- BBVA Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Banco Bilbao Vizcaya Argentaria (BBVA) 6-KCurrent report (foreign)

Filed: 30 Jan 25, 10:45am

UNITED STATES SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January, 2025

Commission file number: 1-10110

BANCO BILBAO VIZCAYA ARGENTARIA, S.A.

(Exact name of Registrant as specified in its charter)

BANK BILBAO VIZCAYA ARGENTARIA, S.A.

(Translation of Registrant’s name into English)

Calle Azul 4,

28050 Madrid

Spain

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes No X

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes No X

Press Release 01.30.2025 BBVA reports net profit of €10.1 billion in 2024 (+25 percent) For yet another year, the bank stood out among comparable European peers for its unique combination of growth of its lending portfolio (14 percent yoy in constant euros), and profitability, with ROTE of 19.7 percent. In 2024 the Group added 11.4 million new customers and channeled €99 billion in sustainable business, reaching the €300-billion1 goal one year ahead of schedule. Between January and December, BBVA posted a net attributable profit of €10.1 billion, up 25 percent. Earnings per share2 saw a higher increase, 28 percent, on the back of a share buyback. Against 2024 earnings, BBVA will pay a cash dividend of €0.70 per share3, 27 percent more than in 2023, and will execute a new share buyback program for €993 million4. In total, BBVA will distribute €5.03 billion to its shareholders. 1 Accumulated since 2028. 2 Earnings per Share (EPS) figures considering end of period number of shares. 3 Of this amount, €0.29 per share were paid in October as interim dividend of 2024. The additional payout of €0.41 per share is subject to the approval from the bank’s governing bodies. 4 Subject to approval from the bank’s governing bodies and the corresponding regulators.

BBVA ended 2024 with significant progress in its strategy, based in innovation, digitization and sustainability. The Group welcomed a record 11.4 million new customers, of which 66 percent joined the bank through digital channels. Seventy-five percent of active customers use the mobile phone as its main channel. Likewise, the bank channeled €99 billion in sustainable business in 2024, also a record. The bank has thus achieved its goal of mobilizing €300 billion during the 2018-2025 period —one year ahead of schedule. Banking activity stood out, backed by lending growth of 14.3 percent in constant euros vs 2023, together with improvements in market share in most countries in BBVA’s footprint. This resulted in a positive impact on society: 160,000 families were able to purchase a home; SMEs and the self-employed received 715,000 new loans to boost their businesses; and 70,000 larger companies had access to financing from BBVA. Furthermore, in 2024 BBVA allocated €22 billion to finance projects with social impact, such as the construction of hospitals and schools. Except where otherwise stated, the evolution of each of the main headings and changes in the income statement described below refer to constant exchange rates. In other words, they do not take currency fluctuations into account. At the top of the P&L account, net interest income (NII) saw a yoy increase of 13 percent, to a record €25.27 billion, on the back of dynamism

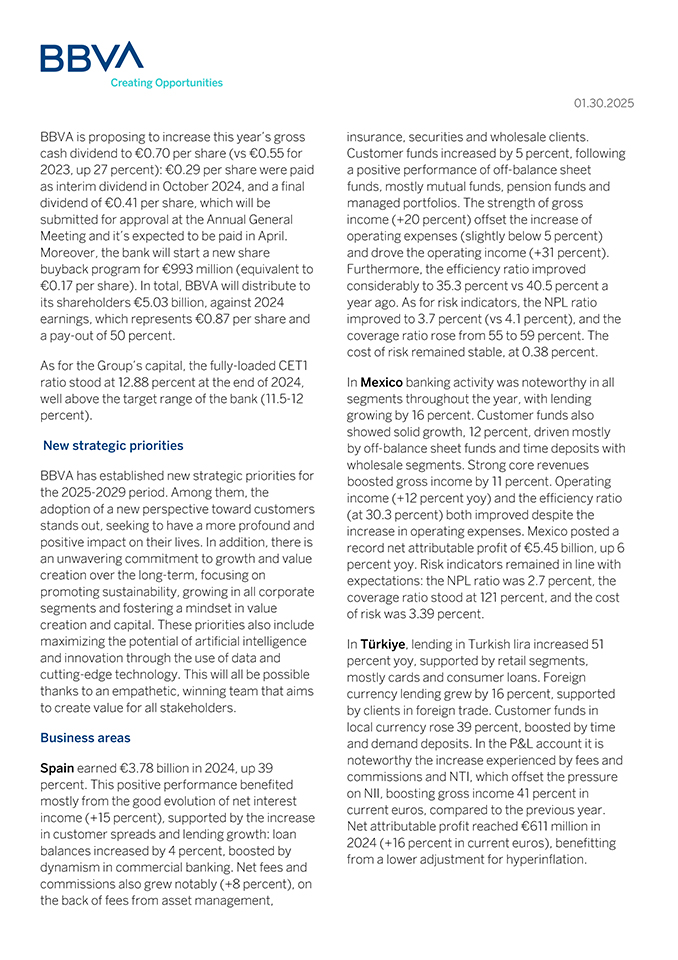

01.30.2025 BBA Creating Opportunities of lending activity in 2024. Net fees and commissions reached €7.99 billion, up 31 percent, thanks mostly to payment systems and asset management. The contribution of Türkiye to this heading was also noteworthy. Core revenues in the banking business -NII and net fees and commissions- rose 16.7 percent to €33.26 billion, with increasing growth quarter after quarter over the past two years. NTI also had a positive performance, with an increase of 91 percent, to €3.91 billion, driven by positive results from hedging foreign currency positions, especially on the Mexican peso. In the heading of other operating income and expenses, the good performance of the insurance business, the end of the contributions to the Single Resolution Fund and a lower impact from hyperinflation in Turkey offset a higher impact from hyperinflation in Argentina and the extraordinary tax on banking institutions in Spain (€285 million, registered in 1Q24). As a result, gross income saw an increase of 25 percent yoy, to €35.48 billion. Operating expenses rose 18 percent yoy, to €14.19 billion, on the back of new hirings in all geographies and a higher level of investment in recent years. Expenses grew below the average inflation rate in BBVA’s footprint (19.6 percent). The remarkable strength of gross income allowed for positive jaws and the efficiency ratio stood at 40 percent, improving the 42-percent target set for the end of 2024. Operating income reached a record €21.29 billion, up 30 percent from a year earlier. Provisions for impairment on financial assets rose 32 percent yoy on the back of a high rate of growth in lending, particularly on retail products, the most profitable in recent years. The accumulated cost of risk, however, remained virtually stable compared to September 2024, at 1.43 percent, in line with expectations. Additionally, the NPL and the coverage ratios improved to 3.0 percent and 80 percent, respectively, thanks to the reduction of loan-loss provisions in all geographies. The total of provisions and other results registered lower provisions compared to a year earlier (-63 percent), mainly originated in Türkiye, to €137 million. The BBVA Group posted a record net attributable profit of €10.05 billion in 2024, up 33 percent from a year earlier (+25 percent in current euros). Earnings per share grew by 28 percent in current euros, also driven by the share buyback program implemented throughout the year. In 4Q24, BBVA earned €2.43 billion. Thanks to these earnings, profitability indicators improved yoy. ROE stood at 18.9 percent, and ROTE at 19.7 percent, notably above the 14-percent target set for the end of the year. This excellent performance has allowed the bank to continue increasing the value for shareholders: At the end of December 2024, the tangible book value per share plus dividends was 17.2 percent higher than a year earlier. The combination of growth and profitability placed BBVA, once again, in a unique position among European banks.

01.30.2025 BBA Creating Opportunities BBVA is proposing to increase this year’s gross cash dividend to €0.70 per share (vs €0.55 for 2023, up 27 percent): €0.29 per share were paid as interim dividend in October 2024, and a final dividend of €0.41 per share, which will be submitted for approval at the Annual General Meeting and it’s expected to be paid in April. Moreover, the bank will start a new share buyback program for €993 million (equivalent to €0.17 per share). In total, BBVA will distribute to its shareholders €5.03 billion, against 2024 earnings, which represents €0.87 per share and a pay-out of 50 percent. As for the Group’s capital, the fully-loaded CET1 ratio stood at 12.88 percent at the end of 2024, well above the target range of the bank (11.5-12 percent). New strategic priorities BBVA has established new strategic priorities for the 2025-2029 period. Among them, the adoption of a new perspective toward customers stands out, seeking to have a more profound and positive impact on their lives. In addition, there is an unwavering commitment to growth and value creation over the long-term, focusing on promoting sustainability, growing in all corporate segments and fostering a mindset in value creation and capital. These priorities also include maximizing the potential of artificial intelligence and innovation through the use of data and cutting-edge technology. This will all be possible thanks to an empathetic, winning team that aims to create value for all stakeholders. Business areas Spain earned €3.78 billion in 2024, up 39 percent. This positive performance benefited mostly from the good evolution of net interest income (+15 percent), supported by the increase in customer spreads and lending growth: loan balances increased by 4 percent, boosted by dynamism in commercial banking. Net fees and commissions also grew notably (+8 percent), on the back of fees from asset management, insurance, securities and wholesale clients. Customer funds increased by 5 percent, following a positive performance of off-balance sheet funds, mostly mutual funds, pension funds and managed portfolios. The strength of gross income (+20 percent) offset the increase of operating expenses (slightly below 5 percent) and drove the operating income (+31 percent). Furthermore, the efficiency ratio improved considerably to 35.3 percent vs 40.5 percent a year ago. As for risk indicators, the NPL ratio improved to 3.7 percent (vs 4.1 percent), and the coverage ratio rose from 55 to 59 percent. The cost of risk remained stable, at 0.38 percent. In Mexico banking activity was noteworthy in all segments throughout the year, with lending growing by 16 percent. Customer funds also showed solid growth, 12 percent, driven mostly by off-balance sheet funds and time deposits with wholesale segments. Strong core revenues boosted gross income by 11 percent. Operating income (+12 percent yoy) and the efficiency ratio (at 30.3 percent) both improved despite the increase in operating expenses. Mexico posted a record net attributable profit of €5.45 billion, up 6 percent yoy. Risk indicators remained in line with expectations: the NPL ratio was 2.7 percent, the coverage ratio stood at 121 percent, and the cost of risk was 3.39 percent. In Türkiye, lending in Turkish lira increased 51 percent yoy, supported by retail segments, mostly cards and consumer loans. Foreign currency lending grew by 16 percent, supported by clients in foreign trade. Customer funds in local currency rose 39 percent, boosted by time and demand deposits. In the P&L account it is noteworthy the increase experienced by fees and commissions and NTI, which offset the pressure on NII, boosting gross income 41 percent in current euros, compared to the previous year. Net attributable profit reached €611 million in 2024 (+16 percent in current euros), benefitting from a lower adjustment for hyperinflation.

BBVA Creating Opportunities 01.30.2025 As for risk indicators, the NPL ratio stood at 3.1 percent, coverage was 96 percent and the cost of risk stood at 1.27 percent. Growth in lending activity (+17 percent) was notable in South America, particularly in commercial banking and new customer resources (+27 percent), mainly in deposits. The area posted a net attributable profit of €635 million, up 17 percent on the back of solid core revenues. In the breakdown per country, Peru registered a profit of €227 million; Argentina earned €182 million; and Colombia posted €90 million. Risk indicators in the region remained stable: The NPL ratio stood at 4.5 percent, coverage ratio was 88 percent, and the cost of risk stood at 2.87 percent. BBVA Corporate Communications Tel. +34 699 337 924 comunicacion.corporativa@bbva.com For more financial information about BBVA visit: https://shareholdersandinvestors.bbva.com/ For more news about BBVA visit: https://www.bbva.com

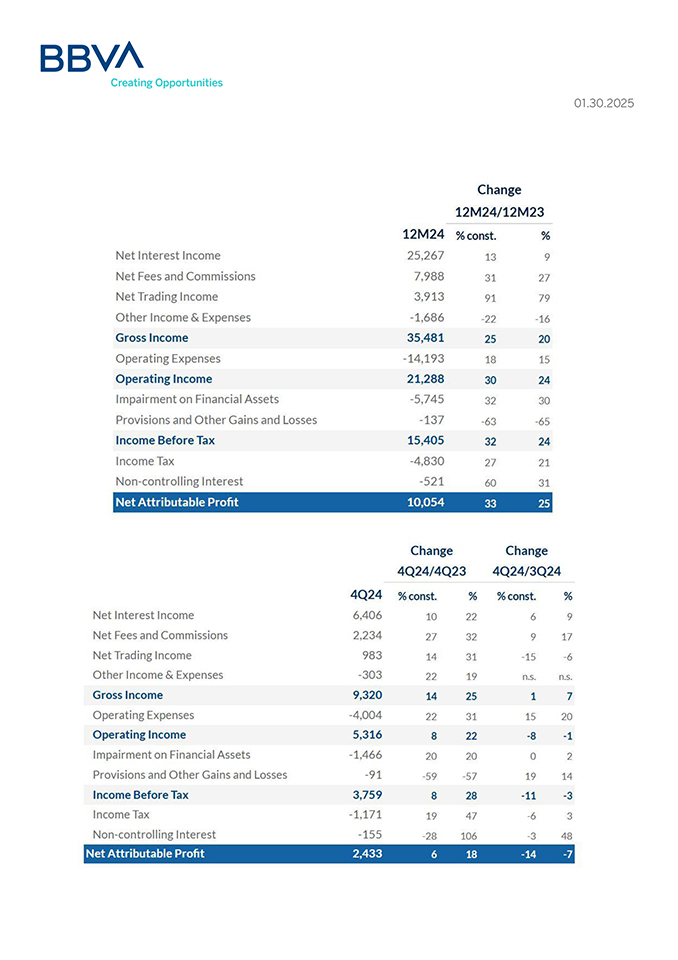

04.29.2019 01.30.2025 Change 12M24/12M23 12M24 % const. % Net Interest Income 25,267 13 9 Net Fees and Commissions 7,988 31 27 Net Trading Income 3,913 91 79 Other Income & Expenses -1,686 -22 -16 Gross Income 35,481 25 20 Operating Expenses -14,193 18 15 Operating Income 21,288 30 24 Impairment on Financial Assets -5,745 32 30 Provisions and Other Gains and Losses -137 -63 -65 Income Before Tax 15,405 32 24 Income Tax -4,830 27 21 Non-controlling Interest -521 60 31 Net Attributable Profit 10,054 33 25 Change 4Q24/4Q23 Change 4Q24/3Q24 4Q24 % const. % % const. % Net Interest Income 6,406 10 22 6 9 Net Fees and Commissions 2,234 27 32 9 17 Net Trading Income 983 14 31 -15 -6 Other Income & Expenses -303 22 19 n.s. n.s. Gross Income 9,320 14 25 1 7 Operating Expenses -4,004 22 31 15 20 Operating Income 5,316 8 22 -8 -1 Impairment on Financial Assets -1,466 20 20 0 2 Provisions and Other Gains and Losses -91 -59 -57 19 14 Income Before Tax 3,759 8 28 -11 -3 Income Tax -1,171 19 47 -6 3 Non-controlling Interest -155 -28 106 -3 48 Net Attributable Profit 2,433 6 18 -14 -7

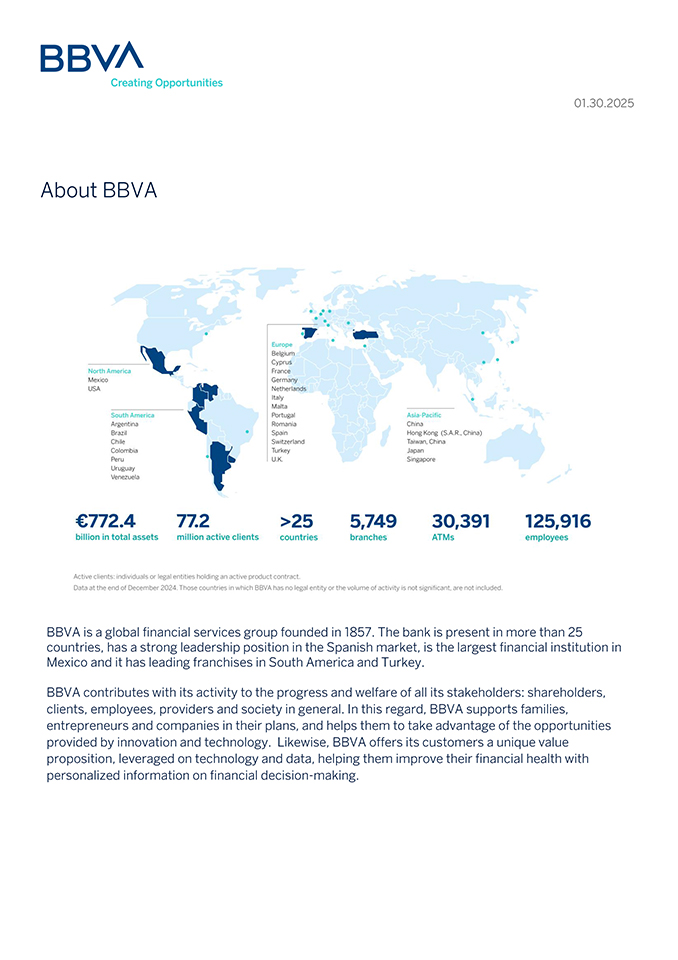

BBVA Creating Opportunities 01.30.2025 About BBVA BBVA is a global financial services group founded in 1857. The bank is present in more than 25 countries, has a strong leadership position in the Spanish market, is the largest financial institution in Mexico and it has leading franchises in South America and Turkey. BBVA contributes with its activity to the progress and welfare of all its stakeholders: shareholders, clients, employees, providers and society in general. In this regard, BBVA supports families, entrepreneurs and companies in their plans, and helps them to take advantage of the opportunities provided by innovation and technology. Likewise, BBVA offers its customers a unique value proposition, leveraged on technology and data, helping them improve their financial health with personalized information on financial decision-making.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Banco Bilbao Vizcaya Argentaria, S.A. | ||||||

Date: January 30, 2025 | ||||||

| By: /s/ MªÁngeles Peláez Morón | ||||||

| ||||||

| Name: MªÁngeles Peláez Morón | ||||||

| Title: Head of Accounting & Regulatory Reporting | ||||||