“This press release is not for dissemination in the USA and shall not be disseminated to USA news services”

15 SEPTEMBER 2010

EXPANSION TO INCREASE GOLD PRODUCTION - SIMBERI, PNG

• GREENLIGHT FOR 3.5 MTPA OXIDE EXPANSION TO 100K OZPA

• SULPHIDE STUDY HIGHLIGHTS 100K OZPA POTENTIAL FOR 10 YEARS

Allied Gold Limited will incrementally increase gold production to approximately 100,000 ozpa by the December 2011 quarter at its 100%-owned Simberi gold mine in Papua New Guinea through a fully-funded US$32 million expansion of the oxide processing circuit from 2.0 million tonnes per annum (Mtpa) to a name plate 3.5 Mtpa.

As previously advised, the company was considering a range of options for the Simberi oxide processing circuit and has decided an expansion to 3.5 Mtpa is the most efficient in terms of immediate project delivery, incremental capital spend and investment payback.

The design work being conducted ensures further expansions to 5 Mtpa can be reconsidered in the future.

Simberi gold production during financial year 2010-11 is expected to be approximately 73,000 ounces at a cash cost of US$700/oz.

When operational at 3.5 Mtpa, production will rise to ~100,000 ozpa with cash costs of US$600/oz generating approximately US$50 million per annum of free cash flow at current world gold prices.

At 3.5 Mtpa the Simberi oxide circuit will treat ~35 million tonnes at a grade of 1.02 g/t with a process recovery of ~90% producing 1 Moz over approximately 10 years.

Expanded throughput to a name plate of 3.5 Mtpa will occur incrementally over the next 12 months. Oxide expansion construction works have commenced on site and are ongoing.

The plant is currently running at approximately 2.3 Mtpa following the recent completion of de-bottlenecking and optimisation initiatives.

In addition to the recent Reserve upgrade, the company has identified further significant un-tested oxide targets in excess of 20Mtpa that are on or around the Sorowar and Pigibo deposits and will be subject to further exploration drilling over the next 12-18 months.

Further reconnaissance exploration will also be conducted over the largely unexplored Western areas of Simberi Island for both oxide and sulphide mineralisation. The company will reconsider an expansion up to 5 Mtpa as part of a future combined oxide and sulphide processing circuit.

100,000 OZPA SIMBERI SULPHIDE PRE-FEASIBILITY

Allied is nearing the finalisation of a pre-feasibility study (PFS) of options to mine the significant sulphide ore resources at Simberi. The sulphide pre-feasibility study delivers the investment basis for decade-long production at Simberi and development optionality.

The key study findings are an indicative capital cost including contingency of US$200 million (+/- 25%) with a single stage roaster treating 1.5 Mtpa at an ore grade of 2.4 g/t of gold and operating costs of ~US$650/oz.

A combined 3.5 Mtpa oxide and 1.5 Mtpa sulphide circuit would produce approximately 200,000 ozpa at a cash cost of US$635/oz providing confidence Simberi can sustain gold output of ~200,000 ozpa for a minimum 10 years.

A formal investment decision on the sulphide development will be subject to a bankable feasibility study (BFS) which is scheduled for calendar 2012 with a two year development timeframe thereafter. This allows for a number of factors influencing the sulphide development including;

| | - | A minimum of at least 3-5 years to process the significant existing Pigiput oxide cap before accessing the first tonnages of sulphide ores, |

| | - | Exploration over the next 12-18 months targeting the Sorowar, Samat and Botlu oxide pits that have previously not been subject to intense drilling for sulphides, and which could further increase the resource position, |

| | - | Identification of additional sulphide resources provides an opportunity to optimise the sulphide roaster and oxide processing plant and correctly scale throughput of the oxide and sulphide plants for optimum gold production and economic return, |

| | - | And should gold prices further strengthen in 2011, Allied could potentially accelerate the bankable feasibility study and bring forward the sulphide development. |

GOLD RIDGE, SOLOMON ISLANDS

Gold refurbishment and construction activities at the fully-funded 120,000 ozpa Gold Ridge Mine in the Solomon Islands continues to progress well and the US$135 million development is on time and on budget for first gold by March 2011.

During the course of September 2010 the company accessed the US$35M debt facility with the International Finance Corporation ensuring the project is fully funded.

As previously advised, most of the long lead items relating to plant expansion are underway and critical path items are nearing completion in coming months.

The company has re-commenced RC drilling and started a comprehensive IP Geophysical Survey which has already confirmed existing mineralisation and found similar chargeability responses adjacent to the existing deposits which warrant further exploration drilling in the near term.

FINANCIAL YEAR 2010-11 OUTLOOK

The company’s financial year 2010-11 production guidance is unchanged for Simberi to produce 18,000 ounces a quarter at an average cash cost of US$700/oz.

In conjunction with various expansion activities the company is targeting a cash cost ~US$600/oz from its gold operations.

During the March 2011 quarter Gold Ridge is scheduled to produce its first gold and as a result Allied Gold’s group gold production will be approximately 200,000 ozpa.

Allied Gold’s cash at bank stands at US$76 million.

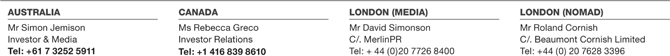

For more details, please contact:

| Simon Jemison | Investor Relations & Media | + 61 0418 853 922 |

| Rebecca Greco | Investor Relations, North America | +1 416 839 8610 |

| David Simonson | c/. Merlin PR | +44 20 7726 8400 |

Competent Persons

The information in this Stock Exchange Announcement that relates to Mineral Exploration results and Mineral Resources, together with any related assessments and interpretations, have been verified by and approved for release by Mr C R Hastings, MSc, BSc, M.Aus.I.M.M., a qualified geologist and full-time employee of the Company. Mr Hastings has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2004 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”. Mr Hastings consents to the inclusion of the information contained in this ASX release in the form and context in which it appears. Mr. C. R. Hastings is also a Qualified Person as defined by Canadian National Instrument 43-101.

Forward-Looking Statements

This press release contains forward-looking statements concerning the projects owned by Allied Gold. Statements concerning mineral reserves and resources may also be deemed to be forward-looking statements in that they involve estimates, based on certain assumptions, of the mineralisation that will be found if and when a deposit is developed and mined. Forward-looking statements are not statements of historical fact, and actual events or results may differ materially from those described in the forward-looking statements, as the result of a variety of risks, uncertainties and other factors, involved in the mining industry generally and the particular properties in which Allied has an interest, such as fluctuation in gold prices; uncertainties involved in interpreting drilling results and other tests; the uncertainty of financial projections and cost estimates; the possibility of cost overruns, accidents, strikes, delays and other problems in development projects, the uncertain availability of financing and uncertainties as to terms of any financings completed; uncertainties relating to environmental risks and government approvals, and possible political instability or changes in government policy in jurisdictions in which properties are located. Forward-looking statements are based on management’s beliefs, opinions and estimates as of the date they are made, and no obligation is assumed to update forward-looking statements if these beliefs, opinions or estimates should change or to reflect other future developments.

Not an offer of securities or solicitation of a proxy

This communication is not a solicitation of a proxy from any security holder of Allied Gold, nor is this communication an offer to purchase or a solicitation to sell securities. Any offer will be made only through an information circular or proxy statement or similar document. Investors and security holders are strongly advised to read such document regarding the proposed business combination referred to in this communication, if and when such document is filed and becomes available, because it will contain important information. Any such document would be filed by Allied Gold with the Australian Securities and Investments Commission, the Australian Stock Exchange and with the U.S. Securities and Exchange Commission (SEC).