UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:

Name of Fund:

BlackRock FundsSM

BlackRock Advantage Small Cap Growth Fund

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock FundsSM,

50 Hudson Yards, New York, NY 10001

Registrant's telephone number, including area code:

Date of reporting period:

Item 1 — Reports to Stockholders

(a) The Reports to Shareholders are attached herewith

BlackRock Advantage Small Cap Growth Fund

Institutional Shares | PSGIX

Annual Shareholder Report — September 30, 2024

This annual shareholder report contains important information about BlackRock Advantage Small Cap Growth Fund (the “Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Institutional Shares | $57 | 0.50% |

How did the Fund perform last year?

For the reporting period ended September 30, 2024, the Fund's Institutional Shares returned 29.42%

For the same period, the Russell 3000® Index returned 35.19% and the Russell 2000® Growth Index returned 27.66%.

What contributed to performance?

Fundamental and sentiment insights contributed to the Fund’s absolute performance. Fundamental measures, especially valuation measures that focus on companies based on their research and development expenditures, worked well. These insights correctly positioned the portfolio in the industrials and consumer staples sectors. Sentiment insights also contributed, led by those that gauged sentiment from conference calls. Textual data evaluation of analysts’ reports was helpful and led to successful positioning in financial stocks. In addition, macro thematic insights that evaluate companies’ E-invoicing at the industry level drove favorable positioning in the consumer discretionary sector.

What detracted from performance?

At a time of strong returns for the broader equity market, few aspects of the Fund’s positioning detracted from absolute performance. With this said, fundamental quality insights finished in negative territory. Defensive measures looking at the quality of company management detracted. Additionally, insights based on external financing measures motivated an unsuccessful overweight to the energy sector. Finally, a measure focusing on companies involved in the artificial intelligence ecosystem led to a negative return in the communication services sector.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

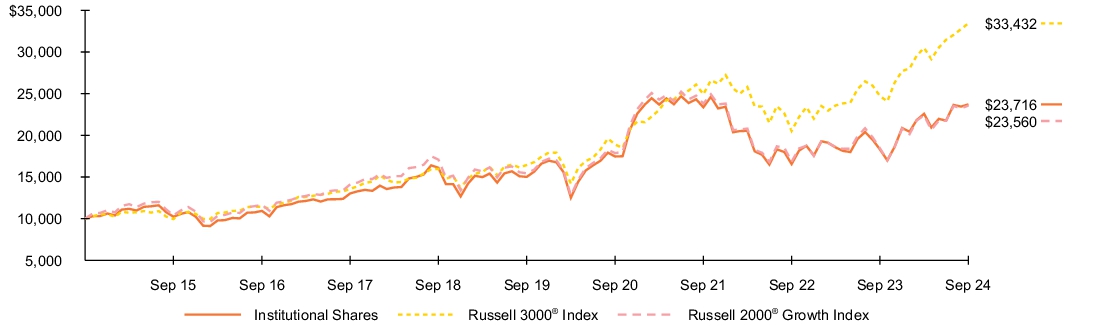

Fund performance

Cumulative performance: October 1, 2014 through September 30, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| 1 Year | | 5 Years | | 10 Years | |

| Institutional Shares | 29.42 | % | 9.58 | % | 9.02 | % |

| Russell 3000® Index | 35.19 | | 15.26 | | 12.83 | |

| Russell 2000® Growth Index | 27.66 | | 8.82 | | 8.95 | |

| Net Assets | $604,830,084 |

| Number of Portfolio Holdings | 598 |

| Net Investment Advisory Fees | $1,681,754 |

| Portfolio Turnover Rate | 148% |

The Fund has added the Russell 3000® Index in response to new regulatory requirements.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of September 30, 2024)

| Sector(a) | Percent of

Net Assets | |

| Health Care | 26.8 | % |

| Industrials | 22.5 | % |

| Information Technology | 21.0 | % |

| Consumer Discretionary | 10.9 | % |

| Financials | 6.7 | % |

| Energy | 3.3 | % |

| Materials | 2.8 | % |

| Communication Services | 2.2 | % |

| Consumer Staples | 1.7 | % |

| Real Estate | 1.1 | % |

| Utilities | 0.1 | % |

| Short-Term Securities | 6.6 | % |

| Liabilities in Excess of Other Assets | (5.7 | ) % |

| Security(b) | Percent of

Net Assets | |

| ExlService Holdings, Inc. | 1.6 | % |

| ACI Worldwide, Inc. | 1.3 | % |

| Maximus, Inc. | 1.0 | % |

| Fabrinet | 1.0 | % |

| Vaxcyte, Inc. | 0.9 | % |

| Sprouts Farmers Market, Inc. | 0.9 | % |

| FTAI Aviation Ltd. | 0.9 | % |

| Corcept Therapeutics, Inc. | 0.9 | % |

| Primoris Services Corp. | 0.8 | % |

| Boise Cascade Co. | 0.8 | % |

(a) | For purposes of this report, sector sub-classifications may differ from those utilized by the Fund for compliance purposes. |

(b) | Excludes short-term securities. |

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by FTSE International Limited and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Advantage Small Cap Growth Fund

Institutional Shares | PSGIX

Annual Shareholder Report — September 30, 2024

PSGIX-09/24-AR

BlackRock Advantage Small Cap Growth Fund

Investor A Shares | CSGEX

Annual Shareholder Report — September 30, 2024

This annual shareholder report contains important information about BlackRock Advantage Small Cap Growth Fund (the “Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Investor A Shares | $86 | 0.75% |

How did the Fund perform last year?

For the reporting period ended September 30, 2024, the Fund's Investor A Shares returned 29.20%

For the same period, the Russell 3000® Index returned 35.19% and the Russell 2000® Growth Index returned 27.66%.

What contributed to performance?

Fundamental and sentiment insights contributed to the Fund’s absolute performance. Fundamental measures, especially valuation measures that focus on companies based on their research and development expenditures, worked well. These insights correctly positioned the portfolio in the industrials and consumer staples sectors. Sentiment insights also contributed, led by those that gauged sentiment from conference calls. Textual data evaluation of analysts’ reports was helpful and led to successful positioning in financial stocks. In addition, macro thematic insights that evaluate companies’ E-invoicing at the industry level drove favorable positioning in the consumer discretionary sector.

What detracted from performance?

At a time of strong returns for the broader equity market, few aspects of the Fund’s positioning detracted from absolute performance. With this said, fundamental quality insights finished in negative territory. Defensive measures looking at the quality of company management detracted. Additionally, insights based on external financing measures motivated an unsuccessful overweight to the energy sector. Finally, a measure focusing on companies involved in the artificial intelligence ecosystem led to a negative return in the communication services sector.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

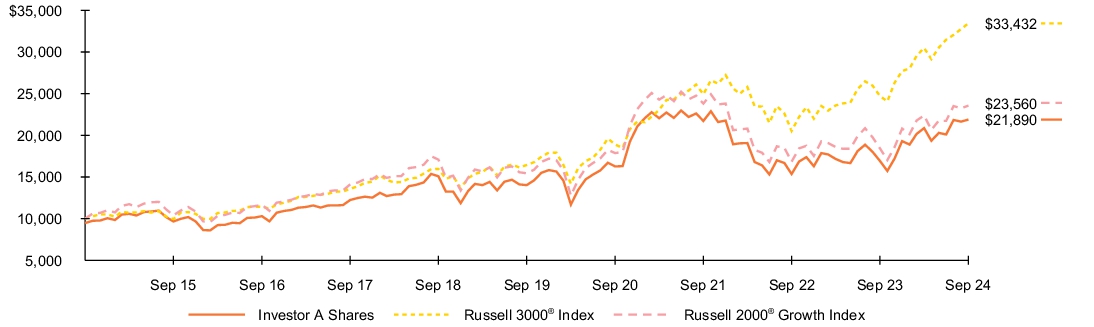

Fund performance

Cumulative performance: October 1, 2014 through September 30, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| 1 Year | | 5 Years | | 10 Years | |

| Investor A Shares | 29.20 | % | 9.32 | % | 8.73 | % |

| Investor A Shares (with sales charge) | 22.42 | | 8.14 | | 8.15 | |

| Russell 3000® Index | 35.19 | | 15.26 | | 12.83 | |

| Russell 2000® Growth Index | 27.66 | | 8.82 | | 8.95 | |

| Net Assets | $604,830,084 |

| Number of Portfolio Holdings | 598 |

| Net Investment Advisory Fees | $1,681,754 |

| Portfolio Turnover Rate | 148% |

The Fund has added the Russell 3000® Index in response to new regulatory requirements.

Assuming maximum sales charges. Average annual total returns with and without sales charges reflect reductions for service fees.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of September 30, 2024)

| Sector(a) | Percent of

Net Assets | |

| Health Care | 26.8 | % |

| Industrials | 22.5 | % |

| Information Technology | 21.0 | % |

| Consumer Discretionary | 10.9 | % |

| Financials | 6.7 | % |

| Energy | 3.3 | % |

| Materials | 2.8 | % |

| Communication Services | 2.2 | % |

| Consumer Staples | 1.7 | % |

| Real Estate | 1.1 | % |

| Utilities | 0.1 | % |

| Short-Term Securities | 6.6 | % |

| Liabilities in Excess of Other Assets | (5.7 | ) % |

| Security(b) | Percent of

Net Assets | |

| ExlService Holdings, Inc. | 1.6 | % |

| ACI Worldwide, Inc. | 1.3 | % |

| Maximus, Inc. | 1.0 | % |

| Fabrinet | 1.0 | % |

| Vaxcyte, Inc. | 0.9 | % |

| Sprouts Farmers Market, Inc. | 0.9 | % |

| FTAI Aviation Ltd. | 0.9 | % |

| Corcept Therapeutics, Inc. | 0.9 | % |

| Primoris Services Corp. | 0.8 | % |

| Boise Cascade Co. | 0.8 | % |

(a) | For purposes of this report, sector sub-classifications may differ from those utilized by the Fund for compliance purposes. |

(b) | Excludes short-term securities. |

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by FTSE International Limited and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Advantage Small Cap Growth Fund

Investor A Shares | CSGEX

Annual Shareholder Report — September 30, 2024

CSGEX-09/24-AR

BlackRock Advantage Small Cap Growth Fund

Class K Shares | PSGKX

Annual Shareholder Report — September 30, 2024

This annual shareholder report contains important information about BlackRock Advantage Small Cap Growth Fund (the “Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Class K Shares | $52 | 0.45% |

How did the Fund perform last year?

For the reporting period ended September 30, 2024, the Fund's Class K Shares returned 29.48%

For the same period, the Russell 3000® Index returned 35.19% and the Russell 2000® Growth Index returned 27.66%.

What contributed to performance?

Fundamental and sentiment insights contributed to the Fund’s absolute performance. Fundamental measures, especially valuation measures that focus on companies based on their research and development expenditures, worked well. These insights correctly positioned the portfolio in the industrials and consumer staples sectors. Sentiment insights also contributed, led by those that gauged sentiment from conference calls. Textual data evaluation of analysts’ reports was helpful and led to successful positioning in financial stocks. In addition, macro thematic insights that evaluate companies’ E-invoicing at the industry level drove favorable positioning in the consumer discretionary sector.

What detracted from performance?

At a time of strong returns for the broader equity market, few aspects of the Fund’s positioning detracted from absolute performance. With this said, fundamental quality insights finished in negative territory. Defensive measures looking at the quality of company management detracted. Additionally, insights based on external financing measures motivated an unsuccessful overweight to the energy sector. Finally, a measure focusing on companies involved in the artificial intelligence ecosystem led to a negative return in the communication services sector.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

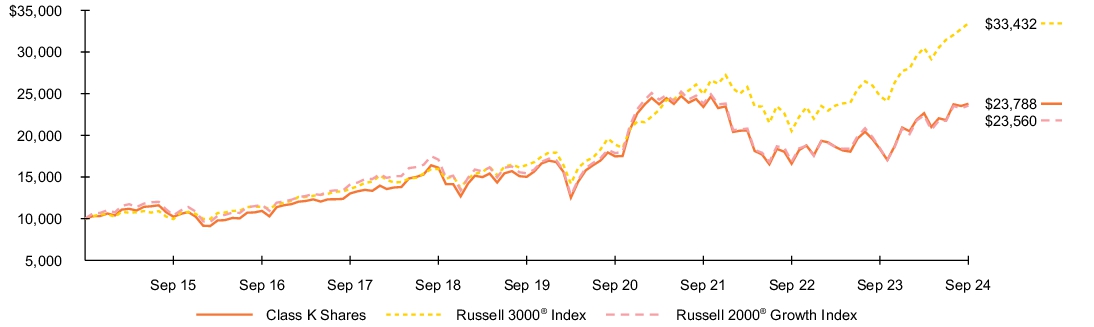

Fund performance

Cumulative performance: October 1, 2014 through September 30, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| 1 Year | | 5 Years | | 10 Years | |

| Class K Shares | 29.48 | % | 9.63 | % | 9.05 | % |

| Russell 3000® Index | 35.19 | | 15.26 | | 12.83 | |

| Russell 2000® Growth Index | 27.66 | | 8.82 | | 8.95 | |

| Net Assets | $604,830,084 |

| Number of Portfolio Holdings | 598 |

| Net Investment Advisory Fees | $1,681,754 |

| Portfolio Turnover Rate | 148% |

The Fund has added the Russell 3000® Index in response to new regulatory requirements.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of September 30, 2024)

| Sector(a) | Percent of

Net Assets | |

| Health Care | 26.8 | % |

| Industrials | 22.5 | % |

| Information Technology | 21.0 | % |

| Consumer Discretionary | 10.9 | % |

| Financials | 6.7 | % |

| Energy | 3.3 | % |

| Materials | 2.8 | % |

| Communication Services | 2.2 | % |

| Consumer Staples | 1.7 | % |

| Real Estate | 1.1 | % |

| Utilities | 0.1 | % |

| Short-Term Securities | 6.6 | % |

| Liabilities in Excess of Other Assets | (5.7 | ) % |

| Security(b) | Percent of

Net Assets | |

| ExlService Holdings, Inc. | 1.6 | % |

| ACI Worldwide, Inc. | 1.3 | % |

| Maximus, Inc. | 1.0 | % |

| Fabrinet | 1.0 | % |

| Vaxcyte, Inc. | 0.9 | % |

| Sprouts Farmers Market, Inc. | 0.9 | % |

| FTAI Aviation Ltd. | 0.9 | % |

| Corcept Therapeutics, Inc. | 0.9 | % |

| Primoris Services Corp. | 0.8 | % |

| Boise Cascade Co. | 0.8 | % |

(a) | For purposes of this report, sector sub-classifications may differ from those utilized by the Fund for compliance purposes. |

(b) | Excludes short-term securities. |

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by FTSE International Limited and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Advantage Small Cap Growth Fund

Class K Shares | PSGKX

Annual Shareholder Report — September 30, 2024

PSGKX-09/24-AR

BlackRock Advantage Small Cap Growth Fund

Class R Shares | BSGRX

Annual Shareholder Report — September 30, 2024

This annual shareholder report contains important information about BlackRock Advantage Small Cap Growth Fund (the “Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Class R Shares | $114 | 1.00% |

How did the Fund perform last year?

For the reporting period ended September 30, 2024, the Fund's Class R Shares returned 28.83%

For the same period, the Russell 3000® Index returned 35.19% and the Russell 2000® Growth Index returned 27.66%.

What contributed to performance?

Fundamental and sentiment insights contributed to the Fund’s absolute performance. Fundamental measures, especially valuation measures that focus on companies based on their research and development expenditures, worked well. These insights correctly positioned the portfolio in the industrials and consumer staples sectors. Sentiment insights also contributed, led by those that gauged sentiment from conference calls. Textual data evaluation of analysts’ reports was helpful and led to successful positioning in financial stocks. In addition, macro thematic insights that evaluate companies’ E-invoicing at the industry level drove favorable positioning in the consumer discretionary sector.

What detracted from performance?

At a time of strong returns for the broader equity market, few aspects of the Fund’s positioning detracted from absolute performance. With this said, fundamental quality insights finished in negative territory. Defensive measures looking at the quality of company management detracted. Additionally, insights based on external financing measures motivated an unsuccessful overweight to the energy sector. Finally, a measure focusing on companies involved in the artificial intelligence ecosystem led to a negative return in the communication services sector.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

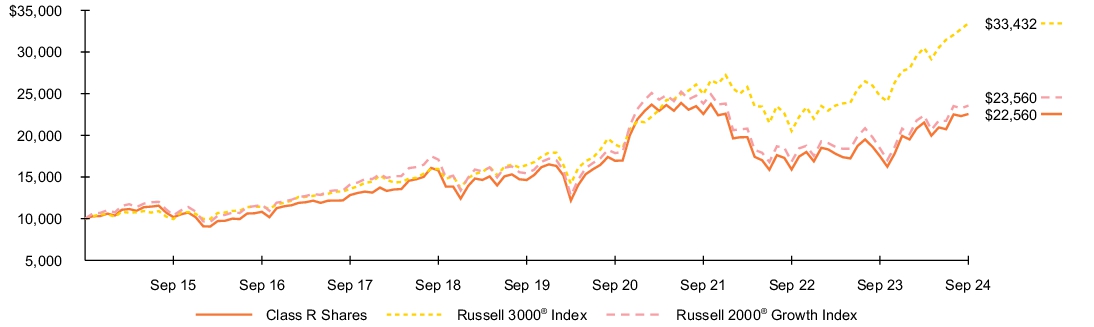

Fund performance

Cumulative performance: October 1, 2014 through September 30, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| 1 Year | | 5 Years | | 10 Years | |

| Class R Shares | 28.83 | % | 9.04 | % | 8.48 | % |

| Russell 3000® Index | 35.19 | | 15.26 | | 12.83 | |

| Russell 2000® Growth Index | 27.66 | | 8.82 | | 8.95 | |

| Net Assets | $604,830,084 |

| Number of Portfolio Holdings | 598 |

| Net Investment Advisory Fees | $1,681,754 |

| Portfolio Turnover Rate | 148% |

The Fund has added the Russell 3000® Index in response to new regulatory requirements.

Average annual total returns reflect reductions for distribution and service fees.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of September 30, 2024)

| Sector(a) | Percent of

Net Assets | |

| Health Care | 26.8 | % |

| Industrials | 22.5 | % |

| Information Technology | 21.0 | % |

| Consumer Discretionary | 10.9 | % |

| Financials | 6.7 | % |

| Energy | 3.3 | % |

| Materials | 2.8 | % |

| Communication Services | 2.2 | % |

| Consumer Staples | 1.7 | % |

| Real Estate | 1.1 | % |

| Utilities | 0.1 | % |

| Short-Term Securities | 6.6 | % |

| Liabilities in Excess of Other Assets | (5.7 | ) % |

| Security(b) | Percent of

Net Assets | |

| ExlService Holdings, Inc. | 1.6 | % |

| ACI Worldwide, Inc. | 1.3 | % |

| Maximus, Inc. | 1.0 | % |

| Fabrinet | 1.0 | % |

| Vaxcyte, Inc. | 0.9 | % |

| Sprouts Farmers Market, Inc. | 0.9 | % |

| FTAI Aviation Ltd. | 0.9 | % |

| Corcept Therapeutics, Inc. | 0.9 | % |

| Primoris Services Corp. | 0.8 | % |

| Boise Cascade Co. | 0.8 | % |

(a) | For purposes of this report, sector sub-classifications may differ from those utilized by the Fund for compliance purposes. |

(b) | Excludes short-term securities. |

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by FTSE International Limited and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Advantage Small Cap Growth Fund

Class R Shares | BSGRX

Annual Shareholder Report — September 30, 2024

BSGRX-09/24-AR

(b) Not Applicable

| Item 2 – | Code of Ethics – The registrant (or the “Fund”) has adopted a code of ethics, as of the end of the period covered by this report, applicable to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. During the period covered by this report, the code of ethics was amended to update certain information and to make other non-material changes. During the period covered by this report, there have been no waivers granted under the code of ethics. The registrant undertakes to provide a copy of the code of ethics to any person upon request, without charge, who calls 1-800-441-7762. |

| Item 3 – | Audit Committee Financial Expert – The registrant’s board of trustees (the “board of trustees”), has determined that (i) the registrant has the following audit committee financial experts serving on its audit committee and (ii) each audit committee financial expert is independent: |

Neil A. Cotty

Henry R. Keizer

Kenneth L. Urish

Under applicable securities laws, a person determined to be an audit committee financial expert will not be deemed an “expert” for any purpose, including without limitation for the purposes of Section 11 of the Securities Act of 1933, as a result of being designated or identified as an audit committee financial expert. The designation or identification of a person as an audit committee financial expert does not impose on such person any duties, obligations, or liabilities greater than the duties, obligations, and liabilities imposed on such person as a member of the audit committee and board of trustees in the absence of such designation or identification. The designation or identification of a person as an audit committee financial expert does not affect the duties, obligations, or liability of any other member of the audit committee or board of trustees.

| Item 4 – | Principal Accountant Fees and Services |

The following table presents fees billed by Deloitte & Touche LLP (“D&T”) in each of the last two fiscal years for the services rendered to the Fund:

| | | | | | | | | | | | | | | | |

| | | (a) Audit Fees | | (b) Audit-Related Fees1 | | (c) Tax Fees2 | | (d) All Other Fees |

| Entity Name | | Current Fiscal Year End | | Previous Fiscal Year End | | Current Fiscal Year End | | Previous Fiscal Year End | | Current Fiscal Year End | | Previous Fiscal Year End | | Current Fiscal Year End | | Previous Fiscal Year End |

| BlackRock Advantage Small Cap Growth Fund | | $30,192 | | $30,192 | | $0 | | $0 | | $15,288 | | $15,300 | | $0 | | $407 |

The following table presents fees billed by D&T that were required to be approved by the registrant’s audit committee (the “Committee”) for services that relate directly to the operations or financial reporting of the Fund and that are rendered on behalf of BlackRock Advisors, LLC (the “Investment Adviser” or “BlackRock”) and entities controlling, controlled by, or under common control with BlackRock (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser) that provide ongoing services to the Fund (“Affiliated Service Providers”):

2

| | | | |

| | | Current Fiscal Year End | | Previous Fiscal Year End |

(b) Audit-Related Fees1 | | $0 | | $0 |

(c) Tax Fees2 | | $0 | | $0 |

(d) All Other Fees3 | | $2,149,000 | | $2,154,000 |

1 The nature of the services includes assurance and related services reasonably related to the performance of the audit or review of financial statements not included in Audit Fees, including accounting consultations, agreed-upon procedure reports, attestation reports, comfort letters, out-of-pocket expenses and internal control reviews not required by regulators.

2 The nature of the services includes tax compliance and/or tax preparation, including services relating to the filing or amendment of federal, state or local income tax returns, regulated investment company qualification reviews, taxable income and tax distribution calculations.

3 Non-audit fees of $2,149,000 and $2,154,000 for the current fiscal year and previous fiscal year, respectively, were paid to the Fund’s principal accountant in their entirety by BlackRock, in connection with services provided to the Affiliated Service Providers of the Fund and of certain other funds sponsored and advised by BlackRock or its affiliates for a service organization review and an accounting research tool subscription. These amounts represent aggregate fees paid by BlackRock and were not allocated on a per fund basis.

(e)(1) Audit Committee Pre-Approval Policies and Procedures:

The Committee has adopted policies and procedures with regard to the pre-approval of services. Audit, audit-related and tax compliance services provided to the registrant on an annual basis require specific pre-approval by the Committee. The Committee also must approve other non-audit services provided to the registrant and those non-audit services provided to the Investment Adviser and Affiliated Service Providers that relate directly to the operations and the financial reporting of the registrant. Certain of these non-audit services that the Committee believes are (a) consistent with the SEC’s auditor independence rules and (b) routine and recurring services that will not impair the independence of the independent accountants may be approved by the Committee without consideration on a specific case-by-case basis (“general pre-approval”). The term of any general pre-approval is 12 months from the date of the pre-approval, unless the Committee provides for a different period. Tax or other non-audit services provided to the registrant which have a direct impact on the operations or financial reporting of the registrant will only be deemed pre-approved provided that any individual project does not exceed $10,000 attributable to the registrant or $50,000 per project. For this purpose, multiple projects will be aggregated to determine if they exceed the previously mentioned cost levels.

Any proposed services exceeding the pre-approved cost levels will require specific pre-approval by the Committee, as will any other services not subject to general pre-approval (e.g., unanticipated but permissible services). The Committee is informed of each service approved subject to general pre-approval at the next regularly scheduled in-person board meeting. At this meeting, an analysis of such services is presented to the Committee for ratification. The Committee may delegate to the Committee Chairman the authority to approve the provision of and fees for any specific engagement of permitted non-audit services, including services exceeding pre-approved cost levels.

(e)(2) None of the services described in each of Items 4(b) through (d) were approved by the Committee pursuant to the de minimis exception in paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Not Applicable

(g) The aggregate non-audit fees, defined as the sum of the fees shown under “Audit-Related Fees,” “Tax Fees” and “All Other Fees,” paid to the accountant for services rendered by the accountant to the registrant, the Investment Adviser and the Affiliated Service Providers were:

| | | | |

| Entity Name | | Current Fiscal Year End | | Previous Fiscal Year End |

| BlackRock Advantage Small Cap Growth Fund | | $15,288 | | $15,707 |

3

Additionally, the amounts billed by D&T in connection with services provided to the Affiliated Service Providers of the Fund and of other funds sponsored and advised by BlackRock or its affiliates during the current and previous fiscal years for a service organization review and an accounting research tool subscription were:

| | |

Current Fiscal Year End | | Previous Fiscal Year End |

$2,149,000 | | $2,154,000 |

These amounts represent aggregate fees paid by BlackRock and were not allocated on a per fund basis.

(h) The Committee has considered and determined that the provision of non-audit services that were rendered to the Investment Adviser and the Affiliated Service Providers that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence.

(i) – Not Applicable

(j) – Not Applicable

| Item 5 – | Audit Committee of Listed Registrant – Not Applicable |

(a) The registrant’s Schedule of Investments is included as part of the Financial Statement and Financial Highlights for Open-End Management Investment Companies filed under Item 7 of this Form.

(b) Not Applicable due to no such divestments during the semi-annual period covered since the previous Form N-CSR filing.

| Item 7 – | Financial Statements and Financial Highlights for Open-End Management Investment Companies |

(a) The registrant’s Financial Statements are attached herewith.

(b) The registrant’s Financial Highlights are attached herewith.

4

| | |

| | SEPTEMBER 30, 2024 |

| | |

| |

| | 2024 Annual Financial Statements and Additional Information |

BlackRock FundsSM

| · | | BlackRock Advantage Small Cap Growth Fund |

|

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

Table of Contents

Derivative Financial Instruments

The Fund may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market, and/or other assets without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the instrument. Pursuant to Rule 18f-4 under the 1940 Act, among other things, the Fund must either use derivative financial instruments with embedded leverage in a limited manner or comply with an outer limit on fund leverage risk based on value-at-risk. The Fund’s successful use of a derivative financial instrument depends on the investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these instruments may result in losses greater than if they had not been used, may limit the amount of appreciation a Fund can realize on an investment and/or may result in lower distributions paid to shareholders. The Fund’s investments in these instruments, if any, are discussed in detail in the Notes to Financial Statements.

| | |

D E R I V A T I V E F I N A N C I A L I N S T R U M E N T S | | 3 |

| | |

Schedule of Investments September 30, 2024 | | BlackRock Advantage Small Cap Growth Fund (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | |

Common Stocks | | | | | | | | |

| | |

| Aerospace & Defense — 1.1% | | | | | | |

AeroVironment, Inc.(a)(b) | | | 9,685 | | | $ | 1,941,842 | |

Astronics Corp.(a) | | | 104 | | | | 2,026 | |

BWX Technologies, Inc. | | | 2,900 | | | | 315,230 | |

Cadre Holdings, Inc. | | | 15,970 | | | | 606,062 | |

Moog, Inc., Class A | | | 19,167 | | | | 3,872,117 | |

| | | | | | | | |

| | |

| | | | | | | 6,737,277 | |

| | |

| Automobile Components — 1.9% | | | | | | |

Adient PLC(a) | | | 13,242 | | | | 298,872 | |

Dorman Products, Inc.(a) | | | 3,856 | | | | 436,191 | |

Goodyear Tire & Rubber Co. (The)(a) | | | 8,712 | | | | 77,101 | |

Modine Manufacturing Co.(a) | | | 36,398 | | | | 4,833,291 | |

Patrick Industries, Inc. | | | 19,001 | | | | 2,705,172 | |

Visteon Corp.(a) | | | 31,089 | | | | 2,960,916 | |

| | | | | | | | |

| | |

| | | | | | | 11,311,543 | |

| | |

| Banks — 0.4% | | | | | | |

Amalgamated Financial Corp. | | | 9,194 | | | | 288,416 | |

Bank OZK | | | 2,831 | | | | 121,705 | |

Bank7 Corp. | | | 15,654 | | | | 586,555 | |

ConnectOne Bancorp, Inc. | | | 3,629 | | | | 90,906 | |

First Business Financial Services, Inc. | | | 2,477 | | | | 112,926 | |

First Internet Bancorp | | | 2,643 | | | | 90,549 | |

Investar Holding Corp. | | | 7,998 | | | | 155,161 | |

Metropolitan Bank Holding Corp.(a) | | | 4,889 | | | | 257,064 | |

ServisFirst Bancshares, Inc. | | | 5,710 | | | | 459,370 | |

| | | | | | | | |

| | |

| | | | | | | 2,162,652 | |

| | |

| Beverages — 0.0% | | | | | | |

National Beverage Corp. | | | 115 | | | | 5,398 | |

| | | | | | | | |

| | |

| Biotechnology — 14.0% | | | | | | |

4D Molecular Therapeutics, Inc.(a) | | | 20,076 | | | | 217,022 | |

Absci Corp.(a) | | | 17,183 | | | | 65,639 | |

ACADIA Pharmaceuticals, Inc.(a) | | | 121,031 | | | | 1,861,457 | |

Acrivon Therapeutics, Inc.(a) | | | 74 | | | | 518 | |

ADMA Biologics, Inc.(a) | | | 153,012 | | | | 3,058,710 | |

Akero Therapeutics, Inc.(a) | | | 16,340 | | | | 468,795 | |

Aldeyra Therapeutics, Inc.(a) | | | 7,619 | | | | 41,066 | |

Alector, Inc.(a) | | | 128,799 | | | | 600,203 | |

Alkermes PLC(a) | | | 53,473 | | | | 1,496,709 | |

Amicus Therapeutics, Inc.(a) | | | 230,048 | | | | 2,456,913 | |

AnaptysBio, Inc.(a) | | | 32,703 | | | | 1,095,550 | |

Anika Therapeutics, Inc.(a) | | | 16,537 | | | | 408,464 | |

Apellis Pharmaceuticals, Inc.(a) | | | 14,404 | | | | 415,411 | |

Apogee Therapeutics, Inc.(a) | | | 6,616 | | | | 388,624 | |

Arcellx, Inc.(a) | | | 12,644 | | | | 1,055,900 | |

Arcturus Therapeutics Holdings, Inc.(a) | | | 41,223 | | | | 956,786 | |

Arcus Biosciences, Inc.(a) | | | 35,110 | | | | 536,832 | |

Arcutis Biotherapeutics, Inc.(a) | | | 68,310 | | | | 635,283 | |

Ardelyx, Inc.(a) | | | 36,108 | | | | 248,784 | |

Arrowhead Pharmaceuticals, Inc.(a) | | | 27,781 | | | | 538,118 | |

ARS Pharmaceuticals, Inc.(a) | | | 7,613 | | | | 110,388 | |

Astria Therapeutics, Inc.(a) | | | 38,051 | | | | 418,941 | |

Aurinia Pharmaceuticals, Inc.(a) | | | 10,021 | | | | 73,454 | |

Avidity Biosciences, Inc.(a) | | | 33,639 | | | | 1,545,039 | |

BioCryst Pharmaceuticals, Inc.(a)(b) | | | 218,402 | | | | 1,659,855 | |

Biohaven Ltd.(a) | | | 21,274 | | | | 1,063,062 | |

Black Diamond Therapeutics, Inc.(a) | | | 1,916 | | | | 8,335 | |

Blueprint Medicines Corp.(a) | | | 36,592 | | | | 3,384,760 | |

Bridgebio Pharma, Inc.(a) | | | 38,331 | | | | 975,907 | |

C4 Therapeutics, Inc.(a) | | | 33,629 | | | | 191,685 | |

CareDx, Inc.(a) | | | 21,600 | | | | 674,460 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | |

| Biotechnology (continued) | | | | | | |

Catalyst Pharmaceuticals, Inc.(a) | | | 104,115 | | | $ | 2,069,806 | |

Celldex Therapeutics, Inc.(a) | | | 13,591 | | | | 461,958 | |

Cogent Biosciences, Inc.(a) | | | 8,277 | | | | 89,392 | |

Coherus Biosciences, Inc.(a)(b) | | | 159,596 | | | | 165,980 | |

Crinetics Pharmaceuticals, Inc.(a) | | | 22,486 | | | | 1,149,035 | |

Cytokinetics, Inc.(a) | | | 4,638 | | | | 244,886 | |

Day One Biopharmaceuticals, Inc.(a) | | | 20,239 | | | | 281,929 | |

Denali Therapeutics, Inc.(a)(b) | | | 66,914 | | | | 1,949,205 | |

Dyne Therapeutics, Inc.(a) | | | 36,445 | | | | 1,309,104 | |

Entrada Therapeutics, Inc.(a) | | | 3,448 | | | | 55,099 | |

Fate Therapeutics, Inc.(a) | | | 61,171 | | | | 214,098 | |

Foghorn Therapeutics, Inc.(a) | | | 175 | | | | 1,629 | |

Geron Corp.(a) | | | 54,488 | | | | 247,375 | |

Halozyme Therapeutics, Inc.(a)(b) | | | 47,274 | | | | 2,705,964 | |

Ideaya Biosciences, Inc.(a) | | | 45,652 | | | | 1,446,255 | |

Immunovant, Inc.(a)(b) | | | 8,186 | | | | 233,383 | |

Inhibrx Biosciences, Inc.(a) | | | 1 | | | | 16 | |

Insmed, Inc.(a)(b) | | | 61,216 | | | | 4,468,768 | |

Intellia Therapeutics, Inc.(a) | | | 40,967 | | | | 841,872 | |

Ionis Pharmaceuticals, Inc.(a) | | | 26,323 | | | | 1,054,499 | |

Iovance Biotherapeutics, Inc.(a)(b) | | | 63,260 | | | | 594,011 | |

iTeos Therapeutics, Inc.(a) | | | 46,514 | | | | 474,908 | |

Janux Therapeutics, Inc.(a) | | | 3,756 | | | | 170,635 | |

Keros Therapeutics, Inc.(a) | | | 9,956 | | | | 578,145 | |

Kiniksa Pharmaceuticals International PLC(a) | | | 53,901 | | | | 1,346,986 | |

Kronos Bio, Inc.(a) | | | 17,065 | | | | 17,063 | |

Krystal Biotech, Inc.(a)(b) | | | 7,592 | | | | 1,381,972 | |

Kura Oncology, Inc.(a) | | | 55,479 | | | | 1,084,060 | |

Kymera Therapeutics, Inc.(a) | | | 33,202 | | | | 1,571,451 | |

Larimar Therapeutics, Inc.(a) | | | 41,578 | | | | 272,336 | |

Madrigal Pharmaceuticals, Inc.(a) | | | 5,172 | | | | 1,097,602 | |

MannKind Corp.(a) | | | 111,795 | | | | 703,191 | |

MeiraGTx Holdings PLC(a) | | | 19,163 | | | | 79,910 | |

MiMedx Group, Inc.(a) | | | 46,834 | | | | 276,789 | |

Mirum Pharmaceuticals, Inc.(a) | | | 11,668 | | | | 455,052 | |

Myriad Genetics, Inc.(a) | | | 6,282 | | | | 172,064 | |

Natera, Inc.(a) | | | 8,115 | | | | 1,030,199 | |

Neurocrine Biosciences, Inc.(a) | | | 1,249 | | | | 143,910 | |

Novavax, Inc.(a) | | | 4,329 | | | | 54,675 | |

Nurix Therapeutics, Inc.(a) | | | 21,899 | | | | 492,071 | |

Nuvalent, Inc., Class A(a) | | | 12,214 | | | | 1,249,492 | |

Organogenesis Holdings, Inc., Class A(a) | | | 56,453 | | | | 161,456 | |

Poseida Therapeutics, Inc.(a) | | | 53,710 | | | | 153,611 | |

Praxis Precision Medicines, Inc.(a) | | | 1,446 | | | | 83,203 | |

Protagonist Therapeutics, Inc.(a) | | | 12,933 | | | | 581,985 | |

Prothena Corp. PLC(a) | | | 8,155 | | | | 136,433 | |

PTC Therapeutics, Inc.(a) | | | 47,088 | | | | 1,746,965 | |

Puma Biotechnology, Inc.(a)(b) | | | 45,522 | | | | 116,081 | |

Recursion Pharmaceuticals, Inc., Class A(a)(b) | | | 90,660 | | | | 597,449 | |

REGENXBIO, Inc.(a) | | | 5,912 | | | | 62,017 | |

Relay Therapeutics, Inc.(a) | | | 98,765 | | | | 699,256 | |

Replimune Group, Inc.(a) | | | 8,851 | | | | 97,007 | |

REVOLUTION Medicines, Inc.(a) | | | 30,269 | | | | 1,372,699 | |

Rhythm Pharmaceuticals, Inc.(a)(b) | | | 20,403 | | | | 1,068,913 | |

Rigel Pharmaceuticals, Inc.(a) | | | 26,122 | | | | 422,654 | |

Sana Biotechnology, Inc.(a) | | | 100,800 | | | | 419,328 | |

Sarepta Therapeutics, Inc.(a) | | | 2,890 | | | | 360,932 | |

Scholar Rock Holding Corp.(a)(b) | | | 15,758 | | | | 126,222 | |

SpringWorks Therapeutics, Inc.(a) | | | 25,373 | | | | 812,951 | |

Stoke Therapeutics, Inc.(a) | | | 33 | | | | 406 | |

Summit Therapeutics, Inc.(a) | | | 8,037 | | | | 176,010 | |

Sutro Biopharma, Inc.(a) | | | 7,716 | | | | 26,697 | |

| | |

| 4 | | 2 0 2 4 B L A C K R O C K A N N U A L F I N A N C I A L S T A T E M E N T S A N D A D D I T I O N A L I N F O R M A T I O N |

| | |

Schedule of Investments (continued) September 30, 2024 | | BlackRock Advantage Small Cap Growth Fund (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | |

| Biotechnology (continued) | | | | | | |

Syndax Pharmaceuticals, Inc.(a) | | | 86,951 | | | $ | 1,673,807 | |

TG Therapeutics, Inc.(a)(b) | | | 102,908 | | | | 2,407,018 | |

Travere Therapeutics, Inc.(a) | | | 26,489 | | | | 370,581 | |

Twist Bioscience Corp.(a) | | | 28,077 | | | | 1,268,519 | |

Ultragenyx Pharmaceutical, Inc.(a) | | | 19,685 | | | | 1,093,502 | |

UroGen Pharma Ltd.(a) | | | 66 | | | | 838 | |

Vanda Pharmaceuticals, Inc.(a) | | | 141,988 | | | | 665,924 | |

Vaxcyte, Inc.(a) | | | 47,496 | | | | 5,427,368 | |

Vera Therapeutics, Inc., Class A(a) | | | 4,090 | | | | 180,778 | |

Veracyte, Inc.(a) | | | 23,869 | | | | 812,501 | |

Vericel Corp.(a) | | | 32,583 | | | | 1,376,632 | |

Verve Therapeutics, Inc.(a) | | | 23,298 | | | | 112,762 | |

Viking Therapeutics, Inc.(a) | | | 2,267 | | | | 143,524 | |

Voyager Therapeutics, Inc.(a) | | | 51,587 | | | | 301,784 | |

Xencor, Inc.(a) | | | 33,116 | | | | 665,963 | |

| | | | | | | | |

| | |

| | | | | | | 84,613,221 | |

| | |

| Broadline Retail — 0.0% | | | | | | |

Etsy, Inc.(a) | | | 966 | | | | 53,642 | |

| | | | | | | | |

| | |

| Building Products — 2.9% | | | | | | |

Advanced Drainage Systems, Inc. | | | 15,064 | | | | 2,367,458 | |

American Woodmark Corp.(a) | | | 7,842 | | | | 732,835 | |

Apogee Enterprises, Inc. | | | 11,401 | | | | 798,241 | |

AZEK Co., Inc. (The), Class A(a) | | | 54,148 | | | | 2,534,127 | |

CSW Industrials, Inc.(b) | | | 5,160 | | | | 1,890,572 | |

Gibraltar Industries, Inc.(a) | | | 39,393 | | | | 2,754,753 | |

UFP Industries, Inc. | | | 22,414 | | | | 2,940,941 | |

Zurn Elkay Water Solutions Corp. | | | 95,965 | | | | 3,448,982 | |

| | | | | | | | |

| | |

| | | | | | | 17,467,909 | |

| | |

| Capital Markets — 2.4% | | | | | | |

Brightsphere Investment Group, Inc. | | | 60,817 | | | | 1,544,752 | |

Donnelley Financial Solutions, Inc.(a)(b) | | | 26,244 | | | | 1,727,643 | |

Evercore, Inc., Class A | | | 2,328 | | | | 589,776 | |

Federated Hermes, Inc., Class B | | | 4,604 | | | | 169,289 | |

GCM Grosvenor, Inc., Class A | | | 11,178 | | | | 126,535 | |

Hamilton Lane, Inc., Class A | | | 13,940 | | | | 2,347,357 | |

Houlihan Lokey, Inc., Class A | | | 16,526 | | | | 2,611,438 | |

Invesco Ltd. | | | 29,133 | | | | 511,575 | |

Piper Sandler Cos. | | | 2,803 | | | | 795,519 | |

PJT Partners, Inc., Class A | | | 26,365 | | | | 3,515,509 | |

SEI Investments Co. | | | 1,005 | | | | 69,536 | |

Silvercrest Asset Management Group, Inc., Class A | | | 12,153 | | | | 209,518 | |

Virtu Financial, Inc., Class A | | | 10,919 | | | | 332,593 | |

| | | | | | | | |

| | |

| | | | | | | 14,551,040 | |

| | |

| Chemicals — 0.7% | | | | | | |

Cabot Corp. | | | 25,000 | | | | 2,794,250 | |

Hawkins, Inc. | | | 1,573 | | | | 200,510 | |

Innospec, Inc. | | | 1,265 | | | | 143,059 | |

Minerals Technologies, Inc. | | | 108 | | | | 8,341 | |

Quaker Chemical Corp. | | | 7,096 | | | | 1,195,605 | |

| | | | | | | | |

| | |

| | | | | | | 4,341,765 | |

| | |

| Commercial Services & Supplies — 0.3% | | | | | | |

Cimpress PLC(a) | | | 14,384 | | | | 1,178,337 | |

Healthcare Services Group, Inc.(a) | | | 8,453 | | | | 94,420 | |

Interface, Inc., Class A | | | 1,817 | | | | 34,469 | |

Viad Corp.(a) | | | 8,251 | | | | 295,633 | |

| | | | | | | | |

| | |

| | | | | | | 1,602,859 | |

| | |

| Communications Equipment — 0.4% | | | | | | |

Calix, Inc.(a) | | | 42,967 | | | | 1,666,690 | |

NETGEAR, Inc.(a) | | | 25,042 | | | | 502,343 | |

| | | | | | | | |

| | |

| | | | | | | 2,169,033 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | |

| Construction & Engineering — 3.5% | | | | | | |

Comfort Systems U.S.A., Inc. | | | 10,330 | | | $ | 4,032,315 | |

Construction Partners, Inc., Class A(a) | | | 42 | | | | 2,932 | |

Dycom Industries, Inc.(a) | | | 25,133 | | | | 4,953,714 | |

EMCOR Group, Inc. | | | 175 | | | | 75,343 | |

Fluor Corp.(a) | | | 38,560 | | | | 1,839,698 | |

IES Holdings, Inc.(a) | | | 4,373 | | | | 872,938 | |

Primoris Services Corp. | | | 87,374 | | | | 5,074,682 | |

Sterling Infrastructure, Inc.(a) | | | 26,103 | | | | 3,785,457 | |

Tutor Perini Corp.(a) | | | 17,019 | | | | 462,236 | |

| | | | | | | | |

| | |

| | | | | | | 21,099,315 | |

| | |

| Consumer Finance — 1.8% | | | | | | |

Enova International, Inc.(a) | | | 20,145 | | | | 1,687,950 | |

EZCORP, Inc., Class A, NVS(a) | | | 137,146 | | | | 1,537,407 | |

FirstCash Holdings, Inc. | | | 24,499 | | | | 2,812,485 | |

LendingTree, Inc.(a) | | | 10,244 | | | | 594,459 | |

OneMain Holdings, Inc. | | | 24,304 | | | | 1,143,989 | |

PROG Holdings, Inc. | | | 37,956 | | | | 1,840,487 | |

Regional Management Corp. | | | 35,716 | | | | 1,168,270 | |

| | | | | | | | |

| | |

| | | | | | | 10,785,047 | |

| | |

| Consumer Staples Distribution & Retail — 1.0% | | | | | | |

Performance Food Group Co.(a) | | | 367 | | | | 28,762 | |

PriceSmart, Inc. | | | 10,820 | | | | 993,060 | |

Sprouts Farmers Market, Inc.(a)(b) | | | 47,237 | | | | 5,215,437 | |

| | | | | | | | |

| | |

| | | | | | | 6,237,259 | |

| | |

| Diversified Consumer Services — 0.8% | | | | | | |

Bright Horizons Family Solutions, Inc.(a) | | | 1,407 | | | | 197,163 | |

Coursera, Inc.(a) | | | 60,640 | | | | 481,482 | |

Frontdoor, Inc.(a) | | | 32,585 | | | | 1,563,754 | |

Laureate Education, Inc., Class A | | | 132,884 | | | | 2,207,203 | |

OneSpaWorld Holdings Ltd. | | | 22,694 | | | | 374,678 | |

| | | | | | | | |

| | |

| | | | | | | 4,824,280 | |

| | |

| Diversified REITs — 0.1% | | | | | | |

CTO Realty Growth, Inc. | | | 20,275 | | | | 385,631 | |

| | | | | | | | |

| | |

| Diversified Telecommunication Services — 0.2% | | | | | | |

ATN International, Inc. | | | 1,544 | | | | 49,933 | |

Bandwidth, Inc., Class A(a) | | | 41,981 | | | | 735,088 | |

IDT Corp., Class B | | | 89 | | | | 3,397 | |

Iridium Communications, Inc. | | | 9,249 | | | | 281,632 | |

| | | | | | | | |

| | |

| | | | | | | 1,070,050 | |

| | |

| Electric Utilities — 0.1% | | | | | | |

TXNM Energy, Inc. | | | 16,975 | | | | 742,996 | |

| | | | | | | | |

| | |

| Electrical Equipment — 1.3% | | | | | | |

Allient, Inc. | | | 30,586 | | | | 580,828 | |

American Superconductor Corp.(a) | | | 10,468 | | | | 247,045 | |

Atkore, Inc. | | | 19,742 | | | | 1,672,937 | |

EnerSys | | | 24,742 | | | | 2,524,921 | |

Generac Holdings, Inc.(a) | | | 5,344 | | | | 849,055 | |

NEXTracker, Inc., Class A(a) | | | 25,540 | | | | 957,239 | |

Powell Industries, Inc. | | | 3,453 | | | | 766,532 | |

| | | | | | | | |

| | |

| | | | | | | 7,598,557 | |

|

| Electronic Equipment, Instruments & Components — 3.7% | |

Avnet, Inc. | | | 12,312 | | | | 668,665 | |

Badger Meter, Inc. | | | 18,431 | | | | 4,025,515 | |

ePlus, Inc.(a) | | | 3,188 | | | | 313,508 | |

Fabrinet(a) | | | 25,828 | | | | 6,106,772 | |

FARO Technologies, Inc.(a) | | | 11,960 | | | | 228,914 | |

Flex Ltd.(a) | | | 66,238 | | | | 2,214,336 | |

Insight Enterprises, Inc.(a) | | | 16,292 | | | | 3,509,134 | |

Itron, Inc.(a) | | | 3,735 | | | | 398,935 | |

| | |

S C H E D U L E O F I N V E S T M E N T S | | 5 |

| | |

Schedule of Investments (continued) September 30, 2024 | | BlackRock Advantage Small Cap Growth Fund (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| Electronic Equipment, Instruments & Components (continued) | |

Kimball Electronics, Inc.(a) | | | 5,009 | | | $ | 92,717 | |

Napco Security Technologies, Inc. | | | 15,532 | | | | 628,425 | |

OSI Systems, Inc.(a) | | | 10,667 | | | | 1,619,571 | |

PC Connection, Inc. | | | 23,880 | | | | 1,801,268 | |

TTM Technologies, Inc.(a) | | | 25,401 | | | | 463,568 | |

| | | | | | | | |

| | |

| | | | | | | 22,071,328 | |

| | |

| Energy Equipment & Services — 2.3% | | | | | | |

Archrock, Inc. | | | 101,873 | | | | 2,061,910 | |

Cactus, Inc., Class A | | | 1,108 | | | | 66,114 | |

ChampionX Corp. | | | 85,342 | | | | 2,573,061 | |

Forum Energy Technologies, Inc.(a) | | | 13,622 | | | | 210,596 | |

Helix Energy Solutions Group, Inc.(a) | | | 11,537 | | | | 128,061 | |

Liberty Energy, Inc., Class A | | | 112,139 | | | | 2,140,734 | |

Noble Corp. PLC | | | 46,850 | | | | 1,693,159 | |

NOV, Inc. | | | 8,656 | | | | 138,236 | |

Oceaneering International, Inc.(a)(b) | | | 97,997 | | | | 2,437,185 | |

Oil States International, Inc.(a) | | | 318 | | | | 1,463 | |

Patterson-UTI Energy, Inc. | | | 23,531 | | | | 180,012 | |

Tidewater, Inc.(a) | | | 29,818 | | | | 2,140,634 | |

| | | | | | | | |

| | |

| | | | | | | 13,771,165 | |

| | |

| Entertainment — 0.2% | | | | | | |

Lions Gate Entertainment Corp., Class B, NVS(a) | | | 12,709 | | | | 87,946 | |

Playstudios, Inc., Class A(a) | | | 117,544 | | | | 177,491 | |

Roku, Inc., Class A(a) | | | 11,954 | | | | 892,486 | |

| | | | | | | | |

| | |

| | | | | | | 1,157,923 | |

| | |

| Financial Services — 1.4% | | | | | | |

Banco Latinoamericano de Comercio Exterior SA, Class E | | | 14,326 | | | | 465,452 | |

Essent Group Ltd. | | | 8,475 | | | | 544,858 | |

Euronet Worldwide, Inc.(a) | | | 24,491 | | | | 2,430,242 | |

International Money Express, Inc.(a) | | | 22,968 | | | | 424,678 | |

Mr. Cooper Group, Inc.(a) | | | 16,571 | | | | 1,527,515 | |

NewtekOne, Inc. | | | 7,928 | | | | 98,783 | |

NMI Holdings, Inc., Class A(a) | | | 32,251 | | | | 1,328,418 | |

Pagseguro Digital Ltd., Class A(a) | | | 39,600 | | | | 340,956 | |

StoneCo Ltd., Class A(a) | | | 83,931 | | | | 945,063 | |

Velocity Financial, Inc.(a) | | | 29,502 | | | | 578,534 | |

| | | | | | | | |

| | |

| | | | | | | 8,684,499 | |

| | |

| Food Products — 0.5% | | | | | | |

Freshpet, Inc.(a) | | | 5,982 | | | | 818,158 | |

John B. Sanfilippo & Son, Inc. | | | 7,634 | | | | 719,963 | |

Lancaster Colony Corp. | | | 3,251 | | | | 574,029 | |

Vital Farms, Inc.(a) | | | 25,234 | | | | 884,956 | |

| | | | | | | | |

| | |

| | | | | | | 2,997,106 | |

| | |

| Ground Transportation — 0.1% | | | | | | |

Covenant Logistics Group, Inc., Class A | | | 9,775 | | | | 516,511 | |

Lyft, Inc., Class A(a) | | | 2,414 | | | | 30,778 | |

XPO, Inc.(a) | | | 960 | | | | 103,210 | |

| | | | | | | | |

| | |

| | | | | | | 650,499 | |

| | |

| Health Care Equipment & Supplies — 4.2% | | | | | | |

Accuray, Inc.(a) | | | 167,936 | | | | 302,285 | |

AngioDynamics, Inc.(a) | | | 95,215 | | | | 740,773 | |

Artivion, Inc.(a) | | | 13,933 | | | | 370,896 | |

Axogen, Inc.(a) | | | 13,333 | | | | 186,929 | |

Axonics, Inc.(a) | | | 21,973 | | | | 1,529,321 | |

Cerus Corp.(a) | | | 261,210 | | | | 454,505 | |

CONMED Corp. | | | 3,484 | | | | 250,569 | |

Glaukos Corp.(a) | | | 1,341 | | | | 174,705 | |

Haemonetics Corp.(a) | | | 14,315 | | | | 1,150,640 | |

Inari Medical, Inc.(a) | | | 13,343 | | | | 550,265 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | |

| Health Care Equipment & Supplies (continued) | | | | | | |

Inogen, Inc.(a) | | | 7 | | | $ | 68 | |

Inspire Medical Systems, Inc.(a)(b) | | | 3,155 | | | | 665,863 | |

iRadimed Corp. | | | 59,934 | | | | 3,014,081 | |

iRhythm Technologies, Inc.(a) | | | 10,549 | | | | 783,158 | |

Lantheus Holdings, Inc.(a) | | | 18,752 | | | | 2,058,032 | |

LeMaitre Vascular, Inc. | | | 40,700 | | | | 3,780,623 | |

Merit Medical Systems, Inc.(a) | | | 5,368 | | | | 530,519 | |

Novocure Ltd.(a) | | | 99,151 | | | | 1,549,730 | |

Omnicell, Inc.(a) | | | 9,785 | | | | 426,626 | |

OraSure Technologies, Inc.(a) | | | 352 | | | | 1,503 | |

PROCEPT BioRobotics Corp.(a) | | | 4,189 | | | | 335,623 | |

Pulmonx Corp.(a) | | | 1,114 | | | | 9,235 | |

RxSight, Inc.(a) | | | 24,134 | | | | 1,192,943 | |

SI-BONE, Inc.(a) | | | 35,730 | | | | 499,505 | |

STAAR Surgical Co.(a) | | | 18,665 | | | | 693,405 | |

Surmodics, Inc.(a) | | | 2,528 | | | | 98,036 | |

Tandem Diabetes Care, Inc.(a) | | | 30,680 | | | | 1,301,139 | |

TransMedics Group, Inc.(a) | | | 16,372 | | | | 2,570,404 | |

Treace Medical Concepts, Inc.(a) | | | 56,186 | | | | 325,879 | |

UFP Technologies, Inc.(a) | | | 77 | | | | 24,386 | |

| | | | | | | | |

| | |

| | | | | | | 25,571,646 | |

| | |

| Health Care Providers & Services — 4.1% | | | | | | |

23andMe Holding Co., Class A(a) | | | 138 | | | | 48 | |

Addus HomeCare Corp.(a) | | | 24,027 | | | | 3,196,312 | |

agilon health, Inc.(a) | | | 99,851 | | | | 392,414 | |

Alignment Healthcare, Inc.(a) | | | 81,409 | | | | 962,254 | |

Brookdale Senior Living, Inc.(a) | | | 32,573 | | | | 221,171 | |

Castle Biosciences, Inc.(a) | | | 17,030 | | | | 485,696 | |

CorVel Corp.(a) | | | 8,388 | | | | 2,741,953 | |

Enhabit, Inc.(a) | | | 515 | | | | 4,068 | |

Ensign Group, Inc. (The) | | | 13,540 | | | | 1,947,323 | |

Guardant Health, Inc.(a) | | | 55,985 | | | | 1,284,296 | |

HealthEquity, Inc.(a)(b) | | | 23,308 | | | | 1,907,760 | |

Hims & Hers Health, Inc., Class A(a) | | | 91,168 | | | | 1,679,315 | |

LifeStance Health Group, Inc.(a) | | | 65,065 | | | | 455,455 | |

PACS Group, Inc.(a) | | | 2,598 | | | | 103,842 | |

Pennant Group, Inc. (The)(a) | | | 8,077 | | | | 288,349 | |

PetIQ, Inc., Class A(a) | | | 2,468 | | | | 75,940 | |

Privia Health Group, Inc.(a)(b) | | | 170,751 | | | | 3,109,376 | |

Progyny, Inc.(a) | | | 98,853 | | | | 1,656,776 | |

RadNet, Inc.(a) | | | 9,787 | | | | 679,120 | |

Select Medical Holdings Corp. | | | 71,332 | | | | 2,487,347 | |

Surgery Partners, Inc.(a) | | | 31,899 | | | | 1,028,424 | |

Viemed Healthcare, Inc.(a) | | | 52,373 | | | | 383,894 | |

| | | | | | | | |

| | |

| | | | | | | 25,091,133 | |

| | |

| Health Care Technology — 0.6% | | | | | | |

Evolent Health, Inc., Class A(a) | | | 35,002 | | | | 989,857 | |

Health Catalyst, Inc.(a) | | | 59,718 | | | | 486,105 | |

HealthStream, Inc. | | | 18,075 | | | | 521,283 | |

Phreesia, Inc.(a) | | | 56,266 | | | | 1,282,302 | |

Teladoc Health, Inc.(a) | | | 54,641 | | | | 501,604 | |

| | | | | | | | |

| | |

| | | | | | | 3,781,151 | |

| | |

| Hotel & Resort REITs — 0.1% | | | | | | |

Ryman Hospitality Properties, Inc. | | | 5,650 | | | | 605,906 | |

Summit Hotel Properties, Inc. | | | 11,220 | | | | 76,969 | |

| | | | | | | | |

| | |

| | | | | | | 682,875 | |

| | |

| Hotels, Restaurants & Leisure — 1.6% | | | | | | |

Brinker International, Inc.(a) | | | 13,427 | | | | 1,027,568 | |

Everi Holdings, Inc.(a) | | | 18,968 | | | | 249,239 | |

Life Time Group Holdings, Inc.(a) | | | 15,035 | | | | 367,155 | |

Lindblad Expeditions Holdings, Inc.(a) | | | 14,441 | | | | 133,579 | |

| | |

| 6 | | 2 0 2 4 B L A C K R O C K A N N U A L F I N A N C I A L S T A T E M E N T S A N D A D D I T I O N A L I N F O R M A T I O N |

| | |

Schedule of Investments (continued) September 30, 2024 | | BlackRock Advantage Small Cap Growth Fund (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | |

| Hotels, Restaurants & Leisure (continued) | | | | | | |

PlayAGS, Inc.(a) | | | 44,180 | | | $ | 503,210 | |

Rush Street Interactive, Inc., Class A(a) | | | 77,755 | | | | 843,642 | |

Shake Shack, Inc., Class A(a) | | | 5,342 | | | | 551,348 | |

Super Group SGHC Ltd. | | | 87,560 | | | | 317,843 | |

Sweetgreen, Inc., Class A(a)(b) | | | 7,704 | | | | 273,107 | |

Texas Roadhouse, Inc. | | | 8,775 | | | | 1,549,665 | |

Travel + Leisure Co. | | | 7,966 | | | | 367,073 | |

United Parks & Resorts, Inc.(a) | | | 1,149 | | | | 58,139 | |

Wingstop, Inc. | | | 8,607 | | | | 3,581,201 | |

| | | | | | | | |

| | |

| | | | | | | 9,822,769 | |

| | |

| Household Durables — 2.1% | | | | | | |

Century Communities, Inc. | | | 13,862 | | | | 1,427,509 | |

Champion Homes, Inc.(a) | | | 2,080 | | | | 197,288 | |

Green Brick Partners, Inc.(a)(b) | | | 5,697 | | | | 475,813 | |

Hovnanian Enterprises, Inc., Class A(a) | | | 31 | | | | 6,335 | |

Installed Building Products, Inc. | | | 11,232 | | | | 2,766,105 | |

LGI Homes, Inc.(a) | | | 5,857 | | | | 694,172 | |

M/I Homes, Inc.(a) | | | 9,812 | | | | 1,681,384 | |

Taylor Morrison Home Corp., Class A(a) | | | 988 | | | | 69,417 | |

Toll Brothers, Inc. | | | 16,371 | | | | 2,529,156 | |

Tri Pointe Homes, Inc.(a) | | | 60,147 | | | | 2,725,261 | |

Vizio Holding Corp., Class A(a) | | | 29,943 | | | | 334,463 | |

| | | | | | | | |

| | |

| | | | | | | 12,906,903 | |

| | |

| Household Products — 0.1% | | | | | | |

Energizer Holdings, Inc. | | | 11,696 | | | | 371,465 | |

Spectrum Brands Holdings, Inc. | | | 874 | | | | 83,152 | |

| | | | | | | | |

| | |

| | | | | | | 454,617 | |

| | |

| Industrial Conglomerates — 0.1% | | | | | | |

Brookfield Business Corp., Class A | | | 12,885 | | | | 326,377 | |

| | | | | | | | |

| | |

| Industrial REITs — 0.1% | | | | | | |

First Industrial Realty Trust, Inc. | | | 15,599 | | | | 873,232 | |

| | | | | | | | |

| | |

| Insurance — 0.7% | | | | | | |

AMERISAFE, Inc. | | | 4,839 | | | | 233,869 | |

Crawford & Co., Class A, NVS | | | 16,840 | | | | 184,735 | |

HCI Group, Inc. | | | 2,967 | | | | 317,647 | |

Investors Title Co. | | | 1 | | | | 230 | |

Oscar Health, Inc., Class A(a) | | | 52,290 | | | | 1,109,071 | |

Palomar Holdings, Inc.(a) | | | 17,966 | | | | 1,700,841 | |

Selective Insurance Group, Inc. | | | 747 | | | | 69,695 | |

Skyward Specialty Insurance Group, Inc.(a) | | | 814 | | | | 33,154 | |

Tiptree, Inc. | | | 28,239 | | | | 552,637 | |

| | | | | | | | |

| | |

| | | | | | | 4,201,879 | |

| | |

| Interactive Media & Services — 1.4% | | | | | | |

DHI Group, Inc.(a) | | | 24,259 | | | | 44,637 | |

EverQuote, Inc., Class A(a) | | | 66,791 | | | | 1,408,622 | |

Grindr, Inc.(a) | | | 14,081 | | | | 167,986 | |

MediaAlpha, Inc., Class A(a) | | | 58,960 | | | | 1,067,766 | |

Nextdoor Holdings, Inc., Class A(a) | | | 87,540 | | | | 217,099 | |

Outbrain, Inc.(a) | | | 38,263 | | | | 185,958 | |

QuinStreet, Inc.(a) | | | 32,633 | | | | 624,269 | |

Yelp, Inc.(a) | | | 91,124 | | | | 3,196,630 | |

ZipRecruiter, Inc., Class A(a) | | | 185,096 | | | | 1,758,412 | |

| | | | | | | | |

| | |

| | | | | | | 8,671,379 | |

| | |

| IT Services — 0.7% | | | | | | |

Backblaze, Inc., Class A(a) | | | 26,018 | | | | 166,255 | |

Brightcove, Inc.(a) | | | 104,741 | | | | 226,241 | |

Couchbase, Inc.(a) | | | 18,845 | | | | 303,781 | |

Grid Dynamics Holdings, Inc., Class A(a) | | | 29,177 | | | | 408,478 | |

Hackett Group, Inc. (The) | | | 26,420 | | | | 694,053 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | |

| IT Services (continued) | | | | | | |

Information Services Group, Inc. | | | 44,889 | | | $ | 148,134 | |

Kyndryl Holdings, Inc.(a) | | | 26,270 | | | | 603,685 | |

Perficient, Inc.(a) | | | 5,857 | | | | 442,086 | |

Squarespace, Inc., Class A(a) | | | 27,160 | | | | 1,261,039 | |

| | | | | | | | |

| | |

| | | | | | | 4,253,752 | |

| | |

| Leisure Products — 0.4% | | | | | | |

YETI Holdings, Inc.(a) | | | 57,142 | | | | 2,344,536 | |

| | | | | | | | |

| | |

| Life Sciences Tools & Services — 0.5% | | | | | | |

10X Genomics, Inc., Class A(a) | | | 19,087 | | | | 430,985 | |

Codexis, Inc.(a) | | | 101,790 | | | | 313,513 | |

Cytek Biosciences, Inc.(a) | | | 32,907 | | | | 182,305 | |

Maravai LifeSciences Holdings, Inc., Class A(a) | | | 65,202 | | | | 541,829 | |

Medpace Holdings, Inc.(a) | | | 2,398 | | | | 800,452 | |

Personalis, Inc.(a) | | | 75,642 | | | | 406,954 | |

Seer, Inc., Class A(a) | | | 137,757 | | | | 271,381 | |

| | | | | | | | |

| | |

| | | | | | | 2,947,419 | |

| | |

| Machinery — 4.4% | | | | | | |

Alamo Group, Inc. | | | 7,046 | | | | 1,269,196 | |

Atmus Filtration Technologies, Inc. | | | 27,225 | | | | 1,021,754 | |

Blue Bird Corp.(a)(b) | | | 23,472 | | | | 1,125,717 | |

Chart Industries, Inc.(a)(b) | | | 14,225 | | | | 1,765,891 | |

Donaldson Co., Inc. | | | 340 | | | | 25,058 | |

Energy Recovery, Inc.(a) | | | 2,665 | | | | 46,344 | |

Federal Signal Corp. | | | 25,654 | | | | 2,397,623 | |

Flowserve Corp. | | | 92,374 | | | | 4,774,812 | |

Franklin Electric Co., Inc. | | | 9,936 | | | | 1,041,492 | |

Kadant, Inc. | | | 2,723 | | | | 920,374 | |

Luxfer Holdings PLC | | | 4,355 | | | | 56,397 | |

Miller Industries, Inc. | | | 2,707 | | | | 165,127 | |

Mueller Industries, Inc.(b) | | | 39,296 | | | | 2,911,834 | |

Mueller Water Products, Inc., Class A | | | 59,099 | | | | 1,282,448 | |

Oshkosh Corp. | | | 24,465 | | | | 2,451,638 | |

SPX Technologies, Inc.(a) | | | 1,966 | | | | 313,498 | |

Tennant Co. | | | 2,016 | | | | 193,617 | |

Trinity Industries, Inc. | | | 16,837 | | | | 586,601 | |

Watts Water Technologies, Inc., Class A | | | 20,109 | | | | 4,166,384 | |

| | | | | | | | |

| | |

| | | | | | | 26,515,805 | |

| | |

| Media — 0.4% | | | | | | |

EW Scripps Co. (The), Class A(a) | | | 43,703 | | | | 98,113 | |

Magnite, Inc.(a) | | | 50,168 | | | | 694,827 | |

PubMatic, Inc., Class A(a) | | | 17,252 | | | | 256,537 | |

TechTarget, Inc.(a) | | | 5,745 | | | | 140,465 | |

Thryv Holdings, Inc.(a) | | | 57,628 | | | | 992,931 | |

| | | | | | | | |

| | |

| | | | | | | 2,182,873 | |

| | |

| Metals & Mining — 1.8% | | | | | | |

Alcoa Corp. | | | 5,625 | | | | 217,012 | |

Alpha Metallurgical Resources, Inc. | | | 7,142 | | | | 1,686,798 | |

Carpenter Technology Corp. | | | 16,367 | | | | 2,611,846 | |

Century Aluminum Co.(a) | | | 101,439 | | | | 1,646,355 | |

Hecla Mining Co. | | | 124,228 | | | | 828,601 | |

Kaiser Aluminum Corp. | | | 23,430 | | | | 1,699,144 | |

Materion Corp. | | | 13,849 | | | | 1,549,149 | |

NioCorp Developments Ltd.(a)(b) | | | 38,227 | | | | 83,335 | |

Olympic Steel, Inc. | | | 7,180 | | | | 280,020 | |

Piedmont Lithium, Inc.(a) | | | 10,679 | | | | 95,363 | |

Tredegar Corp.(a) | | | 18,103 | | | | 131,971 | |

| | | | | | | | |

| | |

| | | | | | | 10,829,594 | |

|

| Mortgage Real Estate Investment Trusts (REITs) — 0.0% | |

TPG RE Finance Trust, Inc. | | | 7,670 | | | | 65,425 | |

| | | | | | | | |

| | |

S C H E D U L E O F I N V E S T M E N T S | | 7 |

| | |

Schedule of Investments (continued) September 30, 2024 | | BlackRock Advantage Small Cap Growth Fund (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | |

| Office REITs — 0.1% | | | | | | |

Brandywine Realty Trust | | | 23,816 | | | $ | 129,559 | |

Kilroy Realty Corp. | | | 17,929 | | | | 693,852 | |

| | | | | | | | |

| | |

| | | | | | | 823,411 | |

| | |

| Oil, Gas & Consumable Fuels — 1.0% | | | | | | |

Ardmore Shipping Corp. | | | 8 | | | | 145 | |

Civitas Resources, Inc. | | | 4,638 | | | | 235,007 | |

DHT Holdings, Inc. | | | 4 | | | | 44 | |

Magnolia Oil & Gas Corp., Class A | | | 62,002 | | | | 1,514,089 | |

Ovintiv, Inc. | | | 39,720 | | | | 1,521,673 | |

Par Pacific Holdings, Inc.(a) | | | 4,554 | | | | 80,150 | |

PBF Energy, Inc., Class A | | | 821 | | | | 25,410 | |

Plains GP Holdings LP, Class A | | | 111,889 | | | | 2,069,947 | |

REX American Resources Corp.(a) | | | 12,183 | | | | 563,951 | |

| | | | | | | | |

| | |

| | | | | | | 6,010,416 | |

| | |

| Paper & Forest Products — 0.3% | | | | | | |

Louisiana-Pacific Corp. | | | 15,416 | | | | 1,656,603 | |

| | | | | | | | |

| | |

| Passenger Airlines — 0.2% | | | | | | |

SkyWest, Inc.(a) | | | 10,796 | | | | 917,876 | |

Sun Country Airlines Holdings, Inc.(a) | | | 32,817 | | | | 367,879 | |

| | | | | | | | |

| | |

| | | | | | | 1,285,755 | |

| | |

| Personal Care Products — 0.1% | | | | | | |

BellRing Brands, Inc.(a) | | | 6,259 | | | | 380,047 | |

| | | | | | | | |

| | |

| Pharmaceuticals — 3.3% | | | | | | |

Amneal Pharmaceuticals, Inc., Class A(a) | | | 31,021 | | | | 258,095 | |

Amphastar Pharmaceuticals, Inc.(a) | | | 22,533 | | | | 1,093,526 | |

Arvinas, Inc.(a) | | | 51,982 | | | | 1,280,317 | |

Atea Pharmaceuticals, Inc.(a) | | | 137,951 | | | | 462,136 | |

Axsome Therapeutics, Inc.(a) | | | 10,380 | | | | 932,851 | |

Biote Corp., Class A(a) | | | 433 | | | | 2,416 | |

Collegium Pharmaceutical, Inc.(a)(b) | | | 10,884 | | | | 420,558 | |

Corcept Therapeutics, Inc.(a)(b) | | | 111,498 | | | | 5,160,127 | |

Edgewise Therapeutics, Inc.(a) | | | 49,186 | | | | 1,312,774 | |

Elanco Animal Health, Inc.(a) | | | 6,823 | | | | 100,230 | |

Enliven Therapeutics, Inc.(a) | | | 3,410 | | | | 87,091 | |

Esperion Therapeutics, Inc.(a) | | | 19,618 | | | | 32,370 | |

Evolus, Inc.(a) | | | 31,666 | | | | 512,989 | |

EyePoint Pharmaceuticals, Inc.(a) | | | 803 | | | | 6,416 | |

Fulcrum Therapeutics, Inc.(a) | | | 72,680 | | | | 259,468 | |

Harmony Biosciences Holdings, Inc.(a)(b) | | | 49,659 | | | | 1,986,360 | |

Harrow, Inc.(a) | | | 13,769 | | | | 619,054 | |

Intra-Cellular Therapies, Inc.(a) | | | 6,115 | | | | 447,435 | |

Jazz Pharmaceuticals PLC(a) | | | 2,794 | | | | 311,280 | |

Longboard Pharmaceuticals, Inc.(a) | | | 9,150 | | | | 304,970 | |

Mind Medicine MindMed, Inc.(a) | | | 31,658 | | | | 180,134 | |

Nektar Therapeutics(a) | | | 36,427 | | | | 47,355 | |

Nuvation Bio, Inc., Class A(a) | | | 77,629 | | | | 177,770 | |

Ocular Therapeutix, Inc.(a) | | | 6,663 | | | | 57,968 | |

Phibro Animal Health Corp., Class A | | | 52,540 | | | | 1,183,201 | |

Prestige Consumer Healthcare, Inc.(a) | | | 2,330 | | | | 167,993 | |

Revance Therapeutics, Inc.(a) | | | 46,207 | | | | 239,814 | |

Scilex Holding Co. (Acquired 05/03/22, cost $349,038)(a)(b)(c) | | | 29,374 | | | | 26,231 | |

SIGA Technologies, Inc. | | | 32,863 | | | | 221,825 | |

Supernus Pharmaceuticals, Inc.(a) | | | 21,346 | | | | 665,568 | |

Tarsus Pharmaceuticals, Inc.(a) | | | 25,275 | | | | 831,295 | |

Terns Pharmaceuticals, Inc.(a) | | | 35,815 | | | | 298,697 | |

Trevi Therapeutics, Inc.(a) | | | 1,021 | | | | 3,410 | |

WaVe Life Sciences Ltd.(a) | | | 25,768 | | | | 211,298 | |

Xeris Biopharma Holdings, Inc.(a) | | | 59,644 | | | | 169,985 | |

| | | | | | | | |

| | |

| | | | | | | 20,073,007 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | |

| Professional Services — 5.2% | | | | | | |

CACI International, Inc., Class A(a) | | | 2,459 | | | $ | 1,240,713 | |

CBIZ, Inc.(a) | | | 1,883 | | | | 126,707 | |

CRA International, Inc. | | | 6,855 | | | | 1,201,819 | |

CSG Systems International, Inc. | | | 5,829 | | | | 283,581 | |

ExlService Holdings, Inc.(a) | | | 248,107 | | | | 9,465,282 | |

Exponent, Inc. | | | 14,479 | | | | 1,669,139 | |

Franklin Covey Co.(a) | | | 10,856 | | | | 446,507 | |

FTI Consulting, Inc.(a) | | | 12,780 | | | | 2,908,217 | |

IBEX Holdings Ltd.(a) | | | 1,904 | | | | 38,042 | |

Insperity, Inc. | | | 54,576 | | | | 4,802,688 | |

Kforce, Inc. | | | 1,182 | | | | 72,634 | |

Maximus, Inc. | | | 66,545 | | | | 6,199,332 | |

Robert Half, Inc. | | | 10,743 | | | | 724,186 | |

TriNet Group, Inc. | | | 22,320 | | | | 2,164,370 | |

Verra Mobility Corp., Class A(a) | | | 4,136 | | | | 115,022 | |

| | | | | | | | |

| | |

| | | | | | | 31,458,239 | |

| | |

| Real Estate Management & Development — 0.4% | | | | | | |

Real Brokerage, Inc. (The)(a)(b) | | | 37,499 | | | | 208,119 | |

RMR Group, Inc. (The), Class A | | | 6 | | | | 152 | |

St. Joe Co. (The) | | | 37,989 | | | | 2,215,139 | |

| | | | | | | | |

| | |

| | | | | | | 2,423,410 | |

| | |

| Retail REITs — 0.1% | | | | | | |

Kite Realty Group Trust | | | 235 | | | | 6,242 | |

Saul Centers, Inc. | | | 2,812 | | | | 117,991 | |

Tanger, Inc. | | | 20,110 | | | | 667,250 | |

| | | | | | | | |

| | |

| | | | | | | 791,483 | |

| | |

| Semiconductors & Semiconductor Equipment — 4.7% | | | | | | |

ACM Research, Inc., Class A(a) | | | 27,638 | | | | 561,051 | |

Ambarella, Inc.(a) | | | 29,674 | | | | 1,673,762 | |

Axcelis Technologies, Inc.(a)(b) | | | 19,477 | | | | 2,042,163 | |

Credo Technology Group Holding Ltd.(a) | | | 74,724 | | | | 2,301,499 | |

Diodes, Inc.(a) | | | 26,036 | | | | 1,668,647 | |

FormFactor, Inc.(a) | | | 14,873 | | | | 684,158 | |

Ichor Holdings Ltd.(a) | | | 15,910 | | | | 506,097 | |

Impinj, Inc.(a)(b) | | | 12,125 | | | | 2,625,305 | |

MaxLinear, Inc.(a) | | | 40,179 | | | | 581,792 | |

Onto Innovation, Inc.(a) | | | 16,995 | | | | 3,527,482 | |

Photronics, Inc.(a) | | | 5,094 | | | | 126,127 | |

Power Integrations, Inc. | | | 35,565 | | | | 2,280,428 | |

Rambus, Inc.(a) | | | 35,081 | | | | 1,481,120 | |

Semtech Corp.(a) | | | 27,792 | | | | 1,268,983 | |

Silicon Laboratories, Inc.(a)(b) | | | 16,157 | | | | 1,867,265 | |

SiTime Corp.(a) | | | 7,606 | | | | 1,304,505 | |

Synaptics, Inc.(a) | | | 47,684 | | | | 3,699,325 | |

Ultra Clean Holdings, Inc.(a) | | | 12,735 | | | | 508,509 | |

| | | | | | | | |

| | |

| | | | | | | 28,708,218 | |

| | |

| Software — 11.3% | | | | | | |

8x8, Inc.(a) | | | 124,309 | | | | 253,590 | |

A10 Networks, Inc. | | | 11,763 | | | | 169,858 | |

ACI Worldwide, Inc.(a) | | | 158,916 | | | | 8,088,824 | |

Agilysys, Inc.(a) | | | 5,704 | | | | 621,565 | |

Alarm.com Holdings, Inc.(a) | | | 43,912 | | | | 2,400,669 | |

Amplitude, Inc., Class A(a) | | | 41,564 | | | | 372,829 | |

Appian Corp., Class A(a) | | | 4,866 | | | | 166,125 | |