- BBVA Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Banco Bilbao Vizcaya Argentaria (BBVA) 6-KCurrent report (foreign)

Filed: 14 Mar 22, 5:24pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2022

Commission file number: 1-10110

BANCO BILBAO VIZCAYA ARGENTARIA, S.A.

(Exact name of Registrant as specified in its charter)

BANK BILBAO VIZCAYA ARGENTARIA, S.A.

(Translation of Registrant’s name into English)

Calle Azul 4,

28050 Madrid

Spain

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

| BBVA. PILLAR 3 2021 | INDEX | P. 1 |

| BBVA. PILLAR 3 2021 | INDEX | P. 2 |

| BBVA. PILLAR 3 2021 | INDEX | P. 3 |

8.5. | Risk management associated with climate change | 241 | ||||

8.6. | Management of direct and indirect impacts | 249 | ||||

8.7. | Participation in international initiatives | 256 | ||||

8.8. | Sustainability index | 257 | ||||

| 258 | ||||||

| BBVA. PILLAR 3 2021 | INDEX OF TABLES | P. 4 |

| BBVA. PILLAR 3 2021 | INDEX OF TABLES | P. 5 |

| BBVA. PILLAR 3 2021 | INDEX OF TABLES | P. 6 |

| BBVA. PILLAR 3 2021 | INDEX OF TABLES | P. 7 |

| BBVA. PILLAR 3 2021 | INDEX OF CHARTS | P. 8 |

| BBVA. PILLAR 3 2021 | EXECUTIVE SUMMARY | P. 9 |

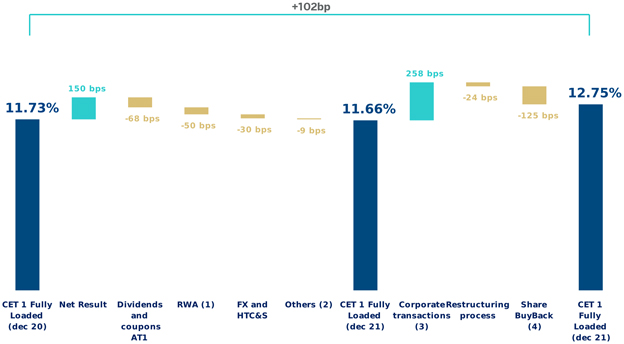

The consolidated fully-loaded CET1 ratio stood at 12.75% at the end of December 2021, which represents an increase of 102 basis points compared to 2020, with the phased-in CET1 ratio of 12.98%, which represents an increase of 83 basis points compared to 2020. The difference between both ratios is mainly explained by the effect of the temporary adjustments for the treatment of the solvency indicators of the impacts of IFRS 9.

These ratios include the effects of the divestments in Paraguay in the first quarter and in the United States in the second quarter of 2021. Additionally, these ratios include the negative non recurring impact of €696 million from the net costs associated with the restructuring process in Spain, as well as the deduction of the total amount of the share buyback program authorized by the European Central Bank, for an amount of €3.5 billion. Excluding these impacts, during the 2021 financial year a high organic generation of results has been registered, which, net of shareholder remuneration and remuneration of the Contingent Convertible bonds (CoCos, for its acronym in English), have contributed +82 basis points to the CET1 ratio and have made it possible to cover the negative evolution of market variables, as well as supervisory impacts and regulatory changes.

Fully loaded risk-weighted assets (RWA) decreased by approximately €-45.4 billion in 2021 compared to 2020, mainly due to the aforementioned divestments in Paraguay and the United States.

Additional Tier 1 capital (AT1) fully-loaded stood at 1.87% (1.86% phased-in) at the end of December 2021, which

includes the reduction effect of €1 billion due to early amortization of an issuance of CoCos dating back to 2016, offset by the positive effect of reducing RWAs.

The Tier 2 fully-loaded ratio stood at 2.37%, which represents an increase of +7 basis points compared to 2020, mainly explained by the effect of the RWA reduction during the 2021 financial year. Regarding the tier 2 phased-in, stood at 2.40%, the difference being with respect to the fully-loaded Tier 2 ratio, mainly due to the temporary treatment of certain subordinated issues.

As a consequence of the foregoing, the fully-loaded total capital ratio stands at 16.99% as of December 2021, with the total phased-in ratio being 17.24% as of the same date.

The Liquidity Coverage Ratio (LCR) and the Net Stable Funding Ratio (NSFR) in the Group remained well above 100% throughout 2021. At December 31, 2021, these ratios stood at 165% (213% considering the excess liquidity of the subsidiaries) and 135%, respectively. Although these requirements are only established at Group level, this minimum is comfortably exceeded in all subsidiaries.

As for the leverage ratio, as of December 31, 2021, the fully loaded ratio was 6.69% (6.80% phased-in), above the minimum required ratio of 3.06%.

The following table shows the main metrics according article 447 of the CRR:

| BBVA. PILLAR 3 2021 | EXECUTIVE SUMMARY | P. 10 |

Table 1. EU KM1 - Key metrics (Million Euros)

| 12-31-2021 | 9-30-2021 | 6-30-2021 | ||||||||||

Available own funds (amounts) | ||||||||||||

Common Equity Tier 1 (CET1) capital | 39,949 | 44,558 | 43,903 | |||||||||

Tier 1 capital | 45,686 | 50,329 | 49,599 | |||||||||

|

|

|

|

|

| |||||||

Total capital | 53,069 | 58,098 | 57,287 | |||||||||

|

|

|

|

|

| |||||||

Risk-weighted exposure amounts | ||||||||||||

|

|

|

|

|

| |||||||

Total risk-weighted exposure amount | 307,795 | 303,002 | 305,599 | |||||||||

|

|

|

|

|

| |||||||

Capital ratios (as a percentage of risk-weighted exposure amount) | ||||||||||||

Common Equity Tier 1 ratio (%) | 12.98 | % | 14.71 | % | 14.37 | % | ||||||

Tier 1 ratio (%) | 14.84 | % | 16.61 | % | 16.23 | % | ||||||

|

|

|

|

|

| |||||||

Total capital ratio (%) | 17.24 | % | 19.17 | % | 18.75 | % | ||||||

|

|

|

|

|

| |||||||

Additional own funds requirements to address risks other than the risk of excessive leverage (as a percentage of risk-weighted exposure amount) | ||||||||||||

Additional own funds requirements to address risks other than the risk of excessive leverage (%) | 1.50 | % | 1.50 | % | 1.50 | % | ||||||

of which: to be made up of CET1 capital (percentage points) | 0.84 | % | 0.84 | % | 0.84 | % | ||||||

of which: to be made up of Tier 1 capital (percentage points) | 1.13 | % | 1.13 | % | 1.13 | % | ||||||

|

|

|

|

|

| |||||||

Total SREP own funds requirements (%) | 9.50 | % | 9.50 | % | 9.50 | % | ||||||

|

|

|

|

|

| |||||||

Combined buffer requirement (as a percentage of risk-weighted exposure amount) | ||||||||||||

Capital conservation buffer (%) | 2.50 | % | 2.50 | % | 2.50 | % | ||||||

Conservation buffer due to macro-prudential or systemic risk identified at the level of a Member State (%) | — | — | — | |||||||||

Institution specific countercyclical capital buffer (%) | 0.01 | % | 0.01 | % | 0.01 | % | ||||||

Systemic risk buffer (%) | — | — | — | |||||||||

Global Systemically Important Institution buffer (%) | — | — | — | |||||||||

Other Systemically Important Institution buffer | 0.75 | % | 0.75 | % | 0.75 | % | ||||||

Combined buffer requirement (%) | 3.26 | % | 3.26 | % | 3.26 | % | ||||||

Overall capital requirements (%) | 12.76 | % | 12.76 | % | 12.76 | % | ||||||

CET1 available after meeting the total SREP own funds requirements (%) | 23,501 | 28,366 | 27,572 | |||||||||

Leverage ratio | ||||||||||||

|

|

|

|

|

| |||||||

Total exposure measure | 671,789 | 663,861 | 665,751 | |||||||||

|

|

|

|

|

| |||||||

Leverage ratio (%) | 6.80 | % | 7.58 | % | 7.45 | % | ||||||

Additional own funds requirements to address the risk of excessive leverage (as a percentage of total exposure measure) | ||||||||||||

Additional own funds requirements to address the risk of excessive leverage (%) | — | — | — | |||||||||

of which: to be made up of CET1 capital (percentage points) | — | — | — | |||||||||

|

|

|

|

|

| |||||||

Total SREP leverage ratio requirements (%) | 3.06 | % | 3.06 | % | 3.06 | % | ||||||

|

|

|

|

|

| |||||||

Leverage ratio buffer and overall leverage ratio requirement (as a percentage of total exposure measure) | ||||||||||||

Leverage ratio buffer requirement (%) | — | — | — | |||||||||

Overall leverage ratio requirements (%) | 3.06 | % | 3.06 | % | 3.06 | % | ||||||

Liquidity Coverage Ratio | ||||||||||||

|

|

|

|

|

| |||||||

Total high-quality liquid assets (HQLA) (Weighted value - average) | 103,823 | 109,943 | 108,610 | |||||||||

|

|

|

|

|

| |||||||

Cash outflows - Total weighted value | 87,615 | 86,066 | 84,470 | |||||||||

Cash inflows - Total weighted value | 24,712 | 21,575 | 23,775 | |||||||||

|

|

|

|

|

| |||||||

Total net cash outflows (adjusted value) | 62,903 | 64,491 | 60,696 | |||||||||

|

|

|

|

|

| |||||||

Liquidity coverage ratio (%) | 165.05 | % | 170.48 | % | 178.94 | % | ||||||

Net Stable Funding Ratio | ||||||||||||

|

|

|

|

|

| |||||||

Total available stable funding | 430,759 | 431,415 | 429,074 | |||||||||

|

|

|

|

|

| |||||||

Total required stable funding | 319,017 | 320,752 | 320,838 | |||||||||

|

|

|

|

|

| |||||||

NSFR ratio (%) | 135.03 | % | 134.50 | % | 133.74 | % | ||||||

|

|

|

|

|

| |||||||

This table is a summary of the main metrics presented in the Pillar 3 report.

| BBVA. PILLAR 3 2021 | EXECUTIVE SUMMARY | P. 11 |

| • | For information on Capital and solvency, see section 3, Own funds and capital. |

| • | For information on Leverage, see section 5, Leverage ratio. |

| • | For information on Liquidity ratios, see section 4.5. Liquidity risk. |

The following sections detail matters relating to the Group’s solvency. These are supplemented by information included in the Group’s Consolidated Financial Statements and Management Report as of year 2021, which also contain the Group’s main activity and profitability indicators.

| BBVA. PILLAR 3 2021 | 1. INTRODUCTION | P. 12 |

1.1. | Applicable regulatory framework | 13 | ||||

1.2. | Regulatory developments in 2021 | 14 | ||||

1.3. | Contents of the 2021 Prudential Relevance Report | 16 | ||||

| BBVA. PILLAR 3 2021 | 1. INTRODUCTION | P. 13 |

1.1. Applicable regulatory framework

As a Spanish credit institution, BBVA is subject to Directive 2013/36/EU of the European Parliament and of the Council dated June 26, 2013, on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms (the “CRD IV Directive”) amended by Directive 2019/878/EU (the “CRD V Directive).

The major regulation governing the solvency of credit institutions is (EU) Regulation No. 575/2013 of the European Parliament and of the Council of June 26, 2013, on the prudential requirements for credit institutions and investment firms amending (EU) Regulation No 648/2012 (“CRR” and in conjunction with Directive CRD IV and any implementing measures of CRD IV, “CRD IV”), which is complemented by several binding Regulatory Technical Standards that are directly applicable to all EU member states, without the need to implement national measures. This Regulation was amended by Regulation 2019/876/EU (“CRR2”) and Regulation 2020/873/EU (“Quick Fix”).

The CRD IV Directive was transposed to Spanish national law by means of the Royal Decree-Law 14/2013, of November 29 (“RD-L 14/2013”), Law 10/2014 of June 26, Royal Decree 84/2015, of February 13 (“RD 84/2015”), Bank of Spain Circular 2/2014 of January 31 and Circular 2/2016 of February 2 (“Bank of Spain Circular 2/2016”).

During 2021, Directive 2019/878 was transposed into the Spanish legal system through the publication of Royal Decree-Law 7/2021, of April 27 (amending Law 10/2014), Royal Decree 970/2021, of November 8 (which modifies RDL 84/2015) and Circular 5/2021, of September 22 (which modifies Circular 2/2016).

In the Macroprudential field, Royal Decree 102/2019 was published in March 2019, establishing the Macroprudential Authority of the Financial Stability Board, establishing its legal regime. The aforementioned Royal Decree also develops certain aspects related to the macroprudential tools contained in Royal Decree-Law 22/2018. Among them, it provides that the Bank of Spain may adopt measures such as the countercyclical buffer for a given sector, sectoral limits on the concentration of exposures or the establishment of limits and conditions on the granting of loans and other operations. These measures are developed in Bank of Spain Circular 5/2021, of September 22.

| BBVA. PILLAR 3 2021 | 1. INTRODUCTION | P. 14 |

1.2. Regulatory developments in 2021

In the field of prudential regulation, the most significant in 2021 has been:

| • | The publication by the European Commission of the proposal for the fully implementation of the Basel III, which represents the last step of the regulatory reform that began after the financial crisis. The European Commission has proposed to the European Parliament and the Council a series of amendments to banking regulations known as the “banking package 2021” to strengthen the resilience of European Union banks against possible future economic shocks, contribute to the recovery of the pandemic and the transition to climate neutrality. The main objective of the reform is to achieve a simpler, more comparable and risk-sensitive framework. To this end, modifications to CRR2 and CRD V are proposed. The European Commission proposes that the new regulations begin to apply from January 1, 2025, for which the debate with the European Parliament and the Council is now beginning. |

| • | The decision of the European Central Bank (hereinafter ECB) not to extend beyond September 2021 the recommendation to limit the distribution of dividends that prompted credit institutions for the first time in March 2020. |

| • | The entry into force of the guidelines on the definition of default (applicable from January 1, 2021), the full application of CRR2 and the updating of the guidelines on internal governance, the guidelines on adequate remuneration policies and the guidelines on the assessment of the suitability of the members of the management body and the holders of key functions (these updates apply from December 31). |

| • | In Spain, in April 2021, Decree-Law 7/2021 was approved, which transposes the CRD V and resolution directives (BRRD 2) into Spanish legislation. In the prudential part, changes have been included in the definition and requirements of Pillar II, the macroprudential buffers and the remuneration regime. |

| • | Regarding the regulations related to macroprudential regulation, during the year 2021, the Basel Committee on Banking Supervision has published its final report on the methodology for the identification of Global Systemic Banks (G-SIBS), proposing a continuous review of this methodology instead of doing it every three years. Additionally, the European Commission has published a public |

consultation on the macroprudential framework and, in turn, has asked the opinion of the European Banking Authority, the European Systemic Risk Board and the European Central Bank on a future review of the framework. |

In the field of resolution, the most significant in 2021 was:

| • | Amendment of CRR2 and BRRD 2 regarding the scope of the resolution (known as the Daisy Chain proposal) through a separate proposal for a Regulation (“Proposal for a Regulation amending Regulation (EU) No 575/2013 and Directive 2014/59 /EU as regards the prudential treatment of global systemically important institution groups with a multiple point of entry resolution strategy and a methodology for the indirect subscription of instruments eligible for meeting the minimum requirement for own funds and eligible liabilities”). |

At the date of publication of this report, the proposal is in the negotiation phase between the Council and the European Parliament.

| • | In Europe, the reform of the European Stability Mechanism Treaty was signed, allowing it to act as a security mechanism for the Single Resolution Fund from the beginning of 2022. The European Banking Authority has developed several level 2 and 3 regulatory texts related to the BRRD 2 and the Single Resolution Board (SRB) has published various guides to improve the resolvability of financial institutions. |

| • | In Spain, the approval of Royal Decree-Law 7/2021 that transposes CRD V and BRRD 2 into Spanish law. In the resolution part, the inclusion of adjustments in the hierarchy of creditors in the event of liquidation and the calibration and subordination of the MREL requirement stand out. |

In the field of Sustainable Finance, the most significant of 2021 has been the following:

The year 2021 has been key to beginning to integrate ESG criteria into decision-making and risk management of financial institutions and for accelerating the development of regulatory frameworks aimed at promoting sustainability.

At a global level, it should be noted that the International Financial Reporting Standards (IFRS) Foundation has announced the creation of a sustainability standards council (International Sustainability Standards Board, ISSB) to create international standards for the disclosure of information related to sustainability. In addition, the Basel Committee of Banking Supervisors is developing

| BBVA. PILLAR 3 2021 | 1. INTRODUCTION | P. 15 |

principles for the management and supervision of these risks, which have been reflected in a consultation.

For its part, Europe has managed to position itself as the pioneer region in this area, giving rise to the adoption of important legislative measures such as the European taxonomy of sustainable activities, the Sustainable Finance Disclosure Regulation (SFDR, for its acronym and, more recently, the proposal for the Corporate Sustainability Reporting Directive (CSRD).

Additionally, the European Commission presented in July 2021 a new strategy for sustainable finance, which establishes new initiatives to face climate change and other environmental challenges. These initiatives have materialized in the Basel III implementation proposal presented by the European Commission in October 2021.

Moreover, the preliminary reports of the European Platform for Sustainable Finance have been published on:

(I) the extension of the taxonomy to intermediate economic activities in terms of sustainability, with the aim of supporting activities that allow the transition to a sustainable economy; and

(II) a social taxonomy that would complete the European taxonomy of “green” activities.

For its part, the ECB published in September the results of the first stress tests in which climate risks have been measured in different activities, and it plans to carry out the first supervisory stress tests on banks by 2022 based on climatic risks.

At the national level, Law 7/2021, of May 20, on climate change and energy transition, provides the regulatory and institutional framework aimed at facilitating and guiding the decarbonisation of the Spanish economy in 2050, as established by the European Union and the commitment made by signing the Paris Agreement. This regulation establishes obligations both for the financial and business sector and for supervisors.

In the field of disclosure, article 32 of this Law requires the publication (both in the management report and in Pillar 3) of an annual report on climate change, the content of which will be developed by means of a decree-law (RDL) within a period of two years. This report can be found in section 8 of this document.

In terms of disclosure and supervisory reporting, the main regulatory developments that occurred during 2021 were as follows:

Supervisory reporting

The regulators have continued with the process of reviewing and updating the reporting framework, highlighting the following publications:

| • | Technical Implementation Standards on supervisory reporting requirements, which amend Commission Regulation 2021/451 with regard to COREP, asset encumbrance, ALMM and G-SII reporting |

The European Banking Authority (EBA) published the final version of the document in December, which has not yet been adopted by the European Commission. The proposed date of application is December 1, 2022, although it is yet to be published in the Official Journal of the European Union (OJEU).

The purpose of these technical standards is to implement in the reporting the regulatory changes referring mainly to securitizations, the non-deductibility of the CET1 software and the additional liquidity monitoring metrics (ALMM), as well as to introduce the measures of proportionality contained in the CRR2.

| • | Technical Implementation Standards amending Regulation 2018/1624 on the provision of information regarding resolution plans in the context of the BRRD 2. |

The EBA published the final version of the document in August, which has not yet been adopted by the European Commission or published in the OJEU. The changes introduced are minimal and are intended to align with the changes introduced by BRRD 2 on MREL.

Disclosure

In the field of Pillar 3, the following regulatory developments stand out:

| • | Technical Implementation Standards amending Regulation 637/2021 on disclosure of information regarding interest rate risk in portfolios other than trading. |

In November, the EBA published the final version of the document, which contains the tables and instructions to breakdown the information regarding interest rate risk in the banking book (IRRBB) in the Pillar 3 report.

These standards have not yet been adopted by the European Commission or published in the OJEU. However, given that the requirement to break down this information (contained in article 448 CRR2) is applicable from June 28, 2021, the EBA recommended using the tables included in this document breaking down the methodology used to calculate the information.

| • | In November, the Basel Committee on Banking Supervision (BCBS) published a technical amendment to its G-SII assessment |

| BBVA. PILLAR 3 2021 | 1. INTRODUCTION | P. 16 |

methodology review process technical amendment completion”). In it, the three-year cycle for the review of the methodology is replaced by a process of monitoring and continuous review. |

Related to the above, in January 2022 it launched its annual exercise to identify which entities are considered to be of global systemic importance (G-SII) based on data as of December 2021. It is an exercise of collection of data on various indicators that are used to determine global systemic importance.

In Europe, these indicators must be broken down both by the entities considered G-SII and those that, not being G-SII, have an exposure measurement greater than €200,000 million, as established in the EBA Guidelines on the breakdown of the indicators of systemic importance (EBA/GL/2020/14). These guidelines establish the table format that must be used to disclose the indicators, which must be identical to that presented to the BCBS.

The annual exercise of the BCBS of January 2022 introduces changes to the indicators. However, given that the EBA guidelines have not yet been modified to include the new table format and taking into account the need to align with the BCBS, this report breaks down using the new indicators established by the BCBS.

| • | Technical Implementation Standards on public disclosures and reporting of MREL and TLAC |

These standards have been published in the OJEU in May 2021 (Regulation 2021/763). The date of application of the reporting requirements is June 28, 2021 for MREL and TLAC, while different dates are established for the public breakdown: June 1, 2021 for TLAC and not before January 1, 2024 for MREL.

Given that at the date of publication of this report BBVA is not considered a G-SII, the TLAC does not apply to it.

| • | Technical Implementation Standards on prudential disclosures of ESG risks. |

In accordance with article 449a CRR2, the EBA has published in January 2022 the final document that establishes the formats and tables to be used to disclose the information related to environmental, social and governance (ESG) risks. Its application will be gradual starting in Pillar 3 of 2022 (to be published in 2023). At the date of publication of this report, it had not yet been adopted by the European Commission or published in the OJEU.

Crypto assets

Another field that has attracted much attention from international organizations and national regulators during 2021 has been that of crypto assets.

At a global level, the Basel Committee on Banking Supervision published in June a preliminary proposal for the prudential treatment of bank exposures to crypto assets, although it has already announced that it is necessary to have a definitive standard, it will continue working on this new framework during 2022.

At the national level, the National Securities Market Commission (Comisión Nacional del Mercado de Valores. CNMV in Spanish) has issued a Circular to regulate the advertising of crypto assets, which will come into force at the beginning of next year. Meanwhile, in Turkey, the Central Bank issued a new regulation in April that forbids the development of business models by financial institutions that involve the use of crypto assets to make payments.

1.3. Contents of the 2021 Prudential Relevance Report

Article 13 of the CRR establishes that the parent entities of the European Union are subject, based on their consolidated situation, to the disclosure requirements set by Part Eight of CRR.

This report provides the prudential information of BBVA Consolidated Group as of December 31, 2021 which has been prepared in accordance with the precepts contained in Part Eight of the CRR, complying with the guidelines published by EBA and the applicable technical implementation standards.

In addition, the main EBA guidelines that apply as of December 31, 2021 are highlighted below:

| • | Guidelines on materiality, proprietary information, and confidentiality, and on the frequency of disclosure of information according to Article 432, sections 1 and 2, and Article 433 of Regulation (EU) No. 575/2013 (EBA/GL/2014/14). These guidelines detail the process and the criteria to be followed regarding the principles of materiality, proprietary information, confidentiality and the right to omit information, and provide guidance for entities to assess the need to publish information more frequently than the annual one. These guidelines were adopted by the Executive Commission of the Bank of Spain in February 2015. |

| BBVA. PILLAR 3 2021 | 1. INTRODUCTION | P. 17 |

| • | Guidelines on reporting and disclosure of exposures subject to measures applied in response to the crisis arising from COVID-19 (EBA/GL/2020/07). These guidelines were adopted by the Executive Commission of the Bank of Spain on June 23, 2020. |

| • | Guidelines amending the EBA/GL/2018/01 guidelines on the uniform disclosure of information pursuant to Article 473a of Regulation (EU) No. 575/2013 (CRR) with regard to transitional provisions to mitigate the impact on own funds caused by the implementation of IFRS 9, aiming to guarantee compliance with the Quick Fix made to the CRR in response to the COVID-19 Pandemic (EBA/GL/2020/12). These guidelines are applicable from August 11, 2020 until the end of the transitional periods contemplated in articles 468 and 473 bis of the CRR (December 31, 2024 and December 31, 2022, respectively) |

| • | Implementing Technical Standards published in June 2020 concerning reporting and disclosure of public information (EBA/ITS/2020/04, hereinafter “New EBA ITS”). These technical standards implement the changes introduced by CRR2. |

In these technical implementation standards, the EBA, following the mandate of the European Commission in article 434a of the CRR2, implements the changes introduced by aforementioned regulation, integrating in a single document most of the disclosure requirements to the market that were disseminated in various guidelines published to date.

Additionally, these regulations also aim to unify, as far as possible, public information with the information reported to the Supervisor through integration in regulatory reporting and has meant in some cases the simplification of standard templates that could contain similar information, maintaining only those templates that include just complete and relevant information, such as those referring to the credit quality of the exposures.

Likewise, together with the aforementioned ITS, the EBA publishes for informative purposes a document called mapping tool that interrelates the quantitative information of most of the standard templates required in Pillar 3 with the regulatory reporting, which has been taken into account in the preparation of this report. The implementation of these standards may produce variations in the content and the way in which the information is presented with respect to previous periods.

| • | Guidelines on sound remuneration policies under Directive 2013/36/EU (EBA/GL/2021/04). These guidelines were adopted by the Executive Commission of the Bank of Spain in December 2021. |

Annex VII contains the list of main changes to the tables with respect to December 2020 derived from the adaptation to the regulations in force as of December 31, 2021.

Additionally, Annex VIII of this report contains the correspondence of the articles of Part Eight of the CRR on disclosure of information that are applicable at the date of the report with the different sections of the document where the required information is found.

The aforementioned annex, together with the rest of the annexes and the tables included in this report, are in an editable format in order to facilitate their treatment, following the recommendations of the EBA Guidelines. This document is called “Pillar 3 2021 - Tables & Annexes”, available in the Shareholders and Investors / Financial Information section of the Group’s website.

The Prudential Relevance Report (IRP - Pillar 3) of the BBVA Group, corresponding to the year ended December 31, 2021, has been prepared in accordance with the requirements of Part Eight of the CRR and approved by the Audit Committee (in its meeting held on March 1, 2022), applying the rules for the preparation of financial information of the BBVA Group and in compliance with the “General Policy for disclosure of economic-financial, non-financial and corporate information” approved by the governance bodies of Banco Bilbao Vizcaya Argentaria, SA.

Likewise, it should be noted that the data disclosed in the IRP - Pillar 3, have been prepared in accordance with the internal processes and controls described in the “Standard for the preparation of periodic public information of Banco Bilbao Vizcaya Argentaria, S.A.” and BBVA Group”. The aforementioned policies and standards guarantee that the information disclosed in the IRP Report - Pillar 3 is subject to the internal control framework defined by the Group, as well as to an adequate level of internal review.

| BBVA. PILLAR 3 2021 | 2. GENERAL INFORMATION REQUIREMENTS | P. 18 |

2. General information requirements

| BBVA. PILLAR 3 2021 | 2. GENERAL INFORMATION REQUIREMENTS | P. 19 |

2.1. Corporate name and differences between the consolidated group for the purposes of solvency regulations and accounting criteria

2.1.1. Corporate name and scope of application

Banco Bilbao Vizcaya Argentaria, S.A. (hereinafter the “Bank” or “BBVA”) is a private law entity subject to the rules and regulations of the banking entities operating in Spain and carries out its activity through branches and agencies throughout the country and abroad.

The bylaws and other public information are available for consultation at the Bank’s registered office (Plaza San Nicolás, 4, Bilbao) and on its website (www.bbva.com).

Solvency regulations are applicable at a consolidated level for the whole Group.

2.1.2. Differences between the consolidated group for the purposes of solvency regulations and accounting criteria

The Consolidated Financial Statements of BBVA Group are presented in accordance with the International Financial Reporting Standards adopted by the European Union (hereinafter referred to as ‘IFRS-EU’) applicable as of December 31, 2021, considering the Bank of Spain Circular 4/2017, and its successive modifications and the other provisions of the financial reporting framework which are applicable and the marking and format requirements established by Regulation EU 2019/815 of European Commission.

On the basis of accounting criteria, companies are considered to form part of a consolidated group when the parent entity holds or can hold, directly or indirectly, control of them. An institution is understood to control a subsidiary when it is exposed, or is entitled to, variable returns as a result of its involvement in the subsidiary and has the capacity to influence those returns through the power it exercises over the subsidiary. For control to exist, the following aspects must be fulfilled:

| a. | Power: An investor has power over a subsidiary when it has current rights that provide it with the capacity to direct its relevant activities, i.e. those that significantly affect the returns of the subsidiary. |

| b. | Returns: An investor is exposed, or is entitled to variable returns, as a result of its involvement in the subsidiary when the returns obtained by the investor for such involvement may vary based on |

| the economic performance of the subsidiary. Investor returns can be positive only, negative only, or positive and negative at the same time. |

| c. | Relationship between power and returns: An investor has control over a subsidiary when it not only has power over the subsidiary and is exposed, or is entitled to, variable returns for its involvement in the subsidiary, but it also has the capacity to use its power to influence the returns it obtains due to its involvement in the subsidiary. |

Therefore, in drawing up the Consolidated Financial Statements of BBVA Group, all dependent companies and consolidating structured entities have been consolidated by applying the full consolidation method.

Associated companies, as well as joint ventures (those over which joint control arrangements are in place), are valued using the equity method.

The list of all the companies forming part of the Group is included in the appendices to the Consolidated Financial Statements of BBVA Group.

For the purposes of solvency regulations, the following subsidiaries form part of the consolidated group, as defined in Article 18 of the CRR:

| • | Credit institutions |

| • | Investment firms |

| • | Financial Institutions |

A financial institution is a company, separate from other institutions (credit institution or investment firm), whose main activity may consist of acquiring holdings or performing one or more of the following activities:

| • | Loans, including in particular consumer finance, credit agreements relating to immovable property, recourse and non-recourse factoring, and financing of commercial transactions (including forfaiting) |

| • | Financial leasing |

| • | Payment services |

| • | Issuing and managing other payment channels (e.g. traveler’s checks and bank checks) |

| • | Granting of guarantees and commitments |

| BBVA. PILLAR 3 2021 | 2. GENERAL INFORMATION REQUIREMENTS | P. 20 |

| • | Trading on their own account or on behalf of customers on any of the following instruments: |

| • | Money market instruments (checks, bills, certificates of deposit etc.) |

| • | Foreign currency |

| • | Financial futures and options |

| • | Foreign-exchange or interest-rate instruments |

| • | Marketable securities |

| • | Participating in the issuance of securities and the provision of corresponding services |

| • | Advising companies with regard to capital structure, industrial strategy and related matters, as well as advice and services for mergers and acquisitions of companies |

| • | Brokerage in the interbank markets |

| • | Managing or advising on equity management |

| • | Custody and administration of marketable securities |

| • | Issuance of electronic money |

This definition includes financial holding companies, mixed financial holding companies, payment institutions and asset management firms, but excludes pure industrial holding companies, insurance companies, insurance holding companies and mixed insurance holding companies.

| • | Auxiliary services companies: A company whose main activity is holding or management of property, management of computing services or any other similar activity of an auxiliary nature with regard to the main activity of one or more institutions (credit institution or investment firm). |

Therefore, for the purposes of calculating solvency requirements, and hence the drawing up of this Prudential Relevance Report, the scope of consolidating entities is different from the scope defined for the purposes of drawing up the Consolidated Financial Statements of BBVA Group.

The effect of the difference between the two regulations is mainly due to:

| • | Withdrawals from the balance made by entities (largely insurance companies regulated by the Solvency II regulatory framework) that are |

consolidated in the Consolidated Financial Statements of BBVA Group by the full consolidation method and consolidated for the purposes of solvency by applying the equity method. |

| • | Entries to the balance contributed mainly by financial entities, consolidated by applying the equity method at the accounting level, but for the purposes of solvency, are proportionally integrated. |

The list of entities that use different consolidation methods in their public and regulatory balance sheets is included in table LI3 in Annex I.

2.1.3. Significant transactions in the Group in 2021

Voluntary takeover bid for the entire share capital of Türkiye Garanti BankasI A.Ş (Garanti)

On November 15, 2021, BBVA announced a voluntary takeover bid addressed to the holders of the 2,106,300,000 shares1 not controlled by BBVA, representing 50.15% of Garanti’s total share capital. BBVA submitted for authorization an application of the voluntary takeover bid to the Capital Markets Board of Turkey (CMB) on November 18, 2021.

The consideration offered by BBVA to Garanti shareholders is 12.20 Turkish Liras in cash for each share. The maximum amount payable by BBVA will be 25,697 million Turkish Liras (equivalent to approximately €1,690 million at an exchange rate of 15.23 Turkish Liras per Euro estimated as of December 31, 2021) assuming all of Garanti’s shareholders sell their shares. BBVA will pay the consideration with its current shareholder’s funds. BBVA reserves the right to reduce or otherwise modify the voluntary takeover bid price by an amount equal to the gross amount of the distribution per share, if Garanti declares or distributes dividends, reserves or any other kind of distribution to its shareholders at any time from the date of the announcement on November 15, 2021 until the day of completion of the voluntary takeover bid. BBVA may cancel the takeover bid at any time before the commencement of the acceptance period.

The acquisition by BBVA of more than 50% of Garanti’s total share capital is subject to the prior approval of several authorities, both in Turkey and in other jurisdictions. BBVA will disclose to the market when all relevant authorizations are obtained. BBVA has received confirmation from the CMB that it will not formally approve the voluntary takeover bid application until the CMB receives confirmation from BBVA that all relevant approvals required by BBVA have been duly obtained. Only after approval by the CMB of the voluntary takeover bid application will the voluntary takeover bid period begin.

| 1 | All references to “shares” or “share” shall be deemed made to lots of 100 shares, which is the trading unit at Borsa Istanbul. |

| BBVA. PILLAR 3 2021 | 2. GENERAL INFORMATION REQUIREMENTS | P. 21 |

The estimated impact will depend on the percentage of shares that are tendered. As of December 31, 2021, BBVA estimated maximum impact of minus 32 basis points in the Common Equity Tier 1 fully loaded ratio and approximately 2% accretion to its book value per share2, (all the above assuming that all Garanti shareholders accept the offer).

On the contrary, in 2021, the BBVA Group underwent two significant divestment operations.

Sale of BBVA’s U.S. subsidiary to PNC Financial Service Group

On June 1 2021, after obtaining all the required authorizations, BBVA completed the sale to The PNC Financial Services Group, Inc. of 100% of the capital stock of its subsidiary BBVA USA Bancshares, Inc., which in turn owned all the capital stock of the bank, BBVA USA.

The consideration received in cash by BBVA amounted to approximately $11.5 billion (price provided in the agreement minus the agreed closing price adjustments) equivalent to approximately €9.6 billion (with an exchange rate of 1.20 EUR / USD).

The accounting of both the results generated by BBVA USA Bancshares since the announcement of the transaction and the closing of its sale has had an aggregate positive impact on the BBVA Group’s Common Equity Tier 1 (“fully loaded”) ratio of approximately 294 basis points, which includes the generation of capital contributed by the subsidiary to the Group until the closing of the transaction (on June 1, 2021) and a profit net of taxes of €582 million. As a result thereof, the BBVA Group has been reflecting the results that BBVA USA Bancshares, Inc. has been generating, as well as the positive impact, mainly, of these results on the Common Equity Tier 1 (“fully loaded”) ratio of BBVA Group. The calculation of the impact on Common Equity Tier 1 has been made taking into account the amount of the transaction in euros and BBVA Group’s financial statements as of June 2021.

The BBVA Group continues to develop an institutional and wholesale business in the United States that it currently carries out through its broker-dealer BBVA Securities Inc. and the New York branch. BBVA also maintains its investment activity in the fintech sector through its participation in Propel Venture Partners US Fund I, L.P.

Sale of the BBVA Group’s stake in Paraguay

On January 22, 2021, once the mandatory authorizations were obtained, BBVA completed the sale of its direct and indirect shareholding of 100% of the capital stock of Banco Bilbao Vizcaya Argentaria Paraguay, S.A. (“BBVA Paraguay”) to Banco GNB Paraguay S.A., a subsidiary of the Gilinski Group. This transaction was originally agreed in 2019. The total amount received by BBVA amounted to approximately USD 250 million (approximately €210 million). The transaction generated a capital loss net of taxes of approximately €9 million. This transaction had a positive impact on the Common Equity Tier 1 (fully loaded) of the BBVA Group of approximately 6 basis points, which is reflected in the capital base of the BBVA Group in the fiscal year 2021.

2.1.4. Reconciliation of the Public Balance Sheet from the accounting perimeter to the regulatory perimeter

This section includes an exercise in transparency to show the reconciliation process between the book balances reported in the public balance sheet (attached to the Consolidated Financial Statements of BBVA Group) and the book balances this report uses (regulatory perimeter), revealing the main differences between both perimeters.

| 2 | The calculation of the impact on Common Equity Tier 1 and tangible book value per share was made taking into consideration the consolidated Group’s financial statements as of December 31, 2021, and an exchange rate of 15.23 Turkish Lira per Euro. The impact on CET1 and the tangible book value per share may be different from the date of this disclosure up to the date of closing of the Voluntary Takeover Bid due to, among other circumstances, changes in the book value of Garanti and changes in the Turkish Lira/Euro exchange rate. |

| BBVA. PILLAR 3 2021 | 2. GENERAL INFORMATION REQUIREMENTS | P. 22 |

Table 2. EU CC2 - Reconciliation of regulatory capital to balance sheet (Million Euros. 12-31-2021)

Public Balance Sheet Headings | Public Balance Sheet | Regulatory balance sheet | Reference to template EU CC1 | |||||||||

Cash, cash balances at central banks and other demand deposits | 67,799 | 68,031 | ||||||||||

Financial assets held for trading | 123,493 | 124,555 | ||||||||||

Non-trading financial assets mandatorily at fair value through profit or loss | 6,086 | 1,728 | ||||||||||

Financial assets designated at fair value through profit or loss | 1,092 | — | ||||||||||

Financial assets at fair value through accumulated other comprehensive income | 60,421 | 45,656 | ||||||||||

Financial assets at amortised cost | 372,676 | 366,622 | ||||||||||

Derivatives - Hedge accounting | 1,805 | 1,649 | ||||||||||

Fair value changes of the hedged items in portfolio hedges of interest rate risk | 5 | 5 | ||||||||||

Joint ventures and associates | 900 | 3,857 | ||||||||||

Insurance and reinsurance assets | 269 | — | ||||||||||

Tangible assets | 7,298 | 7,051 | ||||||||||

Intangible assets | 2,197 | 2,159 | g | ) | ||||||||

Tax assets | 15,850 | 15,462 | ||||||||||

Of which: deferred tax assets | 14,917 | 14,629 | h | ) | ||||||||

Other assets | 1,934 | 3,609 | ||||||||||

Non-current assets and disposal groups classified as held for sale | 1,061 | 1,127 | ||||||||||

|

|

|

| |||||||||

Total Assets | 662,885 | 641,511 | ||||||||||

|

|

|

| |||||||||

Financial liabilities held for trading | 91,135 | 91,417 | ||||||||||

Financial liabilities designated at fair value through profit or loss | 9,683 | 3,396 | ||||||||||

Financial liabilities at amortised cost | 487,893 | 484,848 | o | ) p) r) | ||||||||

Derivatives - Hedge accounting | 2,626 | 2,457 | ||||||||||

Fair value changes of the hedged items in portfolio hedges of interest rate risk | — | — | ||||||||||

Liabilities under insurance and reinsurance contracts | 10,865 | 56 | ||||||||||

Provisions | 5,889 | 5,411 | ||||||||||

Tax liabilities | 2,413 | 1,622 | ||||||||||

Of which: deferred tax liabilities | 1,769 | 1,019 | ||||||||||

Other liabilities | 3,621 | 3,610 | ||||||||||

Non-current assets and disposal groups classified as held for sale | — | 66 | ||||||||||

|

|

|

| |||||||||

Total liabilities | 614,125 | 592,882 | ||||||||||

|

|

|

| |||||||||

Capital | 3,267 | 3,267 | a | ) | ||||||||

Share premium | 23,599 | 23,599 | a | ) | ||||||||

Equity instruments issued other than capital | — | — | ||||||||||

Other equity | 60 | 60 | c | ) | ||||||||

Retained earnings | 31,841 | 30,745 | b | ) | ||||||||

Revaluation reserves | — | — | ||||||||||

Other reserves | (1,857 | ) | (907 | ) | c | ) | ||||||

Less: treasury shares | (647 | ) | (647 | ) | l | ) | ||||||

Profit or loss attributable to owners of the parent | 4,653 | 4,601 | e | ) | ||||||||

Less: interim dividend | (532 | ) | (532 | ) | e | ) | ||||||

Accumulated other comprehensive income (loss) | (16,476 | ) | (16,352 | ) | c | ) | ||||||

Minority interests | 4,853 | 4,797 | ||||||||||

|

|

|

| |||||||||

Total equity | 48,760 | 48,630 | ||||||||||

|

|

|

| |||||||||

Total equity and total liabilities | 662,885 | 641,511 | ||||||||||

|

|

|

| |||||||||

The main differences between the public balance sheet and the regulatory balance sheet are due to withdrawals from the balance generated by insurance, real estate and financial entities that are consolidated through the application of the equity method for the amount of €-22.530 million; and balance entries generated by entities that are consolidated using the proportional integration method for an amount of €+1.156 million.

The following table also shows the risk to which each of the items on the regulatory balance sheet is exposed:

| BBVA. PILLAR 3 2021 | 2. GENERAL INFORMATION REQUIREMENTS | P. 23 |

Table 3. EU LI1 - Differences between the accounting and regulatory scopes of consolidation and the mapping of the financial statements categories with regulatory risk categories (Million Euros. 12-31-2021)

| Carrying values of items(1) | ||||||||||||||||||||||||||||

| Carrying values as reported in published financial statements (2) | Carrying Values under scope of regulatory consolidation (5) | Subject to credit risk framework | Subject to counterparty credit risk framework | Subject to the Securitisation framework | Subject to the market risk framework | Not subject to capital requirements or subject to deduction from capital | ||||||||||||||||||||||

Assets | ||||||||||||||||||||||||||||

Cash, cash balances at central banks and other demand deposits | 67,799 | 68,032 | 67,179 | 853 | — | — | — | |||||||||||||||||||||

Financial assets held for trading | 123,493 | 124,555 | 551 | 83,321 | — | 124,004 | — | |||||||||||||||||||||

Non-trading financial assets mandatorily at fair value through profit or loss | 6,086 | 1,728 | 1,681 | — | 33 | — | 14 | |||||||||||||||||||||

Financial assets designated at fair value through profit or loss | 1,092 | — | — | — | — | — | — | |||||||||||||||||||||

Financial assets at fair value through accumulated other comprehensive income | 60,421 | 45,656 | 45,383 | — | 124 | — | 149 | |||||||||||||||||||||

Financial assets at amortised cost | 372,676 | 366,653 | 353,024 | 9,646 | 3,653 | — | 330 | |||||||||||||||||||||

Derivatives - Hedge accounting | 1,805 | 1,649 | — | 1,649 | — | — | — | |||||||||||||||||||||

Fair value changes of the hedged items in portfolio hedges of interest rate risk | 5 | 5 | — | — | — | — | 5 | |||||||||||||||||||||

Joint ventures and associates | 900 | 3,857 | 3,511 | — | — | — | 346 | |||||||||||||||||||||

Insurance and reinsurance assets | 269 | — | — | — | — | — | — | |||||||||||||||||||||

Tangible assets | 7,298 | 7,053 | 7,053 | — | — | — | — | |||||||||||||||||||||

Intangible assets | 2,197 | 2,159 | 687 | — | — | — | 1,472 | |||||||||||||||||||||

Tax assets(6) | 15,850 | 15,462 | 14,453 | — | — | — | 1,009 | |||||||||||||||||||||

Other assets(7) | 1,934 | 3,682 | 1,472 | — | — | — | 2,210 | |||||||||||||||||||||

Non-current assets and disposal groups classified as held for sale (4) | 1,061 | 1,020 | 1,020 | — | — | — | — | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total assets | 662,886 | 641,511 | 496,014 | 95,469 | 3,809 | 124,004 | 5,535 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Liabilities | ||||||||||||||||||||||||||||

Financial liabilities held for trading | 91,134 | 91,417 | — | 75,596 | — | 91,417 | — | |||||||||||||||||||||

Financial liabilities designated at fair value through profit or loss | 9,683 | 3,396 | — | — | — | — | 3,396 | |||||||||||||||||||||

Financial liabilities at amortised cost | 487,893 | 484,848 | — | 10,454 | — | — | 474,394 | |||||||||||||||||||||

Derivatives - Hedge accounting | 2,626 | 2,457 | — | 2,457 | — | — | — | |||||||||||||||||||||

Fair value changes of the hedged items in portfolio hedges of interest rate risk | — | — | — | — | — | — | — | |||||||||||||||||||||

Liabilities under insurance and reinsurance contracts | 10,865 | 73 | — | — | — | — | 73 | |||||||||||||||||||||

Provisions | 5,889 | 5,411 | 691 | — | — | — | 4,720 | |||||||||||||||||||||

Tax liabilities(3) | 2,413 | 1,622 | 878 | — | — | — | 744 | |||||||||||||||||||||

Other liabilities | 3,621 | 3,593 | — | — | — | — | 3,593 | |||||||||||||||||||||

Liabilities included in disposal groups classified as held for sale (4) | — | 66 | — | — | — | — | 66 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total Liabilities | 614,124 | 592,883 | 1,569 | 88,507 | — | 91,417 | 486,986 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

| (1) | For the purpose of the template, when a single item is associated with the capital requirements according to more than one risk framework, it is shown in all the columns corresponding to the capital requirements to which it is associated. As a result, the sum of the values of the columns by type of risk may be greater than the carrying value according to the scope of regulatory consolidation. |

| (2) | Deferred tax assets that depend on future income, reduced by the amount of deferred tax liabilities (article 38 of the CRR) are € 3,119 million and have a risk weighting of 250% in application of article 48 of the CRR. The remaining tax assets include deferred tax assets that do not depend on future income and current tax assets. |

| (3) | Other assets include mainly an amount of €1,883 million relating to insurance contracts linked to pensions, which are not subject to capital requirements. |

A summary table with the main sources of differences between the amount of exposures in regulatory terms (EAD) and the accounting balances according to the Financial Statements is below:

| BBVA. PILLAR 3 2021 | 2. GENERAL INFORMATION REQUIREMENTS | P. 24 |

Table 4. EU LI2 - Main sources of the differences between regulatory original exposure amounts and carrying values in financial statements (Million Euros. 12-31-2021)

| Items subject to: | ||||||||||||||||||||

| Total | Credit risk framework | Counterparty credit risk framework | Securitisation framework | Market risk framework | ||||||||||||||||

Asset carrying value amount under scope of regulatory consolidation | 719,296 | 496,014 | 95,469 | 3,809 | 124,004 | |||||||||||||||

Liabilities carrying value amount under scope of regulatory consolidation | 181,493 | 1,569 | 88,507 | — | 91,417 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total net amount under regulatory scope of consolidation | 537,803 | 494,445 | 6,962 | 3,809 | 32,587 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Amount of off-balance-sheet | 170,432 | 166,804 | 3,628 | — | ||||||||||||||||

Differences in valuation(1) | (260 | ) | — | — | — | (260 | ) | |||||||||||||

Differences due to netting agreements (netting, long/short positions) (2) | 113,750 | — | 113,750 | |||||||||||||||||

Differences due to accounting Provisions(3) | 5,115 | 5,115 | — | |||||||||||||||||

Differences due to credit risk mitigation techniques (CRM) | (28,582 | ) | (5,267 | ) | (23,315 | ) | — | |||||||||||||

Differences due to credit conversion factors (CCF) | (93,151 | ) | (93,151 | ) | ||||||||||||||||

Differences due to risk transfer securitisations | (1,141 | ) | — | — | (1,141 | ) | ||||||||||||||

Counterparty credit risk in derivatives (includes the add-on) | 12,296 | 12,296 | ||||||||||||||||||

Other | (757 | ) | (9 | ) | (748 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Exposure amounts considered for regulatory purposes | 715,505 | 567,937 | 112,573 | 2,668 | 32,327 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

| (1) | It includes the deduction for prudent valuation adjustments. This deduction is included in row 7 of table EU CC1. |

| (2) | This amount includes the reversal of the accounting netting of derivatives and repurchase agreements to include the netting adjustment applicable in prudential regulation; and the impact of the collateral adjustment on securities financing transactions. |

| (3) | Includes provisions for exposures to credit risk under advanced approach that do not reduce the EAD. |

As the table shows, the main sources of difference between the accounting value on the balance sheet and the amount of exposure for regulatory purposes are the inclusion of off-balance sheet items after the conversion factor, the different treatment of the guarantees eligible as risk mitigation techniques and the regulatory treatment of derivative and securities financing transactions (inclusion of netting rules other than those applied in accounting value and the inclusion of the potential future exposure).

| BBVA. PILLAR 3 2021 | 2. GENERAL INFORMATION REQUIREMENTS | P. 25 |

2.2. Identification of dependent entities with bank capital below the minimum requirement. Possible impediments to transferring own funds

As of December 31, 2021, there are no entities in the Group with capital adequacy below their applicable minimum regulatory requirement.

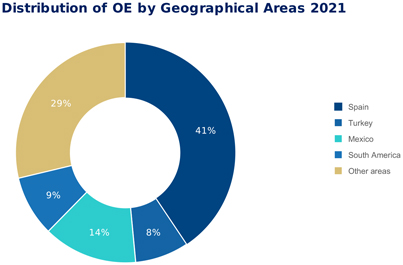

The Group operates mainly in Spain, Mexico, Turkey and South America. The Group’s banking subsidiaries around the world are subject to supervision and regulation (with respect to issues such as compliance with a minimum level of regulatory capital) by a number of regulatory bodies.

The obligation to comply with these capital requirements may affect the capacity of these banking subsidiaries to transfer funds (e.g. via dividends) to the parent company.

In some jurisdictions in which the Group operates, the regulations lay down that dividends may only be paid with the funds available by regulation for this purpose.

2.3. Exemptions from capital requirements at the individual or sub-consolidated level

In accordance with what is set out in the solvency regulations regarding the exemption from capital requirements compliance for Spanish credit institutions belonging to a consolidated group (at individual or sub-consolidated level) established in the aforementioned regulation, the Group obtained exemption from the supervisor on December 30, 2009 for the following companies (this exemption was ratified through ECB decision 1024/2013):

| • | Banco Industrial de Bilbao, S.A. |

| • | Banco Occidental, S.A. |

In addition, for Financiero de Crédito de Portugal (BBVA IFIC, S.A.), the ECB has decided not to apply prudential or liquidity requirements individually

| BBVA. PILLAR 3 2021 | 3. ELIGIBLE OWN FUNDS AND MINIMUM REQUIREMENTS | P. 26 |

3. Eligible own funds and minimum requirements

3.1. | BBVA Group’s regulatory capital tiers | 27 | ||||

3.2. | Eligible own funds | 31 | ||||

3.3. | Own Funds requirements by risk type | 36 | ||||

3.3.1. | Entity risk profile | 36 | ||||

3.3.2. | Breakdown of minimum capital requirements by risk type | 39 | ||||

3.4. | IFRS 9 and OCI Transitional Arrangements | 42 | ||||

3.5. | Procedure used in the capital self- assesment process | 44 | ||||

| BBVA. PILLAR 3 2021 | 3. ELIGIBLE OWN FUNDS AND MINIMUM REQUIREMENTS | P. 27 |

3.1. BBVA Group’s regulatory capital tiers

Article 92 of the CRR establishes that credit institutions must maintain the following own funds requirements at all times:

| a. | Common Equity Tier 1 capital ratio of 4.5%, calculated as Common Equity Tier 1 capital expressed as a percentage on the total amount of risk-weighted assets. |

| b. | Tier 1 capital ratio of 6%, calculated as the level of tier capital 1 expressed as a percentage of the total amount of risk-weighted assets. |

| c. | Total capital ratio of 8%, calculated as the total own funds expressed as a percentage of the total amount of risk-weighted assets |

Notwithstanding the application of the Pillar 1 requirement, CRD IV allows competent authorities to require credit institutions to maintain a level of own funds higher than the requirements of Pillar 1 to cover types of risk other than those already covered by the Pillar 1 requirement (this power of the competent authority is commonly referred to as “Pillar 2”).

Furthermore, from 2016 and in accordance with CRD IV, credit institutions must comply with the following combined requirement of capital buffers at all times: (i) the capital conservation buffer, (ii) the buffer for global systemically important banks (the “G-SIB” buffer), (iii) the entity-specific countercyclical capital buffer, (iv) the buffer for other systemically important banks (“D-SIB” buffer) and (v) the systemic risk capital buffer. The “combined capital buffer requirement” must be met with Common Equity Tier 1 capital (“CET1”) to cover both minimum capital required by “Pillar 1” and “Pillar 2”.

Both the capital conservation buffer and the G-SIB buffer (where appropriate) will apply to credit institutions as it establishes a percentage greater than 0%.

The buffer for global systemically important banks applies to those institutions on the list of global systemically important banks, which is updated annually by the Financial Stability Board (“FSB”). Considering the fact that BBVA does not appear on that list, as at the report date, the G-SIB buffer does not apply to BBVA.

For more details on the quantitative indicators for assessing global systemically important entities, see “Annex VI – G-SIB indicators”.

The Bank of Spain has extensive discretionary powers as regards the countercyclical capital buffer specific to each bank, the buffer for other systemically important financial institutions (which are those institutions considered to be systemically important domestic financial institutions “D-SIB”) and the buffer against systemic risk (to prevent or avoid systemic or

macroprudential risk). The European Central Bank (ECB) has the powers to issue recommendations in this respect following the entry into force on November 4, 2014 of the Single Supervisory Mechanism (SSM).

With regard to minimum capital requirements, following the latest decision of the SREP (Supervisory Review and Evaluation Process), which comes into force as of March 1, 2022, the ECB has notified the Group of maintaining the Pillar 2 requirement at 1.5% (of which at least 0.84% should be satisfied with CET1). Therefore, BBVA must maintain a CET1 capital ratio of 8.60% and a total capital ratio of 12.76% at a consolidated level.

Thus, the consolidated overall capital requirement includes: i) the minimum capital requirement of Common Equity Tier 1 (CET1) of Pillar 1 (4.5%); ii) the capital requirement of Additional Tier 1 (AT1) of Pillar 1 (1.5%); iii) the capital requirement of Tier 2 of Pillar 1 (2%); iv) the CET1 requirement of Pillar 2 (0.84%), v) the capital requirement of Additional Tier 1 (AT1) of Pillar 2 (0.28%); vi) the capital requirement of Tier 2 of Pillar 2 (0.38%); vii) the capital conservation buffer (2.5% of CET1); viii) the capital buffer for Other Systemically Important Institutions (O-SIIs) (0.75% of CET1); and ix) the countercyclical buffer (CCyB) (0.01% of CET1).

The BBVA Group has set the objective of maintaining a fully loaded CET1 ratio at a consolidated level of between 11.5% -12.0%, increasing the target distance to the minimum requirement (currently at 8.60%) at 290-340 basis points. At closing of the financial year 2021, the fully loaded CET1 ratio is above this target management range.

CET1 phased-in ratio reach 12.98% which represents +438 basis points over the minimum requirement of 8.60%.

| BBVA. PILLAR 3 2021 | 3. ELIGIBLE OWN FUNDS AND MINIMUM REQUIREMENTS | P. 29 |

The following table shows the CET1 ratio that would

trigger restrictions on capital distribution and the capital

ratios as of December 2021:

Table 5. Capital distribution constraints (12-31-2021)

| CET1 capital ratio that would trigger capital distribution constraints (%) | Current CET 1 capital ratio(%) | |||||||

CET1 Pillar 1 | 4.50 | % | ||||||

CET1 Pillar 2 (P2R) | 0.84 | % | ||||||

Capital conservation buffer | 2.50 | % | ||||||

D-SIB buffer | 0.75 | % | ||||||

Countercyclical buffer | 0.01 | % | ||||||

CET1 phased-in minimum plus Basel III buffers (excluding capital used to meet other minimum regulatory capital) | 8.60 | % | 12.98 | % | ||||

CET1 phased-in minimum plus Basel III buffers (including capital used to meet other minimum regulatory capital) | N/A | N/A | ||||||

The Group has not been required to use phased-in CET1

capital to meet other capital requirements other than

those established by the SREP letter.

The following table shows the distribution by geographic

areas of the credit exposure for calculation of the

countercyclical capital buffer. Countries where no buffer

is established are grouped:

| BBVA. PILLAR 3 2021 | 3. ELIGIBLE OWN FUNDS AND MINIMUM REQUIREMENTS | P. 30 |

Table 6.1. Geographical breakdown of relevant credit exposures for the calculation of the countercyclical capital buffer (Million Euros. 12-31-2021)

| General credit exposures (1) | Trading book exposure | Securitisation exposure | Own funds requirements | |||||||||||||||||||||||||||||||||||||||||||||||||

| Exposure value for SA | Exposure value for IRB | Sum of long and short position of trading book | Trading book exposure value for internal models | Exposure value for SA | Total exposure value | Of which: General credit exposures | Of which: Trading book exposures | Of which: Securitisation exposures | Total | Risk-weighted exposure amounts | Own funds requirements weights | Countercyclical capital buffer rate | ||||||||||||||||||||||||||||||||||||||||

Geographical |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||

Bulgary | 26 | 5 | — | — | — | 31 | 2 | — | — | 2 | 29 | 0.01 | % | 0.50 | % | |||||||||||||||||||||||||||||||||||||

Slovakia | 3 | 161 | — | — | — | 163 | 19 | — | — | 19 | 238 | 0.11 | % | 1.00 | % | |||||||||||||||||||||||||||||||||||||

Hong Kong | 4 | 3,324 | — | — | — | 3,328 | 50 | — | — | 50 | 621 | 0.30 | % | 1.00 | % | |||||||||||||||||||||||||||||||||||||

Luxemburg | 90 | 1,693 | 16 | 16 | — | 1,816 | 69 | — | — | 69 | 864 | 0.41 | % | 0.50 | % | |||||||||||||||||||||||||||||||||||||

Norway | 20 | 57 | 1 | 1 | — | 78 | 3 | — | — | 3 | 44 | 0.02 | % | 1.00 | % | |||||||||||||||||||||||||||||||||||||

Czech Republic | 14 | 99 | — | — | — | 113 | 2 | — | — | 2 | 30 | 0.01 | % | 0.50 | % | |||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||

Total countries with countercyclical capital buffer | 157 | 5,339 | 17 | 17 | — | 5,529 | 145 | — | — | 145 | 1,826 | 0.86 | % | |||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||

Germany | 208 | 6,371 | 243 | 255 | 47 | 7,124 | 179 | 1 | — | 180 | 2,254 | 1.08 | % | — | ||||||||||||||||||||||||||||||||||||||

Argentina | 7,037 | 372 | 10 | — | — | 7,419 | 332 | — | — | 332 | 4,151 | 1.99 | % | — | ||||||||||||||||||||||||||||||||||||||

Colombia | 14,926 | 704 | 613 | — | — | 16,244 | 792 | 8 | — | 800 | 9,998 | 4.79 | % | — | ||||||||||||||||||||||||||||||||||||||

Spain | 24,491 | 179,418 | 140 | 5 | 2,861 | 206,916 | 5,780 | 15 | 26 | 5,820 | 72,755 | 34.88 | % | — | ||||||||||||||||||||||||||||||||||||||

United States | 692 | 23,758 | 154 | 151 | — | 24,754 | 644 | 2 | — | 645 | 8,066 | 3.87 | % | — | ||||||||||||||||||||||||||||||||||||||

France | 1,312 | 9,045 | 61 | 65 | — | 10,483 | 284 | 1 | — | 286 | 3,572 | 1.71 | % | — | ||||||||||||||||||||||||||||||||||||||

Italy | 20 | 6,487 | 13 | 12 | — | 6,532 | 169 | 1 | — | 169 | 2,116 | 1.01 | % | — | ||||||||||||||||||||||||||||||||||||||

Mexico | 37,477 | 42,311 | 148 | 39 | — | 79,974 | 3,306 | 11 | — | 3,317 | 41,468 | 19.88 | % | — | ||||||||||||||||||||||||||||||||||||||

Netherlands | 548 | 5,150 | 57 | 60 | — | 5,815 | 196 | 1 | — | 197 | 2,458 | 1.18 | % | — | ||||||||||||||||||||||||||||||||||||||

Peru | 22,476 | 847 | 958 | 4 | — | 24,285 | 1,002 | 14 | — | 1,016 | 12,697 | 6.09 | % | — | ||||||||||||||||||||||||||||||||||||||

Portugal | 2,558 | 2,013 | — | 1 | — | 4,573 | 216 | — | — | 216 | 2,696 | 1.29 | % | — | ||||||||||||||||||||||||||||||||||||||

United Kingdom | 2,803 | 7,237 | 139 | 144 | — | 10,322 | 380 | 1 | — | 380 | 4,756 | 2.28 | % | — | ||||||||||||||||||||||||||||||||||||||

Turkey | 43,341 | 510 | 116 | — | — | 43,966 | 2,286 | 2 | — | 2,288 | 28,605 | 13.71 | % | — | ||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||

Total countries with a 0% countercyclical buffer or without countercyclical capital buffer (with own funds requirements greater than 1%) | 157,889 | 284,223 | 2,652 | 736 | 2,908 | 448,407 | 15,566 | 57 | 26 | 15,646 | 195,592 | 93.76 | % | |||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||

Other areas (2) | 8,353 | 14,825 | 243 | 68 | — | 23,491 | 891 | 7 | — | 901 | 11,231 | 5.38 | % | |||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||

Total countries without countercyclical capital buffer (with own funds requirements less than 1%) | 8,353 | 14,825 | 243 | 68 | — | 23,491 | 891 | 7 | — | 901 | 11,231 | 5.38 | % | |||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||

Total | 166,399 | 304,387 | 2,912 | 821 | 2,908 | 477,427 | 16,602 | 64 | 26 | 16,692 | 208,649 | 100.00 | % | |||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||

| (1) | Credit exposure excludes exposures to Central Governments or Central Banks, Regional Governments or Local Authorities, Public sector entities, Multilateral Development Banks, International Organisations and Institutions in accordance with art. 140.4 of Directive 2013/36/EU |

| (2) | A full breakdown of the countries with relevant exposures for the calculation of the countercyclical capital buffer which are included in “Other areas”, is in Annex IV. |

| BBVA. PILLAR 3 2021 | 3. ELIGIBLE OWN FUNDS AND MINIMUM REQUIREMENTS | P. 31 |

Table 6.2. Amount of institution-specific countercyclical capital buffer (Million Euros. 12-31-2021)

| Amount | ||||

Total risk exposure amount | 307,795 | |||

Institution specific countercyclical buffer rate (1) | 0.01 | % | ||

Institution specific countercyclical buffer requirement | 20 | |||

| (1) | Countercyclical capital buffer calculated as of December 2020 in accordance with Commission Delegated Regulation (EU) 2015/1555 |

The countercyclical capital buffer requirement applicable to the BBVA Group is approximately 0.01%, which increased slightly compared to December 2020, mainly due to the sale of the US subsidiary. This sale has

increased the contribution of countries where there are countercyclical buffer requirements. Within this group is Luxembourg with a buffer of 0.5% (rising from 0.25% in 2020) and Hong Kong with a buffer of 1%.

For the purposes of calculating minimum capital requirements, according to Regulation (EU) 575/2013 and subsequent amendments, which entered into force on June 27, 2019 (CRR), the elements and instruments of Tier 1 capital are defined as the sum of Common Equity Tier 1 capital (CET1) and additional Tier 1 capital (AT1), as defined in Part Two, Title I, Chapters I to III of the CRR, as well as their corresponding deductions, in accordance with Articles 36 and 56, respectively.

Also considered are the elements of Tier 2 capital defined in Part Two of Chapter IV, Section I of the CRR. The deductions defined as such in Section II of the same Chapter are also considered.

The level of Common Equity Tier 1 capital essentially comprises the following elements:

| a. | Capital and share premium: this includes the elements described in article 26 section 1, and 28 of the CRR and the EBA list referred to in Article 26 Section 3 of the CRR. |

| b. | Accumulated gains: in accordance with Article 26. 1 c), the gains that may be used immediately and with no restriction to cover any risk or losses are included, in the event that they occur. |

| c. | Other accumulated income and other reserves: in accordance with Article 26. 1, d) and e), this item primarily classifies the exchange-rate differences and the valuation adjustments associated with the portfolio of financial assets at fair value with changes to other comprehensive income. |

| d. | Minority interests eligible as CET1: includes the sum of the Common Equity Tier 1 capital instruments of a subsidiary that arise in the process of its global consolidation and are attributable to natural or legal third persons other than companies included in the consolidation, calculated in accordance with Article 84 et seq. of the CRR. |

| e. | Net profit of the year attributed to the Group: the independently verified profits are included, net of any possible expense or foreseeable dividend |

| previously authorised by the supervisor (following the treatment set out in Article 5 of Decision (EU) 2015/656 of the ECB). As of December 2021, it includes the prudential accrual of 0.23 cents/share as Shareholders remuneration related to 2021 results, which has been agreed by the Management Board on February, 15, 2022 (pending approval by the General Shareholders’ Meeting to be held on March 18, 2022). |

Furthermore, CET1 capital is adjusted mainly through the following deductions:

| f. | Additional value adjustments: this includes adjustments resulting from the prudent valuation of positions at fair value, as set out in Article 105 of the CRR. |

| g. | Intangible assets: these are included net of the corresponding tax liabilities, as set out in Article 36.1 b) and Article 37 of the CRR. It mainly includes goodwill, software and other intangible assets. The amount shall be deducted from the amount of the accounting revaluation of the intangible assets of the subsidiaries derived from the consolidation of the subsidiaries attributable to persons other than the companies included in the consolidation. This includes the positive effect due to the prudent treatment of software following the publication of Delegated Regulation 2020/2176 of December 22. |

| h. | Deferred tax assets: it includes deferred tax assets that rely on future profitability and do not rise from temporary differences (net of the corresponding tax liabilities when the conditions established in Article 38.3 of the CRR are met), as per Article 36.1 c) and Article 38 of the CRR, mainly loss carryforwards (LCFs). |

| i. | Reserves at fair value related to losses or gains from cash flow hedging: includes value adjustments of cash flow hedging of financial instruments not valued at fair value, including expected cash flows in accordance with Article 33 a) of the CRR. |

| BBVA. PILLAR 3 2021 | 3. ELIGIBLE OWN FUNDS AND MINIMUM REQUIREMENTS | P. 32 |

| j. | Negative amounts due to the calculation of the expected losses: the default provision on expected losses in exposure weighted by method based on internal ratings, calculated in accordance with Article 36.1 d) of the CRR, is included. |

| k. | Profit and loss at fair value: these are derived from the entity’s own credit risk, in accordance with Article 33 b) of the CRR. |

| l. | Direct, indirect and synthetic holdings of own instruments (treasury stock): includes the shares and other instruments eligible as capital that are held by any of the Group’s consolidating entities, together with those held by non-consolidating entities belonging to the economic Group, as set out in Article 36.1 f) and Article 42 of the CRR. It mainly includes the amount of the treasury stock up to the maximum limit authorized by the ECB to the BBVA Group and the financing of own treasury shares. |