Woodside Energy Annual Report INCORPORATING APPENDIX 4E

Exhibit 99.1

Australia’s leading energy company

ANNUAL REPORT 2024

This Annual Report 2024 is a summary of Woodside’s operations and activities for the 12-month period ended 31 December 2024 and financial position as of 31 December 2024. Woodside Energy Group Ltd (ABN 55 004 898 962) is the ultimate holding company of the Woodside group of companies. In this report, unless otherwise stated, references to “Woodside”, the “Group”, the “company”, “we”, “us” and “our” refer to Woodside Energy Group Ltd and/or its controlled entities as a whole. The text does not distinguish between the activities of the ultimate holding company and those of its controlled entities.

This report contains references to woodside.com. These references are for the readers’ convenience only and are not incorporated by reference into this report. Similarly, the content of any other websites referred to in this report does not form part of it.

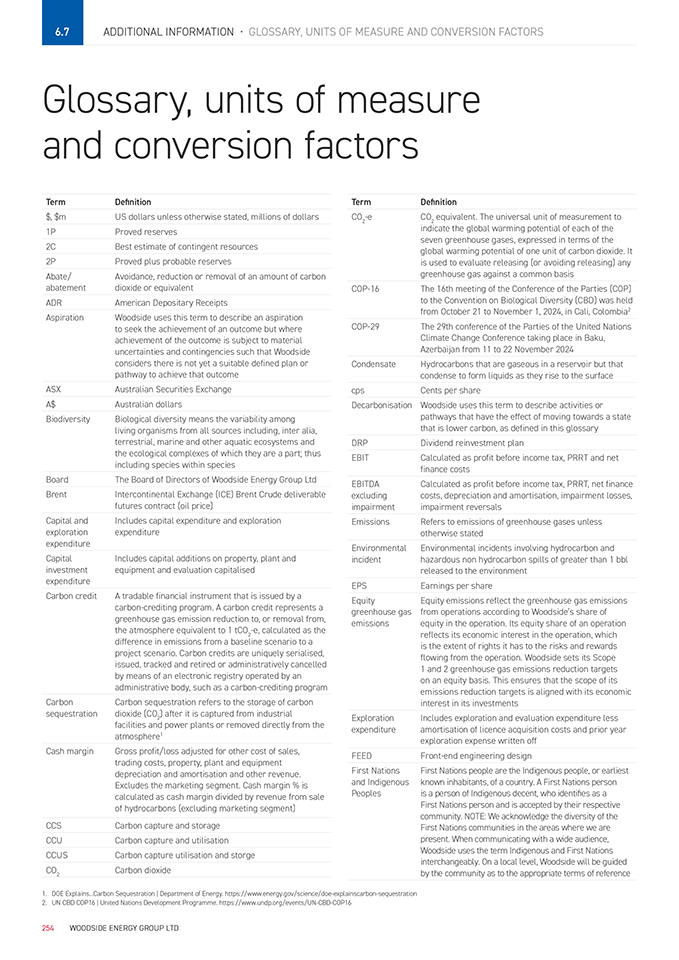

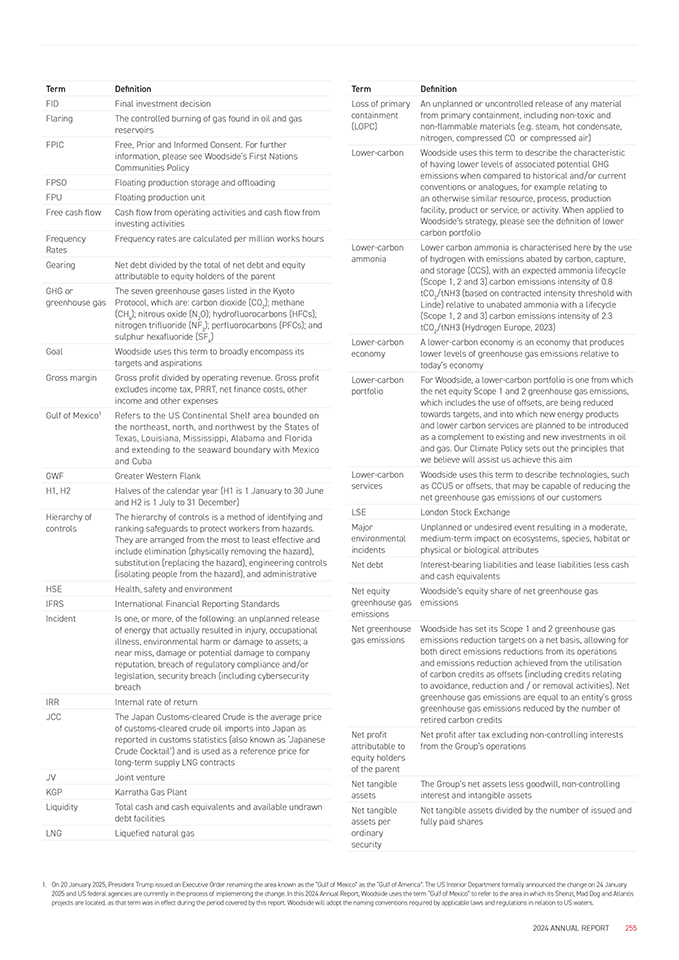

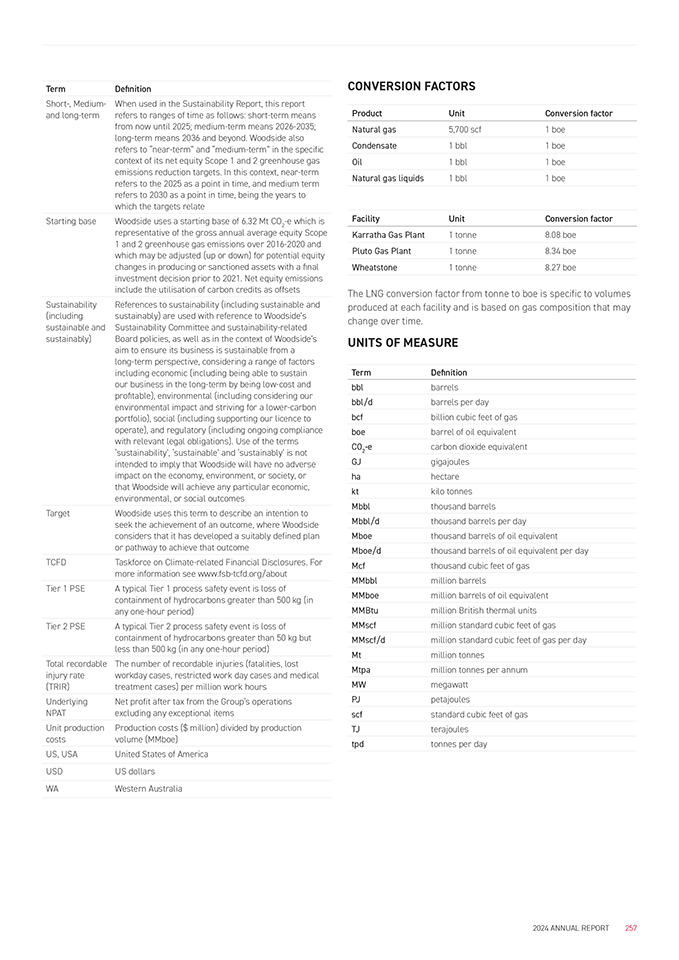

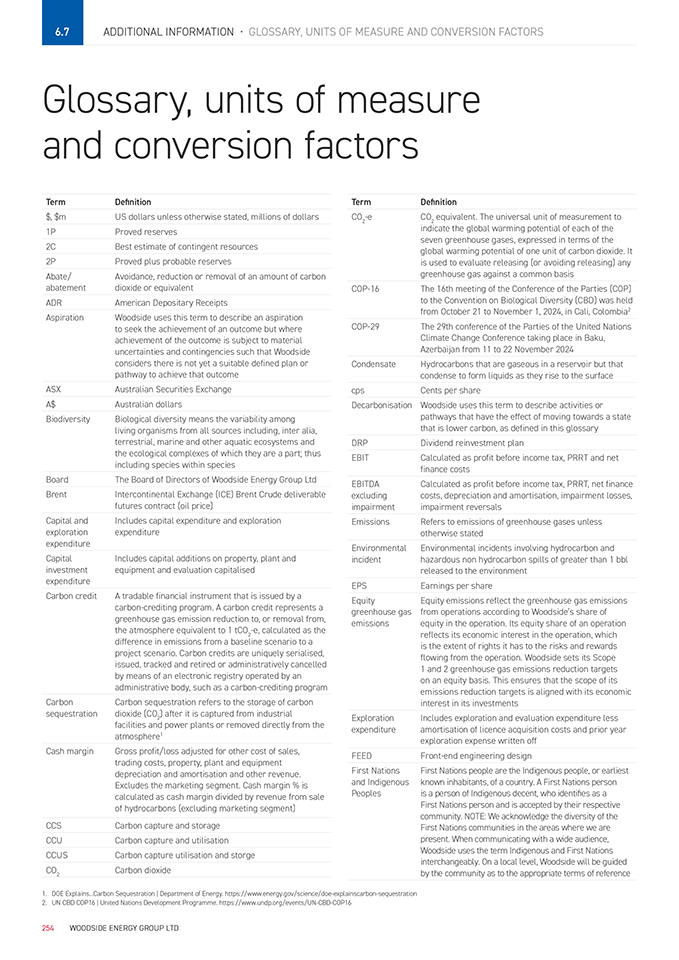

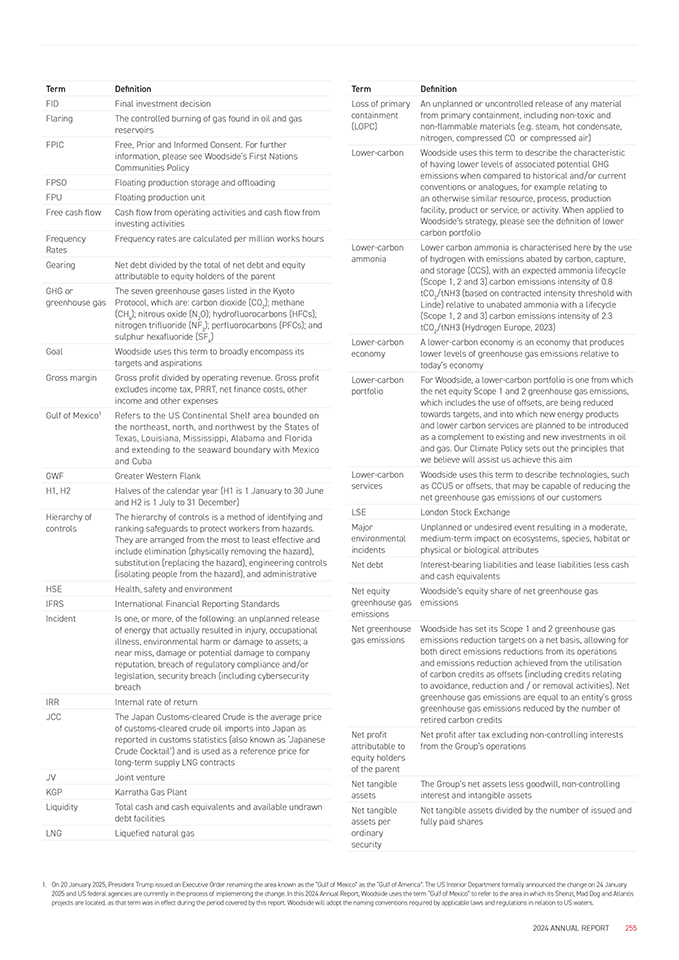

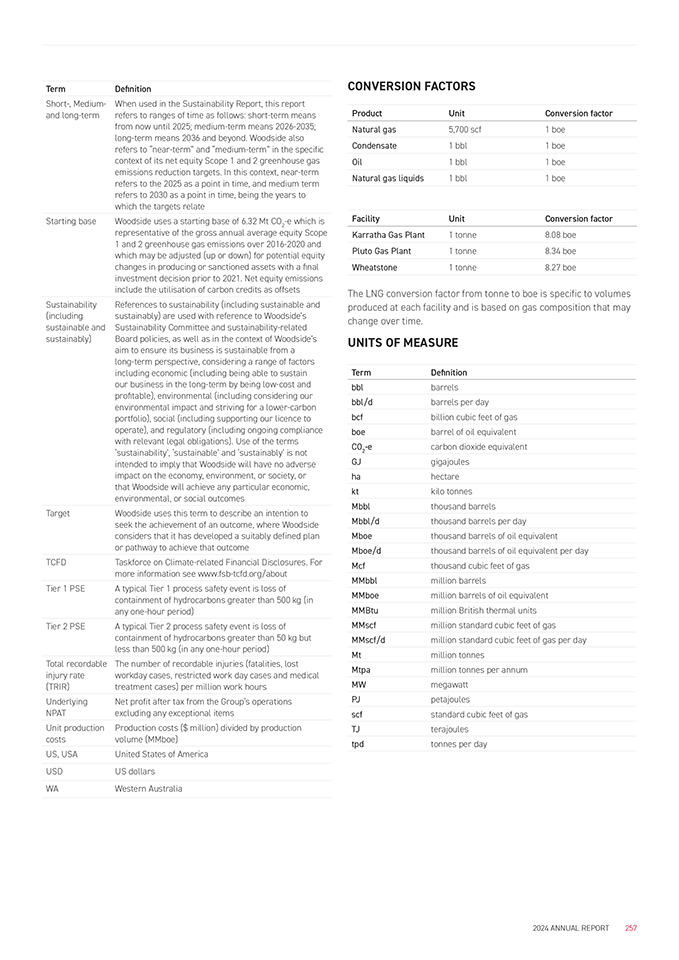

Please refer to section 6.7—Glossary, units of measure and conversion factors for definitions of terms used in this report.

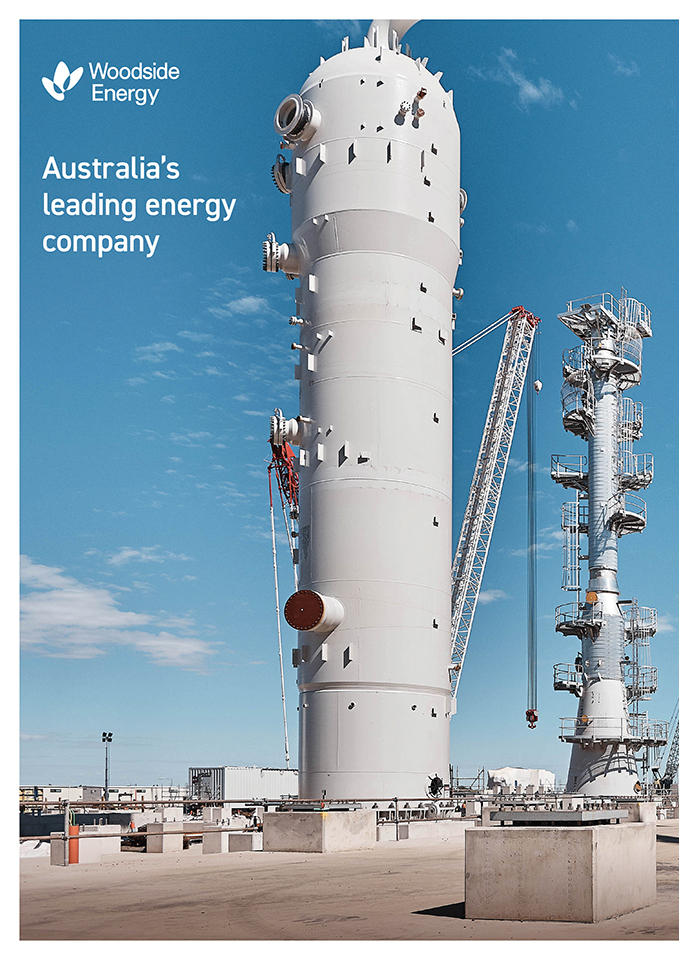

On the cover

In late 2024, the Pluto Train 2 module program was successfully completed, following the arrival of 51 modules, weighing a combined 56,000 metric tonnes.

IMPORTANT CAUTIONARY INFORMATION

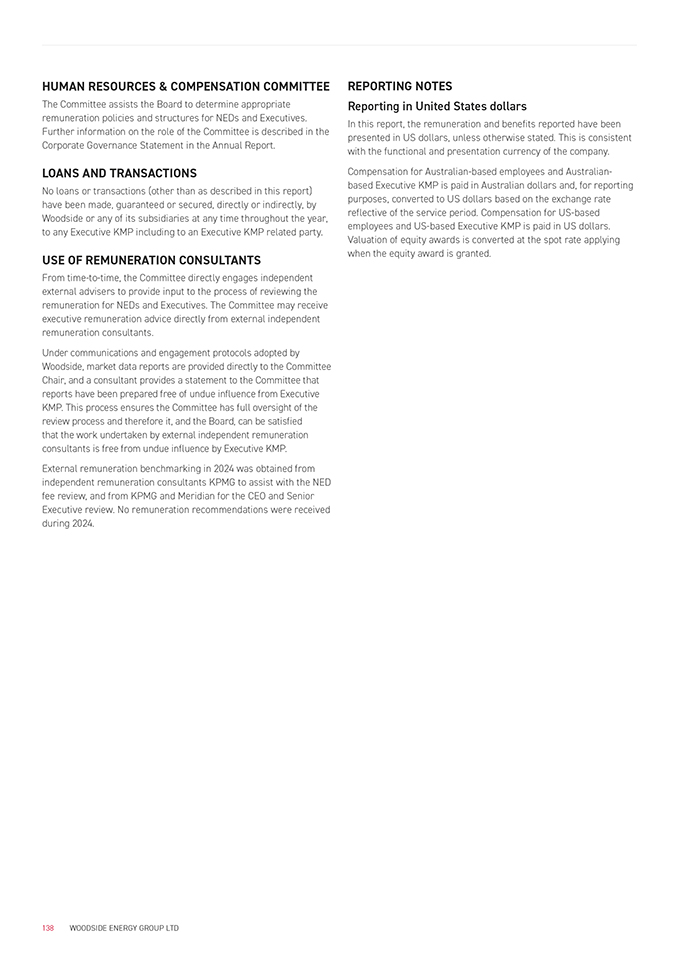

This report contains forward-looking statements, greenhouse gas emissions data, industry, market and competitive position data and Woodside’s Financial Statements. Please refer to section 6.8—Information about this report for important cautionary information relating to these matters.

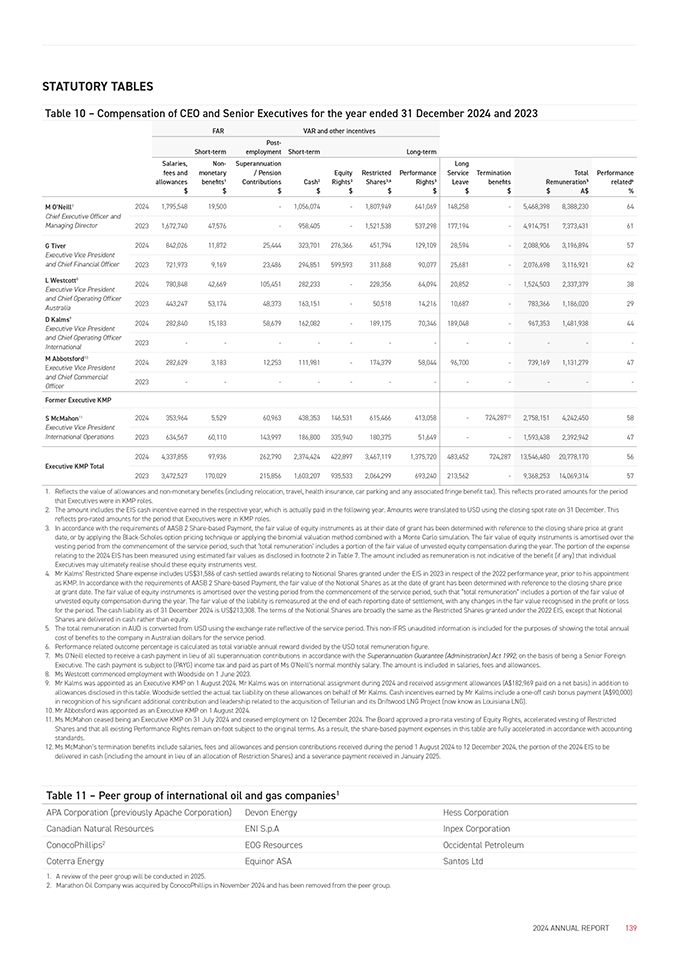

NON-IFRS MEASURES

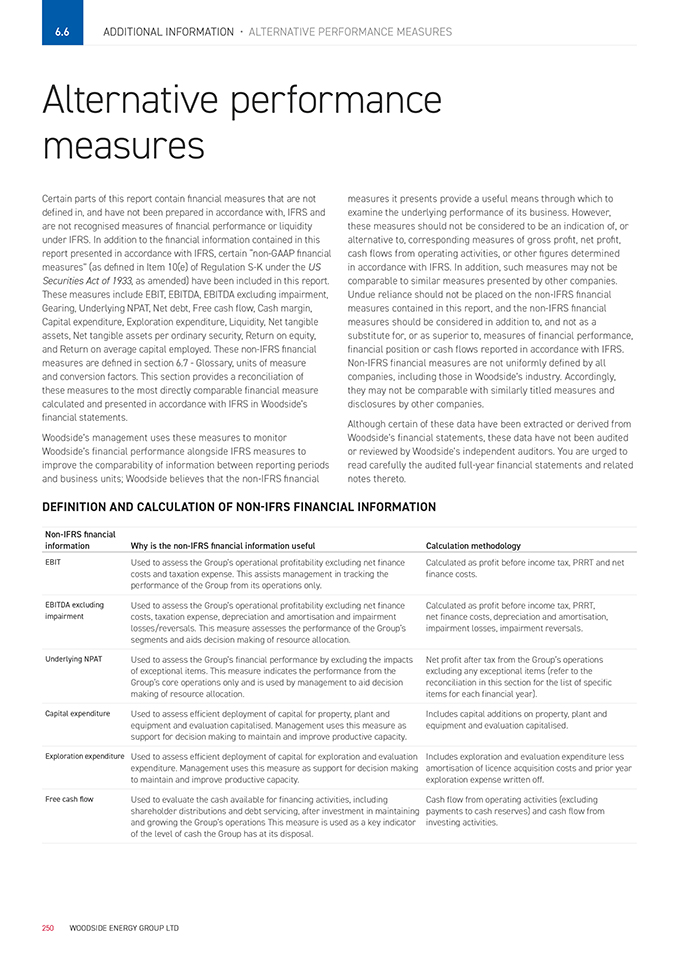

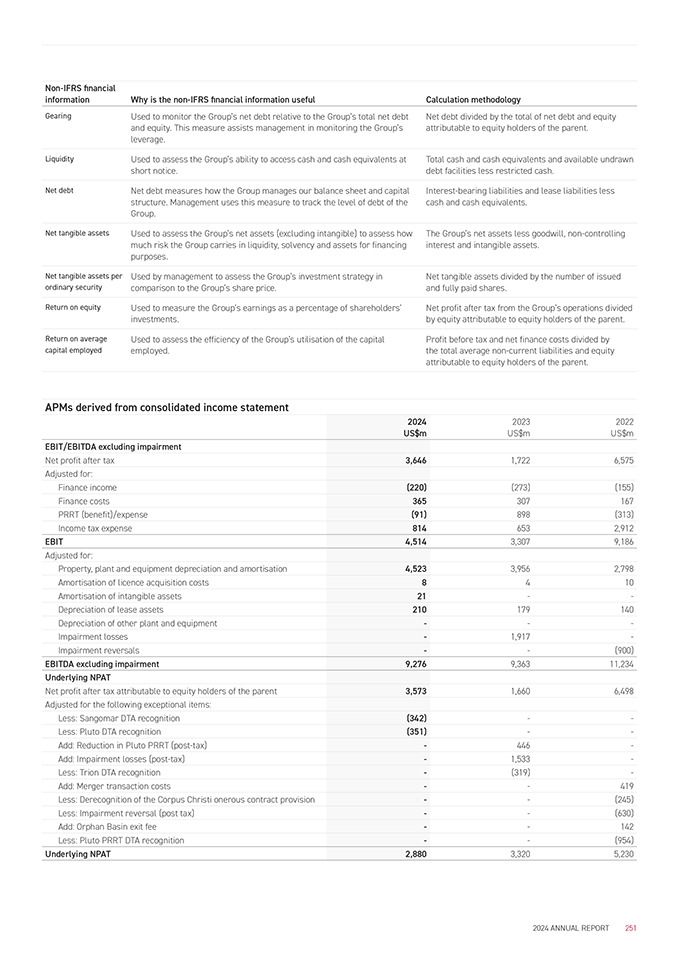

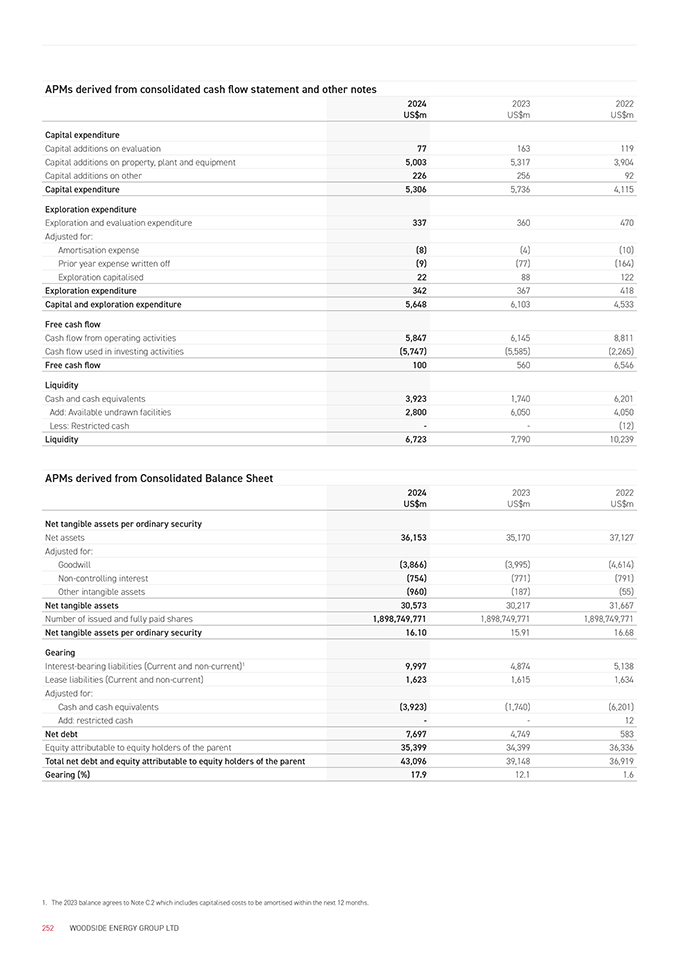

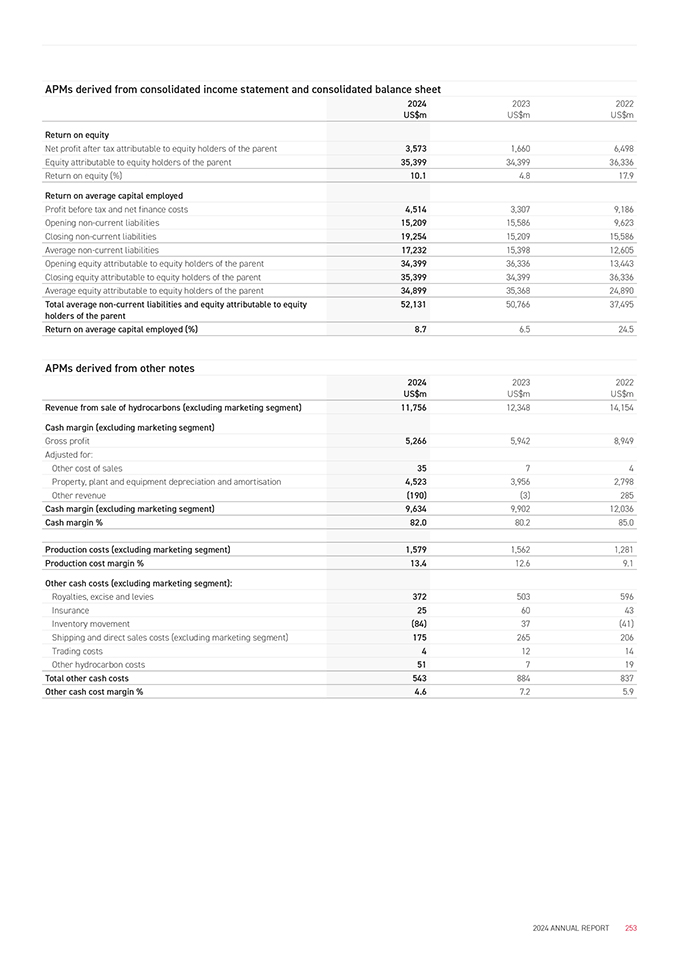

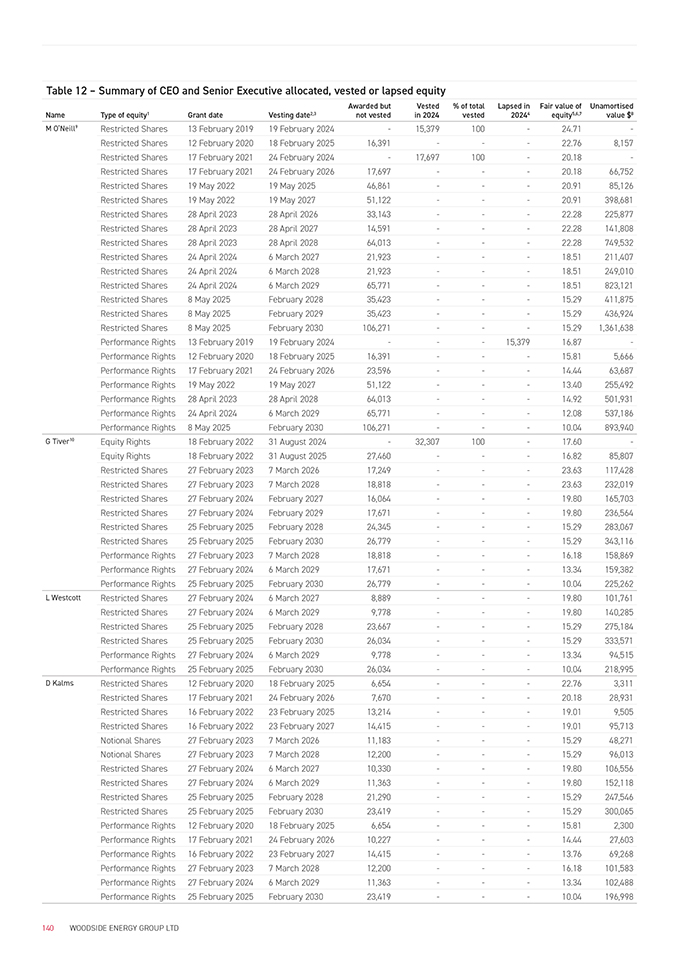

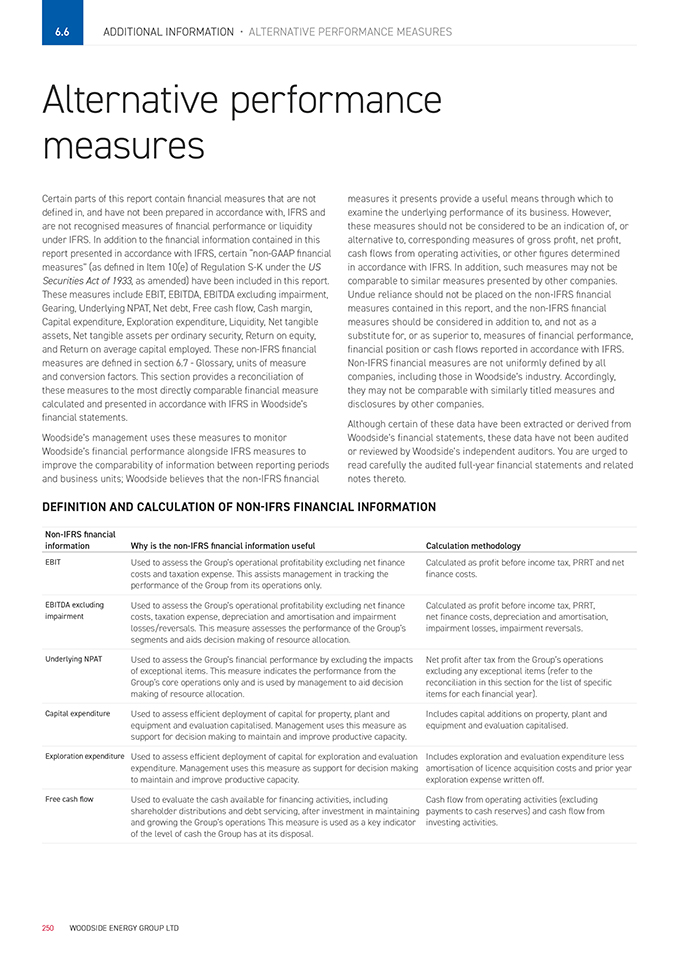

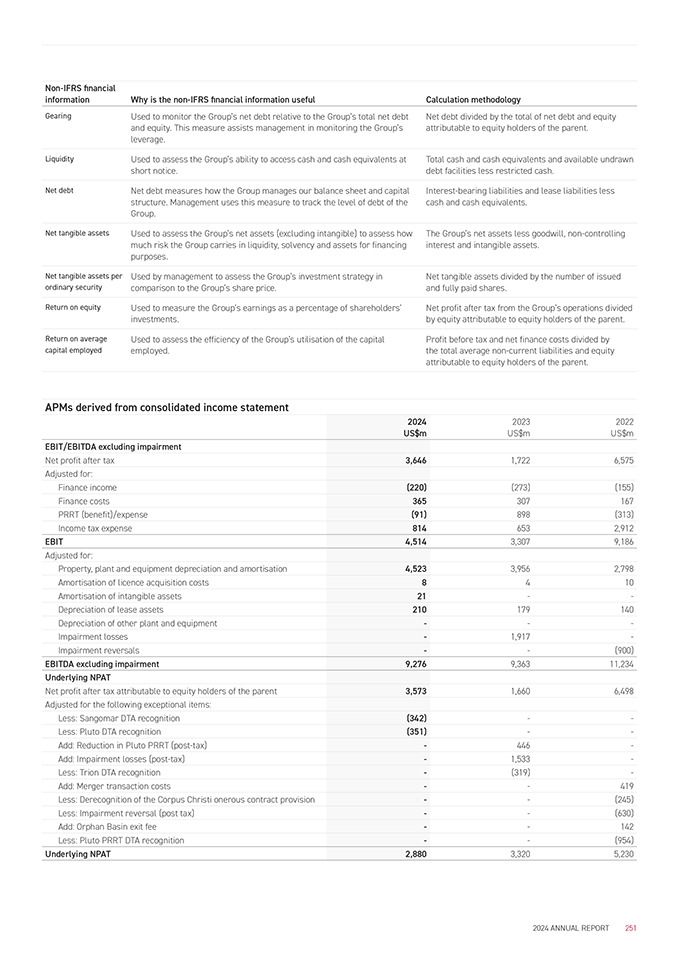

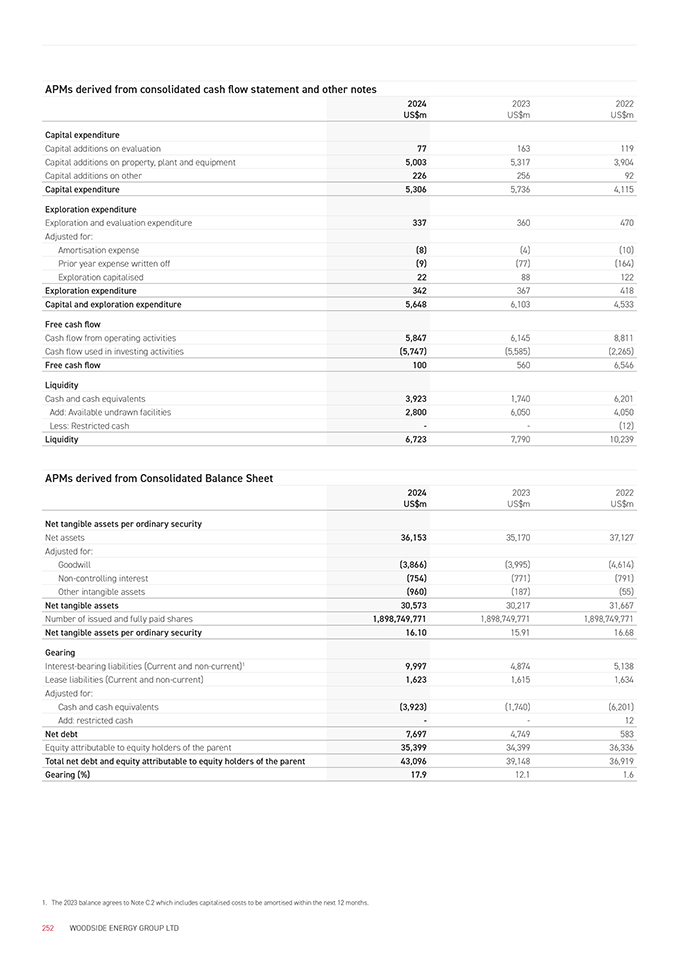

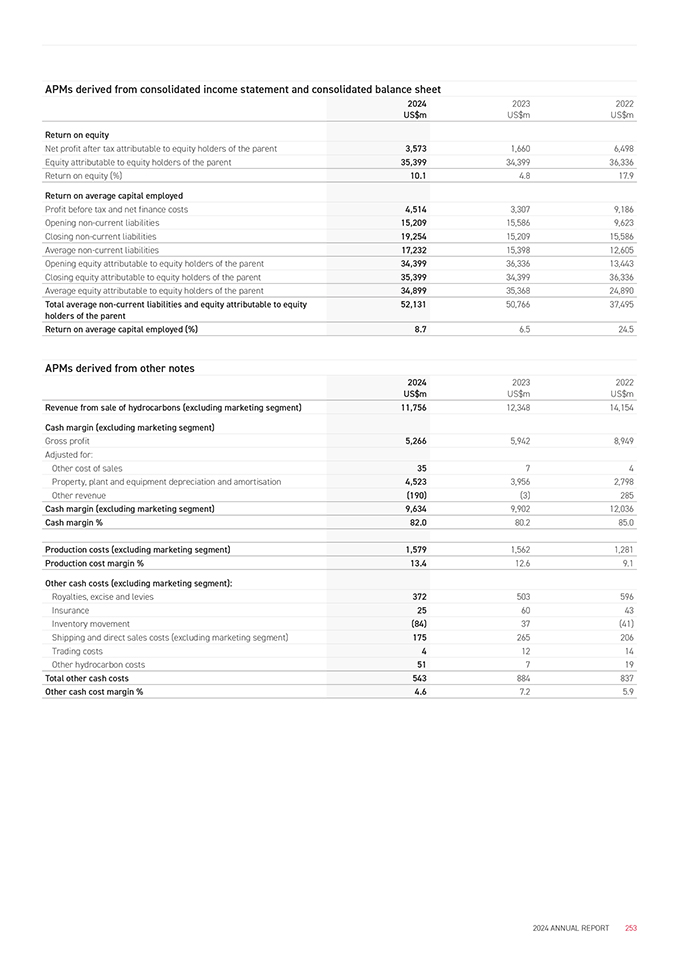

Certain parts of this report contain financial measures that have not been prepared in accordance with International Financial Reporting Standards (IFRS) and are also “non-GAAP financial measures” (as defined in Item 10(e) of Regulation S-K under the US Securities Act of 1933, as amended). Further details are available in section 6.6—Alternative performance measures for further details and a reconciliation of these measures to the most directly comparable IFRS measure presented in Woodside’s Financial Statements. These non-IFRS financial measures are defined in section 6.7—Glossary, units of measure and conversion factors.

SUSTAINABILITY

Sustainability considerations are factored into Woodside’s business activities and investment decisions. Further information regarding Woodside’s approach to sustainability and sustainability performance is included in section 3.8—Sustainability Report and the sustainability section of our website.

ACKNOWLEDGING COUNTRY

Woodside recognises Aboriginal and Torres Strait Islander peoples as Australia’s First Peoples. We acknowledge their connection to land, waters and the environment and pay our respects to ancestors and Elders, past and present. We extend this recognition and respect to First Nations peoples and communities around the world.

Significant progress on the Pluto Train 2 foundation as the Scarborough Energy Project prepares for first LNG cargo in 2026

In 2024, the Karratha Gas Plant in Western Australia celebrated 40 years of operations

Appendix 4E

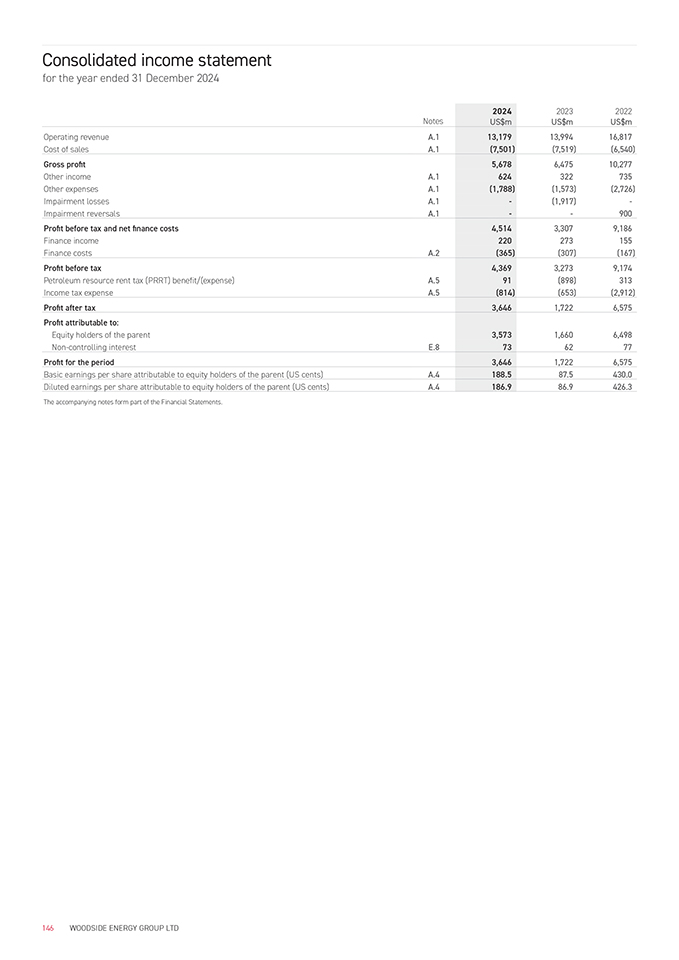

2024 2023 Results for announcement to the market

Revenue from ordinary activities Decreased 6% to US$13,179 million US$13,994 million Profit from ordinary activities after tax attributable to members Increased 115% to US$3,573 million US$1,660 million Net profit for the period attributable to members Increased 115% to US$3,573 million US$1,660 million

Dividends Amount Franked amount per security

Final dividend (US cents per share) Ordinary 53c Ordinary 53c Interim dividend (US cents per share) Ordinary 69c Ordinary 69c None of the dividends are foreign sourced

Previous corresponding period:

Final dividend (US cents per share) Ordinary 60c Ordinary 60c Interim dividend (US cents per share) Ordinary 80c Ordinary 80c

Ex-dividend date for final dividend (Australian Securities Exchange) 6 March 2025 Ex-dividend date for final dividend (New York Stock Exchange) 7 March 2025 Record date for determining entitlements to the final dividend 7 March 2025 Payment date for the final dividend 2 April 2025

31 December 2024 31 December 2023 Net tangible assets per ordinary security1,2 $16.10 $15.91

1. Includes lease assets of $1,291 million and lease liabilities of $1,623 million (2023: $1,230 million and $1,615 million) as a result of AASB 16 Leases.

2. Net tangible assets per ordinary security is a non-IFRS measure. Refer to section 6.6—Alternative performance measures for a reconciliation of these measures to Woodside’s Financial Statements.

IV WOODSIDE ENERGY GROUP LTD

Contents

1. Overview 6

1.1 About Woodside 6 1.2 2024 summary 7 1.3 Chair’s report 10 1.4 Chief Executive Officer’s report 12 1.5 Global portfolio 14

2. Strategy and Financial Performance 16

2.1 Woodside’s strategy 17 2.2 Capital management 18 2.3 Financial overview 22 2.4 Energy markets 24 2.5 Business model and value chain 25

3. Our Business 27

3.1 Australian operations 27 3.2 International operations 30 3.3 Marketing and trading 32 3.4 Projects 34 3.5 Decommissioning 36 3.6 Developments and exploration 38 3.7 New energy opportunities 41 3.8 Sustainability Report 44 3.9 Risk factors 70 3.10 Reserves and Resources Statement 82

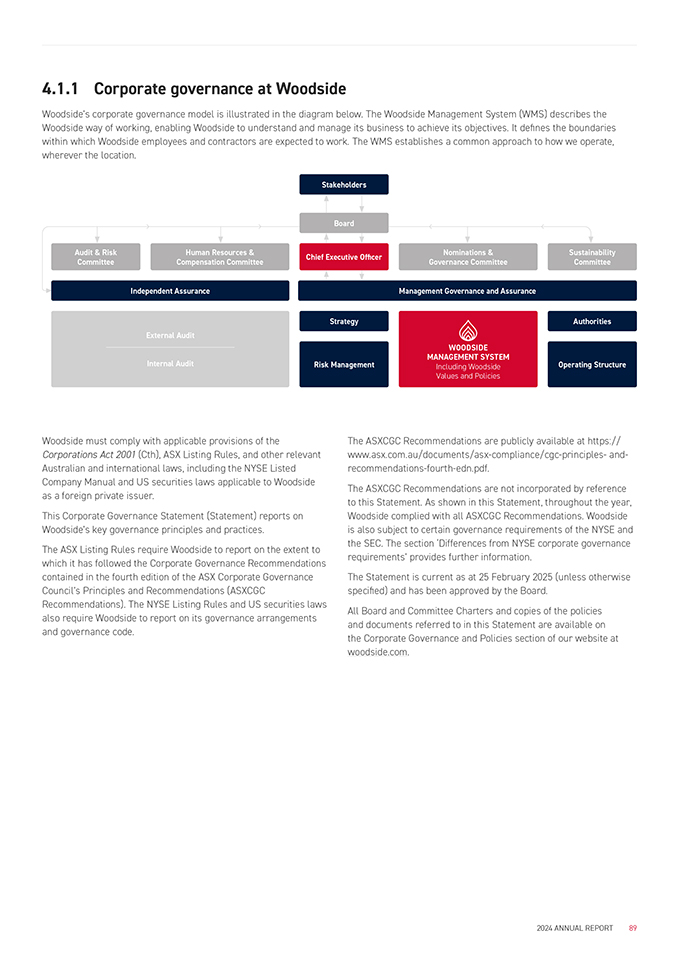

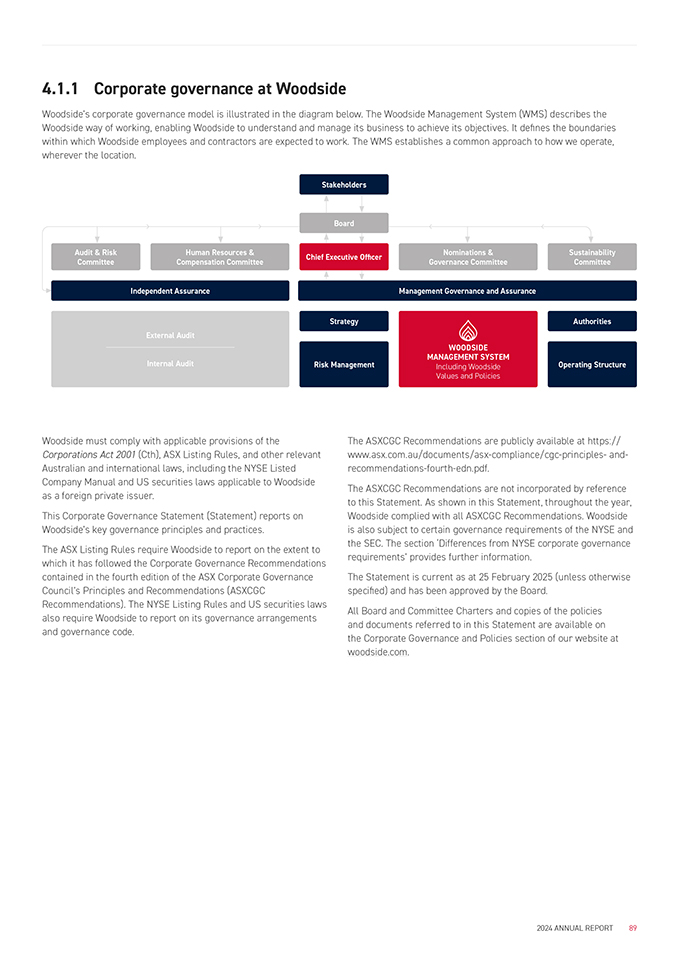

4. Governance 88

4.1 Corporate Governance Statement 88 Corporate governance at Woodside 89 Board of Directors 90 Board Committees 99 Executive Leadership Team 102 Promoting responsible and ethical behaviour 104 Risk management and internal control 106 Inclusion and diversity 108 Other governance disclosures 110 Shareholders 112 4.2 Directors’ report 113 4.3 Remuneration Report 118

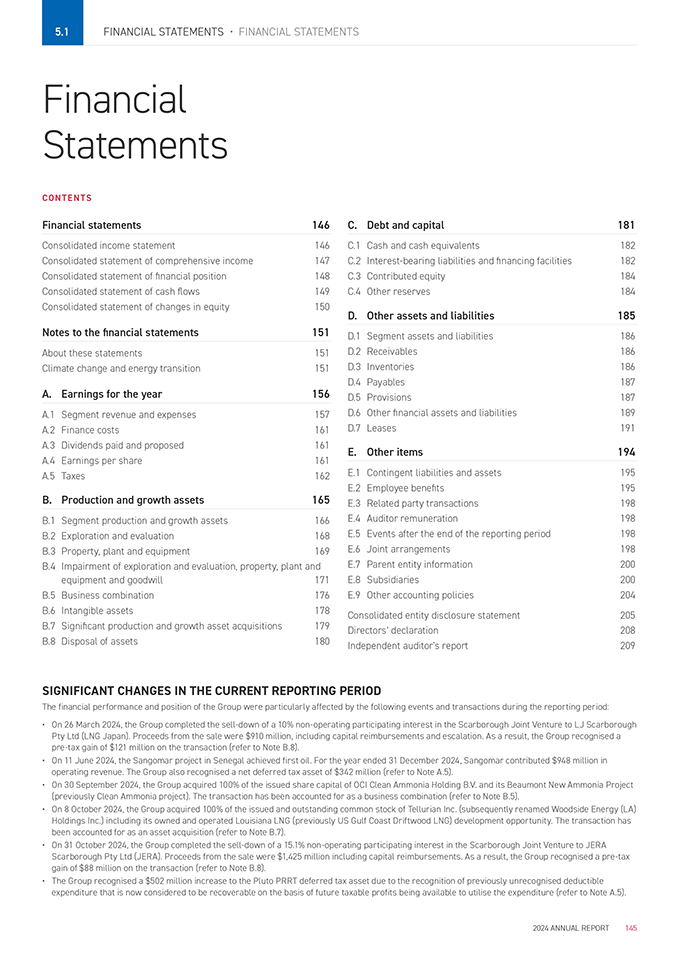

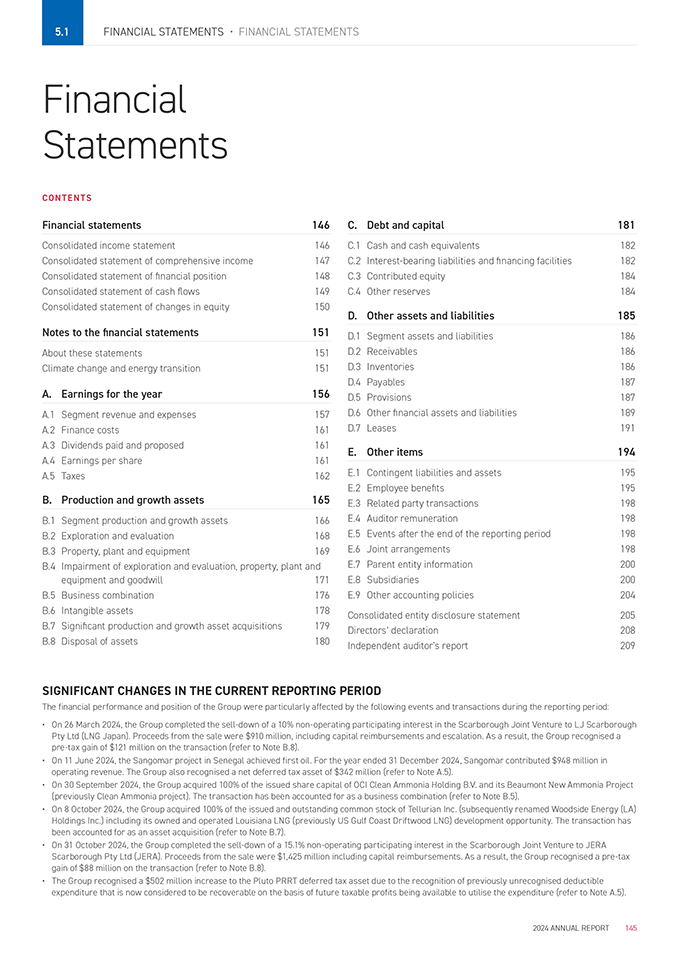

5. Financial Statements 145

5.1 Financial Statements 145

6. Additional Information 215

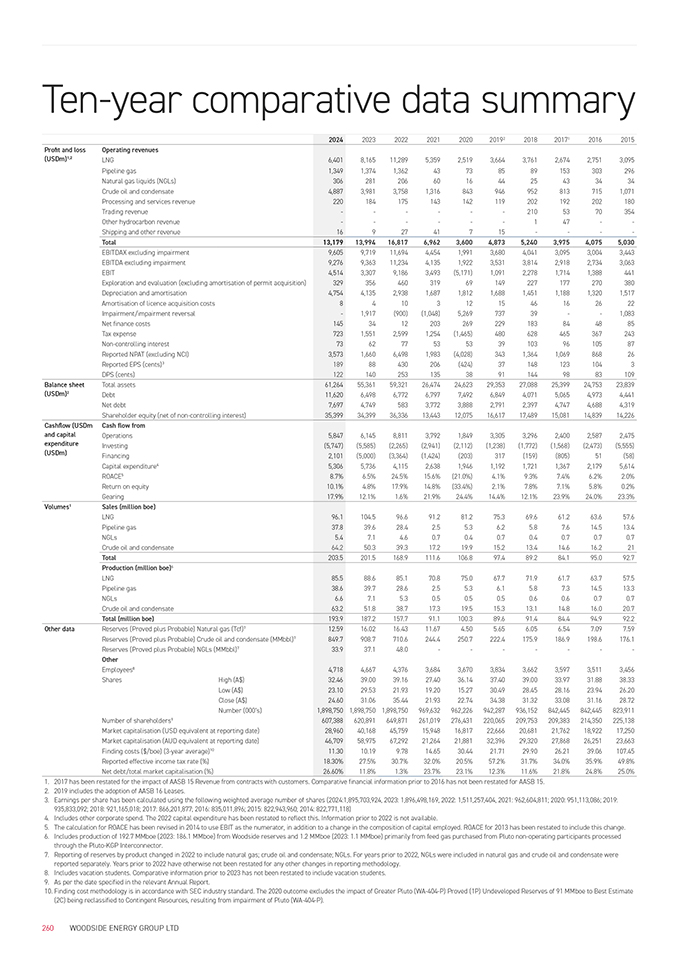

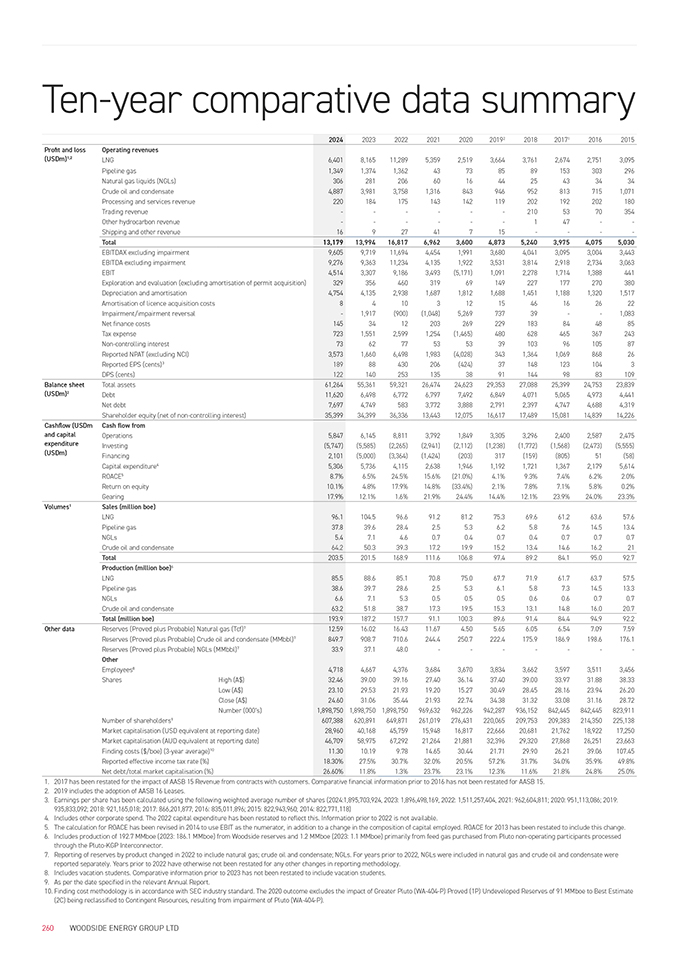

6.1 Supplementary information on oil and gas—unaudited 215 6.2 Three-year financial analysis 221 6.3 Additional disclosures 225 6.4 Shareholder statistics 238 6.5 Asset facts 246 6.6 Alternative performance measures 250 6.7 Glossary, units of measure and conversion factors 254 6.8 Information about this report 258 6.9 Ten-year comparative data summary 260

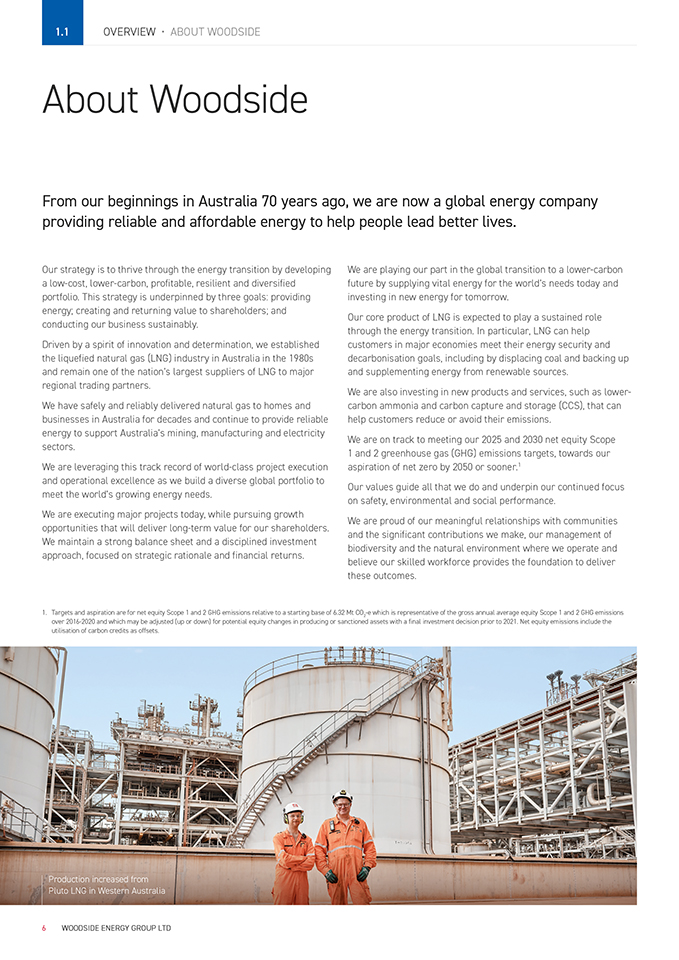

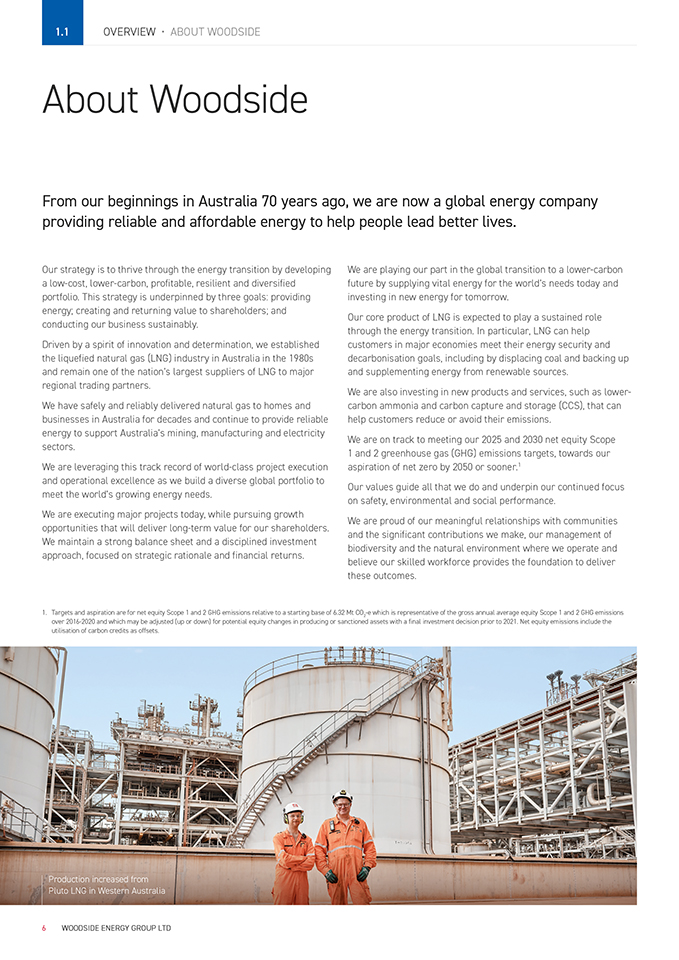

1.1 OVERVIEW • ABOUT WOODSIDE About Woodside From our beginnings in Australia 70 years ago, we are now a global energy company providing reliable and affordable energy to help people lead better lives. Our strategy is to thrive through the energy transition by developing a low-cost, lower-carbon, profitable, resilient and diversified portfolio. This strategy is underpinned by three goals: providing energy; creating and returning value to shareholders; and conducting our business sustainably. Driven by a spirit of innovation and determination, we established the liquefied natural gas (LNG) industry in Australia in the 1980s and remain one of the nation’s largest suppliers of LNG to major regional trading partners. We have safely and reliably delivered natural gas to homes and businesses in Australia for decades and continue to provide reliable energy to support Australia’s mining, manufacturing and electricity sectors. We are leveraging this track record of world-class project execution and operational excellence as we build a diverse global portfolio to meet the world’s growing energy needs. We are executing major projects today, while pursuing growth opportunities that will deliver long-term value for our shareholders. We maintain a strong balance sheet and a disciplined investment approach, focused on strategic rationale and financial returns. We are playing our part in the global transition to a lower-carbon future by supplying vital energy for the world’s needs today and investing in new energy for tomorrow. Our core product of LNG is expected to play a sustained role through the energy transition. In particular, LNG can help customers in major economies meet their energy security and decarbonisation goals, including by displacing coal and backing up and supplementing energy from renewable sources. We are also investing in new products and services, such as lower- carbon ammonia and carbon capture and storage (CCS), that can help customers reduce or avoid their emissions. We are on track to meeting our 2025 and 2030 net equity Scope 1 and 2 greenhouse gas (GHG) emissions targets, towards our aspiration of net zero by 2050 or sooner.1 Our values guide all that we do and underpin our continued focus on safety, environmental and social performance. We are proud of our meaningful relationships with communities and the significant contributions we make, our management of biodiversity and the natural environment where we operate and believe our skilled workforce provides the foundation to deliver these outcomes. 1. Targets and aspiration are for net equity Scope 1 and 2 GHG emissions relative to a starting base of 6.32 Mt CO2-e which is representative of the gross annual average equity Scope 1 and 2 GHG emissions over 2016-2020 and which may be adjusted (up or down) for potential equity changes in producing or sanctioned assets with a final investment decision prior to 2021. Net equity emissions include the utilisation of carbon credits as offsets. Production increased from Pluto LNG in Western Australia 6 WOODSIDE ENERGY GROUP LTD

1.2 OVERVIEW • 2024 SUMMARY 2024 summary NET PROFIT AFTER TAX $3.6 BILLION PRODUCTION VOLUME 194 MMBOE UNDERLYING NET PROFIT AFTER TAX1 $2.9 BILLION DIVIDENDS DETERMINED $2.3 BILLION FREE CASH FLOW1 $0.1 BILLION NET EQUITY SCOPE 1 AND 2 GHG EMISSIONS2 14% BELOW STARTING BASE DELIVERING OUR COMMITMENTS 1. Outstanding performance of world-class assets delivering safe, reliable operations 2. Exceptional startup and performance at Sangomar, achieving nameplate capacity in July 2024 3. Realised near-term value and positioned for long-term profitability through acquisition and divestment activity 4. On track to deliver our net equity Scope 1 and 2 GHG emissions reduction targets 1. This is an alternative performance measure (APM) which is a non-IFRS measure that is unaudited. Woodside believes this non-IFRS measure provides useful performance information, however it should not be considered as an indication of, or as a substitute for, statutory measures as an indicator of actual operating performance (such as net profit after tax or net cash from operating activities) or any other measure of financial performance or position presented in accordance with IFRS. For more information on non-IFRS measures, including reconciliations to Woodside’s Financial Statements, refer to section 6.6 – Alternative performance measures. 2. Targets and aspiration are for net equity Scope 1 and 2 GHG emissions relative to a starting base of 6.32 Mt CO2-e which is representative of the gross annual average equity Scope 1 and 2 GHG emissions over 2016-2020 and which may be adjusted (up or down) for potential equity changes in producing or sanctioned assets with a final investment decision prior to 2021. Net equity emissions include the utilisation of carbon credits as offsets. 2024 ANNUAL REPORT 7

CREATING VALUE We delivered a reported NPAT of $3,573 million, reflecting our strong operational performance amid a lower pricing environment. Our full-year fully franked total dividend was 122 US cps which represents approximately 80% of underlying NPAT, the top end of our targeted dividend payout range. Production 100.3 91.1 157.7 187.2 193.9 Operating revenue 6,962 3,600 16,817 13,994 13,179 2020 2021 202220232024 20202021202220232024 FINANCIAL STRENGTH Our gearing of 17.9% is within our target gearing range of 10-20%. Net debt increased in line with planned major capital expenditure and strategic acquisitions. We maintained our investment grade credit rating and ended the period with liquidity of $6.7 billion. Gearing1 24.4 21.9 12.1 17.9 Liquidity1 6,704 6,125 10,239 7,790 6,723 1.6 20202021202220232024 20202021202220232024 OUTSTANDING OPERATIONS We maintained world-class reliability LNG reliability Process safety events of 97.8% at our operated LNG assets. Our production cost decreased in 2024 as there was reduced turnaround activity. We achieved a 14% reduction in our net equity Scope 1 & 2 emissions reductions.2 97.6 97.7 98.5 98.0 97.8 Tier 1Tier 2 1 2 22 11 0 2020202120222023202420202021202220232024 1. This is an alternative performance measure (APM) which is a non-IFRS measure that is unaudited. Woodside believes this non-IFRS measure provides useful performance information, however it should not be considered as an indication of, or as a substitute for, statutory measures as an indicator of actual operating performance (such as net profit after tax or net cash from operating activities) or any other measure of financial performance or position presented in accordance with IFRS. For more information on non-IFRS measures, including reconciliations to Woodside’s Financial Statements, refer to section 6.6—Alternative performance measures. 2. Targets and aspiration are for net equity Scope 1 and 2 GHG emissions relative to a starting base of 6.32 Mt CO2-e which is representative of the gross annual average equity Scope 1 and 2 GHG emissions over 2016-2020 and which may be adjusted (up or down) for potential equity changes in producing or sanctioned assets with a final investment decision prior to 2021. Net equity emissions include the utilisation of carbon credits as offsets. 8 WOODSIDE ENERGY GROUP LTD

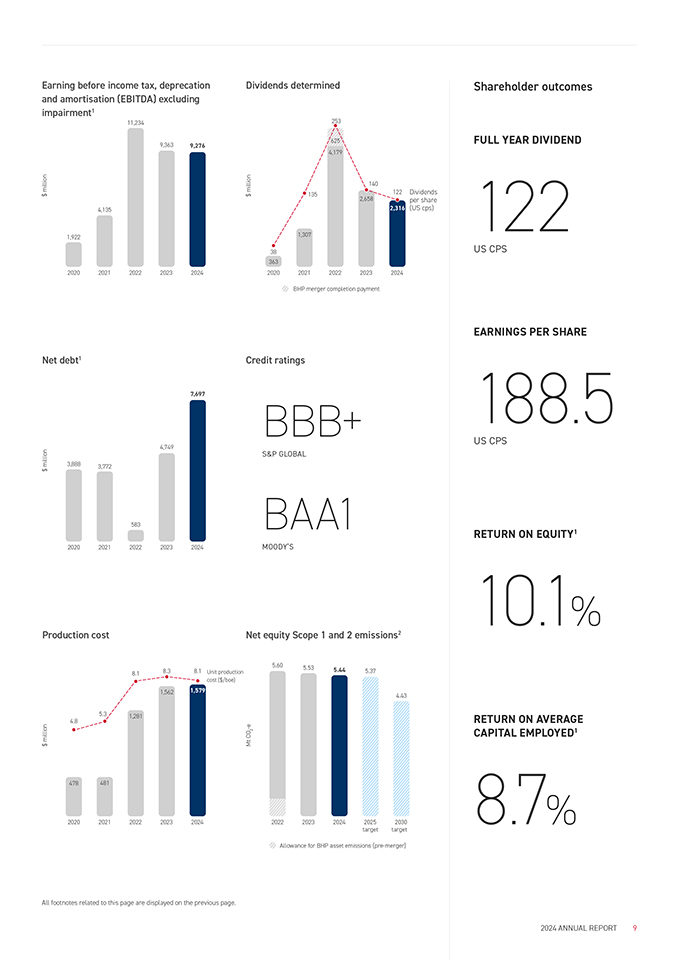

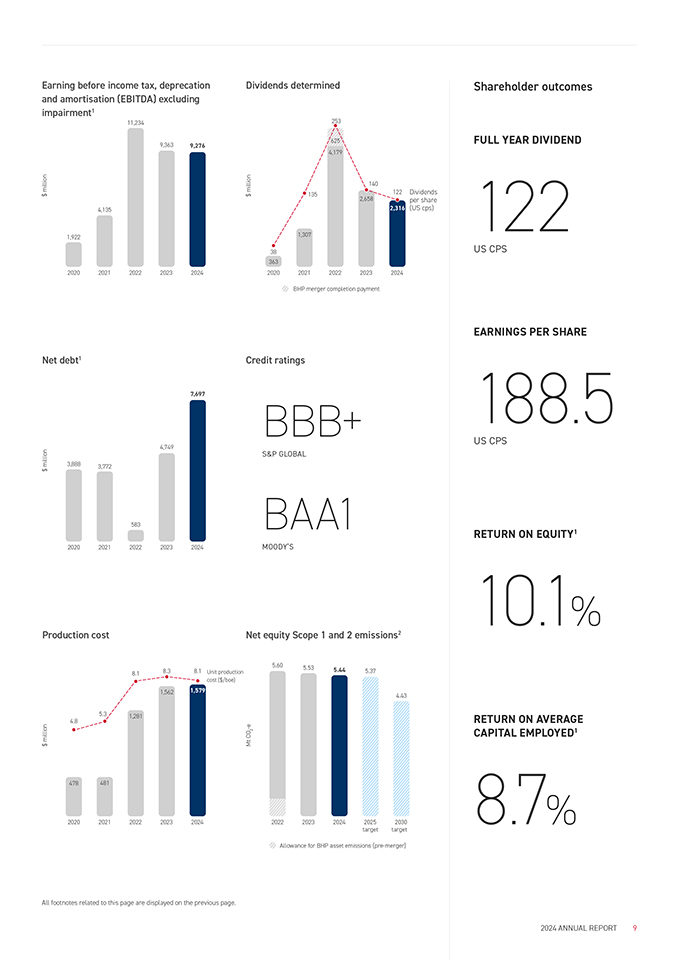

Earning before income tax, deprecation and amortisation (EBITDA) excluding impairment1 Dividends determined Shareholder outcomes 11,234 9,363 9,276 135 253 625 4,179 140 2,658 22 Dividends per share FULL YEAR DIVIDEND 122 4,135 2,316 (US cps) 1,922 38 363 1,307 US CPS 2020 2021 202220232024 20202021202220232024 BHP merger completion payment EARNINGS PER SHARE Net debt1 3,888 3,772 583 4,749 7,697 Credit ratings BBB+ S&P GLOBAL BAA1 188.5 US CPS RETURN ON EQUITY1 20202021202220232024 Production cost MOODY’S Net equity Scope 1 and 2 emissions2 10.1% 8.1 8.3 1,562 8.1 1,579 Unit production cost ($/boe) 5.60 5.53 5.44 5.37 4.43 4.8 5.3 1,281 RETURN ON AVERAGE CAPITAL EMPLOYED1 2020 2021202220232024 20222023202420252030 8.7% 478 481 targettarget Allowance for BHP asset emissions (pre-merger) All footnotes related to this page are displayed on the previous page. 2024 ANNUAL REPORT 9

1.3 OVERVIEW • CHAIR’S REPORT Chair’s report Supplying the world with reliable, affordable and lower-carbon energy is one of the great global challenges of our time. Woodside is accepting this challenge in a way that keeps our people safe, delivers value to our stakeholders and positions our business to thrive through the energy transition. Creating and returning value Our shareholders continue to benefit from the Board’s track record of disciplined investment decisions and strategic oversight of Woodside’s outstanding project delivery and operational performance. In 2024 we delivered an annual net profit after tax (NPAT) of $3.6 billion and underlying NPAT of $2.9 billion. Based on this, the Board has determined a fully franked final dividend of 53 US cents per share, resulting in a total full-year dividend of 122 US cents per share. Woodside’s success also positively impacts a broad range of stakeholders who benefit from the substantial economic and social contributions flowing from our activities. In 2024, we spent $7.9 billion globally on goods and services, including almost $5.1 billion with Australian suppliers. This provides opportunities for local businesses and generates thousands of jobs in local communities. Our strong financial performance also delivers billions of dollars in revenue to governments that underpin investments in community services and infrastructure. Since 2011, Woodside has paid more than A$22 billion in Australian taxes, royalties and levies, and on the latest Australian Government figures we are the country’s fifth-largest taxpayer. In addition, we continue to make significant voluntary social investments into local communities, highlighted by our recent A$50 million commitment to education and cultural infrastructure in Western Australia. Delivering disciplined growth The Board takes a long-term perspective to ensure Woodside can reward our shareholders today while investing in targeted, strategic opportunities to deliver growth and value creation. The decisions that translated into outstanding production performance at our Sangomar Project, and world-class execution of our Scarborough and Trion projects, are set to reward our shareholders for years to come. We are confident of similar value creation from our two major project acquisitions in 2024 – Louisiana LNG and the Beaumont New Ammonia Project. Richard Goyder, AO Chair of the Board Louisiana LNG leverages Woodside’s proven strengths in project execution, operational excellence, marketing and customer relationships to offer significant cash generation and drive long-term shareholder value. By adding a high-quality, fully permitted US LNG development option to Woodside’s portfolio, we are further strengthening our ability to serve global customers and expanding Woodside’s position as a leading independent LNG company. Beaumont New Ammonia is a competitively advantaged, de-risked investment offering strong commercial and strategic rationale. This acquisition forms the centrepiece of our new energy business, offering attractive returns that exceed our capital allocation framework and a significant contribution towards our Scope 3 investment and abatement targets. Providing energy security Through operational excellence and a growing global portfolio, Woodside provides reliable and affordable energy that underpins quality of life and supports economic prosperity. The role that gas plays in energy security and economic development for Australia and the region should not be understated – as a source of electricity and also as a feedstock for industry and essential ingredient in products we rely on in our daily lives. Gas accounted for 60% of Western Australia’s electricity generation in 2023, and provides almost 40% of the energy used by Australia’s manufacturing sector. About 50% of the gas supplied by Woodside to WA customers is used by the state’s mining industry that generates so much of Australia’s wealth. This critical role of gas will continue as Australia builds out its renewable energy network, with the Australian Energy Market Operator forecasting an additional 13 gigawatts of new gas fired electricity will be required over the next 25 years. Globally, LNG is set to play an equally important role in underpinning energy security as populations grow, living standards improve and decarbonisation goals are pursued. While alternative energy sources such as hydrogen are technically feasible, their outlook remains uncertain. In contrast, respected market forecasts show global LNG demand continuing to increase out to 2050, as developing economies seek to reduce their reliance on coal. This presents a tremendous opportunity for secure, reliable LNG suppliers such as Woodside to support regional energy security. 10 WOODSIDE ENERGY GROUP LTD

Woodside Chair Richard Goyder travelled to Senegal in October 2024 to meet with his Excellency, President Bassirou Diomaye Faye, and discuss our partnership in developing the Sangaomar field, which quickly achieved nameplate production capacity of 100,000 barrels of oil per day For example, switching 20 per cent of Asia’s coal-fired power stations to gas would require 310 billion cubic metres of gas per year—roughly three times the volume of Australia’s annual LNG exports. According to S&P Global Commodity Insights analysis, this fuel source switch would also reduce carbon emissions by an estimated 680 million tonnes a year. Supporting a stable energy transition For these reasons, we are confident in an ongoing role for Woodside’s products through the energy transition. We believe the diverse global portfolio we are building today will stand the test of time and deliver enduring shareholder value. While the precise nature of the energy transition is uncertain, we do know that demand for reliable, affordable, and increasingly lower-carbon energy will continue as populations increase and economies develop. Importantly, Woodside does not seek simple solutions to the complex challenge of climate change. We continue to develop a considered, pragmatic and action-oriented approach to successfully navigate the energy transition. We only commit to targets where we have identified a viable pathway to achieving them. Our core product of LNG is well suited for the world’s current and future energy needs because it is flexible, reliable and lower-carbon than coal when used for power generation. At the same time, we are developing new products and services our customers will need to decarbonise, such as lower-carbon ammonia and carbon capture and storage. The Board recognises the complexity of the energy transition, its potential impacts on our business and the diverse views of our investors. We take very seriously the concerns expressed through our shareholder vote on Woodside’s Climate Transition Action Plan. While confident in our strategy and proud of our progress, we will continue to engage deeply and frequently with all investors to ensure your feedback informs our approach. Providing strong leadership During 2024 Woodside continued to refresh its Board membership to ensure the company’s strategic leadership and governance capabilities keep pace with our growing global footprint and broader range of business activities. We were pleased to welcome Ashok Belani and Tony O’Neill as Non-Executive Directors, bringing new experience and expertise in areas including decarbonisation and sustainability. The Board will continue our focus on succession planning. We will maintain the right balance of skills and experience to provide the corporate governance and strategic oversight that our shareholders rightly expect. In this regard, I would like to thank former Directors Frank Cooper and the late Gene Tilbrook for their outstanding and dedicated service to Woodside. You have my assurance that I will continue, and wherever possible expand, my engagement with shareholders, to ensure we continue to meet your expectations as a successful and responsible energy company. I would like to thank the entire Woodside leadership team for another outstanding year. Reflecting on our proud history and achievements during our 70-year milestone, the Board has never been more confident in Woodside’s ability to deliver reliable, affordable and lower-carbon energy to a world that needs it today and into the future. Richard Goyder, AO Chair of the Board 25 February 2025 2024 ANNUAL REPORT 11

1.4 OVERVIEW • CHIEF EXECUTIVE OFFICER’S REPORT Chief Executive Officer’s report Seventy years after our founding, Woodside’s determination to provide energy the world needs while delivering value for our shareholders is stronger than ever. Our outstanding performance in 2024 was underpinned by operational excellence, financial discipline, world-class project delivery and strategic partnerships. We also took transformative decisions during the year that set the foundations for Woodside’s next chapter of growth and value, supporting our strategy to thrive through the energy transition. Safety remains our priority The death in October 2024 of an OCI contractor employee at our Beaumont New Ammonia Project is a painful reminder of the need for constant vigilance and continuous improvement in our safety performance. We are taking action to strengthen our safety culture, simplify our processes and improve our systems. While these initiatives are aimed at sustainable improvement in our safety performance, we are already seeing some positive results. With more than 23 million exposure hours worked across our global activities in 2024, we did not record any Tier 1 safety events or permanent injuries. The outstanding safety record achieved at our Sangomar Project and during delivery of the Pluto Train 2 modules also shows what we are capable of and sets the required standard for Woodside going forward. Outstanding operations performance World-class operating performance across our global assets delivered record full-year production of 194 million barrels of oil equivalent in 2024, at the top end of our guidance range. We matched increased production with greater efficiency, generating strong operating revenue and cash flow. We reduced our overall unit production cost to $8.1 per barrel of oil equivalent, an outstanding result in an inflationary environment. A highlight of 2024 was the production ramp-up at Sangomar, which achieved nameplate capacity of 100,000 barrels within weeks of start-up. Reliability reached 94% during the fourth quarter of 2024, with cargoes delivered to buyers in Europe, Asia and the US. Our operated Australian LNG projects continued their world-class performance with reliability maintained at 98%, among the highest reported globally across the sector. Meg O’Neill Chief Executive Officer and Managing Director Delivering for customers This track record of operational excellence ensures Woodside remains a supplier of choice for major energy customers in the region. During 2024 Woodside signed three agreements for the long-term sale of LNG to customers in Japan, Korea and Taiwan. These agreements demonstrate the value that regional energy customers place on security and certainty of supply, and the ongoing role of LNG in balancing our customers’ energy security and decarbonisation needs. In Australia, we remain a key supplier of reliable and affordable energy to homes and businesses. During the year we made extra supplies of domestic gas available, supporting energy security and meeting ongoing customer demand. This included executed sales of 77 Petajoules (Pj) for delivery across 2025 and 2026 in east coast Australia for local manufacturing, agribusiness and energy retailers. In Western Australia, we executed domestic gas sales of 73 Pj for delivery across 2025 and 2026 to mining, industrial and retail energy customers. With ongoing robust LNG demand forecast for the Asia Pacific region, and near-term structural shortfalls in gas supply forecast for both the east coast and Western Australian markets, Woodside will continue to be a reliable supplier of energy to support local and regional energy security. Project execution for long-term value During 2024 we made significant progress on major projects to deliver Woodside’s next wave of growth and shareholder value. The Scarborough Energy Project in Western Australia was 78% complete at year-end and remains on track for first LNG cargo in 2026. Major milestones achieved during the year included delivery and installation of all 51 Pluto Train 2 modules, and installation of the 433 km offshore trunkline. We also welcomed LNG Japan and JERA as participants in the Scarborough Joint Venture, demonstrating our ability to attract quality, strategic partners to our world-class projects. At our Trion Project offshore Mexico, we transitioned into the construction phase with work commencing on the offshore floating production unit. Trion was 20% compete at year-end, and is on track for first oil in 2028. 12 WOODSIDE ENERGY GROUP LTD

Woodside CEO and Managing Director Meg O’Neill said 2024 was a year of significant progress at the Pluto Train 2 site, with all 51 modules arriving safely and being set by year end We are leveraging these proven project execution and partnering capabilities to generate long-term value from our Louisiana LNG Project acquired in 2024. Louisiana LNG is a game-changing acquisition for Woodside, positioning us as a global LNG powerhouse with greater capacity to meet customer demand across both the Pacific and Atlantic basins. We are working towards readiness for a final investment decision on the 16.5 million tonne per annum foundation development from the first quarter of 2025, and focused on bringing quality strategic partners into this value-creating opportunity. During 2024 we also acquired the Beaumont New Ammonia Project, providing early mover advantage in the growing global market for lower-carbon ammonia. We are targeting first ammonia production in the second half of 2025 and lower-carbon ammonia production in the second half of 2026. We anticipate cost-efficient production from the project, enabling healthy margins and attractive returns once we hit steady state production in 2027. We also streamlined our Australian LNG portfolio with a focus on high-value operating assets, including an agreement to increase our equity interest in the North West Shelf Project to generate near- term cash flow while unlocking future development opportunities. Focus on sustainability Conducting our business sustainably underpins our strategy to thrive through the energy transition. Managing carbon emissions is a fundamental part of operating our assets, with 30 projects approved or implemented during the year to reduce or avoid Scope 1 and 2 emissions. We are firmly on track to meet our net equity Scope 1 and 2 emissions reduction targets, which were 14% below the starting base at year end. We also took a step-change towards achieving our Scope 3 investment and abatement targets through our acquisition of Beaumont New Ammonia. Strong and trusted relationships in the communities where we live and work, including careful management of cultural heritage and environmental impacts, are fundamental to our business. Our 2024 performance demonstrated again that when Woodside performs well, local economies and communities benefit. We paid A$4.1 billion in taxes, royalties and levies payments to Australian governments and were pleased to inject more than $7.9 billion into local economies during 2024, generating thousands of local jobs and supplier opportunities. Our total social contribution spend of A$35.4 million included community investments across our expanding global footprint, ranging from education programs in Trinidad & Tobago and Mexico to sustainable waste management in Senegal. We also revised our leadership structure during 2024 to build greater alignment with Woodside’s strategic priorities and support our evolution into a global business. With our leaders setting the example, we are building a culture at Woodside that values inclusion, flexibility and enabling everyone to perform to their best. As we position Woodside for future success, I could not be prouder of the Woodside team’s performance and the role we play in delivering reliable, affordable and lower-carbon energy to help people lead better lives. Meg O’Neill Chief Executive Officer and Managing Director 25 February 2025 2024 ANNUAL REPORT 13

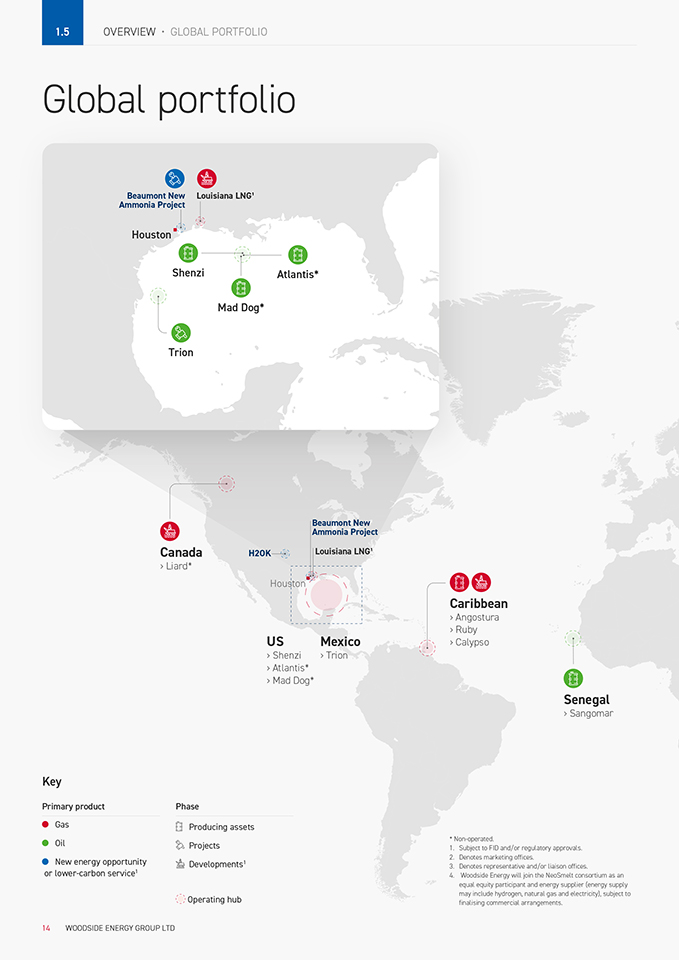

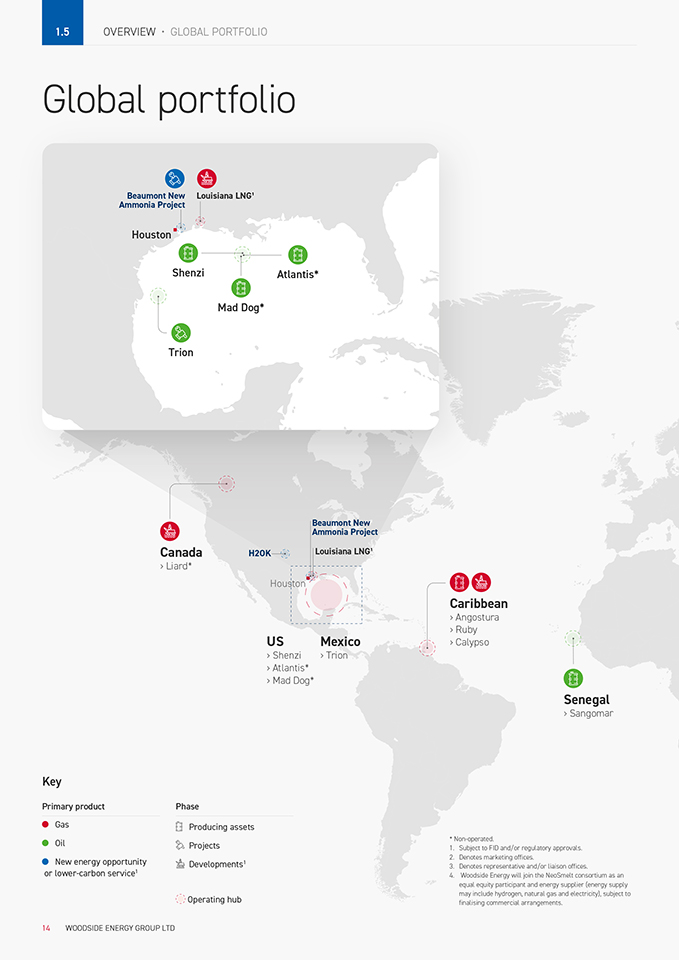

OVERVIEW • GLOBAL PORTFOLIO Global portfolio Beaumont New Louisiana LNG’ Ammonia Project Houston . , ‘ fD ‘‘I fD ShenziAtlantis* fD Mad Dog* Trion r a Canada > Liard* B a i \ct H2QK—--4 ,Louisiana LNG’— ————--1—’’ fiG Houston !/ ‘ \! ‘I us > Shenzi >Atlantis* >Mad Dog* I ———— ‘ Mexico >Trion Caribbean >Angostura >Ruby >Calypso fD Senegal > Sangomar Key Primary productPhase e Gasu Producing assets e Oil e New energy opportunity or lower-carbon service’ Q, Projects Developments’ Operating hub * Non-operated I SubJect to FlO and/or regulatory approvals 2 Denotes marketing offices 3 Denotes representative and/or liaison offices 4 Woodside Energy will join the NeoSmelt consortium as an equal equ1ty part1c1pant and energy supplier (energy supply may include hydrogen, natural gas and electricity), subject to finalising commercial arrangements 14 WOODSIDE ENERGY GROUP LTD

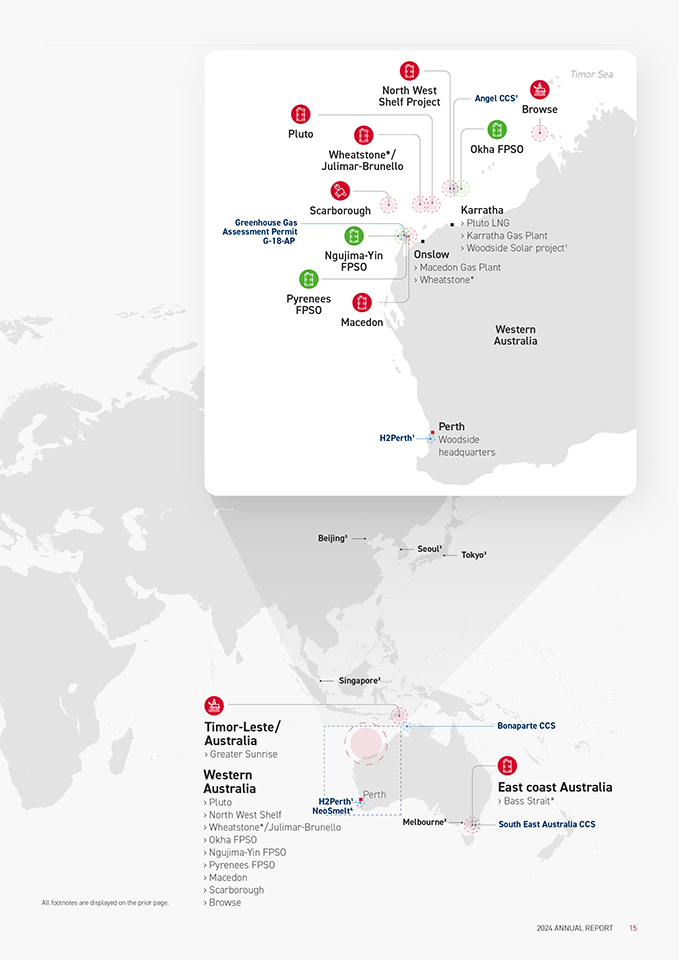

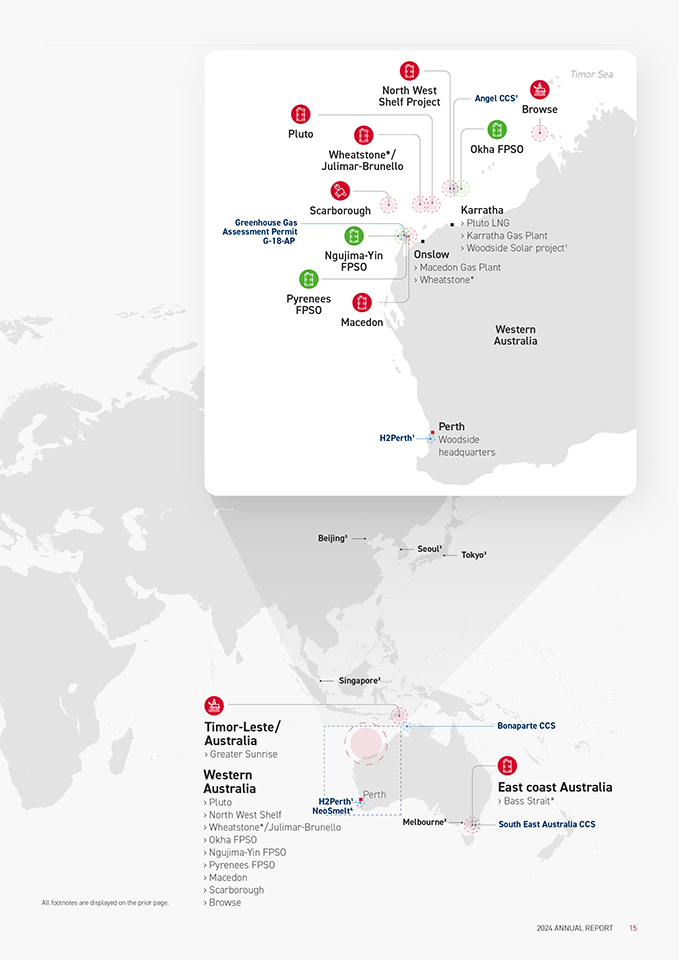

fD Pluto fD North West Shelf Project fD Angel CCS’ Browse Timor Sea Wheatstone* I Julimar-Brunello _ / Scarborough ‘, ; Greenhouse Gas ———— Assessment Permit .1;·; \ G-18-AP W’·’’-’ ·’ • Karratha • > Pluto LNG > Karratha Gas Plant >Woodside Solar proJect’ Ngujima-Yin FPSO Pyrenees FPSOW Macedon Onslow > Macedon Gas Plant >Wheatstone* Western Australia Perth H2Perth’ Woodside headquarters Beijing’ Singapore’ Seoul’ .. Tokyo’ Timor-Leste/ ;——-7 _ -:_ _ —-·—,’—.· ——— Bonaparte CCS l- Australia >Greater Sunrise :( \: I- /: :‘uesa iPerth: East coast Australia > PlutoH:2Perth’.L!’ ,:>Bass Stra1t* > North West ShelfNeoSmelt• All footnotes are displayed on the prior page >Wheatstone*/Juli mar-Brun-l > Okha FPSO > NguJima-Yin FPSO > Pyrenees FPSO >Macedon > Scarborough >Browse ——————Melbourne’, ‘ :::——— South East Australia CCS 2024 ANNUAL REPORT 15

STRATEGY AND FINANCIAL PERFORMANCE Woodside continues to deliver value for our stakeholders. 16

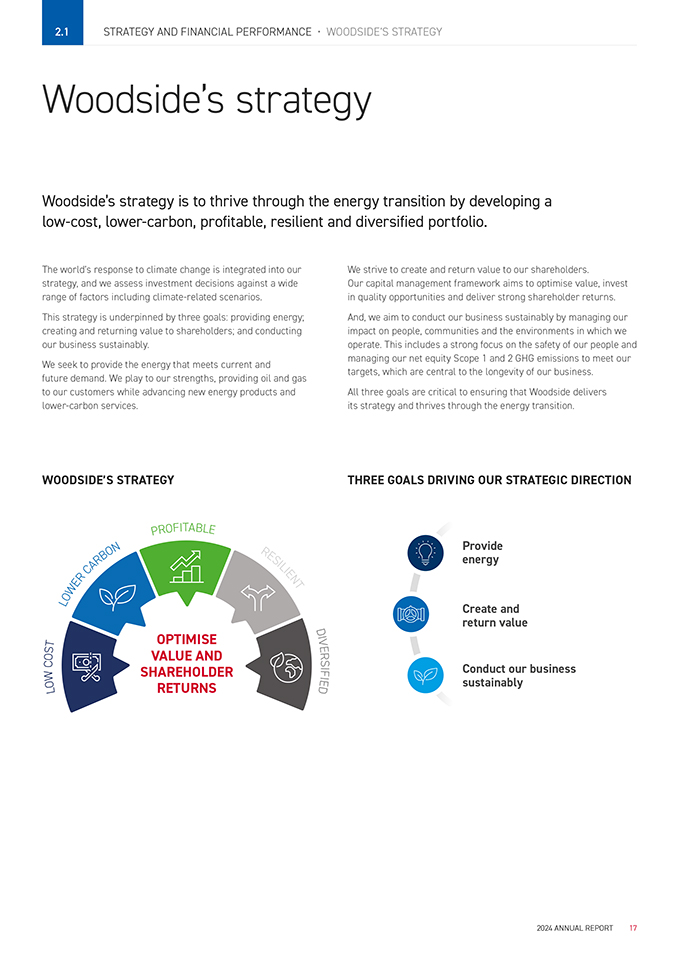

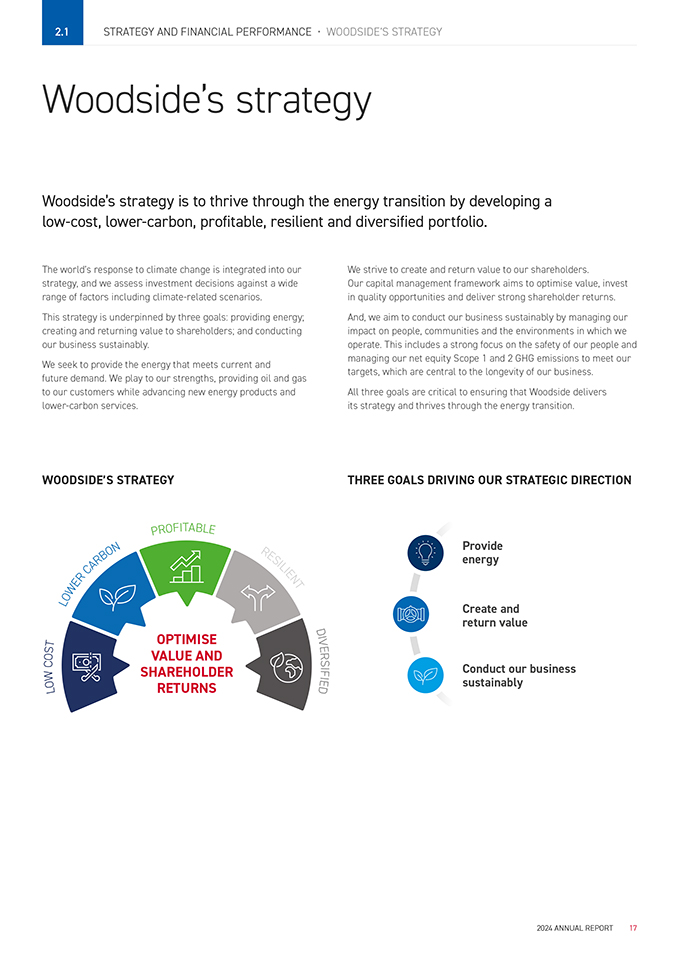

2.1 STRATEGY AND FINANCIAL PERFORMANCE • WOODSIDE’S STRATEGY Woodside’s strategy Woodside’s strategy is to thrive through the energy transition by developing a low-cost, lower-carbon, profitable, resilient and diversified portfolio. The world’s response to climate change is integrated into our strategy, and we assess investment decisions against a wide range of factors including climate-related scenarios. This strategy is underpinned by three goals: providing energy; creating and returning value to shareholders; and conducting our business sustainably. We seek to provide the energy that meets current and future demand. We play to our strengths, providing oil and gas to our customers while advancing new energy products and lower-carbon services. We strive to create and return value to our shareholders. Our capital management framework aims to optimise value, invest in quality opportunities and deliver strong shareholder returns. And, we aim to conduct our business sustainably by managing our impact on people, communities and the environments in which we operate. This includes a strong focus on the safety of our people and managing our net equity Scope 1 and 2 GHG emissions to meet our targets, which are central to the longevity of our business. All three goals are critical to ensuring that Woodside delivers its strategy and thrives through the energy transition. WOODSIDE’S STRATEGY THREE GOALS DRIVING OUR STRATEGIC DIRECTION Provide energy OPTIMISE VALUE AND SHAREHOLDER RETURNS Create and return value Conduct our business sustainably 2024 ANNUAL REPORT 17

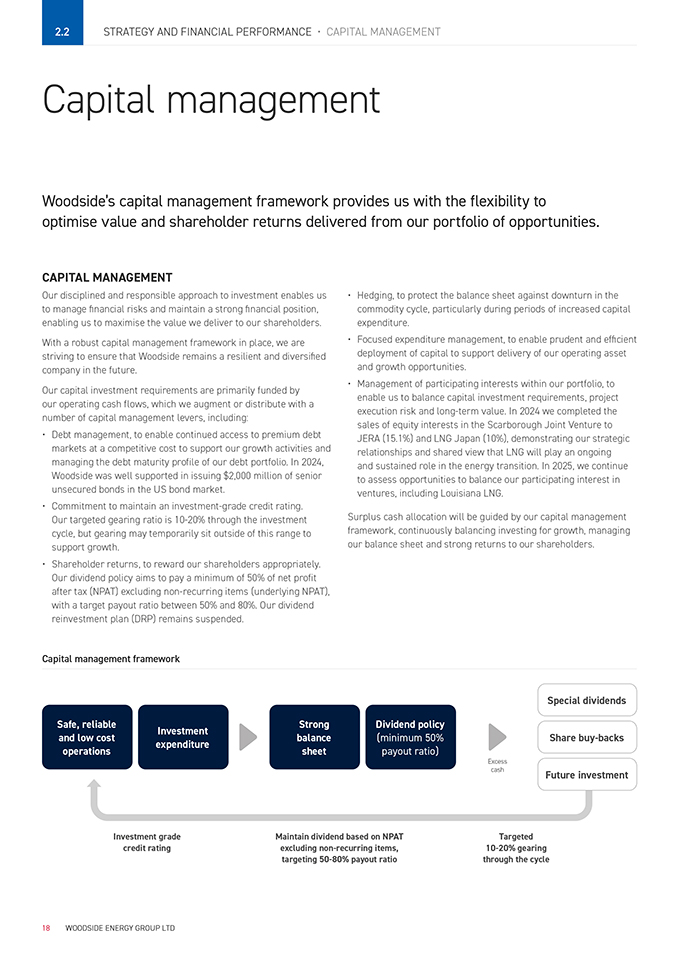

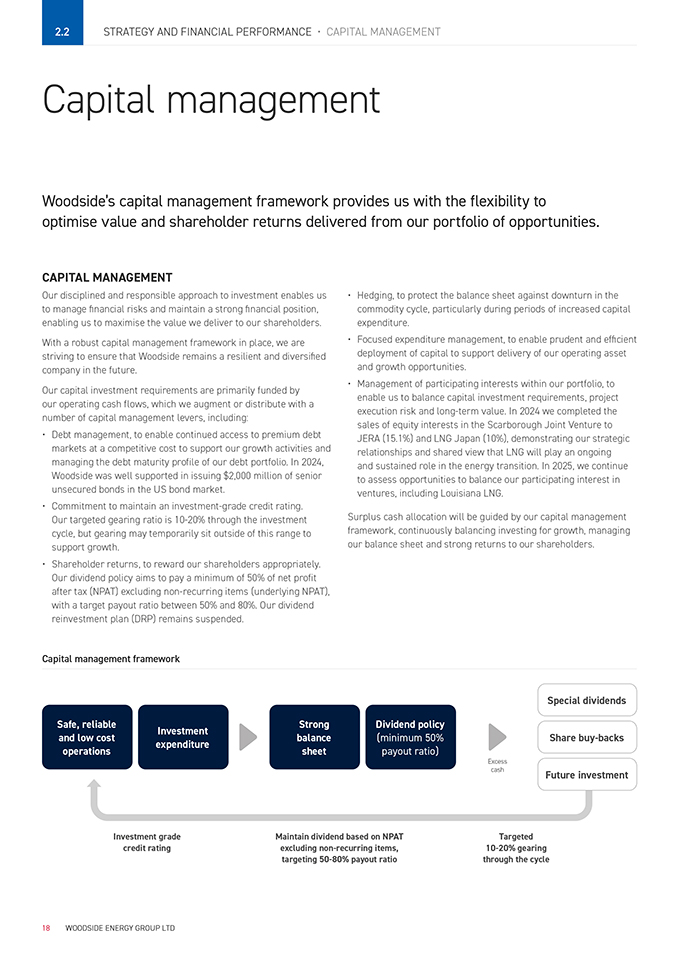

2.2 STRATEGY AND FINANCIAL PERFORMANCE • CAPITAL MANAGEMENT Capital management Woodside’s capital management framework provides us with the flexibility to optimise value and shareholder returns delivered from our portfolio of opportunities. CAPITAL MANAGEMENT Our disciplined and responsible approach to investment enables us to manage financial risks and maintain a strong financial position, enabling us to maximise the value we deliver to our shareholders. With a robust capital management framework in place, we are striving to ensure that Woodside remains a resilient and diversified company in the future. Our capital investment requirements are primarily funded by our operating cash flows, which we augment or distribute with a number of capital management levers, including: • Debt management, to enable continued access to premium debt markets at a competitive cost to support our growth activities and managing the debt maturity profile of our debt portfolio. In 2024, Woodside was well supported in issuing $2,000 million of senior unsecured bonds in the US bond market. • Commitment to maintain an investment-grade credit rating. Our targeted gearing ratio is 10-20% through the investment cycle, but gearing may temporarily sit outside of this range to support growth. • Shareholder returns, to reward our shareholders appropriately. Our dividend policy aims to pay a minimum of 50% of net profit after tax (NPAT) excluding non-recurring items (underlying NPAT), with a target payout ratio between 50% and 80%. Our dividend reinvestment plan (DRP) remains suspended. • Hedging, to protect the balance sheet against downturn in the commodity cycle, particularly during periods of increased capital expenditure. • Focused expenditure management, to enable prudent and efficient deployment of capital to support delivery of our operating asset and growth opportunities. • Management of participating interests within our portfolio, to enable us to balance capital investment requirements, project execution risk and long-term value. In 2024 we completed the sales of equity interests in the Scarborough Joint Venture to JERA (15.1%) and LNG Japan (10%), demonstrating our strategic relationships and shared view that LNG will play an ongoing and sustained role in the energy transition. In 2025, we continue to assess opportunities to balance our participating interest in ventures, including Louisiana LNG. Surplus cash allocation will be guided by our capital management framework, continuously balancing investing for growth, managing our balance sheet and strong returns to our shareholders. Capital management framework Special dividends Safe, reliable and low cost operations Investment expenditure Strong balance sheet Dividend policy (minimum 50% payout ratio) Excess cash Share buy-backs Future investment Investment grade credit rating Maintain dividend based on NPAT excluding non-recurring items, targeting 50-80% payout ratio Targeted 10-20% gearing through the cycle 18 WOODSIDE ENERGY GROUP LTD

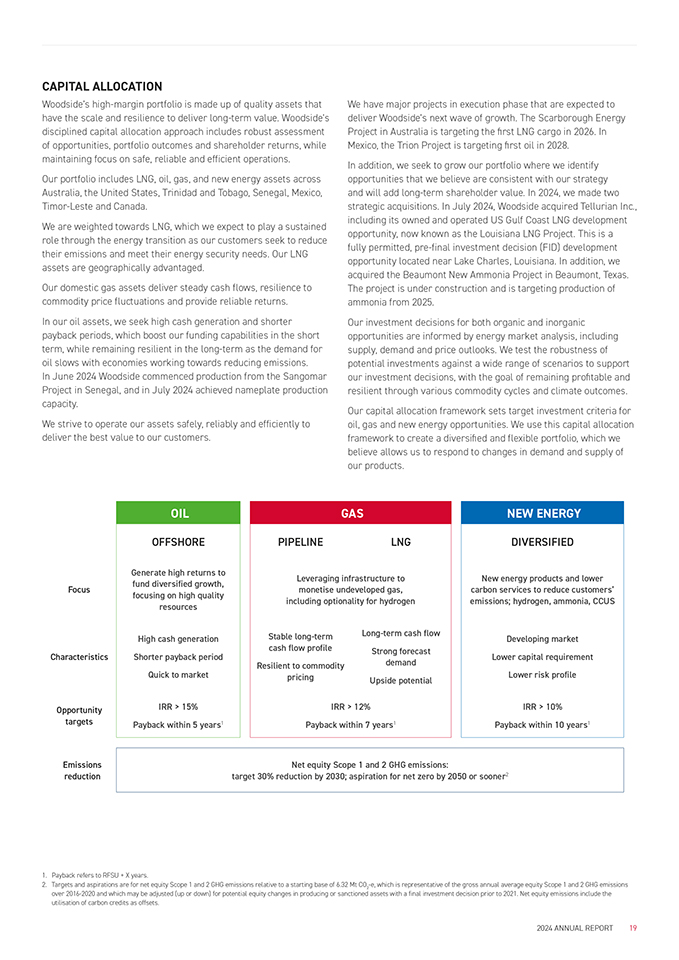

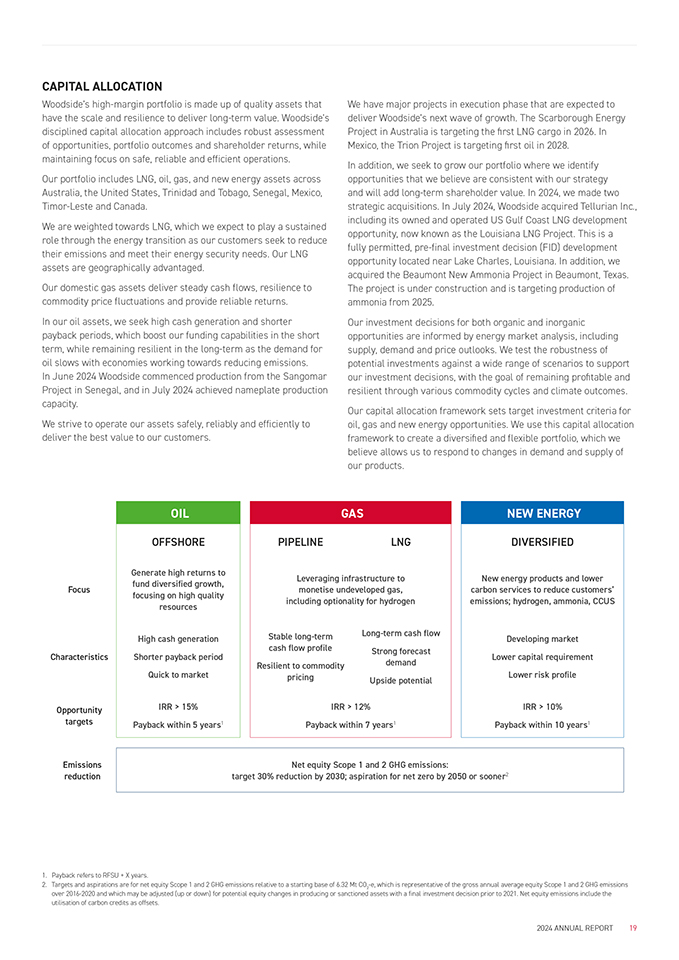

CAPITAL ALLOCATION Woodside’s high-margin portfolio is made up of quality assets that have the scale and resilience to deliver long-term value. Woodside’s disciplined capital allocation approach includes robust assessment of opportunities, portfolio outcomes and shareholder returns, while maintaining focus on safe, reliable and efficient operations. Our portfolio includes LNG, oil, gas, and new energy assets across Australia, the United States, Trinidad and Tobago, Senegal, Mexico, Timor-Leste and Canada. We are weighted towards LNG, which we expect to play a sustained role through the energy transition as our customers seek to reduce their emissions and meet their energy security needs. Our LNG assets are geographically advantaged. Our domestic gas assets deliver steady cash flows, resilience to commodity price fluctuations and provide reliable returns. In our oil assets, we seek high cash generation and shorter payback periods, which boost our funding capabilities in the short term, while remaining resilient in the long-term as the demand for oil slows with economies working towards reducing emissions. In June 2024 Woodside commenced production from the Sangomar Project in Senegal, and in July 2024 achieved nameplate production capacity. We strive to operate our assets safely, reliably and efficiently to deliver the best value to our customers. We have major projects in execution phase that are expected to deliver Woodside’s next wave of growth. The Scarborough Energy Project in Australia is targeting the first LNG cargo in 2026. In Mexico, the Trion Project is targeting first oil in 2028. In addition, we seek to grow our portfolio where we identify opportunities that we believe are consistent with our strategy and will add long-term shareholder value. In 2024, we made two strategic acquisitions. In July 2024, Woodside acquired Tellurian Inc., including its owned and operated US Gulf Coast LNG development opportunity, now known as the Louisiana LNG Project. This is a fully permitted, pre-final investment decision (FID) development opportunity located near Lake Charles, Louisiana. In addition, we acquired the Beaumont New Ammonia Project in Beaumont, Texas. The project is under construction and is targeting production of ammonia from 2025. Our investment decisions for both organic and inorganic opportunities are informed by energy market analysis, including supply, demand and price outlooks. We test the robustness of potential investments against a wide range of scenarios to support our investment decisions, with the goal of remaining profitable and resilient through various commodity cycles and climate outcomes. Our capital allocation framework sets target investment criteria for oil, gas and new energy opportunities. We use this capital allocation framework to create a diversified and flexible portfolio, which we believe allows us to respond to changes in demand and supply of our products. OIL GAS NEW ENERGY OFFSHOREPIPELINELNGDIVERSIFIED Focus Generate high returns to fund diversified growth, focusing on high quality resources Leveraging infrastructure to monetise undeveloped gas, including optionality for hydrogen New energy products and lower carbon services to reduce customers’ emissions; hydrogen, ammonia, CCUS Characteristics High cash generation Shorter payback period Quick to market Stable long-term cash flow profile Resilient to commodity pricing Long-term cash flow Strong forecast demand Upside potential Developing market Lower capital requirement Lower risk profile Opportunity targets IRR > 15% Payback within 5 years1 IRR > 12% Payback within 7 years1 IRR > 10% Payback within 10 years1 Emissions reduction Net equity Scope 1 and 2 GHG emissions: target 30% reduction by 2030; aspiration for net zero by 2050 or sooner2 1. Payback refers to RFSU + X years. 2. Targets and aspirations are for net equity Scope 1 and 2 GHG emissions relative to a starting base of 6.32 Mt CO2-e, which is representative of the gross annual average equity Scope 1 and 2 GHG emissions over 2016-2020 and which may be adjusted (up or down) for potential equity changes in producing or sanctioned assets with a final investment decision prior to 2021. Net equity emissions include the utilisation of carbon credits as offsets. 2024 ANNUAL REPORT 19

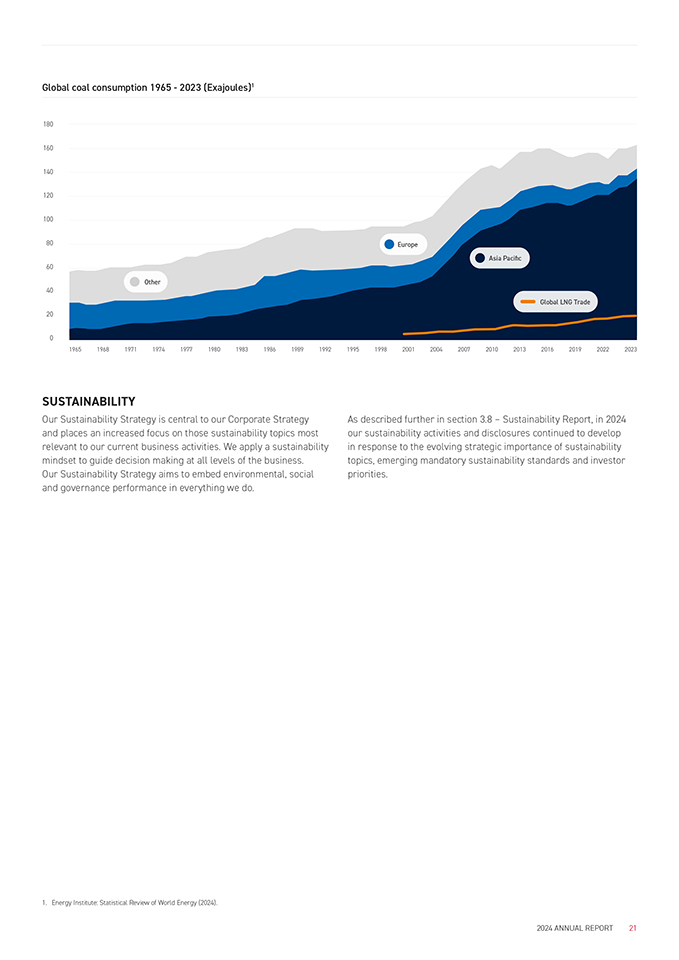

When assessing opportunities, we consider a broad range of portfolio evaluation and opportunity evaluation factors, along with understanding the risks relevant to the opportunity. These assessments can apply to acquisitions or divestments, and for evaluating the impact of a new project on the portfolio. PORTFOLIO EVALUATION CONSIDERATIONS OPPORTUNITY EVALUATION CONSIDERATIONS EARNINGS PER SHARE FREE CASH FLOW FUNDING CAPACITY EMISSIO PROFILE STRATEGIC FIT RR/NPV PAYBACK PERIOD RISK BREAKEVEN GROWTH OPPORTUNITIES ARE SCREENED AGAINST PORTFOLIO METRICS USING PRICE, SCENARIO AND CLIMATE ANALYSIS SUSTAINED NATURAL GAS DEMAND We expect sustained demand for natural gas, especially in Asia and for the decades ahead, supporting our confidence in the value of our current portfolio of producing assets and our sanctioned projects. We also consider these factors carefully in connection with future investment opportunities.1 As an example, China, Japan, South Korea, and all countries within the ASEAN bloc are signatories to the Paris Agreement and have plans to reduce emissions. Collectively, they represent some of the world’s largest economies and more than 25% of the world’s population. The national energy plans of these nations also confirm ongoing demand for natural gas.2,3,4,5 The International Energy Agency’s (IEA’s) 2024 World Energy Outlook (WEO) increased the modelled 2050 demand for LNG in all three of its scenarios including the 1.5°C aligned “Net Zero Emissions” scenario, compared to the 2023 WEO.6 WHY IS NATURAL GAS PART OF THE ENERGY TRANSITION? This sustained demand for natural gas is part of, not instead of, the energy transition, as countries work towards energy security, affordability and emissions reductions goals. Energy transition priorities in Asia include maintaining secure reliable and affordable supplies while also progressively reducing emissions. In 2023, according to the IEA, coal demand in emerging markets and developing economies was the biggest driver in global emissions growth.7 In Asia, coal use continues to grow and is now five times higher than the amount consumed in Europe when coal peaked in the 1980s, and more than six times higher than the total reduction in coal use that Europe has achieved since then (please see the chart on next page). Natural gas demand is sustained by these factors: • Transition priorities: While renewable sources of energy are growing, particularly in countries like China, they have not reached the scale to fully replace coal at current energy demand levels. Total energy demand is also expected to grow as a result of extra power demand expected for electric vehicles and data centres. Sustaining gas supply levels so that available renewables can be directed to higher emissions reductions (like substituting coal first) can support both energy security and faster emissions reduction.8 • Firming renewables: Natural gas can support more renewables to replace coal, by “firming” up their intermittent supply along with batteries. • Fuel switching: Natural gas is an established substitute for coal in power generation where infrastructure exists and can accelerate the impact of coal-to-renewables switching. In 2023, coal-to-gas switching was the largest source of emissions reduction in the US power sector, according to the IEA.7 • Hard-to-abate sectors: Some uses of natural gas are “hard-to-abate”and will be sustained for longer – such as very high temperature industrial heat (in glass, ceramic and steel production) or as chemical feedstock (in fertiliser production).9 1. Additional information is available on our website under Sustainability – woodside.com 2. Ministry of Economy Trade and Industry of Japan, 2024. “Japan 7th Draft Basic Energy Plan” https://www.enecho.meti.go.jp/committee/council/basic_policy_subcommittee/2024/067/067_005.pdf. 3. People’s Republic of China, 2024. “China Energy Outlook 2060 (2024 version)” by Sinopec. 4. ASEAN, 2024. “ASEAN 8th Energy Outlook” https://aseanenergy.org/publications/the-8th-asean-energy-outlook/ 5. The Republic of Korea, 2024. “Working draft of the Korean 11th Basic Plan for Supply and Demand of Power” https://www.shinkim.com/eng/media/newsletter/2480. 6. International Energy Agency (2024): World Energy Outlook 2024 7. International Energy Agency (2024): CO2 Emissions in 2023 8. BCG (2023): The role of infrastructure in Australia’s energy transition, pp. 13-14 9. International Gas Union, 2023. “Global Gas Report 2023”, pp. 76-77. https://www.igu.org/resources/global-gas-report-2023-edition/ 20 WOODSIDE ENERGY GROUP LTD

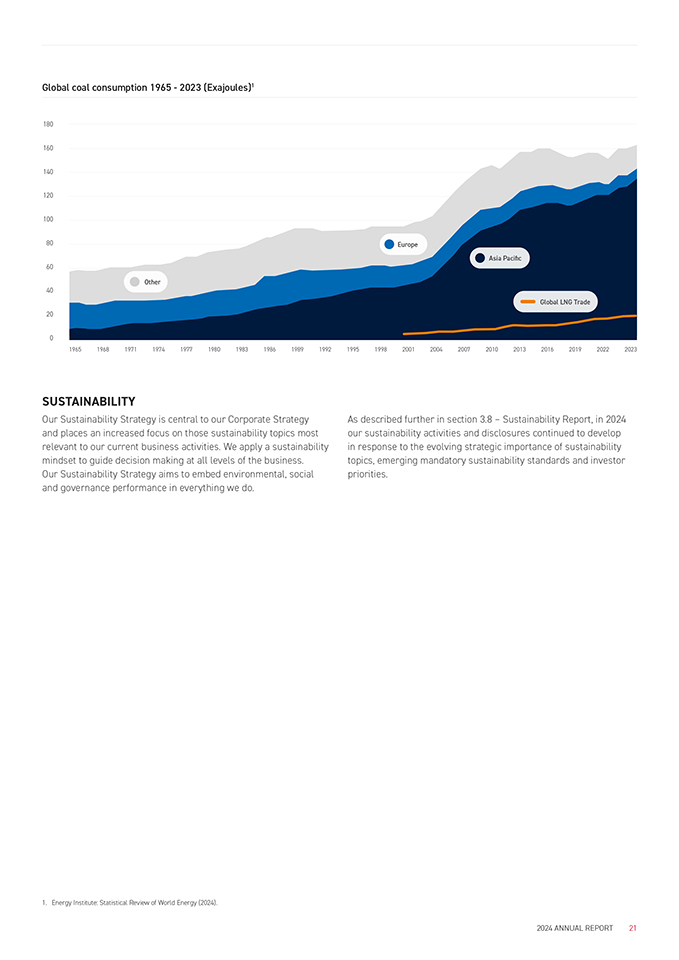

Global coal consumption 1965—2023 (Exajoules)1 180 160 140 120 100 80 60 Other 40 20 Europe Asia Pacific Global LNG Trade 0 1965 1968 1971197419771980198319861989199219951998200120042007201020132016201920222023 SUSTAINABILITY Our Sustainability Strategy is central to our Corporate Strategy and places an increased focus on those sustainability topics most relevant to our current business activities. We apply a sustainability mindset to guide decision making at all levels of the business. Our Sustainability Strategy aims to embed environmental, social and governance performance in everything we do. As described further in section 3.8 – Sustainability Report, in 2024 our sustainability activities and disclosures continued to develop in response to the evolving strategic importance of sustainability topics, emerging mandatory sustainability standards and investor priorities. 1. Energy Institute: Statistical Review of World Energy (2024). 2024 ANNUAL REPORT 21

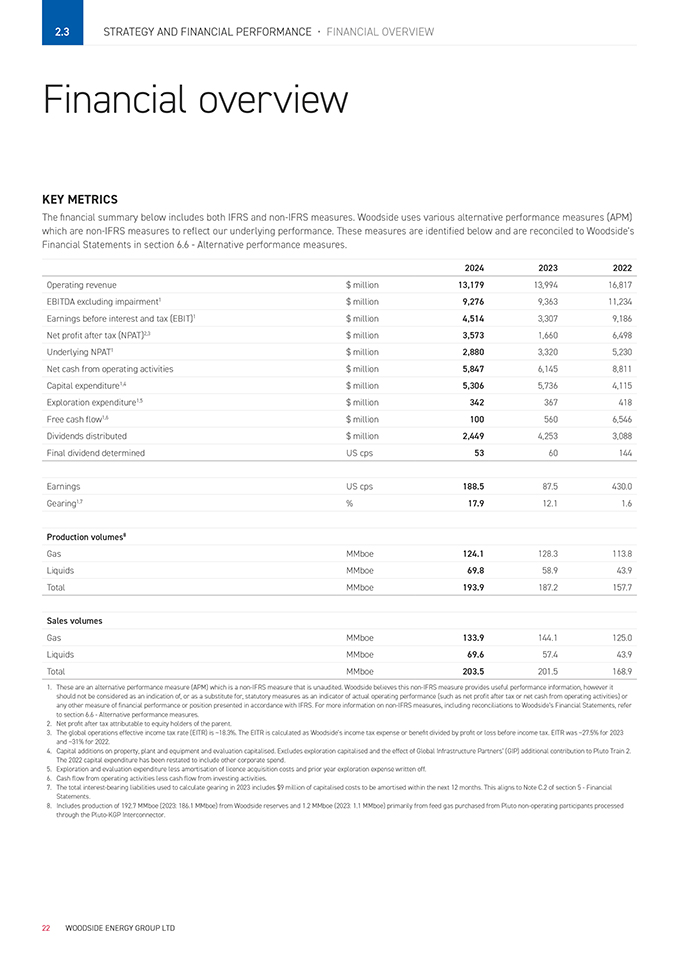

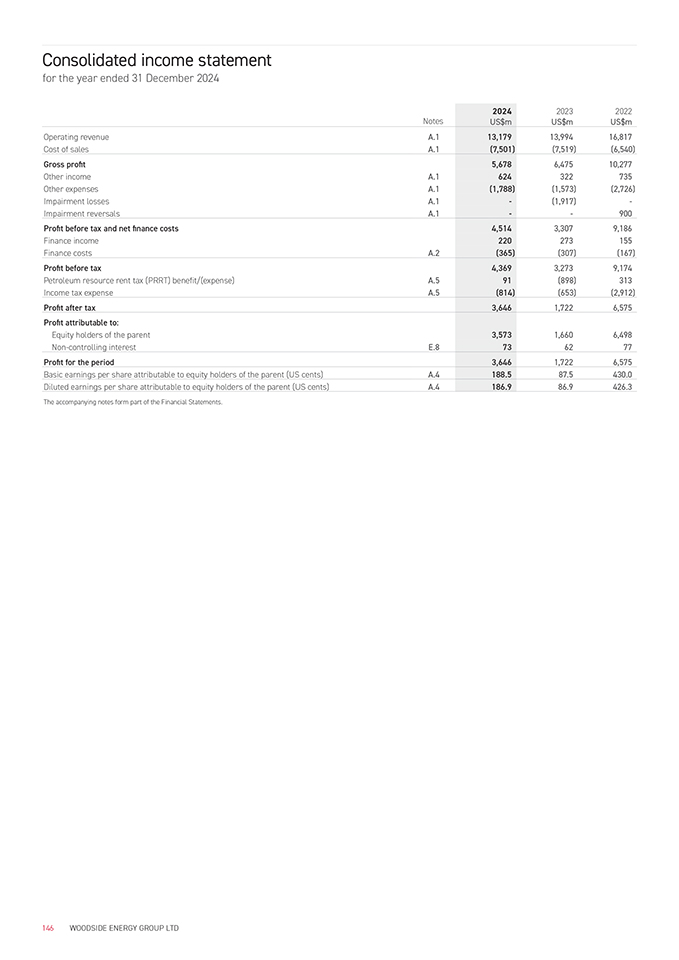

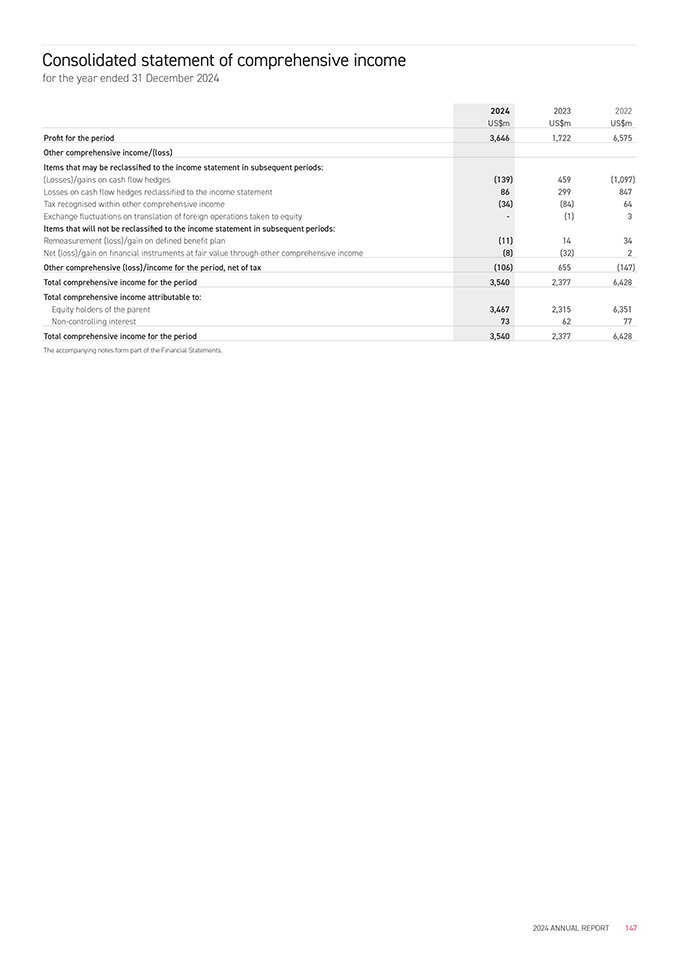

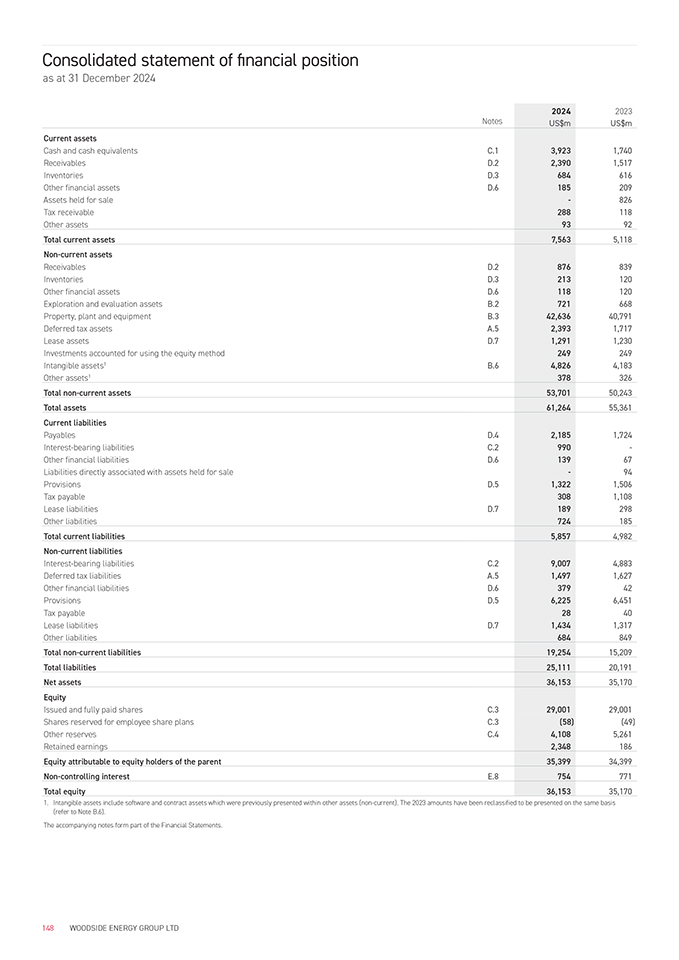

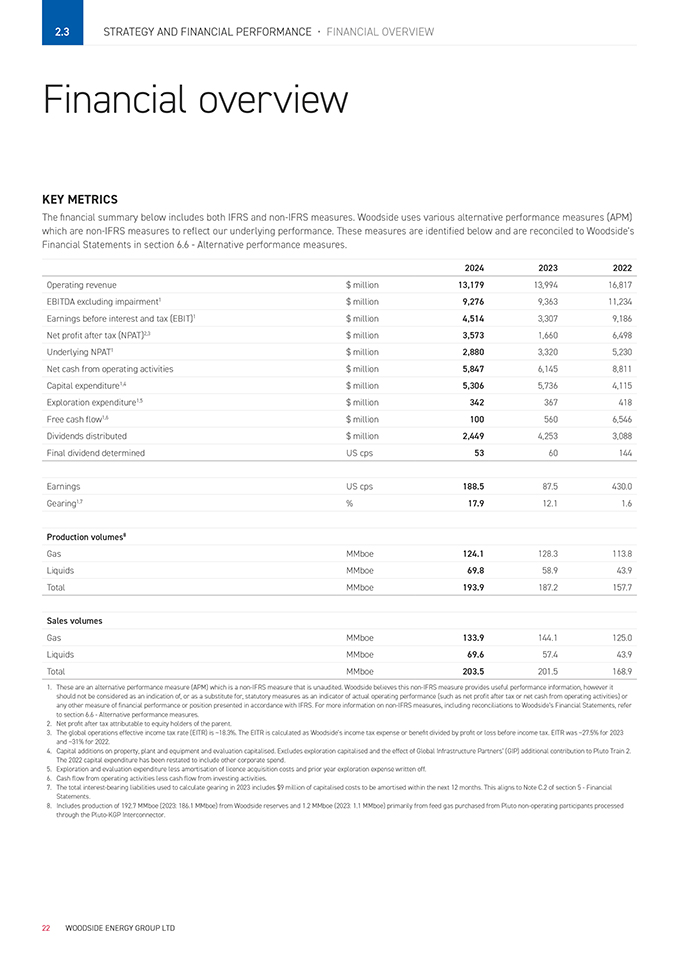

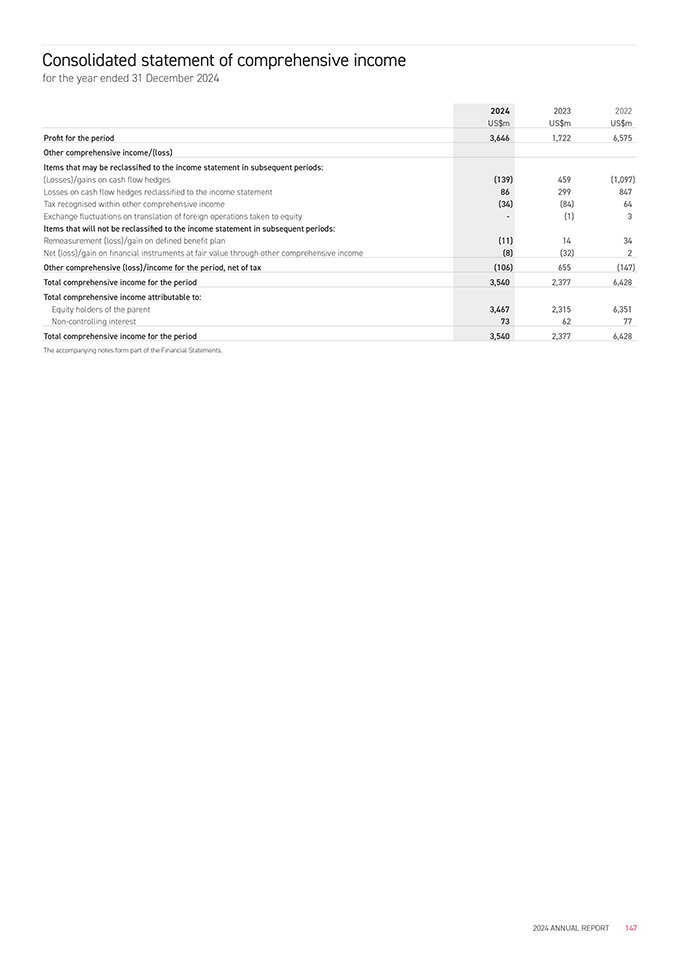

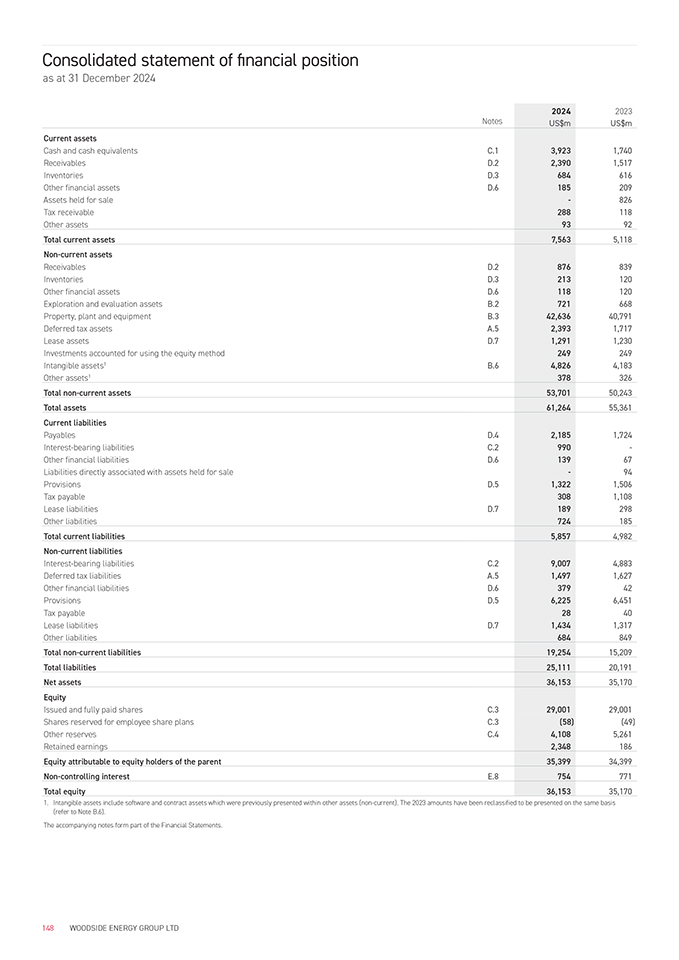

2.3 STRATEGY AND FINANCIAL PERFORMANCE • FINANCIAL OVERVIEW Financial overview KEY METRICS The financial summary below includes both IFRS and non-IFRS measures. Woodside uses various alternative performance measures (APM) which are non-IFRS measures to reflect our underlying performance. These measures are identified below and are reconciled to Woodside’s Financial Statements in section 6.6—Alternative performance measures. 2024 2023 2022 Operating revenue$ million13,17913,99416,817 EBITDA excluding impairment1$ million9,2769,36311,234 Earnings before interest and tax (EBIT)1$ million4,5143,3079,186 Net profit after tax (NPAT)2,3$ million3,5731,6606,498 Underlying NPAT1$ million2,8803,3205,230 Net cash from operating activities$ million5,8476,1458,811 Capital expenditure1,4$ million5,3065,7364,115 Exploration expenditure1,5$ million342367418 Free cash flow1,6$ million1005606,546 Dividends distributed$ million2,4494,2533,088 Final dividend determinedUS cps5360144 EarningsUS cps188.587.5430.0 Gearing1,7%17.912.11.6 Production volumes8 GasMMboe124.1128.3113.8 LiquidsMMboe69.858.943.9 TotalMMboe193.9187.2157.7 Sales volumes GasMMboe133.9144.1125.0 LiquidsMMboe69.657.443.9 TotalMMboe203.5201.5168.9 1. These are an alternative performance measure (APM) which is a non-IFRS measure that is unaudited. Woodside believes this non-IFRS measure provides useful performance information, however it should not be considered as an indication of, or as a substitute for, statutory measures as an indicator of actual operating performance (such as net profit after tax or net cash from operating activities) or any other measure of financial performance or position presented in accordance with IFRS. For more information on non-IFRS measures, including reconciliations to Woodside’s Financial Statements, refer to section 6.6—Alternative performance measures. 2. Net profit after tax attributable to equity holders of the parent. 3. The global operations effective income tax rate (EITR) is ~18.3%. The EITR is calculated as Woodside’s income tax expense or benefit divided by profit or loss before income tax. EITR was ~27.5% for 2023 and ~31% for 2022. 4. Capital additions on property, plant and equipment and evaluation capitalised. Excludes exploration capitalised and the effect of Global Infrastructure Partners’ (GIP) additional contribution to Pluto Train 2. The 2022 capital expenditure has been restated to include other corporate spend. 5. Exploration and evaluation expenditure less amortisation of licence acquisition costs and prior year exploration expense written off. 6. Cash flow from operating activities less cash flow from investing activities. 7. The total interest-bearing liabilities used to calculate gearing in 2023 includes $9 million of capitalised costs to be amortised within the next 12 months. This aligns to Note C.2 of section 5—Financial Statements. 8. Includes production of 192.7 MMboe (2023: 186.1 MMboe) from Woodside reserves and 1.2 MMboe (2023: 1.1 MMboe) primarily from feed gas purchased from Pluto non-operating participants processed through the Pluto-KGP Interconnector. 22 WOODSIDE ENERGY GROUP LTD

CAPITAL MANAGEMENT Final dividend A 2024 final dividend of 53 US cents per share (cps) has been determined, representing a full-year dividend yield of 8.0%.1 The total amount of the final dividend payment comes to $1,006 million which represents approximately 80% of underlying NPAT for the second half of 2024, and will be fully franked for Australian tax purposes.2 The dividend reinvestment plan (DRP) remains suspended. Liquidity and debt service Woodside’s primary sources of liquidity are cash and cash equivalents, net cash generated by operating activities, unused borrowing capacity under its bilateral facilities and syndicated facilities, issuances of debt or equity securities and other sources, such as selldowns. During the year, Woodside generated $5,847 million of cash flow from operating activities, received $2,285 million of proceeds from the equity selldown in the Scarborough Joint Venture and delivered positive free cash flow of $100 million.2,3 Woodside entered into the following new drawn debt facilities in 2024: • $1,200 million seven-year syndicated term loan from Asian and European commercial banks. • $1,000 million ten-year loan from the Japan Bank for International Cooperation (JBIC) to support the Scarborough Energy Project. • $450 million ten-year syndicated term loan from Asian commercial banks. Woodside also, through a wholly owned subsidiary, issued $2,000 million of senior unsecured bonds in the United States, comprising a $1,250 million ten-year bond and a $750 million 30-year bond. Woodside received strong support from commercial banks and investors on all of the 2024 funding activities, including oversubscription of the $1,200 million term loan and $2,000 million US bond issuance. At the end of the period, Woodside had cash and cash equivalents of $3,923 million, drawn debt of $10,050 million, including $1,000 million principal debt payable in 2025, and liquidity of $6,723 million.4 Additional details of Woodside’s credit facilities, including total commitments, maturity and interest and amount outstanding as of 31 December 2024, can be found in Note C.2 to the audited Financial Statements. Woodside’s principal ongoing uses of cash are to meet working capital requirements, fund debt obligations and finance Woodside’s capital expenditure and acquisitions. Working capital is sufficient for present requirements. Woodside’s capital expenditure for 2025 is expected to be between $4,500 million and $5,000 million primarily due to Scarborough and Trion, and remaining acquisition expenditure for Beaumont New Ammonia. Woodside’s capital expenditure estimates exclude Louisiana LNG project expenditure as this remains subject to FID as well as the impact of any subsequent asset selldowns, future acquisitions or other changes in equity. We are targeting first LNG cargo in 2026 for Scarborough and first oil in 2028 for Trion. Total project estimated cost for Scarborough is $12.5 billion ($8.2 billion Woodside share) and $7.2 billion for Trion ($4.8 billion Woodside share including capital carry of PEMEX of approximately US$460 million). Woodside has no off-balance sheet arrangements that have, or are reasonably likely to have, a current or future material effect on Woodside’s financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources. Balance sheet Woodside remains committed to maintaining an investment- grade credit rating, which supports our aims of providing sustainable returns to shareholders and investing in future growth opportunities, in accordance with our capital allocation framework. Any downgrade in credit ratings could affect Woodside’s ability to access capital markets and increase the cost of capital of the existing debt portfolio. In 2024, Woodside’s credit ratings of BBB+ and Baa1 by S&P Global and Moody’s respectively were both maintained.5 Woodside’s gearing at the end of 2024 was 17.9%, within our target range of 10-20%. Woodside’s gearing may at times fall outside the target range of 10-20% as the balance sheet is managed through the investment cycle, including increasing above the range to support growth.6 Commodity price risk management Woodside hedges to protect the balance sheet against downside commodity price risk, particularly during periods of high capital expenditure. Woodside hedged approximately 29.3 MMboe of 2024 volumes. The realised value of these oil price hedges was a pre-tax loss of $202 million. As at 31 December 2024, Woodside has placed oil price hedges for approximately 30 MMboe of 2025 production at an average price of approximately $78.7 per barrel. Woodside has also placed hedges for Corpus Christi LNG volumes to protect against downside pricing risk. These hedges are Henry Hub and Title Transfer Facility commodity swaps. As at 31 December 2024, an average of 94% of 2025 volumes and 67% of 2026 volumes have reduced pricing risk as a result of hedging activities. 1. Calculated based on Woodside’s closing share price on 31 December 2024 of A$24.60 ($15.29) and a US$:A$ exchange rate of 0.6217. 2. Underlying NPAT and free cash flow are a non-IFRS measures. Refer to section 6.6—Alternative performance measures for a reconciliation of these measures to Woodside’s Financial Statements. 3. Cash flow from operating activities less cash flow from investing activities. 4. Liquidity is a non-IFRS measure. Refer to section 6.6—Alternative performance measures for a reconciliation of these measures to Woodside’s Financial Statements. 5. Credit ratings are forward-looking opinions on credit risk. S&P Global’s and Moody’s credit ratings express the opinion of each agency on the ability and willingness of Woodside to meet its financial obligations in full and on time. A credit rating is not a recommendation to buy, sell or hold securities and may be subject to suspension, reduction or withdrawal at any time by an assigning rating agency. Any rating should be evaluated independently of any other information. 6. Gearing and net debt are non-IFRS measures. Refer to section 6.6—Alternative performance measures for a reconciliation of these measures to Woodside’s Financial Statements. 2024 ANNUAL REPORT 23

2.4 STRATEGY AND FINANCIAL PERFORMANCE • ENERGY MARKETS Energy markets Global energy markets during 2024 experienced price volatility resulting from significant geopolitical events, changes of government and energy policy shifts worldwide. Volatility in energy markets reinforces the need for reliable, affordable, and secure energy. Despite price volatility, energy markets have been stable overall due to ample supply and uninterrupted flows. The demand for oil and natural gas highlights the need for ongoing hydrocarbon production and investment. MACROECONOMIC FACTORS In 2024, central banks in advanced economies tried to balance monetary policy to curb inflation without stifling growth. The Organisation for Economic Co-operation and Development’s (OECD’s) December 2024 Economic Outlook projects global GDP growth of 3.3% in 2025, up from the 3.2% in 2024.1 The world’s population is expected to reach 9.7 billion in 2050 (an increase of 1.6 billion from 2024) and global GDP is forecast to almost double, driving increased energy demand.2 Artificial intelligence and data centres may also represent significant drivers of future energy demand. Oil Numerous geopolitical events including Russia’s invasion of Ukraine and conflicts in the Middle East have altered trade flows and contributed to high volatility in oil markets over the past four years. Despite OPEC+ exercising production restraint, the oil market was well supplied as production in the United States, Canada, Brazil and Guyana continued to increase in 2024. In the second half of the year, OPEC+ announced it would delay its planned unwinding of production cuts to 2025, citing strong non-OPEC+ supply and an uncertain demand outlook linked to China’s economic data. Dated Brent averaged US$80.8 per barrel in 2024, 2.3% below average 2023 prices and 7.1% above the five-year average. Liquefied Natural Gas Despite relatively mild weather, global gas markets in 2024 remained tight. Supply uncertainty was exacerbated by Russian LNG sanctions, the end of the Ukraine gas transit deal and weather risks. Wood Mackenzie’s base case scenario forecasts global LNG demand to increase by 55% (220 Mt per annum) to 2034.3 South East Asia is expected to remain the major engine of growth past this period with the power and industrial sectors driving continuous LNG demand growth as domestic production declines. North East Asian LNG prices averaged US$11.9 per million British thermal units (MMBtu), 13.5% below average 2023 prices and 27.8% below the five-year average.3 Australian domestic gas markets The Australian Government released its Future Gas Strategy in 2024 highlighting the importance of gas in the energy transition. Australian domestic gas markets experienced some supply shortfalls in 2024. In Western Australia, the market was finely balanced with increases in power demand offset by the closure of the Kwinana refinery and temporary suspension of BHP’s Nickel West Project. The east coast gas market broadly stabilised during 2024 but did experience seasonal supply gaps. Without further investment, both the west and east coasts of Australia are expected to be structurally short of gas by 2030. New energy products Across the globe, investment in new energy technology has increased, spurred by government policy seeking to reduce long- term emissions. Investment has been currently focused towards solar, wind, battery technologies and electric vehicles. Other products such as hydrogen face challenges specifically relating to cost inflation, uncertainty in demand from end-users, uncertainty around availability and eligibility for government support. Woodside continues to believe that new energy products will play an important role in the energy transition as part of the energy mix. Lower-carbon ammonia is economically advantaged under the United States and European policy settings supporting viability of new projects. Underlying demand for ammonia continues to grow with global population increases together with the expected adoption of new lower-carbon ammonia uses such as power generation, as a marine fuel, and potentially as a hydrogen carrier. 1. OECD Economic Outlook, 4 December 2024. 2. UN World Population Prospects 2024. 3. WoodMackenzie, Global Gas Investment Horizon Outlook, November 2024. 24 WOODSIDE ENERGY GROUP LTD

2.5 STRATEGY AND FINANCIAL PERFORMANCE • BUSINESS MODEL AND VALUE CHAIN Business model and value chain Woodside seeks to optimise returns across the value chain by prioritising competitive growth opportunities; utilising our operational, development and technological capabilities; and investing in customer relationships. 2024 examples Acquire, divest, explore and develop We manage our portfolio through acquisitions, divestments and exploration, based on a disciplined approach to optimising shareholder value and appropriately managing risk. We look for material positions in world-class assets and locations that are aligned with our capabilities and existing portfolio. We are focused on value and look to generate low-cost, lower-carbon development opportunities. During the development phases, we aim to optimise value by selecting the best concept for extracting, processing and delivering energy to our customers. • Acquired the Louisiana LNG opportunity. • Acquired the Beaumont New Ammonia Project. • Completed the sales of equity interests in the Scarborough Joint Venture to JERA (15.1%) and LNG Japan (10%). • Agreed to an asset swap with Chevron under which Woodside will acquire Chevron’s interest in the NWS Project, the NWS Oil Project and the Angel CCS Project, and transfer all of its interest in both the Wheatstone and Julimar-Brunello Projects to Chevron.1 Project execution We are building on decades of project execution expertise, investing in opportunities across the globe. Woodside is benefitting from the increased scope and scale of its projects portfolio through knowledge sharing across projects and our relationships with suppliers and contractors. We design and execute projects with a focus on safety, cost and sustainability. • Completed Sangomar Project and achieved first oil in June 2024, delivering $948 million in revenue to Woodside in 2024. • Continued project execution of Scarborough and Trion, which were 78% and 20% complete respectively by the end of 2024.2 Operate Our operations prioritise safety while focusing on strong reliability and environmental performance in remote and challenging locations. In Australia, our operated assets include the NWS Project and Pluto LNG. We also operate Macedon and three floating production storage and offloading (FPSO) facilities and have non-operated interests in Bass Strait and Wheatstone. Internationally, we operate Sangomar in Senegal, Shenzi in the Gulf of Mexico, Angostura and Ruby in Trinidad and Tobago, and have non-operated interests in Atlantis and Mad Dog in the Gulf of Mexico.3 We endeavour to adopt technology and a continuous improvement mindset to support operational performance and optimise the value of our assets. • Achieved reliability of 98.3% at KGP and 96.1% at Pluto LNG. • Delivered excellent early production performance at Sangomar, quickly achieving nameplate capacity of 100,000 barrels per day. Market and transport Our relationships with customers have been maintained through a track record of reliable delivery since the NWS Project’s first LNG cargo was delivered to Japan in 1989. We are building scale and flexibility in our portfolio by expanding our global supply presence, through our own production and through offtake agreements with third parties, and by maintaining our own shipping fleet. This helps ensure reliable delivery to our customers and creates opportunities to capture value by portfolio and shipping optimisation. We continue to look for opportunities to collaborate with our customers on lower-carbon energy solutions. • Signed sales and purchase agreements with KOGAS, CPC and JERA for the long-term supply of LNG to Korea, Taiwan and Japan respectively. • Received new long-term charter LNG vessel, the Woodside Scarlet Ibis. Decommission Decommissioning is integrated into project planning, from the earliest stages of development through to the end-of-field life. We work with global contractors to safely remove facilities and to plug and abandon wells that are no longer required for our operations. We work with regulators to deliver our decommissioning commitments. • Removed the final two of 18 xmas trees (valve systems) at Enfield. • Successfully recovered the Griffin riser turret mooring. • Decommissioned 149 km of pipeline and recovered more than 90 subsea structures. • Plugged and abandoned seven of ten Stybarrow wells. 1. Completion of the transaction is subject to customary conditions precedent, refer to section 3.1—Australian Operations for details. 2. Scarborough completion percentage excluding Pluto Train 1 modifications. 3. On 20 January 2025, President Trump issued an Executive Order renaming the area known as the “Gulf of Mexico” as the “Gulf of America”. The US Interior Department formally announced the change on 24 January 2025 and US federal agencies are currently in the process of implementing the change. In this 2024 Annual Report, Woodside uses the term “Gulf of Mexico” to refer to the area in which its Shenzi, Mad Dog and Atlantis projects are located, as that term was in effect during the period covered by this report. Woodside will adopt the naming conventions required by applicable laws and regulations in relation to US waters. 2024 ANNUAL REPORT 25

OPER A TIONS Our established track record of operational excellence and reliable supply underpins our success. 26

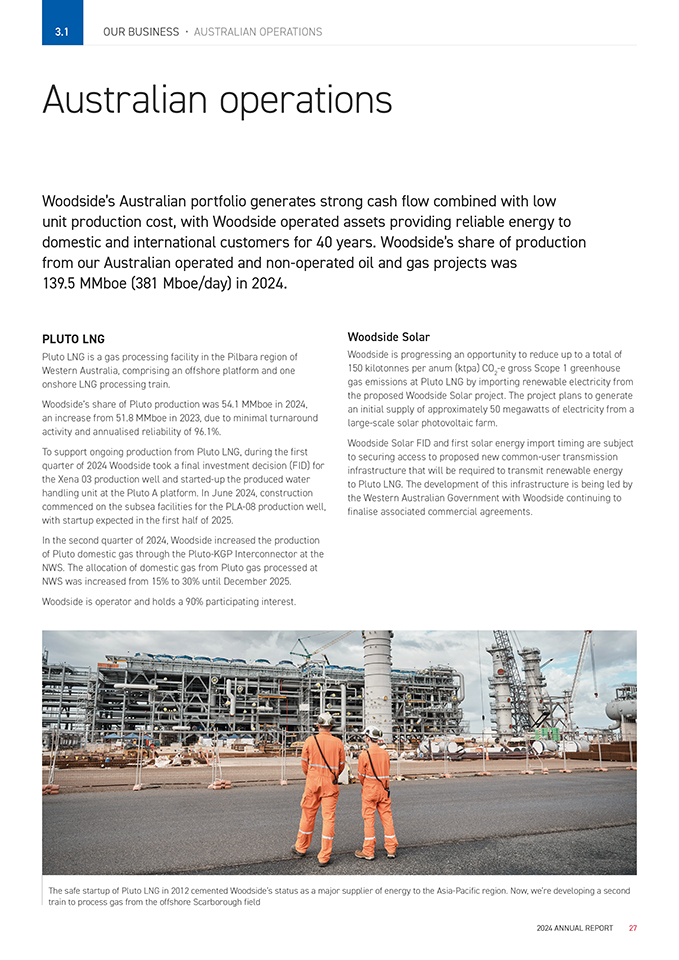

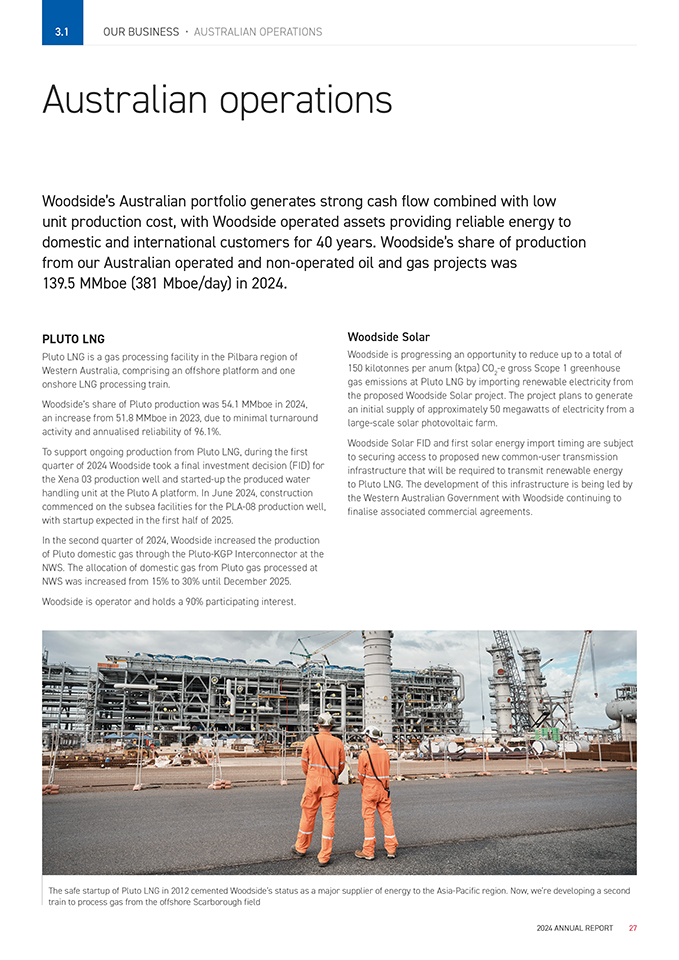

3.1 OUR BUSINESS • AUSTRALIAN OPERATIONS Australian operations Woodside’s Australian portfolio generates strong cash flow combined with low unit production cost, with Woodside operated assets providing reliable energy to domestic and international customers for 40 years. Woodside’s share of production from our Australian operated and non-operated oil and gas projects was 139.5 MMboe (381 Mboe/day) in 2024. PLUTO LNG Pluto LNG is a gas processing facility in the Pilbara region of Western Australia, comprising an offshore platform and one onshore LNG processing train. Woodside’s share of Pluto production was 54.1 MMboe in 2024, an increase from 51.8 MMboe in 2023, due to minimal turnaround activity and annualised reliability of 96.1%. To support ongoing production from Pluto LNG, during the first quarter of 2024 Woodside took a final investment decision (FID) for the Xena 03 production well and started-up the produced water handling unit at the Pluto A platform. In June 2024, construction commenced on the subsea facilities for the PLA-08 production well, with startup expected in the first half of 2025. In the second quarter of 2024, Woodside increased the production of Pluto domestic gas through the Pluto-KGP Interconnector at the NWS. The allocation of domestic gas from Pluto gas processed at NWS was increased from 15% to 30% until December 2025. Woodside is operator and holds a 90% participating interest. Woodside Solar Woodside is progressing an opportunity to reduce up to a total of 150 kilotonnes per anum (ktpa) CO2-e gross Scope 1 greenhouse gas emissions at Pluto LNG by importing renewable electricity from the proposed Woodside Solar project. The project plans to generate an initial supply of approximately 50 megawatts of electricity from a large-scale solar photovoltaic farm. Woodside Solar FID and first solar energy import timing are subject to securing access to proposed new common-user transmission infrastructure that will be required to transmit renewable energy to Pluto LNG. The development of this infrastructure is being led by the Western Australian Government with Woodside continuing to finalise associated commercial agreements. The safe startup of Pluto LNG in 2012 cemented Woodside’s status as a major supplier of energy to the Asia-Pacific region. Now, we’re developing a second train to process gas from the offshore Scarborough field 2024 ANNUAL REPORT 27

NORTH WEST SHELF PROJECT The NWS Project consists of three offshore platforms and the onshore Karratha Gas Plant (KGP). KGP includes five onshore LNG processing trains and two domestic gas trains. Woodside’s share of NWS Project production was 38.1 MMboe in 2024, a decrease from 40.8 MMboe in 2023, due to gradual reservoir decline. World-class reliability continued at KGP achieving an annual reliability rate of 98.3%. In 2024, 11.8 MMboe of Pluto gas was processed at KGP through the Pluto-KGP Interconnector. This was a 5.6% increase compared to 2023. Discussions continued between the NWS Joint Venture participants and other resource owners for the processing of additional third- party gas to utilise available processing capacity at KGP. Processing of Waitsia gas continued and is expected to ramp up when the Waitsia Stage 2 facility commences production. The strategic consolidation of the NWS Project’s ownership structure, through the conditional asset swap agreement with Chevron that was announced in December 2024 (see page 29), is a significant milestone in the 40-year history of this critical energy infrastructure. This transaction creates greater opportunity to fill emerging processing capacity at KGP and maximise value accretive recovery from the NWS Project. The NWS Joint Venture participants took FID on the Lambert West Project which will support ongoing production from the NWS. This project is targeted for startup in the second half of 2025. Additionally, FID was taken on the Low-Low Pressure Operation Project at Goodwyn Alpha, aimed at increasing and accelerating NWS production from the Goodwyn area reservoirs. The NWS Joint Venture participants also progressed a NWS infill program, which includes a proposed subsea tieback of five wells into existing offshore NWS facilities, to be produced via the KGP. This project is targeting FID in 2025. State environmental approval for the NWS Project Extension was received in December 2024; the Federal environmental approval process is ongoing. These approvals would support long-term operations and processing of future third-party gas resources at KGP through to 2070. After 40 years of operations, the NWS Project is entering a period of production decline. With increased ullage due to natural field decline and limited third-party gas-processing demand, LNG train 2 was taken offline as preparations for permanent retirement commenced in the last quarter of 2024. Planned maintenance activities at the Goodwyn Alpha facility, North Rankin Complex and an onshore LNG train at KGP were successfully completed in 2024. Woodside is operator and holds a 33.33% participating interest. Following completion of the asset swap agreement with Chevron announced in 2024, Woodside’s participating interest will increase.1 WHEATSTONE AND JULIMAR-BRUNELLO Wheatstone is an LNG-processing facility near Onslow, Western Australia, comprising an offshore production platform and two onshore LNG-processing trains. It processes gas from several offshore gas fields, including Julimar and Brunello. Woodside’s share of production from Wheatstone was 12.6 MMboe in 2024, a decrease from 13.5 MMboe in 2023, due to unplanned outages affecting the Julimar subsea production system and Wheatstone facility respectively. Wheatstone’s domestic gas plant nameplate capacity was successfully increased for the second consecutive year, with the upgraded nameplate of 230 terajoules (TJ) per day representing a 12% increase from the original design. Woodside is operator and holds a 65% participating interest in the Julimar-Brunello fields. Woodside holds a 13% non-operated interest in the Wheatstone project. Following completion of the asset swap agreement with Chevron announced in 2024, Woodside’s interest in Wheatstone and Julimar-Brunello will reduce to zero. BASS STRAIT Bass Strait is located in the South East of Australia and produces oil and gas through a network of offshore platforms, pipelines and onshore processing facilities located in Victoria. The Bass Strait assets include the Gippsland Basin Joint Venture (GBJV) and the Kipper Unit Joint Venture. Woodside’s share of production from the Bass Strait was 18.8 MMboe in 2024, this was a decrease from 22.8 MMboe in 2023, driven by natural field decline, lower Australian east coast short- term gas market demand, offshore maintenance and reduced production capacity. All of Woodside’s share of gas produced by the GBJV is supplied into the eastern Australian domestic gas market. Through the execution of the Gippsland Asset Streamlining project, the asset has optimised facilities and transitioned to a gas focused business. In 2024, the Halibut, West Kingfish and Cobia oil platforms ceased production, marking the end of 55 years of crude oil production from the Bass Strait. At Longford, the crude stabilisation plant and gas plant 1 were permanently shut-in, streamlining the asset for ongoing gas and condensate production. The Kipper Compression Project, which added compression facilities to the West Tuna Platform, successfully commenced operation in the third quarter of 2024, delivering a production rate increase and enabling continued supply of gas from the Kipper field to the domestic market. The Hastings Generation Project at Long Island Point successfully started up in September, using ethane to generate electricity to supply power to the grid. Woodside holds a 50% non-operating interest in the GBJV and a 32.5% non-operating interest in the Kipper Unit Joint Venture. 1. The NWS Project consists of a number of active joint ventures. Prior to completion of the transaction, Woodside has a participating interest of 33.33% and Chevron has a 16.67% participating interest in all of these joint ventures, apart from the NWS joint ventures with CNOOC. For CLNG JV with CNOOC, Woodside’s participating interest is 25% and Chevron’s is 12.5%. For the Extended Interest JVs with CNOOC, Woodside’s participating interest is 31.567% and Chevron’s participating interest is 15.78%. 28 WOODSIDE ENERGY GROUP LTD

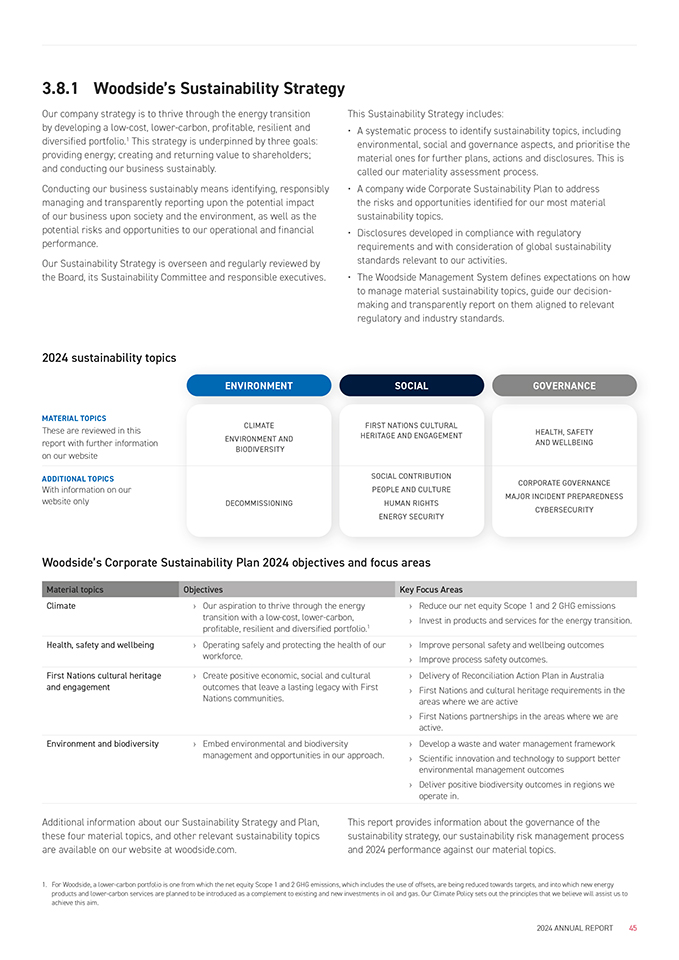

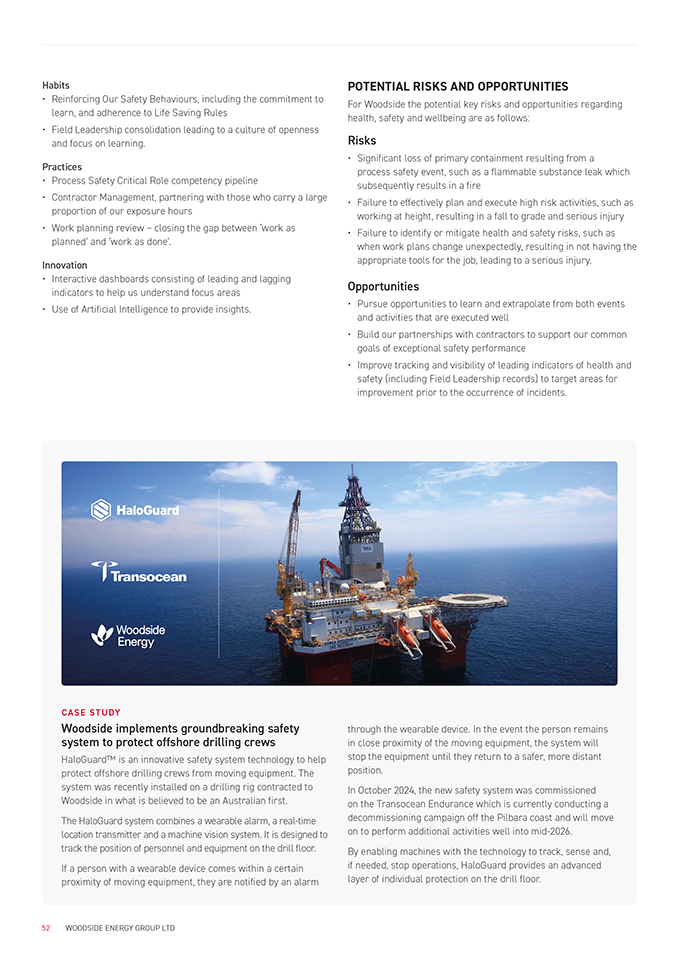

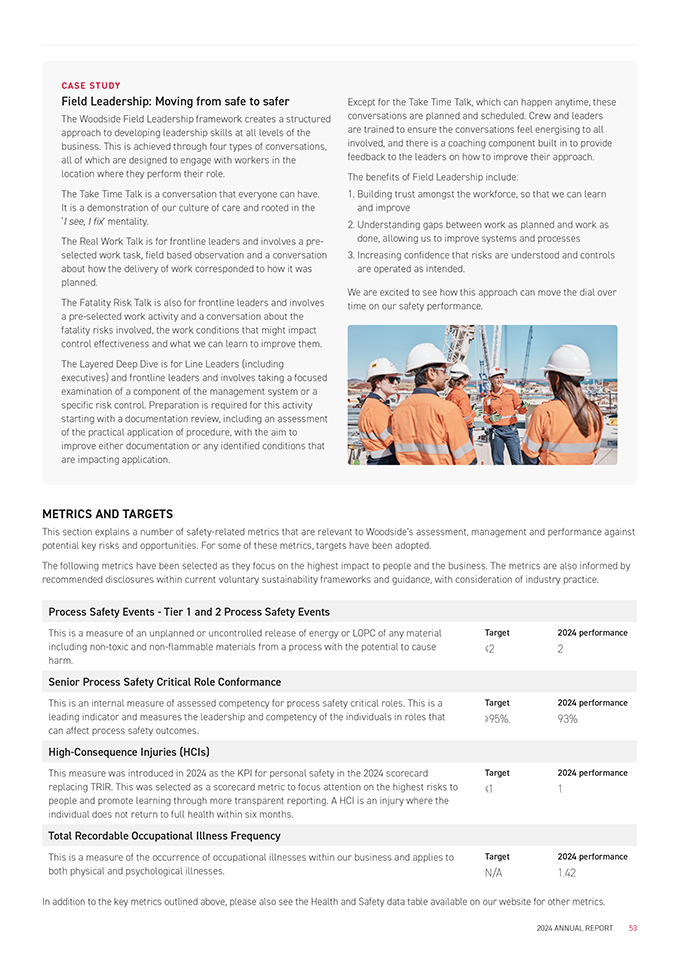

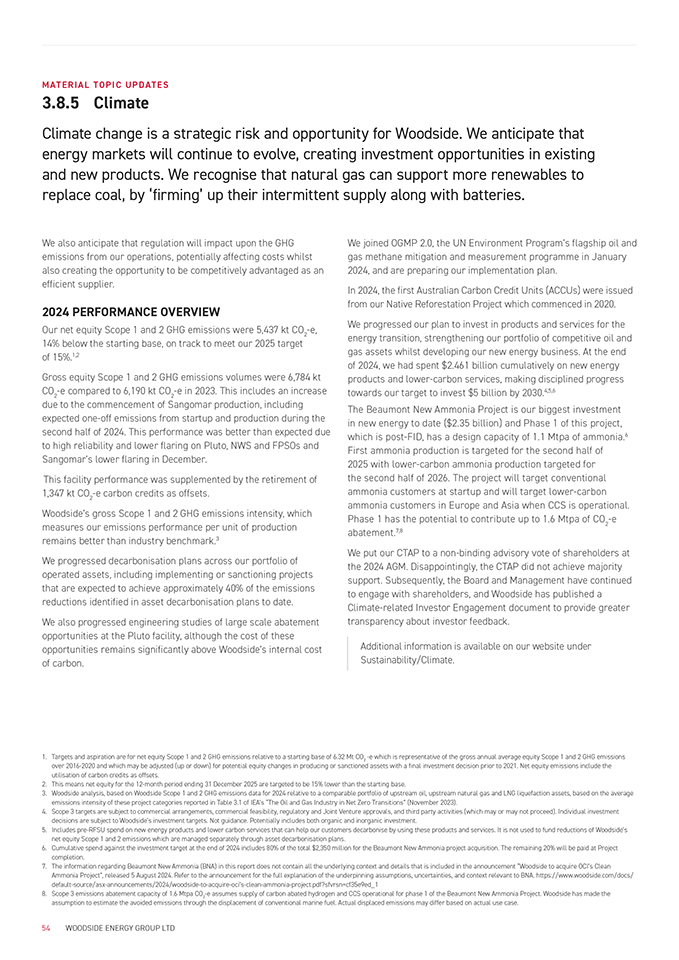

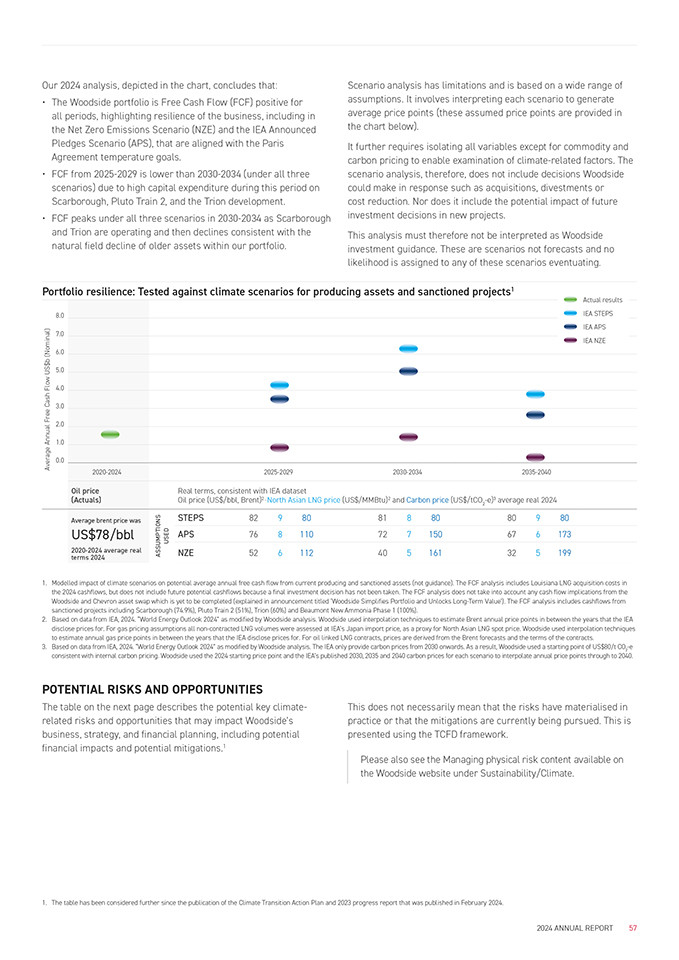

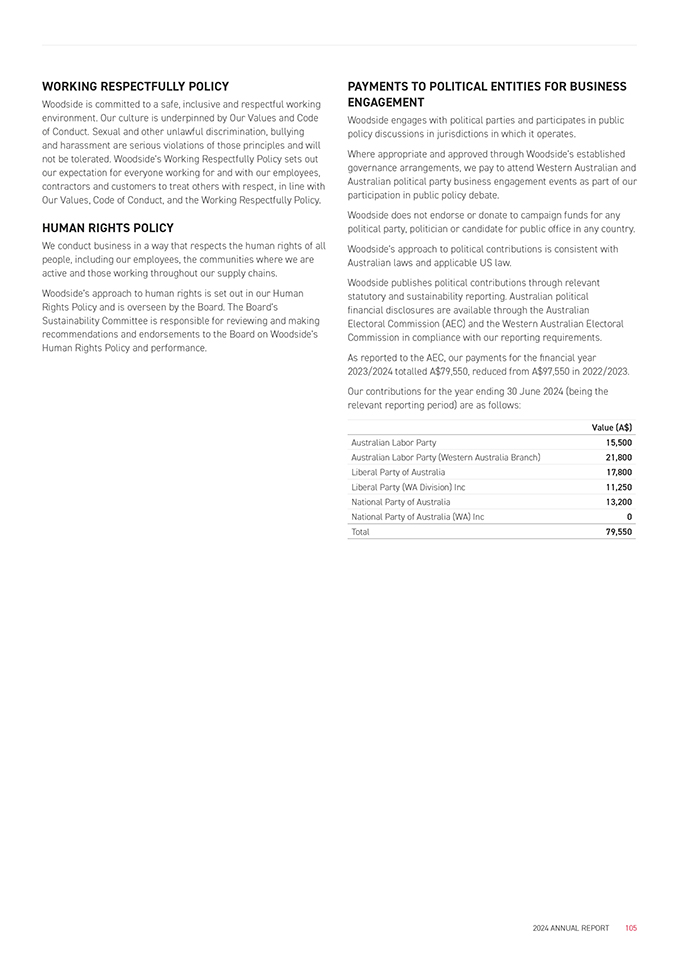

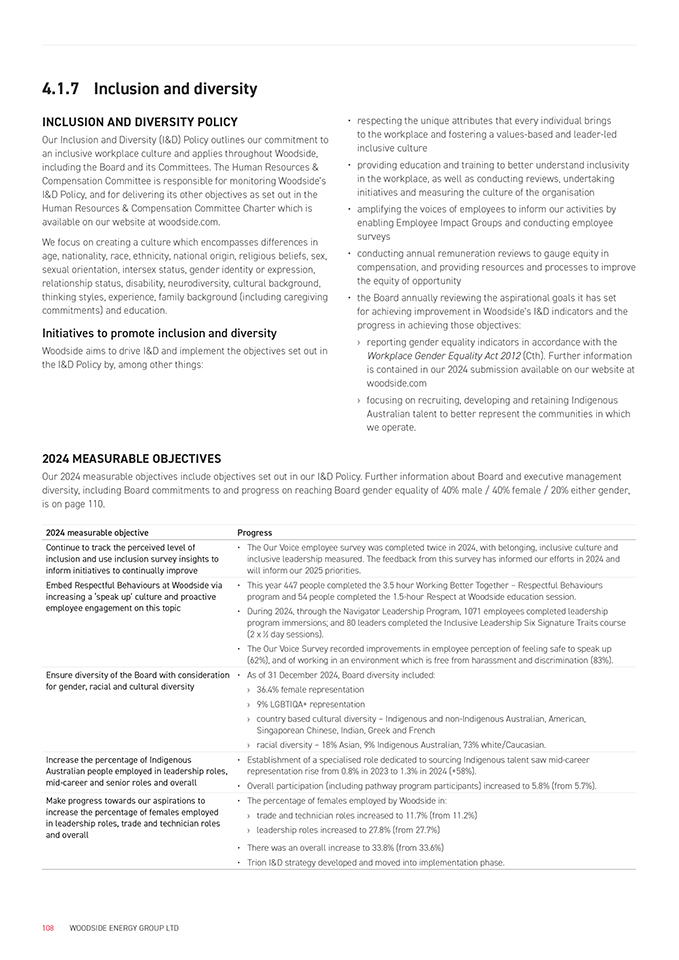

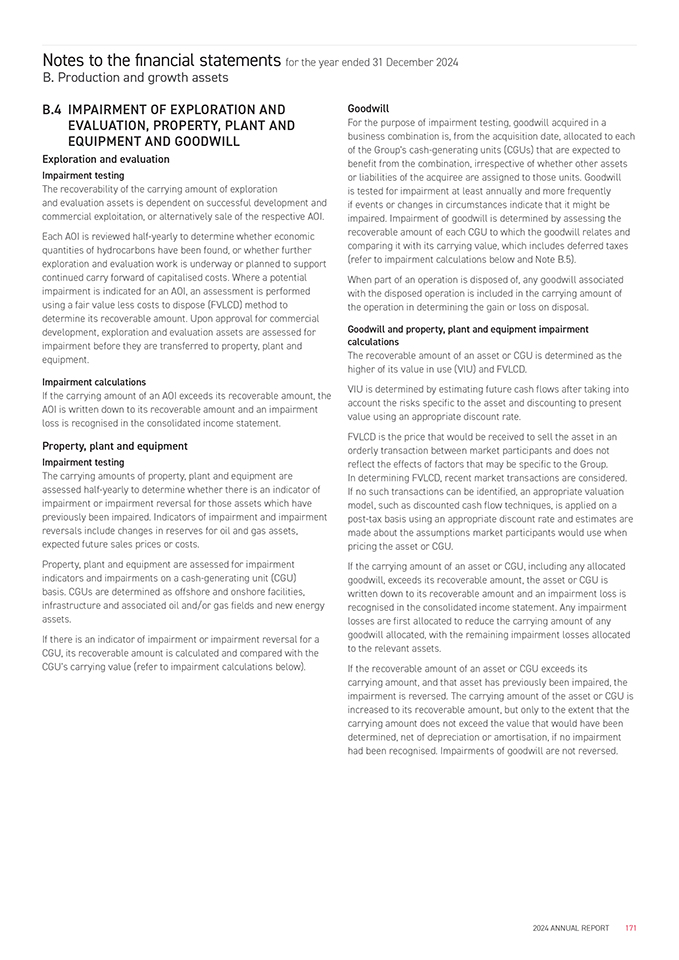

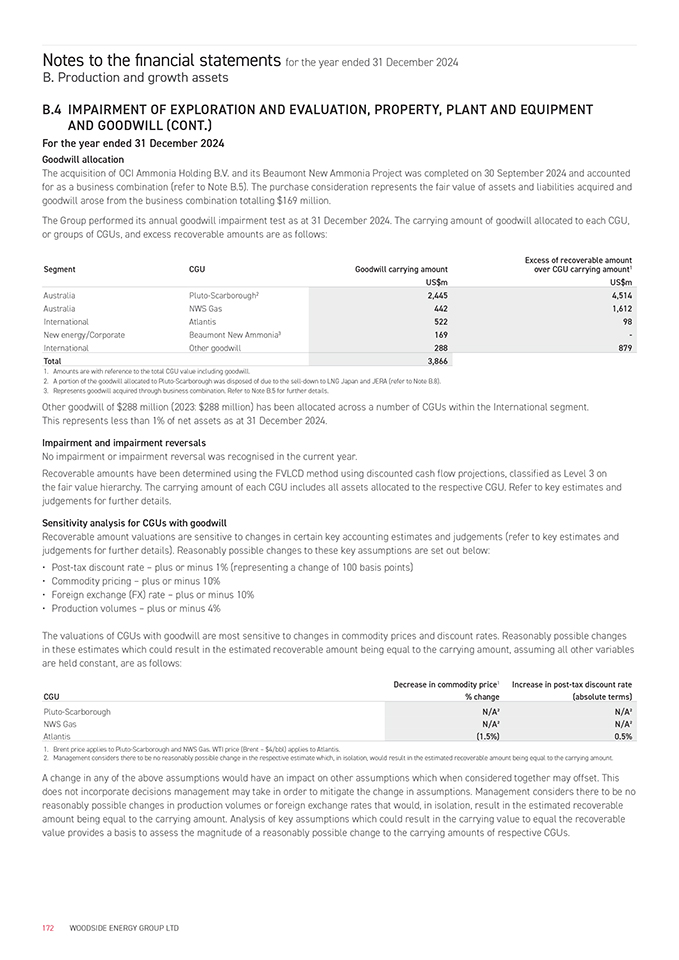

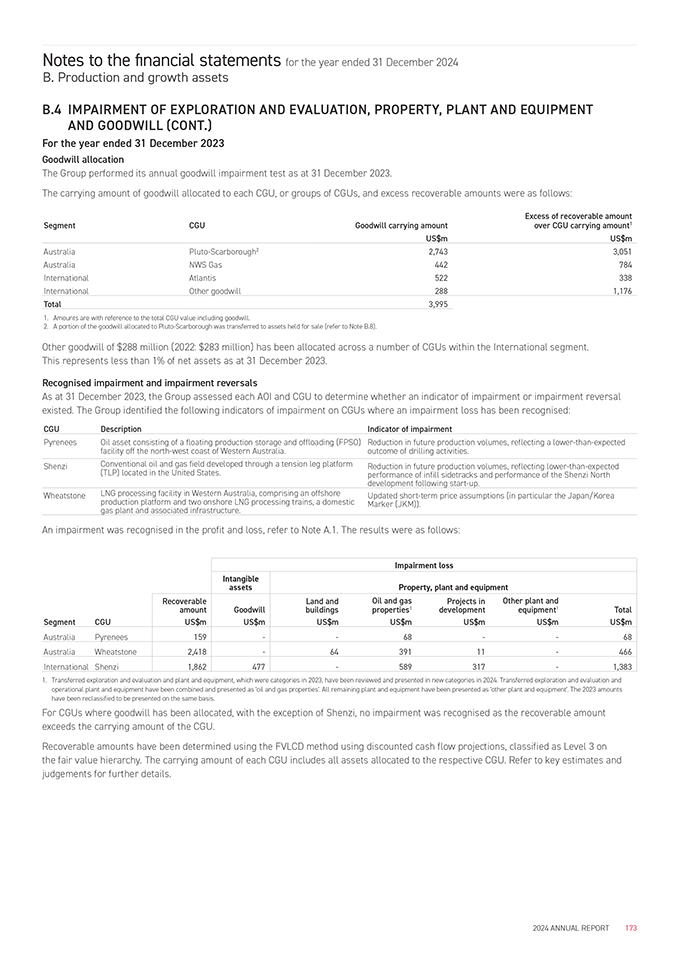

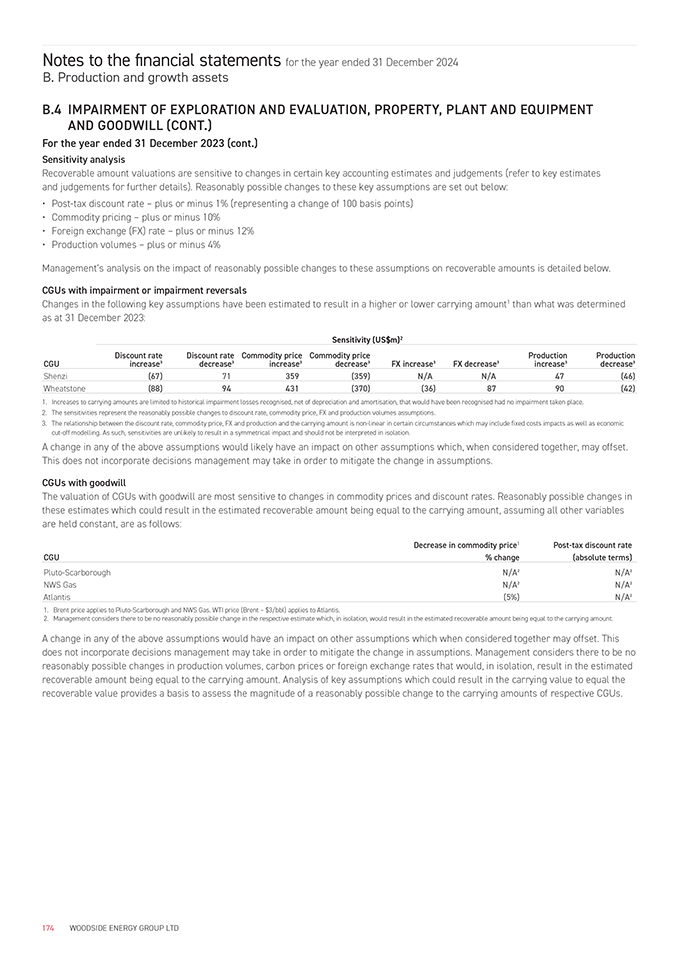

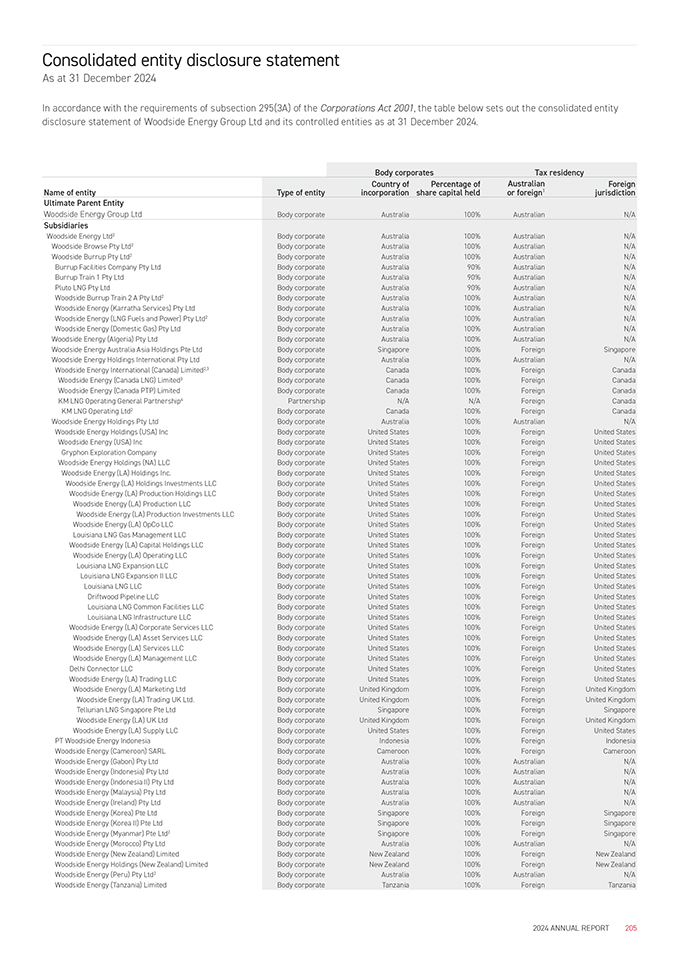

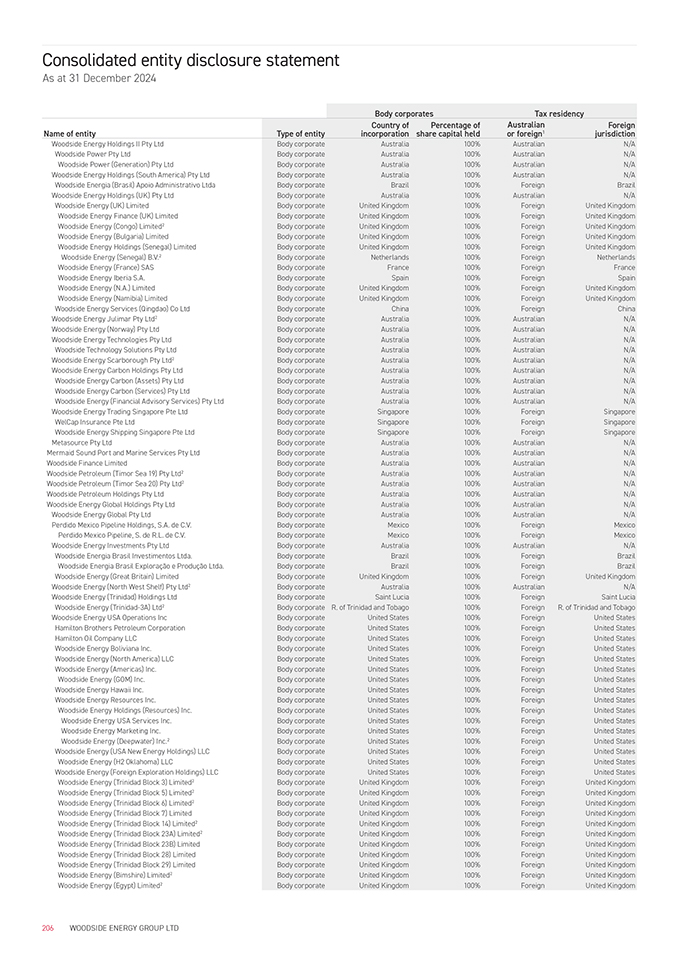

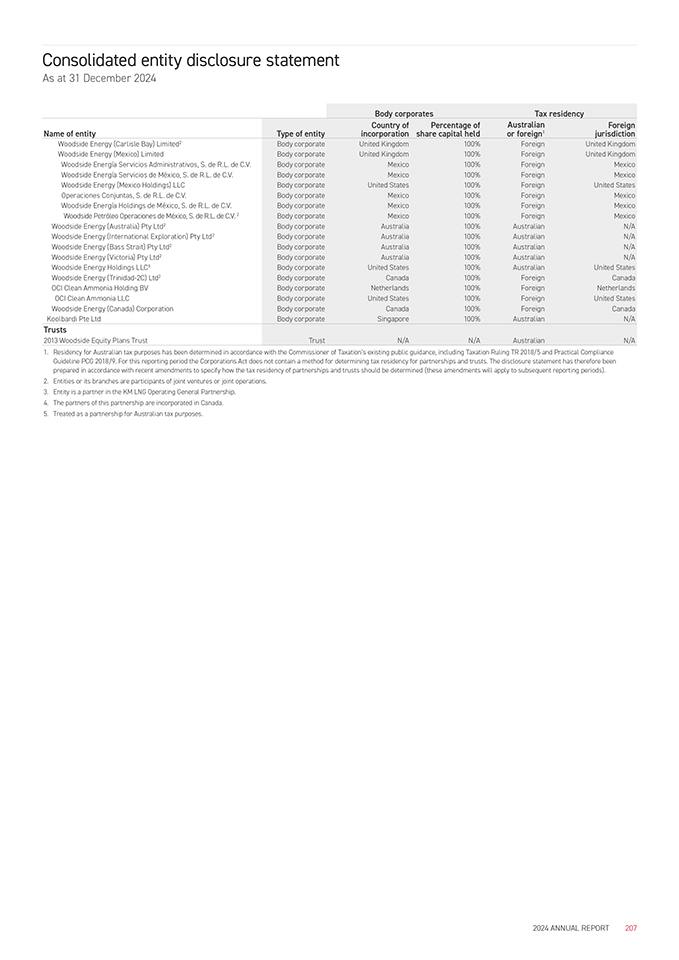

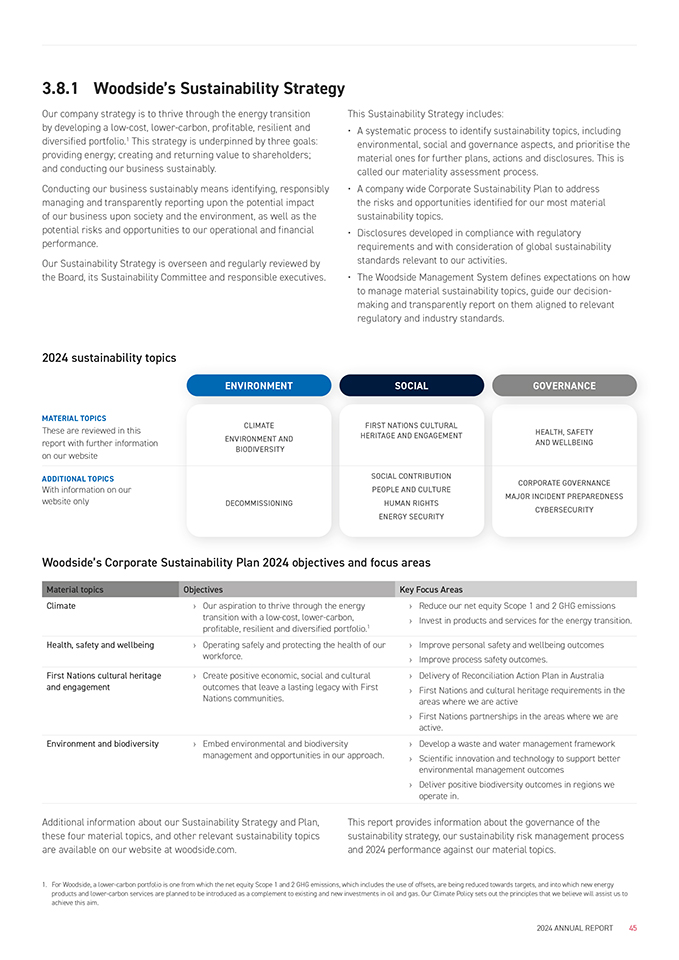

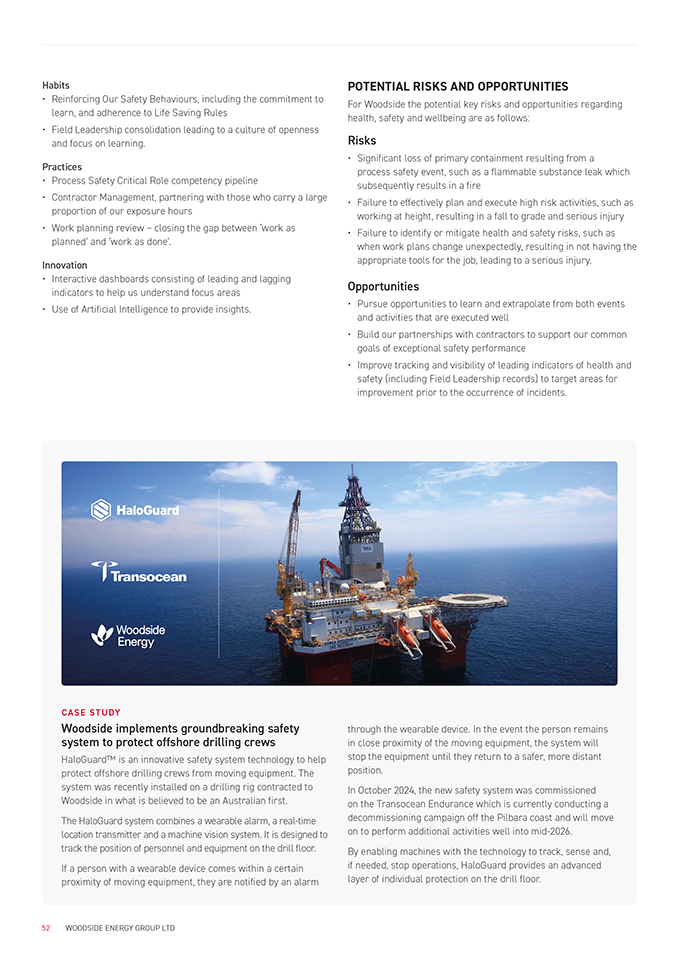

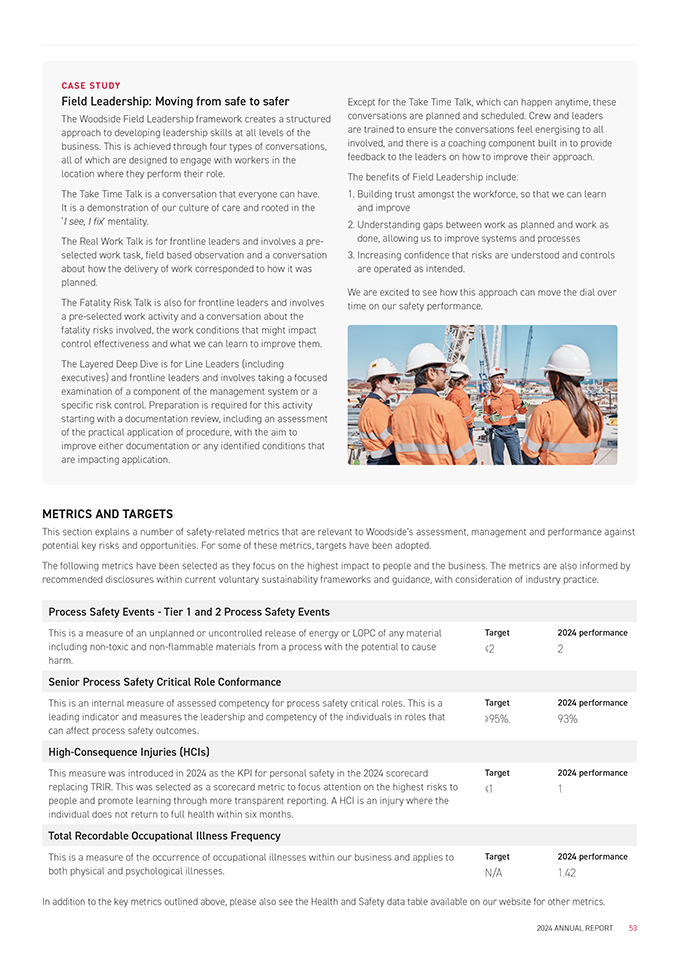

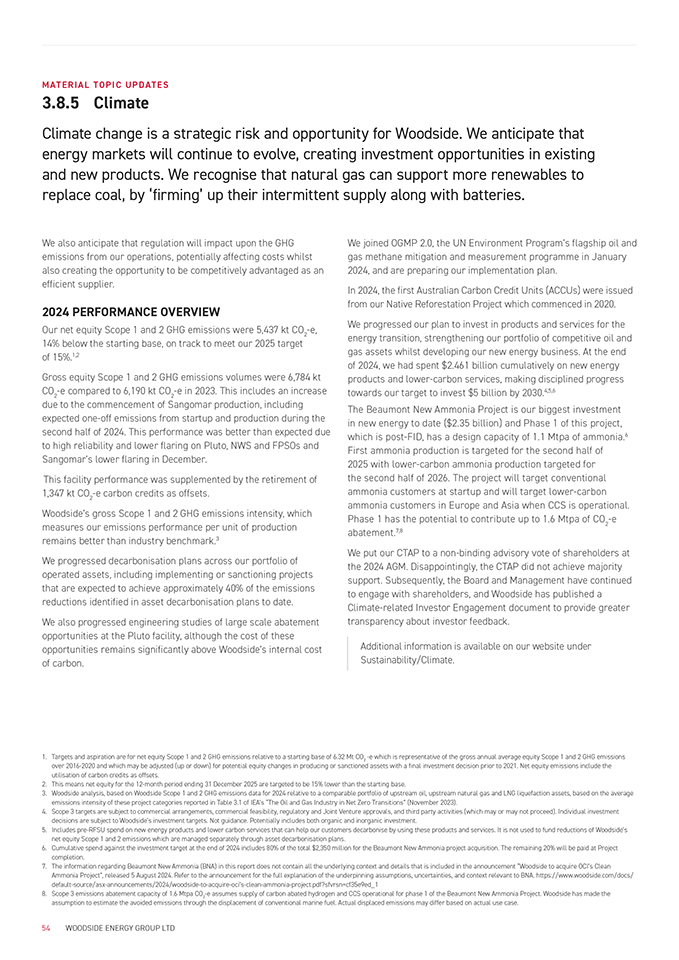

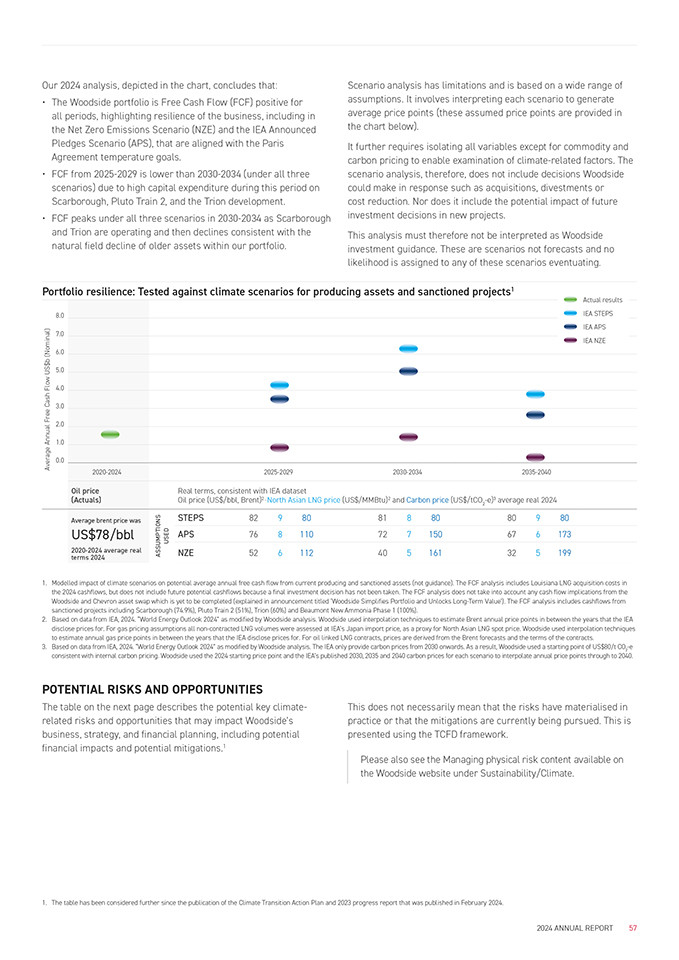

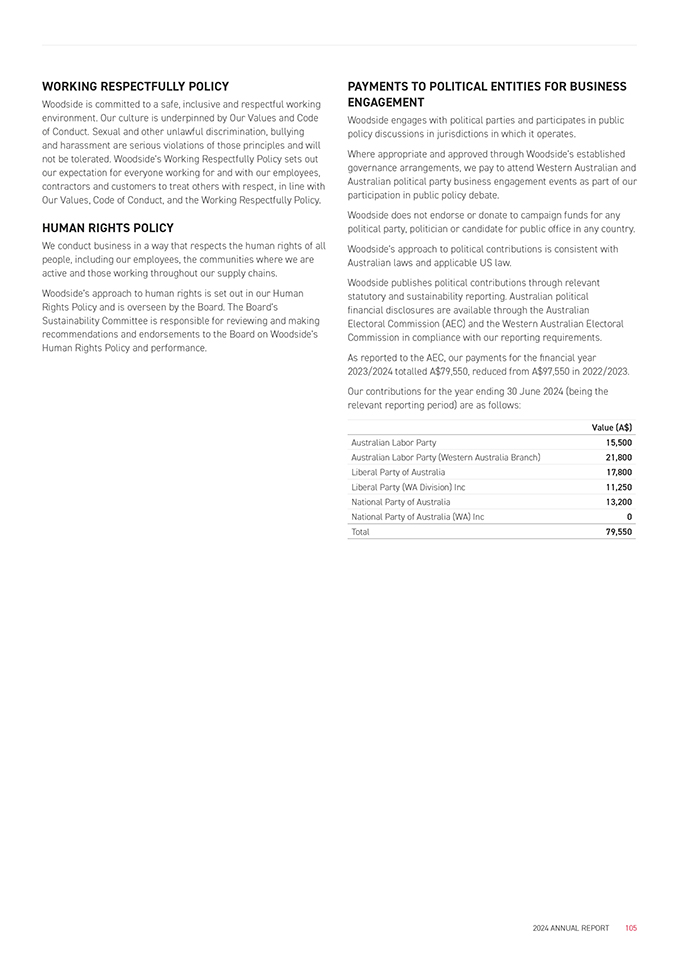

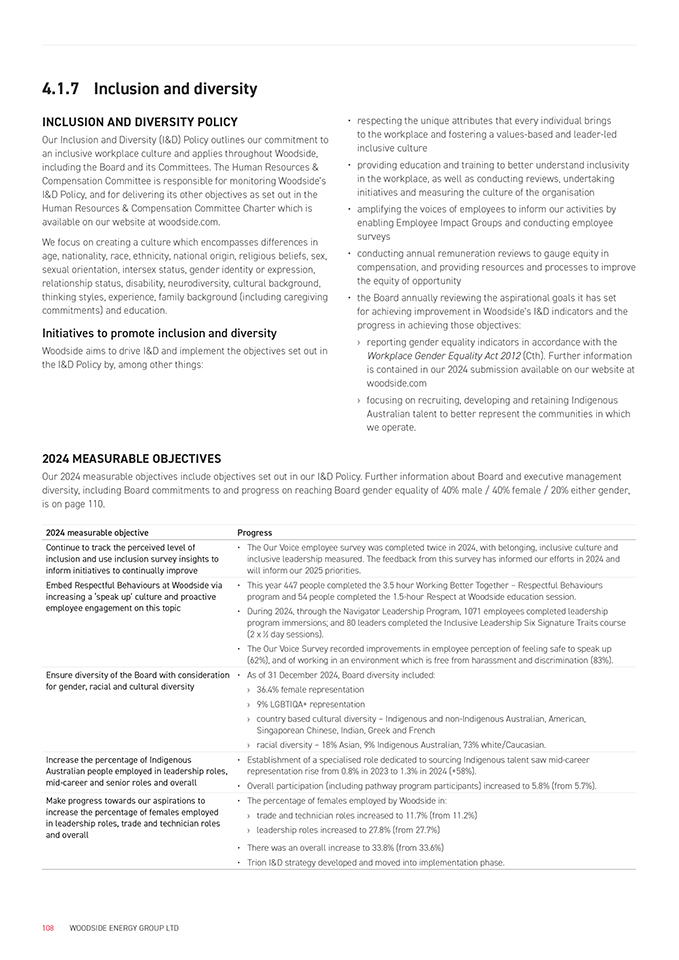

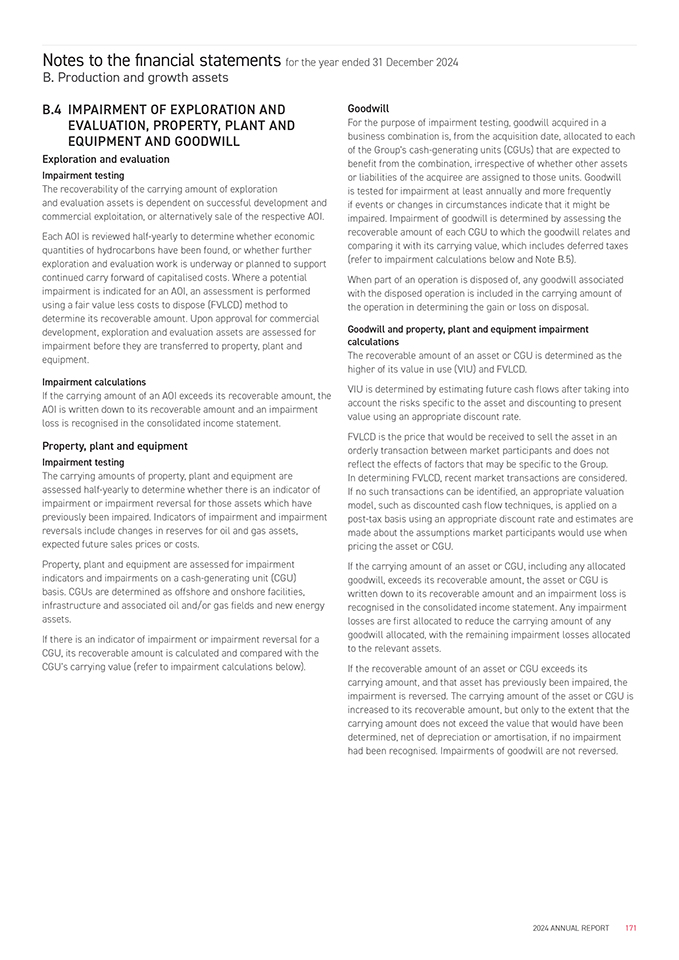

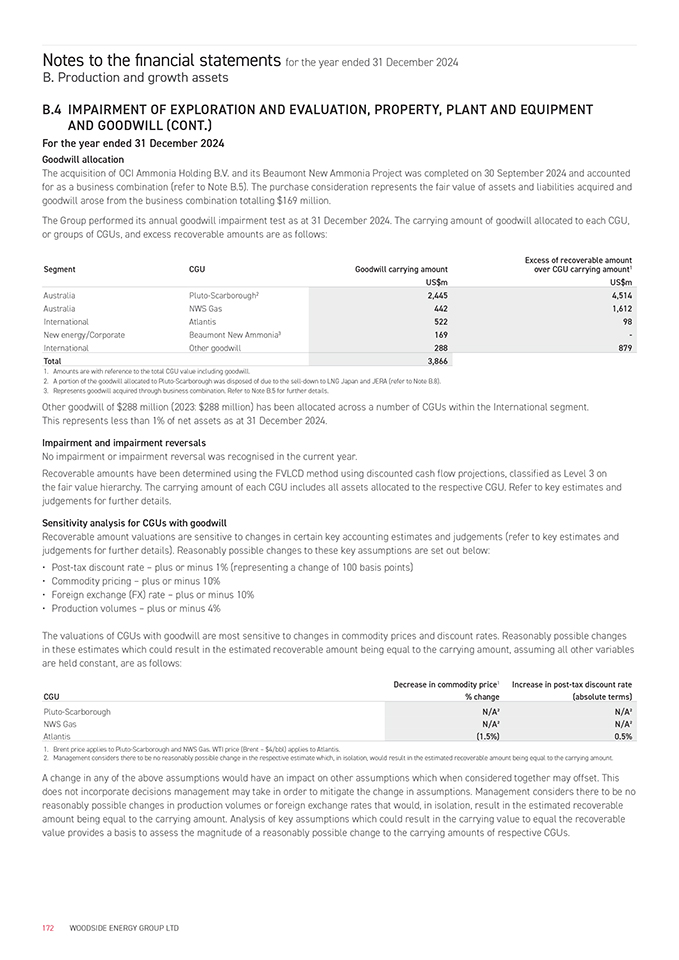

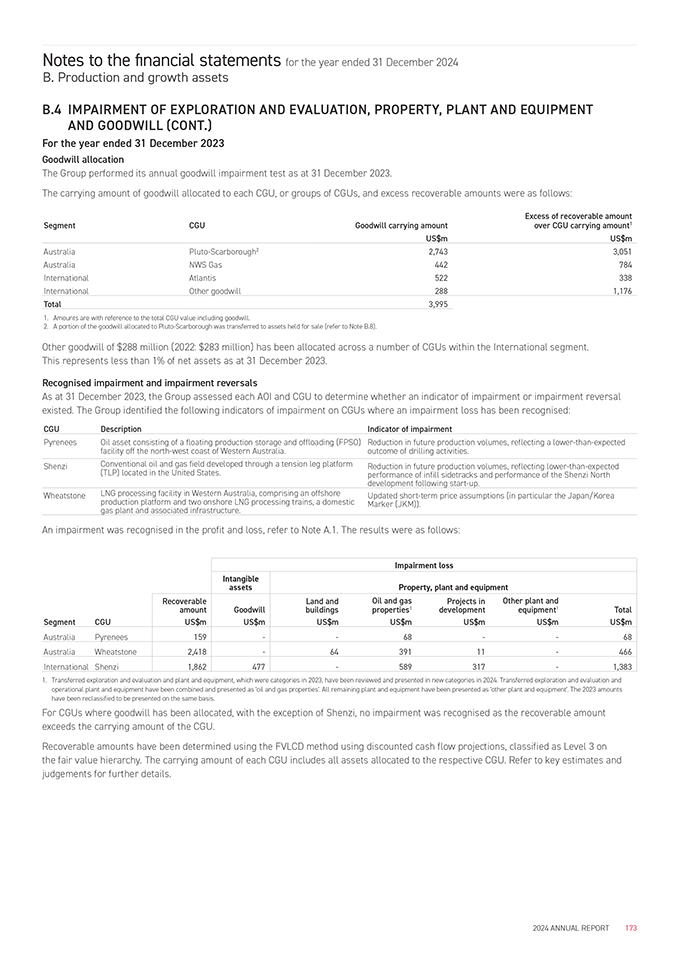

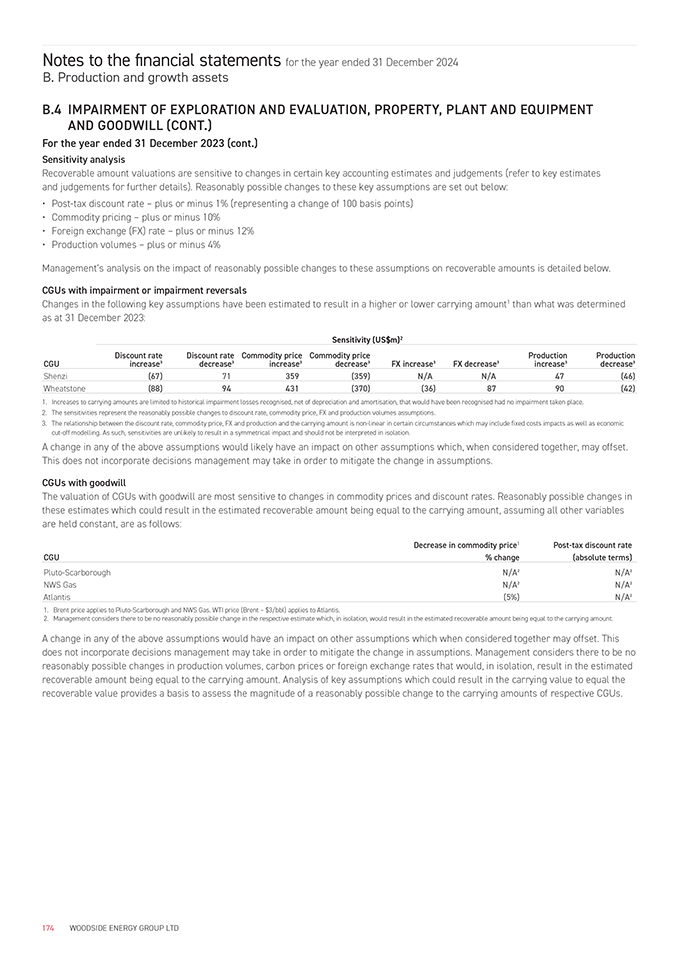

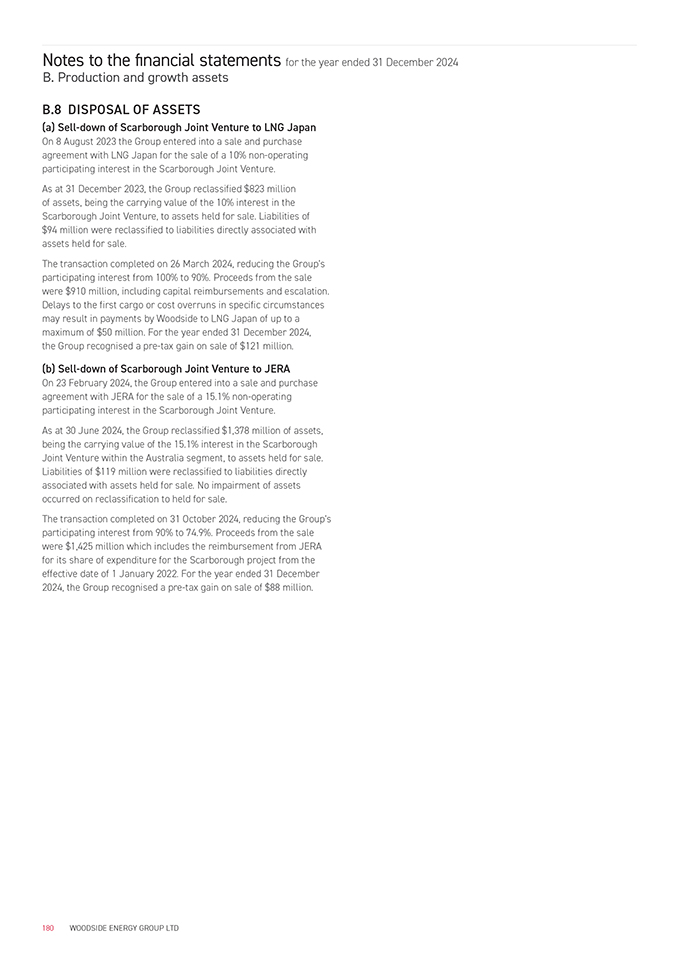

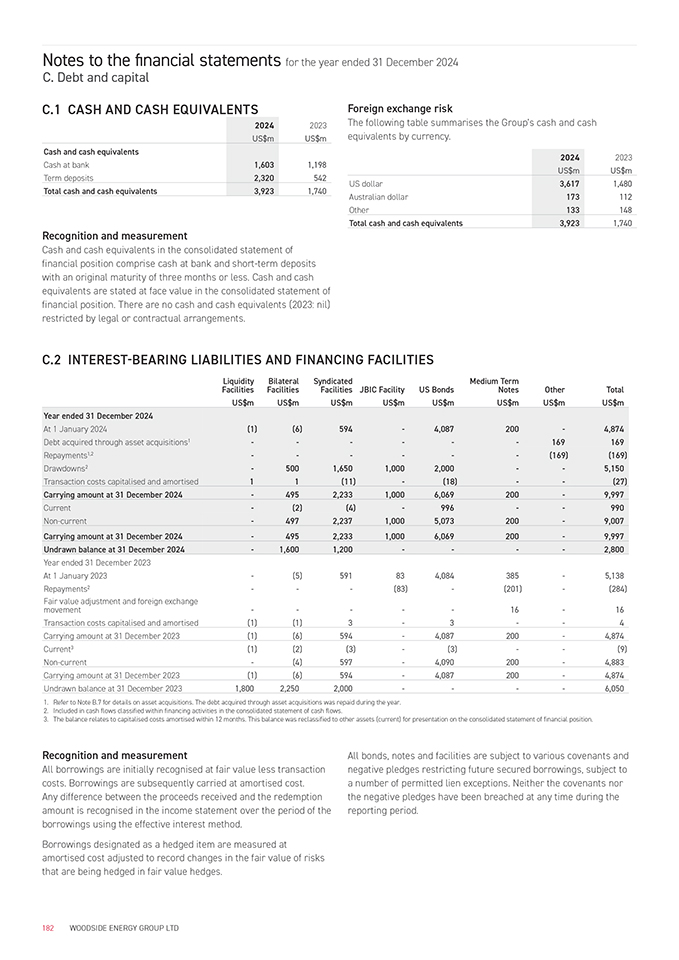

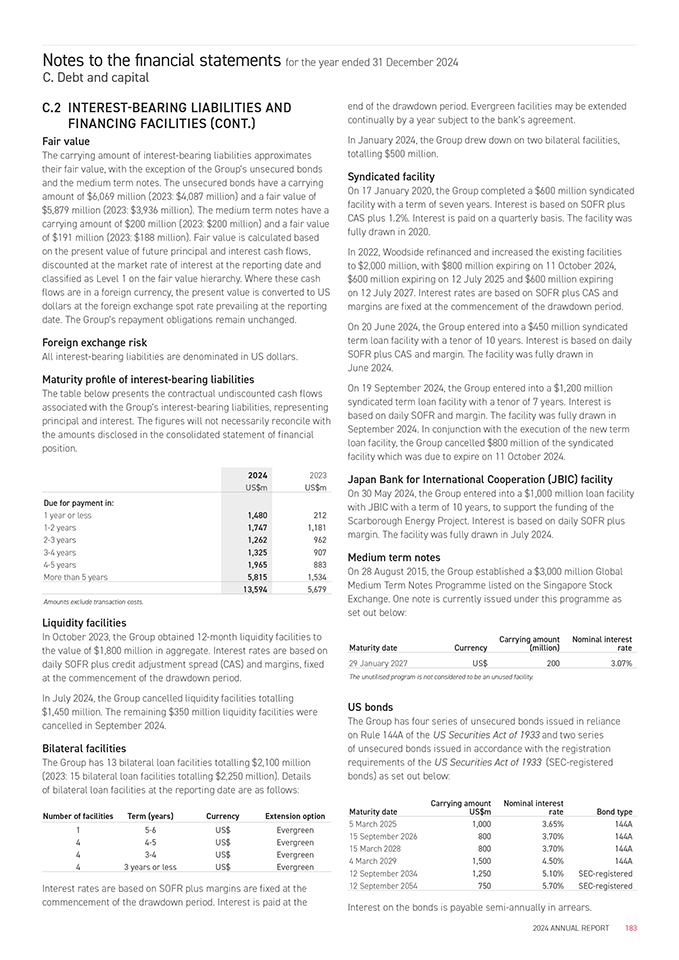

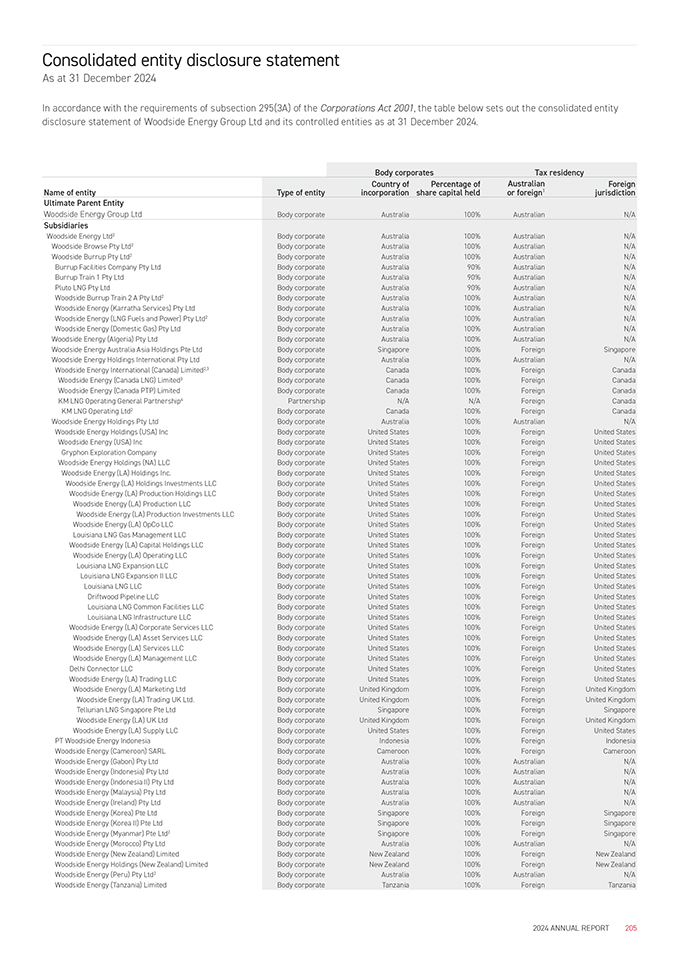

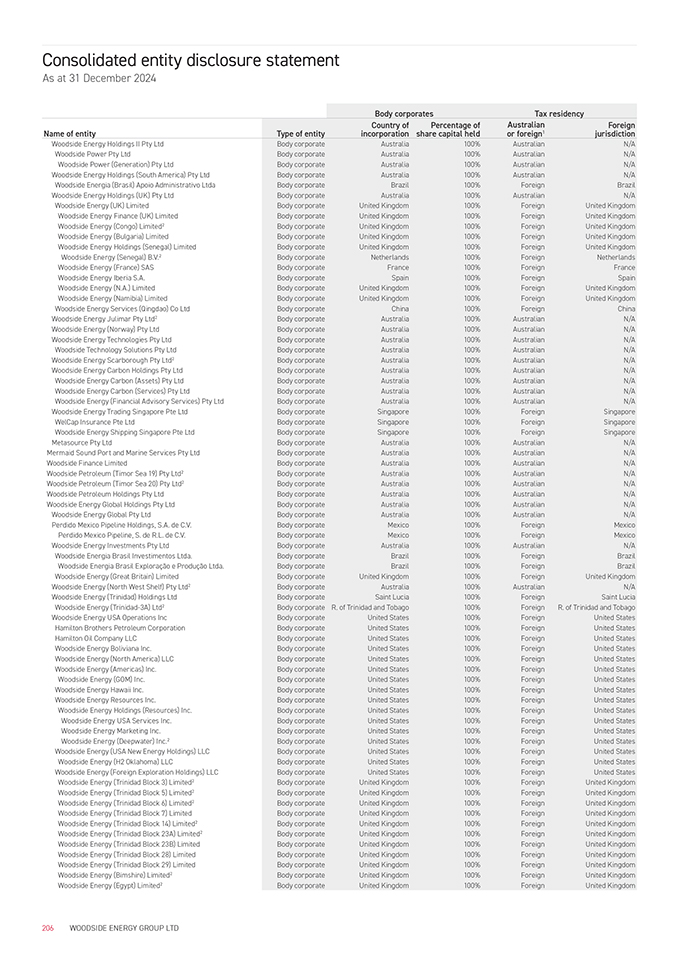

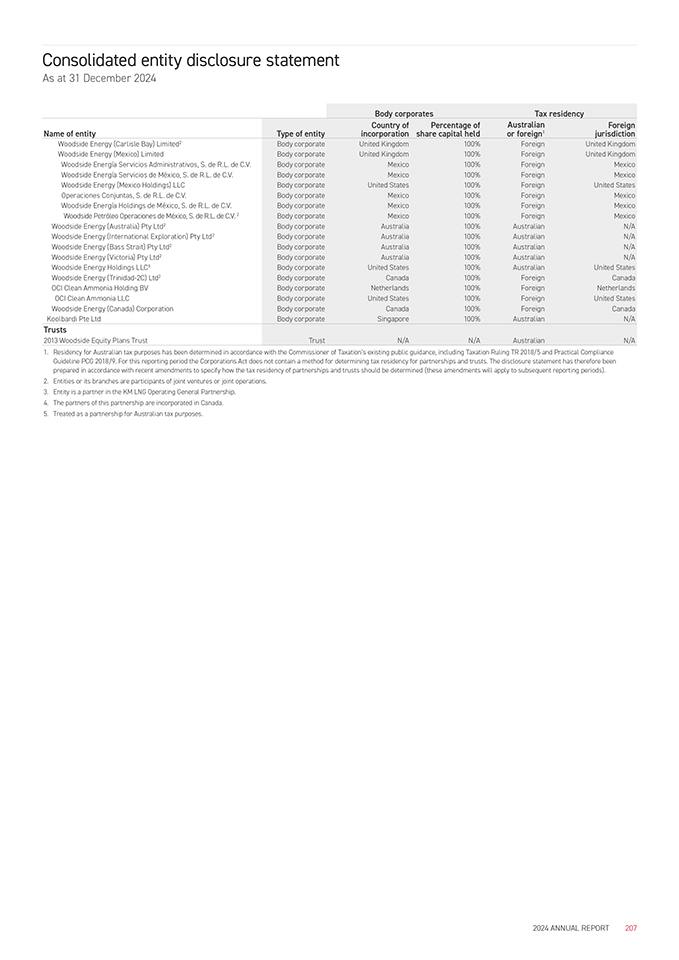

The Karratha Gas Plant in Western Australia has been providing a reliable and affordable supply of natural gas to domestic and international customers for decades OTHER AUSTRALIAN OIL AND GAS ASSETS Woodside operates three FPSO facilities off the North West coast of Western Australia. These are the Ngujima-Yin FPSO (Woodside interest: 60%), Okha FPSO (Woodside interest: 50%) and Pyrenees FPSO (Woodside interest: 40% in WA-43-L and 71.4% in WA-42-L). Woodside’s share of production from the FPSO assets was 7.9 MMboe in 2024, a decrease from 8.0 MMboe in 2023 primarily due to maintenance activities at the Pyrenees FPSO. The Pyrenees FPSO safely completed its planned five-yearly maintenance turnaround in Singapore in May 2024. Macedon (Woodside interest: 71.4%), also operated by Woodside, is a gas project located near Onslow, Western Australia, which produces pipeline gas for the Western Australian domestic gas market. Woodside’s share of production from Macedon in 2024 was 8.0 MMboe, a decrease from 8.2 MMboe in 2023. In October, the facility successfully installed a new front-end compressor, enabling an initial 15% uplift in production. ASSET SWAP In December 2024, Woodside simplified its Australian portfolio and consolidated its focus on operated LNG assets by entering into an agreement with Chevron. Subject to completion, Woodside will acquire Chevron’s 16.67% interest in the North West Shelf (NWS) Project and the NWS Oil Project and a 20% interest in the Angel Carbon Capture and Storage (CCS) Project, and transfer its 13% non-operated interest in the Wheatstone Project and 65% operated interest in the Julimar-Brunello Project to Chevron. Chevron will also make a cash payment to Woodside of up to $400 million. The asset swap provides Woodside with the opportunity to realign its Australian infrastructure interests to provide greater commercial certainty and enhance development prospects. The transaction is subject to the completion of Julimar Phase 3 Project execution and handover which is expected in 2026, and the completion of certain ongoing abandonment activities. The Julimar Phase 3 Project is a four well tie-back to the existing Julimar field production system and is currently in execution phase. Woodside will continue to operate the execution phase, transferring the asset to Chevron at project startup. The effective date of the transaction is 1 January 2024 and is expected to close in 2026. Completion of the transaction is also subject to customary conditions precedent, including Australian Competition and Consumer Commission and Foreign Investment Review Board clearances and other applicable State and Federal regulatory approvals, relevant third-party consents and pre-emption rights of the continuing joint venture participants. 2024 ANNUAL REPORT 29