SCHEDULE 1

Amended DAS Terms

DIVIDEND ACCESS SHARE TERMS

Terms of Issue of the RBSG Series 1 Dividend Access Share

The Series 1 Dividend Access Share will have a nominal value of £0.01 and will be fully paid up at issue. The Series 1 Dividend Access Share will be issued in registered form and will be held in certificated form. Temporary documents of title in relation to the Series 1 Dividend Access Share in certificated form will not be issued pending despatch by post of a definitive certificate. Capitalised terms used and not otherwise defined herein shall have the respective meanings ascribed thereto in paragraph 16 below.

| 2 | Series 1 Dividend Access Share Dividends |

| 2.1 | Subject to the discretions, limitations and qualifications set out herein, non-cumulative dividends on the Series 1 Dividend Access Share will be payable from the date the Company issues the Series 1 Dividend Access Share in respect of the period up to and including the Series 1 Class B Dividend Stop Date (if any). The No dividends will be payable on the Series 1 Dividend Access Share after the Stop Date (if any). Up to and including the Stop Date, the Company will pay dividends when, as and if declared by the Board of Directors. Subject Up to and including the Stop Date, subject to the discretions, limitations and qualifications set out herein, the Series 1 Dividend Access Share shall entitle the holder thereof to receive out of the distributable profits of the Company a non-cumulative dividend (the “Dividend Access Share Dividend”), in priority to the payment of any dividend to the holders of any class of Ordinary Share or Class B Shares and pari passu in such regard with the holders of any other Dividend Access Shares then in issue. |

The Board of Directors shall, by 31 October in each financial year of the Company, decide whether or not to pay an interim dividend on the Ordinary Shares or make an interim Ordinary Share Bonus Issue in that financial year. If it is decided that an interim dividend on the Ordinary Shares or an interim Ordinary Share Bonus Issue is to be paid or made in any financial year, the corresponding semi-annual (hereinafter referred to as “first semi-annual”) Dividend Access Share Dividend or Bonus Issue on the Series 1 Dividend Access Share in the same financial year will be paid or made at the time set out below. The record date for any first semi-annual Dividend Access Share Dividend or Bonus Issue on the Series 1 Dividend Access Share shall be the same as the record date for any interim dividend on the Ordinary Shares or interim Ordinary Share Bonus Issue in the relevant financial year or otherwise shall be three Business Days before 31 October in each year. If paid or made, the first semi-annual Dividend Access Share Dividend or Bonus Issue on the Series 1 Dividend Access Share in a financial year will be paid or made on the same date that the corresponding interim dividend on the Ordinary Shares is paid or interim Ordinary Share Bonus Issue is made. If it is decided that no such interim dividend on the Ordinary Shares or interim Ordinary Share Bonus Issue will be paid or made in a financial year, the first semi-annual Dividend Access Share Dividend or Bonus Issue on the Series 1 Dividend Access Share in such financial year will, if to be paid or made, be so paid or made on 31 October in such financial year (commencing in 2010). Any first semi-annual Dividend Access Share Dividend will only be paid if (to the extent legally required) profits are available for distribution and are permitted by law to be distributed.

The Board of Directors shall, by 31 May in each financial year of the Company, decide whether or not to recommend a dividend on the Ordinary Shares or make an Ordinary Share Bonus Issue which is expressed to be a final dividend for the immediately preceding financial year. If it is decided that such a dividend on the Ordinary Shares or Ordinary Share Bonus Issue is to be recommended and is subsequently approved by Shareholders, the corresponding semi-annual (hereinafter referred to as “second semi-annual”) Dividend Access Share Dividend or Bonus Issue on the Series 1 Dividend Access Share expressed to be for the corresponding period will be paid at the time set out below. The record date for any second semi-annual Dividend Access Share Dividend or Bonus Issue on the Series 1 Dividend Access Share shall be the same as the record date for any final dividend on the Ordinary Shares or final Ordinary Share Bonus Issue for the relevant financial year or otherwise shall be three Business Days before 31 May in each year. If paid or made, the second semi-annual Dividend Access Share Dividend or Bonus Issue on the Series 1 Dividend Access Share in a financial year will be paid or made on the same date that the corresponding final dividend on the Ordinary Shares is paid or final Ordinary Share Bonus Issue is made. If it is decided that no such final dividend on the Ordinary Shares or Ordinary Share Bonus Issue will be paid or made in any year (the “current year”) for the immediately preceding financial year, any second semi-annual Dividend Access Share Dividend or Bonus Issue on the Series 1 Dividend Access Share expressed to be for the corresponding period will, if to be paid or made, be so paid or made on 31 May in the current year (commencing in 2010). Any second semi-annual Dividend Access Share Dividend will only be paid if (to the extent legally required) profits are available for distribution and are permitted by law to be distributed.

If paid or made, the first semi-annual Dividend Access Share Dividend on the Series 1 Dividend Access Share shall be equivalent to (A) the greater of:

(1) 7 per cent. of the Reference Amount multiplied by the actual number of days in the period from (but excluding) the immediately preceding Relevant Date or, if none, the Issue Date to (and including) the current Relevant Date or, if there has occurred prior to such current Relevant Date a Series 1 Class B Dividend Stop Date in respect of any Series 1 Class B Shares, then in respect of those Series 1 Class B Shares, to (and including) such earlier Series 1 Class B Dividend Stop Date, divided by 365 (or 366 in a leap year) and

(2) if a cash dividend or cash dividends on the Ordinary Shares or Ordinary Share Bonus Issue(s) is/are paid or made in the period from (but excluding) the immediately preceding Relevant Date or, if none, the Issue Date to (and including) the current Relevant Date or, if there has occurred prior to such current Relevant Date a Series 1 Class B Dividend Stop Date in respect of any Series 1 Class B Shares, then in respect of those Series 1 Class B Shares, to (and including) such earlier Series 1 Class B Dividend Stop Date, 250 25 per cent. (as adjusted from time to time as provided below, the “Participation Rate”) of the aggregate Fair Market Value of such cash dividend(s) or Ordinary Share Bonus Issue(s) per Ordinary Share multiplied by the then Reference Series 1 Class B Shares Number. Where a dividend in cash is announced which may at the election of a Shareholder or Shareholders be satisfied by the issue or delivery of Ordinary Shares in an Ordinary Share Bonus Issue, or where an Ordinary Share Bonus Issue is announced which may at the election of a Shareholder or Shareholders be satisfied by the payment of cash, then the Fair Market Value of such dividend or Ordinary Share Bonus Issue shall be deemed to be the amount of the dividend in cash or of the payment in cash (as the case may be),

less (B) the Fair Market Value of the aggregate amount of any dividend or distribution paid or made on the Series 1 Class B Shares and/or on any Ordinary Shares issued on conversion of the Series 1 Class B Shares (regardless of who holds such Series 1 Class B Shares or Ordinary Shares at the relevant time) in the period from (but excluding) the immediately preceding Relevant Date or, if none, the Issue Date to (and including) the current Relevant Date (or, if there has occurred prior to such current Relevant Date a Series 1 Class B Dividend Stop Date in respect of any Series 1 Class B Shares, then in respect of those Series 1 Class B Shares to (and including) such earlier Series 1 Class B Dividend Stop Date),

provided that the first semi-annual Dividend Access Share Dividend shall never be less than zero and provided that any first semi-annual Dividend Access Share Dividend on the Series 1 Dividend Access Share shall not in any event exceed a sum which, before taking account of any withholding or deduction required to be made on account of tax from such dividend and when added to any other cash dividends previously paid by the Company on the Series 1 Dividend Access Share since the Issue Date (before taking account of any withholding or deduction required to be made on account of tax from such cash dividends), would exceed the DAS Retirement Dividend Amount.

If paid or made, the second semi-annual Dividend Access Share Dividend on the Series 1 Dividend Access Share shall be equivalent to (A) the greater of:

(1) 7 per cent. of the Reference Amount multiplied by the actual number of days in the period from (but excluding) the Relevant Date falling on (or nearest to) one year prior to the current Relevant Date or, if none, the Issue Date to (and including) the current Relevant Date or, if there has occurred prior to such current Relevant Date a Series 1 Class B Dividend Stop Date in respect of any Series 1 Class B Shares, then in respect of those Series 1 Class B Shares, to (and including) such earlier Series 1 Class B Dividend Stop Date, divided by 365 (or 366 in a leap year) and

(2) if a cash dividend or cash dividends on the Ordinary Shares or Ordinary Share Bonus Issue(s) is/are paid or made in the period from (but excluding) the Relevant Date falling on (or nearest to) one year prior to the current Relevant Date or, if none, the Issue Date to (and including) the current Relevant Date or, if there has occurred prior to such current Relevant Date a Series 1 Class B Dividend Stop Date in respect of any Series 1 Class B Shares, then in respect of those Series 1 Class B Shares, to (and including) such earlier Series 1 Class B Dividend Stop Date, the Participation Rate of the aggregate Fair Market Value of such cash dividend(s) or Ordinary Share Bonus Issue(s) per Ordinary Share multiplied by the then Reference Series 1 Class B Shares Number. Where a dividend in cash is announced which may at the election of a Shareholder or Shareholders be satisfied by the issue or delivery of Ordinary Shares in an Ordinary Share Bonus Issue, or where an Ordinary Share Bonus Issue is announced which may at the election of a Shareholder or Shareholders be satisfied by the payment of cash, then the Fair Market Value of such dividend or Ordinary Share Bonus Issue shall be deemed to be the amount of the dividend in cash or of the payment in cash (as the case may be),

less (B) the Fair Market Value of the aggregate amount of any dividend or distribution paid or made on the Series 1 Class B Shares and/or on any Ordinary Shares issued on conversion of the Series 1 Class B Shares (regardless of who holds such Series 1 Class B Shares or Ordinary Shares at the relevant time) in the period from (but excluding) the Relevant Date falling on (or nearest to) one year prior to the current Relevant Date or, if none, the Issue Date to (to including) the current Relevant Date (or, if there has occurred

prior to such current Relevant Date a Series 1 Class B Dividend Stop Date in respect of any Series 1 Class B Shares, then in respect of those Series 1 Class B Shares to (and including) such earlier Series 1 Class B Dividend Stop Date)and less the Fair Market Value of the immediately preceding first semi-annual Dividend Access Share Dividend or Bonus Issue paid or made (if any),

provided that the second semi-annual Dividend Access Share Dividend shall never be less than zeroprovided that the second semi-annual Dividend Access Share Dividend shall never be less than zero and provided that any second semi-annual Dividend Access Share Dividend on the Series 1 Dividend Access Share shall not in any event exceed a sum which, before taking account of any withholding or deduction required to be made on account of tax from such dividend and when added to any other cash dividends previously paid by the Company on the Series 1 Dividend Access Share since the Issue Date (before taking account of any withholding or deduction required to be made on account of tax from such cash dividends), would exceed the DAS Retirement Dividend Amount.

If the Participation Rate is adjusted during the course of a financial year, the amount of the semi-annual Dividend Access Share Dividend in such financial year, if determined by reference to the Participation Rate, shall itself be adjusted in such manner as the Independent Financial Adviser (acting as an expert) considers appropriate to take account of the date(s) on which the adjustment(s) to the Participation Rate become effective. A written opinion of the Independent Financial Adviser in respect thereof shall be conclusive and binding on all parties, save in the case of manifest error.

The initial Participation Rate is 250 as at [date of shareholder approval] 2014 is 25 per cent. Upon the happening of any of the events in respect of which the Series 1 Class B Share Conversion Price or the Series 1 Class B Share Relevant Amount shall be adjusted as provided in:

(i) sub-paragraphs 4(b)(i) to (x) (inclusive) of the Series 1 Class B Share Terms (subject to the provisions of the last paragraph of paragraph 4(a) of the Series 1 Class B Share Terms), the Participation Rate shall also be adjusted at the same time as follows:

and

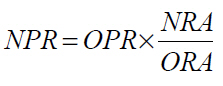

(ii) paragraph 4(l) of the Series 1 Class B Share Terms (subject to paragraph 4(a) of the Series 1 Class B Share Terms), the Participation Rate shall also be adjusted at the same time as follows:

where:

NPR means the new Participation Rate, following such adjustment;

OPR means the old Participation Rate, immediately prior to such adjustment;

NCP means the new Series 1 Class B Share Conversion Price following such adjustment;

OCP means the old Series 1 Class B Share Conversion Price, immediately prior to such adjustment;

NRA means the new Series 1 Class B Share Relevant Amount following such adjustment; and

ORA means the old Series 1 Class B Share Relevant Amount, immediately prior to such adjustment

In addition to the above, the Board of Directors may at any time in its sole and absolute discretion declare a dividend on the Series 1 Dividend Access Share. Any such dividend shall not be a “Dividend Access Share Dividend” for the purposes of these Terms of Issue. If the Board of Directors does so declare a dividend, it shall also determine the amount of such dividend, the record date for such dividend and the date on which such dividend is to be paid or made. Any such dividend will only be paid if (to the extent legally required) profits are available for distribution and are permitted by law to be distributed. The Board of Directors may exercise their discretion not to pay a dividend under this sub-paragraph notwithstanding the previous setting aside of a sum to provide for payment of that dividend. As soon as practicable after resolving that a dividend shall be paid under this sub-paragraph, the Board of Directors shall give notice thereof to the holder of the Series 1 Dividend Access Share in accordance with paragraph 11.

| 2.2 | The Company shall, upon determining any dividend pursuant to this paragraph 2, cause the amount thereof to be notified to the holders of Series 1 Dividend Access Share in accordance with paragraph 11. |

| 2.3 | In the event of a change to the accounting reference date of the Company, the references in this paragraph 2 to (i) 31 May shall be deemed to be changed to such date as falls five months after the new accounting reference date and (ii) 31 October shall be deemed to be changed to such date as falls ten months after the new accounting reference date. |

In the event of a change in accounting reference date from 31 Decemberof the Company, the Company shall make such other changes to the dividend payment arrangements described above as, following consultation with an Independent Financial Adviser (acting as an expert), it determines are fair and reasonable to take account of any initial stub period(s) when the new accounting reference date is introduced.

In the event of a change in the frequency of dividend payments on the Ordinary Shares such that they are not paid semi-annually consistent with the payment of Dividend Access Share Dividends on the Series 1 Dividend Access Share, the Company shall make such changes to the Dividend Access Share Dividend payment arrangements described in this paragraph 2 as, following consultation with the Independent Financial Adviser (acting as an expert), it determines are fair and reasonable to take account of such changed frequency.

| 2.4 | Non-cumulative dividends on the Series 1 Dividend Access Share are payable in respect of the period up to and including the Series 1 Class B Dividend Stop Date (if any). After the Series 1 Class B Dividend Stop Date (if any) the right of the holder of this the Series 1 Dividend Access Share to any dividends (including any Dividend Access Share Dividends in respect of any ) hereunder shall cease and the Series 1 Dividend Access Share shall, without the need for any consent of or approval from the holder of the Series 1 Dividend Access Share or any other action by the Company or the holder of the Series 1 Dividend Access Share, be re-designated as a single Series 1 Class B Share on terms identical to |

all other Series 1 Class B Shares in issue during each of the 30 consecutive dealing days during which the Series 1 Class B Dividend Trigger Event occurs shall cease, but this is without prejudice to the right to Dividend Access Share Dividends in respect of any Series 1 Class B Shares not in issue on each such dayat the Stop Date.

| 2.5 | If any doubt shall arise as to the appropriate amount of any Dividend Access Share Dividend, and then following consultation between the Company and an Independent Financial Adviser, a written opinion of such Independent Financial Adviser in respect thereof shall be conclusive and binding on all parties, save in the case of manifest or proven error. |

| 2.6 | (i) Until (and including) 31 December 2015, the DAS Retirement Dividend Amount will be £1,500,000,000. On or after 1 January 2016, the DAS Retirement Dividend Amount shall be subject to increase as set out below. |

(ii) If aggregate cash dividends paid (before taking account of any withholding or deduction required to be made on account of tax from such cash dividends) on the Series 1 Dividend Access Share between the Issue Date and 31 December 2015 (both such dates inclusive) are less than £1,500,000,000, (a) the difference between £1,500,000,000 and the gross aggregate amount (if any) so paid between the Issue Date and 31 December 2015 (both such dates inclusive) shall be referred to as the “Unpaid Amount” and (b) the DAS Retirement Dividend Amount shall be increased such that the DAS Retirement Dividend Amount shall only be deemed to have been paid once the gross amount paid of cash dividends on the Series 1 Dividend Access Share (before taking account of any withholding or deduction required to be made on account of tax from such cash dividends) is equal to the Unpaid Amount (increased as described in this paragraph 2.6(ii)).

On any date on or after 1 January 2016 on which a dividend (the “Relevant Dividend”) is to be paid on the Series 1 Dividend Access Share (an “Unpaid Amount Recalculation Date (First Period)”), the Unpaid Amount shall, prior to such dividend being paid, be recalculated by increasing it to an amount equal to:

(x) the Unpaid Amount

plus

(y) 5% x the Unpaid Amount x Number of Completed Years (First Period)

plus (if the Unpaid Amount Recalculation Date (First Period) falls on a day other than a day which is an anniversary of the previous Unpaid Amount Recalculation Date (First Period) or, in the case of the first Unpaid Amount Recalculation Date (First Period), a day other than 1 January in any year)

(z) 5% x the Unpaid Amount x [Actual Number of Days in Incomplete Period (First Period) divided by 365 (or 366 if all or part of the Incomplete Period (First Period) falls in a leap year)]

The Relevant Dividend (before taking account of any withholding or deduction required to be made on account of tax from such dividend) shall then be deducted from the Unpaid Amount and the resulting figure will become the new Unpaid Amount going forward.

“Number of Completed Years (First Period)” means the number (if any) of completed periods of 365 (or, in the case of any period including all or part of a leap year, 366) days from (and including) the previous Unpaid Amount Recalculation Date (First Period) (or, in

the case of the first Unpaid Amount Recalculation Date (First Period), from (and including) 1 January 2016) to but excluding the Unpaid Amount Recalculation Date (First Period).

“Actual Number of Days in Incomplete Period (First Period)” means the actual number of days in the relevant Incomplete Period (First Period).

“Incomplete Period (First Period)” means, in respect of any Unpaid Amount Recalculation Date (First Period), any period of time from (and including) the immediately preceding annual anniversary of the previous Unpaid Amount Recalculation Date (First Period) (or, in the case of the first Unpaid Amount Recalculation Date (First Period), from (and including) the immediately preceding 1 January) to (but excluding) the relevant Unpaid Amount Recalculation Date (First Period).

(iii) If aggregate cash dividends paid (before taking account of any withholding or deduction required to be made on account of tax from such cash dividends) on the Series 1 Dividend Access Share between the Issue Date and 31 December 2020 (both such dates inclusive) are less than the DAS Retirement Dividend Amount, (a) the Unpaid Amount will be determined on 1 January 2021 in accordance with paragraph 2.6(ii) as if 1 January 2021 was an Unpaid Amount Recalculation Date (First Period) and (b) the DAS Retirement Dividend Amount shall be increased such that the DAS Retirement Dividend Amount shall only be deemed to have been paid once the gross amount paid of cash dividends on the Series 1 Dividend Access Share (before taking account of any withholding or deduction required to be made on account of tax from such cash dividends) is equal to the Unpaid Amount (increased as described in this paragraph 2.6(iii)).

On any date on or after 1 January 2021 on which a Relevant Dividend is to be paid on the Series 1 Dividend Access Share (an “Unpaid Amount Recalculation Date (Second Period)”), the Unpaid Amount shall, prior to such dividend being paid, be recalculated by increasing it to an amount equal to:

(x) the Unpaid Amount

plus

(y) 10% x the Unpaid Amount x Number of Completed Years (Second Period)

plus (if the Unpaid Amount Recalculation Date (Second Period) falls on a day other than a day which is an anniversary of the previous Unpaid Amount Recalculation Date (Second Period) or, in the case of the first Unpaid Amount Recalculation Date (Second Period), a day other than 1 January in any year)

(z) 10% x the Unpaid Amount x [Actual Number of Days in Incomplete Period (Second Period) divided by 365 (or 366 if all or part of the Incomplete Period (Second Period) falls in a leap year)]

The Relevant Dividend (before taking account of any withholding or deduction required to be made on account of tax from such dividend) shall then be deducted from the Unpaid Amount and the resulting figure will become the new Unpaid Amount going forward.

“Number of Completed Years (Second Period)” means the number (if any) of completed periods of 365 (or, in the case of any period including all or part of a leap year, 366) days from (and including) the previous Unpaid Amount Recalculation Date (Second Period) or, in the case of the first Unpaid Amount Recalculation Date (Second Period), from (and including) 1 January 2021) to but excluding the Unpaid Amount Recalculation Date (Second Period).

“Actual Number of Days in Incomplete Period (Second Period)” means the actual number of days in the relevant Incomplete Period (Second Period).

“Incomplete Period (Second Period)” means, in respect of any Unpaid Amount Recalculation Date (Second Period), any period of time from (and including) the immediately preceding annual anniversary of the previous Unpaid Amount Recalculation Date (Second Period) (or, in the case of the first Unpaid Amount Recalculation Date (Second Period), from (and including) the immediately preceding 1 January) to (but excluding) the relevant Unpaid Amount Recalculation Date (Second Period).

(iv) All determinations of the DAS Retirement Dividend Amount (including the Unpaid Amount) in accordance with this paragraph 2.6 shall be made by the Company in its sole and absolute discretion and shall be binding on the holder of the Series 1 Dividend Access Share.

| 3 | Payment of Dividend Access Share Dividends Discretionary |

If, in the opinion of the Board of Directors, the distributable profits of the Company are sufficient to cover the payment, in full, of the Dividend Access Share Dividend on the relevant Dividend Access Share Dividend payment date and also the payment in full of all other dividends and other amounts stated to be payable on such date on any Parity Securities in issue (other than the Ordinary Shares and the Series 1 Class B Shares), the Board of Directors may:

| | (a) | pay in full the Dividend Access Share Dividend on the relevant Dividend Access Share Dividend payment date; or |

| | (b) | in their sole and absolute discretion resolve at least 10 Business Days prior to the relevant Dividend Access Share Dividend payment date that no Dividend Access Share Dividend shall be paid or that a Dividend Access Share Dividend shall be paid only in part. |

The Board of Directors shall not be bound to give their reasons for exercising their discretion under this sub-paragraph. The Board of Directors may exercise their discretion in respect of a dividend notwithstanding the previous setting aside of a sum to provide for payment of that dividend to the extent that, in the opinion of the Board of Directors (i) there are insufficient distributable profits to cover the payment, in full, of the Dividend Access Share Dividend on the relevant Dividend Access Share payment date and also the payment in full of all other dividends and other amounts stated to be payable on such date on any Parity Securities in issue (other than the Ordinary Shares and the Series 1 Class B Shares) or (ii) the payment of the Dividend Access Share Dividend would breach or cause a breach of the capital adequacy requirements applicable to the Company.

If, at least 10 Business Days prior to a Dividend Access Share Dividend payment date, the Board of Directors considers that the distributable profits of the Company are insufficient to cover the payment in full of the Dividend Access Share Dividend and also the payment in full of all other dividends or other amounts stated to be payable on such Dividend Access Share Dividend payment date on any Parity Securities (other than the Ordinary Shares and the Series 1 Class B Shares), then the Board of Directors may pay a reduced Dividend Access Share Dividend. This will be paid in proportion to the dividends and other amounts which would have been due on the Series 1 Dividend Access Share and any other shares and other instruments of the Company (other than the Ordinary Shares and the Series 1 Class B Shares) on such Dividend Access Share Dividend payment date which are

expressed to rank equally with the Series 1 Dividend Access Share as regards participation in profits if there had been sufficient profit.

The Board of Directors may in its discretion decide that the Dividend Access Share Dividend in any financial year will not be paid at all or will be paid only in part even when distributable profits are available for distribution. If the Board of Directors decides not to pay the Dividend Access Share Dividend in respect of a period or determines that it shall be paid only in part, then the right of the holder of the Series 1 Dividend Access Share to receive the relevant Dividend Access Share Dividend in respect of that period will be lost either entirely or as to the part not paid, as applicable, and the Company will have no obligation in respect of the amount of Dividend Access Share Dividend not paid either to pay the relevant Dividend Access Share Dividend in respect of that period or to pay interest thereon, whether or not Dividend Access Share Dividends are paid in respect of any future financial period.

As soon as practicable after resolving that no Dividend Access Share Dividend shall be paid or that it shall be paid only in part, the Board of Directors shall give notice thereof to the holder of the Series 1 Dividend Access Share in accordance with paragraph 11.

| 4 | Payment of Dividend Access Share Dividends |

Subject to these terms of issue, the Company will, if to be paid, pay any dividends on the Series 1 Dividend Access Share, including Dividend Access Share Dividends , out of its distributable profits in sterling. Dividend Access Share Dividends Such dividends may be paid by the Company by crediting any account which the holder of the Series 1 Dividend Access Share, or in the case of joint holders, the holder whose name stands first in the register in respect of the Series 1 Dividend Access Share, has with the Company, whether in the sole name of such holder or the joint names of such holder and another person or person, unless the Company has received not less than one month’s notice in writing from such holder or joint holders directing that payment be made in another manner permitted by the Articles.

Any such Dividend Access Share Dividend dividend may be paid by any bank or other funds transfer system or, if agreed by the Company, such other means and to or through such person, in each case as the holder or joint holders may in writing direct.

If payment in respect of the Series 1 Dividend Access Share into any such bank account is to be made on a Dividend Access Share Dividend payment date which is not a Business Day, then payment of such amount will be made on the next succeeding Business Day, without any interest or payment in respect of such delay.

Payments in respect of amounts payable by way of Dividend Access Share Dividend dividend will be subject in all cases to any applicable fiscal or other laws and other regulations.

If the Board of Directors decides to pay a Dividend Access Share Dividend and either (i) no dividend has been paid on the Ordinary Shares and/or distribution made thereon in respect of the corresponding period or (ii) a dividend has been paid and/or a distribution has been made on the Ordinary Shares otherwise than in cash in respect of the corresponding period, the Board of Directors may in its discretion determine that such Dividend Access Share Dividend shall be paid in whole or in part by the Company issuing Series 1 Class B Shares, credited as fully paid, to the holder of the Series 1 Dividend Access Share. The number of such Series 1 Class B Shares to be issued to the holder shall be such number

of Series 1 Class B Shares as shall be certified by the Independent Financial Adviser (acting as an expert) to be as nearly as possible equal to (but not greater than) the cash amount (disregarding any withholding or deduction required to be made on account of any tax and any associated tax credit) of such semi-annual Dividend Access Share Dividend or part thereof otherwise payable to such holder of the Series 1 Dividend Access Share, based on the Fair Market Value of a Series 1 Class B Share at the time of such determination. A written opinion of the Independent Financial Adviser in respect thereof shall be conclusive and binding on all parties, save in the case of manifest error.

The basis of allotment in accordance with the immediately preceding paragraph shall be such that the holder of the Series 1 Dividend Access Share may not receive a fraction of a Series 1 Class B Share (for this purpose calculating entitlements on the basis of a holder’s entire holding of Series 1 Class B Shares). The Board of Directors may make such provisions as they think fit for any fractional entitlements, including provisions whereby, in whole or in part, fractional entitlements are disregarded or the benefit thereof accrues to the Company and/or under which fractional entitlements are accrued and/or retained.

The Series 1 Class B Shares so allotted shall rank pari passu in all respects with the fully paid Series 1 Class B Shares then in issue save only as regards participation in any dividend on the Series 1 Class B Shares payable by reference to a record date falling on or prior to the date of issue of the Series 1 Class B Shares so allotted.

The new Series 1 Class B Shares issued in respect of the whole (or some part) of the relevant dividend declared in respect of the Series 1 Dividend Access Share shall be in certificated form unless the Company and a holder agree otherwise.

The Board of Directors may undertake and do such acts and things as they may consider necessary or expedient for the purpose of giving effect to the provisions of this paragraph 4.

| 5 | Restrictions on Dividends and Redemption |

If any Dividend Access Share Dividend is not declared and paid in full in cash or otherwise, the Company:

| | (i) | may not, and shall procure that no member of the Group shall, declare or pay dividends or other distributions upon any Parity Securities (whether in cash or otherwise, and whether payable on the same date as the relevant Dividend Access Share Dividend or subsequently) or make any Ordinary Share Bonus Issue (whether to be made on the same date as the relevant Dividend Access Share Dividend or subsequently), and the Company may not, and shall procure that no member of the Group shall, set aside any sum for the payment of these dividends or distributions; or |

| | (ii) | may not, and shall procure that no member of the Group shall, redeem, purchase or otherwise acquire (whether on the same date as the relevant Dividend Access Share Dividend is payable or subsequently) for any consideration any of its Parity Securities or any depository or other receipts or certificates representing Parity Securities (other than any such purchases or acquisitions which are made in connection with any Employee Share Scheme), and (save as aforesaid) the Company may not, and shall procure that no member of the Group shall, set aside any sum or establish any sinking fund (whether on the same date as the relevant Dividend Access Share Dividend is payable or subsequently) for the redemption, |

purchase or other acquisition of Parity Securities or any depository or other receipts or certificates representing Parity Securities,

in each case until such time as Dividend Access Share Dividends are no longer payable (including as a result of the Stop Date occurring) or payment of Dividend Access Share Dividends in cash or otherwise has resumed in full, as the case may be.

| 6 | Rights upon Liquidation |

On a winding-up or liquidation, voluntary or otherwise, the holder of the Series 1 Dividend Access Share will rank in the application of the assets of the Company available to shareholders: (1) equally in all respects with holders of Ordinary Shares and Series 1 Class B Shares and any other class of shares or securities of the Company in issue or which may be issued by the Company which rank or are expressed to rank equally with the Series 1 Dividend Access Share, the Ordinary Shares or the Series 1 Class B Shares on a winding-up or liquidation and (2) junior to all other shareholders and all creditors of the Company.

In such event the holder of the Series 1 Dividend Access Share will be deemed to hold one -tenth (as adjusted from time to time as provided below, the “Winding Up Ratio”) of one Ordinary Share and will be entitled to receive out of the surplus assets of the Company remaining after payment of all prior-ranking claims, a sum equal to that payable to a holder of one -tenth (as adjusted) of one Ordinary Share in such event.

The initial Winding Up Ratio is one-tenth. Upon each adjustment of the Series 1 Class B Share Winding Up Ratio in accordance with the Series 1 Class B Share Terms (or, if there are no Series 1 Class B Shares outstanding at the relevant time, upon any event that would have led to such an adjustment if there had been Series 1 Class B Shares outstanding at such time), the Winding Up Ratio shall also be adjusted at the same time and to the same extent.

The holder of the Series 1 Dividend Access Share will only be entitled to receive notice of and to attend any general meeting of shareholders and to speak to or vote upon any resolution proposed at such meeting if a resolution is proposed which either varies or abrogates any of the rights and restrictions attached to the Series 1 Dividend Access Share or proposes the winding up of the Company (and then in each such case only to speak and vote upon any such resolution).

If the holder of the Series 1 Dividend Access Share is entitled to vote upon a resolution proposed at a general meeting of shareholders, on a show of hands the holder of the Series 1 Dividend Access Share or any proxy or a corporate representative for the holder, in each case who is present in person, will have one vote. On a poll, the holder of the Series 1 Dividend Access Share who is entitled to vote and who is present in person, by proxy or by corporate representative, will have one vote.

Other provisions in the Articles relating to voting procedures also apply to the Series 1 Dividend Access Share.

For as long as the Dividend Access Share remains in issue and the Reference Amount is greater than zeroUntil and including the Stop Date, the Company may not purchase or otherwise acquire any of its Ordinary Shares or other Parity Securities (other than the Series 1 Class B Shares) or any depositary or other receipts or certificates representing Ordinary Shares or Parity Securities (other than the Series 1 Class B Shares) other than any such purchases or acquisitions which are made in connection with any Employee Share Scheme or which are made from HM Treasury or its nominees.

The Series 1 Dividend Access Share will, when issued, be fully paid and, as such, will not be subject to a call for any additional payment. An amount equal to the nominal value of £0.01 of the Series 1 Dividend Access Share will be credited to the Company’s issued share capital account.

The Series 1 Dividend Access Share will be issued in registered form to HM Treasury or its nominee. The Series 1 Dividend Access Share shall not be transferable.

Title to the Series 1 Dividend Access Share will be evidenced by registration on the register of members of the Company in accordance with the Articles.

See “Registrar” below.

The rights, preferences and privileges attached to the Series 1 Dividend Access Share may be varied or abrogated in accordance with the Articles (including Article 6). In addition, the Company may make such changes to the terms of issue of the Series 1 Dividend Access Share as it, in its sole discretion, deems necessary in order to ensure that the Series 1 Dividend Access Share continues to count as core common equity tier 1 capital for the purposes of regulatory requirements applicable to it, and such changes may be made without the consent of the holder of the Series 1 Dividend Access Share. The Company will notify the holder of the Series 1 Dividend Access Share in accordance with paragraph 11 if it makes any such changes.

Subject as provided in paragraph 15, the rights attached to the Series 1 Dividend Access Share will not be deemed to be varied by the creation or issue of (a) any further Dividend Access Shares or any other Parity Securities or any other share capital ranking equally with or junior to the Series 1 Dividend Access Share or (b) any preference shares, in each case whether carrying identical rights or different rights in any respect, including as to dividend, premium or entitlement on a return of capital, redemption or conversion and whether denominated in sterling or any other currency. Any further Dividend Access Shares, any other Parity Securities or any other share capital ranking equal with or junior to the Dividend Access Share may either carry identical rights in all respects with the Series 1 Dividend Access Share or carry different rights.

Notices given by the Company will be given by the Registrar on its behalf unless the Company decides otherwise.

A notice may be given by the Company to the holder of the Series 1 Dividend Access Share in certificated form by sending it by post to the holder’s registered address. Service of the notice shall be deemed to be effected by properly addressing, prepaying and posting a letter by first class post containing the notice, and to have been effected on the day after the letter containing the same is posted. Where the holder’s registered address is outside the United Kingdom, all notices shall be sent to him by air mail post.

A notice may be given by the Company to the joint holders of the Series 1 Dividend Access Share by giving the notice to the joint holder first named in the register. A notice may be given by the Company to the extent permitted by the Companies Act by electronic communication, if so requested or authorised by the holder, the holder having notified the Company of an e-mail address to which the Company may send electronic communications, and having agreed to receive notices and other documents from the Company by electronic communication. If the holder notifies the Company of an e-mail address, the Company may send the holder the notice or other document by publishing the notice or other document on a website and notifying the holder by e-mail that the notice or other document has been published on the website. The Company must also specify the address of the website on which it has been published, the place on the website where the notice may be accessed and how it may be accessed, and where the notice in question is a notice of a meeting, the notice must continue to be published on that website throughout the period beginning with the giving of that notification and ending with the conclusion of the meeting, save that if the notice is published for part only of that period then failure to publish the notice throughout that period shall not invalidate the proceedings of the meeting where such failure is wholly attributable to circumstances which it would not be reasonable to have expected the Company to prevent or avoid.

If at any time the Company is required by a tax authority to deduct or withhold taxes from payments made by the Company with respect to the Series 1 Dividend Access Share, the Company will not pay additional amounts. As a result, the net amount received from the Company by the holder of the Series 1 Dividend Access Share, after the deduction or withholding, will be less than the amount the holder would have received in the absence of the deduction or withholding.

The creation and issuance of the Series 1 Dividend Access Share and the rights attached to it shall be governed by and construed in accordance with the laws of Scotland.

Computershare Investor Services PLC located at The Pavilions, Bridgwater Road, Bristol BS99 6ZZ will maintain the register and will act as Registrar.

The Company reserves the right at any time to appoint an additional or successor registrar. Notice of any change of registrar will be given to the holder of the Series 1 Dividend Access Share.

The Company may, at any time and from time to time, and with the consent of HM Treasury, create or issue further Dividend Access Shares.

“Actual Number of Days in Incomplete Period (First Period)” has the meaning provided in paragraph 2.6;

“Actual Number of Days in Incomplete Period (Second Period)” has the meaning provided in paragraph 2.6;

“Articles” means the articles of association of the Company;

“Board of Directors” means the Board of Directors of the Company or a duly authorised committee of such Board of Directors;

“Bonus Issue” means, in relation to the Series 1 Dividend Access Share, an issue of Series 1 Class B Shares to the holder of the Series 1 Dividend Access Share by way of capitalisation of profits or reserves;

“Business Day” means a day on which banks are open for business in London;

“Class B Shares” means Class B Shares (of whatever series) in the capital of the Company;

“Companies Act” means the Companies Act 2006 (as amended from time to time); “Company” means The Royal Bank of Scotland Group plc;

“current year” has the meaning provided in paragraph 2.1;

“DAS Retirement Dividend Amount” means £1,500,000,000 subject to increase as described in paragraph 2.6;

“dealing day” means a day on which the Relevant Stock Exchange or relevant market is open for business and on which Ordinary Shares, Securities or Spin-Off Securities (as the case may be) may be dealt in (other than a day on which the Relevant Stock Exchange or relevant market is scheduled to or does close prior to its regular weekday closing time);

“Directors” means the executive and non-executive directors of the Company who make up its board of directors;

“Dividend” shall have the meaning given in paragraph 14 of the Series 1 Class B Share Terms;

“Dividend Access Share Dividend” has the meaning provided in paragraph 2.1;

“Dividend Access Shares” means Dividend Access Shares (of whatever series) in the capital of the Company;

"Employee Share Scheme” means a scheme for encouraging or facilitating the holding of shares in or debentures of the Company or any Subsidiary by or for the benefit of: (a) the bona fide employees or former employees of the Company or any other member of the Group (including ABN AMRO Holding RBS Holdings N.V. and its subsidiaries from time to time) or (b) the spouses, civil partners, surviving spouses, surviving civil partners, or minor children or step-children of such employees or former employees;

“Fair Market Value” means, with respect to any property on any date, the fair market value of that property as determined in good faith by an Independent Financial Adviser (acting as an expert) provided that (i) the Fair Market Value of a dividend in cash shall be the amount of such cash; (ii) the Fair Market Value of any other cash amount shall be the amount of such cash; (iii) where Securities, Spin-Off Securities, options, warrants or other rights are publicly traded in a market of adequate liquidity (as determined by an Independent Financial Adviser, acting as an expert), the Fair Market Value (a) of such Securities or Spin-Off Securities shall equal the arithmetic mean of the daily Volume Weighted Average Prices of such Securities or Spin-Off Securities and (b) of such options, warrants or other rights shall equal the arithmetic mean of the daily closing prices of such options, warrants or other rights, in the case of both (a) and (b) during the period of five dealing days on the relevant market commencing on such date (or, if later, the first such dealing day such Securities, Spin-Off Securities, options, warrants or other rights are publicly traded) or such shorter period as such Securities, Spin-Off Securities, options, warrants or other rights are publicly traded; (iv) where Securities, Spin-Off Securities, options, warrants or other rights are not publicly traded (as aforesaid) or if the fair market value Fair Market Value of such publicly traded securities cannot be determined as provided in (iii) after a period of 15 calendar days following the relevant date, the Fair Market Value of such Securities, Spin-Off Securities, options, warrants or other rights shall be determined in good faith by an Independent Financial Adviser (acting as an expert), on the basis of a commonly accepted market valuation method and taking account of such factors as it considers appropriate, including the market price per Ordinary Share, the dividend yield of an Ordinary Share, the volatility of such market price, prevailing interest rates and the terms of such Securities, Spin-Off Securities, options, warrants or other rights, including as to the expiry date and exercise price (if any) thereof. Such amounts shall, in the case of (i) above, be translated into the Relevant Currency (if declared or paid or payable in a currency other than the Relevant Currency) at the rate of exchange used to determine the amount payable to Shareholders who were paid or are to be paid or are entitled to be paid the dividend in cash in the Relevant Currency; and in any other case, shall be translated into the Relevant Currency (if expressed in a currency other than the Relevant Currency) at the Prevailing Rate on that date. In addition, in the case of (i) and (ii) above, the Fair Market Value shall be determined on a gross basis and disregarding any withholding or deduction required to be made on account of tax, and disregarding any associated tax credit;

“first semi-annual” has the meaning provided in paragraph 2.1;

“FSA” means the Financial Services Authority or such other governmental authority in the United Kingdom (or if the Company becomes domiciled in a jurisdiction other than the United Kingdom, in such other jurisdiction) having supervisory authority over the Group in respect of any banking business carried on;

“Further Series 1 Class B Shares” means any further Series 1 Class B Shares issued from time to time and consolidated and forming a single series with the then Series 1 Class B Shares in issue;

“Group” means the Company and its subsidiary undertakings;

“HM Treasury” means The Commissioners of Her Majesty’s Treasury of, as at the Issue Date, 1 Horse Guards Road, London SW1A 2HQ;

“in certificated form” means a share or other security which is not in uncertificated form;

“Incomplete Period (First Period)” has the meaning provided in paragraph 2.6;

“Incomplete Period (Second Period)” has the meaning provided in paragraph 2.6;

“Independent Financial Adviser” means an independent financial institution of international repute appointed at its own expense by the Company and approved in writing by HM Treasury (such approval not to be unreasonably withheld or delayed);

“Issue Date” means [●] 22 December 2009;

“London Stock Exchange” means the London Stock Exchange plc;

“Number of Completed Years (First Period)” has the meaning provided in paragraph 2.6;

“Number of Completed Years (Second Period)” has the meaning provided in paragraph 2.6;

“Ordinary Share Bonus Issue” means, in relation to the Ordinary Shares, an issue of Ordinary Shares credited as fully paid to the relevant Shareholders by way of capitalisation of profits or reserves and where such Ordinary Shares are, or are expressed to be, issued in lieu of a dividend (whether a cash dividend equivalent or other amount is announced or would otherwise be payable to Shareholders, whether at their election or otherwise);

“Ordinary Shares” means the ordinary shares of the Company of 25 pence nominal each as at the Issue Date;

“Parity Securities” means (i) the Ordinary Shares and the Series 1 Class B Shares of the Company and (ii) any other securities of the Company or any other member of the Group ranking or expressed to rank pari passu with the Ordinary Shares and/or the Series 1 Class B Shares and/or the Series 1 Dividend Access Share on a return of capital or distribution of assets on a winding-up, either issued by the Company or, where issued by another member of the Group, where the terms of the securities benefit from a guarantee or support agreement entered into by the Company which ranks or is expressed to rank pari passu with the Ordinary Shares and/or the Series 1 Class B Shares and/or the Series 1 Dividend Access Share on a return of capital or distribution of assets on a winding-up;

“Parity Value” means, in respect of any dealing day, the sterling amount calculated as follows:

| PV | = | N x VWAP |

| | | |

| where: | | |

| | | |

| PV | = | the Parity Value |

| | | |

N | = | the number of Ordinary Shares determined by dividing £0.50 by the Series 1 Class B Share Conversion Price in effect on such dealing day rounded down, if necessary, to the nearest whole number of Ordinary Shares |

| | | |

| VWAP | = | the Volume Weighted Average Price of an Ordinary Share on such dealing day, provided that if on any such dealing day the Ordinary Shares shall have been quoted cum-Dividend or cum-any other entitlement (including, for the avoidance of doubt, any Ordinary Share Bonus Issue), the Volume Weighted Average Price of an Ordinary Share on such dealing day shall be deemed to be the amount thereof reduced by an amount equal to the Fair Market Value of any such Dividend or entitlement (including, for the avoidance of doubt, any Ordinary Share Bonus Issue) per Ordinary Share |

| | | as at the date of first public announcement of such Dividend or entitlement (or, if that is not a dealing day, the immediately preceding dealing day); |

“Participation Rate” has the meaning provided in paragraph 2.1;

“Prevailing Rate” means, in respect of any currencies on any day, the spot rate of exchange between the relevant currencies prevailing as at or about 12 noon (London time) on that date as appearing on or derived from the Relevant Page or, if such a rate cannot be determined at such time, the rate prevailing as at or about 12 noon (London time) on the immediately preceding day on which such rate can be so determined;

“record date” means, in respect of any entitlement to receive a dividend or other distribution declared, paid or made, or any rights granted, the record date or other due date for the establishment of the relevant entitlement;

“Reference Amount” means £25,500,000,000 plus the aggregate Series 1 Class B Share Relevant Amount of any Further Series 1 Class B Shares issued by the Company to HM Treasury after the Issue Date and before the record date for the relevant Dividend Access Share Dividend, less the aggregate Series 1 Class B Relevant Amount of any Series 1 Class B Shares which were in issue during the 30 consecutive dealing days during which a Series 1 Class B Dividend Trigger Event occurred;

“Reference Series 1 Class B Shares Number” means the Reference Amount divided by the Series 1 Class B Share Relevant Amount;

“Regulations” has the meaning specified in the Series 1 Class B Share Terms;

“Relevant Currency” means sterling or, if at the relevant time or for the purposes of the relevant calculation or determination, the London Stock Exchange is not the Relevant Stock Exchange, the currency in which the Ordinary Shares are quoted or dealt in on the Relevant Stock Exchange at such time;

“Relevant Date” means, in respect of any semi-annual Dividend Access Share Dividend or Bonus Issue, the date on which the Company pays or makes the same or, subject to paragraph 2.3, if the same is not paid or made, means 31 October of the relevant year in the case of a first semi-annual Dividend Access Share Dividend or Bonus Issue, and 31 May of the relevant year in the case of a second semi-annual Dividend Access Share Dividend or Bonus Issue;

“Relevant Dividend” has the meaning provided in paragraph 2.6;

“Relevant Page” means the relevant page on Bloomberg or such other information service provider selected by the Company that displays the relevant information;

“Relevant Stock Exchange” means the London Stock Exchange or, if at the relevant time the Ordinary Shares are not at that time listed and admitted to trading on the London Stock Exchange, the principal stock exchange or securities market on which the Ordinary Shares are then listed, admitted to trading or quoted or dealt in;

“second semi-annual” has the meaning provided in paragraph 2.1;

“Securities” means any securities including, without limitation, Ordinary Shares, or options, warrants or other rights to subscribe for or purchase or acquire Ordinary Shares;

“Series 1 Class B Dividend Trigger Event” means, in relation to any Series 1 Class B Shares in issue at any time, the payment by the Company of total cash dividends on the

Series 1 Dividend Access Share since the Issue Date in an aggregate amount (before taking account of any withholding or deduction required to be made on account of tax from such cash dividends) equal to the DAS Retirement Dividend Amount;

“Series 1 Class B Share Conversion Price” means the Conversion Price as defined in paragraph 4(a) of the Series 1 Class B Share Terms;

“Series 1 Class B Dividend Stop Date” means the date falling 20 days after the Series 1 Class B Dividend Trigger Event;

“Series 1 Class B Dividend Trigger Event” means in relation to Series 1 Class B Shares in issue at the relevant time, the Parity Value for 20 or more dealing days in any period of 30 consecutive dealing days equals or exceeds £0.65 and, for the avoidance of doubt, there can be more than one such event based on the time of issue of the relevant Series 1 Class B Shares;

“Series 1 Class B Share Relevant Amount” means “Series 1 Class B Share Relevant Amount” means £0.50 per Series 1 Class B Share, subject to adjustment as provided in paragraph 4(l) of the Series 1 Class B Share Terms;

“Series 1 Class B Shares” means the 51,000,000,000 Series 1 Class B Shares of £0.01 each in the capital of the Company issued on the Issue Date, together with any Further Series 1 Class B Shares (as such term is defined in the Series 1 Class B Share Terms) issued by the Company from time to time;

“Series 1 Class B Share Terms” means the terms of the Series 1 Class B Shares approved by the Board of Directors on [●] 23 November 2009;

“Series 1 Class B Share Winding Up Ratio” means the Winding Up Ratio as defined in paragraph 3 of the Series 1 Class B Share Terms;

“Series 1 Dividend Access Share” means the Series 1 Dividend Access Share of the Company with a nominal value of £0.01 issued by the Company on the Issue Date;

“Shareholders” means the person(s) in whose name(s) Ordinary Shares are for the time being registered in the register of Ordinary Share ownership maintained by or on behalf of the Company;

“Specified Date” has, for the purpose of any paragraph in which such expression is used, the meaning given in the relevant paragraph;

“Spin-Off Securities” means equity share capital of an entity other than the Company or options, warrants or other rights to subscribe for or purchase equity share capital of an entity other than the Company;

“sterling” means the lawful currency of the United Kingdom from time to time;

“Stop Date” means the date on which the Series 1 Class B Dividend Trigger Event occurs;

“Subsidiary” has the meaning provided in Section 1159 of the Companies Act 2006;

“subsidiary undertaking” has the meaning provided in Section 1162 of the Companies Act 2006;

“Unpaid Amount” has the meaning provided in paragraph 2.6;

“Unpaid Amount Recalculation Date (First Period)” has the meaning provided in paragraph 2.6;

“Unpaid Amount Recalculation Date (Second Period)” has the meaning provided in paragraph 2.6;

“Volume Weighted Average Price” means, in respect of an Ordinary Share, Security or, as the case may be, a Spin-Off Security on any dealing day, the order book volume-weighted average price of an Ordinary Share, Security or, as the case may be, a Spin-Off Security published by or derived (in the case of an Ordinary Share) from Bloomberg page RBS LN EQUITY VAP or (in the case of a Security (other than Ordinary Shares) or Spin-Off Security) from the principal stock exchange or securities market on which such Securities or Spin-Off Securities are then listed or quoted or dealt in, if any, or, in any such case, such other source as shall be determined to be appropriate by an Independent Financial Adviser (acting as an expert) on such dealing day, provided that, if on any such dealing day such price is not available or cannot otherwise be determined as provided above, the Volume Weighted Average Price of an Ordinary Share, Security or a Spin-Off Security, as the case may be, in respect of such dealing day shall be the Volume Weighted Average Price, determined in good faith by an Independent Financial Adviser (acting as an expert); and

“Winding Up Ratio” has the meaning provided in paragraph 6.

References to any issue or offer or grant to Shareholders “as a class” or “by way of rights” shall be taken to be references to an issue or offer or grant to all or substantially all Shareholders, other than Shareholders to whom, by reason of the laws of any territory or requirements of any recognised regulatory body or any other stock exchange or securities market in any territory or in connection with fractional entitlements, it is determined not to make such issue or offer or grant.

In making any calculation or determination of Volume Weighted Average Price, such adjustments (if any) shall be made as an Independent Financial Adviser considers appropriate to reflect any consolidation or sub-division of the Ordinary Shares or any issue of Ordinary Shares by way of capitalisation of profits or reserves, or any like or similar event.