UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-05685 | |

| Williamsburg Investment Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

John Chilton, Esq.

| Sullivan & Worcester LLP 1666 K Street, NW Washington, D.C. 20006 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (513) 587-3400 | |

| Date of fiscal year end: | March 31 | |

| | | |

| Date of reporting period: | September 30, 2023 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

(a)

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Davenport Core Leaders Fund (DAVPX) |

| | |

| | Davenport Value & Income Fund (DVIPX) |

| | |

| | Davenport Equity Opportunities Fund (DEOPX) |

| | |

| | Davenport Small Cap Focus Fund (DSCPX) |

| | |

| | Davenport Balanced Income Fund (DBALX) |

| | |

| | |

| | |

| | |

| SEMI-ANNUAL REPORT |

| | |

| | |

September 30, 2023

(Unaudited) |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| THE DAVENPORT FUNDS |

| LETTER TO SHAREHOLDERS (Unaudited) | September 30, 2023 |

Dear Shareholders,

Stocks seemed to run out of gas in the third quarter. The S&P 500® Index and Russell 2000® Index lost 3.27% and 5.13%, respectively. Most of the losses were concentrated in September, which historically is the worst month of the year for stocks. It wasn’t surprising to see equity markets stall a bit, especially after a surprising first half rally. Even large cap technology stalwarts cooled off as the artificial intelligence (AI) craze seemed to fade. Year-to-date, the S&P 500® Index and Russell 2000® Index finished the period up 13.07% and 2.54%, respectively.

We think there are a few reasons most stocks have recently lost ground. For starters, we’ve begun to see some signs of consumer stress. Consumers comprise about two-thirds of all economic activity. Recent commentary from numerous retailers suggests consumer spending is a little softer. Goldman Sachs recently noted that credit card losses are rising at their fastest pace since the 2008 financial crisis. This clearly indicates the average consumer’s ability to spend and take on extra debt may be more restrained. The pandemic bounce back appears to have run its course, the government moratorium on student loan payments has ended, and inflation still lurks with the cost of everything from olive oil to car insurance moving higher. Of note, CNBC recently highlighted a recent Fed study showing that 80% of Americans have less cash on hand than they did at the start of the pandemic. The positive offset is that unemployment remains very low and the consumer still appears quite healthy in absolute terms.

The next issue is the Federal Reserve (the “Fed”). Inflation has receded from the extremes of last year, but remains stubbornly high. Major inputs such as oil prices and wages are pushing higher. With inflation still high and economic growth still decent, the Fed sees no need to back away from tighter monetary policy and has embraced a “higher for longer” approach to interest rates. At its September meeting, the Fed held its benchmark interest rate at 5.25%-5.5%, which is the highest level in 22 years. Policymakers also indicated one more rate hike would be coming before year-end and talked down the likelihood of rate cuts next year. Another increase would make a total of 12 rate hikes since policy tightening began in early 2022 and would be the fastest pace of tightening on record. Higher rates can have a dampening effect on borrowing, economic activity and asset values. They also increase the allure of bonds and other fixed income instruments, thereby creating stiffer competition for stocks.

Having described a somewhat cautionary narrative, we also note a large swath of stocks are already trading well off their highs and look attractive. Indeed, the performance of the S&P 500® Index, which year-to-date has largely been driven by a handful of stocks, does not reflect the performance of the average stock. Interestingly, the equal-weighted S&P 500® Index, which adjusts for the outsized contribution of the large tech companies that have led the market, is now up only 1.9% year-to-date. Many names have actually been hitting new 52-week lows. For the trading week that ended September 22, 120 stocks on the New York Stock Exchange hit new 52-week highs while 303 hit new lows, while NASDAQ had 161 new highs compared to 750 new lows. Not surprisingly, shares of income-oriented stocks (e.g. REITs and utilities) that are especially sensitive to higher interest rates have been particularly vulnerable. The same goes for shares of businesses that are more economically sensitive or consumer exposed. This tells us equity markets partially reflect the aforementioned interest rate and consumer headwinds.

We recognize the headwinds facing markets, but have continued to find a number of deals for our strategies. In many of these cases, recent price pullbacks have created alluring risk/reward profiles. With the S&P trading at 18x forward earnings estimates, we wouldn’t classify the overall market as being a great deal in the context of the current interest rate environment. This is especially true if higher wages and financing costs eat into those earnings estimates. However, we think we can earn reasonable returns by identifying solid franchises trading for valuations that already discount some duress (the equal-weighted S&P trades closer to 14x earnings). We also note that, while “higher for longer” is the mantra du jour, the worst of Fed tightening may be behind us. Fresh signs of “peak Fed” could once again breathe life into stocks. Finally, we note sentiment indicators currently sound a bearish tone. The CNN “Fear & Greed Index” currently stands at 25 out of 100, putting it in the “fear” zone. As we’ve seen before, widespread negativity can sometimes reverse and lead to market gains.

Please see our fund letters for discussion of specific ideas and investment themes. Thank you for your trust.

Davenport Core Leaders Fund (DAVPX)

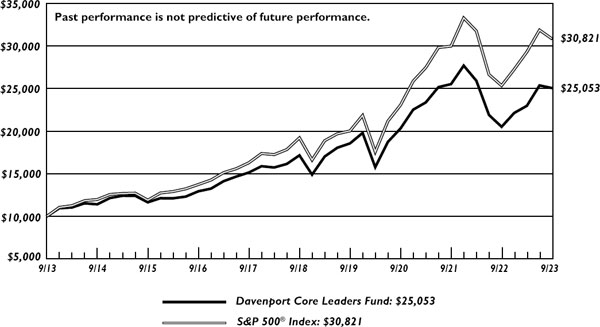

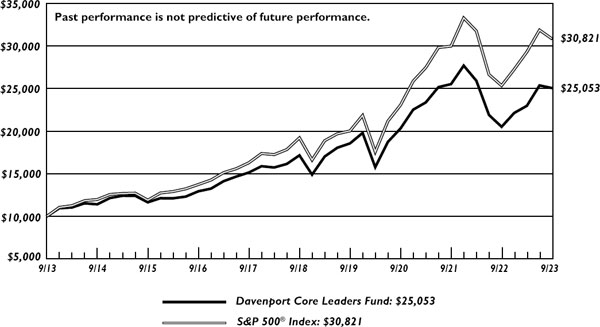

The following chart represents Davenport Core Leaders Fund (DAVPX) performance and the performance of the S&P 500® Index, the Core Leaders Fund’s primary benchmark, for the periods ended September 30, 2023.

| | Q3 2023 | 1 Year | 3 Years* | 5 Years* | 10 Years* | Since

Inception*

1/15/98 |

| Core Leaders Fund (DAVPX) | (1.23%) | 22.16% | 7.25% | 7.86% | 9.62% | 7.24% |

| S&P 500® Index** | (3.27%) | 21.62% | 10.15% | 9.92% | 11.91% | 8.02% |

30-Day SEC Yield: 0.23%; Expense Ratio in current prospectus: 0.87%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month-end, may be obtained by calling 1-800-281-3217.

| * | Returns greater than one year are annualized. |

| ** | The S&P 500® Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

The Davenport Core Leaders Fund (DAVPX) declined 1.23% during the third quarter, faring better than the 3.27% decline for the S&P 500® Index. For the calendar year, the Fund is up 13.17%, modestly outpacing the 13.07% gain for the S&P 500®. We are pleased to have made up significant ground relative to the index. More importantly, we remain confident in the Fund’s long-term positioning.

As the technology sector’s outperformance reversed course during the third quarter, our strategy benefitted from stock selection within the group. Positions in Intuit, Inc. (INTU), Alphabet, Inc. (GOOG/L), Adobe, Inc. (ADBE) and Meta Platforms, Inc. (META) all managed to add to year-to-date gains. In addition, underweight stances in large index constituents such as Apple, Inc.

(AAPL) and Microsoft Corporation (MSFT) aided relative results. We added to our position in Microsoft amid weakness, though we remain comfortable with an underweight stance in Apple. Other top contributors included energy names such as EOG Resources, Inc. (EOG) and Pioneer Natural Resources Company (PXD). We exited the latter position amid recent strength in order to re-allocate the funds to better risk/reward opportunities. In addition to Microsoft, two such opportunities included Brookfield Corporation (BN) and Abbott Laboratories (ABT), which were top detractors for the period alongside Martin Marietta Materials, Inc. (MLM) and American Tower Corporation (AMT).

We initiated a position in dominant semiconductor manufacturer NVIDIA Corporation (NVDA) during the quarter. NVIDIA has been a standout performer this year on the back of a transformational shift in data center spend towards accelerated compute technologies and generative AI adoption. NVIDIA’s fundamentals have inflected as the company leverages its leading GPU technology (Graphics Processing Unit) that is key to enabling these new trends. While NVDA is up considerably this year, we note that out year consensus earnings estimates have been revised higher by more than threefold, and the valuation appears more compelling compared to just a few months ago. The company recently delivered an impressive beat and raise earnings report with guidance exceeding the most bullish estimates on the street. However, the stock weakened following the release. While we acknowledge being late to the game with NVIDIA, we believe the muted stock response to an otherwise encouraging quarter created a narrow window of opportunity to initiate a position. The purchase is consistent with our bullish view on the secular growth in artificial intelligence and accelerated computing infrastructure and helps to round out our exposure to the theme. We believe NVIDIA is a durable growth story with a wide moat, great balance sheet, strong cash generation, visionary management team and one of the highest quality pick and shovel plays in the semiconductor space.

While maintaining the stated mandate of “owning a collection of the world’s most established, dominant and durable franchises”, the Fund has leaned a bit more into growth over the past year, resulting in meaningful exposure to powerful themes such as Artificial Intelligence, Cybersecurity, Clean Energy Transition, and Cell & Gene Therapy. As a result, the Fund has benefited from the outperformance of several holdings we emphasized when they were out of favor last year such as Amazon.com (AMZN), Adobe, Inc. (ADBE), Meta Platforms, Inc. (META), and Intuit, Inc. (INTU). While we still think there is room to run in many of these larger holdings, we have been planting seeds for the future with new ideas such as NVIDIA Corporation (NVDA), Vertex Pharmaceuticals, Inc. (VRTX), Palo Alto Networks, Inc. (PANW) and Advanced Micro Devices, Inc. (AMD) and adding to names where we have high long-term conviction that have lagged in the short-term such as Danaher Corporation (DHR), Brookfield Corporation (BN), Walt Disney Company (DIS), and Abbott Laboratories (ABT).

In sum, we are pleased with recent performance, yet remain committed to the continuous process of optimizing the risk/reward profile of the strategy as a whole. As a result, we feel the strategy offers timeliness, quality and significant long-term growth potential.

Recent Purchases:

Abbott Laboratories (ABT) – ABT’s momentum presents an attractive setup going into year-end. Considering ABT’s opportunity for further growth and stock pullback, we thought it was an opportune time to add to the position.

Advanced Micro Devices, Inc. (AMD) – With a broadening suite of products, we believe AMD will align with our bullish thematic view around generative AI and secular growth in data center spend so we elected to initiate a purchase.

Aon, plc (AON) – AON has been a steady value creator over the years and has outperformed the S&P over most time periods. We note that AON has returned significant capital to shareholders via buybacks and plans to remain active near-term. As such, we elected to add to our position.

Brookfield Corporation (BN) – While many of the BN’s assets face challenges, the majority of the real estate portfolio is extremely high quality. We believed investors were overlooking the massive amounts of cash flow this business was generating so we added to our position.

Brookfield Corporation (BN) – Despite a well-received earnings update, the shares are modestly lower from our last add in July. We decided to increase exposure to a proven capital allocator generating strong free cash flow while also trading at a wide discount to its net asset value.

Danaher Corporation (DHR) – With the stock having only modestly rebounded from 2023 lows, we think it is an opportune time to add to the position recognizing that the company may still face several more challenging quarters.

Microsoft Corporation (MSFT) – MSFT has pulled back in recent weeks alongside broader weakness in the technology sector, and valuation has become more compelling for this high-quality compounder. We elected to take advantage of recent weakness in the stock and added to the position.

NVIDIA Corporation (NVDA) – We initiated a position in NVDA and believe the purchase is consistent with our bullish view on the secular growth in artificial intelligence and accelerated computing infrastructure and helps round out our theme.

NVIDIA Corporation (NVDA) – Since our initial purchase, shares of NVDA have pulled back from recent highs, however, our conviction in NVDA’s long-term growth potential is unchanged and we elected to increase our position size.

Palo Alto Networks, Inc. (PANW) – We find PANW’s potential to benefit from secular growth opportunities appealing. Given our views around growth potential, we initiated a position.

UnitedHealth Group, Inc. (UNH) – We feel recent weakness is overdone, resulting in an attractive buying opportunity in a secular grower at a discounted valuation.

Walt Disney Company (DIS) – DIS announced significant cost-cutting efforts. Although challenges remain, we found DIS’s current valuation was compelling and elected to add.

Recent Sales:

Brookfield Asset Management (BAM) – As a reminder, at the end of 2022, Brookfield spun 25% of its asset management entity (BAM) to shareholders, creating two separate entities: BAM and Brookfield Corporation (BN). We elected to sell our position and added more exposure to emphasize BN, which we believe offers the best risk/reward at the moment.

Constellation Brands, Inc. (STZ) – While we remain attracted to STZ and think the company will benefit from sounder capital allocation given activist involvement, we felt we could put the funds to work into more timely situations and sold our position.

Johnson & Johnson (JNJ) – Although we are pleased and consider JNJ a defensive stalwart, we thought relative opportunities in other companies warranted a reallocation of funds and sold our position.

Markel Group, Inc. (MKL) – Although we chipped MKL, we remain confident in their ability to return to double-digit book value growth alongside improved underwriting results, solid MKL Ventures cash flows and attractive investment returns.

Pioneer Natural Resources Company (PXD) – PXD has caught a recent bid alongside the rest of the energy sector. While we are attracted to the company’s quality asset base and capital return policy, we elected to take advantage of recent strength and chipped our position.

Pioneer Natural Resources Company (PXD) – We elected to chip again to take advantage of recent strength and redeploy funds.

Pioneer Natural Resources Company (PXD) – While we appreciate the PXD’s high-quality asset base and cash return policy, we felt the funds could be used in more timely ideas that offer better long-term growth prospects and ultimately elected to sell.

TJX Companies, Inc. (TJX) – TJX has recently benefited from consistent results and the anticipation of a consumer tradedown phenomenon during the back-to school shopping season. Though we think results will be deserving of the stock’s premium multiple, we elected to take some profits and reduce the position size modestly.

Davenport Value & Income Fund (DVIPX)

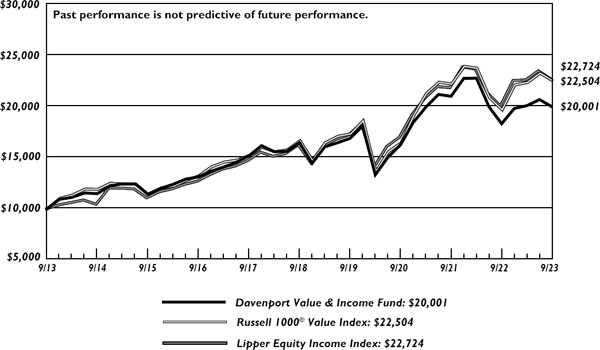

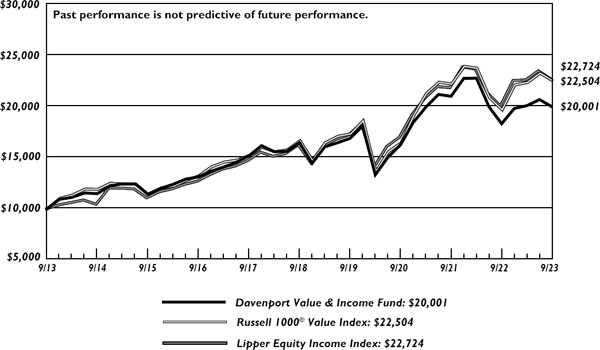

The following chart represents Davenport Value & Income Fund (DVIPX) performance and the performance of the Russell 1000® Value Index, the Fund’s primary benchmark, and the S&P 500® Index for the periods ended September 30, 2023.

| | Q3 2023 | 1 Year | 3 Years* | 5 Years* | 10 Years* | Since

Inception*

12/31/10 |

| Value & Income Fund (DVIPX) | (3.44%) | 8.97% | 7.08% | 3.92% | 7.18% | 8.93% |

| Russell 1000® Value Index** | (3.17%) | 14.44% | 11.05% | 6.23% | 8.45% | 9.55% |

| S&P 500® Index** | (3.27%) | 21.62% | 10.15% | 9.92% | 11.91% | 12.27% |

30-Day SEC Yield: 1.77%; Expense Ratio in current prospectus: 0.88%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month-end, may be obtained by calling 1-800-281-3217.

| * | Returns greater than one year are annualized. |

| ** | The Russell 1000® Value Index measures the performance of the Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values. The S&P 500® Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. Standard & Poor’s Financial Services LLC, a division of S&P Global, is the source and owner of the registered trademarks related to the S&P 500® Index. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

The Davenport Value & Income Fund (DVIPX) declined 3.44% in the third quarter, bringing its year-to-date return to positive 0.78%. This compares to the Fund’s primary benchmark, the Russell 1000® Value Index, which declined 3.17% in the third quarter and is up 1.79% year-to-date. Ongoing interest rate increases and the Fed’s espousing a “higher for longer” mantra weighed on risk assets, as 5%+ “risk-free” rates available in short-term Treasury bills are competing for investors’ capital.

For the second straight quarter, the Fund’s performance was led by Fairfax Financial Holdings Ltd (FRFHF). Insurers such as Fairfax are benefiting from higher interest rates as they reinvest lower-yielding maturing securities from their investment portfolios. That, along with continued robust increases for insurance policies (driven by prior year natural disasters), have enabled insurers to produce impressive growth rates. Fellow insurers Markel Group Corporation (MKL), Chubb Ltd (CB), and Berkshire Hathaway, Inc. (BRK.B) also were among the Fund’s top 10 contributors for the quarter. Beyond insurance, our two Energy holdings, Chevron Corporation (CVX) and Coterra Energy, Inc. (CTRA) benefited from the rise in underlying commodity prices. Crude oil jumped 30% for the quarter, amid continued OPEC production discipline, while natural gas prices lifted almost 9%. Among the Fund’s worst performers for the quarter, we see little commonality: Florida utility NextEra Energy, Inc. (NEE) was worst (Utilities in general performed poorly, as competing yields from Treasury securities pressured valuations), followed by Lamar Advertising Company (LAMR), which cited decelerating advertising demand. United Parcel Service, Inc. (UPS) also declined as its settlement with the Teamsters union creates certainty around its labor situation for the next five years, albeit with some incremental costs to absorb in 2024. McDonald’s Corporation (MCD) fundamental performance remains strong even though its stock price flagged during the quarter. Other detractors included Diageo, plc (DEO) and defense contractor L3Harris Technologies, Inc. (LHX).

Our transactions during the quarter were relatively few, but we believe consistent with Value & Income’s mandate of seeking stocks with depressed valuations and solid dividend income. On the purchase side of the ledger, we added aerospace and defense conglomerate RTX Corporation (RTX), formerly Raytheon, as well as Walt Disney Company (DIS) and Anheuser-Busch InBev S.A./N.V. (BUD). RTX shares got put in the “clearance” aisle, after the company announced that a component in its geared turbofan engine may be failing prematurely, requiring earlier-than-expected replacement. Since announcing this issue, the stock has lost about $30 billion of market value, implying a fairly significant “margin of safety” vs. the estimated $3 billion cost. Meanwhile, the company is in the midst of a $33-35 billion return of capital program through 2025, with share buybacks driving the share count -1.4% year-over-year, while RTX’s dividend is 7% higher than a year ago. Disney needs little introduction, and is working to recover from several media-related snafus, including a carriage dispute with Charter Communications, a recent settlement with the screenwriters’ guild, and a pending resolution of its partial ownership of streaming service Hulu that should bring finality to that overhang. CEO Bob Iger has indicated the company intends to restore its dividend later this year. Meanwhile, shares trade at their lowest level since 2014, even as Disney has good line-of-sight to substantial earnings growth in 2024 and beyond from a multi-billion dollar profitability improvement in its streaming businesses (Disney+, e.g.).

Global brewer Anheuser-Busch has been performing well outside the United States, and now faces easy comparisons within the US as it seeks to claw back market share that Bud Light surrendered from a marketing faux pas earlier this year. The company operates globally and possesses many key brands (Michelob, Stella Artois, Kona, Landshark, ShockTop), so the impact

of a single brand in a single country is relatively modest. To that point, in spite of Bud Light’s well-documented US woes, Anheuser reported total company growth of 7% year-over-year in its most-recent quarter. Shares trade near 15x earnings, and earlier this year the company recently increased its dividend 50%.

In terms of exits during the quarter, we sold Gaming & Leisure Properties, Inc. (GLPI), Crown Castle Inc. (CCI), Cannae Holdings, Inc. (CNNE), and J.M. Smucker Company (SJM). For GLPI, we saw a well-run company that had held up better than most real-estate holdings in a higher interest rate environment. Wireless tower operator Crown Castle’s business is unlikely to grow much in the next couple years, as Sprint/TMobile churn and higher interest rates conspire against it. Further, management indicated that telecom customers’ 5G spending has peaked. The combination of those factors make it unlikely Crown Castle will be able to grow its dividend meaningfully until 2025, at the earliest. Cannae continues to offer intriguing sum-of-the-parts potential, albeit in a non-dividend paying, small-cap security that we’d been gradually pruning. When liquidity presented itself, we exited the balance of our position. Finally, Smucker snatched defeat from the jaws of victory, in our view, when it unexpectedly announced that it would lever up and issue stock to acquire Hostess at a rich valuation (vs. buying back its own stock, which Smucker had been doing heretofore). As the company spends the next few years deleveraging, we suspect dividend growth will be anemic, at best.

In sum, we view our diversified Fund of large, well-established companies trading at reasonable valuations and with good dividend growth provide attractive equity exposure. We are pleased that three of our companies increased their dividends during the quarter, in-sync with their traditional schedule. JPMorgan Chase & Company (JPM) banked a 5% improvement to its quarterly payout, while Philip Morris International, Inc. (PM) provided a 2% fillip, and Keurig Dr. Pepper, Inc. (KDP) brewed up an 8% increase. We calculate the average dividend growth rate for the stocks we own in the Fund at 9% year-over-year.

Recent Purchases:

Anheuser-Busch InBev S.A./N.V. (BUD) – A marketing issue in the company’s largest North American brand led to significant market share losses. These headwinds appear to have been adequately discounted, providing an opportunity to establish a position at a historically low valuation.

Bristol Myers Squibb Company (BMY) – BMY’s newly launched products showed impressive growth, continuing to provide evidence that they should be able to grow through upcoming patent expirations. As such, we elected to add to our position.

Bristol Myers Squibb Company (BMY) – We continue to view BMY as uniquely inexpensive, with an impressive spectrum of already-approved pharmaceuticals to help it bridge the near-term “known-known” patent expiration cliff and elected to add to our position for the second time this quarter.

Fidelity National Financial, Inc. (FNF) – While we appreciate that mortgage refinancing activity may remain soft, the housing market remains strong, commercial mortgage activity appears to be lifting, and interest rates have leveled off. As such, we elected to add to our position.

J.M. Smucker Company (SJM) – We feel SJM improved its financial flexibility and expect SJM to sell its Post shares, and redeploy those proceeds. We consider this profile attractive relative to the stock’s valuation and elected to add to our position.

NextEra Energy, Inc. (NEE) – With NEE shares trading near their lowest level in nearly 5 years, we view shares as incrementally attractive, and took this time to add to our position.

Oracle Corporation (ORCL) – ORCL has been a solid performer this year. Key financial targets were reaffirmed for FY24 and FY26 and believe the long-term thesis on ORCL remains intact. As such, we used this opportunity to increase our position.

RTX Corporation (RTX) – The irony of the stock’s sharp sell-off on the engine recall news, is that it came on the same day that the company reported 13% organic growth for the second quarter, with management raising 2023 revenue and earnings guidance, and backlog having reached a new record ($185 billion, more than two years’ worth of revenue) amid $25B of new orders and a very robust 1.34x book-to-bill result. As such we elect to initiate a 1% position in RTX.

Target Corporation (TGT) – While the health of the consumer remains a near-term question mark, we view TGT as well-positioned to provide value and flex its inventory position when demand strengthens. Given that sales today are ~38% higher than pre-pandemic levels, we elected to add to our position.

Walt Disney Company (DIS) – While the company may continue to face headwinds in the near-term, we think they are more than reflected in the current valuation, with the shares valued at 16.9x and 14.5x calendar 2024 and 2025 earnings estimates, respectively. We think the current valuation offers an attractive risk/reward opportunity in a high-quality business and elect to establish a position.

Recent Sales:

Berkshire Hathaway, Inc. (BRK.B) – With several other insurance/conglomerate holdings in DVIPX, we’ve used recent strength to chip our position. We appreciate that underwriting profitability historically has been cyclical, and we don’t want to over-extrapolate current favorable market conditions.

Cannae Holdings, Inc. (CNNE) – Not much has changed with the CNNE story as the discount to its sum-of-the parts remains at ~50%. CNNE remains a meaningful holding in other portfolios as we expect the discount to close over time (or CNNE to liquidate), however the lack of a dividend and current market cap make it less of a fit and sold our position.

Comcast Corporation (CMCSA) – While CMCSA’s valuation remains undemanding, the year-to-date lift in the stock price enabled us to trim the position size, with the risk/reward appearing somewhat more balanced now than it was entering the year.

Crown Castle, Inc. (CCI) – After having grown its dividend at a compound annual rate of 8.4% since converting to a REIT in 2014, CCI’s dividend is likely to grow at perhaps just 1% annually from 2023-2025. Amid this potentially lengthy valley, we opted to exit our position in CCI.

Deere & Company (DE) – The combination of declining crop prices and higher interest rates may presumably impact the cost of farm equipment. As such, we elect to trim our position size.

Fairfax Financial Holdings Ltd (FRFHF) – We elect to chip our position reflecting the stock’s superior performance: +34% year-to-date, and +55% in the past year.

Gaming and Leisure Properties, Inc. (GLPI) – GLPI had become one of the smallest positions in the portfolio and we decide to exit our remaining holdings.

J.M. Smucker Company (SJM) – SJM appeared to be executing well, but that narrative took a left-hand turn earlier last month, when the company announced it is acquiring Hostess Brands at a valuation more than 50% higher than SJM itself trades at, using a combination of debt and SJM shares. As such, we opted to exit our relatively short-lived position in SJM.

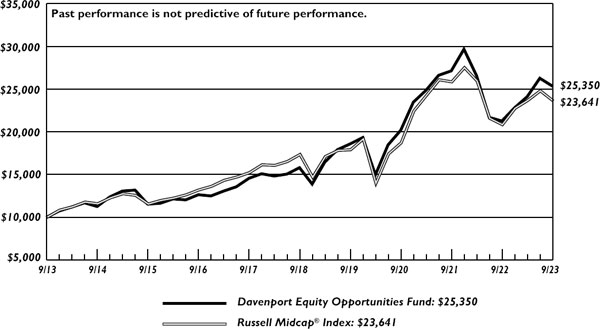

Davenport Equity Opportunities Fund (DEOPX)

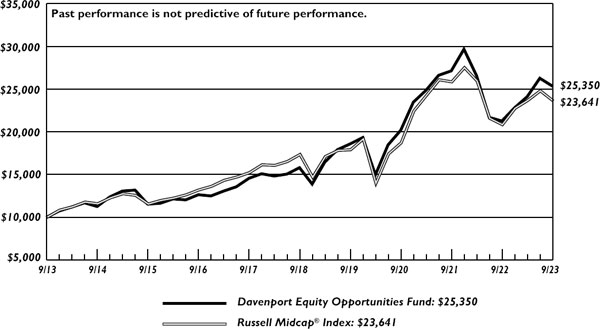

The following chart represents Davenport Equity Opportunities Fund (DEOPX) performance and the performance of the Russell Midcap® Index, the Fund’s primary benchmark, and the S&P 500® Index for the periods ended September 30, 2023.

| | Q3 2023 | 1 Year | 3 Years* | 5 Years* | 10 Years* | Since

Inception*

12/31/10 |

| Equity Opportunities Fund (DEOPX) | (3.52%) | 19.19% | 7.91% | 9.91% | 9.75% | 11.32% |

| Russell Midcap® Index** | (4.68%) | 13.45% | 8.09% | 6.38% | 8.98% | 10.06% |

| S&P 500® Index** | (3.27%) | 21.62% | 10.15% | 9.92% | 11.91% | 12.27% |

30-Day SEC Yield: 0.33%; Expense Ratio in current prospectus: 0.89%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month-end, may be obtained by calling 1-800-281-3217.

| * | Returns greater than one year are annualized. |

| ** | The Russell Midcap® Index measures the performance of the 800 smallest companies in the Russell 1000®, which represents approximately 25% of the total market capitalization of the Russell 1000®. The S&P 500® Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. Standard & Poor’s Financial Services LLC, a division of S&P Global, is the source and owner of the registered trademarks related to the S&P 500® Index. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

The Davenport Equity Opportunities Fund (DEOPX) was down 3.52% during the third quarter, holding in better than the 4.68% decline for the Russell Midcap® Index. For the calendar year, the Fund is up 11.14%, nicely outpacing the 3.91% gain for the Index.

Specialty insurance holdings Fairfax Financial Holdings Ltd. (FRFHF) and Markel Group Corporation (MKL) were among the Fund’s top performers, benefitting from their status as beneficiaries of higher interest rates. In addition to improving investment income, firm insurance pricing should remain a tailwind for these companies that we believe still carry undemanding valuations. Elsewhere, the strategy benefitted from the long awaited approval of the merger between Black Knight, Inc. (BKI) and Intercontinental Exchange, Inc. (ICE). We elected to monetize our position in BKI prior to the consummation of the deal since the stock had appreciated to within a narrow discount to the ultimate takeout value. Key detractors for the period included Xylem, Inc. (XYL), Alight, Inc. (ALIT) and Envois Corporation (ENOV). Envois struggled alongside broader weakness in the healthcare sector related to emerging concerns that

popular weight loss drugs called GLP-1’s could potentially reduce future incidents of orthopedic surgery cases (i.e. lower rates of obesity will result in fewer joint replacement surgeries). We believe this narrative to be far-fetched given the aging population and pent-up demand for elective surgeries. Furthermore we think the company’s recent acquisition of LimaCorporate, a European orthopedics leader, should be meaningfully value-accretive over time. Given recent developments and our ongoing conviction, we elected to use recent weakness to add to the position.

We initiated a position in Allstate Corporation (ALL), one of the largest personal auto and homeowners insurance companies in the United States. After experiencing unprecedented profitability in 2020, auto insurer losses began rising midway through 2021 due to increased driving and inflationary cost pressures. Sustained higher used car prices, car parts, attorney fees, and longer repair times combined to drive loss severity significantly higher. An increase in catastrophe events further weighed on results. These trends resulted in Allstate reported a loss of $1.3B in 2022, its first net loss since 2008. While recent performance has been poor, Allstate is actively implementing significant rate increases across its operations, increasing rates by 16.9% in 2022 and 8.4% since the beginning of 2023. These price increases take time to flow through results as they are implemented when 6-month policies come up for renewal. We believe Allstate is nearing a material inflection point as price increases implemented over the last few quarters begin to positively impact reported results. Additionally, Allstate’s $63B investment portfolio is primarily made up of fixed income securities which stand to benefit from higher interest rates. We believe Allstate could earn between $15 and $20 per share in a normalized operating environment. Applying a through-cycle multiple of 10x PE results in a $150-200 share price, implying a 31.5% - 75.4% return from today’s levels.

We also initiated a position Avantor, Inc. (AVTR), which we view as a “toll booth” business set to benefit from future investment and innovation in the biopharma space. Avantor provides ~6 million products and services to the biopharma, healthcare, and advanced technologies & applied materials industries. With around 85% of revenue recurring and over 40% generated from 15+ year customers, this business has been remarkably stable over time. However, COVID-19 created a significant disruption as volatile order patterns led to rolling inventory challenges. While transitory in nature, these factors weighed on reported results and investor sentiment (destocking represented a ~500 basis point headwind to topline organic growth this year). We believe Avantor is well positioned to rebound from recent challenges as operations normalize, allowing the company to revert back toward its historical formula of mid-single digit topline growth. After a ~40% decline over the last year, shares are trading near their lowest valuation since the company came public, representing a significant discount to larger life science tool and medical supplier peers. Though the next few quarters might be choppy, we see significant upside over time as revenue trends normalize and the valuation recovers to historical ranges.

We are pleased with results to date and believe that recent value-oriented additions to the strategy should add an element of timeliness. As always, we strive to own a collection of high-quality businesses that compound at high rates of return and feel that each of our holdings exhibits these characteristics. Further, we are confident that our willingness to be contrarian and ride out a few near-term headwinds will pay off over the long term.

Recent Purchases:

Allstate Corporation (ALL) – While near-term results have been poor, we believe ALL is nearing a material inflection point as price increases implemented over the last few quarters begin to positively impact reported results. We view the recent underperformance in ALL’s insurance operations as an attractive opportunity and elected to initiate a position.

Avantor, Inc. (AVTR) – AVTR operates, in our view, a traditionally resilient business model, generating significant free cash flow with a high degree of earnings visibility. However, COVID-19 created a significant disruption in an otherwise stable business. We believe AVTR is well positioned to rebound from recent challenges as operations normalize and elected to initiate a position.

Avantor, Inc. (AVTR) – Since establishing our initial position in AVTR, the company appointed a new CFO with a strong background in both investment banking and leadership roles in the life sciences industry. We elected to use cash proceeds from the recent BKI sale to make our position in AVTR more meaningful.

Avantor, Inc. (AVTR) – Though the company’s recent quarterly results did not convey the same degree of optimism as larger comps such as Danaher (DHR) and Thermofisher (TMO), we think AVTR is well positioned to rebound from recent challenges as operations normalize and elected to add to our position a second time.

Enovis Corporation (ENOV) – Despite solid recent results, ENOV has pulled back materially from recent highs alongside broader weakness in the health care sector. We think this provides an opportunity to add to a high quality compounder with an attractive risk/reward setup.

Enovis Corporation (ENOV) – With the shares valued at just 11x 2024 consensus EBITDA estimates compared to 15.6x for medical device peers, we think this is an attractive opportunity to add to our position (for the second time this quarter) and believe the valuation discount should narrow as the Recon segment becomes the biggest driver of the company.

Etsy, Inc. (ETSY) – While the business is going through a choppy patch at present, ETSY has differentiated its brand and offers a niche platform where consumers love the unique/authentic experience of buying non-commoditized wares from artisan sellers. We think this, alongside a large addressable market and secular tailwinds for ecommerce make ETSY a secular grower over time and elected to take the position to 1.5%.

Recent Sales:

Black Knight, Inc. (BKI) – The shares have rallied sharply in response to the announcement of an asset sale agreement between BKI, Intercontinental Exchange and Constellation Software that appears to pave the way for regulatory approval of ICE’s offer to acquire BKI. Given these factors, we elected to use the above average trading liquidity to monetize the position.

Fairfax Financial Holdings Ltd (FRFHF) – Though we elect to take some profits with the stock at fresh all-time highs, FRFHF remains a top position given the company’s strong operating momentum (run rate pre-tax operating earnings of ~$100 per share) and an undemanding valuation (stock trades at 0.85x consensus 2023 BVPS [Book value per share] estimates).

O’Reilly Automotive, Inc. (ORLY) – We remain attracted to the company’s distinct competitive advantages (namely its parts distribution network and superior fulfillment capabilities) and demand drivers (average age of car on the road at record highs), but acknowledge that the shares could take a breather as the company faces tougher comparisons following a period of strong performance and chipped our position.

O’Reilly Automotive, Inc. (ORLY) – Not much has changed since previous chip and we elected to take this time to trim our position again.

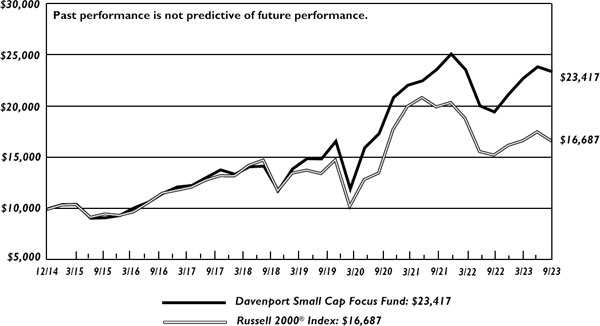

Davenport Small Cap Focus Fund (DSCPX)

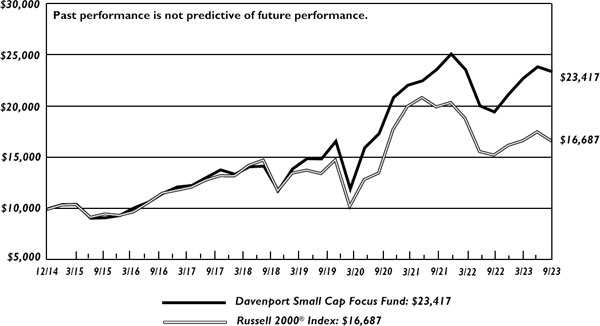

This chart represents Davenport Small Cap Focus Fund (DSCPX) performance and the performance of the Russell 2000® Index, the Small Cap Focus Fund’s primary benchmark, for the periods ended September 30, 2023.

| | Q3 2023 | 1 Year | 3 Year* | 5 Year* | Since

Inception*

12/31/14 |

| Small Cap Focus Fund (DSCPX) | (1.98%) | 20.21% | 10.48% | 10.56% | 10.22% |

| Russell 2000® Index** | (5.13%) | 8.93% | 7.16% | 2.40% | 6.03% |

30-Day SEC Yield: 0.82%; Expense Ratio in current prospectus: 0.91%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month-end, may be obtained by calling 1-800-281-3217.

| * | Returns greater than one year are annualized. |

| ** | The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® index, representing approximately 8% of the total market capitalization of the Russell 3000®. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

The Davenport Small Cap Focus Fund (DSCPX) was down 1.98% during the third quarter, proving more resilient than the 5.13% decline for the Russell 2000® Index. For the calendar year, the Fund is up 10.32%, versus the 2.54% gain for the Index.

The Fund had an eclectic mix of contributors in the third quarter. Canadian natural gas producer Peyto Exploration & Development Corporation (PEYUF) was the Fund’s top performer alongside a strong energy tape. Additionally, the company announced an acquisition of complimentary assets from Repsol, which we believe will be significantly accretive to future production and cash flow per share over time. Health savings account provider HealthEquity, Inc. (HQY) (highlighted last quarter) was another top contributor, reporting strong results and new business wins amid a favorable backdrop of rising interest rates. Other key contributors included NewMarket Corporation (NEU) and Kinsale Capital Group, Inc. (KNSL). Key detractors included Alight, Inc. (ALIT), Lamar Advertising Company (LAMR), Enovis Corporation (ENOV) and Monarch Casino & Resort, Inc. (MCRI). We elected to add to the latter two positions amid weakness. In the case of Monarch, it remains our top position. While the near term is murky given a difficult consumer backdrop, we are attracted to the company’s debt free balance sheet, cheap valuation and attractive capital return policy.

During the quarter we initiated a position in pool and spa supplies retailer Leslie’s, Inc. (LESL). Shares of LESL had declined precipitously from recent highs given several temporary (in our view) headwinds including: an unusual pool season due to poor weather, excess chemicals among homeowners, and a general slowing in more discretionary purchases (i.e. hot tubs and above-ground pools). With close to 1,000 locations throughout the U.S. and 80% of sales tied to maintenance, LESL enjoyed 59 years of consecutive sales growth before the issues in 2023. Put simply, we don’t believe the business is broken and think current levels represent an attractive entry point in the specialty retailer. The pool industry enjoys secular growth drivers such as a growing installed base and pool maintenance is non-discretionary. Additionally, the desire for newer technologies (i.e. automation, robotic vacuum) is driving additional growth. Long-term, LESL should be able to grow sales at a mid-single digit to high-single digit pace and grow EPS in the mid- to high-teens. With the stock trading at <11x normalized earnings, we think our entry point is attractive and are willing to wait for a more normal pool season next year.

We also initiated a position in California Resources Corporation (CRC), one of the largest oil & gas producers in California. While oil and gas companies generally track a difficult to predict underlying commodity, CRC has a number of unique characteristics underpinning its valuation. The company’s oil and gas operations benefit from favorable pricing as California imports roughly 90% of the natural gas and 60% of oil consumed in the state. This “energy island” dynamic allows CRC to realize significantly higher prices than traditional benchmarks during volatile consumption periods. Additionally, CRC is developing a series of carbon capture and sequestration projects in California through its subsidiary Carbon TerraVault. Carbon TerraVault has 25 completed permits submitted to the EPA for Class VI wells and a 51%/49% joint venture partnership with Brookfield Asset Management valued at ~$2B. Carbon capture projects in California benefit from both federal IRS 45Q credits as well as California Low Carbon Fuel Standard (LCFS) credits. CRC believes its carbon capture operations could generate ~$185-200M in EBITDA by 2028. Ultimately, we believe CRC offers an attractive risk reward given the combination of its highly cash generative oil and gas operations and significant exposure to the budding Carbon Capture and Storage industry.

In sum, we are pleased to have performed well during a difficult period for small cap stocks and continue to think the asset class appears timely. While our valuation discipline and emphasis on quality has served us well through a turbulent period, we have not shied away from situations where we believe a contrarian/long term approach can sow the seeds for future outperformance.

Davenport Balanced Income Fund (DBALX)

The following chart represents Davenport Balanced Income Fund (DBALX) performance and performance of the Fund’s primary benchmark, the Russell 1000® Value Index for the periods ended September 30, 2023.

| | Q3 2023 | 1 Year | 3 Year* | 5 Year* | Since

Inception*

12/31/15 |

| Balanced Income Fund (DBALX) | (2.38%) | 5.40% | 3.83% | 3.03% | 4.56% |

| Russell 1000® Value Index** | (2.21%) | 9.70% | 5.56% | 4.56% | 5.78% |

30-Day SEC Yield: 3.04%; Expense Ratio in current prospectus: 0.94%

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month-end, may be obtained by calling 1-800-281-3217.

| * | Returns greater than one year are annualized. |

| ** | The Russell 1000® Value Index measures the performance of the Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values |

The Davenport Balanced Income Fund (DBALX) decreased 2.38% during the third quarter of 2023 compared to the 2.21% decrease for the blended 60% Russell 1000® Value Index and 40% Bloomberg Intermediate Government/Credit Bond Index. Year-to-date, the Fund is up 0.98% compared to the 1.47% increase for the blended benchmark.

For the second straight quarter, the Fund’s equity performance was led by Fairfax Financial Holdings Ltd. (FRFHF). Insurers such as Fairfax are benefiting from higher interest rates as they reinvest lower-yielding maturing securities from their investment portfolios. That, along with continued robust increases for insurance policies (driven by prior year natural disasters), have enabled insurers to produce impressive growth rates. Fellow insurers Markel Group Corporation (MKL), Chubb Ltd. (CB), and Berkshire Hathaway, Inc. (BRK.B) also were among the Fund’s top contributors for the quarter. Among the Fund’s worst performers for the quarter, we see little commonality: Florida utility NextEra Energy, Inc. (NEE) was worst (Utilities in general performed poorly, as competing yields from Treasury securities pressured valuations), followed by Lamar Advertising Company (LAMR), which cited decelerating advertising demand. United Parcel Service, Inc. (UPS) also declined as its settlement with the Teamsters union creates certainty around its labor situation for the next five years, albeit with some incremental costs to absorb in 2024.

Our transactions during the quarter were relatively few, but we believe consistent with the Fund’s mandate of seeking stocks with depressed valuations and solid dividend income. On the purchase side of the ledger, we added aerospace and defense conglomerate RTX Corporation (RTX), formerly Raytheon, as well as Walt Disney Company (DIS). RTX shares got put in the “clearance” aisle, after the company announced that a component in its geared turbofan engine may be failing prematurely, requiring earlier-than-expected replacement. Since announcing this issue, the stock has lost about $30 billion of market value, implying a fairly significant “margin of safety” vs. the estimated $3 billion cost. Meanwhile, the company is in the midst of a $33-35 billion

return of capital program through 2025, with share buybacks driving the share count -1.4% year-over-year, while RTX’s dividend is 7% higher than a year ago. Disney needs little introduction, and is working to recover from several media-related snafus, including a carriage dispute with Charter Communications, a recent settlement with the screenwriters’ guild, and a pending resolution of its partial ownership of streaming service Hulu that should bring finality to that overhang. CEO Bob Iger has indicated the company intends to restore its dividend later this year. Meanwhile, shares trade at their lowest level since 2014, even as Disney has good line-of-sight to substantial earnings growth in 2024 and beyond from a multi-billion dollar profitability improvement in its streaming businesses.

The Fund’s fixed income allocation includes 29 high quality bonds diversified across nine sectors with the top allocations including U.S. Treasuries (20%), Financials (20%), Energy (12%), Communications (10%), and Consumer Non-Cyclical (6%). The credit quality remains high investment grade (A2/A/A+) with a 5.73% yield-to-worst, 3.92 years effective maturity and a 3.22 years duration versus 2.17 years in Q4 2022.

The third quarter presented opportunities and challenges as yields drifted higher while credit markets felt fragile. Macroeconomic drivers continued to dictate market behavior with investors acutely focused on economic data and monetary policy. The Fed raised its target interest rate range a well telegraphed 25 basis points to 5.25% - 5.5% in July and paused in September. The updated quarterly Summary of Economic Projections (SEP), also known as the dot plots, for September illustrated a Fed belief in economic growth with moderating inflation. During the final week of the quarter, mixed messages emerged from the central bank spanning from hawkish to dovish outlooks that fueled rate volatility. Idiosyncratic and sector level opportunity were subdued in the third quarter with range bound corporate spread movement.

We continued our duration extension strategy in the third quarter. We exited six positions including three short-term Treasuries and three short-term corporates (Boeing 1.433% 2024, BlackRock 3.5% 2024, and Brookfield Finance 4% 2024). We added six new positions to the Fund including two Treasuries (0% 2024 T-bills and 4.75% 2025 T-notes) and four corporates (Bank of Montreal 5.92% 2025, ONEOK 5.55% 2026, Charles Schwab 5.875% 2026, and Waste Management 4.875% 2029). Collectively, yield-to-worst reached 5.73% and duration rose to 3.22 years.

Looking ahead, we believe the Fund’s fixed income portfolio is positioned for the likelihood of persistent inflation above the Fed’s 2% target. The impact of higher for longer interest rates on individual and corporate balance sheets does not happen immediately but with a lag that impacts aggregate economic growth and the potential attractiveness of Treasuries. Structurally, our duration and credit barbell setup offers embedded flexibility to take advantage of attractive yields as well as an evolving yield curve term structure.

In closing, we are continuing to find opportunities in some of the overlooked areas of the market. We think eventually investor attention will shift and our collection of high quality dividend payers/growers should provide solid returns for the equity portion of the Fund. Additionally, our defensive fixed income positioning should continue to provide current income and a volatility buffer in the near-term.

Sincerely,

John P. Ackerly IV, CFA

President, The Davenport Funds

| DAVENPORT CORE LEADERS FUND |

| PERFORMANCE INFORMATION (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment in

Davenport Core Leaders Fund and the S&P 500® Index

| | | |

| | Average Annual Total Returns

(for the periods ended September 30, 2023) | |

| | | |

| | 1 Year | | 5 Years | | 10 Years | |

| Davenport Core Leaders Fund (a) | 22.16% | | 7.86% | | 9.62% | |

| S&P 500® Index | 21.62% | | 9.92% | | 11.91% | |

| | | | | | | |

| (a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| DAVENPORT VALUE & INCOME FUND |

| PERFORMANCE INFORMATION (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment in

Davenport Value & Income Fund, the Russell 1000® Value Index

and the Lipper Equity Income Index

| | | |

| Average Annual Total Returns

(for the periods ended September 30, 2023) | |

| | | |

| | 1 Year | | 5 Years | | 10 Years | |

| Davenport Value & Income Fund (a) | 8.97% | | 3.92% | | 7.18% | |

| Russell 1000® Value Index | 14.44% | | 6.23% | | 8.45% | |

| Lipper Equity Income Index | 13.09% | | 6.86% | | 8.55% | |

| | | | | | | |

| (a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| DAVENPORT EQUITY OPPORTUNITIES FUND |

| PERFORMANCE INFORMATION (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment in

Davenport Equity Opportunities Fund and the Russell Midcap® Index

| | | |

| | Average Annual Total Returns

(for the periods ended September 30, 2023) | |

| | | |

| | 1 Year | | 5 Years | | 10 Years | |

| Davenport Equity Opportunities Fund (a) | 19.19% | | 9.91% | | 9.75% | |

| Russell Midcap® Index | 13.45% | | 6.38% | | 8.98% | |

| | | | | | | |

| (a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| DAVENPORT SMALL CAP FOCUS FUND |

| PERFORMANCE INFORMATION (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment in

Davenport Small Cap Focus Fund and the Russell 2000® Index

| | | |

| | Average Annual Total Returns

(for the periods ended September 30, 2023) | |

| | | |

| | | | | | Since | |

| | 1 Year | | 5 Years | | Inception(b) | |

| Davenport Small Cap Focus Fund (a) | 20.21% | | 10.56% | | 10.22% | |

| Russell 2000® Index | 8.93% | | 2.40% | | 6.03% | |

| | | | | | | |

| (a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | Commencement of operations was December 31, 2014. |

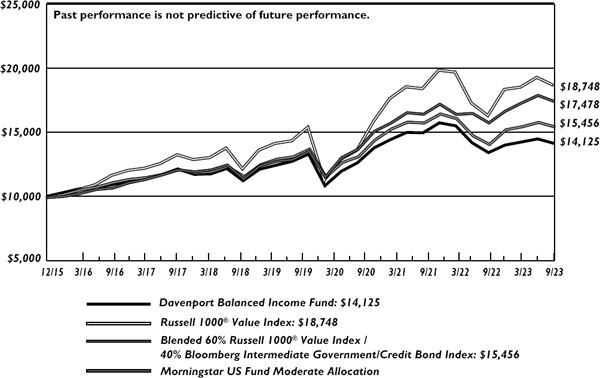

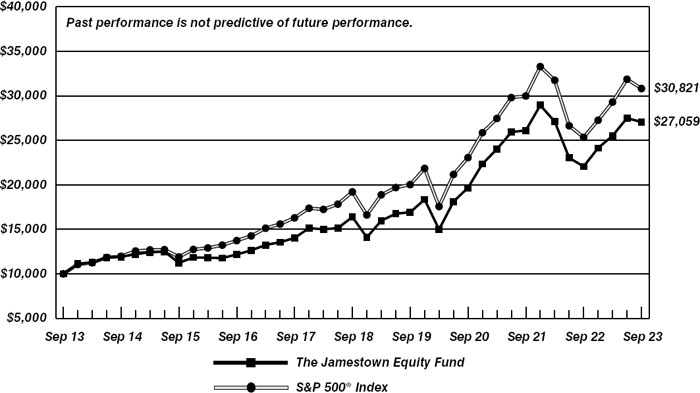

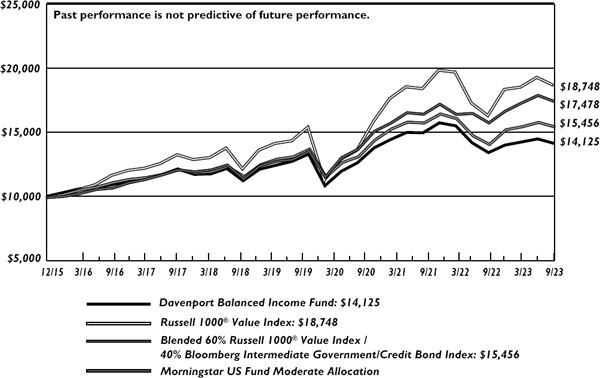

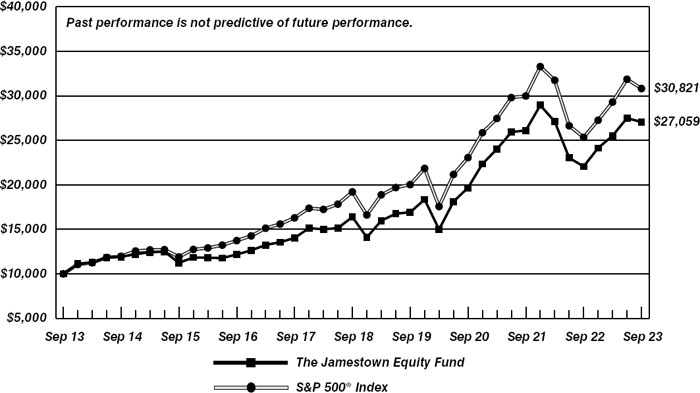

| DAVENPORT BALANCED INCOME FUND |

| PERFORMANCE INFORMATION (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment in Davenport Balanced

Income Fund, the Russell 1000® Value Index, a Blended 60% Russell 1000® Value

Index / 40% Bloomberg Intermediate Government/Credit Bond Index

and the Morningstar US Fund Moderate Allocation

| | | |

| | Average Annual Total Returns

(for the periods ended September 30, 2023) | |

| | | |

| | | | | | Since | |

| | 1 Year | | 5 Years | | Inception(b) | |

| Davenport Balanced Income Fund (a) | 5.40% | | 3.03% | | 4.56% | |

| Russell 1000® Value Index | 14.44% | | 6.23% | | 8.45% | |

| Blended 60% Russell 1000® Value Index /40% Bloomberg Intermediate Government/Credit Bond Index | 9.70% | | 4.56% | | 5.78% | |

| Morningstar US Fund Moderate Allocation | 10.53% | | 6.89% | | 7.47% | |

| | | | | | | |

| (a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | Commencement of operations was December 31, 2015. |

Davenport Balanced Income Fund (the “Fund”) is not sponsored, endorsed, sold or promoted by Morningstar, Inc. or any of its affiliates (all such entities, collectively, “Morningstar Entities”). The Morningstar Entities make no representation or warranty, express or implied, to the owners of the Fund or any member of the public regarding the advisability of investing in equity securities generally or in the Fund in particular or the ability of the Fund to track general equity market performance. THE MORNINGSTAR ENTITIES DO NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF THE FUND OR ANY DATA INCLUDED THEREIN AND MORNINGSTAR ENTITIES SHALL HAVE NO LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN.

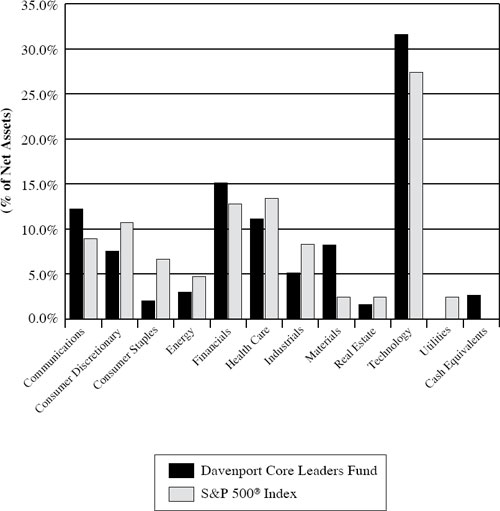

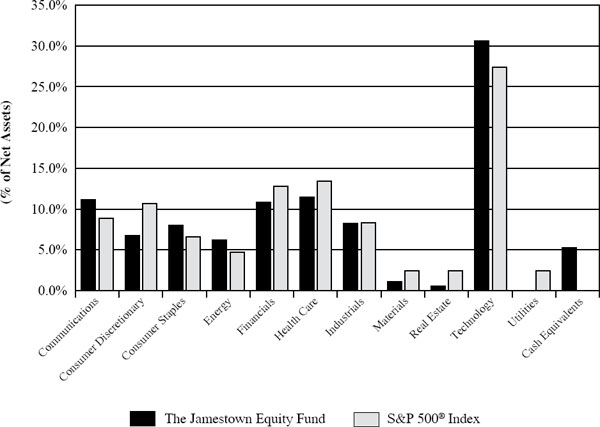

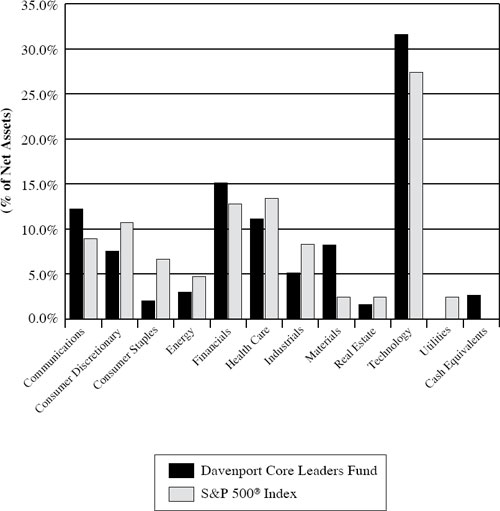

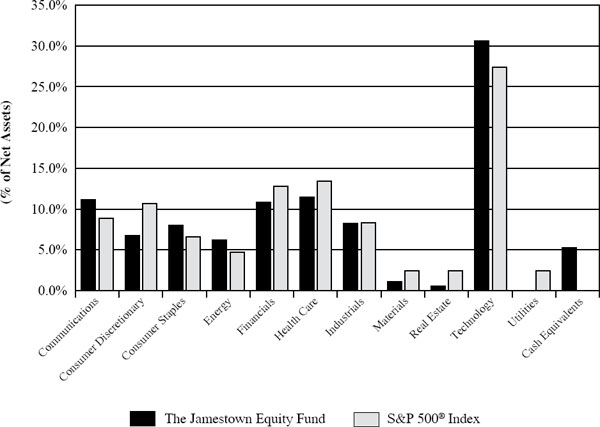

| DAVENPORT CORE LEADERS FUND |

| PORTFOLIO INFORMATION |

| September 30, 2023 (Unaudited) |

Sector Allocation vs. the S&P 500® Index

Top 10 Holdings

| Security Description | % of Net Assets |

| Microsoft Corporation | 4.5% |

| Adobe, Inc. | 4.1% |

| Amazon.com, Inc. | 4.1% |

| Meta Platforms, Inc. - Class A | 3.8% |

| Danaher Corporation | 3.6% |

| Alphabet, Inc. - Classes A and C | 3.5% |

| Brookfield Corporation | 3.3% |

| Markel Group, Inc. | 3.1% |

| Accenture plc - Class A | 3.0% |

| Walt Disney Company (The) | 3.0% |

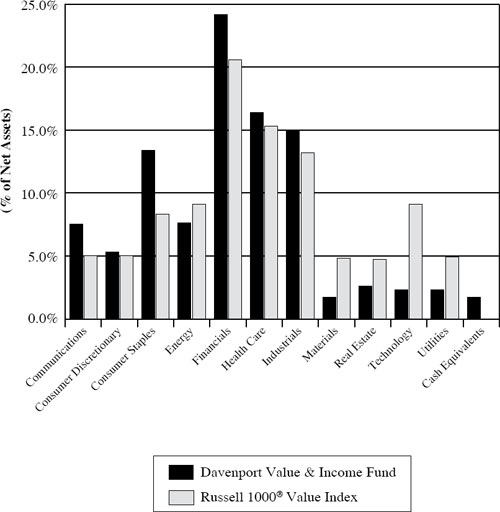

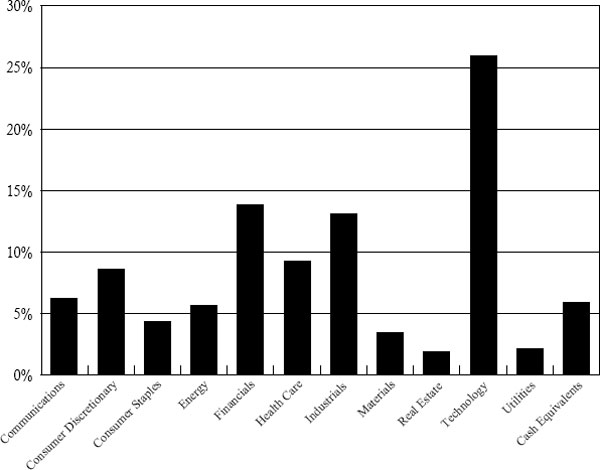

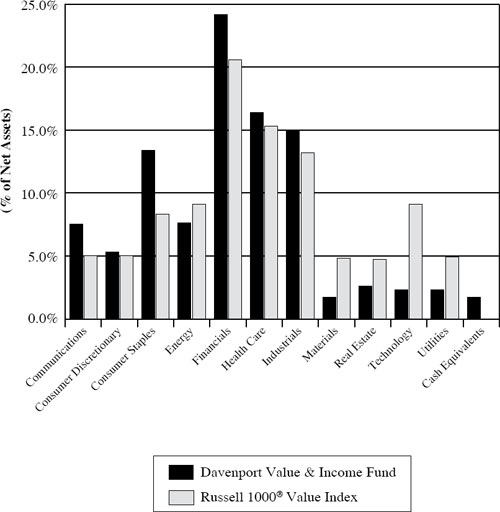

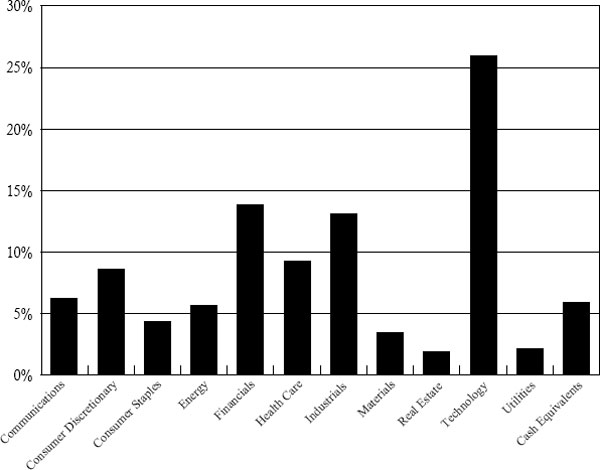

| DAVENPORT VALUE & INCOME FUND |

| PORTFOLIO INFORMATION |

| September 30, 2023 (Unaudited) |

Sector Allocation vs. the Russell 1000® Value Index

Top 10 Holdings

| Security Description | % of Net Assets |

| Fairfax Financial Holdings Ltd. | 4.3% |

| Johnson & Johnson | 4.1% |

| Berkshire Hathaway, Inc. - Class B | 3.6% |

| Markel Group, Inc. | 3.4% |

| Chevron Corporation | 3.3% |

| Comcast Corporation - Class A | 3.2% |

| Watsco, Inc. | 2.9% |

| Alphabet, Inc. - Class A | 2.9% |

| Bristol-Myers Squibb Company | 2.8% |

| McDonald’s Corporation | 2.8% |

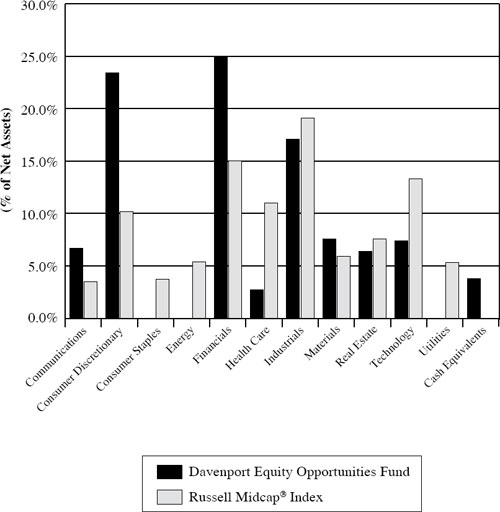

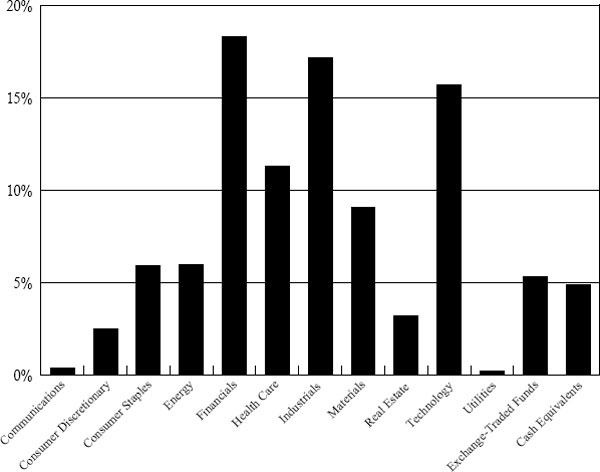

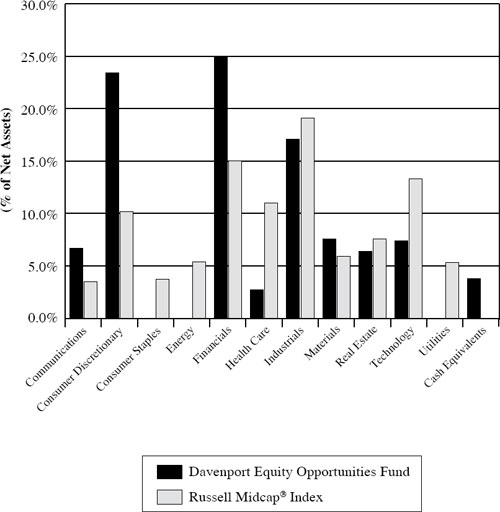

| DAVENPORT EQUITY OPPORTUNITIES FUND |

| PORTFOLIO INFORMATION |

| September 30, 2023 (Unaudited) |

Sector Allocation vs. the Russell Midcap® Index

Top 10 Holdings

| Security Description | % of Net Assets |

| Markel Group, Inc. | 6.8% |

| Fairfax Financial Holdings Ltd. | 6.7% |

| Take-Two Interactive Software, Inc. | 5.8% |

| DraftKings, Inc. - Class A | 4.3% |

| Live Nation Entertainment, Inc. | 4.2% |

| Martin Marietta Materials, Inc. | 4.2% |

| Brookfield Corporation | 4.2% |

| Enovis Corporation | 4.1% |

| Xylem, Inc. | 4.1% |

| Mobileye Global, Inc. - Class A | 3.9% |

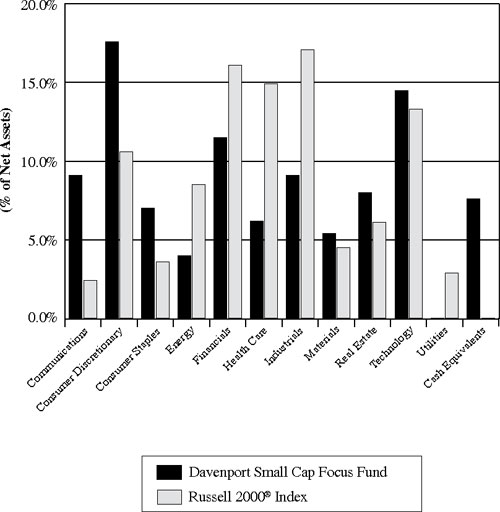

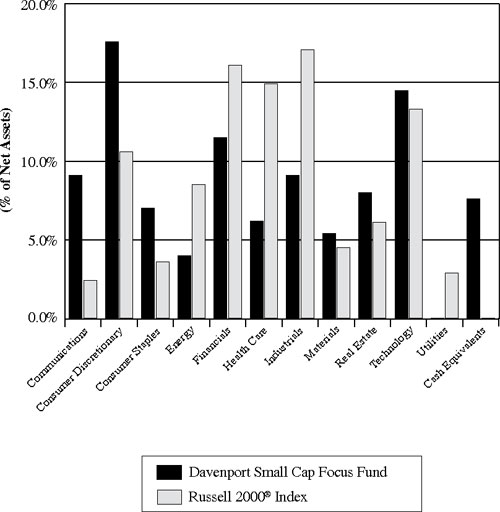

| DAVENPORT SMALL CAP FOCUS FUND |

| PORTFOLIO INFORMATION |

| September 30, 2023 (Unaudited) |

Sector Allocation vs. the Russell 2000® Index

Top 10 Holdings

| Security Description | % of Net Assets |

| Monarch Casino & Resort, Inc. | 5.5% |

| Verra Mobility Corporation | 5.2% |

| J & J Snack Foods Corporation | 4.7% |

| Kinsale Capital Group, Inc. | 4.6% |

| Janus International Group, Inc. | 4.4% |

| Stewart Information Services Corporation | 4.2% |

| Enovis Corporation | 4.2% |

| NewMarket Corporation | 3.9% |

| Alight, Inc. - Class A | 3.9% |

| Liberty Latin America Ltd. - Class C | 3.7% |

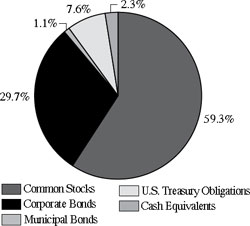

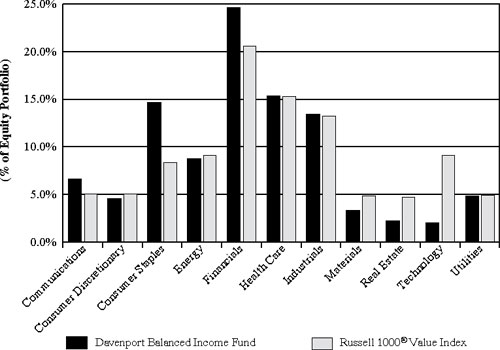

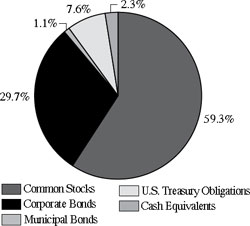

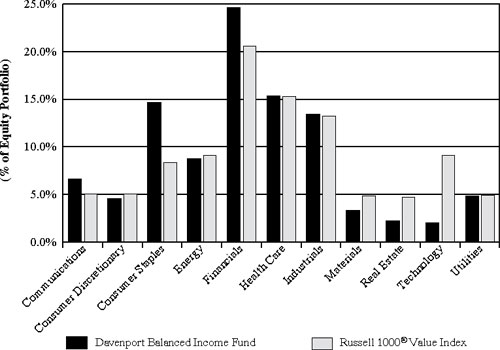

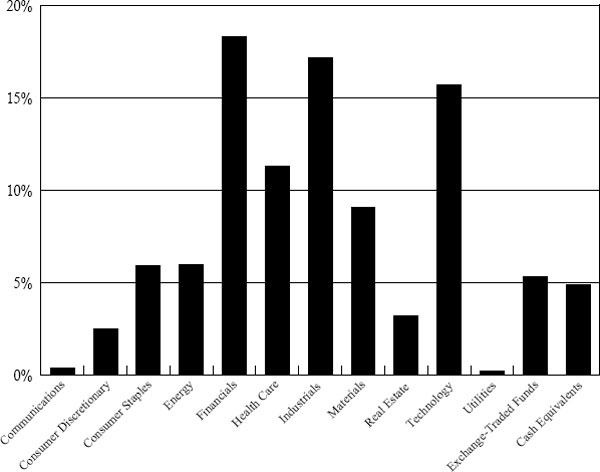

| DAVENPORT BALANCED INCOME FUND |

| PORTFOLIO INFORMATION |

| September 30, 2023 (Unaudited) |

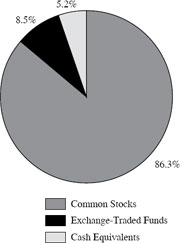

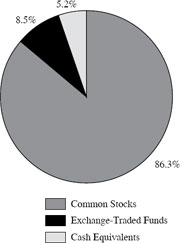

Asset Allocation (% of Net Assets)

| Ten Largest Equity Holdings | % of Net Assets |

| Fairfax Financial Holdings Ltd. | 2.3% |

| Johnson & Johnson | 2.1% |

| Berkshire Hathaway, Inc. - Class B | 1.9% |

| Chevron Corporation | 1.8% |

| Perrigo Company plc | 1.7% |

| Markel Group, Inc. | 1.7% |

| Comcast Corporation - Class A | 1.7% |

| Watsco, Inc. | 1.6% |

| L3Harris Technologies, Inc. | 1.5% |

| United Parcel Service, Inc. - Class B | 1.5% |

Equity Sector Concentration vs. the Russell 1000® Value Index (59.3% of Net Assets)

| Bond Portfolio (38.4% of Net Assets) |

| Number of Fixed-Income Securities | 29 |

| Average Quality | A2/A |

| Effective Maturity | 3.92 yrs. |

| Average Effective Duration | 3.22 yrs. |

| Sector Breakdown | % of Bond

Portfolio |

| Communications | 10.6% |

| Consumer Discretionary | 6.6% |

| Consumer Staples | 6.1% |

| Energy | 12.1% |

| Financials | 20.4% |

| Health Care | 6.4% |

| Industrials | 2.4% |

| Technology | 9.1% |

| Utilities | 3.6% |

| Municipal | 2.9% |

| U.S. Treasury | 19.8% |

| Credit Quality | Composite Quality |

| AAA | 0.0% |

| AA | 25.6% |

| A | 36.0% |

| BBB | 35.6% |

| Not Classified | 2.8% |

| DAVENPORT CORE LEADERS FUND |

| SCHEDULE OF INVESTMENTS |

| September 30, 2023 (Unaudited) |

| COMMON STOCKS — 97.4% | | Shares | | | Value | |

| Communications — 12.2% | | | | | | | | |

| Alphabet, Inc. - Class A (a) | | | 152,184 | | | $ | 19,914,798 | |

| Alphabet, Inc. - Class C (a) | | | 54,011 | | | | 7,121,350 | |

| Electronic Arts, Inc. | | | 122,808 | | | | 14,786,083 | |

| Meta Platforms, Inc. - Class A (a) | | | 99,374 | | | | 29,833,069 | |

| Walt Disney Company (The) (a) | | | 288,548 | | | | 23,386,816 | |

| | | | | | | | 95,042,116 | |

| Consumer Discretionary — 7.5% | | | | | | | | |

| Amazon.com, Inc. (a) | | | 252,107 | | | | 32,047,842 | |

| Home Depot, Inc. (The) | | | 33,721 | | | | 10,189,137 | |

| TJX Companies, Inc. (The) | | | 185,553 | | | | 16,491,951 | |

| | | | | | | | 58,728,930 | |

| Consumer Staples — 2.0% | | | | | | | | |

| Costco Wholesale Corporation | | | 27,728 | | | | 15,665,211 | |

| | | | | | | | | |

| Energy — 3.0% | | | | | | | | |

| EOG Resources, Inc. | | | 181,511 | | | | 23,008,334 | |

| | | | | | | | | |

| Financials — 15.1% | | | | | | | | |

| Aon plc - Class A | | | 58,461 | | | | 18,954,226 | |

| Berkshire Hathaway, Inc. - Class B (a) | | | 65,098 | | | | 22,803,829 | |

| Brookfield Corporation | | | 810,074 | | | | 25,331,014 | |

| Intercontinental Exchange, Inc. | | | 102,761 | | | | 11,305,765 | |

| JPMorgan Chase & Company | | | 100,544 | | | | 14,580,891 | |

| Markel Group, Inc. (a) | | | 16,434 | | | | 24,198,901 | |

| | | | | | | | 117,174,626 | |

| Health Care — 11.1% | | | | | | | | |

| Abbott Laboratories | | | 176,019 | | | | 17,047,440 | |

| Danaher Corporation | | | 113,506 | | | | 28,160,839 | |

| Novo Nordisk A/S - ADR | | | 133,060 | | | | 12,100,476 | |

| UnitedHealth Group, Inc. | | | 41,680 | | | | 21,014,639 | |

| Vertex Pharmaceuticals, Inc. (a) | | | 22,500 | | | | 7,824,150 | |

| | | | | | | | 86,147,544 | |

| Industrials — 5.1% | | | | | | | | |

| Honeywell International, Inc. | | | 83,096 | | | | 15,351,155 | |

| Republic Services, Inc. | | | 77,394 | | | | 11,029,419 | |

| Union Pacific Corporation | | | 65,445 | | | | 13,326,565 | |

| | | | | | | | 39,707,139 | |

| Materials — 8.2% | | | | | | | | |

| Air Products & Chemicals, Inc. | | | 76,240 | | | | 21,606,416 | |

| Martin Marietta Materials, Inc. | | | 55,714 | | | | 22,869,483 | |

| Sherwin-Williams Company (The) | | | 74,351 | | | | 18,963,222 | |

| | | | | | | | 63,439,121 | |

| DAVENPORT CORE LEADERS FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 97.4% (Continued) | | Shares | | | Value | |

| Real Estate — 1.6% | | | | | | | | |

| American Tower Corporation | | | 78,030 | | | $ | 12,832,034 | |

| | | | | | | | | |

| Technology — 31.6% | | | | | | | | |

| Accenture plc - Class A | | | 77,160 | | | | 23,696,608 | |

| Adobe, Inc. (a) | | | 62,967 | | | | 32,106,873 | |

| Advanced Micro Devices, Inc. (a) | | | 106,419 | | | | 10,942,002 | |

| Analog Devices, Inc. | | | 60,210 | | | | 10,542,169 | |

| Apple, Inc. | | | 99,394 | | | | 17,017,247 | |

| Broadcom, Inc. | | | 22,544 | | | | 18,724,595 | |

| Intuit, Inc. | | | 40,741 | | | | 20,816,207 | |

| Mastercard, Inc. - Class A | | | 58,798 | | | | 23,278,716 | |

| Microsoft Corporation | | | 111,175 | | | | 35,103,506 | |

| NVIDIA Corporation | | | 25,724 | | | | 11,189,683 | |

| Palo Alto Networks, Inc. (a) | | | 33,083 | | | | 7,755,978 | |

| ServiceNow, Inc. (a) | | | 29,625 | | | | 16,559,190 | |

| Visa, Inc. - Class A | | | 76,346 | | | | 17,560,343 | |

| | | | | | | | 245,293,117 | |

| | | | | | | | | |

| Total Common Stocks (Cost $500,342,311) | | | | | | $ | 757,038,172 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 3.1% | | Shares | | | Value | |

| First American Treasury Obligations Fund - Class X, 5.26% (b) (Cost $24,084,381) | | | 24,084,381 | | | $ | 24,084,381 | |

| | | | | | | | | |

| Total Investments at Value — 100.5% (Cost $524,426,692) | | | | | | $ | 781,122,553 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (0.5%) | | | | | | | (4,083,850 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 777,038,703 | |

ADR - American Depositary Receipt.

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of September 30, 2023. |

See accompanying notes to financial statements.

| DAVENPORT VALUE & INCOME FUND |

| SCHEDULE OF INVESTMENTS |

| September 30, 2023 (Unaudited) |

| COMMON STOCKS — 98.3% | | Shares | | | Value | |

| Communications — 7.5% | | | | | | | | |

| Alphabet, Inc. - Class A (a) | | | 173,065 | | | $ | 22,647,286 | |

| Comcast Corporation - Class A | | | 558,833 | | | | 24,778,655 | |

| Walt Disney Company (The) (a) | | | 140,690 | | | | 11,402,924 | |

| | | | | | | | 58,828,865 | |

| Consumer Discretionary — 5.3% | | | | | | | | |

| Lowe’s Companies, Inc. | | | 93,313 | | | | 19,394,174 | |

| McDonald’s Corporation | | | 83,188 | | | | 21,915,047 | |

| | | | | | | | 41,309,221 | |

| Consumer Staples — 13.4% | | | | | | | | |

| Anheuser-Busch InBev S.A./N.V. - ADR | | | 213,025 | | | | 11,780,283 | |

| Bunge Ltd. | | | 128,040 | | | | 13,860,330 | |

| Diageo plc - ADR | | | 118,039 | | | | 17,609,058 | |

| Keurig Dr Pepper, Inc. | | | 499,931 | | | | 15,782,822 | |

| Philip Morris International, Inc. | | | 202,763 | | | | 18,771,798 | |

| Target Corporation | | | 105,859 | | | | 11,704,830 | |

| Walmart, Inc. | | | 95,166 | | | | 15,219,898 | |

| | | | | | | | 104,729,019 | |

| Energy — 7.6% | | | | | | | | |

| Chevron Corporation | | | 152,979 | | | | 25,795,319 | |

| Coterra Energy, Inc. | | | 712,573 | | | | 19,275,100 | |

| Enbridge, Inc. | | | 433,180 | | | | 14,377,244 | |

| | | | | | | | 59,447,663 | |

| Financials — 24.2% | | | | | | | | |

| Berkshire Hathaway, Inc. - Class B (a) | | | 79,977 | | | | 28,015,943 | |

| Brookfield Asset Management Ltd. - Class A | | | 433,924 | | | | 14,467,026 | |

| Brookfield Corporation | | | 641,892 | | | | 20,071,963 | |

| Chubb Ltd. | | | 64,576 | | | | 13,443,432 | |

| Fairfax Financial Holdings Ltd. | | | 40,880 | | | | 33,478,676 | |

| Fidelity National Financial, Inc. | | | 455,613 | | | | 18,816,817 | |

| JPMorgan Chase & Company | | | 138,488 | | | | 20,083,530 | |

| Markel Group, Inc. (a) | | | 17,818 | | | | 26,236,827 | |

| Wells Fargo & Company | | | 340,290 | | | | 13,904,249 | |

| | | | | | | | 188,518,463 | |

| Health Care — 16.4% | | | | | | | | |

| Bristol-Myers Squibb Company | | | 378,295 | | | | 21,956,242 | |

| Elevance Health, Inc. | | | 50,279 | | | | 21,892,482 | |

| Johnson & Johnson | | | 206,662 | | | | 32,187,607 | |

| Medtronic plc | | | 265,903 | | | | 20,836,159 | |

| Perrigo Company plc | | | 524,618 | | | | 16,761,545 | |

| Sanofi - ADR | | | 271,069 | | | | 14,540,141 | |

| | | | | | | | 128,174,176 | |

| DAVENPORT VALUE & INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 98.3% (Continued) | | Shares | | | Value | |

| Industrials — 15.0% | | | | | | | | |

| Deere & Company | | | 28,791 | | | $ | 10,865,147 | |

| L3Harris Technologies, Inc. | | | 123,059 | | | | 21,427,033 | |

| Norfolk Southern Corporation | | | 74,214 | | | | 14,614,963 | |

| RTX Corporation | | | 96,410 | | | | 6,938,628 | |

| TE Connectivity Ltd. | | | 151,609 | | | | 18,728,260 | |

| United Parcel Service, Inc. - Class B | | | 138,010 | | | | 21,511,619 | |

| Watsco, Inc. | | | 60,103 | | | | 22,702,105 | |

| | | | | | | | 116,787,755 | |

| Materials — 1.7% | | | | | | | | |

| Avery Dennison Corporation | | | 70,386 | | | | 12,857,410 | |

| | | | | | | | | |

| Real Estate — 2.6% | | | | | | | | |

| Lamar Advertising Company - Class A | | | 244,472 | | | | 20,406,078 | |

| | | | | | | | | |

| Technology — 2.3% | | | | | | | | |

| Oracle Corporation | | | 167,781 | | | | 17,771,363 | |

| | | | | | | | | |

| Utilities — 2.3% | | | | | | | | |

| NextEra Energy, Inc. | | | 306,392 | | | | 17,553,198 | |

| | | | | | | | | |

| Total Common Stocks (Cost $631,456,745) | | | | | | $ | 766,383,211 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 1.6% | | Shares | | | Value | |

| First American Treasury Obligations Fund - Class X, 5.26% (b) (Cost $12,853,327) | | | 12,853,327 | | | $ | 12,853,327 | |

| | | | | | | | | |

| Total Investments at Value — 99.9% (Cost $644,310,072) | | | | | | $ | 779,236,538 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.1% | | | | | | | 562,299 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 779,798,837 | |

ADR - American Depositary Receipt.

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of September 30, 2023. |

See accompanying notes to financial statements.

| DAVENPORT EQUITY OPPORTUNITIES FUND |

| SCHEDULE OF INVESTMENTS |

| September 30, 2023 (Unaudited) |

| COMMON STOCKS — 96.2% | | Shares | | | Value | |

| Communications — 6.7% | | | | | | | | |

| DISH Network Corporation - Class A (a) | | | 1,175,074 | | | $ | 6,885,933 | |

| Take-Two Interactive Software, Inc. (a) | | | 285,371 | | | | 40,063,235 | |

| | | | | | | | 46,949,168 | |

| Consumer Discretionary — 23.4% | | | | | | | | |

| Cannae Holdings, Inc. (a) | | | 1,018,253 | | | | 18,980,236 | |

| DraftKings, Inc. - Class A (a) | | | 1,026,321 | | | | 30,214,890 | |

| Etsy, Inc. (a) | | | 166,245 | | | | 10,736,102 | |

| Live Nation Entertainment, Inc. (a) | | | 354,332 | | | | 29,423,729 | |

| Mobileye Global, Inc. - Class A (a) | | | 657,103 | | | | 27,302,630 | |

| O’Reilly Automotive, Inc. (a) | | | 28,684 | | | | 26,069,740 | |

| Pool Corporation | | | 56,370 | | | | 20,073,357 | |

| | | | | | | | 162,800,684 | |

| Financials — 24.9% | | | | | | | | |

| Allstate Corporation (The) | | | 128,504 | | | | 14,316,630 | |

| Brookfield Asset Management Ltd. - Class A | | | 450,370 | | | | 15,015,336 | |

| Brookfield Corporation | | | 924,295 | | | | 28,902,705 | |

| Fairfax Financial Holdings Ltd. | | | 57,306 | | | | 46,930,749 | |

| Fidelity National Financial, Inc. | | | 516,896 | | | | 21,347,805 | |

| Markel Group, Inc. (a) | | | 31,953 | | | | 47,050,473 | |

| | | | | | | | 173,563,698 | |

| Health Care — 2.7% | | | | | | | | |

| Avantor, Inc. (a) | | | 881,893 | | | | 18,590,304 | |

| | | | | | | | | |

| Industrials — 17.1% | | | | | | | | |

| Enovis Corporation (a) | | | 542,842 | | | | 28,624,059 | |

| ESAB Corporation | | | 209,524 | | | | 14,712,775 | |

| J.B. Hunt Transport Services, Inc. | | | 110,027 | | | | 20,742,290 | |

| Watsco, Inc. | | | 69,061 | | | | 26,085,721 | |

| Xylem, Inc. | | | 314,023 | | | | 28,585,514 | |

| | | | | | | | 118,750,359 | |

| Materials — 7.6% | | | | | | | | |

| Martin Marietta Materials, Inc. | | | 71,088 | | | | 29,180,202 | |

| Sherwin-Williams Company (The) | | | 91,710 | | | | 23,390,636 | |

| | | | | | | | 52,570,838 | |

| Real Estate — 6.4% | | | | | | | | |

| American Tower Corporation | | | 143,420 | | | | 23,585,419 | |

| Lamar Advertising Company - Class A | | | 248,061 | | | | 20,705,652 | |

| | | | | | | | 44,291,071 | |

| DAVENPORT EQUITY OPPORTUNITIES FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 96.2% (Continued) | | Shares | | | Value | |

| Technology — 7.4% | | | | | | | | |

| Alight, Inc. - Class A (a) | | | 3,087,455 | | | $ | 21,890,056 | |

| Autodesk, Inc. (a) | | | 72,539 | | | | 15,009,044 | |

| PTC, Inc. (a) | | | 105,431 | | | | 14,937,464 | |

| | | | | | | | 51,836,564 | |

| | | | | | | | | |

| Total Common Stocks (Cost $578,045,893) | | | | | | $ | 669,352,686 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 3.8% | | Shares | | | Value | |

| First American Treasury Obligations Fund - Class X, 5.26% (b) (Cost $26,358,340) | | | 26,358,340 | | | $ | 26,358,340 | |

| | | | | | | | | |

| Total Investments at Value — 100.0% (Cost $604,404,233) | | | | | | $ | 695,711,026 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (0.0%) (c) | | | | | | | (41,345 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 695,669,681 | |

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of September 30, 2023. |

| (c) | Percentage rounds to less than 0.1%. |

See accompanying notes to financial statements.

| DAVENPORT SMALL CAP FOCUS FUND |

| SCHEDULE OF INVESTMENTS |

| September 30, 2023 (Unaudited) |

| COMMON STOCKS — 89.6% | | Shares | | | Value | |

| Communications — 9.1% | | | | | | | | |

| Cable One, Inc. | | | 27,251 | | | $ | 16,776,805 | |

| Liberty Latin America Ltd. - Class C (a) | | | 2,975,275 | | | | 24,278,244 | |

| Shenandoah Telecommunications Company | | | 871,793 | | | | 17,967,654 | |

| | | | | | | | 59,022,703 | |

| Consumer Discretionary — 17.6% | | | | | | | | |

| Cannae Holdings, Inc. (a) | | | 1,115,479 | | | | 20,792,528 | |

| DraftKings Inc. - Class A (a) | | | 617,006 | | | | 18,164,657 | |

| Leslie’s, Inc. (a) | | | 3,000,000 | | | | 16,980,000 | |

| Monarch Casino & Resort, Inc. | | | 576,298 | | | | 35,788,106 | |

| OneSpaWorld Holdings Ltd. (a) | | | 1,983,340 | | | | 22,253,075 | |

| | | | | | | | 113,978,366 | |

| Consumer Staples — 7.0% | | | | | | | | |

| J & J Snack Foods Corporation | | | 184,874 | | | | 30,254,630 | |

| Seaboard Corporation | | | 4,035 | | | | 15,143,355 | |

| | | | | | | | 45,397,985 | |

| Energy — 4.0% | | | | | | | | |

| California Resources Corporation | | | 150,000 | | | | 8,401,500 | |

| Peyto Exploration & Development Corporation | | | 1,719,782 | | | | 17,352,601 | |

| | | | | | | | 25,754,101 | |

| Financials — 11.5% | | | | | | | | |

| Diamond Hill Investment Group, Inc. | | | 102,730 | | | | 17,317,196 | |

| Kinsale Capital Group, Inc. | | | 72,834 | | | | 30,162,744 | |

| Stewart Information Services Corporation | | | 622,446 | | | | 27,263,135 | |

| | | | | | | | 74,743,075 | |

| Health Care — 3.4% | | | | | | | | |

| Perrigo Company plc | | | 693,996 | | | | 22,173,172 | |

| | | | | | | | | |

| Industrials — 9.1% | | | | | | | | |

| Enovis Corporation (a) | | | 514,566 | | | | 27,133,065 | |

| ESAB Corporation | | | 320,511 | | | | 22,506,283 | |

| Teekay Tankers Ltd. - Class A | | | 219,292 | | | | 9,129,126 | |

| | | | | | | | 58,768,474 | |