UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-05686 |

AIM Investment Securities Funds (Invesco Investment Securities Funds)

(Exact name of registrant as specified in charter)

| 11 Greenway Plaza, Suite 1000 Houston, Texas 77046 |

| | | (Address of principal executive offices) (Zip code) |

Sheri Morris 11 Greenway Plaza, Suite 1000 Houston, Texas 77046 |

| | | (Name and address of agent for service) |

Registrant's telephone number, including area code: | (713) 626-1919 | |

Date of fiscal year end: | | 02/29 | | | | |

Date of reporting period: | | 02/29/2020 | | | | |

Item 1. Report to Stockholders.

Annual Report to Shareholders | February 29, 2020 |

Invesco Corporate Bond Fund

Nasdaq:

A: ACCBX C: ACCEX R: ACCZX Y: ACCHX R5: ACCWX R6: ICBFX

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund's shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Fund's web- site, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by enrolling at invesco.com/edelivery.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call (800) 959-4246 to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with your financial intermediary or all funds held with the fund complex if you invest directly with the Fund.

Andrew Schlossberg

Letters to Shareholders

Dear Shareholders:

This annual report includes information about your Fund, including performance data and a complete list of its investments as of the close of the reporting period. Inside is a discussion of how your Fund was managed and the factors that affected its performance during the reporting period.

The reporting period proved to be another tumultuous time for both global equities and fixed-income secu- rities. In early 2019, global equity markets were buoyed by a more accommodative stance from central banks and optimism about a potential US-China trade deal. In May, US-China trade concerns and slowing global growth led to a global equity sell-off and rally in US Treasuries. Despite the May sell-off, domestic equity mar- kets rallied in June in anticipation of a US Federal Reserve (the Fed) interest rate cut and closed the second quarter with modest gains. Continued US-China trade worries and signs of slowing global economic growth led to increased market volatility in August. The US Treasury yield curve inverted several times as fears of a US recession increased. As a result, global equity markets were largely flat for the third quarter. In the final

months of 2019, geopolitical and macroeconomic issues largely abated. This combined with better-than-expected third quarter corporate earnings and initial agreement of the phase one US-China trade deal provided a favorable backdrop for equities and impressive fourth quar- ter global equity returns.

As the new year began, US equities were largely buoyed in January by the signing of the phase one trade agreement and strong eco- nomic data although returns were dampened by the spread of the Coronavirus (COVID-19). Concerns over the virus had a greater impact on international equities, which were largely lower for the month. As the virus spread outside of China and the number of cases increased, fears of diminished global growth led to a sharp global equity sell-off at the end of February 2020 and sent the yield on the US 10-year Treasury to a new all-time low.

Throughout 2019, central banks continued to be accommodative, providing sources of liquidity. In July, the Fed lowered interest rates for the first time in 11 years. It again lowered rates in September and once again in October. During the rest of the year, the Fed left rates unchanged. Overseas, the European Central Bank left its policy rate unchanged and continued its bond purchasing program. In 2020, with the increased spread of the coronavirus, the Fed shifted from a more neutral policy to the possibility of further rate cuts in the new year. As 2020 unfolds, we'll see how the interplay of interest rates, economic data, geopolitics and a host of other factors affect US and overseas equity and fixed income markets.

Investor uncertainty and market volatility, such as we witnessed during the reporting period, are unfortunate facts of life when it comes to investing. That's why Invesco encourages investors to work with a professional financial adviser who can stress the importance of starting to save and invest early and the importance of adhering to a disciplined investment plan. A financial adviser who knows your unique finan- cial situation, investment goals and risk tolerance can be an invaluable partner as you seek to achieve your financial goals. Financial advis- ers can also offer a long-term perspective when markets are volatile and time-tested advice and guidance when your financial situation or investment goals change.

Visit our website for more information on your investments

Our website, invesco.com/us, offers a wide range of market insights and investment perspectives. On the website, you'll find detailed infor- mation about our funds, including performance, holdings and portfolio manager commentaries. You can access information about your account by completing a simple, secure online registration. To do so, select "Log In" on the right side of the homepage, and then select "Register for Individual Account Access."

In addition to the resources accessible on our website and through our mobile app, you can obtain timely updates to help you stay informed about the markets and the economy by connecting with Invesco on Twitter, LinkedIn or Facebook. You can access our blog at blog.invesco.us.com. Our goal is to provide you the information you want, when and where you want it.

Finally, I'm pleased to share with you Invesco's commitment to both the Principles for Responsible Investment and to considering environ- mental, social and governance issues in our robust investment process. I invite you to learn more at invesco.com/esg.

Have questions?

For questions about your account, contact an Invesco client services representative at 800 959 4246.

All of us at Invesco look forward to serving your investment management needs. Thank you for investing with us.

Sincerely,

Andrew Schlossberg

Head of the Americas,

Senior Managing Director, Invesco Ltd.

2Invesco Corporate Bond Fund

Bruce Crockett

Dear Shareholders:

Among the many important lessons I've learned in more than 40 years in a variety of business endeavors is the value of a trusted advocate.

As independent chair of the Invesco Funds Board, I can assure you that the members of the Board are strong advocates for the interests of investors in Invesco's mutual funds. We work hard to represent your interests through oversight of the quality of the investment management services your funds receive and other matters important to your investment, including but not limited to:

Ensuring that Invesco offers a diverse lineup of mutual funds that your financial adviser can use to strive to meet your financial needs as your investment goals change over time.

Monitoring how the portfolio management teams of the Invesco funds are performing in light of changing economic and market conditions.

Assessing each portfolio management team's investment performance within the context of the investment strategy described in the fund's prospectus.

Monitoring for potential conflicts of interests that may impact the nature of the services that your funds receive.

We believe one of the most important services we provide our fund shareholders is the annual review of the funds' advisory and sub-

advisory contracts with Invesco Advisers and its affiliates. This review is required by the Investment Company Act of 1940 and focuses on the nature and quality of the services Invesco provides as the adviser to the Invesco funds and the reasonableness of the fees that it charges for those services. Each year, we spend months carefully reviewing information received from Invesco and a variety of independent sources, such as performance and fee data prepared by Lipper, Inc. (a subsidiary of Broadridge Financial Solutions, Inc.), an independent, third-party firm widely recognized as a leader in its field. We also meet with our independent legal counsel and other independent advisers to review and help us assess the information that we have received. Our goal is to assure that you receive quality investment management services for a reasonable fee.

I trust the measures outlined above provide assurance that you have a worthy advocate when it comes to choosing the Invesco Funds. On behalf of the Board, we look forward to continuing to represent your interests and serving your needs.

Sincerely,

Bruce L. Crockett

Independent Chair

Invesco Funds Board of Trustees

3Invesco Corporate Bond Fund

Management's Discussion of Fund Performance

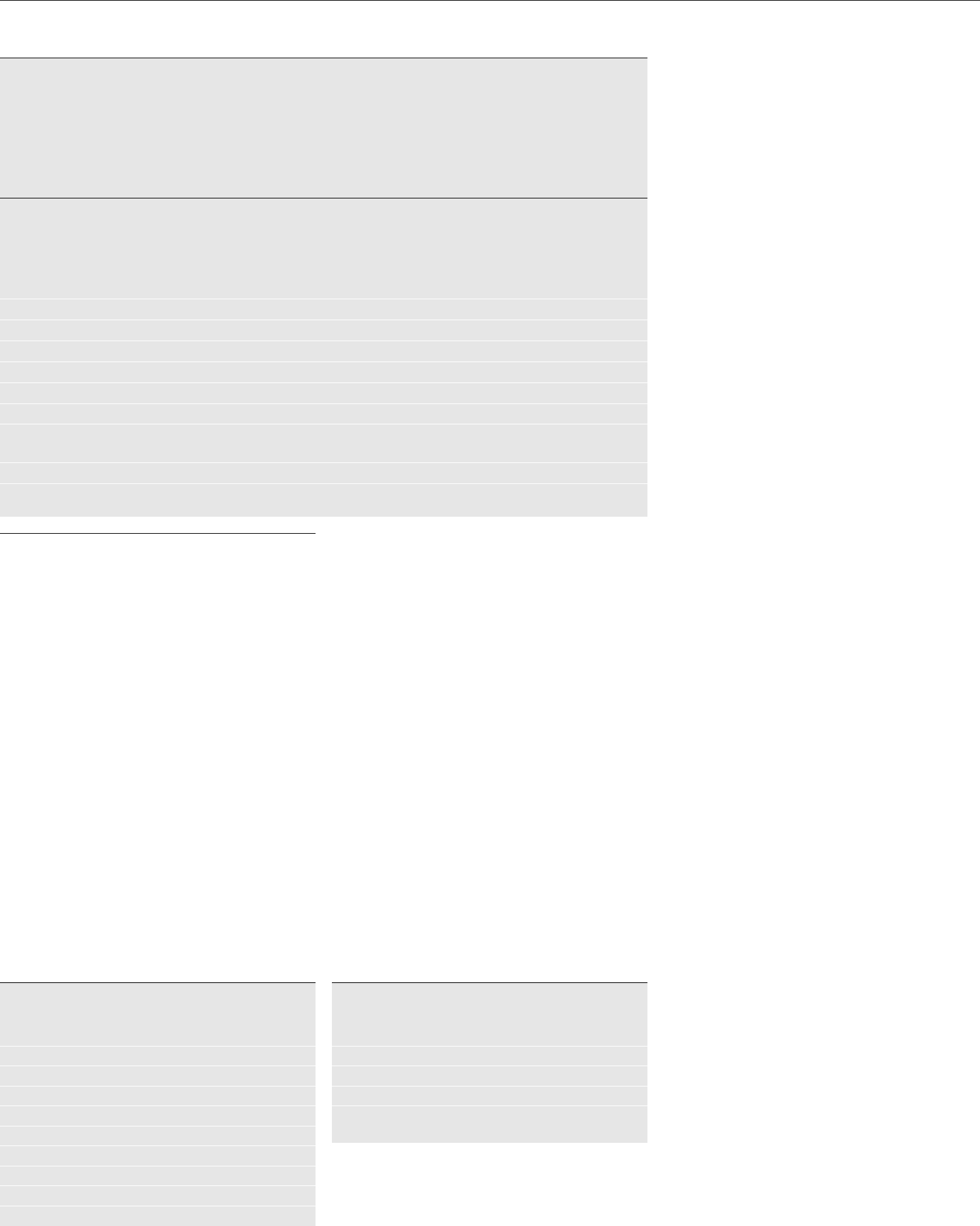

Performance summary

For the fiscal year ended February 29, 2020, Class A shares of Invesco Corporate Bond Fund (the Fund), at net asset value (NAV), underperformed the Fund's broad market/style-specific benchmark, the Bloomberg Barclays U.S. Credit Index.

Your Fund's long-term performance appears later in this report.

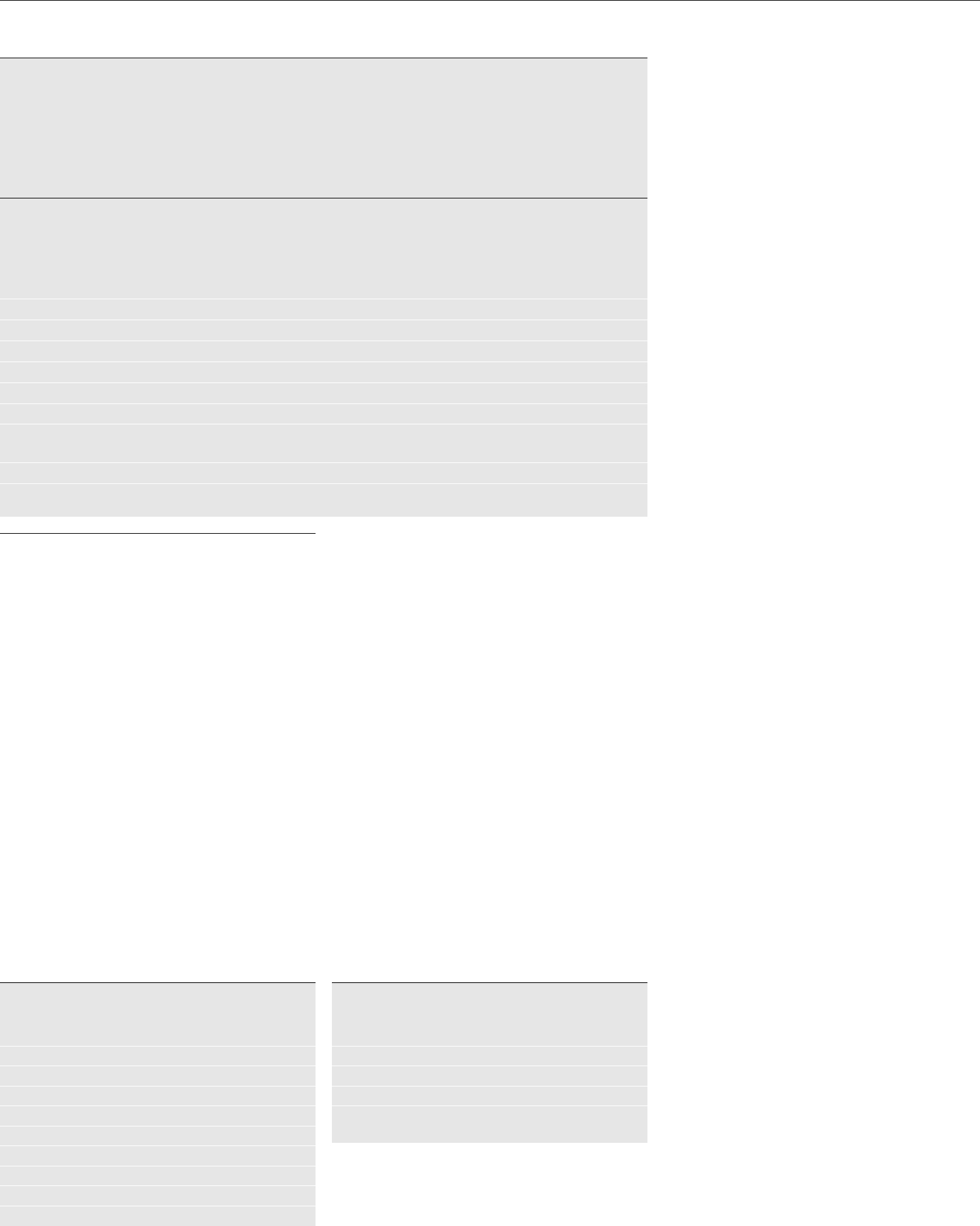

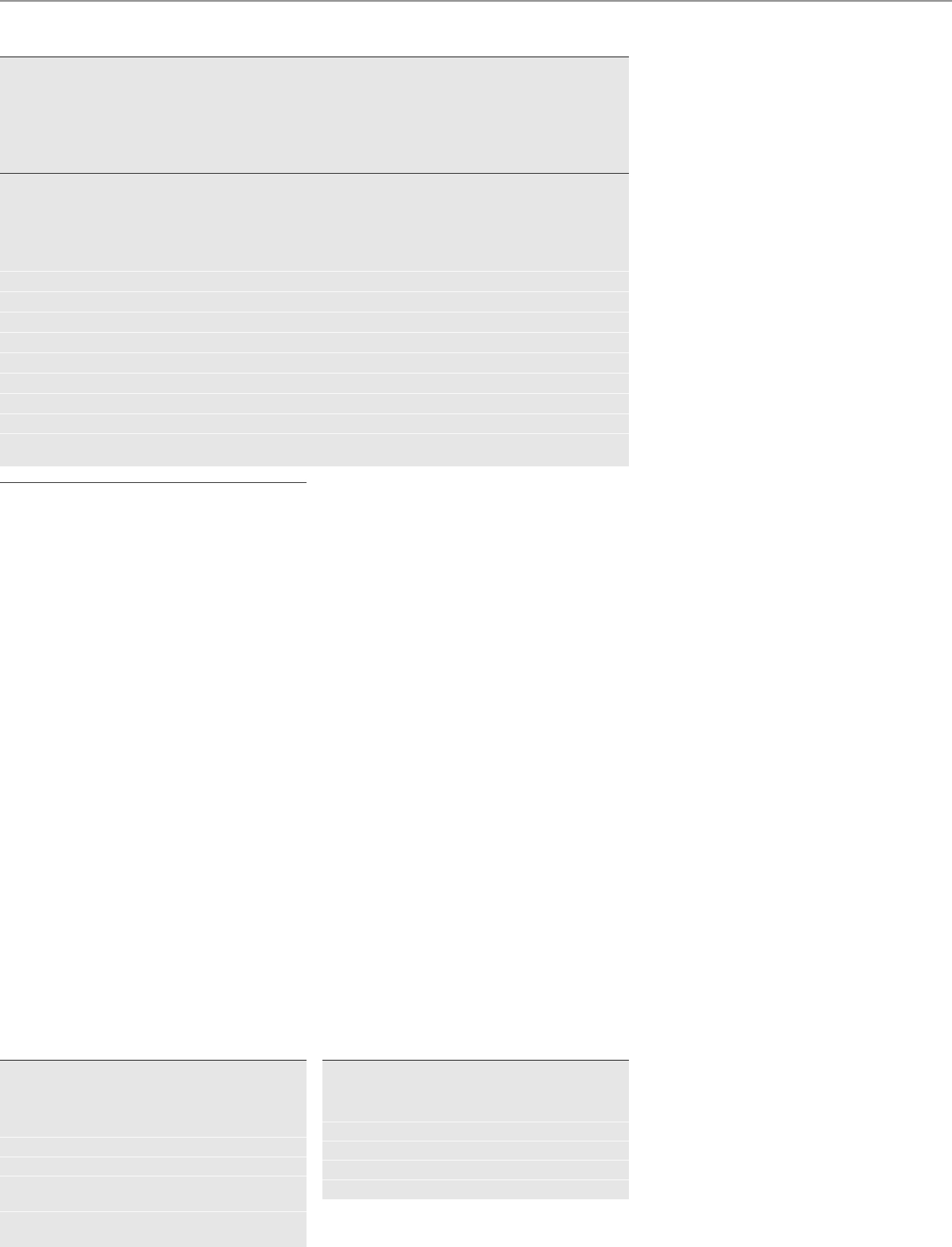

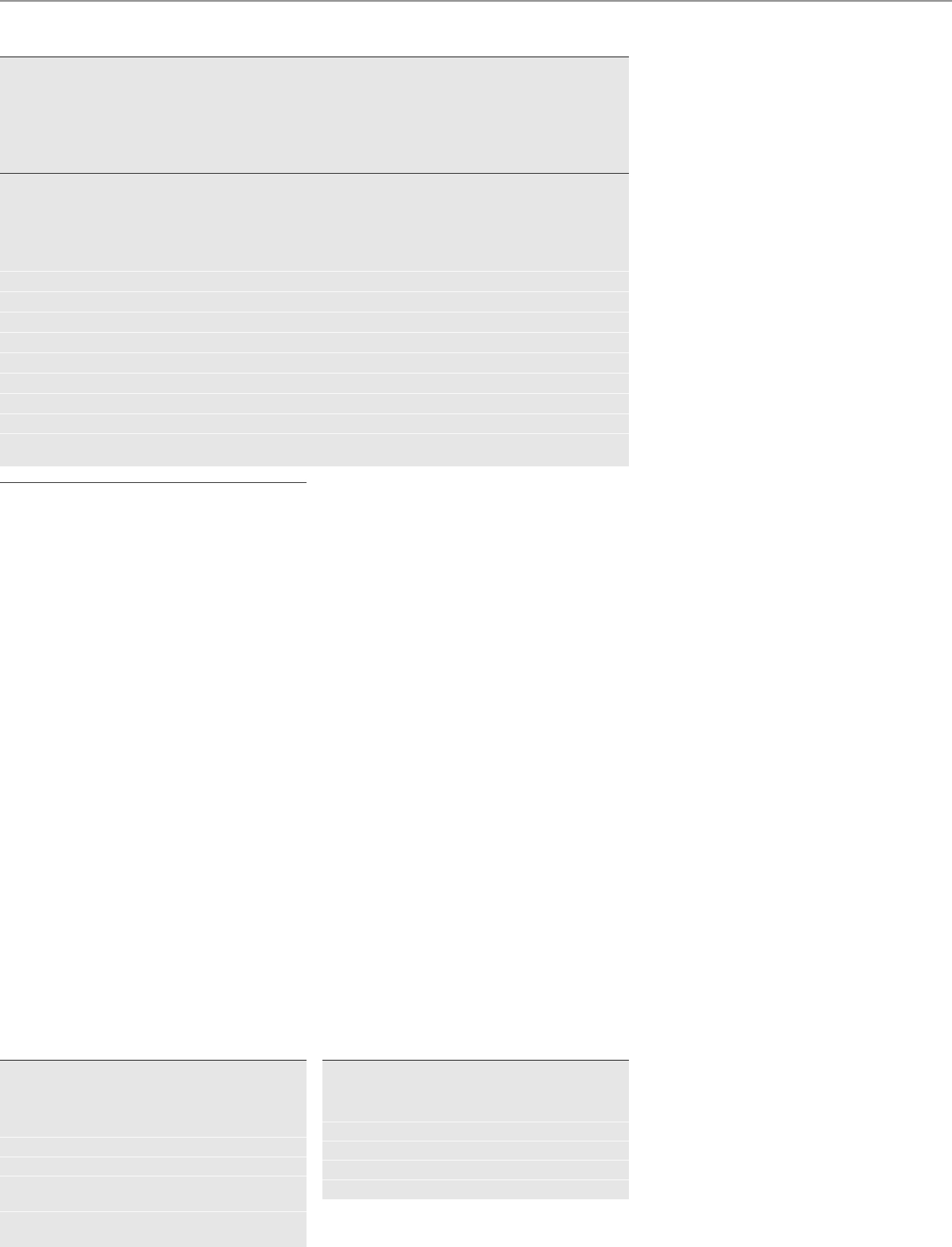

Fund vs. Indexes

Total returns, 2/28/19 to 2/29/20, at net asset value (NAV). Performance shown does not include applicable contingent deferred sales charges (CDSC) or front-end sales charges, which would have reduced performance.

Class A Shares | 15.20% |

Class C Shares | 14.43 |

Class R Shares | 15.06 |

Class Y Shares | 15.62 |

Class R5 Shares | 15.55 |

Class R6 Shares | 15.62 |

Bloomberg Barclays U.S. Credit Index (Broad Market/Style-Specific Index) | 15.30 |

Lipper BBB Rated Funds Index (Peer Group Index) | 15.57 |

Source(s): RIMES Technologies Corp.; Lipper Inc.

fiscal year, duration of the portfolio was main- tained in line with the broad market/style- specific benchmark, on average, and the tim- ing of changes and the degree of variance from the Fund's broad market/style-specific benchmark had a small negative effect on relative returns. Buying and selling US Trea- sury futures was an important tool used for the management of interest rate risk and to maintain our targeted portfolio duration dur- ing the fiscal year.

Part of the Fund's strategy in seeking to manage credit and currency risk during the fiscal year entailed purchasing and selling credit and currency derivatives. We sought to manage credit risk by purchasing and selling credit default swaps at various points throughout the fiscal year. Management of currency risk was carried out via currency forwards and options on as-needed basis and we believe it was effective in managing the currency positioning within the Fund during the fiscal year.

Market conditions and your Fund

During the fiscal year, US Treasury yields fell considerably, especially in February 2020, as concerns regarding the spread of the Corona- virus (COVID-19) took hold. The US credit market performed strongly over the fiscal year, with total returns above 15%, as mea- sured by the Bloomberg Barclays U.S. Credit Index. Credit spreads tightened for most of the fiscal year, but with worries stemming from the coronavirus, credit spreads widened in the last two months. With spreads roughly unchanged over the past 12 months, the pri- mary driver of returns was the decline in US Treasury yields. In particular, the 10-year US Treasury yield fell from 2.73% at the begin- ning of the fiscal year to 1.13% as of Febru- ary 29, 2020.1

During the fiscal year, the US Federal Re- serve (the Fed) cut interest rates three times: in July, September and October 2019 for a total decrease of 75 basis points.2 (A basis point is one one-hundredth of a percent- age point.) As a result, the federal funds tar- get rate stood at a range of 1.50% to 1.75%, on October 31, 2019, as well as at the end of the fiscal year.2 In addition to the decline in interest rates, US Treasury yields fell across all maturities. US investment grade credit returns were positive each month during the fiscal year, except for September. The out-of-

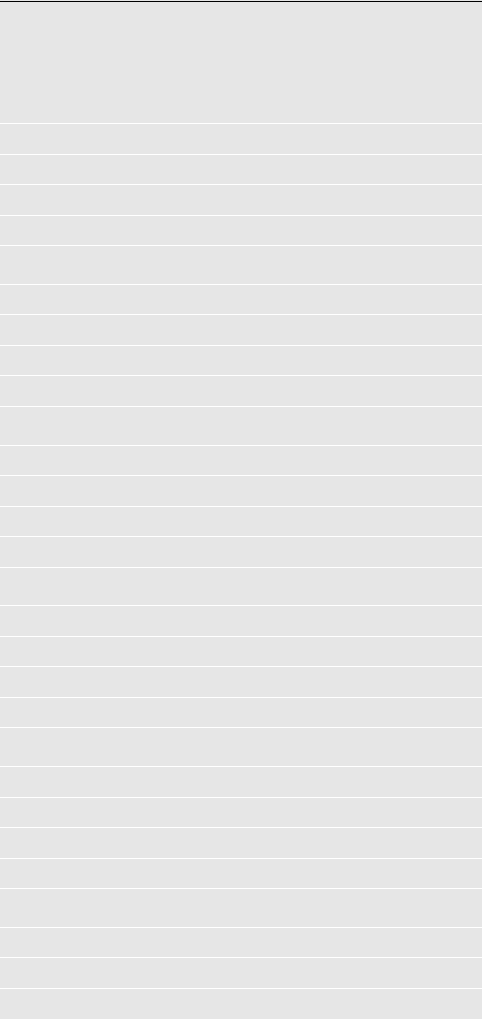

Portfolio Composition

By security type | % of total net assets |

U.S. Dollar Denominated Bonds & |

Notes | 87.51% |

U.S. Treasury Securities | 4.84 |

Preferred Stocks | 1.63 |

Asset-Backed Securities | 1.28 |

Security Types Each Less Than |

1% of Portfolio | 1.36 |

Money Market Funds Plus Other |

Assets Less Liabilities | 3.38 |

index US high yield sector posted a positive return for the fiscal year, as did emerging markets credit.

The Fund, at NAV, posted a positive return for the fiscal year, but underperformed its broad market/style-specific benchmark, the Bloomberg Barclays U.S. Credit Index. Secu- rity selection in investment grade corporate bonds was the most notable contributor to the Fund's relative performance. Security selection in the financials and industrials sec- tors contributed significantly to the Fund's relative performance, as did an out-of-index exposure to the high yield sector.

The Fund's shorter duration relative to the broad market/style-specific benchmark damp- ened its performance, as interest rates fell meaningfully during the fiscal year. Addition- ally, an underweight allocation to the non- corporate credit sector, particularly local au- thority issuers, was a minor detractor from the Fund's relative performance, as the sec- tor performed well during the fiscal year.

The Fund may use active duration and yield curve positioning for risk management and for generating excess return versus its broad market/style-specific benchmark. Duration measures a portfolio's price sensitivity to in- terest rate changes. Yield curve positioning refers to actively emphasizing particular points (maturities) along the yield curve with favorable risk-return expectations. During the

Top Five Debt Issuers*

% of total net assets |

1. U.S. Treasury | 4.84% |

2. Enterprise Products | |

Operating LLC | 2.47 |

3. AbbVie, Inc. | 1.92 |

4. AT&T, Inc. | 1.69 |

5. Sprint Spectrum Co. LLC/Sprint | |

Spectrum Co. II LLC/Sprint | |

Spectrum Co. III LLC | 1.52 |

We wish to remind you that the Fund is subject to interest rate risk, meaning when interest rates rise, the value of fixed income securities tends to fall. The risk may be greater in the current market enviroment be- cause interest rates are near historic lows. The degree to which the value of fixed income securities may decline due to rising interest rates may vary depending on the speed and magnitude of the increase in interest rates, as well as individual security characteristics, such as price, maturity, duration and coupon and market forces, such as supply and de- mand for similar securities. We are monitor- ing interest rates, and the market, economic and geopolitical factors that may impact the direction, speed and magnitude of changes to interest rates across the maturity spectrum, including the potential impact of monetary policy changes by the Fed and certain foreign central banks. If interest rates rise or fall faster than expected, markets may experience increased volatility, which may affect the value and/or liquidity of certain of the Fund's investments.

Thank you for investing in Invesco Corpo- rate Bond Fund and for sharing our long-term investment horizon.

1Source: US Department of the Treasury

2 Source: US Federal Reserve

The Fund's holdings are subject to change, and there is no assurance that the Fund will continue to hold any particular security.

*Excluding money market fund holdings, if any.

Data presented here are as of February 29, 2020.

4Invesco Corporate Bond Fund

Portfolio Managers:

Matthew Brill

Chuck Burge

Michael Hyman

Scott Roberts

Todd Schomberg

The views and opinions expressed in management's discussion of Fund performance are those of Invesco Advisers, Inc. These views and opinions are subject to change at any time based on factors such as market and economic conditions. These views and opinions may not be relied upon as investment advice or recommendations, or as an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but Invesco Advisers, Inc. makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

See important Fund and, if applicable, index disclosures later in this report.

5Invesco Corporate Bond Fund

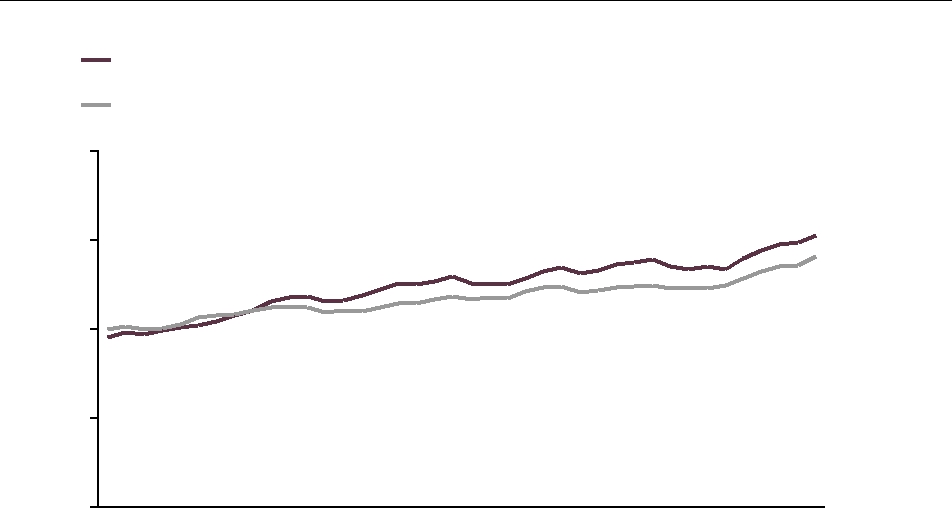

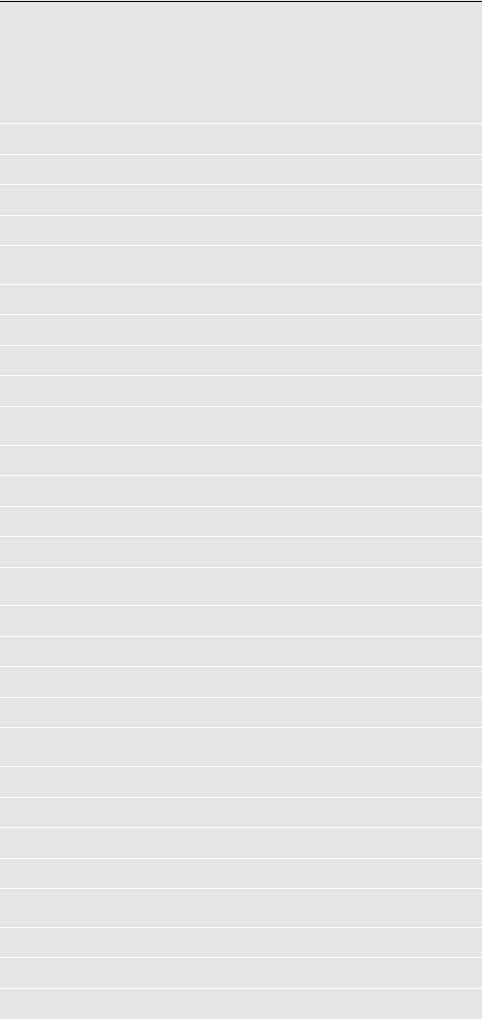

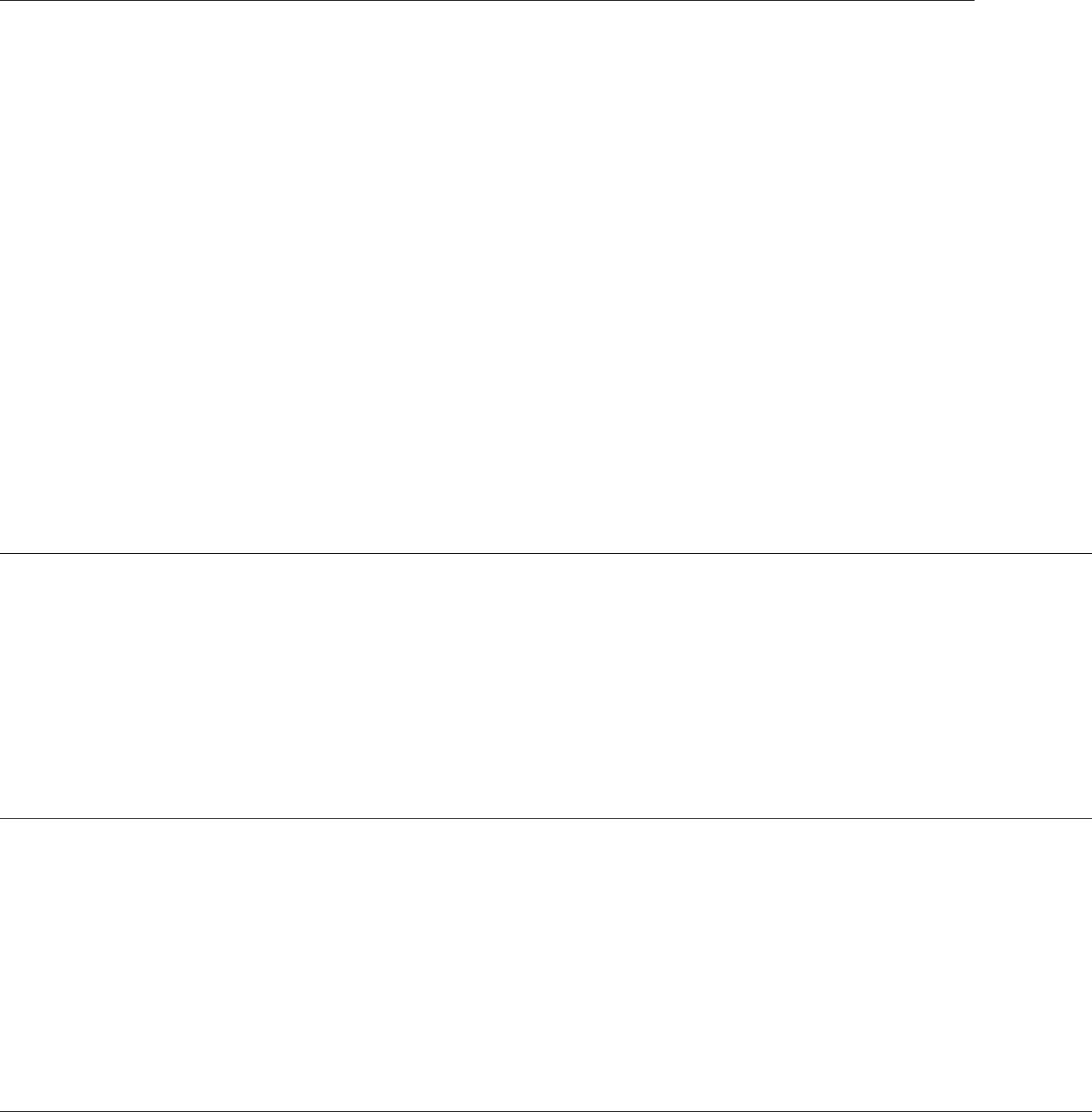

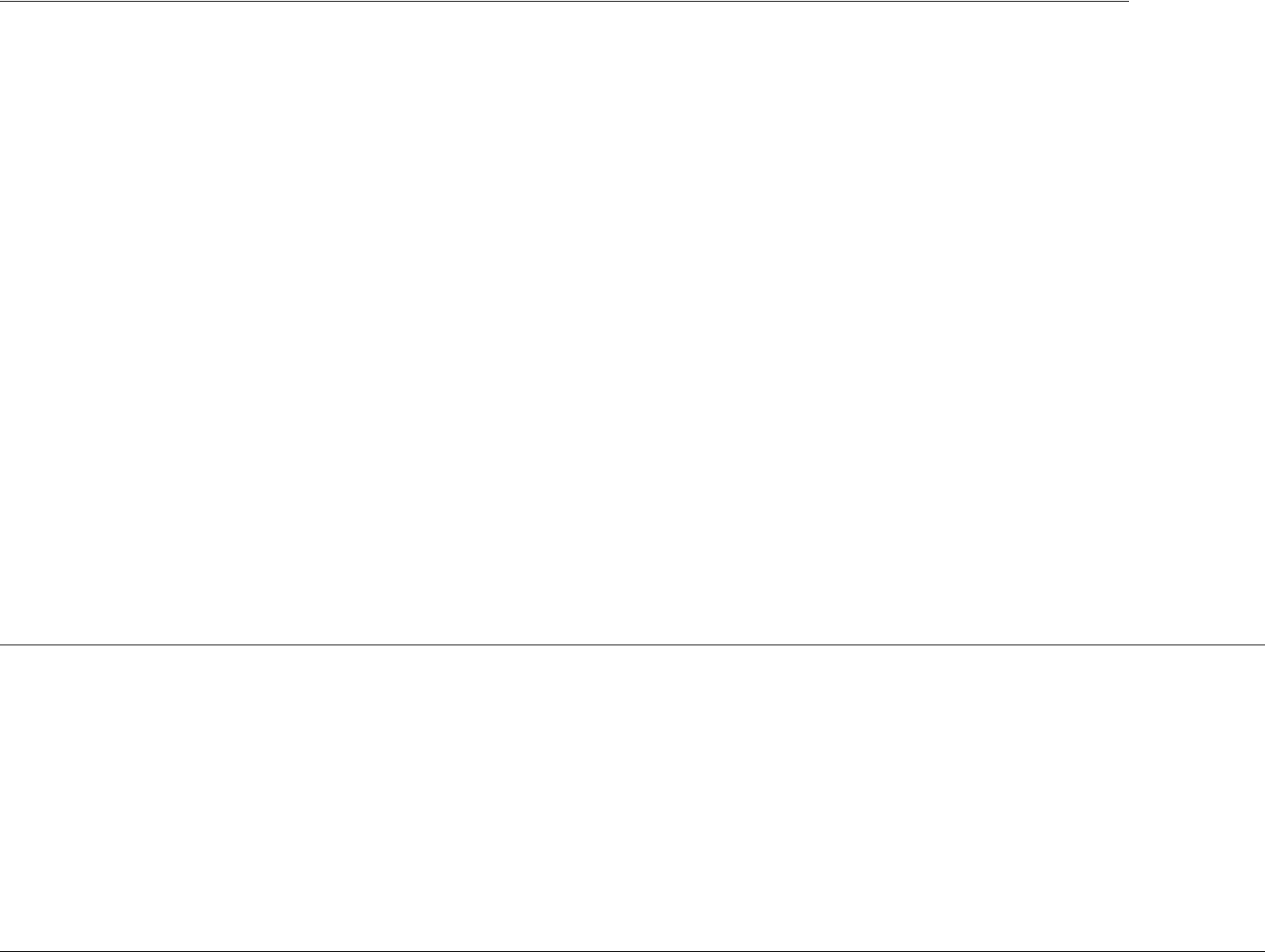

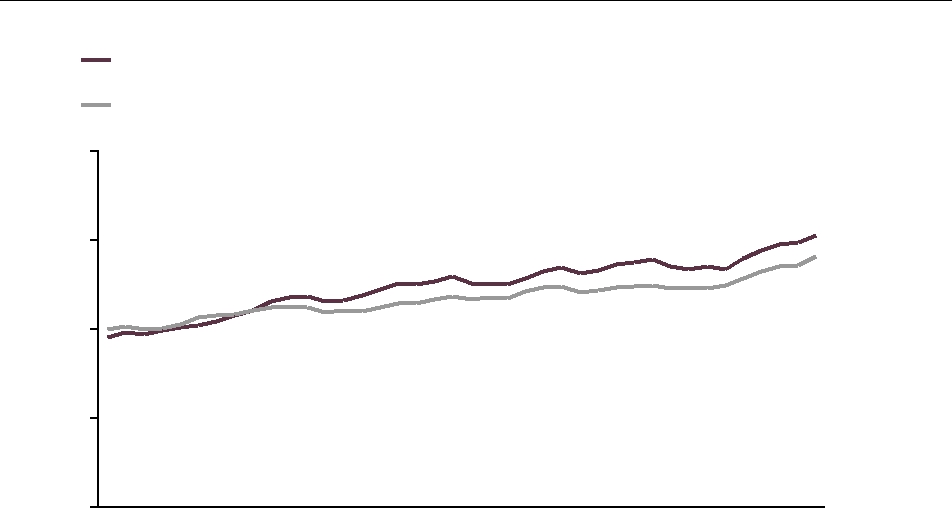

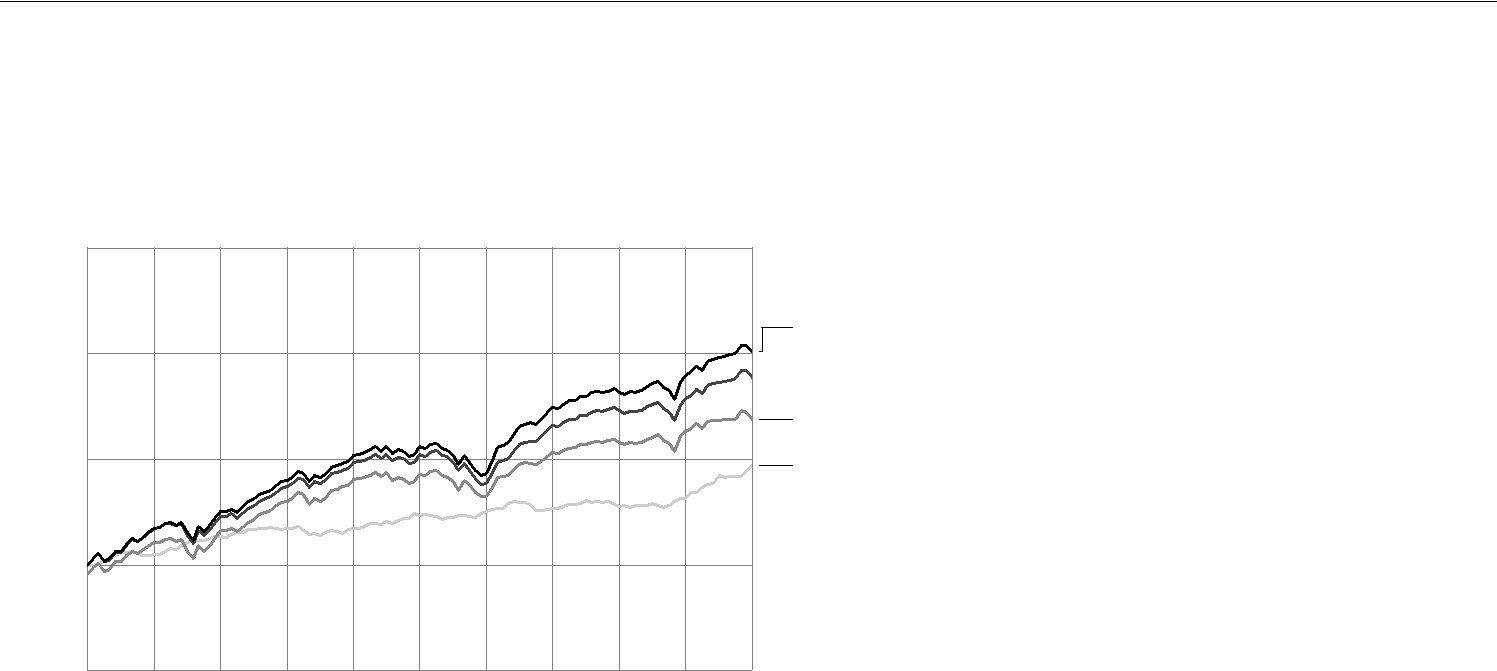

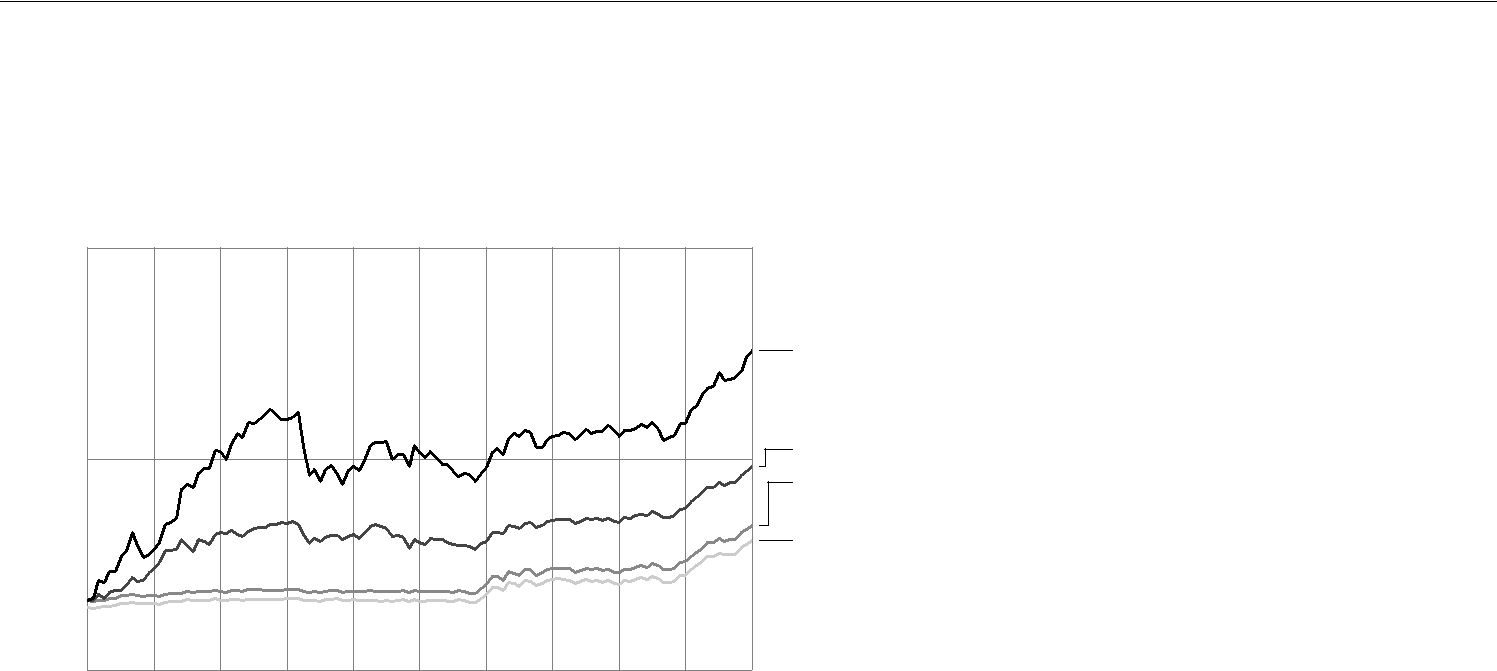

Your Fund's Long-Term Performance

Results of a $10,000 Investment — Oldest Share Class(es)

Fund and index data from 2/28/10

$20,000

$17,638 Lipper BBB Rated Funds Index1

$17,081 Bloomberg Barclays U.S. Credit Index2

$17,004 Invesco Corporate Bond Fund — Class A Shares

$17,004 Invesco Corporate Bond Fund — Class A Shares

15,000

10,000

5,000

2/28/10 | 2/11 | 2/12 | 2/13 | 2/14 | 2/15 | 2/16 | 2/17 | 2/18 | 2/19 | 2/20 |

1 Source: Lipper Inc.

2 Source: RIMES Technologies Corp.

Past performance cannot guarantee future results.

The data shown in the chart include rein- vested distributions, applicable sales charges and Fund expenses including management

fees. Index results include reinvested divi- dends, but they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses and management fees; performance of a market index does not. Per-

formance shown in the chart and table(s) does not reflect deduction of taxes a share- holder would pay on Fund distributions or sale of Fund shares.

6Invesco Corporate Bond Fund

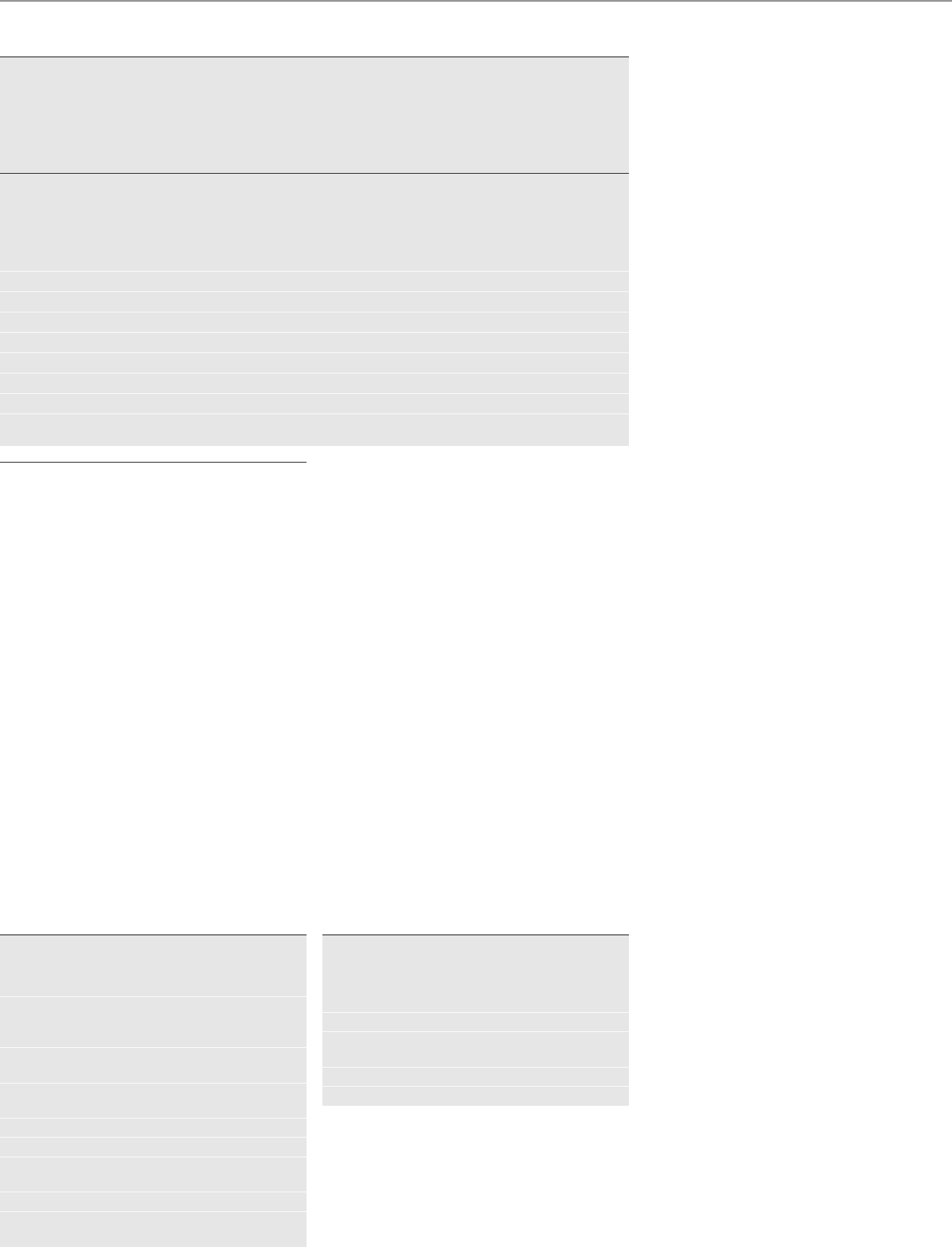

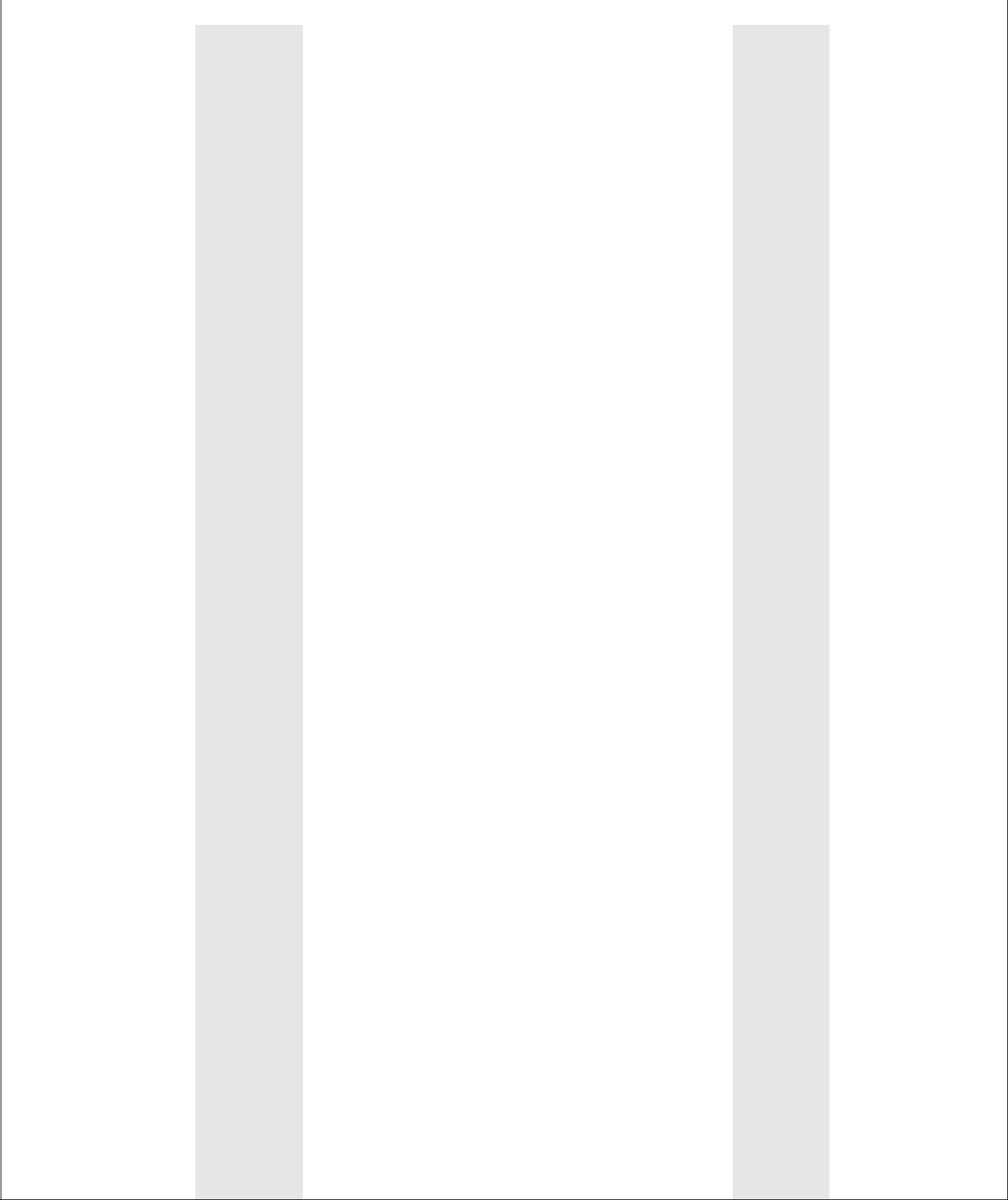

Average Annual Total Returns

As of 2/29/20, including maximum applicable sales charges

Class A Shares

Inception (9/23/71) | 7.06% |

10 Years | 5.45 |

5 | Years | 4.14 |

1 | Year | 10.33 |

Class C Shares | |

Inception (8/30/93) | 5.33% |

10 Years | 5.18 |

5 | Years | 4.31 |

1 | Year | 13.43 |

Class R Shares | |

10 Years | 5.66% |

5 | Years | 4.80 |

1 | Year | 15.06 |

Class Y Shares | |

Inception (8/12/05) | 5.83% |

10 Years | 6.20 |

5 | Years | 5.31 |

1 | Year | 15.62 |

Class R5 Shares | |

10 Years | 6.31% |

5 | Years | 5.41 |

1 | Year | 15.55 |

Class R6 Shares | |

10 Years | 6.26% |

5 | Years | 5.50 |

1 | Year | 15.62 |

Effective June 1, 2010, Class A, Class C and Class I shares of the predecessor fund, Van Kampen Corporate Bond Fund, advised by Van Kampen Asset Management were reorganized into Class A, Class C and Class Y shares, respectively, of Invesco Van Kampen Corporate Bond Fund (re- named Invesco Corporate Bond Fund). Re- turns shown above, prior to June 1, 2010, for Class A, Class C and Class Y shares are blended returns of the predecessor fund and Invesco Corporate Bond Fund. Share class returns will differ from the predeces- sor fund because of different expenses.

Class R shares incepted on June 6, 2011. Performance shown prior to that date is that of the Fund's and the predecessor fund's Class A shares, restated to reflect the higher 12b-1 fees applicable to Class R shares.

Class R5 shares incepted on June 1, 2010. Performance shown prior to that date is that of the predecessor fund's Class A shares and includes the 12b-1 fees applicable to Class A shares.

Class R6 shares incepted on Septem-

ber 24, 2012. Performance shown prior to that date is that of the Fund's and the pre- decessor fund's Class A shares and in- cludes the 12b-1 fees applicable to Class A shares.

The performance data quoted represent past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ performance for the most recent month- end performance. Performance figures re- flect reinvested distributions, changes in net asset value and the effect of the maxi- mum sales charge unless otherwise stated. Performance figures do not reflect deduc- tion of taxes a shareholder would pay on Fund distributions or sale of Fund shares. Investment return and principal value will fluctuate so that you may have a gain or loss when you sell shares.

Class A share performance reflects the maximum 4.25% sales charge, and Class C share performance reflects the applicable contingent deferred sales charge (CDSC) for the period involved. The CDSC on Class C shares is 1% for the first year after purchase. Class R, Class Y, Class R5 and Class R6 shares do not have a front-end sales charge or a CDSC; therefore, perfor- mance is at net asset value.

The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Fund performance reflects any applicable

fee waivers and/or expense reimburse- ments. Had the adviser not waived fees and/or reimbursed expenses currently or in the past, returns would have been lower. See current prospectus for more informa- tion.

7Invesco Corporate Bond Fund

Invesco Corporate Bond Fund's investment objective is to seek to provide current income with preservation of capital. Capital appreciation is a secondary objective that is sought only when consistent with the Fund's primary investment objective.

Unless otherwise stated, information presented in this report is as of February 29, 2020, and is based on total net assets.

Unless otherwise noted, all data provided by Invesco.

To access your Fund's reports/prospectus, visit invesco.com/fundreports.

About indexes used in this report

The Bloomberg Barclays U.S. Credit Index is an unmanaged index considered representative of publicly issued, SEC- registered US corporate and specified for- eign debentures and secured notes.

The Lipper BBB Rated Funds Index is an unmanaged index considered representa- tive of BBB-rated funds tracked by Lipper.

The Fund is not managed to track the per- formance of any particular index, including the index(es) described here, and conse- quently, the performance of the Fund may deviate significantly from the performance of the index(es).

A direct investment cannot be made in an index. Unless otherwise indicated, index results include reinvested dividends, and they do not reflect sales charges. Perfor- mance of the peer group, if applicable, reflects fund expenses; performance of a market index does not.

This report must be accompanied or preceded by a currently effective Fund prospectus, which contains more complete information, including sales charges and expenses. Investors should read it carefully before investing.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

8Invesco Corporate Bond Fund

Schedule of Investments(a)

February 29, 2020

Principal

AmountValue

U.S. Dollar Denominated Bonds & Notes–87.51%

Advertising–0.23% | | | |

Lamar Media Corp., | | | |

3.75%, 02/15/2028(b) | $ 3,842,000 | $ | 3,862,363 |

4.00%, 02/15/2030(b) | 1,302,000 | | 1,305,255 |

| | | 5,167,618 |

Aerospace & Defense–0.63% | | | |

Boeing Co. (The), | | | |

2.95%, 02/01/2030 | 7,000,000 | | 7,351,189 |

3.95%, 08/01/2059 | 5,000,000 | | 5,483,503 |

Moog, Inc., 4.25%, 12/15/2027(b) | 149,000 | | 151,980 |

Spirit AeroSystems, Inc., 4.60%, | | | |

06/15/2028 | 96,000 | | 95,394 |

TransDigm UK Holdings PLC, 6.88%, | | | |

05/15/2026 | 301,000 | | 316,907 |

TransDigm, Inc., | | | |

6.50%, 07/15/2024 | 70,000 | | 71,721 |

6.38%, 06/15/2026 | 141,000 | | 145,145 |

Triumph Group, Inc., 7.75%, | | | |

08/15/2025 | 331,000 | | 328,655 |

| | | 13,944,494 |

Agricultural & Farm Machinery–0.02% | | |

Titan International, Inc., 6.50%, | | | |

11/30/2023 | 470,000 | | 353,870 |

Air Freight & Logistics–0.00% | | | |

XPO Logistics, Inc., 6.50%, | | | |

06/15/2022(b) | 84,000 | | 84,099 |

Airlines–5.60% | | | |

American Airlines Pass Through Trust, | | | |

Series 2017-1, Class B, 4.95%, | | | |

02/15/2025 | 2,076,900 | | 2,232,796 |

Series 2016-1, Class AA, 3.58%, | | | |

01/15/2028 | 1,673,737 | | 1,836,253 |

Series 2019-1, Class B, 3.85%, | | | |

02/15/2028 | 3,613,534 | | 3,791,678 |

Series 2016-3, Class AA, 3.00%, | | | |

10/15/2028 | 4,036,714 | | 4,299,037 |

Series 2017-1, Class AA, 3.65%, | | | |

02/15/2029 | 2,761,247 | | 3,045,077 |

Series 2017-2, Class A, 3.60%, | | | |

10/15/2029 | 3,746,014 | | 4,014,579 |

Series 2017-2, Class AA, 3.35%, | | | |

10/15/2029 | 4,663,913 | | 5,044,690 |

Series 2019-1, Class AA, 3.15%, | | | |

02/15/2032 | 7,379,602 | | 7,965,534 |

Avianca Holdings S.A. (Colombia), | | | |

9.00%, 05/10/2023(b) | 2,909,000 | | 2,465,377 |

British Airways Pass Through Trust | | | |

(United Kingdom), | | | |

Series 2019-1, Class A, 3.35%, | | | |

06/15/2029(b) | 2,556,000 | | 2,724,893 |

Series 2019-1, Class AA, 3.30%, | | | |

12/15/2032(b) | 6,049,427 | | 6,593,548 |

| Principal | | |

| Amount | | Value |

Airlines–(continued) | | | |

Delta Air Lines Pass Through Trust, | | | |

Series 2019-1, Class A, 3.40%, | | | |

04/25/2024 | $ 3,233,000 | $ | 3,443,124 |

Series 2019-1, Class AA, 3.20%, | | | |

04/25/2024 | 4,673,000 | | 4,968,471 |

Delta Air Lines, Inc., | | | |

3.63%, 03/15/2022 | 9,961,000 | | 10,264,069 |

3.80%, 04/19/2023 | 2,065,000 | | 2,149,842 |

2.90%, 10/28/2024 | 7,922,000 | | 7,990,793 |

3.75%, 10/28/2029 | 10,445,000 | | 10,483,221 |

LATAM Airlines Group S.A. Pass | | | |

Through Trust (Chile), | | | |

Series 2015-1, Class A, 4.20%, | | | |

11/15/2027 | 4,849,648 | | 5,023,496 |

Norwegian Air Shuttle ASA Pass Through | | | |

Trust (Norway), | | | |

Series 2016-1, Class B, 7.50%, | | | |

11/10/2023(b) | 4,549,019 | | 4,824,747 |

Series 2016-1, Class A, 4.88%, | | | |

05/10/2028(b) | 4,288,499 | | 4,183,809 |

Southwest Airlines Co., 2.63%, | | | |

02/10/2030 | 3,055,000 | | 3,075,493 |

United Airlines Pass Through Trust, | | | |

Series 2014-2, Class B, 4.63%, | | | |

09/03/2022 | 1,594,765 | | 1,666,028 |

Series 2016-1, Class B, 3.65%, | | | |

01/07/2026 | 2,301,310 | | 2,410,871 |

Series 2019-2, Class B, 3.50%, | | | |

05/01/2028 | 2,833,000 | | 2,939,440 |

Series 2018-1, Class A, 3.70%, | | | |

03/01/2030 | 4,649,206 | | 4,989,386 |

Series 2018-1, Class AA, 3.50%, | | | |

03/01/2030 | 4,381,019 | | 4,770,132 |

Series 2019-1, Class A, 4.55%, | | | |

08/25/2031 | 2,021,743 | | 2,325,737 |

Series 2019-1, Class AA, 4.15%, | | | |

08/25/2031 | 3,942,854 | | 4,467,608 |

| | | 123,989,729 |

Alternative Carriers–0.17% | | | |

CenturyLink, Inc., | | | |

Series S, 6.45%, 06/15/2021 | 299,000 | | 310,885 |

Series Y, 7.50%, 04/01/2024 | 264,000 | | 296,450 |

4.00%, 02/15/2027(b) | 1,966,000 | | 1,980,548 |

Level 3 Financing, Inc., | | | |

5.38%, 05/01/2025 | 717,000 | | 733,430 |

5.25%, 03/15/2026 | 377,000 | | 389,950 |

| | | 3,711,263 |

Aluminum–0.04% | | | |

Alcoa Nederland Holding B.V., | | | |

6.75%, 09/30/2024(b) | 600,000 | | 616,506 |

Novelis Corp., 4.75%, | | | |

01/30/2030(b) | 198,000 | | 194,966 |

| | | 811,472 |

Apparel Retail–0.05% | | | |

L Brands, Inc., | | | |

6.88%, 11/01/2035 | 539,000 | | 548,042 |

6.75%, 07/01/2036 | 303,000 | | 307,575 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

9Invesco Corporate Bond Fund

| | Principal | | |

| | Amount | | Value |

Apparel Retail–(continued) | | | | |

Michaels Stores, Inc., 8.00%, | | | | |

07/15/2027(b) | $ | 267,000 | $ | 223,065 |

| | | | 1,078,682 |

Apparel, Accessories & Luxury Goods–0.03% | | |

Hanesbrands, Inc., | | | | |

4.63%, 05/15/2024(b) | | 69,000 | | 72,249 |

4.88%, 05/15/2026(b) | | 560,000 | | 587,636 |

| | | | 659,885 |

Asset Management & Custody Banks–1.14% | | |

Affiliated Managers Group, Inc., | | | | |

4.25%, 02/15/2024 | | 4,515,000 | | 4,908,673 |

Apollo Management Holdings L.P., | | | | |

4.95%, 01/14/2050(b)(c) | | 7,115,000 | | 7,161,618 |

Blackstone Holdings Finance Co. LLC, | | | | |

5.00%, 06/15/2044(b) | | 4,355,000 | | 5,643,174 |

Carlyle Holdings II Finance LLC, | | | | |

5.63%, 03/30/2043(b) | | 5,900,000 | | 7,492,917 |

| | | | 25,206,382 |

Auto Parts & Equipment–0.04% | | | | |

Adient Global Holdings Ltd., 4.88%, | | | | |

08/15/2026(b) | | 200,000 | | 173,005 |

Dana Financing Luxembourg S.a.r.l., | | | | |

5.75%, 04/15/2025(b) | | 132,000 | | 136,345 |

Dana, Inc., 5.38%, 11/15/2027 | | 221,000 | | 223,763 |

Panther BF Aggregator 2 L.P./Panther | | | | |

Finance Co., Inc. (Canada), | | | | |

6.25%, 05/15/2026(b) | | 135,000 | | 138,925 |

8.50%, 05/15/2027(b) | | 178,000 | | 181,444 |

Tenneco, Inc., 5.00%, 07/15/2026 | | 115,000 | | 99,190 |

| | | | 952,672 |

Automobile Manufacturers–2.85% | | | |

Ford Motor Credit Co. LLC, | | | | |

5.09%, 01/07/2021 | | 2,887,000 | | 2,962,561 |

5.60%, 01/07/2022 | | 410,000 | | 432,718 |

3.35%, 11/01/2022 | | 7,372,000 | | 7,444,550 |

5.58%, 03/18/2024 | | 5,254,000 | | 5,624,923 |

4.06%, 11/01/2024 | | 4,000,000 | | 4,078,620 |

General Motors Financial Co., Inc., | | | | |

Series B, 6.50%(d) | | 200,000 | | 203,651 |

3.20%, 07/06/2021 | | 1,175,000 | | 1,189,028 |

5.10%, 01/17/2024 | | 2,352,000 | | 2,575,870 |

Hyundai Capital America, | | | | |

2.85%, 11/01/2022(b) | | 3,237,000 | | 3,320,404 |

4.30%, 02/01/2024(b) | | 14,635,000 | | 15,770,048 |

2.65%, 02/10/2025(b) | | 5,060,000 | | 5,161,388 |

3.50%, 11/02/2026(b) | | 6,823,000 | | 7,218,826 |

J.B. Poindexter & Co., Inc., 7.13%, | | | | |

04/15/2026(b) | | 539,000 | | 570,479 |

Toyota Motor Credit Corp., 2.15%, | | | | |

02/13/2030 | | 3,406,000 | | 3,449,445 |

Volkswagen Group of America | | | | |

Finance LLC (Germany), | | | | |

2.65%, (3 mo. USD LIBOR + | | | | |

0.94%), 11/12/2021(b)(c) | | 2,876,000 | | 2,905,495 |

3.20%, 09/26/2026(b) | | 200,000 | | 210,274 |

| | | | 63,118,280 |

| Principal | | |

| Amount | | Value |

Automotive Retail–0.23% | | | |

Advance Auto Parts, Inc., 4.50%, | | | |

12/01/2023 | $ 3,400,000 | $ | 3,738,857 |

Asbury Automotive Group, Inc., | | | |

4.75%, 03/01/2030(b) | 113,000 | | 115,260 |

AutoZone, Inc., 3.75%, | | | |

04/18/2029 | 200,000 | | 226,460 |

Lithia Motors, Inc., | | | |

5.25%, 08/01/2025(b) | 108,000 | | 112,905 |

4.63%, 12/15/2027(b) | 106,000 | | 108,775 |

Murphy Oil USA, Inc., 5.63%, | | | |

05/01/2027 | 300,000 | | 317,895 |

Penske Automotive Group, Inc., | | | |

5.50%, 05/15/2026 | 509,000 | | 529,029 |

| | | 5,149,181 |

Biotechnology–2.22% | | | |

AbbVie, Inc., | | | |

2.30%, 11/21/2022(b) | 6,144,000 | | 6,249,433 |

3.75%, 11/14/2023 | 250,000 | | 268,106 |

2.60%, 11/21/2024(b) | 10,844,000 | | 11,213,492 |

3.20%, 11/21/2029(b) | 8,501,000 | | 8,984,637 |

4.05%, 11/21/2039(b) | 9,357,000 | | 10,352,006 |

4.88%, 11/14/2048 | 4,254,000 | | 5,242,897 |

Amgen, Inc., | | | |

2.45%, 02/21/2030 | 1,695,000 | | 1,725,456 |

3.15%, 02/21/2040 | 3,286,000 | | 3,397,843 |

3.38%, 02/21/2050 | 1,694,000 | | 1,731,589 |

| | | 49,165,459 |

Brewers–0.20% | | | |

Anheuser-Busch InBev Worldwide, Inc. | | | |

(Belgium), | | | |

4.00%, 04/13/2028 | 300,000 | | 338,473 |

8.00%, 11/15/2039 | 2,414,000 | | 3,914,295 |

Molson Coors Beverage Co., 5.00%, | | | |

05/01/2042 | 249,000 | | 282,185 |

| | | 4,534,953 |

Broadcasting–0.32% | | | |

AMC Networks, Inc., | | | |

5.00%, 04/01/2024 | 329,000 | | 331,467 |

4.75%, 08/01/2025 | 61,000 | | 60,926 |

Clear Channel Worldwide Holdings, | | | |

Inc., 9.25%, 02/15/2024(b) | 223,000 | | 237,402 |

Gray Television, Inc., 7.00%, | | | |

05/15/2027(b) | 167,000 | | 181,462 |

iHeartCommunications, Inc., 8.38%, | | | |

05/01/2027 | 275,000 | | 299,145 |

NBCUniversal Media LLC, 5.95%, | | | |

04/01/2041 | 3,964,000 | | 5,780,916 |

TV Azteca S.A.B. de C.V. (Mexico), | | | |

8.25%, 08/09/2024(b) | 300,000 | | 272,126 |

| | | 7,163,444 |

Building Products–0.06% | | | |

Advanced Drainage Systems, Inc., | | | |

5.00%, 09/30/2027(b) | 138,000 | | 143,051 |

Owens Corning, 4.30%, | | | |

07/15/2047 | 250,000 | | 268,386 |

Standard Industries, Inc., | | | |

6.00%, 10/15/2025(b) | 725,000 | | 759,430 |

5.00%, 02/15/2027(b) | 47,000 | | 48,360 |

| | | 1,219,227 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

10 | Invesco Corporate Bond Fund |

| | Principal | | |

| | Amount | | Value |

Cable & Satellite–1.98% | | | | |

Altice Financing S.A. (Luxembourg), | | | | |

7.50%, 05/15/2026(b) | $ | 260,000 | $ | 274,144 |

CCO Holdings LLC/CCO Holdings Capital | | | | |

Corp., | | | | |

5.75%, 09/01/2023 | | 576,000 | | 582,552 |

5.75%, 02/15/2026(b) | | 1,273,000 | | 1,325,893 |

4.50%, 08/15/2030(b) | | 131,000 | | 132,719 |

Charter Communications Operating LLC/ | | | | |

Charter Communications Operating | | | | |

Capital Corp., | | | | |

4.91%, 07/23/2025 | | 5,493,000 | | 6,158,334 |

5.38%, 04/01/2038 | | 2,239,000 | | 2,575,146 |

5.75%, 04/01/2048 | | 2,515,000 | | 3,003,664 |

6.83%, 10/23/2055 | | 4,449,000 | | 6,011,803 |

Comcast Corp., | | | | |

3.95%, 10/15/2025 | | 1,775,000 | | 1,987,740 |

6.45%, 03/15/2037 | | 1,885,000 | | 2,786,319 |

4.60%, 10/15/2038 | | 2,560,000 | | 3,226,996 |

3.25%, 11/01/2039 | | 1,040,000 | | 1,126,575 |

3.45%, 02/01/2050 | | 4,305,000 | | 4,759,236 |

4.95%, 10/15/2058 | | 2,621,000 | | 3,586,240 |

Cox Communications, Inc., 3.35%, | | | | |

09/15/2026(b) | | 2,316,000 | | 2,473,673 |

CSC Holdings LLC, | | | | |

7.75%, 07/15/2025(b) | | 434,000 | | 457,866 |

10.88%, 10/15/2025(b) | | 356,000 | | 391,271 |

6.63%, 10/15/2025(b) | | 200,000 | | 209,502 |

5.50%, 05/15/2026(b) | | 265,000 | | 274,984 |

DISH DBS Corp., | | | | |

5.88%, 11/15/2024 | | 239,000 | | 245,648 |

7.75%, 07/01/2026 | | 130,000 | | 139,933 |

Globo Comunicacao e Participacoes | | | | |

S.A. (Brazil), 4.88%, | | | | |

01/22/2030(b) | | 1,191,000 | | 1,193,084 |

UPC Holding B.V. (Netherlands), | | | | |

5.50%, 01/15/2028(b) | | 200,000 | | 203,190 |

Virgin Media Secured Finance PLC | | | | |

(United Kingdom), 5.50%, | | | | |

08/15/2026(b) | | 239,000 | | 246,502 |

VTR Finance B.V. (Chile), 6.88%, | | | | |

01/15/2024(b) | | 200,000 | | 204,333 |

Ziggo B.V. (Netherlands), 5.50%, | | | | |

01/15/2027(b) | | 225,000 | | 232,175 |

| | | | 43,809,522 |

Casinos & Gaming–0.07% | | | | |

Boyd Gaming Corp., | | | | |

6.38%, 04/01/2026 | | 115,000 | | 120,100 |

6.00%, 08/15/2026 | | 113,000 | | 116,396 |

MGM Resorts International, | | | | |

7.75%, 03/15/2022 | | 301,000 | | 330,131 |

6.00%, 03/15/2023 | | 559,000 | | 602,789 |

Wynn Las Vegas LLC/Wynn Las Vegas | | | | |

Capital Corp., 5.50%, | | | | |

03/01/2025(b) | | 319,000 | | 313,813 |

| | | | 1,483,229 |

Coal & Consumable Fuels–0.02% | | | | |

SunCoke Energy Partners | | | | |

L.P./SunCoke Energy Partners | | | | |

Finance Corp., 7.50%, | | | | |

06/15/2025(b) | | 602,000 | | 543,299 |

| | Principal | | |

| | Amount | | Value |

Commodity Chemicals–0.13% | | | | |

Alpek S.A.B. de C.V. (Mexico), | | | | |

4.25%, 09/18/2029(b) | $ | 1,987,000 | $ | 2,077,408 |

Koppers, Inc., 6.00%, | | | | |

02/15/2025(b) | | 219,000 | | 216,260 |

Nufarm Australia Ltd./Nufarm | | | | |

Americas, Inc. (Australia), 5.75%, | | | | |

04/30/2026(b) | | 153,000 | | 151,141 |

Olin Corp., 5.63%, 08/01/2029 | | 509,000 | | 514,421 |

| | | | 2,959,230 |

Communications Equipment–0.03% | | |

Hughes Satellite Systems Corp., | | | | |

7.63%, 06/15/2021 | | 281,000 | | 296,421 |

5.25%, 08/01/2026 | | 263,000 | | 289,063 |

| | | | 585,484 |

Construction & Engineering–0.18% | | | |

AECOM, 5.13%, 03/15/2027 | | 133,000 | | 137,804 |

Shea Homes L.P./Shea Homes | | | | |

Funding Corp., 4.75%, | | | | |

02/15/2028(b) | | 3,579,000 | | 3,587,572 |

Valmont Industries, Inc., 5.00%, | | | | |

10/01/2044 | | 250,000 | | 288,220 |

| | | | 4,013,596 |

Construction Machinery & Heavy Trucks–0.11% | | |

Ashtead Capital, Inc. (United | | | | |

Kingdom), 4.00%, | | | | |

05/01/2028(b) | | 2,115,000 | | 2,137,675 |

Westinghouse Air Brake Technologies | | | | |

Corp., 4.95%, 09/15/2028 | | 209,000 | | 237,847 |

| | | | 2,375,522 |

Construction Materials–1.42% | | | | |

Carrier Global Corp., | | | | |

2.24%, 02/15/2025(b) | | 7,631,000 | | 7,772,701 |

2.49%, 02/15/2027(b) | | 2,982,000 | | 3,038,671 |

2.72%, 02/15/2030(b) | | 6,236,000 | | 6,338,958 |

3.38%, 04/05/2040(b) | | 5,956,000 | | 6,122,869 |

3.58%, 04/05/2050(b) | | 4,027,000 | | 4,141,102 |

CRH America Finance, Inc. (Ireland), | | | | |

3.95%, 04/04/2028(b) | | 3,524,000 | | 3,999,721 |

| | | | 31,414,022 |

Consumer Finance–1.29% | | | | |

Ally Financial, Inc., | | | | |

4.13%, 03/30/2020 | | 4,155,000 | | 4,167,507 |

5.13%, 09/30/2024 | | 434,000 | | 481,699 |

4.63%, 03/30/2025 | | 1,303,000 | | 1,422,869 |

American Express Co., Series C, | | | | |

4.90% (3 mo. USD LIBOR + | | | | |

3.29%)(c)(d) | | 3,075,000 | | 3,063,100 |

Capital One Financial Corp., 3.75%, | | | | |

03/09/2027 | | 6,970,000 | | 7,619,932 |

Credit Acceptance Corp., | | | | |

5.13%, 12/31/2024(b) | | 1,381,000 | | 1,425,882 |

6.63%, 03/15/2026(b) | | 1,923,000 | | 2,023,751 |

Discover Bank, 4.68% (5 yr. | | | | |

U.S. Swap Rate + 1.73%), | | | | |

08/09/2028(c) | | 1,990,000 | | 2,116,395 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

11 | Invesco Corporate Bond Fund |

| | Principal | | |

| | Amount | | Value |

Consumer Finance–(continued) | | | | |

Navient Corp., | | | | |

8.00%, 03/25/2020 | $ | 99,000 | $ | 99,516 |

7.25%, 01/25/2022 | | 160,000 | | 168,685 |

7.25%, 09/25/2023 | | 1,040,000 | | 1,120,590 |

5.00%, 03/15/2027 | | 486,000 | | 471,274 |

Synchrony Financial, 4.50%, | | | | |

07/23/2025 | | 4,000,000 | | 4,399,021 |

| | | | 28,580,221 |

Copper–0.64% | | | | |

First Quantum Minerals Ltd. (Zambia), | | | | |

7.50%, 04/01/2025(b) | | 548,000 | | 523,112 |

Freeport-McMoRan, Inc., | | | | |

5.00%, 09/01/2027 | | 4,626,000 | | 4,574,513 |

4.13%, 03/01/2028 | | 4,062,000 | | 3,854,229 |

4.25%, 03/01/2030 | | 4,062,000 | | 3,827,419 |

5.40%, 11/14/2034 | | 1,102,000 | | 1,077,401 |

Taseko Mines Ltd. (Canada), 8.75%, | | | | |

06/15/2022(b) | | 445,000 | | 401,751 |

| | | | 14,258,425 |

Data Processing & Outsourced Services–0.49% | | |

Alliance Data Systems Corp., 4.75%, | | | | |

12/15/2024(b) | | 2,112,000 | | 2,077,680 |

Cardtronics, Inc./Cardtronics USA, | | | | |

Inc., 5.50%, 05/01/2025(b) | | 212,000 | | 217,918 |

Fiserv, Inc., 4.20%, 10/01/2028 | | 2,400,000 | | 2,746,180 |

PayPal Holdings, Inc., | | | | |

2.65%, 10/01/2026 | | 3,243,000 | | 3,389,923 |

2.85%, 10/01/2029 | | 2,247,000 | | 2,363,675 |

| | | | 10,795,376 |

Department Stores–0.01% | | | | |

Kohl's Corp., 5.55%, 07/17/2045 | | 249,000 | | 267,177 |

Diversified Banks–10.07% | | | | |

Africa Finance Corp. (Supranational), | | | | |

4.38%, 04/17/2026(b) | | 7,620,000 | | 8,247,583 |

ANZ New Zealand (Int'l) Ltd. (New | | | | |

Zealand), 2.13%, 07/28/2021(b) | | 3,990,000 | | 4,034,676 |

Australia & New Zealand Banking Group | | | | |

Ltd. (Australia), | | | | |

2.95%, 07/22/2030(b)(c) | | 3,576,000 | | 3,657,759 |

6.75%(b)(d) | | 3,847,000 | | 4,345,514 |

Banco del Estado de Chile (Chile), | | | | |

2.70%, 01/09/2025(b) | | 2,875,000 | | 2,910,938 |

Bank of America Corp., | | | | |

3.86%, (3 mo. USD LIBOR + | | | | |

0.94%), 07/23/2024(c) | | 8,727,000 | | 9,342,152 |

7.75%, 05/14/2038 | | 2,850,000 | | 4,614,856 |

Series AA, 6.10%(d) | | 6,420,000 | | 7,121,738 |

Series DD, 6.30%(d) | | 2,040,000 | | 2,303,497 |

Series Z, 6.50%(d) | | 4,500,000 | | 4,969,627 |

Bank of China Ltd. (China), 5.00%, | | | | |

11/13/2024(b) | | 2,850,000 | | 3,182,622 |

Barclays Bank PLC (United Kingdom), | | | | |

5.14%, 10/14/2020 | | 765,000 | | 781,498 |

7.63%, 11/21/2022 | | 200,000 | | 222,974 |

Barclays PLC (United Kingdom), | | | | |

4.84%, 05/09/2028 | | 965,000 | | 1,068,310 |

BBVA Bancomer S.A. (Mexico), | | | | |

4.38%, 04/10/2024(b) | | 2,015,000 | | 2,151,869 |

| Principal | | |

| Amount | | Value |

Diversified Banks–(continued) | | | |

BNP Paribas S.A. (France), | | | |

4.38%, 03/01/2033(b)(c) | $ 5,330,000 | $ | 5,895,719 |

4.50%(b)(c)(d) | 6,218,000 | | 5,942,076 |

BPCE S.A. (France), 2.38%, | | | |

01/14/2025(b) | 3,971,000 | | 4,032,094 |

Citigroup, Inc., | | | |

3.50%, 05/15/2023 | 3,980,000 | | 4,187,778 |

2.88%, (3 mo. USD LIBOR + | | | |

0.95%), 07/24/2023(c) | 1,575,000 | | 1,616,939 |

5.50%, 09/13/2025 | 4,845,000 | | 5,676,203 |

3.98%, 03/20/2030(c) | 4,000,000 | | 4,529,983 |

4.65%, 07/23/2048 | 1,983,000 | | 2,629,173 |

Series Q, 5.95%(d) | 1,570,000 | | 1,593,212 |

Series T, 6.25%(d) | 2,110,000 | | 2,345,613 |

Series U, 5.00%(d) | 7,500,000 | | 7,688,962 |

Series V, 4.70%(c)(d) | 2,340,000 | | 2,312,213 |

Credit Agricole S.A. (France), | | | |

8.13%(b)(d) | 202,000 | | 239,044 |

Federation des caisses Desjardins du | | | |

Quebec (Canada), 2.05%, | | | |

02/10/2025(b) | 5,537,000 | | 5,608,319 |

Global Bank Corp. (Panama), 4.50%, | | | |

10/20/2021(b) | 6,573,000 | | 6,747,184 |

HSBC Holdings PLC (United Kingdom), | | | |

4.00%, 03/30/2022 | 2,070,000 | | 2,165,022 |

2.69%, (3 mo. USD LIBOR + | | | |

1.00%), 05/18/2024(c) | 2,663,000 | | 2,680,842 |

6.00%(d) | 5,365,000 | | 5,578,715 |

ING Groep N.V. (Netherlands), | | | |

6.00%(d) | 465,000 | | 464,954 |

JPMorgan Chase & Co., | | | |

2.30%, 08/15/2021 | 4,545,000 | | 4,553,408 |

2.70%, (3 mo. USD LIBOR + | | | |

0.89%), 07/23/2024(c) | 5,790,000 | | 5,842,170 |

3.63%, 12/01/2027 | 2,750,000 | | 2,982,709 |

3.70%, 05/06/2030(c) | 4,000,000 | | 4,458,246 |

4.26%, (3 mo. USD LIBOR + | | | |

1.58%), 02/22/2048(c) | 1,935,000 | | 2,423,921 |

Series W, 2.69% (3 mo. USD | | | |

LIBOR + 1.00%), 05/15/2047(c) | 5,770,000 | | 5,116,519 |

Series HH, 4.60% (SOFR + | | | |

3.13%)(c)(d) | 3,330,000 | | 3,350,813 |

Series I, 5.24% (3 mo. USD LIBOR | | | |

+ 3.47%)(c)(d) | 2,726,000 | | 2,725,305 |

Series V, 5.23% (3 mo. USD LIBOR | | | |

+ 3.32%)(c)(d) | 2,005,000 | | 1,998,474 |

National Australia Bank Ltd. | | | |

(Australia), 3.93%, | | | |

08/02/2034(b)(c) | 1,690,000 | | 1,848,834 |

Royal Bank of Scotland Group PLC (The) | | | |

(United Kingdom), | | | |

3.50%, (3 mo. USD LIBOR + | | | |

1.48%), 05/15/2023(c) | 5,711,000 | | 5,899,077 |

3.75%, 11/01/2029(c) | 1,895,000 | | 1,970,882 |

SMBC Aviation Capital Finance DAC | | | |

(Ireland), | | | |

3.00%, 07/15/2022(b) | 3,147,000 | | 3,249,321 |

4.13%, 07/15/2023(b) | 4,076,000 | | 4,382,807 |

Societe Generale S.A. (France), | | | |

7.38%(b)(d) | 202,000 | | 211,550 |

7.38%(b)(d) | 1,507,000 | | 1,578,243 |

7.38%(b)(d) | 3,665,000 | | 3,956,166 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

12 | Invesco Corporate Bond Fund |

| | Principal | | |

| | Amount | | Value |

Diversified Banks–(continued) | | | | |

Standard Chartered PLC (United | | | | |

Kingdom), | | | | |

3.09%, (3 mo. USD LIBOR + | | | | |

1.20%), 09/10/2022(b)(c) | $ | 3,395,000 | $ | 3,425,373 |

2.97%, (3 mo. USD LIBOR + | | | | |

1.15%), 01/20/2023(b)(c) | | 1,442,000 | | 1,454,140 |

4.30%, 02/19/2027(b) | | 1,628,000 | | 1,752,021 |

7.50%(b)(d) | | 200,000 | | 210,187 |

7.75%(b)(d) | | 2,690,000 | | 2,899,793 |

Sumitomo Mitsui Financial Group, Inc. | | | | |

(Japan), 3.04%, 07/16/2029 | | 4,755,000 | | 5,064,737 |

Wells Fargo & Co., | | | | |

4.15%, 01/24/2029 | | 4,000,000 | | 4,599,317 |

5.38%, 11/02/2043 | | 7,865,000 | | 10,400,742 |

4.75%, 12/07/2046 | | 2,045,000 | | 2,572,460 |

Westpac Banking Corp. (Australia), | | | | |

2.89%, 02/04/2030(c) | | 3,166,000 | | 3,213,023 |

| | | | 223,029,896 |

Diversified Capital Markets–1.03% | | | |

Credit Suisse AG (Switzerland), | | | | |

3.00%, 10/29/2021 | | 2,065,000 | | 2,114,045 |

Credit Suisse Group AG (Switzerland), | | | | |

7.50%(b)(d) | | 2,410,000 | | 2,603,149 |

7.25%(b)(d) | | 330,000 | | 364,879 |

5.10%(b)(d) | | 4,230,000 | | 4,203,563 |

Macquarie Bank Ltd. (Australia), | | | | |

6.13%(b)(c)(d) | | 5,010,000 | | 5,295,996 |

UBS Group AG (Switzerland), 3.13% | | | | |

(3 mo. USD LIBOR + 1.47%), | | | | |

08/13/2030(b)(c) | | 7,847,000 | | 8,327,543 |

| | | | 22,909,175 |

Diversified Chemicals–0.21% | | | | |

Chemours Co. (The), 7.00%, | | | | |

05/15/2025 | | 105,000 | | 98,131 |

Dow Chemical Co. (The), 3.15%, | | | | |

05/15/2024 | | 2,023,000 | | 2,148,589 |

OCP S.A. (Morocco), 4.50%, | | | | |

10/22/2025(b) | | 2,259,000 | | 2,446,877 |

| | | | 4,693,597 |

Diversified Metals & Mining–0.60% | | | |

Corp. Nacional del Cobre de Chile (Chile), | | | | |

3.15%, 01/14/2030(b) | | 3,425,000 | | 3,509,206 |

3.70%, 01/30/2050(b) | | 2,345,000 | | 2,373,102 |

Hudbay Minerals, Inc. (Canada), | | | | |

7.63%, 01/15/2025(b) | | 285,000 | | 275,143 |

Teck Resources Ltd. (Canada), | | | | |

6.13%, 10/01/2035 | | 5,753,000 | | 6,844,580 |

Vedanta Resources Ltd. (India), | | | | |

6.38%, 07/30/2022(b) | | 291,000 | | 278,141 |

| | | | 13,280,172 |

Diversified REITs–0.99% | | | | |

iStar, Inc., 4.75%, 10/01/2024 | | 560,000 | | 572,799 |

Trust F/1401 (Mexico), | | | | |

5.25%, 12/15/2024(b) | | 4,124,000 | | 4,556,669 |

5.25%, 01/30/2026(b) | | 3,705,000 | | 4,076,787 |

4.87%, 01/15/2030(b) | | 4,150,000 | | 4,551,512 |

6.39%, 01/15/2050(b) | | 6,695,000 | | 7,872,885 |

| | Principal | | |

| | Amount | | Value |

Diversified REITs–(continued) | | | | |

VICI Properties L.P./VICI Note Co., Inc., | | | | |

3.50%, 02/15/2025(b) | $ | 93,000 | $ | 93,319 |

3.75%, 02/15/2027(b) | | 93,000 | | 92,477 |

4.13%, 08/15/2030(b) | | 93,000 | | 93,291 |

| | | | 21,909,739 |

Drug Retail–0.17% | | | | |

CVS Pass Through Trust, 5.77%, | | | | |

01/10/2033(b) | | 1,772,364 | | 2,113,406 |

CVS Pass-Through Trust, 6.04%, | | | | |

12/10/2028 | | 1,341,328 | | 1,548,071 |

| | | | 3,661,477 |

Electric Utilities–2.18% | | | | |

Commonwealth Edison Co., | | | | |

Series 127, 3.20%, 11/15/2049 | | 4,289,000 | | 4,557,861 |

DPL, Inc., 4.35%, 04/15/2029(b) | | 42,000 | | 39,285 |

Drax Finco PLC (United Kingdom), | | | | |

6.63%, 11/01/2025(b) | | 3,600,000 | | 3,766,086 |

Electricite de France S.A. (France), | | | | |

6.00%, 01/22/2114(b) | | 6,655,000 | | 8,667,771 |

Georgia Power Co., | | | | |

2.85%, 05/15/2022 | | 3,862,000 | | 3,987,689 |

Series A, 2.20%, 09/15/2024 | | 10,999,000 | | 11,263,669 |

Southern Co. (The), Series B, 5.50%, | | | | |

03/15/2057(c) | | 11,592,000 | | 11,941,359 |

Xcel Energy, Inc., 3.50%, | | | | |

12/01/2049 | | 3,632,000 | | 4,011,226 |

| | | | 48,234,946 |

Electrical Components & Equipment–0.03% | | |

EnerSys, | | | | |

5.00%, 04/30/2023(b) | | 476,000 | | 499,603 |

4.38%, 12/15/2027(b) | | 107,000 | | 108,471 |

| | | | 608,074 |

Electronic Components–1.43% | | | | |

Corning, Inc., 5.45%, 11/15/2079 | | 28,236,000 | | 31,575,786 |

Electronic Equipment & Instruments–0.03% | | |

Itron, Inc., 5.00%, 01/15/2026(b) | | 239,000 | | 246,684 |

MTS Systems Corp., 5.75%, | | | | |

08/15/2027(b) | | 316,000 | | 322,430 |

| | | | 569,114 |

Environmental & Facilities Services–0.01% | | |

Waste Pro USA, Inc., 5.50%, | | | | |

02/15/2026(b) | | 219,000 | | 214,111 |

Fertilizers & Agricultural Chemicals–0.01% | | |

OCI N.V. (Netherlands), 6.63%, | | | | |

04/15/2023(b) | | 211,000 | | 219,335 |

Financial Exchanges & Data–0.12% | | |

Moody's Corp., | | | | |

4.88%, 02/15/2024 | | 232,000 | | 258,369 |

5.25%, 07/15/2044 | | 1,665,000 | | 2,280,892 |

MSCI, Inc., 5.25%, 11/15/2024(b) | | 60,000 | | 61,769 |

| | | | 2,601,030 |

Food Distributors–0.02% | | | | |

US Foods, Inc., 5.88%, | | | | |

06/15/2024(b) | | 466,000 | | 475,127 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

13 | Invesco Corporate Bond Fund |

| | Principal | | |

| | Amount | | Value |

Food Retail–0.34% | | | | |

Albertson's Cos., Inc./Safeway, Inc./New | | | | |

Albertson's L.P./Albertson's LLC, | | | | |

3.50%, 02/15/2023(b) | $ | 3,502,000 | $ | 3,515,132 |

6.63%, 06/15/2024 | | 363,000 | | 373,886 |

4.63%, 01/15/2027(b) | | 248,000 | | 244,739 |

5.88%, 02/15/2028(b) | | 193,000 | | 200,942 |

4.88%, 02/15/2030(b) | | 1,812,000 | | 1,816,530 |

Alimentation Couche-Tard, Inc. | | | | |

(Canada), 2.95%, 01/25/2030(b) | | 1,317,000 | | 1,357,142 |

| | | | 7,508,371 |

Forest Products–0.02% | | | | |

Norbord, Inc. (Canada), 5.75%, | | | | |

07/15/2027(b) | | 410,000 | | 430,642 |

Gas Utilities–0.08% | | | | |

AmeriGas Partners L.P./AmeriGas | | | | |

Finance Corp., | | | | |

5.63%, 05/20/2024 | | 298,000 | | 310,572 |

5.88%, 08/20/2026 | | 464,000 | | 482,268 |

Suburban Propane Partners | | | | |

L.P./Suburban Energy Finance | | | | |

Corp., 5.50%, 06/01/2024 | | 590,000 | | 585,286 |

Superior Plus L.P./Superior General | | | | |

Partner, Inc. (Canada), 7.00%, | | | | |

07/15/2026(b) | | 339,000 | | 363,695 |

| | | | 1,741,821 |

Health Care Equipment–0.00% | | | | |

Teleflex, Inc., 4.88%, 06/01/2026 | | 50,000 | | 52,267 |

Health Care Facilities–0.83% | | | | |

Acadia Healthcare Co., Inc., 6.50%, | | | | |

03/01/2024 | | 164,000 | | 168,783 |

HCA Healthcare, Inc., 6.25%, | | | | |

02/15/2021 | | 621,000 | | 645,483 |

HCA, Inc., | | | | |

5.00%, 03/15/2024 | | 9,500,000 | | 10,565,418 |

5.38%, 02/01/2025 | | 242,000 | | 268,036 |

5.25%, 04/15/2025 | | 151,000 | | 171,682 |

5.88%, 02/15/2026 | | 166,000 | | 187,701 |

5.38%, 09/01/2026 | | 111,000 | | 123,743 |

5.50%, 06/15/2047 | | 5,161,000 | | 6,143,779 |

| | | | 18,274,625 |

Health Care REITs–0.54% | | | | |

Diversified Healthcare Trust, 6.75%, | | | | |

12/15/2021 | | 2,606,000 | | 2,770,726 |

Healthpeak Properties, Inc., 4.25%, | | | | |

11/15/2023 | | 983,000 | | 1,070,504 |

MPT Operating Partnership L.P./MPT | | | | |

Finance Corp., | | | | |

5.00%, 10/15/2027 | | 605,000 | | 632,851 |

4.63%, 08/01/2029 | | 2,463,000 | | 2,592,320 |

Physicians Realty L.P., 4.30%, | | | | |

03/15/2027 | | 1,775,000 | | 1,980,806 |

Welltower, Inc., 3.10%, | | | | |

01/15/2030 | | 2,680,000 | | 2,864,642 |

| | | | 11,911,849 |

Health Care Services–1.16% | | | | |

AMN Healthcare, Inc., 5.13%, | | | | |

10/01/2024(b) | | 181,000 | | 186,053 |

| | Principal | | |

| | Amount | | Value |

Health Care Services–(continued) | | | |

Cigna Corp., | | | | |

4.50%, 03/15/2021(b) | $ | 1,860,000 | $ | 1,898,171 |

3.75%, 07/15/2023 | | 5,052,000 | | 5,381,620 |

2.72%, (3 mo. USD LIBOR + | | | | |

0.89%), 07/15/2023(c) | | 5,327,000 | | 5,394,803 |

4.38%, 10/15/2028 | | 1,938,000 | | 2,206,069 |

4.80%, 08/15/2038 | | 5,467,000 | | 6,586,594 |

CVS Health Corp., 2.63%, | | | | |

08/15/2024 | | 3,015,000 | | 3,116,163 |

Envision Healthcare Corp., 8.75%, | | | | |

10/15/2026(b) | | 145,000 | | 77,162 |

Hadrian Merger Sub, Inc., 8.50%, | | | | |

05/01/2026(b) | | 371,000 | | 380,404 |

MPH Acquisition Holdings LLC, | | | | |

7.13%, 06/01/2024(b) | | 281,000 | | 262,091 |

Team Health Holdings, Inc., 6.38%, | | | | |

02/01/2025(b) | | 172,000 | | 95,101 |

| | | | 25,584,231 |

Home Improvement Retail–0.35% | | | |

Hillman Group, Inc. (The), 6.38%, | | | | |

07/15/2022(b) | | 131,000 | | 117,859 |

Lowe's Cos., Inc., 3.65%, | | | | |

04/05/2029 | | 6,778,000 | | 7,520,159 |

| | | | 7,638,018 |

Homebuilding–1.22% | | | | |

Ashton Woods USA LLC/Ashton Woods | | | | |

Finance Co., 9.88%, | | | | |

04/01/2027(b) | | 251,000 | | 284,972 |

Beazer Homes USA, Inc., 5.88%, | | | | |

10/15/2027 | | 41,000 | | 41,616 |

KB Home, 4.80%, 11/15/2029 | | 456,000 | | 479,940 |

Lennar Corp., | | | | |

8.38%, 01/15/2021 | | 36,000 | | 37,645 |

5.38%, 10/01/2022 | | 324,000 | | 344,351 |

4.75%, 11/15/2022 | | 172,000 | | 180,294 |

5.25%, 06/01/2026 | | 636,000 | | 702,683 |

M.D.C. Holdings, Inc., | | | | |

3.85%, 01/15/2030 | | 8,643,000 | | 8,659,206 |

6.00%, 01/15/2043 | | 12,008,000 | | 13,277,546 |

Mattamy Group Corp. (Canada), | | | | |

5.25%, 12/15/2027(b) | | 174,000 | | 180,525 |

4.63%, 03/01/2030(b) | | 1,700,000 | | 1,652,477 |

Meritage Homes Corp., 5.13%, | | | | |

06/06/2027 | | 322,000 | | 359,142 |

PulteGroup, Inc., 6.38%, | | | | |

05/15/2033 | | 15,000 | | 18,429 |

Taylor Morrison Communities, Inc., | | | | |

6.63%, 07/15/2027(b) | | 352,000 | | 382,578 |

5.75%, 01/15/2028(b) | | 226,000 | | 250,346 |

Taylor Morrison Communities, | | | | |

Inc./Taylor Morrison Holdings II, | | | | |

Inc., 5.88%, 04/15/2023(b) | | 57,000 | | 61,156 |

| | | | 26,912,906 |

Hotel & Resort REITs–0.09% | | | | |

Service Properties Trust, | | | | |

4.95%, 02/15/2027 | | 1,665,000 | | 1,768,722 |

4.95%, 10/01/2029 | | 249,000 | | 262,938 |

| | | | 2,031,660 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

14 | Invesco Corporate Bond Fund |

| Principal | | |

| Amount | | Value |

Hotels, Resorts & Cruise Lines–0.20% | | |

Royal Caribbean Cruises Ltd., | | | |

3.70%, 03/15/2028 | $ 4,310,000 | $ | 4,428,559 |

Household Products–0.06% | | | |

Reynolds Group Issuer, Inc./LLC, | | | |

5.13%, 07/15/2023(b) | 90,000 | | 91,088 |

7.00%, 07/15/2024(b) | 732,000 | | 740,239 |

Spectrum Brands, Inc., | | | |

5.75%, 07/15/2025 | 331,000 | | 340,099 |

5.00%, 10/01/2029(b) | 108,000 | | 111,831 |

| | | 1,283,257 |

Independent Power Producers & Energy Traders–0.08% |

AES Corp. (The), 5.50%, | | | |

04/15/2025 | 733,000 | | 751,626 |

Calpine Corp., 5.50%, 02/01/2024 | 248,000 | | 244,283 |

Enviva Partners L.P./Enviva Partners | | | |

Finance Corp., 6.50%, | | | |

01/15/2026(b) | 210,000 | | 218,929 |

NRG Energy, Inc., 6.63%, | | | |

01/15/2027 | 622,000 | | 649,660 |

| | | 1,864,498 |

Industrial Conglomerates–0.78% | | | |

GE Capital International Funding Co. | | | |

Unlimited Co., 4.42%, | | | |

11/15/2035 | 5,911,000 | | 6,758,387 |

General Electric Co., 5.55%, | | | |

01/05/2026 | 9,094,000 | | 10,610,607 |

| | | 17,368,994 |

Industrial Machinery–0.25% | | | |

Cleaver-Brooks, Inc., 7.88%, | | | |

03/01/2023(b) | 576,000 | | 569,039 |

EnPro Industries, Inc., 5.75%, | | | |

10/15/2026 | 489,000 | | 520,955 |

Mueller Industries, Inc., 6.00%, | | | |

03/01/2027 | 492,000 | | 498,321 |

Parker-Hannifin Corp., 3.25%, | | | |

06/14/2029 | 3,633,000 | | 3,924,912 |

| | | 5,513,227 |

Industrial REITs–0.16% | | | |

Cibanco S.A. Ibm/PLA Administradora | | | |

Industrial S de RL de C.V. (Mexico), | | | |

4.96%, 07/18/2029(b) | 1,844,000 | | 1,993,825 |

Prologis L.P., | | | |

2.13%, 04/15/2027 | 640,000 | | 648,302 |

3.00%, 04/15/2050 | 796,000 | | 812,089 |

| | | 3,454,216 |

Integrated Oil & Gas–1.35% | | | |

Occidental Petroleum Corp., 2.90%, | | | |

08/15/2024 | 12,219,000 | | 12,392,252 |

Petrobras Global Finance B.V. | | | |

(Brazil), 5.75%, 02/01/2029 | 353,000 | | 398,625 |

Petroleos Mexicanos (Mexico), | | | |

6.88%, 08/04/2026 | 110,000 | | 120,092 |

5.95%, 01/28/2031(b) | 115,000 | | 112,700 |

6.95%, 01/28/2060(b) | 1,670,000 | | 1,609,463 |

| Principal | | |

| Amount | | Value |

Integrated Oil & Gas–(continued) | | | |

Saudi Arabian Oil Co. (Saudi Arabia), | | | |

2.88%, 04/16/2024(b) | $10,449,000 | $ | 10,739,740 |

4.25%, 04/16/2039(b) | 1,687,000 | | 1,873,649 |

4.38%, 04/16/2049(b) | 2,407,000 | | 2,730,202 |

| | | 29,976,723 |

Integrated Telecommunication Services–1.97% | | |

Altice France S.A. (France), 7.38%, | | | |

05/01/2026(b) | 400,000 | | 420,220 |

AT&T, Inc., | | | |

3.07%, (3 mo. USD LIBOR + | | | |

1.18%), 06/12/2024(c) | 2,832,000 | | 2,867,127 |

5.25%, 03/01/2037 | 2,660,000 | | 3,282,854 |

5.15%, 03/15/2042 | 3,670,000 | | 4,486,584 |

5.35%, 12/15/2043 | 3,360,000 | | 4,174,534 |

4.75%, 05/15/2046 | 2,895,000 | | 3,418,703 |

5.15%, 02/15/2050 | 8,382,000 | | 10,518,335 |

5.70%, 03/01/2057 | 2,735,000 | | 3,782,862 |

Cincinnati Bell, Inc., | | | |

7.00%, 07/15/2024(b) | 202,000 | | 212,855 |

8.00%, 10/15/2025(b) | 43,000 | | 46,324 |

CommScope, Inc., 6.00%, | | | |

03/01/2026(b) | 413,000 | | 424,690 |

Embarq Corp., 8.00%, 06/01/2036 | 425,000 | | 453,379 |

Frontier Communications Corp., | | | |

10.50%, 09/15/2022 | 146,000 | | 66,658 |

11.00%, 09/15/2025 | 159,000 | | 73,140 |

Telecom Italia Capital S.A. (Italy), | | | |

6.38%, 11/15/2033 | 46,000 | | 53,407 |

7.20%, 07/18/2036 | 589,000 | | 730,861 |

Telefonica Emisiones S.A. (Spain), | | | |

7.05%, 06/20/2036 | 2,865,000 | | 4,137,943 |

T-Mobile USA, Inc., 6.50%, | | | |

01/15/2026 | 1,352,000 | | 1,425,887 |

Verizon Communications, Inc., | | | |

4.81%, 03/15/2039 | 2,267,000 | | 2,909,817 |

Virgin Media Finance PLC (United | | | |

Kingdom), 6.00%, | | | |

10/15/2024(b) | 200,000 | | 204,977 |

| | | 43,691,157 |

Interactive Media & Services–1.21% | | |

Cable Onda S.A. (Panama), 4.50%, | | | |

01/30/2030(b) | 200,000 | | 203,870 |

Cumulus Media New Holdings, Inc., | | | |

6.75%, 07/01/2026(b) | 247,000 | | 256,960 |

Diamond Sports Group LLC/Diamond | | | |

Sports Finance Co., | | | |

5.38%, 08/15/2026(b) | 4,738,000 | | 4,377,410 |

6.63%, 08/15/2027(b) | 339,000 | | 275,217 |

Match Group, Inc., 5.63%, | | | |

02/15/2029(b) | 5,513,000 | | 5,838,805 |

Tencent Holdings Ltd. (China), | | | |

2.99%, 01/19/2023(b) | 2,073,000 | | 2,143,964 |

3.60%, 01/19/2028(b) | 4,305,000 | | 4,649,590 |

3.93%, 01/19/2038(b) | 3,137,000 | | 3,619,179 |

Twitter, Inc., 3.88%, | | | |

12/15/2027(b) | 5,404,000 | | 5,532,345 |

| | | 26,897,340 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

15 | Invesco Corporate Bond Fund |

| Principal | | |

| Amount | | Value |

Internet & Direct Marketing Retail–0.88% | | |

Alibaba Group Holding Ltd. (China), | | | |

4.20%, 12/06/2047 | $ 2,190,000 | $ | 2,653,157 |

4.40%, 12/06/2057 | 2,190,000 | | 2,792,528 |

QVC, Inc., | | | |

4.75%, 02/15/2027 | 1,869,000 | | 1,841,822 |

5.45%, 08/15/2034 | 12,014,000 | | 12,115,588 |

| | | 19,403,095 |

Investment Banking & Brokerage–1.77% | | |

Cantor Fitzgerald L.P., 6.50%, | | | |

06/17/2022(b) | 3,205,000 | | 3,513,029 |

Charles Schwab Corp. (The), Series E, | | | |

4.63%(d) | 4,560,000 | | 4,624,114 |

Goldman Sachs Group, Inc. (The), | | | |

6.75%, 10/01/2037 | 4,675,000 | | 6,705,332 |

4.80%, 07/08/2044 | 4,280,000 | | 5,480,797 |

Series P, 5.00%(d) | 3,255,000 | | 3,200,511 |

Jefferies Group LLC/Jefferies Group | | | |

Capital Finance, Inc., 4.15%, | | | |

01/23/2030 | 3,874,000 | | 4,203,119 |

Morgan Stanley, | | | |

4.35%, 09/08/2026 | 350,000 | | 392,097 |

2.70%, 01/22/2031(c) | 10,493,000 | | 10,836,376 |

Raymond James Financial, Inc., | | | |

4.95%, 07/15/2046 | 228,000 | | 292,488 |

| | | 39,247,863 |

IT Consulting & Other Services–0.07% | | |

DXC Technology Co., 4.45%, | | | |

09/18/2022 | 1,460,000 | | 1,546,519 |

Leisure Facilities–0.03% | | | |

Cedar Fair L.P./Canada's Wonderland | | | |

Co./Magnum Management Corp., | | | |

5.38%, 06/01/2024 | 247,000 | | 252,042 |

Six Flags Entertainment Corp., | | | |

4.88%, 07/31/2024(b) | 352,000 | | 348,158 |

| | | 600,200 |

Life & Health Insurance–2.52% | | | |

American Equity Investment Life | | | |

Holding Co., 5.00%, | | | |

06/15/2027 | 3,375,000 | | 3,737,621 |

Athene Global Funding, 2.50%, | | | |

01/14/2025(b) | 3,440,000 | | 3,532,004 |

Athene Holding Ltd., 4.13%, | | | |

01/12/2028 | 7,130,000 | | 7,595,838 |

Brighthouse Financial, Inc., 4.70%, | | | |

06/22/2047 | 6,627,000 | | 6,715,529 |

Dai-ichi Life Insurance Co. Ltd. (The) | | | |

(Japan), 4.00%(b)(d) | 3,060,000 | | 3,253,805 |

Global Atlantic Fin Co., 4.40%, | | | |

10/15/2029(b) | 10,195,000 | | 10,791,468 |

MetLife, Inc., | | | |

4.13%, 08/13/2042 | 2,400,000 | | 2,874,677 |

Series C, 5.25%(d) | 3,990,000 | | 3,964,564 |

Series D, 5.88%(d) | 300,000 | | 334,745 |

Nationwide Financial Services, Inc., | | | |

5.38%, 03/25/2021(b) | 6,660,000 | | 6,934,272 |

3.90%, 11/30/2049(b) | 3,344,000 | | 3,759,079 |

Prudential Financial, Inc., 3.91%, | | | |

12/07/2047 | 2,001,000 | | 2,268,728 |

| | | 55,762,330 |

| | Principal | | |

| | Amount | | Value |

Life Sciences Tools & Services–0.02% | | |

Charles River Laboratories | | | | |

International, Inc., 4.25%, | | | | |

05/01/2028(b) | $ | 383,000 | $ | 386,121 |

Managed Health Care–0.17% | | | | |

Centene Corp., | | | | |

5.25%, 04/01/2025(b) | | 340,000 | | 351,050 |

5.38%, 06/01/2026(b) | | 521,000 | | 549,317 |

5.38%, 08/15/2026(b) | | 155,000 | | 163,331 |

4.63%, 12/15/2029(b) | | 221,000 | | 236,879 |

UnitedHealth Group, Inc., 3.75%, | | | | |

07/15/2025 | | 2,134,000 | | 2,366,243 |

| | | | 3,666,820 |

Marine Ports & Services–0.05% | | | | |

Adani Abbot Point Terminal Pty. Ltd. | | | | |

(Australia), 4.45%, | | | | |

12/15/2022(b) | | 1,004,000 | | 1,024,117 |

Metal & Glass Containers–0.25% | | | | |

Ardagh Packaging Finance | | | | |

PLC/Ardagh Holdings USA, Inc., | | | | |

6.00%, 02/15/2025(b) | | 200,000 | | 209,000 |

Ball Corp., 5.25%, 07/01/2025 | | 359,000 | | 397,742 |

Berry Global, Inc., | | | | |

5.50%, 05/15/2022 | | 144,000 | | 145,079 |

6.00%, 10/15/2022 | | 58,000 | | 59,088 |

Flex Acquisition Co., Inc., | | | | |

6.88%, 01/15/2025(b) | | 195,000 | | 190,127 |

7.88%, 07/15/2026(b) | | 252,000 | | 256,365 |

OI European Group B.V., 4.00%, | | | | |

03/15/2023(b) | | 73,000 | | 74,034 |

Silgan Holdings, Inc., 4.13%, | | | | |

02/01/2028(b) | | 4,279,000 | | 4,300,395 |

| | | | 5,631,830 |

Movies & Entertainment–0.17% | | | | |

AMC Entertainment Holdings, Inc., | | | | |

5.75%, 06/15/2025 | | 268,000 | | 215,851 |

6.13%, 05/15/2027 | | 285,000 | | 228,720 |

Netflix, Inc., | | | | |

5.88%, 11/15/2028 | | 1,110,000 | | 1,250,027 |

5.38%, 11/15/2029(b) | | 1,927,000 | | 2,098,599 |

| | | | 3,793,197 |

Multi-line Insurance–0.73% | | | | |

American International Group, Inc., | | | | |

4.50%, 07/16/2044 | | 2,260,000 | | 2,776,108 |

Fairfax Financial Holdings Ltd. | | | | |

(Canada), 4.85%, 04/17/2028 | | 3,010,000 | | 3,382,186 |

Guardian Life Insurance Co. of | | | | |

America (The), 3.70%, | | | | |

01/22/2070(b) | | 3,061,000 | | 3,466,516 |

Nationwide Mutual Insurance Co., | | | | |

4.95%, 04/22/2044(b) | | 3,210,000 | | 4,210,674 |

XLIT Ltd. (Bermuda), 5.50%, | | | | |

03/31/2045 | | 1,670,000 | | 2,392,361 |

| | | | 16,227,845 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

16 | Invesco Corporate Bond Fund |

| | Principal | | |

| | Amount | | Value |

Multi-Utilities–0.41% | | | | |

CenterPoint Energy, Inc., | | | | |

2.50%, 09/01/2024 | $ | 3,210,000 | $ | 3,316,744 |

Series A, 6.13%(d) | | 5,595,000 | | 5,772,949 |

| | | | 9,089,693 |

Office REITs–0.39% | | | | |

Alexandria Real Estate Equities, Inc., | | | | |

3.95%, 01/15/2027 | | 2,940,000 | | 3,262,843 |

3.38%, 08/15/2031 | | 1,848,000 | | 2,052,299 |

4.00%, 02/01/2050 | | 2,811,000 | | 3,400,817 |

| | | | 8,715,959 |

Office Services & Supplies–0.05% | | | |

Pitney Bowes, Inc., 5.20%, | | | | |

04/01/2023 | | 1,079,000 | | 1,082,145 |

Oil & Gas Drilling–0.02% | | | | |

Ensign Drilling, Inc. (Canada), 9.25%, | | | | |

04/15/2024(b) | | 223,000 | | 200,981 |

Precision Drilling Corp. (Canada), | | | | |

5.25%, 11/15/2024 | | 207,000 | | 183,670 |

Transocean, Inc., 8.00%, | | | | |

02/01/2027(b) | | 81,000 | | 67,939 |

| | | | 452,590 |

Oil & Gas Equipment & Services–0.17% | | |

Baker Hughes, a GE Co. LLC/Baker | | | | |

Hughes Co-Obligor, Inc., 3.34%, | | | | |

12/15/2027 | | 3,477,000 | | 3,660,474 |

Hilcorp Energy I L.P./Hilcorp Finance | | | | |

Co., 6.25%, 11/01/2028(b) | | 256,000 | | 186,974 |

| | | | 3,847,448 |

Oil & Gas Exploration & Production–1.95% | | |

Antero Resources Corp., 5.63%, | | | | |

06/01/2023 | | 285,000 | | 154,612 |

Ascent Resources Utica | | | | |

Holdings LLC/ARU Finance Corp., | | | | |

10.00%, 04/01/2022(b) | | 177,000 | | 151,284 |

Callon Petroleum Co., | | | | |

6.13%, 10/01/2024 | | 231,000 | | 183,645 |

6.38%, 07/01/2026 | | 92,000 | | 71,792 |

Cameron LNG LLC, | | | | |

3.30%, 01/15/2035(b) | | 4,239,000 | | 4,567,430 |

3.40%, 01/15/2038(b) | | 4,567,000 | | 5,025,679 |

Concho Resources, Inc., 4.38%, | | | | |

01/15/2025 | | 6,682,000 | | 6,899,574 |

Continental Resources, Inc., 5.00%, | | | | |

09/15/2022 | | 24,378,000 | | 24,350,694 |

Genesis Energy L.P./Genesis Energy | | | | |

Finance Corp., | | | | |

6.25%, 05/15/2026 | | 255,000 | | 213,651 |

7.75%, 02/01/2028 | | 304,000 | | 265,620 |

Gulfport Energy Corp., | | | | |

6.63%, 05/01/2023 | | 423,000 | | 222,206 |

6.00%, 10/15/2024 | | 236,000 | | 79,060 |

QEP Resources, Inc., 5.63%, | | | | |

03/01/2026 | | 480,000 | | 385,212 |

Southwestern Energy Co., | | | | |

7.50%, 04/01/2026 | | 190,000 | | 145,355 |

7.75%, 10/01/2027 | | 434,000 | | 329,851 |

| | Principal | | |

| | Amount | | Value |

Oil & Gas Exploration & Production–(continued) | | |

Whiting Petroleum Corp., | | | | |

Conv., 1.25%, 04/01/2020 | $ | 39,000 | $ | 35,198 |

5.75%, 03/15/2021 | | 241,000 | | 139,117 |

6.63%, 01/15/2026 | | 172,000 | | 63,214 |

| | | | 43,283,194 |

Oil & Gas Refining & Marketing–0.28% | | |

Calumet Specialty Products Partners | | | | |

L.P./Calumet Finance Corp., | | | | |

7.63%, 01/15/2022 | | 347,000 | | 344,185 |

EnLink Midstream Partners L.P., | | | | |

4.85%, 07/15/2026 | | 371,000 | | 318,531 |

5.60%, 04/01/2044 | | 327,000 | | 252,606 |

NuStar Logistics L.P., 6.00%, | | | | |

06/01/2026 | | 556,000 | | 582,118 |

Parkland Fuel Corp. (Canada), | | | | |

6.00%, 04/01/2026(b) | | 406,000 | | 425,021 |

5.88%, 07/15/2027(b) | | 3,025,000 | | 3,113,723 |

PBF Holding Co. LLC/PBF Finance | | | | |

Corp., 6.00%, 02/15/2028(b) | | 317,000 | | 313,830 |

Sunoco L.P./Sunoco Finance Corp., | | | | |

5.88%, 03/15/2028 | | 723,000 | | 741,326 |

| | | | 6,091,340 |

Oil & Gas Storage & Transportation–9.07% | | |

Antero Midstream Partners | | | | |

L.P./Antero Midstream Finance | | | | |

Corp., 5.38%, 09/15/2024 | | 410,000 | | 310,575 |

Cheniere Energy Partners L.P., | | | | |

5.63%, 10/01/2026 | | 236,000 | | 237,622 |

Crestwood Midstream Partners | | | | |

L.P./Crestwood Midstream Finance | | | | |

Corp., 5.75%, 04/01/2025 | | 241,000 | | 236,178 |

DCP Midstream Operating L.P., | | | | |

5.13%, 05/15/2029 | | 394,000 | | 387,834 |

Energy Transfer Operating L.P., | | | | |

5.88%, 01/15/2024 | | 508,000 | | 569,803 |

2.90%, 05/15/2025 | | 4,349,000 | | 4,441,503 |

3.75%, 05/15/2030 | | 7,127,000 | | 7,237,755 |

4.90%, 03/15/2035 | | 8,695,000 | | 9,386,911 |

5.00%, 05/15/2050 | | 7,841,000 | | 7,979,016 |

Series A, 6.25%(d) | | 515,000 | | 460,026 |

Enterprise Products Operating LLC, | | | | |

3.13%, 07/31/2029 | | 3,900,000 | | 4,085,990 |

2.80%, 01/31/2030 | | 7,601,000 | | 7,779,412 |

4.80%, 02/01/2049 | | 2,369,000 | | 2,767,199 |

4.20%, 01/31/2050 | | 2,786,000 | | 2,970,672 |

3.70%, 01/31/2051 | | 15,335,000 | | 15,354,783 |

3.95%, 01/31/2060 | | 7,233,000 | | 7,116,362 |

Series D, | | | | |

6.88%, 03/01/2033 | | 2,660,000 | | 3,771,447 |

4.88%, 08/16/2077(c) | | 11,201,000 | | 10,996,526 |

Hess Midstream Operations L.P., | | | | |

5.63%, 02/15/2026(b) | | 389,000 | | 388,939 |

Holly Energy Partners L.P./Holly | | | | |

Energy Finance Corp., 5.00%, | | | | |

02/01/2028(b) | | 95,000 | | 95,772 |

Kinder Morgan Energy Partners L.P., | | | | |

4.30%, 05/01/2024 | | 2,383,000 | | 2,586,281 |

Kinder Morgan, Inc., | | | | |

7.80%, 08/01/2031 | | 9,500,000 | | 13,357,533 |

7.75%, 01/15/2032 | | 7,672,000 | | 11,185,202 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

17 | Invesco Corporate Bond Fund |

| Principal | | |

| Amount | | Value |

Oil & Gas Storage & Transportation–(continued) | | |

MPLX L.P., | | | |

2.79%, (3 mo. USD LIBOR + | | | |

0.90%), 09/09/2021(c) | $ 7,864,000 | $ | 7,887,362 |

2.99%, (3 mo. USD LIBOR + | | | |

1.10%), 09/09/2022(c) | 5,688,000 | | 5,709,405 |

4.80%, 02/15/2029 | 2,355,000 | | 2,640,560 |

4.70%, 04/15/2048 | 2,781,000 | | 2,903,754 |

5.50%, 02/15/2049 | 3,731,000 | | 4,197,431 |

NGL Energy Partners L.P./NGL Energy | | | |

Finance Corp., 7.50%, | | | |

04/15/2026 | 357,000 | | 304,297 |

NGPL PipeCo. LLC, 7.77%, | | | |

12/15/2037(b) | 7,250,000 | | 9,408,624 |

Plains All American Pipeline L.P., | | | |

Series B, 6.13%(d) | 6,150,000 | | 5,447,393 |

Plains All American Pipeline L.P./PAA | | | |

Finance Corp., 3.55%, | | | |

12/15/2029 | 13,704,000 | | 13,509,292 |

Sabine Pass Liquefaction LLC, | | | |

5.75%, 05/15/2024 | 10,100,000 | | 11,365,742 |

Targa Resources Partners L.P./Targa | | | |

Resources Partners Finance Corp., | | | |

5.25%, 05/01/2023 | 2,445,000 | | 2,444,230 |

5.13%, 02/01/2025 | 439,000 | | 441,748 |

5.88%, 04/15/2026 | 677,000 | | 698,646 |

5.00%, 01/15/2028 | 201,000 | | 198,894 |

5.50%, 03/01/2030(b) | 63,000 | | 62,430 |

Western Midstream Operating L.P., | | | |

4.00%, 07/01/2022 | 2,910,000 | | 2,981,394 |

2.70%, (3 mo. USD LIBOR + | | | |

0.85%), 01/13/2023(c) | 3,960,000 | | 3,946,179 |

3.10%, 02/01/2025 | 2,149,000 | | 2,149,991 |

Williams Cos., Inc. (The), | | | |

4.13%, 11/15/2020 | 6,204,000 | | 6,267,995 |

7.88%, 09/01/2021 | 140,000 | | 153,267 |

3.60%, 03/15/2022 | 3,670,000 | | 3,788,301 |

4.55%, 06/24/2024 | 399,000 | | 437,412 |

3.75%, 06/15/2027 | 250,000 | | 262,421 |

| | | 200,910,109 |

Other Diversified Financial Services–0.76% | | |

Carlyle Finance LLC, 5.65%, | | | |

09/15/2048(b) | 11,281,000 | | 14,757,548 |

eG Global Finance PLC (Netherlands), | | | |

6.75%, 02/07/2025(b) | 259,000 | | 253,712 |

Football Trust V, 5.35%, | | | |

10/05/2020(b) | 450,270 | | 460,128 |

ILFC E-Capital Trust II, 4.15%, | | | |

12/21/2065(b)(c) | 620,000 | | 507,430 |

Lions Gate Capital Holdings LLC, | | | |

6.38%, 02/01/2024(b) | 242,000 | | 237,763 |

LPL Holdings, Inc., 5.75%, | | | |

09/15/2025(b) | 241,000 | | 250,638 |

Tempo Acquisition LLC/Tempo | | | |

Acquisition Finance Corp., 6.75%, | | | |

06/01/2025(b) | 378,000 | | 377,172 |

| | | 16,844,391 |

Packaged Foods & Meats–0.40% | | | |

B&G Foods, Inc., | | | |

5.25%, 04/01/2025 | 237,000 | | 234,529 |

5.25%, 09/15/2027 | 96,000 | | 95,160 |

| Principal | | |

| Amount | | Value |

Packaged Foods & Meats–(continued) | | |

Conagra Brands, Inc., 5.30%, | | | |

11/01/2038 | $ 300,000 | $ | 364,520 |

Hershey Co. (The), 3.13%, | | | |

11/15/2049 | 2,833,000 | | 3,059,504 |

JBS USA LUX S.A./JBS USA Food | | | |

Co./JBS USA Finance, Inc., | | | |

5.50%, 01/15/2030(b) | 217,000 | | 229,404 |

Kraft Heinz Foods Co., | | | |

6.88%, 01/26/2039 | 249,000 | | 297,925 |

5.00%, 06/04/2042 | 235,000 | | 236,345 |

Lamb Weston Holdings, Inc., 4.63%, | | | |

11/01/2024(b) | 186,000 | | 193,982 |

Mars, Inc., 2.70%, 04/01/2025(b) | 3,334,000 | | 3,525,695 |

Pilgrim's Pride Corp., 5.88%, | | | |

09/30/2027(b) | 398,000 | | 413,184 |

TreeHouse Foods, Inc., 6.00%, | | | |

02/15/2024(b) | 223,000 | | 230,713 |

| | | 8,880,961 |

Paper Packaging–0.13% | | | |

Cascades, Inc./Cascades USA, Inc. | | | |

(Canada), 5.38%, 01/15/2028(b) | 2,547,000 | | 2,629,778 |

Trivium Packaging Finance B.V. | | | |

(Netherlands), 5.50%, | | | |

08/15/2026(b) | 200,000 | | 207,625 |

| | | 2,837,403 |

Paper Products–0.16% | | | |

Mercer International, Inc. (Germany), | | | |

6.50%, 02/01/2024 | 157,000 | | 161,186 |