*Not pictured: Johnny Cameron, Mark Fisher and Bill Friedrich (each appointed in March 2006)

Chairman

Sir George Mathewson (age 65)

CBE, DUniv, LLD, FRSE, FCIBS

C (Chairman), N (Chairman)

Appointed to the Board in September 1987 and as Chairman in April 2001, Sir George Mathewson has a wide background in finance, technology and management and spent some of his career in the United States. He became Group Chief Executive in January 1992 and, in March 2000, he was appointed Executive Deputy Chairman. He is a director of The Scottish Investment Trust PLC and the Institute of International Finance, Inc. He is also president of the International Monetary Conference, a member of the Advisory Committee of Bridgepoint Capital Limited and a member of the Financial Reporting Council. He was chief executive of the Scottish Development Agency from 1981 to 1987 and is a former president of the British Bankers’ Association.

Deputy Chairman and

Chairman-designate

Sir Tom McKillop* (age 62)

C, N

Appointed to the Board as Deputy Chairman in September 2005, Sir Tom is a non-executive director of BP p.l.c., and was formerly chief executive of AstraZeneca plc. He was formerly president of the European Federation of Pharmaceutical Industries and Associations and chairman of the British Pharma Group. He is Pro-Chancellor of the University of Leicester and a trustee of the Council for Industry and Higher Education.

Executive directors

Sir Fred Goodwin (age 47)

DUniv, FCIBS, FCIB, LLD

Group Chief Executive

C

Appointed to the Board in August 1998, Sir Fred Goodwin is a Chartered Accountant. He was formerly chief executive and director, Clydesdale Bank PLC and Yorkshire Bank PLC. He is chairman of The Prince’s Trust, a non-executive director of Bank of China Limited and a former president of the Chartered Institute of Bankers in Scotland.

Lawrence Fish (age 61)

Chairman and Chief Executive

Officer of Citizens Financial

Group, Inc.

Appointed to the Board in January 1993, Lawrence Fish is an American national. He is a career banker and was a director of the Federal Reserve Bank of Boston. He is a trustee of The Brookings Institution and a director of the Financial Services Roundtable, Textron Inc., and numerous community organisations in the USA.

Gordon Pell (age 56)

FCIBS, FCIB

Chief Executive,

Retail Markets

Appointed to the Board in March 2000, Gordon Pell was formerly group director of Lloyds TSB UK Retail Banking before joining National Westminster Bank Plc as a director in February 2000 and then becoming chief executive, Retail Banking. He is also a director of Race for Opportunity and a member of the National Employment Panel and the FSA Practitioner Panel.

Guy Whittaker (age 49)

Group Finance Director

C

Appointed to the Board in February 2006, Guy Whittaker was formerly group treasurer at Citigroup Inc., based in New York, having previously held a number of management positions within the financial markets business at Citigroup. He was elected a Lady Beaufort Fellow of Christ's College Cambridge in 2004.

Johnny Cameron (age 51)

FCIBS

Chief Executive, Corporate Markets

Appointed to the Board in March 2006, Johnny Cameron has held a number of senior positions in financial institutions including County NatWest, Dresdner Kleinwort Benson and RBS. He was appointed Managing Director, Corporate and Institutional Banking in 1998, before being promoted to Deputy Chief Executive, Corporate Banking and Financial Markets (renamed Corporate Markets in January 2006) in 2000, and Chief Executive in 2001.

Mark Fisher (age 46)

FCIBS

Chief Executive, Manufacturing

Appointed to the Board in March 2006, Mark Fisher is a career banker, having joined the Group in 1981 as a graduate trainee. Mark has held a number of senior management positions in NatWest Retail Bank, including Finance Director and latterly Chief Operating Officer. He was responsible for overseeing the successful integration of NatWest on to the RBS operational platform following the acquisition in 2001, and has since then completed the integration of Churchill Insurance. Mark is also Chairman of The Association for Payment Clearing Services (APACS).

Non-executive directors

Colin Buchan* (age 51)

A, C, R

Appointed to the Board in June 2002, Colin Buchan was educated in South Africa and spent the early part of his career in South Africa and the Far East. He has considerable international investment banking experience, as well as experience in very large risk management in the equities business. He was formerly a member of the group management board of UBS AG and head of equities of UBS Warburg. He is chairman of UBS Securities Canada Inc. and vice-chairman of Standard Life Investments Limited. He is also a director of Merrill Lynch World Mining Trust Plc, Merrill Lynch Gold Limited, Royal Scottish National Orchestra Society Limited and World Mining Investment Company Limited.

Jim Currie* (age 64)

D.Litt

R

Appointed to the Board in November 2001, Jim Currie is a highly experienced senior international civil servant who spent many years working in Brussels and Washington. He was formerly director general at the European Commission with responsibility for the EU’s environmental policy and director general for Customs and Excise and Indirect Taxation. He is also a director of Total Holdings UK Limited, an international advisor to Eversheds and a consultant to Butera & Andrews UK Limited.

Bill Friedrich* (age 56)

Appointed to the Board in March 2006, Bill Friedrich was appointed to the Board of BG Group plc as an Executive Director, Deputy Chief Executive and General Counsel in October 2000. Since 2005, he has had primary responsibility for the Group’s overall strategy function and portfolio development activities as well as oversight of the Group’s organisational and human resource matters. Prior to that he was responsible for BG’s operations in North and South America and various Group-wide staff functions. He joined British Gas plc in December 1995 as General Counsel after a 20-year career with Shearman & Sterling, based in New York, where he became a partner in 1983.

Archie Hunter* (age 62)

A (Chairman), C

Appointed to the Board in September 2004, Archie Hunter is a Chartered Accountant. He was Scottish senior partner of KPMG between 1992 and 1999 and President of The Institute of Chartered Accountants of Scotland in 1997/1998. He has extensive professional experience in the UK and North and South America. He is currently chairman of Macfarlane Group plc, a director of Edinburgh US Tracker Trust plc, Convenor of Court at the University of Strathclyde and a governor of the Beatson Cancer Research Institute.

Charles ‘Bud’ Koch (age 59)

Appointed to the Board in September 2004, Bud Koch is an American national. He has extensive professional experience in the USA and is currently chairman of the board of the Federal Home Loan Bank of Cincinnati, chairman of the board of John Carroll University and a trustee of Case Western Reserve University. He was chairman, president and chief executive officer of Charter One Financial, Inc. and its wholly owned subsidiary, Charter One Bank, N.A between 1973 and 2004. He is also a director of Assurant, Inc.

Janis Kong* (age 55)

OBE, DUniv

Appointed to the Board in January 2006, Janis Kong is currently executive chairman of Heathrow Airport Limited, chairman of Heathrow Express Limited and a director of BAA plc and Portmeirion Group plc. She is also a member of the board of Visit Britain and previously served as a member of the board of the South East England Regional Development Agency.

Joe MacHale* (age 54)

A

Appointed to the Board in September 2004, Joe MacHale is currently a non-executive director and chairman of the audit committee of Morgan Crucible plc, a non-executive director of Brit Insurance Holdings plc, and a trustee of MacMillan Cancer Relief. He held a number of senior executive positions with J P Morgan between 1979 and 2001 and was latterly chief executive of J P Morgan Europe, Middle East and Africa Region.

Sir Steve Robson* (age 62)

A

Appointed to the Board in July 2001, Sir Steve Robson is a former senior UK civil servant, who had responsibility for a wide variety of Treasury matters. His early career included the post of private secretary to the Chancellor of the Exchequer and secondment to ICFC (now 3i). He was also a second permanent secretary of HM Treasury, where he was managing director of the Finance and Regulation Directorate. He is a non-executive director of JP Morgan Cazenove Holdings, Xstrata Plc and Partnerships UK plc, and a member of the Chairman’s Advisory Committee of KPMG.

Bob Scott* (age 64)

CBE, FCIBS

C, N, R (Chairman)

Appointed to the Board in January 2001, Bob Scott is an Australian national. He is the senior independent director. He has many years experience in the international insurance business and played a leading role in the consolidation of the UK insurance industry. He is a former group chief executive of CGNU plc and chairman of the board of the Association of British Insurers. He is chairman of Yell Group plc and a non-executive director of Swiss Reinsurance Company (Zurich), Jardine Lloyd Thompson Group plc and Focus DIY Group Limited. He is also a trustee of the Crimestoppers Trust and an adviser to Duke Street Capital.

Peter Sutherland* (age 59)

KCMG

C, N

Appointed to the Board in January 2001, Peter Sutherland is an Irish national. He is a former attorney general of Ireland and from 1985 to 1989 was the European Commissioner responsible for competition policy. He is chairman of BP p.l.c. and Goldman Sachs International and honorary president and member of the Advisory Council for the European Movement – Ireland. He was formerly chairman of Allied Irish Bank and a director general of GATT and the World Trade Organisation.

Group Secretary and

General Counsel

Miller McLean (age 56)

FCIBS

C

Miller McLean was appointed Group Secretary in August 1994. He is a trustee of the Industry and Parliament Trust, a non-executive chairman of The Whitehall and Industry Group and a director of The Scottish Parliament and Business Exchange.

| A | member ofthe Audit Committee |

| C | member ofthe Chairman’s Advisory Group |

| N | member ofthe Nominations Committee |

| R | member ofthe Remuneration Committee |

| * | independent non-executive director |

61

Report of the directors

The directors have pleasure in presenting their report together with the audited accounts for the year ended 31 December 2005.

Profit and dividends

The profit attributable to the ordinary shareholders of the company for the year ended 31 December 2005 amounted to £5,392 million compared with £4,856 million for the year ended 31 December 2004, as set out in the consolidated income statement on page 97.

An interim dividend of 19.4p per ordinary share was paid on 7 October 2005 totalling £619 million (2004 – £529 million). The directors now recommend that a final dividend of 53.1p per ordinary share totalling £1,700 million (2004 – £1,308 million) be paid on 9 June 2006 to members on the register at the close of business on 10 March 2006. Subject to approval of the dividend at the Annual General Meeting, shareholders will be offered the opportunity to participate in a dividend reinvestment plan, which will replace the current scrip dividend scheme.

Activities and business review

The company is a holding company owning the entire issued ordinary share capital of the Royal Bank, the principal direct operating subsidiary undertaking of the company. The “Group” comprises the company and all its subsidiary and associated undertakings, including the Royal Bank and NatWest. The Group is engaged principally in providing a wide range of banking, insurance and other financial services. The financial risk management objectives and policies of the Group and information on the Group’s exposure to price, credit, liquidity and cash flow risk are contained in Note 34 on the financial statements. Details of the principal subsidiary undertakings of the company are shown in Note 15. A review of the business for the year to 31 December 2005, of recent events and of likely future developments is contained in the Operating and financial review.

Business developments

In August 2005, the Group announced a strategic partnership with Bank of China (BoC). Subsequently, a Group-led consortium acquired a 10% shareholding in BoC through a majority-owned subsidiary for US$3.1 billion (£1.7 billion). The Group’s share of the investment (US$1.6 billion) was financed through the disposal of its 2.2% holding in the issued share capital of Banco Santander Central Hispano, S.A. Following receipt of all required regulatory approvals, the investment was completed in December 2005. The two banks will co-operate across a range of business activities in China including credit cards, wealth management, corporate banking and personal lines insurance. They will also closely co-operate in key operational areas including financial controls, risk management, human resources and corporate governance.

Going concern

The directors are satisfied that the Group has adequate resources to continue in business for the foreseeable future. For this reason, they continue to adopt the ‘going concern’ basis for preparing the accounts.

Ordinary share capital

During the year ended 31 December 2005, the ordinary share capital was increased by the following issues:

| (a) | 13.5 million ordinary shares allotted as a result of the exercise of options under the company’s executive, sharesave and option 2000 schemes and a further 0.7 million ordinary shares allotted in respect of the exercise of options under the NatWest executive and sharesave schemes which had been exchanged for options over the company’s shares following the acquisition of NatWest in 2000; |

| | |

| (b) | 7.4 million ordinary shares allotted in lieu of cash dividends; and |

| | |

| (c) | 2.3 million ordinary shares allotted under the company’s employee share ownership plan. |

Details of the authorised and issued ordinary share capital at 31 December 2005 are shown in Note 30.

Preference share capital

Details of issues of preference shares during the year and the authorised and issued share capital at 31 December 2005 are shown in Note 30.

Authority to repurchase shares

At the Annual General Meeting in 2005, shareholders renewed the authority for the company to make market purchases of up to 317,495,924 ordinary shares. The directors have not exercised this authority to date. The Group has however announced its intention to repurchase up to £1 billion of ordinary shares over the course of the next 12 months, and shareholders will be asked to renew this authority at the Annual General Meeting in April.

62

Shareholdings

As at 27 February 2006, the company had been notified of the following interests in its shares, in accordance with section 198 of the Companies Act 1985:

| | | Number of shares | | % held | | | | Number of shares | | % held |

|

|

|

|

|

|

|

|

|

|

|

| Ordinary shares: | | | | | | 5½% cumulative preference shares: | | | | |

| Legal & General Group plc | | 98,761,695 | | 3.40 | | Commercial Union Assurance plc | | 91,429 | | 22.86 |

| Barclays PLC | | 126,816,644 | | 3.97 | | Mr P. S. and Mrs J. Allen | | 86,999 | | 21.75 |

| The Capital Group of Companies, Inc | | 95,578,555 | | 3.01 | | Bassett-Patrick Securities Limited* | | 46,255 | | 11.56 |

| 11% cumulative preference shares: | | | | | | E M Behrens Charitable Trust | | 20,000 | | 5.00 |

| Guardian Royal Exchange | | | | | | Mrs Gina Wild | | 19,800 | | 4.95 |

| Assurance plc | | 129,830 | | 25.97 | | Trustees of The Stephen Cockburn | | | | |

| Windsor Life Assurance | | | | | | Limited Pension Scheme | | 19,879 | | 4.97 |

| Company Limited | | 51,510 | | 10.30 | �� | Miss Elizabeth Hill | | 16,124 | | 4.03 |

| Mr S. J. and Mrs J. A. Cockburn | | 30,810 | | 6.16 | | Mr W. T. Hardison Jr. | | 13,532 | | 3.38 |

| Cleaning Tokens Limited | | 25,500 | | 5.10 | | Ms C. L. Allen | | 13,200 | | 3.30 |

| | | | | | | Ms J. C. Allen | | 12,750 | | 3.18 |

|

|

|

|

|

|

|

|

|

|

|

| * | Notification has been received on behalf of Mr A. W. R. Medlock and Mrs H. M. Medlock that they each have an interest in the holding of 51/2 % cumulative preference shares registered in the name of Bassett-Patrick Securities Limited noted above and that there are further holdings of 5,300 and 5,000 shares, respectively, of that class registered in each of their names. |

Directors

The names and brief biographical details of the directors are shown on page 61. All directors, except:

- Sir Angus Grossart, Lord Vallance and Iain Robertson, whoretired from the Board on 20 April 2005, and Eileen Mackay,who retired from the Board on 31 December 2005,

- Sir Tom McKillop, who was appointed to the Board on1 September 2005, Janis Kong, who was appointed to theBoard on 1 January 2006, and Guy Whittaker, who wasappointed to the Board on 1 February 2006, and

- Fred Watt, who resigned from the Board on 31 January 2006,

served throughout the year and to the date of signing of the financial statements.

Sir Tom McKillop, Colin Buchan, Janis Kong, Bob Scott, Peter Sutherland and Guy Whittaker will retire and offer themselves for election or re-election at the company’s Annual General Meeting. Bill Friedrich, Johnny Cameron and Mark Fisher have been appointed as directors with effect from 1 March 2006 and will also offer themselves for election at the company’s Annual General Meeting.

Details of the service agreement for Guy Whittaker are set out on page 77. Johnny Cameron has a service agreement with The Royal Bank of Scotland plc dated 29 March 1998 which may be terminated by Mr Cameron giving six months notice to the Royal Bank and by the Royal Bank giving 12 months notice to Mr Cameron. Mark Fisher has a service agreement with The Royal Bank of Scotland plc dated 3 May 2000 which may be terminated by either party giving six months notice to the other. No other director seeking election or re-election has a service agreement.

Sir George Mathewson will retire as Chairman of the Board with effect from the conclusion of the Annual General Meeting on 28 April 2006. The Group has secured his continued employment to serve in an advisory role to the Group. Sir Tom McKillop will succeed Sir George as Chairman.

Directors’ interests

The interests of the directors in the shares of the company at 31 December 2005 are shown on page 82. None of the directors held an interest in the loan capital of the company or in the shares and loan capital of any of the subsidiary undertakings of the company, during the period from 1 January 2005 to 27 February 2006.

Employee proposition

The Group recognises that staff performance is central to the successful delivery of its overall business strategy. Accordingly, the Group focuses on maintaining an employee proposition that attracts, engages and retains the best available talent.

Employee recruitment

Utilising a wide range of recruitment channels, including an open internal jobs market, talent forums and detailed succession planning, the Group ensures that the recruitment and development of employees is closely aligned to organisational requirements. A strong standing as an employer of choice prompts applications from hundreds of thousands of potential candidates each year. Similarly, all vacancies are displayed internally and RBS employees can apply for any role.

The Group retains a high profile as a graduate recruiter, providing a wide range of development programmes. In 2005, more than 14,000 graduates applied for over 230 places with the Group. The Group also received the Association of Graduate Recruiters Award for delivering the ‘Best Integrated Marketing Recruitment Campaign’ targeted at graduates.

63

Report of the directorscontinued

Group-wide co-ordination and access to recruitment and interview skills training ensures recruitment complies with internal and regulatory requirements. In addition, the Group continues to ensure all appointees are appropriately referenced and screened prior to joining the organisation.

Employee reward

The Group acknowledges that its continuing success is closely linked to the performance, skills and individual commitment of its employees. Significant focus is therefore given to offering an exceptional reward proposition to all RBS Group employees in order to attract, motivate and retain the best available talent at every level.

In 2005, employee costs of £5,992 million, including National Insurance and pension costs of £864 million, made up over a third of total expenditure.

The Group’s remuneration and benefits package, Total Reward, (consisting of salary, bonus, share scheme and competitive pension benefits) is acknowledged as one of the most comprehensive and flexible packages in the financial services sector. Salary awards within the Group reflect individual performance, offering greater increases for high performers, as well as acknowledging market competitor movements.

RBSelect, the Group’s benefits choice programme, forms part of the Total Reward package. It provides for UK staff in the Group a flexible way of tailoring their reward to reflect their own individual lifestyle needs. Options range from subsidised childcare vouchers and discounted personal insurance products to environmentally friendly bicycle purchases.

Employees can also participate in bonus incentive plans specific to their business and share in the Group’s ongoing success through profit sharing, Buy As You Earn and Sharesave schemes, which align their interests with those of shareholders. UK employees participate in profit sharing that is directly related to the annual performance of the Group. For the last seven years this has amounted to a further 10 percent of basic salary.

To enable employees to get the most from Total Reward, a wide range of information about reward and benefits has been introduced through RBSpeople.com, an internet site offering 24 hour access from home or work.

The RBS group Charity Lottery was launched during 2005. Employees contributing to the prize fund through a small monthly entry fee have the chance to win up to 50% of the total funds collected each month. The remainder, after payment of a small lottery-operating fee, is donated to charity.

The Group continues to offer membership of its final pension scheme, with the entire cost being met by the Group. The largest scheme is the Royal Bank of Scotland Group Pension Fund, with 80,000 employee members in the UK.

Employee learning and development

The Group actively encourages learning and development and is committed to creating and providing opportunities both inside and outside the workplace. These experiences are provided through a variety of developmental initiatives, technological innovations and learning networks and forums. Creating and maintaining a talented network of people across the Group ensures not only a strong leadership capability, but also a high performing workforce.

In 2005 a new Group-wide approach to leadership development was launched. Called the “Leadership Journey”, it defines success at different leadership levels and the key developmental challenges that employees face as they progress within the Group. A suite of development programmes has been designed and implemented to ensure appropriate leadership development, supporting the challenges that individual leaders face whilst completing different stages of the Leadership Journey.

A core component of this ongoing activity is the Group’s Executive Leadership Programme (developed in conjunction with the Harvard Business School) and the establishment of an on-site business school at the Group Headquarters at Gogarburn, Edinburgh, which opened in January 2006. The Business School is central to the Group’s commitment to developing its leaders, and equipping them with the skills and confidence necessary to lead in complex and challenging environments.

Employee communication

Employee engagement is encouraged through a variety of means including a corporate intranet, Group and divisional magazines, team meetings led by line managers, briefings held by senior managers and regular dialogue with employees and employee representatives.

During 2005, the high quality of the Group’s internal communications was reflected by success in a number of prestigious external awards schemes. Awards were attained at both Group and divisional level and included a Gold Award for hub magazine, the Manufacturing division’s internal publication, at the UK Communicators in Business Awards, and a Gold Award for the Group Communications team in the Regular Communications category at the International Visual Communication Association Awards

The Group Chief Executive and other senior Group executives regularly communicate with employees through ‘Question Time’ style programmes, broadcast on the Group’s internal television network. An ‘Open Air’ debate chaired by the Group Chief Executive on Diversity and Inclusion, seeking to ensure equality of opportunity for employees and customers, typifies this approach.

64

Employee consultation

The Group’s confidential global Employee Opinion Survey is externally designed, undertaken and analysed annually on behalf of the Group by International Survey Research (“ISR”).

The survey enables employees to maximise their contribution to the Group by expressing their views and opinions on a range of key issues.

The results from the 2005 survey, which 86% of Group employees completed, demonstrated significant improvements for the fifth successive year. This year, for the very first time, the Group scored above the ISR Global Financial Services Norm in every single category.

The survey results are presented at Board, divisional and team levels. Action plans are developed to address any issues identified. With continuing year-on-year improvement, strong divisional results and improvements in all leading indicators, it is believed that results are sustainable, particularly given the Group’s focus on continuous improvement.

In addition to direct communication and consultation with employees, the Group recognises the trade union Amicus in the UK, and the Irish Bank Officials Association and the Services, Industrial, Professional and Technical Union in Ireland. These formal relationships are complemented by works council arrangements in many of the Group’s mainland Europe-based operations.

The Group has an European Employee Communication Council that provides elected employee representatives with an opportunity to better understand market conditions and strategic decisions with transnational impact on our European operations.

Diversity

The Group’s “Managing Diversity” policy sets a framework and a minimum standard within which all employees can develop to their full potential irrespective of race, gender, marital status, age, disability, religious belief, political opinion or sexual orientation. Each division has developed and delivered an action plan incorporating both Group and division-specific priorities to promote diversity across all areas of the employee lifecycle.

The success of this approach culminated in the Group receiving a Gold Standard Award in the Race for Opportunity Benchmarking Survey, having previously attained a Bronze in 2004. The Group maintains its involvement in and support of the UK Employers’ Forum on Age, Employers’ Forum on Disability, Employers’ Forum on Belief, Stonewall and of the Government’s Age Positive campaign.

The Group is also committed to ensuring that all prospective applicants for employment are treated fairly and equitably throughout the recruitment process. Its comprehensive resourcing standards cover the attraction and retention of individuals with disabilities. Reasonable adjustments are provided to support applicants in the recruitment process where these are required. The Group provides reasonable workplace adjustments for new entrants into the Group and for existing employees who become disabled during their employment.

Health, safety, wellbeing and security

The health, safety, wellbeing and security of RBS staff and customers continue to be a priority for the Group. Regular reviews are undertaken of both policies and processes to ensure compliance with current legislation and best practice. The Group focus is on ensuring that these policies are closely linked to the operational needs of the business.

Corporate responsibility

Business excellence requires that the Group meets changing customer, shareholder, investor, employee and supplier expectations. The Group believes that meeting high standards of environmental, social and ethical responsibility is key to the way it does business.

The Board regularly considers corporate responsibility issues and receives a formal report twice each year. Further details of the Group’s corporate responsibility policies will be contained in the 2005 Corporate Responsibility Report.

Code of ethics

The Group has adopted a code of ethics that is applicable to all of the Group’s employees and a copy is available upon request.

Charitable contributions

In 2005 the contribution to the Group’s Community Investment programmes increased to £56.2 million (2004 – £45.8 million). The total amount given for charitable purposes by the company and its subsidiary undertakings during the year ended 31 December 2005 was £24.3 million (2004 – £20.1 million).

Corporate governance

The company is committed to high standards of Corporate governance. Details are given on pages 67 to 72.

Political donations

No political donations were made during the year.

At the Annual General Meeting in 2002, shareholders gave authority for the company and certain of its subsidiaries to make political donations and incur political expenditure up to a maximum aggregate sum of £675,000 as a precautionary measure in light of the wide definitions in The Political Parties, Elections and Referendums Act 2000, for a period of four years. These authorities have not been used and it is not proposed that the Group’s longstanding policy of not making contributions to any political party be changed. A resolution to renew a general Group authority will be proposed at the Annual General Meeting on 28 April 2006.

65

Report of the directorscontinued

Policy and practice on payment of creditors

The Group is committed to maintaining a sound commercial relationship with its suppliers. Consequently, it is the Group’s policy to negotiate and agree terms and conditions with its suppliers, which includes the giving of an undertaking to pay suppliers within 30 days of receipt of a correctly prepared invoice submitted in accordance with the terms of the contract or such other payment period as may be agreed.

At 31 December 2005, the Group’s trade creditors represented 27 days (2004 – 27 days) of amounts invoiced by suppliers. The company does not have any trade creditors.

Directors' indemnities

In terms of section 309C of The Companies Act 1985 (as amended), the directors of the company, members of the Group Executive Management Committee and Approved Persons of the Group (under the Financial Services and Markets Act 2000) have been granted Qualifying Third Party Indemnity Provisions by the company.

Auditors

The auditors, Deloitte & Touche LLP, have indicated their willingness to continue in office. A resolution to re-appoint Deloitte & Touche LLP as the company’s auditor will be proposed at the forthcoming Annual General Meeting.

By order of the Board.

| |

| Miller McLean |

| Secretary |

| 27 February 2006 |

| |

| |

| The Royal Bank of Scotland Group plc |

| is registered in Scotland No. 45551. |

66

Corporate governance

The company is committed to high standards of corporate governance, business integrity and professionalism in all its activities.

Throughout the year ended 31 December 2005, the company has complied with all of the provisions set out in the revised Combined Code issued by the Financial Reporting Council in July 2003 (the “Code”) except in relation to the authority reserved to the Board to make the final determination of the remuneration of the executive directors, which is explained below in the paragraph headed ‘Remuneration Committee’.

The company has also complied with the Smith Guidance on Audit Committees in all material respects.

Under the US Sarbanes-Oxley Act of 2002, enhanced standards of corporate governance and business and financial disclosure apply to companies, including the company, with securities registered in the US. The Group complies with all currently applicable sections of the Act.

Board of directors

The Board is the principal decision-making forum for the company. It has overall responsibility for leading and controlling the company and is accountable to shareholders for financial and operational performance. The Board approves Group strategy and monitors performance. The Board has adopted a formal schedule of matters detailing key aspects of the company’s affairs reserved to it for its decision. This schedule is reviewed annually.

The roles of the Chairman and Group Chief Executive are distinct and separate, with a clear division of responsibilities. The Chairman leads the Board and ensures the effective engagement and contribution of all non-executive and executive directors. The Group Chief Executive has responsibility for all Group businesses and acts in accordance with the authority delegated by the Board. Responsibility for the development of policy and strategy and operational management is delegated to the Group Chief Executive and other executive directors.

All directors participate in discussing strategy, performance and the financial and risk management of the company. Meetings of the Board are structured to allow open discussion.

The Board met nine times during 2005 and was supplied with comprehensive papers in advance of each Board meeting covering the Group’s principal business activities. Members of the executive management attend and make regular presentations at meetings of the Board.

Board balance and independence

The Board currently comprises the Chairman, six executive directors and eleven non-executive directors. The Board functions effectively and efficiently, and is considered to be of an appropriate size in view of the scale of the company and the diversity of its businesses. The directors provide the Group with the knowledge, mix of skills, experience and networks of contacts required. The Board Committees contain directors with a variety of relevant skills and experience so that no undue reliance is placed on any individual.

The non-executive directors combine broad business and commercial experience with independent and objective judgement. The balance between non-executive and executive directors enables the Board to provide clear and effective leadership and maintain the highest standards of integrity across the company’s business activities. The names and biographies of all Board members are set out on page 61.

The composition of the Board is subject to continuing review and the provisions of the Code will be taken into account in respect of the balance of the Board. The Code requires the Board to determine whether its non-executive members are independent.

The Board currently comprises ten independent and seven non-independent directors (including executive directors), in addition to the Chairman. Sir Tom McKillop is Chairman-designate and Bob Scott has been nominated as the senior independent director.

The Board considers that all non-executive directors are independent for the purposes of the Code, with the exception of Bud Koch who was formerly Chairman, President and Chief Executive Officer of Charter One Financial, Inc. which was acquired by Citizens Financial Group, Inc. in 2004.

Re-election of directors

At each Annual General Meeting, one third of the directors retire and offer themselves for re-election and each director must stand for re-election at least once every three years. Any non-executive directors who have served for more than nine years will also stand for annual re-election and the Board may consider their independence at that time. The proposed reelection of directors is subject to prior review by the Board.

The names of directors standing for re-election at the 2006 Annual General Meeting are contained on page 63 and further information will be given in the Chairman’s letter to shareholders in relation to the company’s Annual General Meeting.

Information, induction and professional development

All directors receive accurate, timely and clear information on all relevant matters. Any requests for further information or clarification are dealt with or co-ordinated by the Group Secretary.

The Group Secretary is responsible for advising the Board, through the Chairman, on all governance matters. All directors have access to the advice and services of the Group Secretary who is responsible to the Board for ensuring that Board procedures are followed and that applicable rules and regulations are complied with. In addition, all directors are able, if necessary, to obtain independent professional advice at the company’s expense.

Each new director receives a formal induction, including visits to all the Group’s major businesses and meetings with senior management. The induction is tailored to the director’s specific requirements. Existing directors undertake such professional development as they consider necessary in assisting them to carry out their duties as directors.

67

Corporate governancecontinued

Performance evaluation

The annual performance evaluation of the Board and its Committees was undertaken in the autumn of 2005. The evaluation, which covered the operation and effectiveness of the Board, the Remuneration Committee and the Nominations Committee, was conducted by the Group Secretary using a detailed questionnaire and meetings with each director. Amongst the areas reviewed were the composition of the Board, Board processes and performance against objectives.

In addition, each director discussed his or her own performance with the Chairman and the senior independent director met individually with the executive directors and with the non-executive directors as a group without the Chairman present, to consider the Chairman’s performance. The report on the Board evaluation, which was designed to assist the Board in further improving its performance, was considered and discussed by the Board as a whole and specific actions are currently being implemented.

A review of the effectiveness of the Audit Committee was undertaken during the year by PricewaterhouseCoopers and was the subject of a separate report to the Board. Amongst the areas reviewed were the composition and performance of the Committee and the Committee’s role in relation to internal and external audit, risk management and financial reporting.

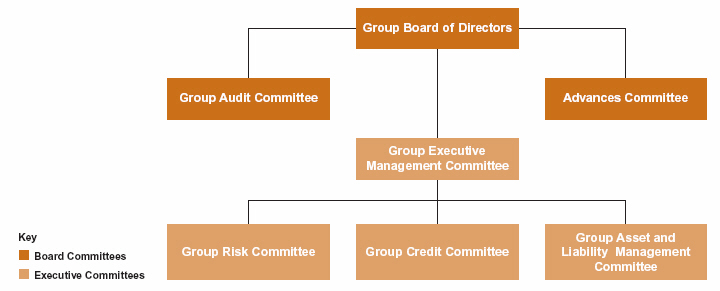

Board Committees

In order to provide effective oversight and leadership, the Board has established a number of Board Committees with particular responsibilities. The Committee chairmanship and membership are reviewed on a regular basis. The names and biographies of all Board Committee members are set out on page 61.

The terms of reference of the Audit, Remuneration and Nominations committees and the standard terms and conditions of the appointment of non-executive directors are available on the Group's website (www.rbs.com) and copies are available on request.

Audit Committee

All members of the Audit Committee are independent non-executive directors. The Audit Committee holds at least five meetings each year. The Audit Committee’s report is contained on pages 71 and 72.

Remuneration Committee

All members of the Remuneration Committee are independent non-executive directors. The Remuneration Committee holds at least three meetings each year.

The Remuneration Committee is responsible for assisting the Board in discharging its responsibilities and making all relevant disclosures in relation to the formulation and review of the Group’s executive remuneration policy. The Remuneration Committee makes recommendations to the Board on the remuneration arrangements for its executive directors and the Chairman. The Directors’ Remuneration Report is contained on pages 73 to 81.

Responsibility for determining the remuneration of executive directors has not been delegated to the Remuneration Committee, and in that sense the provisions of the Code have not been complied with. The Board as a whole reserves the authority to make the final determination of the remuneration of directors as it considers that this two stage process allows greater consideration and evaluation and is consistent with the unitary nature of the Board. No director is involved in decisions regarding his or her own remuneration.

Nominations Committee

The Nominations Committee comprises independent non-executive directors, under the chairmanship of the Chairman of the Board. The Nominations Committee meets as required.

The Nominations Committee is responsible for assisting the Board in the formal selection and appointment of directors. It considers potential candidates and recommends appointments of new directors to the Board. The appointments are based on merit and against objective criteria, including the time available to, and the commitment which will be required of, the potential director.

In addition, the Nominations Committee considers succession planning for the Chairman, Group Chief Executive and non-executive directors. The Nominations Committee takes into account the knowledge, mix of skills, experience and networks of contacts which are anticipated to be needed on the Board in the future. The Chairman, Group Chief Executive and non-executive directors meet to consider executive succession planning. No director is involved in decisions regarding his or her own succession.

The Board is aware of the other commitments of its directors and is satisfied that these do not conflict with their duties as non-executive directors of the company.

68

Meetings

The number of meetings of the Board and the Audit, Remuneration and Nominations Committees and individual attendance by members is shown below.

| | | Board | | Audit | | Remuneration | | Nominations |

|

|

|

|

|

|

|

|

|

| Total number of meetings | | | | | | | | |

| in 2005 | | 9 | | 9 | | 5 | | 5 |

|

|

|

|

|

|

|

|

|

| Number of meetings | | | | | | | | |

| attended in 2005 | | | | | | | | |

|

|

|

|

|

|

|

|

|

| Sir George Mathewson | | 9 | | – | | – | | 5 |

|

|

|

|

|

|

|

|

|

| Sir Tom McKillop* | | 2 | | – | | – | | 2 |

|

|

|

|

|

|

|

|

|

| Lord Vallance** | | 4 | | – | | – | | – |

|

|

|

|

|

|

|

|

|

| Sir Angus Grossart** | | 4 | | – | | – | | – |

|

|

|

|

|

|

|

|

|

| Sir Fred Goodwin | | 9 | | – | | – | | – |

|

|

|

|

|

|

|

|

|

| Mr Buchan | | 9 | | 8 | | 5 | | – |

|

|

|

|

|

|

|

|

|

| Dr Currie | | 9 | | – | | 5 | | – |

|

|

|

|

|

|

|

|

|

| Mr Fish | | 6 | | – | | – | | – |

|

|

|

|

|

|

|

|

|

| Mr Hunter | | 9 | | 9 | | – | | – |

|

|

|

|

|

|

|

|

|

| Mr Koch | | 9 | | – | | – | | – |

|

|

|

|

|

|

|

|

|

| Mr MacHale | | 9 | | 9 | | – | | – |

|

|

|

|

|

|

|

|

|

| Miss Mackay | | 9 | | 9 | | 5 | | – |

|

|

|

|

|

|

|

|

|

| Mr Pell | | 9 | | – | | – | | – |

|

|

|

|

|

|

|

|

|

| Mr Robertson** | | 3 | | – | | – | | – |

|

|

|

|

|

|

|

|

|

| Sir Steve Robson | | 9 | | 9 | | – | | – |

|

|

|

|

|

|

|

|

|

| Mr Scott | | 9 | | – | | 5 | | 4 |

|

|

|

|

|

|

|

|

|

| Mr Sutherland | | 8 | | – | | – | | 4 |

|

|

|

|

|

|

|

|

|

| Mr Watt | | 9 | | – | | – | | – |

|

|

|

|

|

|

|

|

|

* Sir Tom McKillop was appointed to the Board on 1 September 2005.

** Lord Vallance, Sir Angus Grossart and Iain Robertson retired from the Board on 20 April 2005.

Relations with shareholders

The company communicates with shareholders through the annual report and by providing information in advance of the Annual General Meeting. Individual shareholders can raise matters relating to their shareholdings and the business of the Group at any time throughout the year. Shareholders are given the opportunity to ask questions at the Annual General Meeting or submit written questions in advance. The chairmen of the Audit, Remuneration and Nominations Committees are available to answer questions at the Annual General Meeting.

Communication with the company’s largest institutional shareholders is undertaken as part of the company’s investor relations programme. During the year, the directors received copies of analysts’ reports and a monthly report from the Group’s investor relations department which includes an analysis of share price movements, the Group’s performance against the sector, and key broker comments. In addition, information on major investor relations activities and changes to external ratings are provided. In 2005, the senior independent director attended results presentations to enhance his understanding of the views of major shareholders and would be available to shareholders if concerns could not be addressed through the normal channels. The arrangements used to ensure that directors develop an understanding of the views of major shareholders are considered as part of the annual Board performance evaluation.

The Chairman, Group Chief Executive, Group Finance Director and, if appropriate, the senior independent director communicate shareholder views to the Board as a whole.

In 2005, a survey of investor perceptions was undertaken on behalf of the Board by independent advisers, and the findings were considered by the Board.

Internal control

The Board of directors is responsible for the Group’s system of internal control that is designed to facilitate effective and efficient operations and to ensure the quality of internal and external reporting and compliance with applicable laws and regulations. In devising internal controls, the Group has regard to the nature and extent of the risk, the likelihood of it crystallising and the cost of controls. A system of internal control is designed to manage, but not eliminate, the risk of failure to achieve business objectives and can only provide reasonable, and not absolute, assurance against the risk of material misstatement, fraud or losses.

The Board has established a process for the identification, evaluation and management of the significant risks faced by the Group, which operated throughout the year ended 31 December 2005 and to 27 February 2006, the date the directors approved the Report and Accounts. This process is regularly reviewed by the Board and meets the requirements of the guidance ‘Internal Control: Guidance for Directors on the Combined Code’ issued by the Institute of Chartered Accountants in England and Wales in 1999.

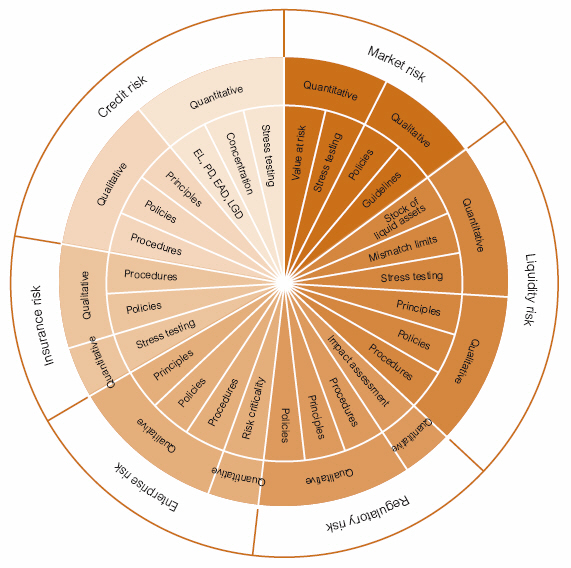

The effectiveness of the Group’s internal control system is reviewed regularly by the Board and the Audit Committee. Executive management committees or boards of directors in each of the Group’s businesses receive quarterly reports on significant risks facing their business and how they are being controlled. These reports are combined and submitted to the Board as quarterly risk and control assessments. Additional details of the Group’s approach to risk management are given in the ‘Risk management’ section of the ‘Operating and financial review’ on pages 38 to 58. The Audit Committee also receives regular reports from Group Risk Management and Group Internal Audit. In addition, the Group’s independent auditors present to the Audit Committee reports that include details of any significant internal control matters which they have identified. The system of internal controls of the authorised institutions and other regulated entities in the Group is also subject to regulatory oversight in the UK and overseas. Additional details of the Group’s regulatory oversight are given in the Supervision and Regulation section on pages 205 to 208.

69

Corporate governancecontinued

Disclosure controls and procedures

As required by US regulations, the Group Chief Executive and the Group Finance Director have evaluated the effectiveness of the company’s disclosure controls and procedures (as defined in the rules under the US Securities Exchange Act of 1934). This evaluation has been considered and approved by the Board which has authorised the Group Chief Executive and the Group Finance Director to certify that as at 31 December 2005, the company’s disclosure controls and procedures were adequate and effective and designed to ensure that material information relating to the company and its consolidated subsidiaries would be made known to them by others within those entities.

Changes in internal controls

There was no change in the company’s internal control over financial reporting that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the company’s internal control over financial reporting.

70

Audit Committee Report

The members of the Audit Committee are Archie Hunter (Chairman), Colin Buchan, Joe MacHale, Eileen Mackay, until her retirement on 31 December 2005, and Sir Steve Robson. All members of the Audit Committee are independent non-executive directors. The Audit Committee holds at least five meetings each year, two of which are held immediately prior to submission of the interim and annual financial statements to the Group Board. This core agenda is supplemented by additional meetings as required, four being added in 2005. Audit Committee meetings are attended by relevant executive directors, the internal and external auditors and risk management executives. At least twice per annum the Committee meets privately with the external auditors. The Audit Committee also visits business divisions and certain Group functions under a programme set at the beginning of each year.

The Board is satisfied that all the Audit Committee members have recent and relevant financial experience. Although the Board has determined that each Member of the Audit Committee is an ‘Audit Committee Financial Expert’ and is independent, each as defined in the SEC rules under the US Securities Exchange Act of 1934 and related guidance, the members of the Audit Committee are selected with a view to the expertise and experience of the Audit Committee as a whole, and the Audit Committee reports to the Board as a single entity. The designation of a director or directors as an ‘Audit Committee Financial Expert’ does not impose on any such director any duties, obligations or liability that are greater than the duties, obligations and liability imposed on such director as a member of the Audit Committee and Board in the absence of such a designation. Nor does the designation of a director as an ‘Audit Committee Financial Expert’ affect the duties, obligations or liability of any other member of the Board.

The Audit Committee is responsible for:

- assisting the Board in discharging its responsibilities and inmaking all relevant disclosures in relation to the financialaffairs of the Group;

- reviewing accounting and financial reporting and regulatorycompliance;

- reviewing the Group’s systems of internal control; and

- monitoring the Group’s processes for internal audit, riskmanagement and external audit.

Full details of the responsibilities of the Audit Committee are available at www.rbs.com/content/corporate_responsibility/corporate_governance/downloads/group_audit.pdf.

The Audit Committee has adopted a policy on the engagement of the external auditors to supply audit and non-audit services, which takes into account relevant legislation regarding the provision of such services by an external audit firm. The Audit Committee reviews the policy annually and prospectively approves the provision of audit services and certain non-audit services by the external auditors.

Annual audit services include all services detailed in the annual engagement letter including the annual audit and interim reviews (including US reporting requirements), periodic profit verifications and reports to regulators including skilled persons reports commissioned by the Financial Services Authority (e.g. Reporting Accountants Reports).

Annual audit services also include statutory or non-statutory audits required by any Group companies that are not incorporated in the United Kingdom. Terms of engagement for these audits are agreed separately with management, and are consistent with those set out in the audit engagement letter, as local regulations permit.

The prospectively approved non-audit services include the following classes of service:

- capital raising, including consents, comfort letters andrelevant reviews of registration statements;

- provision of accounting opinions relating to the financialstatements of the Group;

- provision of reports that, according to law or regulation,must be rendered by the external auditors;

- tax compliance services;

- corporate finance services relative to companies that willremain outside the Group; and

- insolvency work relating to the Group’s customers.

The Audit Committee approves all other permitted non-audit services on a case by case basis. The relevant submissions by management outline the service required and confirm that the external auditor’s independence will not be compromised. In addition, the Audit Committee reviews and monitors the independence and objectivity of the external auditors when it approves non-audit work to be carried out by them, taking into consideration relevant legislation and ethical guidance.

Information on the audit and non-audit services carried out by the external auditors is detailed in Note 4 to the Group’s accounts.

The Audit Committee undertakes an annual evaluation to assess the independence and objectivity of the external auditors and the effectiveness of the audit process, taking into consideration relevant professional and regulatory requirements. The results of this evaluation are reported to the Board.

The Audit Committee makes recommendations to the Board for it to put to the Shareholders for their approval at the Annual General Meeting, in relation to the appointment, re-appointment and removal of Deloitte & Touche LLP as the external auditors and to approve the remuneration and terms of engagement of the external auditors.

71

Corporate governancecontinued

In 2004 KPMG conducted a review of the effectiveness of Group Internal Audit. It is intended that there will be an external review of the effectiveness of Group Internal Audit every three years, with internal reviews continuing in the intervening years. In 2005 the Audit Committee conducted a review of Group Internal Audit that involved cross Group participation and the external auditors.

During 2005 PricewaterhouseCoopers conducted an external review of the effectiveness of the Audit Committee. It is intended that there will be an external review of the effectiveness of the Audit Committee every three years, with internal reviews by the Board continuing in the intervening years.

In 2005 the Audit Committee reviewed the audit committee structure throughout the Group and as a result proposed to the Board a reorganisation and strengthening of the structure to ensure that audit committees would cover each separate Group business appropriately. That recommendation was accepted by the Board and is now being implemented.

72

Directors’ remuneration report

The Remuneration Committee

The members of the Remuneration Committee are Bob Scott (Chairman), Colin Buchan, Jim Currie and Eileen Mackay, until her retirement on 31 December 2005. All members of the Remuneration Committee are independent non-executive directors.

During the accounting period, the Remuneration Committee received advice from Watson Wyatt, Mercer Human Resource Consulting and Ernst & Young LLP on matters relating to directors’ remuneration in the UK (Watson Wyatt and Ernst & Young) and US (Mercer). In addition, the Remuneration Committee has taken account of the views of the Chairman of the Board and the Group Chief Executive on performance assessment of the executive directors.

In addition to advising the Remuneration Committee, Watson Wyatt provided professional services in the ordinary course of business, including actuarial advice and benefits administration services to subsidiaries of the Group and investment consulting advice to The Royal Bank of Scotland Pension Trustees Limited. Mercer Human Resource Consulting provided advice and support in connection with a range of benefits, pension actuarial and investment matters. Ernst & Young provided professional services in the ordinary course of business, including actuarial and corporate recovery advice.

Remuneration policy

The executive remuneration policy was approved by shareholders at the company’s Annual General Meeting in 2005. At the beginning of 2005, the Remuneration Committee decided to conduct a comprehensive review of all aspects of the executive remuneration package. A review of this depth had not been undertaken since 2000/2001. Its terms of reference were to examine all aspects of the executive remuneration strategy, policy and practice in light of the changing business make up and strategy of the Group and the evolution of best practice on executive remuneration. Following this review, the Remuneration Committee made no change to the overall executive remuneration policy, which is set out below. However, as a result of this review, the Group is making a number of changes to executive director remuneration practice which are described below.

The objective of the executive remuneration policy is to provide, in the context of the company’s business strategy, remuneration in form and amount which will attract, motivate and retain high calibre executives. In order to achieve this objective, the policy is framed around the following core principles:

- Total rewards will be set at levels that are competitive withinthe relevant market, taking each executive director’sremuneration package as a whole.

- Total potential rewards will be earned through achievementof demanding performance targets based on measuresconsistent with shareholder interests over the short, mediumand longer-term.

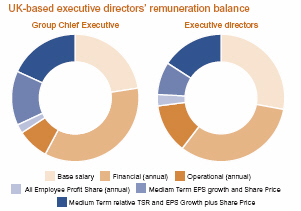

- Remuneration arrangements will strike an appropriate balancebetween fixed and performance-related rewards. Performance-related elements will comprise the major part of executiveremuneration packages. See illustrative charts below.

- Incentive plans and performance metrics will be structuredto be robust through the business cycle.

- Remuneration arrangements will be designed to support thecompany’s business strategy, to promote appropriateteamwork and to conform to best practice standards.

The above diagram has been prepared to illustrate the use of performance metrics in the total compensation package. For the Group Chief Executive 22% of the package is fixed and 78% is performance related. For the other executive directors, 28% is fixed and 72% is performance related. Values are entered on the basis of on target performance; long term incentives are shown at the approximate expected value at grant. Pension and other benefits have been excluded. Financial metrics include profit growth, cost control and ROE.

The non-executive directors’ fees are reviewed annually by the Board, on the recommendation of its Chairman. The level of remuneration reflects the responsibility and time commitment of directors and the level of fees paid to non-executive directors of comparable major UK companies. Non-executive directors do not participate in any incentive or performance plan.

The Remuneration Committee approves the remuneration arrangements of senior executives below Board level who are members of the Group Executive Management Committee, on the recommendation of the Group Chief Executive, and reviews all long-term incentive arrangements which are operated by the Group.

Components of executive remuneration

UK based directors

Salary

Salaries are reviewed annually as part of total remuneration, having regard to remuneration packages received by executives of comparable companies. The Remuneration Committee uses a range of survey data from remuneration consultants and reaches individual salary decisions taking account of the remuneration environment and the performance and responsibilities of the individual director.

Benefits

UK-based executive directors are eligible to participate in The Royal Bank of Scotland Group Pension Fund (“the RBS Fund”).

73

Directors’ remuneration reportcontinued

The RBS Fund is a non-contributory defined benefit fund which provides pensions and other benefits within Inland Revenue limits. Certain directors receive additional pension and life assurance benefits in excess of Inland Revenue limits. Details of pension arrangements of directors are shown on page 81.

From April 2006, new tax legislation will apply to UK pensions; in particular any pension in excess of the Lifetime Allowance will be subject to additional taxation. The Group will allow directors and employees whose benefits do, or are likely to exceed the Lifetime Allowance to opt-out of future tax-approved pension provision. In such cases the Group will pay the individual a salary supplement in lieu of pension provision. The Group will not meet the cost of any additional tax that individuals may incur as a result of their benefits exceeding the new Lifetime or Annual Allowances.

Executive directors are eligible to receive a choice of various employee benefits or a cash equivalent, on a similar basis to other employees. In addition, as employees, executive directors are eligible also to participate in Sharesave, Buy As You Earn and the Group profit sharing scheme, which currently pays up to 10 per cent of salaries, depending on the Group’s performance. These schemes are not subject to performance conditions since they are operated on an all-employee basis. Executive directors also receive death-in-service benefits.

Short-term annual incentives

As part of the overall review of the executive remuneration package referred to above, short term incentive levels were considered and the Remuneration Committee agreed to increase annual incentive potentials to reflect market practice and the setting of stretching new targets. As a result, from 2006 individual UK-based executive directors will normally have a maximum annual incentive potential of between 160% and 200% of salary. These will typically focus from year to year on the delivery of a combination of appropriate Group and individual financial and operational targets approved by the Remuneration Committee.

For the Group Chief Executive, the annual incentive is primarily based on specific Group financial performance measures such as operating profit, earnings per share growth and return on equity. The remainder of the Group Chief Executive’s annual incentive is based on a range of non-financial measures which may include measures relating to shareholders, customers and staff.

For the other executive directors a proportion of the annual incentive is based on Group financial performance and a proportion on division financial performance. The remainder of each individual’s annual incentive opportunity is dependent on achievement of a range of non-financial measures, specific objectives and key result areas. Divisional performance includes measures such as operating income, costs, bad debts or operating profit. Non-financial measures include customer measures (e.g. customer numbers, customer satisfaction), staff measures (e.g. employee engagement) and efficiency and change objectives.

For exceptional performance, as measured by the achievement of significant objectives, executive directors may be awarded incentive payments of up to 200% of salary, or 250% of salary, in the case of the Group Chief Executive. This discretion to pay additional bonuses for exceptional performance was last used in 2002 to recognise the successful integration of Natwest.

Long-term incentives

The company provides long-term incentives in the form of share options and share or share equivalent awards. Their objective is to encourage the creation of value over the long-term and to align the rewards of the executive directors with the returns to shareholders.

The Group’s policy is to encourage executives to hold shares and retain vested long-term incentives. This policy has successfully built high levels of shareholdings and equity participation amongst executives. A table showing directors’ interests in shares and the estimated value of the shares and vested long term incentives held by executives is shown on page 82. In light of the already high levels of share price exposure, the Remuneration Committee is not proposing to introduce mandatory or guideline shareholding requirements for executives at this time.

Medium-term performance plan

The medium-term performance plan (“MPP”) was approved by shareholders in April 2001. Each executive director is eligible for an annual award under the plan in the form of share or share equivalent awards. Whilst the rules of the plan allow awards over shares worth up to one and a half times earnings, the Remuneration Committee has adopted a policy of granting awards based on a multiple of salary. Normally awards are made at one times salary to executive directors, with one and a half times salary being granted in the case of the Group Chief Executive. No changes will be made to this policy without prior consultation with shareholders. All awards under the plan are subject to three-year performance targets.

The award in 2005 is subject to two performance measures. First, the annual growth in the company’s earnings per share (“EPS”) must exceed the annualised growth of the Retail Prices Index (“RPI”) plus three per cent. If this condition is satisfied, the company’s total shareholder return (“TSR”) is compared with the TSR of a comparator group of companies. The companies are Aviva plc; Banco Santander Central Hispano S.A. (“BSCH”); Barclays PLC; Citigroup inc.; HBOS plc; HSBC Holdings PLC; Legal & General Group plc; Lloyds TSB Group plc; Prudential plc and Standard Chartered PLC. Awards made under the plan will not vest if the company’s TSR is below the median of the comparator group. Achievement of the EPS target and median TSR performance against the comparator companies will result in vesting of 25% of the award, increasing to 200% if the company achieves a TSR ranking at first position in the comparator group and exceeds the TSR of the second placed comparator company by at least 34%.

During 2005, the Remuneration Committee reviewed all elements of the plan including the performance conditions, the vesting schedule and the comparator group. As a result, it is intended that for awards made from 2006, 50% of the award will vest on a relative TSR measure and 50% will vest on growth in adjusted EPS over the three year performance period.

74

The introduction of the EPS element is designed to ensure that the plan includes a performance measure which is in the clear line of sight for the participants and which reflects the business strategy for the next few years.

For the TSR element, vesting will be based on the level of outperformance by the Group of the median of the comparator group TSR over the performance period. The Remuneration Committee believes this method of measuring relative TSR performance provides a more approriate measure of management performance. This change is permitted under the rules of the plan. Awards made under the plan will not vest if the company’s TSR is below the median of the comparator group. Achievement of median TSR performance against comparator companies will result in vesting of 25% of the award. Outperformance of median TSR performance by up to 9% will result in vesting on a straight-line basis from 25% to 125%, outperformance by 9% to 18% will result in vesting on a straight-line basis from 125% to 200%. Vesting at 200% will occur if the company outperforms the median TSR performance of the comparator group by at least 18%.

Following the Remuneration Committee’s review of the plan, the comparator group was amended to comprise UK and international banking groups, which the Remuneration Committee considers more appropriate in the context of the Group’s business and performance. For awards made from 2006, the companies in the comparator group will be ABN Amro Holdings N.V.; BSCH; Barclays PLC; Citigroup Inc; HBOS plc; HSBC Holdings plc; Lloyds TSB Group plc and Standard Chartered PLC.

For the EPS element, the level of EPS growth over the three year period will be calculated by comparing the adjusted EPS in the year prior to the year of grant with that in the final year of the performance period. Each year the vesting schedule for the EPS growth measure will be agreed by the Remuneration Committee at the time of grant, having regard to the business plan, performance relative to comparators and analysts’ forecasts.

Options

The executive share option scheme was approved by shareholders in January 1999. The operation of the scheme was reviewed as part of the overall executive remuneration review and the Remuneration Committee is satisfied that no changes are required. Each executive director is eligible for an annual grant of an option, exercisable at the market price at the time of grant. Options granted to executive directors are typically over shares worth one and a quarter times salary with an upper maximum in appropriate circumstances of two and a half times salary, over shares at the market value at date of grant. No payment is made by the executive director on the grant of an option award.

All executive share option grants are subject to a performance condition which is reviewed by the Remuneration Committee annually. The performance target is currently that the options are exercisable only if, over a three year period from the date of grant, the growth in the company’s EPS has exceeded the growth in the RPI plus nine per cent. This EPS performance target, which is consistent with market practice, measuresunderlying financial performance and represents a long-term test of performance. For awards made from 2004, there is no re-testing of the performance condition.

US based director – Lawrence Fish

Lawrence Fish's total remuneration package was reviewed in 2004 by the Remuneration Committee as a result of the acquisition of Charter One and his changing RBS responsibilities in North America. A new cash long-term incentive plan was approved by shareholders at the 2005 Annual General Meeting. The remuneration policy for Mr Fish is as follows:

Base salary is set having regard to the levels of base salary in other US banks and the appropriate balance of fixed and variable remuneration for US based executives of UK listed companies operating within the corporate governance frameworks of the UK.

Benefits Mr Fish accrues pension benefits under a number of arrangements in the US. Details are provided on page 81. In addition he is entitled to receive other benefits on a similar basis to other Citizens employees.

Short term performance rewards take the form of an annual incentive plan which rewards the achievement of Group, business unit and individual financial and non-financial targets. The normal maximum annual bonus potential is two times salary, although additional amounts to a maximum of a further two times salary may be awarded, at the discretion of the Board, for exceptional performance as measured by the achievement of significant objectives.

Long term incentives consist of the following components:

- The two grants made under the Citizens Phantom 2000 Planvested on 1 January 2005 and 1 January 2006, respectively.

The value of units at the time of vesting is performance-linked and is based on the cumulative economic profitgenerated by Citizens, the trend in economic profit and onthe external market trends in the US banking sector, usingprice/earnings ratios of comparator US banks. This measurewas chosen to establish a clear link between the potentialincentive and the performance of Citizens. No other grantswill be made under this plan.

- A grant under the RBS medium-term performance planwithin the levels, and on the same terms, available to UKbased executives.

- A grant under the executive share option scheme within thelevels, and on the same terms, available to UK basedexecutives.

- A grant under the new Citizens Long Term Incentive Plan.Performance is measured on a combination of Growth inProfit before Tax and Relative Return on Equity based ona comparison of Citizens with comparator US banks. Thetargets for this plan are set on an annual basis over the threeyear term of the grant.

75

Directors’ remuneration reportcontinued

Total shareholder return performance

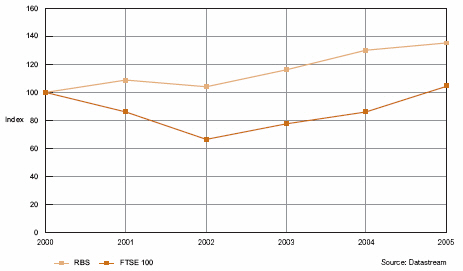

The undernoted performance graph illustrates the performance of the company over the past five years in terms of total shareholder return compared with that of the companies comprising the FTSE 100 index. This index has been selected because it represents a cross-section of leading UK companies. The total shareholder return for the company and the FTSE 100 have been rebased to 100 for 2000.

Total shareholder return

Service contracts

The company’s policy in relation to the duration of contracts with directors is that executive directors’ contracts generally continue until termination by either party, subject to the required notice, or until retirement date. The notice period under the service contracts of executive directors will not normally exceed 12 months. In relation to newly recruited executive directors, subject to the prior approval of the Remuneration Committee, the notice period from the employing company required to terminate the contract will not normally exceed 12 months unless there is a clear case for this. Where a longer period of notice is initially approved on appointment, it will normally be structured such that it will automatically reduce to 12 months in due course.

All new service contracts for executive directors will be subject to approval by the Remuneration Committee. Those contracts will normally include standard clauses covering the performance review process, the company’s normal disciplinary procedure, and terms for dismissal in the event of failure to perform or in situations involving actions in breach of the Group’s policies.

Any compensation payment made in connection with the departure of an executive director will be subject to approval by the Remuneration Committee, having regard to the terms of the service contract and the reasons for termination.

Information regarding executive directors’ service contracts is summarised in the table and notes below.

| Name | | Date of current contract/

Employing company | | Normal retirement age | | Notice period –

from company | | Notice period –

from executive |

|

|

|

|

|

|

|

|

|

| Sir Fred Goodwin | | 1 August 1998 | | 60 | | 12 months | | 6 months |

| | | The Royal Bank of Scotland plc | | | | | | |

| | | | | | | | | |

| Mr Pell | | 20 February 2006 | | 60 | | 12 months | | 6 months |

| | | The Royal Bank of Scotland plc | | | | | | |

| | | | | | | | | |

| Mr Watt* | | 28 September 2000 | | 60 | | 12 months | | 6 months |

| | | The Royal Bank of Scotland plc | | | | | | |

| | | | | | | | | |

| Mr Fish | | 18 February 2004 | | 65 | | 12 months | | 12 months |

| | | Citizens Financial Group, Inc. | | | | | | |

|

|

|

|

|

|

|

|

|

* Mr Watt resigned as a director on 31 January 2006.76

Except as noted below, in the event of severance of contract where any contractual notice period is not worked, the employing company may pay a sum to the executive in lieu of this period of notice. Any such payment would, at maximum, comprise base salary and a cash value in respect of fixed benefits (including pension plan contributions). In the event of situations involving breach of the employing company’s policies resulting in dismissal, reduced or no payments may be made to the executive. Depending on the circumstances of the termination of employment, the executive may be entitled, or the Remuneration Committee may exercise its discretion to allow, the executive to exercise outstanding awards under long-term incentive arrangements subject to the rules of relevant plan. The exception to these severance arrangements relates only to Mr Fish.