- BBVA Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Banco Bilbao Vizcaya Argentaria (BBVA) 6-KCurrent report (foreign)

Filed: 16 Feb 22, 6:15am

UNITED STATES SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2022

Commission file number: 1-10110

BANCO BILBAO VIZCAYA ARGENTARIA, S.A.

(Exact name of Registrant as specified in its charter)

BANK BILBAO VIZCAYA ARGENTARIA, S.A.

(Translation of Registrant’s name into English)

Calle Azul 4,

28050 Madrid

Spain

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

| Form 20-F X | Form 40-F |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

| Yes | No X |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

| Yes | No X |

Annual Report on the Remuneration of BBVA Directors Reference year 2021 Report approval date 9 February 2022

| ||||||

| 2 | ||||||

1. | 8 | |||||

2. | 9 | |||||

| 9 | ||||||

| 10 | ||||||

3. | 13 | |||||

| 14 | ||||||

| 15 | ||||||

| 16 | ||||||

3.3.1. Elements of the remuneration system for executive directors | 16 | |||||

3.3.2. Main terms and conditions of the executive directors’ contracts | 19 | |||||

4. | 22 | |||||

| 22 | ||||||

4.2. Remuneration accrued by non-executive directors in 2021 | 25 | |||||

| 27 | ||||||

| 41 | ||||||

| 43 | ||||||

5. | 44 | |||||

6. | 57 | |||||

| 57 | ||||||

| 58 | ||||||

| 63 | ||||||

| 65 | ||||||

| 66 | ||||||

| 67 | ||||||

This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy, the Spanish original shall prevail.

Annual Report on the Remuneration of BBVA Directors - 2021 | 1 |

Remuneration of executive directors 2021

The remunerations accrued by executive directors in 2021 are the result of application of the Directors’ Remuneration Policies approved by the General Shareholders Meeting.

Summary table of remuneration accrued in 20211

(Thousands of euro and shares)

| Director | Fixed (paid in 2021)

| Variable (payable in 2022)

| Deferred Variable (payable in 2022)

| |||||||||||||||||

| Annual Fixed Remuneration | Other items

|

Upfront Payment2 AVR 2021

| Deferred AVR 20183

| Deferred AVR

| ||||||||||||||||

In kind

|

Pension1 /Other

| Cash

| Shares

| Cash5

| Shares

| Cash5

| Shares

| |||||||||||||

Chairman (Carlos Torres Vila) | 2,924 | 328 | 340 | 849 | 159,235 |

| 364 | 107,386 | 146 | 27,898 | ||||||||||

Chief Executive Officer (Onur Genç) | 2,179 | 158 | 1,254 | 645 | 120,977 | 332 | 61,282 | - | - | |||||||||||

| (1) | Agreed annual contribution to cover the retirement contingency (EUR 439 thousand) minus the downward adjustment to the “discretionary pension benefits” of EUR 98 thousand registered in 2021 (see section 4.3. A. c.) and “Cash in lieu of pension” and mobility allowance of the Chief Executive Officer. Moreover, and in accordance with the contractual provisions described in section 4.3 A. c) below, the Bank has paid in 2021 annual insurance premiums to cover death and disability contingencies of an amount of EUR 574 thousand in the case of the Chairman and EUR 295 thousand in the case of the Chief Executive Officer. |

| (2) | 40% of Annual Variable Remuneration (AVR) accrued in 2021. |

| (3) | In 2022 falls due the first payment of the 2018 Deferred AVR (60%) in the case of the Chairman and payment of the entire 2018 Deferred AVR in the case of the Chief Executive Officer, once the relevant downward adjustments due to the result of multi-year performance indicators have been applied (see section 4.3 B c). Exchange rate at the end of January 2022 (1.1156 USD/EUR) in the case of the Chief Executive Officer. |

| (4) | In 2022 falls due the second payment to the Chairman of 2017 Deferred AVR (20%). The Chief Executive Officer does not have any 2017 Deferred AVR pending payment. |

| (5) | Includes updates made per the year-on-year CPI. |

Total remuneration of executive directors corresponding to 2021: link with results and comparison with previous years

1 In accordance with Circular 4/2013 of the CNMV, for the purposes of this Report, remunerations accrued in 2021 are those in which the accrual period had ended as at 31 December 2021 and, in the case of variable remuneration, those with regard to which vesting has occurred as at the date of the Report, once it has been verified that malus arrangements preventing or limiting its payment to the beneficiary are not applicable.

This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy, the Spanish original shall prevail.

Annual Report on the Remuneration of BBVA Directors - 2021 | 2 |

Remuneration of executive directors corresponding to 2021 financial year is the result of the changes introduced in the Remuneration Policy approved at the General Meeting of 20 April 2021, by virtue of which, in the case of the Chairman, the amount of the annual contribution agreed to cover the retirement contingency was reduced from EUR 1,642 thousand (67% of the Annual Fixed Remuneration) to EUR 439 thousand (15% of the Annual Fixed Remuneration). As a result of the foregoing, the remainder of the annual contribution established in the previous policy was integrated, in part, in his Annual Fixed Remuneration and, in part, in his “Target” Annual Variable Remuneration, abiding by, in each case, the balance established in the Policy between these two components (45%-55%), with a reduction in the total amount to be transferred to them of EUR 157 thousand. As a result of these changes the Chairman’s total remuneration was reduced with respect to the figure stipulated in the previous policy. Likewise the change of structure involved an increase of his pay at risk linked to the Institution’s results.

|

In the table included below, comparative information of the total remuneration corresponding to three financial years (which in this case includes total remuneration of directors in each of them, considering the total AVR of the financial year and not considering deferred variable remunerations from previous years).

For this purposes, together with the change of the Directors’ Remuneration Policy approved in 2021 financial year, it may be outlined that the executive directors waived the Annual Variable Remuneration corresponding to 2020 financial year, in view of the situation arising from the COVID-19 crisis, which for the rest of the workforce, who did not waive it, partially or in full, had an achievement of 60%.

On the other hand, 2021 Annual Variable Remuneration is explained by the excellent results obtained by the Group in the different Annual Performance Indicators for the calculation of 2021 AVR determined by the Board of Directors at the beginning of that year. Notwithstanding the context marked by the high impact of the economic crisis originated by COVID-19 and the high uncertainty regarding the prospects for recovery, the Corporate Bodies2 set targets for the calculation of the 2021 AVR, which were over the analysts consensus at that time (set at EUR 2,944 million in the case of the Attributable Profit). As a result of the management carried out, these targets have not only been achieved, but overachieved.

Thus, the BBVA Group has obtained a recurring attributable profit of EUR 5,069 million, without including the results generated, until June 2021, by BBVA USA and its subsidiaries and the costs of the restructuring plan in Spain. The amount of profit considered for incentive purposes has been said recurring profit, excluding, in addition, the cost savings not budgeted generated in the year by the restructuring plan in Spain, reaching, therefore, an attributable profit of EUR 5,028 million. This data of profit is the one also considered for the calculation of the rest of the financial indicators for incentive purposes.

2 For the purposes of this Report the Board of Directors of BBVA and its Committees.

This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy, the Spanish original shall prevail.

Annual Report on the Remuneration of BBVA Directors - 2021 | 3 |

Chairman | 2021 | 2020 | 2019 | |||||||||||||||||||||||||||

Annual Fixed Remuneration (EUR thousand) | 2,924 | 2,453 | 2,453 | |||||||||||||||||||||||||||

Remuneration in kind (EUR thousand) | 328 | 228 | 184 | |||||||||||||||||||||||||||

Annual pension contribution (EUR thousand) | 3401 | 1,657 2 | 1,6413 | |||||||||||||||||||||||||||

Annual Variable Remuneration 4 (miles €) | 4,244 | 0 | 3,180 | |||||||||||||||||||||||||||

“Target” AVR (EUR thousand) | 3,572 | 2,997 | 2,997 | |||||||||||||||||||||||||||

Level of achievement | 119% | 60%6 | 106.11% | |||||||||||||||||||||||||||

| Annual Performance Indicators | Wei. | Res.5 | Tgt. | Ach. | Wei. | Res. | Tgt.6 | Ach. | Wei. | Res. | Tgt. | Ach. | ||||||||||||||||||

Attributable profit (excluding corporate transactions) | 10% | 5,028 mill.€ | ● | 150% | - | 3,084 mill.€ | ● | 0% | 10% | 4,830 mill.€ | ● | 112% | ||||||||||||||||||

Tangible Book Value per share | 15% | 6.55 | ● | 97% | - | 6.15 | ● | 43% | 10% | 6.50 | ● | 100% | ||||||||||||||||||

RORC | 10% | 14.03% | ● | 150% | - | 6.76% | ● | 0% | 15% | 8.79% | ● | 113% | ||||||||||||||||||

Efficiency ratio | 10% | 45.51% | ● | 123% | - | 46.82% | ● | 119% | 15% | 48.50% | ● | 109% | ||||||||||||||||||

Customer Satisfaction (NPS) | 10% | 101 | ● | 101% | - | 107 | ● | 107% | 10% | 97 | ● | 97% | ||||||||||||||||||

Mobilisation of sustainable financing | 10% | 30,615 mill. € | ● | 120% | - | - | - | - | - | - | ||||||||||||||||||||

Digital sales | 10% | 99 | ● | 99% | - | 86 | ● | 86% | 10% | 113 | ● | 113% | ||||||||||||||||||

Individual indicators | 25% | 120 | ● | 120% | - | - | - | 30% | 102 | ● | 102% | |||||||||||||||||||

TOTAL REMUNERATION (EUR thousand) | 7,837 | 4,338 | 7,458 | |||||||||||||||||||||||||||

| (1) | From the annual agreed contribution to the retirement pension corresponding to 2020 (EUR 1,462 thousand), 15% (EUR 246 thousand) was registered in 2020 as “discretionary pension benefits”. In 2021, this amount was adjusted by reference to the result of 2020 AVR of the rest of the Bank’s staff (as the Chairman waived its accrual in 2020). The foregoing resulted in a downward adjustment of EUR 98 thousand which had to be registered in 2021. Therefore, in 2021 the annual agreed contribution for the retirement pension corresponding to 2021 (EUR 439 thousand) has been reduced in an amount of EUR 98 thousand (see section 4.3 A c). |

| (2) | From the annual agreed contribution to the retirement pension corresponding to 2019 (EUR 1,462 thousand), 15% (EUR 246 thousand) was registered in 2019 as “discretionary pension benefits”. In 2020 this amount was adjusted by reference to the 2019 Annual Variable Remuneration of the Chairman, which resulted in an upward adjustment of EUR 15 thousand which had to be registered in 2020 financial year. Therefore, in 2020 the annual agreed contribution to the retirement pension (EUR 1,462 thousand) was increased in an amount of EUR 15 thousand. |

| (3) | From the annual agreed contribution to the retirement pension corresponding to 2018 (EUR 1,462 thousand), the adjustment to the “discretionary pension benefits” of that year, which had to be registered in 2019, was of EUR 1 thousand, applying the criteria set forth in note 2 above. |

| (4) | Amount of total Annual Variable Remuneration in cash. Of this remuneration, 40% shall be paid in 2022 (in equal parts in cash and BBVA shares), while the remaining 60% (40% in cash and 60% in BBVA shares) has been deferred and is subject to the results of multi-year performance indicators (see section 4.3. B). |

| (5) | Results for incentive purposes (see Section 4.3 B a) “Link between the 2021 AVR with results”). |

| (6) | In 2020, incentive-related targets for executive directors were not approved due to their waiver of all 2020 AVR in view of the exceptional circumstances arising from the COVID-19 crisis. For comparative purposes, the level of achievement reached for the Group targets for the rest of the workforce is included (60%). |

This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy, the Spanish original shall prevail.

Annual Report on the Remuneration of BBVA Directors - 2021 | 4 |

Chief Executive Officer | 2021 | 2020 | 2019 | |||||||||||||||||||||||||||

Annual Fixed Remuneration (EUR thousand) | 2,179 | 2,179 | 2,179 | |||||||||||||||||||||||||||

Remuneration in kind (EUR thousand) | 158 | 132 | 144 | |||||||||||||||||||||||||||

Other fixed allowances (EUR thousand) | 1,254 | 1,254 | 1,160 | |||||||||||||||||||||||||||

Annual Variable Remuneration 1 (EUR thousand) | 3,224 | 0 | 2,854 | |||||||||||||||||||||||||||

“Target” AVR (EUR thousand) | 2,672 | 2,672 | 2,672 | |||||||||||||||||||||||||||

Level of achievement | 121% | 60%3 | 106.82% | |||||||||||||||||||||||||||

Annual Performance Indicators | Wei. | Res.2 | Tgt. | Ach. | Wei. | Res. | Tgt.3 | Ach. | Wei. | Res. | Tgt. | Ach. | ||||||||||||||||||

Attributable profit (excluding corporate transactions) | 15% | 5,028 mill.€ | ● | 150% | - | 3,084 mill.€ | ● | 0% | 20% | 4,830 mill.€ | ● | 112% | ||||||||||||||||||

Tangible Book Value per share | 10% | 6.55 | ● | 97% | - | 6.15 | ● | 43% | 10% | 6.50 | ● | 100% | ||||||||||||||||||

RORC | 10% | 14.03% | ● | 150% | - | 6.76% | ● | 0% | 15% | 8.79% | ● | 113% | ||||||||||||||||||

Efficiency ratio | 15% | 45.51% | ● | 123% | - | 46.82% | ● | 119% | 15% | 48.50% | ● | 109% | ||||||||||||||||||

Customer Satisfaction (NPS) | 15% | 101 | ● | 101% | - | 107 | ● | 107% | 15% | 97 | ● | 97% | ||||||||||||||||||

Mobilisation of sustainable financing | 10% | 30,615 mill. € | ● | 120% | - | - | - | - | - | - | ||||||||||||||||||||

Digital sales | 10% | 99 | ● | 99% | - | 86 | ● | 86% | 10% | 113 | ● | 113% | ||||||||||||||||||

Individual indicators | 15% | 120 | ● | 120% | - | - | - | 15% | 102 | ● | 102% | |||||||||||||||||||

TOTAL REMUNERATION (EUR thousand) | 6,815 | 3,565 | 6,337 | |||||||||||||||||||||||||||

| (1) | Amount of total Annual Variable Remuneration in cash. Of this remuneration, 40% shall be paid in 2022 (in equal parts in cash and BBVA shares), while the remaining 60% (40% in cash and 60% in BBVA shares) has been deferred and is subject to the results of multi-year performance indicators (see section 4.3. B). |

| (2) | Results for incentive purposes (see Section 4.3 B a) “Link between the 2021 AVR with results”). |

| (3) | In 2020, incentive-related targets for executive directors were not approved due to their waiver of all 2020 AVR in view of the exceptional circumstances arising from the COVID-19 crisis. For comparative purposes, the level of achievement reached for the Group targets for the rest of the workforce is included (60%). |

This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy, the Spanish original shall prevail.

Annual Report on the Remuneration of BBVA Directors - 2021 | 5 |

Deferred remuneration from previous years payable in 2022

| 2018 Deferred AVR (EUR thousand and shares) |

|

|

|

| ||||||||||||||||

| Executive directors | Maximum amount of 2018 DAVR | Reduction (ex post adjustments) | Final amount of 2018 DAVR | Amount of 2018 DAVR to be paid in 20221 | Amount of 2018 DAVR to be paid each year in 2023 | |||||||||||||||

| Cash | Shares | Cash | Shares | Cash | Shares | Cash2 | Shares | Cash | Shares | |||||||||||

| Chairman | 574 | 180,785 | -1% | -1% | 569 | 178,977 | 341 | 107,386 | 114 | 35,795 | ||||||||||

| Chief Executive Officer | 302 | 61,901 | -1% | -1% | 299 | 61,282 | 299 | 61,282 | - | - | ||||||||||

| (1) | Relates to the first payment (60%) in the case of the Chairman (with 20% scheduled to be paid in 2023 and the remaining 20% scheduled to be paid in 2024) and the entire payment in the case of the Chief Executive Officer, in view of the deferral periods and payment schedules established in the remuneration policies applicable to each of them in 2018. The January 2022 closing exchange rate was used to calculate the Chief Executive Officer’s 2018 Deferred AVR in euros (USD/EUR 1.1156). |

| (2) | This amount will be updated through application of the CPI in the amount of EUR 23 thousand in the case of the Chairman and EUR 33 thousand in the case of the Chief Executive Officer. |

The results obtained for each of the 2018 DAVR Multi-year Performance Indicators, and the threshold for no reduction set for each of them, are detailed below:

2018 Deferred AVR (long-term measurement period 2019 - 2021)

| ||||||||||||||

2018 DAVR Multi- year Performance Indicators | Solvency | Liquidity | Profitability | |||||||||||

| Economic Adequacy (Economic Equity/ECR) | Fully loaded CET1 | LtSCD (loan-to-stable customer deposits) | LCR (Liquidity Coverage Ratio) | (Net Margin - Loan-Loss Provisions)/Average Total Assets | ROE (Return on Equity) | TSR (Total Shareholder Return) | ||||||||

| Weighting | 20% | 20% | 10% | 10% | 10% | 20% | 10% | |||||||

| Threshold for no reduction | ≥ 100% | ≥ 9.48% | ≤ 140% | ≥ 106% | ≥ 0.20% | ≥ 1.0% | 1st to 8th | |||||||

| Result | 152% ● | 11.97% ● | 104% ● | 147% ● | 1.18% ● | 8.7% ● | 9th ● | |||||||

| % reduction | 0% | 0% | 0% | 0% | 0% | 0% | 1% | |||||||

With respect to the TSR indicator, which tracks total returns for shareholders, BBVA’s performance was compared to that of the peer group approved by the Board of Directors in 2019 and set forth in Annex 2 over the three-year period from 1 January 2019 to 31 December 2021.

Second payment of the 2017 Deferred AVR

The amount of this remuneration was determined in the 2021 financial year considering the result of the Multi-year Performance Indicators approved in 2017, which was reported in the Annual Report on the Remuneration of Directors corresponding to the 2020 financial year. In 2022 the second payment of this deferred remuneration falls due to the Chairman, in the following terms:

Chairman’s 2017 Deferred AVR (EUR thousand and shares)

| ||||||||||||||

| Maximum amount of 2017 DAVR | Amount of 2017 DAVR paid in 2021 (60%) | Amount of 2017 DAVR to be paid in 2022 (second payment 20%) | Amount of 2017 DAVR to be paid in 2023 (third payment 20%) | |||||||||||

| Cash | Shares | Cash1 | Shares | Cash2 | Shares | Cash | Shares | |||||||

| 675 | 139,488 | 405 | 83,692 | 135 | 27,898 | 135 | 27,898 | |||||||

| (1) | Amount updated in 2021 through application of the CPI in the amount of EUR 6 thousand. |

| (2) | Amount that will be updated in 2022 through application of the CPI in the amount of EUR 11 thousand. |

This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy, the Spanish original shall prevail.

Annual Report on the Remuneration of BBVA Directors - 2021 | 6 |

2021 remuneration of non-executive directors

The remuneration accrued by non-executive directors in 2021 is the result of application of the Directors’ Remuneration Policy approved by the General Meeting held on 20 April 2021. The amounts corresponding to the positions of member of the Board, member and chair of the Board Committees, and Deputy Chair and Lead Director, albeit having been reallocated, have not experienced any increases since 2007.

2021 Annual fixed allowance

(EUR thousand)

| Non-executive directors | Board of Directors | Executive Committee | Audit Committee | Risk and Compliance Committee | Remuneration Committee | Appointments and Corporate Governance Committee | Technology and Cybersecurity Committee | Other positions 1 | Total | ||||||||||||||||||||||||||||||||||||

José Miguel Andrés Torrecillas | 129 | 167 | 66 | 115 | 50 | 527 | |||||||||||||||||||||||||||||||||||||||

Jaime Caruana Lacorte | 129 | 167 | 165 | 107 | 567 | ||||||||||||||||||||||||||||||||||||||||

Raúl Galamba de Oliveira | 129 | 107 | 43 | 278 | |||||||||||||||||||||||||||||||||||||||||

Belén Garijo López | 129 | 66 | 107 | 46 | 349 | ||||||||||||||||||||||||||||||||||||||||

Sunir Kumar Kapoor | 129 | 43 | 172 | ||||||||||||||||||||||||||||||||||||||||||

Lourdes Máiz Carro | 129 | 66 | 43 | 238 | |||||||||||||||||||||||||||||||||||||||||

José Maldonado Ramos | 129 | 167 | 46 | 342 | |||||||||||||||||||||||||||||||||||||||||

Ana Peralta Moreno | 129 | 66 | 43 | 238 | |||||||||||||||||||||||||||||||||||||||||

Juan Pi Llorens | 129 | 214 | 46 | 43 | 80 | 512 | |||||||||||||||||||||||||||||||||||||||

Ana Revenga Shanklin | 129 | 107 | 236 | ||||||||||||||||||||||||||||||||||||||||||

Susana Rodríguez Vidarte | 129 | 167 | 107 | 46 | 449 | ||||||||||||||||||||||||||||||||||||||||

Carlos Salazar Lomelín | 129 | 43 | 172 | ||||||||||||||||||||||||||||||||||||||||||

Jan Verplancke | 129 | 43 | 43 | 214 | |||||||||||||||||||||||||||||||||||||||||

Total | 1,673 | 667 | 431 | 642 | 278 | 301 | 171 | 130 | 4,293 | ||||||||||||||||||||||||||||||||||||

| (1) | Amounts received in 2021 by José Miguel Andrés Torrecillas, as Deputy Chair of the Board of Directors, and by Juan Pi Llorens, as Lead Director. |

In addition, non-executive directors received remuneration in kind amounting to a total of EUR 102 thousand in 2021.

Fixed remuneration system with deferred delivery of BBVA shares

Through the implementation of this system, the number of “theoretical shares” allocated to each non-executive director is equal to 20% of the total annual fixed allowance in cash received by each such director in 2020 based on the average closing price of the BBVA share during the 60 trading sessions prior to the General Meeting of 20 April 2021, which was EUR 4.44 per share. Pursuant to the Policy, BBVA shares will only be delivered after directors cease to hold such office, given that this is not due to a serious dereliction of duties.

| Non-executive directors | “Theoretical shares” allocated in 2021 | “Theoretical shares” accumulated as at 31/12/2021 | ||||||||

José Miguel Andrés Torrecillas | 22,860 | 98,772 | ||||||||

Jaime Caruana Lacorte | 25,585 | 56,972 | ||||||||

Raúl Galamba de Oliveira | 9,500 | 9,500 | ||||||||

Belén Garijo López | 15,722 | 77,848 | ||||||||

Sunir Kumar Kapoor | 7,737 | 30,652 | ||||||||

Lourdes Máiz Carro | 10,731 | 55,660 | ||||||||

José Maldonado Ramos | 15,416 | 123,984 | ||||||||

Ana Peralta Moreno | 10,731 | 26,396 | ||||||||

Juan Pi Llorens | 23,079 | 115,896 | ||||||||

Ana Revenga Shanklin | 7,568 | 7,568 | ||||||||

Susana Rodríguez Vidarte | 20,237 | 161,375 | ||||||||

Carlos Salazar Lomelín | 5,642 | 5,642 | ||||||||

Jan Verplancke | 9,024 | 21,416 | ||||||||

Total | 183,832 | 791,681 | ||||||||

This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy, the Spanish original shall prevail.

Annual Report on the Remuneration of BBVA Directors - 2021 | 7 |

ANNUAL REPORT ON THE REMUNERATION OF DIRECTORS COMPANY NAME: Banco Bilbao Vizcaya Argentaria, S.A. REGISTERED OFFICE: Plaza de San Nicolás, número 4, 48005, Bilbao (Bizkaia) Tax identification number (CIF): A-48265169. |

This report has been prepared in accordance with the provisions of Article 541 of the Consolidated text of the Spanish Corporate Enterprises Act, approved by Royal Legislative Decree 1/2010, of 2 July, and in accordance with the provisions of Spanish National Securities Market Commission (CNMV) Circular 4/20133.

The Board of Directors of Banco Bilbao Vizcaya Argentaria, S.A. (BBVA, the Institution, the Company or the Bank), at its meeting held on 9 February 2022 and on the proposal of the Remuneration Committee, has approved this Annual Report on the Remuneration of BBVA Directors (the Remunerations Report or the Report), the purpose of which is to disclose complete, clear and comprehensible information on the remuneration policy applicable to the members of the BBVA Board of Directors for the current financial year (2022), together with a global summary of the application of the remuneration policy during the financial year last ended (2021) and a breakdown of the individual remuneration of each type accrued by each director during such financial year.

The BBVA Directors’ Remuneration Policy applicable in 2021 and 2022 was that approved by the General Meeting held on 20 April 2021 (the Directors’ Remuneration Policy or the Policy). This Policy is fully compliant with the modifications introduced by Act 5/2021, of 12 April, to article 529 novodecies of the Consolidated text of the Spanish Corporate Enterprises Act, approved by Royal Legislative Decree 1/2010, of 2 July4.

This Report also includes information on the BBVA Group General Remuneration Policy, which is based on the same principles as those governing the BBVA Directors’ Remuneration Policy and which also sets forth certain special provisions applicable to the categories of staff whose professional activities have a material impact on the risk profile of BBVA or its Group (the Identified Staff), including members of BBVA Senior Management.

This Report, together with the statistical appendix included in section 5, has been disclosed as other relevant information simultaneously with the annual corporate governance report, and will be submitted for a consultative vote as a separate item on the agenda of the Annual General Meeting for the 2022 financial year. Likewise, this Report is included, in a separate section, in the management report of the individual

3 Circular 4/2013, of 12 June, of the National Securities Market Commission, which establishes the templates of the annual report on the remuneration of directors of listed companies and of the members of the board of directors and of the control committee of savings banks that issue securities admitted to trading on official securities markets, as amended by Circular 3/2021, of 28 September, of the National Securities Market Commission, which amends Circular 4/2013, of 12 June, which establishes the templates for the annual report on remuneration of directors of listed companies and members of the board of directors and of the control committee of savings banks that issue securities admitted to trading on official securities markets; and Circular 5/2013, of 12 June, which establishes the annual corporate governance report templates for listed public limited companies, savings banks and other entities that issue securities admitted to trading on official securities markets.

4 Which governs the approval regime and the minimum content of the directors’ remuneration policy of listed companies.

This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy, the Spanish original shall prevail.

Annual Report on the Remuneration of BBVA Directors - 2021 | 8 |

financial statements of BBVA and the consolidated financial statements of the BBVA Group for the 2021 financial year.

Annex 3, Alignment with the Format set out in Circular 4/2013, specifies the location in this Report of the information set forth in each section of the standardised electronic format published by the CNMV.

This document should be read in conjunction with the BBVA Directors’ Remuneration Policy and Note 54 of the Annual Report of BBVA Group’s consolidated Annual Financial Statements for the 2021 financial year, which includes, individually and by item, the remuneration of the directors for the 2021 financial year. These documents, and this Report, are available on the Bank’s website (www.bbva.com).

2. BBVA Group General Remuneration Policy

BBVA has a BBVA Group General Remuneration Policy that is generally applicable to all employees and senior managers of BBVA and the companies that comprise its group (the BBVA Group or the Group) and is directed towards the recurrent generation of value for the Group, the alignment of the interests of the Group’s employees and shareholders with prudent risk management and the furtherance of the strategy defined by the Group (the BBVA Group General Remuneration Policy).

This policy is one of the elements devised by the Board of Directors, as part of the Bank’s Corporate Governance System, to promote proper management and oversight of the Institution and its Group, and is based on the following principles:

| ● | creating long-term value; |

| ● | achieving results through prudent and responsible risk-taking; |

| ● | attracting and retaining the best professionals; |

| ● | Rewarding level of responsibility and professional trajectory; |

| ● | ensuring internal equity and external competitiveness; |

| ● | ensuring equal pay for men and women; and |

| ● | ensuring the transparency of the remuneration model. |

BBVA has defined the Group General Remuneration Policy based on these principles, taking into account, in addition to obligatory compliance with the legal requirements applicable to credit institutions and the different sectors in which the Group operates, alignment with best market practices. As such, items have been included in this Policy that are aimed at reducing exposure to excessive risks and aligning remuneration with the Group’s business strategy and its long-term objectives, values and interests.

Thus, the foregoing principles contribute to ensuring that the BBVA Group General Remuneration Policy:

| contributes to the business strategy of BBVA and its Group and to the achievement of its objectives, values, interests, value creation and long-term sustainability; |

This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy, the Spanish original shall prevail.

Annual Report on the Remuneration of BBVA Directors - 2021 | 9 |

| is compatible with and promotes prudent and effective risk management and does not provide incentives to assume risks that exceed the level tolerated by the Institution or the Group, in a manner that is consistent with the BBVA Group’s risk strategy and culture; |

| is clear, comprehensible and transparent, with simple wording that facilitates understanding of the different components of remuneration and the conditions for the award, vesting and payment thereof. To that end, it clearly distinguishes between the criteria for determining fixed remuneration and variable remuneration; |

| is gender neutral, reflecting equal remuneration for the same duties or duties of equal value, and does not differentiate or discriminate on the basis of gender; |

| includes measures to avoid conflicts of interest, promoting the independence of judgement of persons involved in decision-making and in the oversight and control of management and the establishment of remuneration systems; and |

| procures that remuneration is not based solely or primarily on quantitative criteria, taking into account appropriate qualitative criteria that reflect compliance with applicable regulations, and corporate culture and values. |

2.2. Special provisions applicable to Identified Staff

The BBVA Group General Remuneration Policy includes a section that contains the specific rules applicable to the Identified Staff of BBVA and its Group, which includes members of the Board of Directors5 and BBVA Senior Management. These rules have been established in accordance with the regulations and recommendations applicable to the remuneration schemes of such staff and, in particular, with the provisions of Act 10/2014 of 26 June on the regulation, supervision and solvency of credit institutions (Act 10/2014) and its implementing regulations.

These rules aim to further align BBVA’s remuneration practices with applicable regulations, good governance recommendations and best market practices.

The result is an incentive scheme that is particularly oriented towards aligning the remuneration of the members of the Identified Staff with the Group’s long-term objectives, values and interests, with the creation of value, and with prudent risk management on the basis of, inter alia, the following key features:

● Balance between fixed and variable remuneration

The fixed and variable components of total remuneration must be appropriately balanced, ensuring that the policy is fully flexible with regard to payment of the variable components such that these components may be reduced in their entirety, where appropriate.

| 5 | The remuneration of members of the BBVA Board of Directors is regulated by a specific remuneration policy, as described later in this Report. Directors are expressly excluded from the scope of application of the BBVA Group’s General Remuneration Policy, although they are members of Identified Staff by virtue of the applicable regulations. |

This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy, the Spanish original shall prevail.

Annual Report on the Remuneration of BBVA Directors - 2021 | 10 |

For these purposes, the Bank has defined certain “target” ratios between the main components of the fixed and variable remuneration, taking into account both the duties carried out and the impact thereof on the risk profile. In the case of control functions, in order to reinforce the independence and objectivity of such functions, the fixed components of their remuneration have a greater weight than the variable components, the latter being related, for the most part, to the function’s own goals.

| ● | Variable remuneration limit |

The variable component of the remuneration for a financial year shall be limited to a maximum amount of 100% of the fixed component of total remuneration, unless the General Shareholders’ Meeting resolves to increase this percentage, up to a maximum of 200%.

| ● | Prohibition on hedging strategies |

The use of personal hedging strategies and insurance relating to variable remuneration and liability that could undermine the effects of alignment with prudent risk management is prohibited.

● Specific rules for the accrual, award, vesting and payment of Annual Variable Remuneration

● Accrual and award of Annual Variable Remuneration

In order to ensure alignment with results and long-term sustainability, the annual variable remuneration of the Identified Staff (including executive directors and members of Senior Management) will not accrue, or will accrue in a reduced amount, if certain profit and capital ratio levels, as determined by the Board of Directors, are not achieved. These levels shall also be applicable to the rest of the staff.

Likewise, the annual variable remuneration will be reduced in the event that, at the time of each beneficiary’s performance evaluation, there has been a downturn in the Group’s results or other parameters, such as the level of achievement of budgeted targets.

The annual variable remuneration of members of the Identified Staff, as well as that of the other employees of the BBVA Group, consists of an annual incentive that reflects performance as measured through the achievement of certain targets that are aligned with the risk incurred, and is calculated on the basis of:

(i) annual performance indicators (financial and non-financial), which take into account current and future risks as well as the strategic priorities defined by the Group (Annual Performance Indicators);

(ii) scales of achievement that may be established according to the weighting assigned to each indicator and based on the targets set for each of them; and

(iii) a “target” annual variable remuneration, representing the amount of the annual variable remuneration in the event that 100% of the previously established targets are reached (the Target Annual Variable Remuneration or Target Bonus).

The amount to be received as annual variable remuneration through application of the corresponding scales of achievement may range from 0% - 150% of the “target” annual variable remuneration. The resulting amount will constitute the annual variable remuneration of each beneficiary (the Annual Variable Remuneration or AVR).

|

This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy, the Spanish original shall prevail.

Annual Report on the Remuneration of BBVA Directors - 2021 | 11 |

The financial annual performance indicators will be aligned with the most relevant management metrics for the Bank while the non-financial indicators will be related to the strategic targets defined at the Group level, the area level and for each individual beneficiary.

In no event will variable remuneration limit the Group’s capacity to strengthen its capital base in accordance with regulatory requirements, and it will take into account current and future risks as well as the cost of the necessary capital and liquidity, reflecting performance that is sustainable and adapted to risk.

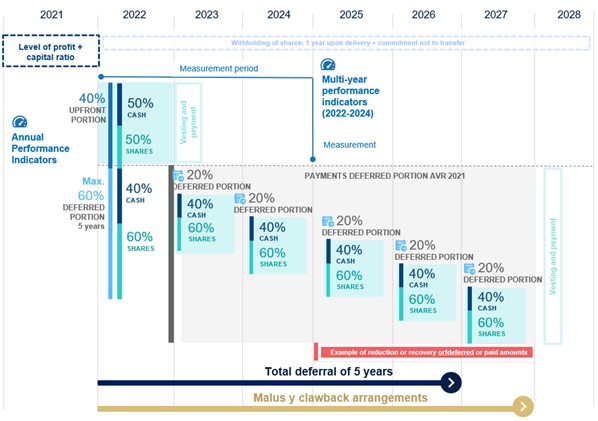

● Upfront payment

Once granted, 60% of the Annual Variable Remuneration of the Identified Staff — 40% in the case of members of the Identified Staff with particularly high variable remuneration and members of BBVA Senior Management — will vest and be paid, if the applicable conditions are met, during the first four months of the financial year as a general rule (the Upfront Portion).

● Deferral rules

40% of the Annual Variable Remuneration — 60% in the case of members of the Identified Staff with particularly high variable remuneration and members of BBVA Senior Management — will be deferred for a period of four years (the Deferred Portion, the Deferred AVR or the DAVR). In the case of members of BBVA Senior Management, the deferral period shall be five years.

● Payment in shares or instruments

50% of the Annual Variable Remuneration, including both the Upfront Portion and the Deferred Portion, shall be established in BBVA shares or in instruments linked to BBVA shares. For members of BBVA Senior Management, 50% of the Upfront Portion and 60% of the Deferred Portion shall be established in BBVA shares.

● Withholding period

The shares or instruments awarded as Annual Variable Remuneration, both for the Upfront Portion and the Deferred Portion, shall be withheld for a one-year period following delivery. The foregoing shall not apply to those shares or instruments the sale of which would be required to honour the payment of taxes accruing on delivery.

● Ex post adjustments to the Deferred Portion

In order to ensure that the assessment process of the results to which the Annual Variable Remuneration is linked falls within a multi-year framework that considers long-term results, and to ensure that the effective payment of the Annual Variable Remuneration is made over a period that takes into account the economic cycle of the Institution and its risks, the Annual Variable Remuneration of the Identified Staff will be subject to ex post adjustments aligned with prudent risk management that are linked to the results of multi-year performance indicators. In this way, the Deferred AVR of members of the Identified Staff may be reduced, but never increased, based on the results of indicators that are aligned with the Group’s core metrics for risk control and management, related to solvency, liquidity, profitability and value creation (the Multi-year Performance Indicators).

● Malus and clawback arrangements

The entirety of the Annual Variable Remuneration of members of the Identified Staff shall be subject to variable remuneration malus and clawback arrangements during the whole deferral and withholding of shares period.

|

This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy, the Spanish original shall prevail.

Annual Report on the Remuneration of BBVA Directors - 2021 | 12 |

As a result of the foregoing, the BBVA Group has applied a solid and consistent remuneration policy over time that contributes to its business strategy and sustainable performance and that is aligned with the long-term interests of the Institution, the interests of its shareholders and prudent risk management.

3. Directors’ Remuneration Policy applicable in 2021

The remuneration policy applicable to members of the Board of Directors is based on the same principles and, in the case of executive directors, is subject to the same scheme that inspires the BBVA Group General Remuneration Policy described in the previous section6.

This policy was approved by the General Shareholders’ Meeting held on 20 April 2021, is applicable during the 2021, 2022 and 2023 financial years, and is available on the Bank’s website (the Directors’ Remuneration Policy or the Policy).

The primary new developments in this Policy as compared to the previous policy are as follows:

● Explicit incorporation of the principle of equal pay for men and women.

● Incorporation of sustainability metrics into the variable remuneration scheme for executive directors.

● Transformation of the Chairman’s pension system, resulting in a change in the remuneration amounts and reduction of his total remuneration.

● Changes to the payment schedule for the Deferred Portion of the Annual Variable Remuneration of executive directors.

● Changes to the malus and clawback arrangements of the Annual Variable Remuneration of executive directors.

● Adaptation to new regulatory developments with entry into force in 20217 and to good governance recommendations and other technical improvements in transparency and clarity of the remuneration scheme.

|

The Directors’ Remuneration Policy has been designed in accordance with corporate legislation and the specific regulations applicable to credit institutions and in accordance with the provisions of the Bylaws, while also taking into account best practices and recommendations on the field of remuneration at the local and international levels.

The Policy distinguishes between the remuneration system applicable to the directors in their capacity as such (non-executive directors) and that applicable to executive directors (those who perform management duties in the Institution), and contains different measures to promote prudent management of excessive risks and tailor remuneration to the long-term interests of the Institution, as described in section 2.

6 www.bbva.com

7 In particular, to the changes introduced by Act 5/2021, of 12 April, by which the Consolidated text of the Spanish Corporate Enterprises Act, approved by Royal Legislative Decree 1/2010, of 2 July was amended.

This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy, the Spanish original shall prevail.

Annual Report on the Remuneration of BBVA Directors - 2021 | 13 |

3.1. Decision-making process for approval of the Policy

In accordance with the Regulations of the Board of Directors, one of the Board’s functions is to approve the remuneration policy applicable to the directors for purposes of submitting it to the General Shareholders’ Meeting.

For its part, the Remuneration Committee is the body that assists the Board in matters of remuneration, and is responsible for proposing to the Board of Directors, for its submission to the General Shareholders’ Meeting, the remuneration policy applicable to the directors, together with its corresponding report.

In addition, as part of the decision-making process in remuneration matters, the Remuneration Committee works with the Risk and Compliance Committee, which participates in the establishment of the remuneration policy to ensure that it is consistent with sound and effective risk management and does not provide incentives to take risks in excess of the level tolerated by the Institution.

The Remuneration Committee is charged with ensuring compliance with the remuneration policies established by the Company and reviewing them periodically, proposing any modifications it may deem necessary in order to ensure, among other things, that such policies are adequate for the purposes of attracting and retaining the best professionals, contribute to the creation of long-term value and the adequate control and management of risks, and comply with the principle of equal pay.

In 2021, new regulations governing remuneration that took effect during the financial year, together with developments in market practice, the outcome of dialogue between BBVA and its investors and the very nature of the Bank’s Corporate Governance System, led the Remuneration Committee to review the directors’ remuneration policy and the remuneration system as a whole.

To this end, the Remuneration Committee was assisted by the Bank’s internal services, as well as with the advice of two leading independent consulting firms on the remuneration of directors and senior managers: Willis Towers Watson, for analyses and market comparisons, and J&A Garrigues, S.L.P., for legal analysis of the Policy.

In the development of the Policy, the Remuneration Committee analysed the remuneration payable by the main comparable financial institutions in BBVA’s peer group for remuneration purposes to individuals holding similar positions, as well as market practice in relation to variable remuneration models, including deferral schemes, in the case of the Chairman and the Chief Executive Officer.

Finally, pursuant to the provisions of Articles 511 bis and 529 novodecies of the Spanish Corporate Enterprises Act, the Directors’ Remuneration Policy was submitted, as a separate item on the agenda, for the approval of the Bank’s General Shareholders’ Meeting held on 20 April 2021, which approved it with a majority voting in favour (93.59%). Both the text of the Policy and the specific Remuneration Committee report in respect thereof were made available to shareholders following the date on which the General Meeting was called.

As part of the governance and supervision model of the Policy, the Remuneration Committee is empowered to propose to the Board of Directors for approval or, where applicable, submission to the General Meeting where required by law, the implementation of all amendments or exceptions to the Policy that may be necessary during its term.

This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy, the Spanish original shall prevail.

Annual Report on the Remuneration of BBVA Directors - 2021 | 14 |

Specifically, the Policy provides that the Board of Directors, following analysis by and on the proposal of the Remuneration Committee, may agree to make temporary exceptions to the Policy in connection with the award, vesting and/or payment of all components provided for in the Policy in the event this is necessary to serve the long-term interests and sustainability of the Company as a whole or to ensure its viability. In no event may any exceptions be applied that are based on gender considerations or other aspects that could be considered discriminatory; they must be supported by a sound justification and comply with the provisions of applicable regulations.

The BBVA Directors’ Remuneration Policy is published on the Bank’s website: www.bbva.com .

3.2. Remuneration system for non-executive directors

In accordance with the provisions of Article 33º bis of the Bylaws, the remuneration system for non-executive directors is based on the criteria of responsibility, dedication and incompatibilities inherent to the role that they carry out, and consists of exclusively fixed remuneration comprised of the following components:

| Concept | Payment | Other characteristics | ||

A. Fixed annual allocation | Monthly in cash for the position of Board member and Committee member and for the performance of other duties or responsibilities (such as the position of Lead Director or Deputy Chair) |

Overall limit approved by the General Meeting:

EUR 6 million per year

See amounts received in 2021 in section 4.2. A and B below | ||

B. Remuneration in kind |

The Bank pays the corresponding premiums (healthcare and accident insurance policies) that are allocated to the directors as remuneration in kind | |||

C. Fixed remuneration system with deferred delivery of BBVA shares | Annual allocation of a number of “theoretical shares”, with effective delivery after the director ceases to hold such office for any reason other than a serious dereliction of duties. | Allocation equal to 20% of the total annual fixed allowance in cash received during the previous financial year | ||

Amounts corresponding to the annual fixed allowance approved by the Board of Directors

| Position | EUR thousand | |

Member of the Board of Directors | 129 | |

Member of the Executive Committee | 167 | |

Chair of the Audit Committee | 165 | |

Member of the Audit Committee | 66 | |

Chair of the Risk and Compliance Committee | 214 | |

Member of the Risk and Compliance Committee | 107 | |

Chair of the Remuneration Committee | 107 | |

Member of the Remuneration Committee | 43 | |

Chair of the Appointments and Corporate Governance Committee | 115 | |

Member of the Appointments and Corporate Governance Committee | 46 | |

Chair of the Technology and Cybersecurity Committee* | 107 | |

This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy, the Spanish original shall prevail.

Annual Report on the Remuneration of BBVA Directors - 2021 | 15 |

Member of the Technology and Cybersecurity Committee | 43 | |

Deputy Chair | 50 | |

Lead Director | 80 |

*As of the date of this Report, the position of Chair of the Technology and Cybersecurity Committee is not remunerated as the Chairman of the Board of Directors serves in this role.

These amounts were approved by the Board of Directors on 29 May 2019, on the proposal of the Remuneration Committee, following analysis of the corresponding market comparisons, with no increases since 2007 (although they have been reallocated to adapt them to the functions of each Committee).

3.3. Remuneration system for executive directors

The executive directors have their own remuneration system that is defined in accordance with best market practices. Its items are set out in Article 50º bis of the Bylaws and are the same as those that are generally applicable to Senior Management.

3.3.1. Elements of the remuneration system for executive directors

| Concept | Allocation criteria | Payment | Reference / Amount | Adjustments / Condition | ||||

| A. Annual Fixed Remuneration (“AFR”) | 🌑 Assigned duties and level of responsibility

🌑 Competitive in the market | Monthly cash payments | Chairman: EUR 2,924 thousand

Chief Executive Officer: EUR 2,179 thousand | N/A | ||||

| B. Benefits and remuneration in kind | In line with those granted to Senior Management | Allowances and premiums or payments made by the Bank and charged as remuneration in kind | See breakdown of amounts for 2021 in section 4.3. A. b). | N/A | ||||

| C. Contribution to pension and insurance systems | As per contract and Policy (contingencies of retirement, death and disability) | At the time of the contingency (in the form of income or capital in the case of the retirement pension) |

Chairman: Annual contribution to the pension of EUR 439 thousand plus premiums for death and disability coverage

See breakdown of amounts for premiums in 2021 in section 4.3. A c). | Terms set forth in his contract and, in any case, provided that his cessation of office is not due to a serious dereliction of duties | ||||

Chief Executive Officer: he does not have a retirement pension. The Bank pays death and disability coverage premiums.

See breakdown of amounts for premiums in 2021 in section 4.3. A c) | N/A | |||||||

| D. Other fixed allowances | As per contract and Policy | Monthly payment | Chief Executive Officer: cash in lieu of pension (30% of AFR) and annual international mobility allowance of EUR 600 thousand | N/A | ||||

This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy, the Spanish original shall prevail.

Annual Report on the Remuneration of BBVA Directors - 2021 | 16 |

| E. Annual Variable Remuneration (“AVR”) | Results of annual performance indicators (financial and non-financial), based on pre-established targets, scales of achievement and weightings, which will be equated to the “target” AVR if 100% of the targets set are achieved | In cash and shares (more than 50% in shares)

40% up front and 60% deferred (DAVR) for 5 years. | Target bonus Chairman: EUR 3,572 thousand

Target bonus Chief Executive Officer: EUR 2,672 thousand 🌑 Scales of achievement limited to 150% of Target Bonus

🌑 Maximum of 200% of fixed remuneration, as resolved by the General Meeting | 🌑 Ex post adjustments: result of multi-year performance indicators (downward Deferred AVR adjustments only) 🌑 Malus and clawback arrangements for 100% of the AVR 🌑 One-year withholding of shares | ||||

| F. Non-competition agreement | As per contract and Policy | Monthly payment during the non-competition period, after the executive director ceases to hold such office | 2 times the AFR (one for each year of duration of the agreement) | Terms set forth in their contracts and provided that cessation of office is not due to retirement, disability or serious dereliction of duties | ||||

In addition, in the same way as for the other members of the Identified Staff, the Policy establishes that fixed and variable components must be appropriately balanced in the total remuneration of executive directors.

To this end, the Directors’ Remuneration Policy establishes the theoretical relative proportion between the main fixed and variable components of the remuneration of BBVA’s executive directors (target ratios), taking into account both the role carried out by executive directors and their impact on the risk profile of the Group, and that this proportion is aligned with the proportions for this ratio generally established for the rest of the members of the Identified Staff:

| Executive director | Position | Annual Fixed Remuneration | “Target” Annual Variable Remuneration | |||

Carlos Torres Vila | Chairman | 45% | 55% | |||

Onur Genç | Chief Executive Officer | 45% | 55% | |||

The Annual Variable Remuneration that is ultimately awarded to each executive director in each financial year shall be calculated in accordance with the rules for the award thereof established in the Policy and shall be subject to the same vesting and payment rules applicable to the AVR of the Identified Staff described in section 2.2. above, with certain specific terms due to their status as directors. Thus, in order to align remuneration with effective risk management:

● The Upfront Portion (40%) of the AVR will vest and be paid, if the applicable conditions are met, during the first quarter of the financial year, while the remaining 60% shall be deferred for a period of 5 years — the Deferred Portion —.

As a new development, the Policy approved in 2021 establishes that, if the applicable conditions are met, an amount equal to 20% of the Deferred AVR will be paid at the end of each year for each of the 5 years of deferral.

● The Upfront Portion of the AVR will be paid in equal parts cash and BBVA shares, while 60% of the Deferred Portion will be paid in BBVA shares and the other 40% will be paid in cash. |

This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy, the Spanish original shall prevail.

Annual Report on the Remuneration of BBVA Directors - 2021 | 17 |

● The Deferred Portion of the AVR may be reduced, but never increased, based on the results of pre-established Multi-year Performance Indicators.

The Multi-year Performance Indicators, which relate to solvency, liquidity, profitability and the creation of value, help to ensure that the remuneration system for executive directors is consistent with the Group’s risk strategy and long-term performance. Following the end of the third year of deferral, the results of the Multi-year Performance Indicators will determine whether any potential ex post downward adjustments need to be made to the Deferred Portion of the AVR that remains outstanding.

● Moreover, the full amount of the Annual Variable Remuneration for executive directors will be subject to malus and clawback arrangements on the same terms as those applicable to the rest of the Identified Staff.

The application of the malus and clawback arrangements will be tied to a downturn in financial performance of the Bank as a whole or of a particular unit or area thereof or of the exposures created by an executive director, when such downturn in financial performance arises from a set of circumstances established in the Policy. In addition, as a new development, the Policy approved in 2021 provides that such clauses may also be applied in the event that the referred circumstances cause significant reputational damage to the Bank, regardless of the financial impact caused.

● The BBVA shares delivered as Annual Variable Remuneration, both for the Upfront Portion and the Deferred Portion, shall be withheld for a one-year period following delivery. The foregoing shall not apply to those shares which sale would be required to honour the payment of taxes accruing on delivery.

● The use of personal hedging strategies and insurance relating to variable remuneration and liability that could undermine the effects of alignment with prudent risk management is prohibited.

● The variable component of the remuneration for a financial year shall be limited to a maximum amount of 100% of the fixed component of total remuneration, unless the BBVA General Shareholders’ Meeting resolves to increase this percentage, up to a maximum of 200%, all in accordance with the procedure and requirements set forth in applicable regulations. |

In addition, the Policy includes additional restrictions on the transferability of shares received as variable remuneration, which have also been modified in the Policy approved in 2021 for purposes of aligning them with the provisions of Recommendation 62 of the CNMV Code of Good Governance of Listed Companies, revised in June 2020.

Thus, executive directors may not transfer shares derived from the settlement of variable remuneration until a period of at least three years has elapsed unless the director in question maintains, at the time of the transfer, through the ownership of shares, options or other financial instruments, a net economic exposure to the variation in the prices of the shares for a market value equal to at least twice his Annual Fixed Remuneration. The foregoing shall not apply to the shares that the director needs to dispose of in order to cover the costs associated with the acquisition thereof or, upon favourable assessment of the Remuneration Committee, to address an extraordinary situation. |

The rules for the award, vesting and payment of the Annual Variable Remuneration of executive directors are represented in the graphic example below, using the 2021 financial year as a reference:

This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy, the Spanish original shall prevail.

Annual Report on the Remuneration of BBVA Directors - 2021 | 18 |

3.3.2. Main terms and conditions of the executive directors’ contracts

The remunerations and economic rights and compensations of each executive director are determined based on their level of responsibility and the duties they perform, and are competitive in comparison to those of equivalent functions at the group of main peer institutions. These terms and conditions are reflected in their respective contracts, which are approved by the Board of Directors on the proposal of the Remuneration Committee.

Pursuant to the Policy, the main characteristics of the executive directors’ contracts are as follows:

● They are indefinite in duration.

● They do not establish any notice periods, minimum contract term clauses or loyalty clauses.

● They include a post-contractual non-competition clause.

● They do not contain indemnification payment commitments.

● They contain a welfare portion in view of the individual circumstances of each executive director, including appropriate insurance and pension systems.

|

Pension commitments assumed in favour of the executive directors

This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy, the Spanish original shall prevail.

Annual Report on the Remuneration of BBVA Directors - 2021 | 19 |

The Bank has assumed pension commitments to cover the contingency of retirement of the Chairman. These commitments have the following main characteristics, in line with those of the commitments assumed in favour of the rest of the members of the Bank’s Senior Management:

● They consist of defined-contribution systems under which the annual pension contributions made to cover the contingency of retirement are established in advance (15% of Annual Fixed Remuneration).

● They do not provide for the possibility of receiving the retirement pension in advance.

● They stipulate that 15% of the agreed annual contributions be considered “discretionary pension benefits”, as set forth in applicable regulations, and therefore, they will be variable. |

The Bank has not assumed any retirement commitments in favour of the Chief Executive Officer, instead paying him an annual sum in cash (cash in lieu of pension) equal to 30% of his Annual Fixed Remuneration.

In addition, the Bank has assumed commitments in favour of both the Chairman and the Chief Executive Officer to cover the contingencies of disability and death on the terms set out below.

Commitments assumed in favour of the Chairman

The Directors’ Remuneration Policy approved in 2021 has made significant changes to the Chairman’s pension system:

● A significant reduction in the annual contribution made to cover the contingency of retirement, which has gone from EUR 1,642 thousand to EUR 439 thousand, thereby representing 15% of his Annual Fixed Remuneration.

● A reduction in coverage levels (% of AFR) for the contingencies of death and disability. |

Contingency of retirement

|

● The Chairman is entitled to a retirement pension when he reaches the retirement age established by law. The amount of this pension will be equal to the sum of the contributions made by the Bank and their corresponding yields up to this date.

● The annual agreed contribution amounts to EUR 439 thousand (15% of his Annual Fixed Remuneration).

● On the other hand, 15% of the annual contribution will be based on variable components and considered “discretionary pension benefits”. It will be subject to the conditions of delivery in shares, withholding and clawback established for this type of remuneration in the applicable regulations.

● The benefit may be received in the form of income or capital.

● Receipt of the benefit is conditioned on his cessation of office not being due to a serious dereliction of duties.

● If the contractual relationship is terminated before he reaches retirement age for reasons other than a serious dereliction of duties, he will remain entitled to the benefit, which will be calculated on the basis of all contributions made by the Bank up to that date plus the corresponding accumulated yield, without the Bank being required to make any additional contributions as of that date.

|

This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy, the Spanish original shall prevail.

Annual Report on the Remuneration of BBVA Directors - 2021 | 20 |

Contingency of disability or death

|

● Death while serving in his role will give rise to an entitlement to an annual widow’s and orphan’s pension for each of his children, until they reach the age of 25, in an amount equal to 50% and 20% (40% in the case of full orphaning), respectively, of the Annual Fixed Remuneration.

● These pensions would be paid from the total fund accumulated for the retirement pension at that time, with the Bank assuming the amount of the corresponding annual insurance premiums to complete the benefit coverage. The cumulative benefits of the widow’s and orphan’s pension may not exceed 150% of the Annual Fixed Remuneration.

● In the event of total or full permanent disability while serving in his role, he will be entitled to receive an annual pension equal to 60% of his Annual Fixed Remuneration.

● This pension would be paid, firstly, from the total fund accumulated for the retirement pension at that time, with the Bank assuming the amount of the corresponding annual insurance premiums to complete the benefit coverage.

● Death while in a situation of disability will give rise to an entitlement to an annual widow’s and orphan’s pension for each of his children, until they reach the age of 25, in an amount equal to 85% and 35% (40% in the case of full orphaning), respectively, of the disability pension that he had been receiving, with such reversion being limited in all cases to 150% of the disability pension itself.

|

In 2021, the Chairman’s contract was amended to adapt it to the terms and conditions set forth in the Policy approved by the General Meeting in 2021, which are described in sections 3 and 4 of this Report.

Commitments assumed in favour of the Chief Executive Officer

The Bank has not assumed any retirement commitments in favour of the Chief Executive Officer, although his contract gives him the right to receive an annual sum in cash (cash in lieu of pension) in an amount equal to 30% of his Annual Fixed Remuneration.

Contingency of disability or death

|

● Death while serving in his role will give rise to an entitlement to an annual widow’s and orphan’s pension for each of his children, until they reach the age of 25, in an amount equal to 50% and 20% (30% in the case of full orphaning), respectively, of the Annual Fixed Remuneration for the previous 12 months, with the Bank assuming the amount of the corresponding annual insurance premiums to guarantee the benefit coverage. The cumulative benefits of the widow’s and orphan’s pension may not exceed 100% of the Annual Fixed Remuneration for the previous 12 months.

● In the event of total or full permanent disability while serving in his role, he will be entitled to receive an annual pension in an amount equal to 62% of his Annual Fixed Remuneration for the previous 12 months. This pension will revert to his spouse and children in the event of death in the percentages cited above but shall be limited in all cases to 100% of the disability pension, with the Bank assuming the amount of the corresponding annual insurance premiums to guarantee the benefit coverage.

|

Other terms and conditions of the executive directors’ contracts

| ● | Supplemental allowances to the Chief Executive Officer’s fixed remuneration |

This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy, the Spanish original shall prevail.

Annual Report on the Remuneration of BBVA Directors - 2021 | 21 |

Moreover, in view of his status as an international executive, the Chief Executive Officer’s contract provides that he is entitled to an annual cash sum as a mobility allowance, in line with potential commitments made in favour of other expatriate members of Senior Management, the amount of which has been set at EUR 600 thousand per year.

| ● | Post-contractual non-competition clauses |

Finally, the executive directors’ contracts also include a post-contractual non-competition clause with a duration of two years following the cessation as BBVA executive directors, in respect of which they will receive remuneration, payable monthly, in an amount equal to their Annual Fixed Remuneration for each year in which the non-competition agreement remains in place, provided that their cessation as executive director is not due to their retirement, disability or serious dereliction of duties.

| ● | Termination of the contractual relationship |

The executive directors’ contracts do not include a right to severance payments in the event of termination of the contractual relationship.

4. Results of implementation of the Policy in 2021

The Directors’ Remuneration Policy in effect during the financial year last ended (2021) was that approved by the Bank’s Annual General Shareholders’ Meeting held on 20 April 2021. The outline and main characteristics of the Policy are set forth in section 3 above.

The way in which the Policy was implemented in 2021 is detailed below, following the procedure established for this purpose in the Policy itself and in the Regulations of the Board of Directors and the Remuneration Committee. No deviations from the same occurred during the financial year. No temporary exceptions were made to the Policy either in accordance with the procedure set forth therein, given the absence of any circumstances that would justify or advise this.

The process followed to implement the Directors’ Remuneration Policy and to determine the individual remuneration of directors was led and overseen directly by the Remuneration Committee. During the 2021 financial year, this Committee took the actions detailed below, among others, submitting to the Board of Directors the corresponding resolutions proposals where appropriate.

4.1. Activity carried out by the Corporate Bodies in 2021

BBVA Directors’ Remuneration Policy

The Remuneration Committee analysed the approaches put forward as regards the approval of a new Directors’ Remuneration Policy in 2021, in view of, among other things, the regulatory developments that were expected to enter into force in that same financial year and market practices.

Following this analysis, the Remuneration Committee submitted the new proposed Policy, together with its corresponding report, to the Board of Directors, following analysis by the Risk and Compliance Committee.

Once approved by the Board of Directors, the Policy was submitted to the Annual General Shareholders’ Meeting held on 20 April 2021, which approved it with a majority voting in favour (93.59%). This Policy is

This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy, the Spanish original shall prevail.

Annual Report on the Remuneration of BBVA Directors - 2021 | 22 |

fully compliant with the modifications introduced by Act 5/2021, of 12 April, to article 529 novodecies of the Consolidated text of the Spanish Corporate Enterprises Act, approved by Royal Legislative Decree 1/2010, of 2 July.

Implementation, supervision and monitoring of the Directors’ Remuneration Policy

During the 2021 financial year, the Remuneration Committee and the Board of Directors have carried out the necessary actions to implement, supervise and monitor the provisions of the Directors’ Remuneration Policy.

To this end, the Board of Directors has analysed the remuneration matters pertaining to directors, approving the following resolutions, in accordance with the proposals submitted, in each case, by the Remuneration Committee and based on the prior analysis work, discussion and interaction carried out by this Committee with the executive level:

● Remuneration matters for non-executive directors

In accordance with the statutory framework and the Directors’ Remuneration Policy, in application of the fixed remuneration system with deferred delivery of shares applicable to non-executive directors, the Board of Directors approved the allocation of a number of “theoretical shares” to each non-executive director beneficiary of the system, with this allocation corresponding to 20% of the total annual fixed allowance in cash received in the previous financial year.

● Remuneration matters for executive directors

With regard to the remuneration of executive directors, the Board of Directors, on the proposal of the Remuneration Committee:

● Noted the waiver by the executive directors, members of Senior Management and certain members of the Identified Staff of the accrual of 2020 Annual Variable Remuneration, in view of the exceptional circumstances arising from the COVID-19 crisis, which, in the case of the executive directors, led to no AVR having been accrued in 2020.

● Approved the amount of the executive directors’ Deferred AVR from the 2017 financial year, in light of the results of the pre-established Multi-year Performance Indicators and in application of the corresponding targets, scales and weightings approved by the Board of Directors at the time, in addition to determining the amount corresponding to the update of such AVR.

● Approved the payment of executive directors’ Deferred AVR from the 2017 financial year scheduled for 2021, once the Audit Committee and the Appointments and Corporate Governance Committee, within the scope of their respective remits, and the Board itself, had verified that the malus and clawback clauses set out in the remuneration policies applicable to those financial years did not have to be applied.

● Approved the amendment of the Chairman’s contract to adapt its terms and conditions to the amendments included in the new Directors’ Remuneration Policy approved by the General Meeting held on 20 April 2021.

● ���Approved the minimum thresholds for Attributable Profit and the Capital Ratio to generate the 2021 AVR of executive directors in line with those applied for the rest of the BBVA staff, including Senior Management members.

● Approved the Annual Performance Indicators for the 2021 AVR and their respective weightings, as well as the Multi-year Performance Indicators corresponding to the Deferred Portion of the 2021 AVR, with the prior

|

This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy, the Spanish original shall prevail.

Annual Report on the Remuneration of BBVA Directors - 2021 | 23 |

analysis of the Risk and Compliance Committee in the case of the latter, and with the Multi-year Performance Indicators also being applicable to the rest of the Identified Staff, including Senior Management members.

● Approved the targets and scales of achievement associated with the Annual Performance Indicators for the 2021 AVR of executive directors.

|

Finally, the Board of Directors resolved to submit to the 2021 Annual General Shareholders’ Meeting:

● The approval of a maximum level of variable remuneration of up to 200% of the fixed component of total remuneration applicable to a maximum of 339 members of the Identified Staff, including executive directors and Senior Management members; submitting also the corresponding report for the shareholders regarding this resolution, in accordance with the text proposed by the Remuneration Committee.

● The consultative vote on the Annual Report on the Remuneration of BBVA Directors for the 2020 financial year, based on the text proposed by the Remuneration Committee, prepared in accordance with the provisions of CNMV Circular 4/2013 and in compliance with the provisions of Article 541 of the Spanish Corporate Enterprises Act.

|

For further details on the activities carried out by the Remuneration Committee in 2021, the Committee’s 2021 activity report, which is available to shareholders on the Bank’s website, can be consulted.

This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy, the Spanish original shall prevail.

Annual Report on the Remuneration of BBVA Directors - 2021 | 24 |

4.2. Remuneration accrued by non-executive directors in 2021

Set forth below is a breakdown of the individual remuneration accrued by non-executive directors in 2021 through implementation of the remuneration system described in section 3.2. above:

A. 2021 Annual fixed allowance

(EUR thousand)

| Non-executive directors | Board of Directors | Executive Committee | Audit Committee | Risk and Compliance Committee | Remuneration Committee |

Appointments | Technology and Cybersecurity Committee | Other positions 1 | Total | |||||||||

José Miguel Andrés Torrecillas | 129 | 167 | 66 |

|

| 115 |

| 50 | 527 | |||||||||

| Jaime Caruana Lacorte | 129 | 167 | 165 | 107 |

|

|

|

| 567 | |||||||||

Raúl Galamba de Oliveira | 129 |

|

| 107 |

|

| 43 |

| 278 | |||||||||

| Belén Garijo López | 129 |

| 66 |

| 107 | 46 |

|

| 349 | |||||||||

| Sunir Kumar Kapoor | 129 |

|

|

|

|

| 43 |

| 172 | |||||||||

| Lourdes Máiz Carro | 129 |

| 66 |

| 43 |

|

|

| 238 | |||||||||

José Maldonado Ramos | 129 | 167 |

|

|

| 46 |