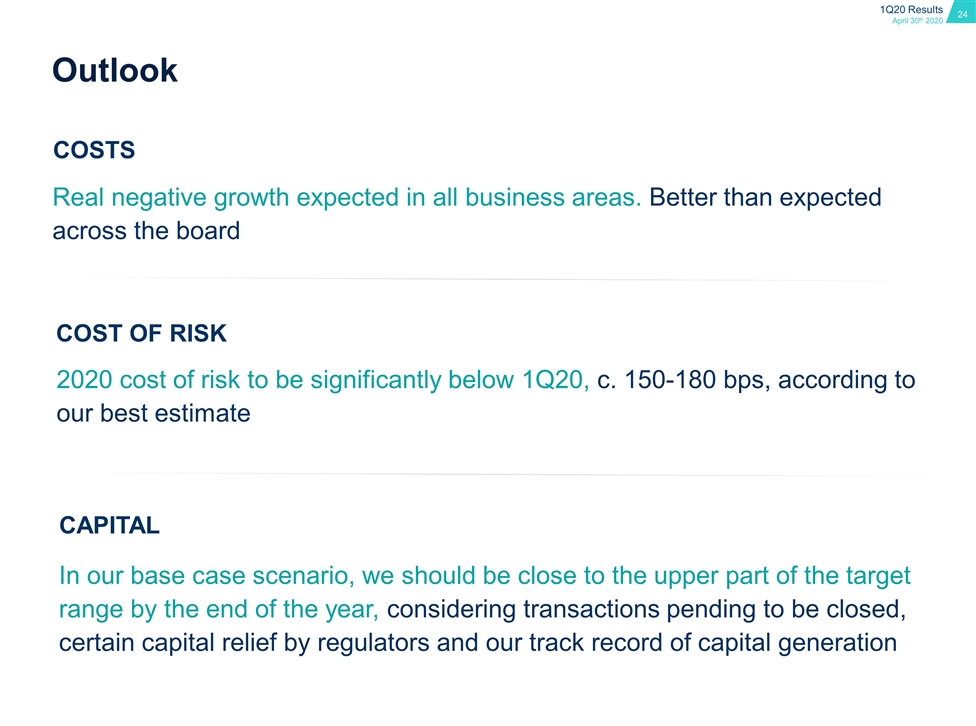

Outlook COSTS Real negative growth expected in all business areas. Better than expected across the board 2020 cost of risk to be significantly below 1Q20, c. 150-180 bps, according to our best estimate COST OF RISK CAPITAL In our base case scenario, we should be close to the upper part of the target range by the end of the year, considering transactions pending to be closed, certain capital relief by regulators and our track record of capital generation

Final Remarks Outstanding Operating Income growth, demonstrating resilience as we manage through the crisis Risk indicators impacted by significant COVID-19 provision frontloading, including updated macro scenarios and specific provisions for most affected exposures Our priorities are clear: First and foremost, the safety and health of our employees, clients and society, and support our clients in navigating through the crisis We operate from a position of strength. Capital and liquidity well above requirements

01 07 09 05 06 08 10 12 13 Gross Income breakdown Net Attributable Profit evolution P&L Accounts by business unit Argentina: hyperinflation adjustment ALCO Portfolio, NII Sensitivity and LCRs & NSFRs Garanti: wholesale funding RWAs by business area Book Value of the main subsidiaries Digital sales breakdown Annex 11 02 Stages breakdown by business areas TBV Per share and dividends evolution 03 EAD to most vulnerable sectors in the current environment Outstanding loan commitments 04 Customer Spread by country 14 CET1 Sensitivity to market impacts 15

01 Net Attributable Profit evolution

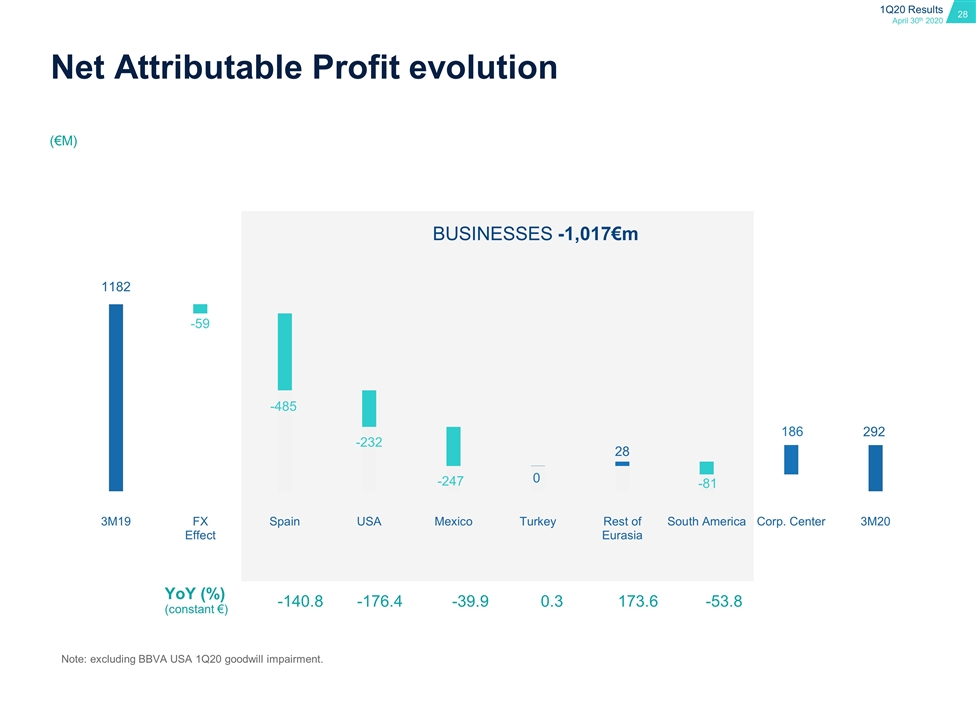

YoY (%) (constant €) -140.8 -176.4 -39.9 0.3 173.6 -53.8 BUSINESSES -1,017€m (€m) Note: excluding BBVA USA 1Q20 goodwill impairment. Net Attributable Profit evolution

02 Gross Income breakdown

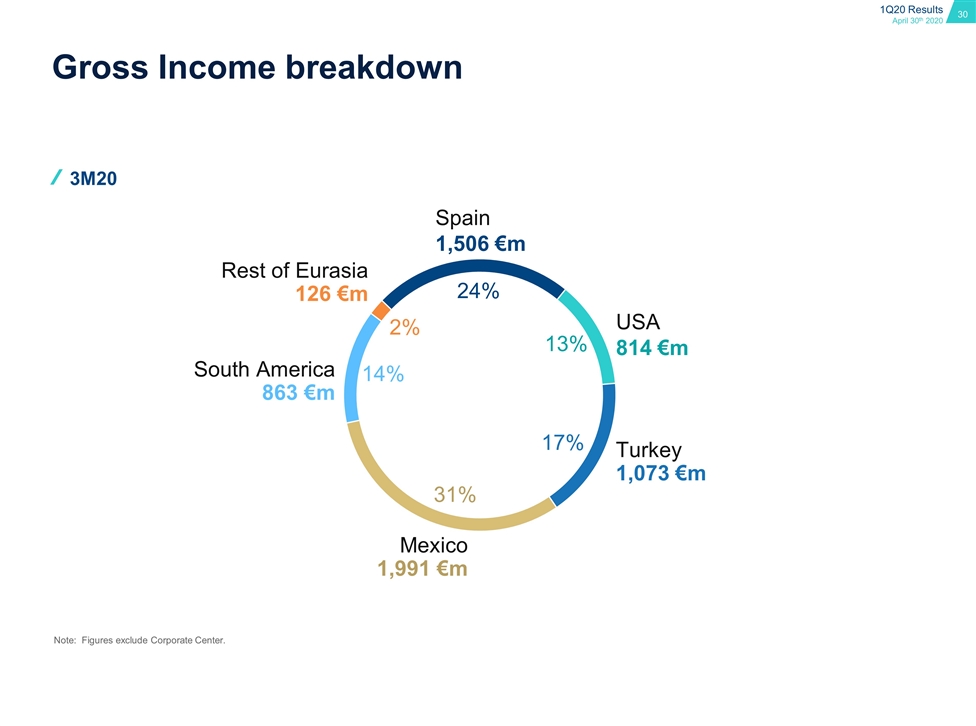

Note: Figures exclude Corporate Center. 3M20 Spain 1,506 €m USA 814 €m Turkey 1,073 €m Mexico 1,991 €m South America 863 €m Rest of Eurasia 126 €m Gross Income breakdown

03 Rest of Eurasia Corporate Center Colombia Peru P&L Accounts by business unit

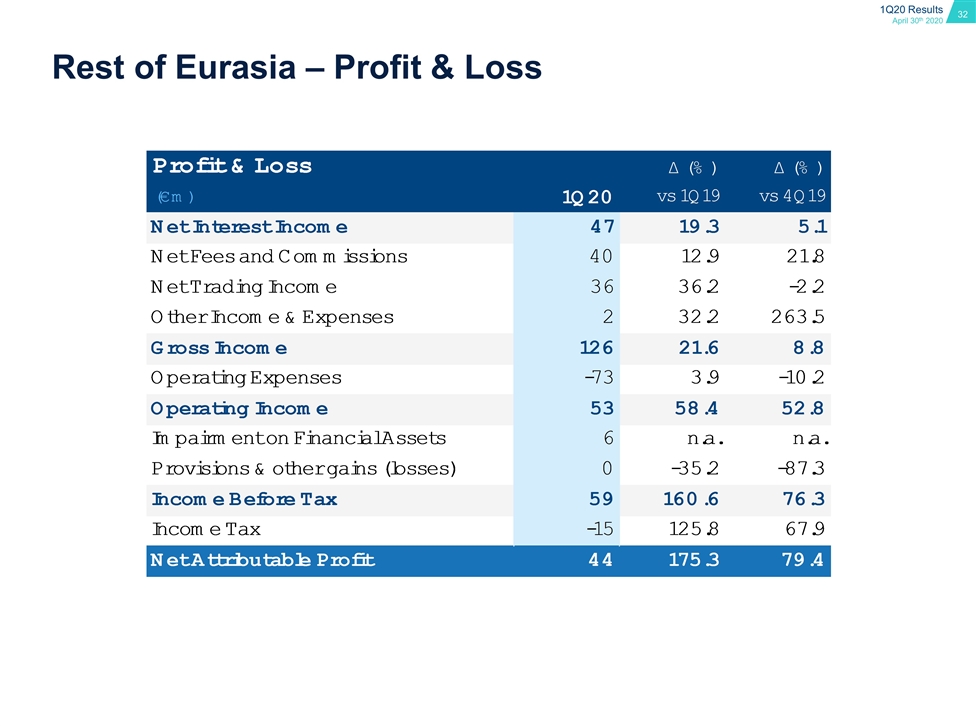

Rest of Eurasia – Profit & Loss

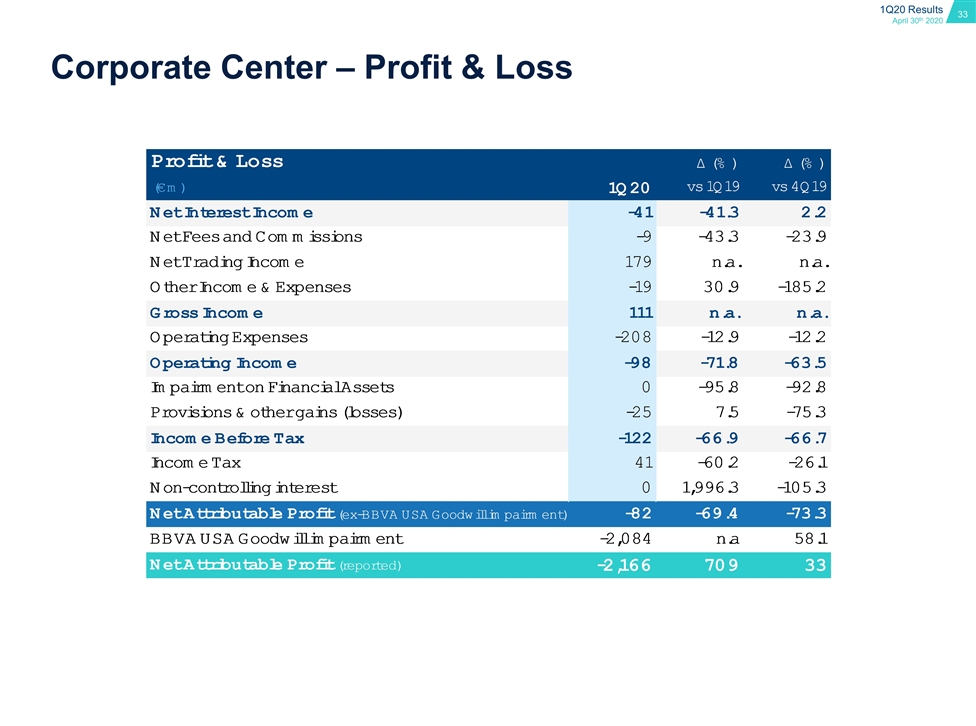

Corporate Center – Profit & Loss

Colombia – Profit & Loss

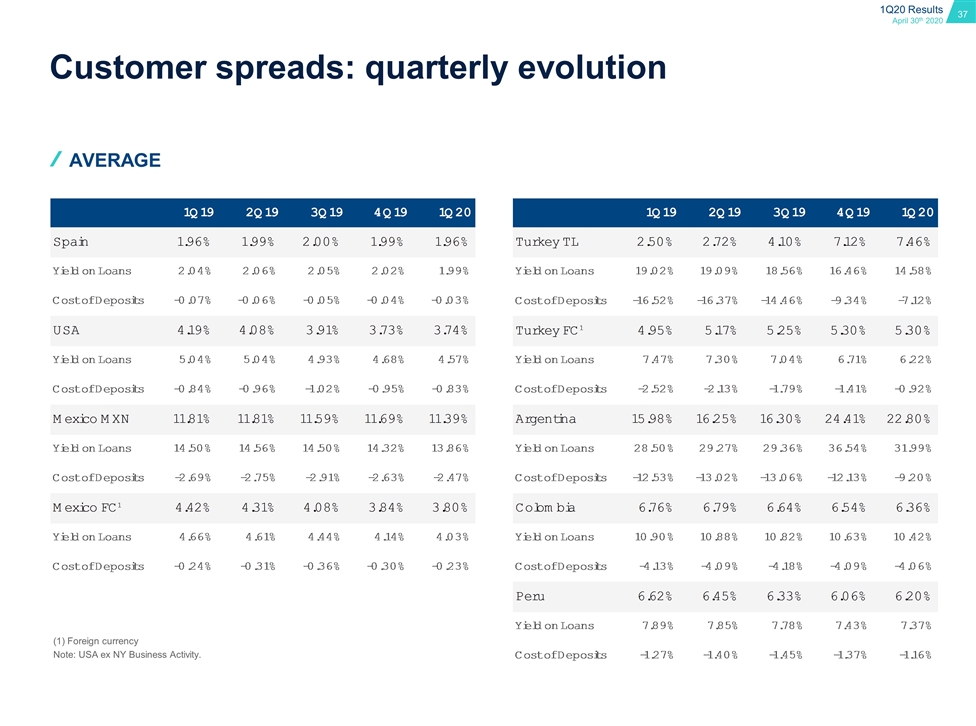

04 Customer spread by country

(1) Foreign currency Note: USA ex NY Business Activity. Customer spreads: quarterly evolution Average

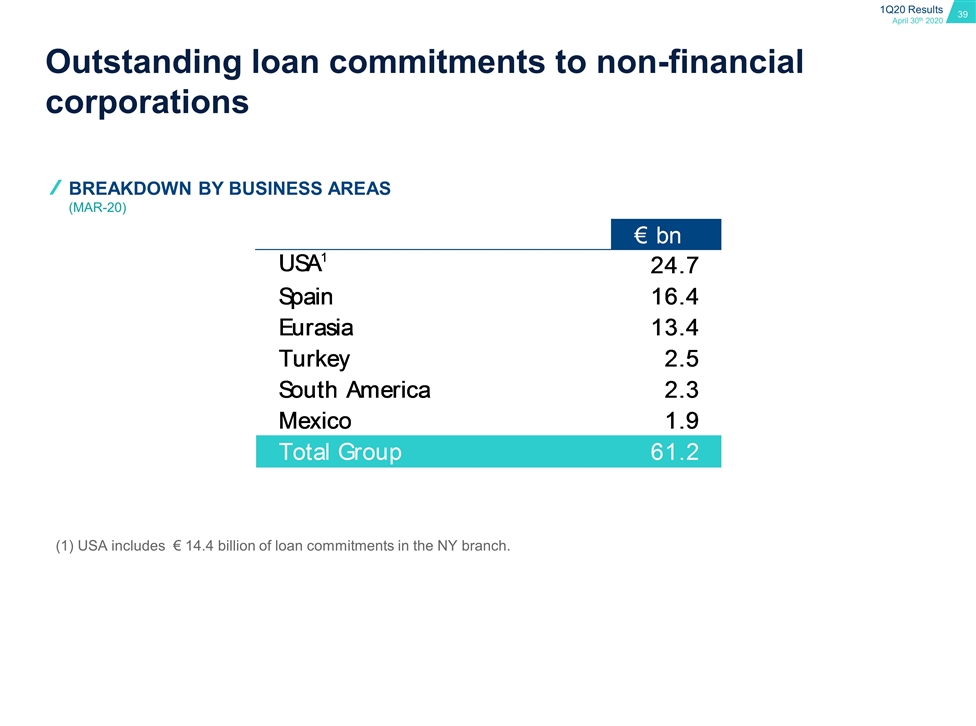

05 Outstanding loan commitments to non-financial corporations

Outstanding loan commitments to non-financial corporations (1) USA includes € 14.4 billion of loan commitments in the NY branch. Breakdown by BUSINESS AREAS (MAR-20)

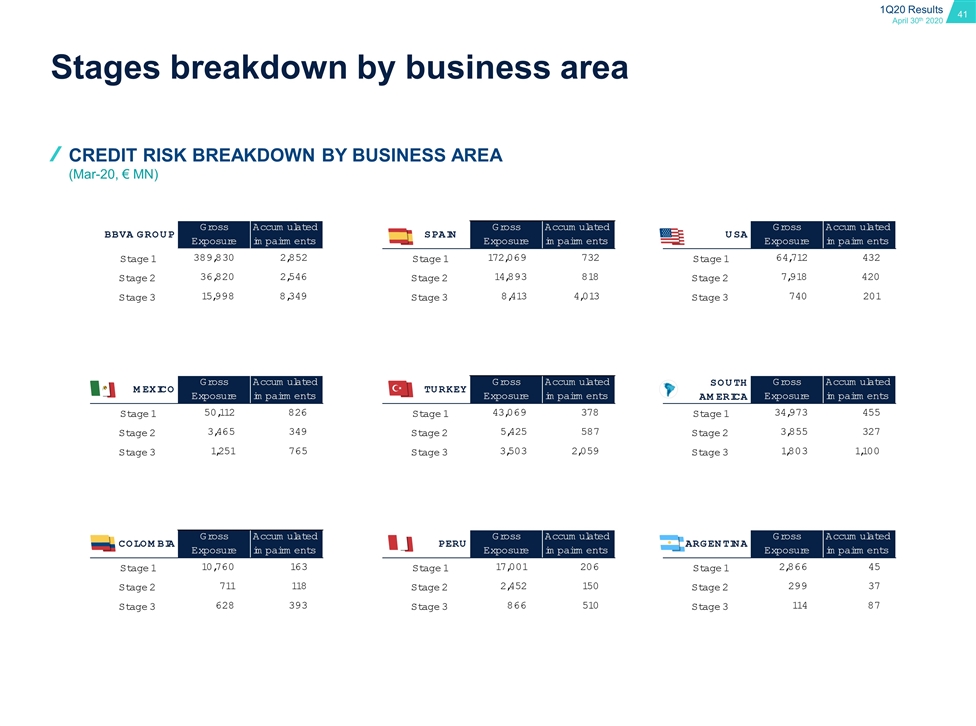

06 Stages breakdown by business areas

Stages breakdown by business area CREDIT RISK Breakdown by business area (Mar-20, € MN)

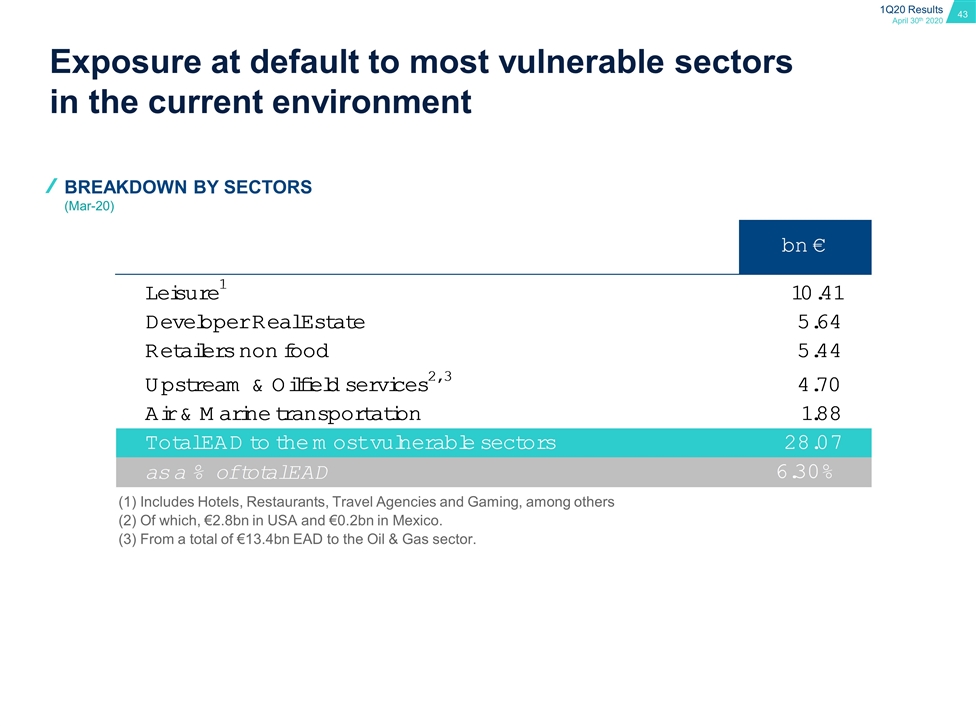

07 EAD to most vulnerable sectors in the current environment

Exposure at default to most vulnerable sectors in the current environment Breakdown by sectors (Mar-20) (1) Includes Hotels, Restaurants, Travel Agencies and Gaming, among others (2) Of which, €2.8bn in USA and €0.2bn in Mexico. (3) From a total of €13.4bn EAD to the Oil & Gas sector.

08 ALCO Portfolio, NII Sensitivity and LCRs & NSFRs

ALCO portfolio USA Turkey Mexico South America Euro1 52.4 54.3 50.8 Alco portfolio breakdown by region (€ BN) Euro alco portfolio maturity profile (€ BN) Euro alco yield (Mar-20, %) Amort Cost (HTC) Fair Value (HTC&S) March 2020 (€BN) (€BN) (duration) South America 0.1 3.2 1.3 years Mexico 1.0 5.6 1.8 years Turkey 4.5 3.4 4.0 years USA 6.7 5.7 1.9 years Euro 15.5 8.7 3.3 years Spain 11.6 3.8 Italy 3.7 1.1 Rest 0.1 3.9 1.2% (1) Figures excludes SAREB senior bonds (€4.6bn as of Mar-19, and €4.5bn for Dec-19 and Mar-20) and High Quality Liquid Assets portfolios (€8.7bn as of Mar-19, €11.1bn as of Dec-19 and €12.6bn as of Mar-20) .

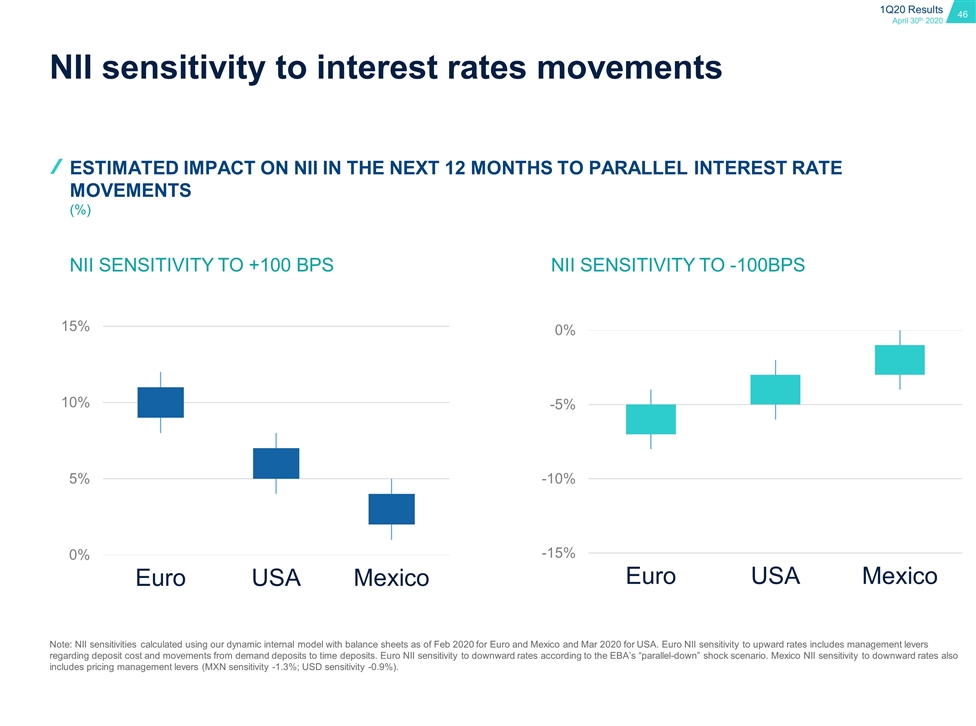

Estimated impact on nii in the next 12 months to parallel interest rate movements (%) Nii sensitivity to +100 bps Nii sensitivity to -100bps NII sensitivity to interest rates movements Note: NII sensitivities calculated using our dynamic internal model with balance sheets as of Feb 2020 for Euro and Mexico and Mar 2020 for USA. Euro NII sensitivity to upward rates includes management levers regarding deposit cost and movements from demand deposits to time deposits. Euro NII sensitivity to downward rates according to the EBA’s “parallel-down” shock scenario. Mexico NII sensitivity to downward rates also includes pricing management levers (MXN sensitivity -1.3%; USD sensitivity -0.9%).

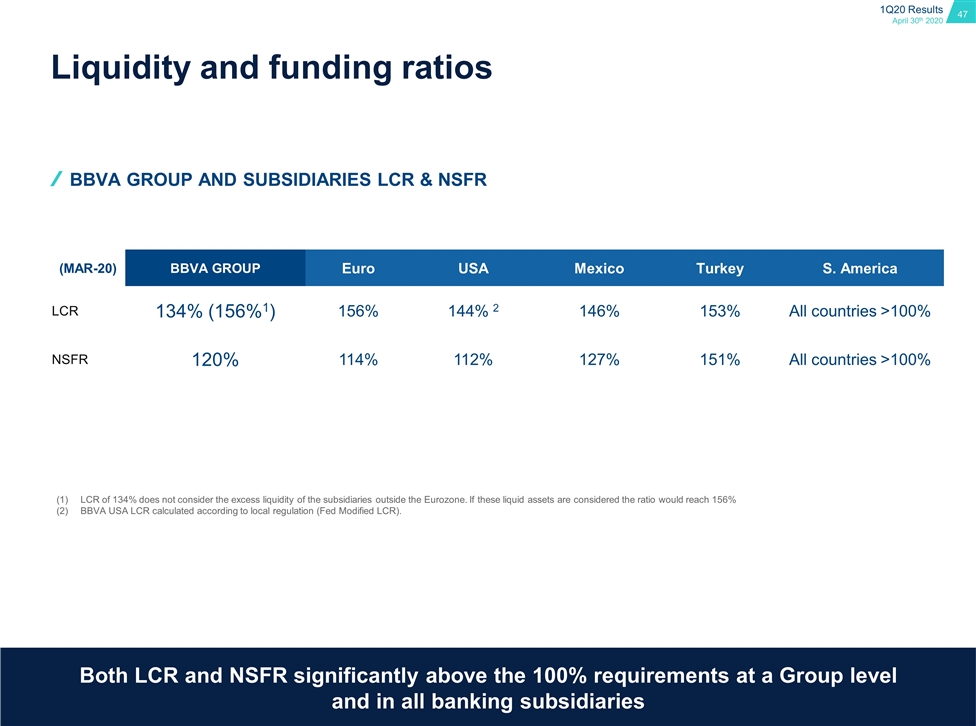

Liquidity and funding ratios (mar-20) BBVA Group Euro USA Mexico Turkey S. America LCR 134% (156%1) 156% 144% 2 146% 153% All countries >100% NSFR 120% 114% 112% 127% 151% All countries >100% Bbva group and subsidiaries lcr & NSFR LCR of 134% does not consider the excess liquidity of the subsidiaries outside the Eurozone. If these liquid assets are considered the ratio would reach 156% BBVA USA LCR calculated according to local regulation (Fed Modified LCR). Both LCR and NSFR significantly above the 100% requirements at a Group level and in all banking subsidiaries

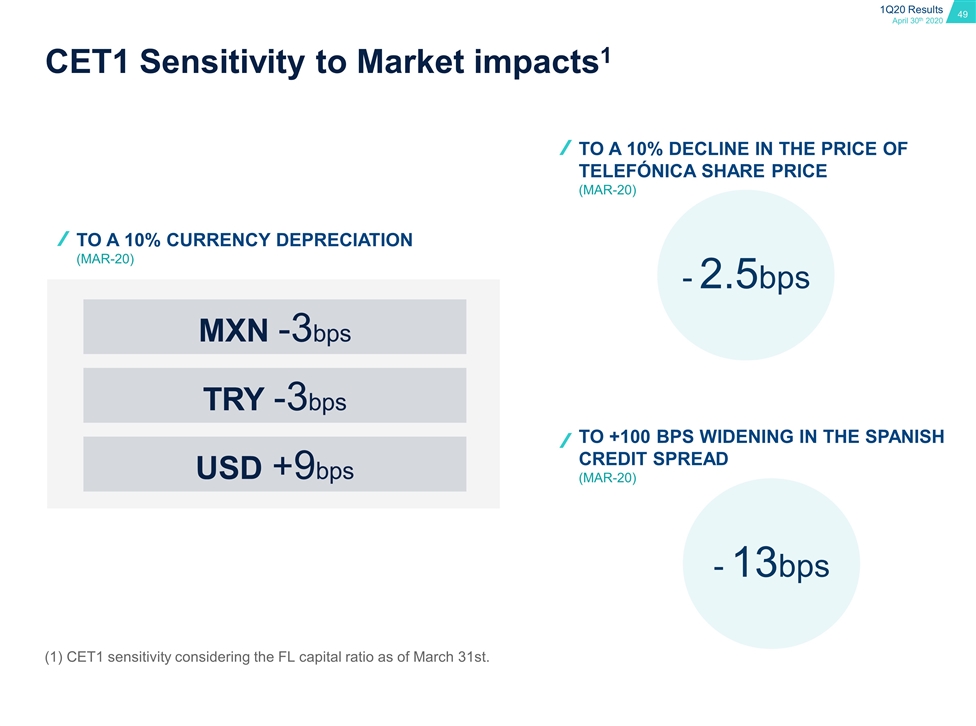

09 CET1 sensitivity to market impacts

CET1 Sensitivity to Market impacts1 - 2.5bps MXN -3bps TRY -3bps USD +9bps - 13bps To a 10% currency depreciation (MAR-20) to a 10% decline in the price of tELEFóNICA share price (MAR-20) To +100 bps widening in the Spanish credit spread (MAR-20) (1) CET1 sensitivity considering the FL capital ratio as of March 31st.

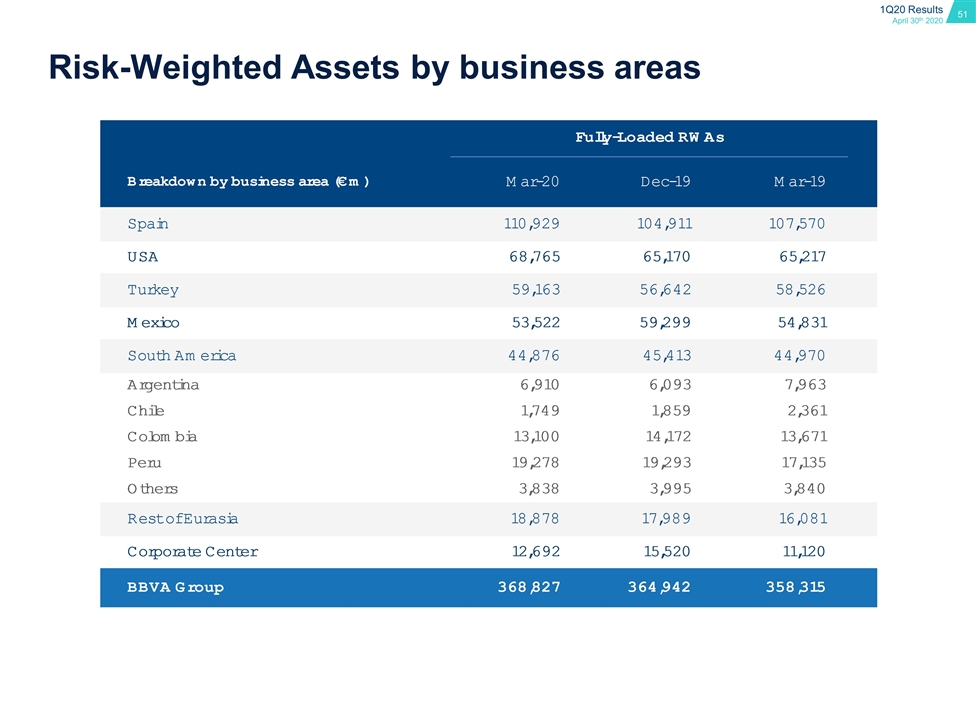

10 RWAs by business area

Risk-Weighted Assets by business areas

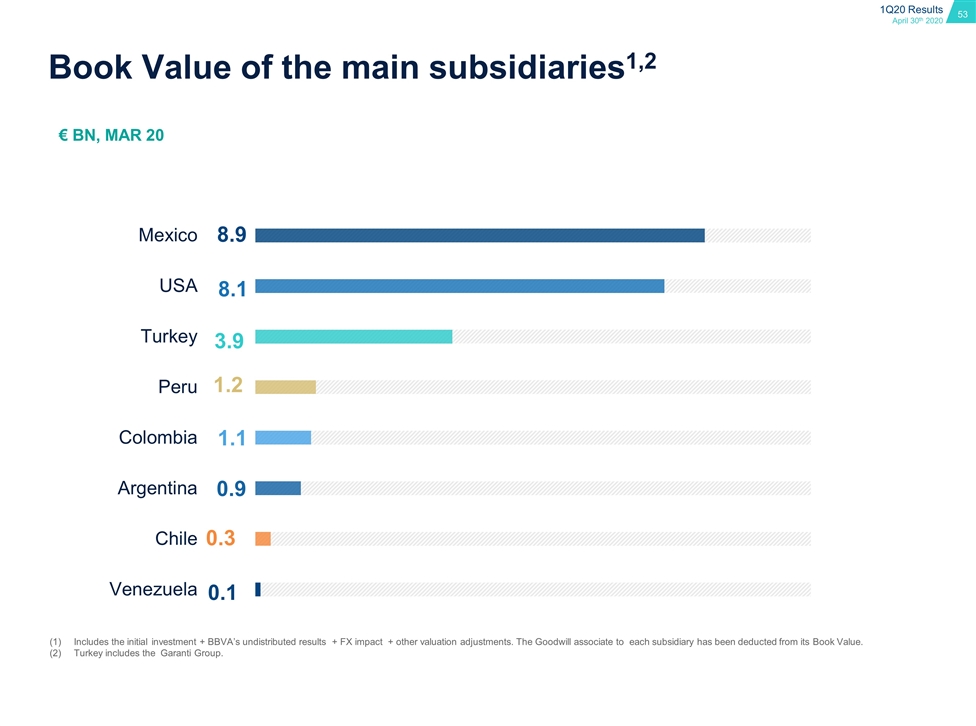

11 Book Value of the main subsidiaries

€ Bn, MAR 20 Includes the initial investment + BBVA’s undistributed results + FX impact + other valuation adjustments. The Goodwill associate to each subsidiary has been deducted from its Book Value. Turkey includes the Garanti Group. Book Value of the main subsidiaries1,2

12 TBV per share and dividends evolution

Shareholder’s return: TBV per share and dividends TBV per Share & Dividends (€ PER SHARE) DIVIDENDS +1.7% TBV/SHARE

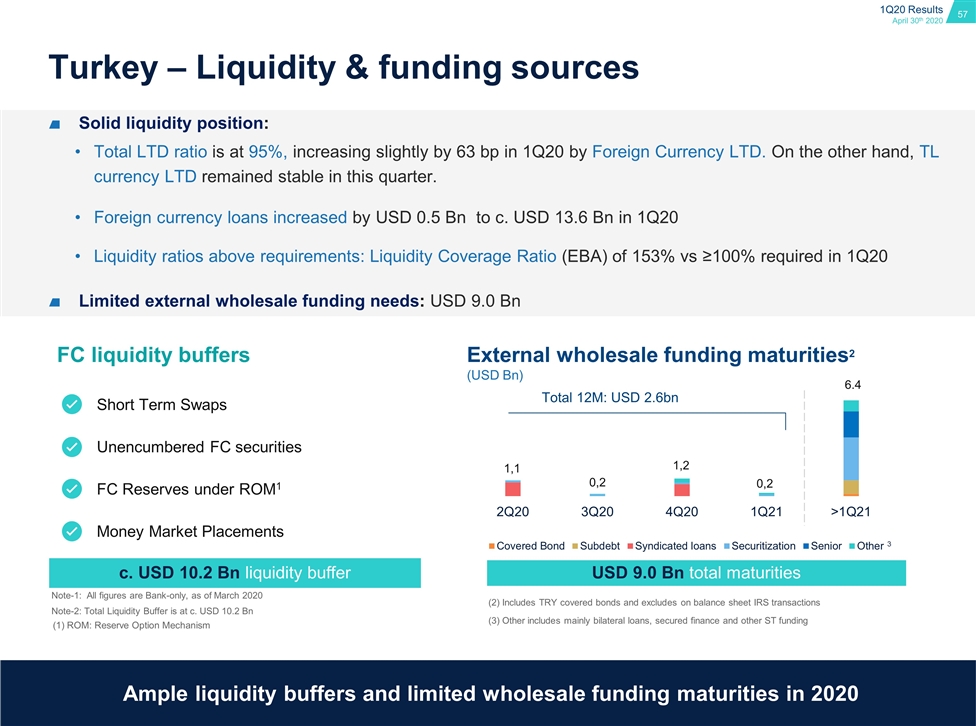

13 Garanti: wholesale funding

Turkey – Liquidity & funding sources (1) ROM: Reserve Option Mechanism Ample liquidity buffers and limited wholesale funding maturities in 2020 Solid liquidity position: Total LTD ratio is at 95%, increasing slightly by 63 bp in 1Q20 by Foreign Currency LTD. On the other hand, TL currency LTD remained stable in this quarter. Foreign currency loans increased by USD 0.5 Bn to c. USD 13.6 Bn in 1Q20 Liquidity ratios above requirements: Liquidity Coverage Ratio (EBA) of 153% vs ≥100% required in 1Q20 Limited external wholesale funding needs: USD 9.0 Bn FC liquidity buffers External wholesale funding maturities2 (USD Bn) Note-1: All figures are Bank-only, as of March 2020 (2) Includes TRY covered bonds and excludes on balance sheet IRS transactions Short Term Swaps Unencumbered FC securities FC Reserves under ROM1 Money Market Placements (3) Other includes mainly bilateral loans, secured finance and other ST funding 3 1,1 0,2 1,2 0,2 Total 12M: USD 2.6bn USD 9.0 Bn total maturities c. USD 10.2 Bn liquidity buffer Note-2: Total Liquidity Buffer is at c. USD 10.2 Bn

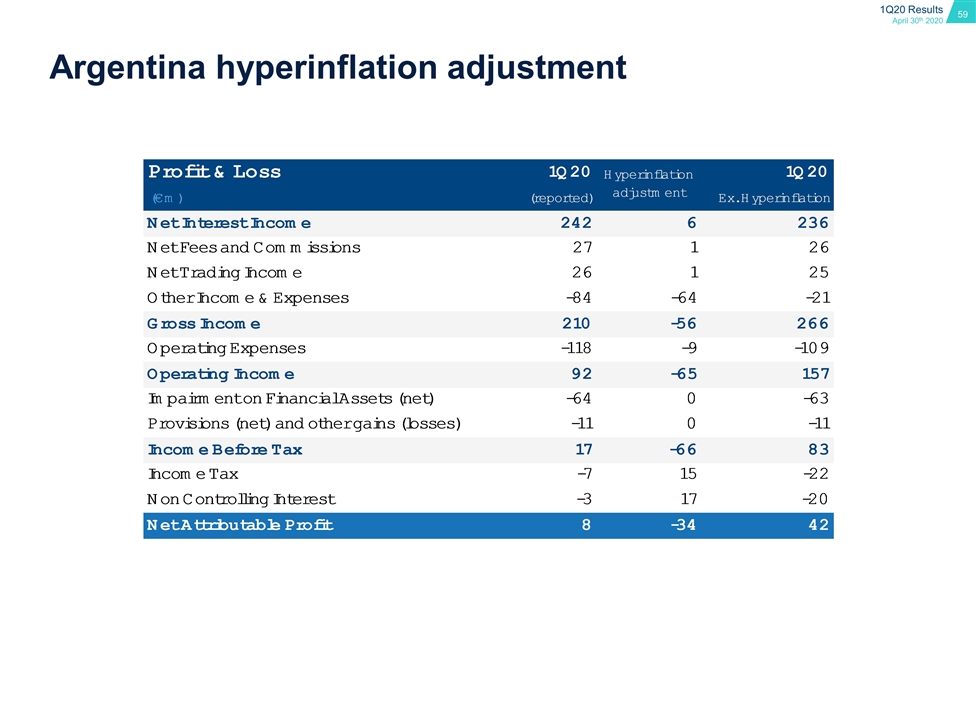

14 Argentina: hyperinflation adjustment

Argentina hyperinflation adjustment

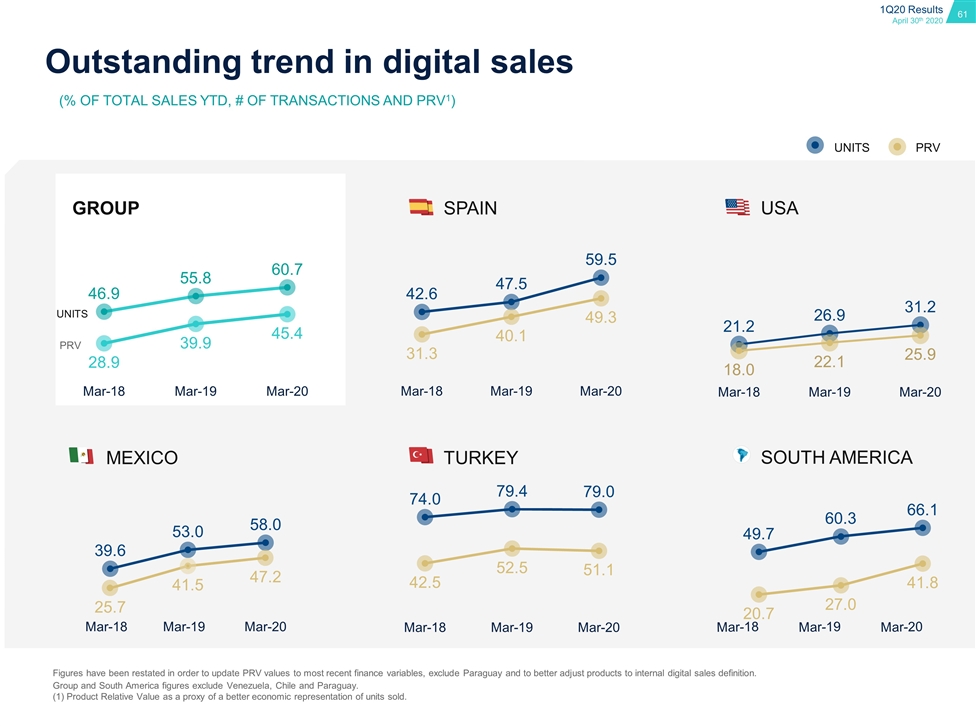

15 Digital sales breakdown

Outstanding trend in digital sales Figures have been restated in order to update PRV values to most recent finance variables, exclude Paraguay and to better adjust products to internal digital sales definition. Group and South America figures exclude Venezuela, Chile and Paraguay. (1) Product Relative Value as a proxy of a better economic representation of units sold. GROUP SPAIN USA MEXICO TURKEY SOUTH AMERICA UNITS PRV UNITS PRV (% of total sales YtD, # of transactions and PRV1)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Banco Bilbao Vizcaya Argentaria, S.A. | ||||||

| Date: April 30, 2020 |

By: /s/ María Ángeles Peláez Morón

| |||||

| ||||||

| Name: María Ángeles Peláez Morón | ||||||

| Title: Authorized representative | ||||||