- BBVA Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Banco Bilbao Vizcaya Argentaria (BBVA) 6-KCurrent report (foreign)

Filed: 4 Mar 22, 6:11am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2022

Commission file number: 1-10110

BANCO BILBAO VIZCAYA ARGENTARIA, S.A.

(Exact name of Registrant as specified in its charter)

BANK BILBAO VIZCAYA ARGENTARIA, S.A.

(Translation of Registrant’s name into English)

Calle Azul 4,

28050 Madrid

Spain

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

Banco Bilbao Vizcaya Argentaria, S.A. (“BBVA”), in compliance with the Spanish Securities Market legislation, hereby proceeds to notify the following:

OTHER RELEVANT INFORMATION

Further to the notice of Inside Information of 29 October 2021, with registration number 1127 (the “Initial II”)1, and to the notice of Inside Information of 19 November 2021, with registration number 1182 (the “II for First Tranche Execution”)2, BBVA hereby announces the completion of the execution of the First Tranche of the Program Scheme as the maximum monetary amount of 1,500 million euros communicated in the II for First Tranche Execution has been reached.

With the acquisition of the last shares referenced below, the total number of own shares acquired during the execution of the First Tranche is 281,218,710 own shares, representing, approximately, 4.22% of BBVA’s share capital as of this date. All acquisitions made in execution of the First Tranche have been duly notified to the competent authorities, in accordance with the provisions of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014, and Commission Delegated Regulation (EU) 2016/1052 of 8 March 2016.

As disclosed in the II for First Tranche Execution, the purpose of the First Tranche is to reduce BBVA’s share capital by means of the redemption of the shares acquired. In this regard, it has been proposed to the next Annual General Shareholders’ Meeting of BBVA, to be foreseeably held on 18 March 2022, at second call, a reduction of BBVA’s share capital through the redemption of own shares3. Upon the approval of the share capital reduction, BBVA expects to carry out the redemption of all of the own shares acquired in execution of the First Tranche.

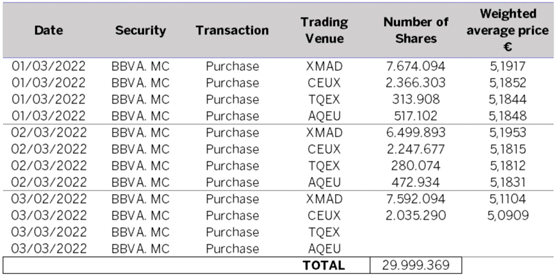

Likewise, based on the information received from J.P. Morgan AG as manager of the First Tranche, BBVA informs that it has carried out the following transactions on its own shares in execution of the First Tranche between 1 and 3 March, 2022 (both included):

| 1 | The term “Program Scheme” shall have the same meaning as provided in the Initial II. |

| 2 | The term “First Tranche” shall have the same meaning as provided in the II for First Tranche Execution. |

| 3 | For further information on the Annual General Shareholders’ Meeting and the proposed resolutions please see https://shareholdersandinvestors.bbva.com/corporate-governance-and-remuneration-policy/2022-annual-general-meeting/ |

Issuer name: Banco Bilbao Vizcaya Argentaria, S.A. - LEI K8MS7FD7N5Z2WQ51AZ71

ISIN Code of the ordinary shares of BBVA: ES0113211835

Detailed information regarding the transactions carried out within the referred period is attached as Annex 1.

Madrid, 3 March 2022

ANNEX 1

Detailed information on each of the transactions carried out in execution of the First Tranche between 1 and 3 March 2022 (both inclusive)

https://shareholdersandinvestors.bbva.com/the-share/significant-events/#2022

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Banco Bilbao Vizcaya Argentaria, S.A. | ||||||

| Date: March 3, 2022 | ||||||

| By: | /s/ Antonio Borraz Peralta | |||||

| Name: Antonio Borraz Peralta | ||||||

| Title: Assets and Liabilities Management Director | ||||||