Presentation of information

In this document, and unless specified otherwise, the term ‘company’ means The Royal Bank of Scotland Group plc, ‘RBS’ or the ‘Group’ means the company and its subsidiaries, ‘the Royal Bank’ means The Royal Bank of Scotland plc and ‘NatWest’ means National Westminster Bank Plc.

The company publishes its financial statements in pounds sterling (‘£’ or ‘sterling’). The abbreviations ‘£m’ and ‘£bn’ represent millions and thousands of millions of pounds sterling, respectively, and references to ‘pence’ represent pence in the United Kingdom (‘UK’). Reference to ‘dollars’ or ‘$’ are to United States of America (‘US’) dollars. The abbreviations ‘$m’ and ‘$bn’ represent millions and thousands of millions of dollars, respectively, and references to ‘cents’ represent cents in the US. The abbreviation ‘€’ represents the ‘euro’, the European single currency, and the abbreviations ‘€m’ and ‘€bn’ represent millions and thousands of millions of euros, respectively.

Certain information in this report is presented separately for domestic and foreign activities. Domestic activities primarily consist of the UK domestic transactions of the Group. Foreign activities comprise the Group’s transactions conducted through those offices in the UK specifically organised to service international banking transactions and transactions conducted through offices outside the UK.

The geographic analysis in the average balance sheet and interest rates, changes in net interest income and average interest rates, yields, spreads and margins in this report have been compiled on the basis of location of office – UK and overseas. Management believes that this presentation provides more useful information on the Group’s yields, spreads and margins of the Group’s activities than would be provided by presentation on the basis of the domestic and foreign activities analysis used elsewhere in this report as it more closely reflects the basis on which the Group is managed. ‘UK’ in this context includes domestic transactions and transactions conducted through the offices in the UK which service international banking transactions.

The results, assets and liabilities of individual business units are classified as trading or non-trading based on their predominant activity. Although this method may result in some non-trading activity being classified as trading, and vice versa, the Group believes that any resulting misclassification is not material.

International Financial Reporting Standards

As required by the Companies Act 2006 and Article 4 of the European Union IAS Regulation, the consolidated financial statements of the Group are prepared in accordance with International Financial Reporting Standards issued by the International Accounting Standards Board (IASB) and interpretations issued by the International Financial Reporting Interpretations Committee of the IASB (together ‘IFRS’) as adopted by the European Union. They also comply with IFRS as issued by the IASB.

Acquisition of ABN AMRO

On 17 October 2007, RFS Holdings B.V. (“RFS Holdings”), which at the time was owned by RBSG, Fortis N.V., Fortis S.A./N.V., Fortis Bank Nederland (Holding) N.V. (“Fortis”) and Banco Santander, S.A. (“Santander”), completed the acquisition of ABN AMRO Holding N.V. (which was renamed RBS Holdings N.V. on 1 April 2010).

RFS Holdings, which is now jointly owned by RBSG, the Dutch State (following its acquisition of Fortis) and Santander (the “Consortium Members”), is continuing the process of implementing an orderly separation of the business units of RBS Holdings N.V. As part of this reorganisation, on 6 February 2010, the businesses of RBS Holdings N.V. acquired by the Dutch State were legally demerged from the RBS Holdings N.V. businesses acquired by the Group and were transferred into a newly established holding company, ABN AMRO Bank N.V. (save for certain assets and liabilities acquired by the Dutch State that were not part of the legal separation and which will be transferred to the Dutch State as soon as possible).

Legal separation of ABN AMRO Bank N.V. occurred on 1 April 2010, with the shares in that entity being transferred by RBS Holdings N.V. to a holding company called ABN AMRO Group N.V., which is owned by the Dutch State. Certain assets within RBS Holdings N.V. continue to be shared by the Consortium Members. RBS Holdings N.V. is a fully operational bank within the Group and is independently rated and licensed and regulated by the Dutch Central Bank.

Statutory results

RFS Holdings is jointly owned by the consortium members. It is controlled by the company and is therefore fully consolidated in its financial statements. Consequently, the statutory results of the Group include the results of ABN AMRO. The interests of Fortis, and its successor the State of the Netherlands, and Santander in RFS Holdings are included in minority interests.

Presentation of information continued

Restatements

Divisional results for 2008 have been restated to reflect the Group’s new organisational structure that includes a Non-Core division comprising individual assets, portfolios and lines of business that the Group intends to run off or dispose. The Non-Core division is reported separately from the divisions which form the Core Group. In addition, separate reporting of Business Services (formerly Group Manufacturing) and Centre results has changed and, with the exception of certain items of a one off nature, costs incurred are now allocated to the customer-facing divisions and included in the measurement of the returns which they generate. The changes do not affect the Group’s results. Comparatives have been restated accordingly.

IAS 1 (Revised 2007) ‘Presentation of Financial Statements’ has required the Group to present a third balance sheet (31 December 2007) as a result of the restatement of the Group’s income statement following the implementation of IFRS 2 (see below). A fourth balance sheet (31 December 2006) has not been presented as there is no material impact on that period.

Results for 2008 have been restated for the amendment to IFRS 2 ‘Share-based Payment’. This has resulted in an increase in staff costs amounting to £169 million for 2008 with no material effect on earlier periods.

Glossary

A glossary of terms is detailed on pages 355 to 359.

Forward-looking statements

Certain sections in this document contain ‘forward-looking statements’ as that term is defined in the United States Private Securities Litigation Reform Act of 1995, such as statements that include the words ‘expect’, ‘estimate’, ‘project’, ‘anticipate’, ‘believes’, ‘should’, ‘intend’, ‘plan’, ‘probability’, ‘risk’, ‘Value-at-Risk (VaR)’, ‘target’, ‘goal’, ‘objective’, ‘will’, ‘endeavour’, ‘outlook’, ‘optimistic’, ‘prospects’ and similar expressions or variations on such expressions.

In particular, this document includes forward-looking statements relating, but not limited to: the Group’s restructuring plans, capitalisation, portfolios, capital ratios, liquidity, risk weighted assets, return on equity, cost:income ratios, leverage and loan:deposit ratios, funding and risk profile; the Group’s future financial performance; the level and extent of future impairments and write-downs; the protection provided by the APS; and to the Group’s potential exposures to various types of market risks, such as interest rate risk, foreign exchange rate risk and commodity and equity price risk. These statements are based on current plans, estimates and projections, and are subject to inherent risks, uncertainties and other factors which could cause actual results to differ materially from the future results expressed or implied by such forward-looking statements. For example, certain of the market risk disclosures are dependent on choices about key model characteristics and assumptions and are subject to various limitations. By their nature, certain of the market risk disclosures are only estimates and, as a result, actual future gains and losses could differ materially from those that have been estimated.

Other factors that could cause actual results to differ materially from those estimated by the forward-looking statements contained in this document include, but are not limited to: the full nationalisation of the Group or other resolution procedures under the Banking Act 2009; the global economy and instability in the global financial markets, and their impact on the financial industry in general and on the Group in particular; the financial stability of other financial institutions, and the Group’s counterparties and borrowers; the ability to complete restructurings on a timely basis, or at all, including the disposal of certain non-core assets and assets and businesses required as part of the EC State Aid restructuring plan; organizational restructuring; the ability to access sufficient funding to meet liquidity needs; cancellation or failure to renew governmental support schemes; the extent of future write-downs and impairment charges caused by depressed asset valuations; the inability to hedge certain risks economically; the value and effectiveness of any credit protection purchased by the Group; unanticipated turbulence in interest rates, foreign currency exchange rates, credit spreads, bond prices, commodity prices and equity prices; changes in the credit ratings of the Group; ineffective management of capital or changes to capital adequacy or liquidity requirements; changes to the valuation of financial instruments recorded at fair value; competition and consolidation in the banking sector; HM Treasury exercising influence over the operations of the Group; the ability of the Group to attract or retain senior management or other key employees; regulatory change or a change in UK Government policy; changes to the monetary and interest rate policies of the Bank of England, the Board of Governors of the Federal Reserve System and other G7 central banks; impairment of goodwill; pension fund shortfall; litigation and regulatory investigations; general operational risks; insurance claims; reputational risk; general geopolitical and economic conditions in the UK and in other countries in which the Group has significant business activities or investments, including the United States; the ability to achieve revenue benefits and cost savings from the integration of certain of RBS Holdings N.V.’s businesses and assets; changes in UK and foreign laws, regulations, accounting standards and taxes, including changes in regulatory capital regulations and liquidity requirements; the participation of the Group in the APS and the effect of such Scheme on the Group’s financial and capital position; the ability to access the contingent capital arrangements with HM Treasury; the conversion of the B Shares in accordance with their terms; limitations on, or additional requirements imposed on, the Group’s activities as a result of HM Treasury’s investment in the Group; and the success of the Group in managing the risks involved in the foregoing.

The forward-looking statements contained in this document speak only as of the date of this report, and the Group does not undertake to update any forward-looking statement to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

For a further discussion of certain risks faced by the Group, see Risk factors on pages 7 to 22.

Business review

Description of business

Introduction

The Royal Bank of Scotland Group plc is the holding company of a large global banking and financial services group. Headquartered in Edinburgh, the Group operates in the United Kingdom, the United States and internationally through its two principal subsidiaries, the Royal Bank and NatWest. Both the Royal Bank and NatWest are major UK clearing banks whose origins go back over 275 years. In the United States, the Group’s subsidiary Citizens is a large commercial banking organisation. The Group has a large and diversified customer base and provides a wide range of products and services to personal, commercial and large corporate and institutional customers in over 50 countries.

Following placing and open offers in December 2008 and in April 2009, HM Treasury owned 70.3% of the enlarged ordinary share capital of the company.

In December 2009, the company issued £25.5 billion of new capital to HM Treasury. This new capital took the form of B shares, which do not generally carry voting rights at general meetings of ordinary shareholders but are convertible into ordinary shares and qualify as core tier one capital.

Following the issuance of B shares, HM Treasury’s holding of ordinary shares of the company remained at 70.3% although its economic interest rose to 84.4%.

HM Treasury has agreed not to convert its B shares into ordinary shares to the extent that its holding of ordinary shares following the conversion would represent more than 75% of the company’s issued ordinary share capital.

In March 2010, the company converted 935,228 non-cumulative dollar preference shares in the company into ordinary shares resulting in approximately 1.6 billion ordinary shares being issued. This increase in the company's issued ordinary share capital resulted in HMT's holding in the company's ordinary shares reducing to approximately 68.4%.

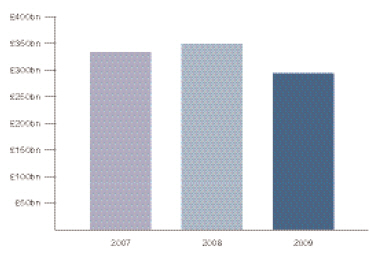

The Group had total assets of £1,696.5 billion and owners’ equity of £77.7 billion at 31 December 2009. The Group’s capital ratios, which included the equity minority interest of the State of the Netherlands and Santander in ABN AMRO, were a total capital ratio of 16.1 per cent., a core Tier 1 capital ratio of 11.0 per cent. and a Tier 1 capital ratio of 14.1 per cent., as at 31 December 2009.

Organisational structure and business overview

Following a comprehensive strategic review, changes have been made to the Group’s operating segments in 2009. A Non-Core division has been created comprising those lines of business, portfolios and individual assets that the Group intends to run off or sell. Furthermore, Business Services (formerly Group Manufacturing) is no longer reported as a separate division and its costs are now allocated to the customer-facing divisions along with certain central costs. UK Retail & Commercial Banking has been split into three segments (UK Retail, UK Corporate and Wealth). Ulster Bank has become a specific segment. The remaining elements of Europe & Middle East Retail & Commercial Banking, Asia Retail & Commercial Banking and Share of shared assets form part of Non-Core. The segment measure is now Operating profit/(loss) before tax which differs from Contribution used previously; it excludes certain infrequent items and RFS Holdings minority interest, which is not an operating segment of the Group. Comparative data have been restated accordingly.

UK Retail offers a comprehensive range of banking products and related financial services to the personal market. It serves customers through the RBS and NatWest networks of branches and ATMs in the United Kingdom, and also through telephone and internet channels.

UK Corporate is a leading provider of banking, finance, and risk management services to the corporate and SME sector in the United Kingdom. It offers a full range of banking products and related financial services through a nationwide network of relationship managers, and also through telephone and internet channels. The product range includes asset finance through the Lombard brand.

Wealth provides private banking and investment services in the UK through Coutts & Co and Adam & Company, offshore banking through RBS International, NatWest Offshore and Isle of Man Bank, and international private banking through RBS Coutts.

Global Banking & Markets (GBM) is a leading banking partner to major corporations and financial institutions around the world, providing an extensive range of debt and equity financing, risk management and investment services to its customers. The division is organised along six principal business lines: money markets; rates flow trading; currencies and commodities; equities; credit markets and portfolio management & origination.

Global Transaction Services ranks among the top five global transaction services providers, offering global payments, cash and liquidity management, and trade finance and commercial card products and services. It includes the Group’s corporate money transmission activities in the United Kingdom and the United States as well as Global Merchant Services, the Group’s United Kingdom and international merchant acquiring business.

Ulster Bank is the leading retail and commercial bank in Northern Ireland and the third largest banking group on the island of Ireland. It provides a comprehensive range of financial services through both its Retail Markets division which has a network of branches and operates in the personal and bancassurance sectors, and its Corporate Markets division which provides services to SME business customers, corporates and institutional markets.

US Retail & Commercial provides financial services primarily through the Citizens and Charter One brands. US Retail & Commercial is engaged in retail and corporate banking activities through its branch network in 12 states in the United States and through non-branch offices in other states. It ranks among the top five banks in New England.

RBS Insurance sells and underwrites retail and SME insurance over the telephone and internet, as well as through brokers and partnerships. Its brands include Direct Line, Churchill and Privilege, which sell general insurance products direct to the customer, as well as Green Flag and NIG.

Business review continued |

Through its international division, RBS Insurance sells general insurance, mainly motor, in Germany and Italy. The Intermediary and Broker division sells general insurance products through independent brokers.

Business Services (formerly Group Manufacturing) supports the customer-facing businesses and provides operational technology, customer support in telephony, account management, lending and money transmission, global purchasing, property and other services. Business Services drives efficiencies and supports income growth across multiple brands and channels by using a single, scalable platform and common processes wherever possible. It also leverages the Group’s purchasing power and is the Group’s centre of excellence for managing large-scale and complex change.

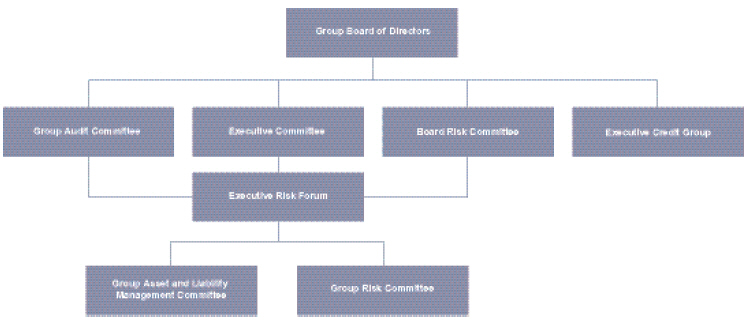

Central Functions comprises group and corporate functions, such as treasury, funding and finance, risk management, legal, communications and human resources. The Centre manages the Group’s capital resources and Group-wide regulatory projects and provides services to the operating divisions.

Non-Core Division manages separately assets that the Group intends to run off or dispose. The division contains a range of businesses and asset portfolios primarily from the GBM division including RBS Sempra Commodities, linked to proprietary trading, higher risk profile asset portfolios including excess risk concentrations, and other illiquid portfolios. It also includes a number of other portfolios and businesses including regional markets businesses that the Group has concluded are no longer strategic.

Business divestments

To comply with European Commission State Aid (EC State Aid) requirements the Group has agreed a series of restructuring measures to be implemented over a four year period. This will supplement the measures in the strategic plan previously announced by the Group. These include divesting fully RBS Insurance, Global Merchant Services and RBS Sempra Commodities, as well as divesting the RBS branch-based business in England & Wales and the NatWest branches in Scotland, along with the Direct SME customers across the UK.

Relationship with major shareholder

The UK Government currently owns 68.4 per cent. of the issued ordinary share capital of RBS. The UK Government’s shareholding in RBS is currently held by the Solicitor for the Affairs of HM Treasury as nominee for HM Treasury and managed by UK Financial Investments Limited (“UKFI”), a company wholly owned by HM Treasury. The relationship between HM Treasury and UKFI, and between UKFI and Government investee banks is set out in the UKFI Framework Document and Investment Mandate, agreed between HM Treasury and UKFI.

The Framework Document sets out UKFI’s overarching objective, to “develop and execute an investment strategy for disposing of the investments [in the banks] in an orderly and active way through sale, redemption, buy-back or other means within the context of an overarching objective of protecting and creating value for the taxpayer as shareholder, paying due regard to the maintenance of financial stability and to acting in a way that promotes competition.”

It states that UKFI will manage the UK financial institutions in which HM Treasury holds an interest “at an arms length and on a commercial basis and will not intervene in day-to-day management decisions of the Investee Companies (including with respect to individual lending or remuneration decisions)”.This document also makes it clear that such UK financial institutions “will continue to have their own independent boards and management teams, determining their own strategies and commercial policies (including business plans and budgets).”

HM Treasury expects UKFI to act in the same way as any other engaged institutional shareholder would. The UKFI Investment Mandate states that it will “follow best institutional shareholder practice. This includes compliance with the Institutional Shareholders’ Committee’s Statement of Principles together with any developments to best institutional shareholder practice arising from recommendations or guidance contained in the Walker Review or elsewhere.”

For example, RBS announced on 17 February 2009 that it had reached an agreement with UKFI in respect of certain changes to its remuneration policy. RBS also undertook to conduct a review of its strategy and UKFI was actively engaged in reviewing the output of this review, as any other engaged shareholder would be expected to be. RBS has made a commitment to comply with the FSA Remuneration Code. These rules came into force on 1 January 2010 and are in line with the agreement reached by the G-20, setting global standards for the implementation of the Financial Stability Board’s remuneration principles. RBS agreed that it will be at the leading edge of implementing the G-20 principles. UKFI was granted consent rights over the shape and size of the RBS aggregate bonus pool for the 2009 performance year. Separate to the shareholding relationship, RBS has a number of relationships with the UK Government arising out of the Government’s provision of support.

As a result of the Government’s recapitalisation of RBS, an undertaking was given to UKFI in 2008 to appoint a new Chairman and three new Non-executive Directors to the Group Board. This undertaking has been completed by the following appointments: Philip Hampton as Chairman, Sandy Crombie as Senior Independent Director and Philip Scott and Penny Hughes as Non-executive Directors. In addition, Brendan Nelson was appointed as a Non-executive Director with effect from 1 April 2010. Subsequently, UKFI were consulted as majority shareholder on proposed Non-executive Director appointments but in all cases the usual process for appointments was followed i.e. candidates were considered by the Nominations Committee and then recommended to the Group Board for approval. For the avoidance of doubt, no member of the Board represents or acts on the instructions of UKFI or HMT. There is no further arrangement with UKFI in this regard, beyond usual shareholder rights, and no such arrangements with any other shareholder.

In connection with its accession to the APS (further details of which are set out above), RBS has undertaken to provide lending to creditworthy UK homeowners and businesses in a commercial manner. RBS’s compliance with this commitment is subject to a monthly reporting process to the UK Government. The lending commitment does not require RBS to engage in uncommercial practices.

Certain other considerations relating to RBS’s relationship with HM Treasury and UKFI are set out in the risk factors headed “HM Treasury (or UKFI on its behalf) may be able to exercise a significant degree of influence over the Group”.

Other than in relation to these areas, however, the UK Government has confirmed publicly that its intention is to allow the financial institutions in which it holds an interest to operate their business independently, as set out in UKFI’s governance documents described above.

As a result of the UK Government’s holding, the UK Government and UK Government controlled bodies became related parties of the Group. In the normal course of business the Group enters into transactions with many of these bodies on an arms' length basis.

The Group is not a party to any transaction with the UK Government or any UK Government controlled body involving goods or services which is material to the Group, or any such transaction that is unusual in its nature or conditions. To the Group's knowledge, the Group is not a party to any transaction with the UK Government or any UK Government controlled body involving goods or services which is material to the UK Government or any UK Government controlled body. However, given the nature and extent of the UK Government controlled bodies, the Group may not know whether a transaction is material for such a party.

Any outstanding loans made by the Group to or for the benefit of the UK Government or any UK Government controlled body, were made on an arm's length basis and (A) such loans were made in the ordinary course of business, (B) were made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons, and (C) did not involve more than the normal risk of collectibility or present other unfavorable features. The Group notes, however, that with respect to outstanding loans made by the Group to or for the benefit of the UK Government or any UK Government controlled body, there may not exist any comparable transactions with other persons.

Recent Developments

On 25 March 2010, the RBS Group announced its intention to launch (i) an offer to exchange certain subordinated debt securities issued by Group members for new senior debt and (ii) tender offers in respect of certain preference shares, preferred securities and perpetual securities issued by Group members. The RBS Group announced the offers on 6 April 2010 and will seek shareholder approvals as required in coordination with the annual general meeting of The Royal Bank of Scotland Group plc scheduled to take place on 28 April 2010.

In January 2010, the FSA informed the Group that it intended to commence an investigation into certain aspects of the handling of customer complaints. On 25 March 2010 FSA formally notified the Group of the appointment of investigators in respect of aspects of complaint handling relating to RBS and NatWest retail bank products and services. The company and its subsidiaries intend to co-operate fully with this investigation.

In March 2010, the company converted 935,228 non-cumulative dollar preference shares in the company into ordinary shares resulting in approximately 1.6 billion ordinary shares being issued. This increase in the company's issued ordinary share capital resulted in HMT's holding in the company's ordinary shares reducing to approximately 68.4%.

In the UK, the OFT has been investigating RBS Group for alleged conduct in breach of Article 101 of the Treaty on the Functioning of the European Union and/or the Chapter 1 prohibition of the Competition Act 1998 relating to the provision of loan products to professional services firms. RBS Group co-operated fully with the OFT's investigation. On 30 March 2010 the OFT announced that it has arrived at an early resolution agreement with RBS Group by which RBS Group will pay a (discounted) fine of £28.59 million and admit a breach in competition law relating to the provision of loan products to professional services firms.

Brendan Nelson has been appointed as a non-executive director with effect from 1 April 2010. Brendan will succeed Archie Hunter as Chairman of the Group Audit Committee with effect from the conclusion of the Group's Annual General Meeting on 28 April 2010.

Legal separation of ABN AMRO Bank N.V. occurred on 1 April 2010, with the shares in that entity being transferred by RBS Holdings N.V. to a holding company called ABN AMRO Group N.V., which is owned by the Dutch State. Certain assets within RBS Holdings N.V. continue to be shared by the Consortium Members. RBS Holdings N.V. is a fully operational bank within the Group and is independently rated and licensed and regulated by the Dutch Central Bank.

Competition

The Group faces strong competition in all the markets it serves. However, the global banking crisis has reduced either the capacity or appetite of many institutions to lend and has resulted in the withdrawal or disappearance of a number of market participants and significant consolidation of competitors, particularly in the US and UK. Competition for retail deposits has intensified significantly as institutions have re-orientated their funding strategies following the difficulties experienced in the wholesale markets since late 2007.

Competition for corporate and institutional customers in the UK is from UK banks and from large foreign financial institutions who are also active and offer combined investment and commercial banking capabilities. In asset finance, the Group competes with banks and specialised asset finance providers, both captive and non-captive. In European and Asian corporate and institutional banking markets the Group competes with the large domestic banks active in these markets and with the major international banks.

In the small business banking market, the Group competes with other UK clearing banks, specialist finance providers and building societies.

In the personal banking segment the Group competes with UK banks and building societies, major retailers and life assurance companies. In the mortgage market the Group competes with UK banks and building societies. A number of competitors have either left or scaled back their lending in the mortgage and unsecured markets. The Group’s life assurance businesses compete with Independent Financial Advisers and life assurance companies.

In the UK credit card market large retailers and specialist card issuers, including major US operators, are active in addition to the UK banks. In addition to physical distribution channels, providers compete through direct marketing activity and the internet.

In Wealth Management, The Royal Bank of Scotland International competes with other UK and international banks to offer offshore banking services. Coutts and Adam & Company compete as private banks with UK clearing and private banks, and with international private banks. Competition in wealth management remains strong as banks maintain their focus on competing for affluent and high net worth customers.

Business review continued |

In Ireland, Ulster Bank competes in retail and commercial banking with the major Irish banks and building societies, and with other UK and international banks and building societies active in the market.

In the United States, Citizens competes in the New England, Mid- Atlantic and Mid West retail and mid-corporate banking markets with local and regional banks and other financial institutions. The Group also competes in the US in large corporate lending and specialised finance markets, and in fixed-income trading and sales. Competition is principally with the large US commercial and investment banks and international banks active in the US.

Risk factors

Set out below are certain risk factors which could affect the Group’s future results and cause them to be materially different from expected results. The Group’s results are also affected by competition and other factors. The factors discussed in this report should not be regarded as a complete and comprehensive statement of all potential risks and uncertainties.

The company and its United Kingdom bank subsidiaries may face the risk of full nationalisation or other resolution procedures under the Banking Act 2009.

Under the provisions of the Banking Act , substantial powers have been granted to HM Treasury and the Bank of England as part of the special resolution regime to stabilise banks that are in financial difficulties (the “SRR”), which includes certain consultation and consent rights granted to the FSA (the FSA, together with HM Treasury and the Bank of England, the “Authorities”). The SRR confers powers on the Bank of England: (i) to transfer to the private sector all or part of the business of a United Kingdom incorporated institution with permission to accept deposits pursuant to Part IV of the FSMA (a “relevant entity”) or the securities of such relevant entity; (ii) to transfer all or part of the business of the relevant entity to a “bridge bank” established by the Bank of England and also confers a power on HM Treasury to transfer into temporary public ownership (nationalise) the relevant entity or its United Kingdom incorporated holding company. The Banking Act also provides for two new insolvency and administration procedures for relevant entities.

The purpose of the stabilisation options is to address the situation where all or part of the business of a relevant entity has encountered, or is likely to encounter, financial difficulties. Accordingly, the stabilisation options may only be exercised if the FSA is satisfied that (i) a relevant entity such as the company’s United Kingdom banking subsidiaries, including The Royal Bank of Scotland plc (“RBS”) and National Westminster Bank Plc (“NatWest”), is failing, or is likely to fail, to satisfy the threshold conditions set out in Schedule 6 to the FSMA; and (ii) having regard to timing and other relevant circumstances, it is not reasonably likely that (ignoring the stabilisation options) action will be taken that will enable the relevant entity to satisfy those threshold conditions. The threshold conditions are conditions which an FSA-authorised institution must satisfy in order to retain its FSA authorisation. They are relatively wide-ranging and deal with most aspects of a relevant entity’s business, including, but not limited to, minimum capital resource requirements. It is therefore possible that the FSA may trigger one of the stabilisation options before an application for an insolvency or administration order could be made.

The stabilisation options may be exercised by means of powers to transfer property, rights or liabilities of a relevant entity and shares and other securities issued by a relevant entity. HM Treasury may also take the parent company of a relevant entity (such as the company) into temporary public ownership provided that certain conditions set out in Section 82 of the Banking Act are met. Temporary public ownership is effected by way of a share transfer order and can be actioned irrespective of the financial condition of the parent company.

If HM Treasury makes the decision to take the company into temporary public ownership, it may take various actions in relation to any securities issued by the company (the “Securities”) without the consent of holders of the Securities, including (among other things):

| (i) | transferring the Securities free from any contractual or legislative restrictions on transfer; |

| (ii) | transferring the Securities free from any trust, liability or encumbrance; |

| (iii) | extinguishing any rights to acquire Securities; |

| (iv) | delisting the Securities; |

| (v) | converting the Securities into another form or class (including for example, into equity securities); or |

| (vi) | disapplying any termination or acceleration rights or events of default under the terms of the Securities which would be triggered by the transfer. |

Where HM Treasury has made a share transfer order in respect of securities issued by the holding company of a relevant entity, HM Treasury may make an order providing for the property, rights or liabilities of the holding company or of any relevant entity in the holding company group to be transferred and where such property is held on trust, removing or altering the terms of such trust.

Accordingly, there can be no assurance that the taking of any such actions would not adversely affect the rights of holders of the Securities and/or adversely affect the price or value of their investment or that the ability of the company to satisfy its obligations under contracts related to the Securities would be unaffected. In such circumstances, such holders may have a claim for compensation under one of the compensation schemes currently existing under, or contemplated by, the Banking Act if any action is taken in respect of the Securities (for the purposes of determining an amount of compensation, an independent valuer must disregard actual or potential financial assistance provided by the Bank of England or HM Treasury). There can be no assurance that holders of the Securities would thereby recover compensation promptly and/or equal to any loss actually incurred.

If the company was taken into temporary public ownership and a partial transfer of its or any relevant entity’s business was effected, or if a relevant entity were made subject to the SRR and a partial transfer of its business to another entity was effected, the transfer may directly affect the company and/or its Group companies by creating, modifying or cancelling their contractual arrangements with a view to ensuring the provision of such services and facilities as are required to enable the bridge bank or private sector purchaser to operate the transferred business (or any

Business review continued |

part of it) effectively. For example, the transfer may (among other things) (i) require the company or Group companies to support and co-operate with the bridge bank or private sector purchaser; (ii) cancel or modify contracts or arrangements between the company or the transferred business and a Group company; or (iii) impose additional obligations on the company under new or existing contracts. There can be no assurance that the taking of any such actions would not adversely affect the ability of the company to satisfy its obligations under the issued Securities or related contracts.

If the company was taken into temporary public ownership and a partial transfer of its or any relevant entity’s business was effected, or if a relevant entity were made subject to the SRR and a partial transfer of its business to another entity was effected, the nature and mix of the assets and liabilities not transferred may adversely affect the company’s financial condition and increase the risk that the company may eventually become subject to administration or insolvency proceedings pursuant to the Banking Act.

While the main provisions of the Banking (Special Provisions) Act 2008 were in force, which conferred certain transfer powers on HM Treasury, the United Kingdom Government took action under that Act in respect of a number of United Kingdom financial institutions, including, in extreme circumstances, full and part nationalisation. There have been concerns in the market in the past year regarding the risks of such nationalisation in relation to the company and other United Kingdom banks. If economic conditions in the United Kingdom or globally were to deteriorate, or the events described in the following risk factors occur to such an extent that they have a materially adverse impact on the financial condition, perceived or actual credit quality, results of operations or business of any of the relevant entities in the Group, the United Kingdom Government may decide to take similar action in relation to the company under the Banking Act. Given the extent of the Authorities’ powers under the Banking Act, it is difficult to predict what effect such actions might have on the Group and any securities issued by the company or Group companies. However, potential impacts may include full nationalisation of the company, the total loss of value in Securities issued by the company and the inability of the company to perform its obligations under the Securities.

If the relevant stabilisation option was effected in respect of the company or the stabilisation options were effected in respect of a relevant entity or its business within the Group, HM Treasury would be required to make certain compensation orders, which will depend on the stabilisation power adopted. For example, in the event that the Bank of England were to transfer some of the business of a relevant entity to a bridge bank, HM Treasury would have to make a resolution fund order including a third party compensation order pursuant to the Banking Act (Third Party Compensation Arrangements for Partial Property Transfers) Regulations 2009. However, there can be no assurance that compensation would be assessed to be payable or that holders of the Securities would recover any compensation promptly and/or equal to any loss actually incurred.

The Group’s businesses, earnings and financial condition have been and will continue to be affected by the global economy and instability in the global financial markets.

The performance of the Group has been and will continue to be influenced by the economic conditions of the countries in which it operates, particularly the United Kingdom, the United States and other countries throughout Europe, the Middle East and Asia. The outlook for the global economy over the near to medium term remains challenging, particularly in the United Kingdom, the United States and other European economies. In addition, the global financial system has yet to fully overcome the difficulties which first manifested themselves in August 2007 and financial markets conditions have not yet fully normalised. These conditions led to severe dislocation of financial markets around the world and unprecedented levels of illiquidity in 2008 and 2009, resulting in the development of significant problems at a number of the world’s largest corporate institutions operating across a wide range of industry sectors, many of whom are the Group’s customers and counterparties in the ordinary course of its business. In response to this economic instability and illiquidity in the market, a number of governments, including the United Kingdom Government, the governments of the other EU member states and the United States Government, have intervened in order to inject liquidity and capital into the financial system, and, in some cases, to prevent the failure of these institutions.

Despite such measures, the volatility and disruption of the capital and credit markets have continued, with many forecasts predicting only modest levels of GDP growth over the course of 2010. Similar conditions are likely to exist in a number of the Group’s key markets, including those in the United States and Europe, particularly Ireland. These conditions have exerted, and may continue to exert, downward pressure on asset prices and on availability and cost of credit for financial institutions, including the company, and will continue to impact the credit quality of the Group’s customers and counterparties. Such conditions, alone or in combination with regulatory changes or actions of other market participants, may cause the Group to incur losses or to experience further reductions in business activity, increased funding costs and funding pressures, lower share prices, decreased asset values, additional write-downs and impairment charges and lower profitability.

The performance of the Group may be affected by economic conditions impacting euro-zone member states. For example the financial problems experienced by the government of Greece, may lead to Greece issuing significant volumes of debt which may in turn reduce demand for debt issued by financial institutions and corporate borrowers. This could adversely affect the Group’s access to the debt capital markets and may increase the Group’s funding costs, having a negative impact on the Group’s earnings and financial condition. In addition, euro-zone countries in which the Group operates may be required to provide financial assistance to Greece, which may in turn have a negative impact on the financial condition of those EU member states. Should the economic conditions facing Greece be replicated in other euro-zone member states, the risks above would be exacerbated.

In addition, the Group will continue to be exposed to the risk of loss if major corporate borrowers or counterparty financial institutions fail or are otherwise unable to meet their obligations. The Group currently experiences certain business sector and country concentration risk, primarily focused in the United States, the United Kingdom and the rest of Europe and relating to personal and banking and financial institution exposures. The Group’s performance may also be affected by future recovery rates on assets and the historical assumptions underlying asset recovery rates, which (as has already occurred in certain instances) may no longer be accurate given the unprecedented market disruption and general economic instability. The precise nature of all the risks and uncertainties the Group faces as a result of current economic conditions cannot be predicted and many of these risks are outside the control of the Group.

The Group was required to obtain State Aid approval, for the aid given to the Group by HM Treasury and for the Group’s State Aid restructuring plan, from the European Commission. The Group is subject to a variety of risks as a result of implementing the State Aid restructuring plan. The State Aid restructuring plan includes a prohibition on the making of discretionary dividend or coupon payments on existing hybrid capital instruments (including preference shares and B Shares) for a two-year period commencing no later than 30 April 2010, which may impair the Group’s ability to raise new Tier 1 capital through the issuance of ordinary shares and other Securities.

The Group was required to obtain State Aid approval for the aid given to the Group by HM Treasury as part of the placing and open offer undertaken by the company in December 2008 (the “First Placing and Open Offer”), the issuance of £25.5 billion of B shares in the capital of the company which are, subject to certain terms and conditions, convertible into ordinary shares in the share capital of the company (the “B Shares”) to HM Treasury, a contingent commitment by HM Treasury to subscribe for up to an additional £8 billion of B Shares if certain conditions are met and the Group’s participation in the Asset Protection Scheme (the “APS”) (the “State Aid”).

As a result of the First Placing and Open Offer (approved as part of the European Commission’s approval of a package of measures to the banking industry in the United Kingdom in October 2008), the Group was required to cooperate with HM Treasury to submit a forward plan to the

Business review continued |

European Commission. This plan was submitted and detailed discussions took place between HM Treasury, the Group and the European Commission. The plan submitted not only had regard to the First Placing and Open Offer, but also the issuance of B Shares to HM Treasury, the commitment by HM Treasury to subscribe for additional B Shares if certain conditions were met and the Group’s participation in the APS. As part of its review, the European Commission was required to assess the State Aid and to consider whether the Group’s long-term viability would be assured, that the Group makes a sufficient contribution to the costs of its restructuring and that measures are taken to limit any distortions of competition arising from the State Aid provided to the Group by the United Kingdom Government. The Group, together with HM Treasury, agreed in principle with the European Competition Commissioner the terms of the State Aid and the terms of a restructuring plan (the “State Aid restructuring plan”). On 14 December 2009, the European Commission formally approved the Group’s participation in the APS, the issuance of £25.5 billion of B Shares to HM Treasury, a contingent commitment by HM Treasury to subscribe for up to an additional £8 billion of B Shares and the State Aid restructuring plan. The prohibition on the making of discretionary dividend (including preference shares and B Shares) or coupon payments on existing hybrid capital instruments for a two-year period commencing no later than 30 April 2010 will prevent the company from paying dividends on its ordinary and preference shares and coupons on other Tier 1 securities for the same duration, and it may impair the Group’s ability to raise new Tier 1 capital through the issuance of ordinary shares and other Securities.

It is possible a third party could challenge the approval decision in the European Courts (within specified time limits). The Group does not believe that any such challenge would be likely to succeed but, if it were to succeed, the European Commission would need to reconsider its decision, which might result in an adverse outcome for the Group, including a prohibition or amendment to some or all of the terms of the State Aid. The European Commission could also impose conditions that are more disadvantageous, potentially materially so, to the Group than those in the State Aid restructuring plan.

The Group is subject to a variety of risks as a result of implementing the State Aid restructuring plan. There is no assurance that the price that the Group receives for any assets sold pursuant to the State Aid restructuring plan will be at a level the Group considers adequate or which it could obtain in circumstances in which the Group was not required to sell such assets in order to implement the State Aid restructuring plan or if such sale were not subject to the restrictions (including in relation to potential purchasers of the United Kingdom branch divestment) contained in the terms thereof. Further, should the Group fail to complete any of the required disposals within the agreed timeframes for such disposals, under the terms of the State Aid clearance, a divestiture trustee can be empowered to conduct the disposals, with the mandate to complete the disposal at no minimum price.

Furthermore, if the Group is unable to comply with the terms of the State Aid approval it could constitute a misuse of aid. In circumstances where the European Commission doubts that the Group is complying with the terms of the State Aid approval, it may open a formal investigation. At the conclusion of this investigation, if the European Commission decides that there has been misuse of aid, it can issue a decision requiring HM Treasury to recover the misused aid which could have a material adverse impact on the Group.

In implementing the State Aid restructuring plan, the Group will lose existing customers, deposits and other assets (both directly through the sale and potentially through the impact on the rest of the Group’s business arising from implementing the State Aid restructuring plan) and the potential for realising additional associated revenues and margins that it otherwise might have achieved in the absence of such disposals. Further, the loss of such revenues and related income may extend the time period over which the Group may pay any amounts owed to HM Treasury under the APS or otherwise. The implementation of the State Aid restructuring plan may also result in disruption to the retained business and give rise to significant strain on management, employee, operational and financial resources, impacting customers and giving rise to separation costs which could be substantial.

The implementation of the State Aid restructuring plan may result in the emergence of one or more new viable competitors or a material strengthening of one or more of the Group’s competitors in the Group’s markets. The effect of this on the Group’s future competitive position, revenues and margins is uncertain and there could be an adverse effect on the Group’s operations and financial condition and its business generally. If any or all of the risks described above, or any other currently unforeseen risks, materialise, there could be a materially negative impact on the Group’s business, operations, financial condition, capital position and competitive position.

The Group’s ability to implement its strategic plan depends on the success of the Group’s refocus on its core strengths and the balance sheet reduction programme arising out of its previously announced non-core restructuring plan and the State Aid restructuring plan.

In light of the changed global economic outlook, the Group has embarked on a financial and core business restructuring which is focused on achieving appropriate risk-adjusted returns under these changed circumstances, reducing reliance on wholesale funding and lowering exposure to capital intensive businesses. A key part of this restructuring is the programme announced in February 2009 to run-down and sell the Group’s non-core assets and the continued review of the Group’s portfolio to identify further disposals of certain non-core assets. Assets identified for this purpose and allocated to the Group's Non-Core division totalled £252 billion, excluding derivatives, as at 31 December 2008. At 31 December 2009, this total had reduced to £187 billion, excluding the Group's interest in RBS Sempra Commodities LLP (“RBS Sempra Commodities”), which was transferred to the Non-Core division during 2009. This balance sheet reduction programme will continue alongside the disposals under the State Aid restructuring plan approved by the European Commission.

Because the ability to dispose of assets and the price achieved for such disposals will be dependent on prevailing economic and market conditions, which may remain challenging, there is no assurance that the Group will be able to sell or run-down (as applicable) those businesses it is seeking to exit either on favourable economic terms to the Group or at all. Furthermore, where transactions are entered into for the purpose of selling non-core assets and businesses, they may be subject to conditions precedent, including government and regulatory approvals and completion mechanics that in certain cases may entail consent from customers. There is no assurance that such conditions precedent will be satisfied, or consents and approvals obtained, in a timely manner or at all. There is consequently a risk that the Group may fail to complete such disposals by any agreed longstop date.

Furthermore, in the context of implementing the State Aid restructuring plan, the Group is subject to certain timing and other restrictions which may result in the sale of assets at prices below those which the Group would have otherwise agreed had the Group not been required to sell such assets as part of the State Aid restructuring plan or if such sale were not subject to the restrictions contained in the terms of the State Aid conditions.

Business review continued |

In addition, the Group may be liable for any deterioration in businesses being sold between the announcement of the disposal and its completion. In certain cases, the period between the announcement of a transaction and its completion may be lengthy and may span many months. Other risks that may arise out of the disposal of the Group’s assets include ongoing liabilities up to completion of the relevant transaction in respect of the assets and businesses disposed of, commercial and other risks associated with meeting covenants to the buyer during the period up to completion, the risk of employee and customer attrition in the period up to completion, substantive indemnity obligations in favour of the buyer, the risk of liability for breach of warranty, the need to continue to provide transitional service arrangements for potentially lengthy periods following completion of the relevant transaction to the businesses being transferred and redundancy and other transaction costs. Further, the Group may be required to enter into covenants agreeing not to compete in certain markets for specific periods of time. In addition, as a result of the disposals, the Group will lose existing customers, deposits and other assets (both directly through the sale and potentially through the impact on the rest of the Group’s business arising from implementing the restructuring plans) and the potential for realising additional associated revenues and margins that it otherwise might have achieved in the absence of such disposals.

Any of the above factors, either in the context of State Aid-related or non-core or other asset disposals, could affect the Group's ability to implement its strategic plan and have a material adverse effect on the Group's business, results of operations, financial condition, capital ratios and liquidity and could result in a loss of value in the Securities.

The extensive organisational restructuring may adversely affect the Group’s business, results of operations and financial condition.

As part of its refocus on core strengths and its disposal programme, the Group has undertaken and continues to undertake extensive organisational restructuring involving the allocation of assets identified as non-core assets to a separate Non-Core Division, and the run-down and sale of those assets over a period of time. In addition, to comply with State Aid clearance, the Group agreed to undertake a series of measures to be implemented over a four-year period from December 2009, which include disposing of RBS Insurance (subject to potentially maintaining a minority interest until the end of 2014). the company will also divest by the end of 2013 Global Merchant Services, subject to the company retaining up to 20 per cent. of each business within Global Merchant Services if required by the purchaser, and its interest in RBS Sempra Commodities, as well as divesting the RBS branch-based business in England and Wales and the NatWest branches in Scotland, along with the direct small and medium-sized enterprise (“SME”) customers and certain mid-corporate customers across the United Kingdom. On 16 February 2010, the company announced that RBS Sempra Commodities had agreed to sell its Metals, Oil and European Energy business lines, subject to certain conditions including regulatory approvals. The Group and its joint venture partner, Sempra Energy, are continuing to consider ownership alternatives for the remaining North American Power and Gas businesses of RBS Sempra Commodities.

In order to implement the restructurings referred to above, various businesses and divisions within the Group will be re-organised, transferred or sold, or potentially merged with other businesses and divisions within the Group. As part of this process, personnel may be reallocated, where permissible, across the Group, new technology may be implemented, and new policies and procedures may be established in order to accommodate the new shape of the Group. As a result, the Group may experience a high degree of business interruption, significant restructuring charges, delays in implementation, and significant strain on management, employee, operational and financial resources. Any of the above factors could affect the Group’s ability to achieve its strategic objectives and have a material adverse effect on its business, results of operations and financial condition or could result in a loss of value in the Securities.

Lack of liquidity is a risk to the Group’s business and its ability to access sources of liquidity has been, and will continue to be, constrained.

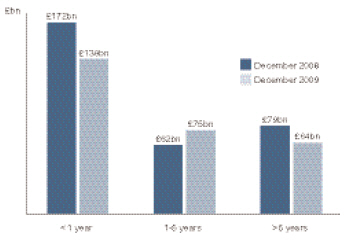

Liquidity risk is the risk that a bank will be unable to meet its obligations, including funding commitments, as they fall due. This risk is inherent in banking operations and can be heightened by a number of enterprise specific factors, including an over-reliance on a particular source of funding (including, for example, short-term and overnight funding), changes in credit ratings or market-wide phenomena such as market dislocation and major disasters. During the course of 2008 and 2009, credit markets worldwide experienced a severe reduction in liquidity and term-funding. During this time, perception of counterparty risk between banks also increased significantly. This increase in perceived counterparty risk also led to reductions in inter-bank lending, and hence, in common with many other banking groups, the Group’s access to traditional sources of liquidity has been, and may continue to be, restricted.

The Group’s liquidity management focuses on maintaining a diverse and appropriate funding strategy for its assets, controlling the mismatch of maturities and carefully monitoring its undrawn commitments and contingent liabilities. However, the Group’s ability to access sources of liquidity (for example, through the issue or sale of financial and other instruments or through the use of term loans) during the recent period of liquidity stress has been constrained to the point where it, like other banks, has had to rely on shorter term and overnight funding with a consequent reduction in overall liquidity, and to increase its recourse to liquidity schemes provided by central banks. While during the course of 2009 money market conditions improved, with the Group seeing a material reduction of funding from central banks and the issuance of non-government guaranteed term debt, further tightening of credit markets could have a negative impact on the Group. The Group, in line with other financial institutions, may need to seek funds from alternative sources, potentially at higher costs of funding than has previously been the case.

In addition, there is also a risk that corporate and institutional counterparties with credit exposures may look to reduce all credit exposures to banks, given current risk aversion trends. It is possible that credit market dislocation becomes so severe that overnight funding from non-government sources ceases to be available.

Like many banking groups, the Group relies on customer deposits to meet a considerable portion of its funding. Furthermore, as part of its ongoing strategy to improve its liquidity position, the Group is actively seeking to increase the proportion of its funding represented by customer deposits. However, such deposits are subject to fluctuation due to certain factors outside the Group’s control, such as a loss of confidence, increasing competitive pressures or the encouraged or mandated repatriation of deposits by foreign wholesale or central bank depositors, which could result in a significant outflow of deposits within a short period of time. There is currently heavy competition among United Kingdom banks for retail customer deposits, which has increased the cost of procuring new deposits and impacted the Group’s ability to grow its deposit base. An inability to grow, or any material decrease in, the Group’s deposits could, particularly if accompanied by one of the other factors described above, have a negative impact on the Group’s ability to satisfy its liquidity needs unless corresponding actions were taken to improve the liquidity profile of other deposits or to reduce assets. In particular, the liquidity position of the Group may be negatively impacted if it is unable to achieve the run-off and sale of non-core and other assets as expected. Any significant delay in those plans may require the Group to consider disposal of other assets not previously identified for disposal to achieve its funded balance sheet target level.

The governments of some of the countries in which the Group operates have taken steps to guarantee the liabilities of the banks and branches operating in their respective jurisdiction. Whilst in some instances the operations of the Group are covered by government guarantees alongside

Business review continued |

other local banks, in other countries this may not necessarily always be the case. This may place the Group’s subsidiaries operating in those countries, such as Ulster Bank Ireland Ltd, which did not participate in such government guarantee schemes, at a competitive disadvantage to the other local banks and therefore may require the Group to provide additional funding and liquidity support to these operations.

There can be no assurance that these measures, alongside other available measures, will succeed in improving the funding and liquidity in the markets in which the Group operates, or that these measures, combined with any increased cost of any funding currently available in the market, will not lead to a further increase in the Group’s overall cost of funding, which could have an adverse impact on the Group’s financial condition and results of operations or result in a loss of value in the Securities.

Governmental support schemes may be subject to cancellation, change or withdrawal or may fail to be renewed, which may have a negative impact on the availability of funding in the markets in which the Group operates.

Governmental support schemes may be subject to cancellation, change or withdrawal (on a general or individual basis, subject to relevant contracts) or may fail to be renewed, based on changing economic and political conditions in the jurisdiction of the relevant scheme. To the extent government support schemes are cancelled, changed or withdrawn in a manner which diminishes their effectiveness, or to the extent such schemes fail to generate additional liquidity or other support in the relevant markets in which such schemes operate, the Group, in common with other banking groups, may continue to face limited access to, have insufficient access to, or incur higher costs associated with, funding alternatives, which could have a material adverse impact on the Group’s business, financial condition, results of operations and prospects or result in a loss of value in the Securities.

The financial performance of the Group has been and will be affected by borrower credit quality.

Risks arising from changes in credit quality and the recoverability of loans and amounts due from counterparties are inherent in a wide range of the Group’s businesses. Whilst some economies stabilised over the course of 2009, the Group may continue to see adverse changes in the credit quality of its borrowers and counterparties, for example, as a result of their inability to refinance their indebtedness, with increasing delinquencies, defaults and insolvencies across a range of sectors (such as the personal and banking and financial institution sectors) and in a number of geographies (such as the United Kingdom, the United States, the Middle East and the rest of Europe, particularly Ireland). This trend has led and may lead to further and accelerated impairment charges, higher costs, additional write-downs and losses for the Group or result in a loss of value in the Securities.

The actual or perceived failure or worsening credit of the Group’s counterparties has adversely affected and could continue to adversely affect the Group.

The Group’s ability to engage in routine funding transactions has been and will continue to be adversely affected by the actual or perceived failure or worsening credit of its counterparties, including other financial institutions and corporate borrowers. The Group has exposure to many different industries and counterparties and routinely executes transactions with counterparties in the financial industry, including brokers and dealers, commercial banks, investment banks, mutual and hedge funds and other institutional clients. As a result, defaults by, or even the perceived creditworthiness of or concerns about, one or more corporate borrowers, financial services institutions or the financial services industry generally, have led to market-wide liquidity problems, losses and defaults and could lead to further losses or defaults, by the Group or by other institutions. Many of these transactions expose the Group to credit risk in the event of default of the Group’s counterparty or client and the Group does have significant exposures to certain individual counterparties (including counterparties in certain weakened sectors and markets). In addition, the Group’s credit risk is exacerbated when the collateral it holds cannot be realised or is liquidated at prices not sufficient to recover the full amount of the loan or derivative exposure that is due to the Group, which is most likely to occur during periods of illiquidity and depressed asset valuations, such as those recently experienced. Any such losses could have a material adverse effect on the Group’s results of operations and financial condition or result in a loss of value in the Securities.

The Group’s earnings and financial condition have been, and its future earnings and financial condition may continue to be, affected by depressed asset valuations resulting from poor market conditions.

Financial markets continue to be subject to significant stress conditions, where steep falls in perceived or actual asset values have been accompanied by a severe reduction in market liquidity, as exemplified by recent events affecting asset-backed collateralised debt obligations, residential mortgage-backed securities and the leveraged loan market. In dislocated markets, hedging and other risk management strategies have proven not to be as effective as they are in normal market conditions due in part to the decreasing credit quality of hedge counterparties, including monoline and other insurance companies and credit derivative product companies. Severe market events have resulted in the Group recording large write-downs on its credit market exposures in 2007, 2008 and 2009. Any deterioration in economic and financial market conditions could lead to further impairment charges and write-downs. Moreover, market volatility and illiquidity (and the assumptions, judgements and estimates in relation to such matters that may change over time and may ultimately not turn out to be accurate) make it difficult to value certain of the Group’s exposures. Valuations in future periods, reflecting, among other things, then-prevailing market conditions and changes in the credit ratings of certain of the Group’s assets, may result in significant changes in the fair values of the Group’s exposures, even in respect of exposures, such as credit market exposures, for which the Group has previously recorded write-downs. In addition, the value ultimately realised by the Group may be materially different from the current or estimated fair value. Any of these factors could require the Group to recognise further significant write-downs or realise increased impairment charges, any of which may adversely affect its capital position, its financial condition and its results of operations or result in a loss of value in the Securities.

Further information about the write-downs which the Group has incurred and the assets it has reclassified can be found in the Risk, capital and liquidity management section of the Business review.

The value or effectiveness of any credit protection that the Group has purchased from monoline and other insurers and other market counterparties (including credit derivative product companies) depends on the value of the underlying assets and the financial condition of the insurers and such counterparties.

The Group has credit exposure arising from over-the-counter derivative contracts, mainly credit default swaps (“CDSs”), which are carried at fair value. The fair value of these CDSs, as well as the Group’s exposure to the risk of default by the underlying counterparties, depends on the valuation and the perceived credit risk of the instrument against which protection has been bought. Since 2007, monoline and other insurers and other market counterparties (including credit derivative product companies) have been adversely affected by their exposure to residential mortgage linked and corporate credit products, whether synthetic or otherwise, and their actual and perceived creditworthiness has deteriorated

Business review continued |

rapidly, which may continue. If the financial condition of these counterparties or their actual or perceived creditworthiness deteriorates further, the Group may record further credit valuation adjustments on the credit protection bought from these counterparties under the CDSs in addition to those already recorded and such adjustments may have a material adverse impact on the Group’s financial condition and results of operations.

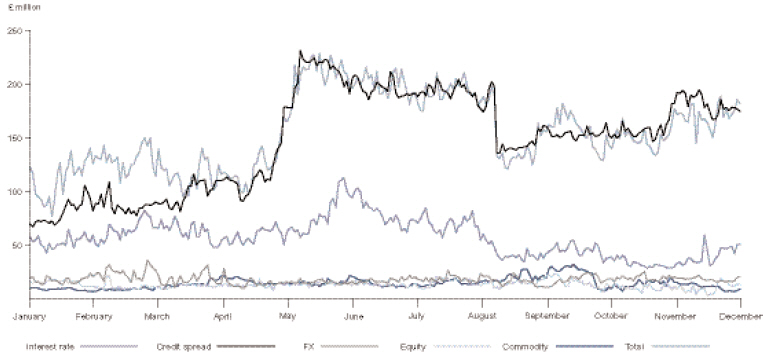

Changes in interest rates, foreign exchange rates, credit spreads, bond, equity and commodity prices and other market factors have significantly affected and will continue to affect the Group’s business.

Some of the most significant market risks the Group faces are interest rate, foreign exchange, credit spread, bond, equity and commodity price risks. Changes in interest rate levels, yield curves and spreads may affect the interest rate margin realised between lending and borrowing costs, the effect of which may be heightened during periods of liquidity stress, such as those experienced in the past year. Changes in currency rates, particularly in the sterling-US dollar and sterling-euro exchange rates, affect the value of assets, liabilities, income and expenses denominated in foreign currencies and the reported earnings of the company’s non-United Kingdom subsidiaries (principally Citizens Financial Group, Inc. (“Citizens”) and RBS Securities Inc.) and may affect income from foreign exchange dealing. The performance of financial markets may affect bond, equity and commodity prices and, therefore, cause changes in the value of the Group’s investment and trading portfolios. This has been the case during the period since August 2007, with market disruptions and volatility resulting in significant reductions in the value of such portfolios. While the Group has implemented risk management methods to mitigate and control these and other market risks to which it is exposed, it is difficult, particularly in the current environment, to predict with accuracy changes in economic or market conditions and to anticipate the effects that such changes could have on the Group’s financial performance and business operations.

The Group’s borrowing costs and its access to the debt capital markets depend significantly on its and the United Kingdom Government’s credit ratings.

The company and other Group members have been subject to a number of downgrades in the recent past. Any future reductions in the long-term or short-term credit ratings of the company or one of its principal subsidiaries (particularly RBS) would further increase its borrowing costs, require the Group to replace funding lost due to the downgrade, which may include the loss of customer deposits, and may also limit the Group’s access to capital and money markets and trigger additional collateral requirements in derivatives contracts and other secured funding arrangements. Furthermore, given the extent of the United Kingdom Government ownership and support provided to the Group through HM Treasury’s guarantee scheme (announced by the United Kingdom Government on 8 October 2008) (the “Credit Guarantee Scheme”), any downgrade in the United Kingdom Government’s credit ratings could adversely affect the Group’s own credit ratings and may have the effects noted above. All credit rating agencies have reaffirmed the United Kingdom Government’s AAA rating, although S&P changed its outlook to “negative” on 21 May 2009. Fitch reaffirmed the United Kingdom Government’s stable outlook on 31 July 2009 and Moody’s reiterated the United Kingdom Government’s stable outlook on 26 October 2009. Credit ratings of the company, RBS, ABN AMRO Holding N.V. (which was renamed “RBS Holdings N.V.” on 1 April 2010) (“ABN AMRO”), The Royal Bank of Scotland N.V. (which was renamed from “ABN AMRO Bank N.V.” on 6 February 2010), Ulster Bank and Citizens are also important to the Group when competing in certain markets, such as over-the-counter derivatives. As a result, any further reductions in the company’s long-term or short-term credit ratings or those of its principal subsidiaries could adversely affect the Group’s access to liquidity and competitive position, increase its funding costs and have a negative impact on the Group’s earnings and financial condition or result in a loss of value in the Securities.

The Group’s business performance could be adversely affected if its capital is not managed effectively or if there are changes to capital adequacy and liquidity requirements.

Effective management of the Group’s capital is critical to its ability to operate its businesses, to grow organically and to pursue its strategy of returning to standalone strength. The Group is required by regulators in the United Kingdom, the United States and in other jurisdictions in which it undertakes regulated activities, to maintain adequate capital resources. The maintenance of adequate capital is also necessary for the Group’s financial flexibility in the face of continuing turbulence and uncertainty in the global economy. Accordingly, the purpose of the issuance of the £25.5 billion of B Shares, the grant of the Contingent Subscription (as defined below) and the previous placing and open offers was to allow the Group to strengthen its capital position. The FSA’s recent liquidity policy statement articulates that firms must hold sufficient eligible securities to survive a liquidity stress and this will result in banks holding a greater amount of government securities, to ensure that these institutions have adequate liquidity in times of financial stress.