UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05686

AIM Investment Securities Funds (Invesco Investment Securities Funds)

(Exact name of registrant as specified in charter)

11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Address of principal executive offices) (Zip code)

Sheri Morris 11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Name and address of agent for service)

Registrant’s telephone number, including area code: (713) 626-1919

Date of fiscal year end: 2/28

Date of reporting period: 2/28/2022

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

(a) The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

(b) Not applicable.

| | |

| | |

| Annual Report to Shareholders | | February 28, 2022 |

Invesco Corporate Bond Fund

Nasdaq:

A: ACCBX ∎ C: ACCEX ∎ R: ACCZX ∎ Y: ACCHX ∎ R5: ACCWX ∎ R6: ICBFX

Management’s Discussion of Fund Performance

| | | | |

| |

Performance summary | |

For the fiscal year ended February 28, 2022, Class A shares of Invesco Corporate Bond Fund (the Fund), at net asset value (NAV), underperformed the Bloomberg U.S. Credit Index, the Fund’s broad market/style-specific benchmark. Your Fund’s long-term performance appears later in this report. | | | | |

| |

Fund vs. Indexes | |

Total returns, 2/28/21 to 2/28/22, at net asset value (NAV). Performance shown does not include applicable contingent deferred sales charges (CDSC) or front-end sales charges, which would have reduced performance. | |

Class A Shares | | | -3.79 | % |

Class C Shares | | | -4.60 | |

Class R Shares | | | -4.16 | |

Class Y Shares | | | -3.66 | |

Class R5 Shares | | | -3.47 | |

Class R6 Shares | | | -3.54 | |

Bloomberg U.S. Credit Index▼ (Broad Market/Style-Specific Index) | | | -3.25 | |

Lipper BBB Rated Funds Index∎ (Peer Group Index) | | | -3.02 | |

| |

Source(s): ▼RIMES Technologies Corp.; ∎Lipper Inc. | | | | |

Market conditions and your Fund

In the first quarter of 2021, rising 10-year US Treasury yields increased significantly to 1.74%,1 its highest level since January 2020, reflecting higher inflation expectations. Largely a result of economic optimism, government bond yields rose globally during the first quarter of 2021 as investors began to price in higher levels of economic growth and inflation moving towards a post-pandemic world. On the fiscal front, another stimulus package was signed into law and COVID-19 vaccine approvals and administration ramped up. 30-year Treasury yields moved higher by 0.75% to end the quarter at 2.41%.1 Importantly, short-term rates, which are closely tied to Federal Reserve policy, were quite steady. Two-year US Treasury yields moved up just 0.05% to 0.16%.1

Fixed income markets settled down in the second quarter of 2021, posting gains and rebounding from negative performance experienced during the early part of the fiscal year due to a sharply rising interest rate environment. Despite higher volatility stemming from inflation concerns and the potential for rising interest rates, investors remained optimistic about the strength of the economic recovery after the Bureau of Economic Analysis reported that US gross domestic product grew at a 6.4% annualized rate for the first quarter of 2021.2 As the US COVID-19 vaccination rate neared the 50% threshold, consumers resumed pre-pandemic activities in the third quarter of 2021 and economically sensitive areas such as the consumer discretionary and industrials sectors began to recover.

In the fourth quarter of 2021, concerns about inflation heightened as US inflation rose to 7%,3 its highest level in nearly 40 years. Though the US Federal Reserve (the Fed) left policy rates unchanged in the quarter, the Fed indicated its accommodative policies were coming to an end in 2022

through a willingness to raise interest rates to combat inflation and the announced reduction of its monthly bond purchase program. Additionally, US interest rate moves and inflation risk significantly affected fixed income valuations during the quarter. The two-year Treasury yield rose moderately from 0.27% to 0.73%, while the 10-year increased slightly from 1.48% to 1.52%.1 The yield curve, as measured by the yield differential between two- and 10-year Treasuries flattened during the quarter. Despite the withdrawal of central bank support and coronavirus variants raising concerns about economic reopenings and the resumption of travel, we believe investors are cautiously optimistic and expect corporate balance sheets to continue to recover meaningfully in 2022. At the beginning of 2022, geopolitical and economic tensions between Ukraine and Russia culminated with the latter invading Ukraine. World leaders levied sanctions against Russia that we believe will likely have material effects on its fixed income markets, particularly sovereign debt, corporates and levels of liquidity. Regarding inflation concerns, political uncertainty should give central banks a reason to be cautious, with the Fed unlikely to raise rates by more than 0.25% at the March Federal Open Market Committee meeting, whereas before this crisis, a 0.50% increase was increasingly likely.

The Fund, at NAV, generated negative returns for the fiscal year and underperformed its broad market/style-specific benchmark, the Bloomberg U.S. Credit Index.

Security selection in investment-grade corporate bonds was the most notable contributor to the Fund’s relative performance. Security selection in the consumer non-cyclical, electric and banking sub-sectors contributed significantly to the Fund’s relative performance. Overweights to the communications, energy and consumer cyclical sub-sectors were the primary detractors from the Fund’s relative performance. Additionally,

underperformance from Treasuries and other government-related assets was driven by a flattening of the yield curve, signaling inflation concerns. The Fund’s duration relative to the broad market/style-specific benchmark contributed to relative performance.

The Fund may use active duration and yield curve positioning for risk management and for generating excess return versus its broad market/style-specific benchmark. Duration measures a portfolio’s price sensitivity to interest rate changes. Yield curve positioning refers to actively emphasizing particular points (maturities) along the yield curve with favorable risk-return expectations. During the fiscal year, the duration of the portfolio was maintained in line with the broad market/ style-specific benchmark, on average and the timing of changes and the degree of variance from the Fund’s broad market/style-specific benchmark had a small negative effect on relative performance. Buying and selling US Treasury futures was an important tool used for the management of interest rate risk and to maintain our targeted portfolio duration during the fiscal year.

Part of the Fund’s strategy in seeking to manage credit and currency risk during the fiscal year entailed purchasing and selling credit and currency derivatives. We sought to manage credit risk by purchasing and selling credit default swaps at various points throughout the fiscal year. Management of currency risk was carried out via currency-forwards and options on an as-needed basis and we believe it was effective in managing the currency positioning within the Fund during the fiscal year.

We wish to remind you that the Fund is subject to interest rate risk, meaning when interest rates rise, the value of fixed income securities tends to fall. The risk may be greater in the current market environment because interest rates are near historic lows. The degree to which the value of fixed income securities may decline due to rising interest rates may vary depending on the speed and magnitude of the increase in interest rates, as well as individual security characteristics, such as price, maturity, duration and coupon and market forces, such as supply and demand for similar securities. We are monitoring interest rates and the market economic and geopolitical factors that may impact the direction, speed and magnitude of changes to interest rates across the maturity spectrum, including the potential impact of monetary policy changes by the Fed and certain foreign central banks. If interest rates rise or fall faster than expected, markets may experience increased volatility, which may affect the value and/or liquidity of certain of the Fund’s investments.

Thank you for investing in Invesco Corporate Bond Fund and for sharing our long-term investment horizon.

| | |

| 2 | | Invesco Corporate Bond Fund |

| 1 | Source: US Department of the Treasury |

| 2 | Source: US Bureau of Economic Analysis |

| 3 | Source: US Bureau of Labor Statistics |

Portfolio manager(s):

Matthew Brill

Chuck Burge

Michael Hyman

Niklas Nordenfelt

Todd Schomberg

The views and opinions expressed in management’s discussion of Fund performance are those of Invesco Advisers, Inc. and its affiliates. These views and opinions are subject to change at any time based on factors such as market and economic conditions. These views and opinions may not be relied upon as investment advice or recommendations, or as an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but Invesco Advisers, Inc. makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

See important Fund and, if applicable, index disclosures later in this report.

| | |

| 3 | | Invesco Corporate Bond Fund |

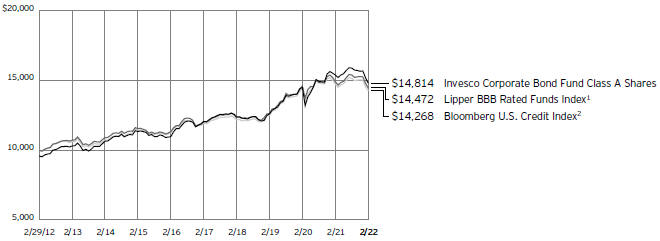

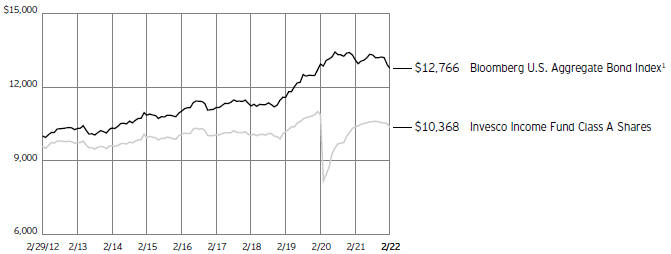

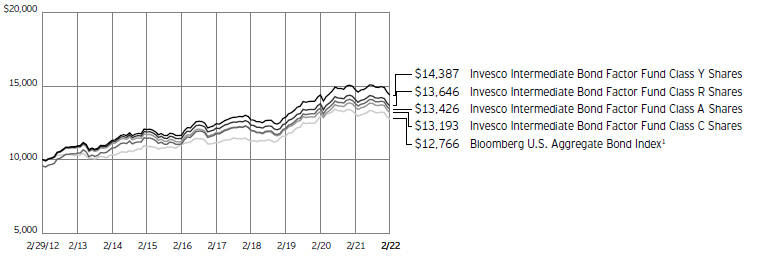

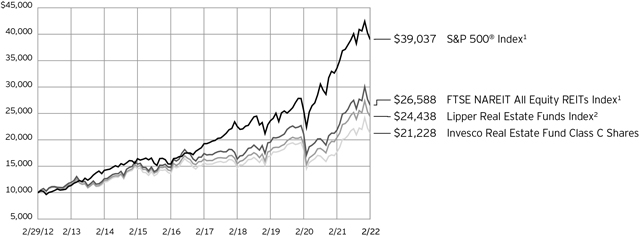

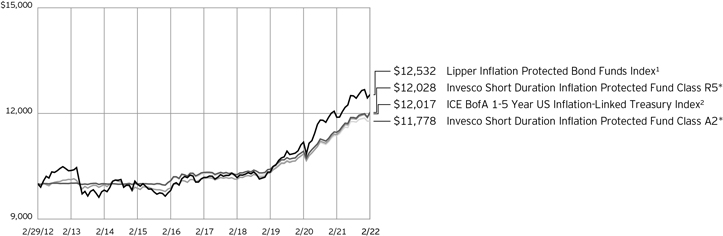

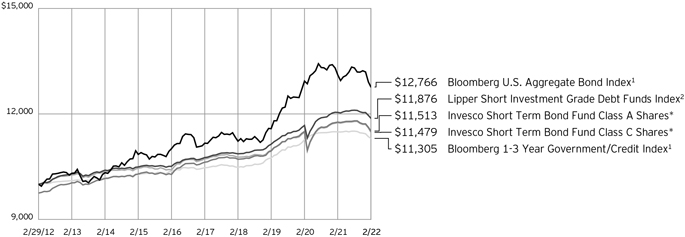

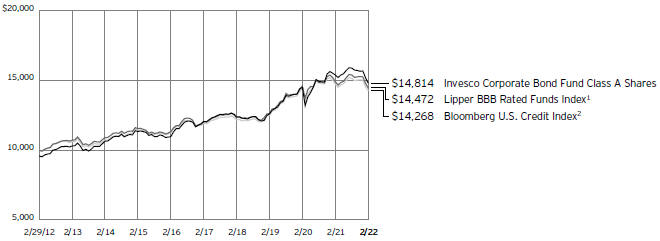

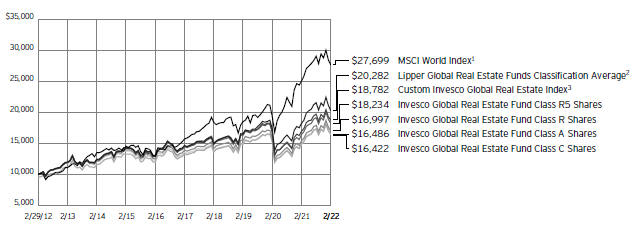

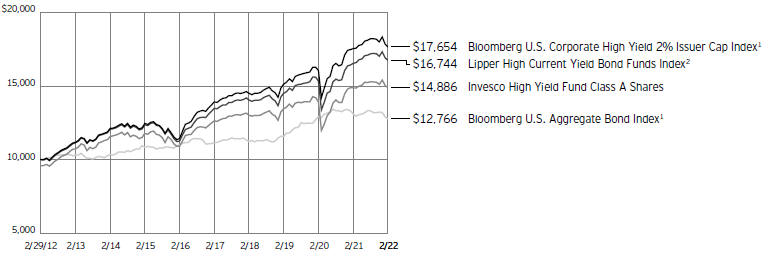

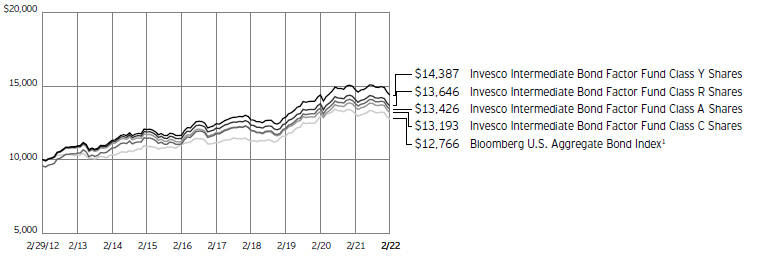

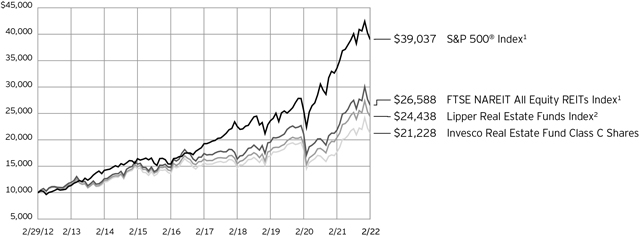

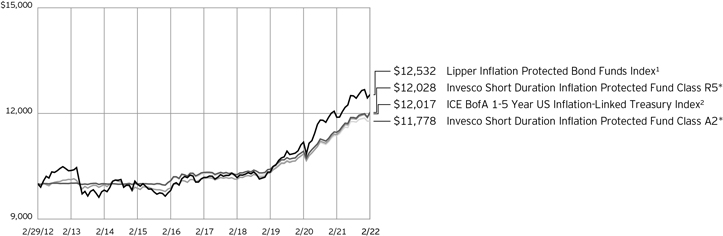

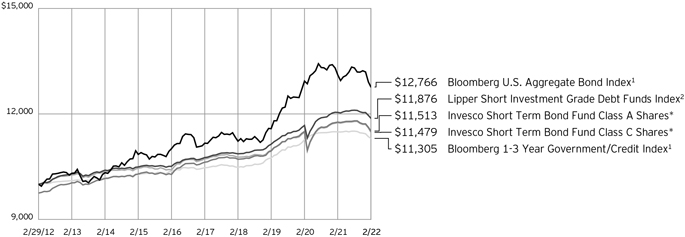

Your Fund’s Long-Term Performance

Results of a $10,000 Investment – Oldest Share Class(es)

Fund and index data from 2/29/12

| 2 | Source: RIMES Technologies Corp. |

Past performance cannot guarantee future results.

The data shown in the chart include reinvested distributions, applicable sales charges and Fund expenses including management

fees. Index results include reinvested dividends, but they do not reflect sales charges. Performance of the peer group, if applicable, reflects Fund expenses and management fees; performance of a market index does

not. Performance shown in the chart does not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

| | |

| 4 | | Invesco Corporate Bond Fund |

| | | | |

| |

Average Annual Total Returns | |

As of 2/28/22, including maximum applicable sales charges | |

Class A Shares | | | | |

Inception (9/23/71) | | | 6.81 | % |

10 Years | | | 4.01 | |

5 Years | | | 3.30 | |

1 Year | | | -7.92 | |

Class C Shares | | | | |

Inception (8/30/93) | | | 5.08 | % |

10 Years | | | 3.86 | |

5 Years | | | 3.42 | |

1 Year | | | -5.51 | |

Class R Shares | | | | |

Inception (6/6/11) | | | 4.41 | % |

10 Years | | | 4.20 | |

5 Years | | | 3.94 | |

1 Year | | | -4.16 | |

Class Y Shares | | | | |

Inception (8/12/05) | | | 5.26 | % |

10 Years | | | 4.72 | |

5 Years | | | 4.45 | |

1 Year | | | -3.66 | |

Class R5 Shares | | | | |

Inception (6/1/10) | | | 5.53 | % |

10 Years | | | 4.85 | |

5 Years | | | 4.55 | |

1 Year | | | -3.47 | |

Class R6 Shares | | | | |

10 Years | | | 4.87 | % |

5 Years | | | 4.59 | |

1 Year | | | -3.54 | |

Effective June 1, 2010, Class A, Class C and Class I shares of the predecessor fund, Van Kampen Corporate Bond Fund, advised by Van Kampen Asset Management were reorganized into Class A, Class C and Class Y shares, respectively, of Invesco Van Kampen Corporate Bond Fund (renamed Invesco Corporate Bond Fund). Returns shown above, prior to June 1, 2010, for Class A, Class C and Class Y shares are those for Class A, Class C and Class I shares of the predecessor fund. Share class returns will differ from the predecessor fund because of different expenses.

Class R6 shares incepted on September 24, 2012. Performance shown prior to that date is that of the Fund’s Class A shares at net asset value and includes the 12b-1 fees applicable to Class A shares.

The performance data quoted represent past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ performance for the most recent month-end performance. Performance figures reflect reinvested distributions, changes in net asset value and the effect of the maximum sales charge unless otherwise stated. Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares. Investment return and principal value will

fluctuate so that you may have a gain or loss when you sell shares.

Class A share performance reflects the maximum 4.25% sales charge, and Class C share performance reflects the applicable contingent deferred sales charge (CDSC) for the period involved. The CDSC on Class C shares is 1% for the first year after purchase. Class R, Class Y, Class R5 and Class R6 shares do not have a front-end sales charge or a CDSC; therefore, performance is at net asset value.

The performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses.

Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had the adviser not waived fees and/or reimbursed expenses currently or in the past, returns would have been lower. See current prospectus for more information.

| | |

| 5 | | Invesco Corporate Bond Fund |

Supplemental Information

Invesco Corporate Bond Fund’s primary investment objective is to seek to provide current income with preservation of capital. Capital appreciation is a secondary objective that is sought only when consistent with the Fund’s primary investment objective.

| ∎ | Unless otherwise stated, information presented in this report is as of February 28, 2022, and is based on total net assets. |

| ∎ | Unless otherwise noted, all data is provided by Invesco. |

| ∎ | To access your Fund’s reports/prospectus, visit invesco.com/fundreports. |

About indexes used in this report

| ∎ | The Bloomberg U.S. Credit Index is an unmanaged index considered representative of publicly issued, SEC-registered US corporate and specified foreign debentures and secured notes. |

| ∎ | The Lipper BBB Rated Funds Index is an unmanaged index considered representative of BBB-rated funds tracked by Lipper. |

| ∎ | The Fund is not managed to track the performance of any particular index, including the index(es) described here, and consequently, the performance of the Fund may deviate significantly from the performance of the index(es). |

| ∎ | A direct investment cannot be made in an index. Unless otherwise indicated, index results include reinvested dividends, and they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses; performance of a market index does not. |

|

|

This report must be accompanied or preceded by a currently effective Fund prospectus, which contains more complete information, including sales charges and expenses. Investors should read it carefully before investing. |

|

| NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE |

| | |

| 6 | | Invesco Corporate Bond Fund |

Fund Information

| | | | | |

| Portfolio Composition | |

| By security type | | % of total net assets |

| |

U.S. Dollar Denominated Bonds & Notes | | | | 88.74 | % |

| |

U.S. Treasury Securities | | | | 5.02 | |

| |

Preferred Stocks | | | | 2.78 | |

| |

Security Types Each Less Than 1% of Portfolio | | | | 1.70 | |

| |

Money Market Funds Plus Other Assets Less Liabilities | | | | 1.76 | |

| |

| Top Five Debt Issuers* | | | | | |

| | | % of total net assets |

| |

1. U.S. Treasury | | | | 5.02 | % |

| |

2. Goldman Sachs Group, Inc. (The) | | | | 2.21 | |

| |

3. Bank of America Corp. | | | | 2.09 | |

| |

4. Kinder Morgan, Inc. | | | | 1.82 | |

| |

5. Citigroup, Inc. | | | | 1.46 | |

The Fund’s holdings are subject to change, and there is no assurance that the Fund will continue to hold any particular security.

| * | Excluding money market fund holdings, if any. |

Data presented here are as of February 28, 2022.

| | |

| 7 | | Invesco Corporate Bond Fund |

Schedule of Investments(a)

February 28, 2022

| | | | | | |

| | | Principal Amount | | | Value |

U.S. Dollar Denominated Bonds & Notes-88.74% |

Advertising-0.32% | | | | | | |

Interpublic Group of Cos., Inc. (The), 4.75%, 03/30/2030 | | $ | 4,332,000 | | | $ 4,810,409 |

Lamar Media Corp., | | | | | | |

3.75%, 02/15/2028 | | | 2,800,000 | | | 2,695,000 |

4.00%, 02/15/2030 | | | 1,319,000 | | | 1,271,819 |

3.63%, 01/15/2031 | | | 523,000 | | | 491,764 |

| | | | | | | 9,268,992 |

|

Aerospace & Defense-0.78% |

Boeing Co. (The), | | | | | | |

2.75%, 02/01/2026(b) | | | 3,569,000 | | | 3,573,484 |

2.20%, 02/04/2026 | | | 4,977,000 | | | 4,858,827 |

5.15%, 05/01/2030 | | | 4,617,000 | | | 5,102,839 |

5.81%, 05/01/2050 | | | 7,411,000 | | | 8,817,551 |

TransDigm UK Holdings PLC, 6.88%, 05/15/2026 | | | 301,000 | | | 311,210 |

TransDigm, Inc., 6.38%, 06/15/2026 | | | 141,000 | | | 143,911 |

| | | | | | | 22,807,822 |

|

Agricultural Products-0.27% |

Bunge Ltd. Finance Corp., 2.75%, 05/14/2031(b) | | | 8,227,000 | | | 7,837,211 |

|

Airlines-2.00% |

American Airlines Pass-Through Trust, | | | | | | |

Series 2016-3, Class A, 3.00%, 10/15/2028 | | | 3,257,897 | | | 3,234,196 |

Series 2017-2, Class AA, 3.35%, 10/15/2029 | | | 267,489 | | | 270,236 |

Series 2021-1, Class B, 3.95%, 07/11/2030 | | | 2,985,000 | | | 2,856,665 |

Series 2021-1, Class A, 2.88%, 07/11/2034 | | | 3,875,000 | | | 3,744,249 |

American Airlines, Inc./AAdvantage Loyalty IP Ltd., | | | | | | |

5.50%, 04/20/2026(c) | | | 1,236,000 | | | 1,266,900 |

5.75%, 04/20/2029(c) | | | 753,000 | | | 771,125 |

British Airways Pass-Through Trust (United Kingdom), | | | | | | |

Series 2019-1, Class AA, 3.30%, 12/15/2032(c) | | | 3,466,615 | | | 3,480,528 |

Series 2021-1, Class A, 2.90%, 03/15/2035(c) | | | 1,943,814 | | | 1,909,334 |

Delta Air Lines Pass-Through Trust, | | | | | | |

Series 2019-1, Class A, 3.40%, 04/25/2024 | | | 3,090,000 | | | 3,109,924 |

Series 2020-1, Class AA, 2.00%, 06/10/2028 | | | 2,671,757 | | | 2,556,602 |

Delta Air Lines, Inc., 7.38%, 01/15/2026(b) | | | 425,000 | | | 477,479 |

Delta Air Lines, Inc./SkyMiles IP Ltd., | | | | | | |

4.50%, 10/20/2025(c) | | | 3,686,775 | | | 3,786,235 |

4.75%, 10/20/2028(c) | | | 11,003,675 | | | 11,485,943 |

| | | | | | |

| | | Principal Amount | | | Value |

|

Airlines-(continued) |

United Airlines Pass-Through Trust, | | | | | | |

Series 2014-2, Class B, 4.63%, 09/03/2022 | | $ | 1,081,901 | | | $ 1,094,800 |

Series 2016-1, Class B, 3.65%, 01/07/2026 | | | 1,744,759 | | | 1,722,274 |

Series 2020-1, Class A, 5.88%, 10/15/2027 | | | 5,285,428 | | | 5,589,726 |

Series 2018-1, Class A, 3.70%, 03/01/2030 | | | 289,375 | | | 286,566 |

Series 2018-1, Class AA, 3.50%, 03/01/2030 | | | 3,467,345 | | | 3,525,197 |

Series 2019-1, Class A, 4.55%, 08/25/2031 | | | 1,679,658 | | | 1,791,548 |

Series 2019-1, Class AA, 4.15%, 08/25/2031 | | | 3,116,844 | | | 3,347,734 |

United Airlines, Inc., | | | | | | |

4.38%, 04/15/2026(c) | | | 883,000 | | | 881,852 |

4.63%, 04/15/2029(c) | | | 1,090,000 | | | 1,065,257 |

| | | | | | | 58,254,370 |

|

Alternative Carriers-0.05% |

Level 3 Financing, Inc., 3.75%, 07/15/2029(b)(c) | | | 1,285,000 | | | 1,148,096 |

Lumen Technologies, Inc.,

Series P, 7.60%, 09/15/2039 | | | 459,000 | | | 404,781 |

| | | | | | | 1,552,877 |

|

Apparel Retail-0.03% |

Gap, Inc. (The), 3.63%, 10/01/2029(b)(c) | | | 851,000 | | | 772,283 |

|

Apparel, Accessories & Luxury Goods-0.02% |

Kontoor Brands, Inc., 4.13%, 11/15/2029(c) | | | 666,000 | | | 628,844 |

|

Application Software-0.31%salesforce.com, inc., |

2.90%, 07/15/2051 | | | 6,414,000 | | | 5,829,296 |

3.05%, 07/15/2061 | | | 3,631,000 | | | 3,289,295 |

| | | | | | | 9,118,591 |

|

Asset Management & Custody Banks-1.26% |

Affiliated Managers Group, Inc., 4.25%, 02/15/2024 | | | 3,852,000 | | | 4,019,151 |

Ameriprise Financial, Inc., 3.00%, 04/02/2025 | | | 3,007,000 | | | 3,063,757 |

Apollo Management Holdings L.P., 2.65%, 06/05/2030(c) | | | 229,000 | | | 221,554 |

Ares Capital Corp., | | | | | | |

2.88%, 06/15/2028(b) | | | 4,312,000 | | | 3,996,901 |

3.20%, 11/15/2031 | | | 400,000 | | | 361,852 |

Bank of New York Mellon Corp. (The), Series I, 3.75%(b)(d)(e) | | | 5,832,000 | | | 5,440,323 |

Blackstone Secured Lending Fund, | | | | | | |

2.75%, 09/16/2026 | | | 7,027,000 | | | 6,748,284 |

2.13%, 02/15/2027(c) | | | 4,127,000 | | | 3,822,781 |

2.85%, 09/30/2028(c) | | | 2,399,000 | | | 2,211,839 |

CI Financial Corp. (Canada), 3.20%, 12/17/2030 | | | 4,309,000 | | | 4,062,638 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 8 | | Invesco Corporate Bond Fund |

| | | | | | |

| | | Principal Amount | | | Value |

Asset Management & Custody Banks-(continued) |

FS KKR Capital Corp., 1.65%, 10/12/2024 | | $ | 2,555,000 | | | $ 2,451,137 |

Hercules Capital, Inc., 2.63%, 09/16/2026 | | | 375,000 | | | 357,325 |

| | | | | | | 36,757,542 |

|

Auto Parts & Equipment-0.36% |

Avis Budget Car Rental LLC/Avis Budget Finance, Inc., | | | | | | |

4.75%, 04/01/2028(b)(c) | | | 4,969,000 | | | 4,727,208 |

5.38%, 03/01/2029(b)(c) | | | 1,884,000 | | | 1,856,578 |

Clarios Global L.P./Clarios US Finance Co., 8.50%, 05/15/2027(c) | | | 178,000 | | | 185,743 |

Dana Financing Luxembourg S.a.r.l., 5.75%, 04/15/2025(c) | | | 132,000 | | | 133,820 |

Dana, Inc., 5.38%, 11/15/2027 | | | 221,000 | | | 225,697 |

Nemak S.A.B. de C.V. (Mexico), 3.63%, 06/28/2031(c) | | | 3,204,000 | | | 2,901,927 |

NESCO Holdings II, Inc., 5.50%, 04/15/2029(c) | | | 506,000 | | | 487,048 |

| | | | | | | 10,518,021 |

|

Automobile Manufacturers-1.38% |

Allison Transmission, Inc., 3.75%, 01/30/2031(c) | | | 1,046,000 | | | 972,853 |

American Honda Finance Corp., 1.30%, 09/09/2026(b) | | | 2,820,000 | | | 2,700,424 |

Ford Motor Co., | | | | | | |

3.25%, 02/12/2032(b) | | | 755,000 | | | 713,558 |

4.75%, 01/15/2043 | | | 345,000 | | | 334,315 |

Ford Motor Credit Co. LLC, | | | | | | |

4.39%, 01/08/2026 | | | 795,000 | | | 811,957 |

2.70%, 08/10/2026 | | | 2,367,000 | | | 2,269,361 |

2.90%, 02/10/2029 | | | 334,000 | | | 312,457 |

5.11%, 05/03/2029 | | | 450,000 | | | 475,130 |

4.00%, 11/13/2030 | | | 332,000 | | | 329,902 |

General Motors Financial Co., Inc., Series B, 6.50%(d)(e) | | | 200,000 | | | 206,800 |

Hyundai Capital America, | | | | | | |

4.30%, 02/01/2024(b)(c) | | | 11,151,000 | | | 11,525,191 |

2.65%, 02/10/2025(c) | | | 3,379,000 | | | 3,376,404 |

2.00%, 06/15/2028(c) | | | 4,246,000 | | | 3,951,667 |

J.B. Poindexter & Co., Inc., 7.13%, 04/15/2026(c) | | | 426,000 | | | 442,614 |

Nissan Motor Acceptance Co. LLC, 1.85%, 09/16/2026(c) | | | 10,446,000 | | | 9,800,990 |

Volkswagen Group of America Finance LLC (Germany), 1.63%, 11/24/2027(b)(c) | | | 2,251,000 | | | 2,120,806 |

| | | | | | | 40,344,429 |

|

Automotive Retail-0.49% |

Asbury Automotive Group, Inc., | | | | | | |

4.50%, 03/01/2028 | | | 137,000 | | | 134,885 |

4.63%, 11/15/2029(b)(c) | | | 658,000 | | | 642,771 |

5.00%, 02/15/2032(c) | | | 1,739,000 | | | 1,690,690 |

Group 1 Automotive, Inc., 4.00%, 08/15/2028(c) | | | 1,053,000 | | | 1,016,645 |

Lithia Motors, Inc., 3.88%, 06/01/2029(b)(c) | | | 4,401,000 | | | 4,351,049 |

| | | | | | |

| | | Principal Amount | | | Value |

Automotive Retail-(continued) |

Sonic Automotive, Inc., | | | | | | |

4.63%, 11/15/2029(c) | | $ | 3,122,000 | | | $ 2,968,538 |

4.88%, 11/15/2031(c) | | | 3,629,000 | | | 3,435,266 |

| | | | | | | 14,239,844 |

|

Biotechnology-0.18% |

AbbVie, Inc., 4.88%, 11/14/2048 | | | 1,844,000 | | | 2,122,656 |

Amgen, Inc., | | | | | | |

2.00%, 01/15/2032(b) | | | 450,000 | | | 416,819 |

3.15%, 02/21/2040 | | | 2,803,000 | | | 2,623,496 |

| | | | | | | 5,162,971 |

|

Brewers-0.26% |

Anadolu Efes Biracilik ve Malt Sanayii A.S. (Turkey), 3.38%, 06/29/2028(c) | | | 2,337,000 | | | 2,155,018 |

Anheuser-Busch InBev Worldwide, Inc. (Belgium), | | | | | | |

8.00%, 11/15/2039 | | | 2,130,000 | | | 3,207,769 |

4.35%, 06/01/2040 | | | 1,943,000 | | | 2,075,667 |

| | | | | | | 7,438,454 |

|

Broadcasting-0.02% |

Gray Television, Inc., 7.00%, 05/15/2027(c) | | | 444,000 | | | 467,563 |

|

Building Products-0.09% |

Carrier Global Corp., 2.72%, 02/15/2030 | | | 155,000 | | | 150,923 |

Johnson Controls International PLC/Tyco Fire & Security Finance S.C.A., 2.00%, 09/16/2031 | | | 1,733,000 | | | 1,581,521 |

Owens Corning, 4.30%, 07/15/2047 | | | 250,000 | | | 264,586 |

Standard Industries, Inc., 5.00%, 02/15/2027(c) | | | 508,000 | | | 511,823 |

| | | | | | | 2,508,853 |

|

Cable & Satellite-2.43% |

CCO Holdings LLC/CCO Holdings Capital Corp., | | | | | | |

5.00%, 02/01/2028(c) | | | 187,000 | | | 188,360 |

4.75%, 03/01/2030(c) | | | 607,000 | | | 597,136 |

4.50%, 08/15/2030(c) | | | 676,000 | | | 652,185 |

4.50%, 05/01/2032 | | | 809,000 | | | 769,889 |

4.50%, 06/01/2033(c) | | | 1,952,000 | | | 1,832,879 |

4.25%, 01/15/2034(c) | | | 217,000 | | | 199,872 |

Charter Communications Operating LLC/Charter Communications Operating Capital Corp., | | | | | | |

4.91%, 07/23/2025 | | | 4,413,000 | | | 4,680,479 |

5.38%, 04/01/2038 | | | 249,000 | | | 260,819 |

3.50%, 06/01/2041 | | | 3,353,000 | | | 2,901,911 |

3.50%, 03/01/2042 | | | 4,172,000 | | | 3,602,202 |

5.75%, 04/01/2048 | | | 2,146,000 | | | 2,376,564 |

3.90%, 06/01/2052 | | | 3,628,000 | | | 3,161,435 |

6.83%, 10/23/2055 | | | 3,796,000 | | | 4,764,631 |

3.85%, 04/01/2061 | | | 4,400,000 | | | 3,662,198 |

4.40%, 12/01/2061 | | | 1,787,000 | | | 1,595,731 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 9 | | Invesco Corporate Bond Fund |

| | | | | | |

| | | Principal Amount | | | Value |

Cable & Satellite-(continued) |

Comcast Corp., | | | | | | |

3.45%, 02/01/2050(b) | | $ | 3,674,000 | | | $ 3,435,515 |

2.80%, 01/15/2051 | | | 7,562,000 | | | 6,328,300 |

2.89%, 11/01/2051(c) | | | 4,849,000 | | | 4,214,078 |

2.94%, 11/01/2056(c) | | | 4,622,000 | | | 3,897,977 |

2.99%, 11/01/2063(c) | | | 3,277,000 | | | 2,734,401 |

Cox Communications, Inc., | | | | | | |

2.60%, 06/15/2031(c) | | | 2,926,000 | | | 2,757,676 |

3.60%, 06/15/2051(c) | | | 7,372,000 | | | 6,841,282 |

CSC Holdings LLC, | | | | | | |

6.50%, 02/01/2029(c) | | | 727,000 | | | 737,233 |

5.75%, 01/15/2030(c) | | | 817,000 | | | 723,878 |

4.50%, 11/15/2031(c) | | | 264,000 | | | 240,610 |

5.00%, 11/15/2031(c) | | | 200,000 | | | 166,736 |

DISH DBS Corp., 7.75%, 07/01/2026 | | | 130,000 | | | 131,800 |

Gray Escrow II, Inc., 5.38%, 11/15/2031(c) | | | 391,000 | | | 376,944 |

Sirius XM Radio, Inc., | | | | | | |

4.00%, 07/15/2028(c) | | | 412,000 | | | 396,797 |

4.13%, 07/01/2030(c) | | | 1,025,000 | | | 970,444 |

3.88%, 09/01/2031(b)(c) | | | 5,085,000 | | | 4,692,616 |

Virgin Media Finance PLC (United Kingdom), 5.00%, 07/15/2030(c) | | | 296,000 | | | 280,355 |

Virgin Media Secured Finance PLC (United Kingdom), 5.50%, 05/15/2029(c) | | | 200,000 | | | 200,133 |

VZ Secured Financing B.V. (Netherlands), 5.00%, 01/15/2032(b)(c) | | | 549,000 | | | 520,998 |

| | | | | | | 70,894,064 |

|

Casinos & Gaming-0.30% |

Boyne USA, Inc., 4.75%, 05/15/2029(c) | | | 1,715,000 | | | 1,687,380 |

DraftKings, Inc., Conv., 0.00%, 03/15/2028(c)(f) | | | 5,450,000 | | | 4,133,825 |

Everi Holdings, Inc., 5.00%, 07/15/2029(c) | | | 521,000 | | | 511,563 |

MGM Resorts International, | | | | | | |

7.75%, 03/15/2022 | | | 301,000 | | | 301,974 |

6.00%, 03/15/2023 | | | 559,000 | | | 576,575 |

Mohegan Gaming & Entertainment, 8.00%, 02/01/2026(c) | | | 513,000 | | | 518,745 |

Scientific Games International, Inc., 8.25%, 03/15/2026(c) | | | 592,000 | | | 618,954 |

Wynn Resorts Finance LLC/Wynn Resorts Capital Corp., 5.13%, 10/01/2029(c) | | | 424,000 | | | 408,607 |

| | | | | | | 8,757,623 |

|

Computer & Electronics Retail-0.57% |

Dell International LLC/EMC Corp., | | | | | | |

4.00%, 07/15/2024 | | | 2,698,000 | | | 2,801,324 |

6.02%, 06/15/2026 | | | 3,627,000 | | | 4,050,031 |

4.90%, 10/01/2026 | | | 1,587,000 | | | 1,720,207 |

8.35%, 07/15/2046 | | | 940,000 | | | 1,428,371 |

3.45%, 12/15/2051(c) | | | 2,595,000 | | | 2,201,795 |

Leidos, Inc., 2.30%, 02/15/2031 | | | 4,736,000 | | | 4,272,369 |

| | | | | | | 16,474,097 |

| | | | | | |

| | | Principal Amount | | | Value |

Construction & Engineering-0.04% |

AECOM, 5.13%, 03/15/2027 | | $ | 133,000 | | | $ 136,543 |

Great Lakes Dredge & Dock Corp., 5.25%, 06/01/2029(b)(c) | | | 520,000 | | | 521,347 |

Howard Midstream Energy Partners LLC, 6.75%, 01/15/2027(c) | | | 536,000 | | | 532,698 |

| | | | | | | 1,190,588 |

|

Construction Machinery & Heavy Trucks-0.01% |

Wabtec Corp., 4.95%, 09/15/2028 | | | 209,000 | | | 227,421 |

|

Construction Materials-0.11% |

CRH America Finance, Inc. (Ireland), 3.95%,

04/04/2028(b)(c) | | | 3,123,000 | | | 3,321,148 |

|

Consumer Finance-0.56% |

Ally Financial, Inc., | | | | | | |

5.13%, 09/30/2024 | | | 434,000 | | | 460,286 |

4.63%, 03/30/2025(b) | | | 1,303,000 | | | 1,370,085 |

2.20%, 11/02/2028(b) | | | 2,473,000 | | | 2,314,280 |

Series C, 4.70%(d)(e) | | | 2,073,000 | | | 1,927,890 |

FirstCash, Inc., 5.63%, 01/01/2030(b)(c) | | | 362,000 | | | 360,058 |

Navient Corp., | | | | | | |

7.25%, 09/25/2023(b) | | | 624,000 | | | 655,340 |

5.00%, 03/15/2027 | | | 486,000 | | | 469,741 |

5.63%, 08/01/2033 | | | 221,000 | | | 192,680 |

OneMain Finance Corp., | | | | | | |

6.88%, 03/15/2025 | | | 300,000 | | | 320,499 |

7.13%, 03/15/2026 | | | 735,000 | | | 797,648 |

3.88%, 09/15/2028 | | | 3,554,000 | | | 3,297,490 |

5.38%, 11/15/2029 | | | 519,000 | | | 522,892 |

Synchrony Financial, 4.50%, 07/23/2025 | | | 3,412,000 | | | 3,583,649 |

| | | | | | | 16,272,538 |

|

Copper-0.14% |

Freeport-McMoRan, Inc., | | | | | | |

5.00%, 09/01/2027 | | | 2,626,000 | | | 2,708,273 |

4.38%, 08/01/2028 | | | 506,000 | | | 513,185 |

5.40%, 11/14/2034(b) | | | 826,000 | | | 929,489 |

| | | | | | | 4,150,947 |

|

Data Processing & Outsourced Services-0.31% |

Block, Inc., 3.50%,

06/01/2031(b)(c) | | | 3,167,000 | | | 2,978,817 |

Clarivate Science Holdings Corp., | | | | | | |

3.88%, 07/01/2028(c) | | | 3,254,000 | | | 3,079,830 |

4.88%, 07/01/2029(b)(c) | | | 531,000 | | | 500,659 |

Fidelity National Information Services, Inc., 2.25%, 03/01/2031 | | | 530,000 | | | 483,022 |

PayPal Holdings, Inc., 2.85%, 10/01/2029 | | | 1,917,000 | | | 1,911,762 |

| | | | | | | 8,954,090 |

| | |

Department Stores-0.03% | | | | | | |

Macy’s Retail Holdings LLC, | | | | | | |

5.88%, 04/01/2029(c) | | | 500,000 | | | 511,842 |

4.50%, 12/15/2034 | | | 275,000 | | | 245,163 |

| | | | | | | 757,005 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 10 | | Invesco Corporate Bond Fund |

| | | | | | |

| | | Principal Amount | | | Value |

Distributors-0.19% |

Genuine Parts Co., | | | | | | |

1.88%, 11/01/2030 | | $ | 2,582,000 | | | $ 2,319,568 |

2.75%, 02/01/2032 | | | 3,467,000 | | | 3,320,762 |

| | | | | | | 5,640,330 |

|

Diversified Banks-11.63% |

Africa Finance Corp. (Supranational), 4.38%, 04/17/2026(c) | | | 7,620,000 | | | 7,948,651 |

African Export-Import Bank (The) (Supranational), | | | | | | |

2.63%, 05/17/2026(c) | | | 1,433,000 | | | 1,375,823 |

3.80%, 05/17/2031(c) | | | 1,858,000 | | | 1,810,621 |

Australia & New Zealand Banking Group Ltd. (Australia), 6.75%(b)(c)(d)(e) | | | 3,444,000 | | | 3,747,193 |

Banco do Brasil S.A. (Brazil), 3.25%, 09/30/2026(c) | | | 3,144,000 | | | 3,024,717 |

Banco Mercantil del Norte S.A. (Mexico), | | | | | | |

5.88%(c)(d)(e) | | | 2,475,000 | | | 2,286,900 |

6.63%(c)(d)(e) | | | 2,457,000 | | | 2,261,669 |

Banco Santander S.A. (Spain), | | | | | | |

1.72%, 09/14/2027(d) | | | 3,400,000 | | | 3,216,810 |

2.75%, 12/03/2030 | | | 3,000,000 | | | 2,736,404 |

Bank of America Corp., | | | | | | |

3.86%, 07/23/2024(d) | | | 7,445,000 | | | 7,616,705 |

1.10% (SOFR + 1.05%), 02/04/2028(g) | | | 4,260,000 | | | 4,261,438 |

2.69%, 04/22/2032(d) | | | 6,050,000 | | | 5,824,225 |

2.30%, 07/21/2032(d) | | | 2,970,000 | | | 2,757,755 |

2.57%, 10/20/2032(d) | | | 3,181,000 | | | 3,014,526 |

2.97%, 02/04/2033(d) | | | 3,216,000 | | | 3,153,361 |

2.48%, 09/21/2036(d) | | | 5,040,000 | | | 4,579,716 |

7.75%, 05/14/2038 | | | 2,417,000 | | | 3,500,475 |

2.68%, 06/19/2041(d) | | | 13,021,000 | | | 11,455,321 |

Series AA, 6.10%(b)(d)(e) | | | 5,695,000 | | | 5,996,237 |

Series DD, 6.30%(b)(d)(e) | | | 1,741,000 | | | 1,882,683 |

Series RR, 4.38%(d)(e) | | | 7,381,000 | | | 7,131,522 |

Bank of China Ltd. (China), 5.00%, 11/13/2024(c) | | | 2,850,000 | | | 3,035,891 |

Barclays PLC (United Kingdom), | | | | | | |

2.28%, 11/24/2027(d) | | | 2,551,000 | | | 2,462,245 |

3.33%, 11/24/2042(d) | | | 2,601,000 | | | 2,380,444 |

BBVA Bancomer S.A. (Mexico), 4.38%, 04/10/2024(c) | | | 1,666,000 | | | 1,720,045 |

BNP Paribas S.A. (France), | | | | | | |

2.16%, 09/15/2029(c)(d) | | | 2,248,000 | | | 2,083,271 |

4.38%, 03/01/2033(c)(d) | | | 250,000 | | | 257,679 |

4.63%(b)(c)(d)(e) | | | 5,265,000 | | | 5,017,545 |

BPCE S.A. (France), | | | | | | |

2.05%, 10/19/2027(c)(d) | | | 3,650,000 | | | 3,502,602 |

2.28%, 01/20/2032(c)(d) | | | 3,204,000 | | | 2,911,344 |

| | | | | | |

| | | Principal Amount | | | Value |

Diversified Banks-(continued) |

Citigroup, Inc., | | | | | | |

3.50%, 05/15/2023 | | $ | 3,395,000 | | | $ 3,474,110 |

5.50%, 09/13/2025 | | | 3,836,000 | | | 4,184,198 |

0.74% (SOFR + 0.69%), 01/25/2026(g) | | | 2,067,000 | | | 2,070,272 |

3.11%, 04/08/2026(d) | | | 3,424,000 | | | 3,470,563 |

3.98%, 03/20/2030(d) | | | 3,412,000 | | | 3,593,766 |

4.41%, 03/31/2031(d) | | | 2,787,000 | | | 3,022,163 |

2.57%, 06/03/2031(d) | | | 266,000 | | | 254,264 |

2.56%, 05/01/2032(d) | | | 3,911,000 | | | 3,715,399 |

2.52%, 11/03/2032(d) | | | 2,125,000 | | | 2,003,181 |

3.06%, 01/25/2033(d) | | | 1,789,000 | | | 1,765,286 |

2.90%, 11/03/2042(d) | | | 3,216,000 | | | 2,903,428 |

4.65%, 07/23/2048 | | | 1,693,000 | | | 1,983,528 |

3.88%(d)(e) | | | 6,892,000 | | | 6,581,860 |

Series A, 5.95%(d)(e) | | | 1,192,000 | | | 1,206,900 |

Series V, 4.70%(d)(e) | | | 2,340,000 | | | 2,296,242 |

Citizens Bank N.A., 2.25%, 04/28/2025 | | | 2,836,000 | | | 2,828,117 |

Commonwealth Bank of Australia (Australia), 2.69%, 03/11/2031(c) | | | 3,057,000 | | | 2,855,263 |

Credit Agricole S.A. (France), | | | | | | |

1.91%, 06/16/2026(b)(c)(d) | | | 1,828,000 | | | 1,779,730 |

4.75%(c)(d)(e) | | | 5,718,000 | | | 5,360,625 |

7.88%(b)(c)(d)(e) | | | 2,555,000 | | | 2,729,059 |

Danske Bank A/S (Denmark), 1.55%, 09/10/2027(c)(d) | | | 2,939,000 | | | 2,772,042 |

Federation des Caisses Desjardins du Quebec (Canada), 2.05%, 02/10/2025(c) | | | 4,680,000 | | | 4,620,406 |

HSBC Holdings PLC (United Kingdom), | | | | | | |

1.65%, 04/18/2026(d) | | | 1,970,000 | | | 1,899,966 |

2.25%, 11/22/2027(d) | | | 4,186,000 | | | 4,037,866 |

2.01%, 09/22/2028(d) | | | 5,480,000 | | | 5,146,671 |

2.36%, 08/18/2031(d) | | | 201,000 | | | 184,801 |

2.87%, 11/22/2032(d) | | | 5,727,000 | | | 5,437,479 |

6.00%(d)(e) | | | 3,938,000 | | | 4,046,295 |

ING Groep N.V. (Netherlands), | | | | | | |

3.88%(d)(e) | | | 212,000 | | | 188,415 |

6.88%(c)(d)(e) | | | 1,670,000 | | | 1,677,219 |

JPMorgan Chase & Co., | | | | | | |

1.15% (3 mo. USD LIBOR + 0.89%), 07/23/2024(g) | | | 4,962,000 | | | 5,003,804 |

2.08%, 04/22/2026(d) | | | 4,632,000 | | | 4,565,216 |

3.63%, 12/01/2027 | | | 2,348,000 | | | 2,446,840 |

3.70%, 05/06/2030(d) | | | 3,412,000 | | | 3,549,022 |

2.58%, 04/22/2032(d) | | | 4,087,000 | | | 3,918,960 |

2.96%, 01/25/2033(d) | | | 1,790,000 | | | 1,770,875 |

4.26%, 02/22/2048(d) | | | 1,651,000 | | | 1,812,576 |

Series W, 1.51% (3 mo. USD LIBOR + 1.00%), 05/15/2047(g) | | | 5,505,000 | | | 4,733,199 |

Series V, 3.53% (3 mo. USD LIBOR + 3.32%)(e)(g) | | | 1,768,000 | | | 1,759,160 |

Mitsubishi UFJ Financial Group, Inc. (Japan), | | | | | | |

2.05%, 07/17/2030 | | | 4,387,000 | | | 4,046,182 |

2.49%, 10/13/2032(d) | | | 1,815,000 | | | 1,709,617 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 11 | | Invesco Corporate Bond Fund |

| | | | | | |

| | | Principal Amount | | | Value |

Diversified Banks-(continued) |

Mizuho Financial Group, Inc. (Japan), | | | | | | |

2.20%, 07/10/2031(d) | | $ | 5,865,000 | | | $ 5,436,399 |

2.56%, 09/13/2031 | | | 3,186,000 | | | 2,916,983 |

National Australia Bank Ltd. (Australia), | | | | | | |

2.33%, 08/21/2030(c) | | | 256,000 | | | 233,016 |

2.99%, 05/21/2031(c) | | | 2,367,000 | | | 2,261,603 |

NatWest Group PLC (United Kingdom), 3.50%, 05/15/2023(d) | | | 4,559,000 | | | 4,574,880 |

Nordea Bank Abp (Finland), | | | | | | |

3.75%(b)(c)(d)(e) | | | 1,221,000 | | | 1,059,218 |

6.63%(c)(d)(e) | | | 3,428,000 | | | 3,689,385 |

Royal Bank of Canada (Canada), 0.76% (SOFR + 0.71%), 01/21/2027(g) | | | 6,586,000 | | | 6,596,168 |

Standard Chartered PLC (United Kingdom), | | | | | | |

2.68%, 06/29/2032(c)(d) | | | 3,806,000 | | | 3,512,430 |

3.27%, 02/18/2036(c)(d) | | | 4,512,000 | | | 4,169,679 |

4.30%(c)(d)(e) | | | 5,262,000 | | | 4,709,490 |

7.75%(c)(d)(e) | | | 4,646,000 | | | 4,851,864 |

Sumitomo Mitsui Financial Group, Inc. (Japan), | | | | | | |

1.47%, 07/08/2025 | | | 2,924,000 | | | 2,823,429 |

3.04%, 07/16/2029 | | | 3,934,000 | | | 3,926,223 |

2.14%, 09/23/2030 | | | 6,557,000 | | | 5,982,808 |

Sumitomo Mitsui Trust Bank Ltd. (Japan), 1.35%, 09/16/2026(c) | | | 5,202,000 | | | 4,948,076 |

Turkiye Vakiflar Bankasi T.A.O. (Turkey), 5.50%, 10/01/2026(c) | | | 3,672,000 | | | 3,398,418 |

U.S. Bancorp, | | | | | | |

2.49%, 11/03/2036(d) | | | 6,629,000 | | | 6,208,043 |

3.70%(d)(e) | | | 4,204,000 | | | 3,920,230 |

UniCredit S.p.A. (Italy), | | | | | | |

1.98%, 06/03/2027(c)(d) | | | 3,337,000 | | | 3,114,342 |

3.13%, 06/03/2032(c)(d) | | | 2,828,000 | | | 2,579,906 |

Wells Fargo & Co., | | | | | | |

2.19%, 04/30/2026(d) | | | 1,374,000 | | | 1,356,525 |

4.15%, 01/24/2029 | | | 3,412,000 | | | 3,642,576 |

3.07%, 04/30/2041(d) | | | 1,988,000 | | | 1,850,383 |

5.38%, 11/02/2043 | | | 6,711,000 | | | 8,065,004 |

4.75%, 12/07/2046 | | | 1,746,000 | | | 1,963,795 |

Series BB, 3.90%(d)(e) | | | 2,918,000 | | | 2,810,399 |

Westpac Banking Corp. (Australia), | | | | | | |

2.67%, 11/15/2035(d) | | | 101,000 | | | 91,563 |

3.13%, 11/18/2041 | | | 1,996,000 | | | 1,795,903 |

| | | | | | | 338,847,121 |

|

Diversified Capital Markets-1.37% |

Credit Suisse Group AG (Switzerland), | | | | | | |

4.19%, 04/01/2031(c)(d) | | | 2,792,000 | | | 2,901,957 |

4.50%(b)(c)(d)(e) | | | 4,764,000 | | | 4,212,567 |

5.10%(b)(c)(d)(e) | | | 4,230,000 | | | 3,944,475 |

5.25%(c)(d)(e) | | | 4,357,000 | | | 4,154,182 |

7.13%(c)(d)(e) | | | 3,667,000 | | | 3,718,301 |

7.25%(c)(d)(e) | | | 330,000 | | | 341,600 |

7.50%(c)(d)(e) | | | 5,779,000 | | | 5,894,869 |

Macquarie Bank Ltd. (Australia), 6.13%(c)(d)(e) | | | 5,010,000 | | | 5,064,283 |

| | | | | | |

| | | Principal Amount | | | Value |

Diversified Capital Markets-(continued) |

UBS Group AG (Switzerland), | | | | | | |

3.13%, 08/13/2030(c)(d) | | $ | 7,105,000 | | | $ 7,028,802 |

4.38%(c)(d)(e) | | | 2,932,000 | | | 2,657,125 |

| | | | | | | 39,918,161 |

|

Diversified Metals & Mining-0.74% |

Corp. Nacional del Cobre de Chile (Chile), 3.15%, 01/15/2051(c) | | | 1,214,000 | | | 984,534 |

FMG Resources August 2006 Pty. Ltd. (Australia), 4.38%, 04/01/2031(c) | | | 2,932,000 | | | 2,849,977 |

Rio Tinto Finance USA Ltd. (Australia), 2.75%, 11/02/2051(b) | | | 4,046,000 | | | 3,563,327 |

Teck Resources Ltd. (Canada), | | | | | | |

6.13%, 10/01/2035 | | | 5,021,000 | | | 6,143,637 |

6.25%, 07/15/2041 | | | 6,504,000 | | | 7,875,083 |

| | | | | | | 21,416,558 |

|

Diversified REITs-0.87% |

CubeSmart L.P., | | | | | | |

2.25%, 12/15/2028 | | | 1,053,000 | | | 1,003,599 |

2.50%, 02/15/2032 | | | 2,181,000 | | | 2,044,080 |

iStar, Inc., | | | | | | |

4.75%, 10/01/2024 | | | 828,000 | | | 835,208 |

5.50%, 02/15/2026 | | | 191,000 | | | 195,473 |

Trust Fibra Uno (Mexico), | | | | | | |

5.25%, 12/15/2024(c) | | | 4,124,000 | | | 4,299,435 |

5.25%, 01/30/2026(c) | | | 3,705,000 | | | 3,788,492 |

4.87%, 01/15/2030(c) | | | 3,446,000 | | | 3,417,157 |

6.39%, 01/15/2050(b)(c) | | | 9,390,000 | | | 9,639,023 |

| | | | | | | 25,222,467 |

|

Drug Retail-0.10% |

CVS Pass-Through Trust, | | | | | | |

6.04%, 12/10/2028 | | | 1,044,215 | | | 1,142,897 |

5.77%, 01/10/2033(c) | | | 1,576,398 | | | 1,789,109 |

| | | | | | | 2,932,006 |

|

Education Services-0.24% |

Grand Canyon University, 3.25%, 10/01/2023 | | | 6,960,000 | | | 6,994,800 |

|

Electric Utilities-2.65% |

Alfa Desarrollo S.p.A. (Chile), 4.55%, 09/27/2051(c) | | | 3,117,000 | | | 2,643,045 |

American Electric Power Co., Inc., 3.88%, 02/15/2062(d) | | | 10,567,000 | | | 9,860,984 |

Commonwealth Edison Co., Series 127, 3.20%, 11/15/2049 | | | 3,659,000 | | | 3,462,717 |

Drax Finco PLC (United Kingdom), 6.63%, 11/01/2025(c) | | | 3,016,000 | | | 3,065,100 |

Duke Energy Corp., 3.25%, 01/15/2082(d) | | | 2,648,000 | | | 2,438,552 |

Duke Energy Progress LLC, 2.50%, 08/15/2050 | | | 8,927,000 | | | 7,386,592 |

Electricidad Firme de Mexico Holdings S.A. de C.V. (Mexico), 4.90%, 11/20/2026(c) | | | 1,453,000 | | | 1,418,063 |

Electricite de France S.A. (France), 6.00%, 01/22/2114(c) | | | 6,655,000 | | | 7,438,395 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 12 | | Invesco Corporate Bond Fund |

| | | | | | |

| | | Principal Amount | | | Value |

Electric Utilities-(continued) |

Enel Finance International N.V. (Italy), 2.88%, 07/12/2041(c) | | $ | 3,560,000 | | | $ 3,072,165 |

Eversource Energy, Series R, 1.65%, 08/15/2030 | | | 88,000 | | | 78,134 |

Interconexion Electrica S.A. ESP (Colombia), 3.83%, 11/26/2033(c) | | | 1,241,000 | | | 1,215,106 |

Mercury Chile Holdco LLC (Chile), 6.50%, 01/24/2027(c) | | | 4,362,000 | | | 4,217,051 |

PacifiCorp, 2.90%, 06/15/2052 | | | 4,821,000 | | | 4,247,060 |

Southern Co. (The),

Series B, | | | | | | |

4.00%, 01/15/2051(d) | | | 13,249,000 | | | 12,769,254 |

5.50%, 03/15/2057(b)(d) | | | 10,246,000 | | | 10,118,063 |

Series 21-A, 3.75%, 09/15/2051(d) | | | 2,246,000 | | | 2,094,620 |

Talen Energy Supply LLC, 7.63%, 06/01/2028(c) | | | 587,000 | | | 526,351 |

Vistra Operations Co. LLC, | | | | | | |

5.63%, 02/15/2027(c) | | | 180,000 | | | 184,531 |

5.00%, 07/31/2027(c) | | | 324,000 | | | 326,783 |

4.38%, 05/01/2029(c) | | | 605,000 | | | 587,316 |

| | | | | | | 77,149,882 |

|

Electrical Components & Equipment-0.17% |

Acuity Brands Lighting, Inc., 2.15%, 12/15/2030 | | | 4,891,000 | | | 4,509,614 |

EnerSys, | | | | | | |

5.00%, 04/30/2023(c) | | | 476,000 | | | 483,361 |

4.38%, 12/15/2027(c) | | | 107,000 | | | 106,331 |

| | | | | | | 5,099,306 |

|

Electronic Components-0.89% |

Corning, Inc., 5.45%, 11/15/2079 | | | 21,859,000 | | | 25,293,369 |

Sensata Technologies, Inc., 3.75%, 02/15/2031(c) | | | 541,000 | | | 504,001 |

Tyco Electronics Group S.A. (Switzerland), 2.50%, 02/04/2032 | | | 125,000 | | | 121,517 |

| | | | | | | 25,918,887 |

|

Electronic Equipment & Instruments-0.10% |

Vontier Corp., | | | | | | |

2.40%, 04/01/2028 | | | 200,000 | | | 182,237 |

2.95%, 04/01/2031 | | | 3,138,000 | | | 2,848,833 |

| | | | | | | 3,031,070 |

|

Electronic Manufacturing Services-0.22% |

Jabil, Inc., 3.00%, 01/15/2031 | | | 6,809,000 | | | 6,503,001 |

|

Environmental & Facilities Services-0.22% |

Covanta Holding Corp., | | | | | | |

4.88%, 12/01/2029(c) | | | 3,667,000 | | | 3,513,476 |

5.00%, 09/01/2030 | | | 404,000 | | | 388,729 |

GFL Environmental, Inc. (Canada), 3.50%, 09/01/2028(b)(c) | | | 2,669,000 | | | 2,552,445 |

| | | | | | | 6,454,650 |

|

Fertilizers & Agricultural Chemicals-0.09% |

Consolidated Energy Finance S.A. (Switzerland), 5.63%, 10/15/2028(c) | | | 294,000 | | | 272,112 |

| | | | | | |

| | | Principal Amount | | | Value |

Fertilizers & Agricultural Chemicals-(continued) |

OCI N.V. (Netherlands), 4.63%, 10/15/2025(c) | | $ | 843,000 | | | $ 846,245 |

OCP S.A. (Morocco), 5.13%, 06/23/2051(c) | | | 1,758,000 | | | 1,423,646 |

| | | | | | | 2,542,003 |

|

Financial Exchanges & Data-1.28% |

B3 S.A. - Brasil, Bolsa, Balcao (Brazil), 4.13%, 09/20/2031(c) | | | 5,788,000 | | | 5,216,435 |

Coinbase Global, Inc., | | | | | | |

3.38%, 10/01/2028(c) | | | 1,543,000 | | | 1,408,875 |

3.63%, 10/01/2031(c) | | | 2,000,000 | | | 1,765,000 |

FactSet Research Systems, Inc., | | | | | | |

2.90%, 03/01/2027 | | | 3,009,000 | | | 3,032,055 |

3.45%, 03/01/2032 | | | 3,641,000 | | | 3,661,509 |

| | |

Intercontinental Exchange, Inc., 1.85%, 09/15/2032 | | | 170,000 | | | 151,875 |

Moody’s Corp., | | | | | | |

2.00%, 08/19/2031 | | | 3,102,000 | | | 2,844,847 |

2.75%, 08/19/2041 | | | 3,628,000 | | | 3,147,151 |

5.25%, 07/15/2044 | | | 1,421,000 | | | 1,727,364 |

3.75%, 02/25/2052 | | | 2,721,000 | | | 2,723,458 |

3.10%, 11/29/2061 | | | 6,625,000 | | | 5,615,587 |

MSCI, Inc., | | | | | | |

3.88%, 02/15/2031(b)(c) | | | 1,983,000 | | | 1,977,051 |

3.63%, 11/01/2031(b)(c) | | | 1,992,000 | | | 1,945,148 |

S&P Global, Inc., 1.25%, 08/15/2030(b) | | | 2,285,000 | | | 2,026,824 |

| | | | | | | 37,243,179 |

|

Food Distributors-0.13% |

American Builders & Contractors Supply Co., Inc., | | | | | | |

4.00%, 01/15/2028(c) | | | 512,000 | | | 501,340 |

3.88%, 11/15/2029(c) | | | 3,447,000 | | | 3,245,575 |

| | | | | | | 3,746,915 |

|

Food Retail-0.22% |

Alimentation Couche-Tard, Inc. (Canada), | | | | | | |

3.44%, 05/13/2041(b)(c) | | | 1,481,000 | | | 1,385,076 |

3.63%, 05/13/2051(c) | | | 4,124,000 | | | 3,843,871 |

PetSmart, Inc./PetSmart Finance Corp., 4.75%, 02/15/2028(c) | | | 1,045,000 | | | 1,043,882 |

| | | | | | | 6,272,829 |

|

Health Care Distributors-0.09% |

McKesson Corp., 1.30%, 08/15/2026 | | | 2,866,000 | | | 2,715,834 |

|

Health Care Facilities-0.37% |

Encompass Health Corp., 4.50%, 02/01/2028(b) | | | 506,000 | | | 493,249 |

HCA, Inc., | | | | | | |

5.00%, 03/15/2024 | | | 7,850,000 | | | 8,254,109 |

5.38%, 02/01/2025 | | | 242,000 | | | 256,551 |

5.25%, 04/15/2025 | | | 151,000 | | | 162,197 |

5.88%, 02/15/2026 | | | 166,000 | | | 179,600 |

5.38%, 09/01/2026 | | | 111,000 | | | 119,572 |

5.88%, 02/01/2029 | | | 216,000 | | | 241,729 |

3.50%, 09/01/2030 | | | 1,234,000 | | | 1,223,511 |

| | | | | | | 10,930,518 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 13 | | Invesco Corporate Bond Fund |

| | | | | | |

| | | Principal Amount | | | Value |

Health Care REITs-0.43% |

CTR Partnership L.P./ CareTrust Capital Corp., 3.88%, 06/30/2028(c) | | $ | 531,000 | | | $ 507,992 |

Diversified Healthcare Trust, | | | | | | |

4.75%, 05/01/2024 | | | 257,000 | | | 252,158 |

9.75%, 06/15/2025 | | | 482,000 | | | 509,754 |

4.38%, 03/01/2031 | | | 268,000 | | | 230,599 |

Healthcare Trust of America Holdings L.P., 2.00%, 03/15/2031(b) | | | 2,390,000 | | | 2,168,944 |

MPT Operating Partnership L.P./MPT Finance Corp., 4.63%, 08/01/2029 | | | 2,064,000 | | | 2,075,362 |

Omega Healthcare Investors, Inc., | | | | | | |

3.38%, 02/01/2031 | | | 230,000 | | | 217,779 |

3.25%, 04/15/2033 | | | 4,647,000 | | | 4,272,968 |

Welltower, Inc., 3.10%, 01/15/2030(b) | | | 2,324,000 | | | 2,326,164 |

| | | | | | | 12,561,720 |

|

Health Care Services-0.95% |

Cigna Corp., | | | | | | |

7.88%, 05/15/2027 | | | 4,693,000 | | | 5,863,400 |

4.38%, 10/15/2028 | | | 1,653,000 | | | 1,793,660 |

4.80%, 08/15/2038 | | | 4,714,000 | | | 5,260,489 |

CVS Health Corp., 1.30%, 08/21/2027(b) | | | 3,492,000 | | | 3,257,087 |

Fresenius Medical Care US Finance III, Inc. (Germany), 1.88%, 12/01/2026(c) | | | 2,775,000 | | | 2,658,959 |

Global Medical Response, Inc., 6.50%, 10/01/2025(b)(c) | | | 508,000 | | | 498,975 |

Piedmont Healthcare, Inc., | | | | | | |

Series 2032, 2.04%, 01/01/2032 | | | 1,567,000 | | | 1,443,634 |

Series 2042, 2.72%, 01/01/2042 | | | 1,513,000 | | | 1,354,748 |

2.86%, 01/01/2052(b) | | | 1,729,000 | | | 1,528,443 |

Providence St. Joseph Health Obligated Group, Series 21-A, 2.70%, 10/01/2051 | | | 4,628,000 | | | 3,949,713 |

| | | | | | | 27,609,108 |

|

Health Care Supplies-0.01% |

Mozart Debt Merger Sub, Inc., 3.88%, 04/01/2029(c) | | | 273,000 | | | 259,432 |

|

Homebuilding-0.66% |

Lennar Corp., | | | | | | |

4.75%, 11/15/2022 | | | 172,000 | | | 174,497 |

4.75%, 11/29/2027(b) | | | 2,223,000 | | | 2,418,968 |

M.D.C. Holdings, Inc., | | | | | | |

3.85%, 01/15/2030 | | | 6,697,000 | | | 6,757,150 |

6.00%, 01/15/2043 | | | 3,845,000 | | | 4,168,309 |

3.97%, 08/06/2061 | | | 5,921,000 | | | 4,856,534 |

Taylor Morrison Communities, Inc., 6.63%, 07/15/2027(c) | | | 673,000 | | | 692,773 |

Taylor Morrison Communities, Inc./Taylor Morrison Holdings II, Inc., 5.88%, 04/15/2023(c) | | | 57,000 | | | 58,282 |

| | | | | | | 19,126,513 |

| | | | | | |

| | | Principal Amount | | | Value |

Hotel & Resort REITs-0.03% |

Service Properties Trust, 4.50%, 03/15/2025 | | $ | 1,062,000 | | | $ 996,910 |

|

Hotels, Resorts & Cruise Lines-0.32% |

Carnival Corp., | | | | | | |

10.50%, 02/01/2026(c) | | | 150,000 | | | 168,569 |

5.75%, 03/01/2027(b)(c) | | | 295,000 | | | 287,713 |

Expedia Group, Inc., | | | | | | |

3.60%, 12/15/2023 | | | 2,512,000 | | | 2,568,841 |

4.63%, 08/01/2027 | | | 3,884,000 | | | 4,160,554 |

2.95%, 03/15/2031 | | | 185,000 | | | 177,590 |

Hilton Domestic Operating Co., Inc., 3.63%, 02/15/2032(c) | | | 1,980,000 | | | 1,884,722 |

| | | | | | | 9,247,989 |

|

Hypermarkets & Super Centers-0.25% |

Walmart, Inc., 6.50%, 08/15/2037 | | | 5,079,000 | | | 7,313,778 |

|

Independent Power Producers & Energy Traders-0.63% |

AES Corp. (The), | | | | | | |

1.38%, 01/15/2026 | | | 2,653,000 | | | 2,522,978 |

2.45%, 01/15/2031 | | | 4,699,000 | | | 4,353,306 |

Calpine Corp., 3.75%, 03/01/2031(c) | | | 4,464,000 | | | 4,069,628 |

Clearway Energy Operating LLC, 4.75%, 03/15/2028(c) | | | 589,000 | | | 593,070 |

EnfraGen Energia Sur S.A./EnfraGen Spain S.A./Prime Energia S.p.A. (Spain), 5.38 %, 12/30/2030(c) | | | 5,671,000 | | | 4,626,146 |

Vistra Corp., 7.00%(b)(c)(d)(e) | | | 2,295,000 | | | 2,281,368 |

| | | | | | | 18,446,496 |

|

Industrial Conglomerates-0.17% |

Bidvest Group UK PLC (The) (South Africa), 3.63%, 09/23/2026(c) | | | 2,813,000 | | | 2,707,569 |

GE Capital International Funding Co. Unlimited Co., 4.42%, 11/15/2035 | | | 2,111,000 | | | 2,376,018 |

| | | | | | | 5,083,587 |

|

Industrial Machinery-0.25% |

EnPro Industries, Inc., 5.75%, 10/15/2026 | | | 489,000 | | | 507,895 |

Flowserve Corp., 2.80%, 01/15/2032(b) | | | 3,523,000 | | | 3,245,563 |

Mueller Water Products, Inc., 4.00%, 06/15/2029(c) | | | 518,000 | | | 495,379 |

Ritchie Bros. Holdings, Inc. (Canada), 4.75%,

12/15/2031(b)(c) | | | 530,000 | | | 527,427 |

Roller Bearing Co. of America, Inc., 4.38%, 10/15/2029(c) | | | 66,000 | | | 63,772 |

Weir Group PLC (The) (United Kingdom), 2.20%, 05/13/2026(c) | | | 2,501,000 | | | 2,406,646 |

| | | | | | | 7,246,682 |

|

Industrial REITs-0.08% |

LXP Industrial Trust, 2.38%, 10/01/2031 | | | 2,407,000 | | | 2,223,003 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 14 | | Invesco Corporate Bond Fund |

| | | | | | |

| | | Principal Amount | | | Value |

Insurance Brokers-0.08% |

Arthur J. Gallagher & Co., 3.50%, 05/20/2051 | | $ | 2,315,000 | | | $ 2,179,116 |

Ryan Specialty Group LLC, 4.38%, 02/01/2030(c) | | | 264,000 | | | 254,311 |

| | | | | | | 2,433,427 |

|

Integrated Oil & Gas-1.75% |

BP Capital Markets America, Inc., | | | | | | |

3.06%, 06/17/2041 | | | 5,222,000 | | | 4,689,145 |

2.77%, 11/10/2050 | | | 5,526,000 | | | 4,625,870 |

2.94%, 06/04/2051 | | | 4,954,000 | | | 4,176,956 |

3.00%, 03/17/2052 | | | 4,723,000 | | | 4,023,309 |

BP Capital Markets PLC (United Kingdom), | | | | | | |

4.38%(d)(e) | | | 4,346,000 | | | 4,356,865 |

4.88%(d)(e) | | | 1,722,000 | | | 1,712,055 |

Gray Oak Pipeline LLC, 2.60%, 10/15/2025(c) | | | 2,913,000 | | | 2,882,627 |

Lukoil Capital DAC (Russia), 2.80%, 04/26/2027(c) | | | 4,204,000 | | | 2,290,694 |

Occidental Petroleum Corp., | | | | | | |

5.55%, 03/15/2026 | | | 322,000 | | | 346,461 |

8.50%, 07/15/2027 | | | 87,000 | | | 104,984 |

6.13%, 01/01/2031(b) | | | 305,000 | | | 347,282 |

6.20%, 03/15/2040 | | | 233,000 | | | 259,649 |

4.10%, 02/15/2047 | | | 315,000 | | | 291,881 |

Petroleos Mexicanos (Mexico), 6.70%, 02/16/2032(c) | | | 3,593,000 | | | 3,472,796 |

Qatar Energy (Qatar), 3.30%, 07/12/2051(c) | | | 3,664,000 | | | 3,456,757 |

SA Global Sukuk Ltd. (Saudi Arabia), 1.60%, 06/17/2026(c) | | | 1,803,000 | | | 1,729,726 |

Saudi Arabian Oil Co. (Saudi Arabia), 4.38%, 04/16/2049(c) | | | 2,407,000 | | | 2,566,608 |

Shell International Finance B.V. (Netherlands), | | | | | | |

2.88%, 11/26/2041 | | | 5,316,000 | | | 4,902,075 |

3.00%, 11/26/2051 | | | 5,316,000 | | | 4,852,962 |

| | | | | | | 51,088,702 |

|

Integrated Telecommunication Services-2.33% |

Altice France S.A. (France), | | | | | | |

8.13%, 02/01/2027(c) | | | 472,000 | | | 497,370 |

5.13%, 07/15/2029(c) | | | 253,000 | | | 229,277 |

5.50%, 10/15/2029(c) | | | 325,000 | | | 298,241 |

AT&T, Inc., | | | | | | |

1.38% (3 mo. USD LIBOR + 1.18%), 06/12/2024(b)(g) | | | 2,703,000 | | | 2,751,850 |

2.55%, 12/01/2033 | | | 200,000 | | | 185,665 |

3.10%, 02/01/2043 | | | 4,510,000 | | | 4,033,016 |

3.50%, 09/15/2053 | | | 8,695,000 | | | 7,963,032 |

3.55%, 09/15/2055 | | | 11,107,000 | | | 10,087,640 |

3.50%, 02/01/2061 | | | 2,892,000 | | | 2,553,778 |

British Telecommunications PLC (United Kingdom), 4.25%, 11/23/2081(c)(d) | | | 6,220,000 | | | 5,997,231 |

IHS Holding Ltd. (Nigeria), | | | | | | |

5.63%, 11/29/2026(c) | | | 2,169,000 | | | 2,135,901 |

6.25%, 11/29/2028(c) | | | 1,677,000 | | | 1,642,219 |

| | | | | | |

| | | Principal Amount | | | Value |

Integrated Telecommunication Services-(continued) |

Iliad Holding S.A.S. (France), | | | | | | |

6.50%, 10/15/2026(c) | | $ | 750,000 | | | $ 749,044 |

7.00%, 10/15/2028(b)(c) | | | 300,000 | | | 298,917 |

Telefonica Emisiones S.A. (Spain), 7.05%, 06/20/2036 | | | 2,445,000 | | | 3,181,297 |

Verizon Communications, Inc., | | | | | | |

1.75%, 01/20/2031(b) | | | 3,319,000 | | | 2,990,466 |

2.55%, 03/21/2031 | | | 2,059,000 | | | 1,978,253 |

2.36%, 03/15/2032(c) | | | 3,932,000 | | | 3,674,839 |

4.81%, 03/15/2039 | | | 1,935,000 | | | 2,239,912 |

2.65%, 11/20/2040 | | | 2,177,000 | | | 1,891,537 |

3.40%, 03/22/2041 | | | 2,075,000 | | | 2,001,099 |

2.88%, 11/20/2050 | | | 3,306,000 | | | 2,831,405 |

3.00%, 11/20/2060 | | | 5,951,000 | | | 4,956,781 |

3.70%, 03/22/2061 | | | 2,953,000 | | | 2,820,726 |

| | | | | | | 67,989,496 |

|

Interactive Home Entertainment-0.76% |

Electronic Arts, Inc., | | | | | | |

1.85%, 02/15/2031 | | | 4,495,000 | | | 4,106,605 |

2.95%, 02/15/2051 | | | 4,418,000 | | | 3,810,874 |

ROBLOX Corp., 3.88%, 05/01/2030(b)(c) | | | 5,757,000 | | | 5,482,391 |

WMG Acquisition Corp., | | | | | | |

3.75%, 12/01/2029(c) | | | 6,429,000 | | | 6,150,881 |

3.00%, 02/15/2031(b)(c) | | | 2,963,000 | | | 2,683,930 |

| | | | | | | 22,234,681 |

|

Interactive Media & Services-0.94% |

Alphabet, Inc., | | | | | | |

1.90%, 08/15/2040 | | | 2,247,000 | | | 1,888,292 |

2.25%, 08/15/2060 | | | 3,919,000 | | | 3,140,633 |

Audacy Capital Corp., 6.75%, 03/31/2029(b)(c) | | | 501,000 | | | 475,599 |

Baidu, Inc. (China), | | | | | | |

3.08%, 04/07/2025(b) | | | 1,175,000 | | | 1,187,676 |

1.72%, 04/09/2026 | | | 1,255,000 | | | 1,201,603 |

Match Group Holdings II LLC, | | | | | | |

4.63%, 06/01/2028(c) | | | 790,000 | | | 793,737 |

5.63%, 02/15/2029(c) | | | 4,618,000 | | | 4,797,964 |

3.63%, 10/01/2031(c) | | | 55,000 | | | 51,371 |

Scripps Escrow II, Inc., 3.88%, 01/15/2029(c) | | | 515,000 | | | 483,487 |

Tencent Holdings Ltd. (China), | | | | | | |

1.81%, 01/26/2026(b)(c) | | | 1,509,000 | | | 1,461,591 |

3.60%, 01/19/2028(c) | | | 4,305,000 | | | 4,392,050 |

3.93%, 01/19/2038(b)(c) | | | 3,137,000 | | | 3,048,160 |

Twitter, Inc., 3.88%,

12/15/2027(b)(c) | | | 4,527,000 | | | 4,458,190 |

| | | | | | | 27,380,353 |

|

Internet & Direct Marketing Retail-0.44% |

Alibaba Group Holding Ltd. (China), 3.15%, 02/09/2051 | | | 3,700,000 | | | 2,975,909 |

Amazon.com, Inc., 3.10%, 05/12/2051 | | | 4,625,000 | | | 4,479,180 |

Meituan (China), 2.13%, 10/28/2025(b)(c) | | | 3,055,000 | | | 2,810,107 |

Prosus N.V. (China), 3.26%, 01/19/2027(c) | | | 2,374,000 | | | 2,276,387 |

QVC, Inc., 5.45%, 08/15/2034 | | | 225,000 | | | 191,599 |

| | | | | | | 12,733,182 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 15 | | Invesco Corporate Bond Fund |

| | | | | | |

| | | Principal Amount | | | Value |

Internet Services & Infrastructure-0.53% |

Twilio, Inc., | | | | | | |

3.63%, 03/15/2029(b) | | $ | 3,200,000 | | | $ 3,070,592 |

3.88%, 03/15/2031 | | | 3,079,000 | | | 2,895,646 |

VeriSign, Inc., 2.70%, 06/15/2031 | | | 2,641,000 | | | 2,455,060 |

ZoomInfo Technologies LLC/ ZoomInfo Finance Corp., 3.88%, 02/01/2029(c) | | | 7,289,000 | | | 6,925,206 |

| | | | | | | 15,346,504 |

|

Investment Banking & Brokerage-3.79% |

Brookfield Finance I (UK) PLC (Canada), 2.34%, 01/30/2032 | | | 3,830,000 | | | 3,533,110 |

Brookfield Finance, Inc. (Canada), | | | | | | |

3.90%, 01/25/2028 | | | 3,604,000 | | | 3,788,051 |

2.72%, 04/15/2031 | | | 229,000 | | | 219,223 |

3.63%, 02/15/2052 | | | 5,581,000 | | | 5,189,003 |

Cantor Fitzgerald L.P., 6.50%, 06/17/2022(c) | | | 2,872,000 | | | 2,915,084 |

Charles Schwab Corp. (The), | | | | | | |

Series E, 4.63% (3 mo. USD LIBOR + 3.32%)(b)(e)(g) | | | 3,891,000 | | | 3,883,374 |

Series G, 5.38%(d)(e) | | | 231,000 | | | 244,340 |

Goldman Sachs Group, Inc. (The), | | | | | | |

0.63% (SOFR + 0.58%), 03/08/2024(g) | | | 6,481,000 | | | 6,474,689 |

0.75% (SOFR + 0.70%), 01/24/2025(g) | | | 3,809,000 | | | 3,813,494 |

3.50%, 04/01/2025 | | | 2,952,000 | | | 3,035,769 |

0.84% (SOFR + 0.79%), 12/09/2026(g) | | | 6,521,000 | | | 6,498,974 |

1.09%, 12/09/2026(d) | | | 3,203,000 | | | 3,014,579 |

0.86% (SOFR + 0.81%), 03/09/2027(g) | | | 9,144,000 | | | 9,097,702 |

0.97% (SOFR + 0.92%), 10/21/2027(g) | | | 1,953,000 | | | 1,947,310 |

1.95%, 10/21/2027(d) | | | 3,134,000 | | | 3,004,871 |

1.17% (SOFR + 1.12%), 02/24/2028(g) | | | 1,872,000 | | | 1,881,676 |

1.99%, 01/27/2032(d) | | | 3,078,000 | | | 2,777,340 |

2.38%, 07/21/2032(d) | | | 2,968,000 | | | 2,753,539 |

2.65%, 10/21/2032(d) | | | 3,804,000 | | | 3,610,502 |

3.10%, 02/24/2033(d) | | | 2,213,000 | | | 2,180,272 |

6.75%, 10/01/2037 | | | 4,034,000 | | | 5,307,206 |

3.44%, 02/24/2043(d) | | | 2,667,000 | | | 2,570,559 |

4.80%, 07/08/2044 | | | 3,651,000 | | | 4,183,558 |

Series T, 3.80%(d)(e) | | | 146,000 | | | 138,700 |

Series V, 4.13%(d)(e) | | | 2,539,000 | | | 2,412,050 |

Jefferies Group LLC/Jefferies Group Capital Finance, Inc., 4.15%, 01/23/2030 | | | 3,305,000 | | | 3,473,549 |

Morgan Stanley, | | | | | | |

0.67% (SOFR + 0.63%), 01/24/2025(b)(g) | | | 2,718,000 | | | 2,721,926 |

2.19%, 04/28/2026(d) | | | 2,373,000 | | | 2,343,374 |

3.62%, 04/01/2031(d) | | | 2,833,000 | | | 2,931,336 |

2.24%, 07/21/2032(d) | | | 4,901,000 | | | 4,515,733 |

2.51%, 10/20/2032(d) | | | 2,363,000 | | | 2,233,396 |

2.94%, 01/21/2033(d) | | | 2,593,000 | | | 2,541,531 |

2.48%, 09/16/2036(d) | | | 3,162,000 | | | 2,873,536 |

| | | | | | |

| | | Principal Amount | | | Value |

Investment Banking & Brokerage-(continued) |

NFP Corp., 4.88%, 08/15/2028(c) | | $ | 202,000 | | | $ 195,128 |

Raymond James Financial, Inc., 3.75%, 04/01/2051 | | | 2,003,000 | | | 1,989,849 |

| | | | | | | 110,294,333 |

|

IT Consulting & Other Services-0.20% |

DXC Technology Co., 2.38%, 09/15/2028 | | | 5,109,000 | | | 4,860,923 |

Gartner, Inc., | | | | | | |

4.50%, 07/01/2028(c) | | | 740,000 | | | 750,538 |

3.63%, 06/15/2029(c) | | | 253,000 | | | 245,913 |

| | | | | | | 5,857,374 |

|

Life & Health Insurance-3.65% |

American Equity Investment Life Holding Co., 5.00%, 06/15/2027 | | | 5,798,000 | | | 6,302,399 |

Athene Global Funding, | | | | | | |

1.20%, 10/13/2023(c) | | | 4,515,000 | | | 4,455,929 |

2.50%, 01/14/2025(c) | | | 2,936,000 | | | 2,933,704 |

1.45%, 01/08/2026(c) | | | 2,316,000 | | | 2,213,454 |

Athene Holding Ltd., | | | | | | |

4.13%, 01/12/2028 | | | 6,136,000 | | | 6,454,958 |

6.15%, 04/03/2030 | | | 3,163,000 | | | 3,723,419 |

3.95%, 05/25/2051 | | | 723,000 | | | 691,441 |

3.45%, 05/15/2052(b) | | | 4,142,000 | | | 3,633,945 |

Brighthouse Financial Global Funding, 1.20%, 12/15/2023(c) | | | 4,460,000 | | | 4,382,045 |

Brighthouse Financial, Inc., | | | | | | |

4.70%, 06/22/2047(b) | | | 1,835,000 | | | 1,837,377 |

3.85%, 12/22/2051 | | | 5,622,000 | | | 4,920,636 |

Delaware Life Global Funding, | | | | | | |

Series 22-1,

3.31%, 03/10/2025(c) | | | 5,895,000 | | | 5,895,000 |

Series 21-1, 2.66%,

06/29/2026(c) | | | 13,992,000 | | | 13,813,042 |

F&G Global Funding, 2.00%, 09/20/2028(c) | | | 4,591,000 | | | 4,287,596 |

GA Global Funding Trust, | | | | | | |

2.25%, 01/06/2027(c) | | | 5,133,000 | | | 4,974,325 |

1.95%, 09/15/2028(c) | | | 5,572,000 | | | 5,126,684 |

2.90%, 01/06/2032(c) | | | 5,529,000 | | | 5,191,711 |

MAG Mutual Holding Co., 4.75%, 04/30/2041(h) | | | 11,777,000 | | | 11,509,549 |

Maple Grove Funding Trust I, 4.16%, 08/15/2051(c) | | | 2,428,000 | | | 2,268,654 |

MetLife, Inc., Series D,

5.88%(d)(e) | | | 300,000 | | | 313,046 |

Nationwide Financial Services, Inc., 3.90%, 11/30/2049(c) | | | 2,897,000 | | | 3,015,544 |

| | |

Pacific Life Global Funding II, 0.67% (SOFR + 0.62%), 06/04/2026(c)(g) | | | 3,494,000 | | | 3,505,660 |

Pacific LifeCorp, 3.35%, 09/15/2050(c) | | | 3,060,000 | | | 2,932,586 |

Prudential Financial, Inc., 3.91%, 12/07/2047 | | | 1,707,000 | | | 1,782,258 |

| | | | | | | 106,164,962 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 16 | | Invesco Corporate Bond Fund |

| | | | | | |

| | | Principal Amount | | | Value |

Life Sciences Tools & Services-0.07% |

Illumina, Inc., 2.55%, 03/23/2031 | | $ | 2,313,000 | | | $ 2,194,706 |

|

Managed Health Care-0.47% |

Centene Corp., | | | | | | |

4.63%, 12/15/2029 | | | 526,000 | | | 542,651 |

3.38%, 02/15/2030 | | | 320,000 | | | 307,515 |

3.00%, 10/15/2030 | | | 1,000,000 | | | 954,746 |

2.50%, 03/01/2031 | | | 6,080,000 | | | 5,607,584 |

Kaiser Foundation Hospitals, Series 2021, | | | | | | |

2.81%, 06/01/2041 | | | 3,275,000 | | | 3,032,684 |

3.00%, 06/01/2051 | | | 3,415,000 | | | 3,172,898 |

| | | | | | | 13,618,078 |

|

Metal & Glass Containers-0.05% |

Ardagh Metal Packaging Finance USA LLC/Ardagh Metal Packaging Finance PLC, 3.25%, 09/01/2028(c) | | | 600,000 | | | 564,960 |

Ardagh Packaging Finance PLC/Ardagh Holdings USA, Inc., 5.25%, 04/30/2025(c) | | | 489,000 | | | 496,024 |

Ball Corp., 5.25%, 07/01/2025 | | | 359,000 | | | 380,953 |

| | | | | | | 1,441,937 |

|

Movies & Entertainment-0.18% |

Netflix, Inc., | | | | | | |

5.88%, 11/15/2028 | | | 1,017,000 | | | 1,151,600 |

5.38%, 11/15/2029(c) | | | 252,000 | | | 281,867 |

Tencent Music Entertainment Group (China), | | | | | | |

1.38%, 09/03/2025 | | | 1,560,000 | | | 1,479,164 |

2.00%, 09/03/2030 | | | 2,480,000 | | | 2,214,056 |

| | | | | | | 5,126,687 |

|

Multi-line Insurance-0.27% |

Allianz SE (Germany),

3.20%(c)(d)(e) | | | 2,807,000 | | | 2,426,651 |

American International Group, Inc., 4.50%, 07/16/2044 | | | 1,929,000 | | | 2,144,317 |

Nationwide Mutual Insurance Co., 4.95%, 04/22/2044(c) | | | 2,964,000 | | | 3,296,577 |

| | | | | | | 7,867,545 |

|

Multi-Utilities-0.39% |

Algonquin Power & Utilities Corp. (Canada), 4.75%, 01/18/2082(d) | | | 9,298,000 | | | 8,834,402 |

Dominion Energy, Inc., Series C, 2.25%, 08/15/2031 | | | 354,000 | | | 327,952 |

WEC Energy Group, Inc., 1.38%, 10/15/2027 | | | 2,313,000 | | | 2,153,303 |

| | | | | | | 11,315,657 |

|

Office REITs-0.86% |

Alexandria Real Estate Equities, Inc., | | | | | | |

3.95%, 01/15/2027 | | | 2,329,000 | | | 2,479,064 |

1.88%, 02/01/2033 | | | 11,614,000 | | | 10,280,587 |

2.95%, 03/15/2034(b) | | | 1,998,000 | | | 1,955,222 |

Highwoods Realty L.P., 2.60%, 02/01/2031 | | | 1,917,000 | | | 1,824,689 |

| | | | | | |

| | | Principal Amount | | | Value |

Office REITs-(continued) |

Office Properties Income Trust, | | | | | | |

4.50%, 02/01/2025 | | $ | 4,778,000 | | | $ 4,900,354 |

2.65%, 06/15/2026 | | | 782,000 | | | 744,351 |

2.40%, 02/01/2027 | | | 3,149,000 | | | 2,916,920 |

| | | | | | | 25,101,187 |

|

Oil & Gas Drilling-0.12% |

Delek Logistics Partners L.P./Delek Logistics Finance Corp., 7.13%, 06/01/2028(c) | | | 523,000 | | | 512,242 |

Nabors Industries, Inc., 7.38%, 05/15/2027(c) | | | 509,000 | | | 526,181 |

NGL Energy Operating LLC/NGL Energy Finance Corp., 7.50%, 02/01/2026(c) | | | 405,000 | | | 407,146 |

Precision Drilling Corp. (Canada), | | | | | | |

7.13%, 01/15/2026(c) | | | 100,000 | | | 101,320 |

6.88%, 01/15/2029(c) | | | 395,000 | | | 396,997 |

Rockies Express Pipeline LLC, | | | | | | |

4.95%, 07/15/2029(c) | | | 222,000 | | | 215,156 |

4.80%, 05/15/2030(c) | | | 430,000 | | | 416,747 |

6.88%, 04/15/2040(c) | | | 339,000 | | | 346,309 |

Valaris Ltd., | | | | | | |

12.00% PIK Rate, 8.25% Cash Rate, 04/30/2028(c)(i) | | | 182,000 | | | 190,008 |

Series 1145, 12.00% PIK Rate, 8.25% Cash Rate, 04/30/2028(i) | | | 342,000 | | | 357,048 |

| | | | | | | 3,469,154 |

|

Oil & Gas Equipment & Services-0.26% |

Baker Hughes Holdings LLC/Baker Hughes Co-Obligor, Inc., 3.34%, 12/15/2027 | | | 2,968,000 | | | 3,061,999 |

Bristow Group, Inc., 6.88%, 03/01/2028(c) | | | 761,000 | | | 770,900 |

Petrofac Ltd. (United Kingdom), 9.75%, 11/15/2026(c) | | | 3,614,000 | | | 3,386,083 |

USA Compression Partners L.P./USA Compression Finance Corp., 6.88%, 09/01/2027 | | | 485,000 | | | 486,145 |

| | | | | | | 7,705,127 |

|

Oil & Gas Exploration & Production-1.48% |

Aethon United BR L.P./Aethon United Finance Corp., 8.25%, 02/15/2026(c) | | | 1,046,000 | | | 1,109,137 |

Callon Petroleum Co., | | | | | | |

9.00%, 04/01/2025(c) | | | 192,000 | | | 206,171 |

8.00%, 08/01/2028(b)(c) | | | 501,000 | | | 521,649 |

Cameron LNG LLC, | | | | | | |

3.30%, 01/15/2035(c) | | | 3,617,000 | | | 3,561,919 |

3.40%, 01/15/2038(c) | | | 3,961,000 | | | 3,821,371 |

Civitas Resources, Inc., 5.00%, 10/15/2026(c) | | | 520,000 | | | 513,110 |

ConocoPhillips, 2.40%, 02/15/2031(c) | | | 66,000 | | | 65,002 |

Continental Resources, Inc., | | | | | | |

2.27%, 11/15/2026(c) | | | 1,416,000 | | | 1,351,494 |

2.88%, 04/01/2032(b)(c) | | | 1,771,000 | | | 1,621,846 |

Devon Energy Corp., 5.25%, 10/15/2027 | | | 8,334,000 | | | 8,641,389 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 17 | | Invesco Corporate Bond Fund |

| | | | | | |

| | | Principal Amount | | | Value |

Oil & Gas Exploration & Production-(continued) |

Galaxy Pipeline Assets Bidco Ltd. (United Arab Emirates), | | | | | | |

2.16%, 03/31/2034(c) | | $ | 3,520,000 | | | $ 3,281,030 |

2.94%, 09/30/2040(c) | | | 5,170,000 | | | 4,773,034 |

Gazprom PJSC Via Gaz Finance PLC (Russia), 2.95%, 01/27/2029(c) | | | 5,299,000 | | | 2,702,384 |

Genesis Energy L.P./Genesis Energy Finance Corp., | | | | | | |

6.25%, 05/15/2026 | | | 255,000 | | | 245,682 |

8.00%, 01/15/2027 | | | 546,000 | | | 552,825 |

7.75%, 02/01/2028 | | | 304,000 | | | 300,633 |

Hilcorp Energy I L.P./Hilcorp Finance Co., 6.25%, 11/01/2028(c) | | | 482,000 | | | 492,204 |

Lundin Energy Finance B.V. (Netherlands), | | | | | | |

2.00%, 07/15/2026(c) | | | 2,566,000 | | | 2,479,203 |

3.10%, 07/15/2031(c) | | | 2,566,000 | | | 2,450,702 |

Murphy Oil Corp., | | | | | | |

6.38%, 07/15/2028(b) | | | 2,418,000 | | | 2,508,615 |

6.38%, 12/01/2042 | | | 180,000 | | | 169,040 |

Northern Oil and Gas, Inc., 8.13%, 03/01/2028(c) | | | 811,000 | | | 853,578 |

Ovintiv Exploration, Inc., 5.63%, 07/01/2024 | | | 314,000 | | | 335,985 |

SM Energy Co., 10.00%, 01/15/2025(b)(c) | | | 509,000 | | | 558,724 |

| | | | | | | 43,116,727 |

|

Oil & Gas Refining & Marketing-0.33% |

Parkland Corp. (Canada), 4.50%, 10/01/2029(c) | | | 1,951,000 | | | 1,842,905 |

Petronas Capital Ltd. (Malaysia), | | | | | | |

2.48%, 01/28/2032(c) | | | 2,247,000 | | | 2,106,427 |

3.40%, 04/28/2061(c) | | | 6,289,000 | | | 5,602,776 |

| | | | | | | 9,552,108 |

|

Oil & Gas Storage & Transportation-6.44% |

Boardwalk Pipelines L.P., | | | | | | |

3.40%, 02/15/2031 | | | 2,911,000 | | | 2,844,898 |

3.60%, 09/01/2032 | | | 5,115,000 | | | 5,064,312 |

Cheniere Corpus Christi Holdings LLC, 2.74%, 12/31/2039(c) | | | 3,143,000 | | | 2,873,861 |

CNX Midstream Partners L.P., 4.75%, 04/15/2030(c) | | | 374,000 | | | 362,047 |

Crestwood Midstream Partners L.P./Crestwood Midstream Finance Corp.,

8.00%, 04/01/2029(c) | | | 838,000 | | | 892,721 |

El Paso Natural Gas Co. LLC, 8.38%, 06/15/2032 | | | 1,575,000 | | | 2,106,195 |

Enbridge, Inc. (Canada), | | | | | | |

0.68% (SOFR + 0.63%), 02/16/2024(b)(g) | | | 838,000 | | | 840,394 |

1.60%, 10/04/2026 | | | 1,861,000 | | | 1,775,822 |

3.40%, 08/01/2051 | | | 1,875,000 | | | 1,700,173 |

| | | | | | |

| | | Principal Amount | | | Value |

Oil & Gas Storage & Transportation-(continued) |

Energy Transfer L.P., | | | | | | |

5.88%, 01/15/2024 | | $ | 508,000 | | | $ 537,135 |

2.90%, 05/15/2025 | | | 3,709,000 | | | 3,727,383 |

3.75%, 05/15/2030 | | | 6,281,000 | | | 6,387,407 |

4.90%, 03/15/2035 | | | 9,976,000 | | | 10,448,639 |

5.00%, 05/15/2050 | | | 6,690,000 | | | 6,972,862 |

Series A, 6.25%(d)(e) | | | 342,000 | | | 288,135 |

Enterprise Products Operating LLC, | | | | | | |

3.13%, 07/31/2029 | | | 350,000 | | | 354,123 |

4.80%, 02/01/2049 | | | 2,022,000 | | | 2,208,043 |

4.20%, 01/31/2050 | | | 2,378,000 | | | 2,394,782 |

3.70%, 01/31/2051 | | | 11,472,000 | | | 10,715,663 |

3.30%, 02/15/2053 | | | 2,585,000 | | | 2,269,899 |

Series D,

6.88%, 03/01/2033 | | | 2,270,000 | | | 2,919,175 |

4.88%, 08/16/2077(d) | | | 9,666,000 | | | 8,288,707 |

EQM Midstream Partners L.P., 6.50%, 07/01/2027(c) | | | 197,000 | | | 206,348 |

Hess Midstream Operations L.P., 5.63%, 02/15/2026(c) | | | 729,000 | | | 748,147 |

Kinder Morgan Energy Partners L.P., 4.30%, 05/01/2024 | | | 1,820,000 | | | 1,890,599 |

Kinder Morgan, Inc., | | | | | | |

7.80%, 08/01/2031 | | | 15,785,000 | | | 20,733,169 |

7.75%, 01/15/2032 | | | 16,317,000 | | | 21,635,871 |

3.25%, 08/01/2050(b) | | | 12,666,000 | | | 10,667,539 |

MPLX L.P., | | | | | | |

1.75%, 03/01/2026 | | | 3,164,000 | | | 3,034,075 |

4.80%, 02/15/2029 | | | 2,009,000 | | | 2,203,502 |

4.70%, 04/15/2048 | | | 2,374,000 | | | 2,457,757 |

5.50%, 02/15/2049 | | | 3,234,000 | | | 3,696,446 |

NGL Energy Partners L.P./NGL Energy Finance Corp., 7.50%, 04/15/2026 | | | 357,000 | | | 309,389 |

NGPL PipeCo LLC, 7.77%, 12/15/2037(c) | | | 11,275,000 | | | 15,010,997 |

Northern Natural Gas Co., 3.40%, 10/16/2051(c) | | | 2,162,000 | | | 1,979,319 |

ONEOK Partners L.P., 6.85%, 10/15/2037 | | | 3,593,000 | | | 4,439,914 |

ONEOK, Inc., 6.35%, 01/15/2031 | | | 4,892,000 | | | 5,809,928 |

Plains All American Pipeline L.P., Series B, 6.13%(d)(e) | | | 385,000 | | | 320,397 |

Plains All American Pipeline L.P./PAA Finance Corp., 3.55%, 12/15/2029 | | | 200,000 | | | 197,623 |

Sunoco L.P./Sunoco Finance Corp., 5.88%, 03/15/2028 | | | 723,000 | | | 736,527 |

Tallgrass Energy Partners L.P./Tallgrass Energy Finance Corp., 5.50%, 01/15/2028(c) | | | 562,000 | | | 542,454 |

Targa Resources Partners L.P./Targa Resources Partners Finance Corp., | | | | | | |

5.88%, 04/15/2026 | | | 677,000 | | | 699,764 |

5.00%, 01/15/2028 | | | 201,000 | | | 207,481 |

5.50%, 03/01/2030 | | | 63,000 | | | 66,780 |

Venture Global Calcasieu Pass LLC, 3.88%, 11/01/2033(b)(c) | | | 3,751,000 | | | 3,617,858 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 18 | | Invesco Corporate Bond Fund |