UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05684

Alpine Equity Trust

(Exact name of registrant as specified in charter)

2500 Westchester Avenue, Suite 215

Purchase, New York 10577

(Address of principal executive offices)(Zip code)

(Name and Address of Agent for

Service) | Copy to: |

Samuel A. Lieber Alpine Woods Capital Investors, LLC 2500 Westchester Avenue, Suite 215 Purchase, New York 10577 | Rose DiMartino Attorney at Law Willkie Farr & Gallagher 787 7th Avenue, 40th Floor New York, New York 10019 |

Registrant’s telephone number, including area code: (914) 251-0880

Date of fiscal year end: October 31

Date of reporting period: November 1, 2016 - April 30, 2017

Item 1: Shareholder Report

Table of Contents

Additional Alpine Funds are offered in the Alpine Series Trust and Alpine Income Trust. These Funds include:

| Alpine Dynamic Dividend Fund | Alpine Small Cap Fund |

| | |

| Alpine Rising Dividend Fund | Alpine Ultra Short Municipal Income Fund |

| | |

| Alpine Financial Services Fund | Alpine High Yield Managed Duration Municipal Fund |

Alpine’s Series and Income Funds’ investment objectives, risks, charges and expenses must be considered carefully before investing in funds of the Alpine Series Trust and Alpine Income Trust. The statutory and summary prospectuses contain this and other important information about the investment company, and it may be obtained by calling 1-888-785-5578, or visiting www.alpinefunds.com. Read it carefully before investing.

Mutual fund investing involves risk. Principal loss is possible.

Alpine’s Investment Outlook

Dear Shareholders:

We are pleased to present the semi-annual reports for the Alpine Mutual Funds. The past six months have seen a significant market impact from the election of Donald J. Trump as President. During the ten weeks following the election, the combined agenda of the President and the Republican Congress gave market participants hope that the economy would receive significant fiscal stimulus with a focus on improving corporate earnings. However, at this juncture, roughly six months past the election, no notable legislation has been passed and the prospect of additional economic stimulus seems questionable.

Nevertheless, capital markets continued to trade at strong levels. The overall economic trajectory continues on its slow but steady course of improvement. In fact, corporate profits of many companies have been improving over the past year, following the aftermath of the commodity cycle collapse in 2015. It’s worth noting that over the long term, jobless claims have declined from their nadir of 665,000 new claimants for unemployment per month in March of 2009 to 232,000 in April 2017. This is the lowest number since March of 1973, and well below the 50 year average of 358,000 jobs lost. While business layoffs have declined, stronger hiring patterns represented by job openings across all industries are essential. Job openings have been holding at an average annualized level of 5,655,000 since the beginning of 2016, which is the highest level since December of 2000 when the Bureau of Labor Statistics survey commenced. Notably, the economy has added 16 million jobs since the cycle low point at the end of 2009, growing 1.67% per year to 146 million non-farm jobs. This is even faster than the prior economic expansion from late 2003 through 2007 when the U.S. added 1.43% new jobs per year. However, if we go back almost 17 years to the end of the DotCom bubble in 2000 when non-farm payrolls registered 133 million jobs, the economy has only grown employment by 0.59% per year over. That is a far cry from the previous extended period from 1982, when interest rates started coming down, through December of 2000 as the economy added over 43 million jobs. For that period, non-farm jobs grew at approximately 2.25% per year over an 18 year stretch (Source: Bloomberg). Thus, it is understandable why many Americans believe, that our

economy has stagnated, and are hoping for the return to growth reminiscent of their younger days.

Even, the often mentioned underemployment level, which also includes part-time and marginally employed people, has only recently fallen below the 10% level down to 8.6% from the high of 17.1% in early 2010. Notably, this current level is about the same as the average from the decade between 1997 and 2007 before the economic and financial collapse in 2008. Although auto sales have come off historically strong levels, new home sales continue its steady recovery. For all these reasons, we believe the United States is poised to generate continued overall strength in its economy despite the ongoing headwinds from globalization and excess productive capacity abroad. Nonetheless, we have yet to overcome those factors which have contributed to a delayed capital expenditures (capex) cycle outside of regions and industries dominated by technological hubs or major trans shipments such as ports for goods and commodities. Thus, Alpine believes that the prospect for a return to wage growth is improving, which may become meaningful over the next year or so. This could lead to higher prices and perhaps rising interest rates.

Early in the year, Alpine presented a podcast in which several portfolio managers raised the question “Trump Change or Chump Change?” in assessing the direction of the market. We think that the President’s rhetoric focused many investors on the prospect of rising interest rates and corporate capex in response to a strengthening economy. However, his administration’s agenda for tax reductions, regulatory reform and infrastructure spending (which we believed could have been a significant catalyst for growth) has since floundered. The administration’s ineffectiveness in working with an aligned Congress and the inability to staff many government appointments during the first few months of the Trump Presidency has put into question whether much, if anything, will be accomplished before the prospect of mid-term elections absorbs the House of Representatives. For now, we expect minimal change unless somehow Republicans and Democrats can find common ground on long term economic programs such as infrastructure regeneration. Thus, the United States appears to be back in a state of

1

governmental gridlock, much like the prior eight years, where low rates dominated the financial markets and business cycles. The Federal Reserve (Fed) will likely continue to seek opportunities to normalize interest rates, boosting 25 basis points at a time as the economy and markets permit, over the next 12-18 months. However, the Fed’s so called “dot plot” graph, projecting future interest rates, may shift lower and slower yet again.

Even with moderating prospects, the United States is still leading the world economically, albeit at a slow pace. That said, we see some positive fundamental changes in Japan after nearly two decades of stagnation, and China remains a major industrial force even though it is growing more slowly and must work through its internal financial restructurings over the next number of years. While Europe still appears to be some three or four years behind the United States in terms of job growth and strengthening its banking systems, Germany is leading the Eurozone forward.

It is notable that President Trump’s international policies, specifically, rejecting the Trans-Pacific Partnership and not confirming Article 5 of the North Atlantic Treaty Organization (NATO) – to defend members under attack – may weaken the economic and international prominence of our country. Unless new policy initiatives or alignments could be established, China and Germany, and possibly Japan and even Russia may fill leadership, trade and economic voids that we abandon.

We believe that the equity markets and bond markets should gradually move towards higher interest rates, albeit, the risk of an inflationary shock to both seems much more remote now than it has anytime over the last few years. Nevertheless, we expect the markets to climb the ‘wall of worry’ between the risk of slowing down a little too much or speeding up a little too much. This could enable a significantly longer economic cycle than we have experienced in quite a while. So, the current seven year expansion could last easily for another two to three years and, possibly, longer. This suggests that investors using fixed-income and equity income strategies might still be able to achieve reasonable total returns even if interest rates rise at a modest annual pace. Meanwhile, equity investors will likely still seek growth in companies that are able to expand market share or apply innovative technology to traditional industries. For example, we highlight autonomous cars, drones, power generation, as well as new fields of endeavor, such as “Big Data” and the ever evolving field of bio-pharma research. Ultimately, those companies or entrepreneurs who can affect fundamental change to transform the way we work, play, learn, feed, entertain and protect ourselves, will likely continue to see great opportunities. Our job at Alpine is to find those companies which can capitalize on such

growth, as well as invest in underappreciated businesses which can excel in more traditional or mundane segments of the economy which may offer ongoing value and growth opportunities for investors.

Even though we have enjoyed solid performance by many of our Funds over the past fiscal period, we will continue to explore new ways to add value and attempt to reward your support for our endeavors. We appreciate your interest and look forward to reporting to you at the end of the next fiscal period. Meanwhile, feel free to visit our website for periodic updates on our thinking.

Sincerely,

Samuel A. Lieber

President

Past performance is not a guarantee of future results. The specific market, sector or investment conditions that contribute to a Fund’s performance may not be replicated in future periods.

Mutual fund investing involves risk. Principal loss is possible. Please refer to individual letters for risks specific to that Fund.

This letter and the letters that follow represent the opinions of the Funds’ management and are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security. The information provided is not intended to be, and is not, a forecast of future events, a guarantee of results, or investment advice.

2

Disclosures and Definitions |  |

Definitions and Disclosures

The specific market, sector or investment conditions that contributed to a Fund’s performance may not be replicated in future periods.

Please refer to the Schedule of Portfolio Investments for Fund holdings information. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security.

Diversification does not assure a profit or protect against loss in a declining market.

Favorable tax treatment of Fund distributions may be adversely affected, changed or repealed by future changes in tax laws. Alpine may not be able to anticipate the level of dividends that companies will pay in any given timeframe.

The Funds’ monthly distributions may consist of net investment income, net realized capital gains and/or a return of capital. If a distribution includes anything other than net investment income, the Funds will provide a notice of the best estimate of its distribution sources when distributed, which will be posted on the Funds’ website; www.alpinefunds.com, or can be obtained by calling 1-800-617-7616. We estimate that the Alpine Equity Trust did not pay any distributions during the fiscal semi-annual period ended April 30, 2017 through a return of capital. A return of capital distribution does not necessarily reflect the Funds’ performance and should not be confused with “yield” or “income.” Final determination of the federal income tax characteristics of distributions paid during the calendar year will be provided on U.S. Form 1099-DIV, which will be mailed to shareholders. Please consult your tax advisor for further information.

Neither the Fund nor any of its representatives may give tax advice. Investors should consult their tax advisor for information concerning their particular situation.

All investments involve risk. Principal loss is possible. A small portion of the S&P 500 yield may include return of capital; the 10-year Treasury yield does not include return of capital; Corporate Bonds and High Yield Bonds generally do not have return of capital; a portion of the dividend paid by REITs and REIT preferred stock may be deemed a return of capital for tax purposes in the event the company pays a dividend greater than its taxable income. A stock may trade with more or less liquidity than a bond depending on the number of shares and bonds outstanding, the size of the company, and the demand for the securities. The REIT and REIT preferred stock market are smaller than the broader equity and bond markets and often trade with less liquidity than these markets depending upon the size of the individual issue and the demand of the securities. Treasury notes are

guaranteed by the U.S. government and thus they are considered to be safer than other asset classes. Tax features of a Treasury Note, Corporate Bond, Stock, High Yield Bond, REITs and REIT preferred stock may vary based on an individual’s circumstances. Consult a tax professional for additional information.

Earnings Growth & EPS Growth are not measures of the Funds’ future performance.

Must be preceded or accompanied by a prospectus.

Quasar Distributors, LLC, distributor.

Basis Point is a value equaling one one-hundredth of a percent (1/100 of 1%).

Capitalization rate (or “cap rate”) is the ratio between the net operating income produced by an asset and its capital cost (the original price paid to buy the asset) or alternatively its current market value.

Cash Flow measures the cash generating capability of a company by adding non-cash charges (e.g. depreciation) and interest expense to pretax income.

Consumer Price Index is an index of the variation in prices paid by typical consumers for retail goods and other items.

Diktat an order or decree imposed by someone in power without popular consent.

Dividend Payout Ratio is the fraction of net income a company pays to its stockholders in dividends.

Dividend Yield is the yield a company pays out to its shareholders in the form of dividends. It is calculated by taking the amount of dividends paid per share over a specific period of time and dividing by the stock’s price.

Free cash flow (FCF) is a measure of financial performance calculated as operating cash flow minus capital expenditures. FCF represents the cash that a company is able to generate after laying out the money required to maintain or expand its asset base. Free cash flow is important because it allows a company to pursue opportunities that enhance shareholder value.

FTSE EPRA/NAREIT Developed Europe Index is a subset of the FTSE EPRA/NAREIT® Developed Index and is an unmanaged index designed to track the performance of publicly traded real estate companies, defined as the ownership, trading and development of income-producing real estate, in developed markets worldwide.

FTSE EPRA/NAREIT Emerging Index is a total return index, designed to track the performance of listed real estate companies and REITS in emerging markets.

3

Disclosures and Definitions (Continued) |  |

FTSE EPRA/NAREIT Global Real Estate Index is a total return index that is designed to represent general trends in eligible real estate equities worldwide.

Source: FTSE the funds or securities referred to herein are not sponsored, endorsed, or promoted by the index providers, and the index providers bear no liability with respect to any such funds or securities or any index on which such funds or securities are based. The prospectus contains a more detailed description of the limited relationship the index providers have with the licensee and any related funds.

Ibovespa Index is a total return index weighted by traded volume and is comprised of the most liquid stocks traded on the Sao Paulo Stock Exchange.

Japan Manufacturing Purchasing Managers’ Index (PMI) is a measure of the activity level of purchasing managers in the manufacturing sector in Japan.

Lipper Real Estate Funds Average is an average of funds that invest at least 80% of their portfolio in equity securities of domestic and foreign companies engaged in the real estate industry.

Markit Eurozone Manufacturing PMI measures the performance of the manufacturing sector and is derived from a survey of 600 industrial companies.

MSCI Daily TR Net EAFE Index USD is a free float adjusted market cap weighted index designed to measure developed market equity performance, excluding the U.S. and Canada.

MSCI Emerging Markets Index is a total return, free-float adjusted market capitalization weighted index that is designed to measure the equity market performance in the global emerging markets.

MSCI Europe Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in Europe. The MSCI Europe Index consists of the following 15 developed market country indexes: Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the United Kingdom*.

MSCI REIT (RMS) Index is a total return index comprising the most actively traded equity REITs that are of reasonable size.

MSCI World Index is a free float-adjusted market cap weighted index that is designed to measure the equity market performance of developed markets.

Source: MSCI makes no express or implied warranties or representations and shall have no liability whatsoever

with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

Return on Equity (ROE) is the amount of net income returned as a percentage of shareholders equity. Return on equity measures a corporation’s profitability by revealing how much profit a company generates with the money shareholders have invested.

Russian MICEX Index is cap-weighted composite index calculated based on prices of the 50 most liquid Russian stocks of the largest and dynamically developing Russian issuers presented on the Moscow Exchange. MICEX Index was launched on September 22, 1997 at base value 100. The MICEX Index is calculated in real time and denominated by Moscow Exchange in Russian rubles.

S&P 500® Index is a total return, float-adjusted market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance. Total return indexes include reinvestments of all dividends.

S&P Developed Ex-US Property Index is a total return index that defines and measures the investable universe of publicly traded property companies domiciled in developed countries outside of the U.S. The companies included are engaged in real estate related activities, such as property ownership, management, development, rental and investment. Total return indexes include reinvestments of all dividends.

S&P 500® Financials Index comprises those companies included in the S&P 500 that are classified as members of the GICS® financials sector.

S&P Global Infrastructure Index is a total return index that is designed to track 75 companies from around the world chosen to represent the listed infrastructure industry while maintaining liquidity and tradability. To create diversified exposure, the index includes three distinct infrastructure clusters: energy, transportation, and utilities. Net Total Return (NTR) indexes include reinvestments of all dividends minus taxes.

S&P 500® Telecommunication Services Index comprises those companies included in the S&P 500® that are classified as members of the GICS telecommunications services sector.

4

Disclosures and Definitions (Continued) |  |

The S&P 500® Index, the S&P Developed ex. U.S. Property Index, and the S&P Global Infrastructure Index (the “Indices”) are products of S&P Dow Jones Indices LLC and have been licensed for use by Alpine Woods Capital Investors, LLC. Copyright © 2015 by S&P Dow Jones Indices LLC. All rights reserved. Redistribution or reproductions in whole or in part are prohibited without written the permission of S&P Dow Jones Indices LLC. S&P Dow Jones Indices LLC, its affiliates, and third party licensors make no representation or warranty, express or implied, with respect to the Index and none of such parties shall have any liability for any errors, omissions, or interruptions in the Index or the data included therein.

Shanghai Stock Exchange Composite Index is an index comprised of all stocks that are traded on the Shanghai Stock Exchange.

Tier 1 Cities – represent the most developed areas of China with the most affluent and sophisticated consumers. They are also considered to be the center of main economic activity.

Tier 2 Cities – represent less developed areas of China than Tier 1 cities.

Yield is the income return on an investment

Yield Curve is a line that plots the interest rates, at a set point in time, of bonds having equal credit quality but differing maturity dates.

5

Equity Manager Reports

| | Alpine International Real Estate Equity Fund |

| | |

| | Alpine Realty Income & Growth Fund |

| | |

| | Alpine Emerging Markets Real Estate Fund |

| | |

| | Alpine Global Infrastructure Fund |

| | |

| | Alpine Global Realty Growth & Income Fund |

6

| Alpine International Real Estate Equity Fund |  |

| Comparative Annualized Returns as of 4/30/17 (Unaudited) |

| | | 6 Months(1) | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Since Inception(2) |

| Alpine International Real Estate Equity Fund — Institutional Class | | | 9.31% | | | | 3.91% | | | | -0.98% | | | | 1.70% | | | | -4.99% | | | | 4.66% | |

| Alpine International Real Estate Equity Fund — Class A (Without Load) | | | 9.21% | | | | 3.68% | | | | -1.22% | | | | 1.44% | | | | N/A | | | | 4.49% | |

| Alpine International Real Estate Equity Fund — Class A (With Load) | | | 3.18% | | | | -2.00% | | | | -3.07% | | | | 0.29% | | | | N/A | | | | 3.40% | |

| FTSE EPRA/NAREIT Global Ex-U.S. Index(3) | | | 5.85% | | | | 3.69% | | | | 2.96% | | | | 6.12% | | | | N/A | | | | N/A | |

| MSCI EAFE Index | | | 11.47% | | | | 11.29% | | | | 0.86% | | | | 6.78% | | | | 0.87% | | | | 4.47% | |

| Lipper International Real Estate Funds Average(4) | | | 5.79% | | | | 2.74% | | | | 2.23% | | | | 5.86% | | | | -1.23% | | | | 4.66% | |

| Lipper International Real Estate Funds Ranking(4) | | | N/A(5) | | | | 11/52 | | | | 43/45 | | | | 39/42 | | | | 23/23 | | | | 1/1 | |

| Gross Expense Ratio (Institutional Class): 1.39%(6) | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Expense Ratio (Institutional Class): 1.39%(6) | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross Expense Ratio (Class A): 1.64%(6) | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Expense Ratio (Class A): 1.64%(6) | | | | | | | | | | | | | | | | | | | | | | | | |

| | (1) | Not annualized. |

| | (2) | Institutional Class shares commenced on February 1, 1989 and Class A shares commenced on December 30, 2011. Returns for indices are since February 1, 1989. |

| | (3) | Index commenced on October 31, 2008. |

| | (4) | The since inception data represents the period beginning February 2, 1989 (Institutional Class only). |

| | (5) | FINRA does not recognize rankings for less than one year. |

| | (6) | As disclosed in the prospectus dated February 28, 2017. |

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than the performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 60 days. If it did, total returns would be reduced. Returns for the Class A shares with sales charge reflect a maximum sales charge of 5.50%. Performance for the Class A shares without sales charges does not reflect this load.

FTSE EPRA/NAREIT Global ex-U.S. Index is a total return index that is designed to represent general trends in eligible real estate equities outside the United States. MSCI EAFE Index is a total return, free-float adjusted market capitalization weighted index that measures the performance of stocks from Europe, Asia, and the Far East. This is one of the most widely used measures of international stock performance. Source: MSCI. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder. Lipper Analytical Services, Inc. is an independent mutual fund research and rating service. The Lipper International Real Estate Funds Average is an average of funds that invest at least 80% of their portfolio in equity securities of domestic and foreign companies engaged in the real estate industry. The highest rank is 1 and the lowest is based on the total number of funds ranked in the category. Lipper rankings for the periods shown are based on fund total returns with dividends and distributions reinvested and do not reflect sales charges. The FTSE EPRA/NAREIT Global ex-U.S. Index, the MSCI EAFE Index and the Lipper International Real Estate Funds Average are unmanaged and do not reflect direct fees associated with a mutual fund, such as investment adviser fees; however, the Lipper International Real Estate Funds Average reflects fees charged by the underlying funds. The performance for the Alpine International Real Estate Equity Fund reflects the deduction of fees for these value added services. Investors cannot directly invest in an index.

Expense Ratios reflect the ratios reported in the Fund’s most recent prospectus. The Alpine International Real Estate Equity Fund has a contractual expense waiver that continues through February 28, 2018. Where a Fund’s gross and net expense ratios are the same for the period reported, the contractual expense reimbursement level was not reached as of the end of that period. To the extent the Fund’s expenses were reduced by waivers, the Fund’s total returns were increased. In these cases, in the absence of the expense waivers, the Fund’s total returns would have been lower.

To the extent that the Fund’s historical performance resulted from gains derived from participation in Initial Public Offerings (“IPOs”) and/or Secondary Offerings, there is no guarantee that these results can be replicated in future periods or that the Fund will be able to participate to the same degree in IPO/Secondary Offerings in the future.

7

Alpine International Real Estate Equity Fund (Continued) |  |

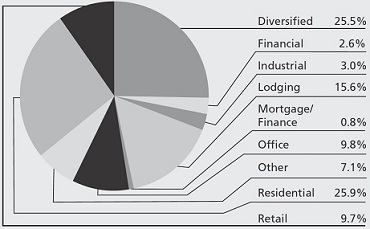

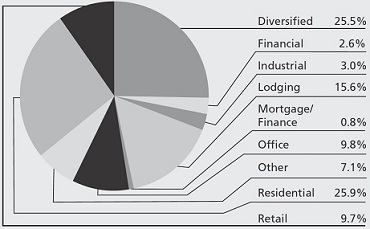

Portfolio Distributions* (Unaudited)

| Top 10 Holdings* (unaudited) |

| 1. | | IWG PLC | | | 4.71 | % |

| 2. | | Dalata Hotel Group PLC | | | 3.83 | % |

| 3. | | The Phoenix Mills, Ltd. | | | 3.08 | % |

| 4. | | South Asian Real Estate PLC | | | 2.98 | % |

| 5. | | Hulic Co., Ltd. | | | 2.78 | % |

| 6. | | Accor SA | | | 2.68 | % |

| 7. | | DLF, Ltd. | | | 2.57 | % |

| 8. | | TerraForm Power, Inc.-Class A | | | 2.53 | % |

| 9. | | Kenedix, Inc. | | | 2.38 | % |

| 10. | | Hispania Activos Inmobiliarios Socimi SA | | | 2.30 | % |

| * | Portfolio Distributions percentages are based on total investments. Top 10 Holdings do not include short-term investments and percentages are based on total net assets. Portfolio holdings and sector distributions are as of 04/30/17 and are subject to change. Portfolio holdings are not recommendations to buy or sell any securities. |

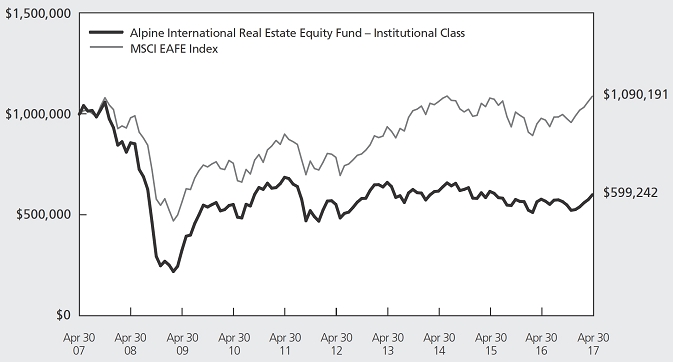

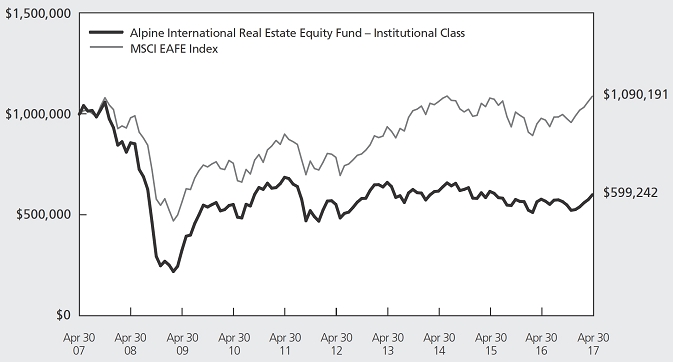

Value of a $1,000,000 Investment (Unaudited)

This chart represents a comparison of a hypothetical $1,000,000 investment in the Fund versus a similar investment in the Fund’s benchmark. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees, if applicable. Without the waiver and recovery of fees, the Fund’s total return would have differed.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that shares, when redeemed, may be worth more or less than their original cost.

8

Alpine International Real Estate Equity Fund (Continued) |  |

Commentary

Dear Shareholders:

We present the semi-annual results for the Alpine International Real Estate Equity Fund. For the six month period ended April 30, 2017, the closing NAV was $21.24 per share, representing a total return of 9.31%. The Fund’s benchmark index, the FTSE EPRA/NAREIT Global Ex-U.S. Index returned 5.85% over the same period. In the context of broader equity markets, the MSCI EAFE Index produced a total return of 11.47%. All references in this letter to the Fund’s performance relate to the performance of the Fund’s Institutional Class.

Performance Drivers

The Semi-Annual period kicked off a week before Trump’s unexpected election victory and ended as the clock was winding down on his first one hundred days in office. Over those six months, global real estate equity returns underperformed the broader market by a wide margin but exhibited a degree of resilience in the face of a series of geopolitical shocks, mounting macroeconomic uncertainties and the imminent threat of Federal Reserve (Fed) action. The Trump election immediately ignited expectations for an expansionary fiscal policy which set off a backing up of global yields as the reflationary impulse drove a reflexive sell off of bond proxies including real estate investment trusts (REITs). The dramatic sell off of the so-called interest rate sensitive sectors proved to be short lived and offered a good opportunity for active managers to accumulate oversold stocks. There were further headwinds on the horizon as the Fed hiked rates in December and March, but shares continued to grind out positive returns. Underpinning performance during the period was the reflation trade, particularly in emerging Asia, driven by resurging cyclical momentum in China. This was offset modestly toward the end of the period as increasing political noise and legislative defeats tempered market sentiment for a near-term payoff from the Trump trade.

In Japan, the developers and Japan REITs (JREITs) lagged the market as uncertainty over Bank of Japan (BoJ) policy, an appreciating yen and fading tailwinds on the reflation trade weighed on the shares. The FTSE EPRA/NAREIT Developed Europe Index saw strong absolute returns but underperformed on a relative basis primarily due to the strength of financials across many of the broader indices, the lack of visibility on Brexit negotiations and concerns over election outcomes, most importantly in France. Once again there was notable dispersion at the country level with Sweden and the U.K. outperforming versus relative weakness in France and Germany. In the U.K., the real estate securities posted an impressive rally toward the end of the period, easily eclipsing the more-than respectable performance of the broad index. Coming up on the one-year anniversary of the historic Brexit vote, there are still

few signs of stress in the London commercial market. In fact recent transactions such as the sale of Facebook’s headquarters (Rathbone Square) and the sale of the Cheesegrater (the Leadenhall building) have been supportive of valuations and have prompted a spate of special dividend payments from the proceeds. Yields appear to have stabilized and occupier demand has underpinned resilient top line rental values, however incentives are increasing while lease durations and break year options are coming in. Nonetheless Brexit risks remain front and center and share volatility could swing based on sentiment toward the negotiations and any news of financial sector tenants shifting personnel out of London. The Australian REIT (AREIT) market was resilient yet underperformed the broader market as it too was a casualty of the threat of the back up in interest rates. Finally, emerging market (EM) real estate saw strong overall results despite expectations for further rate hikes from the Fed, fears over protectionist trade policies from the Trump administration and geopolitical tensions ramping up in North Korea, Brazil, Turkey and the Middle East. At the country level, India and Brazil saw strong relative performance while Turkey and Indonesia were laggards.

Portfolio Overview

At six month period end on April 30, 2017, the top 10 positions accounted for 29.84% of the portfolio versus 31.59% six months ago as three companies fell out of the top 10: China Resources Land, Ichigo in Japan and JM in Sweden and were replaced by Accor the French hotel company, DLF in India and Hispania in Spain. Other notable adjustments to the portfolio included establishing positions in Patrizia in Germany and Purplebricks in the U.K. as well as Shinoken, Open House and Takara Leben in Japan. Other modest adjustments to the portfolio included increasing its position in the US, exiting its exposure to South African REITs, while reducing exposure to China. The Fund’s top three overweight positions remained in India, the U.S. and Ireland and it maintained its top underweight positions in China/Hong Kong, Australia and Canada.

The Fund’s country allocations adjusted during the period as our assessment of the macroeconomic conditions, stock valuations, investment opportunities and risks continued to evolve. During the period under review the Fund’s largest allocation was to Japan. While the economic data out of Japan has not met expectations, we continue to be encouraged by the recovery in real estate fundamentals, the potential tailwind from policy initiatives and continued strength in transactions in the physical property market. The portfolio remains overweight India and we are very constructive on the long term prospects for the overall economy as well as its real estate sector.

9

Alpine International Real Estate Equity Fund (Continued) |  |

Passage of a real estate reform bill in March of this year requiring developers to hold 70% of pre-sales cashflow in an escrow account until project completion should inject a higher degree of confidence into the overall market while creating substantial barriers to entry for undercapitalized developers. Although a weak British pound has prompted yet another wave of investor appetite for London assets, the positions in the U.K. were significantly reduced due to the late-cyclicality of the London office market as well as the negative implications of Brexit. The position in China/Hong Kong was decreased. Caution with respect to the credit markets, Moody’s recent downgrade of China’s credit rating and the sustainability of the strength in the physical property market as concerns over growing intervention, particularly in Tier I markets, by the government led us to be more defensive in our China allocation. The position in Brazil was modestly reduced based on valuation and increasing political risks. While we believe that the country remains attractive on a longer term view, the raised execution risk on reforms could ratchet up the risk premium on asset prices and weigh on the growth and inflation outlook. The Fund maintained significant underweights to the Australian, Canadian and South African markets due to the macroeconomic outlook, specifically commodity pricing, as well as instability in the currencies. Finally, the Fund hedged its currency exposure to the yen, euro and pound.

The top five contributors to the Fund’s performance over the period under discussion were IWG, Purplebricks, Global Logistic Properties (GLP), Dalata Hotel Group and JM.

| | • | IWG (formerly Regus) is one of the pioneers and global leaders in flexible workspace solutions. The shares are recovering after a challenging 2016 which saw a slower pace of network expansion and margin pressure on the mature portfolio. Early operating evidence suggests that these trends are reversing and the shares are beginning to reflect this recovery as well as the company’s attractive organic growth prospects. |

| | | |

| | • | Purplebricks is a U.K.-based online residential real estate broker offering a hybrid model in which vendors pay a small fixed fee rather than the percentage-based charges of traditional brokers. The shares outperformed based on the company exceeding market share expectations in the U.K. and Australia markets. The shares were furthered buoyed by the announcement of an expansion into the U.S. market. |

| | | |

| | • | GLP is a Singapore-based owner, developer and manager of logistics assets in China, Japan, Brazil and the U.S. The company is in the midst of evaluating at least three potential buyout bids from Blackstone, Warburg Pincus and a management-led consortium, which has narrowed the discount to NAV significantly. |

| | • | Dalata Hotel Group is a Irish hotel company with primary exposure to Ireland and the U.K. A recovery in RevPAR trends and good visibility on its development pipeline are expected to drive robust top line growth. |

| | | |

| | • | JM is a leading Swedish developer focusing on residential projects in Stockholm. The company has benefitted from the ongoing strength in the Stockholm market and a supportive macroeconomic backdrop have led to an acceleration of housing starts and expected margin expansion. Strong operating cash flow leaves its balance sheet in a net cash position and helped to support its share buyback and dividend program. |

The top five negative contributors to the Fund’s performance for the period ended April 30 were Ichigo, South Asian Real Estate, Invincible Investment, Dewan Housing and Fibra Uno.

| | • | Ichigo is an asset manager in Japan. Share performance was weak as management conservatively guided for its first profit decline in six years due to temporary delays in asset sales to its Japan REITs (JREITs) and infrastructure fund. Its underlying asset management business appears to be able to continue to grow and Ichigo potentially can support its shares through buybacks and cash dividends. |

| | | |

| | • | South Asian Real Estate (SARE)* is a residential developer in India. |

| | | |

| | • | Invincible Investment is a JREIT focused primarily in hotel and residential assets. The shares have underperformed due to weakening sentiment for hotel operating metrics and caution over the outlook for increased supply. The company issued equity in the period to acquire more residential assets. A high relative dividend yield and the potential for share buybacks could, in our view, help to narrow the NAV discount over the medium term. |

| | | |

| | • | Dewan Housing, a pan-Indian housing finance company, is one of the largest players in the lower-middle income affordable segments. The company is positioned to benefit from the Modi government’s focus on affordable housing but we sold off early on in the period due to the demonetization program in India which temporarily sapped liquidity away from lower income buyers. |

| | | |

| | • | Fibra Uno is the largest Mexican Fibra (REIT equivalent) holding a diversified portfolio of assets across Mexico. Management has put together a high quality portfolio with solid operating metrics and a robust acquisition/development pipeline which has the shares trading at a premium to its NAV. However, |

| * | The Fund purchased South Asian Real Estate PLC (“SARE”) through a private placement in 2007. There is no public market for the holding. As of April 30, 2017, the holding was valued based upon an equal weighting of an income approach and a market approach. |

10

Alpine International Real Estate Equity Fund (Continued) |  |

| | going forward, investors remain cautious as to management’s ability to source accretive deals and drive value creation on share-based acquisitions. Additionally the company’s distribution growth and funds from operation (FFO) yield have lagged peers recently. |

Outlook

As we look beyond the largely symbolic 100-day assessment period of the new Trump administration markets appear to be consolidating gains from the global reflation trade which began as rates bottomed in the summer of 2016 but caught a “massive and huge” tailwind from the Trump election and renewed cyclical momentum in China. Risk appetite appears to have crested for the moment in the face of mixed messages for growth prospects from the hard versus soft economic indicators, and perhaps most significantly an ongoing reevaluation of the ability of the U.S. to enact fiscal stimulus, tax reform, infrastructure and deregulation in a timely manner. So which economies could be best positioned to drive the next leg of the global reflation trade? Where does the Fed’s dot plot go from here? What risk could higher bond yields pose to the global economy? These are just a few of the questions that remain top of mind for all investors as we continue to climb a wall of worry comprised of political and policy uncertainties, the constantly evolving trends for growth and inflation, as well as a diverse array of potential geopolitical threats.

Broadly speaking, we see cause for guarded optimism as the global growth environment appears more balanced than it has in recent memory. A pro-growth agenda, reflationary policies and a measured tightening of interest rates have generally been supportive for real estate returns on an historical basis, however, political uncertainties and a maturing cycle amplify downside risks. In the U.S. REIT market, we expect a widening differentiation of operating data but an overall healthy (but peaking) same-store rental outlook supporting net operating income (NOI) growth in 2017. There are developing signs of cyclical momentum in European markets and the risk premia associated with political outcomes appear to be narrowing. Japan has clearly underperformed but we believe that it’s only a matter of time before equities returns reflect strong underlying fundamentals and robust transaction levels in the physical market. To this point, first quarter 2017 transaction volumes in Japan rose by 51% year over year (YoY) with acquisitions by overseas investors rising 3.7 times from first quarter 2016 levels according to CBRE. Emerging markets lagged the reflation trade in Q4 2016 but have since recovered from low valuations and have been supported by an improving earnings profile. A growing U.S. economy has historically been a positive for developing markets absent trade protectionism and a sharp overshoot in rates and/or currencies.

While we believe global monetary policy will remain extremely accommodative there seems to be greater scope for divergence among central banks since quantitative easing (QE) regimes were initiated in response to the financial crisis. The Fed increased rates at both its December and March meetings and markets are currently pricing in one to two increases for the remainder of 2017. However, until there is greater visibility on the new administration’s fiscal agenda it is difficult to say with any conviction where U.S. rates might settle. Adding further uncertainty into the equation are Fed Chair Yellen’s comments regarding shrinking the central bank’s $4.5 trillion balance sheet. The challenge is not exclusively a question of magnitude and pace of the drawdown, but how the Treasury aims to cope with a funding gap as the Fed unwinds $2.5 trillion in government securities. If not handled well, the read through to bond yields and mortgage rates could heighten volatility. The BoJ is expected to stay the course in its battle against deflation and to augment its current approach with further fiscal initiatives. While its commitment to the official Japanese Government Bond (JGB) buying target of JPY80 trillion (approximately $72 billion USD) per annum could be weakening we still believe Kuroda, the Governor of the Bank of Japan, when he says that only an extended overshoot of his 2% consumer price index (CPI) target would trigger policy tightening. We are nowhere near that level. So this leaves all eyes on the tone and tenor of the European Central Bank (ECB) as Mario Draghi, President of the European Central Bank, finds himself occupying the middle ground between the Fed’s tightening impulse and the BoJ’s policy stance. Current market talk is rife with uneasiness regarding the ECB reducing its monthly asset purchases into 2018 and what this policy shift could ultimately mean for bond yields, especially in Spain and Italy.

In China, the government’s intervention revitalized cyclical momentum in its economy, providing much of the heavy lifting for the global reflation trade. Indeed, nominal gross domestic product (GDP) growth in China accelerated from 9.6% YoY in fourth quarter 2016 to 11.8% YoY in first quarter 2017. While uncertainties remain regarding the sustainability of the recovery absent unprecedented liquidity from the People’s Bank of China (PBOC) we remain firmly of the view that slowdowns in China are based on policy shifts not sharp decelerations in demand. The U.S. government stepped back its threat of labeling China a currency manipulator and with tensions rising in North Korea it’s imperative that relations between the U.S. and China are guided by political pragmatism. Periodic volatility in the growth outlook for China could reverberate through global markets and remains one of the dominant drivers of macro instability, particularly with respect to EMs. In the run up to the critical National Congress in fourth quarter 2017 (held every five years) the current Chinese government will want to do everything in its power to

11

Alpine International Real Estate Equity Fund (Continued) |  |

ensure political and economic status quo which should help it to consolidate its power and provide leverage to shape the Politburo Standing Committee. As such, we remain cautiously optimistic that China can avoid any so-called “hard landing” in its economy through a mix of political reforms as well as monetary and fiscal measures.

It remains our expectation that there will likely be wide dispersion and volatility of returns by sector and geography, making this an attractive environment for active management. We have outlined frequently in our discussions with shareholders that at this point in the cycle the drivers for real estate have clearly shifted away from cap rate compression toward growth prospects. A strong fiscal impulse and reflationary backdrop could provide a tailwind for this view and reinforce our long-held preference for companies with attractive valuations, good visibility of cash flow and a history of growing dividends. As such we maintain our bias for markets and asset types with favorable supply/demand dynamics supporting rising net absorption trends as well as heightened rental tension. Another noteworthy investment theme for global real estate could likely come from mergers & acquisitions (M&A) – as divergent valuations, cheap financing and the market’s emphasis on growth could drive consolidation.

In our view, the geopolitical landscape collectively represents one of the most significant pressures to our outlook as equity markets have become increasingly more phlegmatic about political risks over time. The nuclear aspirations of North Korea and the war in Syria could pose existential threats to nearby regions. The Temer government coalition in Brazil is hanging by a thread after the most recent scandal placing the reform agenda and the viability of Temer’s administration very much in question. The constitutional referendum in Turkey and the purge of cabinet members in South Africa

reinforce autocratic ideals inconsistent with shareholder risk tolerance. In the U.K. and Europe uncertainty over the direction of Brexit could add to volatility in asset markets. Although the Netherlands and France have avoided electoral pitfalls, Germany and Italy might still present further challenges for the Eurozone outlook. The list is big and continues growing.

And finally perhaps the biggest wild card in the outlook is that after 100 days of the new administration there are more questions than answers surrounding the potential for a sea change in the US. Foremost among them being to what extent does the current administration’s inability to drive legislation undermine its domestic agenda? Where could investors ultimately calibrate their expectations for the President’s ability to overcome the ideological divisions within his own administration, then cobble together consensus in the Republican Party and finally reach out to enough Democrats to enact meaningful legislation? For the time being the economic agenda appears to be languishing and there seems to be a narrowing path for the new administration to enact any meaningful legislation in advance of the August recess.

Differentiation – whether in markets, asset types or growth models – should remain a dominant theme in portfolio construction. Alpine’s Real Estate team carefully evaluates the risk/reward proposition of each position in the portfolio and monitors volatility carefully. The managers remain extremely selective in our approach to the markets and deploying capital.

We thank our shareholders for their continued support.

Sincerely,

Samuel A. Lieber

Portfolio Manager

This letter represents the opinions of the Fund’s management and is subject to change, is not guaranteed and should not be considered a recommendation to buy or sell any security. The information provided is not intended to be, and is not, a forecast of future events, a guarantee of future results, or investment advice. Views expressed may vary from those of the firm as a whole.

Earnings growth is not representative of the fund’s future performance.

Past performance is no guarantee of future results.

Diversification does not assure a profit nor protect against loss in a declining market.

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to risks, including the following in alphabetical order:

Concentration Risk – The Fund’s strategy of concentrating in companies in a specific industry means that its performance will be closely tied to the performance of a particular market segment. The Fund’s concentration in these companies may present more risks than if it were broadly diversified over numerous industries and sectors of the economy. A downturn in these companies would have a larger impact on the Fund than on a mutual fund that does not concentrate in such companies. At times, the performance of these companies will lag the performance of other industries or the broader market as a whole.

12

Alpine International Real Estate Equity Fund (Continued) |  |

Currency Risk – The value of investments in securities denominated in foreign currencies increases or decreases as the rates of exchange between those currencies and the U.S. dollar change. Currency conversion costs and currency fluctuations could erase investment gains or add to investment losses. Currency exchange rates can be volatile, and are affected by factors such as general economic conditions, the actions of the U.S. and foreign governments or central banks, the imposition of currency controls and speculation.

Cybersecurity Risk – Cybersecurity incidents may allow an unauthorized party to gain access to Fund assets, customer data (including private shareholder information), or proprietary information, or cause the Fund, the Adviser and/or its service providers (including, but not limited to, Fund accountants, custodians, sub-custodians, transfer agents and financial intermediaries) to suffer data breaches, data corruption or lose operational functionality.

Equity Securities Risk – The stock or other security of a company may not perform as well as expected, and may decrease in value, because of factors related to the company (such as poorer than expected earnings or certain management decisions) or to the industry in which the company is engaged (such as a reduction in the demand for products or services in a particular industry). Holders of common stock generally are subject to more risks than holders of preferred stock or debt securities because the right to repayment of common stockholders’ claims is subordinated to that of preferred stock and debt securities upon the bankruptcy of the issuer.

Foreign and Emerging Market Securities Risk – The Fund’s investments in securities of foreign issuers or issuers with significant exposure to foreign markets involve additional risk. Foreign countries in which the Fund may invest may have markets that are less liquid, less regulated and more volatile than U.S. markets. The value of the Fund’s investments may decline because of factors affecting the particular issuer as well as foreign markets and issuers generally, such as unfavorable or unsuccessful government actions, reduction of government or central bank support and political or financial instability. Lack of information may also affect the value of these securities. To the extent the Fund focuses its investments in a single country or only a few countries in a particular geographic region, economic, political, regulatory or other conditions affecting such country or region may have a greater impact on Fund performance relative to a more geographically diversified fund. The risks of foreign investments are heightened when investing in issuers in emerging market countries. Emerging market countries tend to have economic, political and legal systems that are less fully developed and are less stable than those of more developed countries. Less developed markets are more likely to experience problems with the clearing and settling of trades and the holding of securities by banks, agents and depositories are less developed than those in the United States. They are often particularly sensitive to market movements because their market prices tend to reflect speculative expectations. Low trading volumes may result in a lack of liquidity and in extreme price volatility.

Foreign Currency Transactions Risk – Foreign securities are often denominated in foreign currencies. As a result, the value of the Fund’s shares is affected by changes in exchange rates. The Fund may enter into foreign currency transactions to try to manage this risk. The Fund’s ability to use foreign currency transactions successfully depends on a number of factors, including the foreign currency transactions being available at prices that are not too costly, the availability of liquid markets and the ability of the Adviser to accurately predict the direction of changes in currency exchange rates.

Growth Stock Risk – Growth stocks typically are very sensitive to market movements because their market prices tend to reflect future expectations. When it appears those expectations will not be met, the prices of growth stocks typically fall. Growth stocks as a group may be out of favor and underperform the overall equity market while the market concentrates on undervalued stocks.

Initial Public Offerings and Secondary Offerings Risk – The Fund may invest a portion of its assets in shares of IPOs or secondary offerings of an issuer. IPOs and secondary offerings may have a magnified impact on the performance of a fund with a small asset base. The impact of IPOs and secondary offerings on the Fund’s performance likely will decrease as the Fund’s asset size increases, which could reduce the Fund’s returns. IPOs and secondary offerings may not be consistently available to the Fund for investing. IPO and secondary offering shares frequently are volatile in price due to the absence of a prior public market, the small number of shares available for trading and limited information about the issuer. Therefore, the Fund may hold IPO and secondary offering shares for a very short period of time. This may increase the turnover of the Fund and may lead to increased expenses for the Fund, such as commissions and transaction costs. In addition, IPO and secondary offering shares can experience an immediate drop in value if the demand for the securities does not continue to support the offering price.

13

Alpine International Real Estate Equity Fund (Continued) |  |

Interest Rate Risk – Interest rates may rise resulting in a decrease in the value of securities held by the Fund, or may fall resulting in an increase in the value of such securities. Securities having longer maturities generally involve a greater risk of fluctuations in the value resulting from changes in interest rates.

Leverage Risk – The Fund may use leverage to purchase securities. Increases and decreases in the value of the Fund’s portfolio will be magnified when the Fund uses leverage. The Fund may also have to sell assets at inopportune times to satisfy its obligations. The use of leverage is considered to be a speculative investment practice and may result in the loss of a substantial amount, and possibly all, of the Fund’s assets.

Liquidity Risk – Some assets held by the Fund may be impossible or difficult to sell, particularly during times of market turmoil. These illiquid assets may also be difficult to value. If the Fund is forced to sell an illiquid asset to meet redemption requests or other cash needs, the Fund may be forced to sell at a loss.

Management Risk – The Adviser’s judgment about the quality, relative yield or value of, or market trends affecting, a particular security or sector, or about interest rates generally, may be incorrect. The Adviser’s security selections and other investment decisions might produce losses or cause the Fund to underperform when compared to other funds with similar investment objectives and strategies.

Market Risk – The price of a security held by the Fund may fall due to changing market, economic or political conditions.

Micro Capitalization Company Risk – Stock prices of micro capitalization companies are significantly more volatile, and more vulnerable to adverse business and economic developments than those of larger companies. Micro capitalization companies often have narrower markets for their goods and/or services and more limited managerial and financial resources than larger, more established companies, including small or medium capitalization companies.

Operational Risk – Your ability to transact with the Fund or the valuation of your investment may be negatively impacted because of the operational risks arising from factors such as processing errors and human errors, inadequate or failed internal or external processes, failures in systems and technology, changes in personnel, and errors caused by third party service providers or trading counterparties. It is not possible to identify all of the operational risks that may affect the Fund or to develop processes and controls that completely eliminate or mitigate the occurrence of such failures. The Fund and its shareholders could be negatively impacted as a result.

Real Estate Investment Trusts (“REITs”) Risk – REITs’ share prices may decline because of adverse developments affecting the real estate industry including changes in interest rates. The returns from REITs may trail returns from the overall market. Additionally, there is always a risk that a given REIT will fail to qualify for favorable tax treatment. REITs may be leveraged, which increases risk. Certain REITs charge management fees, which may result in layering the management fee paid by the fund.

Real Estate Securities Risk – Risks associated with investment in securities of companies in the real estate industry include: declines in the value of real estate; risks related to local economic conditions, overbuilding and increased competition; increases in property taxes and operating expenses; changes in zoning laws; casualty or condemnation losses; variations in rental income, neighborhood values or the appeal of properties to tenants; changes in interest rates and changes in general economic and market conditions.

Small and Medium Capitalization Company Risk – Securities of small or medium capitalization companies are more likely to experience sharper swings in market values, less liquid markets, in which it may be more difficult for the Adviser to sell at times and at prices that the Adviser believes appropriate and generally are more volatile than those of larger companies.

Undervalued Stock Risk – The Fund may pursue strategies that may include investing in securities, which, in the opinion of the Adviser, are undervalued. The identification of investment opportunities in undervalued securities is a difficult task and there is no assurance that such opportunities will be successfully recognized or acquired. While investments in undervalued securities offer opportunities for above-average capital appreciation, these investments involve a high degree of financial risk and can result in substantial losses.

Please refer to pages 3-5 for other important disclosures and definitions.

14

| Alpine Realty Income & Growth Fund |  |

| Comparative Annualized Returns as of 4/30/17 (Unaudited) | | | | |

| | | 6 Months(1) | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Since Inception(2) |

| Alpine Realty Income & Growth Fund — Institutional Class | | 5.96% | | 7.56% | | 9.74% | | 9.67% | | 3.77% | | 11.07% | |

| Alpine Realty Income & Growth Fund — Class A (Without Load) | | 5.82% | | 7.28% | | 9.45% | | 9.39% | | N/A | | 11.58% | |

| Alpine Realty Income & Growth Fund — Class A (With Load) | | -0.02% | | 1.37% | | 7.41% | | 8.16% | | N/A | | 10.40% | |

| MSCI US REIT Index | | 4.09% | | 5.88% | | 8.92% | | 9.23% | | 4.73% | | 10.75% | |

| S&P 500® Index | | 13.32% | | 17.92% | | 10.47% | | 13.68% | | 7.15% | | 5.68% | |

| Lipper Real Estate Funds Average(3) | | 3.73% | | 5.66% | | 7.99% | | 8.32% | | 4.08% | | 10.11% | |

| Lipper Real Estate Funds Ranking(3) | | N/A(4) | | 41/265 | | 16/232 | | 15/203 | | 83/134 | | 7/46 | |

| Gross Expense Ratio (Institutional Class): 1.36%(5) | | | | | | | | | | | | |

| Net Expense Ratio (Institutional Class): 1.06%(5) | | | | | | | | | | | | |

| Gross Expense Ratio (Class A): 1.61%(5) | | | | | | | | | | | | |

| Net Expense Ratio (Class A): 1.31%(5) | | | | | | | | | | | | |

| | (1) | Not annualized. |

| | (2) | Institutional Class shares commenced on December 29, 1998 and Class A shares commenced on December 30, 2011. Returns for indices are since December 29, 1998. |

| | (3) | The since inception data represents the period beginning December 31, 1998 (Institutional Class only). |

| | (4) | FINRA does not recognize rankings for less than one year. |

| | (5) | As disclosed in the prospectus supplement dated April 10, 2017 to the propectus dated February 28, 2017. |

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than the performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 60 days. If it did, total returns would be reduced. Returns for the Class A shares with sales charge reflect a maximum sales charge of 5.50%. Performance for the Class A shares without sales charges does not reflect this load.

MSCI US REIT Index is a gross, total return, free float-adjusted market capitalization index that is comprised of equity REITs. The index is based on MSCI USA Investable Market Index (IMI) its parent index which captures large, mid and small caps securities. With 144 constituents, it represents about 99% of the US REIT universe and securities are classified in the REIT sector according to the Global Industry Classification Standard (GICS®). It however excludes Mortgage REIT and selected Specialized REITs. This index reinvests as much as possible of a company’s dividend distributions. The reinvested amount is equal to the total dividend amount distributed to persons residing in the country of the dividend-paying company. Gross total return indexes do not, however, include any tax credits. Source: MSCI. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder. S&P 500® Index is a total return, float-adjusted market capitalization weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance. Total return indexes include reinvestments of all dividends. Lipper Analytical Services, Inc. is an independent mutual fund research and rating service. The Lipper Real Estate Funds Average is an average of funds that invest at least 80% of their portfolio in equity securities of domestic and foreign companies engaged in the real estate industry. The highest rank is 1 and the lowest is based on the total number of funds ranked in the category. Lipper rankings for the periods shown are based on fund total returns with dividends and distributions reinvested and do not reflect sales charges. The MSCI US REIT Index, the S&P 500® Index and the Lipper Real Estate Funds Average are unmanaged and do not reflect direct fees associated with a mutual fund, such as investment adviser fees; however, the Lipper Real Estate Funds Average reflects fees charged by the underlying funds. The performance for the Alpine Realty Income & Growth Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

Expense Ratios reflect the ratios reported in the Fund’s most recent prospectus. The Alpine Realty Income & Growth Fund has a contractual expense waiver that continues through February 28, 2019. Where a Fund’s gross and net expense ratios are the same for the period reported, the contractual expense reimbursement level was not reached as of the end of that period. To the extent the Fund’s expenses were reduced by waivers, the Fund’s total returns were increased. In these cases, in the absence of the expense waivers, the Fund’s total returns would have been lower.

To the extent that the Fund’s historical performance resulted from gains derived from participation in Initial Public Offerings (“IPOs”) and/or Secondary Offerings, there is no guarantee that these results can be replicated in future periods or that the Fund will be able to participate to the same degree in IPO/Secondary Offerings in the future.

15

Alpine Realty Income & Growth Fund (Continued) |  |

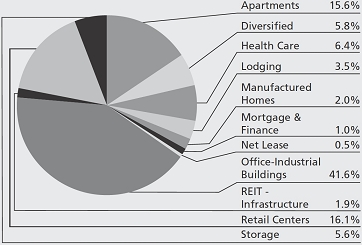

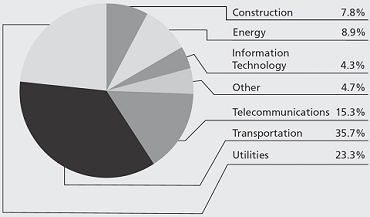

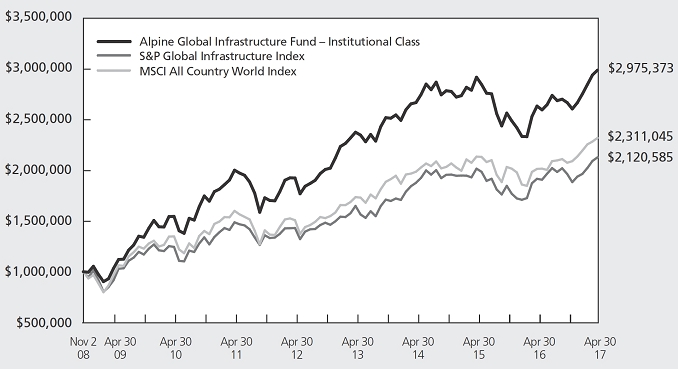

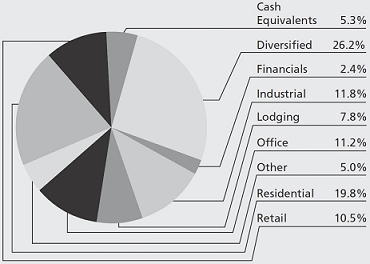

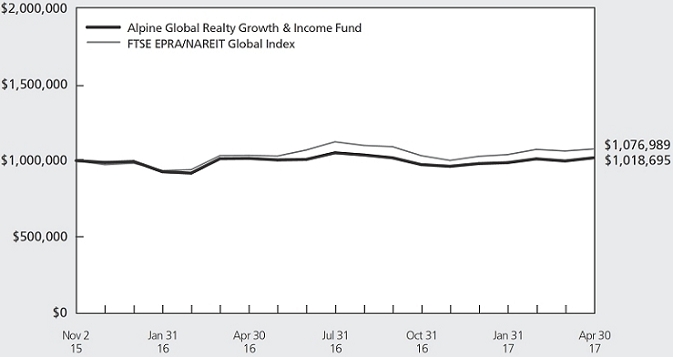

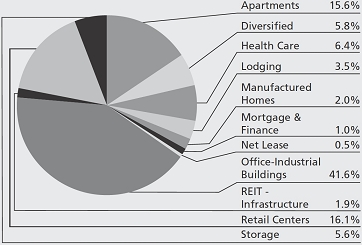

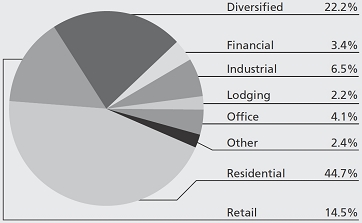

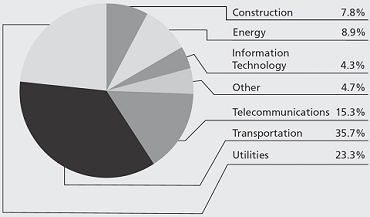

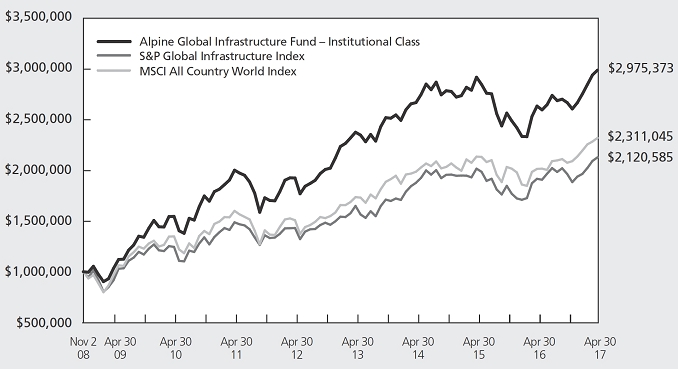

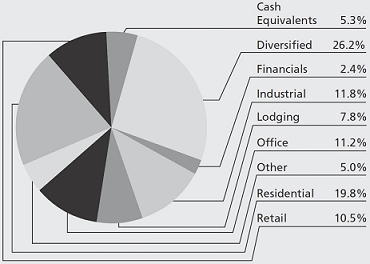

Portfolio Distributions* (Unaudited)

| Top 10 Holdings* (unaudited) | |

| 1. | | Simon Property Group, Inc. | 7.35 | % |

| 2. | | Boston Properties, Inc. | 5.66 | % |

| 3. | | Digital Realty Trust, Inc. | 5.18 | % |

| 4. | | Essex Property Trust, Inc. | 5.11 | % |

| 5. | | Alexandria Real Estate Equities, Inc. | 4.77 | % |

| 6. | | Public Storage | 4.51 | % |

| 7. | | AvalonBay Communities, Inc. | 4.39 | % |

| 8. | | Prologis, Inc. | 4.39 | % |

| 9. | | Vornado Realty Trust | 4.00 | % |

| 10. | | Equity Residential | 3.98 | % |

| * | Portfolio Distributions percentages are based on total investments. Top 10 Holdings do not include short-term investments and percentages are based on total net assets. Portfolio holdings and sector distributions are as of 04/30/17 and are subject to change. Portfolio holdings are not recommendations to buy or sell any securities. |

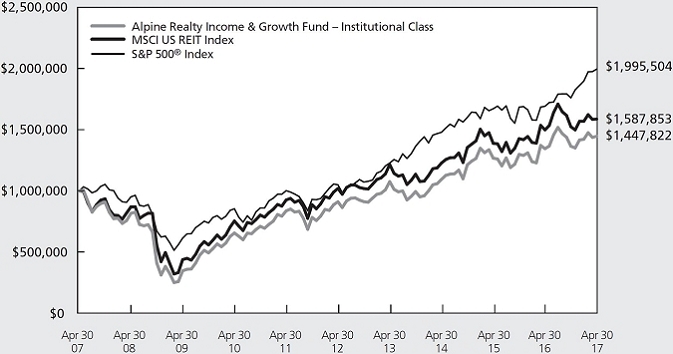

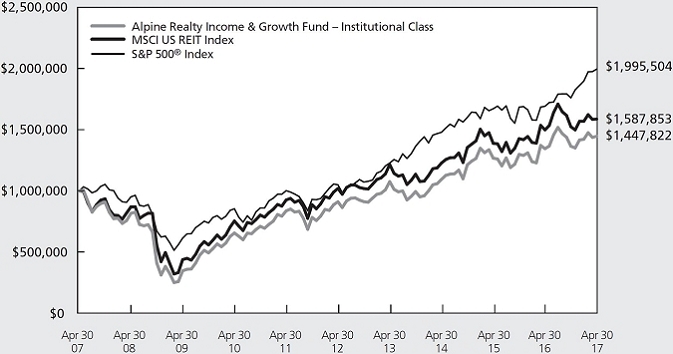

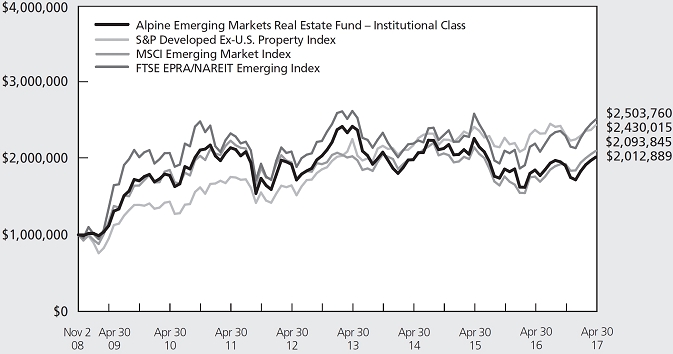

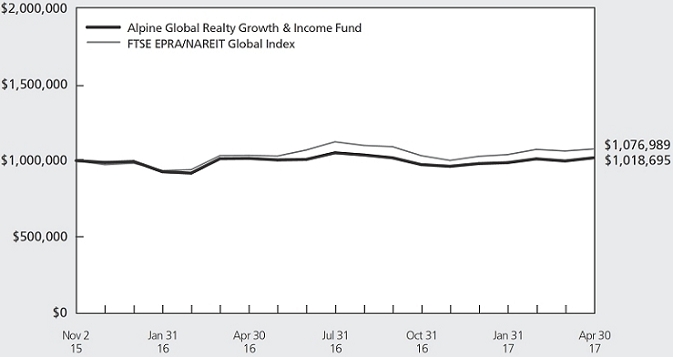

Value of a $1,000,000 Investment (Unaudited)

This chart represents a comparison of a hypothetical $1,000,000 investment in the Fund versus a similar investment in the Fund’s benchmarks. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees, if applicable. Without the waiver and recovery of fees, the Fund’s total return would have differed.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that shares, when redeemed, may be worth more or less than their original cost.

16

Alpine Realty Income & Growth Fund (Continued) |  |

Commentary

Dear Shareholders:

We welcome the opportunity to report the results of the Alpine Realty Income & Growth Fund for the fiscal semi-annual period ended April 30, 2017. During this period, the Fund produced a total return of 5.96% which compares to the 3.73% return of the Lipper Real Estate Funds average, 4.09% return of the MSCI US REIT Index (the RMS Index) and the 13.32% return of the S&P 500® Index 500 Index (the S&P). All references in this letter to the Fund’s performance relate to the performance of the Fund’s Institutional Class.

At April 30, 2017, the Fund’s net asset value per share had increased to $22.56 from $22.11 six months prior. During this timeframe, the Fund paid two quarterly distributions of $0.1875 per share totaling $0.375 per share for the fiscal period and one long term capital gain distribution of $0.47. Since its inception at $10.00 per share on December 29, 1998 through April 30, 2017, the Fund has delivered an annualized total return to shareholders of 11.07% including cumulative distributions of $18.85. The performance chart on page 15 presents the Fund’s returns for the current period, one-year, three-year, five-year, ten-year, and since inception periods.

Following the November 2016 U.S. presidential election, investor optimism regarding the potential for favorable business conditions and reduced taxes from the new Trump administration’s policy objectives led to increased confidence in corporate earnings and to some degree less interest in the dividend paying equities of real estate investment trusts (REITs). This confidence manifested itself in a new all-time high for the S&P on March 1, 2017 including heightened expectations for inflationary growth that resulted in the yield on the Ten Year US Treasury obligation rising to 2.63% on March 13, its highest level since July 2014. In this context, the average returns of REIT equities as represented by the RMS Index lagged the overall performance of broader indices. Despite the positive 4.09% return in the period, the RMS Index closed the latest fiscal semi-annual period nearly 7.5% below its all-time high achieved on August 1, 2016 while broader indices reached new highs.

Within the real estate category, the best performing sectors over the six months included the data center and lodging REITs, perceived to have the highest earnings growth and return potential in the near term from strong secular trends and renewed economic optimism, respectively, and the two private prison REITs. The prison REITs’ stock prices more than doubled after the election

in large part due to renewed confidence that these prison operators would continue to be used by government agencies, an outcome that had been somewhat in doubt under a prospective Clinton administration. The subsectors lagging overall REIT averages included the net lease and the retail shopping center and regional mall landlords. While valuations in the net lease group were pressured by rising interest rates, the stocks of retail landlords suffered most particularly from fear that brick-and-mortar retailing may be in a permanent secular decline.

For the Fund, the top contributors to its performance during the latest six month period ended April 30, 2017 included three companies within the data center subsector and two apartment REITs. Data center REITs, including three of the Fund’s holdings – Digital Realty Trust, Coresite Realty Corporation, and Equinix – continued to benefit from strong demand from network service, cloud, and information technology providers, demonstrated by very healthy leasing trends and by the returns on invested capital these entities achieved in their new facilities developments and expansion efforts. As a group, the returns of all of the data center REITs in the RMS Index exceeded 20% in the latest six month period. Also producing above average returns were the apartment REITs whose performances previously during calendar year 2016 lagged overall REIT averages primarily on concerns of decelerating fundamentals that were resulting from a wave of new supply additions impacting landlord pricing power in many markets. Two of the Fund’s largest overweight positions in this subsector, Essex Property Trust and AvalonBay Communities, however, reported better than anticipated results in their west coast markets where the impacts of new supply had been most feared and had their stock valuations rewarded by investors. Relative to the overall return of the RMS Index, some of the greatest positive attribution was produced by our overweight positions in the aforementioned data center REITs, Digital Realty and Coresite Realty, as well as another data center holding, DuPont Fabros Technology; the above described investment in Essex Property Trust; and the Fund’s non-ownership of Brixmor Property Group, a shopping center owner whose stock declined significantly during the period on concerns of slowing retail sales and store bankruptcies.

Holdings that underperformed REIT average returns and detracted the most from Fund performance were retail shopping center and regional mall landlords. As noted above, these two subsectors were among the weakest

17

Alpine Realty Income & Growth Fund (Continued) |  |

performing property groups during the period. Announcements of proposed store closures by major department stores such as Macy’s and Sears, bankruptcy declarations by many retailers particularly in the apparel category, signs of flat to weakening retail store sales trends, and the continued success of internet-based shopping, the most noteworthy example being Amazon, all reinforced investor fears about the viability of brick-and-mortar retailing. The facts are fairly clear. The U.S. is hugely over-retailed in terms of shopping space per capita and needs both a significant reduction of the weakest retailer venues and smarter strategies by the retailers themselves. For the Fund, the most negative contributions to overall results were delivered by Simon Property Group, Macerich Company, GGP, Inc., and Taubman Centers, all regional mall entities, and Kimco Realty, one of the sector’s largest shopping center landlords. Relative to the overall returns of the RMS Index, the securities that created the most impactful negative attribution to performance included the aforementioned regional mall REITs, Simon, Macerich, and Taubman, as well as the Fund’s non-ownership of the two private prison owners, CoreCivic and The Geo Group, which significantly outperformed overall REIT averages.

Both the overall equities market and the real estate sector are now over eight years into a recovery that began in March of 2009. Valuations are near all-time highs in broad indices such as the S&P while real estate operating fundamentals, in terms of occupancies, rental rates, and valuations, have in many sectors reached or exceeded pre-financial crisis levels. As a result, within numerous geographic markets and property types, including apartments, hotels, senior living, and self-storage, new supply additions have increased to take advantage of the positive fundamentals and,

consequently, have put temporary pressure on landlord pricing power. Though such new development remains below historic levels generally, we nevertheless believe that for the health of real estate property markets and for valuations and prices of equities in both the REIT indices and the overall stock market, the domestic economy needs to reaccelerate in terms of job creation, business confidence, and capital spending. The early investor confidence in future earnings growth from improved business conditions and reduced taxes under the new Trump administration has seemingly stalled somewhat and, in our opinion, will likely not reignite until some of the proposed policy objectives are enacted and demonstrated in reaccelerating economic growth.

The Fund’s portfolio remains structured to capture the pockets of stronger near term economic potential through overweight investments in those areas that can benefit from above average employment, demographic shifts, and innovation. While we still find the technology driven economies of the west coast and the Boston/Cambridge metropolitan area on the east coast as most attractive, some of the Fund’s largest overweight positions also continue to be in the data center, life science, and cell tower areas where demand drivers stay steady despite vacillations in overall Gross Domestic Product growth. Additionally, we anticipate that we will continue to employ low levels of leverage both in the execution of the Fund’s strategy and to manage unexpected Fund flows. We look forward to providing an update on real estate trends and Fund performance at the end of the fiscal year in October 2017.

Sincerely,

Robert W. Gadsden

Portfolio Manager

This letter represents the opinions of the Fund’s management and is subject to change, is not guaranteed and should not be considered a recommendation to buy or sell any security. The information provided is not intended to be, and is not, a forecast of future events, a guarantee of future results, or investment advice. Views expressed may vary from those of the firm as a whole.

Earnings growth is not representative of the fund’s future performance.