| ASX:ALD | TSX:ALG | AIM:AGLD | 10 September 2010 |

Media Release

Company Announcements Office

Australian Securities Exchange Ltd

“This press release is not for dissemination in the United States and

shall not be disseminated to United States news services.”

GOLD RESERVES INCREASED BY 155% TO

2.15 MILLION OUNCES AT SIMBERI GOLD PROJECT

HIGHLIGHTS

| | · | Extensive drilling programme over the past 18 months has resulted in a substantial increase of 1.31 million ounces of gold ore, equivalent to a 155% increase in Proven and Probable Reserves |

| | · | Total Proven and Probable Reserves by material types are now: |

| | § | Oxide - 26.3M/t at 1.03g/t |

| | § | Transitional - 4.5M/t at 1.11g/t |

| | § | Sulphide – 15.1M/t at 2.31g/t |

| | · | Increased Reserves to underpin current Oxide plant expansion and delivery of Sulphide Pre-Feasibility Study expected to be completed by the end of this month |

| | · | Ongoing exploration program aims to focus on testing known Sulphide and Oxide mineralisationat Sorowar, Pigiput, Pigibo and Samatwhich remain open |

| | · | Group Reserves increased to 3.43 million ounces |

Allied Gold (ASX:ALD, TSX:ALG, AIM:AGLD) has received new Proven and Probable Reserve Estimates for the Simberi Island gold deposits from consultants Golder Associates totalling 45.9Mt @ 1.46g/t Au for 2.15 million ounces of contained gold. This is a substantial increase of 1.31 million ounces of gold ore equivalent to a 155% increase in Reserves. Previous Proven and Probable Reserves (September 2009) were reported as 22.0 million tonnes at 1.19g/t Au for 0.84 million ounces of contained gold.

Simberi Reserves Comparison 2009 -2010

| | | | | | | | | September 2009 | | | | | | | | | | | | | | September 2010 | | | | | | | |

| | | Proven | | | Probable | | | Total | | Proven | | | Probable | | | Total | |

| | | Tonnes | | | | | | Tonnes | | | | | | Tonnes | | | | | Tonnes | | | | | | | | | | | | Tonnes | | | | |

| Material Type | | (Mt) | | | Au (g/t) | | | (Mt) | | | Au (g/t) | | | (Mt) | | | Au (g/t) | | (Mt) | | | Au (g/t) | | | Tonnes (Mt) | | | Au (g/t) | | | (Mt) | | | Au (g/t) | |

| Oxide | | | 11.11 | | | | 1.21 | | | | 8.55 | | | | 1.15 | | | | 19.66 | | | | 1.18 | | | | 11.29 | | | | 1.05 | | | | 14.99 | | | | 1.01 | | | | 26.28 | | | | 1.03 | |

| Transitional | | | 0.58 | | | | 1.10 | | | | 0.67 | | | | 1.43 | | | | 1.25 | | | | 1.27 | | | | 0.55 | | | | 1.08 | | | | 3.95 | | | | 1.11 | | | | 4.50 | | | | 1.11 | |

| Sulphide | | | 0.38 | | | | 1.10 | | | | 0.74 | | | | 1.49 | | | | 1.12 | | | | 1.36 | | | | 0.38 | | | | 1.1 | | | | 14.69 | | | | 2.34 | | | | 15.07 | | | | 2.31 | |

| Total | | | 12.06 | | | | 1.20 | | | | 9.96 | | | | 1.19 | | | | 22.03 | | | | 1.19 | | | | 12.23 | | | | 1.06 | | | | 33.62 | | | | 1.60 | | | | 45.85 | | | | 1.46 | |

Exploration drilling completed over the past 18 months, with results previously reported to market, has identified these substantial increases in both oxide and sulphide ore types. The access to sulphide ore at the Pigiput/Pigibo deposits requires the removal of the overlying oxide and transitional ores which collectively total approximately 19Mt.

The company has budgeted exploration expenditure of A$8 million for FY 2011 to undertake 20,000 meters of Core and 40,000 meters of RC drilling. The focus will be targeting pit edge oxides at the Sorowar deposit and underlying sulphide mineralisation at Pigiput, Pigibo and Sorowar, as well as testing the possible link between the Samat North and Samat East deposits.

In order to take advantage of these additional reserves and to allow quicker access to the underlying sulphide ore, the company is currently expanding the oxide process plant from 2.0Mtpa to 3.5Mtpa. In addition to these sulphide Reserves, the Sorowar deposit has approximately 14Mt of ore (including minor transitional and sulphides) that are yet to be mined. On completion of the oxide expansion in 2011, this will equate to a minimum of 10 year oxide mine life to produced annualised average production of approximately 100,000 ounces.

The sulphide Reserves at Pigiput/Pigibo with a minor contribution from the Samat deposit amounts to approximately 15Mt of ore. A pre-feasibility study on the development of the sulphide Mineral Resources will be completed in September 2010. This study is evaluating a 1.5Mtpa sulphide operation that involves roasting of a concentrate to produce an annualised life of mine average of approximately 90,000 ounces over 10 years.

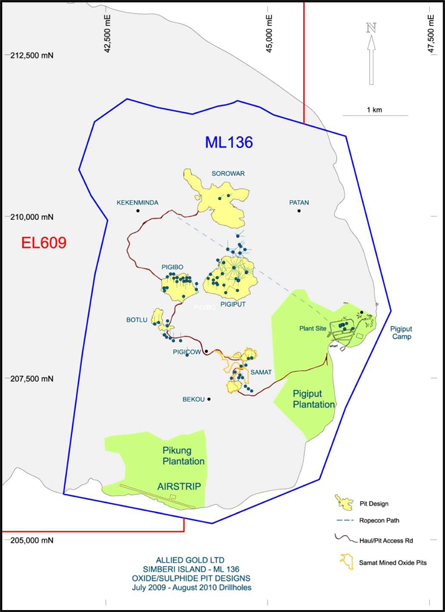

The Mineral Reserves and the Inferred Resources within the pit design, categorised by material type are summarised in the table on the next page. The location of the pits are shown on the plan following the table.

Table 1: Mineral Reserve and Inferred Resource by Material Type

| Classification | | Oxide | | | Transition | | | Sulphide | | | Total Ore | |

| | | Tonnes | | | Au | | | Tonnes | | | Au | | | Tonnes | | | Au | | | Tonnes | | | Au | |

| | | (Mt) | | | (g/t) | | | (Mt) | | | (g/t) | | | (Mt) | | | (g/t) | | | (Mt) | | | (g/t) | |

| Sorowar | | | | | | | | | | | | | | | | | | | | | | | | |

| Proven | | | 6.45 | | | 1.22 | | | | 0.55 | | | 1.08 | | | | 0.38 | | | 1.1 | | | | 7.38 | | | 1.2 | |

| Probable | | | 5.59 | | | 1.17 | | | | 0.52 | | | 1.29 | | | | 0.74 | | | 1.49 | | | | 6.85 | | | 1.21 | |

| Total Mineral Reserves | | | 12.04 | | | 1.2 | | | | 1.08 | | | 1.18 | | | | 1.12 | | | 1.36 | | | | 14.23 | | | 1.21 | |

| Inferred Resource | | | 0.45 | | | 0.84 | | | | 0 | | | 0.82 | | | | 0.06 | | | 1.39 | | | | 0.51 | | | 0.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Pigiput | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proven | | | 4.11 | | | 0.74 | | | | | | | | | | | | | | | | | | 4.11 | | | 0.74 | |

| Probable | | | 5.51 | | | 0.82 | | | | 1.67 | | | 0.86 | | | | 12.51 | | | 2.39 | | | | 19.69 | | | 1.82 | |

| Total Mineral Reserves | | | 9.62 | | | 0.79 | | | | 1.67 | | | 0.86 | | | | 12.51 | | | 2.39 | | | | 23.8 | | | 1.64 | |

| Inferred Resource | | | 1.79 | | | 0.62 | | | | 0.34 | | | 0.71 | | | | 1.02 | | | 2.33 | | | | 3.15 | | | 1.18 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Samat | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proven | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Probable | | | 0.33 | | | 1.13 | | | | 0.11 | | | 2.74 | | | | 1.01 | | | 2.38 | | | | 1.45 | | | 2.12 | |

| Total Mineral Reserves | | | 0.33 | | | 1.13 | | | | 0.11 | | | 2.74 | | | | 1.01 | | | 2.38 | | | | 1.45 | | | 2.12 | |

| Inferred Resource | | | 0.03 | | | 1.09 | | | | 0 | | | 0.53 | | | | 0 | | | 1.62 | | | | 0.03 | | | 1.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Botlu South | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proven | | | 0.74 | | | 1.35 | | | | | | | | | | | | | | | | | | 0.74 | | | 1.35 | |

| Probable | | | 0.12 | | | 1.61 | | | | | | | | | | | | | | | | | | 0.12 | | | 1.61 | |

| Total Mineral Reserves | | | 0.86 | | | 1.39 | | | | 0 | | | | | | | 0 | | | | | | | 0.86 | | | 1.39 | |

| Inferred Resource | | | 0.02 | | | 1.4 | | | | | | | | | | | | | | | | | | 0.02 | | | 1.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Pigibo | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proven | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Probable | | | 3.43 | | | 1 | | | | 1.65 | | | 1.21 | | | | 0.43 | | | 2.04 | | | | 5.51 | | | 1.14 | |

| Total Mineral Reserves | | | 3.43 | | | 1 | | | | 1.65 | | | 1.21 | | | | 0.43 | | | 2.04 | | | | 5.51 | | | 1.14 | |

| Inferred Resource | | | 0.58 | | | 0.77 | | | | 0.02 | | | 0.63 | | | | | | | | | | | 0.6 | | | 0.77 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proven | | | 11.29 | | | 1.05 | | | | 0.55 | | | 1.08 | | | | 0.38 | | | 1.1 | | | | 12.23 | | | 1.06 | |

| Probable | | | 14.99 | | | 1.01 | | | | 3.95 | | | 1.11 | | | | 14.69 | | | 2.34 | | | | 33.62 | | | 1.6 | |

| Total Mineral Reserves | | | 26.28 | | | 1.03 | | | | 4.5 | | | 1.11 | | | | 15.07 | | | 2.31 | | | | 45.85 | | | 1.46 | |

| Inferred Resource | | | 2.87 | | | 0.69 | | | | 0.36 | | | 0.71 | | | | 1.08 | | | 2.28 | | | | 4.31 | | | 1.09 | |

Simberi mineral deposits and 2009-2010 exploration drill holes

Proven and Probable gold Reserves (JORC Compliant) for the group totals 3.43 million ounces as indicated in the table below.

Allied Gold Group Reserves

| | | Proven | | | Probable | | | Total Proven+Probable | |

| | | Tonnes | | | | | | | | | Tonnes | | | | | | | | | Tonnes | | | | | | | |

| Mine | | (Mt) | | | Au (g/t) | | | Au (koz) | | | (Mt) | | | Au (g/t) | | | Au (koz) | | | (Mt) | | | Au (g/t) | | | Au (koz) | |

| Gold Ridge | | | | | | | | | | | | 23.25 | | | | 1.71 | | | | 1,282 | | | | 23.25 | | | | 1.71 | | | | 1,282 | |

| Simberi | | | 12.23 | | | | 1.06 | | | | 417 | | | | 33.62 | | | | 1.60 | | | | 1,732 | | | | 45.85 | | | | 1.46 | | | | 2,149 | |

| Total | | | 12.23 | | | | 1.06 | | | | 417 | | | | 56.87 | | | | 1.65 | | | | 3,014 | | | | 69.10 | | | | 1.54 | | | | 3,431 | |

Note discrepancies due to rounding

Yours faithfully

ALLIED GOLD LIMITED

Mark V. Caruso

Executive Chairman

For more details, please contact:

| Mr Mark Caruso | Executive Chairman | 08 9356 2776 |

| Mr Frank Terranova | Chief Financial Officer | 07 3252 5911 |

| Mr Simon Jemison | Investor Relations & Media | 07 3252 5911 / 0418 853 922 |

Board of Directors: Mark Caruso Executive Chairman & CEO Monty House Non Executive Director Tony Lowrie Non Executive Director Greg Steemson Non Executive Director Frank Terranova ExecutiveDirector& CFO Peter Torre Company Secretary ASX Code: ALD AIM Code: AGLD | | Competent Persons The information in this Stock Exchange Announcement that relates to Mineral Exploration results and Mineral Resources, together with any related assessments and interpretations, have been verified by and approved for release by Mr C R Hastings, MSc, BSc, M.Aus.I.M.M., a qualified geologist and full-time employee of the Company. Mr Hastings has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2004 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”. Mr Hastings consents to the inclusion of the information contained in this ASX release in the form and context in which it appears. The information in this Stock Exchange Announcement that relates to Mineral Reserves has been compiled by Mr J Battista of Golder Associates who is a Member of the Australasian Institute of Mining and Metallurgy. Mr Battista has had sufficient experience in Ore Resource estimation relevant to the style of mineralisation and type of deposit under consideration to qualify as a Competent Person as defined in the 2004 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”. Mr Battista consents to the inclusion of the information contained in this ASX release in the form and context in which it appears. |

| | | |

Principal Office 34 Douglas Street Milton, Queensland 4064 Telephone +61 7 3252 5911 Facsimile +61 7 3252 3552 Email info@alliedgold.com.au Website: www.alliedgold.com.au Postal Address PO Box 2019, Milton 4064 Registered Office Unit B9, 431 Roberts Road Subiaco, WA 6008 Share Registry | | Forward-Looking Statements This press release contains forward-looking statements concerning the projects owned by Allied Gold. Statements concerning mineral reserves and resources may also be deemed to be forward-looking statements in that they involve estimates, based on certain assumptions, of the mineralisation that will be found if and when a deposit is developed and mined. Forward-looking statements are not statements of historical fact, and actual events or results may differ materially from those described in the forward-looking statements, as the result of a variety of risks, uncertainties and other factors, involved in the mining industry generally and the particular properties in which Allied has an interest, such as fluctuation in gold prices; uncertainties involved in interpreting drilling results and other tests; the uncertainty of financial projections and cost estimates; the possibility of cost overruns, accidents, strikes, delays and other problems in development projects, the uncertain availability of financing and uncertainties as to terms of any financings completed; uncertainties relating to environmental risks and government approvals, and possible political instability or changes in government policy in jurisdictions in which properties are located. Forward-looking statements are based on management’s beliefs, opinions and estimates as of the date they are made, and no obligation is assumed to update forward-looking statements if these beliefs, opinions or estimates should change or to reflect other future developments. |

| Computershare Investor Services | | |

Level 2, Reserve Bank Building 45 St Georges Terrace Perth, Western Australia WA 6000 | | Not an offer of securities or solicitation of a proxy This communication is not a solicitation of a proxy from any security holder of Allied Gold, nor is this communication an offer to purchase or a solicitation to sell securities. Any offer will be made only through an information circular or proxy statement or similar document. Investors and security holders are strongly advised to read such document regarding the proposed business combination referred to in this communication, if and when such document is filed and becomes available, because it will contain important information. Any such document would be filed by Allied Gold with the Australian Securities and Investments Commission, the Australian Stock Exchange and with the U.S. Securities and Exchange Commission (SEC). |

BACKGROUND

Allied Gold Limited’s gold production and exploration development portfolio is centred on Simberi and the Tabar Islands of Papua New Guinea and the Gold Ridge Project located on the Island of Guadalcanal in the Solomon Islands.Simberi is approximately 60 kilometres from LihirIsland which hosts a plus 40 million ounce gold resource, (see diagram below).

In 2009-2010, Allied produced 64,327 ounces of gold.Construction has commenced on expansion of the oxide plant at Simberi from 2Mtpa to 3.5Mtpa to increase life of mine annualised production to 95,000 oz. Redevelopment of the Gold Ridge Mine in the Solomon Islands will be completed first quarter 2011 and contribute additional life of mine annualised production of approximately 125,000 oz. A study focused on the feasibility of development of the sulphide resources at Simberi is looking at the optional configuration for an additional 90,000 oz pa sulphide operation.

Total group combined Measured, Indicated and Inferred Resources stand at 7.8Moz. Simberi currently hosts Measured, Indicated and Inferred mineral resources of approximately 5.7 million ounces of gold. Gold Ridge hosts approximately 2.11Moz of Measured, Indicated and Inferred resources. Group Reserves (Proven and Probable) total 3.43 million ounces including 2.15 million ounces at Simberi and 1.28 million ounces at Gold Ridge respectively.

Allied Gold currently owns 100% of Simberi and 100% of the EL on the nearby Tatau and Big Tabar Islands covering a total area of 170km2.Allied holds an additional 130km2 of exploration tenure in the Solomon Islands.