UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05742

Name of Fund: BlackRock FundsSM

BlackRock China A Opportunities Fund

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock FundsSM, 50 Hudson Yards, New York, NY 10001

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 10/31/2024

Date of reporting period: 10/31/2024

Item 1 – Report to Stockholders

(a) The Report to Shareholders is attached herewith.

BlackRock China A Opportunities Fund

Institutional Shares | CHILX

Annual Shareholder Report — October 31, 2024

This annual shareholder report contains important information about BlackRock China A Opportunities Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024.You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 537-4942.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Shares | $108 | 1.00% |

How did the Fund perform last year?

For the reporting period ended October 31, 2024, the Fund’s Instititional Shares returned 16.43%.

For the same period, the MSCI China A Onshore Index returned 14.15%.

What contributed to performance?

Positive contributions were led by fundamental stock selection measures, most notably fundamental valuation insights as markets exhibited a preference for value factor styles. In this vein, traditional valuation metrics comparing stock prices across company earnings, sales and cash flows contributed in the first half of 2024, as risk sentiment remained weak and investors focused on companies with strong cash flows. Defensive quality fundamental measures also contributed to gains amid market volatility, with measures evaluating operating efficiency and dividend consistency proving additive. Sentiment measures added to return as well, successfully positioning the portfolio around evolving market themes. These included measures capturing forward-looking views of company fundamentals based on comments from sell-side analysts as well as insights capturing informed investor positioning, which were effective during the January and April 2024 earnings seasons. Additionally, measures of consumer sentiment and intent based on credit card transactions helped motivate successful positioning with respect to consumer discretionary stocks.

What detracted from performance?

While sentiment insights contributed in aggregate, select trend-based sentiment signals struggled against deteriorating investor confidence throughout the period as well during a drawdown in momentum styles at period-end. Specifically, measures capturing trends across broker reports from Chinese sell-side analysts struggled. In addition, macro thematic insights evaluating industry trends drove unsuccessful positioning. Most notably, measures evaluating hiring trends motivated an underweight to financials which detracted as investors favored defensive brokerage stocks amid broader market volatility.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

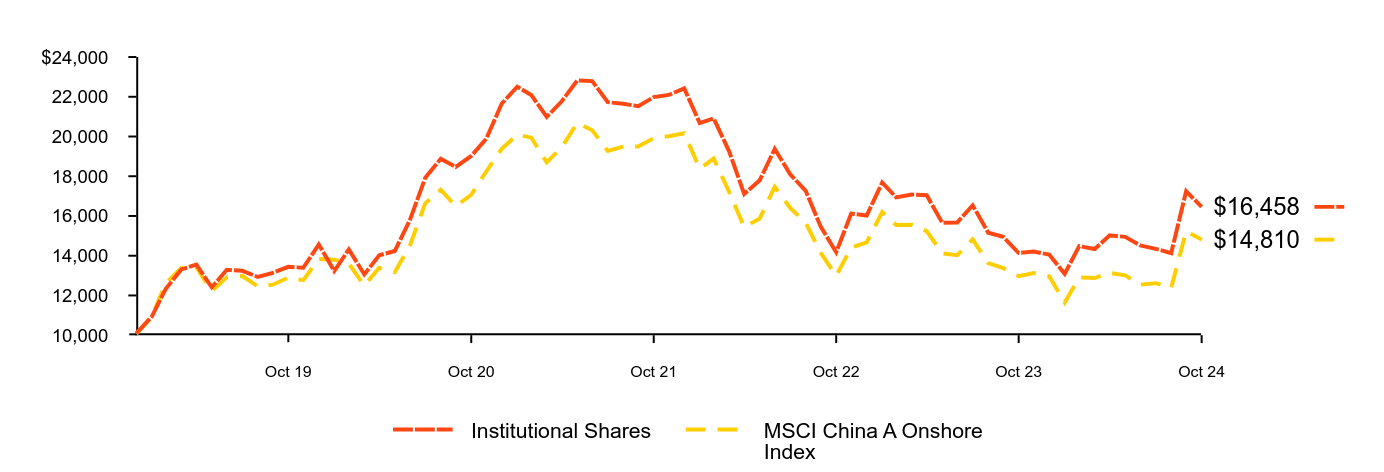

Cumulative performance: December 27, 2018 through October 31, 2024

Initial Investment of $10,000

| Institutional Shares | MSCI China A Onshore Index |

|---|

| Dec 18 | $10,090 | $10,066 |

| Jan 19 | $10,930 | $10,938 |

| Feb 19 | $12,340 | $12,617 |

| Mar 19 | $13,310 | $13,390 |

| Apr 19 | $13,550 | $13,420 |

| May 19 | $12,410 | $12,221 |

| Jun 19 | $13,290 | $12,913 |

| Jul 19 | $13,240 | $12,977 |

| Aug 19 | $12,930 | $12,455 |

| Sep 19 | $13,140 | $12,542 |

| Oct 19 | $13,440 | $12,898 |

| Nov 19 | $13,390 | $12,771 |

| Dec 19 | $14,567 | $13,840 |

| Jan 20 | $13,229 | $13,800 |

| Feb 20 | $14,318 | $13,613 |

| Mar 20 | $13,059 | $12,494 |

| Apr 20 | $14,023 | $13,392 |

| May 20 | $14,238 | $13,172 |

| Jun 20 | $15,780 | $14,488 |

| Jul 20 | $17,923 | $16,635 |

| Aug 20 | $18,875 | $17,322 |

| Sep 20 | $18,467 | $16,490 |

| Oct 20 | $19,022 | $17,071 |

| Nov 20 | $19,884 | $18,238 |

| Dec 20 | $21,657 | $19,381 |

| Jan 21 | $22,504 | $20,093 |

| Feb 21 | $22,092 | $19,941 |

| Mar 21 | $20,985 | $18,698 |

| Apr 21 | $21,774 | $19,453 |

| May 21 | $22,822 | $20,683 |

| Jun 21 | $22,787 | $20,312 |

| Jul 21 | $21,727 | $19,276 |

| Aug 21 | $21,645 | $19,487 |

| Sep 21 | $21,527 | $19,495 |

| Oct 21 | $21,986 | $19,914 |

| Nov 21 | $22,092 | $20,012 |

| Dec 21 | $22,422 | $20,162 |

| Jan 22 | $20,671 | $18,384 |

| Feb 22 | $20,909 | $18,889 |

| Mar 22 | $19,241 | $17,200 |

| Apr 22 | $17,109 | $15,437 |

| May 22 | $17,800 | $15,872 |

| Jun 22 | $19,372 | $17,467 |

| Jul 22 | $18,098 | $16,402 |

| Aug 22 | $17,264 | $15,649 |

| Sep 22 | $15,464 | $14,143 |

| Oct 22 | $14,178 | $12,988 |

| Nov 22 | $16,120 | $14,412 |

| Dec 22 | $16,023 | $14,671 |

| Jan 23 | $17,682 | $16,196 |

| Feb 23 | $16,937 | $15,549 |

| Mar 23 | $17,081 | $15,562 |

| Apr 23 | $17,045 | $15,239 |

| May 23 | $15,662 | $14,121 |

| Jun 23 | $15,674 | $14,024 |

| Jul 23 | $16,540 | $14,819 |

| Aug 23 | $15,158 | $13,624 |

| Sep 23 | $14,953 | $13,376 |

| Oct 23 | $14,136 | $12,974 |

| Nov 23 | $14,208 | $13,126 |

| Dec 23 | $14,054 | $12,962 |

| Jan 24 | $13,085 | $11,647 |

| Feb 24 | $14,483 | $12,904 |

| Mar 24 | $14,336 | $12,874 |

| Apr 24 | $15,023 | $13,140 |

| May 24 | $14,949 | $13,013 |

| Jun 24 | $14,520 | $12,539 |

| Jul 24 | $14,348 | $12,619 |

| Aug 24 | $14,128 | $12,377 |

| Sep 24 | $17,243 | $15,232 |

| Oct 24 | $16,458 | $14,810 |

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| Average Annual Total Returns | 1 Year | 5 Years | Since Fund Inception |

|---|

Institutional Shares ........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 16.43% | 4.13% | 8.90% |

MSCI China A Onshore Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 14.15 | 2.80 | 6.95 |

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $17,147,021 |

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 159 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $0 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 149% |

The Fund commenced operations on December 27, 2018.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

SectorFootnote Reference(a) | Percent of Net Assets |

|---|

Information Technology........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 22.4% |

Financials........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 17.8 |

Industrials........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 14.6 |

Materials........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 10.9 |

Consumer Discretionary........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 9.9 |

Consumer Staples........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 9.5 |

Health Care........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 8.7 |

Communication Services........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.1 |

Energy........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.8 |

Utilities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.8 |

Real Estate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.3 |

Short-Term Securities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.3 |

Liabilities in Excess of Other Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | (1.1) |

|

SecurityFootnote Reference(b) | Percent of Net Assets |

|---|

Contemporary Amperex Technology Co. Ltd., Class A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.0% |

Ping An Insurance Group Co. of China Ltd., Class A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.9 |

Kweichow Moutai Co. Ltd., Class A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.9 |

China Merchants Bank Co. Ltd., Class A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.2 |

Wuliangye Yibin Co. Ltd., Class A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.2 |

BOE Technology Group Co. Ltd., Class A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.5 |

Huatai Securities Co. Ltd., Class A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.3 |

BYD Co. Ltd., Class A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.3 |

Shenzhen Mindray Bio-Medical Electronics Co. Ltd., Class A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.3 |

Midea Group Co. Ltd., Class A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.0 |

| |

| Footnote | Description |

Footnote(a) | For purposes of this report, sector sub-classifications may differ from those utilized by the Fund for compliance purposes. |

Footnote(b) | Excludes short-term securities. |

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 537-4942.

The Fund is not sponsored, endorsed, issued, sold, or promoted by MSCI Inc. and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

© 2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock China A Opportunities Fund

Institutional Shares | CHILX

Annual Shareholder Report — October 31, 2024

BlackRock China A Opportunities Fund

Annual Shareholder Report — October 31, 2024

This annual shareholder report contains important information about BlackRock China A Opportunities Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024.You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 537-4942.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class K Shares | $103 | 0.95% |

How did the Fund perform last year?

For the reporting period ended October 31, 2024, the Fund’s Class K Shares returned 16.51%.

For the same period, the MSCI China A Onshore Index returned 14.15%.

What contributed to performance?

Positive contributions were led by fundamental stock selection measures, most notably fundamental valuation insights as markets exhibited a preference for value factor styles. In this vein, traditional valuation metrics comparing stock prices across company earnings, sales and cash flows contributed in the first half of 2024, as risk sentiment remained weak and investors focused on companies with strong cash flows. Defensive quality fundamental measures also contributed to gains amid market volatility, with measures evaluating operating efficiency and dividend consistency proving additive. Sentiment measures added to return as well, successfully positioning the portfolio around evolving market themes. These included measures capturing forward-looking views of company fundamentals based on comments from sell-side analysts as well as insights capturing informed investor positioning, which were effective during the January and April 2024 earnings seasons. Additionally, measures of consumer sentiment and intent based on credit card transactions helped motivate successful positioning with respect to consumer discretionary stocks.

What detracted from performance?

While sentiment insights contributed in aggregate, select trend-based sentiment signals struggled against deteriorating investor confidence throughout the period as well during a drawdown in momentum styles at period-end. Specifically, measures capturing trends across broker reports from Chinese sell-side analysts struggled. In addition, macro thematic insights evaluating industry trends drove unsuccessful positioning. Most notably, measures evaluating hiring trends motivated an underweight to financials which detracted as investors favored defensive brokerage stocks amid broader market volatility.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

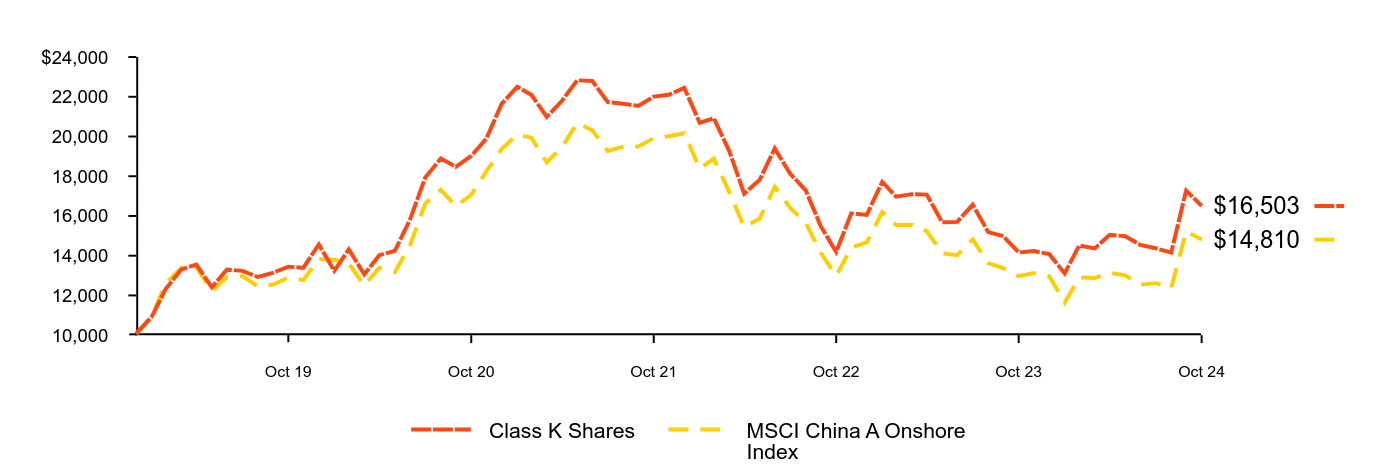

Cumulative performance: December 27, 2018 through October 31, 2024

Initial Investment of $10,000

| Class K Shares | MSCI China A Onshore Index |

|---|

| Dec 18 | $10,090 | $10,066 |

| Jan 19 | $10,930 | $10,938 |

| Feb 19 | $12,340 | $12,617 |

| Mar 19 | $13,310 | $13,390 |

| Apr 19 | $13,550 | $13,420 |

| May 19 | $12,410 | $12,221 |

| Jun 19 | $13,300 | $12,913 |

| Jul 19 | $13,240 | $12,977 |

| Aug 19 | $12,930 | $12,455 |

| Sep 19 | $13,140 | $12,542 |

| Oct 19 | $13,450 | $12,898 |

| Nov 19 | $13,390 | $12,771 |

| Dec 19 | $14,569 | $13,840 |

| Jan 20 | $13,243 | $13,800 |

| Feb 20 | $14,320 | $13,613 |

| Mar 20 | $13,061 | $12,494 |

| Apr 20 | $14,025 | $13,392 |

| May 20 | $14,241 | $13,172 |

| Jun 20 | $15,794 | $14,488 |

| Jul 20 | $17,937 | $16,635 |

| Aug 20 | $18,889 | $17,322 |

| Sep 20 | $18,470 | $16,490 |

| Oct 20 | $19,025 | $17,071 |

| Nov 20 | $19,887 | $18,238 |

| Dec 20 | $21,652 | $19,381 |

| Jan 21 | $22,500 | $20,093 |

| Feb 21 | $22,100 | $19,941 |

| Mar 21 | $20,992 | $18,698 |

| Apr 21 | $21,782 | $19,453 |

| May 21 | $22,830 | $20,683 |

| Jun 21 | $22,795 | $20,312 |

| Jul 21 | $21,735 | $19,276 |

| Aug 21 | $21,652 | $19,487 |

| Sep 21 | $21,534 | $19,495 |

| Oct 21 | $22,006 | $19,914 |

| Nov 21 | $22,100 | $20,012 |

| Dec 21 | $22,449 | $20,162 |

| Jan 22 | $20,685 | $18,384 |

| Feb 22 | $20,923 | $18,889 |

| Mar 22 | $19,266 | $17,200 |

| Apr 22 | $17,120 | $15,437 |

| May 22 | $17,824 | $15,872 |

| Jun 22 | $19,397 | $17,467 |

| Jul 22 | $18,122 | $16,402 |

| Aug 22 | $17,287 | $15,649 |

| Sep 22 | $15,487 | $14,143 |

| Oct 22 | $14,187 | $12,988 |

| Nov 22 | $16,131 | $14,412 |

| Dec 22 | $16,053 | $14,671 |

| Jan 23 | $17,714 | $16,196 |

| Feb 23 | $16,968 | $15,549 |

| Mar 23 | $17,100 | $15,562 |

| Apr 23 | $17,076 | $15,239 |

| May 23 | $15,680 | $14,121 |

| Jun 23 | $15,704 | $14,024 |

| Jul 23 | $16,570 | $14,819 |

| Aug 23 | $15,187 | $13,624 |

| Sep 23 | $14,982 | $13,376 |

| Oct 23 | $14,164 | $12,974 |

| Nov 23 | $14,236 | $13,126 |

| Dec 23 | $14,082 | $12,962 |

| Jan 24 | $13,111 | $11,647 |

| Feb 24 | $14,512 | $12,904 |

| Mar 24 | $14,365 | $12,874 |

| Apr 24 | $15,053 | $13,140 |

| May 24 | $14,979 | $13,013 |

| Jun 24 | $14,549 | $12,539 |

| Jul 24 | $14,377 | $12,619 |

| Aug 24 | $14,156 | $12,377 |

| Sep 24 | $17,277 | $15,232 |

| Oct 24 | $16,503 | $14,810 |

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| Average Annual Total Returns | 1 Year | 5 Years | Since Fund Inception |

|---|

Class K Shares ........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 16.51% | 4.18% | 8.95% |

MSCI China A Onshore Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 14.15 | 2.80 | 6.95 |

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $17,147,021 |

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 159 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $0 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 149% |

The Fund commenced operations on December 27, 2018.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

SectorFootnote Reference(a) | Percent of Net Assets |

|---|

Information Technology........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 22.4% |

Financials........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 17.8 |

Industrials........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 14.6 |

Materials........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 10.9 |

Consumer Discretionary........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 9.9 |

Consumer Staples........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 9.5 |

Health Care........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 8.7 |

Communication Services........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.1 |

Energy........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.8 |

Utilities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.8 |

Real Estate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.3 |

Short-Term Securities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.3 |

Liabilities in Excess of Other Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | (1.1) |

|

SecurityFootnote Reference(b) | Percent of Net Assets |

|---|

Contemporary Amperex Technology Co. Ltd., Class A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.0% |

Ping An Insurance Group Co. of China Ltd., Class A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.9 |

Kweichow Moutai Co. Ltd., Class A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.9 |

China Merchants Bank Co. Ltd., Class A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.2 |

Wuliangye Yibin Co. Ltd., Class A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.2 |

BOE Technology Group Co. Ltd., Class A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.5 |

Huatai Securities Co. Ltd., Class A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.3 |

BYD Co. Ltd., Class A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.3 |

Shenzhen Mindray Bio-Medical Electronics Co. Ltd., Class A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.3 |

Midea Group Co. Ltd., Class A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.0 |

| |

| Footnote | Description |

Footnote(a) | For purposes of this report, sector sub-classifications may differ from those utilized by the Fund for compliance purposes. |

Footnote(b) | Excludes short-term securities. |

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 537-4942.

The Fund is not sponsored, endorsed, issued, sold, or promoted by MSCI Inc. and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

© 2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock China A Opportunities Fund

Annual Shareholder Report — October 31, 2024

(b) Not Applicable

Item 2 – Code of Ethics – The registrant (or the “Fund”) has adopted a code of ethics, as of the end of the period covered by this report, applicable to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. During the period covered by this report, the code of ethics was amended to update certain information and to make other non-material changes. During the period covered by this report, there have been no waivers granted under the code of ethics. The registrant undertakes to provide a copy of the code of ethics to any person upon request, without charge, who calls 1-800-441-7762.

Item 3 – Audit Committee Financial Expert – The registrant’s board of directors (the “board of trustees”), has determined that (i) the registrant has the following audit committee financial experts serving on its audit committee and (ii) each audit committee financial expert is independent:

Neil A. Cotty

Henry R. Keizer

Kenneth L. Urish

Under applicable securities laws, a person determined to be an audit committee financial expert will not be deemed an “expert” for any purpose, including without limitation for the purposes of Section 11 of the Securities Act of 1933, as a result of being designated or identified as an audit committee financial expert. The designation or identification of a person as an audit committee financial expert does not impose on such person any duties, obligations, or liabilities greater than the duties, obligations, and liabilities imposed on such person as a member of the audit committee and board of directors in the absence of such designation or identification. The designation or identification of a person as an audit committee financial expert does not affect the duties, obligations, or liability of any other member of the audit committee or board of directors.

Item 4 – Principal Accountant Fees and Services