UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05742

Name of Fund: BlackRock Funds

All-Cap Energy & Resources Portfolio

Asset Allocation Portfolio

Aurora Portfolio

Capital Appreciation Portfolio

Energy & Resources Portfolio

Global Opportunities Portfolio

Health Sciences Opportunities Portfolio

International Opportunities Portfolio

Mid-Cap Growth Equity Portfolio

Mid-Cap Value Equity Portfolio

Science & Technology Opportunities Portfolio

Small Cap Core Equity Portfolio

Small Cap Growth Equity Portfolio

Small/Mid-Cap Growth Portfolio

U.S. Opportunities Portfolio

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: Anne F. Ackerley, Chief Executive Officer, BlackRock Funds, 55 East 52nd Street, New York, NY 10055.

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 09/30/2010

Date of reporting period: 03/31/2010

| | | | |

| Item 1 | | – | | Report to Stockholders |

| | |

| BlackRock FundsSM | |  |

| |

| SEMI-ANNUAL REPORT | MARCH 31, 2010 (UNAUDITED) | | |

BlackRock All-Cap Energy & Resources Portfolio

BlackRock Aurora Portfolio

BlackRock Capital Appreciation Portfolio

BlackRock Energy & Resources Portfolio

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE

Table of Contents

| | | | | | |

| 2 | | BLACKROCK FUNDS | | MARCH 31, 2010 | | |

Dear Shareholder

The past year has seen a remarkable turnaround from the conditions that plagued the global economy and financial markets in 2008 through early 2009. In our opinion, the “Great Recession” likely ended at some point last summer, thanks primarily to massive fiscal and monetary stimulus. From that point, the global economy has moved into recovery mode and, we believe, is getting ready to start transitioning into an expansion.

Global equity markets bottomed in early 2009 and since that time have soared dramatically higher as investors were lured back into the markets by depressed valuations, desire for higher yields and increasing confidence that all-out financial disaster had been averted. There have been several corrections along the way and volatility levels have remained elevated — reflections of mixed economic data, lingering deflation issues (especially in Europe) and concerns over the future direction of interest rates. On balance, however, strong corporate earnings and a positive macro backdrop have helped keep the equity bull market intact. From a geographic perspective, US equities have generally outpaced their international counterparts in recent months, as the domestic economic recovery has been more pronounced.

Within fixed income markets, improving economic conditions, concerns over the US deficit and a lack of demand at recent Treasury auctions have recently conspired to push Treasury yields higher (and prices correspondingly lower). In this environment, Treasuries have dramatically underperformed other areas of the bond market, particularly the high yield sector, which has been benefiting from increased investor demand. Meanwhile, municipal bonds outperformed taxable sectors over the twelve-month period thanks to continued high demand levels, but have struggled in recent months against a weak fundamental backdrop marked by ongoing state and local budget problems. As in the taxable arena, high yield municipals have been outperforming the rest of the market.

Regarding cash investments, yields on money market securities remain near all-time lows (producing returns only marginally above zero percent), with the Federal Open Market Committee reiterating that economic circumstances are likely to necessitate an accommodative interest rate stance for an “extended period.”

Against this backdrop, the major market averages posted the following returns:

| | | | | | |

Total Returns as of March 31, 2010 | | 6-month | | | 12-month | |

US equities (S&P 500 Index) | | 11.75 | % | | 49.77 | % |

Small cap US equities (Russell 2000 Index) | | 13.07 | | | 62.76 | |

International equities (MSCI Europe, Australasia, Far East Index) | | 3.06 | | | 54.44 | |

3-month Treasury bill (BofA Merrill Lynch 3-Month Treasury Bill Index) | | 0.05 | | | 0.17 | |

US Treasury securities (BofA Merrill Lynch 10-Year US Treasury Index) | | (2.62 | ) | | (6.30 | ) |

Taxable fixed income (Barclays Capital US Aggregate Bond Index) | | 1.99 | | | 7.69 | |

Tax-exempt fixed income (Barclays Capital Municipal Bond Index) | | 0.28 | | | 9.69 | |

High yield bonds (Barclays Capital US Corporate High Yield 2% Issuer Capped Index) | | 10.97 | | | 55.64 | |

Past performance is no guarantee of future results. Index performance shown for illustrative purposes only. You cannot invest directly in an index.

Global financial markets continue to show signs of improvement, but questions about the strength and sustainability of the recovery abound. Through periods of uncertainty, as ever, BlackRock’s full resources are dedicated to the management of our clients’ assets. For additional market perspective and investment insight, visit www.blackrock.com/shareholdermagazine, where you’ll find the most recent issue of our award-winning Shareholder® magazine, as well as its quarterly companion newsletter, Shareholder Perspectives. As always, we thank you for entrusting BlackRock with your investments, and we look forward to your continued partnership in the months and years ahead.

|

| Sincerely, |

|

|

| Rob Kapito |

| President, BlackRock Advisors, LLC |

THIS PAGE NOT PART OF YOUR FUND REPORT

| | |

| Fund Summary as of March 31, 2010 | | BlackRock All-Cap Energy & Resources Portfolio |

| |

Portfolio Management Commentary | | |

How did the Fund perform?

| | • | | During the six-month period, the Fund outperformed its custom blended benchmark, which is comprised 70% of the Wilshire 5000 Modified Energy Cap Weighted Index and 30% of the MSCI All-Country World Energy Index, but underperformed the broad-market S&P 500 Index. The following discussion of relative performance pertains to the Fund’s custom blended benchmark. |

What factors influenced performance?

| | • | | Coal stocks have been an area of leadership within energy over the past couple of quarters. Pricing in Asia strengthened substantially – especially for metallurgical coal – due to strong coal demand. Accordingly, stocks with metallurgical exposure, such as Massey Energy Co., have been strong performers. On the whole, the Fund’s overweight allocation to coal and our strong stock selection within the segment powered both absolute and relative returns during the reporting period. Additionally, our modest overweight exposure to the diversified metals/ mining complex generated positive relative returns, as demand for industrial metals improved during the six months. |

| | • | | Conversely, the Fund’s gold allocation hurt relative returns. The segment had been strong on US dollar (USD) weakness, but the USD experienced a countertrend rally during the period, and gold prices and gold producers suffered. In particular, Agnico-Eagle Mines Ltd. declined more than 16%. Additionally, the Fund’s long-standing underweight in the oil and gas storage and transportation segment hurt relative returns. |

Describe recent portfolio activity.

| | • | | Natural gas prices have lagged the rally in the majority of natural resources. As a result, we selectively added to certain gas producers late in the reporting period. We are emphasizing shale gas producers, as we believe they represent good value at current prices, with significant upside due to strong production growth and the eventual recovery of gas prices. |

Describe Fund positioning at period end.

| | • | | At period end, we continue to be aggressively positioned, with a preference for coal and oil and gas exploration and production stocks. In the current environment, the equities across the energy complex are discounting long-term commodity price expectations far below what we expect given reasonable worldwide economic growth. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Portfolio Information

| | | |

Ten Largest Holdings | | Percent of

Long-Term

Investments | |

Massey Energy Co. | | 5 | % |

CONSOL Energy, Inc. | | 4 | |

Whiting Petroleum Corp. | | 4 | |

Occidental Petroleum Corp. | | 3 | |

Apache Corp. | | 3 | |

EOG Resources, Inc. | | 3 | |

Core Laboratories NV | | 3 | |

FMC Technologies, Inc. | | 3 | |

Peabody Energy Corp. | | 3 | |

Penn West Energy Trust | | 3 | |

| |

Industry Allocation | | Percent of

Long-Term

Investments | |

Oil, Gas & Consumable Fuels | | 66 | % |

Energy Equipment & Services | | 18 | |

Metals & Mining | | 9 | |

Gas Utilities | | 4 | |

Chemicals | | 3 | |

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease.

| | | | | | |

| 4 | | BLACKROCK FUNDS | | MARCH 31, 2010 | | |

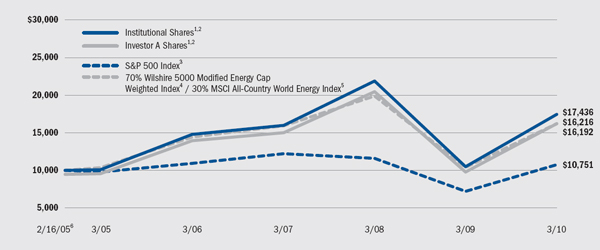

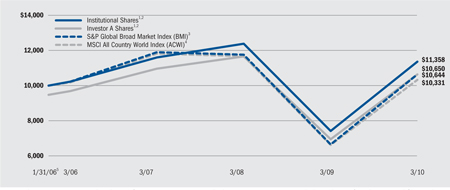

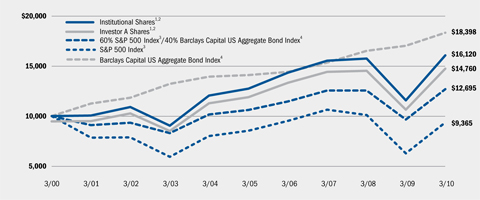

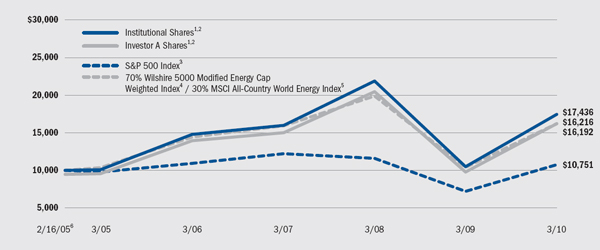

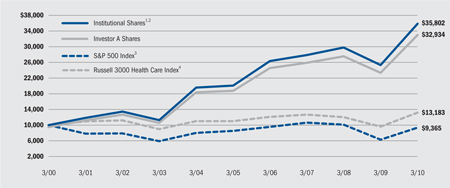

BlackRock All-Cap Energy & Resources Portfolio

Total Return Based on a $10,000 Investment

| 1 | Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| 2 | Under normal market conditions, the Fund invests at least 80% of its total assets in securities of global energy and natural resources companies and companies in associated businesses, as well as utilities (such as gas, water, cable, electrical and telecommunications utilities). |

| 3 | This unmanaged total return index covers 500 industrial, utility, transportation and financial companies of the US markets (mostly New York Stock Exchange (“NYSE”) issues) representing about 75% of NYSE market capitalization and 30% of NYSE issues. S&P 500 is a trademark of the McGraw-Hill Companies. |

| 4 | The Wilshire 5000 Modified Energy Cap Weighted Index is a customized index comprised of the energy sector constituents of the Wilshire 5000 (Full Cap) Index which have been market capitalization weighted and the six largest securities and all securities that have a percentage market value below 0.01% have been removed. |

| 5 | The MSCI All-Country World Energy Index is comprised of the energy sector constituents of the MSCI All-Country World Index, a free float-adjusted market capitalization weighted index designed to measure the equity market performance of developed and emerging markets. |

| 6 | Commencement of operations. |

Performance Summary for the Period Ended March 31, 2010

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns7 | |

| | | | | | 1 Year | | | 5 Year | | | Since Inception8 | |

| | | 6-Month

Total Returns | | | w/o sales

charge | | | w/ sales

charge | | | w/o sales

charge | | | w/ sales

charge | | | w/o sales

charge | | | w/ sales

charge | |

Institutional | | 10.51 | % | | 66.10 | % | | N/A | | | 11.63 | % | | N/A | | | 11.48 | % | | N/A | |

Service | | 10.29 | | | 65.44 | | | N/A | | | 11.18 | | | N/A | | | 11.04 | | | N/A | |

Investor A | | 10.26 | | | 65.39 | | | 56.75 | % | | 11.17 | | | 9.97 | % | | 11.03 | | | 9.87 | % |

Investor B | | 9.88 | | | 64.27 | | | 59.77 | | | 10.38 | | | 10.11 | | | 10.21 | | | 10.08 | |

Investor C | | 9.87 | | | 64.19 | | | 63.19 | | | 10.36 | | | 10.36 | | | 10.24 | | | 10.24 | |

S&P 500 Index | | 11.75 | | | 49.77 | | | N/A | | | 1.92 | | | N/A | | | 1.42 | | | N/A | |

70% Wilshire 5000 Modified Energy Cap Weighted Index / 30% MSCI All-Country World Energy Index | | 8.66 | | | 56.31 | | | N/A | | | 9.36 | | | N/A | | | 9.89 | | | N/A | |

| 7 | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees. |

| 8 | The Fund commenced operations on February 16, 2005. |

N/A - Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

Expense Example

| | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical10 |

| | | Beginning

Account Value

October 1, 2009 | | Ending

Account Value

March 31, 2010 | | Expenses Paid

During the Period9 | | Beginning

Account Value

October 1, 2009 | | Ending

Account Value

March 31, 2010 | | Expenses Paid

During the Period9 |

Institutional | | $ | 1,000 | | $ | 1,105.10 | | $ | 4.88 | | $ | 1,000 | | $ | 1,020.29 | | $ | 4.68 |

Service | | $ | 1,000 | | $ | 1,102.90 | | $ | 7.03 | | $ | 1,000 | | $ | 1,018.25 | | $ | 6.74 |

Investor A | | $ | 1,000 | | $ | 1,102.60 | | $ | 7.02 | | $ | 1,000 | | $ | 1,018.25 | | $ | 6.74 |

Investor B | | $ | 1,000 | | $ | 1,098.80 | | $ | 10.99 | | $ | 1,000 | | $ | 1,014.46 | | $ | 10.55 |

Investor C | | $ | 1,000 | | $ | 1,098.70 | | $ | 10.88 | | $ | 1,000 | | $ | 1,014.56 | | $ | 10.45 |

| 9 | For each class of the Fund, expenses are equal to the annualized expense ratio for the class (0.93% for Institutional, 1.34% for Service, 1.34% for Investor A, 2.10% for Investor B and 2.08% for Investor C), multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

| 10 | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half-year divided by 365. |

See “Disclosure of Expenses” on page 13 for further information on how expenses were calculated.

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2010 | | 5 |

| | |

| Fund Summary as of March 31, 2010 | | BlackRock Aurora Portfolio |

| |

Portfolio Management Commentary | | |

How did the Fund perform?

| | • | | The Fund generated strong results for the six-month period, but underperformed its benchmark, Russell 2500 Value Index. |

What factors influenced performance?

| | • | | Positive stock selection in the health care sector, particularly among health care providers, pharmaceutical makers and health care equipment manufacturers, boosted Fund performance for the period. Notable individual contributors included respiratory therapy provider Lincare Holdings, Inc. and Lifepoint Hospitals, Inc. Strong overall selection in the energy sector also added value, even though natural gas related holdings slumped in conjunction with falling gas prices. In the more defensive utilities sector, an underweight in independent power producers and stock selection among water utilities contributed to results. An underweight in the financials sector and strong performance from the Fund’s metals and mining holdings also benefited performance comparisons. |

| | • | | In contrast, poor relative returns from the Fund’s holdings in the industrials sector hampered performance. In particular, prison operator Corrections Corp. of America and Mueller Water Products, Inc. - Class A stumbled, weighing on overall results. Consumer discretionary stocks rallied during the period on a pickup in consumer spending levels and increasing optimism around the broader economic outlook. Although the Fund’s consumer discretionary holdings produced strong absolute returns, they trailed their benchmark counterparts. Weakness was most pronounced among restaurants and gaming-related names. Lottery ticket maker Scientific Games Corp. - Class A was a notable individual detractor as shares slid in response to disappointing quarterly earnings. Lastly, the Fund’s cash position had a negative impact on performance, given the strong upward move in stock prices during the period. |

Describe recent portfolio activity.

| | • | | During the six months, we reduced an underweight in the financials sector by adding positions in the capital markets, thrifts and mortgage finance and insurance sub-sectors. In utilities, we added several electric utilities names, including Northeast Utilities and NV Energy, Inc. Conversely, we pared an overweight in information technology by selling electronic equipment, instruments and components and semiconductor-related names, such as Tech Data Corp. and Fairchild Semiconductor International, Inc. Similarly, we reduced our weighting in consumer discretionary, closing positions in leisure products manufacturer Hasbro, Inc. and apparel retailer Guess?, Inc. |

Describe Fund positioning at period end.

| | • | | At period end, the Fund continued to maintain a pro-cyclical bias, with overweights in the consumer discretionary, industrials and information technology sectors, and underweights in financials and utilities. While we continue to believe recovery is underway, the road ahead will likely be bumpy. We remain focused on identifying attractively-valued stocks of companies that have rationalized their cost structure, but have the opportunity to increase revenues and maximize operating leverage in a slow-growth environment. We also expect merger and acquisition activity to accelerate this year, which could provide an additional catalyst for stock prices among small- to mid-capitalization companies. |

��

| | • | | On February 23, 2010, the Board of Trustees approved a plan of reorganization, subject to shareholder approval and certain other conditions, whereby BlackRock Mid-Cap Value Equity Portfolio of BlackRock FundsSM will acquire substantially all of the assets and assume certain stated liabilities of the Fund in exchange for newly issued shares of BlackRock Mid-Cap Value Equity Portfolio. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Portfolio Information

| | | |

Ten Largest Holdings | | Percent of

Long-Term

Investments | |

Arbitron, Inc. | | 2 | % |

PHH Corp. | | 2 | |

Donaldson Co., Inc. | | 2 | |

Alpha Natural Resources, Inc. | | 2 | |

CVB Financial Corp. | | 1 | |

Lincare Holdings, Inc. | | 1 | |

Corrections Corp. of America | | 1 | |

TreeHouse Foods, Inc. | | 1 | |

Affiliated Managers Group, Inc. | | 1 | |

Cablevision Systems Corp. - Class A | | 1 | |

| | | |

Sector Allocation | | Percent of

Long-Term

Investments | |

Financials | | 28 | % |

Consumer Discretionary | | 16 | |

Industrials | | 15 | |

Information Technology | | 12 | |

Materials | | 6 | |

Health Care | | 6 | |

Energy | | 6 | |

Utilities | | 5 | |

Consumer Staples | | 5 | |

Telecommunication Services | | 1 | |

For Fund compliance purposes, the Fund’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine sector sub-classifications for reporting ease.

| | | | | | |

| 6 | | BLACKROCK FUNDS | | MARCH 31, 2010 | | |

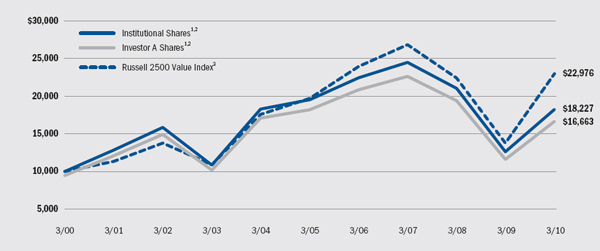

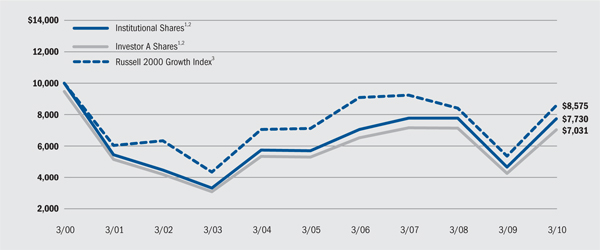

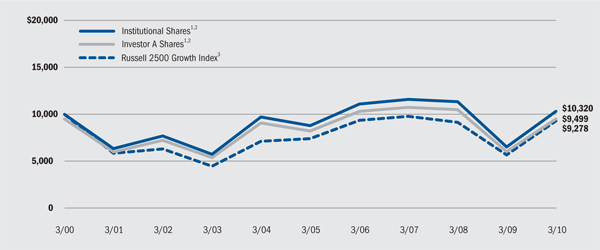

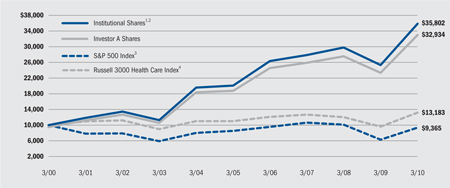

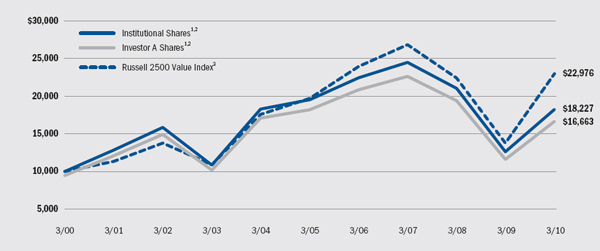

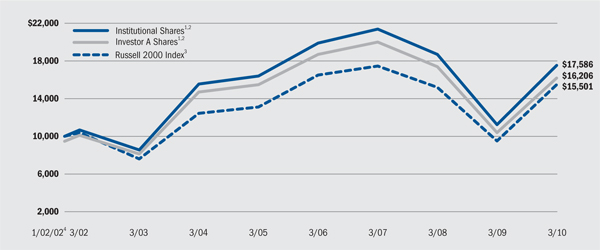

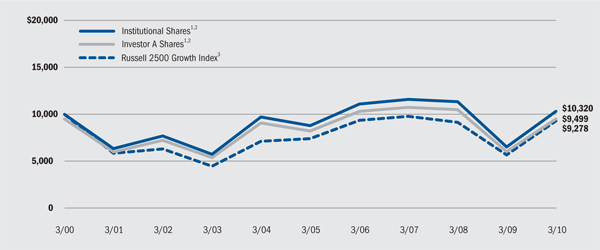

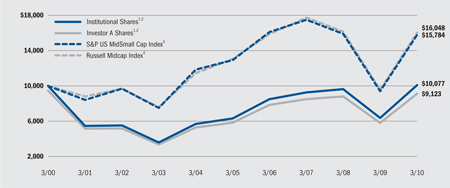

BlackRock Aurora Portfolio

Total Return Based on a $10,000 Investment

| 1 | Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| 2 | Under normal market conditions, the Fund invests at least 80% of its total assets in small- and mid-capitalization common and preferred stocks and securities convertible into common and preferred stocks. |

| 3 | An index composed of the Russell 2500 companies with lower price-to-book ratios and lower forecasted growth values. |

Performance Summary for the Period Ended March 31, 2010

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns4 | |

| | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | 6-Month

Total Returns | | | w/o sales

charge | | | w/ sales

charge | | | w/o sales

charge | | | w/ sales

charge | | | w/o sales

charge | | | w/ sales

charge | |

Institutional | | 13.68 | % | | 44.60 | % | | N/A | | | (1.37 | )% | | N/A | | | 6.19 | % | | N/A | |

Investor A | | 13.45 | | | 44.02 | | | 36.45 | % | | (1.74 | ) | | (2.79 | )% | | 5.81 | | | 5.24 | % |

Investor B | | 13.00 | | | 42.94 | | | 38.44 | | | (2.49 | ) | | (2.65 | ) | | 5.20 | | | 5.20 | |

Investor C | | 13.08 | | | 42.93 | | | 41.93 | | | (2.47 | ) | | (2.47 | ) | | 5.04 | | | 5.04 | |

Class R | | 13.30 | | | 43.61 | | | N/A | | | (1.90 | ) | | N/A | | | 5.60 | | | N/A | |

Russell 2500 Value Index | | 14.66 | | | 67.17 | | | N/A | | | 3.14 | | | N/A | | | 8.67 | | | N/A | |

| 4 | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees. |

N/A - Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

Expense Example

| | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical6 |

| | | Beginning

Account Value

October 1, 2009 | | Ending

Account Value

March 31, 2010 | | Expenses Paid

During the Period5 | | Beginning

Account Value

October 1, 2009 | | Ending

Account Value

March 31, 2010 | | Expenses Paid

During the Period5 |

Institutional | | $ | 1,000 | | $ | 1,136.80 | | $ | 5.75 | | $ | 1,000 | | $ | 1,019.55 | | $ | 5.44 |

Investor A | | $ | 1,000 | | $ | 1,134.50 | | $ | 7.88 | | $ | 1,000 | | $ | 1,017.55 | | $ | 7.44 |

Investor B | | $ | 1,000 | | $ | 1,130.00 | | $ | 12.00 | | $ | 1,000 | | $ | 1,013.66 | | $ | 11.35 |

Investor C | | $ | 1,000 | | $ | 1,130.80 | | $ | 12.01 | | $ | 1,000 | | $ | 1,013.66 | | $ | 11.35 |

Class R | | $ | 1,000 | | $ | 1,133.00 | | $ | 8.77 | | $ | 1,000 | | $ | 1,016.70 | | $ | 8.30 |

| 5 | For each class of the Fund, expenses are equal to the annualized expense ratio for the class (1.08% for Institutional, 1.48% for Investor A, 2.26% for Investor B, 2.26% for Investor C and 1.65% for Class R), multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

| 6 | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half-year divided by 365. |

See “Disclosure of Expenses” on page 13 for further information on how expenses were calculated.

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2010 | | 7 |

| | |

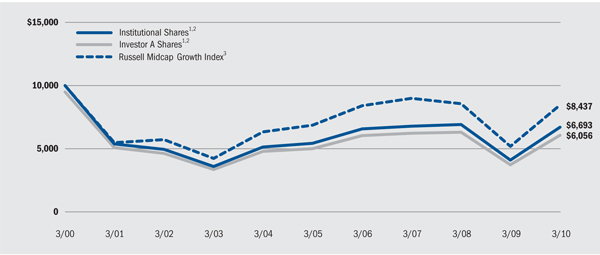

| Fund Summary as of March 31, 2010 | | BlackRock Capital Appreciation Portfolio |

| |

Portfolio Management Commentary | | |

How did the Fund perform?

| | • | | The Fund generated strong returns for the six-month period, but underperformed its benchmark, Russell 1000 Growth Index. |

What factors influenced performance?

| | • | | Stock selection in the industrials sector provided the greatest contribution to the Fund’s relative performance during the reporting period. Within the sector, the Fund’s significant investment in transportation-related companies accounted for the outperformance. Delta Air Lines, Inc. and truck engine manufacturer Cummins, Inc. both surged higher, as the companies continue to experience strong industry growth cycles. |

| | • | | Sector allocation also added value during the period, due to modest overweights in the industrials and consumer discretionary sectors and an underweight exposure to the declining utilities sector. |

| | • | | Despite positive results in the health care providers and services industry, the health care sector detracted significantly from the Fund’s relative returns. Stock-specific fundamental disappointments at Boston Scientific Corp. and Genzyme Corp. accounted for much of the weakness. |

| | • | | Stock selection in information technology detracted, as poor performance in the communications equipment industry overshadowed stock selection success in several other industries. In communications equipment, competition in the smartphone market produced underperformance at both wireless chip manufacturer QUALCOMM, Inc. and smartphone maker Palm, Inc. |

| | • | | Stock selection in the financials and energy sectors also detracted, to a lesser degree. |

Describe recent portfolio activity.

| | • | | The Fund’s sector allocation remained quite stable during the six months. Allocations to the industrials and consumer discretionary sectors increased modestly, while the investment in the energy and financials sectors declined. |

Describe Fund positioning at period end.

| | • | | At period end, our largest overweights relative to the Russell 1000 Growth Index were in the consumer discretionary and industrials sectors, while our most substantial underweight was in consumer staples. |

| | • | | On February 9, 2010, the Board of Trustees approved a plan of reorganization, subject to shareholder approval and certain other conditions, whereby BlackRock Fundamental Growth Fund, Inc. will acquire substantially all of the assets and assume certain stated liabilities of the Fund in exchange for newly issued shares of BlackRock Fundamental Growth Fund, Inc. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Portfolio Information

| | | |

Ten Largest Holdings | | Percent of

Long-Term

Investments | |

Apple, Inc. | | 5 | % |

Microsoft Corp. | | 5 | |

Google, Inc. - Class A | | 4 | |

Hewlett-Packard Co. | | 3 | |

The Procter & Gamble Co. | | 3 | |

Amazon.com, Inc. | | 3 | |

Danaher Corp. | | 3 | |

The Coca-Cola Co. | | 2 | |

Delta Air Lines, Inc. | | 2 | |

Abbott Laboratories | | 2 | |

| | | |

Sector Allocation | | Percent of

Long-Term

Investments | |

Information Technology | | 34 | % |

Health Care | | 16 | |

Consumer Discretionary | | 14 | |

Industrials | | 13 | |

Consumer Staples | | 11 | |

Financials | | 4 | |

Energy | | 4 | |

Materials | | 3 | |

Telecommunication Services | | 1 | |

For Fund compliance purposes, the Fund’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine sector sub-classifications for reporting ease.

| | | | | | |

| 8 | | BLACKROCK FUNDS | | MARCH 31, 2010 | | |

| | |

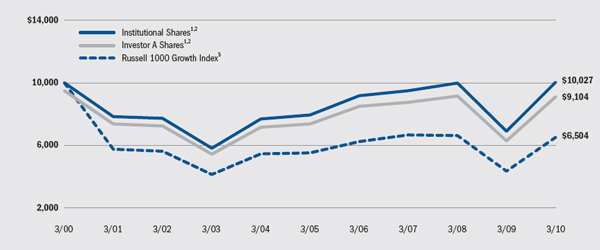

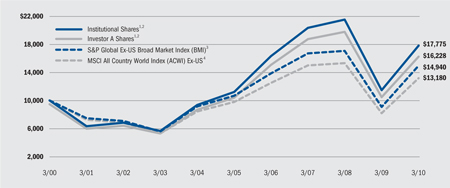

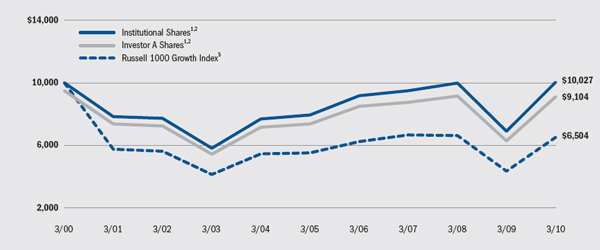

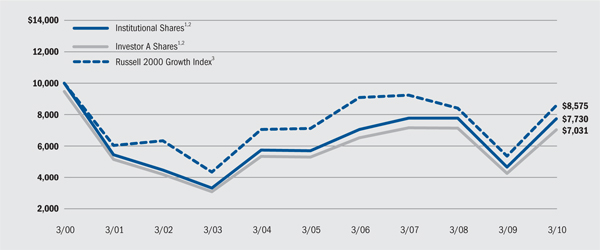

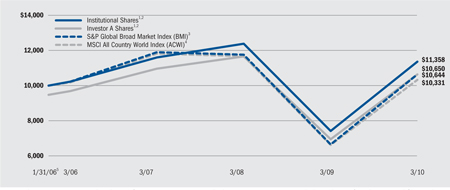

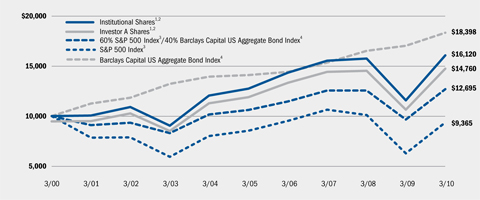

| | BlackRock Capital Appreciation Portfolio |

| |

Total Return Based on a $10,000 Investment | | |

| 1 | Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| 2 | Under normal market conditions, the Fund invests at least 80% of total assets in common and preferred stock and securities convertible into common and preferred stock of mid- and large-size companies. |

| 3 | An index composed of those Russell 1000 securities with greater-than-average growth orientation, generally having higher price-to-book and price-to-earnings ratios, lower dividend yields and higher forecasted growth values. |

Performance Summary for the Period Ended March 31, 2010

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns4 | |

| | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | 6-Month

Total Returns | | | w/o sales

charge | | | w/sales

charge | | | w/o sales

charge | | | w/sales

charge | | | w/o sales

charge | | | w/sales

charge | |

Institutional | | 10.85 | % | | 45.77 | % | | N/A | | | 4.82 | % | | N/A | | | 0.03 | % | | N/A | |

Investor A | | 10.59 | | | 45.07 | | | 37.43 | % | | 4.35 | | | 3.24 | % | | (0.40 | ) | | (0.93 | )% |

Investor B | | 10.10 | | | 43.71 | | | 39.21 | | | 3.51 | | | 3.16 | | | (0.99 | ) | | (0.99 | ) |

Investor C | | 10.19 | | | 44.13 | | | 43.13 | | | 3.66 | | | 3.66 | | | (1.08 | ) | | (1.08 | ) |

Russell 1000 Growth Index | | 12.96 | | | 49.75 | | | N/A | | | 3.42 | | | N/A | | | (4.21 | ) | | N/A | |

| 4 | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees. |

N/A - Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

Expense Example

| | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical6 |

| | | Beginning

Account Value

October 1, 2009 | | Ending

Account Value

March 31, 2010 | | Expenses Paid

During the Period5 | | Beginning

Account Value

October 1, 2009 | | Ending

Account Value

March 31, 2010 | | Expenses Paid

During the Period5 |

Institutional | | $ | 1,000 | | $ | 1,108.50 | | $ | 3.78 | | $ | 1,000 | | $ | 1,021.34 | | $ | 3.63 |

Investor A | | $ | 1,000 | | $ | 1,105.90 | | $ | 6.09 | | $ | 1,000 | | $ | 1,019.15 | | $ | 5.84 |

Investor B | | $ | 1,000 | | $ | 1,101.00 | | $ | 11.16 | | $ | 1,000 | | $ | 1,014.31 | | $ | 10.70 |

Investor C | | $ | 1,000 | | $ | 1,101.90 | | $ | 9.90 | | $ | 1,000 | | $ | 1,015.51 | | $ | 9.50 |

| 5 | For each class of the Fund, expenses are equal to the annualized expense ratio for the class (0.72% for Institutional, 1.16% for Investor A, 2.13% for Investor B and 1.89% for Investor C), multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

| 6 | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half-year divided by 365. See “Disclosure of Expenses” on page 13 for further information on how expenses were calculated. |

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2010 | | 9 |

| | |

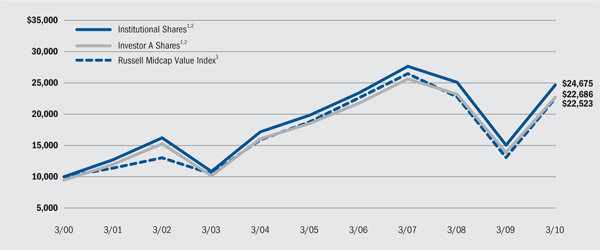

| Fund Summary as of March 31, 2010 | | BlackRock Energy & Resources Portfolio |

| |

Portfolio Management Commentary | | |

How did the Fund perform?

| | • | | During the six-month period, the Fund’s Institutional Shares performed in line with its custom benchmark, the Wilshire 5000 Modified Energy Equal Weighted Index, while Investor A, Investor B and Investor C Shares underperformed the index. Meanwhile, the Fund outperformed the broad-market S&P 500 Index. The following discussion of relative performance pertains to the Fund’s custom benchmark. |

What factors influenced performance?

| | • | | Coal stocks have been an area of leadership within energy over the past couple of quarters. Pricing in Asia strengthened substantially – especially for metallurgical coal – due to strong coal demand; accordingly, stocks with metallurgical exposure, such as Massey Energy Co., have been strong performers. Notably, shares of Massey Energy Co. rose more than 85% during the six months. On the whole, our overweight allocation to coal and our strong stock selection within the segment powered both absolute and relative returns during the reporting period. |

| | • | | Conversely, the Fund’s long-standing underweight in the oil and gas storage and transportation segment hurt relative returns. Our focus on natural gas shale producers also hurt relative performance, as natural gas prices significantly lagged other energy commodities during the period. Nevertheless, natural gas prices are notoriously volatile, and we feel that they cannot go much lower than current pricing at around $4/Mcf (one thousand cubic feet). |

Describe recent portfolio activity.

| | • | | Sub-industry exposures relative to the custom benchmark have been unchanged for quite some time, thus, turnover is very low. We did take some profits in the metals segment and directed the sales proceeds to areas within energy that we continue to find attractive, such as coal and exploration and production stocks. |

Describe Fund positioning at period end.

| | • | | At period end, we continue to be aggressively positioned, with a preference for coal and oil and gas exploration and production stocks. In the current environment, the equities across the energy complex are discounting long-term commodity price expectations far below what we expect given reasonable worldwide economic growth. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Portfolio Information

| | | |

Ten Largest Holdings | | Percent of

Long-Term

Investments | |

Massey Energy Co. | | 9 | % |

Southwestern Energy Co. | | 4 | |

CONSOL Energy, Inc. | | 4 | |

Plains Exploration & Production Co. | | 4 | |

Petrohawk Energy Corp. | | 4 | |

Peabody Energy Corp. | | 4 | |

Alpha Natural Resources, Inc. | | 4 | |

Penn Virginia Corp. | | 4 | |

Newfield Exploration Co. | | 3 | |

Chesapeake Energy Corp. | | 3 | |

| | | |

Industry Allocation | | Percent of

Long-Term

Investments | |

Oil, Gas & Consumable Fuels | | 83 | % |

Metals & Mining | | 11 | |

Energy Equipment & Services | | 4 | |

Gas Utilities | | 2 | |

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease.

| | | | | | |

| 10 | | BLACKROCK FUNDS | | MARCH 31, 2010 | | |

| | |

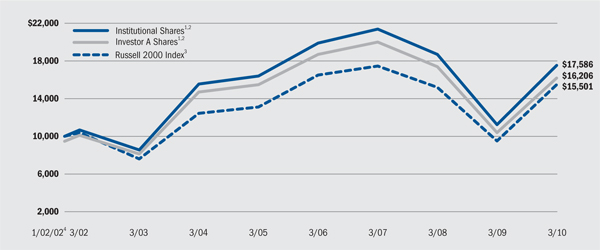

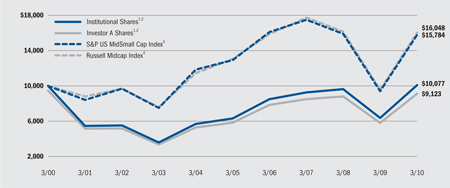

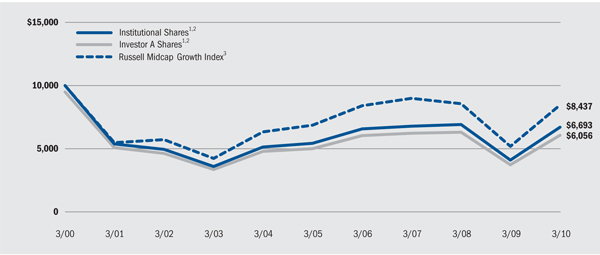

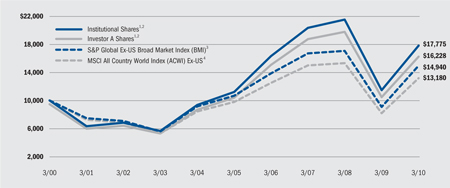

| | BlackRock Energy & Resources Portfolio |

| |

Total Return Based on a $10,000 Investment | | |

| 1 | Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| 2 | Under normal market conditions, the Fund invests at least 80% of its total assets in securities of global energy and natural resources companies and companies in associated businesses, as well as utilities (such as gas, water, cable, electrical and telecommunications utilities). |

| 3 | This unmanaged total return index covers 500 industrial, utility, transportation and financial companies of the US markets (mostly NYSE issues) representing about 75% of NYSE market capitalization and 30% of NYSE issues. S&P 500 is a trademark of the McGraw-Hill Companies. |

| 4 | The Wilshire 5000 Modified Energy Equal Weighted Index is a customized index comprised of the energy sector constituents of the Wilshire 5000 (Full Cap) Index which have been equally weighted and the six largest securities and all securities that have a percentage market value below 0.01% have been removed. |

Performance Summary for the Period Ended March 31, 2010

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns5 | |

| | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | 6-Month

Total Returns | | | w/o sales

charge | | | w/sales

charge | | | w/o sales

charge | | | w/sales

charge | | | w/o sales

charge | | | w/sales

charge | |

Institutional | | 13.71 | % | | 91.43 | % | | N/A | | | 10.32 | % | | N/A | | | 22.02 | % | | N/A | |

Investor A | | 13.50 | | | 90.74 | | | 80.68 | % | | 9.98 | | | 8.80 | % | | 21.59 | | | 20.93 | % |

Investor B | | 13.03 | | | 89.21 | | | 84.71 | | | 9.16 | | | 9.02 | | | 20.92 | | | 20.92 | |

Investor C | | 13.06 | | | 89.26 | | | 88.26 | | | 9.19 | | | 9.19 | | | 20.76 | | | 20.76 | |

S&P 500 Index | | 11.75 | | | 49.77 | | | N/A | | | 1.92 | | | N/A | | | (0.65 | ) | | N/A | |

Wilshire 5000 Modified Energy Equal Weighted Index | | 13.68 | | | 91.89 | | | N/A | | | 9.93 | | | N/A | | | 16.07 | | | N/A | |

| 5 | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees. |

N/A - Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

Expense Example

| | | | | | | | | | | | | | | | | | |

| | | Actual | | Hypothetical7 |

| | | Beginning

Account Value

October 1, 2009 | | Ending

Account Value

March 31, 2010 | | Expenses Paid

During the Period6 | | Beginning

Account Value

October 1, 2009 | | Ending

Account Value

March 31, 2010 | | Expenses Paid

During the Period6 |

Institutional | | $ | 1,000 | | $ | 1,137.10 | | $ | 4.96 | | $ | 1,000 | | $ | 1,020.29 | | $ | 4.68 |

Investor A | | $ | 1,000 | | $ | 1,135.00 | | $ | 7.13 | | $ | 1,000 | | $ | 1,018.25 | | $ | 6.74 |

Investor B | | $ | 1,000 | | $ | 1,130.30 | | $ | 11.10 | | $ | 1,000 | | $ | 1,014.51 | | $ | 10.50 |

Investor C | | $ | 1,000 | | $ | 1,130.60 | | $ | 10.84 | | $ | 1,000 | | $ | 1,014.76 | | $ | 10.25 |

| 6 | For each class of the Fund, expenses are equal to the annualized expense ratio for the class (0.93% for Institutional, 1.34% for Investor A, 2.09% Investor B and 2.04% for Investor C), multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

| 7 | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half-year divided by 365. See “Disclosure of Expenses” on page 13 for further information on how expenses were calculated. |

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2010 | | 11 |

About Fund Performance

| | • | | Institutional Shares are not subject to any sales charge. Institutional Shares bear no ongoing distribution or service fees and are available only to eligible investors. |

| | • | | Service Shares are not subject to any sales charge (front-end load) or deferred sales charge. Service Shares are subject to a service fee of 0.25% per year (but no distribution fee). |

| | • | | Investor A Shares incur a maximum initial sales charge (front-end load) of 5.25% and a service fee of 0.25% per year (but no distribution fee). |

| | • | | Investor B Shares are subject to a maximum contingent deferred sales charge of 4.50% declining to 0% after six years. In addition, Investor B Shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. Investor B Shares automatically convert to Investor A Shares after approximately eight years. (There is no initial sales charge for automatic share conversions.) All returns for periods greater than eight years reflect this conversion. Investor B Shares are only available for purchase through exchanges, dividend reinvestment or for purchase by certain qualified employee benefit plans. |

| | • | | Investor C Shares are subject to a 1.00% contingent deferred sales charge if redeemed within one year of purchase. In addition, Investor C Shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. |

| | • | | Class R Shares are not subject to any sales charge. Class R Shares are subject to a distribution fee of 0.25% per year and a service fee of 0.25% per year. Class R Shares are available only to certain retirement and other similar plans. Prior to October 2, 2006, BlackRock Aurora Portfolio’s Class R Share performance results are those of Institutional Shares (which have no distribution or service fees) restated to reflect Class R Share fees. |

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Refer to www.blackrock.com/funds to obtain performance data current to the most recent month-end. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Each Fund other than BlackRock Capital Appreciation Portfolio may charge a 2% redemption fee for sales or exchanges of shares within 30 days of purchase or exchange. Performance data does not reflect this potential fee. Figures shown in each of the performance tables on the previous pages assume reinvestment of all dividends and distributions, if any, at net asset value on the payable date. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

Performance for BlackRock Aurora, BlackRock Capital Appreciation and BlackRock Energy & Resources Portfolios for the periods prior to January 31, 2005 is based on performance of certain former State Street Research mutual funds that reorganized with the Funds on that date.

The Funds’ investment advisor waived or reimbursed a portion of each Fund’s expenses. Without such waiver and reimbursement, a Fund’s performance would have been lower. BlackRock Advisors, LLC is under no obligation to waive or continue waiving its fees after February 1, 2011. Dividends paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

| | | | | | |

| 12 | | BLACKROCK FUNDS | | MARCH 31, 2010 | | |

Disclosure of Expenses

Shareholders of these Funds may incur the following charges: (a) expenses related to transactions, including sales charges, redemption fees and exchange fees; and (b) operating expenses including advisory fees, service and distribution fees, including 12b-1 fees, and other Fund expenses. The expense examples on the previous pages (which are based on a hypothetical investment of $1,000 invested on October 1, 2009 and held through March 31, 2010) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The tables provide information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their Fund and share class under the headings entitled “Expenses Paid During the Period.”

The tables also provide information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Funds and other funds, compare the 5% hypothetical example with the 5% hypothetical examples that appear in other funds’ shareholder reports.

The expenses shown in the tables are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges, redemption fees or exchange fees. Therefore, the hypothetical examples are useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

Derivative Financial Instruments

The Funds may invest in various derivative instruments, including foreign currency exchange contracts, as specified in Note 2 of the Notes to Financial Statements, which constitute forms of economic leverage. Such instruments are used to obtain exposure to a market without owning or taking physical custody of securities or to hedge market and/or foreign currency exchange rate risks. Such derivative instruments involve risks, including the imperfect correlation between the value of a derivative instrument and the underlying asset, possible default of counterparty to the transaction or illiquidity of the derivative instrument. A Fund’s ability to successfully use a derivative instrument depends on the investment advisor’s ability to accurately predict pertinent market movements, which cannot be assured. The use of derivative instruments may result in losses greater than if they had not been used, may require a Fund to sell or purchase portfolio securities at inopportune times or for distressed values, may limit the amount of appreciation a Fund can realize on an investment or may cause a Fund to hold a security that it might otherwise sell. The Funds’ investments in these instruments are discussed in detail in the Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2010 | | 13 |

| | |

| Schedule of Investments March 31, 2010 (Unaudited) | | BlackRock All-Cap Energy & Resources Portfolio |

| | (Percentages shown are based on Net Assets) |

| | | | | |

| | | Shares | | Value |

Common Stocks | | | | | |

Chemicals — 2.5% | | | | | |

Potash Corp. of Saskatchewan, Inc. | | 154,100 | | $ | 18,391,835 |

Energy Equipment & Services — 18.3% | | | | | |

Calfrac Well Services Ltd. | | 55,100 | | | 1,150,120 |

Cameron International Corp. (a) | | 243,230 | | | 10,424,838 |

Core Laboratories NV | | 170,050 | | | 22,242,540 |

FMC Technologies, Inc. (a)(b) | | 335,290 | | | 21,669,793 |

Halliburton Co. | | 625,100 | | | 18,834,263 |

Key Energy Services, Inc. (a) | | 718,300 | | | 6,859,765 |

Noble Corp. (a) | | 191,110 | | | 7,992,220 |

Schlumberger Ltd. (b) | | 249,180 | | | 15,812,963 |

Smith International, Inc. | | 187,740 | | | 8,039,027 |

Technip SA | | 76,200 | | | 6,185,467 |

Transocean Ltd. (a) | | 130,240 | | | 11,250,131 |

Trican Well Service Ltd. | | 297,300 | | | 3,846,327 |

| | | | | |

| | | | | 134,307,454 |

| | | | | |

Gas Utilities — 4.1% | | | | | |

EQT Corp. | | 401,510 | | | 16,461,910 |

Questar Corp. | | 310,730 | | | 13,423,536 |

| | | | | |

| | | | | 29,885,446 |

| | | | | |

Metals & Mining — 9.2% | | | | | |

Agnico-Eagle Mines Ltd. (b) | | 168,690 | | | 9,390,972 |

BHP Billiton Ltd. - ADR (b) | | 191,110 | | | 15,349,955 |

Eldorado Gold Corp. (a) | | 652,120 | | | 7,916,743 |

Goldcorp, Inc. | | 411,052 | | | 15,299,356 |

Silver Wheaton Corp. (a) | | 1,220,824 | | | 19,142,520 |

| | | | | |

| | | | | 67,099,546 |

| | | | | |

Oil, Gas & Consumable Fuels — 65.1% | | | | | |

Alpha Natural Resources, Inc. (a) | | 198,100 | | | 9,883,209 |

Apache Corp. | | 240,930 | | | 24,454,395 |

Arch Coal, Inc. | | 381,100 | | | 8,708,135 |

Cabot Oil & Gas Corp. | | 236,300 | | | 8,695,840 |

Cameco Corp. | | 82,770 | | | 2,268,726 |

Cenovus Energy, Inc. | | 267,660 | | | 7,015,369 |

CONSOL Energy, Inc. | | 602,830 | | | 25,716,728 |

Crescent Point Energy Corp. | | 423,470 | | | 16,248,339 |

Denbury Resources, Inc. (a) | | 843,890 | | | 14,236,424 |

EnCana Corp. (b) | | 267,660 | | | 8,305,490 |

EOG Resources, Inc. (b) | | 260,470 | | | 24,208,082 |

Forest Oil Corp. (a) | | 365,190 | | | 9,429,206 |

Galleon Energy, Inc. - Class A (a) | | 776,694 | | | 5,268,962 |

Gasco Energy, Inc. (a) | | 1,596,500 | | | 510,880 |

Hess Corp. | | 145,370 | | | 9,092,893 |

Hugoton Royalty Trust | | 1 | | | 17 |

Massey Energy Co. | | 713,739 | | | 37,321,412 |

Newfield Exploration Co. (a) | | 349,000 | | | 18,165,450 |

Noble Energy, Inc. | | 198,600 | | | 14,497,800 |

Occidental Petroleum Corp. (b) | | 294,050 | | | 24,858,987 |

OGX Petroleo e Gas Participacoes SA | | 1,600,000 | | | 14,971,181 |

Oil, Gas & Consumable Fuels (concluded) | | | | | |

Patriot Coal Corp. (a) | | 67,116 | | | 1,373,193 |

Peabody Energy Corp. | | 467,790 | | | 21,378,003 |

Penn West Energy Trust (b) | | 972,400 | | | 20,537,088 |

PetroBakken Energy Ltd. - Class A | | 107,042 | | | 2,795,012 |

PetroChina Co. Ltd. - ADR (b) | | 35,990 | | | 4,218,748 |

Petroleo Brasileiro SA - ADR | | 291,840 | | | 12,983,962 |

Plains Exploration & Production Co. (a) | | 465,710 | | | 13,966,643 |

Premier Oil Plc (a) | | 279,937 | | | 5,247,990 |

Quicksilver Resources, Inc. (a)(b) | | 875,400 | | | 12,316,878 |

Range Resources Corp. (b) | | 374,600 | | | 17,557,502 |

Southwestern Energy Co. (a) | | 471,700 | | | 19,207,624 |

StatoilHydro ASA | | 402,522 | | | 9,366,432 |

StatoilHydro ASA - ADR | | 169,840 | | | 3,962,367 |

Suncor Energy, Inc. | | 281,080 | | | 9,146,343 |

Talisman Energy, Inc. | | 827,500 | | | 14,117,150 |

Whiting Petroleum Corp. (a)(b) | | 316,730 | | | 25,604,453 |

| | | | | |

| | | | | 477,636,913 |

| | | | | |

Total Long-Term Investments (Cost — $592,667,214) — 99.2% | | | | | 727,321,194 |

| | | | | |

| | | | | | |

| | | Shares/

Beneficial

Interest | | | |

Short-Term Securities | | | | | | |

BlackRock Liquidity Funds, TempFund, Institutional Class, 0.11% (c)(d) | | 4,676,731 | | | 4,676,731 | |

BlackRock Liquidity Series, LLC Money Market Series, 0.22% (c)(d)(e) | | 112,684,650 | | | 112,684,650 | |

| | | | | | |

Total Short-Term Securities (Cost — $117,361,381) — 16.0% | | | | | 117,361,381 | |

| | | | | | |

Total Investments (Cost — $710,028,595*) — 115.2% | | | 844,682,575 | |

Liabilities in Excess of Other Assets — (15.2)% | | | | | (111,193,298 | ) |

| | | | | | |

Net Assets — 100.0% | | | | $ | 733,489,277 | |

| | | | | | |

| * | The cost and unrealized appreciation (depreciation) of investments as of March 31, 2010, as computed for federal income tax purposes, were as follows: |

| | | | |

Aggregate cost | | $ | 712,574,094 | |

| | | | |

Gross unrealized appreciation | | $ | 179,351,038 | |

Gross unrealized depreciation | | | (47,242,557 | ) |

| | | | |

Net unrealized appreciation | | $ | 132,108,481 | |

| | | | |

| (a) | Non-income producing security. |

| (b) | Security, or a portion of security, is on loan. |

Portfolio Abbreviations

| | | | | | |

| To simplify the listings of portfolio holdings in the Schedules of Investments, the names and descriptions of many of the securities have been abbreviated according to the following list: | | ADR American Depositary Receipts CAD Canadian Dollar USD US Dollar | | | | |

See Notes to Financial Statements.

| | | | | | |

| 14 | | BLACKROCK FUNDS | | MARCH 31, 2010 | | |

| | |

| Schedule of Investments (concluded) | | BlackRock All-Cap Energy & Resources Portfolio |

| | |

| (c) | Investments in companies considered to be an affiliate of the Fund, for purposes of Section 2(a)(3) of the Investment Company Act of 1940, were as follows: |

| | | | | | | | | | |

Affiliate | | Net

Activity | | | Realized

Gain | | Income |

BlackRock Liquidity Funds, TempFund, Institutional Class | | $ | (30,959,333 | ) | | $ | 26 | | $ | 18,587 |

BlackRock Liquidity Series, LLC Money Market Series | | $ | 62,927,900 | | | | — | | $ | 67,069 |

| (d) | Represents the current yield as of report date. |

| (e) | Security was purchased with the cash collateral from loaned securities. |

| • | | For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. |

| • | | Fair Value Measurements — Various inputs are used in determining the fair value of investments, which are as follows: |

| | • | | Level 1 – price quotations in active markets/exchanges for identical assets and liabilities |

| | • | | Level 2 – other observable inputs (including, but not limited to: quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market–corroborated inputs) |

| | • | | Level 3 – unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Fund’s own assumptions used in determining the fair value of investments) |

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For information about the Fund’s policy regarding valuation of investments and other significant accounting policies, please refer to Note 1 of the Notes to Financial Statements.

The following table summarizes the inputs used as of March 31, 2010 in determining the fair valuation of the Fund’s investments:

| | | | | | | | | | | |

| | | Investments in Securities |

Valuation Inputs | | Level 1 | | Level 2 | | Level 3 | | Total |

Assets: | | | | | | | | | | | |

Long-Term Investments: | | | | | | | | | | | |

Chemicals | | $ | 18,391,835 | | | — | | — | | $ | 18,391,835 |

Energy Equipment & Services | | | 128,121,987 | | $ | 6,185,467 | | — | | | 134,307,454 |

Gas Utilities | | | 29,885,446 | | | — | | — | | | 29,885,446 |

Metals & Mining | | | 67,099,546 | | | — | | — | | | 67,099,546 |

Oil, Gas & Consumable Fuels | | | 463,022,491 | | | 14,614,422 | | — | | | 477,636,913 |

Short-Term Securities | | | 4,676,731 | | | 112,684,650 | | — | | | 117,361,381 |

| | | | | | | | | | | |

Total | | $ | 711,198,036 | | $ | 133,484,539 | | — | | $ | 844,682,575 |

| | | | | | | | | | | |

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2010 | | 15 |

| | |

| Schedule of Investments March 31, 2010 (Unaudited) | | BlackRock Aurora Portfolio |

| | (Percentages shown are based on Net Assets) |

| | | | | |

Common Stocks | | Shares | | Value |

Aerospace & Defense — 1.0% | | | | | |

Orbital Sciences Corp.(a) | | 252,677 | | $ | 4,803,390 |

| | | | | |

Auto Components — 1.1% | | | | | |

Dana Holding Corp.(a) | | 238,200 | | | 2,829,816 |

Federal Mogul Corp.(a) | | 125,400 | | | 2,302,344 |

| | | | | |

| | | | | 5,132,160 |

| | | | | |

Building Products — 1.5% | | | | | |

Masco Corp.(b) | | 275,700 | | | 4,278,864 |

Owens Corning(a) | | 97,500 | | | 2,480,400 |

| | | | | |

| | | | | 6,759,264 |

| | | | | |

Capital Markets — 2.9% | | | | | |

Affiliated Managers Group, Inc.(a)(b) | | 79,700 | | | 6,296,300 |

Invesco Ltd. | | 211,500 | | | 4,633,965 |

KBW, Inc.(a) | | 87,000 | | | 2,340,300 |

| | | | | |

| | | | | 13,270,565 |

| | | | | |

Chemicals — 2.6% | | | | | |

Cytec Industries, Inc. | | 20,000 | | | 934,800 |

FMC Corp. | | 81,800 | | | 4,952,172 |

Olin Corp.(b) | | 313,300 | | | 6,146,946 |

| | | | | |

| | | | | 12,033,918 |

| | | | | |

Commercial Banks — 7.8% | | | | | |

Associated Banc-Corp. | | 314,300 | | | 4,337,340 |

Boston Private Financial Holdings, Inc. | | 400,000 | | | 2,948,000 |

Cathay General Bancorp(b) | | 312,100 | | | 3,635,965 |

CVB Financial Corp.(b) | | 676,100 | | | 6,713,673 |

Fulton Financial Corp.(b) | | 372,100 | | | 3,791,699 |

KeyCorp | | 758,600 | | | 5,879,150 |

TCF Financial Corp.(b) | | 314,100 | | | 5,006,754 |

Zions Bancorporation(b) | | 166,000 | | | 3,622,120 |

| | | | | |

| | | | | 35,934,701 |

| | | | | |

Commercial Services & Supplies — 3.1% | | | | | |

Clean Harbors, Inc.(a) | | 42,200 | | | 2,344,632 |

Corrections Corp. of America(a) | | 329,300 | | | 6,539,898 |

The GEO Group, Inc.(a) | | 265,200 | | | 5,256,264 |

| | | | | |

| | | | | 14,140,794 |

| | | | | |

Communications Equipment — 2.6% | | | | | |

ADTRAN, Inc.(b) | | 205,900 | | | 5,425,465 |

Arris Group, Inc.(a) | | 287,600 | | | 3,454,076 |

Ciena Corp.(a)(b) | | 196,600 | | | 2,996,184 |

| | | | | |

| | | | | 11,875,725 |

| | | | | |

Construction & Engineering — 1.6% | | | | | |

KBR, Inc. | | 202,400 | | | 4,485,184 |

Tutor Perini Corp.(a) | | 141,300 | | | 3,073,275 |

| | | | | |

| | | | | 7,558,459 |

| | | | | |

Consumer Finance — 0.6% | | | | | |

SLM Corp.(a) | | 202,400 | | | 2,534,048 |

| | | | | |

Containers & Packaging — 1.0% | | | | | |

Owens-Illinois, Inc.(a) | | 129,200 | | | 4,591,768 |

| | | | | |

Diversified Financial Services — 2.2% | | | | | |

PHH Corp.(a) | | 438,016 | | | 10,324,037 |

| | | | | |

Electric Utilities — 2.0% | | | | | |

Northeast Utilities | | 132,000 | | | 3,648,480 |

NV Energy, Inc. | | 236,200 | | | 2,912,346 |

Westar Energy, Inc. | | 109,700 | | | 2,446,310 |

| | | | | |

| | | | | 9,007,136 |

| | | | | |

Electrical Equipment — 1.9% | | | | | |

AMETEK, Inc. | | 116,900 | | | 4,846,674 |

Polypore International, Inc.(a) | | 226,300 | | | 3,951,198 |

| | | | | |

| | | | | 8,797,872 |

| | | | | |

Electronic Equipment, Instruments & Components — 1.5% | | | | | |

Anixter International, Inc.(a) | | 84,000 | | | 3,935,400 |

Ingram Micro, Inc. - Class A(a) | | 169,000 | | | 2,965,950 |

| | | | | |

| | | | | 6,901,350 |

| | | | | |

Energy Equipment & Services — 2.2% | | | | | |

Complete Production Services, Inc.(a) | | 450,100 | | | 5,198,655 |

Oil States International, Inc.(a) | | 106,500 | | | 4,828,710 |

| | | | | |

| | | | | 10,027,365 |

| | | | | |

Food & Staples Retailing — 1.1% | | | | | |

BJ’s Wholesale Club, Inc.(a) | | 136,100 | | | 5,034,339 |

| | | | | |

Food Products — 3.5% | | | | | |

Chiquita Brands International, Inc.(a)(b) | | 106,600 | | | 1,676,818 |

Del Monte Foods Co. | | 283,230 | | | 4,135,158 |

The J.M. Smucker Co. | | 61,000 | | | 3,675,860 |

TreeHouse Foods, Inc.(a)(b) | | 146,892 | | | 6,444,152 |

| | | | | |

| | | | | 15,931,988 |

| | | | | |

Gas Utilities — 0.8% | | | | | |

New Jersey Resources Corp. | | 97,100 | | | 3,647,076 |

| | | | | |

Health Care Equipment & Supplies — 0.9% | | | | | |

The Cooper Cos., Inc. | | 111,800 | | | 4,346,784 |

| | | | | |

Health Care Providers & Services — 4.3% | | | | | |

Amedisys, Inc.(a)(b) | | 85,600 | | | 4,726,832 |

LifePoint Hospitals, Inc.(a)(b) | | 160,000 | | | 5,884,800 |

Lincare Holdings, Inc.(a) | | 146,000 | | | 6,552,480 |

Tenet Healthcare Corp.(a) | | 436,100 | | | 2,494,492 |

| | | | | |

| | | | | 19,658,604 |

| | | | | |

Hotels, Restaurants & Leisure — 4.2% | | | | | |

Papa John’s International, Inc.(a) | | 149,700 | | | 3,848,787 |

Penn National Gaming, Inc.(a) | | 140,000 | | | 3,892,000 |

Pinnacle Entertainment, Inc.(a) | | 429,700 | | | 4,185,278 |

Scientific Games Corp. - Class A(a) | | 226,829 | | | 3,193,753 |

Vail Resorts, Inc.(a)(b) | | 98,600 | | | 3,952,874 |

| | | | | |

| | | | | 19,072,692 |

| | | | | |

Household Durables — 2.3% | | | | | |

Jarden Corp. | | 178,300 | | | 5,935,607 |

MDC Holdings, Inc. | | 72,100 | | | 2,495,381 |

Newell Rubbermaid, Inc.(b) | | 155,500 | | | 2,363,600 |

| | | | | |

| | | | | 10,794,588 |

| | | | | |

Industrial Conglomerates — 0.5% | | | | | |

Textron, Inc.(b) | | 117,894 | | | 2,502,890 |

| | | | | |

Insurance — 5.7% | | | | | |

Flagstone Reinsurance Holdings Ltd. | | 220,900 | | | 2,531,514 |

The Hanover Insurance Group, Inc. | | 137,330 | | | 5,988,961 |

HCC Insurance Holdings, Inc. | | 84,200 | | | 2,323,920 |

Lincoln National Corp. | | 143,800 | | | 4,414,660 |

Navigators Group, Inc.(a) | | 64,300 | | | 2,528,919 |

See Notes to Financial Statements.

| | | | | | |

| 16 | | BLACKROCK FUNDS | | MARCH 31, 2010 | | |

| | |

| Schedule of Investments (continued) | | BlackRock Aurora Portfolio |

| | (Percentages shown are based on Net Assets) |

| | | | | | |

Common Stocks | | Shares | | Value | |

Insurance (concluded) | | | | | | |

Platinum Underwriters Holdings Ltd. | | 131,923 | | $ | 4,891,705 | |

Primerica, Inc.(a) | | 31,600 | | | 474,000 | |

Tower Group, Inc. | | 142,800 | | | 3,165,876 | |

| | | | | | |

| | | | | 26,319,555 | |

| | | | | | |

IT Services — 1.2% | | | | | | |

Lender Processing Services, Inc. | | 145,500 | | | 5,492,625 | |

| | | | | | |

Machinery — 4.5% | | | | | | |

Donaldson Co., Inc. | | 161,900 | | | 7,304,928 | |

Mueller Water Products, Inc. - Class A | | 854,300 | | | 4,083,554 | |

Snap-On, Inc. | | 84,800 | | | 3,675,232 | |

Terex Corp.(a) | | 244,300 | | | 5,548,053 | |

| | | | | | |

| | | | | 20,611,767 | |

| | | | | | |

Media — 4.2% | | | | | | |

Arbitron, Inc. | | 395,500 | | | 10,544,030 | |

Cablevision Systems Corp. - Class A | | 256,500 | | | 6,191,910 | |

Lions Gate Entertainment Corp.(a) | | 397,700 | | | 2,481,648 | |

| | | | | | |

| | | | | 19,217,588 | |

| | | | | | |

Metals & Mining — 2.5% | | | | | | |

Horsehead Holding Corp.(a) | | 344,580 | | | 4,079,827 | |

Steel Dynamics, Inc. | | 230,800 | | | 4,032,076 | |

Thompson Creek Metals Co., Inc.(a)(b) | | 249,700 | | | 3,378,441 | |

| | | | | | |

| | | | | 11,490,344 | |

| | | | | | |

Multiline Retail — 1.1% | | | | | | |

Saks, Inc.(a)(b) | | 581,500 | | | 5,000,900 | |

| | | | | | |

Multi-Utilities — 1.3% | | | | | | |

Wisconsin Energy Corp. | | 118,400 | | | 5,850,144 | |

| | | | | | |

Oil, Gas & Consumable Fuels — 3.7% | | | | | | |

Alpha Natural Resources, Inc.(a) | | 145,600 | | | 7,263,984 | |

Newfield Exploration Co.(a) | | 95,400 | | | 4,965,570 | |

Rex Energy Corp.(a) | | 128,500 | | | 1,463,615 | |

SandRidge Energy, Inc.(a)(b) | | 442,800 | | | 3,409,560 | |

| | | | | | |

| | | | | 17,102,729 | |

| | | | | | |

Pharmaceuticals — 0.7% | | | | | | |

Watson Pharmaceuticals, Inc.(a) | | 78,800 | | | 3,291,476 | |

| | | | | | |

Real Estate Investment Trusts (REITs) — 5.0% | | | | | | |

Chimera Investment Corp. | | 635,000 | | | 2,470,150 | |

DCT Industrial Trust, Inc. | | 918,240 | | | 4,802,395 | |

The Macerich Co.(b) | | 151,981 | | | 5,822,392 | |

MFA Financial, Inc. | | 834,500 | | | 6,141,920 | |

Redwood Trust, Inc.(b) | | 238,400 | | | 3,676,128 | |

| | | | | | |

| | | | | 22,912,985 | |

| | | | | | |

Real Estate Management & Development — 1.0% | | | | | | |

Forestar Group, Inc.(a) | | 232,000 | | | 4,380,160 | |

| | | | | | |

Road & Rail — 1.0% | | | | | | |

Con-way, Inc. | | 58,400 | | | 2,051,008 | |

Genesee & Wyoming, Inc. - Class A(a) | | 76,000 | | | 2,593,120 | |

| | | | | | |

| | | | | 4,644,128 | |

| | | | | | |

Semiconductors & Semiconductor Equipment — 3.6% | | | | | | |

Intersil Corp. - Class A | | 298,200 | | | 4,401,432 | |

ON Semiconductor Corp.(a) | | 599,200 | | | 4,793,600 | |

Teradyne, Inc.(a) | | 483,900 | | | 5,405,163 | |

Verigy Ltd.(a) | | 185,300 | | | 2,071,654 | |

| | | | | | |

| | | | | 16,671,849 | |

| | | | | | |

Software — 3.3% | | | | | | |

Lawson Software, Inc.(a) | | 625,275 | | | 4,133,068 | |

Novell, Inc.(a) | | 409,592 | | | 2,453,456 | |

Take-Two Interactive Software, Inc.(a) | | 361,900 | | | 3,564,715 | |

TiVo, Inc.(a) | | 279,910 | | | 4,792,059 | |

| | | | | | |

| | | | | 14,943,298 | |

| | | | | | |

Specialty Retail — 3.3% | | | | | | |

Collective Brands, Inc.(a) | | 271,500 | | | 6,173,910 | |

JoS. A. Bank Clothiers, Inc.(a)(b) | | 78,000 | | | 4,262,700 | |

O’Reilly Automotive, Inc.(a) | | 55,400 | | | 2,310,734 | |

Pacific Sunwear of California, Inc.(a) | | 471,200 | | | 2,502,072 | |

| | | | | | |

| | | | | 15,249,416 | |

| | | | | | |

Thrifts & Mortgage Finance — 1.9% | | | | | | |

First Niagara Financial Group, Inc. | | 393,100 | | | 5,589,882 | |

People’s United Financial, Inc. | | 210,300 | | | 3,289,092 | |

| | | | | | |

| | | | | 8,878,974 | |

| | | | | | |

Water Utilities — 1.2% | | | | | | |

American Water Works Co., Inc. | | 244,800 | | | 5,326,848 | |

| | | | | | |

Wireless Telecommunication Services — 0.6% | | | | | | |

Syniverse Holdings, Inc.(a) | | 136,700 | | | 2,661,549 | |

| | | | | | |

Total Long-Term Investments

(Cost — $388,787,831) — 99.0% | | | | | 454,727,848 | |

| | | | | | |

Short-Term Securities | | Shares/

Beneficial

Interest | | | |

BlackRock Liquidity Funds, TempFund, Institutional Class, 0.11%(c)(d) | | 22,884,148 | | | 22,884,148 | |

BlackRock Liquidity Series, LLC Money Market Series, 0.22%(c)(d)(e) | | 77,589,190 | | | 77,589,190 | |

| | | | | | |

Total Short-Term Securities

(Cost — $100,473,338) — 21.9% | | | | | 100,473,338 | |

| | | | | | |

Total Investments (Cost — $489,261,169*) — 120.9% | | | 555,201,186 | |

Liabilities in Excess of Other Assets — (20.9)% | | | | | (96,028,504 | ) |

| | | | | | |

Net Assets — 100.0% | | | | $ | 459,172,682 | |

| | | | | | |

| * | The cost and unrealized appreciation (depreciation) of investments as of March 31, 2010, as computed for federal income tax purposes, were as follows: |

| | | | |

Aggregate cost | | $ | 496,172,963 | |

| | | | |

Gross unrealized appreciation | | $ | 64,798,421 | |

Gross unrealized depreciation | | | (5,770,198 | ) |

| | | | |

Net unrealized appreciation | | $ | 59,028,223 | |

| | | | |

| (a) | Non-income producing security. |

| (b) | Security, or a portion of security, is on loan. |

| (c) | Investments in companies considered to be an affiliate of the Fund, for purposes of Section 2(a)(3) of the Investment Company Act of 1940, were as follows: |

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK FUNDS | | March 31, 2010 | | 17 |

| | |

| Schedule of Investments (concluded) | | BlackRock Aurora Portfolio |

| | |

| | | | | | | | | |

Affiliate | | Net

Activity | | Realized

Gain | | Income |

BlackRock Liquidity Funds, TempFund, Institutional Class | | $ | 14,370,957 | | $ | 67 | | $ | 3,449 |

BlackRock Liquidity Series, LLC Money Market Series | | $ | 48,985,590 | | | — | | $ | 121,552 |

| (d) | Represents the current yield as of report date. |

| (e) | Security was purchased with the cash collateral from loaned securities. |

| • | | For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. |

| • | | Fair Value Measurements — Various inputs are used in determining the fair value of investments, which are as follows: |

| | • | | Level 1 – price quotations in active markets/exchanges for identical assets and liabilities |

| | • | | Level 2 – other observable inputs (including, but not limited to: quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market–corroborated inputs) |

| | • | | Level 3 – unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Fund’s own assumptions used in determining the fair value of investments) |

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For information about the Fund’s policy regarding valuation of investments and other significant accounting policies, please refer to Note 1 of the Notes to Financial Statements.

The following table summarizes the inputs used as of March 31, 2010 in determining the fair valuation of the Fund’s investments:

| | | | | | | | | | | |

| | | Investments in Securities |

Valuation Inputs | | Level 1 | | Level 2 | | Level 3 | | Total |

Assets: | | | | | | | | | | | |

Long-Term Investments1 | | $ | 454,727,848 | | | — | | — | | $ | 454,727,848 |

Short-Term Securities | | | 22,884,148 | | $ | 77,589,190 | | — | | | 100,473,338 |

| | | | | | | | | | | |

Total | | $ | 477,611,996 | | $ | 77,589,190 | | — | | $ | 555,201,186 |

| | | | | | | | | | | |

| 1 | See above Schedule of Investments for values in each industry. |

See Notes to Financial Statements.

| | | | | | |

| 18 | | BLACKROCK FUNDS | | MARCH 31, 2010 | | |

| | |

| Schedule of Investments March 31, 2010 (Unaudited) | | BlackRock Capital Appreciation Portfolio |

| | (Percentages shown are based on Net Assets) |

| | | | | |

Common Stocks | | Shares | | Value |

Air Freight & Logistics — 2.0% | | | | | |

United Parcel Service, Inc. - Class B | | 155,400 | | $ | 10,009,314 |

| | | | | |

Airlines — 2.6% | | | | | |

Delta Air Lines, Inc.(a)(b) | | 744,600 | | | 10,863,714 |

UAL Corp.(a)(b) | | 128,000 | | | 2,502,400 |

| | | | | |

| | | | | 13,366,114 |

| | | | | |

Beverages — 2.2% | | | | | |

The Coca-Cola Co. | | 208,354 | | | 11,459,470 |

| | | | | |

Biotechnology — 3.2% | | | | | |

Amgen, Inc.(a) | | 155,900 | | | 9,316,584 |

Gilead Sciences, Inc.(a) | | 155,600 | | | 7,076,688 |

| | | | | |

| | | | | 16,393,272 |

| | | | | |

Building Products — 0.1% | | | | | |

Masco Corp. | | 44,800 | | | 695,296 |

| | | | | |

Capital Markets — 0.9% | | | | | |

The Goldman Sachs Group, Inc. | | 26,500 | | | 4,521,695 |

| | | | | |

Chemicals — 0.7% | | | | | |

Ecolab, Inc.(b) | | 81,300 | | | 3,573,135 |

| | | | | |

Commercial Banks — 1.5% | | | | | |

Wells Fargo & Co. | | 241,100 | | | 7,503,032 |

| | | | | |

Communications Equipment — 4.2% | | | | | |

Cisco Systems, Inc.(a) | | 344,321 | | | 8,962,675 |

F5 Networks, Inc.(a) | | 58,900 | | | 3,622,939 |

QUALCOMM, Inc. | | 206,323 | | | 8,663,503 |

| | | | | |

| | | | | 21,249,117 |

| | | | | |

Computers & Peripherals — 11.0% | | | | | |

Apple, Inc.(a) | | 111,818 | | | 26,269,403 |

EMC Corp.(a) | | 149,000 | | | 2,687,960 |

Hewlett-Packard Co. | | 278,700 | | | 14,812,905 |

NetApp, Inc.(a)(b) | | 234,900 | | | 7,648,344 |

Seagate Technology(a) | | 251,100 | | | 4,585,086 |

| | | | | |

| | | | | 56,003,698 |

| | | | | |

Diversified Financial Services — 1.9% | | | | | |

JPMorgan Chase & Co. | | 105,400 | | | 4,716,650 |

Moody’s Corp. | | 166,100 | | | 4,941,475 |

| | | | | |

| | | | | 9,658,125 |

| | | | | |

Energy Equipment & Services — 1.3% | | | | | |

Schlumberger Ltd. | | 53,617 | | | 3,402,535 |

Transocean Ltd.(a) | | 34,405 | | | 2,971,904 |

| | | | | |

| | | | | 6,374,439 |

| | | | | |

Food & Staples Retailing — 2.6% | | | | | |

Wal-Mart Stores, Inc. | | 188,386 | | | 10,474,262 |

Whole Foods Market, Inc.(a)(b) | | 77,800 | | | 2,812,470 |

| | | | | |

| | | | | 13,286,732 |

| | | | | |

Health Care Equipment & Supplies — 2.7% | | | | | |

St. Jude Medical, Inc.(a) | | 156,000 | | | 6,403,800 |

Zimmer Holdings, Inc.(a) | | 122,700 | | | 7,263,840 |

| | | | | |

| | | | | 13,667,640 |

| | | | | |

Health Care Providers & Services — 2.0% | | | | | |

Express Scripts, Inc.(a) | | 100,900 | | | 10,267,584 |

| | | | | |

Health Care Technology — 1.2% | | | | | |

Cerner Corp.(a)(b) | | 73,700 | | | 6,268,922 |

| | | | | |

Hotels, Restaurants & Leisure — 3.9% | | | | | |

Darden Restaurants, Inc. | | 65,200 | | | 2,904,008 |

Las Vegas Sands Corp.(a)(b) | | 268,900 | | | 5,687,235 |

Starbucks Corp. | | 225,800 | | | 5,480,166 |

Starwood Hotels & Resorts Worldwide, Inc. | | 122,900 | | | 5,732,056 |

| | | | | |

| | | | | 19,803,465 |

| | | | | |

Household Products — 2.9% | | | | | |

The Procter & Gamble Co. | | 233,386 | | | 14,766,332 |

| | | | | |

Internet & Catalog Retail — 2.6% | | | | | |

Amazon.com, Inc.(a) | | 97,540 | | | 13,239,104 |

| | | | | |

Internet Software & Services — 4.8% | | | | | |

Baidu, Inc. - ADR(a)(b) | | 8,700 | | | 5,193,900 |

Google, Inc. - Class A(a) | | 33,954 | | | 19,252,258 |

| | | | | |

| | | | | 24,446,158 |

| | | | | |

IT Services — 0.9% | | | | | |

Mastercard, Inc. - Class A | | 19,000 | | | 4,826,000 |

| | | | | |

Life Sciences Tools & Services — 2.1% | | | | | |

Covance, Inc.(a)(b) | | 95,100 | | | 5,838,189 |

Life Technologies Corp.(a) | | 95,300 | | | 4,981,331 |

| | | | | |

| | | | | 10,819,520 |

| | | | | |

Machinery — 7.5% | | | | | |

Cummins, Inc. | | 107,700 | | | 6,672,015 |

Danaher Corp. | | 159,722 | | | 12,763,385 |

Joy Global, Inc. | | 172,300 | | | 9,752,180 |

PACCAR, Inc. | | 205,900 | | | 8,923,706 |

| | | | | |

| | | | | 38,111,286 |

| | | | | |

Media — 2.9% | | | | | |

CBS Corp. - Class B(b) | | 400,800 | | | 5,587,152 |

Comcast Corp. - Class A | | 489,500 | | | 9,212,390 |

| | | | | |

| | | | | 14,799,542 |

| | | | | |

Metals & Mining — 1.9% | | | | | |

Agnico-Eagle Mines Ltd. | | 32,900 | | | 1,831,543 |

Freeport-McMoRan Copper & Gold, Inc. | | 38,737 | | | 3,236,089 |

United States Steel Corp.(b) | | 75,000 | | | 4,764,000 |

| | | | | |

| | | | | 9,831,632 |

| | | | | |

Multiline Retail — 1.8% | | | | | |

Kohl’s Corp.(a) | | 163,868 | | | 8,976,689 |

| | | | | |

Oil, Gas & Consumable Fuels — 2.4% | | | | | |

Anadarko Petroleum Corp. | | 77,800 | | | 5,666,174 |

EOG Resources, Inc. | | 72,000 | | | 6,691,680 |

| | | | | |

| | | | | 12,357,854 |

| | | | | |

Personal Products — 1.4% | | | | | |

Avon Products, Inc.(b) | | 204,000 | | | 6,909,480 |

| | | | | |

Pharmaceuticals — 4.5% | | | | | |

Abbott Laboratories | | 203,500 | | | 10,720,380 |

Pfizer, Inc. | | 378,100 | | | 6,484,415 |

Teva Pharmaceutical Industries Ltd. - ADR | | 86,700 | | | 5,469,036 |

| | | | | |

| | | | | 22,673,831 |

| | | | | |

See Notes to Financial Statements.

| | | | | | |

| | | BLACKROCK FUNDS | | MARCH 31, 2010 | | 19 |

| | |

| Schedule of Investments (concluded) | | BlackRock Capital Appreciation Portfolio |

| | (Percentages shown are based on Net Assets) |

| | | | | | |

Common Stocks | | Shares | | Value | |

Professional Services — 0.7% | | | | | | |

Manpower, Inc. | | 65,400 | | $ | 3,735,648 | |

| | | | | | |